Austin Tenpenny President aDoor Properties

Josh Rayls Secretary Holiday Builders

Wilma Shortall Past 2nd Vice President Father Daughter Properties

Stephen Moorhead Legal Counsel Moorhead Law Group

Heath Kelly 1st Vice President

Heath Kelly Construction

Kevin Sluder 2rd Vice President Gene’s Floor Covering

Dax Campbell Immediate Past-President CamCon

Shon Owens Tresurer Owens Custom Homes

Janson Thomas 3rd Vice President Swift Supply

Josh Peden Financial Officer Hudson, Peden & Associates

2025 Home Builders

Association of West Florida Board of Directors

Austin Tenpenny, aDoor Properties, President

Heath Kelly, Heath Kelly Construction, First Vice President / President-Elect

Shon Owens, Owens Custom Homes, Treasurer

Josh Rayls, Holiday Builders, Secretary

Kevin Sluder, Gene’s Floor Covering, 2rd Vice President

Janson Thomas, Swift Supply, 3rd Vice President

Wilma Shortall, Father Daughter Properties, Past 2nd Vice President

Dax Campbell, CamCon, Immediate Past-President

Josh Peden, Hudson, Peden & Associates, Financial Officer

Stephen Moorhead, Moorhead Law Group, Legal Counsel

Bill Batting, FBM

Keith Branch, Good Foundations, Cost and Codes Chair

Rick Byars, Florida Power & Light

Mickey Clinard, Centennial Bank

Laura Gilmore, Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Thomas Hammond, Hammond Engineering, Civil Engineering Liaison

John Hattaway, Hattaway Home Design

Lindy Hurd, First International Title, Sales & Marketing Committee Chair

Shellie Isakson-Smith, Guild Mortgage

Mary Jordan, Gulf Coast Insurance, Tradesmen/Workforce Development

Committee Chair

Daniel Monie, KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Zach Noel, Clear Title of NW FL

Suzanne Pollard-Spann, Legacy Insurance Brokers, Ambassadors Committee Chair

Marty Rich, University Lending Group

John Scanlon, Pensacola Energy

Pam Smith, Real Estate Counselors, Pensacola Assn. of Realtors Liaison

Chris Thomas, Acentria Insurance

BUILDER DIRECTORS

Chad Edgar, Joe-Brad Construction

Amir Fooladi, ParsCo, Jessica Ford, FD Builds

Fred Gunther, Gunther Properties

Thomas Henry, Thomas Homes

Alton Lister, Lister Builders, Governmental Affairs Committee Chair

Kyle McGee, Sunchase Construction

Jennifer Reese, Reese Construction Services

Douglas Russell, R-Squared Construction

Anton Zaynakov, Grand Builders

EX-OFFICIO / PAST PRESIDENT BOARD MEMBERS

Edwin Henry, Henry Company Homes

Shelby Johnson, Johnson Construction, Remodeler’s Council Chair

Russ Parris, Parris Construction Company

Executive Director jennifer@hbawf.com

Publisher Malcolm Ballinger malcolm@ballingerpublishing.com

Executive Editor Kelly Oden kelly@ballingerpublishing.com

Art Director Ian Lett ian@ballingerpublishing.com

Graphic Designer/Ad Coordinator Ryan Dugger advertise@ballingerpublishing.com

Editor Morgan Cole morgan@ballingerpublishing.com

Assistant Editor Nicole Willis nicole@ballingerpublishing.com

Sales & Marketing

Paula Rode, Account Executive paula@ballingerpublishing.com

Geneva Strange, Account Executive geneva@ballingerpublishing.com

Maggie Banks, Account Executive maggie@ballingerpublishing.com

Cornerstone, the monthly publication of the Home Builders Association of West Florida serving Escambia and Santa Rosa Counties, is published monthly, twelve (12x) per year. Send address changes to HBA of West Florida, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910. Cornerstone, is published in the interests of all segments of the home building industry and is distributed to its members and others associated with the HBA of West Florida. HBA of West Florida and Ballinger Publishing does not accept responsibility for, or endorse any statement or claims made by advertisers or authors of any articles. Every effort has been made to assure ac-curacy of information, but authenticity cannot be guaranteed. No part of this publication may be reproduced without the written consent of Home Builders Association of West Florida, Copyright ©, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910, 850.476.0318. Advertisers and advertorials in Cornerstone do not constitute an offer for sale in states where prohibited by law.

Dear Members,

As builders, we’re no strangers to cycles. The housing market has always been shaped by forces outside our control— interest rates, lending policies, and broader economic conditions. Right now, we’re facing one of the toughest interest rate environments in decades, and it’s no secret that affordability is the biggest hurdle for buyers. For smaller spec builders, who don’t have the same financial muscle or national reach as large production companies, this environment can feel especially daunting. But here’s the truth: small builders are resilient. We’ve always relied on creativity, adaptability, and strong community ties to succeed—and this market is no different. There are strategies available to help smaller builders not only survive but continue to sell homes and meet the needs of buyers.

One of the most effective tools right now is working with lenders to create incentives that help buyers manage payments. We’ve got several great lenders part of our HBA that can help you. Interview and partner with a preferred lender. Yes, rate buydowns are expensive, but there are other options like 2-1 buydowns, lender credits, etc. Whether temporary or permanent, rate buy downs can make a significant difference in monthly affordability. Closing cost assistance is another strategy that resonates strongly with first-time buyers who may be stretched thin. These are not just marketing tactics—they are real solutions that help families get into homes.

In today’s climate, bigger isn’t always better. Smaller, thoughtfully designed floorplans can bring price points down to more accessible levels without sacrificing quality or livability. First-time buyers and downsizers alike are looking for smart, efficient spaces. By building with intention, smaller builders can capture a market segment that may feel locked out of larger homes.

National builders may have scale, but smaller builders have something they don’t: the ability to build relationships. Buyers appreciate dealing directly with the builder, knowing their home was crafted with care, and feeling a connection to the community. Highlight your local presence, your attention to detail, and your reputation for customer service. These are powerful selling points in a world where buyers crave authenticity and trust.

Realtors remain one of the most important conduits to buyers, especially in markets where traffic is slower. Strengthen your relationships with the realtor community. Offer broker incentives, host open houses, and make it easy for agents to showcase your homes. The more advocates you have in the marketplace, the more doors you’ll open.

As an association, we are committed to being a resource during challenging times. We are actively advocating for policies that reduce regulatory burdens and keep housing costs in check. We are also working to provide education, tools, and networking opportunities to help our members adapt and thrive. Remember—you are not in this alone. The strength of our industry lies in the collective knowledge, support, and advocacy of the HBA community.

Challenging markets create resilient builders. While high interest rates are testing us all, they also present an opportunity to sharpen our strategies and stand out from the crowd. By staying nimble, creative, and connected, smaller builders can continue to put families into homes and keep our communities growing. Together, we’ll weather this cycle, just as we have so many before. And when the winds shift—as they always do—those who adapt today will be the ones leading tomorrow.

Sincerely,

Austin Tenpenny

2025 President, Home Builders Association of West Florida

The HBA of West Florida hosted a reception at Seville celebrating the Pensacola Affordable Housing Project. Thank you to our project partners, the City of Pensacola and the NWFL Community Land Trust / Pensacola Habitat.

It was a great evening honoring our volunteer builders, Johnson Construction, ParsCo, and Sunchase Construction, as well as all of the generous donors. Thank you to everyone who attended and helped make this project a success! Make sure to check out the three homes at the 2025 Parade of Homes this October 10-12th!

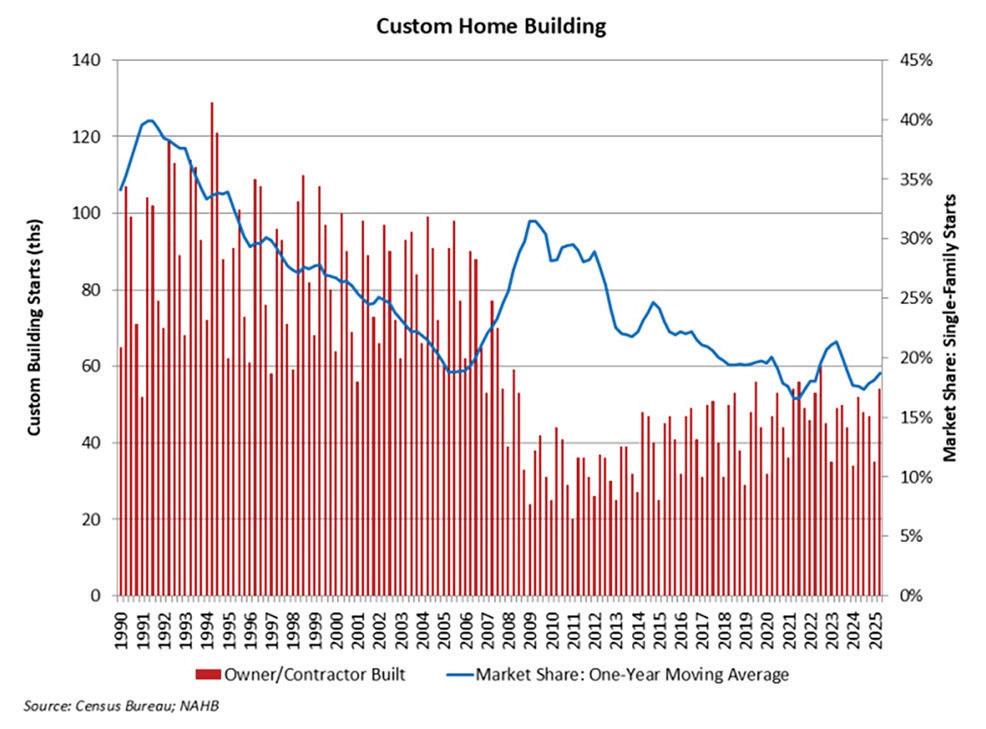

An analysis of census data by NAHB economists shows that custom home building grew 4% in the second quarter of 2025 as high interest rates and home prices suppress demand for traditional spec home production.

There were 54,000 total custom building starts during the second quarter of 2025. Over the last four quarters, custom housing starts totaled 184,000 homes, up 2% from the previous period.

The current market share of custom-built homes is approximately 19% of total single-family starts, the highest since 2022, but still far short of the 31.5% set during the second quarter of 2009, when production home building cratered following the housing market collapse.

As NAHB Chief Economist Dr. Robert Dietz notes in this Eye on Housing post, the custom home building market is less sensitive to the mortgage interest rate cycle than other forms of home building, but is more sensitive to changes in household wealth and stock prices. With spec home building down and the stock market up, custom building is gaining market share.

Whether you’re looking to cut business costs or make smarter personal purchases, the NAHB Member Savings Program offers a wide variety of exclusive benefits. And in 2025, NAHB unveiled several new savings opportunities designed to make membership even more valuable.

From significant discounts on vehicles to better pricing on tech and business tools, here’s what’s new:

NAHB members can receive immediate discounts at Best Buy just by creating an online account with the NAHB member code. Once registered, members can get the lowest price available on all in-store and online items. Plus, for assistance with bulk purchases, appliances, complex deliveries or large installation projects, Best Buy offers NAHB members a dedicated account manager who can help coordinate. Go to nahb.org/bestbuy for more.

Members can save between $500 and $5,000 on the purchase or lease of a Ford truck, van, car or SUV. There is no minimum purchase necessary to take advantage of this deal. Start by filling out a discount request form online, and you’re on your way to significant savings. Go to nahb.org/ford for more details.

Mercedes-Benz Vans has introduced a $500 discount exclusively for NAHB members. This incentive is available on new (unused 2023 model year or newer) Mercedes-Benz cargo vans, crew vans, passenger vans and cab chassis. Visit nahb.org/mbvans for more.

NAHB members can unlock a suite of valuable benefits with QuickBooks provided by Baytek. These include savings of up to 50% on new QuickBooks products, along with exclusive rebates on select items. Members also gain direct access to dedicated Intuit product teams and a specialized migration team offering free transitions from select platforms, as well as access to expert-led training sessions and informative webinars. Go to nahb.org/quickbooks for more.

RAM Trucks is offering NAHB members $1,000 off the purchase or lease of eligible RAM vehicles, including the 1500, Heavy-Duty pickups, chassis cabs and ProMaster vans. This discount stacks with current rebates and low-rate financing offers, giving you maximum value while keeping costs down. Visit nahb. org/ram for details.

With these new offerings, NAHB is continuing its commitment to delivering exceptional value to its members, benefiting their businesses at every level. To explore all of the available offers through the NAHB Member Savings Program, visit nahb.org/savings.

Construction workers are five times more likely to die by suicide than from a jobsite injury, with as many as 50% of all construction workers experiencing a diagnosable mental health problem.

NAHB and its partners – including SAFE Project, the Job-Site Safety Institute (JSI), MindWise Innovations, and others — have been working to address the stigma around talking about mental health issues in the construction industry. The partnership has created resources available to train workers on mental health concerns and associated risk factors, including:

• NAHB-JSI video toolbox talks on Mental Health (embedded below), Substance Misuse and Administering Naloxone

• Storytelling videos on personal experiences

• How to Help in a Crisis Toolbox Talk

More information can be found on the NAHB website in the Member Mental Health and Wellbeing section.

Additionally, as a member of the Construction Industry Alliance for Suicide Prevention, NAHB encourages members to take the pledge to STAND up for suicide preventionand No Shame Pledge.

If you or someone you know needs immediate help, please dial 988, the Suicide and Crisis Lifeline. Organizations interested in participating in the 2025 Stand-Down can register on the CSPW Website.

Most importantly, if you are experiencing mental health issues, please talk to someone, even at work. And if someone comes to you with problems, listen.

The devastating flash floods in Central Texas in July were the latest in a string of tragic flooding incidents involving rivers and streams. As with the mountain river floods in North Carolina after Hurricane Helene, many people are wondering how to prevent such disasters in the future.

Could enhanced building codes help save lives and property in flood-prone areas? Perhaps. But it is important to note there are already enhanced building codes required in flood zones.

The International Residential Code (IRC) Section R306 and International Building Codes (IBC) Section 1612 spell out construction requirements for structures built in flood hazard areas. These provisions equal or exceed the minimum construction standards established under the National Flood Insurance Program (NFIP) required for communities to be eligible for federal flood insurance for buildings constructed in flood hazard areas.

The NFIP minimum construction standards and the I-Codes require new construction and existing buildings that have been substantially damaged by a flood or other event or substantially improved in a remodeling project to be elevated above the depth associated with a flood with a 1% chance of occurring in a year (100-year flood). Construction in floodways — the areas adjacent to a river or other flood source prone to the deepest, fastest-moving floodwaters that cause the most damage — is heavily restricted.

But the nature of flooding makes the uniform development and application of standards, codes, and building requirements very difficult. Floodplains come in many shapes and sizes, including deep river valleys, broad floodplains adjacent to lakes, and coastal areas subject to ocean waves and storm surge.

For example, the Hill Country along the Guadeloupe River, the Asheville region in North Carolina, and the Appalachian areas of eastern Kentucky where severe floods recently occurred are all characterized by mountain valleys and river channels conducive to fast-moving waters and flash flooding. This is in contrast to the areas of the Great Plains along the Missouri and Mississippi rivers where floodplains are often broad and floodwaters can be shallower and slower moving.

In the built environment, shallow urban flooding can occur when storm drains get overloaded.

This variability is baked into flood zone management. Flood Insurance Rate Maps (FIRMs) developed by FEMA identify specific flood hazard areas around water based on the probability of flooding. These include the traditional 1% annual chance (100-year) floodplains, known as special flood hazard areas, floodways, and on some maps the 0.2% annual chance (500-year) floodplain. These mapped flood hazard areas are crucial in determining the risk basis for flood insurance rates and the issuance of building permits.

Even predictive modeling can fail to account for anomalous climate events. A meteorologist reported that 1.5 times more moisture was transported to western North Carolina last year than in any prior recorded event, and the North Carolina State Climate Office said rainfall amounts were well past 1,000-year flood levels.

Additional building codes will never be able to account for these types of events. But buildings built to current codes do withstand flooding far better than older structures. Home owners also have the option to build their homes to above-code standards, including for flood prevention, for an additional cost.

An upcoming cost study from Home Innovation Research Labs estimates the cost of 1 foot of elevation above grade for a typical slab-on-grade home as ranging from $4,800 to $12,200 depending on the method used and climate zone. The incremental cost of an additional foot of elevation ranges from $3,700 to $14,000. Those are significant costs for home owners and renters, especially as America is facing a serious housing affordability crisis.

In addition, Home Innovation Research Labs and NAHB recently developed a series of guidelines published by HUD for designing homes for natural hazards, one of which is for water risks. Also, the National Green Building Standard (NGBS) is currently set to be published in the next few months with an updated standard. The standard includes topics such as resiliency from water events.

A number of home building strategies and techniques can be used to prevent flooding, although hazards persist. Unfortunately, flooding is an intractable issue, but home builders and remodelers are mitigating these risks and hazards with new techniques and products based on science.

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.

Spike Candidate 1-5 Credits

Blue Spike 6-24

Life Spike 25-49

Green Spike 50-99

Red Spike 100-149

Royal Spike 150-249

Super Spike 250-499

Statesman Spike 500-999

Grand Spike 1000-1499

All-Time Big Spike 1500+ Spike Club Members and their credits as of 03/31/2025.

Statesman Spike

Harold Logan

Super Spike

Rod Hurston

Royal Spike

Rick Sprague

Edwin Henry

William “Billy” Moore

Bob Boccanfuso

Charlie Rotenberry

Red Spike

Oliver

Newman Rodgers IV

Green Spike

Spike Credits

Shelby

Stud-to-plate connectors

Thr eaded rod systems