18 minute read

Exness Fees india: How much does Exness charge per trade?

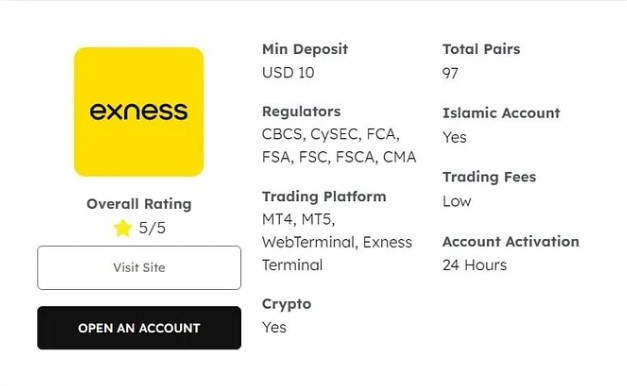

Exness Fees india is a topic that has gained significant interest among Indian traders looking to explore the world of online trading. As one of the leading online trading platforms, Exness has established a strong presence in the Indian market, offering a range of trading instruments and services to its clients. However, one of the primary concerns for traders is understanding the fees and charges associated with using the Exness platform.

In this comprehensive blog post, we will delve into the intricacies of Exness Fees india, providing a detailed breakdown of the various costs involved, as well as a comparative analysis with other brokers operating in the Indian market.

Understanding Exness Fees in India

When it comes to online trading, the fees and charges imposed by the broker play a crucial role in determining the overall profitability of a trader's investments. Exness Fees india is a topic that deserves careful consideration, as it can have a significant impact on the net returns earned by traders.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Importance of Understanding Exness Fees

Understanding the Exness Fees india is essential for several reasons:

Cost Optimization: By being aware of the various fees and charges associated with Exness, traders can make informed decisions and develop strategies to minimize their trading costs, ultimately improving their overall trading performance.

Comparison with Competitors: Knowing the Exness Fees india allows traders to compare the platform's offerings with other brokers in the market, enabling them to make an informed choice about the most cost-effective and suitable option for their trading needs.

Transparent Trading Environment: Transparent disclosure of Exness Fees india by the broker instills trust and confidence in the trading platform, which is crucial for building a long-term relationship between the trader and the broker.

Regulatory Compliance: In the financial services industry, brokers are required to disclose their fees and charges in a clear and transparent manner, adhering to regulatory guidelines. Understanding the Exness Fees india helps traders ensure that the broker is compliant with these regulations.

Read more:

Factors Influencing Exness Fees

The Exness Fees india are influenced by a variety of factors, including:

Trading Instrument: The type of financial instrument being traded (e.g., forex, CFDs, commodities) can impact the fees charged by Exness. Different instruments may have varying commission structures or spreads.

Account Type: Exness offers various account types (e.g., Standard, Pro, ECN) with different fee structures. Traders may need to consider the account type that best suits their trading style and preferences.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Trading Volume: The trading volume and frequency of transactions can affect the overall fees incurred by traders. Exness may offer volume-based discounts or tiered fee structures for high-volume traders.

Market Volatility: During periods of high market volatility, Exness may adjust its spreads or commissions to account for the increased risk and liquidity demands.

Regulatory Requirements: Exness must comply with the regulations set by the financial authorities in India, which can influence the fees and charges levied on traders.

Understanding these factors is crucial for Indian traders to navigate the Exness Fees india effectively and make informed decisions about their trading activities.

How Much Does Exness Charge Per Trade?

The Exness Fees india for each trade can vary depending on several factors, such as the trading instrument, account type, and market conditions. To provide a comprehensive understanding, let's delve into the different fee components associated with Exness trading.

Trading Commissions

Exness offers various account types, each with its own commission structure. The standard account typically charges a commission per lot traded, while the ECN account may have a lower or zero commission but wider spreads.

Standard Account: The commission for the Standard account is typically around $3.5 per lot traded, but this can be subject to change based on market conditions and the specific trading instrument.

ECN Account: The ECN account may have a lower or even zero commission, but the spreads are generally wider to compensate for the lack of commission.

It's important to note that Exness may offer volume-based discounts or special promotional offers that can further reduce the trading commissions for clients.

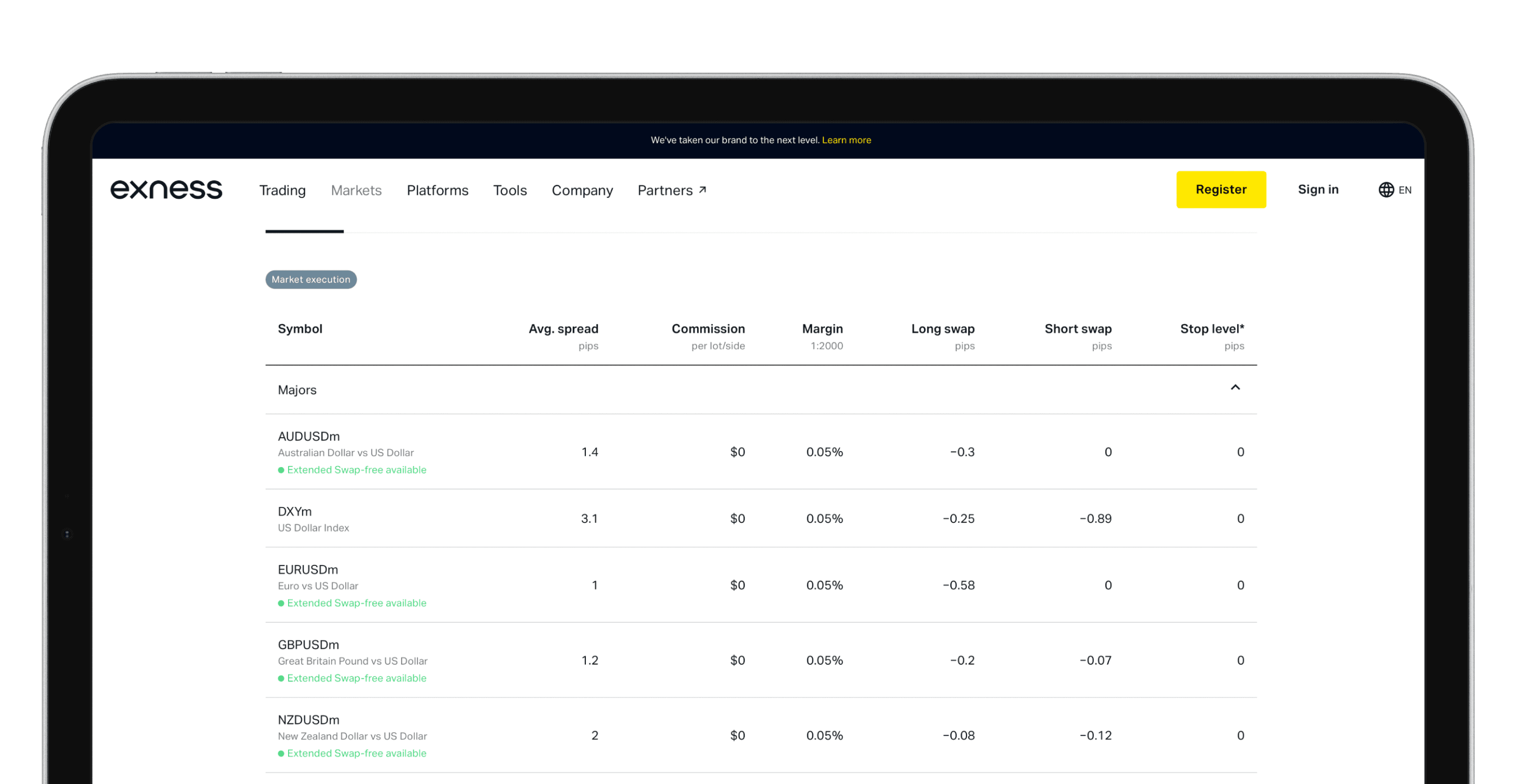

Spreads

The spread is the difference between the bid and ask prices of a financial instrument. Exness, like most brokers, generates a portion of its revenue from the spreads it offers on its trading instruments.

✅ Exness: Open An Account or Go to Website

Forex Pairs: The spreads for major currency pairs on Exness typically range from as low as 0.1 pips for the most liquid pairs, up to several pips for less liquid or exotic pairs.

CFDs: The spreads for CFDs on stocks, indices, and commodities can vary depending on the underlying asset, market conditions, and the specific account type.

Exness may adjust its spreads during times of high market volatility or low liquidity to reflect the increased risk and provide tighter execution for traders.

Overnight Financing (Swaps)

When a trader holds a position overnight, Exness may charge or credit an overnight financing fee, also known as a "swap" or "rollover" fee. This fee is based on the interest rate differential between the two currencies involved in the trade.

Long Positions: For long positions, the trader may be charged a swap fee, which represents the cost of borrowing the base currency.

Short Positions: For short positions, the trader may receive a swap credit, which represents the interest earned on the borrowed currency.

The swap rates can vary based on the trading instrument, the applicable interest rates, and the trader's account type. Traders should carefully consider the impact of swap fees on their long-term positions.

Withdrawal and Deposit Fees

Exness may charge fees for certain withdrawal and deposit methods, such as credit/debit card transactions or bank wire transfers. These fees can vary depending on the payment method used and the trader's account type.

Withdrawal Fees: Exness may charge a small percentage or a fixed fee for withdrawals, depending on the payment method.

Deposit Fees: Deposits may be free of charge or subject to a small fee, again depending on the payment method used.

Traders should review the Exness fee schedule and payment options to understand the applicable withdrawal and deposit fees before initiating any transactions.

Inactivity Fees

Exness may charge an inactivity fee if a trader's account remains dormant for an extended period. This fee is designed to cover the administrative costs associated with maintaining inactive accounts.

Inactivity Period: The inactivity period before Exness starts charging a fee can vary, but it is typically around 90 days of no trading activity.

Inactivity Fee: The inactivity fee charged by Exness can range from a few dollars to a percentage of the account balance, depending on the specific account type and the duration of inactivity.

Traders who plan to take extended breaks from trading should be aware of the Exness inactivity fee policy to avoid any unexpected charges.

Breakdown of Exness Trading Fees

To provide a more comprehensive understanding of the Exness Fees india, let's break down the various fee components in detail:

Account Opening and Maintenance Fees

Exness does not typically charge any account opening or maintenance fees for its trading accounts. This means that traders can open and maintain an Exness trading account without incurring any additional costs.

Trading Commissions

As mentioned earlier, the trading commissions charged by Exness vary depending on the account type. The Standard account typically has a commission of around $3.5 per lot traded, while the ECN account may have a lower or even zero commission.

Spreads

Exness offers competitive spreads, with the spreads for major currency pairs typically ranging from 0.1 pips to several pips, depending on the market conditions and the specific trading instrument.

Swap/Rollover Fees

Exness charges or credits swap/rollover fees for positions held overnight. The swap rates are based on the interest rate differential between the two currencies involved in the trade and can vary depending on the trading instrument and the trader's account type.

Withdrawal and Deposit Fees

Exness may charge a small fee for certain withdrawal and deposit methods, such as credit/debit card transactions or bank wire transfers. Traders should review the Exness fee schedule to understand the applicable fees for their preferred payment methods.

Inactivity Fees

Exness may charge an inactivity fee if a trader's account remains dormant for an extended period, typically around 90 days of no trading activity.

By understanding these various fee components, Indian traders can make informed decisions about their trading activities and develop strategies to minimize their overall trading costs on the Exness platform.

Exness Commission Rates Explained

The Exness Fees india include the commission rates charged by the broker for executing trades. These commission rates vary depending on the trading instrument and the account type selected by the trader.

Standard Account Commission

The Standard account on Exness typically charges a commission of around $3.5 per lot traded. This commission is applied to the trading volume, regardless of the specific trading instrument.

ECN Account Commission

The ECN account on Exness may have a lower or even zero commission, but the spreads are generally wider to compensate for the lack of commission. This account type is often preferred by traders who prioritize tight spreads over low commissions.

Volume-Based Discounts

Exness may offer volume-based discounts on the trading commissions for high-volume traders. These discounts are designed to incentivize larger trading volumes and can help reduce the overall trading costs for such traders.

Promotional Offers

Exness may occasionally introduce promotional offers or discounts on the trading commissions, which can be beneficial for traders, especially those who are new to the platform. These promotions can help offset the trading costs and make the Exness platform more accessible for a wider range of traders.

By understanding the commission rates and the different account types offered by Exness, Indian traders can make an informed decision about the most suitable option for their trading needs and preferences.

Trading Costs with Exness: A Comprehensive Guide

When it comes to Exness Fees india, traders need to consider the various cost components that can impact their overall trading performance. In this section, we'll provide a comprehensive guide to understanding the trading costs associated with the Exness platform.

Spreads and Their Impact on Trading Costs

The spread, which is the difference between the bid and ask prices, is a crucial cost component in trading. Exness offers competitive spreads, with the spreads for major currency pairs typically ranging from 0.1 pips to several pips, depending on the market conditions and the specific trading instrument.

Traders should carefully analyze the spreads offered by Exness and compare them with other brokers to ensure they are getting the best possible pricing for their trades.

Commissions and Their Role in Trading Costs

The trading commissions charged by Exness can have a significant impact on the overall trading costs. As mentioned earlier, the Standard account typically has a commission of around $3.5 per lot traded, while the ECN account may have a lower or even zero commission.

Traders should consider the account type that best suits their trading style and preferences, taking into account the balance between commissions and spreads.

Swaps and Their Effect on Long-Term Positions

The overnight financing or swap fees charged by Exness can impact the profitability of long-term trading positions. Traders should carefully evaluate the swap rates for the instruments they are interested in and factor these costs into their trading strategies.

Understanding the impact of swap fees can help traders make informed decisions about the holding periods for their positions and optimize their trading accordingly.

Other Fees and Charges

In addition to the spreads, commissions, and swaps, traders should also be aware of other fees and charges imposed by Exness, such as withdrawal and deposit fees, as well as any potential inactivity fees.

By carefully reviewing the Exness fee schedule and understanding the various cost components, traders can develop strategies to minimize their overall trading expenses and improve their net trading profits.

Comparing Exness Fees with Other Brokers in India

When evaluating the Exness Fees india, it's crucial to compare them with the fees and charges of other brokers operating in the Indian market. This comparative analysis can help traders make an informed decision about the most cost-effective broker for their trading needs.

Spread Comparison

One of the primary factors to consider is the spreads offered by Exness compared to other brokers. Traders should compare the typical spread ranges for the financial instruments they are interested in across different brokers to identify the most competitive pricing.

Commission Structures

The commission structures of various brokers in India can also vary significantly. Traders should compare the per-lot commissions or any other commission-based fees charged by Exness with those of its competitors to determine the most cost-effective option.

Withdrawal and Deposit Fees

The fees associated with withdrawals and deposits can also play a role in the overall trading costs. Traders should review the payment methods and the corresponding fees offered by Exness and compare them with other brokers to ensure they are getting the best value for their money.

Regulatory Compliance and Transparency

In addition to the fee structures, traders should also consider the regulatory compliance and transparency of the brokers they are evaluating. Exness, being a regulated broker, may offer a higher level of transparency and adherence to industry standards, which can contribute to a more reliable and trustworthy trading environment.

By conducting a comprehensive comparison of the Exness Fees india with other brokers in the Indian market, traders can make an informed decision that aligns with their trading goals and preferences.

Factors Influencing Exness Charges per Trade

The Exness Fees india per trade can be influenced by various factors, both internal and external to the broker. Understanding these factors can help traders anticipate and manage the trading costs associated with the Exness platform.

Market Conditions and Volatility

The prevailing market conditions and the level of volatility can have a significant impact on the Exness Fees india. During periods of high market volatility, Exness may adjust its spreads or commissions to account for the increased risk and liquidity demands.

Traders should be aware of the potential changes in Exness fees during periods of market turmoil and factor them into their trading strategies.

Trading Instrument and Asset Class

The type of financial instrument or asset class being traded can also influence the Exness Fees india. Different instruments, such as forex, CFDs, or commodities, may have varying commission structures or spread ranges.

Traders should familiarize themselves with the fee structures associated with the specific instruments they plan to trade on the Exness platform.

Account Type and Trading Volume

The account type selected by the trader can play a crucial role in determining the Exness Fees india. As mentioned earlier, the Standard account typically has a higher commission, while the ECN account may have lower or even zero commissions but wider spreads.

Additionally, Exness may offer volume-based discounts or tiered fee structures for high-volume traders, which can help reduce the overall trading costs.

Regulatory and Compliance Requirements

The regulatory environment in which Exness operates can also influence the Exness Fees india. Brokers must comply with various financial regulations and guidelines, which can impact the fees and charges they impose on traders.

Staying informed about the regulatory changes and their potential impact on Exness fees can help traders make more informed decisions about their trading activities.

By understanding these factors, traders can better anticipate and manage the Exness Fees india, ensuring they are making the most informed decisions about their trading activities.

Exness Spreads and Their Impact on Trading Costs

The spreads offered by Exness are a crucial component of the Exness Fees india and can have a significant impact on the overall trading costs for traders.

Understanding Exness Spreads

The spread is the difference between the bid and ask prices of a financial instrument. Exness, like most brokers, generates a portion of its revenue from the spreads it offers on its trading instruments.

The spreads on Exness can vary depending on the trading instrument, market conditions, and the specific account type. For example, the spreads for major currency pairs on Exness typically range from as low as 0.1 pips to several pips for less liquid or exotic pairs.

Impact of Spreads on Trading Costs

The spreads offered by Exness can directly impact the trading costs for traders. A tighter spread, which is the difference between the bid and ask prices, can result in lower trading costs per trade, as the trader is paying less for the price difference.

On the other hand, wider spreads can increase the trading costs, as the trader is effectively paying more for the price difference when entering and exiting a position.

Factors Influencing Exness Spreads

The Exness Fees india in terms of spreads can be influenced by several factors, including:

Market Volatility: During periods of high market volatility, Exness may adjust its spreads to reflect the increased risk associated with trading. This means that spreads may widen during major news events or economic releases, impacting traders' costs.

Liquidity: The liquidity of the underlying market can also affect spreads. In highly liquid markets, spreads tend to be tighter due to the availability of buyers and sellers, whereas illiquid markets often lead to wider spreads as the broker faces more difficulty in executing trades efficiently.

Time of Trading: Spreads can also fluctuate based on the time of day. For example, spreads may be tighter during peak trading hours when market activity is high, and may widen during off-peak hours when fewer participants are trading.

By understanding how these factors influence spreads, traders can better manage their expectations regarding Exness Fees india and make more informed trading decisions.

Tips to Minimize Exness Trading Fees in India

Minimizing trading fees is essential for maximizing profits, especially for active traders who execute numerous transactions. Here are some effective strategies to reduce Exness Fees india.

Choosing the Right Account Type

One of the most impactful decisions traders can make is selecting the right account type. Exness offers several account options, including standard and ECN accounts, each with its distinct fee structures.

Active traders might find that an ECN account, despite potentially having wider spreads, ultimately results in lower overall fees due to reduced commissions per trade. By analyzing personal trading styles and volumes, traders can choose an account that aligns well with their trading habits, significantly influencing their overall costs.

Utilizing Promotions and Bonuses

Exness often provides various promotions and bonuses that can further reduce the financial burden of trading fees. Traders should keep an eye out for promotional offers such as deposit bonuses, which can provide additional equity to trade with without incurring extra costs.

By taking advantage of these promotions, traders may offset some of their transaction costs while enhancing their capital base for trading operations.

Timing Trades Wisely

Timing plays a significant role in trading costs, particularly concerning spread fluctuations. By being aware of the best trading times, traders can avoid periods of high volatility or low liquidity that could lead to unfavorable spreads.

Engaging in trading during active hours, often around major forex sessions overlaps, can help traders secure tighter spreads and minimize costs associated with entering and exiting positions.

Implementing Risk Management Strategies

Effective risk management not only protects capital but can also help reduce trading fees through a disciplined approach to trading. By setting clear stop-loss and take-profit levels, traders can avoid unnecessary trades caused by emotional responses to market movements.

This disciplined approach minimizes the number of trades executed, thereby lowering total transaction costs over time and improving overall profitability.

Is Exness Cost-effective for Indian Traders?

When assessing whether Exness Fees india are cost-effective for traders in India, it’s essential to consider various elements beyond mere transactional costs.

Quality of Trading Platform

The quality of the trading platform offered by Exness greatly contributes to its overall value proposition. A user-friendly interface, advanced charting tools, and seamless execution can enhance the trading experience, making even slightly higher fees worthwhile.

With features such as automated trading capabilities and mobile accessibility, traders may find that the advantages of using Exness outweigh any concerns about fees.

Customer Support and Education Resources

Another aspect that influences cost-effectiveness is the level of customer support and educational resources available through Exness. Access to responsive and knowledgeable customer service can save traders time and money when they encounter issues or require assistance.

Moreover, educational materials, webinars, and tutorials provided by Exness can empower traders to improve their skills and strategies, ultimately leading to better trading outcomes and potentially offsetting the cost of fees.

Trading Community and Insights

Being part of a broader trading community can also justify the fees paid. Exness fosters engagement among its users, providing insights into market trends and trading strategies.

Participating in forums or social trading can offer valuable perspectives and ideas that enhance trading performance, which can justify the expense incurred through trading fees.

Conclusion

In conclusion, understanding the Exness Fees india is crucial for traders looking to maximize their profitability while minimizing trading costs. Through comprehensive analyses of trading fees and comparisons to other brokers, traders can identify the best options that suit their individual needs and preferences.

See more:

does exness allow copy trading in india?