2025 Vacant Commercial Properties Report

By: Berwyn Development Corporation

Executive Summary

Berwyn’s commercial real estate market remains stable through late 2025, characterized by a 6.96% market vacancy rate. While the gross vacancy rate is 8.38%, this �gure includes 40,800 SF of cityowned property in the Depot Corridor currently slated for development. When controlling for these active redevelopment sites, the city-wide vacancy rate has actually decreased by 0.77% since 2024.

Corridor & Ward Highlights

•

• The Cermak Road Corridor remains the city's commercial anchor, representing roughly one-third of all commercial inventory It's vacancy rate is healthy at 7 41%

In contrast, the 26th St. Corridor contains only 8% of the city's total inventory but experiences a disproportionately high vacancy rate of 12%.

Long-term vacancy is heavily concentrated in speci�c wards. Ward 2 holds 20.70% (10.01% of the city's total vacant square footage, followed by Ward 6 at 9.03% (10.87%).

Strategic Focus: Long-Term Vacancies

A primary �nding of this report is the persistence of “stagnant” vacancies. Long-term vacancies (de�ned as 35+ months) account for 62.02% (55.49%) of all vacant commercial square footage in Berwyn.

The data indicates that a small number of high-impact properties drive these numbers. The Top 10 largest vacant properties account for a majority share of the city's total vacant square footage. Many of these sites have remained empty for nearly three years. Focused intervention and targeted redevelopment strategies for these speci�c high-impact properties would result in meaningful and immediate improvement to corridor vitality.

Introduction

The Berwyn Development Corporation (BDC) manages the City of Berwyn’s vacant property inventory. In collaboration with City departments and elected of�cials, the BDC veri�es vacancies, supports business attraction, and coordinates redevelopment. This tracking is a vital component of Berwyn’s economic development strategy, driving corridor revitalization, small business formation, and capital attraction.

This report summarizes vacancy conditions as of November 2025. It utilizes parcel-level data and analysis by corridor and ward, provides a regional market comparison, and introduces an expanded focus on vacancy duration.

In 2025, the BDC re�ned its methodology to strengthen analysis and support targeted recommendations. Key improvements include:

Standardized vacancy start dates for better accuracy

Identi�cation of long-term vacancies to highlight persistent challenges.

Inclusion of city-managed properties for a complete inventory Regional market benchmarking using CoStar data.

This report is designed to assist decision-makers and community partners in aligning economic development and redevelopment efforts.

Key Reporting Notes

To ensure clarity for the reader, please note the following:

→

Conditional Dual Reporting: For corridors or wards containing city-owned sites under development, two �gures are provided: the Gross Inventory (total vacancy) and the Market Inventory (vacancy available to the private market). If these numbers are identical, only a single total is shown.

Data Threshold: Vacancy start dates are tracked from January 23, 20023. Properties vacant prior to this data are marked with this baseline, as earlier data was not maintained.

Focus Area: Totals re�ect ground-�oor commercial square footage, representing the space most readily available for businesses.

City-Owned Properties: Four properties in the Depot Corridor totaling 40,800 SF are currently city-owned and pending development. These sites are split between Ward 1 (6804 Windsor) and Ward 2 (6609, 6627, & 6639 Stanley).

Cook County Land Bank: The inventory includes properties held by the Cook County Land Bank. The BDC is actively working to acquire these sites to facilitate new investment.

Active Construction: Several properties currently listed as vacant are undergoing construction. These will transition to occupied status when work is completed and business activity begins.

City-Wide Vacancy Analysis

The City of Berwyn has approximately 2.88 million square feet of ground-floor commercial space. The 2025 data shows that the market vacancy rate is consistently improving. Increases in the gross vacancy are the result of more rigorous inventory management and the active inclusion of strategic redevelopment sites.

Multi-Year Progress

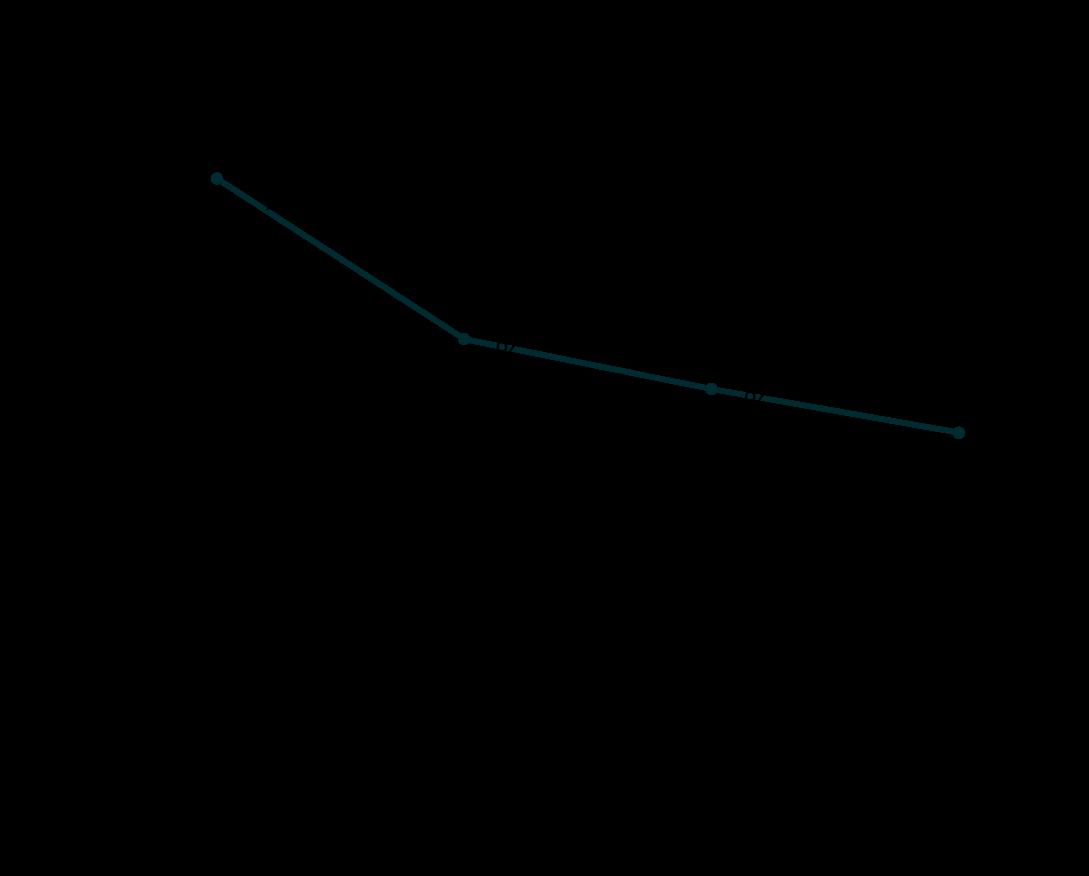

Berwyn has seen a significant and steady decline in commercial vacancy over the last four years. The Market Inventory reached a new low of 6.96% in 2025.

Between 2024 and 2025, the overall market vacancy rate for available commercial space dropped by 0.77%, continuing a four-year trend of growth and new business occupancy.

Gross vs. Market Inventory

To provide an accurate assessment for business attraction and strategic planning, this report utilizes two primary metrics: Gross Vacancy and Market Vacancy. GrossVacancy (8.38%) represents the total inventory of empty ground-floor commercial space in Berwyn. Market Vacancy (6.96%) excludes city-owned redevelopment sites.

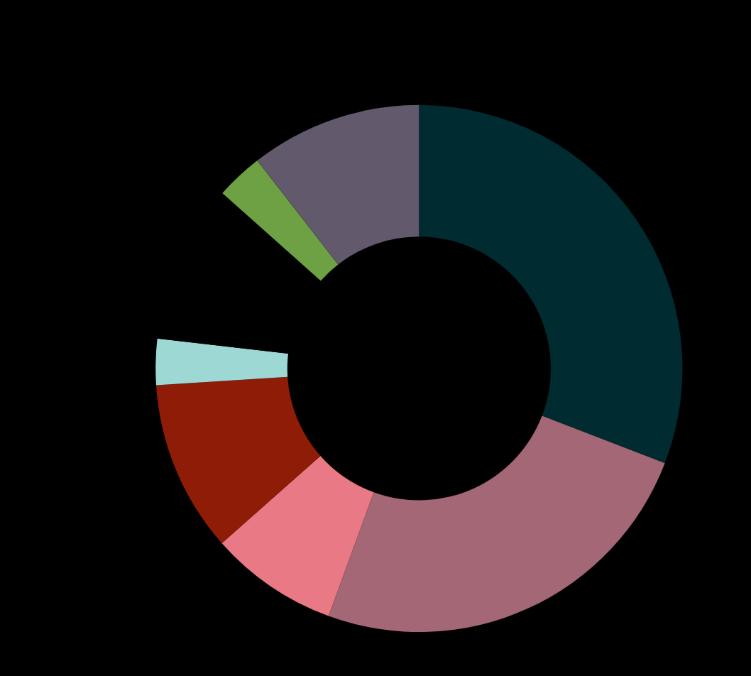

The Market Commercial Vacancy chart visualizes the distribution of 241,108 SF of vacant commercial space. The Depot Corridor’s large slice (24.7%) reflects the total physical vacancy before accounting forcitymanaged redevelopment projects.

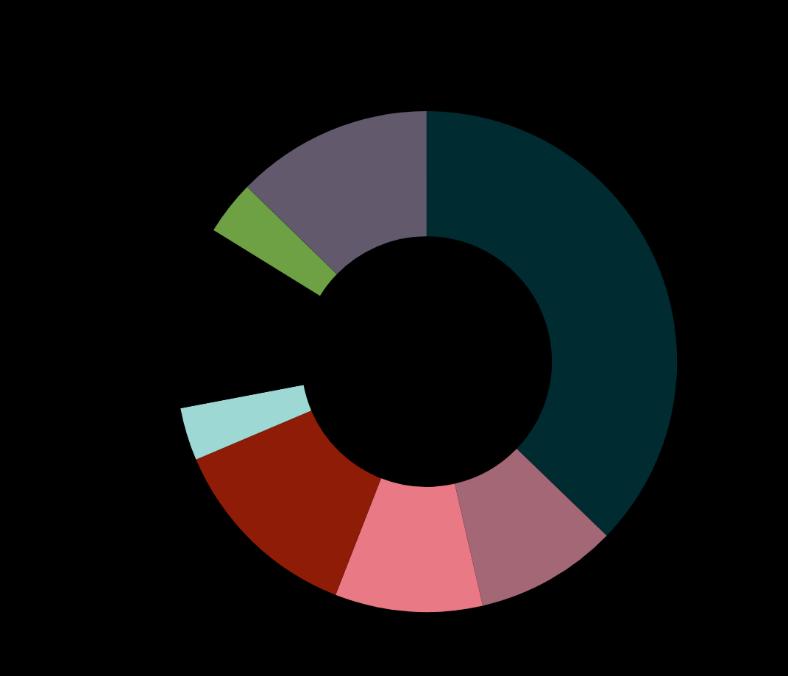

The Gross Commercial Vacancy chart visualizes the 197,333 SFavailable to tenants. Notethe significant reduction in theDepot Corridor's share (down to 15.5%), illustrating that much of the area's vacancy is being addressed through redevelopment actions.

Vacancy Duration

The 2025 vacancy tracking data reveals that Berwyn's primary challenge is not temporary market �uctuation, but persistent, long-term vacancies. While short-term turnover is consistent with healthy business cycles, Berwyn faces a concentration of long-term vacancies that signal a mismatch between older building stock and modern tenant needs.

Data Summary

Properties vacant for 35 months or longer represent a majority of the city's unoccupied space:

•

• By Property Count: 57 3% of all vacant properties (43 out of 75) and 54 9% of available market properties (39 out of 71) are vacant.

By Square Footage: This group is even more dominant, accounting for 63.02% of total vacant square footage and 55 49% of available market square footage

This re�ects a dual market in Berwyn: while modern, small-format spaces see healthy turnover, older and larger buildings remain stagnant.

Factors Driving Long-Term Vacancy

The concentration of vacancy in Berwyn's larger properties aligns with national trends identi�ed by the Brookings Institute and Urban Land Institute (ULI). Industry analysis from American Planning Association (APA) indicates that market demand has shifted toward small, ef�ciently con�gured spaces under 5,000 square feet. This leaves mid-sized and large-format commercial buildings increasingly dif�cult to �ll without signi�cant capital investment. These long-term vacancies are at risk of becoming “zombie buildings” structures where the cost to modernize, divide, or convert the space exceeds its current market value. This dynamic is driven by three compounding factors:

1. 2. 3. Demand for Quality: Tenants are increasingly bypassing commodity Class B and Class C stock in favor of modern, amenity-rich spaces. CBRE research notes that this �ight to quality is a major driver of vacancy in older commercial corridors

The Conversion Gap: While adaptive reuse such as converting retail to residential is a popular concept, ULI indicates it is �nancially and physically dif�cult to execute. Only a small percentage of older commercial buildings meet the structural criteria for cost-effective conversion

Passive Ownership: In the absence of market pressure or incentives, lenders and owners often choose to let a building sit rather than risk capital on speculative renovations in a high interest-rate environment

Strategic Framework for Redevelopment

To address persistent long-term vacancies, the BDC recommends maintaining its partnership with the City to pursue redevelopment through a targeted catalyst strategy. As demonstrated by the 6804 Windsor property, this approach focuses limited resources on high-impact sites to spark broader revitalization.

To implement this cycle across the long-term vacancies, the BDC recommends a four-step intervention process:

Site Diagnosis

Identify speci�c obstacles at the top 10 vacant sites, such as physical condition, zoning restrictions, or unrealistic pricing.

Land Assembly

Combine smaller parcels where necessary and acquire parcels when possible, to create viable development sites.

Infrastructure Investment

Continued investment in public improvements like lighting and sidewalks helps signal market stability and encourage public investment

Corridor Management

Provide dedicated oversight to ensure sustained maintenance and active leasing across Berwyn's commercial corridors.

Regional Market Analysis

The Berwyn Development Corporation (BDC) utilizes data from CoStar to benchmark Berwyn against neighboring markets and the broader Chicago region. Because developers and site selectors use CoStar as a primary baseline, this regional context is essential for positioning Berwyn within the competitive real estate landscape.

The Data

Stakeholders will note a difference between the BDC’s reported vacancy rate (6.96% Market) and the CoStar submarket rate (5.7%). The BDC data provides a more accurate re�ection of Berwyn’s speci�c storefront economy due to three factors:

• • • Geographic Scope: CoStar places Berwyn in the "Cicero/Berwyn Area" submarket. This includes surrounding municipalities like Cicero, North Riverside, Stickney, and Lyons, as well as large-scale malls and power centers that do not exist within Berwyn city limits.

Property Classi�cation: CoStar separates retail and of�ce data into distinct silos. In contrast, the BDC tracks all ground-�oor commercial and mixed-use spaces as a single category, re�ecting how space is actually utilized in Berwyn’s corridors.

Granularity: The BDC utilizes parcel-level veri�cation, including properties that may be currently off-market or under active city-managed redevelopment, providing a more detailed inventory than regional aggregate tools.

Market Insights and Positioning

→

The Berwyn/Cicero market offers a highly competitive leasing entry point at $19.40/SF. Compared to the $25.00/SF average in the Oak Park area, Berwyn is uniquely positioned to capture regional demand from tenants seeking affordability without sacri�cing proximity to the Chicago core. The Chicago metro area is currently seeing a surge in demand from �tness, healthcare, and serviceoriented providers. Berwyn’s inventory includes several smaller-format and mixed-use spaces which align perfectly with these growing categories.

Berwyn’s cost advantage and product mix enable more aggressive recruitment of tenants. Corridors like Cermak Road and 26th Street are particularly well-suited for service providers seeking ready-to-lease formats that require less capital for buildouts than larger-format regional centers.

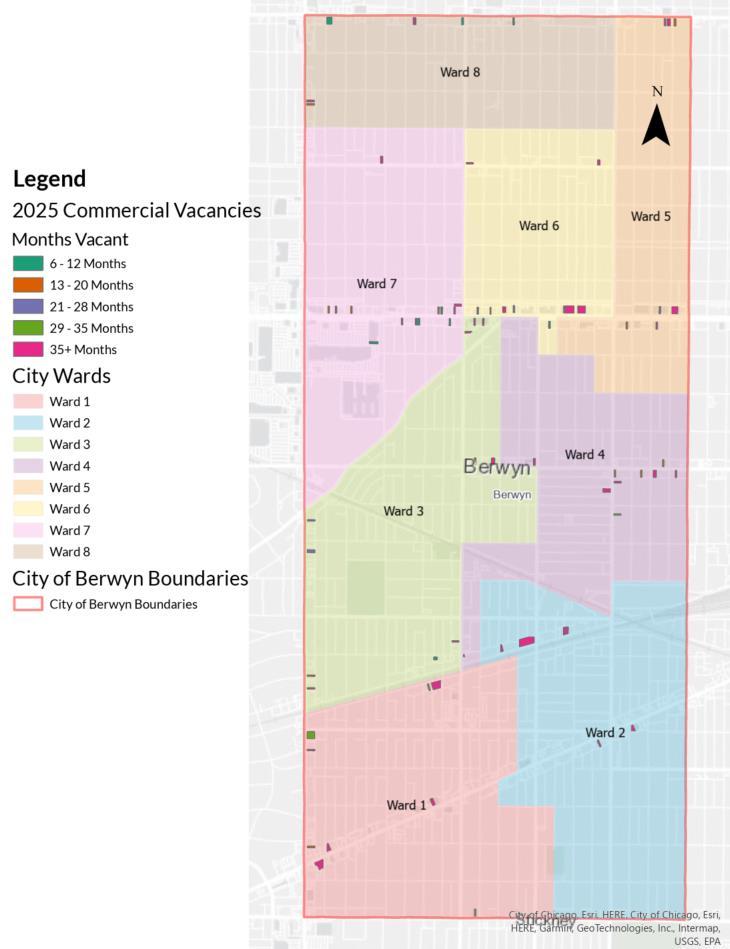

City-Wide Vacancy Map

Vacancy Metrics by Ward

The 1st and 2nd Wards carry high total vacancy rates, but that is largely administrative due to the addition of city owned commercial property undergoing redevelopment activities.

Ward 1's �gure is due to the addition of the 6804 Windsor site.

Ward 2’s �gure is due to the addition of city-managed Stanley sites

The 6th Ward carries one of the highest rates. This ward has historically had a higher vacancy rate but is trending down. It's almost 3% lower than it was in 2024.

Ward 8 sets the benchmark for healthy occupancy at 4.37%, and Ward 4 leads improvement with a -5.38% trend.

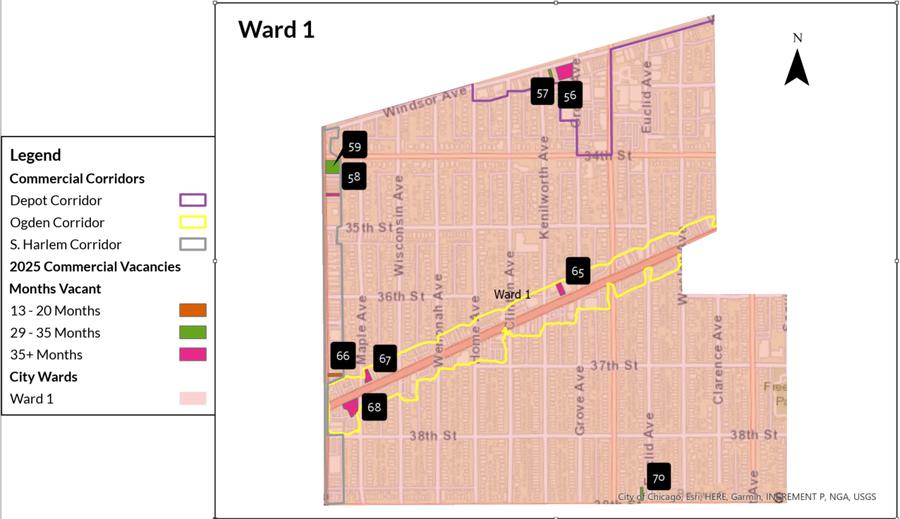

Ward 1 Analysis

2024 Vacancy Rate: 7 72%

2025 Vacancy Rate: 7.95% (5.88%)

Trend: +0.23% (-1.84%)

Summary: Of the 529,833 SF of commercial space in Ward 1, 42,107 SF (31,157 market) is vacant, which represents a 7.95% (5.88%) vacancy rate. This ward includes 6804 Windsor, a city-managed property currently pending sale and redevelopment. Once this site is returned to active use, the market vacancy rate will drop signi�cantly. Long-term vacancies (35+ months) currently account for 6 of the 10 total vacant properties in the ward

Ward 1 Vacancies

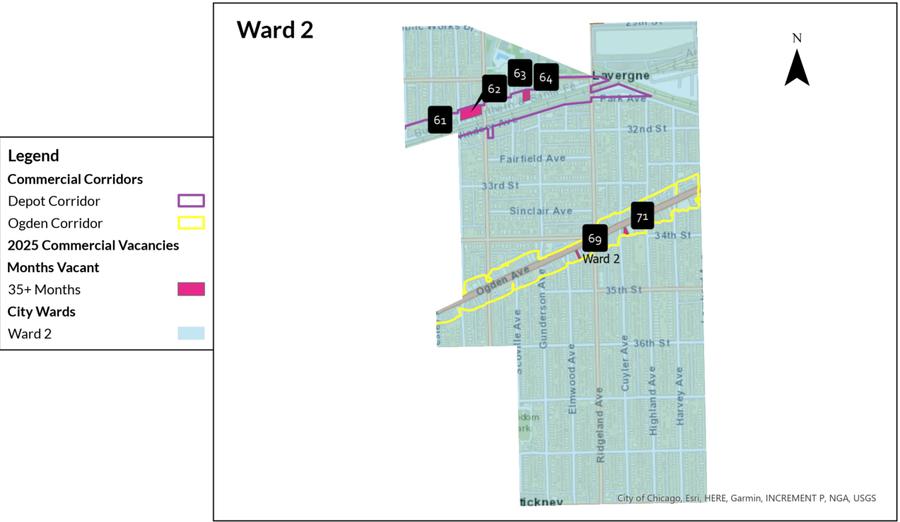

Ward 2 Analysis

2024 Vacancy Rate: 7 92%

2025 Vacancy Rate: 16.82% (6.76%)

Trend: +8.90% (-1.16%)

Summary: Of the 296,700 SF of commercial space in Ward 2, 49,900 SF (20,050 market) is vacant, which represents a 16.82% (6.76%) vacancy rate. The high gross rate is driven by three city-owned properties on Stanley Avenue (6609, 6627, and 6639) that are being prepared for redevelopment. Excluding these projects, the ward’s market health has improved over the last year. Notably, all 7 vacant properties in this ward are in the 35+ month category

Ward 2 Vacancies

owned commercial property

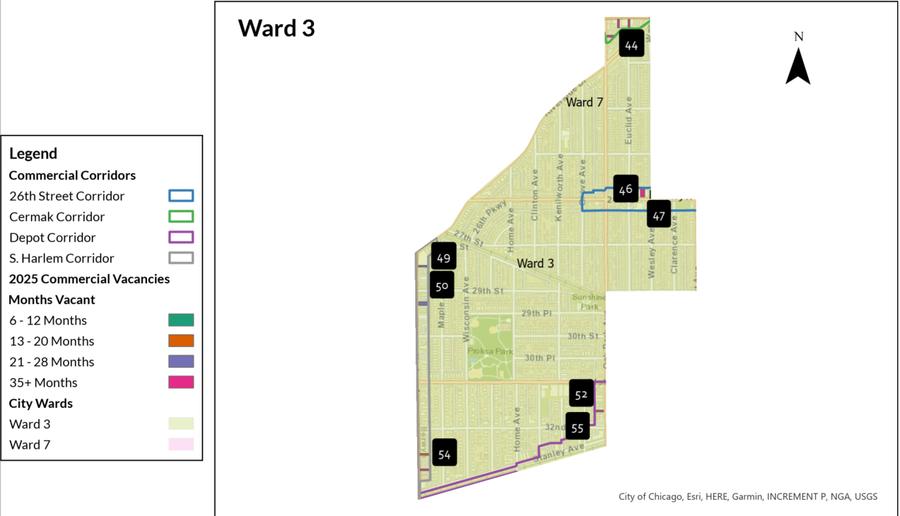

Ward 3 Analysis

2024 Vacancy Rate: 6 77%

2025 Vacancy Rate: 7.16%

Trend: +0.39%

Summary: Of the 274,292 SF of commercial space in Ward 3, 19,639 SF is currently vacant, representing a 7.16% vacancy rate. Vacancy levels have remained stable, with 6 of the 11 tracked properties falling into the long-term category.

Ward 3 Vacancies

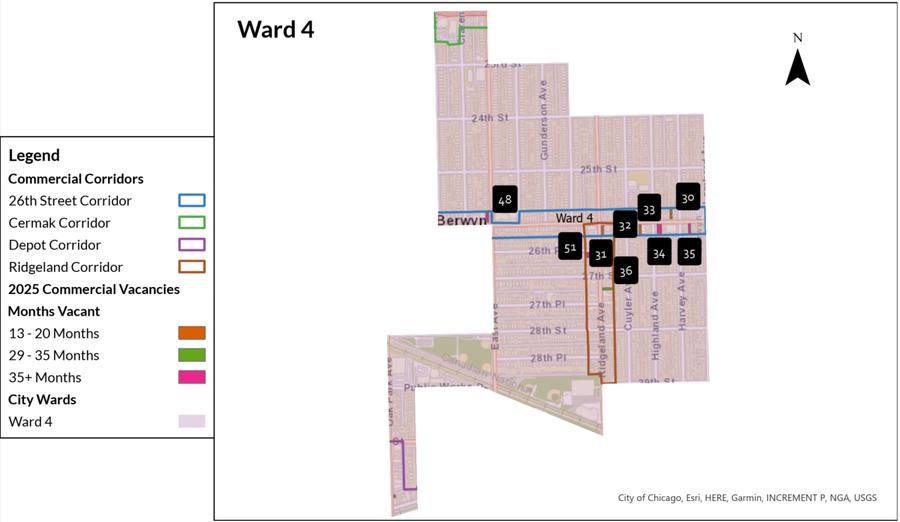

Ward 4 Analysis

2024 Vacancy Rate: 15 29%

2025 Vacancy Rate: 9.91%

Trend: -5.38%

Summary: Of the 286,762 SF of commercial space in Ward 4, 28,421 SF is vacant, representing a 9.91% vacancy rate. Ward 4 has seen the most substantial improvement in Berwyn this year, shifting from double-digit to single-digit vacancy. Half of the 10 vacant sites are long-term, including the large-format opportunity at 6231 W 26th Street.

Ward 4 Vacancies

County Land Bank property

construction

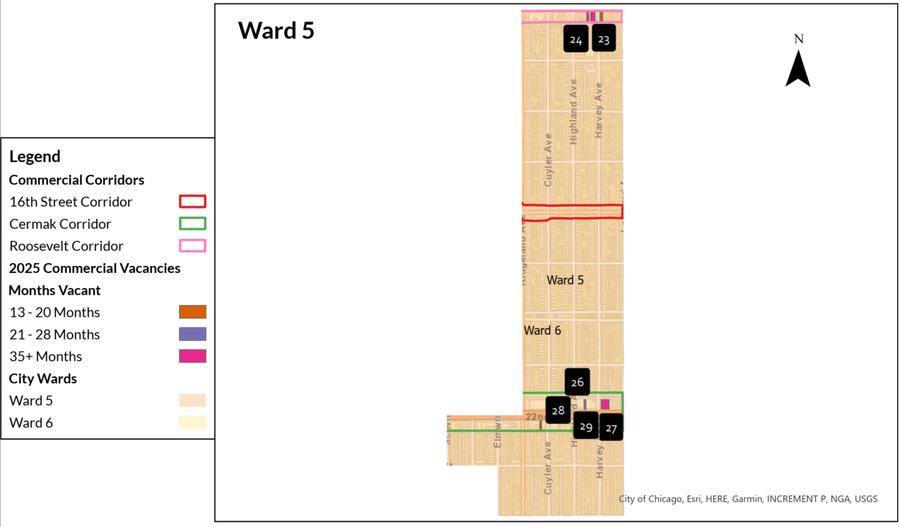

Ward 5 Analysis

2024 Vacancy Rate: 6 16%

2025 Vacancy Rate: 7.85%

Trend: +1.69%

Summary: Of the 281,925 SF of commercial space in Ward 5, 22,137 SF is vacant, representing a 7.85% vacancy rate. This ward contains 4 long-term vacancies out of 7 total properties, including the largest site at 6227 W Roosevelt Rd.

Ward 5 Vacancies

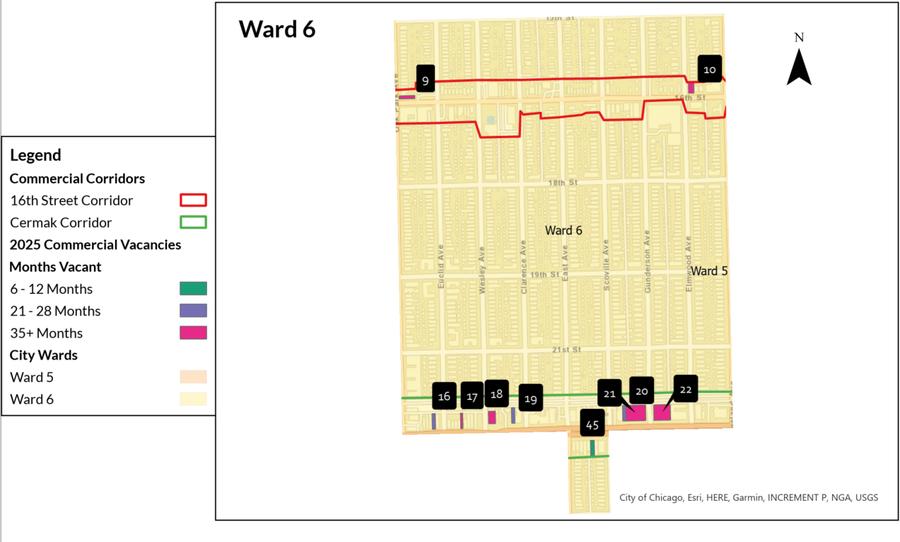

Ward 6 Analysis

2024 Vacancy Rate: 17 39%

2025 Vacancy Rate: 14.57%

Trend: -2.82%

Summary: Of the 224,336 SF of commercial space in Ward 6, 32,679 SF is vacant, representing a 14.57% vacancy rate. Despite the high percentage, the ward is trending positively with a signi�cant reduction in vacant space since 2024. This ward includes 6444 & 6450 Cermak Rd, which is currently undergoing construction. This property's redevelopment will signi�cantly reduce the vacancy rate upon completion

Ward 6 Vacancies

construction

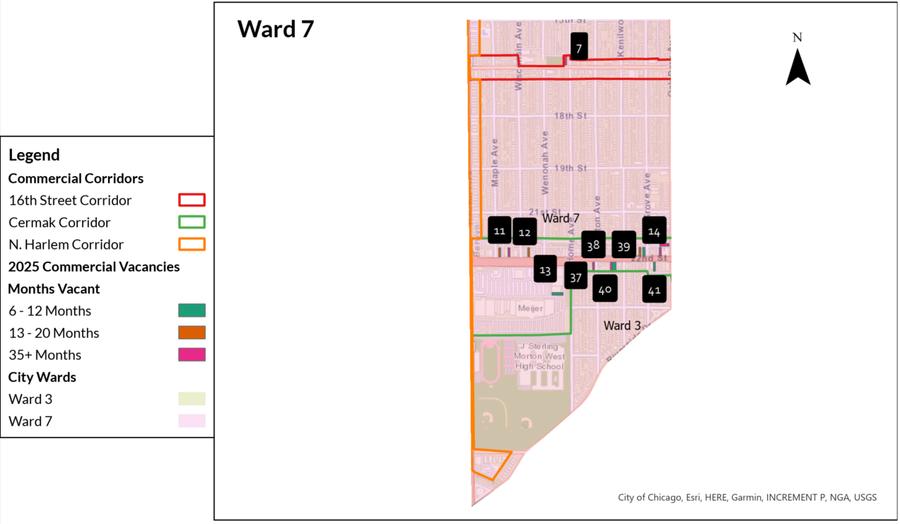

Ward 7 Analysis

2024 Vacancy Rate: 3 72%

2025 Vacancy Rate: 4.89%

Trend: +1.17%

Summary: Of the 617,310 SF of commercial space in Ward 7, 30,173 SF is vacant, representing a 4.89% vacancy rate. Ward 7 maintains one of the strongest occupancy levels in the city. While there are 6 long-term vacancies among the 13 total properties, the low overall rate indicates a competitive market for the Cermak Road corridor.

Ward 7 Vacancies

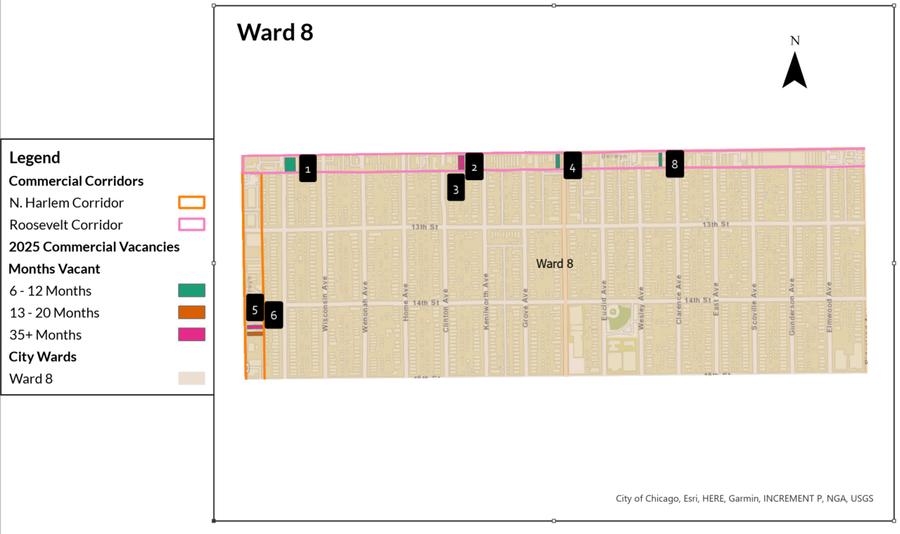

Ward 8 Analysis

2024 Vacancy Rate: 4 24%

2025 Vacancy Rate: 4.37%

Trend: +0.13%

Summary: Of the 367,031 SF of commercial space in Ward 8, 16,052 SF is vacant, representing a 4.37% vacancy rate. Ward 8 continues to be the most stable commercial environment in Berwyn. Only 3 of the 7 vacant properties are long-term, meaning most of the vacancy is the result of healthy business cycles and short-term turnover.

Ward 8 Vacancies

Vacancy Metrics By Corridor

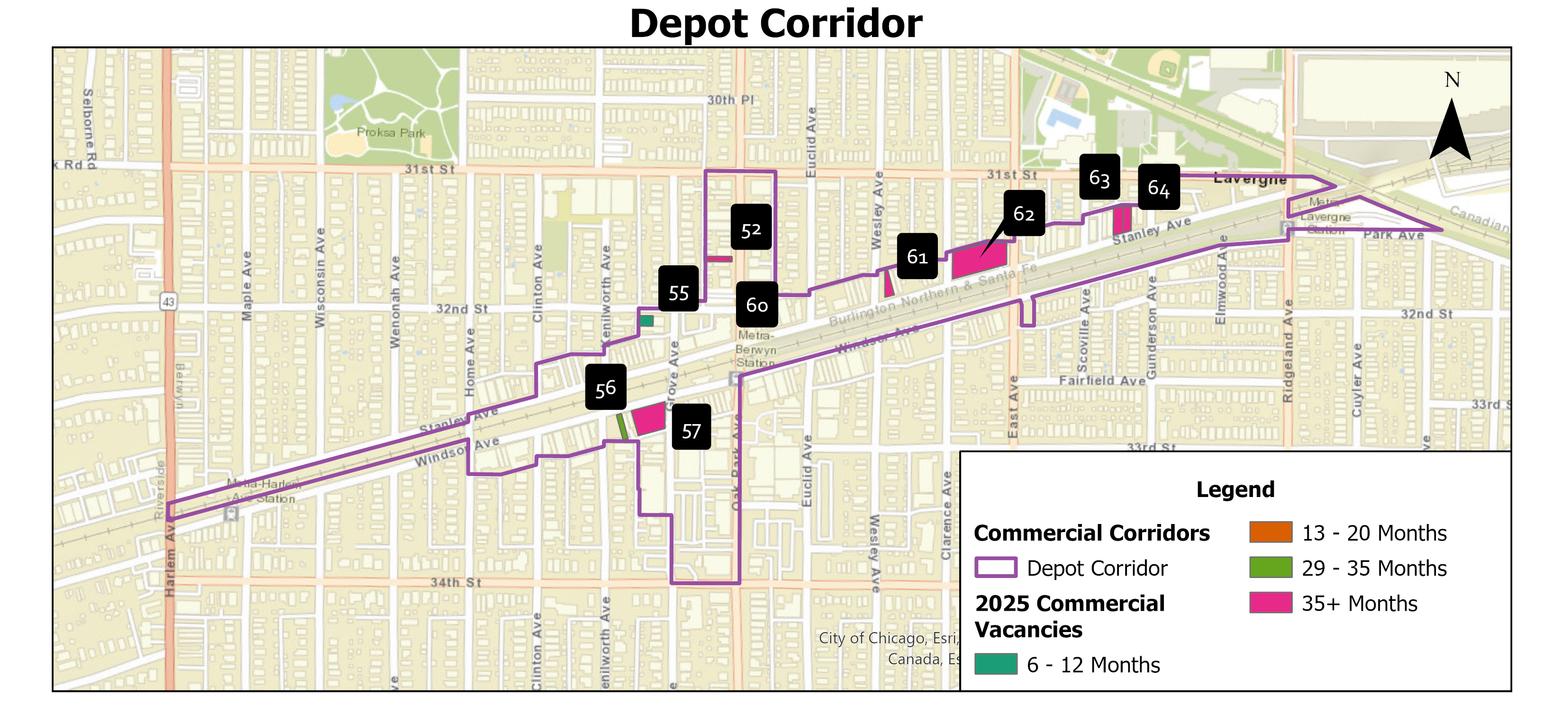

Depot Corridor re�ects an 18.02% vacancy rate, which re�ects the inclusion of the four city owned commercial properties (6804 Windsor, 6609-6639 Stanley) undergoing redevelopment activities. Excluding these managed sites, the market vacancy rate is one of the lowest at 5.53%.

26th Street & Ridgeland Corridors have a vacancy rate of just over 12% but represents only 9% total commercial inventory (258,315). Total vacant space in these corridors only represents approximately 13% of the total 226,133.

In comparison, Cermak Corridor holds over 35% of total commercial inventory. The total vacancy rate of 7.41% represents approximately 31% of the total vacant space available. That's 41,653 vacant SF more than what both 26th street and Ridgeland have vacant.

16th Street Corridor demonstrates high market ef�ciency, maintaining a low 5.90% vacancy across its 116,546 SF inventory following a signi�cant 7.28% improvement over 2024.

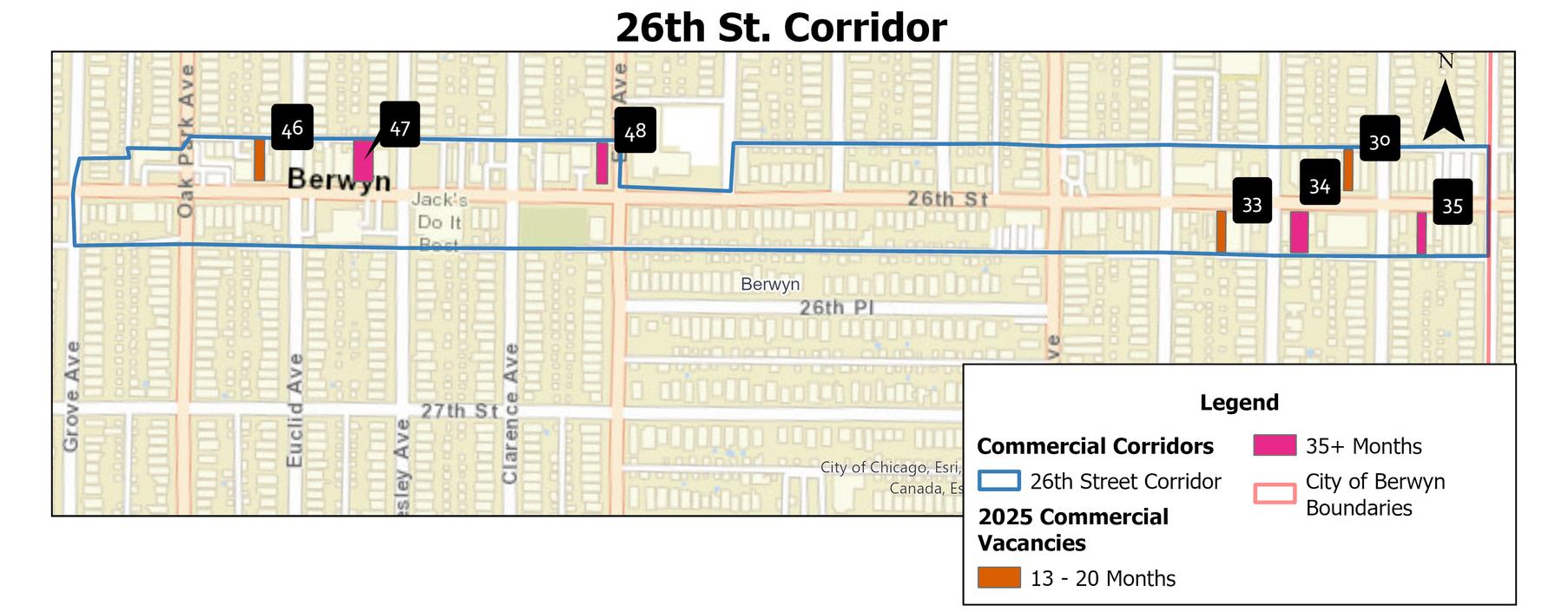

26th Street Analysis

2024 Vacancy Rate: 16.16%

2025 Vacancy Rate: 12.29%

Trend: -3.87%

Summary: 26th Street continues its positive recovery, with 25,086 SF of its 204,070 SF inventory currently vacant. This corridor represents 10.5% of the city's total vacancy. The nearly 4% drop in vacancy over the last year highlights the corridor’s increasing appeal for local small businesses and new retail investment.

26th Street Vacancies

*Cook County Land Bank property

construction

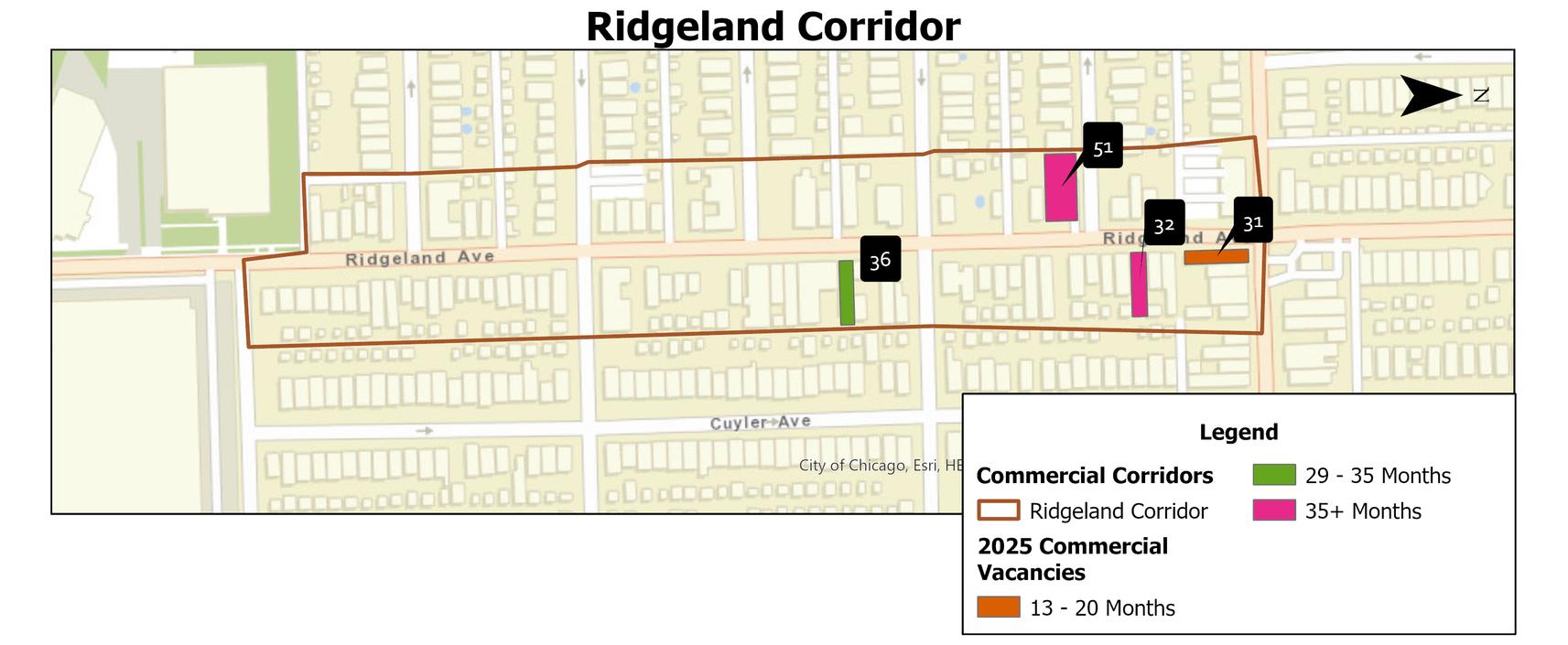

Ridgeland Analysis

2024 Vacancy Rate: 12.17%

2025 Vacancy Rate: 12.39%

Trend: +0.22%

Summary: Ridgeland Avenue remains stable but faces persistent challenges with its smaller commercial footprint and parking availability. Of its 54,245 SF of inventory, 6,723 SF is vacant, accounting for 2.8% of the city’s total vacancy. Most vacancies here are long-term.

Ridgeland Vacancies

Depot Analysis

2024 Vacancy Rate: 6.09%

2025 Vacancy Rate: 18.02% (5.53%)

Trend: +11.93% (-0.56%)

Summary: The Depot Corridor contains 326,883 SF of commercial space, with 58,888 SF currently vacant (18,088 SF market). This corridor accounts for 24.7% of the city's gross vacancy. This �gure is heavily in�uenced by four city-owned redevelopment sites on Windsor and Stanley; excluding these managed projects, the market vacancy rate remains healthy and has improved slightly since 2024.

Depot Vacancies

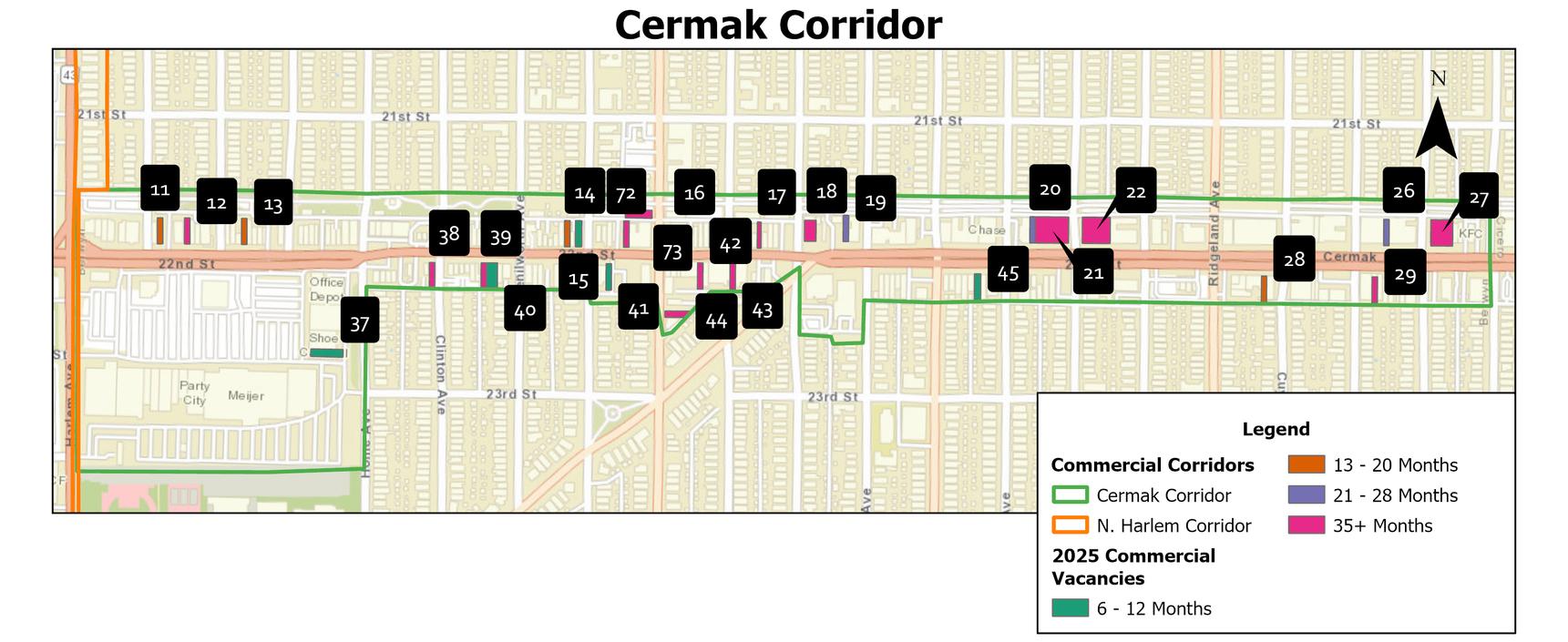

Cermak Analysis

2024 Vacancy Rate: 7.22%

2025 Vacancy Rate: 7.41%

Trend: +0.19%

Summary: Cermak Road is Berwyn’s most signi�cant commercial corridor, consisting of 991,470 SF of ground-�oor space. It accounts for 30.9% of the city’s total commercial vacancy. While 6450 Cermak Road is currently under construction, its completion will signi�cantly reduce the vacancy rate as this site is absorbed into the occupied inventory.

Cermak Vacancies

construction

Cermak Vacancies Continued

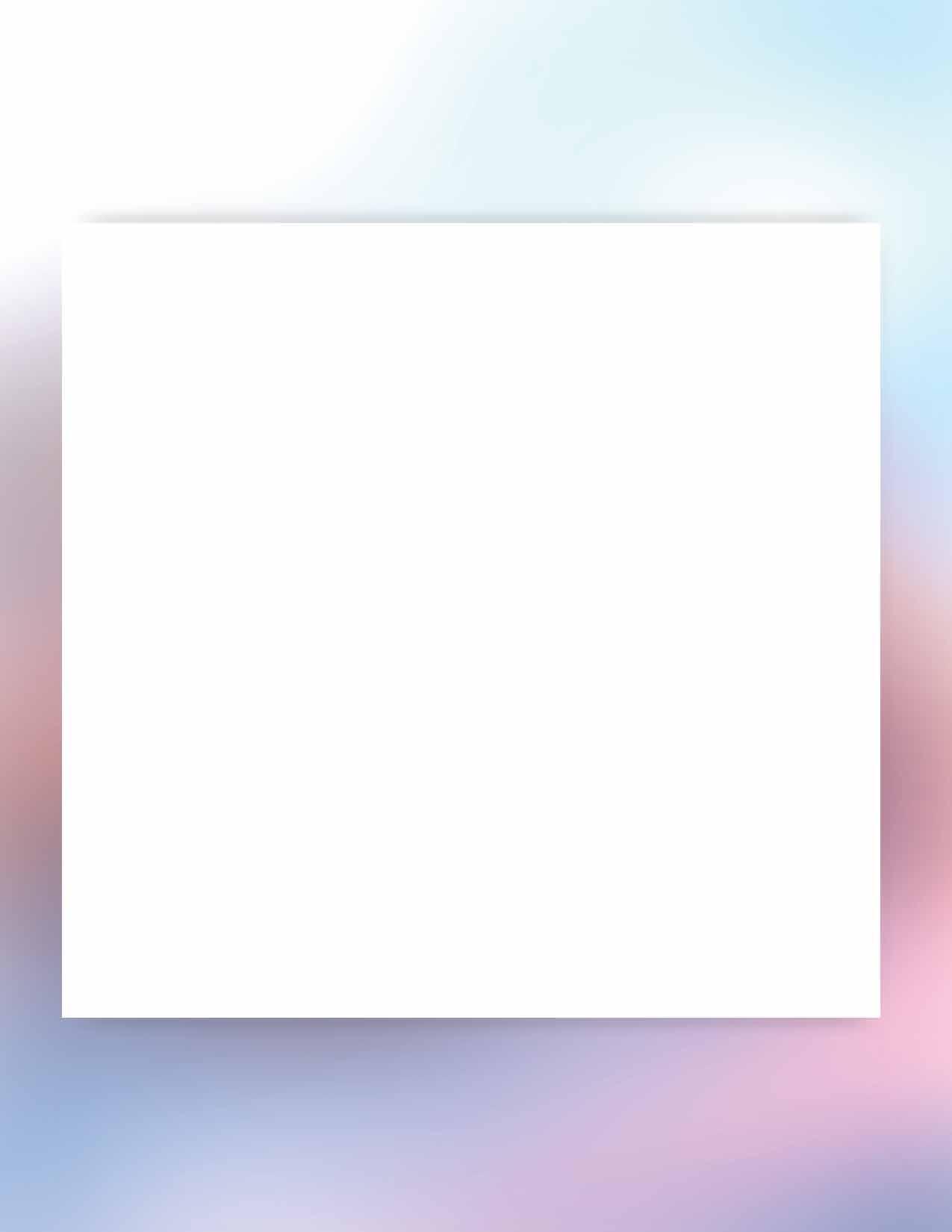

Roosevelt Analysis

2024 Vacancy Rate: 4.58%

2025 Vacancy Rate: 6.86%

Trend: +2.28%

Summary: Roosevelt Road contains 339,225 SF of commercial space, of which 23,255 SF is vacant. This corridor accounts for 9.8% of the city’s total commercial vacancy. The slight increase in vacancy re�ects a few smaller-format spaces entering the market, which the BDC is actively monitoring.

Roosevelt Vacancies

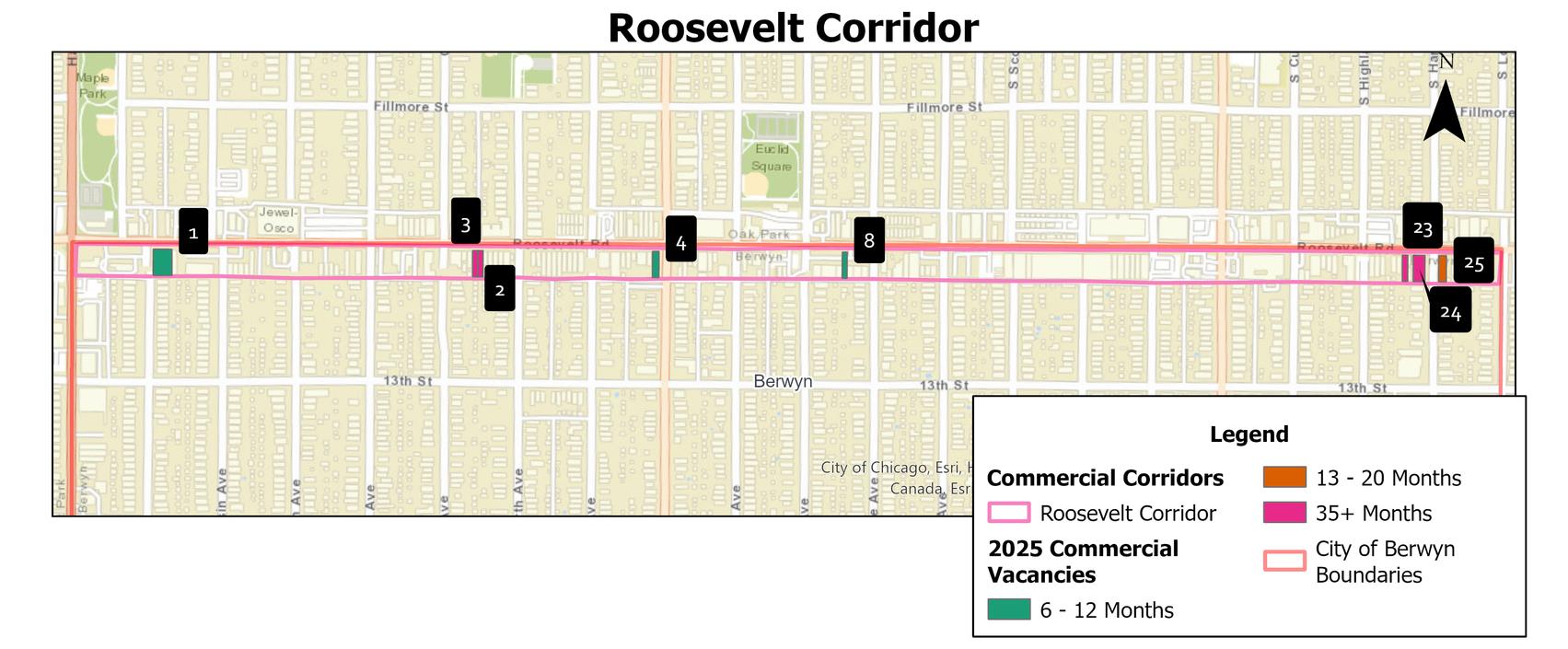

Ogden Analysis

2024 Vacancy Rate: 7.59%

2025 Vacancy Rate: 5.09%

Trend: -2.50%

Summary: Of the 491,937 SF of commercial space along Ogden Avenue, 25,050 SF is vacant. This corridor accounts for 10.5% of the city’s total commercial vacancy. Ogden has shown strong positive movement over the last year, with a 2.5% reduction in vacancy as the market continues to absorb older inventory.

Ogden Vacancies

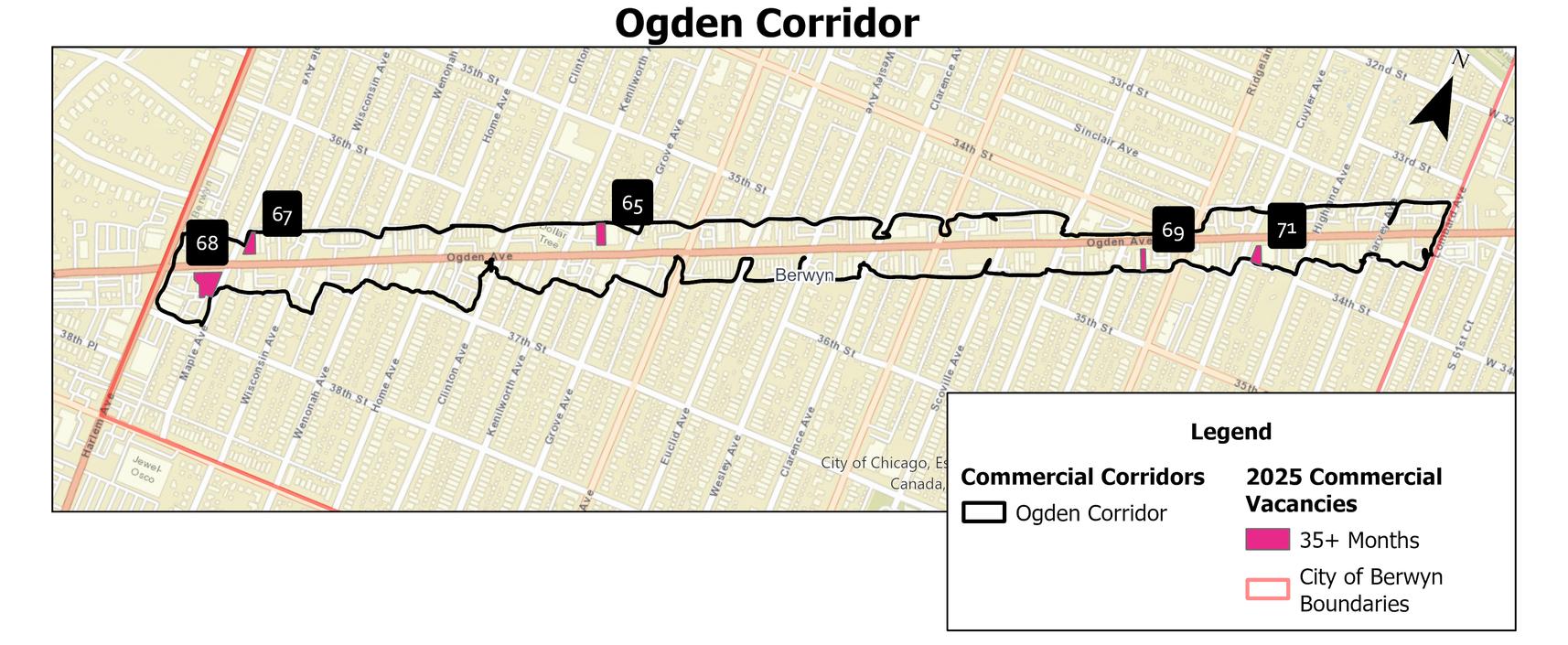

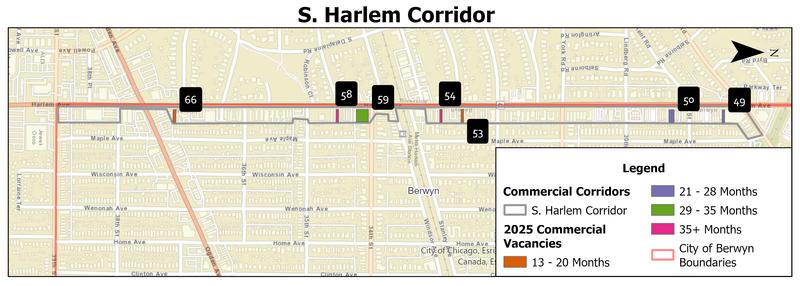

Harlem Analysis

2024 Vacancy Rate: 6.47%

2025 Vacancy Rate: 6.18%

Trend: -0.29%

Summary: Of the 303,894 SF of commercial space on Harlem Avenue, 18,791 SF is vacant, representing 7.9% of the city’s total commercial vacancy. Harlem remains a stable corridor with consistent occupancy levels and minimal year-over-year �uctuation.

Halem Vacancies

*Cook County Land Bank property

16th Street Analysis

2024 Vacancy Rate: 13.18%

2025 Vacancy Rate: 5.90%

Trend: -7.28%

Summary: 16th Street has experienced a major turnaround, with only 6,878 SF of its 116,546 SF total inventory remaining vacant. It now accounts for just 2.9% of the city’s total commercial vacancy. This corridor is nearing full occupancy after a signi�cant 7.28% reduction in vacant space.

16th Street Vacancies

Top 10 High Impact Properties

The following properties represent the largest individual vacancies in Berwyn. Due to their signi�cant square footage and long-term vacancy status, these sites have a disproportionate impact on the citywide vacancy rate. Addressing these speci�c locations through the intervention cycle is essential for meaningful corridor revitalization. City-owned properties at 6804 Windsor and 6609-6639 Stanley have been excluded from this list as they are already undergoing active redevelopment.

Seven of these 10 properties have been vacant for 29 months or longer. These represent the core inventory of stagnant market space that requires the targeted intervention cycle described in the Strategic Framework.

The Cermak Road and Ogden Avenue corridors contain the highest concentraion of these largeformat vacancies. Success in these two areas would have the most signi�cant impact on reducing the market vacancy rate.

While the 6–12 month vacancies are likely to �ll through standard business attraction, the properties in the 35+ month category are the primary candidates for site diagnosis and publicprivate redevelopment partnerships.

Recommendations

Prioritize High-Impact Sites

The Top 10 high-impact available properties accounts for over a third of all current vacancy city-wide.

→ → Action: Launch a site-speci�c diagnosis for these properties

Goal: Identify speci�c barriers to occupancy (price, condition, zoning) and provide a clear path for developers to bridge those gaps.

Expand the Catalyst Strategy

Persistent vacancies of 35 months or longer often require direct intervention to overcome structural or legal hurdles.

→ → Action: Utilize Land Bank partnerships and city-managed acquisitions for properties vacant over 35 months.

Goal: Reposition stagnant properties as ready-for-development anchors that signal corridor stability and spark private investment.

Incentive Small-Format Conversions

Market demand is trending toward smaller, ef�ciently con�gured spaces under 5,000 SF.

→ → Action: Encourage owners of large-format vacancies to subdivide footprints into units under 5,000 SF.

Goal: Match the current "�ight to quality" and service-oriented demand by creating a pipeline of modern, accessible storefronts.

Continue the Finish Line Grant Program

Beyond property redevelopment, Berwyn's success relies on the viability of its individual tenants and their ability to enhance existing businesses.

→ → Action: Continue the TIF funded Finish Line Grant program. Evaluate options to bring this program to other corridors.

Goal: Use these grants to lower the barrier for property owners and tenants to modernize their spaces, making them more attractive to tenants and customers alike.

Streamline Regulatory Pathways

Providing a clear and simple pathway for new businesses to open is as important as the physical space itself.

→

Action: Conduct a recurring audit of administrative processes that an entrepreneur must navigate, such as business licensing and permitting processes to reduce the mental load on small business owners.

Goal: Simply the path from lease signed to open for business, positioning Berwyn as a highly accessible and business friendly community.

Enhance the Vacancy Ordinance & Oversight

The prevent properties from falling into a state of permanent neglect, the city must maintain active pressure on inactive owners.

→ → Action: Regularly review and evaluate the Vacancy Ordinance. Ensure that the registration of vacant properties is strictly enforced and that fee structures encourage active listing and redevelopment.

Goal: Create a �nancial and administrative environment where it is more cost-effective for an owner to renovate or sell a property than to leave it vacant.

Coordinate Occupancy Reporting with County Assessor

Property owners who appeal their local vacancy status as “occupied” must be held to a consistent standard regarding their property tax assessments.

→ → Action: Report properties that have successfully appealed their vacancy status under the local ordinance to the Cook County Assessor’s Of�ce.

Goal: Ensure properties recognized as occupied for business purposes are accurately assessed at market value, protecting the city's tax base and ensuring accurate use of vacancy tax relief.

Conclusion

The 2025 Vacancy Report demonstrates that Berwyn’s commercial market is in a period of signi�cant positive transition. The multi-year decline in market vacancy—from 11.44% in 2022 to 6.96% in 2025 —indicates a resilient storefront economy and a steady demand for commercial space.

However, the analysis also reveals a “dual market” dynamic. While smaller, modern spaces are being absorbed quickly, nearly 55% of the available market square footage is tied up in long-term vacancies of 35 months or longer. These properties represent a structural challenge that the private market cannot solve alone. The difference between the city’s Gross vacancy (8.38%) and Market vacancy (6.96%) represents the BDC’s proactive shift toward managing these dif�cult sites through publicprivate redevelopment rather than waiting for passive market turnover.

Ultimately, the health of Berwyn’s corridors is no longer a question of general demand, but a question of property readiness. By focusing resources on the largest and longest-standing vacancies, Berwyn can unlock signi�cant economic potential and drive the city-wide vacancy rate toward a new goal of sub-5%.