INDUSTRIA BIOTEC

Biotech solutions are ready –time to change the paradigm

Frédéric Pâques, CEO of Standing Ovation SA, on why vegan cheese made with microbial casein can help save the climate.

Focus Pharma Services Record pandemic-powered profits for CDMOs & CROs predicted

Clusters

Life Sciences and Industry Magazine Winter Edition 2022 | Volume 21 | 20 € ISSN 2364-2351 | A 60711 |

in Europe Development and scaling-up at Toulouse White Biotech Interview

Crisis? Biotech Financing

Crisis? What

Better Prep!

The Nexera Prep Series Preparative Purification LC improves productivity tremendously via efficient pre parative work using application-specific LC or LC-MS solutions. It provides better prep processes for drug discovery and purification of functional components in pharmaceutical, chemical and food industries.

Ease-of-operation in a flexible set-up supported by flexible choice of detectors and efficient process automation

Simplifies the fractionation programming using the LabSolutions software’s fractionation simulation function

High sample capacity with a reduced footprint through a space-saving design with support of custom racks

www.shimadzu.eu /better-prep Preparative LC System

Fast recovery of highly purified target compounds by automation of fractionation, concentration, purification and recovery

Keep it simple, stay flexible

Why we need the switch from oil to biotech now

Our species – modern humans, or homo sapiens sapiens – has ever striven for progress. And progress was greatly enabled by fire, a fundamental chemical phenomenon that allows the fast release of large amounts of energy. In the modern age, industry began tapping into coal, oil and more recently shale gas as ‘feedstocks’ (known in biology as ‘substrates’), using heat from their fire, and high pres sure, to crack substances to yield yet other fuels and base chemi cals. Those industries use ‘prefermented’ compounds as an energy source. But processing conditions are harsh, while side-products are often unknown and, in many cases at least, toxic. The exploitation of fossil resources allowed economic growth during an era when by-products and the long-term effects on our species and the en vironment were secondary worries. Those days are over.

DR ALEXANDER KRAJETE is managing director of Krajete GmbH, a company that pioneers high-performance gas fermentation and gas purification. He holds a PhD in chemistry with postdoctoral experience from UC Berkeley. Alexander started his career in the petrochemical industry with Borealis Norway in 2004, where he was project manager for polyolefin upscaling and senior scientist for hydrocarbons. Inspired by archaea, he founded Krajete GmbH in 2012.

So why does biotechnology provide long-term solutions to the legacy of past economic growth? Why has it been so long ignored? Why has it taken so long for large corporations to dis cover the charms of enzymes and microbes, and has it real ly? Or do they just want to keep running their old profitable plants under the guise of green promises or because they lack the know-how?

Unlike chemistry that requires other catalysts, biotech employs enzymes and microbes to accomplish the transformation from component A to B. The biggest difference between the two is intimately related to energy and selectivity. Biotech processes are ‘mild’. They occur within the boundaries of life. And due to the nature of the factors that drive them, enzymatic processes are also selective, influencing for instance the amount of de sired product produced. Biotech processes additionally arise from evolved systems, and both products and ‘waste’ are com patible with Nature. Conventional industrial chemical processes, in comparison, are harsh, often involving high temperatures and high pressures, yielding byproducts and waste that is not compatible with Nature. In the balance that must be struck between a) energy demand, b) selectivity and c) overall fit with Nature, only biotechnology of fers ways to exploit resources in truly long-term and sustainable ways.

But because our societies have been powered by fossil fuels for centuries, it’s difficult for decisionmakers to understand and execute new frameworks in the modern world. It is therefore of utmost importance to look holistically at the big perspective, and ques tion economic growth as the sole key measure for ‘progress’. We need a perspective that equally values a long-term fit with the environment. The impact of a biotech-based economy would quickly become clear (in the form of a restored global ecosystem) if measures are taken now to move towards a fast ‘Global Fossil Exit’. Humanity needs to rediscover the circularity common to ancient cultures and center it again as a fun damental pillar of modern cultures. We can no longer afford to simply ignore our cen tral ally and partner – Nature – in favour of short-sighted economic gains.

3 INTRO Picture: © Krajete GmbH European Biotechnology | Winter Edition | Vol. 21 | 2022

L

COVER STORY

INSIGHT

EUROPE

AMR: Big Pharma’s TEE initiative

Banks and policymakers driving climate change

Agri-coalition for genome editing

Crisis? What Crisis?

M&A – hints of a looming crisis?

2022 looks set to be the worst year for biotech Mergers & Acquisitions since 2018, and some experts have speculated it might herald the start of a new crisis for the sector. External financing is indispensable for drug developers. In the absence of external capital, achieving growth turns into an even greater struggle, and innovation slows. We take a deeper look into the causes behind the ‘new normal’ in partner ships and licensing, and break down why a predicted M&A wave is not cresting as quickly as expected.

Analyst commentary

European Biotech Stocks

Innate immunity and its power in cancer therapy

Interview: Frédéric Pâques, CEO, Standing Ovation SA

Clinical trials

Focus Pharma Services: CDMO/CRO business set to grow

Cell factories: the heart of rAAV manufacturing

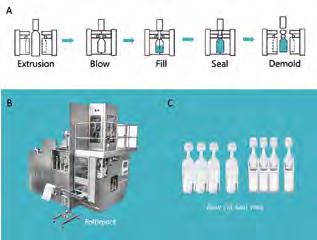

Blow-Fill-Seal technology and vaccine delivery

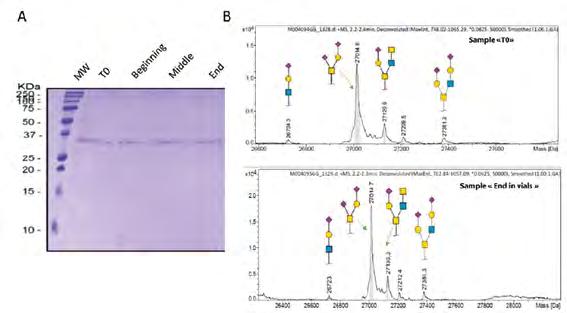

Interview: Christian Nafe, CFO, leon-nanodrugs GmbH

Lessons learned in the face of new health challenges

AGC Biologics doubles mammalian capacity

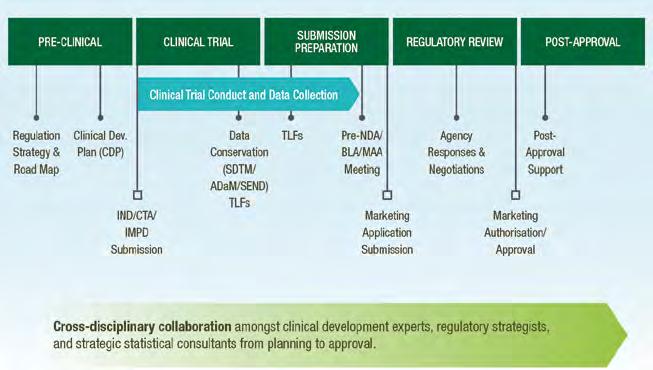

Wholistic approach to strategic consulting

REGIONAL NEWS

65 Special Industrial Biotech Cluster: Toulouse White Biotechnology

Northern Europe: Sweden, Denmark, Norway, Iceland and Finland

Western Europe: France, Belgium, The Netherlands and the UK

Central Europe: Germany, Switzerland and Austria

Southern Europe: Italy, Spain, Croatia and Portugal

Eastern Europe: Czech Republic SCIENCE & TECHNOLOGY

At the interface of AI, healthcare and data science

Biofilms for production

AI-enabling predictive diagnostics; Bio-based electronic devices

Ultra-low freezers: Stability of cancer biomarkers

PICK & MIX

Biopeople

News from Biotech Austria, the ECBF, YEBN and the SBA

Company index/ New product

Encore

IMPRINT European Biotechnology (ISSN 2364-2351) is published quarterly by: BIOCOM AG, Jacobsenweg 61, D-13509 Berlin, Germany, Tel.: +49-30-264921-0, Fax: +49-30-264921-11, Email: service@ european-biotechnology.com, Internet: www.european-biotechnology.com; Publisher: Andreas Mietzsch; Editorial Team: Thomas Gabrielczyk (Editor in Chief), Derrick Williams (Co-editor), Uta Mommert, Gwendolyn Dorow, Margarita Milidakis, Maren Kühr; Advertising: Oliver Schnell, +49-30-264921-45, Christian Böhm, +49-30-264921-49, Andreas Macht, +49-30-264921-54; Distribution: Lukas Bannert, +49-30-264921-72; Graphic Design: Michaela Reblin; Production: Martina Willnow; Printed at: Königsdruck, Berlin; European Biotechnology Life Sciences & Industry Magazine is only regularly available through subscription with a BIOCOM CARD. Annual subscription BIOCOM CARD Europe: €80 for private individuals (students €40) incl. VAT, €120 plus VAT for corporates. Prices includes postage & packaging. Ordered subscriptions can be cancelled within two weeks directly at BIOCOM AG. The subscription is initially valid for one calendar year and is automatically renewed every year after. The subscription can be cancelled at any time and is valid until the end of that calendar month. Failures of delivery, which BIOCOM AG is not responsible for, do not entitle the subscriber to delivery or reimbursement of pre-paid fees. Seat of court is Berlin, Germany. As regards contents: individually named articles are published within the sole responsibility of their respective authors. All material published is protected by copyright. No article or part thereof may be reproduced in any way or processed, copied, and proliferated by electronic means without the prior written consent of the publisher. Cover Photo: Garrykillian - Freepik.com; ® BIOCOM is a registered trademark of BIOCOM AG, Berlin, Germany.

4 CONTENTS European Biotechnology | Winter Edition | Vol. 21 | 2022

8

10

11

20

21

24

26

28

6

EU rules on biogas production ECONOMY

30

34

36

38

40

42

44

12

70

72

74

76

78

79

80

81

82

Picture: © LGarrykillian Freepik.com

46

83

88

89 Events 90

INDUSTRIAL BIOTECH

(Bio)economy 2.0

For years, policies promoting industrial production modelled on naturally occurring cycles have been little more than a thin green veneer used by oil and chemistry multinationals. At the new forum INDUSTRIA BIOTEC, companies presented both new ideas and longignored solutions that – in cooperation with politics – could help avert the looming gas and climate catastrophes.

FOCUS: PHARMA SERVICES

FOCUS: PHARMA SERVICES

EDITORIAL

Empty promises?

Determined to grow

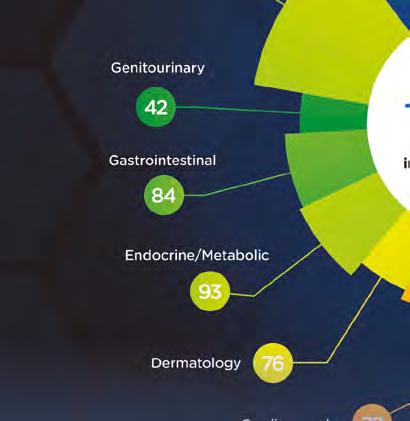

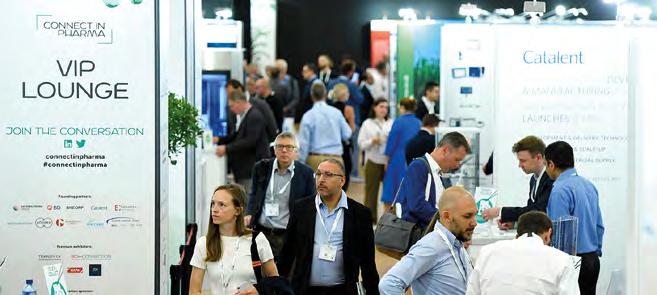

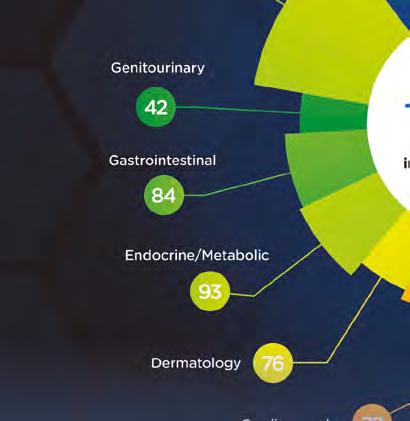

Over 40,000 on-site visitors to the CPHI in Frankfurt have shown that the COVID-19 pandemic has had a positive impact on the (bio)-pharmaceutical sector. A new CPHI annual survey predicts how business will develop in the future, with prospects for CDMOs and CROs looking rosy.

When politicians talk about climate change and the associated systemic shift from nature-exploiting to natureconserving processes, they often sound reasonable and responsible. This was also the case at COP27 in Sharm-el-Sheikh in Egypt. But the ‘er ror’ in the massively underestimated national CO2 emission budgets of the G20 countries – revealed by ex-US Vice President Al Gore’s Climate TRACE coalition – was not taken as an opportunity to decide immediately for binding production budgets. Nor was a decision made to shut down CO2 emitters, which can now be identified by satellite, to make up for lost time in decarbonising the atmosphere (see p. 8). Instead, the somewhat pointless promise was made that from now on, we would take an annual look at the depressing CO2 figures.

Biofairs Compass

In view of how little time is left to de flect the consequences of climate change and lower the world’s still ex cessive energy consumption, we could use another Al Gore to help push nextgen biotechnological processes for en vironmental and climate protection (see p. 58). Significant investments are needed to scale-up nature-compatible production processes and realise the biologisation of industries. At the pre miere of the INDUSTRIA BIOTEC con ference, experts explored rational, lob by-free ways out of the climate and energy crisis – that didn’t rely on emp ty promises.

Thomas Gabrielczyk Editor-in-Chief

Thomas Gabrielczyk Editor-in-Chief

5 CONTENTS European Biotechnology | Winter Edition | Vol. 21 | 2022

30

58 SPECIAL

Pictures: Billionphotos Freepik.com (left below; © Informa (middle); BIOCOM AG (right) and upper left) 48 PharmaPack Europe, Paris, France 50 AMR Conference, Basel, Switzerland 52 BIO-Europe Spring 2023, Basel, Switzerland 54 Swiss Biotech Day 2023, Basel, Switzerland 56 Connect in Pharma 2023, Geneva, Switzerland

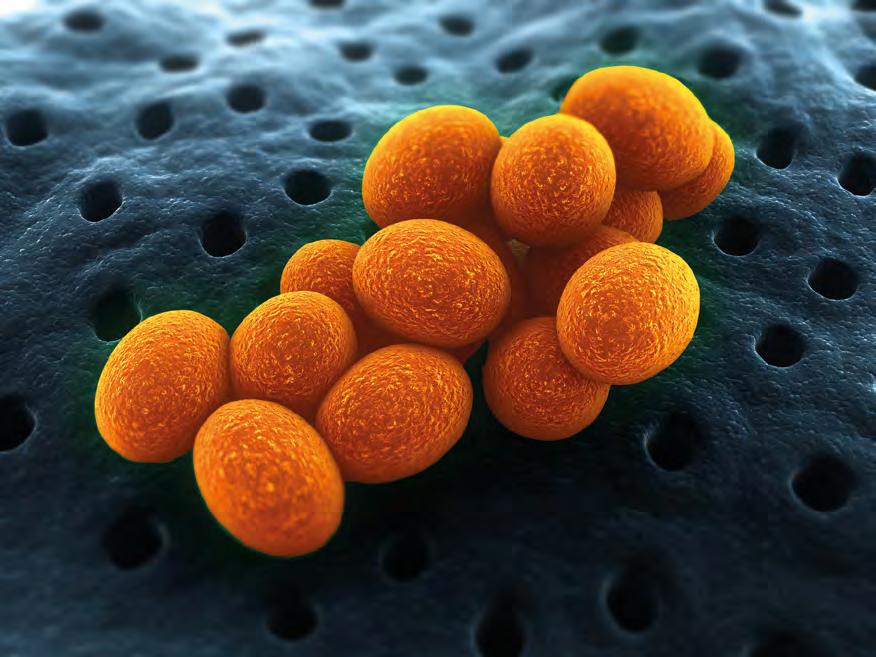

Statistics favours Big Pharma’s TEE pull initiative

AMR Boston-based consultancy firm Charles River Associates has published studies before that clouded the scientific picture in the interest of clients, including those interpreting climate-change to reflect more favourably on the oil industry. The issue of antimicrobial resistance is now in its crosshairs.

Commissioned by the umbrella organisa tion of the European pharmaceutical in dustry EFPIA, the global consulting firm Charles River Associates in Boston has as sessed the benefits of a payment model for antibiotics called Transferable Exclusiv ity Extension. TEE is a pull initiative aimed at motivating research and marketing of new antimicrobial drugs for which there is currently no business model that promises an attractive return on investment.

New global estimates

New model calculations on the benefit of TEE carried out by Charles River As sociates are based on the assumption of 400,000 deaths per year from direct and indirect effects of antimicrobial resistance (AMR) to drugs, which in Europe and the US is still limited to nosocomial infec tions in hospitals. The new estimate is based on the modelling of data published through 2019 by a group headed by the US government’s AMR consultant Mohs

en Naghavi who founded the Institute for Health Metrics and Evaluation (IHME) in L ancet in January and October 2022 (doi: 10.1016/S0140-6736(21)02724-0).

The since then widely adopted data that were e.g. cited at the Global Health Summit in October in Berlin nevertheless seem strangely impractical. The Europe an Centre for Disease Control (ECDC) in Stockholm and the World Health Organ isation (WHO) in Geneva reported com pletely different figures in their AMR Re port 2022: For the year 2020, they only arrive at around 33,000 deaths due to di rect effects of the eight most important drug-resistant microorganisms in the EU, Norway and Iceland. These figures are not based on literature research but are based on data from both EU AMR sur veillance networks, CESAR and EARSNet, and were submitted individually by the member states for each pair of active substance/microbial pathogen. Precisely, because AMR deaths have been declin ing in Europe since 2016, according to the

AMR 2022 report, the reverse increase of a good twelve-fold quoted and postulated by Charles River Associates – mainly due to indirect effects not explained in detail but illustrated in advanced illustrations –seems bizarre at first glance.

TEE: a viable option?

In an online statement published at the end of September, EFPIA – supported by the cost-benefit analysis of Charles River Associates – announces that “the TEE sys tem will revitalise antibiotic research and save Europe money”.

TEE provides that the developer of an eligible novel antibiotic receives a vouch er or coupon. With this, he can either ex tend the exclusivity of his own drug for a certain period of time and prevent com petition from cheaper generics, or he can sell the voucher to another company. Ac cording to EFPIA, the profits are to be used to finance antibiotics research. How this is supposed to work is an open ques tion in view of the recent withdrawal of the big pharmaceutical companies from antibiotics research since 2016. After the exit of Johnson&Johnson, only the com panies MSD, GlaxoSmithKline, Otsuka and Roche remain as antibiotics develop ers alongside the biotech SMEs. Over the next ten years, TEE is expected to provide two new antibiotics per year, CRA calcu lates. The study is apparently intended to dispel doubts that TEE could become an expensive affair because the regulation will cancel out savings made by health systems through the use of generics.

6 European Biotechnology | Winter Edition | Vol. 21 | 2022 INSIGHT EUROPE Picture: Charles River Associates

The table shows a modelling of potential cost savings in €m in six countries reflecting the EU27 market through a new antibiotic incentivised by the TEE over 10 years. Value for France Germany Italy Spain Greece Poland › Clinical benefit 54-75 23-33 87-120 18-25 8-11 18-25 › Productivity 69 30 111 23 10 23 › Transmission 335-466 414-575 296-411 236-327 53.74 189.262 › Diversity 57-79 70-97 50-69 40-55 9-13 32-44 › Enablement 277-644 342-648 245-489 195-390 44-88 156-312 › Insurance 43-165 54-204 38-146 30-116 7-26 24-93

L t.gabrielczyk@biocom.eu

Your research specimens can be priceless and make a difference in the world. That's why secure links at every stage of the cold chain are crucial. B Medical Systems’ products have 40 years of proven reliability in the world's most challenging environments.

Learn how we can help you maintain your specimens safe at every step of the cold chain: www.bmedicalsystems.com

B Medical Systems is a global manufacturer of medical-grade refrigera�on and transport solu�ons with over 40 years of experience.

B Medical Systems is a global manufacturer of medical-grade refrigera�on and transport solu�ons with over 40 years of experience.

B Medical Systems S.à r.l 17, op der Hei, L-9809, Hosingen, Luxembourg

B Medical Systems S.à r.l 17, op der Hei, L-9809, Hosingen, Luxembourg

Tel: +352 92 07 31 1

Tel: +352 92 07 31 1

Email: info@bmedicalsystems.com

Email: info@bmedicalsystems.com

www.bmedicalsystems.com

www.bmedicalsystems.com

LIVES THROUGH RELIABLE AND INNOVATIVE TECHNOLOGY

SAVING

LIVES THROUGH RELIABLE AND INNOVATIVE TECHNOLOGY Laboratory Refrigerators | | Ultra-Low Freezers Pharmacy Refrigerators Laboratory Freezers Transport Boxes

Because SAVING

Banks and policymakers driving climate change

COP27 Last year, the G7 heads declared to end funding for the oil industry by the end of this year. At the COP27 in November, the WHO and United Nations renewed promises to re-direct the hundreds of billions of dollars invested annually in fossil fuels to fund renewable energy initiatives.

make it impossible for the main emitters from the gas and oil industry to cheat and counter the often politically embellished estimates of national CO2 emissions with a reliable database.

G20 countries, including China, are responsible for about 80% of global CO2 emissions. With help of Climate Trace, which relies on AI-analysis of satellite data, now the major emitters can be reliably traced.

While climate researchers worldwide appealed to the decision-makers at the COP27 climate summit in Sharm el-Sheikh for a decisive change in the energy indus try, activists demonstrated in front of the UN conference centre against the billions in subsidies with which politicians con tinue to promote the oil cartels that have long been recognised as destroying nature. “These investments are causing incredi ble damage, destroying biodiversity and devastating livelihoods across the world,” stressed Susan Huang from the NGO Oil Change International. In fact, they want ed to remind policymakers of their prom ise to end funding for fossil resources at the end of this year that was watered down by the International Energy Agency, which claimed the slow transition to renewable energies aggraved climate change. Inside the air-conditioned centre, UN Secre tary-General António Guterres criticised the ongoing investments in fossil fuels. He

pointed to an independent inventory of greenhouse gas emissions created by the ClimateTrace Coalition supported by envi ronmentalist and former US Vice-President Al Gore that could “be a wake-up call to governments and the financial sector, es pecially those that continue to invest in and underwrite fossil fuel pollution.”

World is at a turning point

António Guterres was speaking at the launch of a new independent inventory of greenhouse gas emissions created by the ClimateTrace Coalition and spearhead ed by former US Vice-President Al Gore. The tool that uses satellite data and artifi cial intelligence to make the facility-level emissions of over 70,000 sites around the world visible, will allow leaders to know the location and scope of emissions be ing released. Even today, the validated data that come from over 30,000 sensors

According to Gore, who spoke at COP27 Finance Day, the climate ca tastrophe is currently costing the glob al economy two and a half trillion dol lars annually. He said the world is at a turning point because solutions exist to reverse this dire trend (see p. 58). Ac cording to Anjali Viswamohanan, poli cy director at the Asia Investor Group, it’s not technology that is the solution but fi nance as fossil industry giants are work ing heavily to greenwash their asset and their CI. “We must have zero tolerance for net-zero greenwashing”, suggested Guterres. According to the first report of a UN high-level expert group on the top ic, net-zero pledges must be in line with the UN Intergovernmental Panel on Cli mate Change (IPCC) scenarios limiting warming to 1.5 degrees. Industry experts, however, described the IPCC figures as flawed and said behind closed doors that we would be lucky to stay below 3°C.

EU Commission President Ursula von der Leyen, on the other hand, practised verbal acrobatics and described the EU as “fully on track”, especially after the Coun cil and Parliament agreed to the Com mission’s proposal to include sectors in the CO2 emission targets that have so far not been included on the outside: trans port, buildings, waste and agriculture. The emission reduction target for these sectors by 2030 will now be raised to 40% from 2005 emissions.

8 European Biotechnology | Winter Edition | Vol. 21 | 2022 INSIGHT EUROPE

Picture:Climate Trace

L t.gabrielczyk@biocom.eu

• Ainnocence’s SentinusAITM - Powerful self-evolving artificial intelligence engine - Effectively ranks up to 1010 antibody sequences - 1-2 weeks computational HTP screening • Combined with Sino Biological ‘s high-throughput recombinant antibody development platform, top candidates can be expressed recombinantly at a lower cost and shorter lead time to generate affinity data with a high hit rate of 15% www.sinobiological.com

About Sino Biological

About SentinusAITM Sino Biological specializes in recombinant protein production and antibody development. The company routinely conducts high-throughput projects of up to 1,000 per batch. Sino Biological's manufacturing facility can also handle large-scale production at gram level.

Sino Biological US Inc. (U.S.A)

Tel: +1-215-583-7898 Email: cro_us@sinobiologicalus.com

Sino Biological, Inc. (Global)

Sino Biological Europe GmbH (Europe) Tel: +49(0)6196 9678656 Email: cro-service@sinobiological.com Hit Rate Service Highlights: Screen up to 1010 sequence space Direct access to sequence No animal use Cost effective $ Can be combined with “humanization” module Higher hit rate will be achieved on subsequent computation by incorporating wet-lab data SentinusAITM is a powerful and self-evolving protein design engine created by Ainnocence. Its database contains up to 100 million human antibody sequences as well as an extensive collection of human/animal viral antigen information, resulting in high confidence prediction of binding affinity.

Tel: +86-400-890-9989 Email: cro-service@sinobiological.com Sino Biological and Ainnocence have joined forces to establish an AI-enabled platform for antibody affinity maturation. Lead Time 4 weeks 103 increase High Affinity 15%

NEWS EU funding

In mid-October, the new MIBIREM project kicked off in Vi enna. Under the coordination of the Austrian Institute of Technology, 11 re search groups from six EU coun tries will develop a toolbox for mi crobiome-based soil remediation on contaminated sites. Conventional re mediation technologies are often too expensive and technically demand ing. Microbiomes have a high poten tial to improve such processes. They can degrade organic contaminants. Until 2027, the EU Commission will grant €6.67m to develop a sustaina ble solution to clean up the 324,000 severely contaminated sites, such as mines, landfills or petrol stations, across Europe.

Switch plastic production

After a phase of steady growth, fear is sweeping Europe’s plastics-producing industry. At the end of October, Marco ten Bruggen cate, President of Plastics Europe and VP for Packaging and Specialty Plastics at petrochemical giant Dow, warned at the K 2022 industry trade fair in Düsseldorf, Germany, that the remaining suppliers were leaving Eu rope – investments were threatening to flow overseas. He called for a vig orous approach to the “Green Deal” proclaimed by politicians. A combi nation of chemistry and biotechnol ogy seems to offer great opportuni ties. The German start-up EEDEN GmbH has developed a process to extract and reuse cellulose from tex tile waste, while the French Carbios SA (Clermont-Ferrand) can microbi ally break down PET fibres from syn thetic textiles into their monomers and re-polymerise them.

EU agri-coalition pushes for relaxing rules for genome editing

EUROPE After 17 countries worldwide, including the UK, relaxed rules on grow ing genome-edited crops, a majority of European agriculture ministers are pres suring to exempt genome-edited crops and their products from the strict EU GMO legislation.

“We only need to modify our old leg islative framework regulating modern breeding techniques,” stressed Czech agriculture minister Zdenek Nekula. Among the countries supporting the re laxation of EU GMO laws, currently un der consultation at the EU level, at an informal meeting of ministers in late Sep tember are reportedly the Netherlands, Estonia, Sweden, Lithuania, Netherlands, Malta, Ireland, Italy, Hungary, Romania and Belgium.

The main arguments for the relaxation are the current lack of fertilizers, soaring energy prices and climate change. Ris ing energy prices and the need for more irrigation alone have increased costs for farmers by 35%. “Climate change is coming faster than we are developing new crops,” Euractiv quotes Dutch farm er Hendrik Jan ten Cate. “We need new techniques. There is a big danger to food production in Europe.”

Alternative model

While in the UK the cultivation of high er-yielding crops optimised with the gene scissors seems to be a done deal, in Switzerland the relaxation targeted for 2024 is still being disputed. At the end of October, the Federal Ethics Com mittee on Non-Human Biotechnology (Ekah), which is staffed by internation al experts, announced that a restructur ing of agricultural production could yield much more than high-intensity farming with the genome-edited plants that are to be used primarily as animal feed. The experts recommend stopping the culti vation of concentrated feed, reducing

livestock and meat production and re stricting it to grassland only, as in Ireland, and using the freed-up land to grow food crops. “The state should assume political leadership responsibility in view of the urgency of the climate targets,” says the extra-parliamentary advisory body.

The Swiss also want to limit the import of the soy concentrate needed for inten sive livestock farming.

India, Russia, China, the Phillippines, Nigeria, Kenya, Canada the USA and South American soybean exporters Bra zil, Argentina, Chile, Ecuador, Colombia, Paraguay, Honduras and Guatemala are largely united in deregulating biological mutation breeding:

› If no foreign DNA is present in a ge nome-edited plant and if it could have arisen under natural conditions through random mutation, it is to be evaluated like a classically bred plant. No labelling is envisaged.

› However, if DNA segments have been inserted into the genome using ge nome editing techniques, such plants are generally considered GMOs and fall under genetic engineering laws.

Genetic engineering sceptics describe the consultation on the intended new EU regulation as fake. It is eagerly await ed how the European Commission will shape the new regulations so as not to jeopardise its goal of increasing organ ic cultivation by 30% by 2030 by placing conventional and genome-edited prod ucts on an equal footing. According to scientists at the Swiss Research Institute of Organic Agriculture (FIBL), there is currently no obligation for farmers to de clare what they grow GM crops. A labelfree cultivation of genome-edited plants in the vicinity of organic fields would make it impossible for organic farmers to provide the necessary evidence for or ganic certification.

10 European Biotechnology | Winter Edition | Vol. 21 | 2022 INSIGHT EUROPE

L

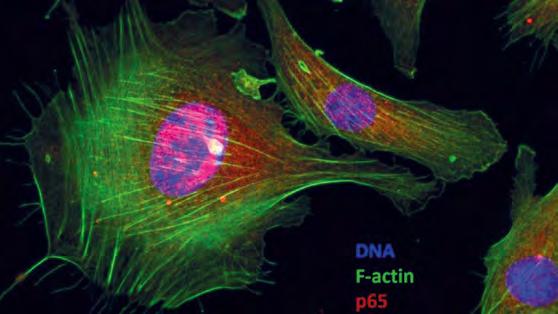

Improved biogas production

HORIZON EUROPE Biogas plays an important role in achiev ing EU energy security. Under its EU action plan, the EU Com mission aims to double biogas production through microbial fermentation of agricultural residues to 35 billion cubic me tres by 2030 to end the EU’s dependence on the Russian fos sil supply. However, the potential of methane as a renewable fuel (CNG) remains untapped. To turn biogas into a cost-ef fective alternative to fossil fuels, researchers within the Micro 4Biogas project will be developing tailored anaerobic microbi al communities recycling organic waste. “We aim to increase the yield of biogas, its quality, the speed of production and the robustness of the whole process,” says Manuel Porcar from the University of Valencia (Spain) that coordinates the Micro4 Biogas project.

Scientists from the project have already collected microbi al samples from multiple biogas plants and they are analys ing them to create microbial communities that are optimised for biogas production.

The idea is to transport the biogas in the existing gas in frastructure replacing natural gas in all scenarios and pre venting energy supply disruptions. “While both photovoltaic and wind energy have the disadvantage of depending on the weather to generate electricity, biogas can be stored and con sumed whenever it is needed,” explains Carlos Roldán, elec trical engineer from the Polytechnic University of Valencia, where biogas from the pilot plant will be used for electrici ty production. The possibility of storing biogas helps stabilise the electricity grid, facilitating the widespread use of intermit tent renewable sources.

Animal biogas

L

SigmaPlot® 15

Designed Specifically to Meet the Needs of Scientists, Professional Researchers and Engineers

SigmaPlot® is an easy-to-use scientific graphing & statistical data analysis software package for researchers, scientists and engineers who need to create precise, publication-quality graphs that best communicates their research results for presentations, technical publications, and the web. Along with advanced curve fitting, a vector-based programming language, macro capability and over 50 frequently used statistical tests, SigmaPlot also provides more than 100 different 2D & 3D graph types from which one can choose a full range of graphing options such as technical axis scales, multiple axes, multiple intersecting 3-D graphs and much more. SigmaPlot now has SigmaStat included with it which is a perfect tool to visualize and understand basic and advanced statistics.

SigmaPlot offers:

•Complete Advisory Statistical Analysis

•Award-Winning Technical Graphing Capability

•Powerful and Easy-to-use Data Analysis

•Ability to Customize every Element of Graph

•Precise Publication-Quality Graphs

•Ability to Publish your Work Anywhere

Latest updates:

•Includes a New Heat Map Macro

•Removes all dependencies on old redistributable by removing Lead Tools and uses Windows Graphics Device Interface + (GDI+) for graph export

•Uses the latest Sentinel License Manager which is compatible with the latest Microsoft Server 2022

•Uses a hosted licensing service for smooth license activation and validation

•Has a new and refreshed ribbon manager that enhances the already commendable user experience in SigmaPlot

LIVESTOCK FARMING Around €2m is being invested through Horizon Europe to unlock the biogas potential in livestock farming. In November, the ALFA project kicked off in Thessaloniki, Greece. ALFA, which is coordinated by QPlan International, promotes 50 large-scale livestock farms in Belgium, Denmark, Greece, Italy, Slovakia and Spain to set up an infrastructure for the production of biogas from un treated animal waste. Ten partners will collaborate to pro mote non-vegan methane production facilities: Agenzia per la Promozione della Ricerca Europea, AzzeroCO2, Centre for Research and Technology Hellas, European Biogas Associa tion, European Dairy Farmers, Food & Bio Cluster Denmark, Pedal Consulting, SUSTAINABLE INNOVATIONS and White Research.

North America & South America

Inpixon USA

2479 E. Bayshore Rd, Suite 195. Palo Alto, CA 94303, United States saves.sales@inpixon.com

Germany, Austria, & Eastern Europe

Inpixon GmBH Königsallee 92a, 40212 Düsseldorf, Germany saveskontakt@inpixon.com

UK & Western Europe

Inpixon UK Ltd

268 Bath Road, Slough, SLI 4DX, UK saves.sales@inpixon.com

©2022 by SYSTAT Software, Inc. SYSTAT, SigmaPlot, SigmaStat, SigmaScan, TableCurve2D, TableCurve3D and PeakFit are trademakes of SYSTAT Software, Inc. All other product or brand names are trademarks or registered trademarks of their respective holders.

11 European Biotechnology | Winter Edition | Vol. 21 | 2022 INSIGHT EUROPE

ANCOVA Global Curve Fit

Principal Component Analysis Regression

Full house at BIO-Europe 2022 in Leipzig

Full house at BIO-Europe 2022 in Leipzig

Crisis? What Crisis?

FINANCING External financing has proven indispensable for small biotech companies in the drug arena, with the majority of firms viewing it as essential for accelerated devel opment. Where external capital is lacking, growth becomes more difficult, and innovation slows. The ‘new normal’ involves partnerships and licensing, especially in Europe, while the M&A wave is not building as fast as once predicted.

Few companies expect to be worse off in 2022 than they were before the pandemic. Fast, generous political aid and a strong recovery in demand in the first half of this year should help prevent it. Overall, 84% of companies expect sales to at least return to pre-pandemic levels in 2022. That’s the survey result across all sectors that emerged from the Euro pean Investment Bank’s (EIB) investment survey at the beginning of November. On the flip side, opinions about the fu ture sounded less positive: the Ukraine war and its consequences look set to “test the resilience of companies consid erably”. Investment conditions have also deteriorated significantly, hamstrung by the energy crisis, uncertainty and slow ing global growth. Expectations regarding the economic situation slipped again into the red (from +27% to -53%). There was also a turnaround in the assessment of the business outlook (down from +34% to +3%), as well as in the outlook for the political and regulatory climate (-40%) and access to external finance (-8%).

View of biotech/pharma

With this dim view of the future from across industries, pharmaceuticals/bio technology probably shouldn’t have high hopes, right? But depending on the inter locutor, the entrepreneurial perspective or the level of development of the com pany or its products, you hear very dif ferent sounds from the community. “On paper, the record cash reserves of the big

pharma ceutical companies, the steep, rapidly approaching patent cliff and the low public biotech valuations should lead to a buying frenzy,” wrote Melanie Sen ior in a recent commentary in nature Bio techno Logy (Nature Biotechnology Vol ume 40, 2022). And since stock markets within biotech indices are still falling, bio tech companies short of cash were hope ful the pharma industry would buy up the external innovation on offer a little more indiscriminately, Senior added.

But that’s not happening. Many pre dicted a new surge based on a wave of top valuations and stock market prices piling up during the pandemic, foresee ing a buying wave in mergers & acqui sitions (M&A). It has not failed to ma terialise completely, but hasn’t turned into the hoped-for spring tide – at least so far. Pfizer’s US$11.6bn acquisition of

Biohaven Pharmaceuticals in May was a high point in 2022. But a possible mega deal (rumoured to be worth around US$40bn) between Merck and Seagen remains stuck, whether for substantive reasons, because of differences over the valuation, or that they’re simply shying away from striking such a major deal in times like these – maybe a combination of all of the above. Outwardly, both par ties continue to claim that there are just some details left to be cleared up. How ever, without it, at the current pace, 2022 is set to be the worst year for M&A since 2018.

By the end of August, the total value of acquisitions in 2022 was just half that of 2021, which in turn was low com pared to 2020 and 2019 (Fig. 1). Accord ing to BioCentury BCIQ, the total val ue of deals was US$41.5bn by August

Fig. 1: M&A over a five year period. The average size of deals has fallen. *Through August. (Source: BioCentury BCIQ in Nat Biotechnol 40, 1546–1550, 2022)

13 European Biotechnology | Winter Edition | Vol. 21 | 2022 COVER STORY Picture: left © Ludwig Schedl for Informa Connect/BIO-Europe

3.0 2.5 2.0 1.5 1.0 0.5 0 1.2 1.8 2.7 1.7 1.1 0.9 0 20 40 60 80 100 120 140 160 2022* 2021 2020 2019 2018 2017

Total

Average deal

Average deal

108 119 132 140 146 96

Total no. deals

number of deals

size ($billions)

size

2022, compared to nearly US$97bn in 2021 and over US$140bn in 2020. And not just megadeals like the Merck/Sea gen proposition are missing. The over all number of deals is down 30%, and is significantly lower in 2022 than in pre vious years.

Patent cliff or just a bump?

Three drugs alone – Humira (adali mumab) from AbbVie, Keytruda (pem brolizumab) from Merck and Opdivo (nivolumab) from Bristol Myers Squibb (BMS) – account for annual sales of over US$45bn. Although these patents are slated to expire in the next few years, there’s been no panic buying on the part of pharmaceutical firms yet.

In financial circles it’s being said that there appears to be no sense of urgen cy on the part of Big Pharma. And when external products or entire companies are bought up, marketed or near-market products are purchased that immediately closes sales gaps. “Anything that comes earlier is not worth the risk or the addi tional R&D costs. The patent problem of Big Pharma companies will not be solved by buying a phase II company,” Gil BarNahum, managing director at Jefferies’ Global Healthcare Investment Banking Group in London, told nature Biotech no Logy. Although according to SVB Se curities, Big Pharma companies have an estimated US$350bn in cash (and up to half a trillion to spend), most appear re

luctant to adopt early-stage programmes with funding needs that might erode their bottom line in an era of double-digit in flation, fragile supply chains and an am bivalent FDA in price discussions.

Acquisitions not excluded

Exceptions of course confirm the rule, and some deals continue to go through. But in addition to product purchases that have already hit the market, a new paradigm appears to be in place. The latest algorithm seems to classify prod ucts in phase II as attractive if they are also accompanied by a groundbreaking treatment option (see table below). Most of the US$26bn Pfizer spent on acquisi tions over the past 12 months went to high-revenue companies, but the sum (which is still below COVID-19 vac cine revenues expected for 2022) also included phase I/II cancer company Trillium Therapeutics (US$2.2bn) and ReViral (US$525m), which has a phase II vaccine candidate against respirato ry syncytial virus (RSV). Bristol Myers Squibb is also less cautious than the pack. It paid US$4.1bn in June for Turn ing Point Therapeutics, which is expect ed to file for approval for the lung can cer drug repotrectinib later this year – with market approval possible in 2023. Repotrectinib adds a strategically fitting precision oncology asset to BMS’s existing portfolio: tyrosine kinase inhib itor target ROS1 and NTRK mutations,

complementing BMS’s non-small cell lung cancer therapies, including Opdi vo (nivolumab), Yervoy (ipilimumab) and Opdualag (nivolumab and relatlimab). GlaxoSmithKline’s (GSK) US$2.1bn ac quisition of Affinivax brought to the company a pneumococcal vaccine can didate that is still in Phase II. Howev er, it’s viewed as groundbreaking, and includes more pneumococcal sero types than approved vaccines. The Brit ish pharmaceutical company also spent US$1.9bn on Sierra Oncology in its bid to rebuild an oncology franchise aban doned nearly a decade ago.

All of these large-volume transactions can therefore be classified under the heading ‘long-term strategy’, with hun dreds of mid-sized biotech companies with early development pipelines re maining largely ignored. Some industry observers put restraint at the forefront of their analyses, while others see these in dividual transactions as the beginning of a larger shopping spree that could bene fit any biotech company that already has products on the market or ones that are about to be approved.

Biotech well positioned

Some biotech fund managers are cau tiously optimistic about the situation. “Many biotech companies are current ly very well positioned and highly attrac tively (low) valued. In addition, many im portant innovations are expected, with

Source: BioCentury BCIQ in Nat Biotechnol 40, 1546–1550, 2022, modified

14 European Biotechnology | Winter Edition | Vol. 21 | 2022 COVER STORY

M&A deals 2022 worth over US$1 billion Buyer-Seller Deal value ($billion) Therapy area (latest stage) › Pfizer-Biohaven 11.6 Migraine (marketed), obsessive–compulsive disorder, epilepsy, rare diseases › Pfizer-Global Blood Therapeutics 5.4 Sickle cell disease complications (marketed), blood disorders › Bristol Myers Squibb-Turning Point 4.1 Cancer (phase III) › Amgen-ChemoCentryx 3.7 Rare autoimmunity (approved) › GlaxoSmithKline-Affinivax 2.7 Viral infection, cancer (phase II) › GSK-Sierra Oncology 1.9 Myelofibrosis (submitted) › Novo Nordisk-Forma Therapeutics 1.1 Sickle cell disease, rare blood disorders (phase II/III)

Built for BiotechSM Strategic product development Full-service clinical research & development Therapeutic & special population expertise Holistic technology ecosystem Get started at premier-research.com/builtforbiotech

growing market potential of the individ ual indications,” says fund manager Lukas Leu (Bellevue Asset). He also brings the patent cliff argument. According to FDA estimates, blockbuster drugs with a total turnover of more than US$250bn will lose their patent protection by 2030. Leu esti mates that the sharp price reductions that will ensue now offer attractive entry op portunities.

In his view, areas like gene thera py are currently moving into the next generation of products and technolo gies. Other more established technol ogies, such as RNA platforms, have rapidly expanded from their initial fo cus on rare diseases to larger indica tions, and could generate significantly

higher revenues than originally antic ipated. An example of this is Bioma rin’s European launch of Roctavian, the first gene therapy for the treatment of severe haemophilia A. After achieving excellent clinical data, Alnylam is also about to receive approval for patisiran, a drug for ATTR amyloidosis with car diomyopathy. Although a niche prod uct, it could generate billions in reve nues in the future. The fund manager of Bellevue Asset Management emphasis es that solid regulatory conditions, cou pled with increasing study applications submitted to the FDA, point to further approvals in the field of drug devel opment: “Innovation is in full swing, new breakthroughs are being driven

and new products are being brought to market quickly.”

Good vibrations at BIO-Europe

At Europe’s largest annual event for bio tech partnerships this year in Leipzig, the unbroken good mood on both sides of the deal table between biotech innova tors and partners from pharma was pal pable. “This was our first personal BIOEurope in three years, and the result exceeded our expectations,” says Anna Chrisman, Managing Director Pharma and Life Sciences at Informa Connect. Around 5,000 participants came to the traditional German trade fair city to take a closer look at the projects presented, or

VC still bold in financing innovation

INTERVIEW VC funds are flush with cash. Some have set new records for closings, but inflation, war and ECB interest rates are spooking others. EuropE an BiotEchnology asked Sander Slootweg, Managing Partner and co-founder of Forbion Capital Partners, about how he’s coping with the complex and difficult times.

EuroBiotech _The BIO-Europe in Leipzig just sent a lot of positive signals. Why is the healthcare market seemingly unaf fected by all the ongoing crises?

Slootweg _There are several reasons why the life sciences venture capital field seems immune to the current challenges facing the business community. It is im portant to understand that during times of crises, a reduction in pharma sales does not occur as it would with fast moving consumer goods. Most of Big Pharma sees their innovation coming from the biotech industry, with more than 80% of newly approved drugs stemming from our indus try. Pharma also has to replenish their pipelines across several areas of interest, having set aside US$500bn collectively for acquisitions – most of which was generat ed from proceeds from COVID-19 vac cines and antivirals. This implies that they are cash rich with low leverage, and there fore not affected by rising interest rates. Another factor that plays into their resil

ience is the fact that pharma can reprice drugs annually to compensate for infla tion, showing they have pricing power.

EuroBiotech _ We have seen and are still seeing record VC fund closings. A lot of

money is being put into the pockets of venture firms. Are your investors, institu tional or otherwise, reluctant to give you new money for new funds?

Slootweg _Based on the reputation that Forbion has carefully curated in the last two decades, we have not been affected. Earlier this year we announced the first close of our Growth Opportunities Fund II at €470m. We expect a final close at €600m despite the setbacks experienced in the markets. We have big plans for 2023, and our investment relations team is confident of success.

EuroBiotech _If you look at the Forbion funds, where does the money come from, and how is this changing (if at all) by region? Do you get more money from European investors...or from the US...or from Asia...than you did in the past?

Slootweg _Forbion has always maintained strict criteria for sourcing investors. We pride ourselves in being a European firm

16 European Biotechnology | Winter Edition | Vol. 21 | 2022 COVER STORY

Picture: © Forbion Capital Partners

Sander Slootweg, Managing Partner, Forbion

to talk investment strategies with poten tial partners in the over 30,000 discus sions agreed via the partnering platform. “Our task has always been to present various biotech clusters and shed light on some of the hidden gems in Europe,” explains Chrisman about this year’s ven ue. Leipzig’s Lord Mayor Clemens Schül ke added: “For the first time, Leipzig was able to present its BioCity Campus at the event, and present new construction pro jects and laboratory space together with private investors.” Biosaxony Managing Director André Hofmann, who heads the local biotech network, was effusive. “The return of BIO-Europe to Saxony af ter 17 years has clearly shown how far we have all come,” he said. The fact that and our investor base reflects that. Hav ing said that, we are seeing keen interest from North America, and that investor base is rapidly growing. As word gets out about our success rate and the companies we have built, we are seeing institutional investors (pension funds, endowments, insurance companies) coming on board. This is a definitive reflection of the prag matic approach we have to investing, and the confidence in the capability and ex pertise of our investment professionals.

EuroBiotech _If you look at the European landscape in VC, it seems to be dominat ed by funds from France, Benelux, the UK, and some US funds with European sites. Am I missing something? Why is Germany still lagging behind?

Slootweg _Germans are known to be great engineers and can execute a clearly laid out plan to perfection. However, the road to success in biotech is never a straight line. Often one has to change course several times along the way in or der to overcome obstacles. Dealing with this type of inherent uncertainty is not a cultural strength of Germans.

EuroBiotech_At the moment the IPO-exit strategy doesn’t seem to offer a good op portunity. So does one just have to wait

the most recent Nobel laureate in med icine, Svante Pääbo, is based in Leip zig was also continuously underlined throughout the trade fair.

No drama in financing

Arno Fuchs, CEO and Owner of FCF Fox Corporate Finance GmbH, has been working in the industry for a long time analysing developments in the US and Europe. “Financing volumes have not fallen very much in the US, but the Americans are holding back somewhat in Europe, so we see a decline of 30% in overall funding volumes here,” Fuchs re ported in an interview with european Bio technoLogy Europe’s dependence on US

financing volumes is evident. However, the CEO does not view the decline as a drama, but as a normal reaction to strong growth in recent years. “The cycles are intact, there are exit opportunities aside from the stock market, there is money that is being invested. Good companies always find the money they need, even now,” Fuchs believes, though “financing rounds may take longer or be somewhat smaller.” Overall, however, the biotech industry is decoupled from other indus tries and the broader market, which suf fer more from fears of inflation and rising interest rates. With a proper and profes sionally executed strategy to approach ing the right investors in a well prepared and targeted manner, Fuchs thinks firms

this phase out? Or does it strongly influ ence strategy in your portfolio?

Slootweg _Having been in the business for over two decades, we have ‘survived’ financial downturns and also experi enced extremely profitable times. It is for this reason that Forbion developed its current strategy, which allows us to exit through M&A or IPO when the markets are buoyant, and to be conservative and invest in companies at attractive terms when the markets are not. The venturecapital business is all about timing and strategy, and of course the public mar kets are an enormous factor when con sidering the next moves for our portfolio companies. A great example I like to refer to is VectivBio, a public company that we sought to invest in two years ago. At the time, our team believed that the company was valued relatively highly on the public markets, and we decided not to invest. In 2022 the situation was differ ent, and we saw VectivBio’s valuation decrease, enabling us to make a value oriented investment. They are now part of our portfolio.

EuroBiotech _We see some smaller funds specialising in early drug development, and strongly interacting with academic institutions or focusing on very special

disease indications. Are these smaller funds possibly more affected by sur rounding critical framework conditions?

Slootweg _I would imagine that this is in deed the case. Funding at the seed stage is far less costly, and this is why you prob ably see the phenomenon of smaller funds in this arena. It is no coincidence that generally speaking, the size of the fi nancing rounds are typically larger as they progress, since there is less risk as you get further into the financing because the companies are better developed both from an IP and operational standpoint.

EuroBiotech _If you are purely optimistic for the future, why is that? Can you per haps explain with describing your key strategy what makes you so positive?

Slootweg _The 21st century is truly the century of biotech. So much more is known about what causes disease and how to best design solutions, and so many diseases are currently poorly or not treated that we believe current market conditions not to be representative of the opportunity we are chasing. We concen trate on three strategies: company crea tion, company building and company expansion. These are three distinct cate gories that drive our success, and ulti mately our positive disposition.

17 European Biotechnology | Winter Edition | Vol. 21 | 2022 COVER STORY Pictures: xxx

L

A senior finance panel discussion at BIO-Europe claimed a ‘silver lining’ in challenging times. One member was Sander Slootweg (Forbion, second from left, interview p. 16).

can also chalk up successes with the se lected family offices that are increasingly interested in the industry.

He sees the large available fund vol umes as further proof that the cycle of money in the innovation process of new active ingredients is intact. Even if these larger sums are being spent somewhat more slowly or in smaller amounts, he says institutional funding capacity re mains intact for existing portfolio com panies, also to buffer delays in clinical trials or difficulties on the logistics, lab capacity or human resources side. The mood among VC investors in many dis cussion rounds at BIO-Europe confirms this assessment. There was no trace of panic or crisis.

A less sanguine view

In her commentary in n ature B iotech no L ogy, Melanie Senior put forward some counter-arguments as to why one should move cautiously when optimism is bubbling. For example, she sees some setbacks in gene therapy candidates or in the use of cell therapeutics as one of the reasons for the reluctance to acquire gene and cell therapy companies, which have fallen sharply. By September 2022, there were only eight such mergers, less than half as many as the year be fore. 2022 deals include Vertex Pharma ceuticals’ acquisition of stem cell com

pany ViaCyte with its type 1 diabetes programme, as well as Galapagos’ ac quisition of CellPoint, whose lead CART cell therapy is in phase I/II trials. In early October, AstraZeneca indulged in a bargain, snapping up struggling gene therapy company LogicBio Therapeu tics for only US$68m, or just over US$2 per share – a fraction of what it would have had to pay for the adeno-associat ed virus -based gene therapy company during the past three years.

Senior also considers the discussion about drug prices in the US to be by no means over. Rather, the so-called Infla tion Reduction Act, which went into ef fect in August 2022, requires the govern ment-funded Medicare program (which covers people over the age of 65) to ne gotiate prices for the ten best-selling out patient drugs in 2026, and 20 best-selling outpatient drugs three years later. Other cost-control measures include rebates on all Medicare drugs whose prices are ris ing faster than inflation, caps on negotiat ed maximum prices, and – for manufac turers who refuse to negotiate – punitive taxes on the previous year’s sales.

Industry lobby group PhRMA com plains that the law will stifle innovation. However, not all drugs are affected by the negotiations. Exceptions are drugs for which there are already generics or bio similars that have been on the mar ket for less than seven years (for small

molecules) or eleven years (for biolog ics) or that will cost Medicare less than US$200m in 2021. The bill will therefore not significantly shorten the market ex clusivity periods (5-7 years for small mol ecules and 12 years for biologics). Ex pensive injectables and other products administered in hospitals will not be ne gotiated until 2028. Orphan drugs that are only approved for rare diseases are also excluded, along with drugs that ac count for over 80% of a company’s sales – a common scenario for biotech compa nies focused on rare diseases.

In Germany, too, an austerity pro gramme in the healthcare sector has the pharmaceutical associations up in arms amidst fears that it could that it could slow innovation. However, a withdraw al of the corresponding law is not up for debate.

Overall, optimism prevails

In general then, a slow trend towards in creasing acquisition activity – coupled with the strong innovation pipeline – are being seen as positive signs that the sec tor should be protected from the head winds of rising interest rates. Even if phar ma is backing off biotech temporarily in terms of acquisitions, the ‘biodollars’ are still flowing when it comes to payment after all negotiated milestones. Manuel Bauer summarised the current market situation for european BiotechnoLogy: “As part of the data collection for EY’s Ger man Biotechnology Report, we are ob serving a continuation of the noticeable downward trend in international M&A transaction activity with a significant ly reduced transaction volume. Simulta neously, there is a trend towards allianc es, so that for the German biotech sector we will see a record year for strategic al liances in 2022 with more than €8bn.”

Bauer has been with EY´s Life Sciences & Healthcare sector as Biotech Leader Ger many, an active observer on the scene for over twenty years, he’s seen plenty of ups and downs. Most of the discussion partners for this article stated, a financial crisis looks different.

18 European Biotechnology | Winter Edition | Vol. 21 | 2022 COVER STORY Pictures: © Ludwig Schedl for Informa Connect/BIO-Europe

L g.kaeaeb@biocom.eu

LISAvienna’s 20th anniversary celebration was a blast

AUSTRIA Vienna is one of Europe’s most dynamic innovation hubs in the life sciences. End of September, the life science community met to celebrate LISAvienna. For 20 years, LISAvienna has been acting as the cluster’s central point of contact. In close collaboration with Austria’s support and funding ecosystem, the platform accompanies and supports bioentrepreneurs through the ups and downs of their journey to transfer innovative business ideas into viable products and services.

LISAvienna provides advice free of charge at the interface of Austria Wirtschaftsser vice – Austria’s promotional bank boost ing innovation and growth – and the Vienna Business Agency.

Vienna’s growing biotechnology, phar maceutical, medical device and digital health community comprises more than 600 organisations, employing a work force of 41,000 people. The Austrian Federal Ministry of Labour and Econo my and the City of Vienna are fully com mitted to advancing the sector and regu larly launch thematic funding programs.

In addition, 14% research tax premi um, well-trained hands-on profession als, an outstanding quality of life and its strategically favourable location in the heart of Europe, all make Austria high ly attractive to the life science business community. In collaboration with the Austrian Business Agency, LISAvienna also provides support for international companies, that want to set up in Aus tria, expand, grow or do research here.

Up to €1m pre-seed and seed financing is available for implementing deep-tech start-ups, and early-stage drug devel opment is eligible for funding from the € 70m KHAN-I via wings4innovation.

Twenty years ago, LISAvienna was in itiated to facilitate joining forces at fed eral and state levels with the life sci ences sector. Its outstanding success proves that the founders Sonja Ham merschmid and Edeltraud Stiftinger were right on the mark! During the cele

bration at the gorgeous Vienna City Hall, they briefly looked back at the struggles in those early days and congratulated their successors on their achievements. Today, LISA – Life Science Austria –is well-known throughout Europe and LISAvienna plays a key role in that. The Austrian booth at BIO-Europe in Leipzig once again pulled in crowds. LISAvien na Managing Directors Johannes Sarx and Philipp Hainzl commented: “Bio medical research, drug and IVD devel opment and manufacturing plus all the related services still are the strongest pillars of Austria’s and Vienna’s life sci ences landscape. In addition to health tech, green and food tech are also gain ing importance, with shared scientif ic infrastructure and cutting-edge re search findings being key drivers. To put

a spotlight on the diversity of topics and actors characterising the community, we invited eight representatives to share insights on stage at our festive anni versary ceremony.” Six stakeholders in LISAvienna were also engaged digital ly in advance to present their organisa tions, tasks and personalities, and cur rent challenges. These videos and a clip based on hundreds of event photos are available on LISAvienna’s YouTube chan nel. There, you can also find a photo mo saic clip containing lots of great memo ries drawn from LISAvienna’s archive.

Contact us: Johannes Sarx und Philipp Hainzl office@LISAvienna.at www.LISAvienna.at

19 European Biotechnology | Winter Edition | Vol. 21 | 2022 ADVERTORIAL

/

Picture: © LISAvienna

Ludwig Schedl

LISAvienna’s former and current Managing Directors: Johannes Sarx, Peter Halwachs, Eva Czernohorszky, Edeltraud Stiftinger, Sonja Hammerschmid, Michaela Fritz, Philipp Hainzl

Have biotech stocks bottomed out?

CHRIS MAGGOS,

BIOCONFIDANT

BIOCONFIDANT

SÀRL Biotechnology was dramatically rewarded in the financial markets through much of 2020 and the first half of 2021, widely credited for providing the COVID-19 vaccines. This followed four already exceptional years in the financial markets, with the Nasdaq Biotech Index (NBI) hitting its all-time high of 5449.32 on 30 August 2021.

The prolonged positive trend brutally reversed in Septem ber 2021 – the persisting COVID-19 pandemic, glob al inflation and geopoliti cal turmoil delivered repeat ed seismic shocks to financial markets, and public equity in vestors, eschewing risk, dra matically reduced their exposure to bio tech. The financing window slammed shut for biotech IPOs and venture capital in vestments dramatically slowed.

The storm in the markets over the past 14 months has been harrowing but re cently, the thunderclouds seem to have a silver lining. Despite the fact that the same fundamental issues – COVID-19, inflation, volatile geopolitics – remain, it would appear that sentiment towards bi otech has improved, as financial markets look to the future. The larger healthcare stocks maintained a more “normal” trad ing pattern, as a haven for investors dur

ing difficult market condi tions, and recently smaller biotech stocks also started to recover somewhat.

Pharmaceutical and larger biotech stocks (i.e. the larger profitable com panies with marketed products) are outperform ing the broader markets in 2022. For ex ample, Dow Jones Index is down 7.7% compared to only 1.3% for the DRG, the NYSE ARCA Pharmaceutical Index, through 15 November. The NBI is only down 9.6% compared to 28% for the Nasdaq composite during the same pe riod. This is a major change from early 2022 and late 2021, when biotech was often among the worst-performing sec tors.

The change occurred over the sum mer; NBI recovered from a low of 3508.58 on 6 June 2022 to 4248.70 at the close on 15 November, an impressive

News from the floor

Abivax SA (Euronext Paris: FR00123 33284 – ABVX), French biotechnolo gy company developing novel thera pies that modulate the immune system to treat chronic inflammatory diseases, viral infections, and cancer, announced the first patient being enrolled in the US into its global Phase III clinical program (“ABTECT program with product candi

date obefazimod for the treatment of mod erate to severe ulcerative colitis (UC).

BioNTech SE (Nasdaq: BNTX) and part ner Pfizer announced that the companies have initiated a Phase I study of a nextgeneration COVID-19 vaccine candidate that aims to enhance SARS-CoV-2 T cell responses and potentially broaden protec

740 point (21%) improvement. It is still 22% below the all-time high of 30 Aug 2021, so there is little doubt that inves tors have retrenched and begun to look for opportunities over the summer.

Nevertheless, the IPO window re mains firmly shut with the fewest num ber of deals getting done year to date in more than five years. This is likely to remain the case while the question re mains: Is this a durable recovery leading to an opening of the financing window, or the eye of the storm and just a prelude to greater losses ahead in light of worsen ing global crises?

More exciting acquisitions by larger companies could drive industry stock performance. Positive data, like the pos itive Clarity AD trial of lecanemab (Bio Arctic/Eisai/Biogen), have driven inves tors into many related neurodegeneration companies. While no company is bullet proof, the industry as a whole is stronger than ever. L

tion against COVID-19. This candidate, BNT162b4, is composed of a T cell an tigen mRNA encoding for SARS-CoV-2 non-spike proteins that are highly con served across a broad range of SARSCoV-2 variants and will be evaluated in combination with the companies’ Omicron BA.4/BA.5-adapted bivalent COVID-19 vaccine.

20 European Biotechnology | Winter Edition | Vol. 21 | 2022 STOCK MARKETS Picture: © BioConfidant Sàrl

L

COMPANY QUOTE M-CAP 52 WEEKS INDICATOR

2cureX AB 0.73 12,300k

4SC AG 1.75 17,700k

AB Science SA 8.13 376,100k

Abcam plc 15.80 3,620,000k

Abionyx Pharma SA 1.84 51,400k

Abivax SA 8.07 178,000k

Ablivia AB 0.02 26,200k

AC Immune SA 2.82 234,800k

Acticor Biotech SA 6.42 67,900k

Active Biotech AB 0.08 25,600k

Adaptimmune Therapeutics plc 2.32 386,600k

ADC Therapeutics SA 3.89 292,700k

Addex Therapeutics Ltd 0.13 5,100k

ADL Bionatur Solutions SA 0.25 13,500k

Adocia SAS 3.67 30,500k

Advicenne SA 3.75 37,400k

Aelis Farma SAS 8.67 109,100k

Affimed NV 2.08 287,600k

Akari Therapeutics plc 0.58 34,400k

ALK-Abelló A/S 13.36 2,710,000k

Alkermes plc 22.70 3,730,000k

Allarity Therapeutics A/S 0.40 4,100k

Allergy Therapeutics plc 0.17 117,100k

Alligator Bioscience AB 0.15 32,900k

Altamira Therapeutics Ltd 5.01 5,100k

Alvotech SAS 5.76 1,430,000k

Alzinova AB 0.16 6,500k

Amniotics AB 0.31 4,900k

Annexin Pharmaceuticals AB 0.09 14,300k

Aprea Therapeutics AB 0.37 19,600k

Aqua Bio Technology ASA 0.65 13,500k

Arctic Zymes Technologies ASA 6.19 320,400k

Arecor Therapeutics plc 2.72 76,600k

Argenx BV 353.80 19,770,000k

Arix Bioscience plc 1.22 157,600k

Arocell AB 0.05 12,000k

Arterra Bioscience SpA 2.13 14,300k

Asarina Pharma AB 0.08 1,800k

Ascelia Pharma AB 2.29 77,100k

Ascendis Pharma A/S 111.65 6,427,200k

Asit Biotech SA 0.12 2,500k

Autolus Therapeutics plc 2.20 206,000k

Avacta Group plc 1.34 357,500k

Avadel Pharmaceuticals plc 7.57 467,800k

Axichem AB 1.26 20,800k

Basilea Pharmaceutica AG 48.27 574,800k

Bavarian Nordic A/S 33.0 2,333,300k

Bergenbio ASA 0.08 6,000k

Bicycle Therapeutics plc 26.02 772,500k

Bioarctic AB 26.50 1,970,000k

Biocartis NV 1.02 99,000k

Bioextrax AB 0.20 1,900k

Biofrontera AG 1.62 100,800k

Biogaia AB 7.68 756,300k

Bioinvent International AB 3.24 215,000k

Biomed-Lublin SA 1.51 97,700k

Biomérieux SA 97.24 11,340,000k

BioNTech SE 161.0 38,870,000k

Biophytis SA 0.05 9,800k

low high

COMPANY

QUOTE M-CAP 52 WEEKS INDICATOR low high

Bioporto Diagnostics A/S 0.31 100,900k

Biosergen AB 1.59 41,600k

Biotage Sweden AB 16.53 1,100,000k

Bioventix plc 41.20 216,700k

Biovica International AB 0.81 17,900k

Bivictrix Therapeutics plc 0.15 9,900k

Blirt SA 0.59 9,100k

Bone Therapeutics SA 0.16 4,200k

Brain AG 5.62 118,000k

C4X Discovery Holdings plc 0.23 59,000k

Calliditas Therapeutics AB 7.64 449,800k

Camurus AB 22.50 1,250,000k

European Biotech Stocks

The unique and most complete list of share price developments of biotech companies listed in Europe – exclusively in European Biotechnology Magazine.

Cantargia AB 0.32 52,500k

Carbios SAS 32.28 360,900k

Cellectis SA 2.18 97,800k

Cellink AB 7.40 433,400k

Celon Pharma SA 2.95 161,500k

Celyad Oncology SA 1.01 23,300k

Centessa Pharmaceuticals plc 3.30 312,300k

Centogene NV 0.69 15,700k

Circassia Pharmaceuticals plc 0.39 166,100k

Cline Scientific AB 0.10 1,600k

Co.don AG 0.03 1,100k

Coegin Pharma AB 0.02 14,700k

CombiGene AB 0.79 15,300k

Cosmo Pharmaceuticals NV 60.10 998,100k

CRISPR Therapeutics AG 57.95 4,553,400k

CSL Ltd 192.22 91,900,000k

Curevac NV 8.10 1,460,000k

Cytotools AG 1.44 7,200k

Cyxone AB 0.04 3,600k

DBV Technologies SA 2.75 257,800k

Deinove SA 0.01 500k

Destiny Pharma plc 0.38 27,600k

Diagonal Bio AB 0.13 1,200k

Diamyd Medical AB 1.21 95,200k

Diasorin SpA 131.45 7,070,000k

e-Therapeutics plc 0.20 118,800k

Elanix Technologies AG 0.04 400k

Elicera Therapeutics AB 0.34 6,800k

Ellen AB 0.30 1,600k

Enzymatica AB 0.31 51,600k

Epigenomics AG 0.34 5,800k

21 European Biotechnology | Winter Edition | Vol. 21 | 2022 FINANCIAL MARKETS

COMPANY QUOTE M-CAP 52 WEEKS INDICATOR low high

Erytech Pharma SA 0.70 22,600k

Esperite NV 0.0 481,400k

Eurobio Scientific SA 17.0 195,300k

Eurocine Vaccines AB 0.06 1,000k

Eurofins Scientific SE 66.0 12,560,000k

Evaxion Biotech A/S 2.24 51,600k

Evgen Pharma plc 0.04 10,900k

Evolva SA 0.08 90,600k

Evotec SE 16.43 2,870,000k

Expres2ion Biotech Holding AB 1.03 38,600k

F-star Therapeutics Inc. 4.50 98,900k

Faron Pharmaceuticals Oy 4.16 244,000k

Fermentalg SA 1.62 65,600k

Fluicell AB 0.20 5,000k

Formycon AG 79.30 1,180,000k

Forward Pharma A/S 2.94 20,900k

Freeline Therapeutics Holding plc 0.58 39,900k

Fusion Antibodies plc 0.52 13,600k

Gabather AB 0.46 6,200k

Galapagos NV 39.35 2,610,000k

Genedrive plc 0.13 9,800k

Geneuro SA 1.68 42,000k

Genfit SA 3.67 185,800k

Genflow Biosciences plc 0.02 6,300k

GENinCode plc 0.13 12,500k

Genkyotex SA 3.22 45,100k

Genmab A/S 420.56 27,457,000k

Genomic Vision SA 0.06 4,300k

Genovis AB 3.75 245,500k

Genoway SA 4.08 36,000k

Gensight Biologics SA 3.56 166,700k

Gentian Diagnostics AS 3.63 56,000k

Genus plc 36.40 2,330,000k

Global Bioenergies SA 4.09 60,800k

Glycorex Transplantation AB 0.24 17,300k

Guard Therapeutics International AB 0.01 2,400k

Hansa Biopharma AB 4.70 209,900k

HBM Healthcare Investments AG 165.0 1,150,000k

Heidelberg Pharma AG 5.70 265,500k

Hemogenyx Pharmaceuticals plc 0.01 12,700k

Herantis Pharma Oyj 3.12 52,700k

Hofseth Biocare ASA 0.26 104,000k

Hookipa Biotech AG 1.09 56,400k

Hybrigenics SA 0.09 18,300k

Idorsia Ltd 14.45 2,591,800k

Immatics NV 9.91 751,500k

Immunic AG 1.40 54,800k

Immunicum AB 0.20 40,500k

Immunovia AB 2.95 68,100k

Immupharma plc 0.05 3,300k

Index Pharm. Holding AB 0.09 47,000k

Infant Bacterial Therapeutics AB 5.77 63,000k

InflaRx NV 2.51 108,000k

Innate Pharma SA 2.14 170,200k

Integragen SA 1.19 7,700k

Intervacc AB 2.66 134,100k

Inventiva SA 4.29 173,800k

IO Biotech Inc. 2.88 80,900k

IRLAB Therapeutics AB 3.12 163,400k

COMPANY QUOTE M-CAP 52 WEEKS INDICATOR

Isofol Medical AB 0.04 6,700k

ISR Holding AB 0.29 20,100k

Kancera AB 0.20 11,200k

Karo Pharma AB 5.39 1,470,000k

Kuros Biosciences AG 1.67 61,500k

Lipigon Pharmaceuticals AB 0.09 1,800k

Lipum AB 1.39 10,600k

Lysogene SA 0.54 10,800k

Lytix Biopharma AS 0.74 30,400k

MaaT Pharma SA 8.68 85,800k

Mabion Ltd 4.54 73,400k

Mainz Biomed BV 9.12 132,200k

Marinomed Biotech AG 71.60 105,400k

MDxHealth SA 0.76 123,800k

Medesis Pharma SA 2.60 11,100k Medigene AG 2.19 55,000k Medincell SA 5.90 146,400k Medivir AB 0.77 43,700k Merus BV 15.60 722,300k

Metabolic Explorer SA 1.67 72,300k

Midatech Pharma plc 0.04 4,400k

Mithra Pharmaceuticals SA 6.05 327,000k

Modus Therapeutics Holding AB 0.22 3,600k

Molecular Partners AG 6.53 230,200k

Morphosys AG 15.36 524,400k

Nabriva Therapeutics plc 2.16 6,600k Nanobiotix SA 3.83 132,100k Neovacs SA 0.01 100k

Newron Pharmaceuticals SpA 2.25 40,200k

Nextcell Pharma AB 0.65 22,400k

NFL Biosciences SA 2.09 10,500k Nicox SA 1.73 73,100k

NLS Pharmaceutics AG 0.67 10,200k

Nordic Nanovector ASA 0.10 11,900k Novacyt SA 0.72 50,600k

Novozymes Biopharma DK A/S 53.84 11,986,600k Noxxon Pharma NV 3.40 4,900k Nucana plc 0.91 50,700k

Nykode Therapeutics ASA 2.25 733,900k ObsEva SA 9.38 779,100k

Okyo Pharma Ltd 0.02 29,000k

Oncimmune Holdings plc 0.47 32,200k

Oncoarendi Therapeutics SA 3.17 44,400k

Oncodesign Biotechnology SA 14.34 99,300k

Oncopeptides AB 1.41 127,700k

OncoZenge AB 0.40 4,700k

Onxeo SA 0.20 22,500k

Open Orphan plc 0.12 88,600k

Optibiotix Health plc 0.21 18,300k Orphazyme A/S 0.15 5,500k

Oryzon Genomics SA 2.12 114,100k

OSE Immuno SA 6.68 123,800k

Ovoca Bio plc 0.05 4,100k

Oxford Biodynamics plc 0.25 35,800k

Oxford Biomedica plc 3.82 367,700k

Oxurion NV 0.11 11,200k

Paion AG 0.92 65,600k

Pangaea Oncology SA 1.53 46,700k

PCI Biotech Holding ASA 0.17 5,800k

low high

22 European Biotechnology | Winter Edition | Vol. 21 | 2022 FINANCIAL

MARKETS

COMPANY QUOTE M-CAP 52 WEEKS INDICATOR

Pharma Mar SA 65.22 1,190,000k

Pharming Group NV 1.14 757,000k

Pharnext SA 0.0 3,900k

Pherecydes Pharma SA 2.18 15,500k

Photocure ASA 9.09 248,200k

Physiomics plc 0.02 2,400k

Pieris Pharmaceuticals Inc. 0.92 68,700k

Plant Advanced Technologies SA 15.75 17,200k

PolyPeptide Laboratories (Sweden) AB 35.06 1,163,300k

Polyphor AG 0.46 21,300k

Poolbeg Pharma plc 0.11 55,000k

Poxel SA 1.47 43,100k

Predilife SA 5.90 21,500k

Probi AB 18.94 218,500k

Promore Pharma AB 0.07 4,600k

ProQR Therapeutics BV 1.19 84,900k

Prostatype Genomics AB 0.16 3,700k

Proteome Sciences plc 0.03 9,000k

Prothena Corporation plc 56.10 2,720,000k

Pure Biologics SA 5.51 12,200k

Q-Linea AB 1.64 47,900k

Qiagen NV 46.26 10,710,000k

Quantum Genomics SAS 0.15 5,400k

QuiaPEG Pharmaceuticals Holding AB 0.01 100k

Quotient Ltd 1.06 3,800k

Redx Pharma plc 0.62 209,300k

Relief Therapeutics Holding AG 0.03 130,400k

Reneuron Group plc 0.27 15,400k

Ryvu Therapeutics SA 8.19 152,900k

Saniona AB 0.29 20,200k

Santhera Pharmaceuticals AG 0.60 31,600k

Sareum Holdings plc 0.96 67,400k

Scancell Holdings plc 0.19 155,700k

Scandion Oncology A/S 0.12 4,800k

Selectimmune Pharma AB 0.32 5,400k

Selvita SA 16.62 305,100k

Sensorion SA 0.46 36,400k

SenzaGen AB 1.16 28,600k

Shield Therapeutics plc 0.14 34,800k

Silence Therapeutics plc 6.32 536,000k

Simris Alg AB 0.26 41,400k

Skinbiotherapeutics plc 0.26 41,000k

Softox Solutions AS 2.70 27,900k

low high

COMPANY QUOTE M-CAP 52 WEEKS INDICATOR

Sophia Genetics SA 1.89 116,000k

Sprint Bioscience AB 0.07 2,900k

Stayble Therapeutics AB 0.37 4,800k

Summit Therapeutics plc 0.96 79,000k

Swedish Orphan Biovitrum AB 19.12 6,030,000k

SynAct Pharma AB 4.87 137,500k

Synairgen Research Ltd 0.18 42,800k

Targovax ASA 0.11 21,200k

Theradiag SA 2.27 29,800k

Theranexus SA 1.82 7,800k

Tissue Regenix Group plc 0.01 50,100k

Tiziana Life Sciences plc 0.62 63,400k

Transgene SA 1.87 189,100k

Trinity Biotech plc 1.34 50,300k

Ultimovacs ASA 9.64 316,800k

uniQure NV 21.56 1,010,000k

Vaccibody AS 2.53 733,900k

Valbiotis SAS 3.60 44,900k

Valirx plc 0.21 18,600k

Valneva SE 6.92 940,700k

VectivBio AG 7.68 342,100k

Verici Dx plc 0.16 26,400k

Verona Pharma plc 12.02 911,900k

Vicore Pharma Holding AB 2.40 172,400k

Virax Biolabs Group Ltd 1.41 14,900k

Virogates A/S 7.37 26,400k

Vita 34 AG 8.76 138,700k

Vivoryon Therapeutics AG 10.0 205,800k

WntResearch AB 0.04 5,500k

X4 Pharmaceuticals Inc. 1.79 124,600k

Xbrane Biopharma AB 6.23 168,600k

Xintela AB 0.05 14,600k

Xlife Sciences AG 31.30 163,800k

Xspray Pharma AB 4.99 113,300k

Yourgene Health plc 0.03 20,300k

Zealand Pharmaceuticals A/S 24.38 1,260,000k

low high

23 European Biotechnology | Winter Edition | Vol. 21 | 2022 FINANCIAL MARKETS

All quotes are listed in Euro. All data is provided without guarantee. The effective date is 22nd November 2022. These Europe-based biotech companies are traded on European stock markets.

How do I find a new job or a new employee? Now, there is an easy solution: eurobiotechjobs.net, the Europe-wide job market for biotechnology and the life sciences. Presented by the European Biotechnology Network.

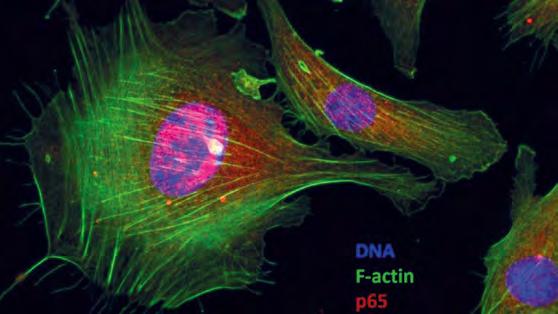

Innate immunity and its power in cancer therapy

KILLER CELLS One of the most distinguishing hallmarks of tumours is their ability to avoid immune recognition. New immunotherapies have focused on breaking down those barriers, leading to treatment breakthroughs for blood cancers. While these therapies have shown great promise for some indications, we still lack effective therapies for many others. A novel route to address this is to the restore innate immunity’s ability to fight cancer.

› Arndt Schottelius – Chief Scientific Officer at Affimed NV, Heidelberg, Germany