How Enzyme-Expressing Yeast Changed the Game

PAGE 16

PLUS California Approves E15 PAGE 22

SD's Redfield Energy Adds Solar Power PAGE 36

How Enzyme-Expressing Yeast Changed the Game

PAGE 16

PLUS California Approves E15 PAGE 22

SD's Redfield Energy Adds Solar Power PAGE 36

Data drives innovation. Th rough CTE InSight , advanced statistical analysis identifies opportunities for improvement and predicts the most impactful change for plant performance. Better data clarity enables optimization. Turn InSight into action.

President & Editor Tom Bryan tbryan@bbiinternational.com

Senior News Editor Erin Voegele evoegele@bbiinternational.com

Contributions Editor Katie Schroeder katie.schroeder@bbiinternational.com

Features Editor Lisa Gibson lisa.gibson@sageandstonestrategies.com

Vice President of Production & Design Jaci Satterlund jsatterlund@bbiinternational.com

Senior Graphic Designer Raquel Boushee rboushee@bbiinternational.com

CEO Joe Bryan jbryan@bbiinternational.com

Chief Operating Officer John Nelson jnelson@bbiinternational.com

Senior Account Manager Chip Shereck cshereck@bbiinternational.com

Account Manager Bob Brown bbrown@bbiinternational.com

Senior Marketing & Advertising Manager Marla DeFoe mdefoe@bbiinternational.com

Customer Service Coordinator Brandon McGarry brandon.mcgarry@bbiinternational.com

Ringneck Energy Walter Wendland Commonwealth Agri-Energy Mick Henderson Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

St. Louis, MO (866) 746-8385 | www.fuelethanolworkshop.com

Now in its 42nd year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercialscale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

St. Louis, MO (866) 746-8385 | www.sustainablefuelssummit.com

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.

St. Louis, MO (866) 746-8385 | www.carboncapturestoragesummit.com

Customer Service Please call 1-866-746-8385 or email service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge with the exception of a shipping and handling United States. To subscribe, visit www.EthanolProducer.com/Subscribe, send an email to subscriptions@bbiinternational.com or call 866-746-8385. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to: Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND, 58203, or editor@bbiinternational.com. Please include contact information. Letters may be edited for clarity or space.

Capturing and storing carbon dioxide in underground wells has the potential to become the most consequential technological deployment in the history of the broader biofuels industry. Deploying effective carbon capture and storage at biofuels plants will cement ethanol and biodiesel as the lowest carbon liquid fuels commercially available in the marketplace. The Carbon Capture & Storage Summit will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible and the financial and marketplace impacts to participating producers.

Please recycle this magazine and remove inserts or samples before recycling

We cover a wide array of topics for January, some we haven’t covered much in the past. We start with this month’s theme, fermentation, and move on to policy, flex-fuel vehicles and solar energy. Our editors are equally excited about all of them.

First, we look at the evolution of fermentation in ethanol production, specifically how glucoamylaseexpressing yeast changed the game. When Lallemand Biofuels & Distilled Spirits introduced the first such product onto the market in 2012, it was a tough sell. As an LBDS spokesperson told us, “Ethanol producers like to be first to be second.” The assessment is quite accurate, in our experience. Today, GA-expressing yeast are a regular and even prominent offering in fermentation product portfolios. Our feature on the evolution and its impacts on yield maximation starts on page 16.

Our second feature this month, starting on page 22, explores the approval of E15 in California, as the California Air Resources Board continues its research into the fuel’s sustainability. It was the last holdout allowing E10, but not E15. It’s an important step for the industry and will help drivers in the state save some money at the pump, as fuel prices continue to rise. The accomplishment is a result of work from trade groups and industry, as well as retailers. A combined effort and significant win.

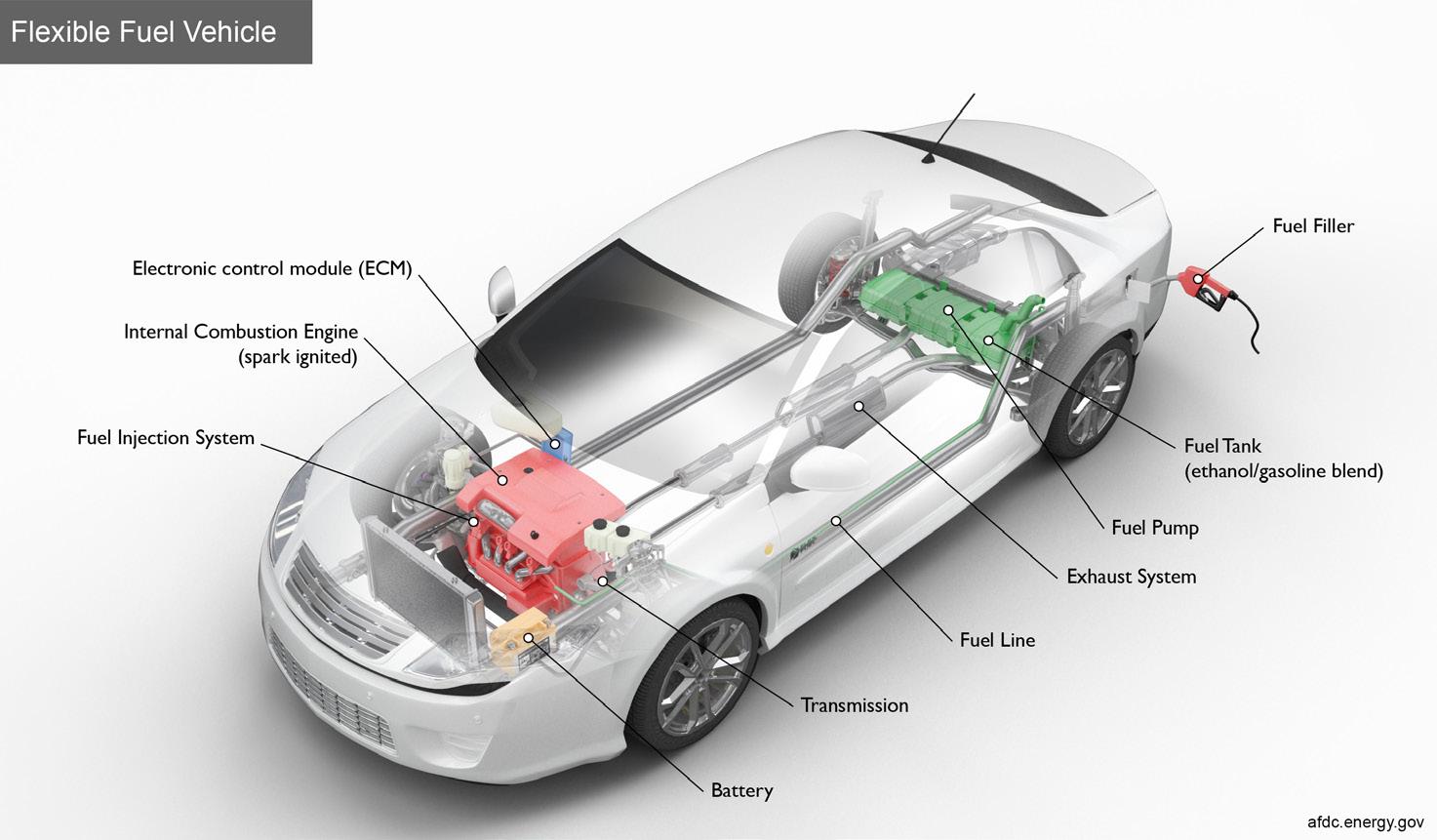

But as the ethanol industry has focused on E15, what happened to the push for flex-fuel vehicles? While they’ve continued to roll off the assembly line for consumers in other parts of the world, their production stalled in the U.S., swapped for electric vehicles to satisfy Biden-era mandates. But 2025 saw a resurgence, bringing six FFV models onto the market. The ethanol industry has not abandoned the battle to ensure FFVs are a standard option, and the fight continues. Find it on page 28.

Finally, we shine a light on Redfield Energy LLC in Redfield, South Dakota, with its gleaming 65-acre solar field just wrapping up its first year of operation. It powers half of the facility’s needs without flickers, without hiccups and without maintenance needs from the plant’s staff. The plant manager says it changes nothing about his team’s work. But it will bring the plant’s CI score down a couple points, and comes with cost savings and tax credits. Take a look, on page 36.

Yeast evolution, a policy win, the FFV push and solar power. It’s all here. Enjoy the read.

-The Editors

Back in September, the California legislature passed AB30, authorizing blends up to 15% ethanol to be sold in the Golden State, and approved it as an “urgency statute,” meaning retailers could sell E15 immediately after Gov. Gavin Newsom signed the bill. He signed the bill in early October. There were sighs of relief, chests thumped, victory laps taken and celebration of a new 650-million-gallon market for ethanol.

Yet, as has been the case with E15 in general, that powerful, sleek California E15 sports car remains parked at the curb, waiting for someone who knows how to drive stick, and for the California Air Resources Board to allow the E15 engine to roar, since they somehow still hold the keys to E15 in the Golden State, urgency statute seemingly notwithstanding. They’ve had eight years to study and consider rules and regulations, but CARB continues to inch forward as if E15 were some mysterious new elixir rather than a fuel that’s only slightly different from the stuff everyone uses all the time, and a blend used safely in cars for 14 years all over the country. E15 is gasoline. EPA says so. ASTM says so. It is approved for use in more than 95% of the vehicles on the road.

CARB wants to treat E15 as an alternative fuel—a move they say would make it easier to get to market faster. As far as I can tell, that path would only make it easier for bureaucrats and rule makers. Selling E15 as an alternative fuel would increase costs for retailers who would have to meet equipment standards for fuel with 14 times more additional ethanol than is actually added to E10 to make it E15. And drivers seeing E15 labeled “alternative” will think it can only be used in flex-fuel vehicles.

It’s not just California, but how is there still an E15 compatibility debate? In addition to all the studies done by the U.S. Department of Energy and U.S. EPA to approve E15, 14 years of real-world use should trump the smattering of refuted small studies done with handfuls of hand-picked problem vehicles. And unless your station has a single-walled fiberglass tank that was installed during the Bush administration (the dad, not the kid), it is almost certainly compatible with E15. It seems the only reason compatibility is still a question is … hell, I don’t know. I can’t think of a reason.

What E15 will actually do in California is save drivers money. Retailers who add E15 price it below E10. Their competitors have to follow, whether they have E15 or not. Even just a few stations selling E15 can force market-wide impact.

Californians could pay less for cleaner fuel already proven by years of use in other markets. The California legislature passed AB30 unanimously and clearly wanted E15 to be made available as soon as possible. CARB should move quickly, let retailers get to work and let drivers start to enjoy the savings that come with clean E15 fuel.

• 165’ Diameter Bins (up to 2.25 Mil. Bu.)

• Up to 21’ Peak Decks & 150K lbs. Rating

•Patented Double-End Stud Bol ts

•Patented Laminated Splice Plates

•Paddle Sweeps

•Capacities up to 12K BPH

•Patented Pivot Point

•Industrial Grade Pushers

•Tower Dryers (up to 12K BPH)

• QuadraTouch ProTM Controls

• Remote Web Access

• Balanced Moisture Content

@2025 SUKUP MANUFACTURING CO SCAN HERE TO FIND YOUR LOCAL SUKUP DEALER

It’s the argument that wouldn’t die: the so-called “food vs. fuel” fallacy that has persisted in the global discourse on the role of biofuels in transport decarbonization. Fortunately, new research has finally driven a stake through its heart.

A study conducted by the respected Nova Institute confirms what has long been proven by market reality: using agricultural biomass for bioenergy and bio-based materials increases food security, enhances resilient and competitive agriculture, supports climate change mitigation and boosts biodiversity protection. This scientific evidence not only dispels the food vs. fuel dogma but also should replace it as the foundation for sound policymaking.

These findings are also true for biomass around the world, but the long-running “food vs. fuel” debate continues to foster discrimination against the use of sustainable crop-based biofuels to reduce emissions from transport. In Europe, this has left transport needlessly and overwhelmingly reliant on fossil fuels, with many European Union member countries still falling short of renewable energy targets.

This discriminatory mindset ignores that bioethanol production actually creates food, with fuel as a byproduct. In some quarters of the European Commission and European Parliament, the false claim that biofuel production is harmful to food security continues to adversely affect EU policy, which unfairly hamstrings member states from using sustainable crop-based biofuels to replace fossil fuels.

A thriving bioeconomy is crucial to the EU effort to move beyond fossil-fuel dependence and toward a circular, carbon-neutral economy. As an important part of the bioeconomy, EU renewable ethanol biorefineries are a strategic domestic asset: producing food, feed, fuel and biogenic CO2 from feedstock grown by European farmers.

Likewise, the renewable fuel produced by ethanol biorefineries, which reduces GHG emissions by 80% on average compared to fossil gasoline, could play a much bigger role in road transport defossilization if the EU’s forthcoming CO2 for Cars Regulation is updated to allow the use of carbon-neutral fuels beyond 2035.

The EU Bioeconomy Strategy will be especially important in setting a more direct course to the net-zero goal. But in order to succeed, the strategy must avoid discriminating against certain types of biomass—even when those applications are proven as sustainable and are already contributing to circular economy and netzero ambitions.

As the Nova report states, “Despite widespread concern and frequent policy pushback against the use of first-generation biomass for industrial applications, often originating from concerns of undermining food security, scientific evidence suggests that these concerns are largely misplaced. The debate is shaped by emotional and political arguments rather than robust data or a comprehensive understanding of the global food system.”

As European Commission President Ursula von der Leyen has said, the EU needs pragmatic solutions to its key challenges. The Bioeconomy Strategy and revisited CO2 for Cars Regulation represent win-win opportunities for the EU: to defossilize the economy, while supporting farmers’ revenue and food production and reducing our dependencies on fossil resources and imports.

This isn’t just a European issue. Ethanol players around the world should help reinforce the message that biorefineries are a strategic asset both locally (supporting farmers and rural economies, food security and energy independence) and globally (helping reduce emissions in the fight against climate change).

In Europe, the ethanol industry publishes annual statistics showing the varied outputs of biorefineries and the diverse agricultural inputs, as well as the arable land, required for this production. We invite ethanol associations around the world to consider coordinating to create similar statistics at a global level.

Maybe talking more about the efficient uses of biomass can help finally put an end to the “food vs. fuel” nonsense.

The Nebraska Ethanol Board has welcomed Jamie Bearup to the board as its labor representative. Bearup is a business representative for the Steamfitters and Plumbers Local Union 464, advocating for skilled labor and supporting projects that strengthen local economies and promote sustainable energy solutions. Bearup was appointed to the NEB in September 2025 by Nebraska Gov. Jim Pillen to serve the remainder of Brad Bird’s term, through August 2026.

A long-time Nebraska labor leader, Bearup has been a member of Local Union 464 for more than 25 years. He has held several roles with the union. Bearup began his career as a steamfitter and has long worked with the ethanol industry in the labor and workforce areas.

“I’m honored and excited to join the NEB at this pivotal time,” Bearup said.

Turnspire Capital Partners LLC has announced that an affiliate has acquired LifeLine Foods LLC and ICM Biofuels LLC. The operations will be combined under The LifeLine Group, with the food business continuing to operate as LifeLine Foods, and the biofuels business being rebranded as LifeLine Biofuels. Turnspire’s partner in the formation of LifeLine is AgraMarke Quality Grains Inc., a Missouri cooperative of corn farmers.

Headquartered in St. Joseph, Missouri, LifeLine’s food business is a leading manufacturer of corn-based products—corn-

ADM has announced that its corn processing complex in Columbus, Nebraska, is the latest facility to begin shipping carbon dioxide via Tallgrass’ Trailblazer pipeline for permanent underground sequestration.

Tallgrass has converted its existing Trailblazer natural gas pipeline to CO2 transportation service. The pipeline spans approximately 400 miles and serves as the backbone to a regional CO2 system designed to capture, transfer and permanently sequester more than 10 million tons per year of CO2 from facilities

starch, masa and other ingredients—serving a diverse array of customers in the food and beverage and building products markets. LifeLine Biofuels leverages a starch stream from the food business to produce renewable fuels and other value-added products with a lower carbon intensity, creating synergies that enhance efficiency and sustainability across the platform.

in Nebraska, Colorado and Wyoming. The CO2 is being sequestered at Tallgrass’s commercial-scale CO2 sequestration hub in Wyoming.

According to ADM, connection to the pipeline has made its Columbus corn processing complex “the largest bioethanol carbon capture facility in the world.” According to Tallgrass, 12 ethanol plants are expected to connect to the Trailblazer mainline over the next year. Several of those facilities have already begun shipping CO2 through the network

In comments submitted to the California Air Resources Board, the Renewable Fuels Association recommended the agency require flex-fuel vehicle capability in all new vehicles with internal combustion engines sold in California, at the earliest practical model year. The comments were submitted in response to a CARB Drive Forward Light-Duty Vehicle Program Workshop on October 21.

“CARB’s number one guiding principle for the Drive Forward program, as stated in the staff presentation, ‘is to design

IFF has announced the launch of Optimash Boost to further increase distillers corn oil (DCO) recovery at fuel ethanol plants. Optimash Boost is a second-generation, clarified cellulase and xylanase enzyme mix, replacing the first-generation product, Optimash F200.

A significant yield gap exists between the industry’s average DCO recovery and its theoretical maximum. Much of this valuable oil remains physically trapped within the fiber structures of

K2 Ethanol Pvt. Ltd, a biomass and biofuel company, has awarded Andritz a contract to build integrated ethanol and animalfeed production plants in India.

The project will include the country’s first ethanol plant powered by agro-residue, supporting India’s renewable energy goals and the sustainable use of agricultural residues.

The greenfield project covers an ethanol distillery with a capacity of 150,000 liters per day and an animal-feed pellet plant with a capacity of 400 tons per day. The multi-grain processing

stringent but flexible programs that achieve cost-effective emission reductions,’” wrote RFA Chief Economist Scott Richman. “RFA believes that implementing a well-structured combination of requirements and incentives to grow the market for higherlevel ethanol blends such as E85 in California would be among the most affordable ways to achieve significant reductions in criteria and greenhouse gas emissions from the state’s light-duty vehicle population.”

the wet cake, a byproduct of ethanol production. Optimash Boost addresses this challenge directly with an upgraded blend of cellulase and xylanase enzymes that disrupt the interaction between these fibers and oil. The new enzymes are formulated as a clarified enzyme mix, as opposed to the whole broth formulation of Optimash F200, allowing Optimash Boost to achieve higher oil recovery at lower comparative dosages

facility will address the growing local demand for both ethanol and animal nutrition. It also aligns with government policies promoting renewable energy sources, including the blending of ethanol with petrol and more sustainable feed solutions.

For this project, Andritz has full engineering, procurement, installation and commissioning responsibility and will leverage its extensive experience from major capital projects in the AsiaPacific region.

By Michael Hora, Principal Engineer

Distillers corn oil (DCO) has become one of the most valuable co-products in ethanol production. Efficient recovery not only drives incremental revenue but also improves overall plant efficiency and throughput. Unlocking the full potential of DCO requires a deep understanding of a plant’s mechanical, chemical, and process dynamics from corn intake to final separation.

At Fluid Quip Technologies (FQT), we approach oil recovery with a modular, integrated strategy, deploying technologies that complement each other across the ethanol production process. Most improvements come from a one-time capital investment rather than recurring chemical or energy costs, making the approach both cost-effective and scalable.

Before considering upgrades, the foundation of any oil recovery effort is understanding the oil content in incoming corn. Typically, 80 to 90% of corn oil resides in the germ, with additional quantities in fiber and outer layers. Gathering at least 12 months of corn quality data, including moisture and fat content, allows the plant to compare theoretical oil input to actual yields, sometimes revealing 10 to 30% untapped oil potential.

Understanding this gap is just the first step. Capturing that oil requires coordinated interventions across the plant, from hammermills and liquefaction systems to fiber handling and centrifugation. Data-driven insights into particle size, starch liberation, and slurry behavior are essential to ensure that every adjustment maximizes recoverable oil without negatively affecting throughput.

Maximizing oil release starts with particle size reduction. Traditional hammermills may leave oil trapped in germ fragments, reducing yield. SGT targets front-end grinding, reduc-

ing germ particle size while minimizing fines, which can disrupt downstream separation. By liberating more oil early in the process, SGT increases total recoverable oil by over 20% while increasing ethanol yields by 3%.

Even with optimized front-end grinding, some oil remains bound in germ and fiber fragments. Amplify provides controlled back-end milling that liberates this residual oil before it’s lost. For plants without an existing grind, Amplify can deliver over a 15% increase in oil recovery, turning previously unrecoverable oil that is lost to the wet cake into revenue.

A series of washing and clarification steps provide additional opportunities for the corn oil to be separated from the fiber for collection by the plant’s existing oil recovery system.

Our corn oil pre-treatment system boosts the performance of any existing distillers corn oil system, creating the optimal conditions for maximizing oil yield.

When combined, these technologies can raise total captured oil by over 20 to 40%, depending on plant configuration, while maintaining process efficiency and minimizing operational complexity.

The true strength of FQT’s approach lies in modularity and integration. SGT, Amplify, DCO Technology, and Overdrive can each be implemented independently, providing incremental improvements without requiring a complete process overhaul. When deployed together, the systems create a continuous, complementary chain of oil liberation from initial germ reduction to final syrup conditioning, while maximizing yield and maintaining plant efficiency.

Modular integration also reduces risk and increases flexibility. Plants can implement systems based on immediate needs and scale over time, ensuring that improvements align with production goals and available capital. Because these solutions rely primarily on mechanical interventions, long-term operational savings are significant. One-time capital investments continue to generate returns year after year, reducing reliance on costly chemicals or continuous process adjustments.

Maximizing corn oil yield is not just about equipment, it requires understanding the interactions between mechanical processes, chemistry, and fermentation dynamics. FQT’s expert engineers combine data-driven analysis, hands-on plant evaluations, and process modeling to identify oil losses, recommend targeted adjustments, and implement proven solutions.

From grind quality to slurry behavior, fiber handling, syrup conditioning and centrifuge optimization, the team ensures that plants capture every available drop of oil. Continuous monitoring and iterative finetuning allow operators to sustain high yields without adding process complexity or recurring chemical costs.

DCO represents a significant revenue opportunity for ethanol producers, but realizing that potential demands a coordinated, science-driven approach. By adopting an integrated platform, plants can increase oil liberation and recovery at every stage.

For ethanol producers aiming to optimize DCO yield, partnering with experienced engineers who understand both the science and the process is essential. An Oil Optimization study is the first step to uncovering the missed DCO opportunities in any plant. At FQT, we deliver the expertise, technology, and actionable insights to transform untapped oil potential into measurable, sustainable results.

MAXIMIZE OIL RECOVERY WITH FLUID QUIP TECHNOLOGIES.

Amplify™ – FQT’s latest oil recovery technology is engineered to separate and mill germ, unlocking more oil on the back end.

Paired with Overdrive™, you can enhance your existing system to optimize yield and e ciency.

And that’s just the start. FQT’s complete oil recovery suite delivers the flexibility and performance your plant needs.

319-320-7709

Yeast providers across the ethanol industry reflect on the impact of glucoamylase-expressing yeast on yield maximization.

By Katie Schroeder

Corn could not become ethanol without yeast.

A self-evident truth for any ethanol producer, the science of fermentation makes ethanol production possible. However, today’s advanced yeast enable production to run at a scale hard to imagine 20 years ago. Today, genetically modified yeasts that coproduce glucoamylase and withstand hostile environments are commonplace, thanks to the innovation and research of yeast and enzyme producers.

Back in the day, ethanol producers used yeast that was not far removed from baker’s

yeast to ferment hundreds of millions of bushels of corn into ethanol. Craig Pilgrim and Matt Richards remember those days. Numerous breakthroughs in yeast science benefited producers throughout the 2000s. Then, in 2012, the ethanol process was forever changed with the introduction of glucoamylase-expressing yeast, which opened the door to genetic enhancements that help producers maximize production.

Richards, who now works as Lallemand’s director of application technology, played a role in bringing this yeast to market through his work at Mascoma LLC, which was acquired by Lallemand in 2014. He and his team were trying to make a yeast that secreted en-

zymes in order to make biofuels out of lignocellulosic materials.

“While we were working on that, we were also looking at kind of what would be a nearer term commercial opportunity in an existing market,” Richards says. “And so, [we] started working on developing secreted enzymes for grain ethanol, and not just for lignocellulosic fuels.”

This pivot led to a collaboration with Lallemand, which utilized its ethanol experience to handle marketing and production. Together, the two companies delivered the first enzyme-expressing yeast product, Transferm, to the market in 2012. Marketing the first enzyme-expressing yeast was a hard sell,

according to Pilgrim, vice president of marketing with Lallemand Biofuels & Distilled Spirits. Ethanol producers like to be the “first to be second,” he explains with a smile. Since then, Lallemand has developed more yeasts that express other enzymes, explains Richards, primarily alpha amylase and trehalase. Alpha amylase targets insoluble starch, leftover after the cook process and solubilizes it in fermentation. Trehalase breaks down trehalose, a sugar created by the yeast, turning it into a fermentable glucose molecule. Lallemand is also looking beyond ethanol production, exploring proteases that could help improve distillers corn oil (DCO) separation.

Enzyme-expressing yeast helped pave the way for producers to broaden their view of what enhancing their process could mean, according to Richards. “There’s a lot of new technology that’s been introduced from the process side and equipment side in terms of oil separation, fiber separation and higher protein products, but [we are] able to also advance the biological engine within the facility and enhancements that can happen there,” he says.

The company acquired BASF’s enzyme business and leveraged that gained expertise in product development, looking at ways to improve glucoamylase replacement, study additional enzyme activity and explore further

proteins. Richards explains that the work of understanding different proteins expressed by organisms continues across the scientific community. “It’s always interesting to be able to, over the years, look at what are some of the new proteins that have been found in the environment and world,” he adds. “And look at what might be some good applications of those, what are ones that have not been utilized before and do more enzyme discovery from that standpoint.”

Long before IFF launched its first line of genetically modified yeasts, it was working

extensively with so-called “cell factories” to produce advanced enzymes, explains Hans Foerster, marketing director for the company’s grain processing business. Those branches converged in 2011, when IFF started to develop enzyme-expressing yeasts that could deliver glucoamylase. Two years later, the company’s first genetically modified yeast, part of its trademarked Synerxia brand, was launched, representing a major advancement in fermentation efficiency. “That yeast replaced about 40% of the glucoamylase that producers had traditionally added in liquid form—what’s known as exogenous enzyme dosing,” Forester says.

He explains that IFF leveraged its deep biotechnological expertise to develop yeast strains that could perform across varying conditions and fermentation environments. The key challenge was engineering genetically modified yeast with the versatility to thrive across the diverse operating conditions found in ethanol plants. “Once again, we were designing a cell factory,” he explains. “Only this time, it came in a 10-kilo box—

ready to use and adaptable to the wide range of environments our customers work in.”

When IFF first introduced its Synerxia yeast solutions, ethanol producers had a range of questions about how these advanced strains would perform in their facilities. Topics like yeast propagation, nitrogen requirements and enzyme dosing were common areas of inquiry. Today, those conversations have evolved. “Most producers now come to us with a clear set of operational goals,” says Foerster. “They’re asking, ‘Here’s what I need to achieve. How will your yeast help me get there, and what should I be watching for?’”

The impact of these yeasts is evidenced in the volume increase that has occurred from 2015 to 2024. Foerster highlights that USDA records show that the ethanol industry’s yield has increased by 10% while corn usage for ethanol has only increased by 5%.

Today, IFF’s Synerxia Gemstone Collection of advanced yeast strains are driven by trait-specific selection—focusing on rate, robustness and yield—to meet the diverse

needs of ethanol producers. Complementing this, IFF formulates glucoamylases designed to pair optimally with these strains, enhancing overall fermentation performance. With insights from its trademarked Xcelis AI predictive modeling, and validation through its Applied Innovation Centers, Forester says producers can confidently blend yeast strains tailored to their evolving process conditions.

Novonesis’ first enzyme-expressing yeast entered the market in 2018. Titled Innova Drive, this glucoamylase-expressing yeast was the first of 10 modified yeasts that Novonesis has brought to the market since, according to comments provided by Billy Whitlock, global marketing manager with Novonesis, and Andrew Dilworth, North America regional marketing manager with Novonesis.

“[Ethanol producers’] business objectives demanded more yield and more ethanol across a wide range of operating conditions

and challenges, and that was a key priority in our innovation goals—to bring a biosolution to the market that would enable consistency and power through tough fermentation conditions,” Whitlock and Dilworth tell Ethanol Producer Magazine

Novonesis utilizes information on ethanol producers’ fermentation challenges, such as failed fermentations due to heat or bacterial infections, to drive new product development. The company prioritizes making yeast more adaptable and increasing yields. Novonesis’ collaboration with MicroBioGen assists the company in identifying yeast strains with characteristics that help producers reach production goals. After a strain is identified, Novonesis’ R&D team engineers yeast strains for commercial use, Whitlock and Dilworth explain.

“In the past five years, we’ve introduced yeast strains that deliver the highest ethanol yields in the industry,” Whitlock and Dilworth assert. “Our product development continues to push boundaries, always aiming to transform customer challenges into innovative so-

lutions. After any new product is developed, confirming the yeasts’ abilities at lab and full scale is a must.”

Industrial yeasts have transformed the ethanol industry by helping producers pursue decarbonization through yield improvements and process efficiency optimization. The Innova line also enables higher throughput and eliminates the need for a compromise between fermentation speeds and output.

Whitlock and Dilworth add that Novonesis comprehends the value that C5 corn fiber conversion could bring to the ethanol industry. “We understand our customers are considering all the future paths for ethanol, and we are excited and committed to ensuring Novonesis will meet them there.”

Enzyme and yeast provider CTE Global started off in the enzyme-expressing yeast space in 2018 with the Innova yeast line, which brought increased robustness and glucoamylase expression. According to Pedro Peña, vice president of technology and innovation with CTE Global, the product proved itself in yield benefits compared to others.

Three fundamental principles guide the company’s innovation in enzyme-expressing yeasts. “First, the feedstock should be converted to fermentable sugars as close to completion as possible,” Peña says. “This informs our approach of enzyme expression for the yeast to work in synchrony with external glucoamylase blends and associated enzyme activities.” CTE’s second principle is to ensure that sugars are metabolized efficiently, funneling as much of the carbon flux as possible toward ethanol. Finally, the yeast should do that day in and day out, consistently throughout the year, even under the inevitable adverse conditions that pop up in the process.

Working closely with customer partners, CTE identifies opportunities for improvement, including overcoming customer challenges. This understanding informs the engineering scope of its innovation partnerships and enables the company’s newest offering, Innova Eclipse, to achieve its designed pupose.

“It might be cliché, but yield is king,” Peña says. “The feedstock is the biggest input cost and making the most of that investment by delivering a higher yield per bushel has been significantly favorable financially for our customers. Operationally, we have seen some plants push higher production rates, leveraging the highest level of robustness, and fast fermentation kinetics to run higher solids or shorter fermentation times, all with little to no compromise on yield.”

For Leaf by Lesaffre, the ethanol industry’s excitement about glucoamylase-expressing yeasts inspired a pivot away from yeasts and enzymes for cellulosic ethanol production toward applying genetic modification to first-generation ethanol production. The company’s first GA-expressing yeast came onto the scene in 2017, according to Kelly Hahler, global technical application manager with Leaf.

When ethanol producers started buying genetically modified yeasts, they had questions, she recalls. The new yeasts came in a cream form rather than in a dry form. At the time, yeasts would be rehydrated and propagated before adding them to the fermenters. Ethanol pro-

ducers wanted to know how to propagate yeasts that came in a cream and how to handle the different logistics surrounding yeast deliveries. Initially, ethanol producers saw genetic modification primarily as a means to reduce costs associated with exogenous enzymes. Over time, their focus shifted to yield maximization by reducing the amount of glycerol coproduced with the ethanol.

Hahler explains that one of her team’s primary goals is to ensure that genetic modifications do not reduce the robustness of the yeast. This can be a challenge, since glycerol is an osmo-protectant, meaning that it helps the yeast cells continue to function as the ethanol concentration in the fermenter rises.

Early on, Leaf’s new product development was fully in-house, but as the demand for GMO yeast grew, the company responded to the need for scientific collaborators specializing in genetic modification. Lesaffre, Leaf’s French parent company, acquired Recombia Biosciences, a company specializing in high-throughput genome editing and synthetic biology. As part of Lesaffre’s Institute of Science and Technology, Recombia had a pivotal role in developing Evolve Evergreen, in collaboration with Leaf’s Green Lab and application experts. After any new product is developed, confirming the yeasts’ abilities at lab and full scale is a must. Hahler leverages her experience in the ethanol industry to organize and execute the tests needed before commercial launch.

Leaf has not abandoned its roots in C5 sugar conversion innovation, Hahler says. C5 sugar conversion constitutes the next major opportunity for a new production boost, but the surrounding pro-

cess changes and capital investment required to effectively process lignocellulosic feedstocks at a full scale is not something the industry is prioritizing—yet.

“Right now, in the industry, there’s such a drive to reduce carbon footprint, and so, there’s a lot of innovation that’s still supporting that,” Hahler says. “And of course [C5 sugar conversion is] definitely of interest to us, especially since we already have a platform for it. And how can we integrate that and improve it into possibly some co-fermentations that customers could potentially be looking at in the future.”

With a long history serving the ethanol industry with technical expertise, Phibro also added enzyme-expressing yeast to its portfolio nearly half a deade ago to meet the evolving needs of its ethanol customers. Jenny Forbes, vice president of sales and service with Phibro, explains that Phibro Ethanol began offering Kinetx, a line of glucoamylase-expressing yeasts, in 2021. Developed in collaboration with Ingenza Ltd., a UK-based engineering biology firm, Phibro’s Kinetx strain was created through Ingenza’s proprietary strain construction and adaptive laboratory evolution (ALE) platforms, explains Moira Adams, product manager of yeast and enzymes with Phibro.

“Over the past five years we have continued the evolution of the Kinetx line of products which features multiple strains, including an improved yield pathway,” she adds. “Each of the products offers a different GA replacement ranging from 40% to 80% replacement depending on the customer’s requirement.”

The ethanol industry’s enthusiasm toward glucoamylaseexpressing yeast was initially accompanied by some skepticism. Ethanol producers experienced some hiccups at the start, explains Forbes. “A lot of things could go wrong, and a month’s worth of ‘gains’ could be easily negated by one or two bad batches.” Genetically modified yeasts have evolved to handle process variation better due to increased robustness and modifications that lead to yield enhancement.

According to Forbes, yeasts and enzyme innovations still have more potential to impact the fermentation process. “If you go back to 2013, [20]14 when the industry started considering this, there were a lot of naysayers,” she says. “I mean, obviously the technology has stuck and worked and been widely adopted, and it just continues to evolve. People might think ‘you’ve hit the ceiling,’ or ‘you’ve hit the maximum capacity of what an organism can do in the process,’ but I think that it remains to be seen.”

Author: Katie Schroeder Katie.schroeder@bbiinternational.com

Why

Whatever line or tank he’s watching over, the all-seeing-IRmadillo™ can tell you the precise concentrations of sugars, acids, ethanol, glycerol, FAN, PAN, moisture and more.

That’s real-time lab-grade data. Continuous tracking. And instant insights.

Live process visibility means you’ll catch problems before they impact production. Identify opportunities you’re missing. And discover possibilities for automation that were previously unimaginable.

Designed for the rigors of industrial production, leading ethanol producers are already using IRmadillo to optimize fermentation, maximize yields, and eliminate costly guesswork.

Maybe it’s time to look deeper into what you’ve been missing?

UK

info@IRmadillo.com • IRmadillo.com

Now available in California, E15 has the potential to boost overall demand while fulfilling the state’s greenhouse gas emissions goals.

By Luke Geiver

California is no longer an E15 holdout. In early October 2025, Governor Gavin Newsom signed Assembly Bill 30 into law, allowing blenders and retailers in the Golden State to blend and offer E15 year-round.

Prior to AB30, California was the only state in the U.S. allowing year-round E10 while prohibiting E15. Urgency among state leaders to reduce consumer fuel prices combined with the state’s ongoing and long-term commitment to reaching its ideal greenhouse gas emission volumes played a major role in ending California’s E15 ban. New strategies deployed by ethanol champions also helped rewrite the state’s E15 policies after several years with no progress.

Although AB30 allows for immediate E15 blending, the California Air Resources Board still has many testing procedures, comment periods and other processes to navigate in the next two years as part of a state-wide

agency approach to new fuels. Despite the ensuing policy steps, E15 has the potential to increase the state’s market potential by 50%, even before CARB finishes its proceedings.

In 2006, California used roughly 900 million gallons of ethanol in its alternative fuel mix. In 2024, the state consumed approximately 1.5 billion gallons of ethanol. For light-duty vehicles in 2024, those ethanol volumes equated to $61.4 billion in sales for a value of $5.6 billion to ethanol producers supplying for E10 blends. Under California’s Low Carbon Fuel Standard, producers received roughly $200 million in credit revenue in 2024 alone.

A 50% increase of ethanol supply to California could result in an additional $2.8 billion for ethanol producers annually. California vehicle registrations and equipment estimates provided by CARB show the statewide total for vehicles capable of using an ethanol blend in 2025 to be nearly 21.4 million. On-road vehicles accounted for 2.2

million, followed by on-road motorcycles at 677,000, lawn and garden equipment at 12.2 million, recreation marine vessels at 779,000, recreational off-road vehicles at 1.1 million and other off-road equipment at 4.2 million.

“The California legislature’s unanimous passage of AB30—and the bill signed into law by Gov. Newsom—was a significant victory for the U.S. ethanol industry,” says Geoff Cooper, Renewable Fuels Association president and CEO.

Many in the industry had given up on securing E15 approval in California, Cooper says. “But we wouldn’t take no for an answer.”

For the past seven years, the ethanol sector has repeatedly run into roadblocks with CARB to move forward with E15. Last

year, however, RFA and others tried a different approach. The ethanol champions pursued legislative action.

In June this year, the California Assembly voted 77 to 0 in favor of AB30, a bill that authorizes E15 use until or while state agencies complete their required evaluation. In October 2024, the California Assembly unanimously approved a bill to require CARB to complete a major portion of its rulemaking process by July 1, 2025. But the state Senate failed to act. Only after Newsom directed CARB to accelerate its efforts on E15 usage and sales did the state move to allow its use immediately.

“People thought we were nuts for taking a legislative run at E15,” Cooper says. “But this strategy paid off and we are now closer

than ever to having E15 gallons flowing in the Golden State.”

Jeff Wilkerson, government policy and regulatory affairs manager for Californiabased Pearson Fuels, knows the state’s ethanol landscape as well as anyone. A University of Nebraska-Lincoln alum, Wilkerson helped shape Pearson Fuels. After starting as a single fueling location that offered E85, Pearson now operates hundreds of E85 locations throughout the state. Last year, Wilkerson and his team helped to add 63 new sites. This year, Wilkerson says, Pearson will add another 60 sites, with another 60 in 2027.

Wilkerson is working with policymakers, retailers and other state agencies to stream-

line the possibility of Pearson offering E15. The demand for E15, an option that can easily be 15 to 30 cents cheaper than E10, is easy to understand, Wilkerson says.

According to Wilkerson, multiple fuel refineries are going offline in the state, including refineries owned by Valero and Phillips 66. The Phillips 66 shutdown and the planned Valero shutdown could reduce in-state refining capacity by almost 20%, he says. Gasoline prices remain high because of new cap and invest programs that add fees to a gallon of gas. In some areas, California is actually looking at drilling for oil in the state again. Fuel prices are a concern in the state now more than ever and they don’t appear to be easing at any point without major intervention. Ethanol blended fuel will con-

agribusiness solutions

For over 20 years, Beyond has been the innovative and trusted experts in selling, implementing and suppor ting grain processing ERP software solutions.

We provide tailored expertise and innovative technology to plants across North America 80+ Ethanol Plants

10,000+ Transactions

We process more than 10,000 digital transactions per daymore than any competitor

tinue to play an increasingly larger role in California, Wilkerson says, despite the fact that overall liquid transportation volumes continue to decrease due to electrification and other alternative fuels.

While Wilkerson views E15 favorably, he says there are still many unknowns and steps to take before the real opportunity and market dynamics are clear.

stock for Oxygenate Blending (CARBOB) requirements already in place for E10. Producers would also need to use the predictive modeling process already established. The model uses statistical analysis and machine learning techniques to forecast carbon emissions for a particular liquid fuel.

CARB does not predict that sampling and inspection procedures will change.

From advanced grain processing to strategic financial tools, we provide comprehensive solutions tailored to your needs Tailored Solutions

“When you try to add a new fuel, you have to go through a lot of permitting,” Wilkerson says.

Through AB30, blends of gasoline containing 10.5% to 15% ethanol by volume can be sold in the state immediately until CARB completes two processes. First, the California Environmental Policy Council will complete its review and public findings of the multimedia evaluation for blends of E15.

Second, that state board has to complete one of the following: adopt a regulation establishing a specification of blends for gasoline containing 10.5% to 15% ethanol by volume; or post an assessment on its website demonstrating that it is not possible for a proposed regulation establishing an E15 specification to meet the requirements of the CEPC relating to impacts on air, water and soil.

Production of E15 must meet CARB’s California Reformulated Gasoline Blend-

Chris Bliley, senior vice president of regulatory affairs at Growth Energy, says the ethanol trade association is already working with retailers, equipment suppliers and others that want to get E15 into their lineup of products. Like Wilkerson, Bliley and his team are in communication with other agencies that will play a role in the final rollout and procedures for E15 in California. Any motor vehicle fuel in the state has to undergo a multimedia evaluation to be conducted by several agencies, including: CARB, Department of Pesticide Regulation, California Water Boards, Office of Environmental Health Hazard Assessment, Department of Forestry and Forest Protection and the CalEPA.

The multimedia evaluation process (already completed for E10 more than 10 years ago) consists of a three-tier process. In the first tier, knowledge gaps are identified and a fuel summary report is created. In tier two, experiments are performed at-

tempting to fill knowledge gaps. In tier three, a multimedia risk assessment report is prepared. Following reviews for each tier, the evaluation process produces a summary and conclusion, which undergoes external scientific review. Before the CalEPA council can make a final determination on a multimedia evaluation, it must receive the peer review information. For E15, AB30 has streamlined the process and put CARB at a stage in between the external peer review and final determination.

The overall preliminary conclusion by CARB on the use of E15 in California states that the fuel does not pose a significant adverse impact on public health or the environment compared to E10.

Currently, CARB is taking public comments and suggestions on ways to update

regulatory requirements to accommodate the use of E15.

According to Cooper, most of the infrastructure needed to ramp up ethanol use in California is already in place. No major changes or big investments are needed in the marketplace, he says. The state also has a surplus of storage capacity for liquid fuels, and most of the tanks are fully compatible with ethanol. In some cases, he adds, many fuel retailers already have E15-approved dispensers in place.

Producers will still need to comply with LCFS and carbon intensity requirements to provide ethanol (corn-based or otherwise) to the state for blending. California fuel blenders will continue to seek the lowestcost source of ethanol, which, according to Cooper, typically has come from corn ethanol produced in the state or the western Corn Belt. Because of the surplus of corn and ethanol production capacity, it is unlikely that California fuel blenders would need to import ethanol to transition to E15. But, Cooper says, if prices for Brazilian ethanol imported to L.A. or San Francisco fall to a level where the product is price-competitive with U.S. ethanol, it is possible import activity could increase.

Bliley believes that once E15 is offered, it will expand quickly. Currently, roughly 9,000 gas stations are selling 13.4 billion gallons of gasoline annually in the state. Pearson fuels supplies E85 to stations around the state, but even still, Wilkerson says some areas of the state remain untapped or undersupplied.

One aspect of California’s E15 product that is unique from many other states will be its year-round approval. Currently, only seven states allow year-round E15. California retailers will be able to sell E15 all year long without interruption and no need for emergency waivers.

CARB has already held an initial scoping workshop on how it will move forward to officially finalize E15 usage in the state, though retailers are allowed to blend and sell the product as of October 2025. The rule-

making process will most likely extend into the second half of 2026 with updated regulations finalized by the beginning of 2027, according to CARB.

Ethanol associations, fuel retailers and others have already started to speak with entities impacted by the potential for E15, including blenders, retailers, equipment suppliers, transportation companies and other supply chain participants. Wilkerson is talking with more potential partners in both existing and prospective locations.

“While E15 is not a new fuel and is a familiar option in many other states, it is an entirely new fuel for the California supply chain,” Cooper says.

In some cases, retailers and marketers weren’t even aware of E15 as a blend. The cost advantage of a higher ethanol blend is also a selling point to consumers that most retailers haven’t taken advantage of before, Wilkerson says.

Showing all parties the many benefits of E15, from cleaner fuel to the positive impact

of agriculture inside and outside of the state, will help speed up the adoption in a state that typically has the first- or second-highest use rate of gasoline and ethanol-blended fuel per year.

RFA in particular is already collaborating with companies that are responsible for distributing more than two-thirds of California’s gasoline, and has hosted several work-

shops with fuel retailers and marketers. The response to the workshops has been positive, according to Cooper. “Many retailers are getting their ducks in a row so they can sell E15 as soon as possible,” he says.

Author: Luke Geiver writer@bbiinternational.com

A new day is dawning for ethanol production. Our industry-leading lineup of yeasts, yeast nutrition, & enzymes are pushing the limits of fermentation and reaching levels of performance never achieved before. Paired with our renowned educational programs and expert services, we’re setting a course for even greater yields and performance.

With LBDS, THE FUTURE OF FERMENTATION IS BRIGHT AND THE POSSIBILITIES ARE ENDLESS.

Despite stalled momentum for E85-capable flex-fuel vehicle growth, ethanol advocates remain focused on opportunities.

By Luke Geiver

Since 2016, momentum for flex-fuel vehicle (FFV) expansion across the U.S. has been slow, if not non-existent. Only in the last two years have new FFV models been offered in the U.S., and there haven’t been many.

Particularly around 2014, the appetite for FFVs was significant. At the time, roughly half of all vehicle models offered in the U.S. included FFV options, according to Monte Shaw, executive director of the Iowa Renewable Fuels Association.

But in 2016, new Corporate Average Fuel Economy standards de-incentivized FFVs in favor of electric vehicles. In addition to CAFE standard changes, automakers became frustrated with the slow pace of E85 infrastructure implementation, and the ethanol industry focused its priorities on E15.

Still, ethanol advocates including Shaw have never stopped promoting greater FFV use.

“We’ve never given up on FFV technology,” Shaw says, while lamenting the missed opportunity during the past nine years without significant FFV adoption growth. “We’ve made progress and will continue to push for it.”

New FFV model options are on the rise. In 2025, the U.S. Department of Energy’s list of alternative or advanced vehicles shows six FFVs offered—the highest in several years.

Buick currently offers two models, the Encore GX and the Envista. Both are meant for E85. The Encore GX goes for $26,000 base MSRP and the Envista is listed at $22,900 base MSRP.

Chevrolet has three FFV options. The Chevy Silverado in the 5.3L V8 goes for $41,400 base MSRP. The Chevy Trailblazer is listed at $23,100 base MSRP. And the Trax, also offered by Chevy, costs $20,400 base MSRP. Lastly, the GMC Sierra pickup goes for $42,300 base MSRP.

Although the current list of FFVs is not long, it is a shift in the right direction. Shaw says change has stemmed from the current administration’s pullback from electric vehicles along with a realization among policymakers that EV components are not typically manufactured or available in the U.S. In addition, EV carbon intensity scores were also set at a baseline linked to 100% renewable electricity. But that’s not the reality, Shaw says.

FFVs from the Midwest were popular among West Coast wholesalers. In California, E85 is commonplace and always a far less expensive fuel option than regular gasoline, making FFVs a popular choice.

Back then, Shaw says, “anything that was a used FFV would be bought and put on a truck and sent to California.”

“Don’t tell me people don’t want FFVs,” he adds.

California-based Pearson Fuels provides E85 options for several of its own retail sites along with hundreds of others across California. Jeff Wilkerson, govern-

ment policy and regulatory affairs manager, says FFV trends in the past five years haven’t changed, despite growing availability of E85 in the state, thanks in large part to Pearson’s efforts.

Currently, roughly 1.3 million FFVs are on the road in California. Those that have been available in recent years like the Chevy Trax or Buick Envista have sold really well, Wilkerson says.

“We continue to do work to expand FFVs in California,” he says. Doing so has helped California drivers typically save up to $2 per gallon when filling E85 into an FFV. Pearson estimates California drivers who have utilized E85 in FFVs over the past 20 years have collectively saved more than $1 billion.

In addition to FFVs, Pearson continues to push the state to streamline the process for adding E85 conversion kits to gasoline engines. The technology is relatively cheap, easy to install and adjusts fuel and oxygen ratios to allow for higher blends.

According to Wilkerson, Pearson has a few conversion kit partners that are interested in expanding to California. The challenge is the California Air Resources Board regulations for alternative fuel conversions. CARB requires each manufacturer to do its own testing on its kits. In 49 other states, EPA approval of a conversion kit suffices, but not in California. Wilkerson has worked hard to get year-round E15 passed in his state and is now working to ease the process for conversion kit testing and availability.

“I would put a kit on a new truck in a heartbeat,” Shaw says.

Meanwhile, the rest of the world wasn’t shying away from FFVs, Shaw says. Toyota offered new FFV models for several consecutive years in South America, Brazil and India. Japan launched new FFV models through Suzuki.

“FFVs are becoming the norm in very important markets around the world,” Shaw says, noting that in some cases, FFVs are run on various ethanol blends starting at E20, especially in countries like Brazil.

In India this year, the Grain Ethanol Manufacturers Association, an organization representing the country’s ethanol producers, called on the government to speed up the expansion of higher ethanol blends while doing the same for FFVs.

Shaw and Wilkerson may be FFV experts and advocates, but like most in the ethanol sector, year-round E15 is the No. 1 priority. Still, 2025 brought multiple efforts to reignite market growth of FFVs.

In March 2025, Rep. Randy Feenstra, R-Iowa, introduced the Comparison of Sustainable Transportation (COST) Act.

The proposed legislation was meant to push the federal government to compare the financial and environmental costs of electric vehicles and E85-capable FFVs. Another purpose of the bill was to examine the costs of replacing the entire federal gasolinepowered vehicle fleet with either EVs or E85 capable FFVs. If passed, the bill would require the U.S. Secretary of Energy to report the findings to Congress.

Feenstra’s 2025 version was a followup to previous bills with similar intent proposed in 2021 and 2023. In a statement referring to the Trump administration’s

ending of Biden-era EV mandates, Feenstra commented on the role E85-capable FFVs could play for the U.S.

“I appreciate President Trump for ending the Biden administration’s radical electric-vehicle mandate on our families, farmers and businesses,” Feenstra commented. “Electric vehicles are expensive, unreliable and unworkable, especially in rural communities. The components needed to make EV batteries are also largely sourced from China. By promoting flex-fuel vehicles, we can support Iowa’s farmers and biofuel producers, prioritize homegrown U.S. fuels over foreign batteries, and strengthen our strategic position against China.”

At the time of the bill’s introduction, Shaw was quick to comment on Feenstra’s work.

“There is no doubt in our mind that, over the next decade, low-carbon biofuels will outperform electric vehicles if judged by sound science,” Shaw said. “Unfortunately, we repeatedly see policymakers put their fingers on the scales. Rep. Feenstra’s biofuels bill will help ensure the competition is on a level, scientifically based playing field.”

Feenstra’s COST act is still awaiting action in the U.S. House.

Another leading voice from Iowa has called for greater attention to FFVs in 2025. The Iowa Corn Growers Association, along with more than 20 other state corn organizations including the National Corn Growers Association, called on Ford Motor Co. to begin building FFVs again. The automaker has moved away from FFVs in favor of EVs in recent years and the corn grower group “expressed deep concern” in

their statement to Ford CEO Jim Farley, especially about the lack of FFV options for the F-series truck lineup.

In 2014, half of all Ford’s, GM’s and Chrysler’s light-duty trucks were FFVs, a far cry from today’s FFV inventory of options. Despite the F-150’s popularity in agricultural states, Ford chose to discontinue any FFV options, a choice the corn growers group said “removes a key fuel choice

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

• OEM Parts Warehouse

•$2 million+ inventory on-hand

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

for rural drivers and undercuts demand for American-grown ethanol.” The corn organizations contend EVs aren’t a one-size-fits-all solution, especially in rural areas with limited charging infrastructure. The letter notes there is no reason to eliminate a biofuel with proven economic and environmental benefits. The corn grower leaders say they

will continue calling on Ford to work with members of Congress and the agriculture community to reinstate smart policies that benefit rural America and consumers.

Stu Swanson, ICGA president who farms near Galt, Iowa, says Ford has a longstanding commitment to American farmers.

“It’s time to renew that commitment by re-

starting the production of flex-fuel vehicles. Iowa corn growers urge Ford to reinstate FFV production and stand with farmers who have stood with them.”

Wilkerson and Shaw agree that nationwide E15 will be the main priority of the ethanol industry until realized. Both offer an unfiltered view on the opportunities that were lost in the past nine years, had California maintained a push and build-up of FFVs to a far greater number than the 1 million vehicles it has today.

Today, Shaw is pushing for FFVs in Iowa and nationwide, despite other priorities. Wilkerson says he is doing the same in California and so are the other major trade groups leading the charge in D.C. RFA, for instance, showcased the Chevy Trax FFV at the 2025 International Fuel Ethanol Workshop & Expo in Omaha.

“Automakers underestimate how many farmers want to drive an FFV pickup,” Shaw says. “Now, we just need to regain momentum, which I think we are doing. We need to find the carrot that can get automakers to see that, as long as they are making liquid fuel vehicles, they should be making an FFV option.”

Author: Luke Geiver writer@bbiinternational.com

Trusted Suppor t Ever y Step of the Way

Fr om f er mentation to final y ield, P hibr o deliv er s a w ide r ange o f solutions tailor e d to y our plant’s speci fi c nee ds. Our compr ehensi v e por tf olio is backed b y hands-on suppor t and t echnical e xpertis e to help y ou driv e consist en t perf or mance and unlo ck long-ter m e cienc y. Count on Phibro Ethanol for:

An timicr obials

De -Emulsifier s Cleaning Enzy mes Yeas t

Ask your Phib ro Account Manager about our full port folio.

As its 65-acre solar field hums along providing half of its power needs, Redfield Energy operates business as usual. The system, situated next to the plant, is seamless, with no flickers or interruptions.

“The solar power ramps up and down with the sunlight,” says Josh Underberg, plant manager at Redfield Energy in Redfield, South Dakota. “Nothing changes here, we don’t have any power flickers, we don’t have any issues whatsoever.”

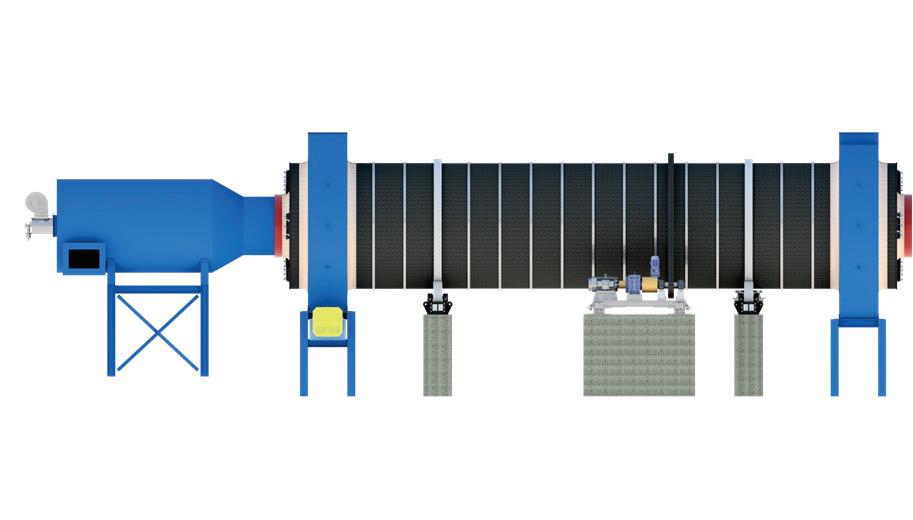

The solar field, designed, installed, operated and maintained by All Energy Solar Inc., has been in service for about one year and is not the only upgrade Redfield implemented in the past two years. Installation of a Whitefox ICE Plus system has improved efficiency and is poised to boost production from 65 MMgy to at least 72 MMgy, says Eric Baukol, Redfield Energy CEO.

“From a company standpoint, we’re growing, and we certainly want to grow, but right now our focus is making our gallons that we have better from a CI standpoint more so than just expanding to expand,” Baukol says.

Redfield began operating its 11.5-MWh direct current solar field in December of 2024. The capital investment amounted to about $20 million and installation took about one year, Baukol says. The first six months showed some standard startup hiccups, but the second have shown the expected results. “So far, we have seen what we expected to see, which is a couple point reduction in our CI score by producing approximately half of our electricity,” Baukol says. “The investment was based off a model of a 2.2-point reduc-

Redfield Energy has greened a portion of its power while reducing electricity needs, for a perfectly complementary duo of process improvements.

By Lisa Gibson

tion in our CI score, and what we’re seeing in the second half of the year lines up with that expectation.”

“I’ve learned from others in the solar industry that you typically see some hiccups right away and then they run really well, and so far, that’s what we’ve seen,” Underberg says.

When Redfield committed to the investment, the 45Z Production Tax Credit had not yet been announced, but the benefits in cost savings and access to West Coast markets still incentivized the project.

“It was still a great option for our gallons that are heading west, California, Oregon, Washington,” Baukol says. “So if your gallons are spread that way, it’s a good investment.”

The solar array at Redfield operates on a pivoting system, east to west as the sun travels across the sky each day, according to Michael

Thalhimer, director of business development for All Energy Solar, adding that not all solar fields have panels that pivot, but the option does “get more juice out of the lemon.”

All Energy Solar is focused on being an end-to-end solution provider, working in collaboration with customers for optimal success, Thalhimer says. “That’s what sets us up to be successful in this space—we are really collaborative. We tend to codevelop the project with the client instead of saying, ‘We’ll let you know when we need to come install this system on your acreage.’

“We support development, which is a big part of the timeline for these projects, typically much longer than the construction phase.”

While the process to get the project developed, up and running can be measured in years not months, the systems are designed to operate long-term, Thalhimer notes. “These are 30- to 40-year sys-

tems, so our capabilities don’t stop after the install.”

The project runway is several years, he says, so conversations need to start early. “It’s a thorough and long process to get these developed from initial discussions. It’s not plug and play. It requires design and engineering.”

All Energy handles operations and maintenance as well as warranty management and other elements of its clients’ projects, ideally without out-sourcing. “We are just now in the first year of supporting the Redfield project with operations and maintenance support, and we aim to stay connected with that project as long as they’ll have us,” he says.

“Ethanol producers are a good candidate for solar energy because anyone who pays a retail utility electric bill can potentially be a good candidate,” he says.

Year-over-year energy price increases are now resembling a hockey stick, Thal-

himer adds. “It is not a steady uptick anymore.” The ethanol industry is laden with high energy consumers, he says, with adjacent land available for solar fields.

“So we provide an alternative solution to providing power for the facility, big or small, and if all the stars align, you end up with the type of project we have with Redfield, where they are producing 10 megawatts of electricity for their facility every day.”

The long-term benefit of a solar field helps curtail those ever-increasing costs, he says. “The energy avoidance of delivered power from the grid is a really long tail benefit. That’s the part of this we’re really proud of—we’re not just giving a system that gets ripped up and replaced when there’s something different in the next four or five years. These are really tested and built to last and to be really multi-decade operating systems for the customers.

CLASSIC CANDIDATE: Ethanol producers are great candidates for solar energy because they often have open land nearby and battle high energy costs for operation, according to Michael Thalhimer, director of business development for All Energy Solar.

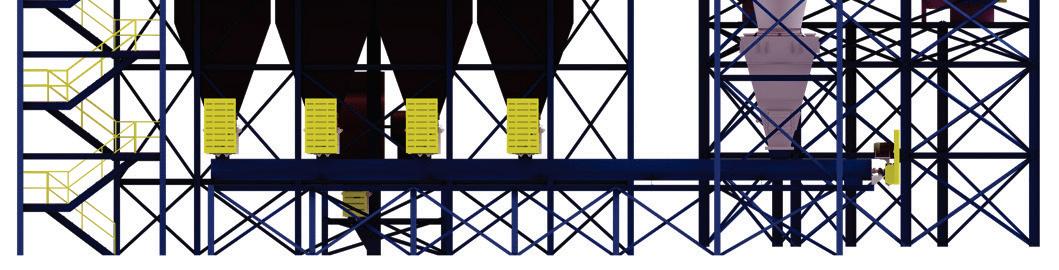

STEPPING STONE: Whitefox ICE Plus offers producers an option to add membranes while continuing to run molecular sieves, at reduced capacity, before completely replacing all sieves with membrane technology.

“That’s why we’re really suited for these projects, because we’re in it for the long haul.”

Thalhimer outlines two main financial incentives for investments in renewable energy such as solar fields. The first is the federal 48E Clean Electricity Investment tax credit. It’s measured as a percentage of the total project cost that the investor can receive back within the first year of the project being in service. For most industrial and commercial-scale renewable power projects as of late, this is 30% of the project cost, Thalhimer says.

“That is set up to be able to come directly back to the owner/investor of the project, based on the tax year the project is put in service,” he says.

Second is the depreciation of the asset. Right now, investments like this qualify for 100% bonus depreciation, which means they can get the full benefit of that particular incentive in the first year. In most cases, the depreciation value is quite similar to the investment tax credit—30%. “That means, together, 60-plus percent of the project cost can be returned within a year of that investment being made in full through two levers,” Thalhimer emphasizes.

“They really accelerate return on investment when almost two-thirds of that project investment comes back within that first year, before you’re even talking about the energy sales.”

Thalhimer notes that for ethanol producers, 45Z is the “extra icing on the cake,” potentially to the tune of a seven-figure credit.

“Solar is absolutely a qualifying investment to earn that credit, as long as you eclipse the necessary CI point improvements to qualify,” he says. “That is another huge potential credit to leverage in addition to the federal tax credit and the depreciation.”

But the policy landscape is changing, with new standards for 48E coming this year. A new set of restrictions prohibits materials from certain foreign entities. “That

does affect our industry and supply chain globally because a lot of solar electric equipment has been manufactured for decades in the far east and that is one of the main areas coming under more scrutiny for imports,” Thalhimer says.

For those who have commenced their project close to or at construction phase, the prior set of rules and policy still fully applies. For those starting efforts in the shorter term, an investment by July 4, 2026 can safe harbor the tax credit.

“While we still have some time to leverage, the rules are changing and starting those conversations sooner will give you the most amount of time to fully develop a concept and see if we can execute it,” Thalhimer says.

In tandem with sourcing half of its power needs from an on-site solar field, Redfield is also reducing the energy required for operations, according to Gillian Harri-

son, CEO of Whitefox. The plant started up its new Whitefox ICE Plus membranebased dehydration system in October 2025.

“So it’s that combination,” Harrison explains. “They’re shrinking their demand to start with in the production process by doing ICE Plus, and then they’re greening their energy source for the energy that they need.”

ICE Plus was developed as a stepping stone from ICE—adding Whitefox’s proprietary membrane dehydration solution to operate complementary to molecular sieves by taking regen and other streams from distillation—to ICE XL—a full replacement of all molecular sieves with membrane technology. ICE Plus leaves the molecular sieve infrastructure in place but operating at reduced capacity while the membranes work alongside them to debottleneck.

“So we’re effectively extending the lifetime by taking load off the sieves, but enabling them in the future to think about replacing those molecular sieves with membranes in a staged approach,” Harrison says. “You can add more membranes in a modular way rather than doing it all in one.”

The ICE systems are designed to increase efficiency and throughput with a CI score reduction. Baukol says the setup at Redfield aims to knock 3.5 points off of the plant’s CI score.

“They are getting used to a different way of running their plant quite quickly, which is brilliant, really,” Harrison says. “They have found the membrane piece relatively straight forward to run. I think they’re finding that easier than the molecular sieve. That’s a testament to their team and ours, and how our respective teams have worked together to do the training and get familiar with a different way of running their facility.”

Decarbonizing energy sources and reducing energy demand go hand-in-hand, she adds. “It makes the energy project more successful because now they need less energy and so a larger proportion of their energy is green than if they just went

for the green energy project on its own. The combination works very well.”

Large projects like solar installations require a core of advocates in an organization to champion the changes, Thalhimer says. “This took a village,” he says of Redfield’s solar field. “This was not a quick yes.

“Redfield’s board really got behind this project as a smart, long-term initiative for

them. This wasn’t a box-checker. This adds a lot of value to their organization.”

Author: Lisa Gibson lisa.gibson@sageandstonestrategies.com