INDUSTRY NEWS Arkansas Universities Take Part in CSBS Community Bank Case Study

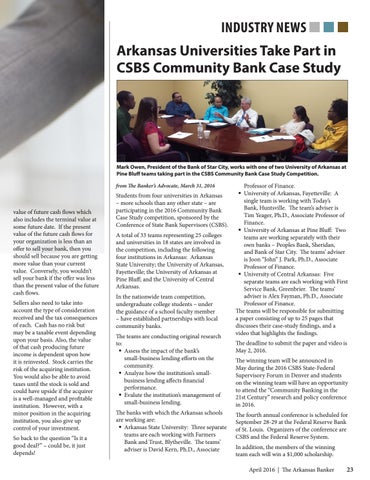

Mark Owen, President of the Bank of Star City, works with one of two University of Arkansas at Pine Bluff teams taking part in the CSBS Community Bank Case Study Competition. from The Banker’s Advocate, March 31, 2016

value of future cash flows which also includes the terminal value at some future date. If the present value of the future cash flows for your organization is less than an offer to sell your bank, then you should sell because you are getting more value than your current value. Conversely, you wouldn’t sell your bank if the offer was less than the present value of the future cash flows. Sellers also need to take into account the type of consideration received and the tax consequences of each. Cash has no risk but may be a taxable event depending upon your basis. Also, the value of that cash producing future income is dependent upon how it is reinvested. Stock carries the risk of the acquiring institution. You would also be able to avoid taxes until the stock is sold and could have upside if the acquirer is a well-managed and profitable institution. However, with a minor position in the acquiring institution, you also give up control of your investment. So back to the question “Is it a good deal?” – could be, it just depends!

Students from four universities in Arkansas – more schools than any other state – are participating in the 2016 Community Bank Case Study competition, sponsored by the Conference of State Bank Supervisors (CSBS). A total of 33 teams representing 25 colleges and universities in 18 states are involved in the competition, including the following four institutions in Arkansas: Arkansas State University; the University of Arkansas, Fayetteville; the University of Arkansas at Pine Bluff; and the University of Central Arkansas. In the nationwide team competition, undergraduate college students – under the guidance of a school faculty member – have established partnerships with local community banks. The teams are conducting original research to: Assess the impact of the bank’s small-business lending efforts on the community. Analyze how the institution’s smallbusiness lending affects financial performance. Evalute the institution’s management of small-business lending. The banks with which the Arkansas schools are working are: Arkansas State University: Three separate teams are each working with Farmers Bank and Trust, Blytheville. The teams’ adviser is David Kern, Ph.D., Associate

Professor of Finance. University of Arkansas, Fayetteville: A single team is working with Today’s Bank, Huntsville. The team’s adviser is Tim Yeager, Ph.D., Associate Professor of Finance. University of Arkansas at Pine Bluff: Two teams are working separately with their own banks – Peoples Bank, Sheridan, and Bank of Star City. The teams’ adviser is Joon “John” J. Park, Ph.D., Associate Professor of Finance. University of Central Arkansas: Five separate teams are each working with First Service Bank, Greenbrier. The teams’ adviser is Alex Fayman, Ph.D., Associate Professor of Finance. The teams will be responsible for submitting a paper consisting of up to 25 pages that discusses their case-study findings, and a video that highlights the findings. The deadline to submit the paper and video is May 2, 2016. The winning team will be announced in May during the 2016 CSBS State-Federal Supervisory Forum in Denver and students on the winning team will have an opportunity to attend the “Community Banking in the 21st Century” research and policy conference in 2016. The fourth annual conference is scheduled for September 28-29 at the Federal Reserve Bank of St. Louis. Organizers of the conference are CSBS and the Federal Reserve System. In addition, the members of the winning team each will win a $1,000 scholarship. April 2016 | The Arkansas Banker

23