Executive Summary

Situational Analysis

Target Markets

Competition

SWOT Analysis

Media Research

Focus Group Analysis

Survey Research

Survey Findings

Social Media Analysis

Observations

Challenge

Big Idea

Execution

Creative Execution

Out

Ice cream lovers have always wanted to experience something unique and delightful when enjoying their ice cream, and this means selecting the best brand that will indulge them and still offer a unique experience that they cannot get from other brands of ice cream.

Aubi & Ramsa ice creams are an experience and not just a simple delight found in a cup of ice cream. Nonetheless, our target market is yearning for a unique experience, and the brand would like to establish it to rank it as the best in the business. This is an ice cream perfect for all adventurous spirits.

To increase Aubi&Ramsa’s awareness as the most sophisticated and luxurious brand while increasing its customers from the already existing target market, rank Aubi & Ramsa as the best ice cream infused with liquor, the most unique, and an essential ingredient for unique experiences.

Aubi & Ramsa is an excellent brand of ice cream. But the present challenge facing Aubi & Ramsa is that the brand does not get the right exposure required to dominate the market because of low brand awareness and recognition. In turn, this limits the number of new customers, given that the prospective market may be finding it challenging to point out the brand’s uniqueness apart from its competitors.

Therefore, Aubi & Ramsa must determine the best way of differentiating itself and stand out in the minds of the prospective consumers.

The research highlighted that people do not choose Aubi & Ramsa to get drunk but approach the brand with curiosity and adventurous spirit. This insight presents the solution to the current problem affecting Aubi & Ramsa. Aubi & Ramsa has an opportunity to expand into different markets as this will significantly increase its brand awareness and recognition using effective marketing tools like social media.

It is imperative to understand the customers’ preferences, thus increasing their ice-cream intake. During the company’s study, most people did not know much about Aubi&Ramsa. Therefore, the company has to market its products through all media platforms, including social media. Aubi & Ramsa can also look to have more products under the brand that are unique and novel compared to that of the competitors as this will intrigue the curious market. There is also a need to have a new approach to promoting the brand and its market by considering the lifestyle approach. In turn, this will allow consumers to build a lifestyle-based relationship with Aubi & Ramsa and integrate the ice creams as part of their regular life.

Aubi & Ramsa is the first ice cream store for adults 21+. Their ice cream and sorbet is infused with premium spirits at 4.9% ABV. The strength of alcoholic ice cream is its potential to break through the limits of the ice cream industry and live in both the liquor and ice cream worlds. In addition, they have been working for many years on developing the perfect ice cream recipe to create the perfect base for a liquor marriage.

Ultra premium ice cream crafted for 21+ adults made with super premium liquors and wine. This product does not include any artificial ingredients, coloring or flavoring. This ice cream is 100% natural, crafted in small batches and proudly made in the Sunshine State. The service is an experience like no other with top of the line packaging.

The companies that are in the same industry as Aubi & Ramsa are Quore Gelato on a local scale since Quore Gelato only has stores in Florida, including Miami, Aventura and Hollywood. Tipsy Scoop, Proof and Hardscoop are in the same industry, but serve as Aubi & Ramsa’s national competitors with stores in Manhattan, Brooklyn, South Carolina and more.

The brand is not uniquely Miami. Although, it was founded and created here in the Sunshine state. Aubi & Ramsa takes Miami to the world, with locations including New York, Tampa, and Las Vegas. In all these locations there are lively young individuals searching for a new unique experience. Acknowledging the brand’s global proposition, Aubi & Ramsa belongs in the most vibrant cities around the world.

26 YEARS OLD, SINGLE

REAL ESTATE AGENT MAKING AROUND 50K A YEAR OR MORE

She is the type of person that loves to find new experiences and look for new and exciting options, even though it might not be cheap. She loves enjoying a drink and has a sweet tooth. She always looks for an excuse to socialize and share a moment with her family and friends. It’s very important for Anna to share what she enjoys and eats on her social platforms such as Instagram and TikTok.

AGED AROUND 35 OR A LITTLE YOUNGER, COUPLE MAKING AROUND 130K A YEAR IN TOTAL

Jake and Jennifer enjoy going out during the weekends and spending money experiencing new things. After a long week of work, they both enjoy a drink and love going out on dates together. They are both heavy social media users, therefore whatever they do they post on their social media platforms such as Instagram. These consumers don’t have to be Miamibased, they could be tourists as well.

Direct competitors to Aubi & Ramsa include Quore, Gelato, Tipsy Scoop, and Van Leeuwen.

Quore Gelato directly competes with Aubi & Ramsa by providing an in-person liquor-infused ice cream experience at its physical locations in Aventura and Hollywood Beach. Quore Gelato offers similar product offerings as Aubi & Ramsa, alcoholic gelatos. And their prices are very similar, with the small size alcoholic ice cream costing $9 and the large size both costing $22.

On the other hand, Tipsy Scoop mainly offers alcoholic ice cream, sorbet varieties, ice cream cake and sandwiches to its customers. Tipsy Scoop directly competes with Aubi & Ramsa by creating liquor-infused ice cream flavors. Tipsy Scoop is sold in liquor stores, restaurants, and grocery stores throughout the United States and in Central America. The Tipsy Scoop brand takes on a more fun and creative brand-style, differing from the luxurious look and feel of Aubi & Ramsa. And the prices are also a bit higher than Aubi & Ramsa’s, at about $13 per unit.

Van Leeuwen competes with Aubi & Ramsa as a premium ice cream company that collaborates with large brands to make flavors together. Van Leeuwen is available for delivery in Miami and New York which compete with Aubi & Ramsa by having a delivery option at $12 per container.

The Aubi & Ramsa brand is fundamentally strengthened by its use of premium ingredients, unique packaging, and the overall in-store experience. Aubi & Ramsa’s diverse line of products also contributes to the brand’s strengths. The Aubi & Ramsa brand is weakened by its niche market appeal, expensive pricing, and its need to expand into retail stores.

Because of Aubi & Ramsa’s unique position within the ice-cream market, the brand has an opportunity to expand into new and undefined markets, diversify its product line, and form strategic partnerships with bars, restaurants, and other venues. Aubi & Ramsa’s reliance on the pricing of premium liquor brands may present a threat to the brand overall. The brand is also threatened by increasing competition in the general ice-cream market, which may lead to decreased market share.

• The A&R bar is an immersive experience and a novel concept that is perfect for creating memories with friends and family.

• The broad range of flavors grants a more tailored experience for seasoned drinkers and encourages repeat business.

• A&R’s use of premium liquor and wines sets a lavish pace that leaves room for competitive pricing in the market.

• A&R’s distinct and elegant packaging separates the brand from other ice cream-based competitors.

• Liquor-infused ice cream is a niche market that can be difficult to define or target.

• Pricing may be discouraging to the brand’s biggest fans.

• A&R suffers from a lack of distribution and is not widely available compared to ice cream-focused competitors.

• A&R can double down on luxury by partnering with renowned restaurants, bars, and retail stores.

• Expanding distribution to online experiences such as newsletters, subscription models, delivery, and/or deals and discounts.

• Focusing in on tourism as a core consumer of A&R by installing poppops around the country.

• Creating seasonal flavoring to enable a wider range of experiences throughout the year.

• Instability in A&R’s pricing model due to the reliance on premium liquor brands.

• Competition from expansion from traditional ice cream brands in retail and emerging liquor-infused ice cream.

• Niche audience; market size may be subject to trends and social norms.

Aubi & Ramsa’s main portal for discovery is its website. Aubi & Ramsa uses social media, predominantly Instagram because the target audience is female-skewed and includes individuals 21+ years old. Instagram helps Aubi & Ramsa reach a specific market where consumers create brand loyalty and buzz. The brand currently uses influencers to further connect with its core audience. Digital advertising is not yet used, but is a powerful and meaningful way to target our audience while being cost effective. Aubi & Ramsa’s strategy should include digital advertising and a TikTok profile moving forward.

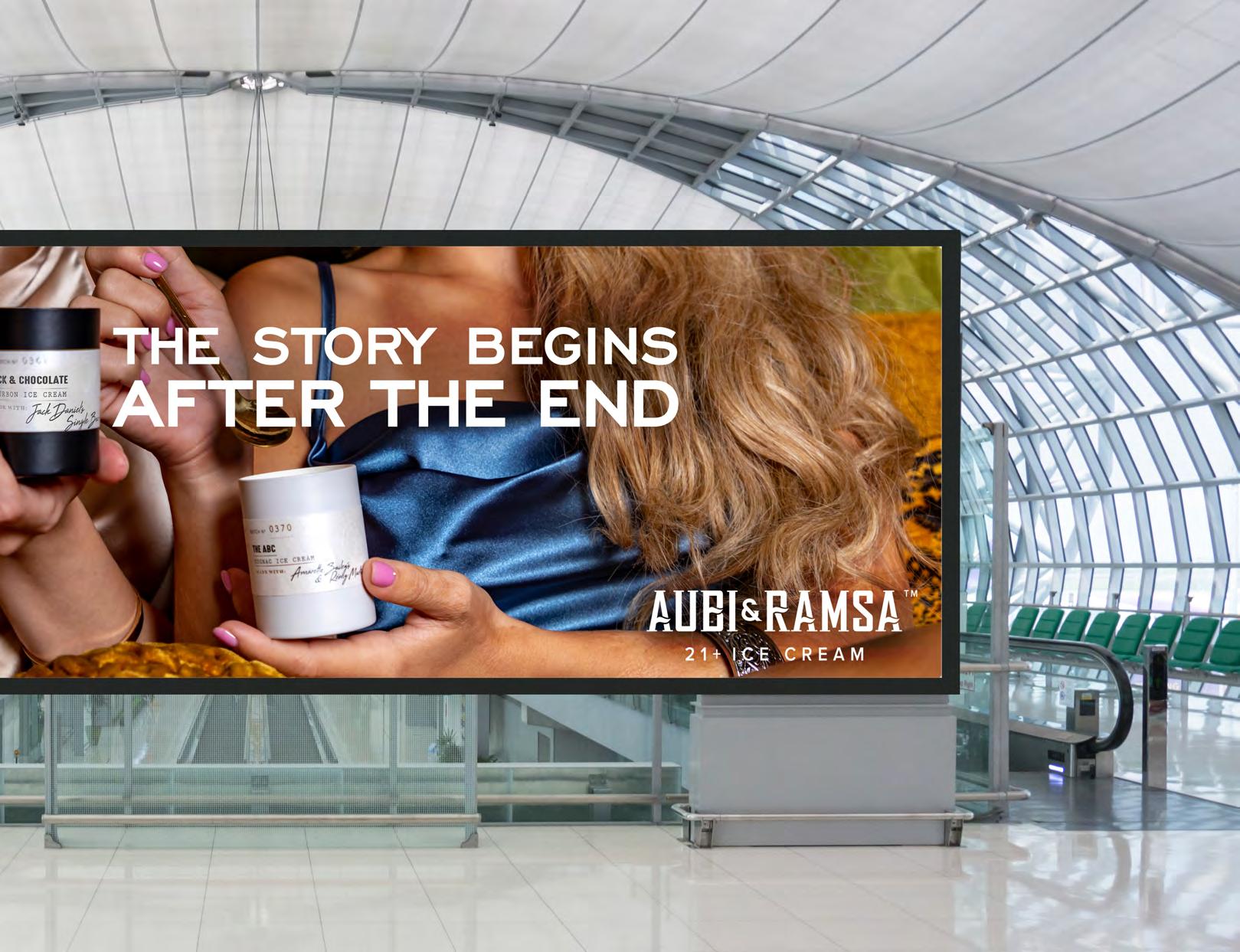

Aubi & Ramsa should increase in-person events like pop-ups because our audience enjoys going out to try new things. Pop-ups are exciting and allow consumers to have a taste of the experience, encouraging visits to the actual stores. Proposed locations include places that are frequented by high income individuals like Brickell, Miami Beach, and Coral Gables, but also airports because tourists are usually willing to pay more. Finally, billboards help reach our target audience as they are often outside. Billboards allow Aubi & Ramsa to showcase creativity through short, impactful messages.

On September 21st and 23rd, two focus groups were conducted where we recruited participants to try Aubi & Ramsa’s alcoholic-infused ice cream and give us feedback.

The focus group had a total of nineteen participants who were chosen from a random selection of people. Participants included students from the University of Miami and Professors, 10 of which were females, and 9 of which were males, ranging from the ages of 21-50 years old.

The purpose of these focus groups was to gather consumer insights and opinions on the ice cream industry and, more specifically, for Aubi & Ramsa.

• Ice cream is seen as a treat that is consumed once a week or month.

• Eating alcohol-infused ice cream is a personal moment they would only share with friends, family, or people they know.

• Aubi & Ramsa is seen as a luxurious ice cream brand that stands out amongst others.

• Participants explained how their upscale packaging makes it look “boujee.”

• Most participants agreed that they would only purchase Aubi & Ramsa at liquor stores, their main stores, or online delivery because of the exclusivity it portrays.

• Participants agreed that the maximum they would pay for a pint of ice cream would be $17, although Aubi & Ramsa’s pint is $22.

• People mentioned that Aubi & Ramsa is social media worthy for the aesthetic and packaging of the brand.

• Participants utilize social media such as TikTok, Instagram, and follow food bloggers through these platforms to try new eating places.

The survey was composed of 33 questions asking a variety of demographic, quantitative and open-ended questions. The overall information of participants’ preference of alcoholic ice cream was acquired.

The survey was distributed to the target participants after a pretest was confirmed. The participants chosen were 21+, more focused on females as Aubi & Ramsa’s target consumers is female-skewed. As of October 1st 2021, there were 345 surveys recorded.

According to Qualtrics, participants ranged from 21 to 78 years old. The female participation rate was 63.10%, consisting of 161 females and the male participation rate was 36.11%, consisting of 95 males. The overall income of the participants fall in the middleupper class income. 42.6% reported back over 100K household income.

1 WHO

We wanted to gain insight about the brand itself, its logo, and its packaging. We also wanted to know if people were willing to try this experience of ice cream infused with alcohol, either as an in-store experience or dessert at a restaurant.

2

A survey was defined and distributed to over 300 21+ plus adults. We wanted to gain a better understanding of who our target audience was. Therefore we asked them questions including demographic questions about age, gender, race, and household income, in addition to qualitative, open questions.

4 3

HABITS

We wanted to gain insight on their ice cream and alcohol consuming habits as well as purchasing habits.

Lastly, we wanted to gain insight on potential preferences in ice cream flavors and preferred liquors.

In our survey, we found that the overall perception of Aubi & Ramsa was positive, even though 71.8% have not heard of the brand before. We believe that it has established itself as a premium alcoholic brand. The brand’s logo was perceived as elegant and closer to that of an alcohol brand, which fits perfectly. The packaging was not associated with ice cream. This shows how Aubi & Ramsa is distinctive from all other ice cream brands out there and deserves either, the liquor aisle or its own category. The bar was seen in synergy with the idea of being elegant.

The idea of having ice cream for participants was tied to a treat or craving. The problem might arise from the frequency of people buying ice cream, but when adding alcohol in the mix, over 50% of our participants were inclined to try. Our results found that 50.8% consume ice cream once a month, while 26.1% eat it once a week or less. People were found to consume alcohol more frequently and combining the two can make people more inclined to purchase. Out of 345 participants, 46.18% said they were unwilling to purchase a pint of ice cream for $20. This comes with the lack of knowing the type of fine alcohol Aubi & Ramsa use. Some participants reported they would buy the product simply for the packaging.

WOULD YOU CONSIDER BUYING A PINT OF YOUR FAVORITE ICE CREAM FLAVOR INFUSED WITH ALCOHOL FOR $20?

Strongly

Disagree

Neither agree nor disagree

Somewhat agree

Somewhat disagree

Strongly agree

HOW MUCH DO YOU SPEND ON ICE CREAM PER WEEK? (INCLUDING ICE CREAM CONES OR PRINTS)

• Participants ranged from 21-78 years old.

• The female participation rate was 63% (161 females) and the male participation rate was 36.11 % (95 males), along with 2 counting as other.

• The participants resulted in mostly middle to upper-income households.

• Can be dependent on overall family income rather than one’s individual income.

• Highest ethnicities recorded were White/Caucasian followed by Hispanic/Latino.

• We found that majority of participants eat ice cream once a month or less.

• Participants are willing to spend more money on alcohol than ice cream.

• Most participants are not familiar with Aubi & Ramsa.

*All of this information was gathered over a 5 week period.

800 FOLLOWER INCREASE

Follower Increase

Increased 800 followers - average increase of 160/200 followers a week

Engagement 0.006% Engagement

Average Likes: 204

Averages Comments: 5

#AubiRamsa has 1.7 mentions

Frequency of Posts

Average Post Per Week: 5

Tone

Sophisticated and social. Classic and modern. Informative and insightful into the ice cream and store locations.

151 FOLLOWER INCREASE 1.0K FOLLOWER INCREASE

Follower Increase

Increased by 1000 - 180/200 new followers a week

Engagement 0.005% Engagement

Average Likes: 620

Averages Comments: 13.2

#TipsyScoop has 11.1k mentions

Frequency of Posts

Average Post Per Week: 7

Tone

Bright and attention grabbing colors mixed with themed ice creams. Very loud and up to date on trends and holidays.

Follower Increase

Increased 151 followers - average increase of 25 followers a week

Engagement 0.006% Engagement

Average Likes: 21

Averages Comments: 2

#QuoreGelato has 100+ mentions

Frequency of Posts

Average Post Per Week: 5

Tone

Informative and fun while incorporating colors and videos to highlight their flavors. Vibrant, young, and trendy.

11 FOLLOWER INCREASE

Follower Increase

Increased by 11 followers

Engagement

0.006% Engagement

Average Likes: 38

Averages Comments: 10

Frequency of Posts

15 videos in total (9 were posted within 35 days)

Tone

Informative and aesthetic content displaying stores and ice cream flavors.

4.4K FOLLOWER INCREASE

Follower Increase

Increased by 4.4 followers

Engagement

0.0075% Engagement

Average Likes: 48

Averages Comments: 7.4

Frequency of Posts

Average Post Per Week: 3.6

Tone

Colorful and fun content showing the process of making their ice cream.

5 FOLLOWER INCREASE

Follower Increase

Increased by 5 followers

Engagement

1.08% Engagement

Average Likes: 21

Averages Comments: 0

Frequency of Posts

Haven’t posted since 2020

Tone

Informational appeal on product packaging and in-store experiences.

We started with our Focus Group findings, including that consumers view ice cream as a treat, and they associated Aubi & Ramsa with “group vibes” or a “movie night set ting at the couch.” We also found a link between Aubi & Ramsa and romantic dates, where many participants mentioned they would go to Aubi & Ramsa on a first date or take their partners there. Another significant observation was that people felt very “boujee” when eating the ice cream, bringing them a lot of excitement with statements like: “I love the vibe the ice cream gives.” More on product insights, we found that consumers are more likely to purchase A&R at a selective liquor store, or a grocery store, at a designated A&R freezer. Participants also mentioned that the brand packaging is social-media worthy and that packaging beats price in this case.

Our survey findings found that A&R’s logo has a fancy and luxurious vibe; therefore, brand consumers see the brand as very elegant, upscale, and sophisticated. It doesn’t fit in the regular ice cream aisle. Since the store is presented as a bar, consumers said it’s a “fun twist on ice cream” for date night or an after-dinner hangout. Both age groups associate Aubi & Ramsa with celebrations and would highly consider ordering alcohol-infused ice cream at a restaurant. However, neither group agreed with buying a $20 pint (although this can change with people knowing it’s fine alcohol). Since consumers look at Aubi & Ramsa as a treat, they look at it as a way to create new memories.

The main observation we gathered from our findings is that people don’t choose Aubi & Ramsa to get drunk. Instead they approach it with curiosity and an adventurous spirit.

IF I’M HAVING A BAD DAY, I’LL TREAT MYSELF TO ICE-CREAM.

The brand has a strong personality and sophistication. This is not a traditional ice-cream, everything is pre-packaged and nothing is in bulk. Rafael describes the brand product by saying, “Our ice cream is the result of years of exploration, refining, and crafting a novelty that has no match.”

• Aubi & Ramsa is perceived as a niche product in the ice cream category. The brand would like to establish a new category for themselves by entering the liquor category.

• The key to achieving the objective is to find a way to differentiate this product in the minds of prospective consumers.

Adults 21-45, primarily women, that earn over $45,000+ per year. This consumer lives in an urban city that loves to find new experiences that aren’t cheap. They also love ice cream, sweets, and enjoying a drink. Attributes include being social, sharing moments with friends/family, and showing off what and where she eats on all social platforms.

• Anna is 23 years old and is a marketing professional who earns around 50K a year. She loves going out and being social, trying new things and showing it off on social media, specifically Instagram and TikTok. Anna is at the stage of her life where she is looking for exciting first-time experiences.

“Everything needs to feel new all the time because I have a desire to reach a “higher” high and I want to feel the rush of it feeling like the first time.”

We believe the insight will work for Aubi & Ramsa because:

• Consumers approach Aubi & Ramsa with curiosity and an adventurous spirit; they want an exciting first-time experience.

• The store experience exemplifies this.

• When consumers tasted the product, they were excited about the brand and were eager to try more flavors and wanted to go with their friends/ or on a date.

For consumers aged 21-45 (primarily female) that have a desire to experience new things and are social, Aubi & Ramsa is an elegant, up-scale liquor-infused ice cream store that offers consumers a unique first-time experience so they can indulge not only in ice cream but in elegance, seduction and sophistication because Aubi & Ramsa is not a place just to enjoy boozy ice cream, it’s also an incredible experience.

Increase brand awareness to attract more customers within their target audience. Highlight how Aubi & Ramsa is unique to stand out from their competitors.

Ensure we effectively reach the primary target audience of adults aged 21+ through relevant media vehicles such as Instagram, TikTok, brand activations channels and more.

Ensure trial and subsequent purchase of products in store and for online delivery among the target audience in selected geographical areas.

Aubi & Ramsa is an alcoholic ice cream brand that faces problems when it comes to positioning. Our goal is to position Aubi & Ramsa, not as a niche product in the ice cream category, but as a part of a new subcategory in the liquor aisle. This new product group should establish Aubi & Ramsa as an innovator and luxury product in the industry. To distinguish itself from others, the brand needs to create new and eye-catching promotional materials.

At A&R we believe there is always a time for firsts. Every experience should be special. Our brand is a pioneer that provides new and unique experiences that are memorable and share-worthy.

Aubi & Ramsa is a delicacy that is appropriate in many settings, social or non-social. Our brand provides a level of sophistication to any event, outing or evening at home while creating a sense of community by:

1. Having high quality ingredients.

2. Creating a lush experience that is easily obtained.

3. Being irresistibly share worthy (between the people experiencing in order to try new flavors and on social media.)

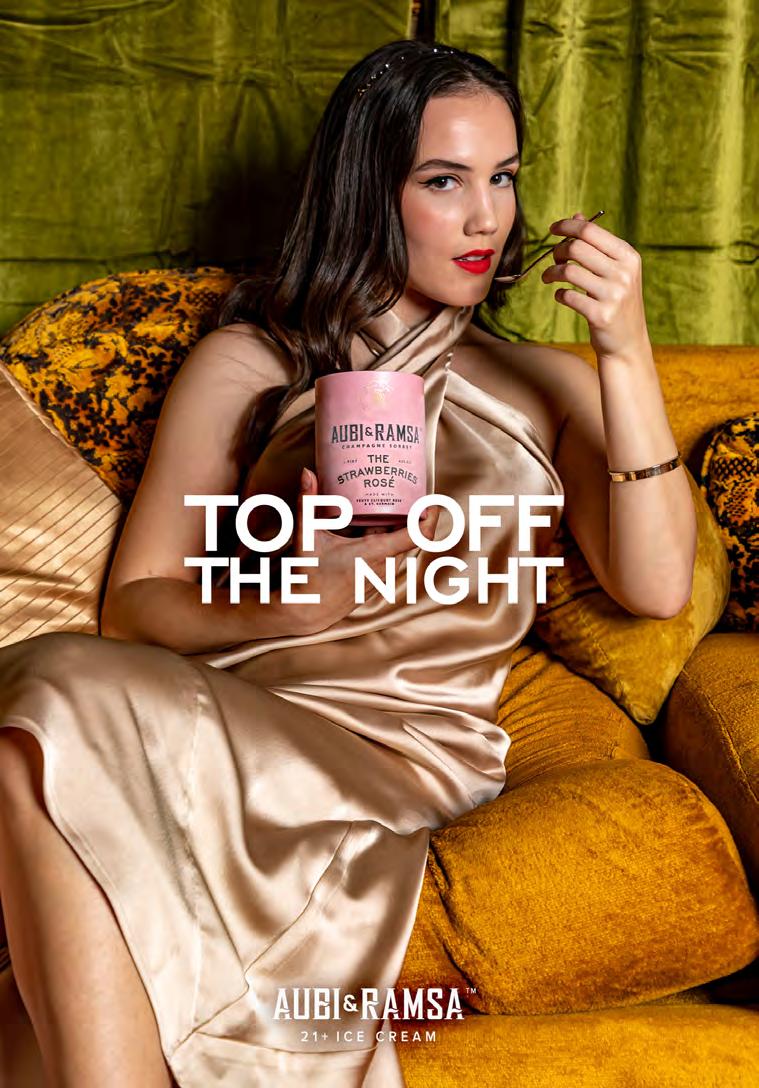

With the big idea in mind, we captured the essence of Aubi & Ramsa through curated. With the use of a vintage glamour-inspired set, and elegant gowns, we wanted to showcase the sophistication of the brand while maintaining the playfulness of Aubi & Ramsa. Multiple different themed sets were used, paired with bright colorful photography to achieve this goal. Through stylized design and photography, brand image and recognition will be established. The images identify the brand being associated with individual or group enjoyment post events.

We focused on producing a highly-stylized campaign with elaborate and opulent home-like settings paired with sophisticated clothing. This ornate style emphasizes the luxury Aubi & Ramsa brings to the table when enjoying a pint, even from the comfort of your home after an eventful night.

The ads feature four taglines:

1. The Story Begins After the End

2. Come Home To Euphoria

3. After Hour Luxury

4. Top Off the Night

These taglines aim to capture the essence of that “euphoric feeling” one gets when tasting that first spoonful of velvety and rich Aubi & Ramsa ice cream after a long night.

An additional element we recommend is to display the out of home ads in detailed, gold frames. A gold frame, such as this one, mixed with the photographic style of the prints, makes some look like Renaissance paintings. The detail of the frame makes Aubi & Ramsa feel like fine art.

Aubi & Ramsa will incorporate these “mobile barlor” carts to increase exposure around cities in a way that is cost-effective and easily transportable to different locations and events.

Aubi & Ramsa would launch an adult scavenger hunt around Miami and New York with clues given on social media. The clues will bring participants to unknown or “hidden” spots that people may not know about. Participants will have a chance to taste the delicious Aubi & Ramsa ice cream as well as win prizes for the top winners.

Aubi & Ramsa would create secret pop-ups or “speakeasys” in cool, hidden, bohemian hot spots in different cities in which it is not yet located. Some possible locations could be the Museum of Ice Cream or bookstores/coffee shops such as Books & Books in Miami or Housing Works in NYC. This promotional activation would emphasize Aubi & Ramsa’s “hidden gem” persona.

Love by Design is a virtual reality short film taking place in Miami’s Design District. The story follows a group that is celebrating their friends birthday while also trying to kindle a love between two people in the party. As they go through the Design District, the user gets to enjoy the scenic views as they get invested in the story, with the bonus of displaying Aubi & Ramsa. With the new developments with the Metaverse and in virtual reality, Aubi & Ramsa has the opportunity to be a innovator in this new space. The VR Short will be displayed in-store and travel to any local festival/events to promote Aubi & Ramsa.