17 minute read

How to Trade Forex on Exness For Beginners

How to Trade Forex on Exness For Beginners: Step-by-Step Guide.

Introduction to Forex Trading on Exness

The foreign exchange market, commonly known as Forex or FX, is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Forex trading involves the exchange of one currency for another, with the goal of profiting from fluctuations in the exchange rates.

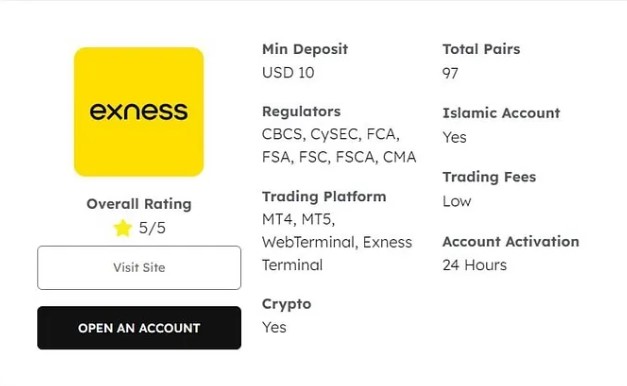

✅ Exness: Open An Account or Go to Website

Exness, a leading global Forex broker, offers a robust and user-friendly platform for traders of all experience levels to participate in the dynamic Forex market. This comprehensive guide will walk you through the step-by-step process of trading Forex on the Exness platform, covering everything from setting up your account to executing your first trade.

Understanding the Forex Market

The Forex market operates 24 hours a day, five days a week, and is decentralized, meaning there is no central exchange or clearinghouse. Instead, the market is made up of a global network of banks, financial institutions, and individual traders, all exchanging currencies.

The Forex market is driven by various factors, including economic indicators, political events, and market sentiment. Traders aim to capitalize on these fluctuations by buying and selling currency pairs, such as the EUR/USD or GBP/JPY, in the hopes of generating profits.

The Role of Exness in Forex Trading

Exness is a reputable and regulated Forex broker that provides traders with a diverse range of trading tools, resources, and support. The Exness platform offers competitive spreads, low latency, and a user-friendly interface, making it an attractive choice for both novice and experienced Forex traders.

By choosing to trade Forex on the Exness platform, you can benefit from the broker's commitment to transparency, security, and client satisfaction. Exness is regulated by several financial authorities, ensuring that your trading activities are conducted in a safe and compliant manner.

Setting Up Your Exness Account

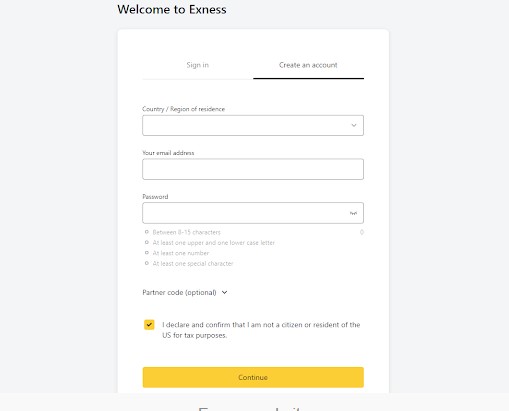

To begin your Forex trading journey with Exness, you'll need to set up an account. The process is straightforward and can be completed entirely online.

Creating Your Exness Account

Visit the Exness website and click on the "Open Account" button. You'll be prompted to choose the type of account you'd like to open, such as a Standard or ECN account. Each account type has its own unique features and trading conditions, so be sure to research and select the one that best suits your trading goals and risk tolerance.

✅ Exness: Open An Account or Go to Website

Next, you'll need to provide personal information, such as your name, date of birth, and contact details. You'll also be asked to choose a base currency for your account and create a secure login.

Verifying Your Identity

As part of the account opening process, Exness will require you to verify your identity. This is a standard procedure for Forex brokers to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

You'll need to provide a copy of a valid government-issued ID, such as a passport or driver's license, as well as proof of your residential address, such as a utility bill or bank statement. Once your documents are submitted and approved, your Exness account will be fully activated and ready for trading.

Funding Your Exness Account

To start trading Forex on the Exness platform, you'll need to fund your account. Exness offers a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets, to make the funding process convenient and secure.

When depositing funds, be sure to review the minimum deposit requirements and any applicable fees. Once your account is funded, you'll be able to access the Exness trading platform and begin exploring the Forex market.

✅ Exness: Open An Account or Go to Website

Understanding the Forex Market Basics

Before diving into Forex trading on the Exness platform, it's essential to have a solid understanding of the fundamental concepts and mechanics of the Forex market.

Currency Pairs and Quotations

In the Forex market, currencies are traded in pairs, where one currency is bought, and the other is sold. The most commonly traded currency pairs are known as the major pairs, which include the EUR/USD, GBP/USD, USD/JPY, and others.

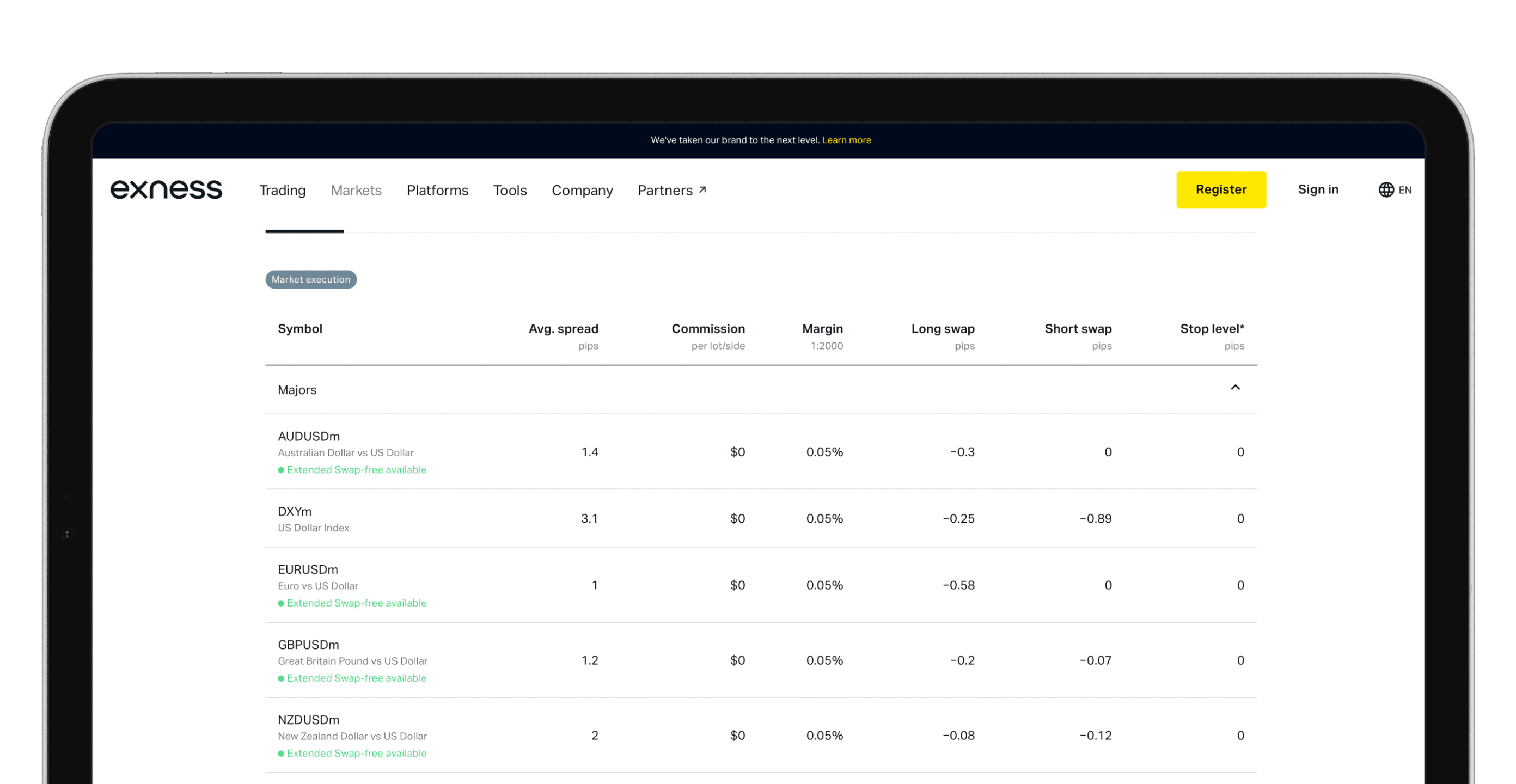

Each currency pair is quoted with two prices: the bid price and the ask price. The bid price is the price at which you can sell the base currency, while the ask price is the price at which you can buy the base currency. The difference between the bid and ask prices is known as the spread, which is a crucial factor in Forex trading.

Leverage and Margin

Forex trading often involves the use of leverage, which allows traders to control a larger position size than their initial investment. Exness offers various leverage ratios, such as 1:30 or 1:500, depending on the account type and the trader's experience level.

While leverage can amplify potential profits, it can also magnify losses. As a result, it's crucial to understand the risks associated with leverage and to practice proper risk management when trading Forex on the Exness platform.

Pips and Lot Sizes

In the Forex market, price movements are typically measured in pips, which represent the smallest possible change in a currency pair's exchange rate. The value of a pip varies depending on the currency pair and the lot size traded.

Lot sizes in Forex trading refer to the standardized unit of a currency pair. The most common lot sizes are micro (0.01 lots), mini (0.10 lots), and standard (1.00 lots). Understanding the relationship between lot sizes and pip values is essential for calculating potential profits and losses in your Forex trades on the Exness platform.

Choosing the Right Trading Platform on Exness

Exness offers a range of trading platforms, each with its own unique features and capabilities. As a beginner Forex trader, it's important to select the platform that best suits your trading style and preferences.

MetaTrader 4 (MT4)

The MetaTrader 4 (MT4) platform is one of the most widely used trading platforms in the Forex industry. Exness provides a customized version of MT4, offering a user-friendly interface, advanced charting tools, and a wide range of technical indicators and analysis tools.

MT4 is known for its versatility, allowing traders to automate their trading strategies using custom-built Expert Advisors (EAs) and scripts. This platform is an excellent choice for both beginner and experienced Forex traders on the Exness platform.

MetaTrader 5 (MT5)

Exness also offers the MetaTrader 5 (MT5) platform, which is the successor to MT4. MT5 features an enhanced user interface, additional order types, and advanced analytical tools, making it a popular choice among more experienced Forex traders.

📥📥📥 Link Download MT4 👈👈👈

📥📥📥 Link Download MT5 👈👈👈

While MT5 shares many similarities with MT4, it also introduces new features, such as the ability to trade multiple asset classes (including stocks, commodities, and indices) and improved backtesting capabilities. Depending on your trading style and preferences, you may find MT5 to be a more suitable platform for your Forex trading on the Exness platform.

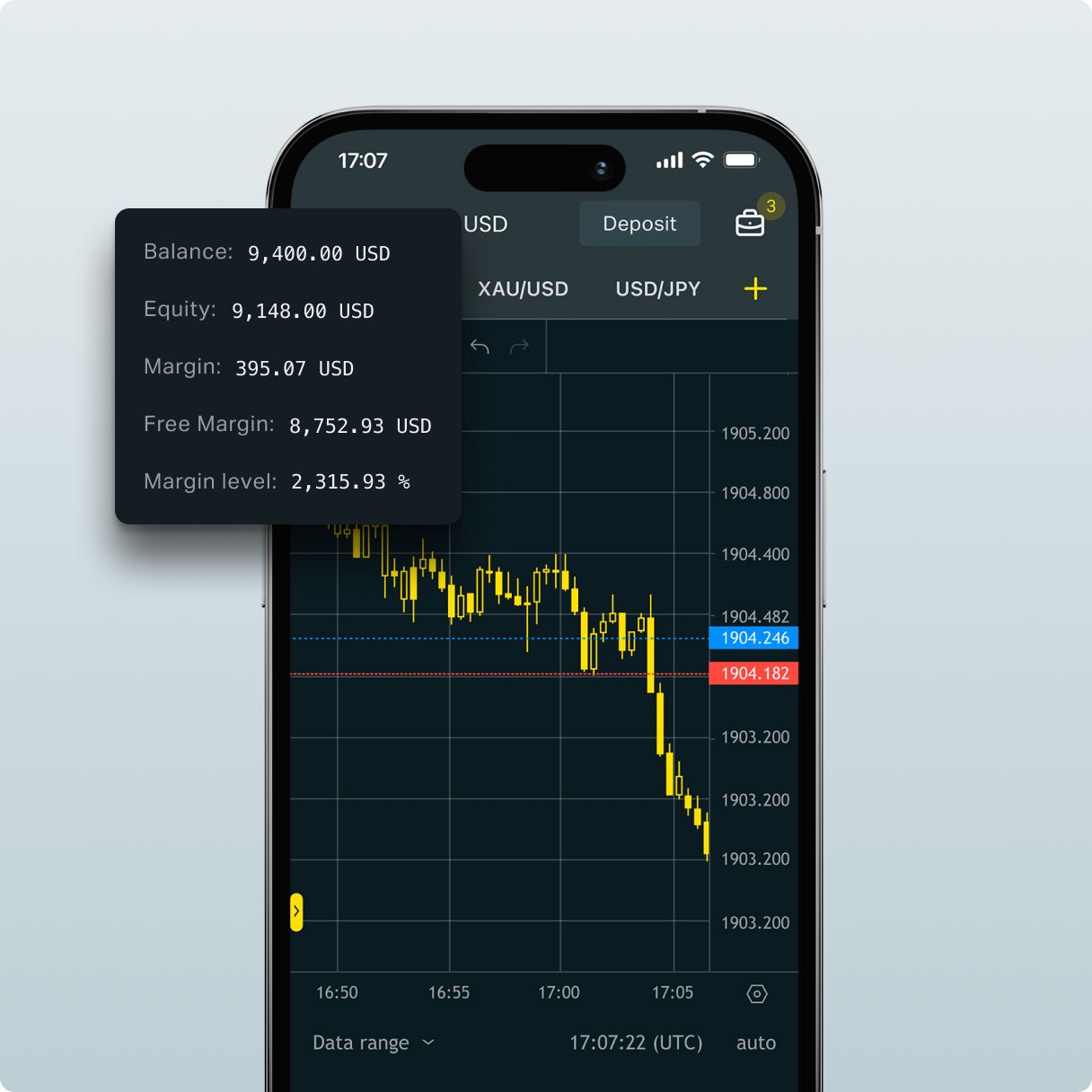

Web and Mobile Trading

In addition to the desktop-based MetaTrader platforms, Exness also provides web-based and mobile trading solutions. The web trading platform allows you to access your Exness account and execute trades directly from your web browser, without the need to install any software.

The Exness mobile app, available for both iOS and Android devices, enables you to monitor the markets, place trades, and manage your account on-the-go. This flexibility can be particularly useful for traders who need to stay connected to the Forex market while away from their desktops.

How to Fund Your Exness Trading Account

Funding your Exness trading account is a straightforward process that can be completed through a variety of payment methods. Choosing the right funding method for your needs is an important consideration when getting started with Forex trading on the Exness platform.

Deposit Methods

Exness supports a wide range of deposit methods, including bank transfers, credit/debit cards, and popular e-wallet services like Skrill, Neteller, and WebMoney. Each payment method may have its own set of minimum deposit requirements, processing times, and associated fees, so it's essential to review the details before making your selection.

When making a deposit, be sure to follow the instructions provided by Exness to ensure a smooth and secure transaction. Additionally, be mindful of any currency conversion fees that may apply when depositing funds from a different base currency.

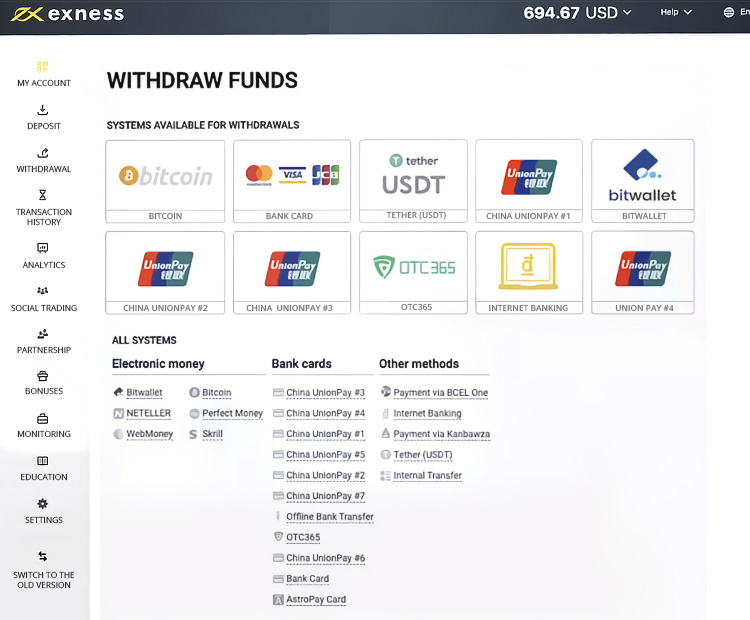

Withdrawal Options

Withdrawing funds from your Exness trading account is equally important as the deposit process. Exness offers various withdrawal methods, including bank transfers, credit/debit cards, and e-wallets, to cater to the diverse needs of its clients.

The withdrawal process may take a few business days to complete, depending on the method chosen and your location. Exness provides detailed information on the withdrawal process, including any applicable fees, processing times, and documentation requirements.

Funding Best Practices

When funding your Exness trading account, it's crucial to exercise caution and due diligence. Ensure that you are using only legitimate and secure payment methods, and be wary of any unsolicited requests for sensitive financial information.

Additionally, it's advisable to keep track of your deposits and withdrawals, as well as any fees incurred, to maintain a clear understanding of your trading account's financial activity. This practice can help you better manage your Forex trading funds and make informed decisions on your trading strategy.

Exploring Different Currency Pairs on Exness

The Forex market offers a vast array of currency pairs for traders to explore on the Exness platform. Understanding the characteristics and dynamics of these currency pairs is essential for developing a successful Forex trading strategy.

Major Currency Pairs

The major currency pairs, which include the EUR/USD, GBP/USD, USD/JPY, and others, are the most actively traded and liquid pairs in the Forex market. These pairs typically exhibit relatively stable and predictable price movements, making them a popular choice for beginner Forex traders on the Exness platform.

When trading the major currency pairs, it's important to stay informed about the economic and political developments in the countries represented by the currencies, as these factors can significantly impact the exchange rates.

Cross-Currency Pairs

Cross-currency pairs, such as EUR/GBP, GBP/JPY, and AUD/NZD, involve the exchange of two currencies that are not directly related to the US dollar. These pairs can offer unique trading opportunities and diversification, as their price movements may not be as closely correlated with the major pairs.

However, cross-currency pairs can also exhibit higher volatility and less liquidity compared to the major pairs. As a beginner Forex trader on the Exness platform, it's advisable to start with the major pairs and gradually explore cross-currency pairs as you gain more experience and understanding of the market dynamics.

Exotic Currency Pairs

Exotic currency pairs involve the US dollar and the currency of an emerging or less-traded economy, such as USD/TRY, USD/ZAR, or USD/MXN. These pairs can be more challenging to trade due to their increased volatility, lower liquidity, and higher spreads.

While exotic currency pairs can offer the potential for higher rewards, they also carry a higher degree of risk. As a beginner Forex trader on the Exness platform, it's generally recommended to focus on the major and cross-currency pairs before venturing into the more complex exotic pairs.

Technical Analysis for Beginners in Forex Trading

Technical analysis is a crucial component of successful Forex trading on the Exness platform. By understanding and applying technical analysis principles, you can identify market trends, patterns, and potential trading opportunities.

Understanding Charts and Candlesticks

The foundation of technical analysis in Forex trading is the interpretation of price charts and candlestick formations. Exness provides a range of charting tools and timeframes, allowing you to analyze the historical and current price movements of your chosen currency pairs.

Familiarize yourself with the different chart types, such as line charts, bar charts, and candlestick charts, and learn how to identify key chart patterns and candlestick formations that can signal potential trading opportunities.

Technical Indicators

Forex trading on the Exness platform also involves the use of technical indicators, which are mathematical calculations based on the price and volume data of a currency pair. Popular technical indicators include moving averages, relative strength index (RSI), stochastic oscillator, and Bollinger Bands.

Experiment with different technical indicators and learn how to interpret their signals within the context of your Forex trading strategy. Keep in mind that no single indicator is foolproof, and it's essential to use a combination of indicators and analysis techniques to make informed trading decisions.

Support and Resistance Levels

Understanding support and resistance levels is another crucial aspect of technical analysis in Forex trading. These levels represent areas where the price of a currency pair is likely to find difficulty in moving higher (resistance) or lower (support).

By identifying and analyzing these key levels on the Exness platform, you can better anticipate potential price movements and make more informed trading decisions. Additionally, learning to recognize breakouts and breakdowns of support and resistance levels can help you identify potential trading opportunities.

Developing a Trading Strategy on Exness

Developing a well-defined trading strategy is essential for success in Forex trading on the Exness platform. Your trading strategy should be tailored to your risk tolerance, trading goals, and personal preferences.

Defining Your Trading Style

Forex traders can adopt various trading styles, such as scalping, day trading, swing trading, or position trading. Each style has its own characteristics, time frames, and risk/reward profiles.

As a beginner Forex trader on the Exness platform, it's important to experiment with different trading styles and find the one that best aligns with your personality, available time, and risk management approach.

Incorporating Technical and Fundamental Analysis

Successful Forex trading on the Exness platform often involves a combination of technical and fundamental analysis. Technical analysis, as discussed earlier, focuses on the historical price patterns and trends, while fundamental analysis examines the underlying economic, political, and market factors that influence currency exchange rates.

By integrating both technical and fundamental analysis into your trading strategy, you can gain a more comprehensive understanding of the market dynamics and make more informed trading decisions on the Exness platform.

Backtesting and Paper Trading

Before implementing your Forex trading strategy on the Exness platform, it's crucial to backtest your approach using historical data. Backtesting allows you to evaluate the performance of your strategy under various market conditions and make necessary adjustments before risking real capital.

Additionally, consider paper trading, or practicing with a demo account, to hone your skills and refine your trading strategy without incurring any financial risk. This approach can help you build confidence and experience before transitioning to live Forex trading on the Exness platform.

Risk Management Techniques for Forex Traders

Effective risk management is the cornerstone of successful Forex trading on the Exness platform. By implementing proper risk management practices, you can protect your trading capital and minimize the impact of potential losses.

Understanding Leverage and Margin

As mentioned earlier, Forex trading on the Exness platform often involves the use of leverage, which can amplify both potential profits and losses. It's crucial to understand the concept of leverage and margin, as well as the risks associated with them.

Determine an appropriate leverage ratio based on your risk tolerance and trading experience, and ensure that you maintain a sufficient margin to avoid margin calls and potential liquidation of your positions.

Setting Stop-Loss and Take-Profit Orders

One of the most fundamental risk management techniques in Forex trading is the use of stop-loss and take-profit orders. Stop-loss orders help limit your potential losses by automatically closing a trade when the price reaches a specified level, while take-profit orders allow you to lock in your gains.

Carefully set these orders based on your risk-reward ratio and market conditions to effectively manage your risk exposure on the Exness platform.

Diversifying Your Portfolio

Diversifying your Forex trading portfolio on the Exness platform can help mitigate the risks associated with any single trade or currency pair. By spreading your capital across multiple currency pairs, you can reduce the impact of potential losses and potentially increase your overall trading profitability.

Additionally, consider diversifying your trading strategies and time frames to further enhance the resilience of your Forex trading approach on the Exness platform.

Executing Your First Trade on Exness

Now that you have a solid understanding of the Forex market, the Exness platform, and the key trading concepts, it's time to execute your first trade on the Exness platform.

Selecting a Currency Pair

Begin by selecting a currency pair that aligns with your trading goals and risk tolerance. As a beginner, it's generally recommended to start with one of the major currency pairs, such as EUR/USD or GBP/USD, as they tend to be more stable and liquid.

Carefully analyze the current market conditions and the currency pair's historical price movements to identify potential trading opportunities.

Placing a Trade on Exness

Once you've selected the currency pair, log in to your Exness trading account and navigate to the trading platform of your choice (e.g., MT4, MT5, or the web-based platform).

Familiarize yourself with the platform's trading interface, including the order entry window, where you can specify the trade details such as the lot size, entry price, stop-loss,and take-profit levels. Be certain about the details you input, as a single mistake can significantly impact your trade.

When placing your first trade on Exness, consider using a small lot size to minimize your exposure. This way, you can familiarize yourself with the execution process and feel more comfortable without risking a substantial amount of capital. Once you've set the parameters of your trade, review everything carefully to ensure accuracy before clicking the "Buy" or "Sell" button.

Monitoring Your Trade

After executing your first trade, it's important to monitor it regularly. Keep an eye on market trends and any economic news that could impact the currency pair you've chosen. Utilizing tools and resources provided by Exness, such as real-time charts and market sentiment indicators, can help you stay informed.

One essential part of monitoring your trade is being prepared to adjust your stop-loss and take-profit orders based on changing market conditions. If the price moves favorably in your direction, consider trailing your stop-loss to secure your profits while allowing further potential gains. Conversely, if the market turns against you, be ready to exit the trade to minimize losses.

Learning from Your Experience

Once your first trade has concluded, whether in profit or loss, it's crucial to reflect on the experience. Analyze what went well and what didn't, taking notes on your decision-making process and the outcomes. This practice not only enhances your trading skills but also helps refine your strategy for future trades.

Keep in mind that each trade presents an opportunity to learn. The Forex market is dynamic, and continuous improvement is key to long-term success. By documenting your trades and reflecting upon them, you'll develop a deeper understanding of market behavior and your own trading psychology, which will ultimately lead to better performance over time.

Conclusion

As you embark on your Forex trading journey on the Exness platform, remember that success requires patience, discipline, and a commitment to ongoing education. From understanding the fundamental concepts of Forex trading to developing a tailored trading strategy, each step builds the foundation for your trading career. Utilize the technical analysis tools available, implement effective risk management techniques, and continuously learn from your trading experiences.

See more:

How to trade in Exness in india

how to deposit in Exness in india

Exness india customer care number 24 7

Exness forex trading legal in india