9 minute read

Best forex trading with high leverage

Top 10 Best forex trading with high leverage presents an attractive opportunity. This article delves into a comprehensive exploration of some of the leading forex trading platforms that allow traders to harness high leverage effectively while navigating the complex landscape of currency trading. Platforms such as Exness, XM, AvaTrade, and FBS will be examined in detail, along with their features, pros and cons, and expert opinions.

BEST FOREX BROKERS trading with high leverage in The World

✅ Exness: Open An Account or Go to Website

✅ JustMarkets: Open An Account or Go to Website

✅ XM: Open An Account or Go to Website

✅ FP Markets: Open An Account or Go to Website

✅ Avatrade: Open An Account or Go to Website

The Significance of High Leverage in Forex Trading

High leverage allows traders to control large positions with a relatively small amount of capital. In essence, it amplifies both profits and losses, making it a double-edged sword. Understanding how to utilize leverage effectively is crucial for anyone looking to enter the forex market. It enables traders to take advantage of small price movements, but it also increases risk exposure. Therefore, selecting the right trading platform that aligns with your risk tolerance and trading goals is essential.

Now, let's delve into the Top 10 Best forex trading with high leverage, exploring each platform's unique offerings.

1. Exness

Introduction

Exness has earned a reputation as one of the top forex brokers globally, particularly known for its user-friendly interface and competitive leverage options. With over a decade of experience in the trading industry, Exness provides a wide variety of financial instruments, including forex, cryptocurrencies, and commodities.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Features

Leverage Options: Up to 1:2000.

Account Types: Multiple account types tailored for different trading styles.

Platforms Supported: MetaTrader 4, MetaTrader 5, and mobile applications.

Customer Support: 24/7 customer service with multilingual support.

Pros and Cons

Pros:

High leverage options for various accounts.

Low spreads and commissions.

Regulated by several authorities, ensuring trustworthiness.

Cons:

Limited educational resources for beginners.

Some withdrawal methods may incur additional fees.

Your Opinions

Exness stands out for its high leverage and extensive asset offerings. However, new traders may need to seek external educational resources to maximize their learning curve on this platform.

2. XM

Introduction

XM is renowned for its commitment to providing a fair trading environment and has gained significant traction among traders worldwide. Offering high leverage, XM ensures satisfactory trading experiences across various markets.

✅ XM: Open An Account or Go to Website

Features

Leverage Options: Up to 1:888.

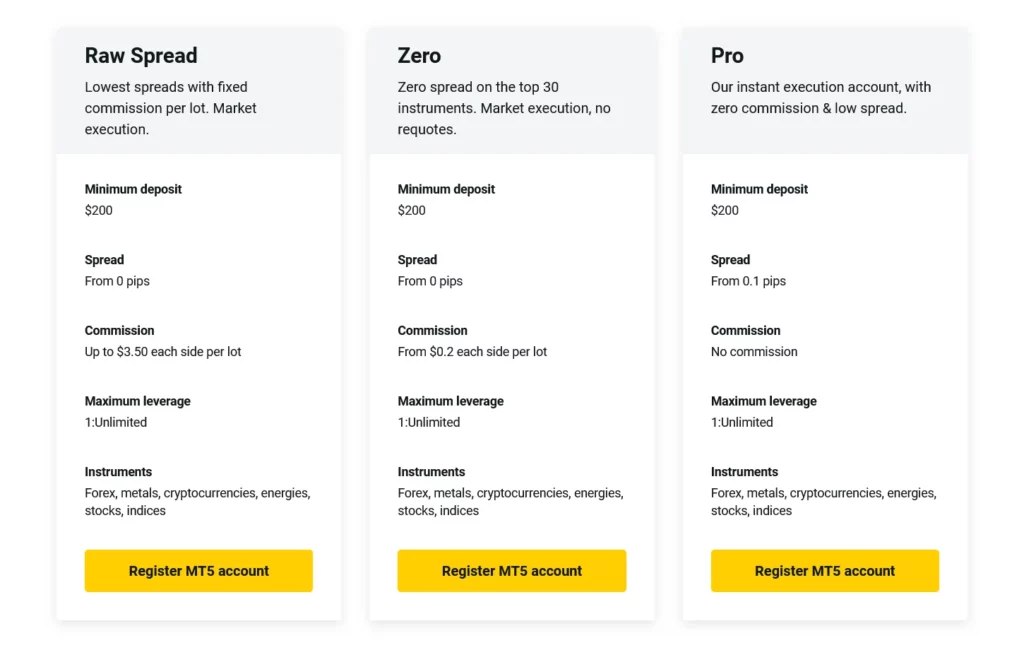

Account Types: Micro, Standard, and Zero accounts to cater to different trader needs.

Trading Tools: Advanced charting tools and market analysis.

Regulatory Compliance: Regulated by multiple international bodies.

Pros and Cons

Pros:

Attractive leverage rates.

Wide range of tradable assets.

Comprehensive customer support with educational resources.

Cons:

Limited payment methods for withdrawals.

Higher spreads on some account types.

Your Opinions

XM offers a compelling package for traders looking for high leverage, although the limited payment options for withdrawals could be improved upon.

3. AvaTrade

Introduction

AvaTrade is a reliable broker that has carved out a niche in the forex trading industry. With a strong focus on providing a user-friendly experience, it appeals to both novice and experienced traders alike.

✅ Avatrade: Open An Account or Go to Website

Features

Leverage Options: Up to 1:400.

Educational Resources: A wealth of tutorials and webinars.

Trading Platforms: Supports multiple platforms, including MetaTrader and its own proprietary platform.

Range of Instruments: Offers a wide selection of trading instruments.

Pros and Cons

Pros:

Excellent educational resources for inexperienced traders.

High leverage options, enhancing profit potential.

Strong regulatory backing.

Cons:

Slightly higher fees compared to competitors.

Limited availability in certain regions.

Your Opinions

AvaTrade is an excellent choice for traders who prioritize education and support. While it does have slightly higher fees, the value provided through learning resources outweighs the downside.

4. FBS

Introduction

FBS is a global brokerage firm offering a broad spectrum of services for forex traders. Known for its competitive leverage options and enticing bonuses, FBS caters to various trader profiles, from beginners to professionals.

Features

Leverage Options: Up to 1:3000.

Promotion Offers: Bonuses and promotions appealing to new traders.

User-Friendly Interface: Intuitive trading platform with advanced technology.

Market Analysis: Regular insights and updates on market trends.

Pros and Cons

Pros:

Extremely high leverage levels available.

Attractive promotional offers.

Diverse account choices.

Cons:

Limited educational content.

Customer service response times can vary.

Your Opinions

FBS shines with its extraordinarily high leverage and promotional incentives. However, traders seeking robust educational content may find themselves needing additional resources.

5. Pepperstone

Introduction

Pepperstone is a well-respected forex broker known for its low-cost trading and high leverage capabilities. Founded in Australia, it has rapidly expanded its reach to become a favorite among traders globally.

Features

Leverage Options: Up to 1:500.

Low Spreads: Competitive spreads across various instruments.

Multiple Account Types: Options between standard and razor accounts.

Advanced Trading Technology: Utilization of cutting-edge trading platforms.

Pros and Cons

Pros:

Exceptional trading conditions with low costs.

Fast execution speeds.

Robust customer service.

Cons:

Fewer educational resources compared to some competitors.

Limited asset coverage compared to larger brokers.

Your Opinions

Pepperstone is an ideal platform for experienced traders looking for low costs and efficient execution. However, it may not suit beginners seeking comprehensive educational tools.

6. IC Markets

Introduction

IC Markets is an Australian-based brokerage firm that prioritizes transparency and fairness. They are known for offering high leverage without compromising on the quality of service, which attracts many professional traders.

Features

Leverage Options: Up to 1:500.

Low Latency: Rapid execution speed due to direct market access.

Variety of Trading Platforms: Access to MetaTrader, cTrader, and mobile applications.

Customer Service: 24/7 support across multiple languages.

Pros and Cons

Pros:

Direct market access ensures fast trade execution.

Competitive commission structure.

Extensive asset offerings.

Cons:

Limited educational materials available.

Restricted to certain geographical locations for trading.

Your Opinions

IC Markets excels in providing a seamless trading experience for seasoned traders. The lack of educational resources could deter newcomers, making it better suited for professionals.

7. Forex.com

Introduction

Forex.com is a prominent name in the forex trading arena, offering a comprehensive suite of trading tools and services. With a solid regulatory framework, Forex.com is known for its dependability and security.

Features

Leverage Options: Up to 1:50 for retail accounts, up to 1:300 for professional accounts.

Innovative Tools: Proprietary trading platform with advanced analytics.

Strong Regulation: Overseen by multiple regulatory authorities.

Diverse Account Types: Various accounts designed for different trading needs.

Pros and Cons

Pros:

Advanced trading tools and features.

Reliable customer support.

Regulated and transparent practices.

Cons:

Lower leverage compared to other brokers.

Higher minimum deposit requirements for certain accounts.

Your Opinions

Forex.com is best suited for serious traders who value regulation and functionality over high leverage options. It's a trustworthy choice for those willing to invest in their trading journey.

8. OctaFX

Introduction

OctaFX is a newer player in the forex market but has quickly established itself as a viable option for traders globally. Their emphasis on customer satisfaction and innovative services sets them apart.

Features

Leverage Options: Up to 1:500.

User Experience: Intuitive trading platforms with a user-friendly interface.

Education and Resources: Comprehensive educational materials for all levels.

Multiple Deposit Methods: Diverse options for funding accounts.

Pros and Cons

Pros:

High leverage coupled with low spreads.

Accessible educational tools for beginners.

Responsive customer service.

Cons:

Limited number of available trading instruments.

Occasional technical issues reported by users.

Your Opinions

OctaFX impresses with its dedication to customer service and educational resources. While it may not offer as many instruments as larger competitors, it remains a solid choice for beginner traders.

9. eToro

Introduction

eToro is a social trading platform that combines trading with a social network aspect, allowing traders to follow and copy others’ trades. This unique approach makes it especially attractive for those less experienced in forex trading.

Features

Leverage Options: Up to 1:30 for retail clients; 1:400 for professional clients.

Copy Trading: Ability to replicate successful traders' strategies.

User-Friendly Interface: Designed for ease of use, even for beginners.

Regulatory Compliance: Adheres to financial regulations across several jurisdictions.

Pros and Cons

Pros:

Innovative social trading features.

Large community and support network.

Beginner-friendly platform.

Cons:

Limited leverage for retail traders.

Higher spreads compared to traditional brokers.

Your Opinions

eToro's social trading model is revolutionary for novice traders looking to learn from experienced individuals. While it may not offer the highest leverage, its unique features provide a valuable learning experience.

10. HotForex

Introduction

HotForex is recognized for its commitment to providing a superior trading experience with a strong focus on customer support. The platform caters to traders of all skill levels and boasts numerous awards for its service.

Features

Leverage Options: Up to 1:1000.

Multiple Account Choices: Customized accounts catering to diverse trading needs.

Robust Educational Resources: Extensive tools, webinars, and tutorials available.

Dedicated Customer Support: 24/5 multilingual support.

Pros and Cons

Pros:

Extremely high leverage options.

Educational programs help traders improve their skills.

Comprehensive trading tools and resources.

Cons:

Limited advanced trading features for professionals.

Occasionally slow withdrawal processes.

Your Opinions

HotForex presents a balanced mix of high leverage and educational resources, making it suitable for traders at all levels. Nonetheless, it may not fully meet the needs of advanced traders seeking complex trading tools.

FAQs

H2: Frequently Asked Questions (FAQs)

H4: What is high leverage in forex trading?

High leverage allows traders to control larger positions with a smaller amount of capital, magnifying both potential profits and losses.

H4: How do I choose the right forex broker?

Look for factors such as regulation, trading fees, account types, educational resources, and the leverage offered to ensure they align with your trading goals.

H4: Is high leverage always advantageous?

While high leverage can amplify gains, it also increases the risk of significant losses. Traders must manage their risk carefully when using high leverage.

H4: Are there any fees associated with high leverage accounts?

Some brokers may charge additional fees or require minimum deposits for accounts with high leverage. Always read the terms and conditions before opening an account.

H4: Can beginners benefit from high leverage?

Beginner traders should be cautious when using high leverage. It is advisable to gain experience and understanding of the forex market before utilizing high leverage options.

Conclusion

In conclusion, the Top 10 Best forex trading with high leverage platforms provide ample opportunities for traders looking to enhance their trading performance. Each platform offers unique features, advantages, and drawbacks, allowing you to select one that best fits your trading style and objectives. Remember, while high leverage can lead to significant profits, it comes with increased risks. Educating yourself about each broker and developing a sound trading strategy is vital for success in the forex market.

✳️ Read more: