5 minute read

Is Exness safe in India?

A crucial question arises for prospective users: Is Exness safe in India? This article delves into the regulatory landscape, security measures, and user experiences to provide a comprehensive assessment of Exness safety for Indian traders.

Understanding the Regulatory Framework

Regulation of Forex Trading in India

Forex trading in India is governed by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). The Foreign Exchange Management Act (FEMA) of 1999 outlines the permissible activities related to foreign exchange. Residents are generally allowed to trade in foreign currency pairs only through authorized dealers and exchanges regulated by SEBI.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Exness's Regulatory Status

Exness is a global brokerage with multiple entities operating under various regulatory licenses such as:

FCA: Exness (UK) Ltd is authorized and regulated by the Financial Conduct Authority in the UK.

FSA: Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025.

CySEC: Exness (Cy) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

FSCA: Exness ZA (PTY) Ltd is authorized and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa.

These are all the licenses the company has now, you can use google to find more information about them.

Exness does not hold a specific license from SEBI or RBI to operate directly as a forex broker within India. As per our research, this means that Indian residents who choose to trade with Exness are technically engaging with an offshore entity.

Is Exness safe in india?

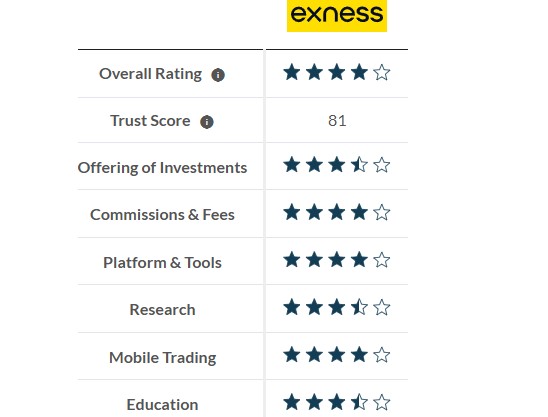

Exness is a regulated broker and is generally considered safe for Indian traders. It's regulated by various international financial authorities, which ensures a certain level of security and transparency.

However, it's important to note that forex trading in India is not explicitly regulated by the Reserve Bank of India (RBI). While many Indian traders use international brokers like Exness, it's crucial to be aware of the potential risks and legal implications.

Implications for Indian Traders

Legal Grey Area

Trading with an offshore broker that is not regulated by SEBI is a complex issue. While it is not expressly illegal for Indian residents to trade with offshore brokers, it does place the onus of due diligence on the individual. There's a degree of legal ambiguity, and traders should be aware of the potential risks associated with FEMA regulations.

Remittance of Funds

Transferring funds to and from an offshore broker can be challenging due to RBI's guidelines on remittances under the Liberalised Remittance Scheme (LRS). Indian traders need to ensure they comply with these regulations when funding their Exness accounts.

Security Measures Employed by Exness

Segregation of Client Funds

Exness segregates client funds from its operational funds. This means that in the unlikely event of the company facing financial difficulties, client funds are held separately and are not used to meet the company's obligations.

Negative Balance Protection

Exness offers negative balance protection. This feature ensures that traders cannot lose more than their deposited amount, which is especially important in the volatile forex market.

Data Encryption and Security Protocols

Exness employs standard security measures such as SSL encryption to protect client data during transmission. They follow industry best practices to safeguard information within their systems.

Two-Factor Authentication (2FA)

To enhance account security, Exness offers Two-Factor Authentication. This adds an extra layer of protection by requiring a secondary verification code in addition to the password during login.

User Experiences and Reputation

Positive Feedback

Many users have reported positive experiences with Exness, highlighting its user-friendly platform, competitive spreads, and fast order execution. The broker has generally received praise for its customer support and transparency.

Complaints and Concerns

As with any broker, there have been some complaints regarding withdrawal processing times and occasional technical glitches. However, it's important to note that the majority of these issues seem to be resolved promptly by Exness's support team.

Risk Management Tips for Indian Traders

Due Diligence

It's crucial to conduct thorough research and understand the legal implications before trading with any offshore broker. Familiarize yourself with FEMA guidelines and RBI regulations.

Start Small

If you decide to trade with Exness, it's advisable to start with a small investment amount to test the platform and its services.

Diversify

Don't put all your eggs in one basket. Explore different trading platforms and asset classes to diversify your trading portfolio.

Use Secure Payment Methods

Opt for payment methods that provide an added layer of security and traceability when depositing and withdrawing funds.

Stay Informed

Keep abreast of regulatory changes and updates that might affect forex trading in India.

Conclusion

Is Exness safe in India? Exness appears to be a safe and reputable broker with strong regulatory oversight in multiple jurisdictions. However, its lack of direct SEBI regulation places it in a grey area within the Indian context. While many Indian traders use Exness without issues, it's essential to be aware of the legal considerations of trading with a broker not regulated by SEBI, potential challenges with fund transfers, and adhere to risk management best practices.

✳️ Read more: