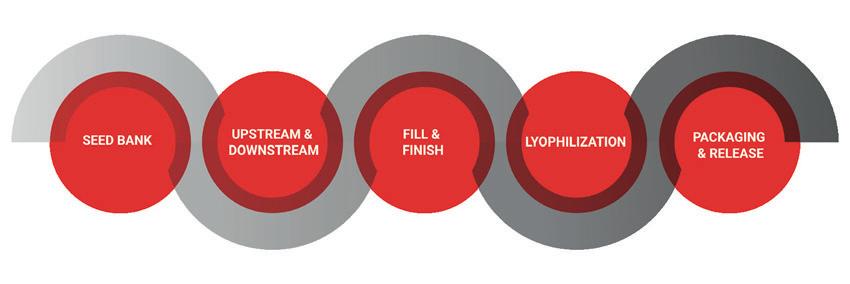

State-of-the-art mammalian cell culture manufacturing facilities in Europe and Asia for clinical and commercial material, ranging from 150 to 13,000 liters.

Customized solutions and efficient handling for your microbial-based products, with upstream and downstream capabilities ranging from 150 to 40,000 liters.

High-quality plasmid DNA and RNA manufacturing for various types of RNA drugs (including siRNA), mRNA vaccines and innovative gene and cell therapies, up to a scale of 3,000 liters.

Rely on a leading Cell & Gene therapy manufacturer with an excellent team and high-tech facilities.

Producing viral vectors for vaccines or cell and gene therapy in a state-of-the-art facility.

A fully integrated set of services and solutions for aseptic fill and finish of medicinal products. Available packaging systems and volumes include:

• Vials (liquid, lyophilized)

• Pre-filled syringes

• Low-level siliconized syringes

• Droptainers

• Ampules

• Tubes

Manufacturing master cell and working cell banks to enable high-quality clinical and commercial production.

We follow a comprehensive Novartis quality assurance system, with all our facilities operating in compliance with cGMP regulations.

To find out how we can help, get in touch at biotech.cooperations@novartis.com www.novartis.com/globalbiotechcooperations

Biotechnology is helping us tackle challenges such as emerging diseases, the impact of ageing in healthcare, population growth, climate change, and the green transition of the economy. Precision medicines, advanced therapies, mRNA and gene editing technologies are transforming the way diseases can be diagnosed and treated, providing life-saving solutions. Biotechnology is also at the forefront of building a sustainable economy, developing better crops, providing new protein sources, and producing bio-based materials.

ION AROCENA is the CEO of AseBio, the Spanish Bioindustry Association. He holds a Bachelor’s degree in Biology from the Complutense University of Madrid, graduating with honours (2003), and a Master’s degree in Business Administration from EOI (2010). He worked in a life sciences venture capital firm for almost a decade before joining AseBio in 2016.

It’s time to place biotechnology at the core of a new, more sustainable European growth model. Since July 1st, Spain holds the Presidency of the Council of the EU with a programme focused on four key pillars: re-industrialisation of the EU and ensuring its strategic autonomy, advancing in the green transition, promoting greater social and economic justice, and strengthening European unity. Biotechnology can play a fundamental role in achieving these objectives. The COVID -19 pandemic highlighted both the vulnerabilities and strengths of the EU life sciences ecosystem. It may be too late or costly to revert some of the latter, but with the lessons learnt in mind, we could still strengthen our capabilities in key technologies for the medicines of tomorrow, such as biologics, cell and gene therapies. While the EU remains a scientific powerhouse in these areas, we struggle to develop technology, launch ventures and grow them into global players. Europe needs to boost investment in R&D and enabling infrastructure, generate and grow more innovative companies, and increase biomanufacturing capacity in this space. On the other hand, biotechnology is crucial for the green transition. New Genomic Techniques (NGTs) are very precise and efficient, allowing us to modify the genome of plants and microorganisms specifically. NGTs are key tools for developing plant varieties that can be climate resilient, pest resistant, require fewer fertilisers and pesticides, or ensure higher yields, contributing to the goals of the green deal and meeting the increasing demand. Their application in microorganisms can also lead to new strains to produce raw materials for other industries, reduce the demand for natural or fossil resources and contribute to the green transition.

Europe is clearly at a turning point that will determine our competitiveness and resilience for the next generation. Legislative proposals affecting the biotech ecosystem are currently under discussion. To mention two, the EC launched a proposal for a new regulation on plants obtained by NGTs paving the road to enable the use of NGTs in Europe. Secondly, the proposal of the Commission for the revision of the EU Pharmaceutical Legislation includes provisions aimed at improving the EU’s regulatory framework and promoting ‘novel technologies, although some may undermine the predictability and stability of EU’s incentives regime and may hamper the industry’s ability to innovate. It is a critical moment for Europe to establish regulatory frameworks which are fit for purpose and enable innovations to happen, allowing their potential to be fulfilled. Only by doing so will Europe be able to lead in global innovation and transition towards a more sustainable economy, thereby strengthening its strategic autonomy.

Cell and Gene Therapies (CGTs) have emerged as one of the fastest growing sectors in the life sciences industry, even though supply chains in the field are more complex than in traditional pharma. That’s because CGTs for rare diseases mostly can’t be produced centrally, and still require a lot of handson work, including directly in clinics. For firms to t ake advantage of Europe’s excellent science base, networking stakeholders and safe reimbursement are proving to be crucial factors. The EU has some catching up to do.

6 NGT deregulation: The end of breeding standstill is in sight

10 EU Commission: Gun-jumping fine for Illumina; Pharmaceutical legislation; EU Commission to cut red tape; Pandemic update

17 Interview: VC m odel fi ts Europe Daniel Parera, M.D. and Dr. Peter Neubeck, Kurma Partners

20 Analyst commentary

21 European Biotech Stocks

24 Artificial intelligence –to ol or trouble?

28 Update on clinical trials

30 Precision therapeutics: optimising early drug discovery

34 Infrastructure makes the difference

57 Spain – an e merging European biotech champion

58 An overview of a sector that has to be proven strategic

60 Paving the way to internationalisation

62 BIOSPAIN 2023: Biotech as a critical industry

64 Northern Europe: Sweden, Denmark, Norway and Finland

66 We stern Europe: France, Belgium, The Netherlands and the UK

68 Central Europe: Germany, Switzerland and Austria

70 Southern Europe: It aly, Spain, Croatia, Slovenia and Portugal

72 Ea stern Europe: Poland, Hungary, Czech Republic & biotech powerhouse Lithuania

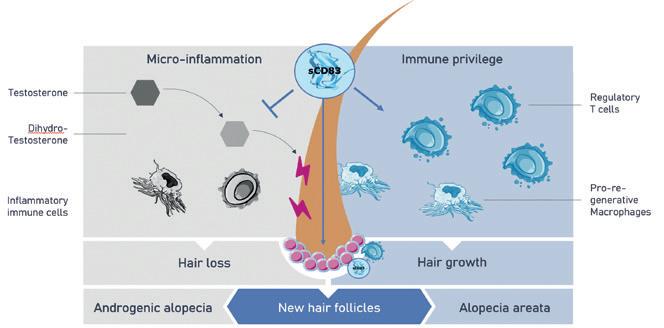

75 Topical hair growth inducer

76 Bot for drug delivery

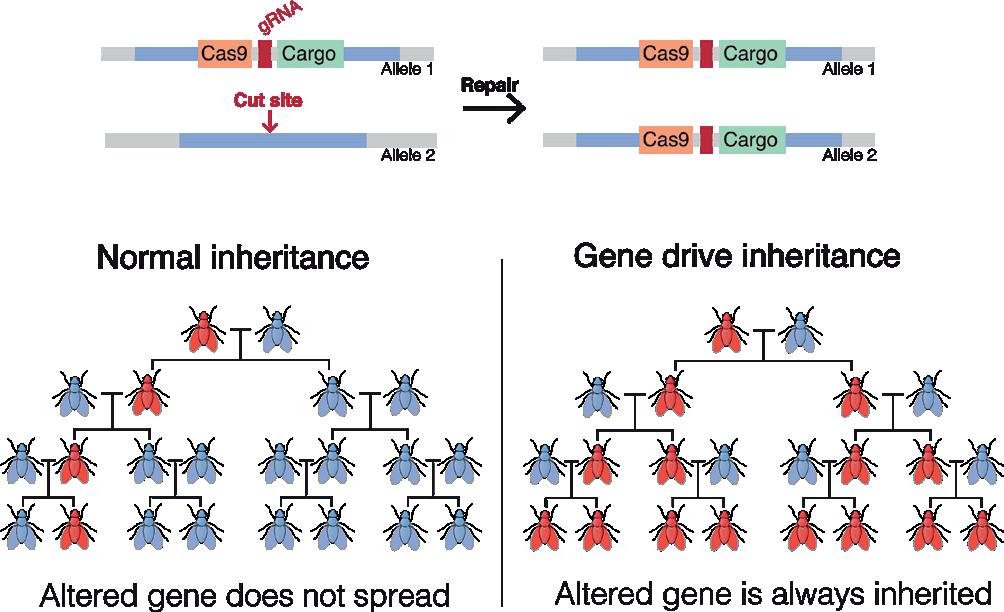

77 Biodiversity: Gene drive for nature protection

PICK & MIX

42 Biopeople

81 News from Biotech Austria,SBA

85 ICPO Forum

86 PharmaLab Congress

88 Company index, New products

89 Events

90 Encore

IMPRINT European Biotechnology (ISSN 2364-2351) is published quarterly by: BIOCOM Interrelations GmbH, Jacobsenweg 61, D-13509 Berlin, Germany, Tel.: +49-30-264921-0, Fax: +49-30-264921-11, Email: service@european-biotechnology.com, Internet: www.european-biotechnology.com; Publisher: Andreas Mietzsch; Editorial Team: Thomas Gabrielczyk (Editor in Chief), Derrick Williams (Co-editor), Dr. Georg Kääb, Uta Mommert, Gwendolyn Dorow, Margarita Milidakis, Maren Kühr; Advertising: Oliver Schnell, +49-30-264921-45, Christian Böhm, +49-30-264921-49, Wolfgang Gutowski, +49-30-264921-54; Distribution: Lukas Bannert, +49-30-264921-72; Graphic Design: Michaela Reblin; Production: Martina Willnow; Printed at: Königsdruck, Berlin; European Biotechnology Life Sciences & Industry Magazine is only regularly available through subscription with a BIOCOM CARD. Annual subscription BIOCOM CARD Europe: €80 for private individuals (students €40) incl. VAT, €120 plus VAT for corporates. Prices includes postage & packaging. Ordered subscriptions can be cancelled within two weeks directly at BIOCOM AG. The subscription is initially valid for one calendar year and is automatically renewed every year after. The subscription can be cancelled at any time and is valid until the end of that calendar month. Failures of delivery, which BIOCOM AG is not responsible for, do not entitle the subscriber to delivery or reimbursement of pre-paid fees. Seat of court is Berlin, Germany. As regards contents: individually named articles are published within the sole responsibility of their respective authors. All material published is protected by copyright. No article or part thereof may be reproduced in any way or processed, copied, and proliferated by electronic means without the prior written consent of the publisher. Cover Photo: Ruslan Batiuk - stock.adobe.com; ® BIOCOM is a registered trademark of BIOCOM AG, Berlin, Germany.

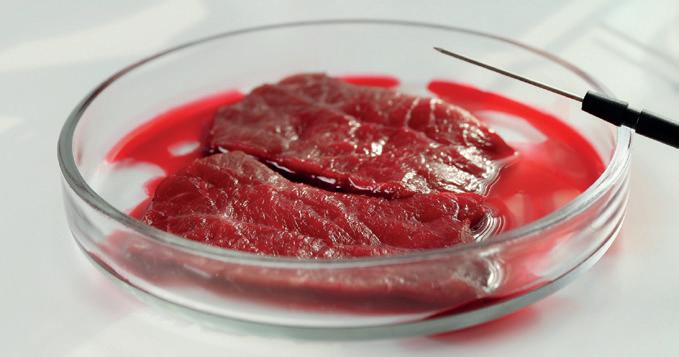

Biotech start-ups that want to completely decouple protein production from agriculture due to environmental and animal protection benefits have been blocked by the EU’s stubbornly slow Novel Food Regulation. This summer, the Dutch Government paved the way to giving consumers early and rapid access to cellular agriculture products through unique tasting events.

Except in Spain and Portugal, the commercialisation of biotech crops stalled in Europe for about 15 years. In July, the EU Commission tabled a draft regulation, backed by agriculture ministers at an informal meeting to incentivise researchers and farmers to make use of new genomic techniques in plant breeding.

Survival of the fittest – that’s how Charles Darwin formulated the idea that the species best adapted to prevailing environmental conditions will win out. In the fastest-growing field in the pharma biotech sector – cell and gene therapy – China now looks set to overtake the US, the biotech world market leader – at least as far as clinical trials are concerned. And Europe? The bloc continues to suffer from a lack of communication/networking and seemingly ineradicable bureaucratic hurdles when it comes to bringing ideas from bench to bedside –with exceptions such as the UK or Spain (see Country Focus, p. 57). Biotech entrepreneurs want to turn that around with historic opportunities for reform of the EU’s pharmaceutical legislation (see. p. 36).

Their biotech colleagues in the boom market of cellular agriculture and precision fermentation – in short, vegan protein substitutes – feel the same. This summer, the Netherlands opted out of the EU system, and will now allow preapproval tastings of novel sustainable foods (see. p. 12).

The EU Commission has already moved on the issue of biotech breeding, and was able to get a majority in the EU Council of Agri-Ministers behind its proposal to create the most liberal set of regulations in the world for approving crops produced with new techniques (see p. 6). Now we have to see how adaptable Europe is in other fields.

Thomas Gabrielczyk Editor-in-Chief

NEW GENOMIC TECHNIQUES With an aggressive legislative proposal to exempt crops modified biotechnologically within the species’ own gene pool from the strict controls of EU genetic engineering rules, the EU Commission wants to bring Europe back to the top of the world in plant breeding. If its draft regulation goes through unchanged, the EU would have one of the most liberal regulations in the world. Most EU agricultural ministers support the draft.

A renaissance of European plant research, once a leader in precision breeding, is promised by the EU Commission’s current attempt to facilitate the use of “new genomic techniques” (NGT). Ex-Commission Vice President Frans Timmermans said in Brussels “farmers will get access to more resilient crops through the new breeding techniques, for which fewer pesticides need to be used and which are better adapted to climate change.” Of 484 development projects, however, just 38 are aimed at improving crop resilience to climate-related abiotic stresses, according to data released by the German Academy of Sciences Leopoldina in mid-August.

At the heart of the Commission’s proposal are plant varieties bred using new

genomic techniques – an internationally unfamiliar term under which the EU Commission subsumes all cis-genetic and genome-editing techniques by which individual nucleotides or DNA sequences in the plant genome can be mutated, deleted, reversed, or reinserted from closely related species using homologous end-joining. While governments worldwide, including the USA or UK regulations, only allow a single targeted change to the plant genome to be deregulated, the EU Commission wants to greenlight 20 of the above changes in any combination for each plant under newly defined, so-called equivalence criteria. With these, the Commission demarcates Class 1 NGT plants from Class 2 NGTs. NGT1 breeds – after formal official confirmation of their status within 30 days – will be treated in the same way as conventional breeds and will only be labelled as NGTs in a seed database but

won‘t be traceable like GMOs are. The deregulation is expected to save seed breeders up to €11,000 per approved variety and a lot of administrative burden, according to the Commission.

Although NGT-2 plants contain only species-specific DNA or that of closely related species, they are considered nonequivalent because they could not even theoretically be produced by conventional breeding methods. They therefore undergo a simplified approval and risk classification procedure compared with transgenic plants containing genetic material foreign to the species.

In contrast to plants containing foreign genes, the EU Commission wants to promote the cultivation and release of these NGT2 varieties:

› if the plants promise improved yields with less fertilizer and pesticide use,

› are better able to withstand abiotic and biotic stress,

› can be better stored and transported, or

› require less water and nutrients for the same yield.

Yet, they are supposed to be subject to labelling and traceability requirements – in short, to contribute to the climate goals of the Green Deal. That this is not in the cards is claimed by a study from Switzerland published at the end of August. “Swiss agriculture should not rely too much on novel genetic engineering” writes the Federal Ethics Committee on Non-Human Biotechnology (Ekah) in its 36-page study as a clear majority of the commission [...] considers the potential

Keep it simple, stay flexible

The Nexera Prep Series Preparative Purification LC improves productivity tremendously via efficient preparative work using application-specific LC or LC-MS solutions. It provides better prep processes for drug discovery and purification of functional components in pharmaceutical, chemical and food industries.

Ease-of-operation in a flexible set-up supported by flexible choice of detectors and efficient process automation

Simplifies the fractionation programming using the LabSolutions software’s fractionation simulation function

High sample capacity with a reduced footprint through a space-saving design with support of custom racks

Fast recovery of highly purified target compounds by automation of fractionation, concentration, purification and recovery

of genetic engineering methods in arable farming to be too insignificant to rely on these methods in view of Switzerland and especially in view of the urgency of the climate goals as a whole”. Instead of relying on NGT breeding, the experts see more potential to mitigate GHG emissions from agriculture in reducing the number of animals in livestock farming, establish grassland farming and expand plant-based nutrition. The report does not cover whether the Paris goals could be achieved by means of biotechnologically and microbially produced protein substitutes. Manufacturers of vegan protein, on the other hand, emphasize that their fermenter-supported processes reduce CO2 emissions by more than 85% and water consumption by at least 60% compared to conventional agriculture and livestock farming, and therefore want to completely decouple protein production from animals and land use

Science and seed industry officials rejoiced at the solution put forward by the EU Commission in the first week of July. “It’s a big step; I’m quite happy,” said Agnès Ricroch, secretary of the life Sciences section of the Academy of Agriculture of France researching at AgroParisTech. “It has been difficult to get money to carry out research using genetically modified organisms and permission for field trials”, she said. “I think this is going to change,” Euroseeds Secretary General Garlich von Essen stressed that “Europe today is the leading developer and exporter of seed worldwide. It is good to see that the foundation

of this success is enshrined in the Commission’s proposal.” Plant breeders, however, criticised that the EC’s draft regulation excludes the question of patents on breeds, from the regulation and delayed a decision on it not earlier than in 2026. According to the European Patent Office, today there are more than 3,000 patents on GMOs, most of them in the hands of multinational seed companies such as BASF, Bayer/ Monsanto or ChinaChem/Syngenta. European Landowners’ Organization (ELO) welcomed the proposals for an EU regulation on plants produced by New Genomic Techniques. However, ELO “strongly advocates for maintaining the integrity of organic production through clear labelling and traceability.” There is a need for more details on both authorisation and notification procedures and their key elements to ensure a swift implementation of the regulation, ELO officials stressed.

Opponents of genetic engineering and consumer protection groups showed the familiar defensive reflexes against GMOs. GMO opponents such as Green MEP Martin Häusling warned that if this draft becomes law, consumers will have “no way of knowing whether they are eating GM food”. According to said Jan Plagge, president of IFOAM Organics Europe, “this proposal is a massive accelerator for a lucrative business.”

In this context, the promise that new bio tech breeds could slow down cli -

mate change shows a value-based split in the anti-GM front, which has successfully kept agribiotech products off the EU market and fields for more than 15 years. Seemingly “green” organisations such as RePlanet that describes itself as “a grassroots citizen organisation driven by science-based solutions to climate change, biodiversity collapse and the need to eliminate poverty” stressed that “there is simply no need to regulate NBTs more strictly than traditional methods.”

In view of the fact that in its draft regulation the Commission can impose releases on EU member states if an NGT2 plant has proven to be harmless in a release in another EU state, there have been efforts by GMO-averse member states to form a blocking minority in the Council of Europe. In addition, the draft regulation prohibits organic farmers from using NGT1 plants, but at the same time offers no practicable coexistence rules for organic farmers. However, at an informal Council meeting, a majority of agricultural ministers backed the draft (see p.57).

Just as in Switzerland, Austria is committed to GMO-free cultivation and wants to block the EU Commission’s deregulation proposal, as it does not contain any effective measures for the coexistence of NGT breeding and organic farming. For the EU, the goal of achieving a 30% organic farming share until 2030 in the absence of appropriate coexistence rules would no longer be achievable and would make the EU largely dependent on imports. As a means to achieve coexistence of organic farming and NGT crops, the Swiss Research Institute of Organic Agriculture proposes a cultivation cadastre that shows before sowing on which field NGT seeds are to be used. This would enable farmers to reach agreements without the need for mandatory labelling of NGT products.

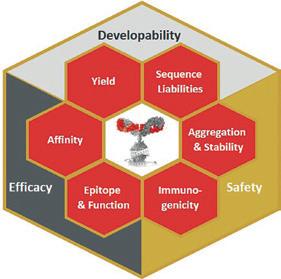

Sino Biological provides rapid and quality guaranteed monoclonal antibody humanization services using complementaritydetermining region (CDR) grafting technology and computer-aided molecular modeling, based on its deep expertise and over 15 years of experience in antibody development.

Short

3-4

• Comparable to Parental Antibodies or Higher •

Affinity Validated by ELISA and SPR/BLI

• Integrated Analysis Platforms

Mouse Antibody CDR and FR Identification

Affinity Validation

Antibody Modeling Identify Key Residues

Human V Gene

Antibody Modeling Search

Antibody Expression

Can be combined with AI-powered affinity maturation service

CDR Grafting

Back Mutations

Align

Learn more about antibody humanization services

As part of the Pharma legislation reform, the European Commission is preparing simplifications in the approval of medicines in Europe. Short approval times for patented medicines is crucial for the profits of biopharma companies which select where to go depending on the quality of regulatory expertise, openness to industry collaboration, clarity of communication, and a positive regulatory track record. The Commission wants to cut red tape and shorten the time needed for benefit-risk assessments by authorities co-funded by manufacturers. Following stakeholder consultation in September, the Commission will present a legislative proposal to this end. The current rules in Regulation EC 1234/2008 on the scope of data and technical information to be provided by manufacturers will be adapted. The initiative also proposes to extend the risk-based approach for categorising changes to certain biologic medicines, and in particular to update the rules for biologics and active substance changes.

In September, the European Commission has authorised an updated COVID-19 vaccine from BioNTech SE and the company’s global commercialisation partner Pfizer Inc. It targets the still dominant Omicron XBB.1.5 variant. However, a potentially new variant called Pirola (BA.2.86), which differs in 35 mutations from XBB.1.5. is currently spreading globally. Though, the US CDC mark its high potential for immune escape, the authority claims to already know that the XB.1.15 vaccine protects against them.

COMPETITION LAW The European Commission has fined US next generation sequencing (NGS) world market leader Illumina Inc. with €432m for intentionally breaching EU merger regulations when taking over cancer diagnosis pioneer Grail Inc for US$8bn despite the bloc’s authorities ongoing probing of the beleaguered deal. Grail says, its Galleri cancer test can detect a signal shared by more than 50 types of cancer with 99.5% specificity and 88% sensitivity.

The fine corresponds to 10% of Illumina’s annual sales and is thus the highest amount possible under EU antitrust law. Grail will receive a symbolic fine of €1,000. Such a high fine for Illumina is necessary because the company “delib -

erately and intentionally” breached the standstill obligation set out in EU merger control law by closing early, the EU Commission said.

Illumina had completed the €8bn acquisition of Grail in August 2021 and put aside the fine to be paid in 2024 after announcing it in September 2020, without notifying EU competition regulators, who had announced in July 2021 that the review would take longer than expected. In September 2022, the Commission blocked the transaction over concerns that it would have significant anticompetitive effects, stifling innovation and reducing choice in the emerging market for blood-based early cancer detection tests. L

BIODIVERSITY In a memorable vote, the European Parliament confirmed a core element of the EU’s biodiversity strategy by a razor-thin majority. The MEPs rejected an application of German EPP leader Manfred Weber to reject the Commission’s proposal (s. photo). For the first time globally, the renaturation law recognises services provided by nature, such as buffering anthropogenic CO2 emissions through carbon sinks, pollinating plants by insects, etc., which are accounted for as free in previous economic models. The bill will allow for 30% of all former peatlands currently exploited for agriculture (excluding cattle farms) to be restored and partially shifted to other use by the end of the decade, a figure rising to 70% by 2050. L

The novel food sector has gotten a boost in The Netherlands. Tasting has grown much easier, helping start-ups get customer feedback early on – a seemingly simple but important step.

PRECISION FERMENTATION As plant-based alternatives to meat take off, novel foods are no longer looking so novel – even when it comes to those that come only indirectly from animals. Many start-ups are pursuing the lab-based development of milk, meat or fish. What’s missing is the customer experience. The Netherlands is now seizing a position at the centre of the novel food movement in Europe by allowing early tasting events.

Food is no longer just food. It may come from traditional agriculture, which now includes products from land that’s extensively or intensively farmed with the digital help of drones to optimise pesticide use. But the term ‘food’ also covers products farmed according to dynamic-organic regulations that explicitly exclude chemistry, or ones that follow traditional methods, like planting and harvesting during certain phases of the moon. Not even to mention genetically modified crops. But much of the ‘food’ we buy from the supermarket may soon no longer require farmland at all. It can be blended by cultivation devices into a product that outwardly resembles the original fruit, vegetable, meat, fish or milk.

Sounds disgusting, inhuman or unnatural? Well, it’s already happening. It would just be a further step down a road that many foods in our industrialised world have taken. We often mix different ingredients and some natural raw materials to create products that taste like what is pictured on the packet. Just look at the ingredients list on the ice cream you buy in your favourite shop. Do you recognise them, or know what they are for?

The new movement of novel foods originating in the lab is actually in most cases aimed at giving consumers more insight, and talking openly about the processes of cultivation or fermentation. But the landscape is also hard to parse. On the one hand, there’s a lot of investor interest in cultured meat, precision fermentation and cow-less milk or cheese. On

the other, the sector is cooling down because the gulf between product and consumer is still pretty deep and wide. At least that’s true in Europe, where regulation of novel food approvals coordinated by European Food Safety Authority (EFSA) is very slow, to say the least. Consumer experiences of cultivated meat were first celebrated in London (2013), and have since also happened in Singapore. The cost of that complex first gen -

eration burger made of diced cellular matrices was a whopping €330,000.

The field has come a long way since those early days. Professor Mark Post from the University of Maastricht in the Netherlands cultured that first burger from muscle stem cells in fetal calf serum, so the method didn’t meet slaughter-free expectations from the start. But Post and his team at Mosa Meat have since learned to use other ingredients for cultivation, and now guarantee results where no animal was harmed.

So far, only California-based Good Meat (formerly known as Eat Just) has managed to have a cultured meat product approved for public sale. Regulators in Singapore – until recently the only country in the world to allow the sale of such products – greenlighted their cultured chicken in December 2020. “Cultured meat is real meat, but you don’t have to slaughter an animal,” said Josh Tetrick, CEO of Good Meat, in a BBC interview.

?Your comment about the new legislation in The Netherlands?

!We thank all 127 members of the Tweede Kamer who voted in favour of finding a way to make food from laboratories possible. Mosa Meat will use these controlled tastings to gather feedback, but also to educate stakeholders on the role that cellular agriculture can play in Europe to meet food sovereignty and sustainability goals.

Now his home country is following suit. At the end of last June, the US Department of Agriculture gave a first-ever approval for cell-cultured meat produced by two companies: Good Meat and Upside Foods. Both grow small amounts of chicken cells into slaughter-free slabs. It was the final regulatory thumbs-up the California-based companies needed to sell and serve their products in the United States. The approval came less than a year after the US Food and Drug Administration (FDA) declared the companies’ products safe to eat, and is a major mile -

stone for the burgeoning cultured meat industry.

But that doesn’t mean cultivated steaks will be hitting supermarket shelves tomorrow. For now, both companies have just been given the go-ahead to sell chickenonly products to a select handful of restaurants. Marketing cell-cultured beef, pork or seafood will require further approvals.

The Netherlands is now building on the early successes of Mark Post and his team, and has taken up the baton from the US approval. In July, the announcement came that it will soon be possible to taste cultivated meat and seafood in the Netherlands. The Dutch government – in collaboration with producers Meatable and Mosa Meat, alongside industry representative Hollandbio – has successfully developed a ‘code of practice’ to allow tastings in controlled environments. The normal novel food approval process does not allow for pre-tasting. This proviso is what drives start-ups to countries and locations, like Singapore, where there is more openness to food innovation.

The historic decision makes the Netherlands the first country in the EU to allow pre-approval tastings of foods derived directly from animal cells prior to novel food approval in the bloc. It follows the government’s ‘National Growth Fund’, which has committed €60m to build a robust cellular agriculture ecosystem to make the Netherlands a global hub for the emerging technology.

The organisation set up to implement the National Growth Fund plan, Cellular Agriculture Netherlands, will be responsible for implementing the code of practice. It includes hiring a panel of experts to evaluate requests from companies to conduct tastings of cultured meat and seafood.

The code of practice was created following an intervention by the Dutch

House of Representatives in 2022. A motion sponsored by MPs Tjeerd de Groot (D66) and Peter Valstar (VVD) called on the government to enter into consultations with Dutch cellular farming producers to allow for pre-approval tastings under controlled and safe conditions. Companies welcomed the move.

Krijn de Nood, CEO of Meatable, commented on the new framework: “This is great news for the Netherlands. We know that cultured meat can make a significant contribution to reducing climate change. By making it possible to taste cultured meat, the Netherlands continues to lead the way in Europe and beyond. For Meatable, this means that we can give consumers the opportunity to taste and experience our products, and use their feedback to make our products even better. Our goal is to make tasty cultured meat, indistinguishable from conventional meat, available to everyone, without harming people, animals or our planet.”

Maarten Bosch, CEO of Mosa Meat, added: “We thank all 127 members of the Tweede Kamer who voted in favour of finding a way to make this possible, and Minister Kuipers, Minister Adema and their teams for their professionalism and cooperation in making this happen. Mosa Meat will use these controlled tastings to gather invaluable feedback on our products and to educate key stakeholders on the role that cellular ag-

riculture can play in helping Europe to achieve its food sovereignty and sustainability goals.”

The motion was supported by 14 of the 17 voting political parties, including the VVD, BBB, CDA, D66, Christen Unie, PvdA, GroenLinks and others. But it has been a long road to the new legislation, as Timen van Haaster from the Dutch biotech industry association Hollandbio told EuropE an BiotEchnology. “It took years, starting with MPs Tjeerd de Groot (D66) and Peter Valstar (VVD) raising the issue in the Dutch parliament,” said van Haaster. In the end, almost two years ago, they tabled a motion calling on the Dutch government to make room for tasting cultured meat in a safe and responsible way before applying for a Novel Food procedure.

Meatable and Mosa Meat are members of Hollandbio, but the cellular farming sector remains small. Because of the long history and the new global dynamics in the field, these few companies and the industry organisation felt they had to start putting cultured meat on the Dutch political agenda. That created more urgency to implement policies that would stimulate development in the field in the Netherlands. Without it, start-ups might have started looking abroad for friendlier policies. After the motion was passed by a

fairly wide margin in the Dutch parliament, the country’s Ministries of Agriculture and Health – in cooperation with Meatable, Mosa Meat, Hollandbio and a regulatory expert – started working on a protocol to enable tastings. This process resulted in a ‘code of practice’ to which companies will adhere. It includes a procedure for assessing the application by independent experts in a committee that will be part of the Cellular Agriculture Netherlands Foundation.

The tasting of cultured meat and fish will be considered a pilot project that will run for a year, and will be evaluated throughout. The pilot project could then be extended for another year. The decision could then also be taken to make it common practice, or to abolish it if there are unresolvable issues.

A committee of several independent experts within the Cellular Agriculture Netherlands Foundation is expected to be set up in September. Once this committee is up and running, applications can be submitted, and the committee will have one month to respond. This means that the Dutch government’s original expectation that a first tasting could take place before the end of 2023 is still on track. For the year of the pilot tastings, around 10-12 tast-

ings are planned, with up to 30 people attending. “The tasting is not a commercial launch; it’s really about tasting and getting customer feedback early on. We think it will be quite an event, the first tastings of their kind in Europe,” says van Haaster. He believes the impact of the events will go beyond the people in the room where the product is offered. “It’s no longer Singapore or the US. Now we have such an event in Europe. It will stimulate the industry,” he adds.

Allowing tastings and gathering data and insights could prove to be a first useful step for companies in the sector, to gain final EFSA Novel Foods approval.

Hollandbio has received a lot of enthusiastic feedback from companies in the cultured meat and fish industry, including – and perhaps especially – from outside the Netherlands. Many start-ups want to know about the process framework, and how it might also work for them. For example, whether they would have to have an R&D site in the Netherlands before being allowed to apply for a tasting proposal (yes). So far, only the cellular meat and seafood sector is included in the code of practice for tastings, but the demand from other sectors is inevitable. “Start-ups, scale-ups and es-

–innovative solutions

– highest quality standards

– expert technical support for optimizing reliability of your immunoassays

tablished companies from other areas of biotechnology have also asked how this

tion, testing and approval of these novel foods in the EU and Germany, and has

not only to a thriving biotech sector, but more importantly to healthier and more sustainable food production.

A pan-European organisation in the novel food industry, Food Fermentation Europe (FFE) is using the new regulation as an opportunity to step up calls for improved framework conditions. The new industry alliance represents companies like Better Dairy, Formo, Imagindairy, Onego Bio, Standing Ovation, Those Vegan Cowboys, and others. FFE spokesman Christian Poppe told EuropE an BiotEchnology that the organisation welcomes the Netherland initiative with open arms. “This is also a demand that we make of German politics,” he said.

“Food Fermentation Europe (FFE) enthusiastically supports the Dutch initiative, which allows innovators in the cultivated meat sector to conduct pre-market tastings of their novel products. This not only provides consumers with an invaluable opportunity to engage with these products but also proves crucial as these companies approach the brink of com -

VENTURE CAPITAL Dusk or dawn for European biotech companies? Is the US funding downturn affecting the European community, and how? EUROPEAN BIOTECHNOLOGY NEWS spoke to the Munich based team of Kurma Partners, Daniel Parera, M.D. and Dr Peter Neubeck.

EuroBiotech _Dear Mr. Parera, Mr. Neubeck how do you assess the funding situation in Europe?

Parera _There is enough funding available and most companies are still well capitalised. But of course, there is still a Corona backlog. A good part of the companies have not been able to reach the planned milestones, to generate all the data they had planned to have on hand by now.

EuroBiotech _There is still a Corona gap?

Neubeck _There is a difference between US and European companies. In particular in the US, there is a resulting cautiousness of investors to not invest at pre-Corona levels. As a result, an increasing number of companies are coming under pressure and need refinancing. But you can’t generalise. European biotechs are being set-up with a slightly different principle - less capital intense, more capital efficient - because in Europe there is typically less overall capital available for biotech.

EuroBiotech _So everything is fine, please stop complaining?

Parera _European companies have to continue to sharpen their focus, they have to deliver a good clinical programme that ticks all the boxes for Big Pharma. In the US, it is typically the goal to build big companies, that have fully staffed in-house functions. Now, with the above described delays, you see organisational adjustments, smaller refinancings, or indication adjustments. This adjustment now takes time and requires additional capital.

EuroBiotech _All of Europe is Kurma’s core territory - or just certain parts of it?

Neubeck_Kurma is a European fund with French origins. We have been expanding across Europe, including Scandinavia, Southern Europe and, increasingly, East-

ern Europe. We are less active in the US, perhaps more with the growth fund. Especially in early-stage syndication, we tend to be the driver and bring in the partner funds.

Parera (adds)_It is a bit different across our funds. Peter does early-stage projects with Kurma Biofund, and with my fund, Kurma Growth Opportunities Fund we do growth-stage financing. Growth is more often in global consortia, and we are also more active in Asia. Kurma funds are “comparably smaller but mighty”. The other big funds have a lot more money. We are making up for it by bringing our deep scientific and operational expertise to the company, which is very much in demand these days.

EuroBiotech_How does Kurma approach early-stage projects?

Neubeck_Kurma has done company creation since its inception and we have continually refined the way we do this. Since Kurma Biofund II we have been creating companies straight out of academia leveraging our internal competencies and finding suitable industrial partners depending on the technology requirements of the specific project. In addition we conceived and created Argobio, an incubator or startup studio, which we set up in early 2021 together with Bpifrance, the French national investment bank, Angelini Pharma, a private international pharmaceutical company, Evotec SE, and Institut Pasteur. The main rationale for creating Argobio was to scale our proven model of company creation with a dedicated team of experienced entrepreneurs and project managers. Since its inception, Argobio has

now more than 10 projects in incubation and the first two projects will be ready for Series A financing still this year. These two projects will be the first deals we will fund with our upcoming Kurma Biofund IV.

EuroBiotech_How do you plan your early projects, is an exit foreseeable at all?

Neubeck _Exits require planning, execution, good timing and some luck. In our current example with Emergence Therapeutics, it was not easy to put together the initial company creation syndicate and the initial development had the usual roller coaster moments. Once we had good data with our lead project, things moved fast and we were able to put together a nice Series A which was one of the largest ever for a German biotech company with close to €90m. If you then add a very hyped ADC market and many Pharmas on the lookout for good projects in the space, you can end up with an attractive early exit as we delivered with Emergence.

Parera (adds)_It is rather rare that very early-stage projects exit soon. That may be a dream, but it is not the rule. A growth opportunities fund in the same house is one helpful way of being able to participate sufficiently over the life-time of a company and several financing rounds.

EuroBiotech _So something like the Emergence exit is for the most part luck?

Neubeck_We are not speculating on a big preclinical deal. The fact that it turned out this way was a very welcome exception in our eyes. But we had laid the groundwork in the way we had built the company and had made very good progress towards the clinic, so it wasn’t “just” luck.

EuroBiotech _ Is Pharma paying more money, for early-stage projects now?

Parera_The pharma landscape in general hasn’t changed that much. The big players still need external innovation for their pipelines. What has changed is the greater diversity of modalities. There are less and better validated modalities and there are pharma companies taking more or less risk and choosing to be active in completely new disease areas and indications or rather in comparably less risky ones. We see that more validated targets and modalities are in higher demand at the moment. It just takes a long time and a couple of approach generations for something completely new being sufficiently validated and generate prevailing data.

EuroBiotech_But if Kurma is rather “smaller but mighty”, then you cannot cover the whole diversity and have to exclude certain areas, I guess?

Parera _We are already diverse in our portfolio, in terms of indications and modalities. We just don’t invest as large tickets in one area as the larger funds. But diversity does not depend on size. Neubeck (adds)_If you just look at the Argobio pipeline, you can already see a great diversity. We are looking for “best in class” and can initially use up to €2.5m, which we can normally double up with non-dilutive funding opportunities and grants. With these €5m to start with, you can take a lot of risk out of these early project ideas and deliver pharma-quality data early on. This is what the bigger VCs are looking for, risk-adjusted projects ready for Series A funding and this is also what guarantees a proper Pharma-grade data package when we get to the point of exit, which remains per definition at clinical PoC.

EuroBiotech _You’ve mentioned that in the US, Flagship or Arch Ventures are building large companies from the start,

fully staffed in-house. Why is this not happening in Europe?

Neubeck _I think we are just doing things a bit differently and there are two main reasons for that – there is still less money available for early stage ideas and the science is usually even earlier-stage, e.g., just a new target without a clear idea of how to address it. Argobio is build exactly to address and exploit this difference in the respective ecosystems on both sides of the Atlantic.

EuroBiotech _How does Kurma invest?

Parera _The market for the investment is important, but you need a team that understands that market and can reach it with the project. So it is very important to pay attention to the composition of the team, as otherwise you simply lose time if you have to restructure.

Neubeck (adds)_We are investing in excellent science and innovation addressing a clear unmet medical need. If these boxes are checked, you either have to have or to create a team that can design and execute a smart development plan.

Parera (again)_You need different qualities within the team: Visionaries and people who can build a well-functioning organisation. With our investment, we are not aiming to help people catch up on their entrepreneurial training from scratch. So we are looking for both the conductor and the orchestra, and it has to be set up well for the perfect sound.

EuroBiotech _Where are you now? Are you looking for funding or projects?

Neubeck _Actually, we are just about to do our final deal with Biofund III and, in parallel, are working on a first closing of our latest fund, Kurma Biofund IV. We are aiming for €250-300m. For this fund we are lining up investment opportunities which will be a mix of good external opportunities and our own proprietary deal flow coming from Kurma and Argobio.

Parera (adds)_We are moving towards final closing of the Growth Opportunities Fund and have already invested in half a dozen projects. Those who deliver good data in difficult times will shine. L

g.kaeaeb@biocom.eu

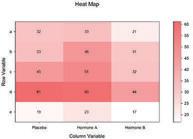

PIERRE-YVES GAUTHIER, HEAD OF STRATEGY, ALPHAVALUE Stock markets love investment concepts, calling the robust ones ‘megatrends’. Golden ageing is one such megatrend banking on the fact that business can extract more from people living longer. Such megatrend investments help – up to the moment when rising interest rates crash the party.

A decade ago AlphaValue had a cynical go at the ‘Older & Fatter’ megatrend which speaks for itself: stocks addressing the good-living excesses of the West and their unhappy outcomes. The idea of that ‘Older & Fatter’ came when Novo Nordisk was already making a fortune from diabetescontaining drug, which later on morphed into weight-containing drugs. The point was made about such a ‘Older & Fatter’ megatrend. In the CNS space, another Danish company, H. Lundbeck, was also quickly widening its offer, to tackle schizophrenia, depression, Parkinson etc.

Today we discovered that the strategy was not worth the effort when measuring on an equal-weighted basis, the performance of the relevant universe made of 21 large European stocks. The outper-

formance is only 25% over 10 years, which is insufficient to cover the risk associated with such a specialist exposure. The sorry point is that this well-oiled investment strategy has been losing money since late 2021 when rates edged up. So much for the megatrend: its attraction is only as great as the cheap money punchbowl of the Fed or ECB.

Indeed things turned nasty from summer 2021 as highlighted by the relative performance decline on an equal-weight basis. On a weighted basis, everyone seems to be in the money, courtesy of Novo Nordisk and the craze for its weight-loss drugs. Remember that back in 2013, Novo was worth €57bn. Now expect to pay €400bn, or 7x its 2013 valuation (but LVMH manages 7x too).

Valneva SE (Nasdaq: VALN; Euronext Paris: VLA) and Pfizer Inc. (NYSE: PFE) announced positive immunogenicity and safety data for their investigational Lyme disease vaccine candidate VLA15 in children and adolescents when given as a booster. These results from the Phase 2 VLA15-221 study showed a strong anamnestic antibody response for all serotypes in children (5 to 11 years), adolescents (12 to 17 years) and adults (18 to 65 years) one month

after administration of a booster dose (month 19). But no boosting at the stock exchange was observed after these still early results (see also page XY).

Abcam plc US Danaher Corporation (NYSE: DHR) has entered into a definitive agreement to acquire all outstanding shares of Abcam plc (NASDAQ: ABCM) for $24.00 per share in cash, or a total enterprise value of approximately $5.7bn, including assumed debt and net of cash

To begin with, our 10-year review is a reminder that ultimately investment concepts matter less than the cost of money or the odd systemic accident such as COVID-19. For that ‘Older & Fatter’ strategy to offer the best relative return one would have had to exit by late 2019. COVID-19 had no positive impact – possibly because it led to an early departure of the targeted audience.

Then, the universe of listed companies associated with ‘Older & Fatter’ is simply as expensive as anything related to health. The underlying organic growth is too thin to justify ‘concept’-type valuation multiples (25x and above). Remember that valuations differ substantially whether on an average, median or equalweighted basis.

Anyway, more of a correction is needed before boarding that ‘Older & Fatter’ slow train again L

acquired. This represents a premium of approximately 50% to the average recent trading price of Abcam’s shares. Founded in 1998 and headquartered in Cambridge, UK, Abcam provides antibodies, reagents, biomarkers and assays to target biological pathways critical to the advancement of drug discovery, life science research and diagnostics to a customer base of approximately 750,000 researchers, as the company stated. L

The unique and most complete list of share price developments of biotech companies listed in Europe – exclusively in European Biotechnology Magazine.

All quotes are listed in Euro. All data is provided without guarantee. The effective date is 12 th September 2023. These Europe-based biotech companies are traded on European stock markets.

DATA SCIENCE CONSULTING Depending on who you talk to, artificial intelligence (AI) is either a saviour or an enslaver. The concerns range from loss of jobs through to robots running society. However, in the life sciences, the use of AI and machine learning (ML) have created some excitement over their potential applications.

› Dr Liesbeth Ceelen, CEO and board member of BioLizard, Belgium

While AI has been steadily evolving in the IT community for decades, for the general public it seems to have only recently made the leap from science fiction to reality. Authorities have identified the need for regulation of AI, while technology-savvy entrepreneurs have already created applications for both highly-skilled personnel and the average consumer, the most prominent example being ChatGPT.

This has led to an ongoing critical review of AI to investigate its uses in and effects on industry and society, such as cost savings, innovation and employment. New applications of AI are also steadily being developed, and data-intensive disciplines in the natural sciences, such as biology or medicine, can particularly benefit from the new possibilities, which enable users to process more data than ever before.

To demonstrate the impact of AI, Mount Sinai Hospital in the US is among a group of leading hospitals pouring hundreds of millions of dollars into AI software. They are buoyed by a growing body of scientific literature – such as a recent study finding that AI readings of mammograms detected 20% more cases of breast cancer than radiologists – along with the conviction that AI is a valuable component of the future of medicine.

As most scientists are neither programmers nor informaticians, a new consulting industry is budding. Supporting the evolution and application of AI in science, and providing the interdisciplinary expertise required to translate the story of any research undertaking into code, they become a gateway for

accessing AI, supplementing a difficultto-find expertise.

In the evolution of medicine, technology has always played a part. In the 1990s and early 2000s, AI algorithms began deciphering complex patterns in X-rays, CT scans and MRI images to spot abnormalities. Likewise, companies incorporated algorithms that scanned masses of patient data to spot trends when developing tailored treatments. AI has generally been welcomed by life science companies for its ability to work with massive amounts of data, and to generate datadriven results such as new drug targets.

Several AI-native drug discovery companies have progressed AI-based mole -

cules into clinical trials, reporting greatly accelerated timelines and reduced costs, and raising high expectations in the R&D community. This performance has been discussed in a recent Nature Reviews article, where the disclosed discovery programmes and preclinical assets of the top 20 of these companies were compared with the top 20 of Big Pharma. Astoundingly, these young AI-native companies already have a combined pipeline with close to 50% of the number of assets that the top 20 of big pharma are running.

Being involved in bringing many projects and innovations from concept to user, the BioLizard team has experienced and worked with a wide range of requests and ideas for the application of AI across the biotech and pharma space.

To give an example of how AI is implemented from concept to product, one recent project for a client was an end-toend, data-driven solution for predicting clinical outcomes in transplantation patients. The main focus was on using RNA sequencing (RNASeq) data to predict different types of organ transplant rejection in patients. The task was to expand and improve the efficiency of the approach by providing an end-to-end workflow, from input of raw RNASeq data through to the prediction of transplantation rejection.

The data analytics & AI team first set out to create predictive models for both acute and long-term organ rejection using a dataset of 60,000 genes from 150 patients. However, the complexity of

Unify and streamline:

Quality Processes

Content Management

Validation Management

Role-Based Training

QC Lab Operations

Reduce Cycle Time

Improve Usability

Maximize Efficiency

Connect to External Partners

the data, compounded by the biological variability among different ethnicities, genders, and ages of the patients, at first made it difficult to derive meaningful biological insights.

Consequently, the team narrowed things down to a more manageable set of genes that were found to have the highest predictive value, and then worked with the client to choose a subset of clinical features that would also be included in the predictive models. This way, the resulting models would take into account not only information related to gene expression, but also other potentially predictive variables, such as the presence of patient comorbidities.

BioLizard improved and tested the models over time, and the final result presented to the client was a highly standardised and data-driven product that is now being validated for use in a clinical setting to predict patient outcomes. This case is a great example of how human input is still necessary to make the most out of AI: by selecting the best set of predictive genes and a complementary subset of clinical information, a client was being enabled to apply AI to its highest potential.

Regulation is a huge consideration in the development and use of AI. The FDA, in a recent discussion paper, acknowledged current and potential use of AI in the field, and agreed that AI/ML has the potential

to accelerate drug development and make clinical trials safer and more efficient. However, the importance of assessing if AI/ML introduces risks is also noted. For example, AI/ML algorithms could amplify errors and pre-existing biases present in underlying data sources and thereby, when the findings are extrapolated outside of the testing environment, raise issues related to generalisability and ethical considerations. These concerns have resulted in the development of standards for AI to address areas such as explainability, reliability, privacy, safety, security, and bias mitigation.

The European Commission also promotes the use of AI, while emphasising the need for data protection. The current draft framework of the EU Artificial Intelligence Act is still evolving, which is why the European AI Alliance has been created to provide a forum for open policy dialogue. Some of the concerns expressed by healthcare AI stakeholders have already been addressed, but one key issue remains. As it stands, provisions for governance of data appear to exclude most real-world data as a source of evidence. This would greatly diminish the applicability of AI in healthcare, as most data from the laboratory or clinical studies could then not be used to train AIs to develop predictive capability. At the time of publication, the regulator is still open for discussion to reach a pragmatic solution. Another real obstacle to the application of AI can be misconceptions. AI is not magic, and cannot provide reliable re -

sults if not fed with the right data and human insights, and if the output is not interpreted correctly. As with all analysis methods, it is important to consider where the data comes from. If an experiment was conducted in a way that is not applicable to the question at hand, AI won’t be able to draw reliable conclusions. On the other hand, applying the vast amounts of public data resources available can be a path forward, when using an applicable and relevant, not necessarily perfect, data set as basis. Identifying the right input data for the question and ensuring careful interpretation of the output information – both of which may be challenging as this requires both biological understanding and expert knowledge in data science – is of crucial importance, and part of the expertise BioLizard is providing.

Another misconception that can easily be overcome is related to costs. Many consider AI to be expensive, while not considering that just like in the wet lab, it is possible to start with small proof-ofconcept studies to see how and where AI will add value to a company. For this reason, BioLizard assists clients by examining their unique situations and pinpointing key areas that could be streamlined using AI/ML. While not always applicable, often opportunities for improvement arise, and BioLizard can help clients decide where AI can add the most value. There can be little doubt that AI is here to stay and, as it evolves, it has the potential to positively transform the life sciences sector. However, regulation and risk mitigation are clearly important, and the industry needs to be a part of that ongoing discussion.

As with any new technology, utilising AI and ML appropriately and wisely is critical to successful implementation. This is why it is important to know who to turn to in order to navigate this new and exciting path towards the ultimate goal – a more efficient life sciences industry that provides new and better solutions for patients. L

Fördergesellschaft IZB mbH Am Klopferspitz 19 82152 Planegg/Martinsried

Tel. + 49 (0)89.55 279 48-0

Fax + 49 (0)89.55 279 48-29

info@izb-online.de www.izb-online.de

Site: 26,000 m2, S1 laboratories

Real estate and facility management on site

Faculty Club and conference rooms for up to 100 people

Kindergarden (Bio Kids), Chemistry School Elhardt

Hotel CAMPUS AT HOME

Restaurant SEVEN AND MORE, The Bowl

On the Martinsried Campus: over 50 start-ups in the IZB, two Max Planck Institutes, ten faculties of the LMU, Clinic of the University Munich

In August, CureVac NV announced that dosing for its Phase II study with a modified COVID-19 mRNA vaccine candidates in collaboration with GlaxoSmithKline plc has been started. A first data read-out of the study that includes a mono- and a bivalent vaccine candidate using modified RNA is expected early in the first half of 2024. The monovalent candidate, CV0601, exclusively encodes the spike protein of the omicron BA.45 variant, while bivalent candidate, CV0701, additionally includes the original SARS-CoV-2 strain.

Swedish biotech company Hansa Biopharma A/S has dosed the first of ten patients with imlifidase in an investigator-initiated single arm Phase II study at Charité Berlin in anti-neutrophil cytoplasmic antibody (“ANCA”)-associated vasculitis caused by pulmonary hemorrhage. Imlifidase acts by cleaving IgGs enzymatically. Efficacy and safety of imlifidase will be assessed by evaluating ANCA antibody seroconversion and titers, adverse events, mortality, as well as amelioration of lung and renal function over a 6-month observation period.

Eli Lilly’s Alzheimer’s drug donanemab has quickly removed amyloid plaques in a pivotal Phase III trial halting disease progression for one year in half of patients. Donanemab is the second antibody, after Eisai’s/Biogen’s accelerated approved lecanemab, that can slow the progression of dementia

Finnish immuno-oncology specialist Valo Therapeutics Oy and its CRO Texcell SA (Evry, France) have agreed to evaluate immune responses in ValoTx’s Phase I study that is designed to assess the immunogenicity of the company’s lead candidate PeptiCRAd-1. ValoTx’s lead platform (Peptide-coated Conditionally Replicating Adenovirus) was developed out of the laboratory of Professor Vincenzo Cerullo at the University of Helsinki. It turns oncolytic adenoviruses into powerful activators of systemic anti-tumour cytotoxic T-cell immunity without the need to generate and manufacture multiple genetically modified viruses. PeptiCRAd-1 is the company’s lead product made up of its virus VALO-D102, which expresses the immuno-stimulatory proteins CD40L and OX40L and is coated with MAGEA3 and NY-ESO-1 peptide derivatives. In the ongoing open-label Phase I study of up to 15 patients in German centres ValoTx will assess the safety and immunological mechanism of action of PeptiCRAd-1 in combination with Merck Sharp & Dohme’s checkpoint inhibitor pembrolizumab in multiple cancer types. The collaboration with Texcell aims at providing insights on PeptiCRAd-1’s ability to modulate immune responses and the mechanism of action of VALO-D102.

Stockholm-based Calliditas Therapeutics AB has reported interim data from its Phase IIb trial in patients with squamous cell carcinoma of the head and neck who were treated with its lead NOX 1 and 4 inhibitor product candidate, setanaxib. The company assumes an encouraging trend in early clinical progression-free survival (PFS) results and sees hints to the presumed anti-fibrotic mode of action of setanaxib. On the basis of 12 evaluable biomarker profiles from patients with recurrent or metastatic SCCHN, transcriptomic analysis supported an anti-fibrotic mode of ac-

tion. The Idiopathic Pulmonary Fibrosis Signaling Pathway and the Hepatic Fibrosis/Hepatic Stellate Cell Activation Pathway were affected. Furthermore, pathologist found preliminary evidence of an increase in immunological activity of treated patients, with favourable changes in Foxp3 and PDL-1 CPS. Additionally, seven out of the 16 evaluable patients were progression-free with either stable disease or partial response. The study is expected to read out final data in 2024.

Immuno-oncology specialist Scancell Holdings plc has opened its ModiFY trial for expansion in combination with checkpoint inhibitors (CPI) and in the neoadjuvant setting. Following the successful completion of Cohort 4, where three patients received at least two doses of Modi-1 combined with CPI, the safety review committee approved on 31 July expansion into two cohorts of patients with renal or head and neck cancer who receive CPI as standard of care. Twenty-one patients will be recruited into each cohort. Patients with triple negative breast cancer will not be included in this part of the study as these patients receive checkpoints in combination with chemotherapy which may induce citrullination in normal cells and induce toxicity. Additionally, recruitment into the neoadjuvant arm of the Modi-1 trial in combination with CPI was also approved. This study will recruit 30 patients who will be randomised at diagnosis to receive either two doses of Modi-1 three weeks apart or two doses of Modi-1 plus one dose of CPI. Tumour biopsies will be taken prior to immunisation and from the tumour resection six weeks following the initial vaccination. The two tumour samples will allow the extent of T cell infiltration and activation pre- and post-Modi-1 vaccination to be assessed with and without a checkpoint inhibitor.

Berlin-based TME Pharma NV has reported in July that one out of six glio -

blastoma patients enrolled in the company’s GLORIA Phase I/II expansion arm showed a complete response after having dosed with the CXCL12 inhibitor NOX-A12 in combination with standard of care radiotherapy and anti-VEGF, bevacizumab. In addition to the patient, whose tumour was no longer detectable by MRI and previously had shown best response of 89.9% tumour shrinkage, two patients were reported to show near-complete reductions (>99%) in tumour size. NOX-A12 (olaptesed pegol) is an intravenously administered, PEGylated L-stereoisomer RNA aptamer that targets CXCL12

PARKINSON'S DISEASE Bayer AG’s gene and cell therapy subsidiary BlueRock Therapeutics has met all safety endpoints in an open-label Phase I study with its Parkinsion’s cell therapy candidate bemdanepro-cel (BRT-DA01). However, there were two severe adverse events that were unrelated to bemdaneprocel, one seizure attributed to the surgical procedure and one COVID-19 case. Both resolved without sequelae. Twelve patients received surgical transplantation of bemdaneprocel cells to the post-commissural putamen bi-laterally, and administration of a one-year immunosuppression regimen. Cohort A (5 subjects) received a dose of 0.9 million cells per putamen. Cohort B (7 subjects) received 2.7 million cells per putamen. Safety and tolerability were assessed at one year, along with evidence of cell survival and motor effects. The feasibility of transplantation was also assessed. All assessments will continue over 24 months. According to BlueRock Therapeutics, no major safety issues were observed in all dosed patients through 12 months. Furthermore, at one-year, exploratory clinical endpoints improved overall, with participants in the high dose cohort showing greater improvement. Data from all 12 patients demonstrated feasibility of transplantation, cell survival, and engraftment. The company announced to begin enrolling participants in H1/2024. Bemdaneprocel (BRT-DA01) is an investigational cell therapy designed to replace

the dopamine-producing neurons that are lost in Parkinson’s disease. These do paminergic neuron precursors are differ entiated from human embryonic stem cells. In a surgical procedure, these neu ron precursors are implanted into the brain of a person with Parkinson’s dis ease. When transplanted, they are hoped to reform neural networks that have been severely affected by Parkinson’s and restore motor and non-motor function to patients.

In mid-August, Lytix Biopharma A/S ’ (Oslo) licensing partner Verrica Pharmaceuticals Inc has reported lesion clearance data from Part 1 of an ongoing Phase II study of VP-315 (LTX 315) for the treatment of basal cell carcinoma (BCC). Consistent clinical and histological clearance of treated BCC lesions was observed by Day 49 post-treatment with the 8 mg dose of VP-315, in four out of six patients (67%) showing complete tumour clearance, and two subjects showing a partial response in tumour burden reduction. Optimisation of the 8 mg dosing regimen is under investigation in Part 2 of the study.

At the end of July, Sanofi SA and BioNTech SE announced the termination of SAR441000 (BNT131), a Phase I program that is part of a multimillion-dollar research collaboration on RNA anticancer agents. SAR441000 is a mixture of mRNAs encoding the four proteins IL12sc, IL-15sushi, IFN-alpha2b and GMCSF. While preclinical data had encouraged Sanofi and BioNTech to clinically investigate SAR441000 as a monotherapy and in combination with Regeneron’s licensed PD-1 blocker, Libtayo, an unpublished interim analysis of the results has now brought the program to an end. Positive interim results with 17 patients with advanced-stage melanoma, cutaneous squamous cell carcinoma or head and neck squamous cell carcinoma presented three years ago had motivated the companies to expand the trial to 77 patients. L

Partner with a leading global CDMO for aseptic fill & finish

For 40+ years, pharma and biotech companies around the world have relied on Vetter to put their parenteral medications on a path to success. We’re proud to help advance your innovative therapy with flexible, robust, scalable processes and services that set our partnership apart:

• Specialized support for your unique clinical development program

• High-quality aseptic filling at both clinical and global commercial scale

• Strategic packaging and device assembly solutions that span your product’s life cycle

• Comprehensive technical, analytical, and regulatory expertise at every step

TARGETED ONCOLOGY THERAPIES Precision medicine tailors therapeutics to individual patients’ diseases, and is seen as the future of clinical practice. With significant time and financial investments being made in developing therapeutics, the ultimate success of patient-data driven precision therapies hinges on three main factors: the quality of the tissue samples, the associated molecular data, and the analysis used in their development.

A foundational aspect of precision oncology is the data-driven understanding of cancer, which requires high-quality biospecimen. Use of suboptimal specimen can therefore lead to loss of vital information critical for biomarker and therapeutic target identification. Obtaining freshly frozen and consistently collected and processed biospecimen with high sample integrity is crucial for generating clinically relevant patient-based data. Accurate therapeutic target identification and defining patient subgroups are critical in precision medicine. To ensure success, the tissue type and patient subgroup should be optimised for each therapeutic target during preclinical research.

Analysing the data is as essential as sample quality. The emerging field of multi-omics offers promise by analytically combining distinct datasets that together provide broader insights into the disease. However, large and complex datasets can present challenges, which machine learning and cloud-based computing tools can help address, facilitating efficient target selection.

In-vitro target validation is necessary before progressing through discovery pipelines. Patient-derived cellular models, like organoids, enhance preclinical validation efforts, optimising chances of success.

Preclinical research presents unique challenges in that it is expensive, laborious, and marked by a high failure rate in identifying therapeutic targets. To address and overcome these challenges, Indivumed Therapeutics developed nRavel ®, a discovery and development platform. Based on the standardised tissue and clinical data collection in partner clinics and the extensive multi-omic data processing, nRavel® sifts through patterns and identifies, characterises, and validates targets using AI-integrated data analytics and patient information, alongside patient based cellular model experimental results.

It utilises the same tissue and corresponding data throughout the entire drug

development process to gain insights, drive therapeutic target and biomarker discovery and validation, and lead development and clinical trial performance to facilitate the discovery and development of targeted therapies.

Starting and ending with the patient in mind, Indivumed Therapeutics is the only company possessing such a vast amount of high-quality, deep molecular data. The company remains at the forefront of therapeutic development, with actionable targets currently being validated using patient-derived organoids across ten cancer types and the ultimate goal of ensuring the global delivery of effective precision therapies to patients in need.

INCUBATOR For 25 years now, BioM has been the network organisation of the biotechnology sector in Munich and Bavaria. To shape the future of biotechnology, BioM identifies relevant and sustainable local, regional and global trends and creates a unique ecosystem for innovation and growth.

Biotechnology has undergone a remarkable transformation in recent years, becoming a dynamic and multifaceted field in which the convergence of areas such as biology, medicine, computer science, and data science plays a central role.

The new tasks of biotechnology lie in increased, interdisciplinary and interactive collaboration. Moreover, the seamless integration of data analysis, cutting-edge digital technologies, such as artificial intelligence and machine learning, is pivotal to staying at the forefront of innovation and ensuring the successful application of biotechnological advancements.

BioM is addressing this trend within its new concept AI4Biotech, by which BioM aims to leverage artificial intelligence and advanced (digital) technologies including data science to revolutionise the field and various aspects of nanoand biotechnology in particular for drug development and delivery.

The innovative field of Advanced Therapy Medicinal Products (ATMPs) and the scaling and manufacturing of cell and gene therapeutics will also have a major impact in therapy and cure of diseases. By developing and fostering scientific networks, Bio M is contributing to unlock the possibilities of these promising approaches.

To achieve the greatest benefit for society, it is important to carry these

trends into all areas and phases of biotechnological developments – and to bring together all players and disciplines. This is what Bio M is doing. We bring together all the stakeholders in biotechnology: scientists, founders, entrepreneurs, investors, and politics.

In addition to our tailored support for founders, we support selected Bavarian pre-seed and early-stage startup teams from the life sciences and healthtech sectors with the Munich Accelerator Life Sciences & Medicine (MAxL), our unique co-creation startup incubator. MAxL offers exclusive high-end infrastructure on 900m2 , access to a vibrant start-up community and BioM 's extensive network. We also offer partnerships with pharma, big biotech, deeptech and other industry

players like strategic partners, CROs and investors.

In an increasingly interconnected world, BioM operates from a global perspective. We empower and support Bavarian biotech companies of all stages to broaden their horizons and make a difference through cross-border collaborations on a global and interdisciplinary level. We will continue to drive the future of biotechnology, not only in Bavaria, but throughout Europe and the world. Together, we will continue to unlock the potential of biotechnology.

Contact us:

Prof. Ralf Huss

BioM Biotech Cluster Development GmbH

Am Klopferspitz 19a

D-82152 Martinsried

info@bio-m.org

LOCATION Austria has gained an outstanding reputation as a research location in the field of life sciences – both as a vibrant hub for science and as a cluster for research-oriented and manufacturing companies. The ABA links international companies with this ecosystem.

The figures speak for themselves: Austria is home to almost 1,000 life sciences companies with a workforce of more than 60,000 employees, alongside 55 research institutions with close to 25,000 employees, and about 77,000 students focusing just on life sciences. It is no exaggeration to say that Austria – a country with just nine million inhabitants – has emerged as one of Europe’s most important research locations for pharmaceuticals and biotechnology. In 2020, the country’s pharmaceutical and biotech sector generated €25bn in revenue, showing 10% annual increases year after year.

Research and development are driven by 35 big pharma players and numerous innovative biotech firms. These include big names like Boehringer Ingelheim, Takeda and Novartis as well as many smaller, innovative companies, service providers, suppliers and sales organisations. The excellent infrastructure in Austria (including laboratory space), the large number of highly qualified employees and the availability of data and donors support the boom as a location for medical research.

Another yet even more important aspect is that foreign and national companies as well as research institutions highly value the unbureaucratic funding along with the intensive linkage between science and industrial research in the country.

Austria

As a life sciences hotspot, Austria has succeeded in creating a rather unique symbiosis fusing science, education, business relocation and cross-cutting business promotion. In terms of its R&D to GDP ratio, Austria is ranked third among all EU member states at 3.26%. The country improved to sixth place in the European Innovation Scorecard and thus leads the group of “strong innovators” within the EU. The good underlying conditions are attracting an increasing number of firms – from multinationals to startups.

› Vienna serves as the centre for cancer research of Boehringer Ingelheim. Boehringer Ingelheim already put a production plant for active pharma -

ceutical ingredients into operation and will open a new cancer research building in 2024.

› The Swiss company Novartis located its largest single facility for research, development and production in Tyrol. The site has made a name for itself in the media because it is home to Europe’s only complete production chain for oral antibiotics.

› The Mainz-based company BioNTech SE, which gained global fame during the coronavirus crisis, acquired PhagoMed, the Viennese developer of precision antibiotics, thus expanding its portfolio of promising anti-infectives.

› 4,500 employees in Vienna, Linz and Orth an der Donau conduct research on gene therapies, recombinant proteins, plasma-based therapies and innovation technology for the Japanese compa -

ny Takeda, a global biopharmaceutical player. Furthermore, Takeda also operates twelve plasma centres in Austria and produces gene therapy products, biologics and other medical products.

› The MedTech startup Sarcura founded in 2019 focuses on developing personalised cell therapies on a large industrial scale. At the end of last year, it succeeded in raising a further €7m from existing and new investors.