Canada Moves to Bolster Biofuels

Page 24

PLUS Policy Turmoil Grips

US Soybean, Biodiesel Producers

Page 12

Charting a Cleaner Course at Sea

Page 18

Custom-designed fall protection and access solutions help get things rolling faster, make everything safer, and even boost profits by speeding up how quickly vehicles move through loading spots.

Contact us to streamline your loading process with a safer, faster setup—built just for your site.

Explore examples of our work at www.CarbisSolutions.com, or give us a call at 1.843.669.6668 to chat about your goals.

The finalization of proposed U.S. policies is critical to relieve growers and producers navigating one of their most challenging years yet.

BY SUSANNE RETKA SCHILL

As global and domestic policies take shape, a route to maritime decarbonization is in the making, and biodiesel and renewable diesel are well-suited to help propel the transition. BY

CAITLIN SCHERESKY

Biodiesel Magazine examines the drivers behind Canada’s new Biofuels Production Incentive and evaluates its potential impacts on farmers and biofuel producers.

BY KATIE SCHROEDER

For biodiesel producers eyeing a potential shift to sustainable aviation fuel, now may be the right time to move.

LUIS HOFFMAN

Joe Bryan

Tom Bryan

John Nelson

Anna Simet

Erin Voegele

Katie Schroeder

Chip Shereck

Bob Brown

Marla DeFoe

Brandon McGarry

CEO jbryan@bbiinternational.com

President tbryan@bbiinternational.com

Chief Operating Officer jnelson@bbiinternational.com

Director of Content & Senior Editor asimet@bbiinternational.com

Senior News Editor evoegele@bbiinternational.com

Associate Editor katie.schroeder@bbiinternational.com

Senior Account Manager cshereck@bbiinternational.com

Account Manager bbrown@bbiinternational.com

Senior Marketing & Advertising Manager mdefoe@bbiinternational.com

Customer Service Coordinator brandon.mcgarry@bbiinternational.com

Jaci Satterlund

Raquel Boushee

Vice President, Production & Design jsatterlund@bbiinternational.com

Senior Graphic Designer rboushee@bbiinternational.com

Subscriptions Subscriptions to Biodiesel Magazine are free of charge to everyone with the exception of a shipping and handling charge for any country outside the United States. To subscribe, visit www.biodieselmagazine.com or send a mailing address and payment (checks made out to BBI International) to: Biodiesel Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Reprints and Back Issues Select back issues are available for $3.95 each, plus shipping. Article reprints are available for a fee. For more information, contact us at 701-746-8385 or service@bbiinternational.com. Advertising Biodiesel Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Biodiesel Magazine advertising opportunities, please contact us at 701-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Please include a name, address and phone number. Letters may be edited for clarity and/or space. Send to Biodiesel Magazine Letters, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203 or email asimet@bbiinternational.com.

St. Louis, MO (866) 746-8385 | www.fuelethanolworkshop.com

Now in its 42nd year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine—that maintains a strong focus on commercial-scale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

St. Louis, MO (866) 746-8385 | www.sustainablefuelssummit.com

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cuttingedge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this worldclass event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomassbased diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.

St. Louis, MO (866) 746-8385 | www.carboncapturestoragesummit.com

Capturing and storing carbon dioxide in underground wells has the potential to become the most consequential technological deployment in the history of the broader biofuels industry. Deploying effective carbon capture and storage at biofuels plants will cement ethanol and biodiesel as the lowest carbon liquid fuels commercially available in the marketplace. The Carbon Capture & Storage Summit will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible and the financial and marketplace impacts to participating producers.

As we move further into the decade, the biomass-based diesel industry finds itself in a defining moment, caught between unprecedented momentum for decarbonization, and perhaps equally unprecedented complexity largely driven by policy uncertainty. On one hand, demand for low-carbon fuels is climbing steadily as states, provinces, entire countries and a vast array of energy consumers adopt increasingly ambitious decarbonization policies. On the other, producers are navigating pressure points that test the resilience and ingenuity this industry is known for: uncertain federal policy signals, shifting feedstock availability, volatile RIN and LCFS credit markets, and mounting interindustry competition between biodiesel and (what has been) a rapidly expanding renewable diesel sector. If there is a unifying thread across this issue’s three feature articles, it is that policy remains both the greatest catalyst and the greatest complication in the push toward low-carbon fuels.

In our cover story, “Leveling the Playing Field,” Associate Editor Katie Schroeder examines the motivations and mechanics behind Canada’s new Biofuels Production Incentive and the circumstances that led to its creation. Canadian biodiesel and renewable diesel producers have long been at a competitive disadvantage compared to U.S. producers benefiting from federal and state incentives. As Jeremy Baines of Tidewater Renewables explains, U.S. fuels entering Canada have been able to capture U.S. production subsidies before earning compliance credits under Canadian programs. The BPI, paired with forthcoming amendments to the Clean Fuel Regulations, aims to provide short-term relief to Canadian biofuel producers a more durable framework takes shape. Meanwhile, Canada’s oilseed sector—especially canola—is navigating market shocks from China, tariffs and shifting demand, underscoring the need for stable domestic offtake.

The U.S. soybean supply chain is experiencing its own turbulence. In “The State of Soy,” contributing writer Susanne Retka Schill outlines how proposed biofuel policies must be finalized to offer some relief from what many stakeholders call one of the toughest years on record. Growers and producers have been squeezed by trade tensions, volatile imports, depressed prices and a prolonged wait for clarity on 45Z. The promise of improved RVOs and long-awaited updates to 45Z is encouraging, but the lack of finalized guidance continues to strain producers—many of whom are operating well below capacity. As Joe Jobe, CEO of the Sustainable Advanced Biofuel Refiners warns, delays are pushing some independent biodiesel producers “to the brink,” with bank financing increasingly difficult to secure amid prolonged negative margins. Transitional relief could make the difference between survival and contraction in the year ahead.

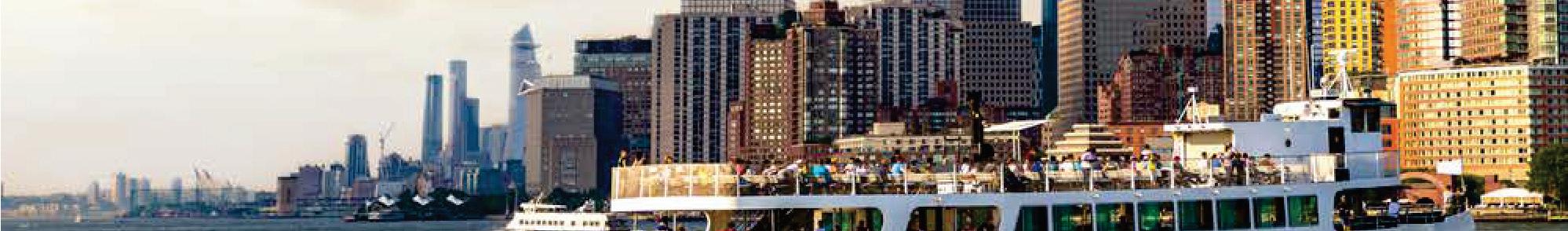

Caitlin Scheresky’s “Charting the Course” takes us offshore, where the maritime industry’s decarbonization journey is picking up speed despite global uncertainty. As the International Maritime Organization debates the adoption of its Net-Zero Framework, policy fragmentation and the postponement of key decisions has left carriers seeking clarity. Yet momentum persists. Biodiesel and renewable diesel are increasingly recognized as practical, ready-now solutions that can bridge the gap between conventional bunkers and emerging fuels like methanol, ammonia and hydrogen. In the Great Lakes region and beyond, biofuels are already proving their value as drop-in options that require no equipment overhauls or costly infrastructure shifts. Pending U.S. legislation—the Renewable Fuel for Ocean-Going Vessels Act—could open a multibillion-gallon market to domestic producers, offering vital new demand for the agricultural and biofuels sectors. The challenges are real, but so is the industry’s proven capacity to meet them head-on. As 2026 unfolds, Biodiesel Magazine will continue to follow the policies, markets and innovations shaping this rapidly evolving landscape. Thank you for reading, and for your continued commitment to an industry that moves us all forward.

Biodiesel and renewable diesel can lower greenhouse gas and particulate matter emissions today in your marine fleet’s existing fueling systems.

Bet ter. Cleaner. Now!® cle anfuels.or g

By Joe Jobe

On Feb. 29, 1968, the Beatles won the Grammy Award for album of the year with “Sgt. Pepper’s Lonely Hearts Club Band.” But something else happened that Leap Day that was an even bigger blessing to the Jobe family—my cousin Angie was born. We are 11 months apart and are still more like siblings than cousins. She likes to quip that she is just a teenager since she has technically only had 14 birthdays. The Sustainable Advanced Biofuel Refiners Coalition (SABR) just celebrated our second official birthday— and while we weren’t founded on Leap Day, we share something in common with Angie: We’re a bit older than our birthday count suggests. In reality, SABR has existed in one form or another for nearly six years.

SABR incorporated as a 501(c)(6) biodiesel trade association in September 2023 with about 20 organizational members, and now we have more than 70, including some of the most seasoned veterans in the industry. This includes Pacific Biodiesel, the first dedicated biodiesel company in the U.S., celebrating 30 years in the industry this year—a milestone I will hit in a little over a year. Other biofuel trade associations represent a broader constituency of advanced biofuels, which is fine. But SABR is a more focused group representing biodiesel stakeholders. This includes every link in the biodiesel value chain: soybean growers and processors, biodiesel producers, glycerin refiners, input suppliers, distributors and retailers. Our truck stop members buy and sell about half of all the biodiesel sold in the U.S.

SABR encourages growth in all biofuels, but we support policies that cause the new fuels, like renewable diesel (RD) and sustainable aviation fuel (SAF), to grow the RFS rather than displace existing biofuels in the program. And SABR supports all feedstocks, but we are unapologetically pro–soybean farmer— the folks who invested their time, talent and treasure to build the biodiesel industry in the first place. Our narrow mission is to pursue corrections to policies that improperly disadvantage biodiesel as a fuel and soy as a feedstock. We seek to level the playing field for biodiesel and soy that has been improperly tilted by flawed policies that are neither feedstock- nor technology-neutral.

SABR has its origins in 2019 when many in the industry and NGOs began lauding the California LCFS as the template for state carbon policy. On behalf of a group of biodiesel clients, I wrote a white paper in an attempt to persuade our peers in the industry that this was a flawed approach. California policy is antiagriculture, with multiple layers of “guardrails” to penalize crop-based feedstocks. It also contains flawed policies that improperly advantage renewable diesel over biodiesel. Biodiesel is also an oxygenated fuel, which makes it combust more efficiently, giving it a better health and emissions profile. Biodiesel further exhibits premium diesel characteristics that provide performance, safety and maintenance benefits. These issues are detailed in the white paper titled “Renewable Diesel and California LCFS Impacts to Soybean Industry,” which is available at sabrcoalition.org under the news tab.

Because the California LCFS falls under the umbrella of the RFS, California policy does not generate any additional demand over what would otherwise be generated by the RFS. It simply dictates where the volumes are consumed and under what policy conditions—favoring renewable diesel from non-soy feedstocks. In 2019, there were approximately 500 million gallons per year of biomass-based diesel sold in California. The white paper predicted that this volume would increase at an accelerating rate and result in a cascade of petroleum refinery conversion projects to renewable diesel, and that this phenomenon would have negative impacts on soy biodiesel in other parts of the country by non-soy renewable diesel in California. That is exactly what happened. Biomass-based diesel in California is now 2 billion to 2.5 billion gallons per year, and very little of it is biodiesel or soybased. That amounts to roughly half of the RFS. And that portion continues to grow at an accelerated rate as the three other western-tier states come online that have adopted California-style LCFS.

SABR spent a good deal of time in 2024 trying to persuade groups that without one more extension of the biodiesel blenders tax credit in order to buy time to fix the new and very flawed 45Z credit, and get a proposed and final rule in place, 2025 would be

an extremely difficult year. Some groups argued that an extension of the blenders credit was not needed because we had 45Z in place and that it was operative, pointing to a Jan. 10, 2025, IRS bulletin. But that was not a final rule—it wasn’t even a proposed rule. Rather, it was a “notice of intent to propose a rule.” Indeed, we are now in December and 2025 volumes have been about half of the previous year’s, back to 2011 rates. The policy uncertainty was in triplicate: tepid RVOs, the lapse of the biodiesel blenders tax credit and the lack of implementing regulations for 45Z. In 2025, some companies went under; others shut down or ran at a fraction of their capacity at a loss. The economic harm has been devastating.

Despite these extreme difficulties, SABR stayed busy and the industry saw some important advocacy wins. There were significant shared victories among all of the biofuel groups working on them, including the dropping of ILUC penalties from 45Z and robust proposed RVOs for 2026 and 2027. There were several key victories in which SABR played a leading role—often working alongside a handful of close partners—to help push important provisions across the finish line. These included securing SAF parity in 45Z, achieving partial transition relief through the extension of the small agri-biodiesel credit—which doubled its value and made it transferable—and advancing a proposal to correct inflated equivalence values for RD, SAF and naphtha in the EPA’s proposed rule.

'SABR supports all feedstocks, but we are unapologetically pro–soybean farmer—the folks who invested their time, talent and treasure to build the biodiesel industry in the first place.'

SABR also collaborated with soybean farmer allies in supporting the half RIN on imported feedstocks, adding an important voice to a unified effort.

Along with flawed California policy, inflated equivalence values for RD, SAF and naphtha have been the primary cause of the displacement of biodiesel by RD and of soy by non-ag feedstocks. The EPA acknowledged in Set 1 that it did not take into account in its EV formula the nonrenewable hydrogen for those fuels. SABR supported the agency’s proposal to fix it, but the EPA punted. In SABR’s resulting lawsuit, SABR got a concession agreement from the EPA that they would readdress it in the 2026 RVO rulemaking, which they did. To illustrate the importance of this issue, at today’s average D4 RIN prices of $1.50, RD is receiving a 15- to 30-centper-gallon improper advantage over biodiesel. When D4 prices top $2 per RIN, as we expect them to in 2026, the windfall grows to 20 to 40 cents per gallon.

With these advocacy victories taking effect in 2026, including a 67% jump in RVOs and expected implementing regs for 45Z, there are welcome signals for a much-needed market recovery in the coming year. It’s no Grammy Award, but unlike my 14-year-old, 57-year-old cousin Angie, SABR and the biodiesel industry will get by with a little help from our friends—and we certainly won’t be waiting for the next Leap Year to push forward toward the prosperous times we need.

Author: Joe Jobe CEO, Sustainable Advanced Biofuel Refiners joe@rockwell.us

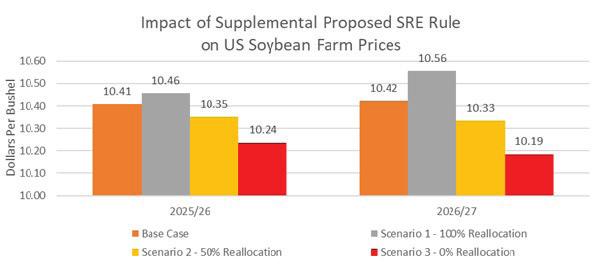

Clean Fuels: Farmers Risk Losing $7.5 Billion if RFS SREs are not Reallocated

Clean Fuels Alliance America shared with U.S. EPA Administrator Lee Zeldin projections of the economic impact for U.S. soybean farmers and processors of EPA’s proposed supplemental “SRE reallocation volume” to the 2026 and 2027 RFS volumes. EPA is co-proposing to either fully (100%) or partially (50%) account for the 2023-25 small refinery exemptions granted this year by adding a supplemental volume in 2026 and 2027. The agency is also taking comment on other volumes, including 0%.

“U.S. soybean farmers and processors could lose between $3.2 billion and $7.5 billion in crop value over the next two years if EPA does not completely reallocate recently exempted RFS volumes,” Clean Fuels wrote in a letter to Zeldin. “With increased farm productivity, U.S. soybean growers are right now harvesting a projected 4.3 billion bushels of soybeans for the season worth $43 billion. And with more than $6 billion of investment, U.S. soybean processors are expected to crush a record 2.5 billion of those bushels next year. Facing retaliatory trade measures from China and growing global competition from countries like Argentina and Brazil, America’s farmers cannot afford to lose the value that U.S. biomass-based diesel brings.”

Clean Fuels engaged World Agricultural Economic and Environmental Services to provide EPA economic analysis of the co-proposed 100% and 50% reallocation supplemental volumes as well as a scenario with 0% reallocation. WAEES’ analysis indicates that if EPA adopts the 50% reallocation proposal rather than complete (100%) reallocation, the results over the 2026-27 timeframe will include:

• 490 million gallons in lost biomass-based diesel production.

• $1.4 billion in lost soybean farm revenue.

• $1.8 billion drop in the value of soybean products to soybean crushers.

If EPA fails to reallocate any of the exempted volumes, WAEES’ analysis shows the results over the 2026-27 timeframe will be considerably worse:

• 1 billion gallons in lost biomass-based diesel production.

• $2.6 billion in lost soybean farm revenue.

• $4.9 billion drop in the value of soybean products to soybean crushers.

Kurt Kovarik, Clean Fuels Vice President of Federal Affairs, stated, “Clean Fuels urges EPA to quickly finalize the robust, timely RFS volumes it proposed in June and ensure they are not eroded by small refinery exemptions. U.S. biodiesel and renewable diesel production supports 10% of the value of every bushel of soybeans grown here. Supporting continued growth of U.S. biomass-based diesel is crucial right now to support American farmers and the agricultural economy.”

FutureFuel Corp. on Nov. 12 confirmed plans to restart its 59 MMgy biodiesel plant in Batesville, Arkansas, during the fourth quarter. The company has begun replenishing inventories of biodiesel raw materials in preparation for a restart late this year.

FutureFuel cited a clearer understanding of regulatory support for biodiesel under the 45Z clean fuel production tax credit as one driver of its decision to restart the plant. In addition, the company said it has observed some movement in the biodiesel input market. A strong soybean harvest coupled with weak demand for soybeans is expected to further decrease input costs for biodiesel, according to FutureFuel.

In June, the company announced a decision to temporarily idle the Batesville plant, citing a lack of clarity regarding the 45Z clean fuels production credit and market factors. In mid-October, FutureFuel announced plans to restart the facility before the end of the year, citing improving economics and regulatory clarity.

The attorneys general of Iowa, Nebraska and South Dakota have asked leadership at four federal agencies to investigate small refiners that may be manipulating the Renewable Fuel Standard small refinery exemption (SRE) program to achieve a financial windfall.

On Oct. 29, Iowa Attorney General Breena Bird, Nebraska Attorney General Mike Hilgers and South Dakota Attorney General Marty Jackley sent a letter to U.S. EPA Administrator Lee Zeldin, U.S. Attorney General Pamela Bondi, U.S. Energy Secretary Christopher Wright and U.S. Securities and Exchange Commission Chairman Paul Atkins encouraging them to investigate “seemingly irreconcilable statements” made by certain SRE applicants to environmental regulators, financial regulators and investors.

The SRE program allows small refineries, defined as those that process no more than 75,000 barrels per day of crude oil, to apply for a waiver of RFS renewable volume obligations (RVOs) for a given compliance year. To be approved, a small refinery must demonstrate “disproportionate economic hardship” in satisfying RVO obligations. According to the attorneys general, both requirements may have been manipulated.

The attorneys general point out that some refineries are reducing their production to satisfy the 75,000-barrel-per-day limitation. They argue that several refineries receiving SREs are intentionally lowering production for the specific purpose of maintaining SRE eligibility.

The attorneys general also cite misleading representations made by some small refineries claiming disproportionate economic harm. They note the EPA’s recent approval of 140 full and partial SRE petitions for 2016-24 while several of those same refiners reported strong financial performance to investors, stating, “These statements made in public to financial regulators and investors appear to be inconsistent with contemporaneous statements of disproportionate hardship to environmental regulators.”

The Sustainable Advanced Biofuel Refiners Coalition is pleased to welcome three new leaders to the board of directors: Ron Kindred, Kerry Fogarty and Chad Gawryliuk. The trio will join nine other directors in representing SABR members, which include feedstock growers, biodiesel producers, distributors, retailers and consumers who advocate for policy that promotes the use of sustainable feedstocks and levels the playing field for all fuels.

“I’m very excited to welcome Ron, Kerry and Chad to the SABR board of directors,” said Joe Jobe, CEO of SABR. “From the feedstock industry to the crush sector and biodiesel, all three are leaders in their own field and will provide a unique perspective and great leadership to our board.”

Kindred is a director and past chairman of the Illinois Soybean Association and has served with the organization for nearly two decades. In addition, he represents Illinois on the American Soybean Association. He raises corn and soybeans on his farm in central Illinois alongside his wife and son.

Fogarty is a quality control manager with Incobrasa Industries, a leading soybean processing and biodiesel manufacturing facility out of Illinois. Fogarty joined Incobrasa in 1997 and has been an integral part of the biodiesel operation. He also sits on the board of directors for the National Oilseed Processors Association.

Based out of the Houston, Texas, area, Gawryliuk is the head of biodiesel at Pilot Company, where he’s been employed since 2019. In his role, Gawryliuk ensures reliable access to biofuels and renewables, supports supply chain optimization and helps his organization navigate the evolving regulatory landscape tied to fuel standards and credits. Prior to Pilot Company, he traded biofuels for AOT Energy Americas in Calgary and Houston.

The Texas Commission on Environmental Quality on Oct. 23 announced the availability of $12 million to support development of alternative fueling facilities supplying compressed natural gas, liquefied natural gas, hydrogen, biodiesel blends of B20 or greater, propane, electricity or methanol blends of 85% or greater.

Funding is offered under the Texas Emissions Reduction Plan’s Alternative Fueling Facilities Program and aims to encourage the construction and reconstruction of eligible fueling facilities within the 88 counties that make up the Clean Transportation Zone. The program offers grants of up to $400,000 for CNG or LNG projects. Grants of up to $600,000 are available for combined CNG and LNG projects. Up to $600,000 or 50% of eligible costs, whichever is less, are available for other fuels.

Calumet Inc. on Nov. 7 announced the MaxSAF expansion at its Montana Renewables facility is progressing on schedule. Renewable fuels production during the third quarter was affected by a sustainable aviation fuel expansion test run.

CEO Todd Borgmann said the MaxSAF expansion remains on track for completion during the first half of 2026. He said the company’s SAF marketing program is ahead of schedule, with about 100 million gallons of SAF fully contracted or in final review.

During the third quarter, Montana Renewables completed a test run to confirm the facility’s ability to generate 120 MMgy to 150 MMgy of SAF. To complete the test, the company slowed production at the plant for approximately one week, according to Borgmann. The test was successful and confirmed the plant’s ability to meet its SAF production target. Data generated as part of the test is being used in final detailed engineering and optimization of the MaxSAF project.

CoBank on Oct. 15 released its latest quarterly insights report, predicting the U.S. EPA will likely delay final action on its proposed Renewable Fuel Standard renewable volume obligations (RVOs) and small refinery exemption (SRE) reallocation proposals until early 2026.

When the EPA proposed its 2026 and 2027 RVOs earlier this year, it was anticipated the agency would release a final rule by the Nov. 1 statutory deadline. However, because the comment period on the delayed SRE reallocation proposal was open through Oct. 31, CoBank said “the final RVO decision will likely be postponed until early 2026.”

According to the report, the renewable diesel supply currently remains tight. CoBank cites industry sources as estimating production capacity utilization was near 60% at the end of the third quarter. With the policy shift from the Blenders Tax Credit to the 45Z Clean Fuel Production Credit, domestic margins remain compressed for renewable diesel and biodiesel producers, with CoBank predicting margins will remain in the red in the near term.

The finalization of proposed U.S. policies is critical to relieve growers and producers navigating one of their most challenging years yet.

BY SUSANNE RETKA SCHILL

The soybean supply chain looks to proposed biofuel polices for hope in the midst of what’s been described as one of the most challenging years ever. For biofuel producers, the uncertainty around final rules and another year of underwhelming volume targets under the Renewable Fuel Standard brought many to the brink. For soybean growers, the year’s challenge came from uncertainty around tariffs and the trade war with China, layered on top of sinking prices and increasing input costs.

Farmers and biofuel producers are caught in a bigger chess game, says Grant Kimberly. “The tariffs are all about big picture things, and not a lot to do with agriculture, but when countries want to retaliate, we’re the ones catching the shrapnel. A lot of trade deals are about rare earth metals and aluminum, selling airplanes, restoring domestic manufacturing. We’re hopeful some increased sales for agriculture products

too,” he says. Kimberly experiences the challenges from multiple directions in his roles as executive director of the Iowa Biodiesel Board, director of market development for the Iowa Soybean Association and as a farmer himself.

The threat of a trade war with China meant growers shifted acres into corn last spring, Kimberly says, which should have strengthened markets some if it hadn’t been for the uncertainties. “Markets hate uncertainty,” Kimberly says, noting that the last trade war spanned two years.

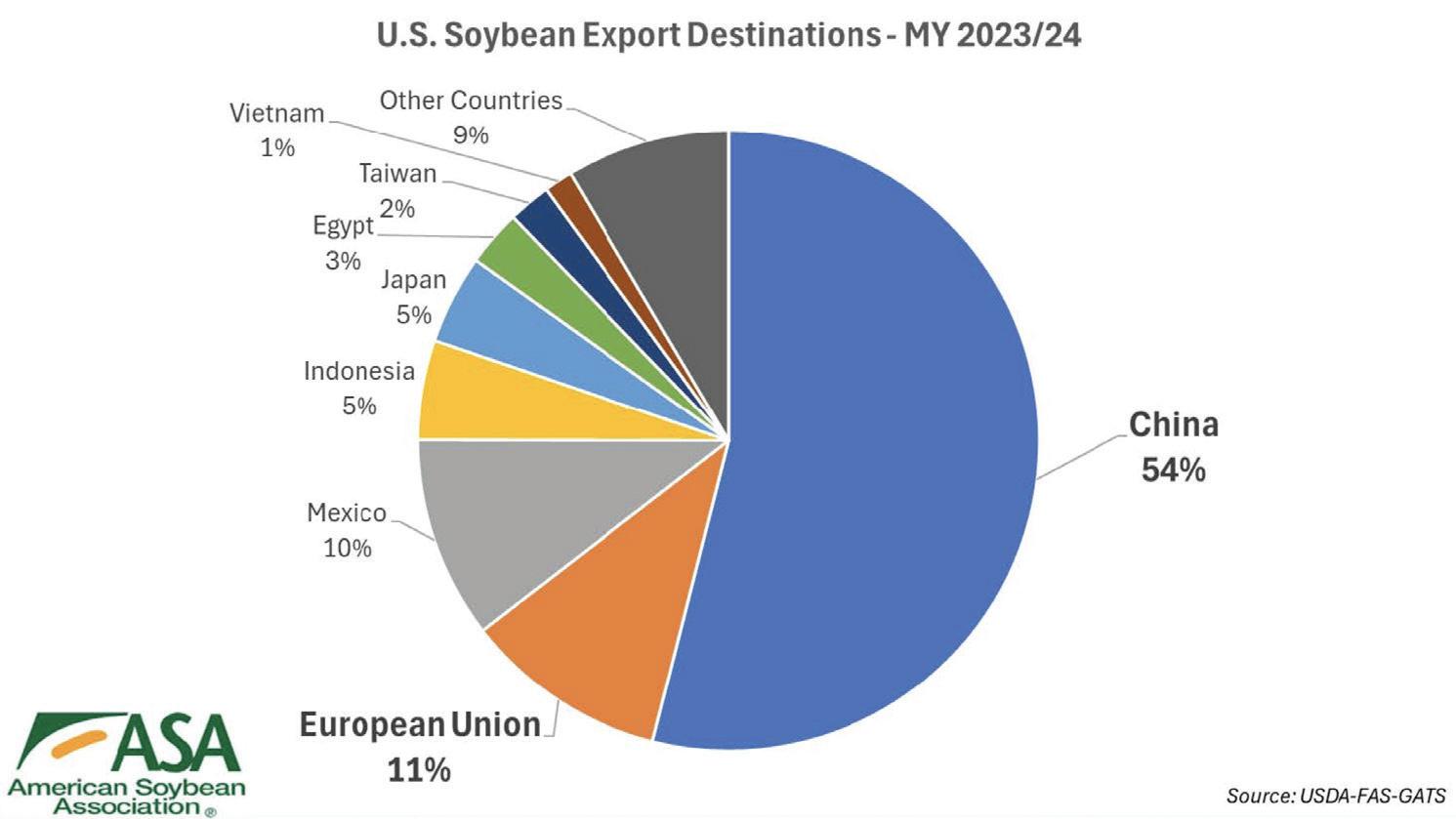

Alexa Combelic, executive director of government affairs for the American Soybean Association, points outs that China had already purchased enough soybeans by late October to get them though the end of the calendar year. “We generally export soybeans to China from the beginning of our harvest season—late August and September through

about the end of January early February,” she says. “That is the time when Brazil's harvest comes online, and when China makes a natural shift from U.S. purchases to Brazilian purchases.”

The U.S. and China reached an agreement in late October that should help the trade situation for soybeans, with China pledging to buy 12 million tons through January, followed by an annual 25 million tons. “While China remained absent from major U.S. markets, global demand painted a healthy picture,” Kimberly adds, noting that in late October, a weekly export report showed soybean movement up 46% compared to last year, excluding China.

China’s dominance as a soybean market, however, is tough to match. “China buys about 60% of the globally available soybeans, after taking out domestic use,” Kimberly says. Last year, China bought between 24 million and 25 million metric tons (mmt) from the U.S. out of

purchases of around 100 mmt to 110 mmt. The next closest buyers of soybeans are the EU and Mexico at roughly 4 to 5 million metric tons, Kimberly notes.

Brazil soybean production poses the biggest long-term challenge for U.S. soybean growers, having exceeded U.S. production in 2018, Kimberly adds. “Brazil continues to grow year after year in soybean production, almost without regard to global price.” Brazil is estimated to have 60 million to 70 million acres that could be brought into production—the equivalent of the land area in the middle U.S., he says.

The biggest impact of the trade war was on farm gate prices, Kimberly says. “Some people say soybean prices aren’t much different this year than last year, so is there really an impact from the trade war? And

the answer is yes, and you see it primarily in the cash price and basis.

“Basis is a regional thing,” Kimberly continues. Basis is the difference between the futures and the price offered by local buyers, reflecting shipping and local demand. “Historically, it could be anywhere from 20 to 50 cents a bushel, but now it’s almost double that in places. And, if you go to North Dakota, they’ve experienced basis levels of $1.65 to $1.75 under the futures market, because they are very export dependent.”

North Dakota had two new crushers come online this year, bringing hope of improved basis, something soybean growers across the country are looking for, says Combelic. “Even without the trade concerns we’re facing now, having additional domestic soybean oil processing for biofuel product means better basis for farmers, because they have a domestic market. It means there’s a lower cost to move that soybean to its market. Across the board, we see an expansion of biobased diesel production in the United States as a huge opportunity for soybean farmers.”

Crushers are operating below capacity right now, she adds, because their expansion plans anticipated growth that didn’t happen when the U.S. EPA underestimated the capacity expansion that actually occurred, setting the 2023-25 renewable volume obligation targets too low.

Midsummer, EPA announced proposed RVOs that promise to better align with capacity. Layered on top of changes to the 45Z Clean Fuel Production Credit in the One Big Beautiful Bill, it greatly improved the soybean supply chain outlook, although the uncertainties surrounding the final rules meant few benefitted from that promise last year.

The proposed RVO was boosted to around 5.61 billion gallons, compared to a little over 3 billion gallons in 2025’s RVO and 2024 domestic consumption of 5.1 billion gallons. The proposed RVO was more than the industry had been lobbying for, says Donnell Rehagen, CEO of the Clean Fuels Alliance America. EPA also proposed a domestic first preference by giving half RINs, renew

able identification numbers, to biofuel produced in the U.S. from imported feedstock, which means the final RVO number would be dependent upon actual imports.

The proposed half-RIN would harmonize the Renewable Fuel Standard with the measure included in Congress’ One Big Beautiful Bill to amend the 45Z Clean Fuel Production Tax Credit to disqualify imported fuels and feedstocks, while allowing Mexican and Canadian participation.

In addition to the domestic fuel and feedstock preference, the One Big Beautiful Bill removed indirect land use change from the calculations to be used for 45Z, which would be a big win for the soybean industry. “Removing ILUC will double the tax credit

value per gallon for soy-based biofuels,” says ASA’s Combelic. “For soy-based renewable diesel, it will double that tax credit from about 20 cents per gallon to about 40 cents per gallon on average, and for soybased biodiesel, it will double that credit from 30 cents to 60 cents per gallon on average. Removing what we saw as a tax on agricultural feed stocks will really improve the value for those fuel producers and provide some encouragement for them to source domestic agricultural feedstocks for their production.”

States goes to California,” Rehagen says. “For a biodiesel or renewable diesel producer, there’s still a significant economic advantage in the value of the LCFS credit if you use used cooking oil or animal fat in lieu of soy.”

However, while removing ILUC from the equation will help soybean in 45Z, it won’t impact the California Low Carbon Fuel Standard. “The reason that’s important is because over half of the fuel produced in the United

A year ago, the flood of UCO imports from China was the big story. With the proposed half RIN and imported feedstocks not qualifying for 45Z, China UCO imports “started to pull back,” says Brian Murphy, general manager of Mahoney Preferred Oil. “There still is a lot of Chinese UCO that gets imported to the United States, but the fuel doesn't get sold domestically, it gets re-exported mostly to the European Union. So, it is taking up space in the RD platform as far as run rates.”

Europe is the destination for RD from U.S. UCO as well, Murphy adds. “Mahoney is now ISCC certified [a required sustainability certification for the EU market]. And because margins for RD and biodiesel producers are not good for making domestic fuel and selling it domestically with a RIN, a lot of it is going to Europe.”

“The cloud hanging over us is trade talks with China and the finalized RVO,” Murphy adds. “So, if we can get that done by the end of January, I think the rest of the year and going forward will be really good for the industry, get margins back for the biodiesel makers and the RD guys, and be good for the farmers.”

Enhance your fuel’s performance with BF320— an optimized antiox idant blend for biodiesel. Kemin’s Customer Laboratory Services ca n evaluate your biodiesel’s oxidative stability and recommend the optimal BF320 application for your needs.

•Tailored antioxidant st rategies

•Oxidative st abilit y evaluation

•Proven product performance

With Kemin Bio Solutions, you get more than products — you gain a pa rtner dedicated to safeguarding your plant’s performance.

While there’s some indication the RVO will be finalized early in the year, guidance for 45Z isn’t expected for some time. “There's essentially no guidance,” says Joe Jobe, CEO of Sustainable Advanced Biofuel Refiners, which is focused on biodiesel. “They put out a notice of intent last January to issue a proposed rule, but they haven't issued a proposed rule.” That lack of implementing regulations has nearly shuttered the industry, Jobe tells Biodiesel Magazine. “Folks are running at maybe half or less of their production capacity. They're shutting on and off, mostly just to keep their

pipes warm and a few of their major customers happy, and most importantly, to keep their labor force.” The changes to 45Z in the One Big Beautiful Bill essentially started the clock over on getting a proposed rule, he adds. What is known, however, is that the 45Z program will be way more complicated than the blenders tax credit it replaces, which provided a $1 tax credit for each gallon. For 45Z, a producer will have to show a plant-specific, feedstock-specific carbon intensity. “There’s a lot more stuff they have to gather. It’s a huge burden,” Kimberly says. “They’ve got to hire auditors, third-party people, to verify

this information. This adds more cost.” Only a few credits are trading now, he adds, but they require insurance coverage because the rules may change—another cost. “The prevailing wage requirement is also a difficult thing for a lot of rural biodiesel producers.”

All those things factor in and hurt farmers and biodiesel producers, Kimberly continues. “The independent biodiesel producers are in big, big trouble. If this delays much longer, I’m afraid we’ll have less biodiesel producers in the next year or two. Banks are starting to cut some of these companies off, I’ve heard. Because there’s so much uncertainty and they’ve been running at a negative margin for so long, they’re running out of cash. That will impact demand for farmers. It’s all related.”

SABR is advocating for transitional relief, Jobe says. “If we were to extend the 40A blenders tax credit for even a short term period of six months or until 45Z has implementing regulations in place, it would turn the light switch back on immediately. So many elements throughout the value chain and so many industries are taking an economic hit because of these delays.”

As global and domestic policies take shape, a clearer route to maritime decarbonization is emerging, and biodiesel and renewable diesel are well-suited to help propel the transition.

BY CAITLIN SCHERESKY

In mid-October, the International Maritime Organization’s Marine Environment Protection Committee convened for its second extraordinary session to discuss the potential adoption of the IMO Net-Zero Framework.

With more than 80% of global trade and 40% of U.S. imports and exports moving through the maritime sector, it’s no surprise that decarbonization efforts are increasingly focused on ships operating in both brown waters—navigable inland or coastal routes— and blue, or international deep-sea, waters. And for good reason, according to Ed Carr, partner at Energy & Environmental Research Associates. “If ships were a country, they would be somewhere around Mexico or Japan in terms of their greenhouse gas emissions,” Carr notes. “It’s approximately 2.9 or 3 percent of global emissions, but a small percentage of a very large number is still a pretty big number.

“The marine sector is not one sector, [and] not all ships are created equal,” Carr continues. “Within shipping, you’ve got dozens of different sectors that operate differently because of their needs. The IMO estimates have [the maritime industry’s fuel demand] at 300 to

330 million metric tons (mmt) of residual or HFO-equivalent fuels per year.”

Pete Probst, president and cofounder of Indigenous Energy, notes the steep environmental cost of not decarbonizing the maritime sector. “When you look at CO2 on a life-cycle basis, for every five years that we wait to reduce the carbon emissions, there’s an additional 13 times more carbon carbon accumulated, which we then have to get rid of.”

The benefits of decarbonizing outweigh the upfront costs. That does not mean, however, that the costs are easy to balance.

While there is no shortage of alternative fuels being used to decarbonize the maritime sector—methanol, ammonia, hydrogen, LNG and biofuels—the move to net-zero emissions is easier said than done. “There are currently more vessels that can fire using methanol than ammonia,” Carr explains. “But the industry is investing in vessels that currently use conventional fuels, but are designed to be able to use alternative fuels with some retrofits. In this category, there are currently more ammonia-ready vessels than meth-

anol-ready vessels, but the orderbook shows methanol leading the charge. The problem is that most are not actually firing on methanol or ammonia right now. Most of the methanol-capable ones may be using some methanol in their firing, but many of them will be predominantly on conventional fuels.

“The energy density of methanol and ammonia is less than half the energy density, both volumetrically and on a mass basis, of conventional bunkers,” Carr continues. “This means that to go the same distance, you need to carry twice as much [fuel], or you can only go half as far,” he continues. “In those situations, you either need to give up cargo space on your vessel in order to carry more fuel, or you need to retool the way that your operations are working and think about refueling more frequently.” The largest container ships can store up to 4.5 million gallons of fuel onboard; giving up cargo space for more fuel or increasing stops could lead to further hurdles.

Hanna Campbell, market development director at the Michigan Soybean Committee and managing director for the Michigan Advanced Biofuels Coalition, sees a unique challenge in the maritime industry. “The [maritime] fueling system is a little bit different as to how vessels get fuel,” she says. “There aren’t as many players in the

game; it's not like an over-the-road truck stopping at any truck stop or gas station along the way. Fueling on the Great Lakes is more of a closed system. It’s easier to speak with the different players because there aren’t as many.”

Regardless of the challenges involved in decarbonizing the industry, Campbell, Probst and Carr all agree on what must come next. “If any of this is going to decarbonize, something’s got to fill the gap, which is where biofuels come in,” Carr says, adding that biofuels made from renewable feedstocks like soybean oil are readily available and proven solutions to decarbonize vessels today.

Probst and Campbell both note the easier transition to biodiesel compared to other alternative fuels like methanol and ammonia. “[Biodiesel] has been around for a long time,” Probst explains. “The technical specs have been ironed out, so there are no issues with running biodiesel at all different blends in any type of diesel applications, including marine vessels. You can do that with pre-existing equipment. You don’t have to change anything on the dock in terms of fueling; you don’t have to change anything, really, in the engine or on the vessels. You can use biodiesel just like you would your petroleum diesel.”

Campbell explains the push toward biodiesel in the U.S. Great Lakes maritime system has been spurred by recent domestic triggers, but our northern neighbors are well-versed. “For a lot of companies, specifically on the Canadian side, biodiesel is nothing new. For many years, they have been trialing biodiesel and testing the waters on different decarbonization options.”

Even with the consensus for biofuels, Carr raises a critical question. “All of this stuff comes with a cost premium, right? [Unless] you have a carrier who’s willing to pay that cost premium [or] you’ve got a client who’s willing to say, ‘Yeah, move my goods with lower carbon intensity,’ … why would anybody be willing to take on that investment when their competitors don’t have to?”

This imbalance in capital and other resources is where the value of the IMO lies. Number one on the IMO’s list of priorities is creating a level playing field for the maritime industry while maintaining safety and efficiency standards across the globe. For this reason, the significance of the MEPC’s work in October cannot be understated.

“Decarbonizing ships is comparatively hard to decarbonizing land-based electricity,” Carr says. “Going into [the MEPC extraor-

dinary session], a lot of countries were thinking very positively, and a lot of industry was talking very positively [because] it provided a sense of certainty that these folks would now be able to tailor and operate their businesses … within that framework.”

“Prior IMO policy required a switch to low-sulfur fuel, so the shipping industry is already looking for cleaner, available fuels,” adds Paul Winters, director of public affairs and federal communications at Clean Fuels Alliance America. This opens pathways for alternative fuels. And while each fuel has its role, biofuels—namely, biodiesel and renewable iesel (RD)—are operation-ready today.

The IMO Net-Zero Framework, which was approved by MEPC 83 held in April this year, comprised of new international regulations aligning with the IMO’s 2023 GHG Strategy, including two specific changes: a global fuel standard, and a global GHG emissions pricing mechanism. “The framework was designed not to say you must use methanol or ammonia or hydrogen or biofuels;

it was designed to say that the carbon intensity of your fuel starts here, and over time has to get lower. It didn’t put a cap on emissions in total. It just said the carbon intensity of the fuel has to come down,” Carr explains.

“Some folks did not like what was being proposed at the IMO and worked hard to oppose what was going on … Ultimately, they punted a year down the road,” he says. “And some of the arguments were legitimate. There was a big question mark about how the IMO’s financial framework fit with Europe’s financial framework. That was not cleanly addressed in the regulations that were written, and it was an issue that was picked upon by some folks … and there were some other things that were left as guidelines or other things that need to be sorted out.”

With the IMO’s Net-Zero Framework decision pushed to next October, on approval, the start date for the framework has been delayed to 2028. More concerning, the lack of set guidelines marks a time of increased uncertainty in the international sector.

This does not mean, however, that the industry has found itself stalled. In the U.S., the bipartisan Renewable Fuel for Ocean-Going Vessels Act has seen success in the Senate. Introduced to both the Senate and House by Sens. Pete Ricketts (R-NE) and Amy Klobuchar (D-MN), and Reps. Mariannette Miller-Meeks (R-IA), John Garamendi (D-CA) and six others, respectively, the legislation would revise the Renewable Fuel Standard to support farmers providing fuel to the maritime sector.

“Right now, the RFS requires biofuel producers to retire RINs from gallons of fuels used in ocean-going vessels. This includes ships operating in the Great Lakes, since they are in international waters,” Winters says. “The Renewable Fuels for Ocean-Going Vessels Act would make a simple change to allow fuel producers to keep the RINs and their value. It has bipartisan, bicameral support. It recently received a hearing in the U.S. Senate, so it can move forward toward adoption in the current Congress.”

An additional area of special interest in the IMO NetZero Mandate, Carr says, is regarding whether the application of crop-based biofuels will be allowed. The FuelEU Maritime regulation—the law of the EU maritime land as of January this year—incentivizes lower-carbon alternative fuels; but just like its sustainable aviation fuel (SAF) counterpart, ReFuelEU, FuelEU Maritime currently bars crop-based biofuels from eligibility in European markets. “[The crop-based biofuels ban] means that the U.S. markets don’t have access to European markets on that front,” Carr notes. “From a U.S. perspective, that makes a big difference in terms of what’s going out there, and it makes a big difference globally, too, in terms of how much feedstock there’s going to be.”

Until the October 2026 reconvening of the MEPC and further industry guidance, stateside movement toward renewables incentives in the maritime sector remain promising for biodiesel and RD producers. And for some, the policy changes are following behind their own initiatives. Campbell points to the Port of Detroit, which in April 2024 released its Decarbonization and Air Quality Improvement Plan to achieve net-zero GHG emissions by 2040. “[The Port of Detroit] is very committed to particulate matter emissions and things like that specifically for the benefit of the communities around the port,” she says. “That commitment helps spur on folks at the terminals and ships coming through.”

Under current RFS guidelines, Winters says, U.S. biodiesel and RD producers are discouraged from supplying to the maritime sector. “They’re missing an opportunity to serve a multibillion-gallon fuel market,” he adds. “Since biodiesel and renewable diesel production represents 10% of the value of all domestically grown soybeans, expansion of the market would directly benefit U.S. farmers and feedstock providers.”

Those benefits, Campbell notes, would include opportunities for biodiesel producers to sell more of their product locally. “There are two biodiesel producers in Michigan, and traditionally a lot of their biodiesel tends to leave the state,” she says. “The maritime market is a big opportunity to keep that circular biodiesel ecosystem here.”

Despite the delay in international guidelines, Carr says the first steps have been made. “Shipping was poised and really on the edge of the first global GHG standard, which is a big deal. It didn’t end up happening—yet. Hopefully it will, but just the fact that an industry that moves in the way that shipping does—historically having taken its time to ensure that things are safe and not going to be a hazard to operate—and was willing to engage in that, I think that says a lot about what’s happening now.”

Author: Caitlin Scheresky caitlin.scheresky@bbiinternational.com

Canada’s new Biofuels Production Incentive aims to reshape cross-border competition, offering short-term relief for domestic producers while raising new questions about market balance, trade tensions and the future of canola.

BY KATIE SCHROEDER

In the pursuit of supporting biofuels, both sides of the U.S.-Canada border have implemented incentive structures to encourage the production or use of renewable fuels over fossil fuels. However, the U.S. 45Z Clean Fuel Production Credit has proven to be a powerful driver of domestic production by granting producers monetary compensation aligned with a lower CI score. U.S. biofuel producers

responded, but with increased production came the need for somewhere to send that fuel. Less than two years before the Inflation Reduction Act’s 45Z took effect in 2025, Canada’s Clean Fuel Regulations—which incentivize the use of renewable fuels—were rolled out nationwide.

Almost simultaneously with the rollout of 45Z, trade turbulence between the U.S. and Canada began, followed by tensions with China that caused disruptions for Ca-

nadian biofuel producers, oilseed processors and farmers. Biofuel producers are encouraging the Canadian government to take a strong stance in support of the domestic industry in response to the United States’ 45Z credit. In September 2025, Canadian Prime Minister Mark Carney announced a Biofuels Production Incentive totaling $370 million over two years, designed to support the country’s biofuels industry. At the time, Biodiesel Magazine reported that the incen-

tive would be applied on a per-liter basis to producers of biodiesel and renewable diesel from January 2026 through December 2027, capped at 300 million liters per facility.

Fred Ghatala with Advanced Biofuels Canada calls the BPI a “step toward” addressing the competitive landscape that has emerged in North America. He explains that the complete renewable diesel and biodiesel supply chains—from feedstock origination to processing to end use under Canada’s federal Clean Fuel Regulations and various provincial policies—can now take place in Canada for “one of the first times in the history of the Canadian biofuel sector.” Canada has roughly 2.4 billion liters (634 million gallons) of installed renewable diesel capacity and 500 million liters of installed biodiesel capacity. Including coprocessing volumes, biodiesel and renewable diesel production can now equate to more than 10% of Canada’s diesel use.

With the introduction of the CFR and British Columbia’s Low Carbon Fuel Standard, Canada became a top destination for renewable fuels due to the monetary incentive created by compliance credit values. Canadian producers have struggled to maintain ongoing production, since U.S. producers can access production credits under 45Z, then export fuel to Canada and also receive credits under the CFR, BC LCFS, and other provincial programs with compliance credit systems.

Tidewater Renewables Ltd., Canada’s first greenfield renewable diesel facility, brought a countervailing (anti-subsidy) and anti-dumping complaint to the Canadian International Trade Tribunal regarding imported U.S. renewable diesel. The Canadian Border Services Agency’s investigation was dropped by the tribunal in early May 2025. However, concerns about an even playing field for Canada’s renewable diesel industry remain.

“Our big irritant has been the unlevel playing field with the U.S. subsidies, being able to get a production subsidy and then also attract the emissions credits on the

other side going across a free trade border,” says Jeremy Baines, president and CEO of Tidewater Renewables.

In light of Canada’s endorsement of the Belém 4X Pledge—which aims to quadruple biofuels use by 2035—the BPI aims to stabilize domestic producers while amendments are made to the CFR that provide the sector with a competitive edge and increase production. “Essentially, the BPI helps us survive so that we can thrive in the near- to medium-term to expand and increase agricultural economic resilience, domestic energy security, Canadian GDP and of course reduce GHG emissions in the process,” Ghatala says.

Accompanying the BPI, the Canadian government announced support for canola farmers through updates to the AgriMarketing Program, which promotes Canadian agri-food products, and the Advanced Payments Program, which offers low-interest cash advances of up to 50% of the ex-

pected value of eligible products. The announcements included an added $75 million investment in the AgriMarketing Program over five years and an increase in the interest-free limit for canola advances from $250,000 to $500,000 under the Advanced Payments Program.

The canola industry is also facing traderelated challenges. Canadian canola farmers and processors are seeking new markets after China—Canada’s second-largest market for canola behind the U.S.—closed its doors by implementing prohibitively high tariffs on canola seed, oil and meal. Beginning in March 2025, Canadian producers were unable to ship canola oil and meal to China. Canola seed shipments were cut off in August with the implementation of additional tariffs. As relationships with the U.S.— Canada’s largest trading partner—remain strained following tariffs imposed in early

2025 by the Trump administration, Canadian oilseed processors and farmers need another market, preferably a domestic one.

Markets the size of the U.S. and China are hard to replace, explains Chris Vervaet, representative of the Canola Council and executive director of the Canadian Oilseed Processors Association. However, he says this challenging season could galvanize the pursuit of new opportunities.

Renewable diesel production has the potential to utilize significant amounts of canola. A renewable diesel plant producing 1 billion liters of fuel annually requires roughly 2.5 million metric tons of canola seed when using canola oil as the feedstock. This volume represents about half of what is typically exported to China each year. “That’s the opportunity that we’re chasing, that’s the opportunity that we’re talking about when it comes to biofuels and market diversification,” Vervaet says.

He adds that the CFR is starting to bear fruit; additional renewable diesel capacity has come online, and refiners have announced further investments in coprocessing capacity. Unfortunately, Canada’s renewable diesel industry has encountered headwinds in recent years with the end of the biodiesel blenders tax credit and the implementation of 45Z. Although the biofuels sector has room to expand and utilize the growing amount of canola oil crushed domestically in western provinces such as Saskatchewan, the industry is currently in survival mode, according to Ghatala. “Keeping the lights on” for Canadian biofuel producers is crucial as producers on both sides of the border deal with uncertainty caused by the new variable credit structure based on carbon intensity.

Vervaet explains that—on its own— the BPI does not meet the challenge. “What it does is keep the lights on for some of the existing biofuel facilities in Canada that are making renewable diesel and biodiesel,” he says. “And that’s a good thing, but it doesn’t drive any incremental demand for canola, and in the situation that we find ourselves

seeing a dip in 2024. Data for 2025 was not available at press time.

where the largest, or one of our largest, markets is completely closed for canola, we need more. We need more than just keeping the lights on.”

Ghatala explains that while the U.S. 45Z works as an “exportable trade subsidy,” the BPI does not have the same scope, serving instead as a short-term measure while CFR amendments are made to help domestic producers be competitive in their own market.

Tidewater has experienced the challenges of competing with imported American fuels firsthand, according to Baines. Completed in 2023 and operating starting in the first quarter of 2024, the facility produces 3,000 barrels per day of renewable diesel. Baines emphasizes that his team is “confident” that their company provides the lowest-cost fuel to its market. “We should be very competitive, and when you have all these imports coming in, really cratering the market and [in] our trade case, the numbers suggested dumped,” says Baines. “It’s not even just at parity price; it’s like they’re [sending] it into our market then

we need Canada … to respond or lose that economic activity.”

Baines says historical imports of renewable diesel to British Columbia— Tidewater Renewables’ primary market— doubled from 2022 to 2023 and doubled again from 2023 to 2024. He explains that although Tidewater’s renewable diesel has the lowest delivered cost in B.C., imports are cratering the market, making it difficult to sell the fuel. “We basically had a very unlevel, unfair playing field where you had all this subsidized product that was being moved to Canada,” Baines says.

Tidewater Renewables uses tallow and used cooking oil alongside its primary feedstock, canola oil. Baines explains that Canadian farmers produce roughly 21 million metric tons of canola seed, 6 million tons of which is exported, with 50% to 70% historically going to China. Canada crushes about 15 million tons of canola, sending about 4.9 million tons of canola oil to the U.S. “A huge portion of that goes into the U.S. biofuels industry,” Baines says. “And then it’s been recycled back across the border as the U.S. biofuels have been imported into Canada. So, what do we need to do to

find a new domestic sink? It’s really value-added manufacturing, more biofuels.”

The BPI could help level the playing field for Canadian biofuel producers, but Baines is waiting for the final ruling to see what tangible impact the incentive and CFR amendments will have. The province of British Columbia, where Tidewater is located, has been receiving significant volumes of fuel from U.S. producers. The province did increase the required percentage of domestically produced biofuels in its fuel supply, and Baines says he has seen some small benefits to his business from the change.

A “North American ring fence” made up of policies that favor regionally produced feedstocks could help create market diversification opportunities for farmers in both the U.S. and Canada, Vervaet says. “We actually think that makes a lot of sense, and we believe something like that could be in scope for these targeted amendments and could go a long way ensuring that as biofuel production grows in Canada, we see canola’s utilization grow in lockstep.”

Expanding domestic renewable diesel is a strong start toward creating a sink for canola oil, but Baines sees sustainable aviation fuel as the next step. He would like to see the government encourage development of this type of value-added manufacturing rather than relying on exporting canola seed in raw form.

Prioritizing domestic production is a key component of the strategy needed for Canada to follow through on its international decarbonization commitments. Although the government is taking important steps toward developing domestic infrastructure projects—something Ghatala emphasizes is important—the biofuels industry must not be overlooked. “If we’ve all affirmed our commitment to the Belém 4X pledge, it’s essential that we’re able to expand our renewable fuel demand, and we can’t expand demand unless we have viable supply,” he says. “The BPI is helping.”

Author: Katie Schroeder Associate Editor, Biodiesel Magazine Katie.schroeder@bbiinternational.com

As of July 2025, California’s Low Carbon Fuel Standard requires renewable fuel producers using specified source feedstocks to secure attestation letters reaching back to the point of origin. This marks a significant shift in compliance expectations, creating new challenges for producers to document and verify every step of their supply chain.

Under California’s LCFS, Specified Source Feedstocks are byproduct fats, oils and greases from commercial or industrial processes. Examples include used cooking oil, animal fats and fish oil, distiller’s corn or sorghum oil, and yellow or brown grease. These feedstocks are used in pathways for biodiesel, renewable diesel, alternative jet fuel and coprocessed refinery products. SSFS

California has rolled out new compliance requirements for renewable fuel producers under its Low Carbon Fuel Standard.

BY DANIELLE ANDERSON

pathways can qualify for a reduced carbon intensity (CI) score, making them especially valuable for producers seeking to maximize LCFS credit generation.

But with this benefit comes stricter oversight: Producers must now provide evidence of chain of custody from the point of origin through delivery to the fuel production facility.

Under the amended LCFS, each entity in the SSFS supply chain must now maintain a supplier attestation letter. Covered entities include points of origin, collectors, aggregators, traders, distributors and storage facilities involved from the feedstock’s origin through delivery to the fuel producer. The attestation letter must do the following:

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biodiesel Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

Danielle Anderson Christianson CPAs and Consultants

'Under the amended LCFS, each entity in the Specified Source Feedstock supply chain must now maintain a supplier attestation letter.'

Confirm Feedstock Integrity

• No additional processing (such as drying or cleanup) beyond what is explicitly included in the pathway life cycle analysis and carbon intensity (CI).

Verify Truth and Accuracy

• Feedstocks meet the definitions approved by the executive officer during fuel pathway validation and certification.

• Deliveries match feedstock transfer documents and are not mixed with other materials.

• Feedstocks were not intentionally produced, modified or contaminated to meet the definition of an SSFS.

Meet Strict Documentation Standards

• On company letterhead.

• Separate letter for each specified source feedstock.

• Signed by an authorized representative of the supplier.

• Maintained by the supplier and submitted electronically upon request by a CARB accredited verifier, verification body or the executive officer.

Looking ahead, starting with the 2026 data year for all pathway reports, crop-based feedstocks will also require attestations from the point of origin through the first gathering point, including submission of farm level geographical shapefiles or coordinates—an added step that will demand both time and resources.

Although the SSFS requirement is already in effect, the California Air Resources Board is still developing implementation guidance. Key questions remain unanswered, particularly: What happens if a producer cannot obtain 100% of the required attestations?

It is not yet clear whether missing attestations will trigger a qualified positive statement through third-party verification, or more severe consequences. While it seems unlikely CARB will immediately classify such situations as adverse verification statements, the risk remains until guidance is finalized.

The new SSFS attestation rule elevates compliance standards and places greater accountability across the feedstock supply chain. For renewable fuel producers, the implications are serious:

• More intensive documentation and tracking, especially from the point of origin.

• Heightened supply chain risks, since producers depend on upstream partners to provide accurate attestations.

• Potential loss of reduced CI scores if attestations or chain of custody evidence are incomplete or missing—directly impacting LCFS credit generation and the economic viability of pathways that rely on SSFS.

The value of SSFS in delivering lower CI credits makes compliance especially critical. Producers unable to demonstrate an unbroken chain of custody risk losing not just compliance standing, but also the financial advantages of their pathways.

With the SSFS attestation requirement already in effect, producers should act quickly to strengthen compliance. Recommended steps include:

• Review supplier relationships to ensure partners can provide compliant attestation letters.

• Develop internal protocols for collecting, reviewing and storing attestations.

• Plan for 2026 required attestations for crop-based feedstocks, including geographical data collection.

• Engage verification bodies early to understand how attestations will be reviewed.

• Communicate with suppliers now about expectations and deadlines to avoid disruptions.

The ability to maintain reduced CI scores will ultimately depend on how quickly producers adapt their systems to meet these new chain of custody and attestation requirements.

California’s new SSFS attestation requirement is a gamechanger for renewable fuel producers. While CARB has yet to finalize implementation guidance, the rule is in effect now—and the consequences for noncompliance could be significant. Producers who act quickly to update compliance systems, strengthen supplier communication and prepare for audits will be best positioned to maintain eligibility for LCFS credits and avoid costly setbacks.

Author: Danielle Anderson Senior Government Policy and Advocacy Manager Christianson CPAs and Consultants

For biodiesel producers eyeing a potential shift to SAF, now may be the right time to move.

BY LUIS HOFFMAN

Very few people want to give up flying. It’s how we stay connected with family, expand business opportunities and take holidays to relax. This makes scaling the production of sustainable aviation fuel (SAF)—along with other technological developments such as battery-powered planes—critical if we want to continue flying while trying to stop climate change. Without it, we risk significantly reducing, or even losing, our freedom to connect. First-generation biodiesel (fatty acid methyl ester or FAME) producers who have the feedstock, capability and resources to switch to SAF production may hold the fate of air travel in their hands.

Although SAF currently represents less than 1% of the overall jet fuel market, several countries including Japan, South Korea, Malaysia, Turkey and Brazil will introduce SAF mandates from 2026 or 2027. This will add to existing commitments from the United

Kingdom and European Union. Meanwhile, several more countries are considering the introduction of SAF targets in the coming years. With growing global demand, supportive policy regimes and a significantly underserved market, now is the time for interested biodiesel producers to make the switch before feedstocks become difficult to secure.

With global SAF demand expected to rise 10-fold from 2024 to 2030, supply pressure on feedstock is already becoming apparent. For example, in late 2024, the Intercontinental Exchange launched a dedicated used cooking oil futures contract in response to rising demand, creating the opportunity for participants to better manage their price exposure.

When considering an investment in the construction of a SAF plant, one of the major constraints is the availability of feedstock

on a long-term supply contract. Consequentially, existing biodiesel producers with contracts in place that can be diverted to make SAF start from a place of advantage.

The need for long-term contracts is further underscored by the changes we can expect to see in feedstock import and export volumes. Around 90% of the U.K.’s SAF is currently produced using imported cooking oil from China. However, with China’s plans to introduce its own SAF targets, some producers will need to begin sourcing alternate feedstocks closer to home. Altogether, having feedstock contracts locked in early in the project development process is essential for managing risk and optimizing project returns.

One of the key benefits of moving from biodiesel to SAF production within the next couple of years is the attractive financial incentives currently on offer, particularly in the U.S. market. On top of the RIN credits that both biodiesel and SAF collect through the U.S. Renewable Fuel Standard, SAF also attracts up to $1 per gallon credit through the 45Z Clean Fuel Production Credit scheme. State credits can also pay up to an additional $1-$2 per gallon for SAF. This brings total incentives for SAF to up to $3.50 per gallon more than biodiesel.

While in Europe there are no dedicated financial incentives yet, changes on the near horizon look promising. For example, there is a proposal to introduce a stronger price signal for SAF production through the Energy Taxation Directive, which would provide a tax exemption. The European Commission is also expected to release a Sustainable Transport Investment Plan later this year, in which industry bodies such as ACI Europe have called upon to allocate specific EU funds to develop SAF production facilities.

Although SAF plants are currently more expensive to build than an equivalent capacity biodiesel plant, incentive regimes, along with the premium price levied on SAF, make for attractive project returns. For most U.S. projects, the typical payback period has fallen to under three years, creating a compelling case for investment.

For biodiesel producers considering converting their facilities, a preliminary techno-economic assessment will estimate the cost of construction, the volume of SAF that will be produced, operational costs such as utilities and financial incentives available. Reusing auxiliary existing infrastructure from the biodiesel plant, such as housing, pretreatment systems and tankage, can reduce product costs by 20%-30%.

Currently, eight technology pathways exist to manufacture SAF, but the HEFA pathway (i.e. hydrotreating fats, oils and greases) offers the industry’s fastest payback and lowest total cost of production while producing comparable yields. This is made possible by

the latest innovations which move away from traditional trickle-bed design, as well as opting for a modular build.

For example, Sulzer’s BioFlux technology is a two-stage liquid full hydrotreating process that first removes the oxygen from the oil and then isomerizes it so that the hydrocarbons resemble jet fuel. Rather than using a conventional trickle bed reactor design which is prone to hot spots, BioFlux uses a liquid full reactor design where the catalyst bed is completely submerged in liquid feed with hydrogen dissolved using a proprietary internals design, leading to homogeneous mixing. This significantly improves the efficiency and efficacy of the reaction, optimizes the volume of hydrogen needed and extends the life of the catalyst. In addition, the process has less equipment, so it is simpler to maintain and more reliable. For example, the traditional method requires gas compressors for recycling the vapor; instead, BioFlux eliminates the vapor recycle loop and gas compressors and uses pumps to move the effluent.

The use of modular design is also transforming construction costs particularly for plants with capacities up to 200,000 tons per annum. For SAF production technologies that use less equipment, modular skids are a practical option that simplify integration, reducing time to market to within two years. These smaller plants are expected to become much more common, decentralizing production and bringing feedstock supply, production and offtake closer together.

For example, with several airline carriers in the Asia-Pacific region now buying SAF, Thailand-based Energy Absolute—who is also a first-generation biodiesel producer—has invested in a new plant in Rayong that will use used cooking oil and palm fatty acid to make about 15 million gallons of SAF a year. The plant has been designed so that it can seamlessly switch from SAF to winter-grade renewable diesel to meet local market demands.

When combining the latest innovations in SAF production with modular design, SAF producers can expect to reduce CAPEX by 20%-30% while benefiting from an ongoing saving of between 10%-20% in OPEX costs.

For biodiesel producers considering a shift to SAF, the window of opportunity to transition is open. With demand accelerating and policy momentum building, biodiesel producers making the switch now will not only corner the market for themselves but pave the way for the success of SAF into the future. Those who wait risk less favorable economics and considerable competition for feedstock.

Author:

Attendees of the Sustainable Fuels Summit seek solutions to the ever yday challenges they face. When you purchase a booth, you're not just buying real estate in the expo hall, you're becoming par t of the most comprehensive and vibrant event available in this dynamic industr y.