all very proud of.

Our customers voted First Response Finance as the ‘Best Car Finance Provider’ in the Consumer Credit Awards 2022 - for the second consecutive year. In addition to that, we also won the prestigious ‘Firm of the Year’ award!

The second recognition came from our dealer partners, who voted us ‘Finance Provider of the Year (Sub-Prime)’ in the Car Dealer Power Awards. We are honoured to have won this award 8 times!

Vans, cars, motorbikes - it doesn't matter what type of vehicle we’re financing, our award-winning service remains the same.

If you want to set up an account with us, email us at marketing@frfl.co.uk

HEAD OF CONTENT

Andy Mayo: editorial@dealernews.co.uk

FINANCIAL EDITOR

Roger Willis: editorial@dealernews.co.uk

PRODUCTS EDITOR/DESIGNER

Colin Williams: design@dealernews.co.uk

COMMERCIAL CONTENT MANAGER

Maurice Knuckey: creative@dealernews.co.uk

CONTRIBUTORS

Roger Willis; Dan Sager; Alan Dowds; Rick Kemp; Adam Bernstein

ACCOUNTS MANAGER

Mark Mayo: accounts@dealernews.co.uk

ADVERTISING

Alison Payne: tel 07595 219093

Paul Baggott: tel 07831 863837 adsales@dealernews.co.uk

CIRCULATION circulation@dealernews.co.uk

TAIWAN AGENCY

Albert Yang, Pro Media Co: info@motopromedia.com; tel +886 4 7264437

PUBLISHER

Colin Mayo: editorial@dealernews.co.uk

British Dealer News, 10 Daddon Court, Clovelly Road Industrial Estate, Bideford EX39 3FH

The UK government has performed an embarrassing U-turn on its proposed replacement for the widely accepted CE consumer and safety product approval scheme. The UKCA (United Kingdom Conformity Assessed) mark was intended to offer a non-European way for manufacturers to show that their products complied with safety and performance rules. But the obvious handicap of having to comply with two competing standards regimes, with increased costs for testing and packaging changes, has long been a complaint from industry bodies across the economy.

The supposed benefit of the scheme was that it would allow the UK to diverge from European

standards for product safety. In reality, it’s been hard to see any advantages for a massively globalised economy, with products designed to cover global markets rather than being custom produced for small national sectors. But in an announcement made on the 1 August, the UK government has said that CE approval will be accepted in Britain indefinitely, with the previous cut-off date of December 2024 now cancelled. That decision seems likely to hole the UKCA scheme below the waterline, with any business that sells in both the UK and the European Union or European Economic Area likely to stick with just one certification scheme, CE, rather than the UKonly proposed scheme.

IT’S A DOUBLE SUCCESS FOR Triumph, as the Hinckley firm revamps another dealership north of the border and completes one more solus outlet with the most recent “Rolling Stones” corporate retail identity (Paint it Black…) and a plush new workshop.

Triumph Edinburgh, on the Pfeffermill Road, complements the recently re-opened Triumph Glasgow, and Hinckley’s PR folk turned up for the opening day on 22 July with the TE-1 prototype electric bike, a Moto2 765 Street Triple and a Scrambler 1200 XE from the James

Bond film Not Time to Die Devron Boulton from Triumph underlined the long-term nature of the relationship, “Edinburgh Triumph has been a valuable part of the Triumph family for many years, and we are delighted that they have upgraded their dealership to meet the new dealer standards. The dealership always provides high levels of customer service and has a huge offering of the new motorcycle line up”.

Neil Roberts, Edinburgh Triumph MD, added, “We are proud to have been a part of the

For the UK bike trade, the impact of the change should be positive. Most protective riding equipment originates outside the UK, with CE approval in place, and the bureaucracy entailed by an additional layer of approval schemes would have added both time and cost. Indeed, the UKCA scheme has

already added costs to wellorganised brands which were preparing for the switchover well in advance and now seem to have wasted their investment.

For further information, see: www.gov.uk/government/ news/uk-government-announcesextension-of-ce-mark-recognitionfor-businesses.

Triumph family since 1991 and thrive off delivering the latest 2023 models to local Triumph owners and riders. We hope our customers enjoy the new dealership and look forward to meeting them all!”

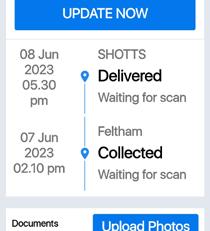

• Documents signed and returned

• We organise delivery date

• Full handover available

Part exchange collected

• Customer in doorway photos

• Before and after photos

• Communication is key

• Regular status updates

Six-digit finance codes

• Professional drivers

• Your own dedicated delivery dashboard to manage your bookings

We’re not about to see the end of the long-running sore that is ‘UK e-scooter legislation’, but it looks like we might be seeing the beginning of the end. The law changes needed to allow currently illegitimate private battery-powered two-wheelers onto British roads, pavements and cycle lanes won’t be seen this side of a general election after the collapse of Liz Truss’s government last autumn killed off the planned Transport Bill. But the Department for Transport is aware it needs to get moving and has awarded a research contract to the Transport Research Laboratory (TRL) to help flesh out plans for the legal use of private e-scooters in public places.

BDN spoke to Dr George Beard, head of new mobility at the TRL, to find out more about the research programme and what it’s aiming for. He first told us that the plan is to legislate for an entirely new class of vehicle – the LZEV – Low-speed Zero Emissions Vehicle – which will provide a legal ‘pigeonhole’ for e-scooters and other future mobility solutions to inhabit. That’s vital because up till now, UK law has insisted that anything with an engine or motor, outside a pedal-equipped bike or a mobility scooter, was a motor vehicle with the

“TRL will be working with the DfT and the wider industry to help deliver a regulatory mechanism to encourage safe, sustainable and inclusive e-scooters,” said Dr Beard. “We believe that e-scooters can represent a genuine modal alternative for many transport users and, if implemented correctly, can be a valuable part of delivering the UK’s decarbonisation goals.”

The TRL research programme will mostly look at the hardware side of e-scooter design, with an eye on safety, sustainability, and accessibility – which means not only that disabled people can potentially use LZEV vehicles but that they won’t have an excessive impact on blind people, for example, in use.

But that may not mean hard and fast design rules for e-scooters, says Dr Beard. “There is a philosophical debate between having a set of regulations which are quite prescriptive – you must have 10in wheels, two disc brakes and a set maximum acceleration – versus something which is more outcomefocused. So if you have a defined performance in terms of stability and braking, and as long as you meet that, it doesn’t matter what your wheel size is. There’s an interesting tradeoff there and potential benefits in terms of

as strict and burdensome as type approval, but then at the other end of the spectrum, we have the e-bike world with a sort of selfcertification. Maybe there’s something in between that feels right for e-scooters, but we haven’t quite worked out exactly how that would operate. We’re keeping those objectives in mind and trying to come up with something that’s as proportionate as possible that works for the industry, but also helps drive good outcomes in terms of safety, sustainability, and consistency. That’s the challenge ahead.”

TRL’s research won’t be looking at other areas of e-scooter legislation, though –issues around where LZEV/e-scooters will be permitted to be used, maximum speeds, age or training restrictions, protective clothing and the like will all be outside its scope –though any relevant findings will be passed on, says Dr Beard.

The research programme is set to run until February 2024 – but we’ll still have to wait until after the next general election for a Transport Bill and any changes in e-scooter law, meaning mid-2025 at the very earliest. In the meantime, expect the current rental trial schemes to continue, the bickering between fans and foes of e-scooters to get even louder, and that long-running legislative sore to

Trailmax RAID is the missing link in the Dunlop adventure tyre line-up. It complements today’s capable adventure and dual-sport bikes with tyre performance to match. Outstanding traction off-road and strong wet grip on-road are paired to balanced wear enabling both the occasional greenlaner and the demanding explorer to face the most challenging journeys.

Authorised & regulated by

The Motor Cycle Industry Association (MCIA), National Motorcyclists Council (NMC) and Transport for London (TfL), together with a host of safety and public transport organisations, have called for long-overdue changes to the motorcycle rider training rules. In a joint letter to the Secretary of State for Transport, Mark Harper, the organisations emphasise the potential safety improvements available from Compulsory Basic Training (CBT), changes which were announced by the DVSA in 2017 – but not acted on.

The signatories to the letter have asked the government to prioritise these changes, which include a variety of technical and practical alterations (see boxout) to the CBT system and the licensing and training environment as a whole.

NMC executive director Craig Carey-Clinch said:

“The changes we call for in our joint letter today were agreed by government several years ago, and their introduction is long overdue. We urge the Secretary of State and the DfT to commence work to implement this positive and potentially life-saving legislation. Our letter marks a moment when the

THE LETTER SIGNATORIES ARE asking the government to implement the following changes to rider training:

y Introduction of a training course to upgrade motorcycle licence entitlements

y The creation of powers to revoke CBT certificates or take other measures for learner riders who have accrued six penalty points

y Restriction of learners who complete CBT on an automatic transmission machine to riding only automatic machines

motorcycle sector, public authorities and road safety organisations have come together to achieve positive change. We urge the government to take note and act in partnership with all parties to make these changes to CBT and also to other areas of motorcycle safety so that a more sustainable and proactive approach can be taken to support casualty reduction for this important mode of mobility, transport and leisure.”

Tony Campbell, CEO at the MCIA, said: “I stand with the letter signatories in expressing our collective concern for road safety and the need to improve CBT. Although it is disheartening that, despite the widespread support, recommended changes proposed by the DVSA following the “Improving Moped and Motorcycle Training” consultation have yet to be implemented, together we can strive for safer roads and the well-being of all road users.

“The time has come for the government to listen and act. Let us work hand-in-hand to bring about the necessary updates and improvements to CBT, ensuring a safer and more inclusive future for moped, motorcycle and other powered light vehicle users across the nation.”

and provision for upgrading entitlement to manual machines for riders with such a restriction

y Establishment of a combined CBT and DAS instructor qualification assessment

y Limiting the time period that down-trained instructors can give instruction

y Changes to the CBT syllabus, including requiring instructors to ensure trainees are appropriately attired for riding

y Condensing the five elements of CBT to four

THE PROBLEM OF FOGGED-UP helmet visors is as old as, er, helmet visors. But now a British firm claims to have developed a high-tech solution in the form of an electrically heated visor insert.

Powered by an external rechargeable battery pack, the clear VISIN insert works for up to eight hours, keeping the visor demisted in

even the very worst conditions.

The VISIN insert has been designed by a West Midlandsbased technology company, Diamond Coatings , which supplies aerospace, medical, military and automotive sectors with specialist custom coating technology. The firm’s Jason Elite developed the idea of the heated visor film, which is

y Strengthening the quality assurance scheme for motorcycle instructors

y Introduction of the theory test as part of or prior to CBT

y Digitising the CBT administration process

y Implementation of earned recognition

The signatory organisations are: MCIA, NMC, TfL, Brake, Roadpeace, Transport North East, Transport for West Midlands, Parliamentary Advisory Council for Transport Safety (PACTS), Transport for Greater Manchester, RoSPA, and Project EDWARD

ROYAL ENFIELD DISPLAYED ITS RANGE OF EIGHT MAIN MODELS AND brought along eight more for demo rides at the inaugural Mallory Bike Bonanza at Mallory Park circuit, Leicestershire, on 15-16 July.

It was the first major outdoor promotion by newly-formed Royal Enfield UK, which took over the importership of the Indian-built singles and twins on 1 May from previous importer/distributor MotoGB.

The large stand and staff of six were sited inside the main gates to the circuit, adding prestige to the event run by Mallory Circuit, the meeting in effect taking over from the Vintage MCC’s Festival of 1000 Bikes. Royal Enfield ran a second display of seven heritage and custom machines in the race paddock. This display included two flat track models based on the modern Scram model, which were ridden in dirt track races held at the circuit on Sunday by RE-sponsored riders Gary Birtwhistle and Paul Young.

Victoria Fulker, Royal Enfield UK marketing manager, told BDN: “As well as showing the new range and the new colours, we also wanted to showcase our history. We also introduced Royal Enfield Finance, offering PCP and HP options.”

With 23 bikes on display, and ten of them in action on track, Royal Enfield was the major presence at the Bonanza. You might say they made a big splash, their bikes and marquees weathering some torrential downpours over the weekend.

Already an official OEM paint supplier for Kawasaki, Triumph and Harley-Davidson, RS Bike Paint has won approval from niche Italian brand Bimota, recently revived by Kawasaki. RS Paint now offers touch-up, aerosol and spray gun paints for Bimota’s entire range of exotic machines as part of its database of 65,000 colour records and formulations.

Phil Allen, MD at RS Bike Paint, said, “To be chosen by such a premium brand is a privilege. We are delighted to be in partnership with Bimota and look forward to providing their customers with a first-class after-sales paint service.”

Pierluigi Marconi, COO of

Preston dealer Bowker Motorrad has partnered with The Waterloo Music Bar in Blackpool as part of its celebration of the 100th anniversary of BMW. The businesses have organised celebration events to mark the occasion and have also produced ‘Overkill’, a Motörhead-themed custom BMW R nineT.

The Music Bar has the only Motörhead-endorsed bar in the UK – Lemmy’s Bar, which inspired the bike’s design, including details such as the Motörhead Snaggletooth logo and Lemmy’s guitar strap on the tank. The Motörhead and Lemmy’s Bar logo have also been stitched into the seat. The bike will be displayed at events throughout Lancashire, promoting The Waterloo Bar and local live music.

John Nichol of Bowker Motorrad said: “We wanted to do something special to celebrate BMW Motorrad’s 100th anniversary. So, we approached Ian at The Waterloo Music Bar. Our idea was to partner with a local business that is making a difference in the local community and dedicate a customised bike to promote their cause. The Waterloo’s passion for live music represented the perfect fit. Ian and his team do an amazing job supporting local bands and charities; we wanted to help.”

Bimota, said, “We have chosen RS Bike Paint as our paint provider due to their industry-wide standing for colour accuracy and first-class customer service. This reflects our mission to provide hand-crafted, high-technology motorcycles to our customers, combined with a comprehensive after-sales programme”.

The Waterloo Music Bar owner, Ian Fletcher, said: “The bike looks amazing. What a great job! It’s great to partner with Bowker Motorrad. Everyone knows about the link between rock music and motorcycles. There’s a deep connection between popular culture and style.

“I suppose you could say it’s a meeting of minds. We both share a passion for delivering exceptional experiences, whether it’s through the world of motorcycles or the power of live music. And, together, we can create more memorable moments for music fans, motorcyclists and the wider community.”

The Motörhead R nineT will be displayed at Bowker Motorrad’s Preston showroom and at local events to help promote The Waterloo Music Bar.

WK BIKES HAS REDUCED PRICES ON TWO OF ITS popular retro-styled machines. The Scrambler 50 sees a £100 cut to £1949 plus OTR, while the Scrambler 125 gets £300 off and is now £1999 plus OTR. The Scrambler 50 is one of just a few 50cc geared motorcycles available and can be ridden by 16-year-olds with a CBT. Both models come with a two-year parts and labour warranty. www.wkbikes.com

AFTERMARKET WARRANTY AND breakdown firm WMS has been renamed, following its takeover by the Opteven Group in 2020. Opteven UK is now in line with the European parent company, which covers nine European markets and has more than 1.5 million warranty end users across the continent. Craig Grant, MD at Opteven UK said, “Transitioning to Opteven is an exciting evolution and will cement our position in the market as a European warranty leader, recognised for our expertise and quality of service”. The rebrand is in name only, the leadership team remains the same and the product portfolio hasn’t changed. Opteven offer warranty options across every type of vehicle, enabling both dealers and customers to choose a combination of coverage and terms to suit their needs. For more information visit: www.opteven.co.uk or contact: ukmarketing@opteven.com.

The Completely Motorbikes retail group has been following a massive growth plan since lockdown. Now the firm has announced further expansion, with a new distribution and retail centre in Quorn, Leicestershire, initially employing 15-20 people. With recent acquisitions in Worcester and Yeovil, that takes it up to 21 locations, covering 16 franchised brands and approaching 250 staff.

the new store on the 29 August stocking another 200 nearly-new superbikes. We’ve taken on CCM and, with a bit of future-proofing in mind, we’re working with Maeving at a couple of sites.”

Ayland points to the Completely online sales and national delivery model, crafted during Covid, as one of the pillars of its success.

THE BACK STREET HEROES CUSTOM championships is set to take pride of place at the CMM magazine Stafford classic bike show this autumn. With classes including Best Chopper, Best Custom, Best Engineering, Best Paint and Best New Skool Custom, the BSH competition will be one of the headline events of the show, alongside hardy perennials such as Henry Cole and Allen Millyard, the Bonhams Auction, live stunt shows, and more than 900 traders. The show takes place on 14-15 October, tickets are on sale now. www.staffordclassicbikeshows.com

BDN spoke to Completely owner Rob Ayland as he was getting set for the opening of the Quorn facility, and he told us about how the firm has grown in 2023. “We’ve acquired two businesses this year to add to our portfolio – Ducati in Worcester, which we kept under the radar until now, and Kawasaki in Yeovil – plus we’ve doubled our footprint in Leicestershire.

“Our Hinckley site has done so well, and then we had the chance of moving into some really nice new premises in Quorn, adding another 12,000sq.ft. We opened

“We have 17 vans running around the country, giving people free nationwide delivery by uniformed drivers in liveried vans, and we don’t charge for it. That’s our USP and we’ve managed to make it work. Online sales since Covid have seen this business grow, and the concept is now embedded in what we do. We’ve mysteryshopped our competitors and even bought bikes off them, and they’re using third-party delivery companies. The customer doesn’t know who they’re buying from, and communication is poor.”

Ayland is happy with how the market is working out overall at the moment, too, despite interest rate rises and cost of living woes. “No

complaints from us. We’re looking at things we can control, not things we can’t, so I think it’s back to the old way of selling and the discipline of being the best. There aren’t people queueing up and throwing money at you like they were a year ago, but stock is plentiful from most manufacturers, not all; we’ve still not got complete stock supply, but on the whole, things are a lot better.

“We’ve also taken the line of not discounting or distressing the market. We’re very much looking at selling motorcycles to people who want to buy them and making our customer service best in class. It sounds like an old cliché, but at the end of the day, if you look at Google, our Hinckley site reviews are the best in the country. Hickley is now selling more than 2000 bikes yearly from a standing start two years ago in lockdown.”

And Ayland reckons there’s more to come for Completely. “We’ve got various things going on over the next six months. We’re far from finished!”

All BS Battery products are available through PARTS EUROPE!

HACKNEY COUNCIL CONTINUES its assault on motorcycling in the London Borough, with its swingeing parking fees plan still on track. It’s issued a final statutory consultation on the policy, despite widespread opposition to the scheme, which will see all bikes – even electric models and mopeds – paying up to £40 a day to park. There’s no consideration for the congestion-busting nature of bikes, their minuscule exhaust emissions, or the impact on riders who are often on lower incomes. As BDN went to press, the council was set to press ahead with its draconian charges.

Both the National Motorcyclists Council and local pressure group Save London Motorcycling, have been working to defeat the plans. A Save London Motorcycling spokesperson said: “We, alongside thousands of others, do not accept this result. The council has a responsibility to make policy that is evidence-based and to monitor the impact of their policies on those who will be affected most. In this case, some of the lowestpaid workers and most vulnerable Hackney residents will suffer hardship as a direct result. The panel’s questions clearly revealed fundamental policy flaws, but councillors still voted to press ahead. They dismissed the £50 a week charges for motorcycle and scooter riders as being affordable and insignificant. We urge everyone concerned with fairness and the lives and livelihoods of Hackney workers, residents, and carers to join our campaign and stand up against this injustice.”

NMC executive director Craig Carey-Clinch added: “The NMC urges Hackney Council to rethink their attack on motorcycle commuting. Riders are a significant body of voters, and the recent result in the Uxbridge by-election should give Hackney and other administrations pause for thought when it comes to policies which are designed to restrict freedom of movement for legitimate two-wheeled transport users in the way that Hackney proposes.”

Pay is a sensitive topic for many, including the government, with various think tanks calling for greater transparency regarding pay structures and decision-making.

It’s important to note, that typically, pay is mandated by market rates. Beyond that, pay, once established, is set through negotiation between employers and employees based on metrics such as organisational and employee performance. This is in sharp contrast to, for example, roles such as GPs, who have clearly defined pay grades and nationally set pay awards.

However, as Lucy Gordon, a director at legal firm Walker Morris, explains, “From a legal perspective, there is no such thing as fair pay, only equal pay. This means that outside of negotiated pay agreements with a trade union, or national pay awards, pay is determined by the employer. It is up to the employer to decide what factors to take into account, whether this is inflation, RPI, or what their competitors are paying.”

She adds that once a baseline pay structure is in place, the employer simply has to ensure that the rate is equal to or above the national minimum wage, and that the structure does not discriminate.

Increasingly there is more innovation around reward offerings and employees tend to now be looking for the full package, rather than cold, hard cash. Indeed, the pandemic has forced many individuals to reassess priorities in terms of work/life balance, families and location.

In an ideal world, Gordon thinks that pay should be more transparent than a one-on-one conversation as to how much employees have contributed over the past 12 months. But she says “pay awards that take into account the volume of hours worked or, for example, revenue generated, can feel unfair to employees who are restricted on hours due to caring commitments or a role which has no direct bearing on revenue creation.” In those circumstances, it could be better to link pay rises to appraisal scores.

BBC reported, WH Smith, Marks & Spencer and Argos all said their breaches were unintentional. That aside, the government’s press release on the breaches noted that the penalties amounted to 200% of the monies owed.

While the NMW has been in place since 1999, the government is also taking steps towards enabling greater levels of pay transparency. In March 2022, it launched a pilot where participating employers listed salary details on job adverts and stopped asking candidates for salary history. The goal was to tackle pay inequality. The government’s view is that listing a salary range on a job advert provides a basis for women to negotiate pay.

A year on and Personnel

The main issue for employers is to ensure that employees receive the national minimum wage (NMW) on average for the hours they work. But NMW law can be complex and a failure to pay it can result in claims for back pay, plus penalties of up to 200% of the underpayment, as well as being included on HMRC’s “named and shamed” list.

The government’s most recent list of employers who breached national minimum wage law, published in June 2023, found more than 200 firms who collectively faced nearly £7m in penalties – on top of which they had to reimburse workers for the lost pay over a decade. Not all breaches were deliberate and as the

Today reported on a survey by a software company, beqom, that found “almost two-thirds of UK employees would be happy to share pay details publicly if it meant better pay equity.”

Further, the publication highlighted a Glassdoor survey that found salary was the most important factor of a job advert for 68% of jobseekers which indicates that it makes business sense to share salary details at the beginning of the application process if an employer wants to attract talent.

The implications for employers is clear: pay fairly, transparently and within the law or risk being unable to attract and retain talent.

There is no such thing as ‘fair’ pay, only equal pay

Despite shocking weather that cancelled the show on Saturday, the 2023 Goodwood Festival of Speed was a massive hit, with 200,000 people through the gates. BDN’s Alan Dowds visited as a guest of Triumph, and had the chance to ride the new 765 Street Triple Moto2 Edition on the famous hill climb course. The Hinckley firm was at the festival alongside Norton, Ducati, Royal Enfield, Yamaha, Aprilia and Honda. And on the racing side, there was a smörgåsbord of two-wheel race legends, from Niall Mackenzie and Mick Doohan to Casey Stoner and Pecco Bagnaia.

But what’s the point of attending Goodwood for a motorcycle manufacturer? On the face of it, it’s a massive car event: riding through West Sussex on the show’s first day, the 15-mile traffic queue was completely insane –and totally bizarre. It’s probably the only traffic jam in the world where Porsches and Lamborghinis outnumber Kias and Dacias!

We asked Yamaha and BMW Motorrad why they attended Goodwood, and both were very positive about the marketing and PR benefits of the festival,

“It is an amazing event, that’s for sure,” said Jeff Turner, marketing manager at Yamaha UK. “Goodwood makes a real effort

were there for the first time, and I think if you’re into motorsport or you’re a petrolhead, it’s got to be on your list of places to go.”

BMW agreed. A spokesperson told us, “Goodwood Festival of Speed is an iconic event allowing BMW Motorrad to showcase its brand to thousands of motorcycle and motorsport fans from the UK and worldwide. For the 2023 festival, we had an eclectic mix of bikes – from custom bikes to the latest production motorcycles –running up the famous hill climb and on display. We interacted with highly engaged festival-goers and reached a significant additional audience through related social media activities.”

But you need to have a great story to tell for the best results, especially online. Turner again: “I think if you’ve got something interesting to show, you get global coverage and coverage outside ‘normal’ media. We showed the prototype DB40, which is part of a strategy of retro-styled machines, and Goodwood’s atmosphere and iconic location was ideal.”

But there was an even bigger story for Yamaha at the 2022 festival, when 500GP legend Wayne Rainey, paralysed since a crash at Misano in 1993, rode his factory Yamaha YZR500. “The Rainey thing was extraordinary,” said Turner. “It’s in the history books now, and everyone will remember the time Rainey came back and rode his bike at

Goodwood. It genuinely brought tears to people’s eyes, and on our social media channels, when we ran the video, interest went through the roof.”

It’s probably fair to say that the Rainey story wouldn’t have happened anywhere else, just because Goodwood has the sheer gravity to attract that level of interest. Where else would you see Schwantz, Agostini, Doohan and Spencer sitting together in the paddock?

“There are two sides to Goodwood,” said Turner. “One is the commercial side, where we showed the DB40, and the other is the racing and heritage side. I think when you move from being a current champion to being a revered champion in the history books, it’s the only place on the planet to go.”

In terms of practicalities, attending Goodwood does need time and administration. It doesn’t necessarily cost a massive sum of cash to be part of the show, but the organisers do expect you to have an interesting, meaningful story to tell. At a more prosaic level, the festival comes at a busy time of year. “There’s always a lot going on in June and July,” said Jeff Turner, “you have to look at the calendar and decide whether you can do it, and have something unique, special, and newsworthy to promote.”

www.goodwood.com/motorsport/ festival-of-speed

Summer is beginning to fade and, as the days get shorter, thoughts turn to the traditional bike show season. Motorcycle Live at the NEC in Birmingham is easily the biggest event in the UK, but after the misery of Covid, it’s facing some serious competition from the likes of the Bike Shed Moto Show in London and the ABR Festival in Warwickshire. And that’s against the backdrop of other changes in the sector: bike firms are now launching products online outside the normal show schedules. That’s partly because they can and partly because there’s more chance of a PR ‘hit’ when you release a new bike in a quiet week in July rather than during a busy show alongside everyone else. On the other hand, despite background pressure from the cost of living crisis, there seems to be a general post-Covid ‘bump’ in people going in-person to gigs, shows, festivals and events.

We spoke to Finlay McAllan, MD at the Motor Cycle Industry Association (MCIA) events arm and asked how Motorcycle Live is progressing and what to expect this year.

“We’re doing extremely well in terms of our trade content, with good manufacturer support,” McAllan said. “We’re up into the mid-40s of brands presenting this year, and we’ve just been speaking to a new manufacturer who is coming for the first time. So while we are at 45 now [mid-August], I see that matching the 50-odd brands we’ve seen in the past.”

And the sometimes-difficult retail section of the show is also

strengthening, according to McAllan. “In terms of retail, we’re seeing an upturn, not new firms signing up, but the companies who continued to support us during the post-Covid years are doing well and expanding accordingly, which is good for the show and the consumer.”

“We’re still working hard to ensure that the ‘Live’ element of Motorcycle Live isn’t just a name. It’s actually a physical thing you can do, and I think there are about eight options to ride currently – all the way from kids’ balance bikes to test rides out on the road. We’ve got our experience adventure track in hall four, and then we’ve got the emerging electric section which was completely booked out last year for the first time. We’ve also got a new Mototrainer feature that’s been in the MotoGP paddock this year. Kawasaki will be sponsoring that, and there will be four simulators on its stand.

“I’m pleased that Black Horse is sponsoring the Trade Day and the free trade tickets. People working in the sector can apply for four free tickets per dealership address. We’re beginning to gain some traction: I understand there was a time when perhaps the dealer network wasn’t completely over-enthused with Motorcycle Live, but in the last decade, it’s changed a lot, and it’s encouraging to see dealers coming back again on trade day, so we’re going to continue to push on that.”

Does the MCIA have a longerterm plan for the next five or ten years? Yes seems to be the answer – but it will be a steady

process. “We’ve got to address the next three to five years,” said McAllan. “We’ve got to make sure the content is relevant, audiences are engaged, and we are bringing the right people through the door.

“But Motorcycle Live is like a supertanker, and you can’t just click your fingers and change direction overnight. I have to make sure that I maintain audience and manufacturer interest. So we’re doing some new things, we’ve moved away from custom bikes, and we have a new feature with Motor Cycle News called ‘Dream Garage’. We’ve got a new stage design and content, and this is just the first of many steps we are taking to refresh the show. A lot is happening in the background in preparation for shows to come.”

Does McAllan see a threat from rival alternative show offerings? “Yes, we’ve got to raise our game. Don’t get me wrong, anyone who presents any motorcycling event must be applauded. We can learn from what we are seeing from these other show organisers, from ABR to regional shows. Things are being done that I can learn from as a show organiser, and that’s a journey we are on now.

“Look at the culture and the community spirit particularly at, say, Bike Shed and ABR. We’ve got that, we just need to develop it and learn the lessons from the guys doing it during the biking season and develop it to make Motorcycle Live the thing to do off-season, that you’ve got to be there.”

Lithium Boost Genius

NOCO leads the way in battery maintenance. Completely automatic from start to finish, notechnical knowledge required.

• Lithium Batteries

• Waterproof Chargers

• Jump Starters

• Boosters

Yuasa has long been recognised as the OE fitment for the majority of motorcycles. With over 40 years of development, every Yuasa motorcycle and scooter battery provides high performance, exceptional quality and proven reliability.

• High Performance MF

• MF

• Yumicron Cx

• Yumicron

• Conventional 12V

• Conventional 6V

• Conventional 12V

• Conventional 6V

• Lawnmower SLA

• Chargers

01394 604040

BRITISH BOUTIQUE BIKE MAKER, Norton has added another outlet to its retail network, this time in the South West of England. Williams Automobiles is, as the name suggests, a car dealer, though it’s a specialist business, stocking Lotus, Morgan and Caterham cars rather than Fords or Vauxhalls. Based in Chipping Sodbury, near Bristol, it fits in with the other dealers Norton has selected: a smaller niche operation with plenty of heritage, style and character. Wiliams will hold stock of the Commando 961 and V4 ranges and offer servicing, accessories and demo rides via a dedicated team.

Williams director Henry Williams said: “We’re delighted to begin our partnership with Norton Motorcycles and make them our very first motorcycle brand available from Williams. It’s a brand with an incredibly rich heritage – much like ours – and has a very exciting product range. We’ve wanted to offer motorcycles for some time, so to have something truly British joining the rest of our made in Britain range is a joy.

“Our conversations with Norton have made it clear from the outset that the company shares our values and our passion for quality, and I look forward to seeing what the future brings as we join their sales partner network.”

Robert Hentschel, Norton Motorcycles CEO, added, “Like Norton, Williams Automobiles has a rich history and is dedicated to showcasing the very best in British engineering. We look for sales partners that share our purpose to provide the highest quality products whilst delivering the very best customer experience. Williams is the perfect candidate, and we’re delighted to be working with Henry and the team as we become their first motorcycle brand.”

The new BSA Gold Star 650 has been a big hit since it was first unveiled at Motorcycle Live in 2021. Thanks to some smart classic styling, quality build and competitive sticker price, it immediately struck a chord with punters and critics alike. BSA struggled initially to get production up and running fully – but the bikes have been coming into the country recently in decent numbers and are out on the road with many happy owners.

And now, the 650 single-cylinder retro-roadster has snapped up a coveted Motor Cycle News award for the Best Retro Bike 2023. According to MCN, its awards “celebrate what we think are the very best motorbikes by category available in the UK right now.” The Gold Star snatched the crown from the 2022 Best Retro class winner, Kawasaki’s Z900RS SE.

Luke Gregory at Lukas Distribution, the BSA UK importer, was delighted with the award.

Aftercare and warranty specialist Ulti-Moto has launched a new product aimed at used bike dealerships, which combines breakdown recovery, a maintenance and repair programme and extensive warranty cover.

“Our Premium Platinum Plan Warranty, available to all dealers – both regulated and non-regulated – includes full UK breakdown cover attended by the AA as well as cover in Europe,” said Ulti-Moto director Steve Keys. “We have worked really hard to bring this to market and would love to see dealers implementing it on all used bike sales, or at least offering it as an upgrade.”

And Keys reckons the plan can help dealers upgrade their retail offering. “I genuinely believe it’s time for motorcycle dealers to be more professional, and offering a 12-month warranty should be the norm, not the exception. A few market-leading

dealers are looking to do this, and, of course, some of the approved used schemes already incorporate a warranty, but they are the exception.

“If we want to be taken seriously as an industry, it’s time we started putting the customer first on used bike sales. A ‘handshake and wink’ warranty is not good enough anymore - especially with the number of distance sales that now take place. Expecting a customer to travel hundreds of miles to repair their bike is unacceptable.

“It also takes the risk of large bills in the future ‘off balance sheet’. With a potential market slowdown in the offing, this could be essential to both dealers’ financial survival and their ability to remain competitive. It’s likely to become a buyers’ market again soon.”

Ulti-Moto 01206 855232 www.ulti-moto.com

“For the BSA Gold Star to win the Best Retro award is a fantastic achievement, especially in its launch year, given the other models and brands in contention within this category. It is an outstanding machine, and I’m so pleased to see the Gold Star get the recognition it deserves. The relaunch of the BSA brand has been incredibly well received, and this award means so much to all the team who have made it happen.”

SINCE THE BANK OF ENGLAND began ratcheting up base rate, 0% finance deals have become a very rare beast. But small bike specialist Mutt Motorcycles, is bucking the trend, with a new interest-free deal. It’s one of three options for new customers who now get a choice from 0% finance, a CBT payment of up to £150 plus a £200 cash discount, or an extra year’s warranty and breakdown cover.

Mutt Motorcycles sales manager Christian Gandar said, “We know everyone has different priorities or requirements when it comes to buying a bike, especially if it’s their first step into the twowheeled world. That’s why we’ve put together a range of different deals. We want to make it easy for anyone and everyone to be able to get on a bike. With our new promotions, hopefully, there is something to suit everyone.”

Customers can choose one of the deals up until the end of October 2023.

www.muttmotorcycles.com

Half-yearly and Q2 results for BMW Group’s motorcycle operations illustrated a nicely lucrative spread of activity. But they attracted no particular attention from Group executive management board chairman Oliver Zipse, who was far too busy upgrading full-year automotive segment forecasts on the back of booming global car sales.

For the six months to 30 June, BMW Motorrad revenue grew by 15.5% to £1.661bn. Associated operating profit was 32.8% higher at £269.8m and operating margin rose to 16.2% from 14.1% in the first half of last year. Pre-tax earnings were 32.1% up to £270.7m and net profit added 13.9% at £191m. Total assets attributable to BMW’s bike business on the Group balance sheet had risen by 7.4% to £1.549bn since the beginning of this year.

Worldwide retail sales of BMW motorcycles, maxiscooters and a token handful of batteryelectric steeds improved by a modest 4.9% to 112,871. Absolutely zilch information on model mix, which indubitably must have been oriented towards premium-priced products, was made available. Individual market performance was also subject to sworn secrecy. However, BDN’s previously published domestic data-mining tracked UK first-half registrations 16% up to 5626 units, for what that’s worth.

Q2 global deliveries to customers advanced by 8% to 64,936, eliciting a 14.4% revenue increase to £853.2m. Operating profit was 24.4% up to £136.4m, pre-tax profit improved by 24.2% to £137.4m and net profit put on 5.7% to £95.9m.

BMW Motorrad didn’t benefit from any full-year outlook upgrade, though. Motorcycle segment deliveries are still predicted to increase “slightly”. Segmental operating margin is, as usual, expected to

A quartet of motorcycle manufacturers aligned on the transatlantic axis have now whistled their way through the first half of 2023. Most have managed to stay in tune. But BDN financial editor Roger Willis hears both rhythm and blues

finish within a range of 8-10%. And RoCE (return on capital employed) should end up between 21 and 26%, again.

The results statement did clarify confusion about why BMW Group half-year net profit took a notional hammering, 50% down to £5.718bn. This was apparently due to a onetime gain of £6.649bn recorded in the same period last year, owing to realignment of the Group’s equity stake in its Chinese BMW Brilliance car manufacturing joint venture.

€-£ currency translation at forex rates applicable on 3 August

German automotive giant Volkswagen Group’s niche Ducati motorcycling operation continued to be a small but gloriously profitable jewel in the crown of its premium brands portfolio during the first half of this year.

Six-monthly revenue from VW’s Bolognabased Ducati outpost climbed by 22.3% to £569m. Operating profit was a muscular 70.9% up to £99.5m. Operating margin rose from 12.6% to 17.6%. And these remarkable figures were achieved with a relatively

modest 4.8% growth in retail sales volume to a record 34,976 units, highlighting the brand’s ability to charge eye-wateringly high prices for its wares.

Setting such an impressive performance in contextual scale, Volkswagen as a whole registered an 18% revenue increase to £134.2bn during the same period. However, adjusted Group operating profit declined by 14.4% to £9.7bn.

The company’s premium brand sector (Audi, Bentley, Lamborghini and Ducati) together turned over £29.3bn, by far the biggest slice (about £26bn) from Audi. Their combined operating profit contribution came in at approximately £2.9bn. Audi’s profit share fell from 83% to 72%. Lamborghini increased from 9% to 13% and Bentley claimed 11%, up from 8%. Ducati took 3%, rising from just 1%.

Smaller but beautifully formed?

Returning to metal bashed and flogged rather than purely banked loot in Wolfsburg or Ingolstadt, total Ducati production in 2023 to date grew by a marginal 1.1% to 36,224 units. Weakest segment by far was the Scrambler sub-brand, where output fell by 12.5% to 5274 and deliveries to customers slumped by 13.8% to 4311. Nevertheless, Ducati vice president for global sales Francesco Milicia flagged 3581 samples of the Scrambler 800 “family” as third best-seller.

Naked/sport cruiser segment production spanning Monster, Diavel and Streetfighter machines also declined slightly, by a narrow 3% to 11,668, and retail uptake only put on 2.2% to 11,397. But some 4299 Monsters grabbed runner-up retail spot worldwide. The dual/hyper segment was effectively leader of the pack. Production of Hypermotard, DesertX and most pertinently Multistrada models only grew by 0.3% to

11,619. But consumer demand went ballistic, leaping by 18.1% to 12,680 bikes rolling out of showrooms. Of these, 6382 were outright best-selling Multistrada V4 steeds in all their various configurations.

The sport segment covering supersport and superbike machinery waving Panigale banners, upon which Ducati loves to be revered, was relatively tame. First-half production stacked on 23.8% to 7663. But retail managed only 1.7% growth to 6588. So there’s a fair chunk of inventory gathering dust somewhere.

Europe strengthened as Ducati’s largest market globally, accounting for 62% of all sales – up from 57% in the first half of last year. Italy’s domestic consumption topped the pile, adding 10% to reach 6639 units. Germany made a 13% gain, selling 4217. The USA reinforced second-tier status, its global share rising to 13% from 12%. US retail headcount grew by 11% to 4504 bikes. Deliveries to aspirant Chinese Ducatisti, including those in Hong Kong, sank to 4% from 7%. Other unspecified markets dropped to a 21% share from 24%.

€-£ currency translation at forex rates applicable on 31 July

A casual glance at Harley-Davidson’s overall numbers on a six-monthly basis promised positivity. But a succession of second-quarter woes had the company crying into its beer.

Half a year in, total turnover had risen by 9.1% to £2.531bn. Revenue from motorcycles and related products was 8.2% up to £2.158bn. The HDFS consumer credit and dealer inventory funding arm put on 17.4% to contribute £362.9m. So far, so good. Only a 35.4% slump in revenue to £11.6m from Harley’s LiveWire electrified spin-off queered the pitch.

However, operating profit was a strangely mixed bag, headlining just 4.3% up to £462.3m. Petrolhead biker earnings accounted for most of that, climbing by 23.3% to £414.9m. But LiveWire posted a £44.2m operating loss. And HDFS profitability plunged by 31.9% to £91.8m, presumably on the back of stiffening allowances for loan defaults. Net profit nevertheless still came in with a 10% gain at £377.1m.

Before moving on to sing from Harley’s seriously afflicted Q2 hymn sheet, there are some half-yearly clues. Global wholesale shipments of motorcycles into its dealer networks during the period grew by a mere 2.4% to 105,171 units. And parallel retail sales worldwide suffered a 4.5% decline to 90,951.

US dealer inventory had risen by 4.4% to 66,817 but domestic sales fell by 7.5% to 56,438. Canada was 6.3% down to 4955, the European-led EMEA region lost 6.1% at 14,037 and Latin America shrank by 10.8%. Sole growth was to be found in Asia-Pacific countries, which were 13% up to 14,406.

The full grievous tale of Q2 began with a 1.6% total revenue shortfall to £1.135bn. Turnover from motorcycles and related products fell by 4.5% to £941.3m, with

associated operating profit 7.9% down to £152.7m. LiveWire revenue took a 43.8% dive to an almost token £5.5m, the brand booking a quarterly operating loss of £25.1m. And although HDFS enjoyed an 18.6% revenue increase to £189.1m, its operating profit plummeted by 31.4% to £46.4m. Combined operating profit across all business sectors was 20.3% in arrears on £174.1m. Quarterly net profit deteriorated by 17.5% to £140m.

Perhaps oddly, Q2 global retail Harley motorcycle sales were positive, 2.6% up to 51,526 units. Key US domestic deliveries also prospered by 1.6% to 32,161, although the EMEA region and Canada were on the back foot.

Boasting a seventh consecutive quarter of growth, half-year performance for Italy’s dominant PTW manufacturer added up to record-breaking results.

Highest-ever net sales revenue generated across Piaggio’s field of operations during this six-month period climbed by 11.3% to pass the billion-quid barrier – £1.003bn to be precise. Turnover specifically from scooters and motorcycles, including related spares and accessories, delivered a 9.2% increase to £818m.

Group operating profit surged by 37.1% to £100.6m, with operating margin improving from 8.1% to 10%. Pre-tax profit was 34.7% up to £84m. An all-time record net profit grew by 43.4% to £55.4m. Net debt stood at £328.9m, benefiting from a 3.3% reduction. Capital expenditure totalled £56.3m, down slightly from £57m in the equivalent period last year.

Powered two-wheeler global sales volume declined marginally by 1.5% to 267,400 units. But the company said a better model mix enhanced revenue and it was particularly strong in the EMEA region (mainly Europe) and the Americas, rising by 15.1%. The Italian market evidently enjoyed 30% growth and North America was 9.2% ahead. Overall, these more than made up for a minor downturn on Asian markets.

A telling factor was the reduction in Q2 wholesale shipments, 10.4% down worldwide to 42,934 units and the US domestic portion of those falling by 14% to 24,229. An enforced shutdown of Harley’s biggest assembly plant at York in Pennsylvania for several weeks in June, owing to recurrent parts shortages, bore an indeterminate degree of responsibility. Losing nearly a month’s production will inevitably also impact on Q3 peak-season product availability.

That wasn’t the only problem, though. Addressing investors on a post-results conference call, Harley-Davidson chairman and chief executive Jochen Zeitz opined that tighter credit terms and conditions for US borrowers are undermining their ability to purchase big-ticket leisure items. “We’ve seen clear impact on demand and affordability with rising interest rates giving pause to highercredit customers,” he said.

However, some US industry analysts think these troubles are of his own making. Quoted by Reuters, one pointed out: “Harley’s price increases and surcharges for popular models have lifted its earnings in previous quarters. But slowing demand is also reflective of consumers becoming less tolerant of price hikes.”

An immediate response from Zeitz has been to revise Harley’s full-year 2023 outlook. He now expects annual revenue growth to be in a range from flat to 3%. HDFS is likely to experience an operating profit decline in a 20-25% range. And LiveWire will incur an operating loss of somewhere between £90m and £100m on the basis of 600-1000 unit sales. $-£ currency translation at forex rates applicable on 2 August

Piaggio claimed to have boosted its scooter segment share in Europe, taking 23.3% of the total market, up from 22.6% in the equivalent six months of 2022. North American scooter share held station at 29.3%. The scooter segment as a whole apparently grabbed a 12.2% improvement in global turnover, with a gain of almost 50% by Beverley, Medley and Liberty high-wheel models and the MP3. Vespa worldwide revenue was more than 10% up. No volume numbers were provided to flesh out the details.

Similarly, besides working to consolidating the presence of its Moto Guzzi and Aprilia motorcycle brands in North America, Piaggio said that both were doing splendidly, without any inconvenient support from actual unit sales headcount. Moto Guzzi’s “strong performance” was based on “turnover up by approximately 30%, thanks in part to the new V100 Mandello”.

Meanwhile Aprilia’s unsubstantiated success was allegedly driven by the RSV4, RS660, Tuono 660 and 1100, and Tuareg 660 models, “the latter also achieving important results in rally competitions”. You’d have to be a true believer to take some of this stuff without a pinch of salt.

Anyway, Piaggio Group chairman and chief executive Roberto Colaninno was very pleased with himself. Concluding his commentary on these results, he said: “For the rest of the year, all our factories will be applying the management productivity system that has enabled us to achieve larger profit margins without substantial price increases.” It’s just a pity we cannot have a clearer picture of what products and how many of them leave those factory gates.

€-£ currency translation at forex rates applicable on 1 August

Boasting a seventh consecutive quarter of growth, half-year performance for Italy’s dominant PTW manufacturer added up to record-breaking results

While already on an impressive growth curve, thanks to evidence of a strong first quarter, the world’s biggest motorcycle manufacturer is still hedging its bets with almost non-existent full-year forecasting.

A flying Q1 start for Honda was led by especially sound figures. Worldwide motorcycle business revenue in the period neatly added 12% to £4.125bn. Operating profit rocketed upwards by 46.7% to £781.9m. Operating margin rose to 19% from 14.5%.

Global wholesale volume put on 5.2% to 4.473 million, an additional 222,000 units. Asia dominated, of course, 5.5% up to 3.781 million. But progress was hindered to some extent by a localised semiconductor supply shortage at Honda’s whollyowned HMSI subsidiary in India, where volume was reduced by 4.3% to 952,000. Vietnam, impacted by a recession, was also in arrears by 4.9% at 506,000.

However, Thailand climbed by a useful 18.3% to 395,000. And Indonesia, fed with product from Astra Honda’s huge AngloJapanese JV affiliate plant in Jakarta, recovered tremendously – 63% up to 1.115 million.

Other emerging regions in total were 5.7% down to 395,000. Among them, Brazilian sales emanating from Honda’s Latin American manufacturing hub at Manaus in the Amazon basin fell by 1.4% to 271,000.

Developed markets were all positive. European sales surged by 46.9% to 119,000. North America was 9.1% up to 120,000. The Japanese domestic contribution improved by 3.6% to 58,000.

Highlighting what it considers to be key products, Honda’s results presentation featured the XL750 Transalp, a global model launched sequentially from Europe since April. And it is already perking up the Indian market in Q2 with a new Dio125 scooter rolled out in July. Inevitably, the brand’s first

Pivoting around the end of June, when Japan’s Rising Sun touches its zenith in the northern hemisphere, Honda, Kawasaki and Suzuki deliver their first quarterly results for current old-school fiscal years. Yamaha is already half way through its more modern calendar year. They are all doing pretty well in the now thoroughly post-pandemic world, according to Roger Willis

mass-market electric PTW got a mention too. This EM1e scooter arrived in Japanese dealers in August, before distribution in Europe and Indonesia.

On the subect of full-year motorcycle business outlook, money was entirely absent. Honda simply reiterated fairly conservative unit sales growth projections, made after the end of its last fiscal year. Overall numbers will hopefully rise by 2.3% to 19.180 million, some 423,000 more machines. Asia should be 1.7% up to 16.375 million. Europe is targeting a 25.4% improvement to 435,000 and North America looking at a 2.4% boost to 470,000.

¥-£ currency translation at forex rates applicable on 10 August

After under-supplying its previously lucrative European motorcycle market last year

for various reasons, Kawasaki’s Powersports & Engine division has now corrected such aberrant behaviour. Q1 results therefore look quite promising.

Divisional revenue was 14.2% up to £788.9m. Accelerating motorcycle shipments to Europe and more off-road/utility vehicles for the US market took due credit, in addition to depreciation of the yen – despite considerably fewer motorcycles sold in SouthEast Asia. Operating profit for the period improved by 11% to £78.3m. Higher revenue was the primary contributor, although rising promotional and fixed costs restricted earnings growth to some extent.

Turnover from motorcycles for developed countries grew by 10.4% to £279.6m, with total Q1 unit sales just 2% up to 50,000. Wholesale volume shipped to Europe climbed sharply by 63.6% to 18,000. But US numbers were

17.4% down at 19,000. Kawasaki plans to ship 220,000 bikes into the developed world during its full year to March 2024.

Emerging markets motorcycle revenue spanning Asia and Latin America declined dramatically by 21.2% to £110.3m, as overall unit sales fell by 37.5% to 45,000. In the Philippines, volume was 37% down to 29,000. And Indonesia dived by 63.6% to a mere 4000. China lost 16.7% at 5000. Nevertheless, an optimistic annual sales target is 360,000 bikes.

Q1 off-road/utility vehicle and personal watercraft shipments, mostly to the USA, were 22.2% up to 22,000 units, eliciting a 44.6% related revenue hike to £249.5m. An indeterminate quantity of general-purpose petrol engines generated a 19.7% revenue increase to £149.5m.

A somewhat arbitary prediction for the division’s full year currently has overall revenue reaching £2.228m, which is 1.7% up on its starting-point estimate in April but 0.2% lower than actual revenue in the previous fiscal year. This doesn’t mean much yet, because the Kawasaki Heavy Industries parent is notorious for multiple forcasting amendments as time goes by… ¥-£ currency translation at forex rates applicable on 9 August

Global motorcycle operations in the first quarter of Suzuki’s new fiscal year were a mixed bag. But at least the rejuvenation of its European bike business seems to be on track. Total Q1 revenue from the segment rose marginally by 0.2% to £477.4m. But operating profit suffered a 22.4% slump to £35.6m. Quarterly production of motorcycles and ATVs rose by 4.9% to 475,000. However, worldwide unit sales were just 1.5% up to 479,000.

Most impressive turnover contribution in the developed world came from Europe, rising by 30.3% to £82m. In contrast, North America was 20.8% down to £65.2m and the Japanese domestic market yielded £30.2m, a 10.7% reduction. Emerging markets across Asia delivered a fairly minor 2.2% increase at £220.9m. Within that, though, India was 23.1% up to £135.3m.

A unit-sales analysis coloured in the monetary picture. Suzuki’s wholly-owned Indian motorcycle plant at Gurgaon in the State

of Haryana not only increased production by 27.8% to 216,000 but also grew sales by 15.4% to 193,000.

Sales in the rest of Asia were 6.4% down to 202,000. China added 2.1% to 123,000 while the Phillipines sank by 14.6% to 41,000. Smaller Asian sources sold 19.8% fewer bikes totalling 38,000. Emerging countries in Latin America were 8.8% lower on 45,000.

Elsewhere, European countries were stars of the show, with combined sales soaring by 33.4% to 13,000, many of them biggerticket bikes. North American

sales in the first half of 2023. Substantially higher profits duly followed, boosted by passing on price inflation to customers and mitigating input cost pressures. The best result is yet to come, though, thanks to muscular upwards revision of full-year forecasts.

Total worldwide revenue from Yamaha-branded motorcycles in the six month period climbed by 16.5% to £3.861bn. Asian turnover led the way, 14.4% up to £2.254bn. Developed markets grew by 15.8% to £1.038bn. Latin America and other emerging markets added 26.8% to £569m. Associated operating profit went ballistic, flaunting 71.7% growth to £339m. Operating margin improved from 6% to 8.8%.

Global unit sales put on 5% to 2.462 million bikes. Asian countries were responsible for 1.961 million of them, a 5.1% overall rise. Star performer was apparently Indonesia, where demand rose by 36%. India and the Philippines achieved respective 8% and 7% gains. Other mainly emerging markets were 3.1% up to 297,000.

sales fell by 9% to 10,000 and Japan lost 12.1% on 12,000.

Suzuki’s full-year forecasts predict annual motorcycle production revised down to 1.5% growth reaching 1.942 million units. Some 121,000 of these will be made in Japan while most of the rest originate in Asia. A mysterious 4000 units are rostered for US assembly.

Worldwide annual sales volume is expected to improve by 3.2% to 1.919 million. Highlights are anticipated 30.1% recovery in Europe, hitting 40,000, and a 20.8% bounce in Japanese domestic sales to 55,000. North America should put on 2.8% at 33,000, Asia is billed to enjoy a 4% gain to 1.589 million. Other unidentified markets are likely to shrivel by 9.5% to 201,000.

¥-£ currency translation at forex rates applicable on 7 August

With semiconductor shortages a thing of the past, Yamaha’s motorcycle business was able to ramp up global shipments and

Among major players in the developed world, European sales volume increased by 12% to 121,000, with its related revenue contribution 21.8% higher at £653m. North American volume grew by 25% to 45,000. Related revenue was 35.8% up to £224m. Only its Japanese domestic market spoiled Yamaha’s party, as units sales volume on home turf dropped by 20.8% to 38,000 and revenue sank by 20.9% to £122m.

Based on such a generally upbeat half-way point performance, revised financial estimates were obviously on the cards. Yamaha’s original motorcycle business 2023 full-year forecast featured total revenue 7.7% higher at £7.607bn. But operating profit had been burdened with a gloomy prediction of 20.9% decline to just £366m. Those figures have now been torn up and replaced.

Instead, annual revenue from bikes is set to rise by 13.6% to £8.034bn. And the operating profit target has been reconfigured as 21.6% up to £564m – a potential all-time record profitability input for the sector, equating to 41.2% of forecast group operating income.

¥-£ currency translation at forex rates applicable on 9 August

With semiconductor shortages a thing of the past, Yamaha’s motorcycle business was able to ramp up global shipments and sales in the first half of 2023

LEGENDARY ENGINEERING DEVELOPER

Ricardo is holding a conference at the EICMA Milan show this year. Riding Future Technologies 8.0 takes place in Milan on Monday 6 November, one day ahead of EICMA, and features a range of guest speakers, including Roberto Canè, e-mobility director at Ducati, and Brian Wismann, VP of product development at Zero Motorcycles. Both will be speaking about how electric power will change biking. Tickets are available now: www.ricardo.com/en.

Specialist commercial lending bank DF Capital, wellknown to many businesses in the motorcycle industry, has appointed Garry Frew as its chief commercial officer.

DUNLOP AT SUZUKA

IT’S A TOUGH AWAY GIG FOR EUROPEANS, BUT Japan’s Suzuka 8 Hours is one of the racing highlights of the year, and Dunlop was working with its major World Endurance teams as usual. The top four spots were all snatched by Hondas – not uncommon at their home race – but the Dunlop-shod BMW Motorrad World Endurance team managed a seventh place and the KM99 Yamaha team finishing 28th in the gruelling race.

TRIUMPH EXTENDS MOTO2 DEAL

TRIUMPH’S ENGINE SUPPLY CONTRACT FOR Moto2 was a surprise when it was announced in 2017, but it’s gone incredibly well for the Hinckley firm. So it’s perhaps less of a surprise that Dorna has signed up for another five year deal. Triumph will continue developing the engine –also used in its 765 Street Triple road bike range – with a new race gearbox and other updates for 2024.

£275K RAISED FOR CHARITY

TWO WHEELS FOR LIFE CELEBRATED A SUCCESSFUL weekend at the Silverstone round of MotoGP, after it raised more than a quarter of a million pounds for its work delivering health care in Africa. The Day of Champions auction alone raised more than £90,000, with additional funds coming from Day of Champions tickets, paddock entry and ride-in sales, two further weekend auctions, the helmet park, a Ducati UK fundraising dinner, Moto X2 two-seater rides and a weekend raffle. Two Wheels for Life has also signed up online celebrity Vanessa Ruck – who posts on social media as thegirlonabike – as an ambassador for the charity. The adventure rider and rally racer will help the charity raise funds for health projects in Africa.

In his new role, Frew will report to DF Capital chief executive Carl D’Ammassa leading the bank’s commercial lending function. He will be responsible for strategy and growth initiatives, to continue supporting manufacturers and dealer customers.

He joins DF Capital from Wells Fargo, where he spent 17 years in a number of senior positions in the US and Europe. For the past six years, he was vice president for strategic relations at Wells Fargo’s commercial distribution finance business. Frew has extensive experience in inventory and distribution finance, as well as financial analysis and business acquisition. He has an executive MBA from the London Business School.

High-end electric superbike brand Verge, has announced a new CFO. Mark Wilson has joined the firm after working as CFO at Aston Martin Lagonda, and his task will be to scale up Verge’s international business. With the company planning to expand into the USA, Wilson will surely be kept busy.

“Verge’s unique innovation, state-of-the-art design, and ambitious vision is attracting enormous interest amongst international investors, despite the challenging economic environment,” said Wilson.

“This is a pivotal moment for the company as it scales up to meet growing customer demand globally. With an order book running well into next year, Verge is primed to exert leadership in the electric superbike category.

I’m thrilled to join such an exciting and dynamic business.”

“Mark’s expertise and experience in the auto industry is extremely valuable to Verge, especially at this stage of our growth,” said Marko Lehtimäki, Verge’s chief technology officer.

“The company’s order book is growing at an accelerating pace, and with the help of future funding rounds, it intends to ensure that delivery capacity is increased to meet the demand. Mark has unparalleled experience in all of these areas. The company is now entering a new era.”

Welcoming him to DF Capital, D’Ammassa said: “Garry’s deep knowledge of our lending products, sectors and customers, as well as his proven track record of career success, make him the perfect fit for this role. I am confident that he will play a significant part in building on our amazing achievements to date, helping us further scale the bank, while putting our customer needs first.”

DAVID EDWARDS IS WELL known at KTM UK – having previously worked there as the Husqvarna brand manager for a seven year stint pre-Covid. He then transferred to the Far East, taking on a role in Singapore with the firm just before lockdown struck – but now he’s back in Blighty, working as dealer development manager.

Edwards is now getting stuck into a few major projects, mostly pushing the existing KTM, Husqvarna Motorcycles, GasGas and WP dealer networks forward. He is also working on incorporating CFMoto and MV Agusta dealers into the network.

Edwards will be in touch with interested dealers, but if you want to jump the queue, he is available at david.edwards@ktm.com.

Eurogrip’s RoadHound Sports Touring tyre and the Protorque Extreme Sports tyre, both quality products at a competitive price and compliment an established range available offering MX, Enduro and Scooter patterns

Bike finance specialist MotoNovo Finance, has announced the expansion of its top ranks with three external appointments to its senior leadership team (SLT). Leanne Christmas joins as conduct and business risk director, Alice Sweet becomes product and proposition director, and James Gearey has been appointed interim commercial and performance director. The new team members will report to managing director Richard Jones, as he continues to reshape the business he joined in February. All three roles have been newly created and will complement the existing SLT.

Leanne Christmas joins from BMW Financial Services and tech firm Alphabet, where she spent seven years as chief compliance officer. She trained at Deloitte as a chartered accountant and previously held several global risk and governance roles within the Barclays Bank group.

Alice Sweet’s appointment sees her join MotoNovo following senior roles at Lloyds Banking Group and the Royal London Group. Most recently, she led Royal London’s UK life insurance business.

James Gearey brings an

Merlin is an independent British brand, redefining the experience on two wheels. Created by riders, for riders, over the last 10 years Merlin has become one of the most sought after brands in the market. As a result Merlin is excited to offer opportunities within the UK for merchandisers.

The merchandisers role can be seen in more detail on the BDN website under ‘Jobs’. Complete with competitive package.

Please send in cover letter and CV to info@merlinbikegear.com

extensive track record, including senior leadership roles at Siemens Financial Services and Aviva. He joins MotoNovo from Covea Insurance, where he was managing director for personal lines and protection.

Richard Jones said: “I am delighted to welcome three new members to my executive team, who bring considerable capability and expertise to help drive our business forward. These are exciting times for MotoNovo Finance, and I am confident we now have the right team in place to help our business embrace the challenges and opportunities that present themselves.”

TECHNOLOGY MANUFACTURER GARMIN HAS BOUGHT THE JL AUDIO company and is set to integrate its premium audio technology into the range of Garmin products. American firm JL designs and makes audio systems for marine, automotive, powersports and other markets, and its know-how is set to improve Garmin’s navigation and Bluetooth equipment.

“JL Audio’s extensive audio experience will create new opportunities to provide premium audio features across a broad range of our markets and products,” said Cliff Pemble, Garmin president. “The JL Audio brand is known worldwide for offering a premium audio experience made possible by their talented and dedicated associates. We look forward to welcoming the JL Audio team into the Garmin family.”

Lucio Proni, JL Audio CEO said, “JL Audio shares Garmin’s vision to deliver unique technology solutions supported by meaningful R&D and engineering. We are thrilled at the opportunity to integrate into Garmin’s product ecosystem. JL Audio will contribute audio knowledge and engineering expertise to create great audio products for many years.”

We are looking for a Qualified Motorcycle/ Scooter Mechanic/Technician

to join our busy West London Vespa Piaggio dealership. Applicants must have a minimum of 3 years' experience. A very competitive salary will be awarded to the successful candidate, which will fully reflect both qualifications and experience.

please apply direct to ragiusscooters@yahoo.co.uk

We are currently looking for the following: An experienced Motorcycle Technician/Mechanic

A competitive salary and benefits package will be awarded to the successful applicant which will reflect both qualifications and experience.

The successful candidate must have experience of modern motorcycle technology and be able to demonstrate an understanding of current diagnostic equipment. The role will be responsible for servicing and repairing predominantly Kawasaki and Suzuki motorcycles.

Please forward your CV with a covering letter to; Dealer Principle, HGB Motorcycles (Ruislip) Ltd, 69-71 Park Way, Ruislip Manor, Middx HA4 8NS or email to brigid@hgbmotorcycles.co.uk

Coventry-based electric retro-bike maker Maeving has taken on its first retail dealership, adding Completely Motorbikes in Gloucester to its existing direct-sales operation.

Completely will line up the neoclassic RM-1 battery-powered commuter alongside the MV Agusta and CCM model ranges, giving customers the chance to see the bikes in the metal. And it’s set to be the first of a small network of dealers selling Maeving bikes across the UK.

Maeving co-founder Seb Inglis-

Jones said: “We believe the new partnership with Completely Motorbikes will be highly beneficial for us in supplementing our ongoing direct-to-consumer operation, giving us greater reach across the country, and greater provision when it comes to test rides and servicing. We are looking to build partnerships with a small collection of premium dealers across the country in time, and we are delighted that the first of these is as strong, successful, and established a dealer as Completely Motorbikes.”

Rob Ayland, owner and MD of Completely Motorbikes said: “We are huge fans of the best of British engineering, and Maeving Motorcycles is a fantastic British marque that we are pleased to stock alongside our other premium brands. We

are particularly proud to be both CCM and Maeving’s first dealer and feel that these two British brands complement each other well, each occupying as they do a unique space within the motorcycle arena.”

www.maeving.com

BMW HAS DOUBLED ITS OFFERING OF BATTERY-POWERED URBAN mobility tools with the launch of the new CE 02, which joins its well-established CE 04 big brother. Seen before in prototype form, the trendy surf-styled ‘eParkour’ scoot comes in either full power 125cc-equivalent 15hp or moped-compliant 5hp/30mph versions, both equipped with riding modes, reverse assist and a USB charging outlet as standard.

The future for high-powered electric motorcycling may still be a bit foggy, but Italian superbike maker Energica is forging ahead with retail outlet growth. And it’s the (also sometimes a bit foggy) green pastures of Limerick, Ireland, which will host the latest member of the Energica family. Sprocket & Hubs Motorcycle Emporium in Limerick is taking on the battery-powered range of high-end machinery in a sub-dealer partnership with the English Electric Motor Co based in Diss, Norfolk.

“We are delighted to expand our electric network into Ireland with the highly reputable Sprocket & Hubs Motorcycle Emporium. This collaboration will further strengthen Energica’s presence in an emerging market, enabling demos to be held within an accessible distance of potential customers in Ireland, under the exceptional service that our new sub-dealer can provide,” said Alec Sharp, owner of English Electric Motor Co.

“We are so excited to introduce Sprocket & Hubs Motorcycle Emporium in our Energica Dealer Family. This agreement opens new possibilities in a new market for our company,” said Energica sales director Giacomo Leone. “For our dealers, Energica means being one step ahead of the times.”

The full-power version weighs in at just 132kg and has a claimed top speed of around 60mph along with a 60-mile range. Keyless ignition, a TFT LCD dash, smartphone link and LED lights round off the tech spec, and the bike also features ABS on the front brake and traction control on the electric drive train, as well as a ‘recuperative stability control’ which reduces rear wheel slip when recharging the battery via the motor while decelerating. The full-power CE 02 has a pair of removable batteries, and charging is via a standard household 13A socket, with an optional 1.5kW fast charger.

In the UK, the full-fat 15hp CE 02 will cost £8450, and the moped version £7450.

After what has been yet another bad month for zero-emissions lobbyists, the batteryelectric PTW sector’s market share in July declined to just 3.9% of all registrations –down from 5.9% in the equivalent period last year. Total electrified volume was 40.1% down year-onyear to 389 units.

The dominant (if that’s really an appropriate word) up-to11kW segment fell by 38.9% to 358 machines. Within that, AMlicenced electric mopeds were 50.6% lower at 158, headed up by 23 samples of the Sur-Ron Light Bee and the more powerful A1 class bikes were 24.9% adrift on 200, led by 42 examples of Sur-Ron Ultra Bee products.

The quantities of machines registered boasting greater power were absolutely trivial. In the 11-35kW range, a mere three 15kW BMW CE 04 maxi scooters were sold, representing a 72.7% reduction. The over-35kW segment was even weaker, 88.2% down to just an unidentified pair of motorcycles. A further 26 units, either exempt or of unknown specification, filled out the overall tally.