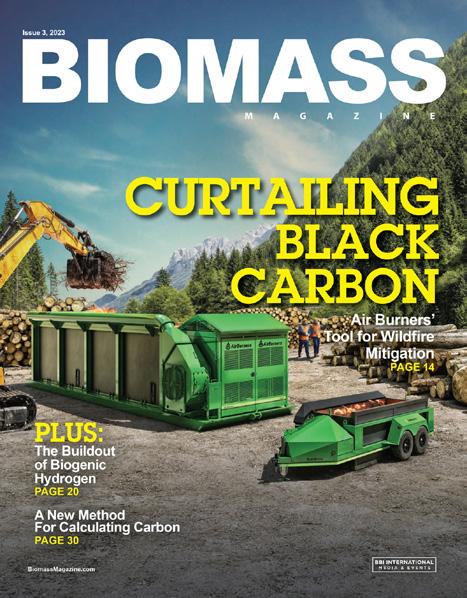

PLUS: The Buildout of Biogenic Hydrogen PAGE 20 A New Method For Calculating Carbon PAGE 30 Issue 3, 2023 BiomassMagazine.com CURTAILING BLACK CARBON Air Burners’ Tool for Wildfire Mitigation PAGE 14

POWERED BY NATURE Eliminate Wood Waste. Generate Power. Charge Electric Vehicles. O -Grid. 772.220.7303 Sales@AirBurners.com AirBurners.com Scan the QR code to learn more about our machines No Grinding Required Clean, Fast Burns Job Done O -Grid Produces Electric & Thermal Energy EV Battery Charging Station The BioCharger® gives you the power to fight climate change by closing the energy loop so you can work o -grid to charge your vehicles, equipment, and power tools. Here’s how: The BioCharger eliminates and converts wood waste into electricity and transfers it to the Battery Storage Module (BSM), so you can recharge your battery-powered machines. The BioCharger developed through a successful, strategic partnership with Volvo Construction Equipment and Rolls Royce, is an eco-friendly, cost-e ective, renewable energy solution for today—and tomorrow. Contact us for a quote today.

COLUMN

04 EDITOR’S NOTE

The Ever-Widening Impacts of Wildfires

By Anna Simet

06 COLUMN

Ukraine and Europe Back Biomethane—Shouldn’t We?

By Johannes Escudero

DEPARTMENTS

08 BIOMASS NEWS ROUNDUP

12 Q&A Finding New Niches

Enviva is expanding into new markets, furthering its mission of decarbonization via sustainable woody biomass.

By Katie Schroeder

FEATURES

14 TECHNOLOGY Behind the Curtain

Air Burners’ air curtain technology offers an environmentally friendly, efficient and potentially lucrative means of eliminating forest and ag waste.

By Anna Simet

20 HYDROGEN

High Hopes for Hydrogen

Multiple new projects promise to expand biogenic hydrogen production, but continued state and federal policy and support is needed to give the sector a boost.

By Susanne Retka Schill

By Susanne Retka Schill

CONTRIBUTIONS

26 DUST Solving Serious Conveyor Dust and Spillage Issues

San Pedro Bioenergy was facing excessive dust and spillage problems until a major conveyor overhaul.

By Shane Tighe

30 CARBON Overhauling Carbon Accounting

Improved carbon accounting methodology for biogas projects will be an industry game-changer.

By Brad Pleima

32 FIBER

Paper and Packaging Slowdown Impacts Wood Fiber Prices

For fiber suppliers, diversification and flexibility in their businesses continues to be valuable.

By Brooks Mendell and Stephen Wright

SPONSORED CONTENT

34 SPOTLIGHT: REMBE INC.

A fully assembled Air Burners

The Many Facets of Flameless Venting

subscribe. Periodicals postage paid at Grand Forks, ND and additional mailing offices. POSTMASTER: Send address changes to Biomass Magazine/ Subscriptions, 308 Second Avenue North, Suite 304, Grand Forks, ND 58203.

BIOMASSMAGAZINE.COM 3

ISSUE 3 | VOLUME 16 Biomass Magazine: (USPS No. 5336, ISSN 21690405) Copyright © 2023 by BBI International is published quarterly by BBI International, 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Four issues per year. Business and Editorial Offices: 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Accounting and Circulation Offices: BBI International 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Call (701) 746-8385 to

¦ ADVERTISER INDEX 25 2024 Biomass Power & Waste-to-Energy Map 07 2024 Int’l Biomass Conference & Expo 02 Air Burners, Inc. 29 CV Technology 17 Fagus GreCon, Inc. 13 FLAMEX Inc. 11 Hermann Sewerin GmbH 22 IEP Technologies 36 KEITH Manufacturing Company 19 KESCO, Inc. 23 Mid-South Engineering Company 16 MoistTech 34 Rembe, Inc. PAGE 20

ON THE COVER

transforms

waste

clean carbon ash. The machines have been tested by

the

Forces to

specifications and

AIR BURNERS INC.

FireBox

wood

into

the U.S. EPA,

U.S. Forest Service, the U.S. DOE and the U.S. Armed

prove their

performance. IMAGE:

ANNA SIMET EDITOR asimet@bbiinternational.com

The Ever-Widening Impacts of Wildfires

As I skimmed the headlines this morning, I read that Canada is experiencing its worst fire season in modern history. Much of the U.S. has experienced some degree of smoke in the past few weeks as it moves out of Canada, and according to reports, a massive plume is on its way to parts of Europe. And the season has not even peaked. The statistics released by the Canadian Interagency Forest Fire Center are staggering—so far, 17.8 million acres have burned, a new record. As to the question of what can be done to mitigate these wildfires, one of the underlining solutions is more dollars, efforts and support toward forest management. This brings me to our cover story and page-20 feature, “Behind the Curtain,” in which I discuss Air Burners’ air curtain technology with company President Brian O’Connor. After buying the company decades ago, he spent many years tweaking and perfecting these systems (he calls them pollution control devices), which—in a nut shell—burn clean wood and ag waste, catch the smoke and particulate matter and burn it again, producing a very minute amount of ash, as well as biochar. And, a new product line allows for electricity production on-site, which can be used to power the machines being used, or plugged into the grid. One of the company’s biggest markets, according to O’Connor, is wildfire mitigation—in fact, Cal Fire owns about a dozen of them. “They arrive on-site and ready to do the job,” he says. “You can drag them around, and they’re easy to take care of.” Though the technology has been tested and approved by the U.S. EPA and seemingly holds great potential, O’Connor believes there are still some misperceptions about them.

Shifting gears, our page-14 feature, “High Hopes for Hydrogen,” lays out federal strategy to renewable hydrogen deployment in the U.S., its potential and the challenges ahead. While this story just scratches the surface in terms of developments in the U.S., it will give you an idea of where things are at—or rather, where they need to be at in order to reach goals. As Retka Schill writes, a top concern is how the carbon intensity of hydrogen will be determined for the new federal incentives, and the specifics of the eligibility roles—specifically dairy biogas, as there is an ongoing debate regarding its carbon intensity score.

On that note, be sure to check out our page-30 contribution, “Overhauling Carbon Accounting,” by EcoEngineers’ Brad Pleima. In the article, Pleima discusses an improved carbon accounting methodology in development by the company and the American Biogas Council. Pleima says the hope is that the methodology will make it easier for biogas projects to quantify and market carbon benefits from renewable natural gas, biogas electricity and digestate.

Finally, later this summer we will be hard at work on a number of U.S. and Canada map projects (fuel pellet plants, biomass power and waste-to-energy facilities, RNG plants, as well as biodiesel, renewable diesel and sustainable aviation fuel operations). If something has changed at your plant in terms of production capacity, fuel, ownership, etcetera—or if you’re building new—we greatly appreciate you letting us know.

4 BIOMASS MAGAZINE | ISSUE 3, 2023

¦ EDITOR’S NOTE

EDITORIAL EDITOR

Anna Simet asimet@bbiinternational.com

ONLINE NEWS EDITOR

Erin Voegele evoegele@bbiinternational.com

STAFF WRITER

Katie Schroeder katie.schroeder@bbiinternational.com

ART

VICE PRESIDENT OF PRODUCTION & DESIGN

Jaci Satterlund jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan jbryan@bbiinternational.com

PRESIDENT

Tom Bryan tbryan@bbiinternational.com

VICE PRESIDENT OF OPERATIONS/MARKETING & SALES

John Nelson jnelson@bbiinternational.com

SENIOR ACCOUNT MANAGER/ BIOENERGY TEAM LEADER

Chip Shereck cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller jtiller@bbiinternational.com

MARKETING & ADVERTISING MANAGER

Marla DeFoe mdefoe@bbiinternational.com

2023 North American SAF Conference & Expo

AUGUST 29-30, 2023

Minneapolis Convention Center, Minneapolis, MN

The North American SAF Conference & Expo is designed to promote the development and adoption of practical solutions to produce SAF and decarbonize the aviation sector. Exhibitors will connect with attendees and showcase the latest technologies and services currently offered within the industry. During two days of live sessions, attendees will learn from industry experts and gain knowledge to become better informed to guide business decisions as the SAF industry continues to expand.

(866) 746-8385 | www.safconference.com

2023 National Carbon Capture Conference & Expo

NOVEMBER 7-8, 2023

Iowa Events Center, Des Moines, IA

The National Carbon Capture Conference & Expo is a two-day event designed specifically for companies and organizations advancing technologies and policy that support the removal of carbon dioxide (CO2) from all sources, including fossil fuel-based power plants, ethanol production plants and industrial processes, as well as directly from the atmosphere. The program will focus on research, data, trends and information on all aspects of CCUS with the goal to help companies build knowledge, connect with others, and better understand the market and carbon utilization.

(866) 746-8385 | www.nationalcarboncaptureconference.com

2024 Int’l Biomass Conference & Expo

MARCH 4-6, 2024

Greater Richmond Convention Center, Richmond, VA

Now in its 17th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 150 exhibitors and 65 speakers from more than 21 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine—that maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development.

(866) 746-8385 | www.BiomassConference.com

Please check our website for upcoming webinars

www.biomassmagazine.com/pages/webinar

Subscriptions Biomass Magazine is free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.BiomassMagazine.com or you can send your mailing address and payment (checks made out to BBI International) to Biomass Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues & Reprints Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 701-746-8385 or service@ bbiinternational.com. Advertising Biomass Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Biomass Magazine advertising opportunities, please contact us at 701-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Biomass Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to asimet@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

BIOMASSMAGAZINE.COM 5

INDUSTRY EVENTS ¦

TM Please recycle this magazine and remove inserts or samples before recycling COPYRIGHT © 2023 by BBI International

Ukraine, Europe Back Biomethane—Shouldn’t We?

BY JOHANNES ESCUDERO

Ukraine expects biomethane to play a key role in reducing its reliance on natural gas imports in coming years, amid a broader wave of support for new renewable gas facilities across Europe. With energy security front of mind amid widespread geopolitical tension, policymakers across the globe would be wise to follow Ukraine’s lead.

Members of Ukrainian parliament recently announced that European Investment Bank funds will support construction of five new biomethane plants in 2023 and the same number in 2024, with new draft laws supporting more biogas capture and biomethane use also under consideration, in a press release issued in March. “Hopefully, this is just the beginning,” said Oleksandr Haydu, chairman of Ukraine’s Committee on Agrarian and Land. “Accordingly, we are ready to support our farmers in these initiatives [and] are working on draft laws.”

Russia’s invasion into Ukraine in February 2022 spurred a tragic conflict that shows no sign of slowing more than one year later, despite more than 22,000 Ukrainian casualties to date, according to the United Nations Commissioner for Human Rights. But while Ukraine’s soldiers continue to defend the sovereignty of its borders, its leaders must devise new ways to keep reliable, affordable and low-carbon energy flowing throughout the country. Besides the immense human toll, the war has pressured Ukraine’s energy security, with the country reliant on European gas imports for roughly 16 billion cubic meters of gas in 2020, according to data from Ukraine’s gas transmission pipeline operator.

Biomethane—a renewable natural gas that provides a reliable, low-emissions fuel derived from the captured emissions of biological waste—is one tool at Ukraine’s disposal to help end its reliance on foreign gas, Ukrainian lawmakers said in the March press release. “Since Ukraine has the largest area of agricultural land in Europe, the potential for biomethane production is great,” Ukraine’s Haydu said. “Production of biogas from agricultural products is a step toward energy independence of Ukraine.”

Europe on Board With Biomethane

Ukraine is not the only European stakeholder embracing biomethane—commonly referred to as renewable natural gas (RNG) in North America. This March, the European Union recognized biomethane among the “strategic net-zero technologies” at the

core of its Net-Zero Industry Act, an ambitious policy proposal intended to ensure that at least 40% of the EU’s green energy manufacturing is located within the bloc’s borders by 2030. That NZIA package supports the European Union’s REPowerEU’s action plan signed in 2022, which aims for a 12-fold increase in biomethane deployment within the EU by 2030.

Here in the U.S., RNG is sometimes underappreciated as a solution for decarbonizing our society—perhaps because the very word “gas” is a nonstarter for a small but vocal contingent of advocacy groups. But how, then, should we view Ukraine and Brussels’ support for biomethane? Faced with the realities of war, geopolitical uncertainty and the urgency of the world’s climate crisis, leaders across the Atlantic are rightfully leaning on RNG to power their societies and reduce emissions for generations to come.

Still, more work is needed: the International Energy Agency recently estimated that 70 billion euros ($765.4 billion) of new investment is required to meet the EU’s long-term goal for 35 billion cubic meters per year of production by 2030, with new government incentives also needed to further close the cost competitiveness gap between lower-emissions biomethane and fossil gas alternatives.

U.S. and Canadian governments have historically supported RNG through public policies aimed at growing renewable and low-carbon clean fuels, decarbonizing our gas supply, and most recently, in the tax code through the Inflation Reduction Act. With nearly 300 RNG facilities online and 500 more in development stages, North America’s domestic deployment of biomethane is off to a strong start. Still, these numbers are just scratching the surface of the need and opportunity presented by societal waste—an unavoidable and constant burden to which all communities contribute.

RNG will not solve the climate crisis alone, but Europe’s support for its growth underscores that a diverse portfolio of low-carbon solutions will be required to both limit climate warming and protect sovereign, democratic nations—including Ukraine— against energy supply shortfalls.

In the words of Ukraine’s Haydu: Hopefully, this is just the beginning.

Author: Johannes Escudero Executive Director, RNG Coalition rngcoalition.com

6 BIOMASS MAGAZINE | ISSUE 3, 2023

Biomass News Roundup

The USDA on June 9 announced the U.S. Forest Service is investing a combined $43 million in 123 projects through the Community Wood Grants and Wood Innovations Grants programs, which promote innovation in wood products and renewable wood energy economies. Several Wood Innovations Grants support bioenergy projects. For wood pellets specifically, in Kentucky, Dunaway Timber Company was awarded $300,000 to support a wood pellet plant, and in Oregon, Wisewood Energy was awarded $699,161 to support an expansion of wood pellet and brick production to service the state’s bulk wood fuels market.

The U.S. exported 720,209 metric tons (MT) of wood pellets in April, down from 909,787 MT exported the previous month, but up over 61,000 MT when compared to April 2022, according to data released by the USDA Foreign Agricultural Service on June 7.

The U.S. exported wood pellets to more than a dozen countries in April. The U.K. was the top destination for U.S. wood pellet exports at 348,724 MT, followed by the Netherlands at 228,318 MT and Japan at 106,706 MT. The value of U.S. wood pellet exports was $129.17 million in April, down from both $169.43 million in March and $145.41 million in April 2022.

Total wood pellet exports for the first four months of the year reached 2.9 million MT at a value of $531.25 million, compared to 2.74 million MT exported during the same period of last year at a value of $458.1 million.

Spain produced a record 768,000 metric tons (MT) of wood pellets in 2022, according to a report filed with the USDA Foreign Agricultural Service’s Global Agricultural Information Network. Domestic consumption and exports were also up when compared to 2021.

According to the report, Spain is among the top 10 producers of wood pellets in the European Union but has not been a top consumer of wood pellets. Domestic consumption, however, increased last year, primarily due to higher residential use and improved competitiveness against alternative energy sources. Biomass tax reductions and incentives to install biomass stoves and boilers also helped boost consumption, although incentives for biomass consumption are relatively low when compared to other EU member states.

According to the report, Spain had 83 operational pellet plants last year, up from 75 in 2021. Total capacity is estimated at 2 million MT per year. Total pellet production in Spain is estimated at approximately 768,000 MT in 2022. In addition to wood, pellets are also produced from olive kernels, tree nutshells, and sunflower

kernels, with total pellet production estimated at approximately 2 million MT last year.

Spain is a net exporter of wood pellets, with exports largely exceeding imports. According to the report, expanding pellet demand in other EU member states, combined with a shortage of wood pellets to supply to the EU from Ukraine and Russia, as well as the impacts of measures against Russia, has triggered a steep increase in Spain’s pellet sales in EU countries. The report estimates that exports were at approximately 200,000 MT last year. Pellets imported into Spain largely come from neighboring Portugal, according to the report.

Drax Group plc announced it has selected two sites in the U.S. to build new bioenergy with carbon capture and storage (BECSS) projects. The company is also developing an option for a project to add BECCS to an existing pellet plant in Louisiana.

Over the past two years, Drax said it has been progressing a number of work streams to develop options for BECCS, with a primary focus on North America. According to the company, it has continued to develop plans for a new-build BECCS power unit capable of producing c.2TWh of electricity from sustainable biomass and capturing c.3Mt of carbon annually. Two initial sites located in the U.S. South have been selected and are progressing to option, according to Drax.

Drax estimates total investment would be approximately $2 billion per plant, with a final investment decision (FID) targeted for 2026. The facilities could be operational as soon as 2030.

The new-build BECCS projects would enable a wider choice of biomass materials, including wood chips. Drax said it is also continuing to evaluate nine additional BECCS sites in North America. To support the development of North American BECCS projects, Drax has hired 80 employees in the U.S. and Canada and is working to establish a global BECCS headquarters in Houston, Texas.

The proposed project to add BECCS capabilities to an existing pellet plant would have the capacity to capture more than 100,000 metric tons of carbon dioxide per year from the pelleting process. The project has a projected capital cost of $150 million, according to Drax. The company is targeting FID for the BECCS pellet project in 2024 or 2025, with commissioning expected to begin as soon as 2026.

The Vermont House on May 11 voted 107 to 42 to override Gov. Phil Scott’s veto of the Affordable Heat Act, which is designed to affordably reduce greenhouse gas (GHGs) in the state’s thermal sector through efficiency, weatherization measures, electrification and decarbonization.

8 BIOMASS MAGAZINE | ISSUE 3, 2023

The bill was introduced in January and was passed by both houses of the Vermont legislature this spring. Scott vetoed the legislation on May 5. He, in part, cited concerns over costs to consumers, particularly provisions of the bill that will raise the costs of fuel oil. The Vermont Senate voted 20 to 10 to override the veto on May 9, followed by the House. The new law establishes a Clean Heat Standard under which obligated parties are required to reduce GHGs attributable to the state’s thermal sector by retiring required amounts of clean heat credits to meet required GHG reductions of the thermal portion of Vermont’s Global Warming Solutions Act, which was enacted in 2020.

The Affordable Heat Act lists advanced wood heating and sustainably sourced biofuels as two of several eligible clean heat measures that can be used to generate credits under the program.

Aemetis Inc., a renewable natural gas and renewable fuels company focused on negative carbon intensity products, announced June 5 that its Aemetis Biogas subsidiary generated federal D3 renewable identification numbers from the U.S. EPA under the Renewable Fuel Standard for the first time, and has filed to generate California Low Carbon Fuel Standard credits for renewable natural gas (RNG) that was delivered to heavy transportation customers starting in late May 2023.

The Aemetis Biogas project is managed by a recently installed Allen Bradley Decision Control System with artificial intelligence (AI) energy and process management capabilities. The integrated, on-site and remote management of the Aemetis Biogas network of dairy digesters supports the rapid addition of dairy digesters to the 40-mile Aemetis pipeline and biogas-to-RNG system with utility interconnect.

The Aemetis Biogas network of dairy digesters in California’s Stanislaus and Merced counties, and the AI Decision Control System, are partially funded by more than $25 million in grants awarded by the California Department of Food & Ag, California Energy Commission, and PG&E

Brightmark RNG Holdings LLC announced five new anaerobic digestion dairy farm RNG projects in western Michigan, designed to convert animal waste to renewable fuels.

Brightmark RNG Holdings LLC is a joint venture between Chevron U.S.A. Inc., a subsidiary of Chevron Corp., and Brightmark Fund Holdings LLC, a subsidiary of Brightmark LLC. The Chevron-Brightmark renewable natural gas joint venture operates a nationwide system of RNG joint venture projects.

The Castor Project, which processes manure from one large digester, is Brightmark and Chevron’s second-largest RNG project. Other Michigan projects in the joint venture include Meadow Rock, Red Arrow, Willow Point and SunRyz. Including these Michigan

projects, the Chevron-Brightmark RNG joint venture has a total of 20 RNG projects across the country.

West Biofuels LLC began construction of a 3-MW bioenergy plant in Burney, California, that will convert forest waste and sustainably sourced wood to renewable electricity, heat and biochar. The bioenergy facility is owned by Hat Creek Bioenergy LLC, developed in collaboration with West Biofuels LLC’s, engineering, procurement and construction management team and local partners, including Fall River Resource Conservation District. The biomass feedstock will be procured from local forest restoration projects resulting from five years of drought and the related resurgence of bark beetle infestation in fir and pine trees. The bioenergy facility’s capital budget is estimated at $25.7 million, and it is expected to be operational in the first quarter of 2024.

Sen. Tammy Duckworth, D-Ill., introduced the Sustainable Aviation Fuels Accuracy Act of 2023, a bipartisan bill that aims to identify the standards required to meet the definition of sustainable aviation fuel (SAF) at the Federal Aviation Administration. The bill would require the federal government to adopt the most up-to-date life cycle emissions models, including GREET or successor life-cycle analysis models to GREET. It would also prevent the federal government from picking winners and losers in the SAF market and clarifies that the U.S. government does not encourage the banning of agricultural feedstocks from being utilized as a viable source of SAF.

Honeywell announced that bp selected Honeywell’s Ecofining technology to help support the production of SAF at five bp facilities across the globe. These facilities include Cherry Point refinery in Blaine, Washington; Rotterdam II refinery in Rotterdam, Netherlands; Lingen refinery in Lower Saxony, Germany; Castellón de la Plana refinery in Castellón, Spain; and Kwinana Oil refinery in Kwinana, Australia. SAF produced from Honeywell’s Ecofining technology is certified for use according to international standards and be used as drop-in replacement without engine modifications, in blends of up to 50%

BIOMASSMAGAZINE.COM 9 BIOMASS NEWS ROUNDUP ¦

The U.S. EPA on June 21 released its final Renewable Fuel Standard “set” rule, which includes a modest increase in biomass-based diesel renewable volume obligations (RVOs) for 2024 and 2025. The agency, however, elected not to finalize provisions of the proposed rule related to electric renewable identification numbers (eRINs).

For 2023, the EPA has set the total renewable fuel RVO at 20.94 billion gallons, including the nested RVOs of 5.94 billion gallons of advanced biofuel, 2.82 billion gallons of biomass-based diesel, and 840 million gallons of cellulosic biofuel. The agency originally proposed to set the 2023 renewable fuel RVO at 20.82 billion gallons, including the nested volumes of 5.82 billion gallons of advanced biofuel, 2.82 billion gallons of biomass-based diesel, and 720 million gallons of cellulosic biofuel. The final 2023 RVO includes a supplemental RVO of 250 million gallons of renewable fuel that completes the EPA’s response to a court remand of the 2016 RFS rule.

The final 2024 and 2025 RVOs include modest increases for biomass-based diesel but reduced RVOs for advanced biofuel and cellulosic biofuel. The EPA has set the 2024 RVO for renewable fuel at 21.54 billion gallons, including the nested volumes of 6.54 billion gallons of advanced biofuel, 3.04 billion gallons of biomass-based diesel and 1.09 billion gallons of cellulosic biofuel. The proposed RVOs for 2024 were set at 21.87 billion gallons, 6.62 billion gallons, 2.89 billion gallons and 1.42 billion gallons, respectively.

For 2025, the EPA has set the total renewable fuel RVO at 22.33 billion gallons, including 7.33 billion gallons of advanced biofuel, 3.35 billion gallons of biomass-based diesel, and 1.38 billion gallons of cellulosic biofuel. The respective proposed RVOs were 22.68 billion gallons, 7.43 billion gallons, 2.95 billion gallons, and 2.13 billion gallons.

Within the final “set” rule, the EPA attributes reductions in cellulosic RVOs to its decision not to finalize eRIN provisions of the proposed rule that would have allowed electricity generated by eligible biogas-fueled facilities to participate in the RFS program.

As proposed in December 2022, the eRIN provisions would have allowed electric vehicle (EV) manufactures to generate electric eRINs based on the light-duty electric vehicles they sell by establishing contracts with parties that produce electricity from qualifying biogas. Some representatives of the U.S. biogas and biofuel industries lobbied against this approach, arguing that biogas electricity producers are the parties that should generate eRINs—in line with how liquid biofuel producers generate renewable identification numbers (RINs) under the RFS.

In the rule, the EPA indicates that stakeholder positions on the proposed rule’s eRIN provisions varied greatly, with some stakeholders strongly supportive of the proposed provisions, some who sought significant modifications to the program while remaining broadly supportive of eRINs conceptually, and others who op-

posed moving forward with any type of eRIN framework. “In light of the significant number of comments provided by stakeholders on EPA’s proposed eRIN approach, and the complexity of many of the topics raised in those comments, and the consent decree deadline on other portions of the rule, we are not finalizing the proposed revisions to the eRIN program at this time,” the EPA said in the final rule. “We have adjusted the final volume requirements for this rulemaking to reflect this decision.”

“Given strong stakeholder interest in the proposed eRIN program and the range of potential benefits that the program could provide, EPA will continue to work on potential paths forward for the eRIN program,” the agency added.

Within the rule, the EPA also addresses its decision to maintain its proposed 2023 RVO for biomass-based diesel and include only modest increases to the 2024 and 2025 biomass-based diesel RVOs. The rule cites U.S. Energy Information Administration data that projects U.S. renewable diesel production capacity could reach nearly 6 billion gallons by 2025, but cautions that some of those projects may not be completed, and the ones that are won’t necessarily produce renewable diesel in the 2023-‘25 timeframe addressed by the “set” rule. The EPA also discusses concerns over feedstock limitations that could result in renewable diesel and biodiesel facilities operating at below capacity, noting that competition for qualifying feedstocks could also reduce in reductions in biodiesel production if larger renewable diesel facilities are able to out-complete smaller biodiesel producers for feedstock.

10 BIOMASS MAGAZINE | ISSUE 3, 2023

¦ BIOMASS NEWS ROUNDUP

The EPA also points to the structure of the RFS program’s nested RVOs in justifying its decision. According to the agency, it believes that excess volumes of biomass-based diesel beyond the biomass-based diesel RVOs will be used to satisfy the advanced biofuel RVOs, within which the biomass-based diesel volume requirement is nested.

“We also believe it is important to maintain space for other advanced biofuels to participate in the RFS program,” the EPA said in the rule. “Although the [biomass-based diesel] industry has matured over the past decade, the production of advanced biofuels other than biodiesel and renewable diesel continues to be relatively low and uncertain. Maintaining this space for other advanced biofuels can, in the long-term, facilitate increased commercialization and use of other advanced biofuels, which may have superior environmental benefits, avoid concerns with food prices and supply, and have lower costs relative to [biomass-based diesel]. Conversely, we do not think increasing the size of this space is necessary through 2025 given that only small quantities of these other advanced biofuels have been used in recent years relative to the space we have provided for them in those years.”

The final rule also includes a variety of other regulatory changes that the EPA said aim to strengthen its implementation of the RFS program. This includes modification of regulatory provisions for biogas-derived renewable fuels to ensure that biogas is produced from renewable biomass and used as a transportation fuel and allow for the use of biogas as an biointermediate; enhancements to third-party oversight provisions, including engineering reviews, the RFS quality assurance program, and annual attest engagements; establishing a deadline for third-party engineering reviews for three-year registration updates; updating procedures for the apportionment of RINs when feedstocks qualifying for multiple D-codes are converted to biogas simultaneously in an anaerobic digester; revising the conversion factor in the formula for calculating the percentage standard for biomass-based diesel to reflect increasing production volumes of renewable diesel; flexibility for RIN generation; reiterating the prohibition on generating RINs not used in the covered location; flexibilities for the generation and maintenance of records for waste feedstock; clarifying the definition of fuel used in ocean-going vessels; modifications to the bonding requirements for foreign parties that participate in the RFS program; and other minor changes and technical corrections.

In general, representatives of the U.S. biofuels industry are criticizing the final “set” rule, describing it as a missed opportunity and disappointment.

BIOMASSMAGAZINE.COM 11

Q&A: Finding New Niches

Enviva is expanding into new markets, furthering its mission of decarbonization via sustainable woody biomass.

BY KATIE SCHROEDER

It was nearly 20 years ago that Enviva was founded, and over the past couple of decades, the company has amassed a portfolio of 10 operating wood pellet plants with a production capacity of 6.2 million metric tons per year. Several more are in various stages of development, and the company also owns, operates and exports pellets out of deep-water marine terminals at the Port of Chesapeake, Virginia; the Port of Wilmington, North Carolina; and the Port of Pascagoula, Mississippi. Directly employing about 1,100, Enviva sells most of its wood pellets through long-term, take-or-pay off-take contracts customers in countries including the United Kingdom, the European Union and Japan. While Enviva’s roots are in helping transition fossil fuel heat and/or power plants to wood pellets, the company is finding additional niches in assisting hardto-abate sectors including steel, cement, lime, chemicals and aviation. Biomass Magazine briefly caught up with Thomas Meth, cofounder, president and CEO of Enviva, about the company’s momentum.

BMM: The wood pellets-to-heatand/or-power space has been Enviva’s mainstay since its inception. What new and emerging markets are you expanding into to further global decarbonization efforts?

Meth: Enviva is the largest producer of sustainably sourced wood pellets in the world. Historically, Enviva has primarily delivered our renewable, drop-in energy substitute for coal to power and heat generators across Europe and Japan. Today, we are seeing an ever-increasing demand for our product beyond heat and power, as the war in Ukraine continues and Russian gas becomes obsolete for much of the world. In the last one to two years alone, there has been growth in demand for our product across hard-to-abate industries, such as lime, steel, cement and asphalt, and their decision to take a close look at defossilizing their production facilities and supply chains.

The potential applications for our product have dramatically increased and are more realistic today than ever before. With cellulosic biofuels from biomass being a notable part of the Renewable Fuel Standard, we see a path to utilizing the biomass industry’s existing or planned installed capacity to accelerate renewable liquid fuel production, most notably sustainable aviation fuel (SAF) to meet the SAF Grand Challenge. We are seeing positive tailwinds across the following industries.

• Power and Heating: We have active discussions to add European contracts as the late-stage offtakes roll off—approx. 2 million metric tons per year (MTPY).

• SAF: Three contracts are already signed with companies in the U.S. and U.K., with continued discussions around 4 million MTPY potential ramping from 2027. In addition, we completed test deliveries to two major oil companies in Europe that are constructing biorefineries and coprocessing biobased feedstock in their existing refineries.

• Aggregates (lime, cement and asphalt): We are having active discussions for approximately 2 million MTPY of potential, ramping up from 2025.

• Methanol: Discussions are active, with approx. 1 million MTPY in potential

starting in 2025-‘26; methanol-powered vessels have been ordered.

• Metals and mining: We have ongoing discussions with an approx. 5 million MTPY of potential in 2027- ’28.

• Carbon sequestration: Contracts are already signed, with additional discussions for an approx. 5 million MTPY potential starting in 2030.

BMM: In the past, Enviva has labeled itself as a wood pellet producer and supplier—it seems you have expanded your self-description, particularly when it comes to the supply of SAF feedstocks. Can you explain?

Meth: As it pertains to Enviva, we will supply wood biomass feedstock derived from the least merchantable, low-value wood from a traditional timber harvest, such as forest byproducts like tree tops, limbs and commercial thinnings. Depending on the customer’s contract, this may or may not be delivered in pellet form. Other variations could include wood chips and processed sawdust.

BMM: What are some of the unique benefits (for renewable liquid fuels producers) of biomass as a feedstock?

Meth: Biomass for renewable liquid fuels producers provides a clear path to reducing historical reliance on crude oil. As already proven in the power and heating industries, biomass as a feedstock has been demonstrated to reduce liquid fuel carbon emissions on a lifecycle basis and provides a sustainable and renewable resource for transportation fuels. Other key benefits include increased energy security through domestically sourced biomass and waste reduction through the use of agricultural waste, including forestry residue, contributing to a more circular economy.

BMM: The U.S. EPA’s biointermediate provisions—which were released last year as a way to expand the feedstock pool for renewable fuels—will they impact the biomass sphere in any way?

12 BIOMASS MAGAZINE | ISSUE 3, 2023

Thomas Meth, Enviva

Meth: Yes, we saw it as a great sign of growth and opportunity for the U.S. market. Historically, Enviva’s business has been export-driven, with a limited domestic customer base. The EPA’s revised provisions provide a way for potential biomass customers to utilize biointermediates to meet their goals of reducing biofuel production costs and expand opportunities for more cost-effective cellulosic biofuels–like woody biomass.

Recognizing the scaling up of SAF is critical to meeting the U.S.’s aggressive climate goals, the White House launched the SAF Grand Challenge, with goals to have 3 billion gallons of SAF produced in the U.S. by 2030 and augmenting to 35 billion gallons by 2050. Recently, we have been encouraged by the actions taken by Congress and the White House (i.e., $1.7 trillion omnibus spending bill and the U.S. Inflation Reduc-

tion Act) about the potential for a significant domestic market in the near future. The passage of the Inflation Reduction Act into law amplifies the U.S. commitment to SAF by providing tax credits for every gallon of SAF produced based on lifecycle greenhouse gas emission reduction percentages. Further, the IRA extends and modifies the tax credit for the production of renewable energy from biomass and other technologies.

Europe is pursuing similar policy initiatives such as ReFuelEU, with the European Parliament voting in support of draft rules to require SAF to account for at least 85% of European Union aviation fuel by 2050. Similarly, the United Kingdom announced the introduction of an SAF mandate, requiring at least 10% of jet fuel to be produced sustainably by 2030.

BMM: What’s the most challenging component right now, when it comes to decarbonization via sustainable biomass?

Meth: Like many other industries today, we must ensure industry’s operational cost position remains low in a world of inflationary pressures and higher interest rates. Simultaneously, we must continue to grow and scale sustainably to meet the ever-insatiable demand of our product as wood biomass continues to play an ever-important role in stabilizing and defossilizing power and heat generation across the globe.

BIOMASSMAGAZINE.COM 13 Q&A

Behind The CURTAIN

BY ANNA SIMET

On an early June morning in Minnesota, the sun is barely visible through a blurry haze that shrouds the landscape from the ground up. 1,300 miles to the east, New York City’s skyscrapers are engulfed in an eerie curtain of smoke, and even those who aren’t particularly sensitive to air quality are cautioned of the outdoors. Such has been the case for weeks, likely with much more in store. The cause, in this case, is not one derived within the states themselves—or even the country—as the rampant, uncontrolled wildfires all across Canada are wreaking havoc on the air across a significant portion of the U.S. From the Midwest to the Northeast and Mid-Atlantic, some states are recording their worst-ever air quality.

But the U.S. is no stranger to unprecedented wildfires. The western part of the country continues to break records with each consecutive wildfire season, heightening the concerns of those in the area, as well as foresters, firefighters, environmentalists and other stakeholders. While there is no silver bullet, aside from climate change mitigation strategies, forest management—thinning and disposal of high-hazard material wherever possible—is a leading solution. To Brian O’Connor, president of Palm City, Florida-based Air Burners Inc., it is perception—or rather, misperception— that is perhaps the biggest challenge in the increasing deployment of the company’s

technology—air curtain burners. In particular, the impression that they are polluting incinerators. Nevertheless, the units, which have been studied and tested at length by the U.S. EPA, are steadily gaining traction—for example, many of his units have been purchased and are used by Cal Fire, which is using them for hazardous fuel reduction activities. “Wildfire mitigation today is a big deal,” O’Connor says. “Our machines get sold to many fire agencies in additional to Cal Fire—in high fire danger areas in Nevada, Arizona and other places in the western U.S., and even Australia. It’s a matter of cleaning the brush out and eliminating it in the machine. And because it’s clean wood waste, you’re left with pure carbon ash and biochar that’s turned back into the soil. There is no hauling or grinding. You can put root balls in there, logs, branches—if it fits, it goes.”

Trial, Error and Success

Backing up to the beginning, as for how O’Connor came to own Air Burners—and ultimately leading it to success—it was very much a case of curiosity and pas-

sion. “Air Burners was doing welding for a company I owned at the time, about 35 years ago, and I learned they had a really cool environmental idea, but just couldn’t sell any of the machines. The inventor had just gotten things rolling with a rental fleet, but unfortunately passed away. The company then bumbled along mostly doing fabrication jobs, but eventually went bankrupt. The largest creditor hung onto the company for several years, but didn’t know what to do with it, and as I got to know them

14 BIOMASS MAGAZINE | ISSUE 3, 2023

¦ TECHNOLOGY

Brian O’Connor led Air Burners from a fledgling business with a clever idea to a successful company with a brilliant technology.

Brian O’Connor, president, Air Burners Inc.

through some subcontract manufacturing, I began to understand what the machine was, and why they couldn’t sell it.”

O’Connor describes himself as somewhat of an environmentalist, and the purpose of the Air Burner technology—reducing smoke and particulate matter from burning—hit home, as a person with asthma. An engineer by trade, O’Connor began to do research on the air curtain concept. “I found it very interesting, and I offered to buy the company,” he explains. “It was

mostly tooling, welding and fabrication equipment, but I put on my engineer hat to understand this whole concept and how it works. I spent about a year building test machines and doing a variety of tests, trying to get this concept down.”

The first full machine that O’Connor built—it didn’t work very well, he admits. “But I got a better understanding of the air curtain and what it’s supposed to do—how it’s supposed to trap particulate matter—so ultimately, I came up with a design that did

work, and really well. In fact, that very first machine that was modified several times, it has been 26 years and it’s still in use today.”

The principle of the air curtain is relatively simple. Clean wood waste such as logs or slash is loaded into a firebox and an accelerant is used to ignite the wood. As the smoke rises off and the wood burns naturally, smoke particles rise up on the hot gasses and encounter the air curtain, which acts like a lid, trapping the smoke and causing it to reburn. “Once the particles are small

BIOMASSMAGAZINE.COM 15

The Air Burners FireBoxes arrive fully assembled and ready for use. They are built on a steel skid base, allowing users to drag them around the work site. The burn chamber is lined with Air Burners’ proprietary thermal ceramic panels, which contain the fire and protect the system.

IMAGE: AIR BURNERS INC.

enough in the reburning process, they can escape through the air curtain and off into the environment,” O’Connor says. “But now, it’s reduced so much that it doesn’t bother anybody. That’s the whole purpose of an air curtain—to create a secondary burn chamber and eliminate the smoke, and it does it very well.”

The better the machine is operated, the better the control is for the air curtain, and the further emissions are reduced, according to O’Connor. He says the machines burn wood waste about 40 times faster than opening burning. “From an economic standpoint, it’s the fastest way to get rid of

16 BIOMASS MAGAZINE | ISSUE 3, 2023

The portable BioCharger generates power to feed on-site charging stations, effectively closing the energy loop for operators to work off-grid and keep electric vehicles, forklifts, excavators, chainsaws and lights at the job site running. Air Burners currently offers the BioCharger with a 450-kilowatt-hour charging station, enough power to recharge multiple machines..

IMAGES: AIR BURNERS INC.

The patented CharBoss is a machine design that was developed through a Cooperative Research And Development Agreement between Air Burners and the U.S. Forest Service. Based on the Air Burners BurnBoss design, the machine was further developed to automatically produce biochar while eliminating clean wood and vegetative waste.

IMAGE: AIR BURNERS INC.

your wood waste,” he says. “Most of what we do are the fireboxes, which are self-contained. To run it incorrectly is to overload it, or pile wood waste above the manifold that’s creating the air curtain, because then it gets dispersed in many different directions and doesn’t do its job. An operator will soon learn it burns much slower then.”

While there are misconceptions of the systems being a form of incineration, O’Connor emphasizes that they are not. “There are no gas jets, no secondary hydrocarbon fuels that support combustion—we only use clean wood waste, and it has to burn naturally,” he says. “You light it as you would an open burn with a drip torch, and then once it’s burning, you just add wood. As it burns down you add more, and at the end of the day, you rake out the ash and the biochar, and life is grand.”

O’Connor says the machines have been tested extensively all across the world, including by the U.S. EPA. “We were really honored to be asked to join them in a cooperative research and development agreement, or a CRADA, and we were a partner for seven years. We did a lot of testing with them and a lot of interesting projects.”

Air Burners has a machine on every continent aside from Antarctica, and resultingly has a library of data.

In-Woods Innovation

Currently, wildfire mitigation is one of Air Burners’ biggest markets. “We have a variety of machines, and all are self-contained and portable,” O’Connor says. “They arrive on-site and ready to do the job. You can drag them around, and they’re easy to take care of.”

One major advantage of the machines is that they don’t require any chipping, grinding or preprocessing of the biomass, so long as it fits.

There are many different Air Burner machines under five lines—the Power Series, FireBox, Roll-Off FireBox, Boss Series and Trench Burner—with the same core concept. The CharBoss, a smaller model in the BossSeries line, was designed in partnership with the U.S. Forest Service.

Based on the Air Burners BurnBoss design, this machine was further developed with an internal system to automatically produce biochar from the waste materials. “Their [Forest Service] goal was to recycle the biochar back to the forest floor, but we do have some customers that use the bigger machines and manually rake out the biochar and sell it,” O’Connor says, adding that a customer in Florida had been selling biochar for approximately $125 per cubic yard, producing around 10 cubic yards per day. “So, he was making over $1,000 a day on biochar, and on top of that, getting paid to eliminate the waste.”

The FireBox and BossSeries lines are popular, but the right fit all depends on the customer’s intentions. “We have customers in California that have a fleet of the BurnBosses and TrackBosses, and they deploy them across the mountain ranges,” O’Connor says. “They have workforces that come out and handload the machines. The BurnBox is ideal to move from pile to pile to eliminate them, rather than move all the piles to one particular site.”

The standard FireBox allows customers options in terms of capacity, requiring as little as three to four tons per hour, but can process up to 13 or 14 tons an hour. “It’s tough sometimes when people look at

DON’T LET THIS HAPPEN TO YOUR FACILITY

Combustible dust can cause personnel injuries, equipment & plant damage. Spark & embers from dryers, hammer mills, pelletizers & coolers can cause cascading dust fires & explosions

GreCon Spark Detection & Extinguishing Systems

are a preventative measure against fire or dust explosions by detecting and extinguishing sparks & embers in processing and conveying equipment without production interruption.

BIOMASSMAGAZINE.COM 17

TECHNOLOGY ¦

Reduce Your Risk • Improve Productivity • Meet Regulations Let us tailor a system for you. Call today 704-912-000 www.fagus-grecon.us

our elimination numbers—they’re used to grinders—and they might say their grinder does 50 tons an hour,” O’Connor says. “But they’re putting 10 tons in and getting 10 tons out. If you put 10 tons into our machines, you get a couple pounds of ash out. We’re eliminating it, and that’s a big difference.”

As for what Air Burners is most excited about, O’Connor says its Power Series is it. As it name suggests, the machines do just that—generate electricity. “From the beginning, I have always thought that we need to make power—there’s just too much potential energy than to simply burn the material,” he says.

But that idea turned out to be rather complicated. “It wasn’t a simple problem,” O’Connor says, mostly because when looking at portability, there were no good options for generators in the 100- to 300-kilowatt range. After a number of years, Air Burners connected with Atlanta, Georgia-based ElectraTherm, which is owned by BITZER. The company manufacturers an organic Rankine cycle generator that Air Burners uses exclusively. “They have the

most installed power of anybody in ORCs, and they’re focused on the smaller sizes,” O’Connor says.

But another issue was that these ORCs weren’t able to work offgrid. “That was another technical problem, but they can now, as we have developed a little microgrid,” O’Connor says. “Our BioCharger has four components—a cooling module, a firebox module, a power module and a battery storage module.”

Air Burners has also partnered with Volvo, which is assisting with knowledge and technical expertise on battery-powered machinery, and Rolls Royce, which builds the chargeable batteries for the system. “All day long, you run your battery-powered excavators, forklifts, loaders, etcetera, eliminating waste,” O’Connor explains. “In doing this, you’re making electricity and storing it in the battery storage module. At night, you plug in your battery-operated machinery, and they recharge.”

He adds that this system is particularly helpful in places like California, which, as of next year, is banning the sale of new small gas engines—even chainsaws. “So here

is the opportunity to eliminate this waste, which there is no use for, turn it into energy on-site, and put the energy into powering the machines. It’s a really cool thing.”

Building Out

On a final note, O’Connor says he believes the air curtain burners are turning the notion that biomass energy is expensive on its head. “You’re getting paid to eliminate waste and generate electricity that can be used on-site with the BioCharger, or sent into the grid, with our on-grid PGFireBox System,” he says. While it seems like a no-brainer, he believes the technology is still fairly misunderstood. “People look at us and think that since we’re burning things, it can’t be good,” he adds. “I think the biggest issue is understanding what our machines actually do—they are a pollution control device. And to the skeptics, we say come look at it.”

Author: Anna Simet asimet@bbiinternational.com

Author: Anna Simet asimet@bbiinternational.com

18 BIOMASS MAGAZINE | ISSUE 3, 2023

Pallet and wood debris disposal, reduction of landfill wood waste, or even post-disaster cleanup are additional uses for air curtain burners. IMAGE: AIR BURNERS INC.

20 BIOMASS MAGAZINE | ISSUE 3, 2023

HIGH HO PES FOR HYDROGEN

BY SUSANNE RETKA SCHILL

Federal goals and incentives are laying a launch pad for renewable hydrogen, aiming at a five-fold increase from current capacity, but biogenic hydrogen could be left on the ground if some environmental advocates succeed in getting restrictive rules.

The Biden administration’s goal is to expand clean hydrogen production from today’s nominal levels to 10 million metric tons per annum (MMTpa) by 2030 and 50 MMTpa by 2050, backed by serious money. The 2021 Bipartisan Infrastructure Law allocates $7 billion to build regional clean hydrogen hubs and the Inflation Reduction Act includes a production tax credit worth between sixty cents for carbon intensity (CI) between 2.5 and 4 kilograms of CO2 equivalent per kilogram of hydrogen (kgCO2e/kgH2), up to a maximum of $3/kg for a CI lower than 0.45 kg CO2e/kg. The details of how CI will be measured and what will be eligible are yet to be determined. A debate is raging right now about how restrictive those rules should be.

Biogenic supporters point out that biogas, particularly dairy manure, could support carbon negative hydrogen. The U.S. DOE reports pyrolysis, though less than 1% of current U.S. production, produces hydrogen with carbon intensities (CI) in a range of 1.5-3.5. kgCO2e/kg H2. That category appears to include other forms of biogenic hydrogen.

Currently, industry annually produces about 10 million metric tons per in the U.S. and 90 million metric tons globally, mostly at oil refineries to be used in refining, ammonia-based fertilizer and other large-scale

chemical production. Using natural gas as the feedstock, hydrogen production generates about 100 million metric tons of greenhouse gases (GHG) each year, according to the DOE’s draft “National Clean Hydrogen Strategy and Roadmap.” The DOE projects the use of clean hydrogen can enable a 4090% reduction in GHG emissions by displacing incumbent fossil fuels. Defining exactly what “clean hydrogen” means is one of the tasks ahead.

The DOE’s document “Clean Hydrogen Pathway to Commercial Liftoff” lays out the vision further. Hydrogen can help fuel difficult-to-decarbonize sectors in industry, chemicals, heavy duty transportation, aviation and marine applications. The document covers the challenges and opportunities in building infrastructure and markets applicable to all production methods, but when it comes to discussing production hurdles, the focus is entirely on electrolysis. “Biogas has been sort of a footnote,” says Gabriel Olson, director of carbon strategy and policy at BayoTech, adding that it is significant that biogenic sources of hydrogen are explicitly named in federal incentives, even though only given a nod in DOE documents.

Headquartered in Albuquerque, New Mexico, BayoTech provides gas storage and transportation equipment, supplying about 80% of the California on-road hydrogen transport market, Olson says. This summer, the company is commissioning its first commercial, modular small-scale hydrogen production unit just west of St. Louis at Wentzville, Missouri. The facility will produce 350

BIOMASSMAGAZINE.COM 21

HYDROGEN ¦

Multiple new projects promise to expand biogenic hydrogen production, but only if unhindered by rules favoring electrolyzers.

tons per year for local industrial gas suppliers, fleet operators and fuel cell equipment manufacturers in a 300-mile radius. Siting its plant on the Ranken Technical College Campus, BayoTech is collaborating with the college to educate and certify skilled workers, developing curriculum on hydrogen manufacturing, plant operations and maintenance, as well as dispensing, fueling and transportation.

BayoTech’s scaled-down steam methane reactor (SMR) builds on technology first developed by Sandia National Laboratory to efficiently miniaturize the massive oil refinery SMR units. Putting production close to the end user minimizes transportation and storage costs, Olson says. “What we were seeing even before the tax credit in the Inflation Reduction Act is an emerging need for hydrogen for a variety of end uses. They’re smaller customers, but typically they don’t have access to a reliable and cost-effective supply of hydrogen.”

There are not many suppliers of hydrogen, Olson says, so the large players effectively have a monopoly, which is reflected in unfavorable contracts and retail prices as high as $30/kg. “We see that as an opportunity,” Olson says. “We see the ability to be more attractive on pricing and contract terms, and to be more flexible.” He lists chip manufacturers, pharmaceuticals and a variety of food products as near-term markets as well as future, larger markets in fueling heavy-duty trucks and power generation, particularly in back-up generators.

While BayoTech’s modular SMR units could be colocated with a biogas producer at a wastewater treatment facility, landfill or livestock anaerobic digester, Olson expects the units will more likely be sited closer to the hydrogen users. In order to produce carbon neutral hydrogen, BayoTech will utilize book-and-claim accounting, contracting the environmental assets of biogas produced elsewhere and applying those credits to the hydrogen produced at their facilities, which use locally supplied pipeline natural gas.

Policy Uncertainties

Two factors could impact the economics of leveraging biogas as a feedstock to create low-carbon hydrogen—the fate of bookand-claim accounting and the framework of the federal production tax credits. “Dairy bio-

22 BIOMASS MAGAZINE | ISSUE 3, 2023

C M Y CM MY CY CMY K ai16819247029_PelletMill.pdf 1 4/19/2023 1:18:26 PM

Construction of BayoTech’s first hydrogen hub is underway. Located in Wentzville, Missouri, the facility will produce 350 tons per year of low-cost, low-carbon hydrogen for local industrial gas suppliers, fleet operators, fuel cell equipment manufacturers and industrial hydrogen users.

gas is considered to be deeply negative with a CI score of negative 300,” Olson says. “That’s great, because you can use that negative carbon intensity to offset your carbon emissions and reach carbon neutrality cost effectively. But the environmental folks in the debate around the production tax credit say ‘That’s not accurate, not fair. Don’t give negative value to biogas, it should be zero at best. ’ ”

Another potential landmine is efforts to disallow book-and-claim. “There’s a debate in California and Colorado that you can’t use biogas from out of state if you want their incentives,” he says. “Some are looking to restrict book-and-claim to only allow local, or even onsite use of biogas.”

On top of those two concerns is uncertainty about how the carbon intensity of hydrogen will be determined for the new federal incentives and the specifics of the eligibility rules. Katrina Fritz, executive director the California Hydrogen Business Council, concurs the debate around federal rules is critically important. “The two packages of incentives at the federal level, the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, have different carbon intensity requirements. The IRS still has to issue guidance, and there’s a hot debate on how strict will it be with hydrogen.” Some groups are advocating stricter rules than any other resource or technology, she says. “There’s no requirement that the grid be 100% renewable when you charge your electric vehicle. Some want a requirement that only hydrogen produced from electrolyzers using wind or solar is allowed, which would totally exclude biomass.”

The business council advocates for inclusive policies that allow the use of biomass and waste to generate hydrogen, and for equal treatment for biogenic hydrogen in any mandates, she says. “It’s been determined by numerous studies and research to be necessary as a decarbonization pathway, and it’s included in the climate change scoping update from 2022 by the California Air Resources Board as a necessary pathway.”

California’s Hydrogen Expansion

California’s Low Carbon Fuel Standard has been a major driver behind the state becoming the nation’s, and indeed the world’s, leading market for hydrogen. Almost 16,000 cars and 66 buses traverse the state’s roads,

with another 103 buses on order. The state has 58 hydrogen fueling stations for cars today, with 37 proposed or under construction. For light- duty vehicles, adding hydrogen fueling can be as simple as adding a pump to existing gas stations. “The footprint is much smaller to put in one pump than to have charging stations for an hour or two,” she says.

The infrastructure for heavy-duty trucks is beginning to develop as well, with three stations in service and another nine funded. That is expected to pick up pace as fleet operators plan for the state’s goal of reaching 100% zero emission vehicles by 2035. They’re going to test both batteries and hydrogen, Fritz says, adding that hydrogen offers some advantages. In addition to a longer range for fuel cell vehicles and much shorter time requirement for refueling with hydrogen, there’s an infrastructure hurdle to overcome for batteries. Charging a fleet of 20 or 30 heavy-duty trucks requires not only upgrad-

ing a facility’s electrical system, but often the substation providing the power. The queues for getting that work done are five or 10 years long, Fritz says. “Today, you can get the hydrogen infrastructure built in one year.”

California hopes to boost its growing hydrogen sector with the aid of a DOE hydrogen hub grant. The infrastructure act allocated $7 billion to support six to eight hydrogen hubs across the nation. “California has a huge coalition of organizations, companies, the California university system and the governor’s office,” Fritz says. California’s $1.6 billion proposal seeks to demonstrate several production systems, including renewables, as well as delivery and end uses. The competition will be stiff, as Fritz reports 33 full proposals were submitted to the DOE. “There will be a very extensive review process,” she adds. “If you’re awarding more than $1 billion to a project, you want to make sure those projects are going to succeed, that they’re going to move the market.”

BIOMASSMAGAZINE.COM 23

HYDROGEN ¦

Building Out California’s Biogenic Hydrogen Sector

The following sampling of biogenic hydrogen projects under development in California demonstrates the multiple approaches being developed to utilize the state’s bountiful biogas, biomass and waste streams.

Yosemite Clean Energy. Yosemite Clean Energy received two $500,000 grants from the California Department of Conservation for its forest biomass to carbon-negative fuels projects. Announced in January, the first grant supports Yosemite’s flagship project in Oroville, California, to produce 24 tons of hydrogen per day. The second grant will support preliminary engineering for Yosemite’s Tuolumne County hydrogen project. Using Austrian firm Repute’s technology, Yosemite gasifies woody biomass into syngas, which is then processed into hydrogen and renewable natural gas. Both gasification and reforming technologies are proven, commercialized processes. In its news release announcing the Oroville project, Yosemite describes its business model as a democratization of clean energy with partial ownership by farmers and forest landowners, who in return will provide wood waste gathered at the end of an orchard’s lifecycle or through sustainable forest management.

Raven SR. Also in January, Wyoming-headquartered Raven SR Inc. announced a collaboration with Chevron New Energies and Hyzon Motors to commercialize a green waste-to-hydrogen production facility at Richmond, California. To produce the hydrogen, the project is expected to divert up to 99 wet tons of green and food waste per day from a landfill into Raven’s noncombustion steam/CO2 reforming process, producing up to 2,400 tons annually of renewable hydrogen. Chevron plans to market its share of hydrogen in northern California. Hyzon, a global supplier of fuel cell electric commercial vehicles, plans to develop a hydrogen fueling hub in Richmond.

The Raven SR technology is a noncombustion thermal, chemical reductive process that converts organic waste and landfill gas to hydrogen and Fischer-Tropsch synthetic fuels. In describing its technology, Raven says it is unlike other hydrogen production

technologies in that its steam/CO2 reformation does not require fresh water as a feedstock and uses less than half the energy of electrolysis. The process is more efficient than conventional hydrogen production and can deliver fuel with low to negative carbon intensity. Additionally, Raven SR’s goal is to generate as much of its own power onsite as possible to reduce reliance on or be independent of the grid. Its modular design provides a scalable means to locally produce renewable hydrogen and synthetic liquid fuels from local waste.

SGH2 Energy. SGH2 Energy is partnering with the city of Lancaster, California, to process 40,000 tons of mixed waste to generate 12,000 kg of hydrogen per day, or 3.8 million kg (3,800 tons) per year. The company will use its patented Solana Plasma Enhanced Gasfication technology to convert waste “from paper to plastics, tires to textiles” into green hydrogen. The process uses a plasma-enhanced thermal catalytic conversion process optimized with oxygen-enriched gas. In the gasification island’s catalyst-bed chamber, plasma forces generate high temperatures that disintegrate the feedstock without ash. The syngas goes through a pressure swing absorber system resulting in pure hydrogen. In February, the company received the final approval from the Lancaster Planning Commission, getting the green

light for the engineering, procurement and construction phase of the project. The approval also clears the company to receive a $3 million grant award from the state.

FuelCell Energy. FuelCell Energy expects to bring its Trigeneration Direct Fuel Cell Power Plant online this fall at the Toyota Logistics Services facility in the Port of Long Beach, California. In its 2022 annual report, the company described the project as “the first fuel cell project in the world to produce electricity, hydrogen and water from direct renewable biogas. To our knowledge, this will be the only distributed hydrogen platform in the world with a 20-year off take agreement with an investment-grade counterparty.”

Biogas sourced from agricultural waste will be utilized by the Trigen facility to produce 1.2 tons of hydrogen, supporting 10,000 Toyota Mirai fuel cell vehicles processed at the port annually, and a fleet of 20 or more Class 8 fuel cell electric trucks. Trigen will also generate 2.3 MW of renewable electricity, more than what the port facility requires. Byproduct water generated by the system will supplement municipal water for the onsite car wash.

Author: Susanne Retka Schill Biomass Magazine freelance writer

24 BIOMASS MAGAZINE | ISSUE 3, 2023

¦ HYDROGEN

Primary resource areas for renewable hydrogen production and conversion in California

SOLVING SERIOUS CONVEYOR DUST AND SPILLAGE ISSUES

When faced with excessive amounts of dust and spillage from conveyor systems, operators logically focus on cleanup, maintenance and downtime mitigation to maintain production levels.

BY SHANE TIGHE

Often, dust and spillage issues can be deemed “minor inconveniences” or “the cost of doing business,” until they raise the cost of operation to such a level that they can no longer be overlooked. However, when a new plant begins production and these issues present themselves at the outset, it is best to address them early. This was the case for San Pedro BioEnergy (SPBE), a biomass power producer in the Dominican Republic. The conveyors carrying organic matter experienced so much fugitive dust and spillage that relatively new components were failing due to fouling. This caused excessive downtime and required excessive maintenance. The increased labor, expense of equipment replacement, and downtime for maintenance raised the cost of operation, rendering the situation unsustainable over the long term.

Sustainable Power Production

Having opened in 2017 in the province of San Pedro de Macorís, SPBE was the first renewable energy plant with biomass-based generation technology in the Dominican Republic. The power producer complies with the standards of the United Nations Global Compact. Its operations are aimed at significantly reducing carbon dioxide emissions and promoting the Sustainable Development Goals of the Dominican government and global community.

The biomass used by the plant consists of 90% sugarcane bagasse and 10% wood chips from construction and demolition (C&D) recycled material. SPBE’s cogeneration unit has a 30.5-MW turbine and a high-efficiency boiler running on a production cycle of 335 days per year with a 30-day annual maintenance shutdown. The traveling grate boiler has a production capacity of 140 metric tons (154 tons) of steam per hour at 32 bar (464 PSI) of pressure.

Along with providing power to the CAEI Sugar Factory—the provider of sugarcane bagasse—the plant distributes power to the National Interconnected Electrical System (SENI) which serves local communities, as well as several industrial customers. “Providing clean power allows us to directly employ over a thousand people and indirectly bring income to thousands of other contractors, partners and servicers,” says Ing. Luis Alberto Pantín González, general manager at SPBE. “With so many people depending on us, we take any outage in production and operations very seriously.”

Clean Energy, Dirty Conveyors

Operating a total of 30 conveyors, the main problem of fugitive dust and spillage were experienced at three critical transfer points leading from the mulcher to the incinerator. Two run horizontally from towers high above the ground and one is inverted at a 45-degree

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

26 BIOMASS MAGAZINE | ISSUE 3, 2023

San Pedro BioEnergy has several interconnected conveyor systems that make up its intricate operation. IMAGE: MARTIN ENGINEERING

angle. Transporting mulch, the 72-inch-wide belts ran for 50 feet, then dropped the material 20-30 feet through unobstructed chutes directly onto impact idlers.

Processed to between 1-100 mm (.04-4 in.) in size, the mulch became lighter and more prone to emit dust. The long, unobstructed drops through the chutes caused impacts that created turbulent air within loading zones that weren’t equipped to control airflow. One of the transfer points was only enclosed by a grated structure, offering no dust or spillage control at all. Two of the loading zones had enclosures with skirting, but the impact idlers created large gaps where high volumes of fugitive dust and fines escaped. “The dust was dense, and the spillage reached waist height in a matter of hours,” says Alfonso Granata Jr. of PeGran SA. “When we were invited to examine the issue, we pointed out some of the causes and offered solutions.”

In its report, the inspection team identified several system design issues that contributed to the dust and spillage issues. One was that the inlet chutes were dropping material behind the loading zones onto the transitions from the tail pulley to the first troughed idler instead of directly onto the impact idlers. This caused the belts to slump, opening large gaps under the skirting where material could escape. Without support, this also caused uncentered loading. Spillage collected underneath the loading zones, piled up past the return belt lines and fouled the tail pullies. Another problem was induced and displaced air in the loading zones. Because of the unobstructed drop height, the impact created “splash” that resulted in dust and spillage being forcefully exhausted.

Other issues included the lack of proper equipment to adequately control and contain material. For example, there were no wear liners on the enclosures, which left the polyurethane skirting to perform double duty, containing material and taking the brunt of the transfer force. This resulted in premature failure of the skirting, contributing to fugitive dust and spillage. Missing consistently across the three transition points were stilling zones (also known as settling zones) and dust collectors to mitigate air flow and control emissions. After the loading zones, dust that did not escape the chute accumulated on the inside walls of enclosures rather than settling back onto the cargo flow, posing a risk of fire or explosion from accidental sparking.

Fugitive material was not just a problem at the transfer points, it was also an issue throughout the transit and discharge of cargo.

Uneven loading made the cargo settle off center, causing the belts to drift. Once the belts reached the discharge zone, the existing belt cleaners did not adequately clear the material from the belts’ surface, allowing fines to cling to the belt and carry back, piling spillage along the belt path. Since these conveyors were located above other parts of the plant, the carryback would drop a long distance, allowing it to spread and collect on all surfaces throughout the plant. This required workers to regularly be taken from other tasks and assigned to clean the spillage. “Every other day, we assigned a four-person crew to the job of cleaning up around these areas, which took an entire shift,” Ing. Pantín says. “This raised the cost of labor, but without it, material would pile up, encapsulate the conveyor and make things worse. We were also struggling with dust fouling the bearings of idlers, pulleys and machinery, causing them to fail prematurely. Every time this happened, we had to shut down for maintenance, which affected power production.”

Modern Transfer Point Design

Reimagining the system meant rethinking every aspect from tail to head pulley. This began with doubling the length of the enclosures from 20 feet to 40 feet, and raising the height of each one a few centimeters. The chute enclosure is modular so that it can be modified in the future. The extra length and height allowed for more airflow control, dust control equipment, an external wear liner and room for the active dust to settle back into the cargo flow.

Starting at the loading zones, the existing impact idlers created a bumpy belt path and gaps between the belt and skirting, allowing dust and fines to escape. Those were replaced by impact cradles and slider support cradles with smooth static bars down the length of the enclosure. The technicians installed 60-inch-wide impact cradles with medium-duty impact absorbing bars. The bars are reinforced by a steel support structure with a base of 50-durometer styrene-butadiene (SBR) rubber and a top layer of slick, ultra high molecular weight (UHMW) plastic. The benefit of bars over idlers is they provide an even belt plane for the skirting to properly seal the enclosure with no gaps. The placement of the units promoted centered loading to mitigate belt drift and less bumping through the settling zones to reduce dust production.

BIOMASSMAGAZINE.COM 27

A grated enclosure did not adequately contain spillage from pouring out of the transfer point. IMAGE: MARTIN ENGINEERING

DUST ¦