February 202 5

February 202 5

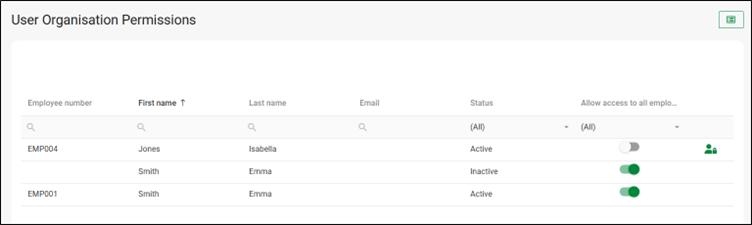

The User Org. Unit Permissions screen has been converted to NextGen. This is a significant milestone in our NextGen project, as it means that all screens under the Security Menu are now in NextGen.

As part of the screen conversion, we’ve introduced several usability enhancements to improve your experience:

• Enhanced overview: We’ve added additional columns such as Employee number, Status and Allow Access for quick reference.

• Filtering Capabilities: Easily filter to see active users only or search for a specific user by any of the columns.

• Toggle for Access Control: On Classic, selecting all Org Units meant that a user would only have access to employees linked to a Position record. A new toggle switch is available that lets you easily manage access to employees. Switching it on selects all Org Units to grant access to all employees including those without a Position record (i.e. employees not linked to an Org Unit). Switching it off allows you to allocate specific access instead using the Access Icon.

• Organised Access Allocation: The Allocate Access page is now organised into two separate tabs for Org Units and Regions permissions respectively.

• Quick View of Selections: We’ve created a quick view section to the right of the screen of the selected Org Units or Regions to make it easy for you to see what access the selected user has.

We’ve also made an enhancement to the way security access is managed for newly created Org Units. The button that was previously available on the Classic screen has been removed and in its place we’ve introduced a new Security setting: Inherit the same security access as the parent unit when a new org. unit is added within the Organisation Hierarchy structure.

When this setting is enabled, any new child Org Units created on the Organisation Hierarchy Units screen will automatically inherit the same security access as their parent Org unit. For example, if a user has Org Unit permissions assigned to a Department, any new Cost Centre added under that Department will automatically inherit the same permissions.

This means that whether you grant access to specific Org Units per parent level regardless of parent level permissions or apply permissions to all child Org Units based on parent level permissions, you’ll have flexibility to manage security access according to your needs.

We’ve added a new warning on the Tax Profile and Terminate and Reinstate bulk action to notify users if the employee has any outstanding arrears payments when processing a termination.

On screen warning example:

The Add New Company workflow has been enhanced to simplify the company onboarding workflow process. A dropdown menu has been added at the start of the workflow, allowing users to select the appropriate Tax Authority for the new company.

Once selected, the screen will update to show relevant fields for the selected Tax Authority simplifying the workflow by ensuring that users are only presented with fields and options relevant to the selected Tax Authority and fields are localised according to the country selection.

Coming Soon - Customisable Grid Display

We’re currently working on an enhancement that will allow users to customise the grids on any screen. Currently, the columns displayed on these grids are fixed and users can only apply visibility conditions to filter specific data. With this enhancement, users will be able to select which columns they want to see by default and re-order them accordingly, offering more flexibility to personalise their workspace.

Example of grid on User Profile screen:

Example of Column Chooser:

Screen conversions – Payslip pay dates

The Payslip Pay Dates screen is being converted to NextGen. Once in NextGen, it’ll be known as the Run Management screen.

Along with the name change, you can also look forward to these usability enhancements:

• Add Interim Runs to Closed Main Runs: You’ll now be able to add interim runs to previously closed Main Runs, not just the most recent one.

• Run Cycle Excel Report: A new report will include all run cycles shown in the grid and if filters are applied, only the filtered results will appear in the Excel file.

• New Slide-Out Window: A slide-out window will now appear from the right, providing easier access to Run Management options.

By default, when employees receive package increases in the middle of a pay period the system will apply the new package for the entire period.

We’re developing a new Calculation Setting: Prorate employee mid-period Package increases this new setting will automatically calculate an employee’s monthly package based on the number of days at the old package value and the new package value, using the selected company proration method. Automating this process reduces the risk of errors associated with manual payroll calculations.

You’re integral to our continued innovation and your input and ideas help shape the future of our product. If you’ve had an idea for a new feature, you can visit our Ideas Portal to share it! Our Ideas Portal is where you get to submit your suggestions or vote for existing ideas you’d like to see brought to life. That’s not all! You can also view ideas that have been voted for the most, view ideas that are in development and ideas that have been released.

Sharing your input is easy:

To submit an idea

1. Click on your initials in the top-right corner of the screen.

2. From the dropdown menu, choose Ideas Portal.

3. Select the option to Submit an idea and fill in the details of your suggestion.

Vote for an idea

1. Click on your initials in the top-right corner of the screen.

2. From the dropdown menu, select Ideas Portal.

3. Browse through the ideas and click on the voting card for the feature you’d like to support.

Namibia

Social Security to increase in March - max from NAD 81 to NAD 99

Niger

Apprenticeship Tax - expat decrease from 5% to 3 % - Social Security deduction no longer an allowed deduction

Ghana

SSNIT Maximum Insurable Salary increased from 52000 to 61000 (for Tier 1 contributions)

Equitorial Guinea

New tax table

Are your Employee Benefits up to scratch?

In addition to providing payroll services across 44 countries in Africa, Axiomatic also:

Consults to retirement funds in South Africa.

Arranges and manages risk cover (life cover, disability cover, dreaded diseases cover, funeral cover etc.) for employees in South Africa.

Advises and manages medial aid and medical insurance schemes in South Africa.

Advises and manages pan-African medical insurance schemes and risk cover across countries in Africa.

Manage an international medical insurance aimed at international employees and third country nationals in Africa.

Start a conversation with us by clicking here

In the early 1970s, when the first outsourced payroll companies were formed, the debate immediately commenced evaluating whether outsourcing payroll was better than insourcing (running the payroll inhouse).

This debate has continued and even escalated since those early days with a plethora of articles having been written promoting either option. When Googling “payroll outsourcing versus insourcing”, there are 58,000 results and the debate has not been settled. Why?

In August 2024 (click here) we published our 2025 South Africa Salary Increase Forecast article and revisited our forecast in November 2024 (click here) where we encouraged clients to adopt a scientific approach to the preliminary salary increase forecast and then to use the unfolding economic data over the next few months to update the original forecast. Wise words as inflation has been moving persistently lower. The October 2024 inflation rate of 2.8% in October was the lowest reading since the 2.2% recorded in June 2020 when we were in the throes of the Covid pandemic. Inflation has ticked up slightly to 3.9% in December 2024.

The salient reasons for the slight increase in December 2024 can be attributed to housing and utilities (4.4%), miscellaneous goods and services (6.6%), food and non-alcoholic beverages (2.5%) and alcoholic beverages and tobacco (4.3%).

Recently there have been hundreds of articles published that state that AI, APIs, integrations and automation are the way of the future and will radically transform payroll. While we agree wholeheartedly, the articles fail to furnish practical advice, tangible examples and/or a case study. One is often left wondering how one can take advantage of this technology. Given this, we will publish a series of articles which provide practical examples of how we, and our clients, have harnessed the power of new technology to streamline processes and save money.

A large client wanted to streamline the salary increase process to provide payroll with a mass update and an automated process to deliver salary increase letters to the employees.

Section 13A of the Pension Funds Act imposes a statutory obligation on employers to pay the retirement fund contributions they deduct from employees in terms of the fund’s rules.

There are two parts to the monthly contribution process:

• The actual contributions due and payable to the fund, and

• The supporting information schedule accompanies the deposit into the fund’s bank account. (In terms of Conduct Standard 1 of 2022: Requirements related to the payment of pension fund contributions).

In the past, payroll was seen as outdated, relying on old methods and manual processes. However, recent technological advances have transformed payroll into a strategic asset, offering valuable data insights.

Axiomatic specialises in integrating payroll systems with APIs, using middleware to ensure seamless data exchange. This integration boosts efficiency, enhances the Employee Value Proposition, and maintains data accuracy and security.

For tailored, efficient, and secure Payroll Integration Solutions.

With a custom user interface and strong audit controls, Axiomatic balances tradition with efficiency, offering tailored, secure Payroll Integration Solutions. This powerful payroll functionality, combined with key middleware, allows companies of all sizes to overcome data silos by creating robust Applications, Data, and API integration on-premise and in the Cloud, all from a single interface.

Axiomatic is proud to partner with ERS Bio. This partnership ensures that the T&A solution provided by ERS Bio, seamlessly integrates with the payroll platform thus saving time and preventing errors.

ERSBio is a South African leader in Time & Attendance and Access Control solutions. Founded in 2003, it offers a cloud-based platform integrating with payroll and HR systems like PaySpace by Deel. Its biometric hardware Facial Recognition, Fingerprint, and Card Machines—ensures accurate time tracking. Key modules include Time & Attendance, Web Clocking, and a Mobile App with GPS tracking. ERSBio provides in-house developed software and strong after-sales support.

Contact: 010 593 0593 | sales@ersbiometrics.co.za

Danie Smal (CPT): danie@ersbiometrics.co.za | 076 828 9968

www.ersbio.co.za

A payroll alliance of 3 specialist Regional Payroll Providers who together provide deep local HR and payroll support for 80+ countries in emerging markets across APAC, Africa and LATAM.

HR Services

Accounting and Tax Services

Cross Border / FDI Specialist Services

Fund, Trust and Fiduciary Services

Risk Assurance & Audit Corporate Services

Advisory

Private Client Services / Family Office

Links International’s 2025 Asia Salary Guide: The Workforce of Tomorrow offers in-depth insights into the evolving job market landscape across Hong Kong, Singapore, and Mainland China.

As these economies rapidly transform driven by innovation, artificial intelligence (AI) & automation, and shifting workforce dynamics businesses are focusing on building resilience, adapting to global uncertainties, and seizing new opportunities.

Download full version here!

Hi, I’m Pacey, your employee self-service bot.

I can help you with payroll + HR requests

• Historical payslips: PDF / text format

• Apply for leave

• Approve inbox items

• View current leave balance

• View personal information

1. Register using employee's national identification (ID) number. 2. Pacey will check that their mobile number and identification number matches their profile on PaySpace to verify them.

Pacey uses interactive messages which gives users a simpler and more consistent way to select the options available to them.

achieve significantly higher response rates compared to text-based lists

Pacey will be licensed as an additional service as explained below.

• Companies using Pacey must be on the Premier / Master Edition as this is a self-service feature.

• The license fee will be charged per active employee, which will provide each employee with a predefined number of conversations per calendar month.

• The pricing structure allows customers to choose from 5, 10, 20, or 30 conversations per employee, per calendar month.

• Employees will be limited to the number of conversations the company chooses. Every time an employee starts a new conversation with Pacey, they will be notified of how many conversations they have remaining for the calendar month.

• The Pacey contact number will be shared with customers upon purchasing this module including a QR code that makes it easy for an employee to scan and save the contact.

How can I help you today?