11 minute read

Best Forex Brokers for small accounts

Top 10 Best Forex Brokers for small accounts, providing essential insights about platforms like Exness, Avatrade, JustMarkets, and XM, among others. A well-chosen broker not only provides access to a diverse range of currencies but also offers favorable trading conditions that empower small account holders to maximize their potential without risking excessive capital.

BEST FOREX BROKERS in The World

✅ Exness: Open An Account or Go to Website

✅ JustMarkets: Open An Account or Go to Website

✅ XM: Open An Account or Go to Website

✅ FP Markets: Open An Account or Go to Website

✅ Avatrade: Open An Account or Go to Website

1. Exness

Introduction

Exness has emerged as one of the leading brokers for traders with small accounts due to its user-friendly platform and flexible trading conditions. Founded in 2008, it offers a robust trading environment that caters to both novice and experienced traders.

✅ Exness: Open An Account or Go to Website

Features

Low Minimum Deposit: Accounts can be opened with as little as $1, allowing traders with limited capital to participate.

Leverage Options: Offers high leverage (up to 1:2000), enabling traders to control larger positions with smaller amounts of capital.

Variety of Account Types: Includes Standard, Pro, and Zero accounts, catering to different trading styles and needs.

No Commissions on Standard Accounts: Traders can enjoy spreads as low as 0.3 pips without paying any commission.

Advanced Trading Tools: Access to MetaTrader 4 and 5, along with various analysis tools.

Pros and Cons

Pros

Flexible deposit requirements

High leverage options

User-friendly interface

Excellent customer support

Cons

Limited educational resources for beginners

Withdrawal options may vary by region

Your Opinion

In my opinion, Exness stands out as an ideal choice for traders with small accounts. Its low initial deposit and commission-free trades allow beginners to get started without significant financial risk. However, the limited educational content may require novices to seek external resources to enhance their understanding of forex trading.

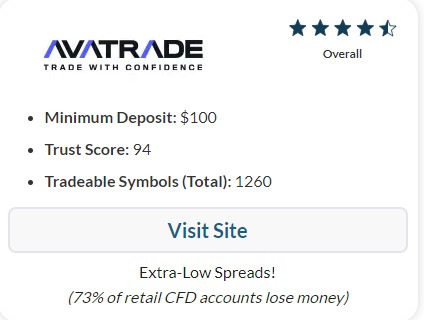

2. Avatrade

Introduction

Avatrade is renowned for its comprehensive range of trading services and educational resources. Established in 2006, the broker provides a sophisticated trading platform suitable for traders with varying levels of experience, including those managing small accounts.

✅ Avatrade: Open An Account or Go to Website

Features

Minimum Deposit of $100: While slightly higher than some competitors, it still remains accessible for most traders.

Diverse Range of Assets: Access to over 250 financial instruments, including commodities, stocks, and cryptocurrencies.

Trading Platforms: Avatrade offers multiple platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO app.

Demo Account Availability: Allows traders to practice without financial risk before committing real money.

Educational Resources: Comprehensive guides, webinars, and tutorials help traders improve their skills.

Pros and Cons

Pros

Extensive educational materials

Diverse trading instruments

Advanced trading platforms

Good customer support

Cons

Higher minimum deposit compared to competitors

Fees on inactivity may apply

Your Opinion

Avatrade is an excellent option for traders who prioritize education alongside trading. The variety offered in assets and platforms is particularly beneficial for those looking to diversify their portfolio. Nevertheless, the higher minimum deposit might deter some traders with very small accounts.

3. JustMarkets

Introduction

JustMarkets is a relatively new entrant in the forex brokerage scene but has quickly gained popularity by offering traders competitive conditions tailored for those with small accounts. Launched in 2019, it aims to provide a transparent trading environment.

✅ JustMarkets: Open An Account or Go to Website

Features

Ultra-Low Minimum Deposit: As low as $1, making it incredibly accessible for beginners.

Variable Spreads: Starting from 0 pips on certain accounts, which can enhance profitability.

Multiple Account Types: Including Standard and Pro accounts, accommodating various trading strategies.

Islamic Accounts Available: For traders following Sharia law, ensuring no swap fees.

User-Friendly Interface: Designed to cater to both new and experienced traders.

Pros and Cons

Pros

Low entry barrier

Competitive spreads

Flexible account types

Strong focus on transparency

Cons

Limited trading instruments compared to larger brokers

Relatively new, may lack extensive track record

Your Opinion

JustMarkets presents a fantastic opportunity for new traders seeking minimal risk. The ultra-low minimum deposit and competitive spreads are undoubtedly appealing. However, it may lack some advanced features found in more established brokers, so traders should consider their long-term goals when choosing this platform.

4. XM

Introduction

XM is a well-established broker that has been operational since 2009. It is widely recognized for its commitment to providing an exceptional trading experience, particularly for those managing small trading accounts.

✅ XM: Open An Account or Go to Website

Features

Low Minimum Deposit: Start trading with just $5, making it accessible for everyone.

Leverage Up to 1:888: High leverage options allow traders to amplify their positions.

Various Account Types: Ranging from Micro accounts to Ultra-Low accounts, catering to different preferences.

Free Educational Material: Extensive resources, including webinars and market analysis, available to all clients.

Negative Balance Protection: Ensures traders cannot lose more than they invest.

Pros and Cons

Pros

Extremely low minimum deposit

High leverage options

Comprehensive educational offerings

Strong regulatory compliance

Cons

Personal account management may not be available for small accounts

High leverage can lead to increased risk

Your Opinion

XM is undoubtedly one of the best options for traders focused on small accounts. With a low minimum deposit and a wealth of educational resources, it effectively empowers new traders to thrive. Caution should be exercised with the high leverage offered, as it can increase risks significantly if not managed properly.

5. FBS

Introduction

FBS has been operating since 2009 and has garnered a reputation for being a trader-friendly platform, particularly for those with small accounts. The broker combines competitive trading conditions with strong promotional offerings.

Features

Minimum Deposit of $1: Making it one of the most accessible brokers for new traders.

Cent Accounts Available: Ideal for small account traders to reduce risk while gaining trading experience.

Promotions and Bonuses: Regular promotional campaigns incentivize trading activity.

Multiple Trading Platforms: Including MT4 and MT5, offering flexibility to traders.

Customer Support: Multi-language support available around the clock.

Pros and Cons

Pros

Very low minimum deposit

Cent accounts help mitigate risk

Frequent bonuses and promotions

Solid customer service

Cons

Limited range of trading instruments

Withdrawal fees may apply depending on methods used

Your Opinion

FBS presents an attractive option for beginner traders due to its extremely low minimum deposit and cent account feature. Furthermore, the promotional bonuses can offer additional value. However, the limited asset range might restrict trading opportunities for more experienced traders.

6. NordFX

Introduction

NordFX is a global forex broker that has been in operation since 2008. It is known for providing a wide range of trading services and solutions for traders managing small accounts.

Features

Minimum Deposit of $10: An affordable entry point for new traders.

Variable Leverage Up to 1:1000: Allows traders to control larger positions with smaller investments.

Wide Range of Instruments: Access to forex pairs, stocks, cryptocurrencies, and commodities.

Referral Programs and Bonuses: Incentives to attract new traders and retain existing ones.

MT4 and MT5 Compatibility: Supports two of the most popular trading platforms.

Pros and Cons

Pros

Low minimum deposit requirement

High leverage capabilities

Diverse range of tradable assets

Attractive referral program

Cons

Limited educational materials for beginners

Higher spreads on certain accounts

Your Opinion

NordFX is an appealing choice for traders with small accounts, primarily due to its low minimum deposit and vast array of trading instruments. However, the lack of educational resources could challenge inexperienced traders aiming to build their knowledge base in forex trading.

7. HotForex

Introduction

HotForex has built a solid reputation since its inception in 2010. It focuses on delivering a wide array of trading products and services, making it a great choice for traders with small accounts.

Features

Minimum Deposit of $5: Accessible to almost anyone interested in forex trading.

Multiple Account Types: Various accounts to suit different trading strategies, including micro accounts.

Free Forex Education: Offers webinars, eBooks, and training sessions for all skill levels.

Tight Spreads: Competitive spreads start at just 0 pips on some accounts.

Negative Balance Protection: Provides safety for traders against losing more than their deposits.

Pros and Cons

Pros

Very low entry cost

Wide selection of educational resources

Negative balance protection ensures risk mitigation

High liquidity and competitive spreads

Cons

Limited promotions compared to other brokers

Some withdrawal fees may apply

Your Opinion

HotForex is undeniably a top contender for traders with small accounts. The combination of low initial investment and rich educational resources gives newcomers a solid foundation for developing their trading skills. However, the fees associated with withdrawals may deter some users.

8. IC Markets

Introduction

IC Markets is an Australian-based forex broker established in 2007, known for its exceptional trading conditions and technology-driven approach. It is especially appealing for scalpers and algorithmic traders with small accounts.

Features

Minimum Deposit of $200: While higher than many competitors, the quality of service justifies the amount.

True ECN Execution: Provides direct access to interbank liquidity, resulting in tight spreads.

High Leverage Options: Up to 1:500 allows traders to maximize their trading potential.

Variety of Trading Platforms: Includes MT4, MT5, and cTrader, offering flexibility.

Comprehensive Market Analysis: Clients receive regular updates and analysis to aid their trading decisions.

Pros and Cons

Pros

Excellent execution speed

Low spreads for scalping

Multiple advanced trading platforms

Robust market analysis provided

Cons

Higher minimum deposit may be prohibitive for some

Limited educational content compared to others

Your Opinion

IC Markets is perfect for traders who employ advanced strategies and require tight spreads and fast execution. However, the higher minimum deposit might not appeal to every trader with a small account, especially those just starting.

9. OANDA

Introduction

OANDA is another reputable broker that has been in business since 1996. It offers a robust trading platform, innovative tools, and a wide range of currency pairs, making it suitable for small account traders.

Features

Minimum Deposit Requirement: No minimum deposit required, allowing traders to start with any amount.

Flexible Leverage Options: Offers leverage up to 1:50 or 1:100 depending on the account type.

Comprehensive Trading Platform: Proprietary platform includes powerful charting and analytics tools.

Regulatory Compliance: Highly regulated across various jurisdictions, ensuring a secure trading environment.

Advanced Order Types: Facilitates various trading strategies and risk management techniques.

Pros and Cons

Pros

No minimum deposit requirement

Innovative trading tools and platform

Highly regulated and secure

Variety of order types available

Cons

Limited account types compared to other brokers

Relatively higher spreads on some accounts

Your Opinion

OANDA is exceptionally user-friendly and allows traders to enter the forex market without a minimum deposit, making it highly attractive for beginners. However, the higher spreads may affect profitability, particularly for frequent traders.

10. Pepperstone

Introduction

Pepperstone, launched in 2010, has quickly positioned itself as one of the top forex brokers globally, particularly appealing to traders with small accounts due to its competitive pricing and rapid execution.

Features

Minimum Deposit of $200: Reasonable for the level of service provided.

ECN Pricing Model: Direct access to the markets results in tight spreads from 0 pips.

Variety of Trading Platforms: Supports popular platforms like MT4, MT5, and cTrader.

Excellent Customer Service: Round-the-clock support through various channels.

Regular Promotions: Offers various incentives for new clients.

Pros and Cons

Pros

Competitive spreads and execution

Excellent customer service

Variety of trading platforms available

Frequent promotions and bonuses

Cons

Higher minimum deposit compared to some other brokers

Limited educational resources

Your Opinion

Pepperstone deserves recognition for its outstanding execution and pricing, making it a strong candidate for traders managing small accounts. The higher minimum deposit might be a concern for absolute beginners, but the quality of service provided makes it a worthy consideration.

FAQs

What is the typical minimum deposit for forex brokers?

Most forex brokers offer a variety of minimum deposit requirements. Many have low thresholds, often starting as low as $1, while others may require deposits ranging from $100 to $200.

Can I trade forex with a small account?

Yes, many brokers cater specifically to small account traders, allowing them to start trading with minimal capital. However, it's essential to manage risk appropriately.

How do I choose the best forex broker for a small account?

Look for brokers that offer low minimum deposits, competitive spreads, good customer support, a variety of account types, and educational resources to help you grow your trading skills.

Is leverage safe for small account traders?

Leverage can magnify profits but also increases potential losses, which makes it crucial for small account traders to use it cautiously and manage their risk effectively.

Do all brokers charge fees for withdrawals?

Not all brokers charge withdrawal fees; however, policies can vary by broker and by withdrawal method. Always check the fee structure before opening an account.

Conclusion

Navigating the world of forex trading can be challenging, especially for those starting with small accounts. However, choosing the right broker can pave the way for success. The Top 10 Best Forex Brokers for small accounts listed above—such as Exness, Avatrade, JustMarkets, and XM—offer traders favorable trading conditions, educational resources, and supportive environments to help them thrive in the forex market.

Ultimately, your choice will depend on your specific trading needs, preferences, and financial goals. It's vital to conduct thorough research and perhaps start with demo accounts to gain valuable experience before committing real capital.

See more:

Best Forex Brokers in ThaiLan 2025

Best Forex Brokers in Saudi arabia 2025

Best Forex Brokers in Sri Lanka 2025

Best Forex Brokers in Nepal 2025

Best Forex Brokers in Qatar 2025

Read more: