This communication is exempt from the General Restriction contained in section 21 of The Financial Services and Markets Act 2000 as an invitation or inducement to engage in investment activity on the grounds that it is made to you as either a certified high net worth individual or as a self-certified sophisticated Investor by reason of the exclusion contained in The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (S.I.2005/1529).

PRESS PLAY →

Our workspaces are underpinned by 3 main factors:

Premium Proposition

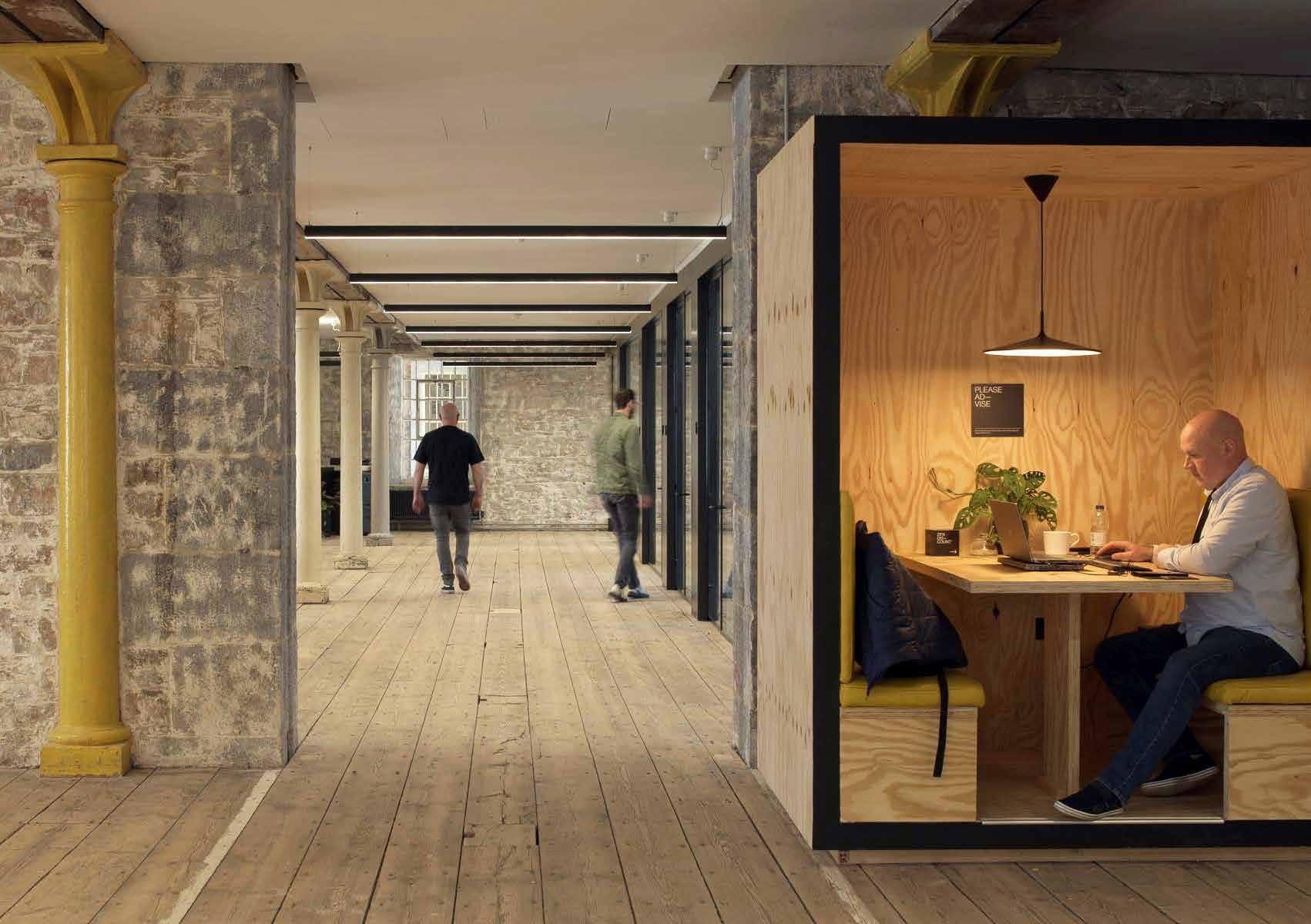

Established Brand 02. 03. 01. BLOCK offers workspaces for the new era of work; versatile, inspiring spaces with style and edge. Spacious coworking zones, cellular private offices, meeting rooms and relaxed lounges provide opportunities to collaborate, innovate and socialise.

Unrivalled Service

The right answer at the right time—taking advantage of a gap in the market and the demand for flexible working solutions (accelerated and amplified by the Covid-19 pandemic), BLOCK offers hybrid environments that perfectly complement working from home.

Re—working how people work.

ACHIEVEMENTS TO DATE

Equity raise for sites 1, 2 & 3 totalling £1.6M

90% occupancy achieved in just 6 months on sites 1 and 2, and in just 3 months for site 3

100% occupancy sustained at all established sites

Clients including KPMG, Babcock, NHS, Universities, Local Government, Francis Clarke, Princess Yachts

1000 gym members and successful coffee shop

TIME LINE

IP established and protected. First two sites contracts signed. Fundraiser executed. Fit out commenced, Funding complete. Taunton site opens.

LOCATIONS

BLOCK will aim to explore opportunities with 50+ potential properties/developers with a view to eventually shortlisting 5—10, ensuring the final locations fulfil the following criteria:

Best in class product – region specific

Difficult to replicate

Sought after location with evidence of demand

Capex contribution from landlord towards fit out

PROSPECTIVE LOCATIONS

Manchester

Liverpool

Birmingham

Worcester

Cardiff

Swansea

Bath

Bristol

Southampton

London

EXISTING

Plymouth

Exeter

Taunton

PROSPECTIVE LOCATIONS

Manchester

Liverpool

Birmingham

Worcester

Cardiff

Swansea

Bath

Bristol

Southampton

London

EXISTING

Plymouth

Exeter

Taunton 800k

Company Structure

BLOCK can demonstrate an EBITDA run rate of circa £2m per annum during 2025.

At this stage a demonstrable EBITDA position in the region of £2.3M with a gross rental income in the region of £6M could result in a wider group valuation of between £15M and £20M, as demonstrated by the following precedent transactions —

Flexible workspace operator acquired for £245m

UK flexible workspace operator BizSpace has been acquired by Sirius Real Estate for £245 million. The deal is based on an enterprise value of £380 million and reflects around a 5.4x multiple of BizSpace’s gross rental income of £45.5 million for the year ending December 31 2019.

Sirius Real Estate is a German-focused firm which owns and operates branded business and industrial sites offering both flexible workspaces and conventional work space across Germany. The company views the acquisition of BizSpace as a strategically valuable opportunity to replicate its German business model in a different marketplace. The company believes that the takeover provides it with a high- quality portfolio in an attractive market that offers organic growth potential for rental income. The firm says that the acquisition offers its shareholders an “opportunity for significant value creation and further long-term growth potential”.

Buyout fund Blackstone buys The Office Group valuing it at $640m.

LONDON (Reuters)

Buyout fund Blackstone BX.N agreed to acquire a majority interest in The Office Group (TOG), valuing the flexible workspace provider at about 500 million pounds ($640 million). Launched in 2003, TOG provides workspace in 36 buildings, mainly across central London, and has a growing client base of more than 15,000 members. Its clients include AOL, Dropbox, Pinterest, British Gas and Santander. “The traditional workspace is being redefined in gateway cities across the globe, as evolving business practices increase demand for flexible office space,” said Anthony Myers, Blackstone’s head of European real estate.

PROFITABLITY TARGETS

MARKET FACTORS

MARKET COMMENT

of companies surveyed identified flexible office space as the most in demand amenity of the future. of office space to be flexible in some form by 2030.

ESSENTIAL LINKS

Forbes

Business Matters Magazine

Yahoo Finance

Harvard Business Review

The Guardian Fastcompany.com

The Times Yourstory.com

The Guardian

AV Magazine

The Times

The New York Times

BBC News

The Financial Times

The Guardian

Hybrid work is now the norm for the year ahead — and beyond. ↗

Flexible workplaces to contribute £12BN to local UK economies in the next decade. ↗

Coworking model thrives post-pandemic. ↗ How Coworking spaces impact employee well-being. ↗

How Coworking spaces help creatives cut costs and stay motivated. ↗

Coworking is making a comeback as companies downsize offices. ↗

Hybrid working to stay with us forever. ↗

Coworking bookings surge 300% in 2023: gofloaters report on hybrid work trends. ↗

IWG reports rise in UK workspace visits as hybrid working takes hold. ↗

Hybrid work could boost Europe’s economy by €113bn. ↗

Hybrid working to become the norm in public sector. ↗

Why are remote corporate workers having more fun? Coworking spaces. ↗

Flexible office space demand to soar over five years. ↗

Hybrid working changes the role of cities forever. ↗

Coworking puts the spark back into office life. ↗

OUR FIRST AWARD —PROJECT OF THE YEAR

The 2023 Michelmores Property Awards celebrates outstanding property and construction projects throughout Somerset, Devon and Cornwall.

OUR SPACES —PLYMOUTH

OUR SPACES —TAUNTON

OUR SPACES —BRISTOL

SITE EXAMPLE — KEY ASSUMPTIONS

PROJECT FUNDING

PROFITABILITY

Breakeven Stress Analysis

KEEP MOVING FORWARD.

Important Information

The content of this promotion has not been approved by an authorised person within the meaning of The Financial Services and Markets Act 2000 (the “Act”). Reliance on this promotion for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all of the property or other assets invested. This communication is exempt from the General Restriction contained in section 21 of The Financial Services and Markets Act 2000 as an invitation or inducement to engage in investment activity on the grounds that it is made to you as either a certified high net worth individual or as a self-certified sophisticated Investor by reason of the exclusion contained in The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (S.I.2005/1529).

01.

In order to qualify as a certified high net worth individual, you must have signed a Statement for a Certified High Net Worth Individual within twelve months ending with the day on which this communication is made.

02.

In order to qualify as a self-certified sophisticated investor you must have signed a Statement for a Self-Certified Sophisticated Investor within twelve months ending with the day on which this communication is made.

sale of securities in any company.

The Offer Shares will be unlisted securities. No application will be made for admission of the Offer Shares to the Official List of the UKLA or to the AIM Market of the London Stock Exchange. Further, neither the UKLA nor the London Stock Exchange has examined or approved the contents of this document. The Offer Shares will not be dealt on any other investment exchange and no application has been or is being made for the Offer Shares to be admitted to trading on any such exchange or market.

Summary of Risks ↓

This offer will not be suitable or appropriate for all recipients of this document. If you are in any doubt about the contents or the action you should take, you should seek the advice of a suitably qualified independent financial adviser who is used to dealing in investments of this kind. You are responsible for making your own decision as to whether or not to invest and its suitability to your personal needs and circumstances.

This communication must not be acted on or relied on by persons who are not high net worth individuals or self-certified Sophisticated Investors. Any investment or investment activity to which this communication relates is available only to relevant persons and will be engaged in only with relevant persons. If you do not qualify as either a high net worth individual, or a self-certified sophisticated investor, you should not take any further action and instead return the document to the person who sent it to you.

This document does not constitute a formal offer, being capable of acceptance, or an invitation to purchase or acquire any securities in any company or any interest therein, nor shall it form the basis of any contract for the

The Offer Shares have not been and will not be registered under the United States Securities Act 1933 or under the securities legislation of any state of the United States and may not be offered or sold in the United States or to any US persons.

The Offer Shares have not been and will not be registered under the applicable securities laws of Australia, Canada, the Republic of Ireland, South Africa, Japan or any other jurisdiction. The distribution of this document in other jurisdictions may be restricted by law and therefore persons into whose possession this Share Offer Document comes should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities law of such jurisdictions. If you are in any doubt as to the action you should take, you are recommended to seek your own professional advice immediately from your stockbroker, bank manager, solicitor, accountant or other independent financial adviser authorised under FSMA.

This is a summary of risks relating to investment into a Seed Enterprise Investment Scheme (SEIS) or Enterprise Investment Scheme (EIS) in Cheriton Group Melville Limited. Other risks may exist, and you are urged to make your own assessment. This list is not comprehensive, and the risks are not presented in any order of importance.

The investor documents have been produced by the Directors of Cheriton Group Melville Limited. We have to make you aware that the Investment Summary has not been approved by a suitably authorised person and is only to be communicated to certified High Net Worth or Sophisticated investors who have agreed to receive such communications. You should satisfy yourself as to the accuracy of the information and financial projections before investing. The investment described in this document will not be suitable for all investors. You have to make your own decision whether to proceed with the investment, and we will not advise you on the suitability to your needs and circumstances.

If you are in doubt about the contents of this offer, or the action you should take, you are strongly recommended to consult a financial adviser authorised under the Financial Services and Markets Act 2000 who specialises in advising on investments in unlisted debt, shares or other securities.

The information provided is based upon current taxation and other legislation, and HMRC practice, and any changes in the legislation or HMRC practice may affect the shares. In particular, if Capital Gains Tax (CGT) rates increase then those Investors who choose to defer a gain may face a higher CGT liability when the deferred gain comes back to charge following the sale of the shares. The value of the tax reliefs will depend on the individual circumstances of Investors. You should seek professional advice tailored to your particular situation.

Risks relating to Cheriton Group Melville Limited

The SEIS or EIS shares will be subject to the trading risks associated with the operation of Cheriton Group Melville Limited and the performance may be affected by factors outside the control of the management team.

Investors should not consider investing if they could require access to their funds. Cheriton Group Melville Limited is an unquoted company that is considered to be higher risk than securities listed on the London Stock Exchange.

Trading risks exist as for any business of this type.

Performance may be affected by factors outside the control of the Directors. There is competition in this market and trends may change quickly, or other innovations may surface. The general state of the economy and government legislation may also have a significant impact on performance.

At the time of writing, the long term effects of the Coronavirus pandemic are unknown. Persistence of strains of coronavirus that are immune to current or future vaccines may affect demand for some of the products or services offered by Cheriton Group Melville Limited.

The company may not achieve the forward statements and forecasts made. The forward statements and forecasts are not a warranty or representation that they will be achieved. Circumstances may determine that they are not achieved. Examples would include lack of customers, the general public demand, the availability of distribution channels, the general economic climate.

Technical and/or supply issues may affect the ability of the company to deliver its products and services.

Past performance and experience of the Directors is not a guide to future performance and may not be repeated.

Investors will hold a minority interest in Cheriton Group Melville Limited and accordingly may have little influence on how the business is conducted, unless they act collectively.

The level of any debt (or any other prior ranking securities) used by Cheriton Group Melville Limited will significantly increase risk.