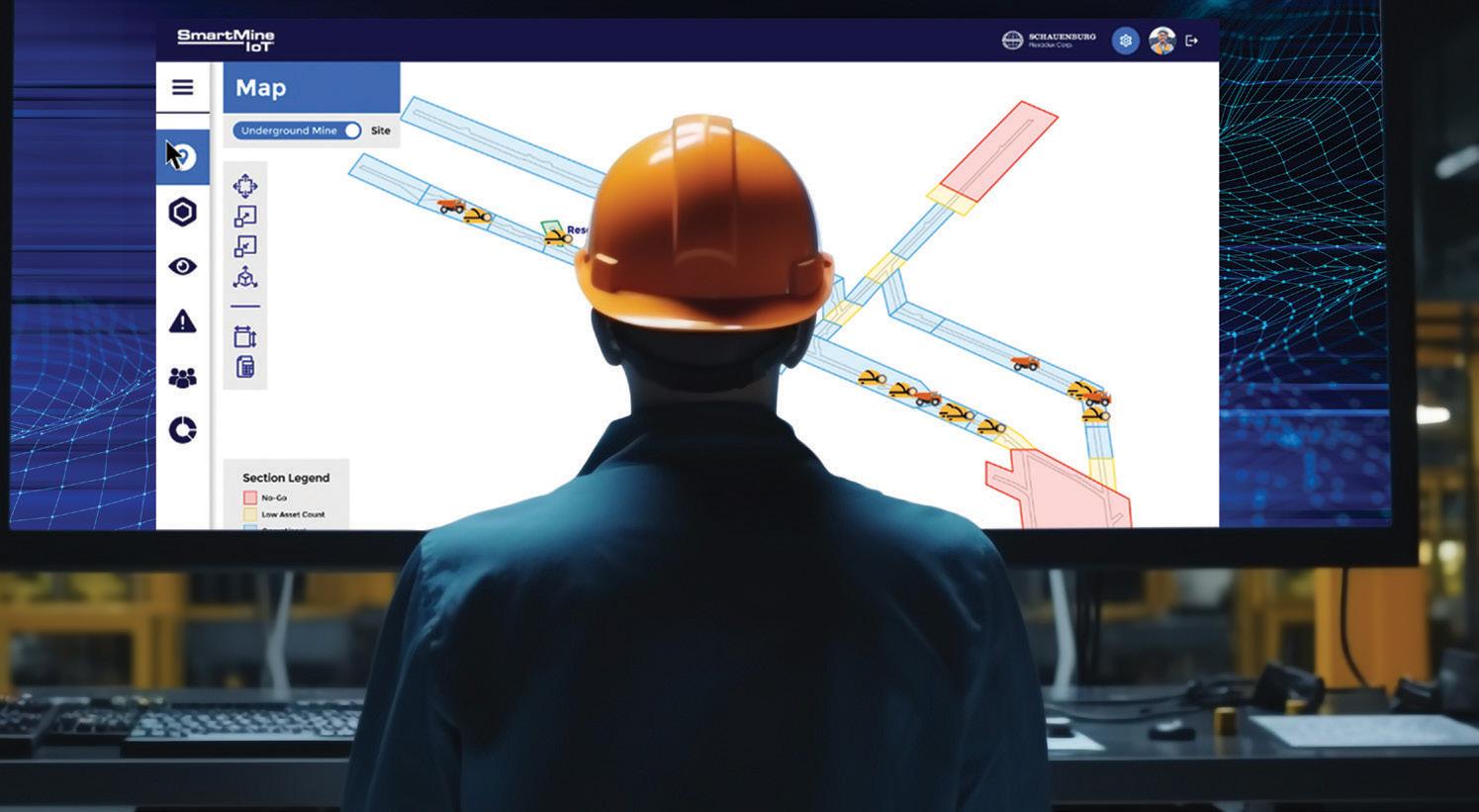

Save on energy and water consumption, and optimise your process with no additional resources. It can be achieved with software! Think of it as the most knowledgeable and experienced mentor guiding your operators 24/7. If your operator needs a break or leaves, just turn on ‘autopilot’.

Digitalisation and artificial intelligence have become part of our day-to-day lives, both personally and in our work environment. The economic pressures and dwindling of resources globally have added to financial strain across all industries. The resource shortage and cost-cutting actions are putting severe strain on employees—and with a dwindling resource pool, it may seem like an endless battle to increase production.

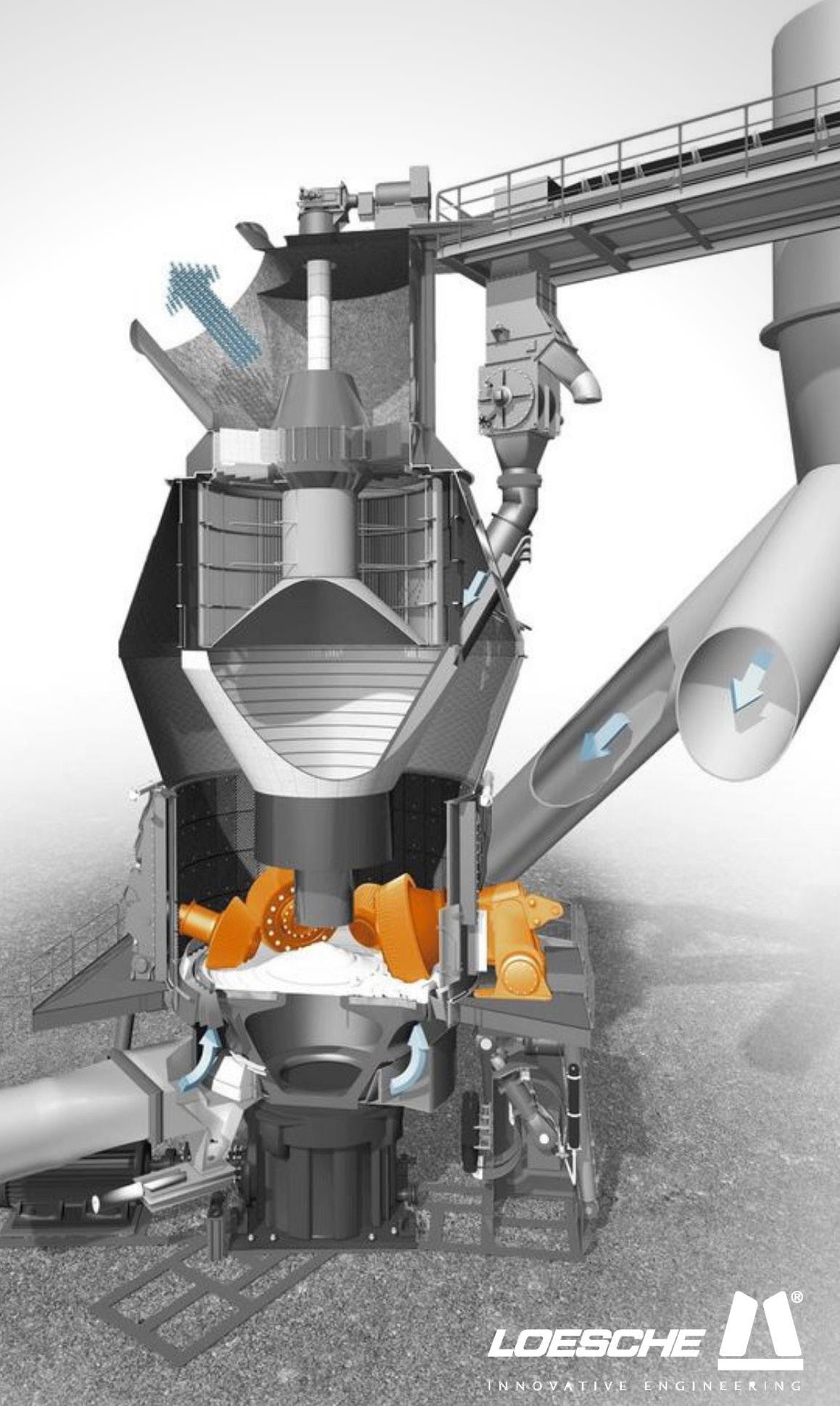

Artificial intelligence (AI) in process control and optimisation is not a new technology and has proven itself in numerous industries and applications. The optimisation and control solutions developed by original equipment manufacturers such as Loesche have been game-changers.

You can trust the technology developed by a product owner that has engineered and perfected its equipment for over 100 years. Loesche has mastered the vertical roller mill and related equipment and has been supporting clients in all industries by engineering solutions to overcome any and all obstacles as they arrive. The digital software developed for automation and control is no different.

Loesche developed its digital solution packages to address specifically skill shortages, energy savings and increasing production, all while utilising clients’ current equipment irrespective of the vendor.

The main goal of the AI software is to reduce the energy consumption of the current equipment, while ensuring an increase in output and keeping your plant performing optimally. You can compare it to having the best and most experience operator sitting with your current operation and advising them to reach all production goals, 24 hours a day, 7 days a week. No annual leave, no sick leave—and, most important, very little production interruptions.

Steinmüller Africa is a B-BBEE level 1 contributor.

Founded in 1960, Steinmüller Africa is a member of The Bilfinger Group of companies, offering a wide range of engineering, manufacturing, pre-fabrication, construction and maintenance services for the power, mining, pulp and paper, petrochemical and other industries all over the world. Steinmüller Africa offers comprehensive expertise in welding and environmental technology, manufacturing, maintenance, lifetime extension plans and project management. In addition, the company provides a wide range of cranes, lifting gear, welding equipment and mobile offices for site establishment.

Your trusted partner in Engineering Excellence!

OUR SERVICES:

Engineering design services

Boiler pressure parts

Commissioning, field, and testing services

Milling plant maintenance

Induction bending of HP/HT piping

Heat treatment (workshop and in situ)

HP heaters & bellows

Piping technology

Pipe supports

Plant erection services

Explosive welding

Shaping the future of industrial engineering

In industrial engineering and machinery, Loesche Engineering Company stands as a testament to innovation, excellence and adaptability. With a history dating back over a century, this German-based firm has consistently pushed the boundaries of technology, revolutionising industries and shaping the future of vertical roller mill technology.

10 FROM THE EDITOR Spirit of innovation and resilience

12 EVENTS

Conferences and meetings for the African mining industry

Showcasing and celebrating over 100 years of automotive history with a unique and exciting collection of vehicles, motorcycles, bicycles and memorabilia in the magnificent setting of the L’Ormarins Estate, situated in the picturesque Franschhoek Valley.

R80 adults | R60 pensioners

R60 motor club members

R40 children (3-12yrs)

Achieving sustainable development in Africa’s oil & gas sector demands collaborative action from all stakeholders

38

The top risks facing the world’s natural resources organisations

44 INVESTMENT

Multibillion-dollar opportunities in cross-border co-operation for oil and natural gas projects in southern Africa

Namibia’s energy sector needs a proactive introduction of solid local content regulations

Female leaders are transforming their respective energy industries into Africa’s most sought-after exploration hot spots

US–Africa: Strengthening security, supporting development and reducing conflict amid geopolitical competition

68

How the Namibian government is ensuring an integrated energy mix and sending a strong signal of confidence to global investors

It is important we all fully understand the immense benefits of oil, and the petroleum products derived from it

80 gas

South Africa needs to use its abundant domestic natural gas to fix its energy crisis today

86 social development

#MiningMatters: The Minerals Council

South Africa highlights the relevance and impact of mining

92

An African Development Bank project returns thousands of children from cobalt mines to schools in the Democratic Republic of the Congo

Iot’s that time of year when once again the junior miners gather to rub shoulders, and I’d like to salute every one of them. Often, they represent the bold frontier of the mining industry, embodying the spirit of innovation, risk-taking and entrepreneurialism.

These companies, typically smaller in scale and exploration-focused, play a crucial role in the diversification and growth of the mining sector. While they face unique challenges and uncertainties, junior miners have the potential to unlock new mineral discoveries, drive economic development and create value for stakeholders.

mining news

PUBLISHER: Donovan Abrahams

EDITOR: Ashley van Schalkwyk (ashley@avengmedia.co.za)

COPY EDITOR (PRINT & ONLINE): Tania Griffin

DESIGN: Shadon Carsten

EDITORIAL SOURCES: NJ Ayuk, HE Haitham Al Gais, Labi Ogunbiyi, African Development Bank, Energy Capital & Power, Aon South Africa, Minerals Council SA

IMAGES: Adobe Stock, Pexels, Freepik

PROJECT MANAGER: Viwe Ncapai

However, the journey of junior miners is not without its obstacles. They face myriad challenges including access to financing, regulatory hurdles and market volatility. Securing investment for exploration and development projects can be particularly challenging, as investors may perceive junior mining ventures as high-risk endeavours.

Despite these challenges, the junior mining sector continues to thrive, fuelled by a relentless spirit of innovation and resilience.

Looking ahead, the future of the junior mining sector in South Africa is brimming with promise and potential. As the global demand for minerals continues to rise—driven by population growth, urbanisation and technological advancements— junior miners are well-positioned to capitalise on emerging opportunities.

By fostering a supportive ecosystem that encourages investment, innovation and collaboration, South Africa can unlock the full potential of its junior mining sector and pave the way for sustainable growth and prosperity. This is precisely why events such as the Junior Indaba are so imperative: The indaba is a superb platform for incisive, informative and frank discussions tackling the challenges of, and opportunities for, junior mining and exploration in South Africa and elsewhere in Africa.

ADVERTISING EXECUTIVES: Andre Evans, Kim Jenneker, Reginald Motsoahae Mellouise Thomas, Lunga Ziwele,

ONLINE CO-ORDINATORS: Majdah Rogers, Ashley van Schalkwyk, Tharwuah Slemang

IT & SOCIAL MEDIA: Tharwuah Slemang

ACCOUNTS: Benita Abrahams, Bianca Alfos

HUMAN RESOURCES MANAGER: Colin Samuels

CLIENT LIAISON: Majdah Rogers

PRINTER: Novus Print

DISTRIBUTION: www.africanminingnews.co.za, www.issuu.com

DIRECTORS: Donovan Abrahams, Colin Samuels

PUBLISHED BY: Aveng Media

Boland Bank Building, 5th Floor

18 Lower Burg Street Cape Town, 8000

Tel: 021 418 3090

Fax: 021 418 3064

Email: ashley@avengmedia.co.za

Website: www.avengmedia.co.za

DISCLAIMER:

© 2024 African Mining News magazine is published by Aveng Media (Pty) Ltd. The Publisher and Editor are not responsible for any unsolicited material. All information correct at time of print.

The Country Club Johannesburg, Auckland Park, South Africa www.juniorindaba.com

The Junior Indaba is a popular meeting place for junior miners and is enjoyed by all for its incisive, informative and frank discussions tackling the challenges and opportunities for exploration and development for junior mining companies in South Africa and elsewhere on the continent.

19 & 20 JUNE

Swakopmund Hotel & Entertainment Centre, Namibia www.saimm.co.za

.This conference will focus on the global impact of African rare earth deposits and their role in the sustainable supply of these critical materials. It will discuss in detail the latest developments in the industry, and explore the opportunities and challenges to the optimisation of the African rare earth value chain. There will be focus on the production of rare earth metals, with specific emphasis on geology, exploration, beneficiation, separation and refining, applications, policies, environmental issues, new technological developments, market opportunities, and the future outlook of the industry.

Africa’s only event dedicated to the water resources sector discussing all aspects of mine water management, treatment, closure, water characterisation and tailings management. This exclusive event will shine a light on the latest policies, research, best practices and developments in water digitalisation that embodies the circular economy, sustainability and innovations for the efficient water usage in the resources sector.

18 & 19 JULY

12 TO 14 JUNE

Grand Karavia Hotel, Lubumbashi, DRC wearevuka.com/mining/drcmining-week Dakar Expo Center, Senegal lpgexpo.com.sg

A premier event that stands at the forefront of shaping the burgeoning liquefied petroleum gas (LPG) market in the West Africa region. In the current landscape, West Africa has emerged as one of Africa’s fastest growing LPG markets, with an impressive annual consumption of nearly 2.9 million tonnes. The expo is a pivotal platform for leaders, industry experts and government representatives in the LPG sector to forge valuable connections, exchange groundbreaking ideas and showcase their latest products and services.

DRC Mining Week stands as the central hub where prominent mining entities gather to cultivate opportunities. This event holds widespread recognition as the foremost business gathering of the year. It serves as the meeting point for industry leaders to exchange innovative ideas and forge business alliances that drive innovation and new prospects in the country.

6 & 7 AUGUST

The Arena, Enmotweni Casino, Mbombela, Mpumalanga, South Africa www.saimm.co.za

The aim of this conference is to provide the opportunity for thought leaders in the global battery value chain to exchange ideas on recent developments in the fields of: materials and high-purity intermediates for battery components; flow-battery electrolytes; processes for the recycling of batteries; market outlook and legislative implications; new projects and entrepreneurship in the battery industry, among others.

MetSoP aims to become the go-to provider for innovative solutions in the mining industry, A leader in flotation reagents and mineral processing

In the realm of mining, where precision meets profitability, MetSoP Pty Ltd emerges as a trailblazer, pushing the boundaries of conventional practices through innovative solutions.

Established in 2019 by Ipfi Manenzhe and Marcus Manyumwa, visionaries with a background in metallurgy, MetSoP swiftly garnered recognition as a leader in flotation reagents and mineral processing consultancy. With a steadfast commitment to excellence and a culture of continuous innovation, the company has redefined standards in the mining industry.

At the core of MetSoP's inception lies a visionary goal: to revolutionise the mining sector through the development of groundbreaking flotation reagents and solutions.

Manenzhe brings to the table a wealth of expertise. His vision is to address industry challenges headon and introduce transformative technologies that optimise mineral recovery and processing efficiency.

He says, “Our primary goal at MetSoP is to continue leading the way in the development of cutting-edge flotation reagents

that optimise mineral recovery and processing efficiency for our clients. We aim to expand our market presence globally, establishing MetSoP as the go-to provider for innovative solutions in the mining industry.”

Manenzhe's journey as the operations director of MetSoP has been marked by resilience, strategic vision and unwavering dedication. From the outset, he immersed himself in every facet of the company's operations, from research and development to strategic planning and market expansion. His leadership ethos fosters a culture of innovation and excellence within the organisation, propelling MetSoP to the forefront of the industry.

“As the director of MetSoP, my journey has been both challenging and rewarding. I have been deeply involved in every aspect of the company's operations, from product development to strategic planning and business expansion. My focus has always been on fostering a culture of innovation and excellence within the organisation, driving us to continuously push the boundaries of what is possible in the field of flotation reagents,” he says. “We established MetSoP in 2019 with a vision to revolutionise the mining industry. Since then, we have

METSOP'S dedication to delivering value-added solutions underscores its status as an industry leader.

experienced significant growth and success, driven by our commitment to excellence and continuous innovation.”

MetSoP's primary objective is clear: to lead the charge in developing cutting-edge flotation reagents that redefine industry standards. The company's commitment extends beyond mere profitability; it aims to optimise mineral recovery and processing efficiency for clients worldwide.

In recent years, MetSoP has achieved significant milestones including the successful launch of several groundbreaking products. These innovations have garnered widespread acclaim from clients, affirming MetSoP's position as an industry leader. Furthermore, the company's strategic expansion of its distribution network has facilitated market penetration and enhanced customer outreach.

Currently, MetSoP remains focused on refining existing products and spearheading new research initiatives to address evolving industry challenges. The company's research and development team is at the forefront of exploring novel approaches to enhance mineral flotation processes and streamline operational efficiency. Moreover, initiatives such as the development of environmentally sustainable flotation reagents underscore MetSoP's commitment to innovation and sustainability.

“Like any industry, the mining sector presents its share of challenges including fluctuating

MetSoP CEO Ipfi Manenzhe: "We established MetSoP in 2019 with a vision to revolutionise the mining industry."

Manenzhe's journey as CEO of MetSoP has been marked by resilience, strategic vision and unwavering dedication.

commodity prices, regulatory changes and environmental concerns. However, we are confident in our ability to adapt and thrive in a dynamic business environment by staying agile, investing in research and development, and maintaining close partnerships with our clients,” says Manenzhe.

“We have several exciting projects in the pipeline, including the development of environmentally sustainable flotation reagents and the integration of advanced technologies such as artificial intelligence and machine learning into our product development process. These initiatives align with our commitment to innovation and sustainability.”

MetSoP is committed to promoting diversity and empowerment within its workforce and supply chain. The company actively pursues BBBEE (Broad-Based Black Economic Empowerment) objectives through targeted recruitment, training programmes and collaboration with BBBEE-compliant vendors. By prioritising inclusivity and community development, MetSoP aims to drive meaningful change and foster a more equitable society—supporting community development projects to empower marginalised groups.

Despite industry challenges, MetSoP remains resilient and adaptable. The company's ability to navigate obstacles is attributed

to its agility, strategic foresight and close collaboration with clients. By embracing innovation and maintaining a customercentric approach, it is wellequipped to overcome challenges and seize opportunities.

MetSoP's success is rooted in its unwavering commitment to excellence, quality and customer satisfaction. By prioritising innovation and staying abreast of industry trends, the company has solidified its reputation as a trusted partner in the mining community. Its dedication to delivering value-added solutions underscores its status as an industry leader.

“Looking ahead, we envision continued growth and expansion for MetSoP, both domestically and regionally. We will remain focused on delivering value to our clients through innovative solutions while upholding the highest standards of corporate responsibility and sustainability,” says Manenzhe.

“One change I would advocate for in the South African mining industry is greater emphasis on sustainable practices and

environmental stewardship. By adopting cleaner technologies, minimising resource wastage and prioritising ecosystem conservation, we can ensure the long-term viability of the mining sector while minimising its impact on the environment and surrounding communities. MetSoP is committed to driving positive change and contributing to a more sustainable future.”

He extends gratitude to the dedicated team at MetSoP, whose collective efforts have propelled the company to new heights of success. Together, they remain steadfast in their commitment to innovation, excellence and sustainability.

As MetSoP continues its journey of pioneering innovation in the mining industry, its vision for a brighter, more sustainable future remains unwavering.

“I would like to express my gratitude to our dedicated team at MetSoP, whose hard work and dedication have been instrumental in our success. Together, we will continue to push the boundaries of innovation and make a positive impact on the mining industry and beyond,” Manenzhe concludes.

For more information, visit metsop.com.

"I would like to express my gratitude to our dedicated team at MetSoP, whose hard work and dedication have been instrumental in our success."

Achieving sustainable development in Africa's oil & gas sector demands collaborative action from all stakeholders

The African continent stands at a pivotal juncture in the global energy sector, with abundant oil and gas reserves offering immense potential for economic growth. However, while the continent holds significant promise, navigating the upstream oil & gas sector in Africa comes with a plethora of risks and potential setbacks that demand careful consideration and strategic planning.

This is against a backdrop of cutbacks in international capital for carbon-intensive oil and gas developments and increasing competition for the same sources of capital. Innovative financing solutions are thus required to fill the void, but can only be truly successful if tailored to specific needs and adopted and respected by all stakeholders.

Nigeria, Africa’s largest oil producer, epitomises the complexities and opportunities within the continent’s energy sector. Over the past decade, the Nigerian oil & gas industry has grappled with insecurity, asset vandalism and community unrest, leading to a decline in investment. This, coupled with the need for the sanctity of contracts and a properly structured fiscal framework, has seen investment in the sector decline to about US$5 billion per annum from highs of about US$22 billion per annum in 2012.

Nigeria has an abundance of unexploited discovered natural gas (as well as significant prospective gas resources), now heralded as a ‘clean’ transition fuel amid global energy shifts. Nigeria should seek to attract significant investment during this transition era (which has also seen crude oil prices rebound) to take full advantage of this, thus retaining the value of crude oil and gas resources to enable it to position itself for its energy transition (toward net zero) agenda.

‘‘Nigeria, Africa's largest oil producer, epitomises the complexities and opportunities within the continent's energy sector.’’

A just energy transition, the paradigm that gained impetus at the December 2023 COP28 conference, is intended to decelerate financing fossil fuel developments while supporting those most vulnerable to the impacts of climate change when facilitating the transition to clean energy. This is not simply a tweak to existing systems; it is a fundamental transformation toward a cleaner, more sustainable future.

This shift is driven by environmental concerns, the changing balance of power on the global stage, and awareness that the energy-producing nations in the Global South (which produce only a fraction of global

emissions) should be given a chance to ‘catch up’ industrially, technological advancement as consumer demands.

It is estimated that Nigeria needs about US$25 billion of annual investment in the next 10 years to achieve crude oil output of three to four million barrels per day and 3bcf per day of gas production for domestic consumption (an ambition). A lack of available infrastructure, whether because of existing compromised infrastructure through age or sabotage or simply a lack of new investment, and competition for capital regionally, poses challenges that will need to be overcome to achieve this. Inadequate infrastructure

impedes the development and operation of oil and gas projects in Africa, increases project costs, delays timelines and heightens operational risks.

The new government has declared that it is ‘open for business’ and will take urgent steps toward solving the fiscal, regulatory, security and other issues discouraging investment and operations in the nation’s petroleum sector—something that is urgently required to help to push its oil and gas production to the ambitious levels being targeted.

The mechanisms are in place: The Petroleum Industry Act (PIA) has done a lot to bring an enabling framework to the industry, including by allowing the Nigerian National Petroleum Corporation and its subsidiaries to raise capital on their own balance sheets, whether by divestitures or development partnerships on their blocks (including risk service contracts, financial and technical service agreements and the likes), crude forward sales, debt or equity capital raisings etc. Still, there is a need to focus more on implementing the PIA in a manner that restores investors’ confidence and boosts oil and gas production, ultimately increasing jobs, the country’s earnings and prosperity.

While international commodity traders have increased their activity and funding of oil production in Nigeria, they rarely support the development of appraisal and near-production assets. Access to innovative capital structures for such capitalintensive projects, involving a more risk-reward approach, will be key to developing such assets, as will the deepening of regional capital markets to bolster the capital available from institutions such as the African Export-Import Bank and planned new initiatives such as the African Energy Bank.

Effectively, more ‘home-grown’

solutions will be required.

As international oil companies shift focus to deep offshore and gas-rich assets, indigenous companies and smaller operators are stepping in to fill the void. However, accessing capital remains challenging. Innovative financing models, such as the contractor risk service model, offer a promising solution. This model, which involves contractors taking financial risks and receiving payment from production, incentivises efficient asset development while mitigating risk for owners and operators.

The contractor taking such risk is effectively a co-financier of, and investor in, the development of the oil block—ensuring a service that would otherwise require immediate payment to benefit from payment from oil and gas production (therein lies the contractor risk).

The success of such models hinges on the support of all stakeholders including operators, joint venture partners, financiers, regulatory authorities and local communities. By aligning incentives and sharing risks, these partnerships can drive sustainable development and enhance investor returns.

The recent completion of the floating, storage and offloading ELI Akaso infrastructure project by the Century Group (ceslintlgroup. com)—part of an alternative crude oil evacuation system (ACOES)— facilitated by the contractor risk service model, exemplifies the potential for collaboration to unlock value and foster growth. The ACOES is being developed as a result of the need to enhance production and supply security from oil blocks in the eastern Niger Delta due to infractions and prolonged outages of the Nembe Creek Trunkline (historically one of Nigeria’s major oil transportation arteries evacuating up to 150 000

bopd of crude from the Niger Delta to the Atlantic coast for export).

The CG model is ‘Made-in-Nigeriafor-Nigeria’, but can be rolled out regionally (and globally, too) in countries where access to capital for oil and gas developments is tough. Contractors work in a vacuum, the aim of which is to optimise oil production to ensure their clients thrive so that they do, too. However, they rarely take financial and production risk executing a ‘pay-as-yougo’ model (often including mobilisation and other hefty prepayment-type fees), which can leave operators hanging where assets underperform. They also get the job done without involving themselves in the issues that may affect joint venture partner relationships.

Local and international investors including UK-listed San Leon Energy plc, World Carrier Corporation and GT Bank plc have invested heavily in Energy Link Infrastructure Limited (ELI), the sponsor of the ACOES and owner of the FSO ELI Akaso and relevant pipeline infrastructure to develop the ACOES.

With the advent of COVID-19 and a lack of production available from anchor clients, ELI needed to look for alternative sources of capital to ensure the FSO ELI Akaso is ready for operations. Without CG’s involvement in a contractor risk service model, the FSO would not be operationally ready and now established as a terminal for oil export. As the Akaso starts to take on barrels from various oil producers, the business should thrive.

CG, as an investor by the application of its contractor risk service model, should also be rewarded and feted for having stood by the business at a time when access to alternative capital was proving difficult. With the success of this approach, CG is

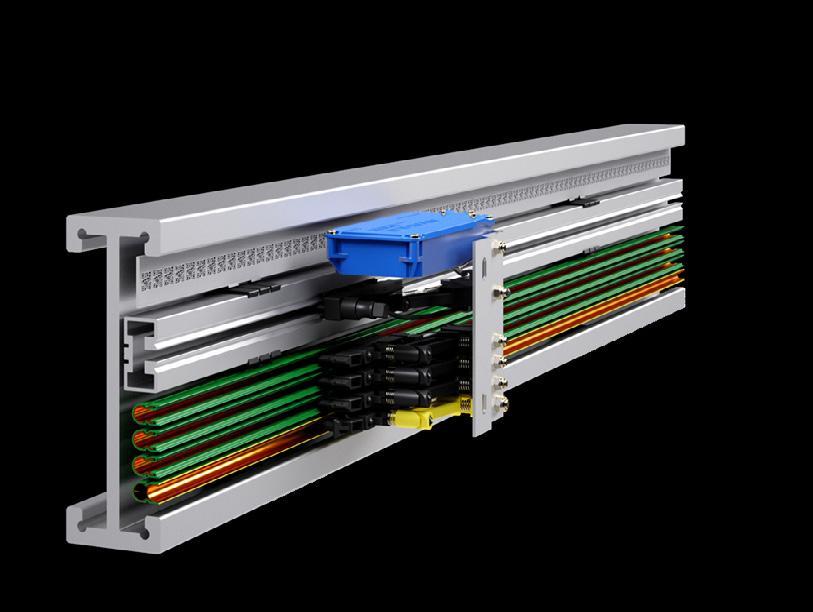

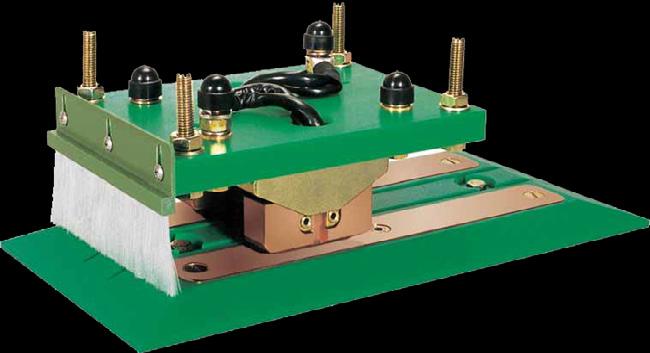

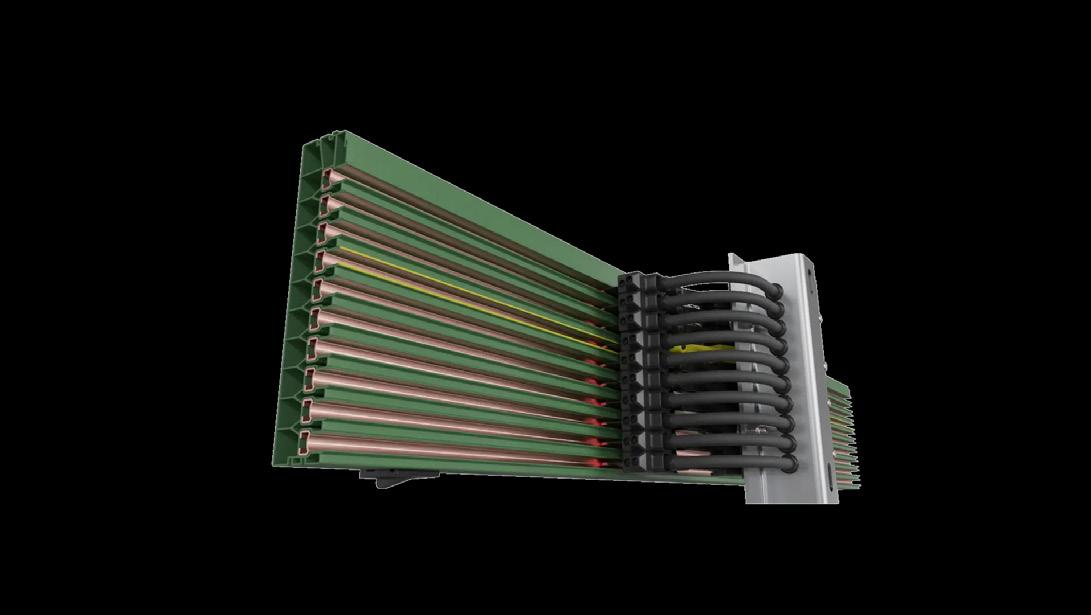

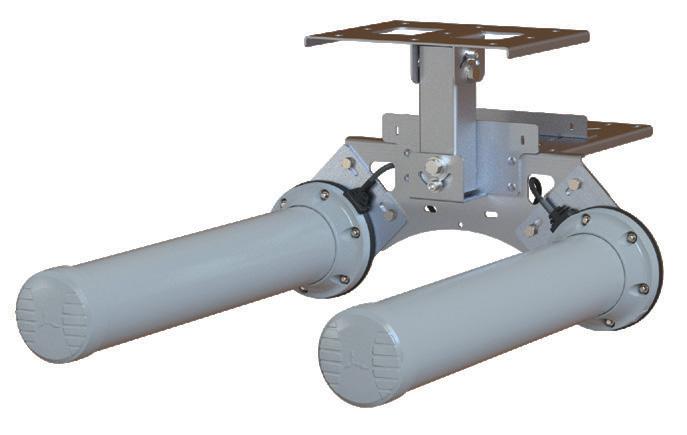

Since 1975, Flow Systems provides prestige and industrial physical barriers for Time and Attendance and Access Control.

The original manufacturer of South Africa’s access control turnstile for the Mining Industry, Flow Systems manufactures, supplies and installs:

• 150 standard models of access control and biometric turnstiles

• Speed gates

• Access control revolving doors

• Access control booths and mant raps

• Standard and Heavy Duty Vehicle access control boom barriers

• Bollards

ensuring the contractor risk service model should be considered by the industry as an alternative, proactive and additional funding source for the development of energy projects.

Looking ahead, achieving sustainable development in Africa’s oil & gas sector demands collaborative action from all stakeholders. Local investors, operators and contractors play a crucial role in de-risking opportunities and crafting an appealing investment narrative that attracts capital. By leveraging local expertise and fostering partnerships, these stakeholders can unlock the sector’s full potential while mitigating risks.

Regulatory frameworks also play a pivotal role in shaping the investment landscape. It is imperative that these frameworks prioritise ease of doing business and uphold contract sanctity to instil confidence among investors.

Additionally, addressing bottlenecks to investment and exits is critical for maintaining investor interest and sustaining growth momentum.

Addressing the need to resolve the long-standing saga and delay in the consummation of the $1.3-billion ExxonMobil sale of its 40% stake in Mobil Producing Nigeria Unlimited to Seplat Nigeria Plc, the Nigerian Minister of State for Petroleum Resources, Heineken Lokpobiri, said on 16 April 2024 (shorturl.at/bwSX8): “Now that the whole world is campaigning against investment in fossil fuel, if we close this transaction and Seplat expands their investments, Bonga North, which is predicated on that resolution, comes on board, and the whole world will know that Nigeria has become a new investment destination— and that is the objective of this government.”

In charting the course for Africa’s upstream oil & gas industry,

daring innovations and strategic partnerships will be indispensable. By embracing risk and seizing opportunities, the continent can harness its energy potential to drive economic prosperity and sustainable development for generations to come.

More local investors, operators and contractors (like Century Group) will need to step up to help to de-risk opportunities and ensure the investment narrative is attractive, properly articulated and understood. With traditional international financing techniques becoming more difficult to secure for oil and gas projects, the contractor risk service model is an invaluable additional tool to ensure the continuing development of energy projects.

Labi Ogunbiyi

Ogunbiyi has been involved in the energy (including renewables), fintech and logistics sectors as an investor, strategic adviser and/or director on several boards.

Offering consistent, superior service is part of OUR commitment to OUR customers

COUNTRYWIDE GEARBOX REPAIRS SPECIALIZES IN THE REPAIR AND OVERHAULING OF UNDERGROUND FLAMEPROOF EQUIPMENT

> Flameproof tractors

> 120G Graders

> Forklifts

> Earth moving Equipment

> LHD Load haul dump machines

The company’s team of highly-skilled technicians are fully trained in the repair & maintenance of variety of internationally branded machines. In particular we offer expert services in the repair of components for New Holland Flameproof Tractors as well as Clark & Spicer.

COMPONENTS SUCH AS

> Gearboxes

> Transmissions

> Differentials

CONTACT US

> Trumpets

> Gear Levers

> Service Exchange units

Orion Minerals Limited is a globally diversified metal explorer and developer duallisted on the Australian Securities Exchange and the Johannesburg Stock Exchange.

The company holds a portfolio of high-quality development and exploration assets in South Africa’s Northern Cape, with mineral rights including known deposits of copper, zinc, nickel, cobalt, platinum group elements, gold, silver, tungsten, rare earth elements, and lithium.

African Mining News spoke with CEO Errol Smart about the importance of critical metals such as copper, and how Orion Minerals is playing its part in supplying future-facing metals that will drive the global transition to a lower carbon future.

“Every single country has a published list of what they call 'critical metals': the key metals that allow each country’s economy to function; without receiving those metals in the quantities they expect, the economies will hit severe speed bumps,” he explains. “Each country has a slightly different list, but globally in the top three economies in the world—North America, China and Europe— there's a convergence of the key metals required to keep the global economy operating. The one metal that is common to all, no matter where you go in the world, is copper.”

Whether it is electric vehicles, generation and transmission, consumption of power and electronics, copper is the common denominator.

“If you look at human history, copper has always been a critical metal—whether in the Bronze Age or the Industrial Revolution, copper has always been there and remains a critical mineral,”

says Smart. “But the supply and demand curve at the moment very strongly shows that there isn’t sufficient copper mining being done, and there hasn’t been sufficient copper exploration. So there hasn’t even been sufficient copper discovered to meet the demand cycle as projected.”

That is one of the main reasons Orion is very involved in copper mining, and why it is excited about exploring the Northern Cape. The company sees this region as a really underserviced and underdeveloped part of the world where there could be significant copper production.

And there is no time like the present to get into the copper game. Smart notes that there isn't sufficient copper supply at the moment to keep smelters going. For instance, China has been forced to curtail some of its smelting capacity. The result is that there has been an undersupply of refined copper products—copper wire, copper tubing, copper plates etc.—and a dramatic increase in the copper price.

“People are now starting to speak of significantly higher copper prices because there is a sustained deficit opening in the market at the moment. And we certainly see potential north of $10 000 per tonne, but many of the analysts are now speaking of $15 000 a tonne being a realistic target within two years,” he adds.

Smart describes the Northern Cape as “a smorgasbord of minerals”, with an incredible endowment of critical metals.

“Because of Orion’s exploration methodologies, it is very much about accessing very large mineral rights packages; modern exploration requires you to fly airborne surveys, and to do remote sensing using satellite technology over large tracts of land. The company has ended up holding prospecting and mining

“WHETHER IN THE BRONZE AGE OR THE INDUSTRIAL REVOLUTION, COPPER HAS ALWAYS BEEN THERE AND REMAINS A CRITICAL MINERAL ”

rights over some incredible opportunities,” he explains.

These include Prieska with copper, zinc, gold and silver; Okiep with copper mineralisation and byproducts of gold and silver; Nababeep with two of South Africa's largest historic tungsten mines; and Jacomynspan with large intrusive nickel, copper, cobalt and platinum deposits. “So there is an incredible opportunity in the combined mineral rights in the Northern Cape,” he iterates.

Smart shares that when Orion Minerals came to South Africa in 2016, there were no players in the Northern Cape, so the company decided to go in, secure mineral title ownership and get all the permitting and licensing organised so that the mines could be developed; joint operations were set up, supported by central logistics and management, financial management, engineering services and the like. “And that's what Orion has been

doing the last six/seven years now and we’re achieving it. It’s actually looking very attractive for us,” he says.

Orion’s strategy is very much around having advanced staged projects that are bankable.

“Everything from our mining title holding, the way we hold our mining and prospecting rights, the way we relate to our communities, our BEE shareholders, the way we relate to suppliers and the supply chain... all that is interconnected to create a sustainable, longterm, long-life mining business of scale,” he says.

“We’ve taken the longer and more sure route to long-term sustainable production, and therefore all our projects are on the path to being permitted. Prieska is fully permitted, with our water rights, SLPs [social & labour plans] and our environmental plans in place. We haven’t built

“At Okiep, we are very close to having our water rights in place, and we expect sign-off on our tailings facility imminently. At Jacomynspan, we are revisiting the entire mining plan including looking at some very interesting modern refining technology that may be done onsite or maybe offsite. It changes the way we mine and there’s a cleaner mining footprint. This is important, as particularly Europe, North America and China are very sensitised toward environmental regulations,” explains Smart.

“Orion is very much about being bank financeable so that we can draw on debt financing in the long term, but currently there is an opportunity at the moment to get into earlier stage production using equity funders, and off-take related funding.”

To take advantage of the opportunity at Prieska, the company has, since August 2023, concluded funding arrangements with both the Industrial Development Corporation and Triple Flag, a big streaming finance corporation. By obtaining this finance, Orion has been able to embark on a trial mining exercise that can be seamlessly rolled out and continued as a small-scale mining operation. “It has been brilliant for us,” he says. “It has allowed us to prove things that

are difficult to prove just on paper. There will always be questions about something that is done purely on paper, but this has put those fears to rest.

“Additionally, it has meant we have been able to recruit an entire mining team, a full management team and a mining crew with contractors resident onsite at Prieska. All our people are permanent or on long-term contracts, giving us surety of delivery—and as a result have been able to recruit some very high skill sets. So, when we go to the bank for finance, we can show we have the team and that they are executing the plan.

“We are now in the finalisation of the trial mining phase, and will then go into project financing. We believe we can build the first processing plant and get it into production within 12 months of us having the money in our hands,” adds Smart.

It is expected that Orion will comfortably achieve 30 000 tonnes per annum of copper production, which is the equivalent of what the old Prieska and Okiep were doing. Additionally, Prieska produces about 60 000 tonnes per annum of zinc. At current prices, that is roughly the equivalent of 16 000 or 17 000 tonnes of copper.

According to Smart, Orion is also working on innovative and exciting metal vapour refining

technology for Ni-Cu-CoPGE at Jacomynspan. “These nickel, copper, cobalt, platinum projects are very interesting. There are a number of them around the world and they tend to be relatively grade, so it’s a very unfair world when trying to mine these deposits, as you only manage to achieve about 75% to 80% metallurgical recovery to concentrate. Refinery smelters will only pay you around 70% of what you deliver in concentrate, so effectively you’re only being paid 49% of what you mine of the nickel.

“With the copper, cobalt and platinum, you are lucky to get paid for 10% of the byproducts contained in the nickel concentrate. Many people are trying to find ways of getting the refining into the hands of the miner so that the miner can add value before disposing of the content. With the whole world of electric vehicles (EVs), in particular, and the whole clean energy transition, all this requires very clean, very highly refined metals in a different form,” he explains.

“There is a global trend at the moment where EV manufacturers—Tesla, Toyota, Hyundai, Nissan—are actually buying into mining operations to get their security of supply. This is because they need to guarantee ESG. We came across a technology and completed

Advancing from an explorer to a developer

Prioritising near term production

Trial mining at PCZM currently underway with Cu ore being stockpiled on surface

Exceptional exploration pipeline with 10 advanced projects and over 100 significant geological/ geophysical targets

Focused on critical metals for the green transition

Financing and strategic partners secured

Strong ESG credentials with renewable energy power supply options

a study to see where we could participate in this.

“This technology blows chlorine vapour and carbonyl vapour through the concentrate, causing it to decompose, resulting in metals in a gas vapour form, which you can precipitate separately in a very refined manner. We’re actually getting to use a method that allows us to recover more than 90% of the concentrate as opposed to around 70% to 80%. So, we immediately recover 15% more of the metal. We’re having a lot of success with it to the point where we are in discussions with the big European EV producers.”

According to Smart, the next five years are going to be a very important period as mining moves into this high ESG transition world. “We have gone about a process for the last nine years of identifying potentially one of the most productive mineral belts in the world. We’ve consolidated holdings over this belt and are busy building the first mine. Also, we are busy doing trial mining at the moment, and believe that in the next 18 to 24 months we will become a significant metal producer in South Africa. It is a very exciting time for Orion, as we

will have met all the objectives of the future metal market and the demand for future metals,” he says.

Things are not only looking up for Orion Minerals, though; its host communities have also benefited. According to Smart, there has been visible improvement. “Prieska and Okiep are two different communities, as is Jacomynspan. Okiep is a long-established mining community with a tradition of mining, so there is a large skill set available. Prieska is an agricultural community, so there’s been no mining. There are no mines within 300km.

“At Prieska, we gave the community an undertaking of 50% community employment—we are currently running at 55%. At the moment we have about 170 people on site, 55% are local or host community. Of our approximately 20 Orion employees, it is 75% host community. One of the key things that we have done with all contractors is that we have made it a condition that they also recruit and train locally. So, of the 150 contractors that we have operating, 50% of them are locals from the host community. This has kept the money in the

communities, and thereby created a secondary economy. People are taking their salaries home and buying their groceries at the local grocer; they are paying school fees to the local school; supporting the local doctors and clinics.

“We employ many of the older, close-to-retirement miners to train the youngsters to become the next generation of skilled operators. We also send people to the Murray & Roberts Training Centre in Gauteng where they complete a formal accredited course,” he adds.

While things are looking rosy for Orion, Smart feels more can be done to improve South Africa’s mining industry. “I’m well known for arguing that the biggest impediment in the local mining industry is red tape. We have a slow, inefficient mineral title management system. To get a prospecting right and a mining right, and go through all the permits, you have to submit 22 related permits. It just takes too long, and it is killing South Africa’s opportunity.

“We have to cut the red tape, get the efficiencies up, and we have to have responsible, reliable, transparent ownership and management. This will allow investors to invest their money and be certain they can fund exploration to an expected outcome—and if they make a discovery, they can develop it into a mine in a reasonable time frame.

“It is not just the Department of Mineral Resources. It’s our Department of Environmental Affairs, our Department of Water, and our Department of Human Settlements. All of these are an interrelated ecosystem that has to start becoming friendly, because mining has been the history of our economy—and can be the future of our economy if allowed,” concludes Smart.

Vezinhlanhla is a 100% wholly black-owned mining contractor established by Prince Vusi, which combines leading experience with the versatility and innovation required by mining to be sustainable for the long term.

Established in 2017 as a mining contractor to service only the mining industry, today Vezinhlanhla is an empowered turnkey contractor with capabilities across the underground and opencast contract mining value chain.

We provide extensive services for coal, gold, iron ore, manganese ore, chrome ore, nickel and platinum group metals (PGMs) producers, undertaking mining operations with continuous miners, roadheaders and drill and blast applications, enabling our clients to outsource according to their unique needs.

Vezinhlanhla's commitment to safety, health, quality and environmental management standards means we work toward continuous improvements in risk management to better deliver project excellence.

Our black empowerment credentials ensure our clients benefit fully in terms of the Mining Charter requirement and the contractual conditions of key minerals purchasers.

The empowerment of women, youth and disabled persons should be achieved in all aspects of works. Vezinhlanhla has more women on board to strengthen the capacity of the business. Youth will also be employed by the company in order to pass on the skills to the next generation as Vezinhlanhla grows, with bursary schemes introduced for students to further their studies. Vezinhlanhla has developed a culture where there will be no discrimination against disabled persons, hence it will seek to find, train and employ disabled persons with potential and enthusiasm.

Vezinhlanhla's objective is to train its staff as well as community undergraduates from university and colleges, especially in engineering, safety and mining; they will be given the opportunity to further their studies in their respective fields.

Vezinhlanhla is committed to broad-based black economic empowerment, supporting the government’s initiative of transformation and affirmative action policies; it will continue to implement such projects where possible.

Vezinhlanhla has initiated projects whereby material and equipment is sourced from black SMMEs, thus speeding up the process of empowering other companies.

Vezinhlanhla strives to be a leading black-owned, diversified mining contractor in Africa while ensuring participation in the discovery, exploration and beneficiation of Africa’s mineral resources.

It is also the mission of Vezinhlanhla to develop and consolidate a diverse portfolio of high-quality assets and services for the benefit of its stakeholders.

To be a leading black-owned South African company that delivers value to all its stakeholders by:

• understanding the needs of our stakeholders.

• delivering on and exceeding those needs.

• attracting and retaining the best talent.

• focusing on core assets—Pareto Principle.

• focusing on owning and operating our own assets.

• embracing diversity.

• ensuring sustainability, growth and good governance.

• Underground Mining & Opencast Mining

• Project Management & Facilities Management

• Plant Maintenance & Conveyor Maintenance

• Crushing & Screening

• Engineering & Drilling

• Bulk Material Transportation & Hauling

THE FUTURE—VEZINHLANHLA INTENDS TO:

• reinforce our position in the market as a reliable and competitive independent producer and supplier.

• grow our sales and customer base.

• acquire coal, gold, iron ore, manganese ore, chrome ore, nickel and PGM assets to develop new projects.

• pursue power generation as a key area of opportunity— a synergistic venture that is now indelibly written into our corporate objectives.

CONTACT DETAILS: info@vezinhlanhla.co.za

+27(0) 087 550 2087

vezinhlanhla.co.za

Facebook @VezinhlanhlaZA

LinkedIn @VezinhlanhlaMining

In a world where the population burgeons and the clamour for resources intensifies, the intricate dance between meeting community needs and sustaining economic growth becomes more challenging than ever. Industries dealing in natural resources—from oil and gas to renewables and mining—find themselves navigating a labyrinth of obstacles.

The spectre of material scarcity, supply chain intricacies and the relentless ebb and flow of commodity prices hang over these sectors, sending ripples across the global landscape. Geopolitical pressures and societal demands to combat climate change add weight to the industry's decisionmaking, with environmental, social and governance (ESG) considerations taking centre stage.

Amid this tumult, organisations are fervently embracing technological strides to usher in a carbonneutral era, while engaging in fierce competition to secure the talent that will drive these transformative breakthroughs, with the transition to clean energy expected to generate 10.3 million new jobs globally by 2030.

According to Jacques de Villiers, general manager of Commercial Inland at Aon South Africa, the natural resources sector is contending with myriad complex and interconnected risks based on Aon’s latest Global Risk Management Survey (t.ly/9zuCT).

“Business interruption, and regulatory or legislative changes emerged as the top two concerns. Inflation across the globe, which has pushed up asset values, exacerbates the effect of business interruption (ranked number one).

“Notably, the top two risks mirror the same top risks identified in

our 2021 survey, underscoring the substantial and interconnected nature of these risks within the natural resources industry.”

NATURAL RESOURCES INDUSTRY TOP 10 RISKS:

• Business Interruption

• Regulatory or Legislative Changes

• Commodity Price Risk or Scarcity of Materials

• Property Damage

• Cyberattack or Data Breach

• Environmental Risk

• Political Risk

• Weather and Natural Disasters

• Climate Change

• Environmental, Social & Governance (ESG) or Corporate Social Responsibility

“Our latest Climate and Catastrophe Insight Report (t.ly/0dsHX) recorded $380 billion economic losses in the last year, a staggering 22% above the 21st century average, which highlights the substantial impact that business interruption has. This becomes more evident in the energy market, where major disruptions have far-reaching consequences for the economy and the country as a whole,” says De Villiers.

The business interruption landscape is growing increasingly complex when considering factors such as:

• Regulatory changes that necessitate continual compliance measures.

• Climate-related events that cause extensive damage.

• Cyberattacks that can cause any operation to grind to a halt.

• Supply scarcity, especially on imported goods.

• Geopolitical events such as conflicts and the fact that South Africa is in an election year.

• Workforce shortages due to talent demand and skills gaps.

“While business interruption remains an ever-present concern, organisations in this sector must navigate the interconnected nature of the top 10 risks to build resilience, as many of these risks feed directly into business interruption,” explains De Villiers.

The natural resources sector’s

pronounced exposure to regulatory or legislative changes can be attributed to the industry’s current environmental impact, the global impetus toward sustainability and evolving stakeholder expectations.

Despite being a key concern for the industry, only 13% of natural resources respondents stated they had quantified

their exposure to regulatory or legislative changes.

“Compliance and regulatory costs are not a new or unforeseen burden for business. However, uncertainty about upcoming regulatory changes may affect business confidence and can have an impact on funding or capital, compliance, risk mitigation, brand or reputation, and financial standing. This is

The natural resources sector is contending with myriad complex and interconnected risks

especially true in an emerging market such as the renewable energy market where regulatory and legislative changes are still in the making and can have farreaching consequences.

“It is essential for organisations to constantly monitor and adapt to an evolving array of new policies and regulations and to be prepared for the ramifications.”

Commodity price risk or scarcity of materials (ranked number three) affects various subsectors within the natural resources industry, especially because commodity prices are set by global markets and thus are profoundly affected by geopolitical volatility and regulatory or legislative changes.

Scarcity of materials, which could also lead to business interruption, is a growing concern amid a surge in renewable energy propelling an unparalleled expansion in

the critical minerals market. The sector stands at the forefront of this energy transition, evident in the dominance of critical minerals investment in 2022: The market for energy transition minerals doubled from 2017 to 2022, when it totaled $320 billion.

Weather and natural disasters and climate change significantly threaten natural resources companies. While survey respondents put them in the top 10 risks, at number eight and number

“Natural resources companies must work to maintain effective, whole enterprise risk management practices and workforce frameworks”

nine, respectively, the risks may warrant being higher on the list. Hurricanes, wildfires and other events such as secondary perils can disrupt operations because natural resources assets are in areas highly exposed to natural

catastrophes. Such events can also damage infrastructure and lead to resource shortages, highlighting the need for companies to have strategies in place to mitigate and recover from property damage.

As the industry increasingly embraces tech for cleaner and more sustainable operations, workforce shortages pose a significant challenge. “The ability to attract and retain top talent is crucial for organisations, as emerging technologies are driving innovation that will help support the energy transition.

“Some examples include smart grids that optimise renewable distribution and grid connectivity; innovative solutions for energy storage (hydrogen and pumped hydro); and carbon capture and storage to reduce emissions. Hydrogen fuel cells offer clean power generation and transportation, while advanced materials elevate the efficiency of solar panels and wind turbines, which all need the right technology and engineering talent to drive and build on these developments, alongside massive infrastructural investment—which all bring their flavour of risk to the table."

Thirty-nine percent of respondents reported their organisations had assessed top risks, while 32% indicated they had developed risk management plans. This is a drop from 2021 when 45% of industry respondents reported risk assessment and 39% reported risk management plans in place.

“It signals the challenges inherent in addressing the volatility of the economy and the uncertainty surrounding the energy transition and geopolitical risks. Natural resources companies must work to maintain effective, whole-enterprise risk management practices and workforce frameworks that consider expanding ESG expectations and reflect the industry’s rapidly rising insurance needs. These include conducting insurable risk profiling and gap analysis and regularly evaluating both existing and emerging risks while determining

Multibillion-dollar opportunities in cross-border co-operation for oil and natural gas projects in southern Africa

Advocacy is one of my greatest priorities as the founder of the African Energy Chamber (energychamber.org). For years, I have been making a case for the growth of Africa’s energy industry by shining a light on the harsh realities of energy poverty across the continent, demonstrating the need for African industrialisation, stressing the importance of establishing political and economic climates that are attractive to foreign investment, and so on.

While our advocacy efforts are far from over, I am pleased to note the many positive developments in the sub-Saharan regions which now motivate me to spotlight certain emergent opportunities and a strategic approach to capitalising on them.

At present, considering the number of promising energy projects currently underway and the numerous trade opportunities arising—from natural gas production in particular—I am compelled to emphasise the need

for cross-border co-operation among all the nations and producers involved in these efforts, which will be vital if we are to achieve true prosperity throughout the continent.

As detailed in Standard Bank’s strategic discussion document, “South African Gas Optionality”, Africa holds natural gas in abundance, both onshore and off, accounting for more than 7% of the world’s proven natural gas reserves.

While Algeria, Egypt and Nigeria together can take claim to more than 80% of Africa’s gas production per 2020 estimates, these figures are rapidly evolving, and much of the gas industry's attention is redirecting further south to Namibia, South Africa, inland to Zimbabwe, and to the east in Tanzania and Mozambique, which is home to the continent’s third largest store of natural gas.

African gas production rates are also on the rise, and forecasts indicate this movement will continue for decades to come. African gas output volumes have grown by 70% since the year 2000 and, as outlined in Standard Bank’s report, should continue to grow to 2050, reaching a yearly output of approximately 520 billion cubic metres.

The report also notes that with these relative newcomers to the African natural gas economy paired up with the more established producers in Nigeria, Senegal and Mauritania in the west and with Algeria and Egypt covering northern Africa, practically the entire perimeter of the African continent could have liquefied natural gas (LNG) operations for the purposes of domestic use or export as early as 2027.

Factoring in Africa’s current LNG capacity of 72 million tonnes per annum (MTPA), the number of LNG facilities either in operation or advanced development, and the supportive role small-scale LNG operators will play going forward,

the report estimates that Africa’s capacity should increase by roughly 69 MTPA in the future.

Cross-border co-operation opportunities abound People may respect man-made borders, but fossil resources certainly do not. Hydrocarbons accumulated beneath the Earth’s crust irrespective of where one nation or another decided their boundaries should be.

However, the tendency of natural gas deposits to span borders— inherent to their location, size and distribution—has, in many cases, already promoted international co-operation around the globe. Where extraction was the concern, neighbouring nations have amicably negotiated operational territories, and it is no different in Africa.

But when it comes to the feasibility of transportation, domestic distribution and export, intraAfrican co-operation is more nuanced than merely the location of gas fields relative to borders.

Developing an effective and prosperous natural gas infrastructure and distribution network will require an earnest commitment to collaboration among nations. Conveniently, as illustrated in “South African Gas Optionality”, potential crossborder partnerships literally crisscross Africa’s southernmost region.

Pipelines running from Lusaka, Zambia to floating storage regasification units (FSRUs) in either Lobito, Angola or Walvis Bay, Namibia, could centrally connect with another running along the new TAZAMA refined product pipeline, which links Ndola, Zambia to the active natural gas operations and the Coral floating LNG operation under development south of the port of Dar es Salaam in Tanzania.

Further south in Mozambique, the rail network connecting Nacala to Lusaka, with stops in Malawi at Blantyre and Lilongwe, along with Chipata, Zambia, offers an inland transportation route. With smallscale LNG trucking support, the connected railway from Beira to Lusaka with stops at Harare and Zave brings Zimbabwe into the fold, accommodating Invictus

Energy’s recent promising finds in the Cabora Bassa Basin and completing Mozambique’s rail and small-scale LNG value chain.

Along the very active coastline of South Africa, a potential pipeline could run from East London, near the proposed site for Coega’s gas-to-power infrastructure, to the existing refineries at Mossel Bay and Cape Town. From there, the pipeline could connect with a potential FSRU at Saldanha Bay before continuing on through the offshore Orange Basin sites and terminating at a future LNG facility at Elizabeth Bay in Namibia.

To see improvement in the quality of life for Africans across the continent, Africa must stay the course toward industrialisation, and natural gas should be a significant driver in that regard.

Despite how environmental activists and Western powers shudder at the idea of an industrialised Africa, when faced with their own energy crisis brought on by the Russia-Ukraine war and the sabotage of the Nord Stream 2 pipeline, the European

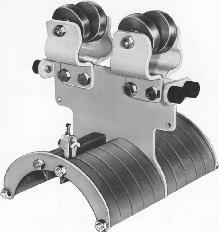

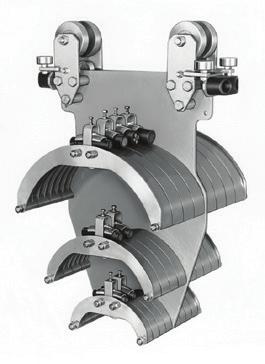

Vibramech is Southern Africa's largest manufacturer of vibrating mineral processing equipment. It supplies equipment to mining and mineral processing industries throughout Africa, Eurasia, Australasia, North and South America. Their equipment can be found operating in processing plants, ocean vessels and mining operations worldwide. The company has extensive experience in gold, diamond, coal, iron ore, manganese, platinum, chrome, nickel, uranium, copper, lithium, mineral sands and aggregate operations.

As an original equipment manufacturer, Vibramech consistently produces a proven and comprehensive range of vibrating equipment including, but not limited to: multislope (or banana) screens, horizontal and inclined screens, dewatering screens, primary & secondary sizing screens, crusher product screens, degrit screens, floats and sinks screens, classifying screens, XRT & X-ray prep screens and feeders, DMS feeders, grizzly feeders, pan feeders, tubular feeders and grease tables. All equipment is manufactured in-house at Vibramech's 32 000m2 premises in Chamdor, 35km west of Johannesburg, South Africa. Almost every piece of equipment is tailor-made to suit a client’s specific requirements, from both a plant layout viewpoint and process considerations.

The company's Vibrasure® online and remote monitoring system enables the monitoring of all aspects of Vibramech vibrating equipment 24/7, providing added insurance for machine performance. Vibramech and/ or its clients can, as required, receive real-time notifications on vibration patterns and bearing temperatures via email, mobile phone messaging or PLC. This will eliminate the occurrence of unplanned downtime due to normally unnoticed detrimental operational issues.

URAS vibrator motors have been part of Vibramech’s key product offering since 1981, and the company is the exclusive URAS vibrator motor distributor for Africa and the Middle East. Vibramech has also

pioneered the use of four vibrator motors to drive vibrating screens and, without question, has the largest worldwide footprint of four-vibrator-motor-driven (FVMD) screens globally. It has successfully installed such FVMD screens around the globe in countries such as the United Kingdom, Australia, Russia, Brazil, Chile, Canada, Botswana, Zimbabwe, Lesotho, Angola, Ghana, Mali and Israel.

Vibramech’s Field Services Department continues to service all equipment supplied into the field, and its installed equipment is supported by regional sales engineers deployed in the provinces of Limpopo, Mpumalanga, North West, Northern Cape and Free State, with a dedicated engineer in Botswana.

Union was quick to designate natural gas as a climate-friendly fuel source.

And it is right to do so. As mentioned in “South African Gas Optionality”, the carbon emissions of a fully industrialised and electrified Africa would likely never exceed 4% of global emissions. Not only is natural gas the cleanest burning fossil fuel, but it is also Africa’s ticket out of energy poverty.

Through the production, domestic distribution and export of natural gas, as well as gas-to-power initiatives, Africa will become healthier and wealthier and capable of building the alternative energy infrastructure that will eventually render our reliance on fossil fuels obsolete. On a reasonable timeline, Africa will follow the developed world in powering itself via a combination of wind, solar and green hydrogen, but none of this will come to pass unless we work together.

As evidenced by the intricacies of just some of the proposed projects among the southern African nations and considering the numerous other projects underway or in development throughout the rest of the continent, cross-border co-operation will be imperative if we are to tack a happy ending onto the great African energy success story.

With initiatives like the African Continental Free Trade Area

(AFCFTA), individual nations will be able to trade in goods, resources and services more easily, and workers will be able to cross borders freely, adding manpower to projects outside their home country.

Once the AfCFTA is fully implemented, I am confident it will facilitate intra-African trade, bring any disputes to a resolution, and speed up commerce where it was once slowed by tariffs and other bureaucratic barriers—but we can always do more.

The nations of Africa need to unify in mindset and mission if we are to become a global energy

powerhouse. This is, of course, in no way a call for a redrawing of boundaries, an erasure of national identities, or the capitulation of smaller nations to wealthier ones, but we must increase the frequency and volume at which we work with one another.

Every African government, indigenous company and individual citizen should cultivate the idea that we are also one people working together to profitably supply the world around us while improving conditions at home.

NJ Ayuk Executive Chairperson African Energy Chamber

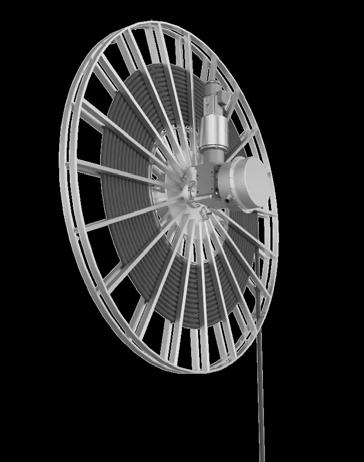

RadonX™, developed by RES, is a highly e ective and successful method for detecting radon release associated with potential uranium resources at depth.

Excellent depth of detection.

• Fast survey and results turnaround.

Highly e ective uranium exploration tool.

Does not measure radiation arising from thorium.

Highly cost e ective compared to other techniques.

E ective for regional surveys and detailed follow-up.

Significantly improved sensitivity compared to alpha detection.

Accurate uranium mineralisation mapping, and drill targeting.

Highly e ective in areas of residual and transported surficial cover.

Improved Gamma counting statistics due to field measurement.

RES’ Ground Geophysics Team specialises in the acquisition, interpretation and modelling of a range of geophysical data. Our interpretation products are signi cantly expanded by including input from structural geologists, economic geologists and remote sensing specialists within the group. This multi-disciplinary approach allows us to con dently generate prospectivity maps and identify targets, through applying a Mineral Systems Analysis type approach, based on applicable deposit styles. Ultimately resulting in more ef cient exploration projects.

www.res.co.za info@res.co.za

Namibia's energy sector needs a proactive introduction of solid local content regulations

Namibia’s oil & gas sector is still looking forward to reaching the production phase: S&P Global analysts (t.ly/3k0xO) do not anticipate Namibia's first oil to come until 2029, and the country’s first gas-to-power project is scheduled to begin in 2027.

Before Namibia achieves these hotly anticipated milestones, Namibian lawmakers have the opportunity to implement thoughtful, effective policy to benefit their people. Specifically, I am referencing local content laws that will help spread future wealth among Namibians, develop the skills of the Namibian people in oil & gas professions, and promote the establishment of Namibian oil & gas businesses. Ultimately, this will help ensure a long-term, sustainable economic impact from the resources.

Local content laws are broad policy tools that governments use across many industries. The goals of local content are multifaceted, promoting domestic businesses by requiring a certain percentage of goods or services to be sourced from domestic companies, motivating international companies to share knowledge and expertise with local firms, stimulating job growth in the domestic economy, and encouraging investment in local infrastructure that benefits the industry.

Namibia is fortunate to be in a position to benefit from the experiences of other oil- and gasproducing states. Namibia can use the best practices that have benefited others and learn from their mistakes. Standing at the precipice of an energy revolution that will help transform its economy, lawmakers in Namibia have something of an advantage, and they need to capitalise on this.

To help local companies and Namibian citizens benefit from oil & gas opportunities across the industry’s value chain, Namibia currently has a draft of the National Upstream Petroleum Local Content Policy, but it has not been passed into law yet. The Ministry of Mines and Energy is consulting with stakeholders to make revisions that will best serve the country and her people.

The draft reflects the government's desire to leverage its recent oil and gas discoveries for broader national development. There is a focus on achieving a balance between local participation and attracting foreign investment.

We love to see that Namibia is moving toward implementing local content regulation or directives, and the draft policy offers a glimpse into its goals.

As I noted last year, I am heartened to see the productive co-operation of Namibian lawmakers and oil and gas companies. I have personally witnessed their efforts to ensure Namibia's best economic opportunities. Unlike too many other African nations, Namibian policymakers are not throwing roadblocks in the way of exploration companies. They also realise that the country will reap the benefits of its new petroleum bounty only if all key stakeholders seize this historic opportunity to put the right policies in place and continue encouraging investments in energy.

Still, Namibia has several key local content hurdles to overcome.For one, growing and maintaining a successful oil & gas industry in Namibia will require significant investments in infrastructure, workforce development and regulatory frameworks. Because the complex energy sector requires high initial investment, specialised technology, particular workforce skills and a long-time horizon for projects, it can be difficult for local companies to readily participate.

In addition to the huge sums of infrastructure financing needed to build out the oil & gas sector, Namibia needs to invest in training and education programmes to create a skilled workforce capable of operating and maintaining this infrastructure. Without substantial input—both financial and educational—from external experts, domestic involvement will likely remain limited, despite any well-planned local content policies.

And we cannot overlook the need to define 'local' clearly. Namibia has to make sure its local content policy leaves no room for

interpretation or nuance to avoid an unfair advantage for some Namibian businesses.

At the same time, it is equally important for the country to be pragmatic in its implementation of the regulations to continue fostering investment. Namibian policymakers need to avoid government overreach. While local content regulations can have positive effects, they can also raise concerns about potential drawbacks such as increased costs or limitations on competition. Striking the right balance between local requirements and international competitiveness will be key to the success of the fledgling oil & gas sector.

Meanwhile, the energy sector must tread carefully to avoid any backlash from the Namibian citizenry. One false step could quickly crumble the people’s support for oil and gas companies.

In today's world, simply focusing on resource extraction is not enough. Oil and gas companies that want to prosper in Namibia must also embrace corporate social responsibility (CSR) and social programmes that foster positive outcomes for the people. Implementing sustainable practices that mitigate the environmental impact of oil and gas activities demonstrates a commitment to responsible resource development. Companies that neglect CSR risk facing community opposition and protests, potentially delaying or derailing projects.

In addition, companies with a strong CSR reputation attract and retain top talent, creating a more positive work environment. That, of course, includes women: In Namibia, women make up almost

52% of the population, so ignoring their potential would be a gross oversight.

A positive social impact should ideally influence government decisions and create a smoother operating environment. The Namibian government can foster this co-operation by favouring companies with strong CSR initiatives when awarding licences and concessions.

Multinationals like Exxon, TotalEnergies, Shell, Galp, Woodside and Chevron stand to be amazing allies in this growth. Likewise, service companies like Halliburton, SLB, Baker Hughes, Technip Energies and many others should play a big role—in boosting Namibia’s oil and gas production as well as in promoting Namibia’s local content environment. With the big contracts they are going after, they would be wise to start hiring and training Namibians in their oil and gas activities NOW.

A commitment to Namibians As long as the country continues along the path toward local content that the Geingob administration initiated, we may well see it becoming obligatory for companies to provide a local content plan and supplier development plan to be eligible to win contracts.

Consider the recent ultimatum (t.ly/pHywm) issued by Maggy Shino, petroleum commissioner of Namibia’s Ministry of Mines and Energy: "We would like to inform those envisaging to service the Namibian oil industry that local content is mandatory, and that the Namibian government will not compromise in providing opportunities for its people to participate meaningfully in the industry.”

In January, she shared the vision of the nation’s pathway to first oil. It is evident from her comments to World Oil that her people are

Resources 4 Africa is pleased to announce the 10th edition of its annual Junior Indaba, a popular meeting place for junior miners which is enjoyed by all for its incisive, informative and frank discussions tackling the challenges and opportunities for exploration and junior mining companies in South Africa and elsewhere in Africa. Discussion topics this year include:

• What can be done to drive exploration in South Africa?

• What is the latest update on the South African cadastral system?

• What is the role of junior miners in meeting the demand for critical minerals and metals?

• How are commodity prices faring in 2024 and what will this mean for juniors?

• What are the challenges and opportunities for junior miners and explorers in the rest of Africa?

• What lessons can be learned from successful junior miners who are already operating in SA and beyond?

• What are investors looking for when considering African junior mining projects?

• And much more…

We will feature a number of junior mining success stories, as well as our regular features –Myth Busters and a showcase of presentations from junior miners across the continent.

foremost in her mind. “First, we need to build the capacity, both in the local workforce and in the institutions that will help oversee, develop and regulate Namibia’s oil & gas industry. We also have an obligation to share up-to-date information with the Namibian people so that they can prepare effectively for first oil production.”

Shino emphasised the importance of knowledge and skill transfer, to ensure Namibian companies and Namibians themselves have

the opportunity “to participate meaningfully and add value to the projects.”

She also called on Namibians themselves, tasking them with some amount of selfdetermination. “A much bigger obligation is further placed on the Namibian people to ensure they equip themselves with the necessary skills required. The oil industry is a highly specialised industry with high standards for HSE [health, safety and

Namibia has to make sure its local content policy leaves no room for interpretation or nuance to avoid an unfair advantage for some Namibian businesses.

environment], and we will not compromise on the international requirements. We must ensure the industry has an effective local content policy and regulatory landscape so that Namibians reap the fruits of their labour. This is central to sustainable governance.”

On his part, Minister of Mines and Energy Tom Alweendo (t.ly/ mCXLt)—who has been a strong advocate for local content— focused on the role of Namibians to step up their entrepreneurial skills and personal responsibility: “Without local entrepreneurs who are curious, innovative and willing to invest their time and energy in acquiring the necessary skills to succeed, it will be extremely challenging, and possibly even impossible, to embark on our local content journey.”

With this mindset, Namibia’s foray into oil and gas will reignite the country’s sluggish economy by encouraging new investment and revitalising the manufacturing sector. At the same time, a proactive introduction of solid local content regulations will no doubt foster job creation, help combat energy poverty, and promote hope and human dignity for the Namibian people.

NJ Ayuk Executive Chairperson African Energy Chamber