Business Cares: Diversity in Business

Markets

Together,

Bob Drida Financial Advisor

First Vice President–Wealth Management

Brad Simenz Financial Advisor Senior Vice President–Wealth Management

Greg Pfaff Financial Advisor First Vice President–Wealth Management

By Hunter Turpin, staff writer

A proposal to convert downtown Milwaukee’s 100 East office tower into apartments could receive $14.4 million in tax incremental financing (TIF) from the city, under a plan released earlier this month.

The 35-story building, located at 100 E. Wisconsin Ave., has been steadily vacating since 2020 as office tenants have found

BY THE NUMBERS

space in newer office buildings. After falling into foreclosure, the building was acquired in 2023 by a development team led by Milwaukee-based Klein Development and restaurateur John Vassallo, who have planned to transform the property into a residential building.

The redevelopment is expected to cost $165 million and will

include 373 apartments. Of those, 75 units will be designated as “workforce housing” for tenants earning up to 100% of Milwaukee’s area median income (AMI).

Milwaukee’s Department of City Development (DCD) is proposing a new TIF district to support the project with $14.4 million in TIF.

Additional financing for the 100 East project could come from state and federal historic tax credits.

Vassallo has said construction work could begin this year.

The city’s TIF support is one of the first projects proposed under DCD’s updated TIF guidelines, which were unveiled in April.

That new plan expanded eligibility for TIF to include conversions of obsolete commercial buildings into housing and projects that include workforce housing units, which are units set aside for renters making between 60% and 100% of the AMI.

For reference, 100% AMI in Milwaukee County equals $77,500 for an individual or $110,700 for a family of four, according to federal data. Previously, the city only considered TIF for housing projects that included units for those earning less than 60% of the AMI, which is generally referred to as affordable housing and usually subsidized by the state or federal government.

“This investment demonstrates that the City of Milwaukee is ahead of the curve nationally when it comes to recognizing the need

to get creative and find a solution to repurpose obsolete buildings,” Vassallo said in the release. “Transforming this building into housing reflects a broader vision of how cities can grow thoughtfully. This development would not be possible without the city’s leadership and commitment to the future of downtown Milwaukee.”

More broadly, however, the updated guidelines have not been well received by developers, many of whom say—among other critiques—the city should codify the guidelines as policy to give developers more certainty that their projects would be supported.

HOUSING PROJECT

In addition to the 100 East TIF announcement, DCD announced that it will also be supporting an affordable housing project in the city’s Harambee neighborhood with TIF.

Located at 3116 N. Doctor Martin Luther King, Jr. Drive, the project, known as Compass Lofts, will include 67 housing units, 56 of which will be set aside for renters earning below 60% of the AMI. The project team is led by Martin Luther King Economic Development Corp. (MLKEDC) and EA Development.

DCD is proposing a TIF investment of $1.37 million. The total estimated development cost is approximately $19.8 million.

By Sonia Spitz, staff writer

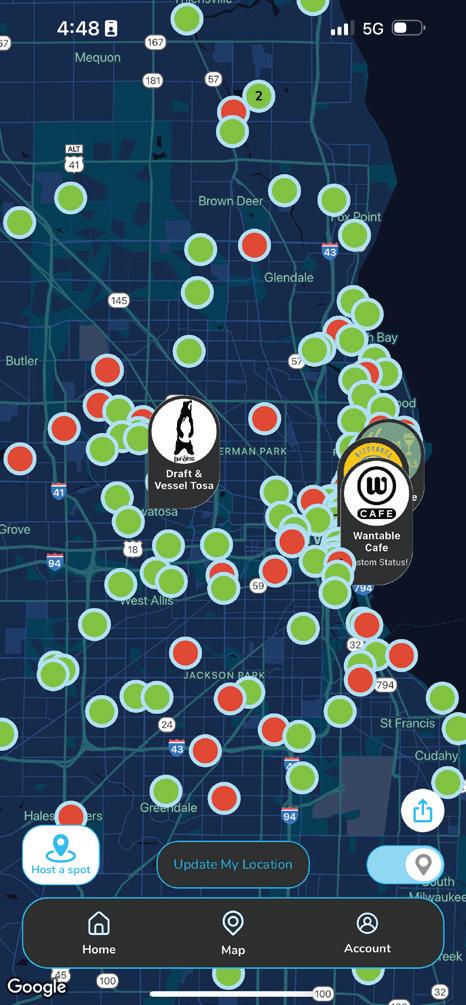

WAUWATOSA-BASED social networking app Sit By Me was created to break the ice between remote workers while increasing revenue for local cafés and co-working spaces.

Founder and CEO Brad Steckart was sitting at a coffee shop writing a paper for graduate school when he looked up and realized three other people were sitting alone, likely doing similar tasks. Four people were occupying four separate tables, leaving nine seats empty but unofficially taken. As the café got busier, Steckart thought there must be a way to optimize café space and create connections between likeminded patrons.

From that experience, Sit By Me, an app that indicates a person’s working status at public venues like cafés and other co-working spaces, was born.

“One in four workers is now remote, and they’re craving more than just productivity –they want people, purpose and places that inspire them,” Steckart said.

Sit By Me uses geographic location services to connect users. Once open, the app displays a map of active users represented by a red or green dot – green indicating “open to chat” and red indicating “working quietly.” Users can down-

load the app for free and upgrade to a premium version with added features for $5 a month.

Steckart, a UW-Stevens Point and UW-Milwaukee alum previously led budget development in the public sector after receiving a master’s degree in public administration. Steckart then transitioned into SaaS (software as a service) work to lead a team at a tech firm that serves state and local governments.

“My focus was helping public sector clients solve complex problems with scalable, user-centered digital solutions,” said Steckart.

“That blend of business strategy and community-minded service is at the core of how I built Sit By Me.”

Sit By Me has partnered with several local businesses including Wantable Cafe and BizStarts Community Market, both in Milwaukee’s Walker’s Point neighborhood, and Haven Cafe in downtown Milwaukee’s Juneau Town neighborhood.

Sit By Me has a presence in Denver, Colorado, and is planning to expand into other peer markets as it gains momentum in Milwaukee. Its next steps include gaining 10,000 users, partnering with 25 businesses and beginning an initial funding round in 2025.

YANCEY STRICKLER

Yancey Strickler, co-founder and former CEO of crowdfunding platform Kickstarter, outlined his career in a keynote speech addressed to more than 550 attendees at the Milwaukee Jewish Federation’s annual Economic Forum. Strickler, who grew up in a town of less than 400 people in southwest Virginia, has played many roles in his life including journalist, music critic, co-founder and author. After leading a multimillion-dollar crowdfunding company for 12 years, he turned his attention to new creative ventures including, currently, Metalabel and Artist Corporations. Strickler, 46, shared lessons learned and his newfound expertise in starting from scratch.

“I’ve come to realize that a lot of the narratives we have about our life are retrospective. I don’t think you live in the shape of a narrative. You just sort of live.”

“Ultimately, starting a business is about, how can you be helpful to other people?”

“If I look back at myself during those initial steps of making Kickstarter, it’s just rampant foolishness. But when you start, it’s so much about what you know and what you don’t know, and then this painful learning of those two things.”

“All of the different struggles I went through were the exact conditions of progress or growth.”

With custom solutions that grow with your business, we have the support you need.

“All the wonder of life is in the open space, which is both what it is and the fact that we can keep rewriting it.”

“You’re going to have those times where you’re in the right pocket, you and the world are moving in synchronicity and it’s all coming so easily. But it won’t always be that way, and who are you then?”

SHAPING YOUR OUTLOOK FOR THE REST OF 2025?

President and co-founder, Craft Beverage Warehouse

“I’ll be watching international economic policy, specifically trade negotiations. Lack of certainty and transparency in trade developments affect our business more than any specific tariffs that are put in place or removed. As large companies hedge prospective trade developments, it moves pricing on commodities that impact our underlying business costs.”

President and CEO, United Way of Greater Milwaukee & Waukesha County

“Our donors trust us to lead solutions to big problems. In 2025, we are transitioning our model to impact based funding. Our goal is to solve important issues faster. Issues like reducing barriers to employment, ending family homelessness, bridging the digital divide, and offering mental wellness support to high school students.”

CEO and board chair, Sellars Absorbent Materials

“We are adding production capacity of our proprietary manufacturing specialty paper technology to support increased demand and future growth. All of the raw materials used in our manufactured products are either made in the U.S. or are presently exempt from tariffs. However, tariffs have had an indirect impact of increasing the costs of our raw materials due to the disruptions, uncertainties, and strong demand for these commodities. Our increased costs are necessitating us to raise prices, which could impact demand.”

President and CEO, Husco

“Uncertainty is top of mind for a company like ours with an international supply chain and facilities. It’s hard to play a game when you don’t know the rules. With trade and tax policy, geopolitical risk and global economic conditions all becoming more difficult to predict, it represents a significant challenge for us and our customers.”

Board chair, Greater Milwaukee Association of Realtors Vice president of leadership and sales, First Weber

“It will continue to be a seller’s market. We do not have enough inventory in most price points, but especially for first-time buyers. The market could absorb about 5,000 more homes for sale. The result is prices are going up, but maybe not as fast as in recent years.”

The latest area economic data.

For the first 5 months of the year, passenger traffic at Milwaukee Mitchell International Airport was down 8.9% to 2,361,301.

Wisconsin’s GDP declined 0.6% during the first quarter of the year.

The number of homes sold in the four-county metro Milwaukee area in June increased by 13.7% compared to a year ago.

Wisconsin’s unemployment rate is at 3.3%

The state’s tourism industry had a $25.8 billion economic impact in 2024, up 3.3% from 2023.

Business analyst, CTaccess 275 Regency Court, Brookfield

ctaccess.com | Industry: IT services and consulting

• Tom Wielenbeck is excited by how quickly IT tools are evolving. “In my training sessions, I often take a real issue a team is facing and build a working solution – sometimes two or three – in a single two-hour meeting. It’s incredibly rewarding.”

• The most challenging part of his current role is the breadth of his responsibilities. He handles the full software development lifecycle, sales, training and support. “I enjoy being the connective tissue across those functions; it gives me a deep understanding of the full impact of our solutions.”

• He’s recently noticed a shift in local businesses preferring to own their IT tools rather than using a subscription model. “Cloudbased and hosted environments are becoming the go-to as businesses recognize long-term savings and flexibility.”

• In his spare time, Wielenbeck enjoys camping, traveling, gaming with friends and cooking.

• He describes himself as a dedicated, improvement-driven worker. “I prioritize deep focus time for complex tasks like development and continuously audit my processes to operate more efficiently.”

• He roasts his own coffee and enjoys making sweet espresso drinks. “When I don’t have energy to make all that though, I will just drink the espresso straight.”

Education:

Bachelor’s, Marquette University

This Q&A is an extended profile from the 2024 edition of Wisconsin 275, a special publication from BizTimes Media highlighting the most influential business leaders in the state. Visit: biztimes.com/wisconsin275 for more.

How do you see the future of your industry?

“7Rivers envisions a future where artificial intelligence and data-driven solutions play a transformative role across industries. Our company is focused on becoming the choice of Fortune 1000 companies, leveraging AI to deliver innovative solutions.”

If you could choose any other career path, what would you want to do?

“No way! I already had that conversation with myself over a dozen years ago and it led me to launch companies like the one I’m driving now: leveraging technology on the edge to drive incredible business value for our customers.”

Do you have a secret talent?

“I would call this more of a superpower: intuitive aptitude. Being able to quickly understand a company’s challenges and opportunities at a level to stand alongside them and create solutions that elevate their business.”

If you could time travel for one day, when and where would you go?

“I have had the opportunity to go to some pretty remarkable places. People that know me well will understand why I named my companies 7Summits and 7Rivers. I love the outdoors. I love the adventure. So, it’s no surprise that I would have loved to have been on a major expedition alongside Roald Amundsen when he drew the first line through the Northwest Passage or made it successfully to the South Pole before anyone else. Those types of

Founder and CEO

7Rivers Inc.

MILWAUKEE

Paul Stillmank is a veteran technology executive and entrepreneur. He is the founder and chief executive officer of 7Rivers Inc., a consulting services firm focused on artificial intelligence and data modernization. The startup raised an initial $4 million seed round in 2023 and an additional $2 million in 2024 to support its expansion. Previously, he founded and grew 7Summits, a Salesforce consultancy, to 200 employees and five appearances on the Inc. 5000 list before selling it to IBM in 2021.

experiences represent what I believe we’re doing in the companies that I’ve created. We are walking a path so that others may follow with the confidence that what some thought was impossible can be achieved, and that the way is safer and clearer by those who helped forge that path.”

What advice would you give to someone going into a leadership position for the first time?

“Focus on vision and purpose first. I cannot emphasize enough the importance of having a clear vision that aligns with the broader mission of the organization. I built 7Summits around a vision of community-driven digital transformation, and now, with 7Rivers, we are leading by staying focused on modernizing businesses through AI and data to drive measurable business value. As a new leader, it’s crucial to inspire and guide your teams with a purpose that aligns with both their individual goals and the company’s goals.”

What is your favorite Wisconsin destination?

“That’s an easy one for me — just picture me sitting in a 1923 cedar and canvas Old Town canoe floating down the beautiful Bois Brule River, fly rod in hand. That river flows through Northwest Wisconsin in Douglas County near the town of Brule, Wisconsin.”

What is your cocktail of choice?

A Sazerac: Rye Whiskey, absinthe, sugar, bitters, lemon or orange.”

Is there anything new that you would like to learn this year?

“Artificial intelligence represents the dawn of a new age.

I deeply believe that and want to continue to learn how AI advancements continue to evolve and help businesses reach new heights.”

What is your definition of success?

“For me, success is building a company that not only grows rapidly but also delivers long-term value and innovationnot just to the companies that we serve, but to the world. Success is unleashing people’s potential and elevating them.”

What are the most important traits to look for when hiring a new employee?

“Curiosity and continuous learning – a desire to stay curious and continually learn, especially in fast-evolving fields like AI and technology. Collaboration and teamwork – the ability to collaborate on a team, contributing to a culture of innovation and collective success. Purpose-driven mindset – a focus on aligning personal work with the broader mission and purpose of the company.”

What’s your favorite movie and why?

“‘A River Runs Through It.’ For those who know me well the ‘why’ is obvious. The fly fishing? Yes. But also, the deep passion to become an expert at something so closely related to the natural world.”

If you could be an Olympian in any sport, what sport would you pick?

“The decathlon. For me, that represents the range of excellence at multiple skills that it takes to be a great athlete, but I related back to building a great company. You need to do so much more than have a great idea.”

BIZTIMES MILWAUKEE: AI continues to have a massive impact on industries across the world. How does Annex see AI as a disruptor in financial services?

SPANO: “The growth and use of AI is causing huge debate throughout the industry and our entire culture. While some in the financial services industry are just now awakening to its potential (and potential danger), we’ve already begun finding collaborative, secure paths to use AI as a supplement to our team. AI isn’t ready, and may never be, to completely listen or interact at a level comparable to our wealth managers. However, it can help perfect our workflows and safeguard our daily work against human error.”

BIZTIMES MILWAUKEE: What do you see as your most important responsibility to your employees?

SPANO: “Our most important responsibility to the Annex team is making sure we’ll be there for them and that we meet our vision together. Annex provides the infrastructure for employees to grow with the firm. In the end, it’s about shared commitment and empowerment. Our best days lie in front of us, and the path forward demands true teamwork, commitment to each other, and support of our shared vision.”

BIZTIMES MILWAUKEE: What do you see as your most important responsibility to your clients?

SPANO: “Our most important responsibilities to clients are two-fold: listening to help them through their financial journey, and aiming to reduce friction (taxes, costs) as a fiduciary while improving outcomes. Personalized planning starts with a deep understanding of the values and objectives of the person we’re planning for, and that starts with listening. Ultimately, our clients tend to experience the best chance for satisfaction when their plan reflects their thoughts, concerns, and goals.”

BIZTIMES MILWAUKEE: Of all the sweeping headlines we’ve experienced this past year, which do you think may have been most overlooked?

SPANO: “In May of 2025, streaming surpassed both broadcast and cable TV in total viewing time in the US. Most people would find that news anticlimactic, since we’ve all noticed the trend. For us at Annex, it’s the culmination of a movement we’ve seen in our clients and potential clients over the past year, an increased reliance on the internet as a source of news, communication, and entertainment across every age group. Every area within Annex Wealth Management, from marketing to reporting and how our clients expect updates, is affected by this change.”

BIZTIMES MILWAUKEE: How does your company foster innovation?

continuous learning and improvement; and we’re steadily seeking clientcentric solutions that address unique client needs and challenges.”

SPANO: “We’ve always done a good job of providing opportunities for every member of our team to collaboratively share innovative ideas and philosophies, and it’s an area we’re focused on even more lately. We continue to embrace and integrate technology into our workflows to improve our level of service and team efficiency; we’re consistently encouraging 17950 W.

THEODORE “TJ” PERLICK MOLINARI has taken the helm as chief executive officer of Milwaukee-based Perlick Corp. during a crucial era of innovation for the bar and beverage equipment manufacturer. He officially became CEO on July 1, representing the company’s fifth generation of family leadership. In his new role, Perlick Molinari will guide Perlick’s long-term vision and strategy. While Perlick is renewing its commitment to making high-quality bar, beverage and refrigeration systems, the manufacturer is also ushering in a period of innovation and modernization, which is reflected by a recently announced company rebrand. Perlick Molinari recently sat down with BizTimes Milwaukee reporter Ashley Smart to discuss the importance of honoring the company’s 107-year-old legacy while modernizing to meet customer demands.

BizTimes: What preparations were taken ahead of you assuming the role of CEO?

Perlick Molinari: “The most important thing to me was having the confidence of all the people in the organization and my family. Without their support, the business isn’t successful. We went on a journey as a family to try to understand what it would take to get that support and if that support existed. Our family is not into putting people in positions just because they’re family members. It’s because it’s the right thing to do for the business, and that’s an approach that we’ve held to for the last 12 years. What’s more important than family support is the support of the organization. We began getting feedback from key people in the organization, asking what they expect to see out of the next leader. We were able to undergo that process, come together as a family, listen and discern, and we aligned around a model of the way that we would like to run the business.”

Theodore

“TJ” Perlick Molinari

CEO Perlick Corp.

8300 W. Good Hope Road, Milwaukee Employees: 250 in Milwaukee, 325 total perlick.com

What does that model look like?

“The CEO is a visionary role. Then you need an integrator, a very hands-on tactical execution person, and then you have the functional leaders who report to that tactical person. A strategy is developed by the CEO and the president, and then it’s executed by the president. My job is to go out and look at what’s coming … to be a voice for the family, from a cultural standpoint, as to what we want to see. That’s what I’m supposed to focus on in my role. And I feel very comfortable doing that.”

What was some of the key feedback you received from company stakeholders?

“They were trying to understand our north star as a company. One key component of that is what we describe as a legacy component. The legacy component includes (the company’s) multigenerational relationships. When we were assessing what we needed in our next leader, what emerged as something that was important to our customers was having a multi-generational touch point, consistency and continuity, so that our customers can expect where we’re going.”

Has anyone in the sixth generation expressed interest in joining the company?

“Our oldest in that generation is 17 years old. The youngest is four. There are 11 kids (total) right now. My cousin Lori is our shareholder director, and she’s in charge of shepherding those kids through the learning process. We don’t have a hard and fast rule yet that you need to go out and seek outside experience. It just so happened to turn out that way for everybody here. I spent 10 years as an attorney outside of Perlick. That is something I would want all of those kids to do. Lori has developed a curriculum where at a certain age, you’re exposed to different aspects of the business – what it is, how it runs – when they’re ready for it.”

What was the purpose of Perlick’s brand refresh announced in February?

“We had come through a challenging chapter in the company’s history, and we needed an opportunity to be a new Perlick. Old companies can become museum pieces. We’re really looking to the future and to innovation. We’ve always been the industry leader, from a standpoint of product, from service, from knowledge, we are the iconic brand. You don’t get that by continuing to rest on what you’ve done in the past. You have to continue to innovate. At our latest trade show, not only did we unveil eight new products, but also eight new technologies at the same time. This team pulled off that almost impossible task with flying colors. We have now become more relevant to our customers and more relevant to the people who work here.”

What are some of Perlick’s newest innovations?

“We’re currently testing geo tracking. In our industry, it’s all about construction schedules and knowledge of where a product is and

what’s in the boxes. Freight companies are notoriously unreliable, so we have nodes in each of the boxes so that we know exactly where those boxes are at all times. They ping the Wi-Fi towers (and provide a location). We are the only ones doing that right now even though that was a huge demand and brought up by the distributors. I was able to say we are the leader. That’s where people expect us to be.”

How often will Perlick launch new products?

“Our goal is one product every quarter. Whether it’s a refresh of a current product or a brand-new product to the market, we want to make sure that as the industry leader, we’re delivering new, innovative products on a regular basis. It’s good for our customers, because usually they’re based on demand from the market.”

How are tariffs and economic uncertainty impacting the business?

“It’s certainly challenging. Domestic suppliers have already taken price increases because they could. That impacts everybody in the next step, which is the manufacturers. We source all of our goods and all those things just got between a 5% and 10% price increase. Our dealer network was hit with between 200 and 300 price increase notices, all effective July 1. Usually, price increases come from different companies at different times of the year, and you can space it out so a dealer can manage it. When everybody comes at the same time, they have to go back and basically refinance the projects. It’s like a 15% increase in cost overall and that’s not something they can eat. People are pumping the brakes as they try to figure out what’s going on with price. It’s causing a lull, which we’re experiencing, and so is everybody else in the industry.”

25_005815_Milwaukee_Biz_Times_JUL_21 Mod: June 12, 2025 10:11 AM Print: 06/16/25 page 1 v2.5

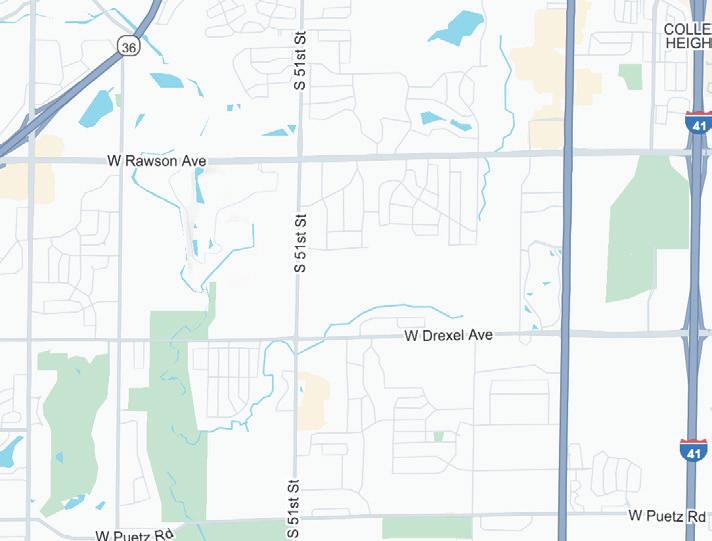

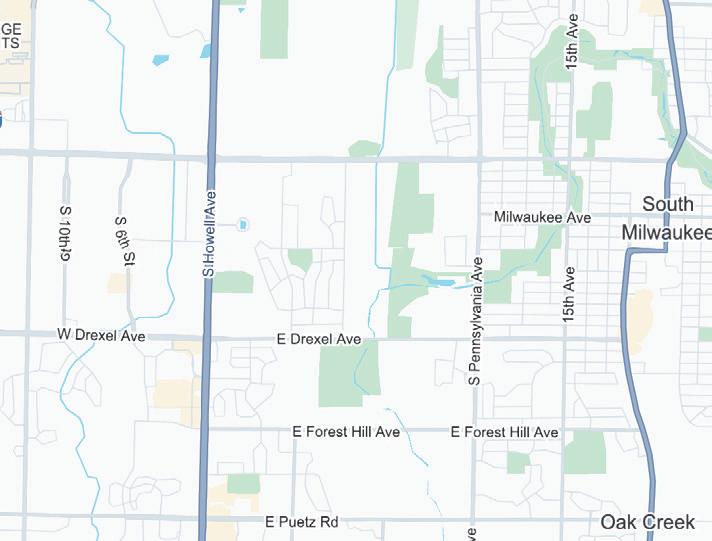

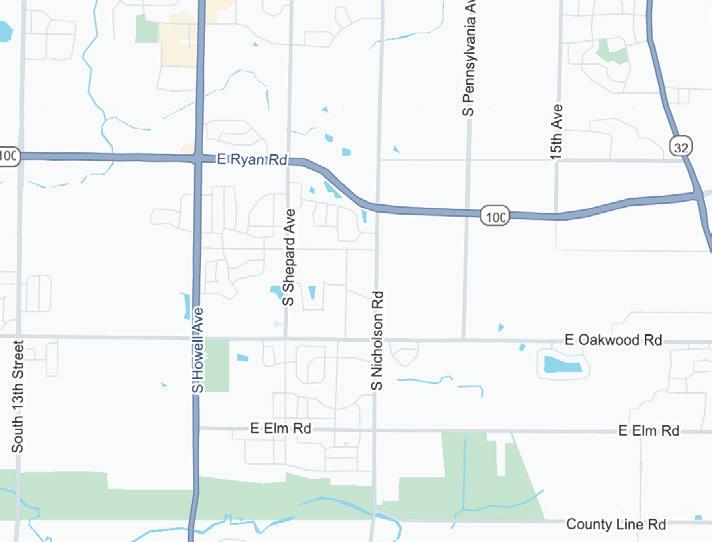

1. Wangard/ Siepmann housing

Costco

Drexel Town Square 4. Derse

5. Buc-ee’s

6. Saputo

7. Modine/ Microbial Discovery Group

8. Krones

9. Yaskawa

10. F Street housing

By Hunter Turpin, staff writer

AT THE

SOUTHERN EDGE

of Milwaukee County, Oak Creek and Franklin are in the middle of a development boom.

A wave of investments – totaling hundreds of millions of dollars – is steadily flowing through the I-94 North-South corridor. These projects are bringing thousands of jobs, hundreds of housing units and new retail options to an area that has historically grown at a slower pace than the more established I-94 East-West corridor through Waukesha County.

In Franklin, Yaskawa America, a Waukegan, Illinois-based manufacturer of motion control and robotics automation systems, plans to

invest $180 million in a new North American headquarters campus. The development will bring 700 new jobs to the city.

Nearby, Saputo, a dairy company based in Canada, continues to expand its footprint. After establishing a 340,000-squarefoot facility in 2021, the company has now opened a second 311,000-square-foot structure adjacent to its current site. The combined investment totals $175 million and will employ around 600 people.

Also, within the past year in Franklin:

» Microbial Discovery Group, a biotech firm based in Oak Creek, opened a 117,000-square-foot facility.

» Modine, based in Racine, is

Map of significant developments in Franklin and Oak Creek

opening a 153,000-squarefoot facility dedicated to its advanced thermal systems group, bringing 200 jobs.

» Krones, a packaging and bottling systems manufacturer, leased a 240,000-squarefoot space near its U.S. headquarters site for a new logistics center.

In Oak Creek, Derse announced plans to build a new 297,000-square-foot facility, moving its headquarters from Milwaukee’s Menomonee Valley. Planned for the southwest corner of West Oakwood Road and South Howell Avenue, the project will be the capstone to the OakView

Business Park.

City officials and industrial real estate experts attribute the growth in both municipalities to the area’s proximity to labor, the freeway and Milwaukee Mitchell International Airport.

“This is just a natural evolution of where Milwaukee County was poised to grow next,” said Andrew Vickers, Oak Creek city administrator. “We’re kind of in the tornado alley of growth.”

Moreover, many of the metro area’s more mature suburban industrial real estate markets have limited land available for new development and the existing stock of buildings are mostly full. For instance, Waukesha County has an industrial space vacancy rate of just 1.3%.

“Try to find 30-plus acres with proximity to labor and a highway. You can’t,” said Jeff Hoffman, principal at Cushman & Wakefield | Boerke. “It’s worth noting, though, that overall the (industrial real estate) market has slowed, and there were quarters last year where even the Franklin-Oak Creek submarket had negative absorption. Still, deals have been getting done and some notable ones at that.”

Both Franklin and Oak Creek have seen more than 20% increases in their populations since 2000, with more housing in the pipeline.

In Oak Creek, Milwaukee-based Barrett Lo Visionary Development is planning an additional 400 apartments at Drexel Town Square in 2026, Milwaukee-based F Street is continuing to expand its Lakeshore Commons housing development and a partnership between Wangard Partners and Siepmann Realty Corp. could bring more than 530 residential units northeast of South 27th Street and West Drexel Avenue.

In Franklin, Mayor John Nelson said the municipality has seen “unprecedented” housing growth in recent years.

Despite this population growth, retail development has been a lagging sector in southern Milwaukee County, according to local retail brokers. But now it’s catching up.

“Milwaukee County and the rest of the metro for the most part are a mature market for most retailers,” said Mike Fitzgerald, principal at Mid-America Real Estate Wisconsin. “Menomonee Falls, Brookfield, Delafield, Grafton, all have reasonable store counts for most of the larger format retailers. Southern Milwaukee County really hasn’t had any ground-up new construction that has occurred over the last decade for those types of retailers, and that’s really where the pent-up demand has started to build.”

That pent-up demand is starting to be released. Buc-ee’s, the Texas-based travel center with a

cult following, has selected Oak Creek for its first Wisconsin location. The 73,000-square-foot store will feature 120 gas pumps and sit near 27th Street and Elm Road. Meanwhile, a Costco store is in early planning stages in Franklin, northwest of Drexel Avenue and 27th Street.

Further, a development connected to Wangard and Siepmann’s housing project in Oak Creek could bring more than 62,000 square feet of retail space and 9.4 acres worth of outlots for development. Known as The Prairie, the project would be one of the few developer-led retail developments in the metro area in several years. Most other retail developments in Oak Creek and elsewhere in recent years have been developed and financed by the end user.

“It will be a good litmus test,” Fitzgerald said. “Seeing if the construction pricing, the rents retailers are willing to pay and the rest of the financials come together.”

Despite the flurry of development, city leaders in both Franklin and Oak Creek say they are being selective with what they approve.

“We say ‘no’ to a lot of projects,” said Vickers. “The ones that materialize are the ones that do fit in our plan and are really quality projects for our community.”

Oak Creek has put limits on certain types of development, including car washes and drivethrus, as well as speculative industrial buildings and distribution centers. Instead, the city is pursuing developments that offer “Oak Creek-sustaining jobs,” Vickers said, pointing to Derse’s new headquarters as an example.

Franklin is taking a similar approach. Nelson said the city is focused on quality commercial development that can broaden the tax base and provide jobs with decent wages.

Both cities are aware that the development boom may only last so long.

“Although we’re announcing a lot of these new greenfield developments and things like that right now, there’s only going to be a 10- or 20-year window where we’re still working on those pieces coming in,” Vickers said.

It has been a wild year politically in the United States under the second term of President Donald Trump, who has delivered on his promise to shake things up in a big way.

Seeking to drastically reduce the U.S. trade deficit, Trump has instituted tariffs on numerous countries, and later delayed, rescinded or changed many of them. Trump recently announced a 25% tariff on Japan and South Korea to begin Aug. 1. The ever-changing tariff situation has created a tremendous amount of uncertainty, putting some businesses into a holding pattern.

The Trump administration has also undertaken a massive crackdown on illegal immigration. The impact of that on the U.S. economy and the labor market are just beginning to be felt.

Earlier this month, Trump signed into law the “Big Beautiful Bill,” which he pushed and includes major tax breaks and spending cuts, that could provide a major boost to the economy. Democrats have complained the tax cuts are heavily in favor of the wealthiest Americans and that cuts to Medicaid and the Supplemental Nutrition Assistant Program (SNAP) will have a devastating effect on lower-income individuals.

With so many big changes sending shockwaves through the country, the U.S. economy slumped during the first quarter, with U.S. GDP falling 0.5%. However, the economy performed better during the second quarter and the Federal Reserve Bank of Atlanta estimates that U.S. GDP grew 2.6% during the quarter.

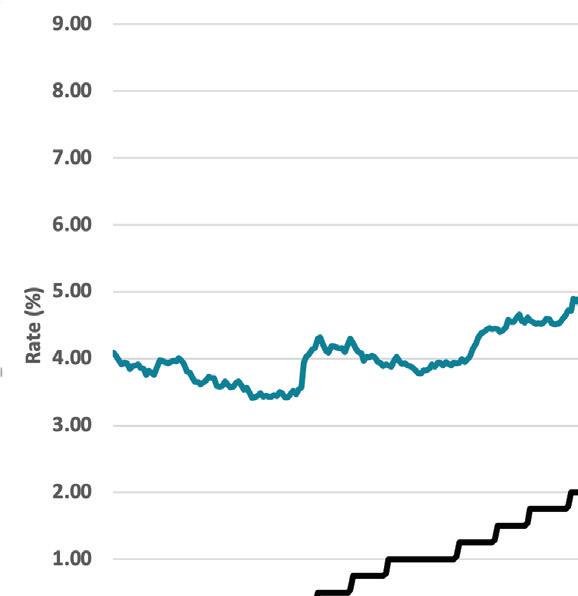

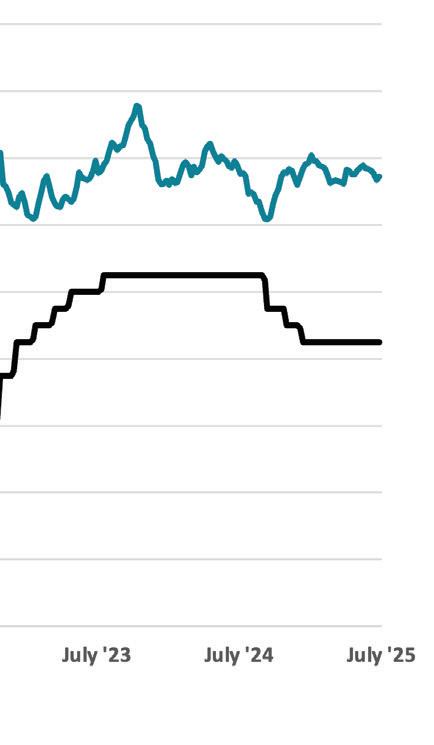

Speaking of the Fed, Trump has also made

waves by calling for the resignation of Federal Reserve chairman Jerome Powell because the Fed has held the federal funds rate steady this year, despite modest inflation with the Consumer Price Index rising only 2.7% in June from a year ago. While Trump has publicly called for interest rate cuts, the Fed has been reluctant to do so anticipating that tariffs imposed by Trump could lead to price hikes.

The Fed hasn’t cut the federal funds rate since 2020 when it tried to boost the economy during the COVID-19 pandemic. It raised interest rates 14 times in 2022, 2023 and 2024 to combat inflation.

Bottom line, there has been a lot to digest during the first half of 2025 and many business leaders are still trying to figure out what’s going to happen next and how to move forward.

Seeking clarity, BizTimes editor Andrew Weiland conducted a Q&A with Brian Jacobsen, chief economist of Brookfield-based Annex Wealth Management, to gain insight into how the events of the first half of the year are affecting the economy and what to expect for the rest of the year.

BizTimes: The U.S. economy got off to a tough start to the year and saw GDP dip slightly (0.5%) during the first quarter. The Federal Reserve Bank of Atlanta projects a second quarter rebound with GDP growth of 2.6%. What’s your take on the current state of the U.S. economy?

Brian Jacobsen: “Tariff uncertainty has led to hesitancy on the part of consumers and business owners. That hesitancy has hurt growth in the near term. Now tariffs are in the headlines again with the Aug. 1 deadline that may or may not

be firm. Thankfully, we now have tax certainty with the passage of the ‘One Big Beautiful Bill.’ It contains a lot of incentives to build and invest in America. Once we get through the tariff drama, the story should be one of reaccelerating growth for the balance of the year.”

Your use of the term “hesitancy” is interesting. We are getting a sense that a lot of businesses have been struggling to deal with uncertainty caused by Trump administration policies during the first half of the year (we’ll address those more specifically later). What do you think?

“According to business and CEO confidence surveys, they’re saying that uncertainty is affecting business decisions and activity. It first showed up in pulling back on expansion plans because they didn’t want to risk expanding in an area where they wouldn’t be cost competitive. Now the uncertainty is being amplified because it is not just about policies, but uncertainty about the health of consumers and their customers. If we can get the

BIZTIMES MILWAUKEE: How do you foster a mission and value-based workplace culture?

KING: “A clear and compelling mission has the power to awaken passion and commitment in people. It creates a shared sense of purpose that guides not only what we do, but how we show up for one another and the community we serve. From a leadership perspective, we actively root our strategic decisions and problem-solving in our values. By staying grounded in both mission and values, we’ve built a workplace culture where people are motivated by meaning.

BIZTIMES: What does innovation and continuous improvement look like at Hunger Task Force?

KING: “At Hunger Task Force, innovation starts with listening. We believe the people closest to the work—our staff, board, volunteers, partner organizations, donors, and especially the people we serve—are our greatest source of insight and inspiration.

By fostering a culture that actively listens to these stakeholders, we stay grounded in real-world needs while remaining agile in how we respond to them. Continuous improvement isn’t just about efficiency or scale, it’s about relevance and impact. When we take the time to listen and respond, we unlock the kind of innovation that advances our mission. It’s not innovation for its own sake; it’s innovation with purpose.”

BIZTIMES: How integral are partnerships with the Milwaukee business community to sustain your operations?

KING: “Collaboration is at the heart of who we are at Hunger Task Force. Our organization is built on partnerships — not just as a strategy, but as a core part of our culture and identity. We understand that ending hunger requires shared effort, vision and responsibility. The Milwaukee business community plays a vital role in sustaining our work. But more than that, we see partnership as mutually beneficial. Businesses that engage with Hunger Task Force have a meaningful opportunity to give back, activate their employees and foster a deeper sense of mission and purpose within their own organizations. These partnerships help companies advance their own goals, strengthen their culture and drive productivity through purposedriven engagement.”

BIZTIMES: What challenges and opportunities do you see on the horizon in 2025?

KING: “As we look ahead, we know many individuals and families will continue to feel the pressure of rising costs, particularly when it comes to housing and groceries. These aren’t abstract issues; they impact family stability. While shifts in federal policy will influence the broader landscape, our focus remains on how we respond thoughtfully, responsibly and with integrity to the needs of our community. At the same time, I see tremendous opportunity in the strength and generosity of Milwaukee. This is a city

that shows up with compassion and a shared belief that everyone deserves dignity and access to healthy food. Partnerships across sectors will be more important than ever. When business leaders, nonprofits, community organizations and residents come together with shared purpose, we can build a safety net that’s not just reactive but also resilient.”

uncertainty resolved early in the Trump administration, we can have more clarity for the balance of it. In a way, this is like ripping the Band-Aid off and we’re just going through the painful part now.”

As for specific issues, let’s start with tariffs. During the first half of the year Trump has imposed numerous tariffs on a host of countries, then he made several changes to the amount of the tariffs and has suspended some. How have the tariffs affected the economy so far this year and what impact do you think they will have moving forward? Are we seeing or are we going to see a severe drop in trade activity?

“The tariffs have had a mixed impact on the economy. While some industries have benefited from the protectionist measures, others have faced increased costs and supply chain disruptions. Moving forward, the uncertainty surrounding tariffs may lead to a cautious approach in trade activities, potentially causing a drop in trade volume. However, administration officials have said that they hope the tariffs can be used as leverage to pry open the foreign markets. In that case, we could see more trade activity. The trade deal with Vietnam is an experiment of whether that will work. The U.S. will impose 20% tariffs on goods from Vietnam, and Vietnam will apply 0% tariffs on U.S. goods. The problem, of course, is whether the people of Vietnam want or can afford what we produce. I don’t see a lot of them buying large U.S. automobiles.”

Another big move by the Trump administration has been the intense crackdown on illegal immigration, including stepping up efforts to deport illegal immigrants. Is this having any impact on the labor market and how do you think the labor market will be affected as this push continues?

“The crackdown on illegal immigration has led to a tighter labor market, particularly in industries that rely heavily on immigrant labor, such as agriculture and construction. As the push continues, we may see increased labor shortages and upward pressure on wages in these sectors. There’s evidence to indicate that the illegal immigration crackdown is also weighing on legal immigration. It takes time, moving and retraining for people to switch from a job in one industry to a job in another industry. We will also likely see continued automation and investment in technology to fill the void. The ‘One Big Beautiful Bill’ lowers the cost to businesses of making that switch. We could continue in this uncomfortable situation where companies are afraid to hire because they don’t know what demand will look like, but they’re also afraid to fire because recruiting and training is time-consuming and costly.”

Led by the work of the new Department of Government Efficiency (DOGE) the Trump administration has directed substantial cuts to federal spending. What impact do you see that having on the economy in the short and long term?

“In the short term, the cuts to federal spending may lead to reduced government services and potential job losses in the public sector. We’re already seeing that in the labor data with federal employment shrinking. There has been a steady decline in federal employment this year that will likely pick up steam. There are also longer wait times to speak to a representative at many government agencies. Even the economic data releases themselves have been affected. The Bureau of Labor Statistics collects data on prices across the country, but with staffing shortages they’ve had to cut back on the amount of data they actually collect. That’s affecting the reliability of those economic indicators. However, in the long term, if the cuts lead to a more efficient government, it could result in a more sustainable fiscal position and potentially lower taxes, which could benefit the economy.”

The Federal Reserve has held interest rates steady this year, despite President Trump’s complaints and criticism of Federal Reserve Chair Jerome Powell. Is the Fed doing the right thing? Do you anticipate any changes to the federal funds rate the rest of the year?

“Inflation isn’t showing signs of accelerating, yet. The labor market is softening, but it’s still solid. Because Fed officials think inflation will slowly build over the next few months, they feel like they are justified in holding rates where they are. I think it’s more likely that companies will end up eating of lot of the tariff costs, which will weigh on profits, which will weigh on growth. If my view is right, then they should cut, but if their view is right, then they should stay on hold. Sometimes you just have to run the experiment and see how things play out. Thankfully, the Fed has demonstrated a willingness and ability to quickly and decisively change course.”

Have we finally gotten inflation under control? Or are tariffs and the labor shortage going to drive up prices? What do you expect for the U.S. inflation rate for the rest of the year?

“While inflation has been relatively stable, imposing tariffs will affect prices, profits, or production. It’s likely to affect all three to various degrees. Thus far, tariffs are showing up in only a handful of consumer prices like imported food items. It will likely show up in car and electronic prices, but the extent to which it will depends on the tug of war between businesses trying to hike prices and trying to compete for market share. That’s why nothing is a foregone conclusion in economics. The labor market shortage is mostly in certain industries, but productivity is improving, so higher wages aren’t inflationary. It would be different if

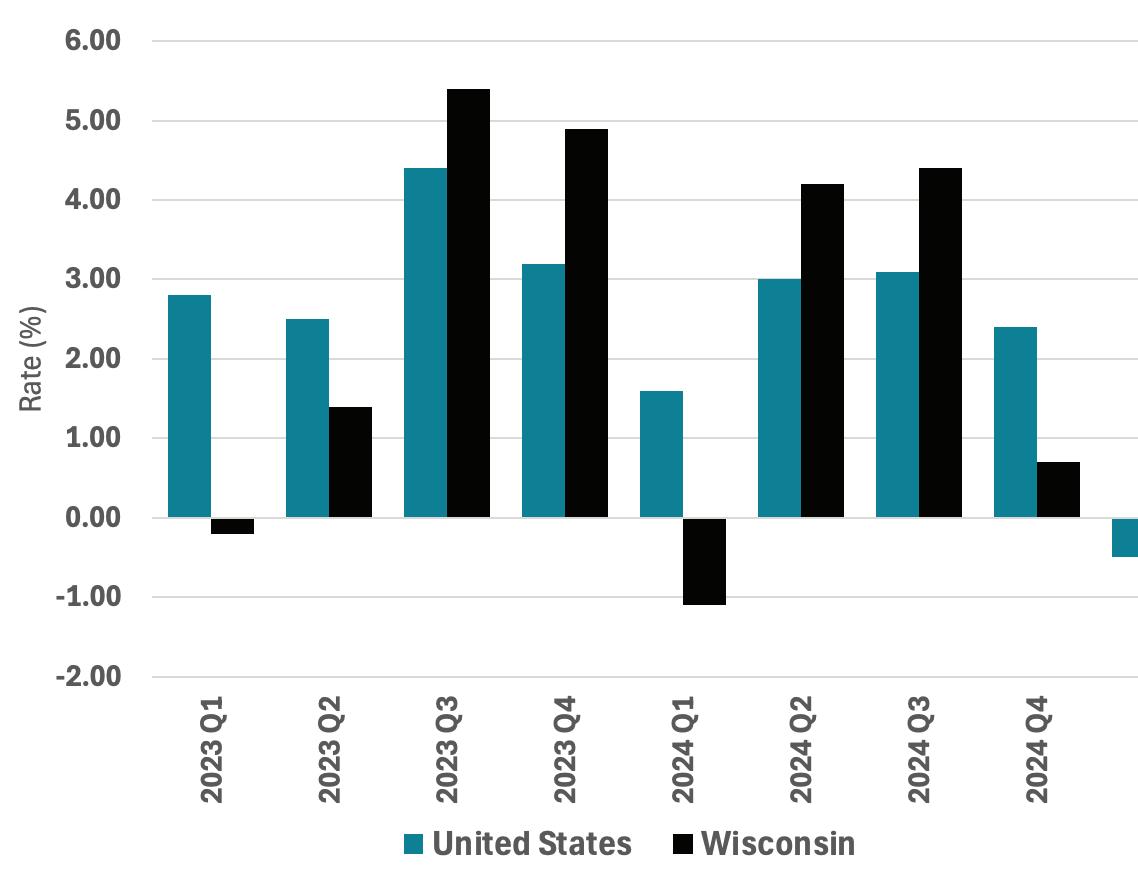

Source: U.S. Bureau of Economic Analysis

BIZTIMES MILWAUKEE: How does your company foster innovation?

COLÓN: We act compassionately, serve humbly and lead courageously. We embrace bold ideas and challenge the status quo, beginning with a culture that engages our colleagues.

BIZTIMES: What did you learn from the last three years? How is your company stronger?

COLÓN: When I became CEO, LSS was facing significant financial challenges. I asked specific questions of my team. Their answers transformed our organization and inspired innovative solutions that brought millions to the bottom line, stabilized infrastructure, expanded impact, and restored colleague morale.

BIZTIMES: What is your favorite success story?

COLÓN: Our financial turnaround represents more than financial success. It reflects trust, innovation, and a renewed commitment to mission. One of my favorite success stories is when a colleague shared that they once considered leaving but now see LSS as a place to grow, not just survive. That’s the kind of impact that matters most.

BIZTIMES: What failure has taught the most?

COLÓN: One lesson came when a highly anticipated major gift didn’t come through. It taught me to be patient. In another case, we received a completely unexpected $1M anonymous donation. It taught me to have faith.

BIZTIMES: Where do you see your company in one to five years?

COLÓN: We will aim to:

» Solidify LSS as a national leader.

» Advance fair pay, responsive government systems and sector sustainability.

» Invest in prevention and early intervention services that address social determinants of health (SDOH).

BIZTIMES: What is your most important responsibility to your employees?

COLÓN: Empowerment and growth - to build a culture where people are valued, supported and inspired to lead from wherever they are in the organization.

BIZTIMES: What is your most important responsibility to your customers?

COLÓN: Compassion is our “secret sauce.” That means we listen deeply to meet the needs of the people we serve with dignity, respect and personalized care.

we saw productivity fall.”

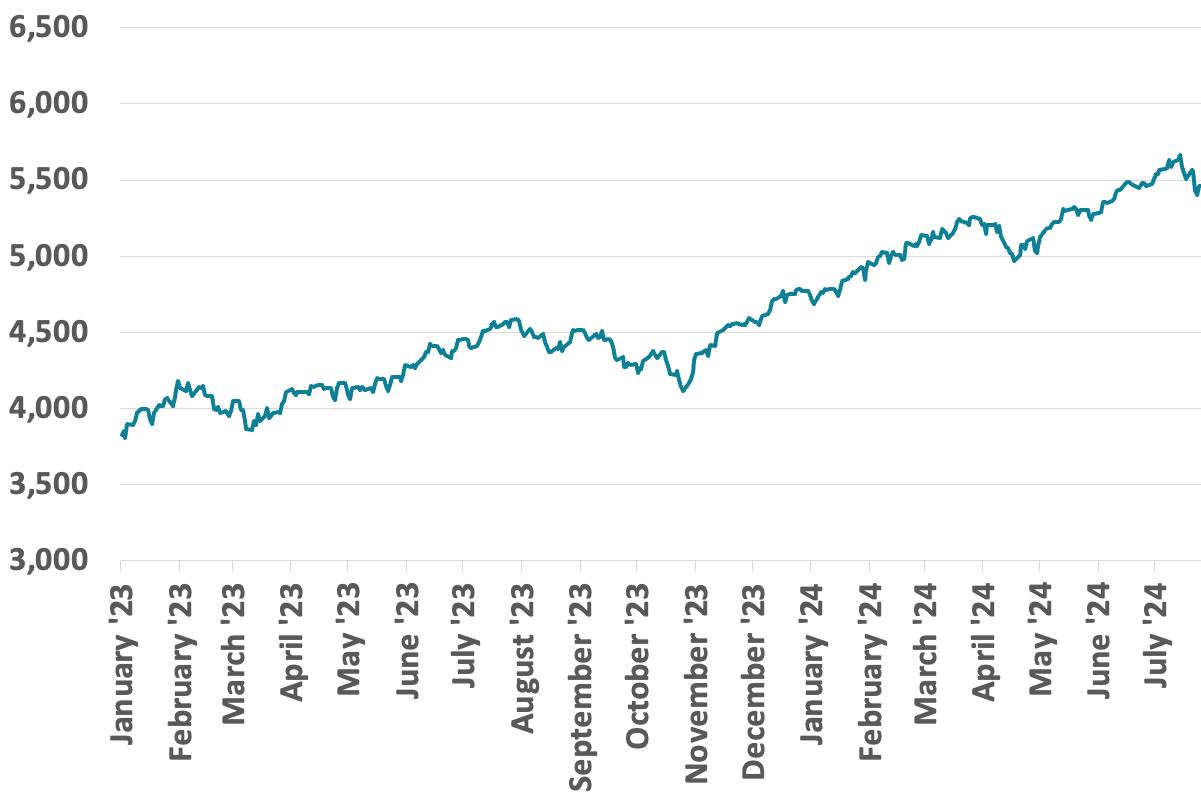

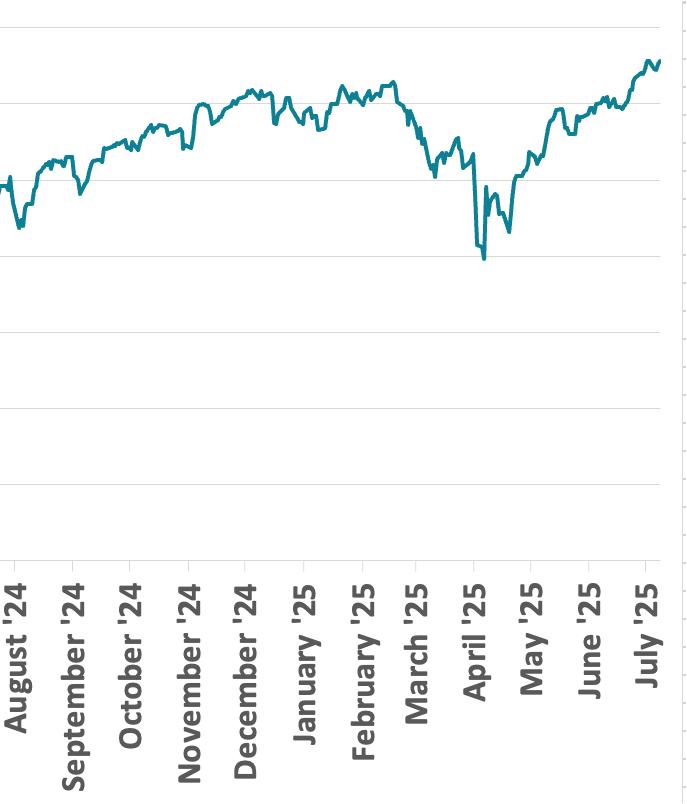

The stock market has been on a roller coaster ride this year. Is that a reflection of the overall economy? What do you anticipate from equity markets for the rest of the year?

“The volatility in the stock market reflects the broader economic uncertainties and policy changes. The market anticipates the economy. Back in early April, the market was expecting a recession, but with the dialing back of the tariffs, the market is saying a recession is a lot less likely. This is why markets can be very confusing. Markets price in expectations and move when reality defies those expectations. For the rest of the year, we can expect continued fluctuations as markets react to new information and policy developments. However, the underlying fundamentals of the economy remain strong, which should provide some support to equity markets.”

Israel’s war against Hamas in Gaza rages on. Israel and Iran have been engaged in fighting, and the U.S. also exchanged hostilities with Iran. What impact will these events have on the economy? Are we in danger of a major global catastrophe that would devastate the world’s economy?

“The conflict in the Middle East poses a risk to global economic stability, particularly through its impact on oil prices and geopolitical tensions. It’s well above my paygrade to say whether a global catastrophe is likely or not. If it happens, a person’s 401(k) balance will be the least of his worries. Assuming we don’t get that catastrophic outcome, remember that the U.S. has been a net exporter of oil for many years. Consumers will feel the pinch of higher gasoline prices and that can affect spending on all sorts of goods and services, but motor fuel is only about 3% of a typical household’s spending. That’s half of what it was during the 2012-2014 period. It’s a situation that needs close monitoring, but it’s more of a political and military issue than a household finance issue.”

Earlier this month, Trump signed the comprehensive “One Big Beautiful Bill” into law. What impact do you think it will have on the economy?

“For most people, passing the bill will feel like a continuation of tax policy, not a tax cut. A higher standard deduction, child tax credit, and no income taxes on tips or overtime are all things that can show up quickly in people’s pocketbooks. They may be subtle for the overall economy, but really significant for the individuals who benefit. For many businesses, the incentives to invest in property, plant and equipment could be a gamechanger for the economy. Those investments can not only

help growth this year but serve as a solid foundation for future growth. There are a lot of legitimate concerns about the deficit effects. Those do need to be dealt with. A deficit of 6.5% of gross domestic product during an economic expansion is unjustifiable. It needs to get to something more sustainable, like 3%, but it doesn’t have to happen all at once. Until that important issue is resolved and there’s a path to 3%, interest rates are likely to keep bouncing around at these relatively high levels. Congress will have another shot at using budget reconciliation in 2026. While 2025 was all about getting a tax deal, 2026 will likely focus on bending the spending curve of the government.”

Looking ahead, after a tumultuous start of the year politically and economically in the United States, do you think the economy will slip into a recession during the second half of the year, or are we going to see growth?

“Despite the challenges, the economy is likely to see growth in the second half of the year. The resilience shown in the second quarter and the potential positive impacts of policy measures suggest that a recession is unlikely. However, continued vigilance is necessary to navigate the uncertainties. President Trump front-loaded a lot of the disruptive policies to try to get those out of the way. By the end of July, which is part of the third quarter, we should have a lot more clarity on policy and businesses can get back to the business of serving clients instead of waiting and watching what policy changes will or won’t happen.” ■

Source: S&P Dow Jones Indices, FRED

Source: Fanny Mae, Federal Reserve, FRED

BIZTIMES MILWAUKEE: What did you learn in the last year?

ANTHONY CRUZ: “In my first year of serving at MATC, my sense of how important the college is to our community has been continually reaffirmed. During my many meetings with our civic leaders, our community-based organization partners and our elected officials, I have gained a true appreciation for how the college impacts our community and how it serves our district residents. Our region needs the skilled graduates we produce to help fill thousands of job openings.

BIZTIMES: What challenge have you learned the most from?

CRUZ: “The last six months have been fraught as the number of federal executive orders involving education proliferates, and Congress mulls possible changes and the potential elimination of funding and federal programs the college depends on. Despite this uncertainty, we are making sure that we are ready under any circumstances to serve our students and our community.

At one point, changes were proposed that would have eliminated Pell Grants for students who are less than half-time and another that would require students to increase credits earned to be considered full-time. We engaged with our lawmakers, U.S. representatives and partners to raise concerns about these proposed changes. We also remain connected to the national associations that advocate for two-year colleges, as well as the Wisconsin Technical College System, to be apprised of developments and updates that affect our students and the taxpayers in our district.”

BIZTIMES: What do you see as your most important responsibility to students and families?

CRUZ: “My most important responsibilities are to ensure that we have up-todate curricula so our graduates have the technical knowledge, professional skills and career essentials our regional employers are looking for. The college currently works with more than 900 partners that help craft courses and curriculum to ensure MATC teaches the skills employers want and need their workers to have. We will always need that expertise. It’s vital we understand the needs of industry and the workforce.

My other important responsibility is to ensure that we have support services in place to help students overcome barriers and obstacles to getting here, staying here and graduating from here. We are always looking for new ways to help everyone succeed.”

BIZTIMES: Do you have any new services to announce?

to equip students with the foundational knowledge and practical skills necessary to pursue biotechnology careers.

The college is also working to establish a peer mentoring program for students to enhance their experience and to provide yet another level of support.”

CRUZ: “MATC will play a pivotal role in advancing personalized medicine in Wisconsin’s federally funded biohealth tech hub by training highly skilled professionals to work with these cutting-edge technologies. The college established a Biotechnology Laboratory Technician program, designed 700

BY ASHLEY SMART, staff writer

LOCAL MANUFACTURERS are working to control what they can in an environment of constant economic uncertainty driven by President Donald Trump’s ever-changing tariff policies.

Since early this year, economic uncertainty has continued to slow down planned capital investments and improvement projects for the state’s manufacturers, said Chris Baichoo, executive director and CEO of Madison-based WMEP Manufacturing Solutions.

“The water is still very murky,” said Baichoo. “Tariffs are really creating a lot of margin compression and input costs are rising. Manufacturers are competing for a smaller slice of the pie.”

Manufacturers are working to implement whatever cost-saving and optimization measures they can now, regardless of the tariffs, said Baichoo.

WMEP is working with local manufacturers to help them reduce lead times, improve their quoting process, boost their speed and optimize the layout of their facilities. The organization can also help manufacturers break into new, profitable markets including life sciences and defense.

“If a company has a fixed amount of resources, we can help them take those resources and put them into markets that are growing,” said Baichoo. “These are things that really help offset tariff costs.”

WMEP is encouraging clients to be pragmatic when considering ways to offset tariffs.

In the coming months, Baichoo believes manufacturers that sought to offset tariffs by purchasing larger inventories of supplies at the start of the year will find themselves in “more dire” conditions as those low-cost materials run out.

Already, WMEP is seeing some clients considering alternatives like redesigning products or swapping out materials. In some cases, manufacturers are evaluating if it’s cheaper to have products shipped into the U.S. in pieces.

“I think we’re on the precipice of it getting to be ugly, because a lot of that (cheaper) material is running out,” said Baichoo.

For metal fabricators like Milwaukee-based Argon Industries, the only realistic tariff mitigation option when the rate for metals is so high is passing along price increases to customers.

Gregory Clement, president of Argon Industries, began receiving a new batch of price increases from suppliers in the middle of June. Most of those increases, which went into effect on July 1, are being passed on to customers because Argon Industries is not able to absorb them.

He’s prioritizing transparency and making sure clients are fully informed of what Argon Industries is paying for materials.

“It’s basically just constantly keeping the customer informed about what’s going on,” said Clement. “When we’re quoting, they see that number, and then as we’re updating pricing, they see that number as well.”

Argon Industries used to be able to lock in materials three months ahead of time to help mitigate price increases. Now, the business is often asked to pay for materials at the time they’re received.

In the coming months, Clement said he’ll be keeping an eye on whether the U.S. finalizes negotiations with Mexico and Canada. Argon Industries has relied heavily on Canada as a supplier of aluminum.

Clement says increasing tariffs on Canadian goods when the country has served as a good supplier “doesn’t make any sense.”

“It is stressful because it affects the whole company,” he said. “We’re constantly monitoring pricing and repricing. It takes a lot of time and effort.”

Ed Paradowski, president of Kenosha-based Reflective Concepts, also finds himself in a tough spot as a local metal fabricator.

Reflective Concepts is one of a handful of

Wisconsin manufacturers using metal that goes through an anodizing process twice, creating a highly reflective material. Reflective Concepts uses that metal to make components for the lighting industry. Globally, only two suppliers in the world sell this highly reflective metal – one is in Germany and the other is in Italy.

When the first round of tariffs was introduced in February at 25%, Paradowski leveraged his relationships with his suppliers to find operational efficiencies like placing larger orders and paying in euros versus dollars. But then, the second round of tariffs at 50% hit in June.

“We’d already grabbed all the low hanging fruit, so any opportunities for further efficiency gains really weren’t there,” said Paradowski. “This was a pure 25% incremental hit.”

Basic metals like carbon steel cost around 45 cents a pound. The metal that Reflective Concepts uses costs between $7 and $10 a pound, not adding in tariffs.

The company has implemented price increases on some items to help cover costs. The increases vary greatly and can be anything from fewer than 5% or up to 20% depending on the product.

While Paradowski supports Trump and his goals of promoting fair trade while bringing manufacturing back to the U.S., he questions the president’s methods in doing so.

“I question it sometimes, because the easiest way to get people to put their checkbook in their pocket and button it is to create uncertainty,” Paradowski said. “Right now, there’s just an awful lot of uncertainty.” n

BIZTIMES MILWAUKEE: How does Palermo’s foster innovation?

NICK FALLUCCA: Innovation is at the heart of everything we do, not just in our products, but in how we run our business. Our mission is to deliver a great pizza experience, and that means embracing innovation across every facet of the company. Whether it’s improving HR processes or finding better ways to price new projects, we empower our people to try new things. In this industry, you either innovate or someone else will do it better.

BIZTIMES: What have you learned from the past three years? How is your company stronger?

FALLUCCA: I think we learn something new every day, but if the last three years have taught us anything, it’s that you have to be adaptable. The retail landscape has changed dramatically. There’s been high turnover, and retailers expect higher margins, more velocity, and for brands to work harder to earn their shelf space. That constant change means having the same conversations with new people over and over. We’ve learned how to drive out inefficiencies without losing what makes us special: our great food, our focus on people, and our commitment to our customers. Those are the things that set us apart.

BIZTIMES: What is your favorite success story?

FALLUCCA: Screamin’ Sicilian continues to be the brand I’m most proud of. We launched it in 2014, and it’s become a multi-million-dollar brand. It’s a premium craft frozen pizza that customers love, and we’ve been able to keep it fresh and growing through continuous innovation.

I’m equally as proud of our people. They are the heart of our business. We’ve been recognized as a “Great Place to Work” for four consecutive years, a recognition based entirely on feedback from our employees, surveyed in eight different languages. That means a lot to me.

BIZTIMES: Where do you see your company in 5 years?

FALLUCCA: Over the next five years, we will continue to innovate, not only in frozen pizza, but across the broader food service industry. Frozen pizza is a $6 billion industry, but the total pizza market is over $60 billion. With our new West Milwaukee facility, we have a tremendous opportunity to serve that market and continue growing. The future looks bright.

BIZTIMES: Does your company have any new products, services to announce?

FALLUCCA: Yes, we’ve recently launched two exciting new products: Cheez-It™ Frozen Pizza and RAGÚ® Frozen Pizza. Both are fun, unique collaborations that are resonating with consumers. We’re also launching Stranger Things Pizza in partnership with Netflix — that’s coming soon and includes a fun surprise for fans of the series.

In addition, we’ve expanded our operations with our new 250,000 squarefoot, state-of-the-art food manufacturing facility in West Milwaukee. This new facility will drive even more innovation in the pizza category and support our continued growth.

3301 W Canal • Milwaukee, WI 53208 414-643-0919 • palermospizza.com

BY SONIA SPITZ, staff writer

UNCERTAINTY CONTINUES to dictate decision-making among employers and employees in the labor market. While most industries are swaying employer-friendly with an abundance of applicants and a lack of open positions, a majority of employers remain hesitant to hire while candidates remain hesitant to make any drastic moves.

Wisconsin’s unemployment rate as of May this year is 3.3%, up from 2.9% in May of 2024, according to the U.S. Bureau of Labor Statistics.

Similarly, the national unemployment rate has risen slightly since May of 2024 from 4% to 4.2%.

While the rise is slow, “it’s definitely creeped up a little bit,” said Ryan Festerling, president and CEO of Brookfield-based QPS Employment Group. “I would say that uncertainty is both political and economic.”

In addition to a slight increase in unemployment, employee turnover is down and retention is up, said Festerling. During years of uncertainty following the COVID-19 pandemic, turnover was high as people faced a rapidly changing job market. Today, people are staying longer at their jobs and exercising more caution in finding a new job as uneasiness returns in light of an unstable economy and new regulations proposed by the Trump administration.

Certain industries have maintained some immunity to the ups and downs of the labor market, including some skills and trade-type sectors like en-

gineering controls, electrical welders and computer numerical control (CNC) jobs. These industries have remained in the candidate-friendly market alongside others like health care and technology.

Unemployment within the skilled trade sector is low and is one of QPS’s most popular picks for job candidates currently. QPS clients are looking at both entry-level skilled trade jobs as well as high-level jobs that require additional training and new proficiency in automation.

“Several manufacturers are looking to automate as much as they can in their facilities,” Festerling said. “If a company finds a way to identify efficiencies and have less low-skilled labor, it actually creates jobs.”

For example, if a manufacturer bought a new $2 million machine, the company would require someone to install it, program it and monitor it, he explained.

Hot industries like finance and accounting and hospitality continue to be challenging for employers as the jobs in those sectors are slightly more nebulous and require more specific credentials to obtain. Those markets are softening, Festerling said.

The narrative of artificial intelligence often revolves around the idea that without embracing it, companies and employees risk falling behind.

The same is now true for the labor market and

its modern hiring practices.

High performers in the job market are widening the skills gap between themselves and the next class of workers by adopting AI into their workflow, said Amanda Daering, founder and CEO of Milwaukee-based talent recruitment firm Newance.

“High performers aren’t just using AI to be efficient, they’re using AI to learn new concepts, to integrate different ideas better,” Daering said. “For those people who aren’t yet embracing AI or are maybe uncomfortable with it, the gap is widening between their performance and their output.”

The surge of AI automation is coming not only with new efficiencies, but with challenges like inauthenticity in applications and mass applying.

Daering agreed that while most industries are swinging employer-friendly, employers are struggling with an increased number of AI-generated applications, which lack authentic content. Those resumes are often being sent in a mass application spree and are not tailored to employers’ criteria.

The Trump administration’s massive crackdown on illegal immigration is sending shockwaves through the labor market as impacted employers and employees struggle to determine what comes next.

Many employers are leaning into their em-

ployee assistance programs or employee resource groups as immigration policy decisions are made on the federal level.

“The uncertainty creates hesitation, and in that hesitation there’s a lot of mistakes that are made,” Daering said. “Even waiting can be a mistake.”

In more severe cases, immigrant workers are being stripped of their residency status or work permitting, Festerling said.

The effect is twofold: a person with residency status who was legally permitted to work in the country is no longer permitted to work here, and the community responds with heightened anxiety.

“They all know someone,” Festerling said. “There’s stories that are being told – some are true, some are not true – but they all cause uncertainty and nervousness.”

At Pewaukee-based VJS Construction Services, the uncertainty has not deterred immigrant employees from applying.

While the number of immigrant applications hasn’t increased, VJS isn’t seeing that pool of candidates dwindle either. VJS hires more U.S. citizens than it does immigrants with legal documentation, but the volume of immigrant worker applications has remained steady “beyond whoever is sitting in the Oval Office,” said Ryan Niegocki, manager of field operations at VJS.

Years ago, employers often focused on mission and purpose when it came to hiring. Today, with a new generation entering the workforce, employers are finding that candidates are seeking more transparency in their roles as well as meaning in their work.

“The clearer and more effective you are about how you’re going to decide, when you’re going to decide, and then to actually decide, will be very

powerful,” said Daering.

In addition to transparency, taking care of current employees, remaining curious about what is happening just outside of the business, and creating flexible work arrangements to combat uncertainty is increasingly important, said Festerling.

“We’re all trying to figure out the triangulation between immigration, tariffs and business uncertainty and how they’re all going to interplay and interact,” he said. ■

BY SAMANTHA DIETEL, staff writer

THE NONPROFIT SECTOR has faced tremendous uncertainty this year amid federal funding cuts.

Since President Donald Trump took office in January, his administration has sought to cut government spending. Many of those funding cuts have affected nonprofit organizations in Milwaukee and across Wisconsin, and the possibility of future cuts loom.

This period of uncertainty for nonprofits is likely to continue for the rest of the year, said Tony Shields, president and CEO of the Wisconsin Philanthropy Network.

“Due to the dynamic process of creating federal legislation and the extensive discussions and information involved, continuous challenges and uncertainty are expected throughout the year,” Shields said.

Nonprofits and social service organizations are experiencing “increased competition for private and philanthropic dollars due to federal funding cuts and fewer federal funding opportunities,” the Federal Reserve Bank of Chicago reported in June.

Organizations serving low-income communities have also reported concern about the impact of reduced federal funding, such as on the availability of child care, according to the Federal Reserve.

The Wisconsin Philanthropy Network has heard similar concerns from grant makers and grantees. Organizations receiving significant federal funding are financially vulnerable, including those addressing basic needs such as food insecurity, housing and health care, Shields said.

“Some nonprofits believe philanthropy can compensate for federal cuts, like during COVID-19,” Shields said. “However, this is unrealistic because pandemic relief was supported by both philanthropy and federal programs. Nonprofits should not rely on this belief.”

Hunger Task Force, Milwaukee’s network of local food pantries, has experienced two significant federal funding cuts so far this year.

In the spring, the U.S. Department of Agriculture canceled the Local Food Purchase Assistance program, which provided funds for food banks to purchase food from local farmers and producers. Last year, Hunger Task Force received $250,000 through the program to purchase vegetables, beef and fish from Wisconsin producers.

At the time the LFPA was canceled, vegetable farmers had already planted seeds for this year’s growing season. Hunger Task Force secured funding from a donor to continue this program through its network of food pantries, said Matt King, CEO of Hunger Task Force.

“Hunger Task Force decided that we were going to honor our commitment to these farmers and make the investment to continue the program, because we believe that it’s the right thing to do,” King said. “These folks are vital to our state and local economy and food system, and their produce provides fresh and healthy foods that pantries don’t often receive.”

Soon after the USDA canceled the LPFA program, the USDA also canceled food bank deliveries nationwide, including $615,000 in food orders for Hunger Task Force. The canceled deliveries to Hunger Task Force included 13 semi-truck loads of milk, chicken, cheese, pork and eggs scheduled to arrive in summer and fall.

Considering the rising cost of groceries, having these healthy foods available at Hunger Task Force pantries is particularly crucial, King said.

The canceled items were also “a significant backbone of the food supply that we had anticipated for the second half of this year,” he said.

“Our food inventory is still strong, and so while those cuts were disruptive, they were not disastrous,” King said. “We have ensured that our local food pantry won’t feel those cuts. We’ve had to do that by making some food purchases, and so it has had a budget impact for our organization, and we have incurred unanticipated expenses as a result.”

Looking ahead, the federal reconciliation bud-

get bill, known as “The One Big Beautiful Bill,” which Trump signed into law on July 4, includes at least $230 billion in cuts to the Supplemental Nutrition Assistance Program, or FoodShare in Wisconsin, and structural changes to the program.

As a result of those impending changes to SNAP, Hunger Task Force expects to see an increase in need and an increase in visits to food pantries, King said.

“This will be the single most devastating program change and cut that food banks and anti-hunger organizations across the country will see,” King said of the cuts to SNAP. “In Wisconsin, over 700,000 people participate in a SNAP program each month, including 240,000 in Milwaukee County, so the cuts in SNAP … will significantly increase hunger in our community, and will be hard to undo in the future.”

The Medical College of Wisconsin, which received $113 million in funding from the National Institutes of Health in fiscal year 2024, faces the possibility of future NIH cuts that could force the academic nonprofit to shrink its research enterprise.

Trump’s budget request for fiscal year 2026 includes an approximate 40% reduction in funding for the NIH, equaling nearly $18 billion. This indicates that significant funding cuts for MCW may be on the horizon, Dr. John Raymond, president and CEO of MCW, previously told BizTimes.

While MCW has strong private sector relationships, those companies “have a limited capacity to absorb such a tremendous cut that is happening in such a short period of time with no warning whatsoever,” Raymond said.

“In the long term, we may well have to shrink our research enterprise,” Raymond said. “If the NIH funding is reduced by 40%, you can’t go to the private sector and make up $20 billion of a deficit, and you certainly can’t pivot quickly to be able to fill those gaps.”

MCW has also had to navigate other threats to its NIH funding this year. In February, the National Institutes of Health issued guidance that capped the indirect cost reimbursement rate for all current and new NIH awards to 15% of grants effective Feb. 10, but a federal judge has since blocked that guidance. The NIH also began terminating research grants related to LGBTQ+ issues, diversity, equity and inclusion and other topics. MCW lost $6.6 million as a result of those grant terminations.

GMF SURVEY REPORTS ‘OVERWHELMING CONCERN’ ABOUT FUTURE

In May, the Greater Milwaukee Foundation surveyed recipients rep-

resenting grantees with open grants and organizations with agency endowments at the foundation to learn whether or how national changes may be influencing their work.

Based on 103 responses to the survey, the top three challenges nonprofits are facing are: an increase in community needs and demands for services; a reduction in funds and/or funding freezes from the federal government; and policy changes affecting services they can provide.

“Although a snapshot in time, the survey results underscore what we continue to hear from nonprofits at sector-specific convenings,” said Carrie Scholz, director of community leadership at the Greater Milwaukee Foundation.

Scholz said the survey responses indicate “an overwhelming concern about anticipated significant cuts on the horizon.”

“The nonprofits express concerns about how these cuts will impact their immediate capacity to deliver services and ultimately remain open,” Scholz said. “Many nonprofits are turning to one another to leverage resources so that community members can access what they need for as long as possible. As a next step, the foundation, in collaboration with others, is exploring how to further support nonprofit partners in this changing environment.”

A recent attempt to cut federal funding for AmeriCorps has also created instability for some nonprofits in Wisconsin.

At the end of April, the Trump administration cut funding for all Serve Wisconsin AmeriCorps programs. As Wisconsin’s AmeriCorps agency and state Board for National and Community Service, Serve Wisconsin administers federal AmeriCorps funding to organizations in the state.

On June 5, a federal judge ordered that the Trump administration must restore AmeriCorps funding to Serve Wisconsin programs, as well as to other states that sued the Trump administration in April, according to Wisconsin Watch reporting.

“We are excited that several programs have been able to welcome back AmeriCorps members who were serving prior to the grant terminations, and that others are moving forward with previously planned summer AmeriCorps members, including positions at youth camps and on conservation crews,” said Jeanne Duffy, executive director of Serve Wisconsin.

Many AmeriCorps members serve in schools, medical clinics, nonprofit organizations or local government offices. These AmeriCorps members provide literacy and math tutoring, substance use

recovery coaching, support for youth who are homeless, and other services. Many AmeriCorps members receive living stipends during their period of service. AmeriCorps was founded in 1993.

In September, Serve Wisconsin announced it had received $12.8 million in AmeriCorps funding for 875 members.

Serve Wisconsin AmeriCorps programs include: Boys & Girls Clubs of Greater Milwaukee’s ClubCorps, College Possible Milwaukee, LibraryCorps, Marquette University’s 414 Fellows, Milwaukee Christian Center’s YouthBuild program, Milwaukee Justice Center’s MJC AmeriCorps, Public Allies Wisconsin, Racine Zoo AmeriCorps program, Teach for America Milwaukee, as well as other statewide programs.

The AmeriCorps cuts created uncertainty for Milwaukee Christian Center’s YouthBuild program, which depended on AmeriCorps funding to support nine members of the program’s current cohort.