2021 was a challenging climate for all. Arts House Limited (AHL) continued to play a significant role in bridging the arts and audiences through our festivals and programmes, diverse spaces and placemaking efforts, and ensuring that livelihoods for artists and outreach to community were sustained in a safe manner – all whilst delivering a year‐round calendar of events to support the arts sector.

With shifting boundaries and the gradual relaxation of safety measures, Arts House Limited (AHL) focused on presenting physical, digital and hybrid programmes while navigating uncharted terrains and uncertainty. In spite of new challenges, 2021 truly was a year of milestones.

Firstly, the team at AHL undertook more exciting Festivals including new programmes in our sixth arts venue – Stamford Arts Centre. Last year, for the first time, we managed the Singapore Writers Festival (SWF), the Golden Point Award (GPA), and launched the Our Cultural Medallion Story in November 2021 – the nation’s first dedicated showcase commissioned by NAC to honour Singapore's Cultural Medallion (CM) recipients and their artistic achievements. The Singapore International Festival of Arts 2021 (SIFA 2021) was also reimagined into a hybrid festival for the future, and attended by more than 15,000 attendees.

Through our various programming platforms, AHL encouraged artists to pivot to digital or hybrid presentations so as to maintain and broaden their audience base across our diversifying portfolio of national events. While supportive, our audiences unsurprisingly retained a penchant for live events. In time, with the return of in-person events, AHL drew about 50,000 attendees to our activities and festivals in FY21/22 alone, spanning 3 signature events and 100 literary arts activities.

Next, AHL also ramped up and focused efforts on bridging the Arts and Education sectors with AHL Learn, where we invited teachers, educators, and instructors to explore some of AHL’s highlights. During the session, educators were able to learn more about the themes explored through pinnacle platforms such as the SIFA, SWF, as well as The Arts House’s slate of literary arts programming.

Furthermore, as the cultural place manager of the Civic District, AHL enlivened the precinct and its historic centres by injecting new life into these spaces. Programmes such as The Clock Tower Climb at Victoria Theatre and Victoria Concert Hall (VTVCH) were introduced in 2021, alongside numerous other initiatives to activate the precinct and harness the collaborative spirit amongst its arts stakeholders, including OUT OF SIGHT, Time Heist: Civic District, and many more.

In efforts to help sustain and uplift the arts sector, AHL also continued working with partners to build sector capacity and capability development, maintaining and managing presentation venues for artists, as well as enhancing outreach to audiences through the arts.

These included the support of:

1. Singapore's signature visual arts season, Singapore Art Week (SAW), where AHL aligned our programming efforts, including the AliWALL Festival 2022 at Aliwal Arts Centre (21 – 23 January 2022) with Light to Night Festival. As part of AHL’s placemaking efforts within the Civic District, The Arts House (TAH) also extended its opening hours on Fridays and Saturdays during SAW.

2. SingLit: Read Our World, a movement to encourage the discovery of local literature, which TAH’s signature Textures programme (4 March – 3 April 2022) sought to also champion.

3. Freelance producers and artists, including via two programmes titled Artist’s Block and Order On The Go (February – March 2022).

4. Educators and urban farmers Cultivate Central in Goodman Grows (September – November 2021 and March 2022) – an initiative that uses the Goodman Arts Centre gardens as a socially‐driven community farm for artists, food growers, nature and community to connect.

All of these efforts and happenings mentioned above could not have been possible without our Donors, Partners, arts community and tenants who have shown their unwavering faith in the Arts in unpredictable times, and we look forward to creating more memories in the arts together with AHL in the coming years.

We look forward to welcoming more visitors at our in-person Festivals and programmes as we continue to enliven and uplift the arts sector through creative, multidisciplinary and diversified programming.

Thank you for your consistent support throughout the past year.

Hybrid Festival which saw over 70 productions with more than 200 programmes and activities attended by more than 15,000 attendees

First year of organising SWF, which featured over 160 programmes to 52,000 audiences

Photo courtesy of Tuckys Photography

Photo courtesy of Tuckys Photography

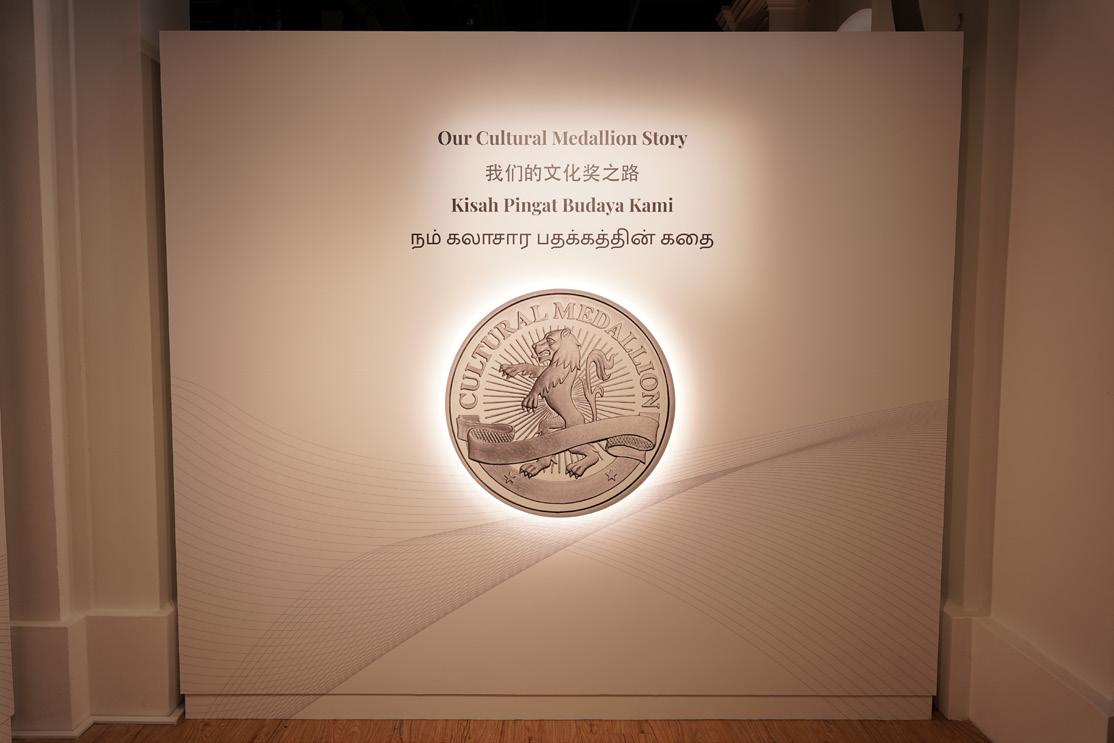

AHL launched a long-term showcase to recognise and celebrate the achievements of over 130 Cultural Medallion recipients

Officially appointed to manage SAC in 2022

Took over the organisation of GPA, which attracted close to 2,000 entries, the highest number since its inception in 1993

New programmes in Civic District as Cultural Place Manager –The Clock Tower Climb, Time Heist: Civic District, etc.

Arts House Limited (AHL) is a not-for-profit organisation committed to enriching lives through the arts. AHL is the cultural place manager of Singapore’s Civic District. It manages two key national monuments –– The Arts House (TAH), a multidisciplinary arts centre with a focus on literary programming, and the Victoria Theatre & Victoria Concert Hall (VTVCH), a heritage building that is home to the Singapore Symphony Orchestra. It also runs performing arts space Drama Centre (DC) as well as three creative enclaves for artists, arts groups and creative businesses –– the Goodman Arts Centre (GAC), Aliwal Arts Centre (AAC), and Stamford Arts Centre (SAC).

AHL organises the Singapore International Festival of Arts (SIFA) – an annual pinnacle performing arts festival; as well as the Singapore Writers Festival (SWF) – a multilingual festival presenting the world’s leading literary talents. In addition, AHL manages Our Cultural Medallion Story – the showcase on Singapore’s Cultural Medallion recipients at TAH.

AHL was set up on 11 December 2002 as a public company limited by guarantee governed by its own Constitution documents, under the National Arts Council (NAC). First set up as The Old Parliament House Limited in 2002, it was renamed Arts House Limited in 2014. For more information, visit www.artshouselimited.sg .

CHARITY REGISTRATION NUMBER:

01658 200210647W

UNIQUE ENTITY NUMBER (UEN):

INSTITUTION OF PUBLIC CHARACTER (IPC) STATUS:

Effective 1 Jan 2020 – 31 Dec 2022

REGISTERED ADDRESS:

28 Aliwal Street #03-07

Singapore 199918

A leader in nurturing, inspiring and enriching communities through the arts in Singapore.

3.3.1

DBS Bank Ltd

Standard Chartered (Singapore) Ltd

BANKERS: AUDITOR:

Ernst & Young LLP

RELATED ENTITIES:

The Company does not have any subsidiary, associate, or joint venture.

MANAGEMENT:

Tan Boon Hui, Executive DirectorBridging the arts and audiences by transforming ideas into realities through our distinctive spaces and programmes.

EXCELLENCE We embrace change and champion innovation in our pursuit of creative explorations and meaningful arts experiences. We perform at the highest standards, striving to be the best that we can be.

3.3.2

RESPECT

We treat others how we would like to be treated. We value each person’s worth and contribution and celebrate authenticity and diversity. We remain grounded and humble in our interactions.

3.3.3 INTEGRITY

3.3.4

PEOPLEORIENTED

We uphold ourselves to the highest ethical standards, and are transparent and accountable for our actions.

We believe in our people and recognise that we can only achieve our goals by working and collaborating so that we can lean on and learn from one another. We also put others before self in our service to the arts.

As of 31 March 2022, AHL’s board comprised 13 directors. An AGM as well as four Board meetings were held during the financial year. The directors and their attendance at the Board meetings are listed below:

A renewal of AHL’s Board was carried out in FY 21/22, and seven new Directors were appointed (Mr Lim Yingjie Eugene, Mr Sarker Arijit Ranjan, Mr Tan Gim Hai Adrian, Ms Yasmin Hannah Ramle, Mr Chua Buan Keat, Mr Zulkifli bin Mohamed Amin, and ex-officio Executive Director Mr Tan Boon Hui). Three Directors (Mr Ong Chao Choon, Mr Ang Kah Eng Kelvin, and Mrs Maniza Jumabhoy) retired, having reached the end of their terms on 31 May 2021.

All directors are appointed by NAC and none are remunerated for their services, except for Mr Tan Boon Hui who serves as AHL’s Executive Director and ex-officio of the Board.

The Board conducts regular self-evaluation once every three years or during each term to assess its performance and effectiveness.

The Board has delegated specific responsibilities to four Committees and each Committee has its own terms of reference, roles and responsibilities approved by the Board. The Board acknowledges the ultimate responsibility on all matters; the Committees retain the authority to examine issues and report back to the Board with their recommendations. Minutes of these meetings are also circulated at the Board Meeting.

Over the past year, the SIFA Committee was replaced by the Programming Committee to better address AHL’s programming remit, which has grown significantly over the years. Beyond SIFA, AHL now also manages SWF, Golden Point Award (GPA), and year-long programming at its various venues.

Key Board appointments as at the end of the financial year are as listed below: Board

Tan Wee Yan Wilson Chairman (1 Jun 2019) Chairman, EZ-Link Pte Ltd

Madeleine Lee Suh Shin

Audit and Risk Management Committee Chairman (1 Jun 2021)

MD/CIO, Athenaeum Pte Ltd

Finance Committee Chairman, FY2018

Board Director, 3 Aug 2016

Programming Committee Chairman, 1 July 2021

Lynette Pang Hsu Lyin

Board Director, 1 Jun 2021

Deputy Chief Executive, Planning and Corporate Development, NAC

SIFA Committee Chairman, 25 Jun 2018

Board Director, 31 Mar 2016

Kwok Siew Loong Kenneth

Board Director, 1 Jun 2021

Senior Director, Service Quality and Community Engagement, Ministry of National Development (on secondment from NAC)

Board Director, 31 Mar 2016

Ong Han Peng

Finance Committee Chairman (1 Apr 2020)

Founder & Managing Director, 1-Group Board Director, 1 Jun 2019

Phua Hwee Choo

Human Resources Committee Chairman (2 Jul 2019)

Deputy Principal, Development, Singapore Polytechnic Board Director, 1 Jun 2019

Tan Boon Hui

Board Director (Ex-Officio), 21 Apr 2021

Executive Director, AHL

Lim Yingjie Eugene

Board Director, 1 Jun 2021

CEO, The Assembly Place

Yasmin Hannah Ramle

Board Director, 1 Jun 2021

Director of Comms, SEA at a global management consulting firm

Sarker Arijit Ranjan

Tan Gim Hai Adrian

Board Director, 1 Jun 2021

Programming Committee Chairman, 11 Mar 2022

Co-President, Asia-Pacific, Mastercard

Partner, TSMP Law Corporation

Board Director, 1 Jun 2021

Zulkifli bin Mohamed Amin

Board Director, 1 Oct 2021

Assistant Music Director/ Youth Leader, Orkestra Melayu Singapura

Chua Buan Keat

Board Director, 1 Oct 2021

Group CEO, Goldbell Corporation P/L

The Audit and Risk Management Committee (ARMC) was established in August 2016 and comprises four nonexecutive and independent directors. The ARMC assists the Board in its oversight of AHL’s financial reporting, system of internal controls, risk management and governance, internal and external audits, and interested person transactions (if any).

Committee members as at the end of the financial year are listed below:

Chua Buan Keat

Tan Gim Hai Adrian (stepped down on 11 Mar 2022)

Lynette Pang Hsu Lyin (joined on 11 Mar 2022)

- -

The Finance Committee (FC) was established in April 2014 and comprises three non-executive and independent directors. The FC assists the Board in its oversight of AHL’s finances, budgeting process and matters relating to AHL’s use of reserves. The Board observes the maximum limit of four consecutive years for Directors holding the appointment of FC Chairman.

Committee members as at the end of the financial year are listed below:

The Programming Committee comprises five non-executive and independent directors. The Programming Committee assists the Board in providing oversight on governance and programming direction for AHL-organised events and platforms. It also provides suggestions for collaboration and presentation opportunities, as well as ideas for community engagement to link AHL to relevant international and local arts practitioners.

Committee members as at the end of the financial year are listed below:

Note: Chairman was Lynette Pang Hsu Lyin until she stepped down on 11 Mar 2022.

The Human Resource (HR) Committee was established in April 2016 and comprises three non-executive and independent directors. The HR Committee assists the Board in providing oversight on executive and leadership development, reviewing and approving executive remuneration policies, approving the principles and budget for the annual salary increment and bonus pay-outs, reviewing and approving the principles of AHL’s HR policy changes, and attending to HR-related matters raised to the Board.

Committee members as at the end of the financial year are listed below:

Board Meetings

Board meetings are held on a quarterly basis with a quorum of at least three Board members. The meetings aim to review results, performance, forward plans and prospects of AHL. Staff who are not Directors may be invited to attend Board Meetings to provide information but they do not vote or participate in Board decision-making matters.

AHL has a policy in place for Conflict of Interest for the Board as well as for staff to ensure that directors and officers act independently and in the best interest of AHL. The Policy for Conflict of Interest and declaration form are circulated to the Board Directors upon joining and on an ongoing basis as and when their personal appointments change.

Board members are also reminded of the requirement for full and immediate disclosure in writing to the Board when a conflict-of-interest situation arises. If and where there is present or potential conflict of interest, the director is required to disclose the conflict situation and recuse him/herself from the discussion and all decision-making with regard to the matter.

During the year, the Board endorsed the Strategy Map for FY22/23 as well as various work plans for key functions, including plans for festival and venue programming, Civic District placemaking, partnerships, asset management and leasing, as well as upgrading and maintenance of venues.

Establishment of The Old Parliament House Limited, a company limited by guarantee, to manage the old Parliament House which will be converted into a multi-disciplinary arts and heritage centre.

The Old Parliament House Limited was officially renamed Arts House Limited on 19 March 2014.

2010

Arts House Limited is officially appointed to manage Goodman Arts Centre.

The Singapore Arts Festival celebrates 30 years of performance longevity, attracting over 700,000 people. Inking of a strategic alliance between the Singapore Arts Festival and the Edinburgh International Festival, and renewal of the Memorandum of Understanding with the Scottish Arts Council on 4 June.

2017

Arts House Limited is officially appointed to manage Victoria Theatre & Victoria Concert Hall.

2017

Arts House Limited is officially appointed to manage Aliwal Arts Centre.

Arts House Limited took over the organisation of the annual Singapore Writers Festival (SWF), Golden Point Award (GPA), and launched a long-term showcase on the Cultural Medallion.

Arts

2022

Arts House Limited is officially appointed to manage Stamford Arts Centre.

Festivals

Event

Technical

Customer

Centre

Executive Director

Tan Boon Hui*

Saburulla Abdul Gani Director, Corporate Facilities Management

Yeow Ju Li Senior Director, Strategy & Planning, and Corp Admin

Oh Boon Ping Director, Finance

Isniati Ali Director, Human Resources & IT

Jasmine Gan Director, Marketing & Communications

Lee Mun Ping Director, Placemaking & Partnership Development

AHL believes in our people and is committed to developing their competencies and empowering them to better serve our clients, stakeholders and communities with respect, excellence and integrity.

To achieve this, we have four long-term human resource strategies:

i. Develop a consistent and compelling AHL employer brand to attract the right talent

ii. Develop workforce capabilities

iii. Keep our people engaged, enabled and energised

iv. Grow leadership pipeline

AHL continues to invest in engaging our people and building their capabilities to keep them future ready and well-equipped to excel at work and help AHL achieve our mission.

We enhanced our talent acquisition strategy to attract and select candidates with the “best fit” for AHL. The onboarding process was also improved to better orientate our new hires to the mission, vision and culture of AHL.

AHL recognises the importance of building a more agile workforce. We launched an internal transfer framework where our people can apply for internal job openings as part of self-initiated career development to enable them to gain new experiences, skills, and build new capabilities.

We showed concern and support to our people in spite of the challenges posed by the COVID-19 pandemic. A series of “Fireside Chats” with our Executive Director were organised, in compliance with prevailing safe management restrictions and measures.

In addition, we hosted a virtual Year-End Celebration event, where our people enjoyed an afternoon of online entertainment and games.

Our leadership team also took the opportunity to thank our people for their hard work with specially curated care packs that were sent after the event.

At our first “All Hands” town hall in January 2022, we showcased 2021’s highlights and achievements, shared updates from our last Fireside chat, which included a slew of brand-new initiatives from HR, Finance and Marcomms. Executive Director shared the exciting plans and directions ahead based on FY22/23 strategic objectives of “Unify, Uplift & Unlock”.

The journey to improve our people and culture will continue as we remain committed to developing a strong team of people.

AHL is financially supported by Government grants, rental and service charge income, venue hire income, donations, sponsorships and sales of tickets for its programmes.

The Board approves the annual budget that is closely linked to AHL’s Strategy Map for the year. Quarterly results are presented to the Board, together with comparisons to the approved budget as well as explanations for any variances.

Fixed assets are tagged and properly recorded in a fixed asset register to track any additions, disposals and movements. Physical sighting of assets is performed periodically, and the value of assets are adequately insured.

AHL manages its reserves in accordance with a Reserves Policy that is approved by the Board to ensure adequate reserves for long-term financial sustainability. Reserves are invested in Singapore Dollar fixed deposits in accordance with AHL’s Investment Policy that is also approved by the Board.

Both the Annual Report and Audited Financial Statements of AHL are published on our website at www.artshouselimited.sg .

In accordance with the Code of Governance, the remuneration of key management staff is disclosed. These start from a base of $100,000 and increase in bands of $100,000 thereafter.

Further details on other staff’s remuneration and the results for the Financial Year ended 31 March 2022 can be found in the Audited Financial Statements.

During the year, there were no staff employed by AHL who are close family members of the Executive Director and/or Directors of the Company.

Each of our diverse venue spaces delivers unique art experiences through our signature programmes: The Arts House at the historic Old Parliament building focuses on literary arts and works inspired by literature; Aliwal Arts Centre, located in Kampong Gelam, showcases programmes that explore the mix of rich heritage and contemporary culture of this unique area, and Goodman Arts Centre offers familyfriendly programmes that champion communitybuilding and sustainable art, while providing access to the centre’s many artistic tenants.

This year, AHL took over the management of Stamford Arts Centre (SAC), bringing the total venues in our portfolio to six, including Victoria Theatre and Victoria Concert Hall, and Drama Centre. SAC is a creative enclave that focuses on traditional arts and creative businesses.

In addition, we also took over the organisation of the annual Singapore Writers Festival (SWF), the biennial Golden Point Award (GPA), and launched a long-term showcase on the Cultural Medallion, the highest cultural award in Singapore that recognises and celebrates the achievements of Singapore’s Cultural Medallion recipients.

In FY21, AHL leveraged both physical and online platforms to reach over 74,000 physical and online attendees through our year-long cultural programmes, offering respite in another year of health and economic uncertainty, to audiences in Singapore and beyond. As Singapore emerges progressively from the pandemic in early 2022, AHL saw a positive rise in physical attendance for our signature programmes such as Light to Night Festival at The Arts House, AliWALL Festival 2022 and Textures 2022.

Programme highlights from FY21 include:

4.1.1

4 March – 3 April 2022

Responding to the prevailing safe management measures and continued remote working situation in Singapore, AHL brought Textures, our annual festival that celebrates Singapore literature to the doorsteps of Singaporeans.

Textures 2022 took Singapore literature to public libraries and community spaces in Ang Mo Kio, Punggol, Sembawang and Toa Payoh with a variety of family-friendly activities, from a travelling installation featuring about 80 e-books from National Library Board (NLB) and artist works inspired by Singaporean literature, to interactive workshops and activities.

AHL also partnered the Singapore Book Publishers Association (SBPA) to host over 10 leading publishers and booksellers, and showcase around 20 literary arts activities at SBPA’s Singapore Literature Book Bazaar at TAH from 7 –20 March 2022.

Both editions of Textures featured digital programmes like storytelling videos and podcast episodes. These included the commission of an online, interactive murder mystery, A Red Sky at Dawn by Troy Chin as part of Textures 2021, which was awarded Winner of Excellence in Narrative award at the Asia Games Award 2021.

Textures 2022 featured digital programmes such as storytelling videos Wildest Dreams: Stories adapted from SingaPuraPura by veteran storyteller Kamini Ramachandran, and Crosstalk, a podcast series hosted by artistic director Jason Wee on the art and life of writing across generations of writers.

Textures 2022 attracted 17,162 physical and digital attendees.

4.1.2

20 June – 11 July 2021

Limited and TAH, StoryFest is a festival that celebrates and showcases a variety of styles, repertoires, and cultural arts presentations of storytelling from Singapore and around the world.

StoryFest 2021 was held from 20 June – 11 July 2021 as a virtual festival, with a series of evocative talks, interactive storytelling sessions, performances and workshops hosted across Zoom, VOD and StoryFest’s YouTube channel.

Programmes featured included livestreamed workshops and lectures such as Singapore Showcase: Celebrating the Feminine in Folklore, where the strength and wits of mythical female characters were honoured and performed by Singaporean storytellers and spoken word artists. Another festival favourite, the Young Storytellers Showcase: Stories from Our Shores, presented emerging storytelling talents in multidisciplinary performances.

4.1.3

22 – 24 October 2021

AHL collaborated with Hafidz Abdul Rahman to pilot the presentation of Cherita Hantu –a multi-sensory storytelling session unlike any other, complete with smells, sounds, re-enactments and good old scare tactics.

Having curated horror stories with his followers on social media for two years, Hafidz further developed these supernatural encounters into literary texts with AHL’s support. This project cumulated with a live presentation from 22 – 24 October 2021 at TAH, where audiences were treated to five of the most spine-tingling stories that had been written.

Over 270 tickets to all eight shows were sold out in less than an hour after ticket sales started. Ghost Stories Archive has the potential to be developed further and amplify the wider Singapore community’s interest in local stories and writing.

14 January – 3 February 2022

As part of AHL’s place-making efforts within the Civic District, TAH extended our opening hours on Fridays and Saturdays during the Light to Night Festival as well as the national Singapore Art Week and presented a series of arts and literary programmes from 14 January – 3 February 2022 which attracted 11,018 visitors to TAH.

Highlights included:

The Same Side of the Moon Always Faces Earth (14 January – 6 February): A project by artist and illustrator Farizwan Fajari (also more famously known as Speak Cryptic), this project was inspired by the migrant stories of seafarers who made their way to Singapore by sea for a better life many decades ago.

The City Beneath the City (14 January – 3 April): Inspired by artist and writer Jason Wee’s own short story, this was a whimsical installation that imagined a fantastical copy of our island-city growing and building under our present one. This installation featured an exciting collaboration between Jason Wee and design firm WY-TO.

Curiocity: A Tessellation of Memories (14 January – 3 February): A second immersive light installation by NLB in partnership with TAH, the exhibition invited visitors to step back in time for an introspective journey into the city's past, piecing together forgotten places from our history.

Everything Light Touches: Panorama Paintings from Private Collections (20 January – 6 February): AHL worked with Art Agenda S.E.A. to curate this rare showcase of a dozen panoramic pictures on loan from private art collections in Singapore that traces a capsule history of modern Asian art. This collection which was displayed publicly for the first time received astounding feedback.

The Cultural Medallion Literary Pursuits: This programme comprised a set of two interactive games designed to facilitate self-directed engagement with Our Cultural Medallion Story showcase. Visitors were invited to scan a QR code to access a series of questions on Cultural Medallion recipients, where they then had to hunt for the answers at the showcase. This fact-hunting game proved to be popular particularly with youths and families with young children.

The Reading Room: A reading nook for visitors to find respite from the Light to Night Festival crowds, where some also got their customised poetry typewritten by Adam Tie from The Novel Encounter.

4.1.5

To strengthen strategic partnerships and engagement with the Cultural Medallion recipients, AHL organised the EYE RISE exhibition with Singapore University of Technology and Design (SUTD) at TAH from 4 –20 March 2022. The exhibition featured works of Cultural Medallion recipient, Ong Kim Seng, and Immanuel Koh, Assistant Professor at SUTD.

Through paintings, computer renders, 3D-printed sculptures and videos, EYE RISE: Urbanscapes Between Human and Machine juxtaposed a series of rarely exhibited watercolours by Ong Kim Seng with computer-generated renders by Professor Koh.

A critical talk was held on 20 March between the two artists, moderated by Ken Tan, Senior Director of Programming and Producing, at AHL.

In continuation of promoting and redefining Singapore’s urban art and placemaking efforts for Kampong Gelam, AliWALL 2022 and D’Tour were held over the weekend of 21 – 23 January 2022 and attracted 10,386 physical and digital attendees.

21 – 23 January 2022

Highlights included:

Reality in Construction, a participative outdoor mural that activated the large iconic wall of AAC. Spaz and TraseOne from urban collective and AAC tenant, RSCLS, were joined by artists Has. J, Kristal Melson and Slacsatu to paint a narrative-driven mural inspired by urban living. Festival-goers were also invited to contribute to a designated section of the mural, under the artists’ supervision.

Permission to Dream was an immersive multi-sensory experience which featured fantasy-filled digital art, performance, set design and sound. This dreamy production was a collaboration between visual artist Howie Kim, stage designer Akbar Syadiq, plus up and coming performers in a series of improvisational roving performances.

The Courtyard featured a larger-than-life inflatable sculpture by artist Howie Kim that spilled from the indoor spaces into the courtyard. The Courtyard also housed Saturday's Plan, an art market presented in collaboration with North East Social Club, a network of creatives.

D’Tour: Visitors experienced Kampong Gelam through the stories and anecdotes by RSCLS and other artists in this walking tour of the street art that is iconic to this trendy and yet deeply cultural neighbourhood.

AliWALL Festival 2022 brought artists and audiences closer to reflect on urban living, both now and for the future.

i.

D’Tour: Visitors experienced Kampong Gelam through the stories and anecdotes by RSCLS and other artists in this walking tour of the street art that is iconic to this trendy and yet deeply cultural neighbourhood.

ii. Street Art and Murals: Beyond Framed Narratives and Clichés: In this panel discussion complementing D’Tour by RSCLS, various mural artists came together to discuss selected artworks from Singapore and elsewhere, reflecting on the social impact of their art form and practice.

iii. Mixtape v2.0: If Kampong Gelam were a piece of music, what would it sound like? Mixtape v2.0 by RSCLS invited members of the public to contribute music and song titles and create a cacophonic mixtape of this distinct neighbourhood. These submissions were added to a new Mixtape v2.0 Spotify playlist.

4.2.3

16

20 March, 23 – 27 March 2022

To support the livelihood of the arts community, AHL commissioned Order on the Go, written and performed by Erwin Shah Ismail, directed by Cherilyn Woo and produced by The Entity. In this promenade theatre experience, actor and emerging playwright Erwin Shah Ismail brought a collection of stories inspired by his interviews with various food delivery cyclists in Singapore to life. This solo roving performance paid tribute to the frontline workers who toiled tirelessly rain or shine, bringing fresh meals to our doorsteps.

The show performed to full capacity of 300 from 16 – 20 March and 23 – 27 March 2022, and drew excellent audience feedback.

D’Tour provided audiences with insights into street artmaking and allowed participants to better appreciate and respond to the cultural identity of Kampong Gelam today.

Located within the sprawling GAC compound lush with greenery, Goodman Grows invited visitors to participate in creative handson activities and nature-inspired adventures. An initiative in collaboration with permaculture designers, Cultivate Central (CC), Goodman Grows turned the GAC’s gardens into a community farm to advocate for greater care of our environment.

AHL worked with CC to present an array of over 40 digital and physical programmes connecting artists, food growers, nature and the wider Singapore community.

Highlights included:

i.

An art market with eco-living stalls, live outdoor performances, and open studios where artists showcased their workspaces for visitors to view their artworks, amongst other programmes.

ii.

Online programmes which included a Telegram Talks series that focused on permaculture, composting and gardening in small spaces, and online lessons on creating “cocodamas”, inviting children to jam with musicians using items from nature and their homes.

iii.

Artists in Conversation podcasts featured talks with selected artists and the community at GAC, engaging in holistic cultural conversations for audiences to better understand the relationship between arts and nature.

Two editions of Goodman Grows were organised on 20 & 21 November 2021 as well as 11 & 12 March 2022, attracting 5,421 digital and physical attendees.

4.4.1

After taking over SAC in March 2022, AHL launched a new SAC microsite as part of AHL’s main website, as well as our social media platforms.

AHL also showcased the following programmes at SAC:

4.4.2

AHL commissioned Artist’s Block, an audio-guided trail by Artwave and produced by The Entity that leads visitors into SAC and Waterloo Street. Exploring our connection to traditional arts and how spaces interact with the way artists create, Artist’s Block was produced in collaboration with four arts groups residing in SAC: Dance groups P7:1SMA and Shantha Ratii Initiatives, opera company Traditional Arts Centre (Singapore) and traditional Chinese musicians Ding Yi Music Company.

AHL further worked with the above artists in INTERMISSIONS, presenting an educational video series which offered behind-the-scenes glimpses into their studios. The artists also shared about the traditional arts and its relevance to contemporary Singapore, while presenting their art through performance.

For FY21, the videos featured Artistic Director Shantha Ratii of Shantha Ratii Initiatives (SRI) and Assistant Conductor Dedric Wong and General Manager Elvia Goh from Ding Yi Music Company.

The two videos received over 16,500 views as of 30 April 2022.

4.5.1

Following the success of AHL’s partnership with Trafalgar that featured a tour of Victoria Theatre & Victoria Concert Hall (VTVCH) as a cultural and heritage tour in their staycation packages back in October 2020, AHL developed a fully independent tour of VTVCH led by AHL’s internal staff.

Launched on 9 December 2021, The Clock Tower Climb at Victoria Theatre & Victoria Concert Hall features the climb up the Clock Tower as a highlight, inviting participants to get up close and personal with the rarely-accessible Clock Tower and the internal workings of the Tower’s bells, as well as the interesting historical trivia of VTVCH, Singapore’s second oldest building and one of the most iconic landmarks in the heart of the Civic District.

The tour is supported by the Singapore Tourism Board’s Experience StepUp Fund.

AHL rebranded the educators outreach and engagement initiative to AHL Learn where we aim to engage with educators on a closer level. Besides having engagement sessions, we also developed educational resources, suitable programmes and tours aimed at students. Content are shared onsite as well as online, via AHL’s various websites.

The safety and well-being of artists, patrons and staff remained AHL’s utmost priority and performed its due diligence in accordance with MOH guidelines to ensure that its venues and festivals remain as safe spaces for everyone.

While planning the creative aspects of each production, AHL had to also ensure that there was strict adherence to safety management measures (SMM) for all programmes and events. This included a higher frequency of cleaning and disinfection of all venues with in-person events, adhering to the number of guests, artists and crew allowed at in-person events according to the latest restrictions, Pre-event Testing (PET) for some shows, as well as reminders to patrons to maintain a safe distance at all times.

AHL will continue to stay vigilant to protect the health and well-being of all artists, patrons and staff.

Following a winning digital Singapore International Festival of Arts (SIFA) v2.020 in the second half of 2020, and faced with ever-evolving pandemic requirements and restrictions, the 44th edition of SIFA which took place from 14 - 30 May 2021 demonstrated what an international festival might look like in the future, with its format of live, hybrid, and digital programmes. With 70 productions, over 200 physical and digital performances and activities — it was one of the largest arts festivals in

the world to be staged since the outbreak of the global pandemic last year. In addition, 15 of the productions were made available as Video-On-Demand (VOD), which brought Singapore to a global digital audience.

As travel restrictions remained, the team discovered novel ways to present international artists and bring the arts closer to the audiences. In The Journey, illusionist Scott Silven connected virtually with 30 participants as he performed live at home in Scotland. Geneva-based Cie Gilles Jobin, embracing motion capture, virtual and augmented reality, featured dancers beamed live from Switzerland onto screens at the Esplanade Theatre in Cosmogony

SIFA 2021 also boasted a bumper crop of nine commissions, some of which celebrated debut collaborations. The Commission, an uproarious satire on theatre-making in the midst of COVID-19, featured the union of three theatre companies — Pangdemonium, Singapore Repertory Theatre and Wild Rice. Chekov’s Three Sisters was given a fresh spin with local company Nine Years Theatre performing live alongside screen projections of American actors from SITI Company (NYC).

Due to the new safe management measures, the team had to cancel two performances of The Commission and the live presentation of seven productions. The team quickly pivoted, resulting in an expanded total of 17 VOD offerings. The VOD viewing period was also extended by a week, i.e. 5 – 20 June to encourage greater access. SIFA 2021 weathered many upheavals and challenges, but the team was nonetheless able to deliver a full and successful festival experience.

AHL welcomed Natalie Hennedige (pictured below) as the new Festival Director for SIFA after the tenure of Gaurav Kripalani came to a close in 2021. Helming the direction for SIFA 2022 – 2024, Natalie has defined a three-year arc intended to bring focus to performance and creation in the physical and online space, around the recurring title of The Anatomy of Performance. Returning from 20 May – 5 June 2022 with the title The Anatomy of Performance – Ritual, invited guests got a sneak peek of the festival programmes which features new commissioned works by a mix of local and international artists, at the SIFA 2022 Programme Reveal Event held on 22 February 2022 at Pasir Panjang Power Station.

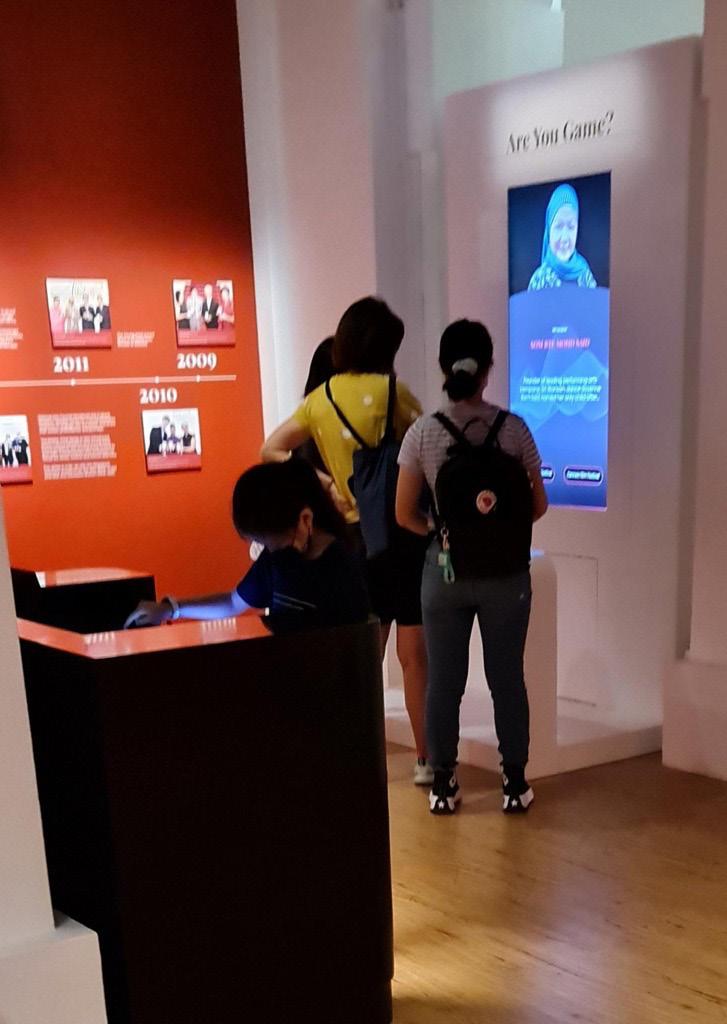

Commissioned by NAC, AHL launched a long-term showcase to recognise and celebrate the achievements of the Cultural Medallion (CM) recipients at level 1 of The Art House, accompanied by a new dedicated website. Launched on 26 November 2021 by Minister Edwin Tong, MCCY, Our Cultural Medallion Story has welcomed over 7,100 visitors as at 31 March 2022. Admission to Our Cultural Medallion Story is free and it is open from Tuesdays to Sundays, 10am – 7pm.

In the physical showcase of Our Cultural Medallion Story, visitors could use a Near-Field Communication (NFC) token to enjoy a more interactive experience across the following sections:

Milestones of the CM initiative, accompanied with the display of the Medallion, lapel-pin and certificate

Digital screening of over 40 short videos about the CM recipients from 2004 to date

Digital interactive comprising more information on all CM recipients, including individual videos and / or images of artworks, news reports, etc.

A book section in partnership with NLB, featured over 250 published books by and related to the CM recipients.

Digital interactive quiz to introduce selected CM recipients

Digital check out kiosk for visitors to obtain their next ‘art-inerary'based on their interaction with the showcase content

AHL organised GPA for the first time in FY21. The competition went fully digital in its application process and received close to 2,000 entries, the highest number since its inception in 1993 by NAC. The increase in submissions is consistent across all eight categories of short story and poetry in the nation’s four official languages –– English, Chinese, Malay and Tamil.

This biennial creative writing competition is a significant platform for discovering new writers whose works exhibit literary merit and for encouraging literary expression. Besides the diverse topics explored in the entries, the 15th edition continued to attract participants from all walks of life. It saw contestants from nine to 89 years old, with significant participation from youths as almost half of the submissions were from writers aged 30 and below.

An award ceremony for the 39 winning works was held in The Arts House on 11 December 2021, with NAC Chairman Goh Swee Chen as Guest of Honour.

2021 was also the first year AHL organised the Singapore Writers Festival (SWF). SWF is Singapore’s national literary festival that presents a diverse lineup of Singaporean and international writers through high-quality multidisciplinary programmes that place Singapore on the regional map.

SWF 2021 featured over 10 headlining authors across languages and genres including coveted names such as Ocean Vuong, R.L. Stine, and Elizabeth Gilbert. With the theme of “Guilty Pleasures”, SWF 2021 also had the opportunity to feature names that are not typically associated with literary festivals such as Tan France and Bjorn Shen to broaden the Festival’s base of appeal. A new addition to the Festival programming for 2021 were four keynote commissions by Bjorn Shen, Debasmita Dasgupta, Edith Podesta, and Rizman Putra, who presented unique programmes interpreting the theme through different mediums respectively.

Not only were programmes held across multiple venues such as the Malay Heritage Centre, The Projector, Practice Tuckshop and the National Library Plaza, SWF 2021 was the Festival’s first hybrid edition which included both physical and digital components to allow adaptability to an evolving COVID-19 situation. Apart from in-person panels and readings, SWF 2021 also featured

programmes digitally in various formats such as livestreams, Zoom workshops, microsites, IGTV videos, podcasts, and pre-recorded videos. The Festival also featured an extended Video-On-Demand period where patrons could watch over 60 festival programmes after their initial broadcast at their convenience. The Festival achieved a total of 209 programmes featuring 218 authors, attracting an overall attendance of 37,494.

In order to energise the vernacular languages literary scene, SWF dedicates a focus on one language in each edition. SWF 2021 included an intentional focus on a higher proportion of Chinese programmes, with a total of 38 vernacular language programmes. SWF works closely with language partners to expand the festival’s audience base; SWF 2021 explored new relationships with organisations such as Kamelia Co., Brown Voices, and TrendLit, while also working with those from previous Festivals. More significantly, SWF 2021 included major partnerships with Sing Lit Station and Singapore Book Council who helped to curate eight Youth Fringe programmes and the SEA Focus programming track respectively.

For its signature Literary Pioneer Exhibition, Hedwig Anuar was chosen as the Festival’s first children’s Literary Pioneer. SWF worked with the National Library Board as a venue and resource partner. An interactive familyfriendly exhibition was held at the National Library Plaza over the Festival period, accompanied by a digital microsite, honouring Hedwig Anuar for her work as the first Singaporean Director of the National Library.

Overall, SWF 2021 achieved healthy numbers with 51% of audiences being first-time patrons of the Festival, which was in line with the Festival’s aim to reach out to new audiences with a more accessible theme and programming direction. 84% of audiences also stated that they were keen on revisiting the festival in upcoming editions.

9.1.1

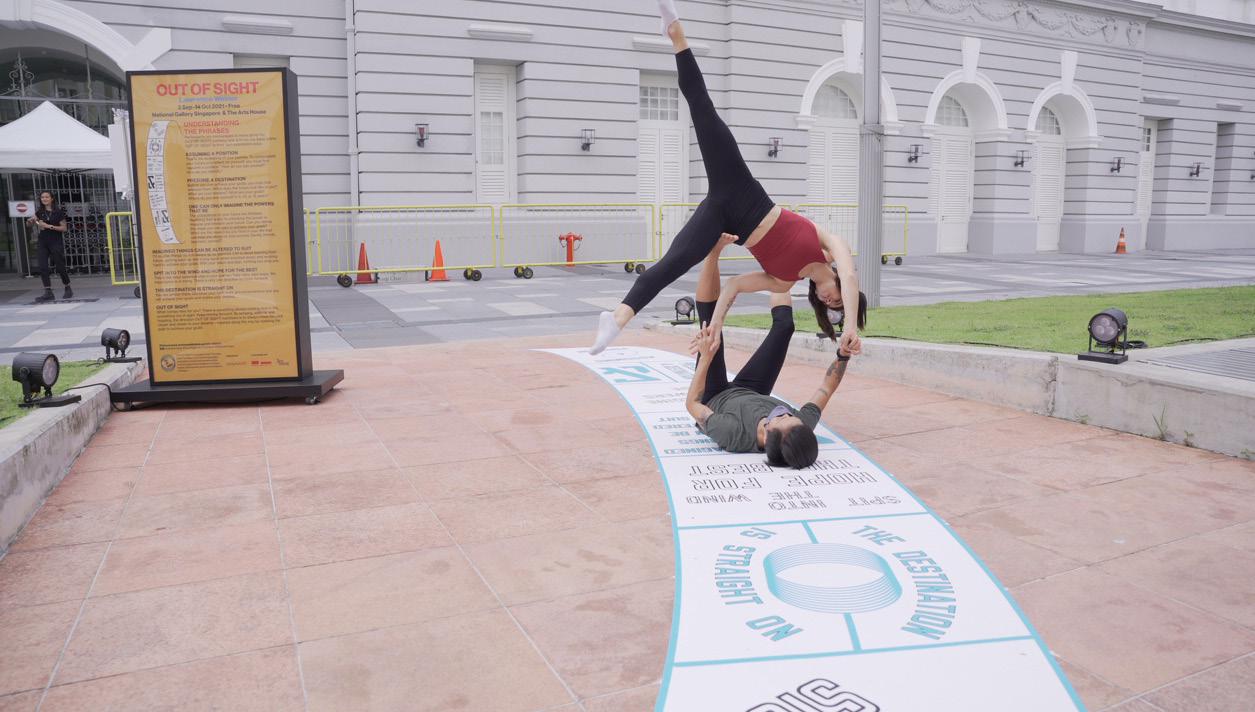

Out of Sight (OOS) was a participatory, interactive, social sculpture by Lawrence Weiner, one of the world’s top living artists. The interactive piece took the form of a giant hopscotch court, populated with fun and provocative phrases that invite audiences to see, play, think, and be inspired. The installation has toured cities like Miami, Melbourne, New York, Chicago and San Francisco, and was installed in Singapore for the first time as one of the Civic District Alliance’s (CDA) placemaking initiatives.

The Civic District introduced a series of initiatives to activate its spaces and bring more footfall into the arts precinct.

From 2 September –14 October 2021, OOS was presented as a free public installation in the Civic District as an initiative to build the precinct’s identity as an arts and cultural precinct and activate the spaces within the Civic District in a way that engages the public.

The installation was displayed at the National Gallery Singapore (NGS) and The Arts House (TAH), amassing a total of 51,728 visitors.

In May 2021, LTA led a placemaking pilot project that aimed to enhance the vibrancy of MRT stations by forging stronger connections between the stations and their surrounding precincts. The Civic District was one of the selected precincts for the pilot.

For the Civic District, the placemaking pilot focused on two key objectives: (1) enhancing wayfinding in order to build awareness of the precinct; and (2) to profile the five arts and cultural institutions in the district – Asian Civilisations Museum (ACM), Esplanade - Theatres on the Bay (TECL), National Gallery Singapore (NGS), The Arts House (TAH), and Victoria Theatre & Victoria Concert Hall (VTVCH), thereby also branding the Civic District as an arts and cultural precinct. The focus of the campaign aimed to tackle the lack of branding and awareness about the Civic District in general, as evidenced in surveys conducted with the public and Civic District stakeholders.

With that in mind, creative assets were developed for installation at LTA and SMRTapproved spaces within City Hall and Raffles Place MRT Stations, and the pilot was launched on 5 November. The campaign was covered on local news channels on the same day.

9.1.3

Civic District Edition

To further reinforce the identity of the Civic District as a place of discovery for the arts, heritage, and culture, as well as a go-to destination for the community, the CDA partnered with local tour operator, Singapore Sidecars, to:

i. curate a bespoke Civic District Art Tour that runs for the whole of 2022, including tangible touchpoints at each arts/cultural institution and involve commercial stakeholder(s);

ii. organise a hop-on-hop-off shuttle service for the Light to Night Festival (14 January –3 February 2022).

Launched on 14 January 2022, the Civic District Art Tour is a new curated experience that takes participants on an interesting ride in a Vespa’s sidecar along a scenic route around the Civic District. The paid tour features special stops at arts and cultural stakeholders where participants can learn more about the institutions, their buildings and unique events/offerings. Capitol Singapore, a commercial stakeholder, came on board as a sponsor as the final stop of the tour – where participants can learn more about its conservation buildings while also enjoying the dining and lifestyle offerings available.

Also launched on 14 January 2022 and in time with the opening of the Light to Night Festival, the Singapore Sidecars Shuttle Service featured a Civic District-branded fleet of sidecars to introduce an additional layer of excitement and buzz to the festivities, shuttling festival-goers to and from the festival’s various locations, allowing them to take in the spectacular light projections on the monuments of the Civic District while soaking in the iconic night views at the heart of Singapore.

The Singapore Sidecars Shuttle Service was available from 7pm – 10pm on Friday and Saturday nights of the festival, as well as over the Chinese New Year period (1 – 3 February 2022). The shuttle service was well received by the public, and ferried a total of 486 participants through the Civic District.

9.1.4

In March 2022, a Civic District Capsule was launched as part of Restaurant Week Singapore. The capsule featured participating restaurants from the precinct arts institutions with specially curated “art menus” as The Ultimate Art & Dining Experience

The campaign involved the restaurants who are commercial stakeholders of the Civic District, and aimed to increase awareness of the lifestyle offerings in the precinct. Branded as an art and dining experience, the campaign sought to also encourage patrons to complete their day out in the Civic District by exploring the venues beyond the restaurants –soaking in the rich history and participating in the free art events available.

The Ultimate Art & Dining Experience for March’s edition of Restaurant Week Singapore ran from 4 – 27 March 2022.

9.1.5

Building upon the adoption of digital programming since the beginning of the pandemic, two digital activations were planned for the Civic District. These digital activations allow for interaction with the Civic District to continue independent of safe distancing measures while also encouraging footfall to the area.

9.1.5.1

Time Heist: Civic District

A paid digital experience, Time Heist: Civic District, developed in collaboration with Double Confirm Productions and Sightlines Entertainment, will run from 31 March – 3 July 2022. This interactive choose-your-adventure experience brings audiences through the Civic District as they solve a mystery by exploring the nooks and crannies of the Civic District.

To strengthen connection and increase mindshare of the Civic District, AHL launched Sparky, The Civic District Guide with Sparky as our avatar – a free, self-guided tour web-based application for users to access information about and wayfinding around the Civic District, bringing them on a journey through the arts, culture and heritage in the district.

The pandemic continued into 2021 and live events in Singapore were still restricted with safe management measures on live audience capacity. These limitations had impacted events sponsorship from the corporate sector tremendously. Nevertheless, AHL managed to garner cash contributions of close to $430,000 from 40 donors, sponsors and supporters in FY21. We also received over $1 million of in-kind sponsorship that is critical in defraying programming and Festival expenses.

For SWF, AHL secured a total cash contribution of over $52,000 from five sponsors and $56,000 of in-kind support. For SIFA 2022, AHL has confirmed over $173,000 from six cash donors and sponsors, as well as $396,000 of in-kind support to date.

Notably, our two public lifts at VTVCH received a total cash donation of $100,000 from a single donor, supporting the operations and maintenance of the two lifts for the next three years.

“We are happy to support SIFA for the past 3 years on our media spaces at bus shelters and shopping malls islandwide to bring awareness to this international arts festival. It is especially meaningful in these pandemic times that our media networks in these public places have been able to help broadcast SIFA’s specially curated programmes to even more arts enthusiasts in Singapore.”

Evlyn Yang Managing Director, JCDecaux

"The arts have been a source of comfort and respite for many in the last eighteen months and we are pleased to support The Rhythm of us, presented by the SDT and SSO"

Joris Dierckx CEO, BNP Paribas, Singapore

As the overall climate of events sponsorship from the private sector has changed over the past two years, AHL looks to steer towards philanthropy and individual giving in the future.

10.1.1

If you are a huge fan of Italian food, Tipo Pasta Bar will definitely be one of your go-to spots when it comes to quality pasta. Known for its handmade pasta, you can also build your own pasta at the eatery.

A space that enriches and completes a perfect day in Kampong Gelam, Tipo Pasta Bar also provides a place that bridges the arts and audiences at its new joint. Be it after watching a show or before attending a festival, Tipo Pasta Bar makes a natural extension of the Aliwal Arts Centre experience, giving customers an added incentive to revel in the spirit of Kampong Gelam.

Arts House Ltd (AHL) salutes our sponsors and donors for their generous contributions through cash donations, sponsorship and in-kind support. These organisations and individuals play an exemplary role in supporting the making, appreciation and preservation of arts. As we continue our commitment to bring the value of arts to the community, we would also like to thank National Arts Council for their confidence and support.

AHL endeavours to continue our fundraising and cultivation efforts, to build a regular pool of sponsors and donors, and strengthen engagements to grow our supporters through long term sustainable partnerships, strategically aligned to AHL’s mission and goals.

For example, in August, AHL will celebrate National Day with a facade light up of monuments under our care in the Civic District, i.e. The Arts House, Victoria Theatre

and Victoria Concert Hall. AHL will also partner various stakeholders to present a range of programmes in our four official languages at The Arts House and Victoria Theatre from July to September, as well as celebrate our traditional arts and cultural diversity with Singapore Night Festival at Stamford Arts Centre during the last weekend of August as part of the Festival.

Other future plans are further listed below:

In June 2022, Monstrous Fun at The Arts House and the annual Goodman Open House offered a range of literary, performing and visual arts programmes by Singapore artists suitable for families to grow audiences and nurture interest in Singapore arts from young.

The Festival theme for SWF 2022 is “IF”. In its 25th edition, the Festival embraces a quarter life crisis as it grapples with its origins, ponders what could have been as well as considers the endless possibilities in its future – what can be. The word “if” allows for retrospection as well as ideation. We consider what we could have unfolded differently, and also imagine radical new futures as a global community.

To celebrate its 25th edition, SWF 2022 invites festivalgoers to enjoy a larger array of programmes across 10 days over the span of three weekends from 4 – 20 November 2022. Returning to several venues at Singapore’s vibrant Civic District, with the historic The Arts House as the main festival ground, SWF 2022 features new and exciting Singapore and international authors in in-person and online programmes and events.

Building on a quarter of a century of proud legacy, audiences can expect to experience engaging conversations with some of the world’s best authors, in a variety of formats from lectures, live interviews, workshops, multi-disciplinary performances, and even some unusual but engaging programmes such as literary meals and immersive audio journeys. Last but not least, a first-of-its-kind initiative for the festival, SWF 2022 invites past Festival Directors to curate a series of programmes pondering an alternative history for the festival.

One of SWF 2022’s key focuses would be to showcase the best of Singapore literature through its national vernacular languages of Chinese, Malay, and Tamil, by collaborating with the local literary communities. SWF 2022 hopes to showcase the multi-culturalism that is unique to Singapore’s literary scene within both regional and global contexts. Find out more at singaporewritersfestival.com

Festival Director Natalie Hennedige will continue in her three-year arc of The Anatomy of Performance with a new title for 2023: Some People. Returning in May 2023, The Anatomy of Performance 2023 – Some People explores People bound together collectively for some reason or other – becoming therefore a collective protagonist. We will build upon the foundational programming pillars of 2022 to deliver new in-person commissions and virtual programmes under Creation, Life Profusion and SIFA X. For more updates, visit sifa.sg .

AHL’s annual festival Textures 2023 will add to the late-night festivities during Light to Night, and thereafter, when it returns to celebrate Singapore literature at The Arts House in January. Light to Night at The Arts House celebrates the arts as part of the Light to Night Festival and Singapore Art Week.

Another AHL signature event, Aliwal Urban Arts Festival will continue to promote and define Singapore’s urban art and placemaking efforts for Kampong Gelam with a weekend of arts festivities as part of the Singapore Art Week 2023.

Having joined Arts House Limited (AHL) in February 2021 as Executive Director, Boon Hui built a firm foundation for the organisation to enter its next phase of growth. He oversaw the transition of key national projects to AHL in 2021/22, including the Singapore Writers Festival and management of Stamford Arts Centre, as well as the successful launch of Our Cultural Medallion Story at The Arts House. These projects added to AHL’s portfolio of arts venues and year-long calendar of arts events including the Singapore International Festival of Arts.

Beyond AHL, Boon Hui continued to be a steadfast champion of creativity and the arts, tirelessly engaging artists both locally and internationally. He was a dynamic, creative and innovative arts leader who made a significant and positive impact on those who knew him. He will be greatly missed.

Induction and orientation are provided to incoming governing board members upon joining the Board.

Are there governing board members holding staff1 appointments? (skip items 2 and 3 if “No”)

Staff does not chair the Board and does not comprise more than one third of the Board.

There are written job descriptions for the staff’s executive functions and operational duties, which are distinct from the staff’s Board role.

The Treasurer of the charity (or any person holding an equivalent position in the charity, e.g. Finance Committee Chairman or a governing board member responsible for overseeing the finances of the charity) can only serve a maximum of 4 consecutive years.

If the charity has not appointed any governing board member to oversee its finances, it will be presumed that the Chairman oversees the finances of the charity.

All governing board members must submit themselves for re-nomination and reappointment, at least once every 3 years.

The Board conducts self evaluation to assess its performance and effectiveness once during its term or every 3 years, whichever is shorter.

Is there any governing board member who has served for more than 10 consecutive years? (skip item 7 if “No”)

The charity discloses in its annual report the reasons for retaining the governing board member who has served for more than 10 consecutive years.

There are documented terms of reference for the Board and each of its committees.

There are documented procedures for governing board members and staff to declare actual or potential conflicts of interest to the Board at the earliest opportunity.

Governing board members do not vote or participate in decision making on matters where they have a conflict of interest.

The Board periodically reviews and approves the strategic plan for the charity to ensure that the charity’s activities are in line with the charity’s objectives.

There is a documented plan to develop the capacity and capability of the charity and the Board monitors the progress of the plan.

The Board approves documented human resource policies for staff.

There is a documented Code of Conduct for governing board members, staff and volunteers (where applicable) which is approved by the Board.

There are processes for regular supervision, appraisal and professional development of staff.

Are there volunteers serving in the charity? (skip item 16 if “No”)

There are volunteer management policies in place for volunteers.

There is a documented policy to seek the Board’s approval for any loans, donations, grants or financial assistance provided by the charity which are not part of the charity’s core charitable programmes.

The Board ensures that internal controls for financial matters in key areas are in place with documented procedures

The Board ensures that reviews on the charity’s internal controls, processes, key programmes and events are regularly conducted.

The Board ensures that there is a process to identify, and regularly monitor and review the charity’s key risks.

AHL does not provide any loans, donations, grants or financial assistance

The Board approves an annual budget for the charity’s plans and regularly monitors the charity’s expenditure.

Does the charity invest its reserves (e.g. in fixed deposits)? (skip item 22 if “No”)

The charity has a documented investment policy approved by the Board.

Did the charity receive cash donations (solicited or unsolicited) during the financial year? (skip item 23 if “No”)

All collections received (solicited or unsolicited) are properly accounted for and promptly deposited by the charity.

Did the charity receive donations in kind during the financial year? (skip item 24 if “No”)

All donations in kind received are properly recorded and accounted for by the charity.

"The charity discloses in its annual report —

(a) the number of Board meetings in the financial year; and

(b) the attendance of every governing board member at those meetings."

Are governing board members remunerated for their services to the Board? (skip items 26 and 27 if “No”)

No governing board member is involved in setting his own remuneration.

The charity discloses the exact remuneration and benefits received by each governing board member in its annual report. OR

The charity discloses that no governing board member is remunerated.

Does the charity employ paid staff? (skip items 28, 29 and 30 if “No”)

No staff is involved in setting his own remuneration.

The charity discloses in its annual report —

(a) the total annual remuneration for each of its 3 highest paid staff who each has received remuneration (including remuneration received from the charity’s subsidiaries) exceeding $100,000 during the financial year; and

(b) whether any of the 3 highest paid staff also serves as a governing board member of the charity.

The information relating to the remunerationof the staff must be presented in bands of $100,000.

OR

The charity discloses that none of its paid staff receives more than $100,000 each in annual remuneration."

The charity discloses the number of paid staff who satisfies all of the following criteria:

(a) the staff is a close member of the family3 belonging to the Executive Head4 or a governing board member of the charity;

(b) the staff has received remuneration exceeding $50,000 during the financial year.

The information relating to the remuneration of the staff must be presented in bands of $100,000. OR

The charity discloses that there is no paid staff, being a close member of the family3 belonging to the Executive Head4 or a governing board member of the charity, who has received remuneration exceeding $50,000 during the financial year.

The charity has a documented communication policy on the release of information about the charity and its activities across all media platforms.

9.2 Complied

1 Staff: Paid or unpaid individual who is involved in the day to day operations of the charity, e.g. an Executive Director

2 Volunteer: A person who willingly serves the charity without expectation of any remuneration.

3 Close member of the family: A family member belonging to the Executive Head or a governing board member of a charity —

(a) who may be expected to influence the Executive Head’s or governing board member’s (as the case may be) dealings with the charity; or

(b) who may be influenced by the Executive Head or governing board member (as the case may be) in the family member’s dealings with the charity.

A close member of the family may include the following:

(a) the child or spouse of the Executive Head or governing board member;

(b) the stepchild of the Executive Head or governing board member;

(c) the dependant of the Executive Head or governing board member.

(d) the dependant of the Executive Head’s or governing board member’s spouse.

4 Executive Head: The most senior staff member in charge of the charity’s staff.

The directors present their statement to the members together with the audited financial statements of Arts House Ltd. (the "Company") for the financial year ended 31 March 2022.

In the opinion of the directors,

(i) the financial statements of the Company are drawn up so as to give a true and fair view of the financial position of the Company as at 31 March 2022 and the financial performance, changes in accumulated fund and cash flows of the Company for the financial year ended on that date, and

(ii) at the date of this statement, there are reasonable grounds to believe that the Company will be able to pay its debts as and when they fall due.

The directors of the Company in office at the date of this statement are:

Tan Wee Yan Wilson

Lynette Pang Hsu Lyin

Madeleine Lee Suh Shin

Kwok Siew Loong Kenneth

Ong Han Peng

Phua Hwee Choo

Lim Ying Jie Eugene (Appointed on 1 June 2021)

Sarker Arijit Ranjan (Appointed on 1 June 2021)

Tan Gim Hai Adrian (Appointed on 1 June 2021)

Yasmin Hannah Ramle (Appointed on 1 June 2021)

Zulkifli bin Mohamed Amin (Appointed on 1 October 2021)

Collin Tseng Chern Yang @ Collin Liu Chern Yang (Appointed on 1 July 2022)

As the Company is limited by guarantee, the Board of Directors does not consider it necessary to report on the matters to be disclosed under Schedule 12.8 and 12.9 of the Companies Act 1967.

The Company has a conflict of interest policy. The Company requires that Members of the Board to comply with the policy and fully disclose to the Board immediately when a conflict of interest situation arises.

Ernst & Young LLP have expressed their willingness to accept re-appointment as auditor.

On behalf of the Board of Directors:

Tan Wee Yan Wilson, Director Ong Han Peng Joseph, DirectorSingapore, 16 November 2022

For the financial year ended 31 March 2022

Independent auditor’s report to the members of Arts House Ltd.

Opinion

We have audited the financial statements of Arts House Ltd. (the “Company”), which comprise the balance sheet as at 31 March 2022, the statement of comprehensive income, statement of changes in accumulated funds and cash flow statement of the Company for the financial year then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying financial statements are properly drawn up in accordance with the provisions of the Singapore Companies Act 1967 (the “Act”), the Singapore Charities Act 1994 and other relevant regulations (the “Charities Act and Regulations”) and Financial Reporting Standards in Singapore (“FRSs”) so as to give a true and fair view of the financial position of the Company as at 31 March 2022 and of the financial performance, changes in accumulated funds and cash flows of the Company for the financial year ended on that date.

We conducted our audit in accordance with Singapore Standards on Auditing (“SSAs”). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the Accounting and Corporate Regulatory Authority (“ACRA”) Code of Professional Conduct and Ethics for Public Accountants and Accounting Entities (“ACRA Code”) together with the ethical requirements that are relevant to our audit of the financial statements in Singapore, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the ACRA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Management is responsible for other information. The other information comprises the directors’ statement set out on page 69 but does not include the financial statements and our auditor’s report thereon.

Our opinion on the financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Management is responsible for the preparation of financial statements that give a true and fair view in accordance with the provisions of the Act, the Charities Act and Regulations and FRSs, and for devising and maintaining a system of internal accounting controls sufficient to provide a reasonable assurance that assets are safeguarded against loss from unauthorised use or disposition; and transactions are properly authorised and that they are recorded as necessary to permit the preparation of true and fair financial statements and to maintain accountability of assets.

In preparing the financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

The directors’ responsibilities include overseeing the Company’s financial reporting process.

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with SSAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with SSAs, we exercise professional judgement and maintain professional scepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

• Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease to continue as a going concern.

• Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with the directors regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

In our opinion, the accounting and other records required by the Act to be kept by the Company have been properly kept in accordance with the provisions of the Act, and the Charities Act and Regulations.

During the course of our audit, nothing has come to our attention that causes us to believe that during the financial year:

(a) the use of donation moneys was not in accordance with the objectives of the Company as required under regulation 11 of the Charities (Institutions of a Public Character) Regulations; and

(b) the Company has not complied with the requirements of regulation 15 (Fund-raising expenses) of the Charities (Institutions of a Public Character) Regulations.

The accompanying accounting policies and explanatory notes form an integral part of the financial statements.

The accompanying accounting policies and explanatory notes form an integral part of the financial statements.

For the financial year ended 31 March 2022

At 1 April 2020

Net surplus for the financial year, representing total comprehensive income for the financial year

At 31 March 2021

At 1 April 2021

Net deficit for the financial year, representing total comprehensive income for the financial year

At 31 March 2022

For the financial year ended 31 March 2022

Operating activities

Deficit before grants

Adjustments:

Building rental expenses (Note (i))

Depreciation of fixed assets and right-of-use assets

Allowance for expected credit loss on trade receivables

Write back of allowance for expected credit loss on trade receivables

Interest income

Interest expense

Operating cash flows before changes in working capital

Decrease/(increase) in trade and other receivables

Increase in unbilled receivables

Decrease/(increase) in prepaid operating expenses

Increase/(decrease) in trade and other payables

Decrease in contract liabilities

Cash flows used in operations, representing net cash flows used in operating activities

Investing activities

Purchase of fixed assets and right-of-use assets

Decrease/(increase) in investment in long-term deposits

Interest income received

Net cash flows from/(used in) investing activities

Financing activities

Government grants received

Interest paid on lease liabilities

Payment of principal portion of lease liabilities

Note (i): Building rental expenses for buildings under management by the Company are fully funded by National Arts Council via market rental subvention grants. These expenses are non-cash in nature.

The accompanying accounting policies and explanatory notes form an integral part of the financial statements.

For the financial year ended 31 March 2022

Arts House Ltd. (the “Company”) is incorporated and domiciled in Singapore, limited by guarantee and does not have share capital.

The Company has been registered as a Charity, Registration No. 01658 under the Singapore Charities Act 1994 of Singapore with effect from 24 February 2003. The registered office and principal place of business of the Company is located at 28 Aliwal Street #03-07 Singapore 199918.

The principal activities of the Company are:

• To manage national arts venues, which serve as venues for hire, as well as workspaces for artistic creation and arts housing;

• To produce and present year-round arts programming, including national pinnacle events Singapore International Festival of Arts and Singapore Writers Festival;

• To act as cultural place-maker for the historic Civic District; and

• To deliver national platforms such as the showcase of Cultural Medallion recipients.

The financial statements of the Company have been prepared in accordance with the Financial Reporting Standards in Singapore (“FRS”).

The financial statements have been prepared on the historical cost basis except as disclosed in the accounting policies below.

The financial statements are presented in Singapore Dollars (“$”).

The accounting policies adopted are consistent with those of the previous financial year except that in the current financial year, the Company has adopted all the new and revised standards which are effective for annual financial periods beginning on or after 1 April 2021. The adoption of these standards did not have any material effect on the financial performance or position of the Company.

The Company has not adopted the following standards that have been issued but not yet effective:

Description