Meet The New Boss

Storytelling at Scale

PodcastVideos.com helps companies, their agencies, and individuals create video content that connects, builds trust, fuels marketing and delivers measurable results.

• Video Podcasts

• Educational Videos

• Training Videos

• Culture & Brand Videos

• Industry Thought Leadership Videos

• Product & Service Videos

• Social Media Advertising Videos

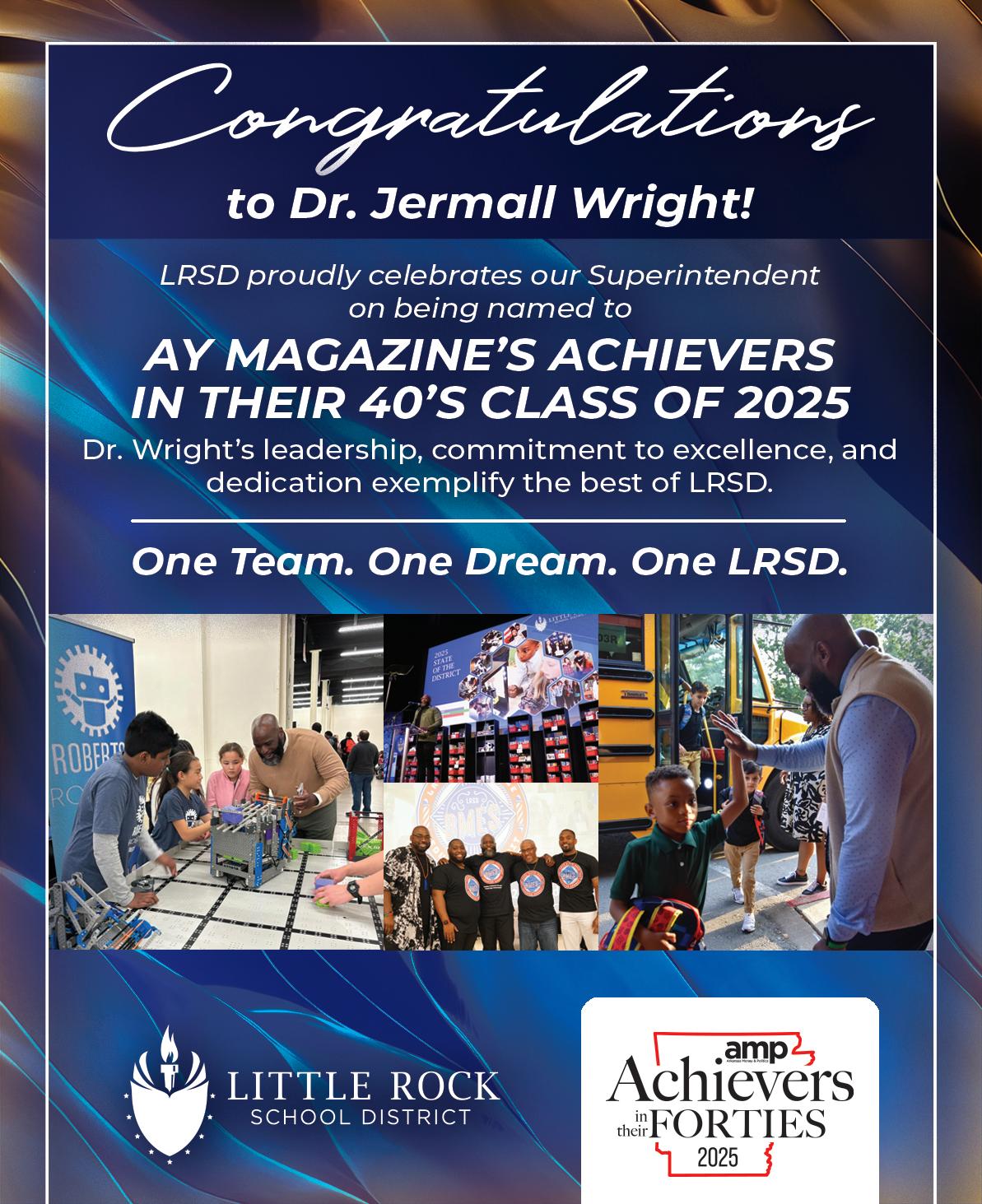

A special nod to our founder Eric Howerton, recognized as an Arkansas Money & Politics Achievers in their Forties, for leading this vision forward.

THERE THERE SEE Y’ALL THERE SEE Y’ALL THERE SEE Y’ALL THERE SEE Y’ALL THERE SEE Y’ALL THERE Y’ALL Y’ALL THERE Y’ALL THERE THERE SEE Y’ALL THERE THERE SEE Y’ALL THERE Y’ALL THERE Y’ALL THERE Y’ALL THERE $10

Trusted Advisor to Banks & Financial Institutions.

Over the last three decades, Stephens has executed on over 10 transactions totaling over $2.4 billion in value for Simmons First National Corporation

OVERVIEW OF TRANSACTION:

$345MM TRANSACTION is a milestone for both client and Stephens

STEPHENS served as LEAD LEFT BOOK-RUNNING MANAGER on the offering LARGEST REGIONAL BANK EQUITY offering of 2025* *U.S. banks with branches in multiple states and total assets between $10 billion and $100 billion.

JULY 22, 2025

FEATURES SEPTEMBER 2025

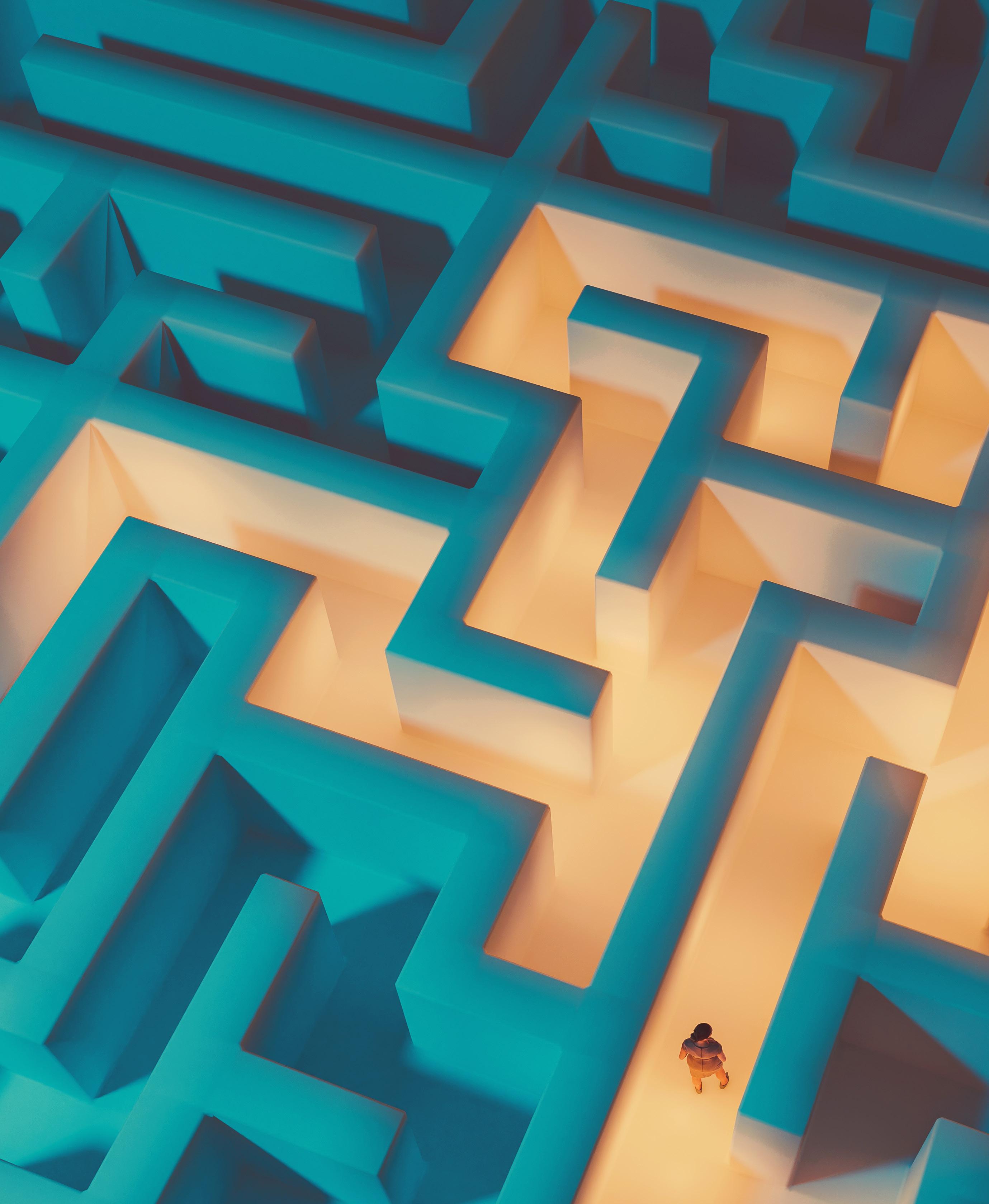

THE FUTURE IS NOW AMP spoke with several Arkansas bankers about the future of digital banking, the rise of artificial intelligence in banking and more.

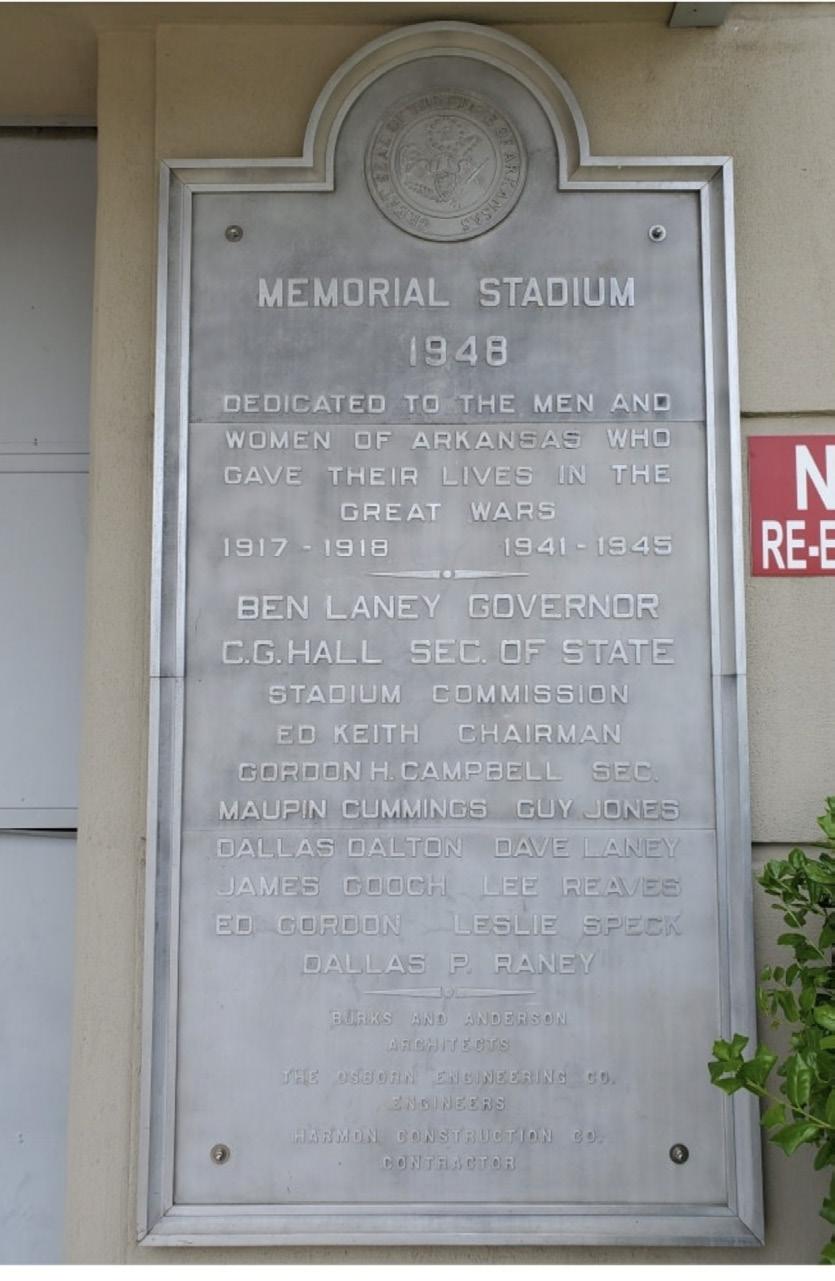

NOW WHAT? The Hogs may have played their last game in Little Rock’s War Memorial Stadium. How will the state’s grand ol’ lady adapt to a new era?

Female bankers are making strides when it comes to advancing in the traditionally male banking industry, but there remains work to do.

Money management is not the career for those expecting the same out of every day. Managing assets requires the ability to ride waves of change.

Readers once again revealed to us their favorite financial advisors in the Natural State. AMP is proud to shine a light on these financial advisors.

ACHIEVERS IN THEIR FORTIES

AMP once again recognizes some of the best and brightest in the state, those business leaders who have found success and are poised to do much more.

Howard Hurst is keeping his family business going strong at Tipton & Hurst, perhaps one of Arkansas’ most well-known and iconic firms.

Reimagining

The Central Arkansas Library System’s Main Library in downtown Little Rock has undergone a reimagining, including a new Boulevard Bread location.

When Jacksonville Mayor Jeff Elmore and his family purchased the former Keith & Co. Artisan Sandwich Shop, it was not something they had planned for.

Arkansas’ reputation as a haven for mountain biking and other outdoor pursuits generates significant revenue for the state.

Arkansas athletics director Hunter

like his peers across the country, has had to deal with issues no one saw coming 20 years ago.

PRESIDENT & PUBLISHER

Heather Baker | hbaker@armoneyandpolitics.com

EDITOR-IN-CHIEF

Dwain Hebda | dwain@armoneyandpolitics.com

SENIOR EDITOR

Mark Carter | mcarter@armoneyandpolitics.com

ASSOCIATE EDITOR

Mak Millard | mmillard@armoneyandpolitics.com

EDITORIAL COORDINATOR

Darlene Hebda | darlene@armoneyandpolitics.com

COPY EDITOR

Sarah DeClerk | sdeclerk@armoneyandpolitics.com

STAFF WRITERS

Doug Crise | dcrise@armoneyandpolitics.com

Alex Hardgrave | ahardgrave@armoneyandpolitics.com

MANAGING DIGITAL EDITOR

Kellie McAnulty | kmcanulty@armoneyandpolitics.com

ONLINE WRITER

Kilee Hall | khall@armoneyandpolitics.com

PRODUCTION MANAGER

Mike Bedgood | mbedgood@armoneyandpolitics.com

SENIOR ART DIRECTOR

Angela Stark | astark@armoneyandpolitics.com

GRAPHIC DESIGNERS

Lora Puls | lpuls@armoneyandpolitics.com

Lee Smith | lsmith@armoneyandpolitics.com

SENIOR ACCOUNT EXECUTIVE

Greg Churan | gchuran@armoneyandpolitics.com

Michelle Daugherty | michelle@armoneyandpolitics.com

Mary Funderburg | mary@armoneyandpolitics.com

Karen Holderfield | kholderfield@armoneyandpolitics.com

Ryan Parker | ryan@armoneyandpolitics.com

Carrie Sublett | carrie@armoneyandpolitics.com

EXECUTIVE ASSISTANT

Jessica Everson | jeverson@armoneyandpolitics.com

ADVERTISING ASSISTANT

Katie Beth Smith | ksmith@armoneyandpolitics.com

ADVERTISING COORDINATOR

Lisa Hern | ads@armoneyandpolitics.com

CIRCULATION

circulation@armoneyandpolitics.com

ADMINISTRATION

Marissa Porter | ayoffice@armoneyandpolitics.com

CEO | Vicki Vowell

TO ADVERTISE call 501-244-9700 email hbaker@ armoneyandpolitics.com

TO SUBSCRIBE

armoneyandpolitics.com/subscribe

CONTRIBUTORS

Krista Langston, Cara Lank, Mary LeSieur, Sandy Starnes, Jason Burt, Nelson Chenault, Chris Scott, Scott Street

Yurachek,

The mayor’s place Women in banking

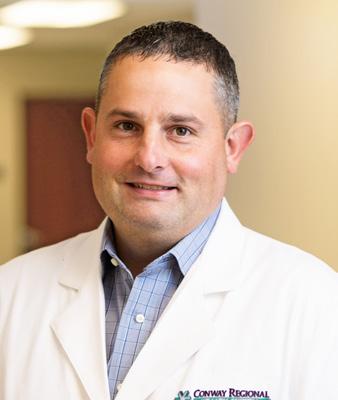

Meet The New Boss ON THE COVER

Simmons Bank President and CEO Jay Brogdon sits down with AMP to discuss the future of one of Arkansas’ largest banks. The story starts on page 16.

Photo by Jason Burt.

FEEDBACK

CHAMPIONS OF HEALTHCARE 2025: CARELINK, RANDI METCALF Wow!! Great stuff!! Congrats.

Bo Renshaw

LREA MEMBERS: HUGG & HALL

Hugg & Hall is outstanding in every way.

Charles T. Coleman

TROUTMAN JOINS SOUTHERN ECONOMIC DEVELOPMENT COUNCIL BOARD

Gary Troutman is simply first class guy.

Kevin Watson

LARKIN TO RETIRE AFTER 27 YEARS WITH ARKANSAS COMMUNITY FOUNDATION

Heather, your dedication and leadership have been truly inspiring! Congratulations! All the best in retirement!

Sandra Storment

COBURN GOSS TAKES THE HELM AT ARGENTA CONTEMPORARY THEATRE

This is so exciting! ACT is incredibly lucky to have him.

Tami Baker

NATURAL THINKING, POSITIVE RESULTS: FROM HORMONE BALANCE TO GUT HEALTH, NATURAL MEDICINE SOLUTIONS ARE TAKING OFF IN ARKANSAS

Heather Baker wonderful publication. Always amazing work.

Thank you for highlighting my friend. (Dr. Amy Beard)

Dallas Guynes

CONGRATULATIONS ON YOUR 58 APW CONTEST JOURNALISM AWARDS! You guys are the best!!

Steve Arrison

TOP ONLINE ARTICLES

Aug. 3 — Sept. 1

1 Hall of Famer Jimmy Johnson Coming Back to Arkansas

2 AMP Best of 2025

3 Outdoor Vehicle Manufacturer Gets Green Light for Arkansas

4 11 Nonstop Flights From Little Rock

5 Digs of the Deal: Castle on the Lake, Marylake Monastery

6 All for One: LREA Looks to Second 50 Years

7 Moxy Hotel Bringing Style, Social Energy to South Fayetteville

8 Natural Appeal: Tourists Flocking to Arkansas in Record Numbers

9 Moore Sports: Wess Moore Leaves Local TV for Digital Era

10 Growth Brings Big Names: Little Rock Touchdown Club Gears Up for 2025 Season

Former University of Arkansas Basketball Coach Nolan Richardson is being honored as Arkansan of the Year by the Arkansas Broadcasters Association and will be inducted during the association’s annual convention Sept. 15 at Oaklawn in Hot Springs.

arkansasrazorbacks.com

Photo:

Longtime Arkansas sports broadcaster Wess Moore stepped into the digital space with Moore Sports , a new program that launched just in time for football season.

Heather Larkin, longtime president and CEO of Arkansas Community Foundation, will retire at the end of 2025.

By Mark Carter

THE GUTTER AND THE STARS

Most of us aspire for inclusion on Santa’s nice list, but it is that devilishly tempting naughty list that grabs our collective attention and won’t let go. Pop culture revels in the tawdry, and we get sucked in like moor ponies in the Grimpen Mire.

Eyes will be drawn to headlines reporting of disaster long before those proclaiming steady as she goes. Crime-related content makes up the majority of subject matter we absorb through television and movies, virtually all of it tawdry. The genre of the decade is true crime.

It seems naughty is vastly more interesting.

Are we instinctively drawn to it? Do we climb up from the gutter to stamp our name on the nice list, or do we fall from grace onto its counterpart? From whence do we begin the journey?

The Irish author Oscar Wilde may have hinted at a response with a line from his 1892 play, Lady Windermere’s Fan:

“We are all in the gutter, but some of us are looking at the stars.” (Yes, the line was borrowed by Chrissie Hynde and the Pretenders.)

So Hobbes or Rousseau? Is mankind animalistic in nature and refined by civilization or inherently good and poisoned by it? The answer, as it usually does, lies somewhere in the murky middle (if not entirely in Paul’s Epistle to the Romans).

PUBLISHER’S LETTER

TAs Solomon wrote in Proverbs, “For as he thinketh in his heart, so is he.”

Therefore, think good thoughts, gentle reader. Real Housewives of New Jersey can wait.

***

We’re reminded of a quest for higher calling gone array in Thailand back in 2022. Every monk in a Buddhist temple was defrocked after testing positive for yaba, a version of Thai street meth. The four monks, including the abbot, were sent to rehab and replaced.

The quest for a higher calling was once again usurped by the pull of a quick high.

Meth is one of the devil’s most effective tools, and though monks — or priests, pastors, rabbis or imams — may answer a divine call, they are people first. And as the news reminds us each and every day, people come in various states of condition, good and bad.

Yaba comes in pill form and costs around 20 baht, which translates to about 50 cents. An official from the United Nations Office on Drugs and Crime told a Thai paper after the news broke that meth, particularly yaba, can easily be found on every street corner in Thailand. Supply is up, he stressed.

Demand does not appear to be lacking either. That same year, 2 tons of meth hidden in marble tiles were shipped from the Middle East to Sydney, eventually falling victim to the largest drug bust in Australian history.

We trust the monks who strayed from the path found retribution and release from addiction. The path will always be there, waiting for them. Unfortunately, so will the yaba peddlers.

By Heather Baker

THE PACE PICKS UP

he slow, leisurely pace of summer begins to vanish in August as students prepare for and then launch another school year. Then, in September, things pick up as football takes hold. This month’s issue of Arkansas Money & Politics is as busy as the fall season can seem. Inside, readers will find our annual list of “Achievers in Their Forties,” in which we recognize some of the state’s brightest upand-comers; readers’ choices for the state’s “Best Financial Advisors”; and our yearly spotlight shined on women in banking, honoring the female trailblazers in Arkansas who broke through the glass ceiling of an industry traditionally peopled mostly by men.

Donning the cover this month is new Simmons Bank CEO Jay Brogdon, who spoke with us about Simmon’s legacy and what’s ahead. Hunter Yurachek, who speaks to the Little Rock Touchdown Club Sept. 15, was also gracious enough to grant us an interview. (This is not exactly a slow time for him.)

Speaking with editor-in-chief Dwain Hebda, Yurachek dishes on the crazy times enveloping college athletics, how the Hogs will compete in the transfer portal/NIL age and more.

We will also look at the banking and finance industries, consider the future of Little Rock’s War Memorial Stadium, and readers will “meet the new boss” — millennials taking charge in the workplace.

There really is a lot to digest and absorb in this month’s issue, and we appreciate our readers more than ever. Hit me up with any story ideas at hbaker@armoneyandpolitics.com.

Heather Baker with Hunter Yurachek

UAMS TACKLING ARKANSAS’ MATERNAL HEALTH CRISIS WITH INNOVATION AND COLLABORATION

By Krista Langston

For too long, maternal health outcomes in Arkansas have reflected a persistent crisis, particularly for women in rural areas and those insured by Medicaid. At the University of Arkansas for Medical Sciences in Little Rock, we refuse to accept that geography, race or income should determine whether a mother survives pregnancy or receives the care she deserves. That belief is the foundation for our innovative and collaborative approach to improving maternal health outcomes across the state. We are committed to creating a system where every mother in Arkansas has access to the care and support she needs before, during and after childbirth.

One of the most direct ways we are closing the gap in care is through our mobile health units. In light of hospital closures and the reduction of obstetric services in many communities, these units serve as mobile clinics that deliver critical services directly into underserved areas. They provide well-woman exams, prenatal and postpartum care, mental health screenings and contraceptive services, all coordinated by a dedicated team of providers and community health workers. By eliminating transportation challenges and other logistical barriers, we are making high-quality maternal care available to women who might otherwise go without.

We are also expanding access to doulas, who offer compassionate and continuous support during labor and delivery. Doula care is associated with lower rates of cesarean deliveries, fewer birth complications and increased satisfaction with the birth experience. For many women, doulas often serve as essential advocates within complex health care systems. Through our partnership with the Doula Alliance of Arkansas, we are increasing the number of trained and certified doulas in the state and providing scholarships to help build a workforce that reflects the diverse communities we serve. These doulas are not only present in birthing rooms but are becoming integrated into the broader clinical care teams across hospitals.

Another key innovation addresses the issue of unintended pregnancies, which affect 54 percent of women in Arkansas. Closely spaced pregnancies and lack of postpartum contraception can lead to serious consequences, including delayed prenatal care, maternal hemorrhage, increased neonatal intensive care unit stays and even infant death. To reduce those risks, UAMS developed the Immediate Postpartum Long-Acting Reversible Contraceptive Initiative. The program gives new mothers the opportunity to receive long-acting contraception before leaving the hospital after childbirth.

Over a two-year pilot, we saw outcomes that surpassed national benchmarks. Our patients had lower rates of short-interval pregnancies and reported greater satisfaction with their ability

to plan for their reproductive futures. Those results helped pave the way for the passage of House Bill 1385 in 2023, a critical piece of legislation that now allows all birthing hospitals in Arkansas to receive Medicaid reimbursement for immediate postpartum LARC insertion. This policy shift reflects how research, patient-centered care and legislative action can come together to create long-term improvements in reproductive care.

To ensure that these innovations are adopted statewide, collaboration has been essential. UAMS works closely with the recently announced Arkansas Center for Women & Infants’ Health and the Arkansas Perinatal Quality Collaborative to build capacity and standardize care. Through the Alliance for Innovation on Maternal Health, Arkansas has adopted evidence-based clinical protocols to better manage obstetric emergencies such as hemorrhage, hypertension and complications from cesarean sections. ARPQC provides hands-on training in hospitals across the state to ensure that staff are prepared to deliver consistent, high-quality care even in highstress situations or amid staffing challenges.

In August, UAMS co-hosted the Arkansas Maternal Health Roundtable with the Arkansas Hospital Association. The event convened representatives from the 33 delivering hospitals in Arkansas and served as a catalyst for collaboration, alignment and shared accountability. Participants engaged with data, exchanged best practices, and discussed strategies for implementing both legislative changes and clinical improvements in a sustainable and patient-centered way.

Data continues to guide our work. The Arkansas Maternal Mortality Review Committee, established in 2019, has completed four years of maternal death reviews. The data is sobering: 92 percent of maternal deaths in Arkansas have been deemed preventable. This statistic demands not only our attention but our action. It reinforces the importance of the interventions we are pursuing, from Medicaidcovered contraception and doula support to emergency preparedness and mobile access.

The efforts are not just innovative — they are effective. We have already seen improved outcomes, increased engagement and greater patient and provider satisfaction across our programs.

We believe Arkansas can and must lead the way in redefining maternal health. We are proving that it is possible to build a system that honors the dignity of every mother and baby, regardless of their circumstances. We are committed to continuing our work in collaboration with partners, patients and communities who share our vision. Together, we can make Arkansas a safer and healthier place to give birth.

Krista Langston is executive director of community programs at the UAMS Institute for Community Health Innovation.

EXPERIENCE you trust.

RELATIONSHIPS you count

Building the Cornerstones of Arkansas Communities

At C.R. Crawford Construction, we believe the strongest foundations are built on more than concrete and steel—they’re built on TRUST, COLLABORATION, and PROVEN RESULTS.

From Hotel Vin to The Plaza at Pinnacle Springs—with Ruth’s Chris Steak House and Un Deux Trois Café—our work in Northwest Arkansas represents more than high-profile projects. It reflects enduring partnerships with clients who trust that their investments are protected. Every project is delivered with precision, efficiency, and lasting value—built to stand the test of time.

THE PLAZA AT PINNACLE SPRINGS Rogers, Arkansas

THE USDA’S BEST-KEPT FINANCING SECRET UNLOCKING BIG OPPORTUNITIES FOR ARKANSAS BUSINESSES

By Cara Lank

When most Arkansans hear “USDA loan,” it’s not unusual to envision endless rows of rice or industrial poultry farms, but here is the reality:

The U.S. Department of Agriculture Business and Industry Guaranteed Loan Program is one of the most versatile, underutilized and impactful financing tools available for rural economic development, and it is not for agricultural operations.

For business owners and developers looking to fund a project, whether it is expanding a manufacturing facility, acquiring a competitor or building a hotel, do not overlook the USDA B&I program. The financing terms can be more flexible, the guarantees stronger and the possibilities broader than one might expect. Through its B&I lending program, the USDA has transformed communities, funded ambitious projects and created jobs right here in Arkansas. Yet too many business owners and even bankers are unfamiliar with the program or the up to $25 million in funding that accompanies it. That is why we call it the “hidden gem” of government guaranteed lending.

The USDA’s B&I loan program focuses on rural communities with populations of less than 50,000. The goal is simple: stimulate economic growth in rural communities by funding projects that create jobs, improve infrastructure and support local economies. One of the most common misconceptions is that USDA loans are reserved for agriculture or housing. They are not. In fact, with some farm exceptions, the program is open to most for-profit businesses, nonprofits, cooperatives, tribes and public bodies. With “no restrictions on the size of the business, owner occupancy or net worth,” the B&I program seeks to reduce the number of obstacles standing in the way of rural investments.

The USDA Rural Development Guaranteed Lending Programs make it possible to finance projects that would otherwise be too risky for conventional bank lending. B&I loans can go up to $25 million with an 80-percent federal guarantee, and funds can be put toward a variety of eligible uses, including business acquisitions, expansions, debt refinancing, and the purchase of machinery, equipment or real estate. Most interestingly, eligibility is determined by geography and population density, not perception.

Using the USDA’s online mapping tool often yields surprising results. A water park in Kissimmee, Florida? Eligible. Some parts of suburban areas one might never think of? Also eligible. The

point is rural is not always as rural as one might imagine. While Arkansas is rich in rural communities that have big potential, they still face unique financing challenges. Large projects in these areas often struggle to attract bank financing because of perceived risk or lack of comparable deals. The USDA’s guarantee changes that equation, enabling banks such as Stone Bank to say yes when they might otherwise have to say no.

The result? Access to capital that drives real change. Earlier this year, the Arkansas Center for Health Improvement noted that “Arkansas leads the nation in the percentage of rural hospitals vulnerable to closure,” with nearly 50 percent of current rural hospitals at risk. Meanwhile, Stone Bank has processed B&I loans to fund medical facilities in communities where critical lifesaving resources are hours, not minutes, away. B&I loans have also made manufacturing plants, hotels and even technology companies viable in rural towns. The projects do not just help the borrower; they ripple outward, bringing jobs, boosting local tax revenue and improving quality of life.

The USDA program can appeal to both local owner-operators and largescale investors, including billion-dollar private equity funds. In fact, the program can be leveraged for projects up to $100 million through participation with other banks and lenders. The truth is USDA loans are not something borrowers want to “figure out as they go.” Success requires a lender with deep program knowledge, established contacts in Washington, and the ability to structure deals that meet both the borrower’s and USDA’s requirements. Without that expertise, projects can stall or fail to get approved.

The USDA B&I loan program is not a niche curiosity. It is a strategic tool for building rural prosperity. The biggest challenge is not convincing people it works. It is letting them know it exists in the first place.

Here is a challenge to business leaders in the Natural State and beyond: Think bigger about rural investment. Look past the stereotypes, and the next time you hear “USDA loan,” do not picture a farm. Picture your next growth opportunity.

Cara Lank is the chief credit officer at Stone Bank, which she has served since 2016. Lank has also served as chairman of the National Rural Lenders Association Government Relations Committee.

SATURDAY

OCTOBER 11

6PM

STATEHOUSE CONVENTION CENTER LITTLE ROCK, ARKANSAS

DENISE & TIM LUFT

GALA FOR GOOD CO-CHAIRS ENTERTAINMENT BY THE BAYOU ROYALS

THE EARLIER, THE SMARTER

TEACHING TEENS TO MASTER FINANCES IS KEY

By Sandy Starnes

Financial literacy is the cornerstone of any smart relationship with money. Knowing how to budget, save, borrow and invest is as essential as knowing how to read or write in today’s economy.

Learning those skills marks the beginning of a lifelong journey of managing finances confidently. It poses an opportunity for public schools to prioritize financial literacy the way they do math, reading and science. Eighty-eight percent of adults in the U.S. did not feel prepared to manage money when they graduated from high school, and even now, only about 57 percent of them would call themselves “financially literate.”

The numbers drop even further when we look globally, at only 33 percent of the world’s population claiming to have a solid understanding of basic financial concepts. If these topics had been part of the curriculum from the get-go, perhaps those numbers might be stronger today.

Instilling practical financial literacy skills early on equips students to make responsible financial decisions, avoid highinterest debt and build a more secure financial future. The practices increase the likelihood of accruing wealth over time, setting students on a clear path toward success. Earlier generations lived in a simpler financial world. Most transactions were in cash, and only the affluent had access to loans.

Loans, credit and debit cards, and electronic transfers are the norm now, and even in brick-and-mortar stores, cash is only used for about 11 percent of the transactions. The takeaway: Establishing a solid relationship with one’s bank is more important than ever, providing the guidance and support needed to cultivate success. That is where community banks make a unique difference. Unlike larger institutions, they directly invest in the future of the areas they serve, which includes helping young people open savings accounts and teaching them how credit works.

Community banks build personal connections that make their customers feel like someone is walking beside them as they grow, something that is especially invaluable during a stage of transition.

Citizens Bank recognized how important it is for youth to foster that kind of relationship and launched its Bank in a School program at Southside Charter High School in Batesville in 2023 to help students begin their financial journeys early. The system provides participating students with hands-on experience in areas such as personal savings, credit scores, budgeting, financial management and banking operations. It was the first program of its kind in the state and is among less than 1 percent of banks nationwide to offer something like it.

The benefits of the program extend far beyond the individual. A financially literate generation strengthens the economy by preparing young entrepreneurs to launch businesses responsibly and helping new families make smarter choices. When young people understand how money works, they are better equipped to fuel economic growth and stability for their state and communities.

This October, Citizens Bank will launch its third year of the program at Southside Charter High School. The program has given students something most adults never had: a safe, immersive environment to learn money management while simultaneously running a real bank branch inside the school. Students who have graduated from the program say it gave them confidence to approach adulthood. It empowered them to move forward by opening their first savings account, being able to explain how credit works and learning to balance budgets.

They leave the program feeling prepared for life’s first big financial decisions, which have the power to either set them back for years or set them on an upward trajectory. Eleven students have gone through the program since its launch. When the program starts back up for the 2025-2026 school year, it will continue breaking new ground on Arkansas education, workforce readiness and financial security. That should be the standard, not the exception.

While several banks have followed Citizens Bank’s lead, Arkansas contains more than 300 high schools, and many students leave feeling unready to manage adulthood. Generation Alpha, an umbrella term for individuals born between 2012 and now, has been projected to turn the financial world on its head. The oldest of the group are currently 13, but even now, they realize the role money will play in their lives.

About 77 percent of them consider it cool to be financially savvy, and 91 percent believe financial knowledge and skills are necessary for meeting their life goals. An education system that meets them where they are ensures they can thrive in a modern system so significantly controlled by money.

After all, every student deserves the chance to graduate having tools that will help them in the years to come.

Sandy Starnes is a senior vice president and director of marketing at Batesville-based Citizens Bank. Starnes serves as a board member of the Independence County Public Education Foundation, IMPACT Independence County, BankOn Arkansas+ and the American Bankers Association Professional Development Advisory Board. She was also appointed to the American Bankers Association Emerging Leaders Advisory Board of Directors in 2017 as Arkansas’ sole representative.

ANSWERING A NEED

ROGERS FARM MAKES A HOME IN NORTHWEST ARKANSAS

By Scott Street

In more than 30 years of health care administration, I have learned that helping children thrive starts with removing barriers for families. Too often, parents navigate a maze of appointments and multiple providers just to get the therapy their child needs. That is why at Pediatrics Plus, we have consolidated comprehensive, high-quality services under one roof — making life easier for parents who would otherwise juggle appointments across different locations while also balancing work, caring for other children and managing daily life.

Families in northwest Arkansas already know Pediatrics Plus as a trusted partner in their children’s care. Now we are taking that commitment further by opening our innovative Farm model in Little Flock, just outside of Rogers, in late September. The first-of-its-kind setting blends the clinical expertise families count on with the healing power of nature, creating an environment where therapy is as engaging as it is effective. There, children can access occupational therapy, physical therapy, speech-language therapy and applied behavior analysis, all while exploring outdoor spaces designed to spark curiosity, build confidence and support growth. It is a place where learning, healing and play naturally overlap so children feel motivated and excited about their progress.

No two children are alike. Their strengths, challenges and learning styles are as unique as their fingerprints. That is why children with developmental, behavioral or physical differences often benefit from multiple types of therapy, each addressing a different piece of the puzzle. Speech therapy helps children communicate their needs, thoughts and feelings. Occupational therapy builds daily living skills and independence. Physical therapy strengthens bodies, improving mobility and coordination, and ABA can be life-changing for children with autism and other developmental challenges, giving them tools to learn, grow and connect.

Unfortunately, those services are often siloed, leaving parents to coordinate care on their own. Our team has changed that. By offering these therapies together — with therapists collaborating daily in one location — children make faster progress and families feel more supported.

At Pediatrics Plus, we have always believed children learn best in environments that engage their minds and bodies in meaningful, real-world ways. The Farm takes that philosophy to the next level. Imagine a child practicing balance by navigating crop rows in a garden, not just a strip of tape in a therapy room. Picture speech therapy outdoors, where children learn new words by describing vegetables they have planted. Think of occupational therapy that includes grooming miniature horses and gathering eggs, allowing fine motor skills and sensory experiences to grow together.

The Farm is built on the idea that therapy can be immersive, joyful and connected to the rhythms of nature. Beyond therapeutic goals, children also learn transferrable life skills: how to nurture and care for living things and how to communicate and collaborate with others. In the process, they build friendships, practice emotional regulation and develop social skills that will serve them far beyond their time at The Farm. That type of environment supports therapy and builds community, empowering children to see themselves as capable and connected.

We have already seen the impact. Rogers joins our other operational Farm sites in Bryant, Cabot and Conway, and new ones are in development in Springdale and Searcy, as well as Tahlequah, Oklahoma. Our first Farm locations have transformed outcomes for children and families, and the model is now a core part of our vision for the future.

Opening in Rogers was intentional. Northwest Arkansas is one of the fastest-growing regions in the country, attracting families from across the state and beyond. With that growth comes an increased demand for pediatric therapy services. Building The Farm in Rogers is an investment in more than a facility. It is an investment in the children of this region, in their families’ peace of mind and in the long-term health of the community. It is our commitment to ensure caregivers do not have to choose between getting children the care they need and holding their own lives together.

When I look back on my career, I can point to moments that felt like turning points. The opening of The Farm in Rogers will be one of them — not because of the ribbon-cutting or the new facility but because of the relief in families’ faces when they realize everything their child needs is at home.

That is what happens when a community invests in its children. It is what happens when we look beyond the limits of traditional health care models and imagine something better, and it is what we at Pediatrics Plus will keep doing — in Rogers, across northwest Arkansas and in every community we call home.

On Sept. 22, we will open the gates to The Farm in Rogers. More importantly, we will open the door to new possibilities: for children to grow, for families to feel supported and for a region to see what is possible when health care innovation meets community needs — because every child deserves the chance to conquer their world, every family deserves access to the therapies their children need, and every community deserves a place where hope grows.

Scott Street is CEO of Pediatrics Plus.

Jay Brogdon

J One ONE ON

ay Brogdon leans back in a side chair at the conference table in his newly claimed office atop the Simmons Bank Tower in Little Rock.

From this spot, the banking system’s new CEO is but a few blocks from his former digs at the prestigious Stephens investment bank.

It is but a five-minute jaunt by car to get from that point on Brogdon’s career trajectory to this one. In fact, depending on which window at Simmons headquarters one looks out of, the stately glass Stephens tower is easily within sight, on this day shimmering in the roiling Arkansas afternoon heat. Brogdon’s traversing of that distance, however, took considerably more doing.

“If I may, I’ll take you back a little bit,” he said with a wry grin. “George Makris [retiring Simmons CEO and chairman] called me in 2019 and asked me to come over and join as CFO of the company. I’d had a great relationship with the bank, worked very closely with them throughout my tenure at Stephens, but it just wasn’t something that was of interest to me at that point in time in my career, so, of course, I’m very nice about it, but I just said, I’m very flattered, but no.

“The fun part of the story, and if you know George very well, nothing could be more on brand for him — I get a call from him out of the blue in January of 2021, and he says, ‘Jay, you know, I called you a couple years ago, and you told me no. I really don’t like hearing no twice.’”

Brogdon agreed to a lunch meeting, and the long and short of it is Makris, a born salesman who has succeeded in everything from beer to banking, had his man. Brogdon, for his part, once convinced of the opportunity, never looked back.

“I’ve had such a respect for this company for so long,” he said.

Former basketballer Jay Brogdon ready to run Simmons Bank

“I’m a lifelong Arkansan, born and raised here. I’ve had the great fortune of working for Stephens for a lot of my career and now Simmons. I just have a massive amount of respect for what companies like that mean to a state the size of Arkansas.

“George really laid out the kind of vision for overall succession and how there was a contingent of leaders who aren’t going to be able to do this forever and how the board wanted this company to continue to thrive as far into the future as we can see. There were no promises. The bank had to perform, and I had to perform, but as he laid out that vision and how I could fit into it, I felt like everything I had done in my career up to that point prepared me really well for some of the pieces Simmons was missing and needing to bridge to the future.”

It is not the first time Brogdon had been recruited, nor was it the first time he had faced a full-

By Dwain Hebda || Photos by Jason Burt

court press. A star basketball player at Highland High School, pride of a 1,000-soul hamlet in Sharp County, the 6-6 forward landed a basketball scholarship to Harding University in Searcy. He saw extensive playing time for the Bisons over four years, in addition to earning his degree.

Still, it was finance, not banking, that drew his attention following graduation in 2004.

“Banking had to have picked me,” he said. “My parents were schoolteachers. My dad was a basketball coach and a math teacher. My mom was an English teacher. I was interested in business. I got an accounting degree, I spent a few years at Deloitte, the global accounting firm, but I never woke up and said, ‘I want to do banking.’”

As it happened, however, many of the clients he worked with at Deloitte were banks, and by servicing them the way he did over four years, he created a business network practically by default. The pattern continued after he joined Stephens.

“It just so happened that an opportunity opened up at Stephens on the investment banking side,” he said. “Plus, and people may or may not know this, Stephens has a legacy in banking going all the way back to Jack Stephens, so I had the benefit of joining a firm with some commercial banking pedigree and a firm that had a very deep-rooted history in serving banks and growing the investment banking side to advise those banks.”

“We all stand on the shoulders of some giants, right, when it comes to that type of commitment to our communities and to our customers and to this state.”

The shoulders Brogdon refers to are indeed broad, particularly over the past 40 years of the company’s 122-year history. Founded in Pine Bluff in 1903 on first-day deposits of $3,300, the bank grew steadily locally if unremarkably statewide and beyond. By the 1980s, the bank was on shaky ground, which precipitated native Arkie and former Marine Tommy May being named president and CEO in 1987. May, an indefatigable force of nature, took a figurative machete to waste and unnecessary spending wherever he saw it, no matter how seemingly inconsequential.

“One of the things I learned is it’s not always what you do; it’s the message you send. My message then was that we need to tighten up expenses,” May told Arkansas Money & Politics for a 2023 cover story. “We had these big coffee cups with our logo on them. The first thing I did was eliminate that and get smaller ones because when people pour coffee, they drink about a third of what’s in there.

I’ve had the great fortune of working for Stephens for a lot of my career and now Simmons. I just have a massive amount of respect for what companies like that mean to a state the size of Arkansas.

That practical experience put Brogdon on Simmons’ radar, while Simmons’ impact on Main Street, in turn, struck a chord with the young executive, finally prying him loose from Stephens in 2021 after 13 years.

“The purpose and the passion that fuels me is we have such a big impact in the communities we serve and the important role that we play in the formation of businesses, the growth capital for businesses to grow, the way we show up at the school as a booster — whatever it is,” he said. “Those are things that everybody in this company is very, very passionate about, and that’s been true from those who came before us.

“Next thing we did is we took some notepads that were kind of long, and we cut them in half. You could write on that just as easily as the other while doubling your inventory. It wasn’t that we were going to save a lot, but we were wanting to send a message. A lot of what we did was sort of for show, but it worked. Even today, I have people say something to me about us tearing those notepads in half and taking the coffee cups.”

May instilled a similar steeliness in lending discipline to reduce the number of bad loans, and by 1990, he built up enough reserves to go on the offensive. Simmons snapped up a string of failed savings and loan branches to increase its footprint and, in 1992, made national news for rolling out its own credit card. By the time May handed off the leadership baton to Makris in 2013, Simmons Bank had reached $4 billion in assets.

Makris, a former Simmons board member whose family’s beer distributorship in Pine Bluff goes back generations, was faced with the same predicament as his predecessor — expand or die. Within six months, he delivered his answer with the $53.6 million cash purchase of Arkansas-based Metropolitan Bank, an opening acquisition salvo that would continue all the way to the present.

Simmons’ latest big gain — purchase of Houston-based Spirit of Texas Bank, completed in 20221 — brought a former Fortune 100 “Fastest-Growing Company” into the fold, raking

in $2.7 billion in deposits and $2.3 billion in loans. It also gained 37 branch locations and strong representation in growth-rich metros Dallas, Fort Worth, Houston, San Antonio and Austin.

As Makris told AMP in 2023 the company’s art of the deal did not lie in its ability to write the check but in the knack it developed to weed out potential suitors that did not mesh culturally.

“What we really want is to be the acquirer of choice, and over the last 10 years, most all of the acquisitions came to us, or it was mutual,” Makris said. “We’ve got, especially in our markets, a good reputation of coming in and really working with the management team and keeping their culture because it matches our own. Those are the banks we’re looking for, not somebody looking to cash out a deal.”

One primary tenet of that culture is the value Simmons places on talent and its commitment to finding and equipping the right people, placing them in roles where they can be successful. As Brogdon adds the title of CEO and board member to go with the role of president of Simmons First National Corp. and Simmons Bank he has answered to since 2023, that part of the company’s vision and values remains as sharp as ever.

“In this role, you know, I’m not really a recruiter,” he said. “When the team has a final-round candidate for a leader position or a very high performer, my role is to come in and paint the picture of what our business is focused on and really sell, in a very authentic way, that people have an opportunity to come here and make an impact — not just be a producer at a bigger bank than they’re at but to come here and help build and leave their mark on something. We have had incredible success doing that.”

Brogdon said the future lies with the companies that can be progressive enough to not only deploy current technology but envision where such tools can take them in the future.

“Banks, in general, are dinosaurs,” he said. “I mean, banks are highly regulated and move at a really slow pace. When you think about the www. world that we live in and the size and scale that we have as a business today, that compels us to invest in the technology side in ways that will intersect in very advantageous ways, whether you’re a consumer or a small business or the largest commercial customer we work with or anywhere in between.”

Brogdon’s new role does not officially take effect until the first of the year, but he is already making an impression on the troops wherever he goes. He has traveled to various markets to put a face on the title and is known to engage random employees in conversation in hallways out of genuine interest in their jobs and opinions.

Today, Simmons Bank is a regional banking powerhouse with more than 200 locations in six states. It holds $17 billion in loans and $22 billion in deposits and $26.7 billion in assets, per its investor relations department, as of June 30, 2025.

For as impressive as it is, such stats merely serve to toe a starting line for its newest chief executive, whose exuberance makes

him seem even younger than he is for a person leading such a massive enterprise. While no one can foretell the future, of course, his history of staying put professionally suggests a refreshing stability lies ahead, providing the foundation for continued growth even as market trends shift and change surrounds on all sides.

“The industry dynamics are what they are, and they don’t all excite me, by the way,” he said. “There were 20,000 banks, and then there were 10,000 banks, and now there are 4,000 banks. It just continues to consolidate. Where we have seen ourselves as primary beneficiaries in recent history and what I expect to be a primary beneficiary of here in the near future is in the talent acquisition game versus the whole-bank acquisition. With mergers and acquisitions, you have dislocation of associates at the banks that are involved and dislocations of the clients served within those banks.

“Just in recent weeks, in both Tennessee and Texas, we’ve seen some very large acquisitions, and when we look at ourselves and the investments we’ve been making in the business, we bring a very stable platform that is attractive to good talent that just wants to serve their clients well. You look at our company’s investment and succession, the youth that we have on the team — or, as I say a lot of times, the tread left on the tire — we’ve got a lot of runway to execute and grow this business.”

Brogdon will lead a Simmons Bank that has become a regional powerhouse.

Here to Stay

With digital banking now almost exclusive, what is next?

By Mary LeSieur and Mark Carter

hometown banks, much has changed in banking overall in the last generation. Indeed, much has changed in the past decade. Has digital banking taken over completely? Turns out not quite, though it appears to be well on its way to doing so.

The Federal Reserve Bank of Atlanta issued a report this past summer that showed U.S. consumers still hanging on to their checkbooks, although checks are written much less often.

One-third of consumers surveyed in the Atlanta Fed’s Survey and Diary of Consumer Payment Choice reported having written a check in the past 30 days. That said, more than 90 percent of respondents reported preferring a method other than a written check to pay a bill, and just 6 percent of that group reported the use of a personal check in 2024.

In 2020, according to the Atlanta Fed’s research, 19 percent of American consumers paid bills by check, compared to just 7 percent in 2024. Other nuggets from the report include consumers ranking checks the second-worst option for convenience and security, ahead of only money orders and cash, respectively.

Like traditional movie theaters and cable TV, checks are hanging on, but

with each passing year, more consumers bounce to digital means of payment.

Arkansas Money & Politics spoke to four Arkansas bankers who oversee their institutions’ digital efforts. They dished on the digital movement, artificial intelligence, innovation and more. AMP visited with Larry Casey, senior vice president and chief information officer at Jacksonville-based First Arkansas Bank & Trust; Max Harrell, chief lending officer at Generations Bank in Rogers; Tyler Seidel, vice president of treasury management at Signature Bank of Arkansas in Fayetteville; and Jason Taylor, executive vice president and chief financial officer at Batesvillebased First Community Bank.

Arkansas Money & Politics: How dependent on digital banking are customers now? Is it even possible to “bank” anymore without some form of digital banking?

Larry Casey: Digital banking has become deeply woven into the

fabric of daily life for most Americans. From checking balances on a mobile app while waiting in line at the grocery store to paying bills late at night or transferring money to a family member with just a few taps, our customers’ expectations have evolved. The convenience, speed and accessibility of digital channels are now fundamental to how people view their financial well-being.

While it may still be possible for some to “bank” without digital tools, the reality is that digital banking is no longer a luxury or a niche. It has become a necessity for most. Even customers who prefer inperson service often use digital banking for certain transactions. The ability to view accounts, pay bills, deposit checks and even consult with financial experts online is no longer just a competitive advantage; it’s an essential part of the modern banking experience.

At FAB&T, our role is to ensure that digital banking enhances — rather than replaces — the personalized service that defines a community bank. We strive to offer choices: Those who value faceto-face conversations can still visit our

Larry Casey

branches and speak with a trusted banker, while those who prefer the convenience of digital can access a comprehensive suite of online services. In practice, most of our customers use a blend of both depending on their needs and circumstances. Our goal is to ensure that every customer feels empowered whether they engage with us digitally, in person or both.

Max Harrell: Heavily dependent on digital banking. A significant majority of our customers are enrolled in online banking. Consumers are driven more and more to digital experiences that transcend industries. The general expectation is clearly already there that the bank must offer some form of digital banking. I don’t believe we’ll see that slow down anytime soon.

Tyler Seidel: Many customers rely heavily on digital channels — mobile apps, online banking, remote deposit, person-toperson payments, etc. — for their day-to-day banking needs. While it is still possible to bank without some form of digital banking, at Signature Bank of Arkansas, we feel it’s imperative to provide digital services to serve different generations by offering the convenience and speed that digitally native generations like Gen Z and millennials expect while also catering to the physical-first needs of other generations through a blended approach.

Digital platforms offer features like real-time alerts, personalized financial insights and 24/7 access, improving the customer experience and helping us remain competitive and loyal to a wider customer base. While banking is evolving, many of our customers still value the faceto-face interactions and tangible services that physical branches offer.

Essentially, we want our customers to enjoy the freedom of banking on their terms, so while we are heavily focused on continuing to evolve our digital banking capabilities to serve the needs of different

generations of users, we also know many of our customers love the personal, first-name-basis touch in our brick-andmortar locations and we will continue to give them that.

Jason Taylor: Digital banking has become the primary way many customers interact with their bank. While in-person service will always play an important role, today’s customers expect 24/7 access to their accounts for things like checking balances, depositing checks, paying bills and transferring funds. It’s still possible to bank without digital tools, but for most people, the convenience and efficiency of mobile and online banking have made them a part of everyday life.

AMP: How has your bank been out front in innovative digital banking?

Casey: As a community bank, we pride ourselves on listening closely to our customers and responding swiftly to their evolving needs. Innovation, for us, is not about chasing trends — it’s about solving real problems and making banking more accessible, secure and personal.

FAB&T has led the way in several areas of digital banking innovation. We were among the first community banks in our region to offer mobile check deposit, allowing customers to deposit checks from anywhere anytime. Our online banking platform is designed for simplicity and ease of use with an intuitive interface that puts the most important information and functions front and center. We also offer real-time alerts, customizable account views and secure messaging so customers can stay informed and connected.

One of our proudest achievements is our commitment to digital security. We have invested in advanced encryption, multifactor authentication and regular cybersecurity training for our staff. Customers can bank with confidence, knowing their information is protected at every step, but innovation doesn’t stop at technology — it extends to service. Our digital channels are supported by real people who are ready to answer questions,

resolve issues and provide guidance. We host webinars on topics like online security and financial planning, and our digital support team is available to help customers navigate new tools.

In short, we believe that the best digital banking experience is one that feels just as personal as a visit to the branch.

Harrell: We pay a lot of attention to new and innovative digital banking trends. Being a community bank, we desire to continue to support our communities, which include those who prefer a high level of digital engagement and those that prefer a high level of in-person engagement. We have taken the approach that being “out in front” or on the “bleeding edge” for innovative digital bank offerings is not what serves our communities the best. We would prefer to appropriately vet the trend or technology and see how applicable it is to our current customers and future customers while keeping the necessary digital tools and resources up to date and enabled. Focusing on offering the right digital banking services as compared to just offering generic digital banking services is something we try to focus on continuously.

Seidel: Signature Bank of Arkansas is committed to leading the way in innovative digital banking while preserving the personalized service our customers value. We’re investing in technology that makes banking faster, simpler and more secure, from real-time payments and seamless mobile experiences to advanced fraud protection and fully integrated treasury solutions for businesses. Our digital tools are designed to meet the unique needs of every generation, whether that’s mobile-first convenience for tech-savvy customers, robust online services for families or tailored treasury platforms for business owners.

By blending cutting-edge innovation with trusted relationships, Signature Bank delivers a banking experience that keeps us out front — and keeps our customers confident every step of the way.

Taylor: We’ve made intentional investments in creating a seamless digital experience while maintaining the personal

Tyler Seidel

service for which community banking is known. Our digital suite includes advanced mobile check deposit, peer-topeer payments, card management tools and other features that allow customers to manage their finances securely from anywhere. We’ve also worked to integrate financial literacy tools into our platforms, helping customers not only with access but also with making informed financial decisions.

AMP: How will the role of artificial intelligence in banking evolve?

Casey: Artificial intelligence is poised to transform banking in unprecedented ways, but at FAB&T, we view AI as a tool to enhance relationships, not replace them. The thoughtful integration of AI can help us deliver smarter, more responsive service while maintaining the human touch that sets us apart.

AI will increasingly play a role in areas like fraud detection, where machine learning can spot unusual patterns and alert both customers and staff to potential risks faster than ever before. Personalized recommendations — whether for savings, loans or financial planning — can be delivered based on real-time analysis of a customer’s habits and goals. Chatbots and virtual assistants are already making it easier for customers to get answers to simple questions anytime day or night.

However, our vision for AI is grounded in transparency and empathy. We see AI as a way to free up our staff to focus on complex, emotionally nuanced situations that require human judgment and compassion. Routine inquiries and transactions can be handled seamlessly by smart systems, while our bankers are available to support customers through big decisions, life changes or unexpected challenges.

Privacy is paramount. We are committed to using AI responsibly and ensuring that customers understand how their data is being used. Our approach is to be proactive in communicating these changes, offering education and always providing an option for customers to speak directly with a person.

Harrell: AI will have a multitude of use cases. As fraud continues to ramp up and plague the financial system, AI will be

used to combat those fraudulent-type transactions. Credit underwriting could be another use case to help predict and assess credit decisions. Ultimately, the goal of using AI will be to help create efficiencies and improve customer relations.

Seidel: AI in digital banking helps us better protect our customers’ accounts, make everyday banking easier, and gives them personalized financial insights. At Signature Bank of Arkansas, we’re exploring ways of using AI to understand our customers’ needs and offer services tailored to them — while keeping the personal relationships and trusted service they count on. Looking ahead, AI also opens the door to new opportunities, from smarter money management to advanced business banking solutions.

Taylor: AI has the potential to enhance banking by providing personalized insights and anticipating customer needs. At First Community Bank, we remain focused on approaches that maintain the trusted relationships and security our customers value. Any adoption of new technologies will be considered carefully with the priority on serving customers reliably and responsibly.

AMP: What is the next big thing in digital banking?

Casey: If the last decade has been about bringing basic banking services online, the next decade will be about creating truly personalized, seamless experiences that integrate banking into every aspect of our customers’ lives. The next big thing is a shift from “digital banking” as a separate activity to “embedded banking” that meets customers where they are, whether that’s on their phone, on a smart device or even at the point of sale.

We see the rise of open banking and interoperability as key drivers of change. Customers will soon be able to connect their FAB&T accounts securely to a host of other financial platforms, tools and services, giving them more control and flexibility. Digital wallets, contactless payments and integrated budgeting tools will make managing money effortless and intuitive. We’re also exploring ways to use data and technology to anticipate needs and offer proactive solutions — reminding

customers of upcoming bills, suggesting ways to save or offering support in times of crisis. The future is about empowerment, inclusivity and building trust.

Yet even as technology advances, our foundation remains unchanged: We are a community bank first and foremost. The next big thing is not just about what technology can do but how it can help us nurture relationships, foster financial wellness and build stronger communities. Whether through a friendly face at the branch or an app on a smartphone, our mission is to be there for our customers — however they choose to bank.

Harrell: The next big thing in digital banking is integrating personal communication with digital services. This can be done through a variety of mediums, such as online chat or video chat, in which you get a personal touch while being outside of the physical branch or bank locations. This is available, but I believe adoption will become more and more popular.

Seidel: The next big thing in digital banking is using AI to go beyond transactions and create meaningful, personalized experiences. At Signature Bank of Arkansas, we see this as an opportunity to anticipate customer needs — from protecting accounts and offering tailored financial advice to helping businesses forecast cash flow and plan for growth. By blending AI-driven insights with the personal relationships we’re known for, we’re building the future of banking that’s both innovative and community centered.

Taylor: The future will center on anticipatory banking — meeting needs before customers even ask. That could include predictive savings tools, AIdriven insights for budgeting or more comprehensive financial wellness dashboards. We also expect to see a stronger blending of digital and inperson experiences so customers can move easily between channels without losing continuity of service. Our commitment is to remain out front in these areas while keeping community, service and relationships at the heart of everything we do.

Bank of America recognizes Matthew McDaniel, Private Bank Client Manager, for being honored by Arkansas Money & Politics among the 2025 Best Financial Advisors.

At Bank of America Private Bank, we combine the client experience of a boutique private bank with access to extensive resources, institutional-quality solutions and the intellectual capital of one of the world’s largest financial services firms, including traditional, specialty asset, alternative and capital market investment solutions, as well as customized credit and banking offerings, to help maximize wealth.

(collectively

The Chief Investment Office (CIO) provides thought leadership on wealth management, investment strategy and global markets; portfolio management solutions; due diligence; and solutions oversight and data analytics. CIO viewpoints are developed for Bank of America Private Bank, a division of Bank of America, N.A., (“Bank of America”) and Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S” or “Merrill”), a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”)

Investing involves risk, including the possible loss of principle. Past performance is no guarantee of future results. Bank of America Private Bank is a division of Bank of America, N.A., Member FDIC and a wholly owned subsidiary of BofA Corp. Trust, fiduciary and investment management services are provided by Bank of America N.A., Member FDIC and a wholly owned subsidiary of BofA Corp., and its agents. Investment products: Are Not FDIC

ARKANSAS' 75 LARGEST CHARTERED BANKS BANKING

TOP25 LARGEST CREDIT UNIONS in ARKANSAS

Deron K. Hamilton

C NGRATS!

AMP’s Women in Banking 2025

Itzel Sims

Senior Vice President, SBA Director

NMLS#2140020

AMP’s Best Financial Advisors 2025

Andy Arnold*

Senior Vice President, Director of Retirement Plan Services & Wealth Advisor

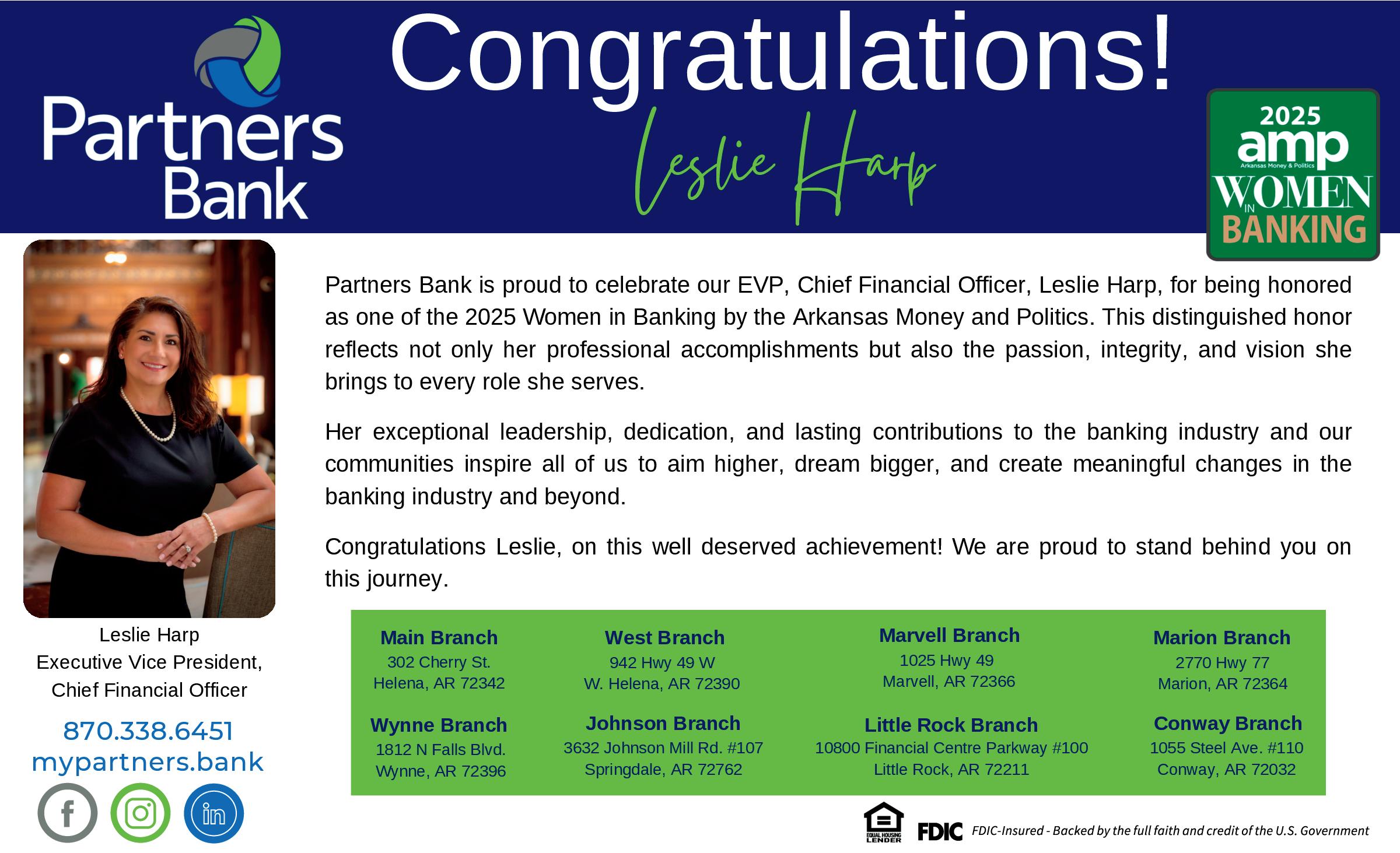

The executives named to Arkansas Money & Politics’ 2025 list of “Women in Banking” were nominated by readers. In a male-dominated industry, their perseverance, hard work and expertise have propelled them to influential positions in Arkansas banking and finance. We are proud to recognize them in this month’s issue.

Although banking has been a male-dominated industry historically, women are breaking the glass ceiling and rising to the top with the expertise, professional achievements and personal tenacity to succeed. These women in the banking industry are leaders who are making a significant contribution to the profession.

The Path Revealed

PROGRESS MAY BE SLOW, BUT IT IS THERE IN BANKING

INDUSTRY

By Mark Carter

For Latrecia Carroll, operations manager and senior vice president at Stone Bank, the obstacles women have traditionally faced in the banking industry are real but not something that cannot be overcome. Sometimes, one just needs a guide to reveal the path. That is why representation matters in the banking industry, she said.

“I’ll never forget meeting a young girl at a community financial literacy event several years ago. She approached me after my talk, eyes wide with excitement, and said, ‘I didn’t know someone like me could do what you do,’” Carroll said. “In that moment, I realized how important it is for young girls to see someone who looks like them succeeding in this field. If my journey can light the way for the next generation, then every challenge I’ve faced has been worthwhile.”

Women have always had their place in the banking industry. Unfortunately, for far too long, that place was at the teller window. In 2025, things are looking up for women in the field, but that does not mean those who reached the industry’s C-suites did not have to work longer and harder to get there. Even with the example set by Carroll and others, obstacles remain. After all, old practices can take root.

Is the climb any easier for women in banking these days?

“I’m not sure it’s ever easy to advance as a woman,” said Natalie Bartholomew, community president for northwest Arkansas at First Community Bank. “I think the better way to answer this question is that there is more awareness, advocacy and support for women to succeed than there was.”

Indeed, while many in the industry face the same obstacles that have always hindered women, pathways that were once closed are opening up. Carroll said opportunities for women in banking are expanding, and each day brings new possibilities — but progress remains slow.

“The conversation around gender equity has grown louder, and organizations are more aware of the value of diverse leadership,” she said. “While the road hasn’t always been easy, doors are opening, and more women are walking through them with confidence and purpose. Although the journey toward true equity continues, it’s inspiring to witness more doors opening and women stepping boldly through them. The increased focus on gender equity and the recognition of diverse leadership has sparked meaningful change, making the path forward brighter for everyone.”

Hillis Schild, executive director of Arvest Bank’s Arvest Opportunity Fund, sees that focus resulting in progress.

“Leadership roles can still be male dominated, and some amount of pay disparity still exists, but I believe that women have lots of opportunities in banking, and if we apply ourselves to constantly improving our banking skill set, we can go very far in the banking industry,” she said.

Although the U.S. banking industry employs more women than men, the old teller mindset remains entrenched to a degree. The annual Gender Balance Index from the Official Monetary and Financial Institutions Forum, an independent banking think tank, revealed slow progress in 2024. Of the 335 institutions it studied, the proportion of female leaders had risen from 14 percent in 2023 to 16 percent.

WOMEN IN BANKING

“While most banks tend to employ more women than men, women aren’t always represented in executive/leadership positions or in board positions,” Bartholomew said. “I do feel confident that more awareness is made toward providing opportunities for women to advance, but it truly starts with women and allies who are in a position of leadership to pave the way for the women behind them. Are they doing their part to advocate for other women? Are they improving policies and procedures to make the bank a better place for women to work? There is still a lot of work to be done, but we are making progress.”

Carroll credited much of the progress to supportive workplace cultures “with a focus on support, equity and inclusion.”

“Progress may be gradual, but with every stride, women are proving that they belong and that their leadership is both valuable and necessary for the future of the industry,” she said. “Women are not only claiming their seats at the table but are also leading conversations, making strategic decisions and shaping the future of banking in ways that were once unimaginable. Their presence and leadership challenges old views, highlights the importance of diversity and helps the industry innovate and better serve all clients and communities.”

Bartholomew has become an important advocate for women in the industry, if not an outright celebrity. Her The Girl Banker podcast and blog, launched in 2017, has become a national brand. She did so not just to advocate for women bankers but to inspire young women to consider a career in banking, she said.

“What started initially as a blog and a small social media presence has turned into the opportunity to speak on national stages, launch a podcast, a merchandise store and manage a Facebook group that has over 11,000 women in banking from all over the country as members,” she said. “At the end of the day, I’m most proud of the community of women in banking that the platform has created.”

Bartholomew will be the keynote speaker at the annual American Bankers Association Bank Marketing Conference, set for Sept. 15 to 17 in New Orleans. It will mark her third keynote address to

the group. The ABA x The Girl Banker Brunch, themed “Amplifying Women’s Voices,” will kick off the event.

“The idea of the brunch is to set the tone for the rest of the conference with a high energy, inspiring session that features a focus on women in banking,” she said.

Bartholomew takes her role as a banking executive “celebrity” seriously.

“It’s an honor I don’t take lightly,” she said. “I feel there is more I can do to make young women aware of opportunities in the banking industry. Typically, young women don’t seek out careers in banking. Instead, banking typically finds them.”

Schild said being a role model in the industry can be fulfilling, but the thought of inspiring young girls to seek out a banking career is humbling.

“All kids need role models they can relate to, and that’s part of the reason I teach financial education when I’m offered that opportunity,” she said. “Teaching and mentoring kids is one of my favorite things to do.”

Carroll said navigating the industry as a woman — and a woman of color at that — led to her being underestimated, overlooked or challenged simply because of her gender.

“Facing these realities has required resilience, grit and confidence,” she said. “On the other hand, I feel a profound sense of pride. My hard work, accomplishments and presence are breaking barriers and showing what is possible for young girls who might otherwise doubt themselves. For me, every career milestone isn’t just my achievement; it’s a reflection of the potential in others.”

Carroll wants girls and young women thinking about a career in banking to know that the journey is worthwhile and that despite lingering prejudices, a C-suite-level office is waiting if they work hard enough.

“When young girls see my success, I hope it affirms that doors can open, and glass ceilings can be cracked,” she said. “With hard work and perseverance, they too can step into spaces where they belong and even lead with confidence and authenticity.”

Natalie Bartholomew

Latrecia Carroll

Hillis Schild

Leaders Who Inspire. Women Who Achieve.

First Financial Bank is honored to congratulate our very own Evelyn Morris and Amber Murphy, recognized among Arkansas’s most influential women in banking. Their leadership not only fuels our bank’s mission but also strengthens the communities we serve.

left to right:

Evelyn Morris | Senior Vice President | Loans Amber Murphy | Vice President | Marketing

KATHERINE AGUILAR

Relationship Banker II

Merchants & Farmers Bank

BROOKE ALBERSON

VP, Compliance

Piggott State Bank

VICKI ANDERSON

VP/Human Resources Director

The First National Bank of Fort Smith

PAULA APPLEGET

Sales Executive

Bank-Tec South

ADRIANA FUENTES ARCHILA

VP, Community Development

ACC Capital

BETTY ARIVETTE

Senior Vice President

The Malvern National Bank

AMANDA ARMSTRONG

Commercial Loan Officer

Southern Bancorp

With 18 years of banking experience under her belt, Amanda Armstrong is passionate about helping people navigate their financial journeys, a mission-focused motivation that directly aligns with her role at Southern Bancorp, one of the nation’s oldest and most impactful community development financial institutions. Outside of work, Armstrong is an active member of her local community and school district, and she enjoys cheering on her kids during sports.

KELLY ASHCRAFT

President/COO

Warren Bank & Trust

KENLEA BAKER

VP, Market Operations Coordinator

Bank of Fayetteville and Farmers & Merchants Bank

LESLIE BALLENTINE

CFO

Community First Trust Co.

TIFFANY BARGER

VP, Senior Private Banker

Simmons Bank

Tiffany Barger serves as a vice president and senior private banker at Simmons Bank, where she provides concierge-level financial solutions to high-net-worth individuals, physicians, executives, and business owners. With nearly 20 years of banking experience, Barger specializes in delivering tailored banking and lending strategies designed to simplify complex financial needs. Known for her relationship-driven approach, she partners closely with clients to provide trusted guidance, personalized service and seamless access to Simmons Bank’s exclusive private banking products and services.

NATALIE BARTHOLOMEW

NWA Community President

First Community Bank

Natalie Bartholomew, a career banker with nearly 25 years of experience in the industry, is the community president in northwest Arkansas at First Community Bank. Bartholomew has a passion for philanthropy and sits on various boards and committees that serve the northwest Arkansas region. She was recognized as the 2015 Young Woman of the Year by the Greater Bentonville Area Chamber of Commerce at the NWA Business Women’s Conference, a 2020 Independent Community Bankers of America “40 Under 40: Community Bank Leaders,” a member of Arkansas Money & Politics “Women in Banking,” and a member of AY About You’s “Intriguing Women” in 2022. She was recently presented with the Young Alumni Award for the department of agricultural business and economics at the University of Arkansas in Fayetteville at the 10th Annual Distinguished Alumnus of the Year event. She received both her bachelor’s and master’s degrees from the University of Arkansas and is an alum of the Graduate School of Banking at Colorado.

She launched The Girl Banker blog in November of 2017 in hopes of creating a voice for women in banking and working mothers. The Girl Banker has been featured in American Banker, the American Bankers Association Bank Marketing newsletter, and a variety of financial industry newsletters since its successful launch. In 2019, she launched The Girl Banker podcast. She and her husband, Colt, have two sons, Brody and Witten.

KELLI BEENE

VP/Director of Human Resources

The Malvern National Bank

KORTNI BEENE

VP/Mortgage Production Leader

Southern Bancorp

Kortni Beene has helped to lead and guide Southern Bancorp’s growing mortgage efforts for nearly 12 years, helping individuals and families across Arkansas and the Southern region open the door to homeownership no matter their zip code or financial position. She is a proud alum of Henderson State University in Arkadelphia and is a 2025 graduate of the Mortgage Bankers Association of Arkansas’ Future Leaders program.

LUCINDA BISHOP

Financial Officer

Bank of Salem

ANASTASIA BLAYLOCK

CSO

Citizens Bank

TORI BOGNER

SVP/Director of Marketing & Communications

Signature Bank of Arkansas

Tori Bogner serves as senior vice president and director of marketing and communications at Signature Bank of Arkansas, where she oversees marketing, communications, advertising, public relations and community engagement initiatives on behalf of the bank. Once described as “wry” by The New York Times, Bogner brings both creativity and strategy to her work while maintaining a deep commitment to the communities she serves. An active community leader, she is a sustainer of the Junior League of Northwest Arkansas, an alumna of Zeta Tau Alpha, and served two terms on the National Board of Directors for the Arkansas Alumni Association. She graduated valedictorian from the now-consolidated Weiner High School before earning both bachelor’s and master’s degrees from the University of Arkansas in Fayetteville, where she also served as student body president. Her dedication to leadership development is reflected in her completion of Leadership Fayetteville, Leadership Benton County and Leadership Arkansas.

LAURA BOGOSLAVSKY

SVP

Eagle Bank & Trust Co.

CHRISTIE BRIGGS

AVP/IT Officer

The First National Bank of Fort Smith

AMY BROOKS

Human Resources Generalist

Chambers Bank

MACHELLE BROWN

AVP/Operations Support Manager

Chambers Bank

SHELBY BRUFFETT

COO

Anstaff Bank

Shelby Bruffett is chief operating officer at Anstaff Bank, where she has worked for 24 years. She previously served the bank in the roles of chief administration officer, chief financial officer, and human resources administrator. A Conway native, she graduated from Conway High School before moving on to Arkansas Tech University in Russellville, where she earned a bachelor’s degree in business administration.

Celebrating Two Decades of Business

Invested In You Since 2025

Signature Bank of Arkansas opened for business on May 9, 2005.

We’re deeply grateful for your trust in choosing us as your bank. Your continued confidence in Signature Bank is a testament to the strength and tradition of community banking. It’s our honor to uphold that tradition and serve your financial needs.

Going above and beyond for our customers? That’s who we’ve been for 20 years. Here’s to the next two decades!

BREANNA BUNTJER

Assistant Branch Manager

CS Bank