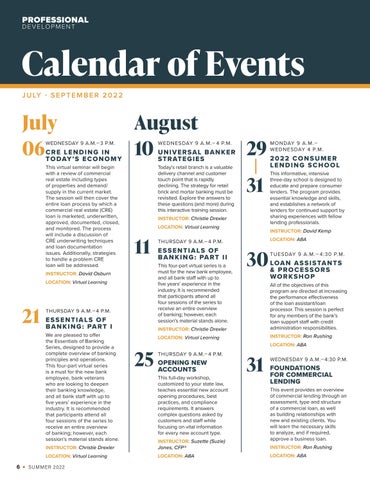

PROFESSIONAL D E V E LO P M E N T

Calendar of Events J U LY - S E P T E M B E R 2 0 2 2

July 06

WEDNESDAY 9 A.M.– 3 P.M.

CRE LENDING IN T O DAY ’ S E C O N O M Y This virtual seminar will begin with a review of commercial real estate including types of properties and demand/ supply in the current market. The session will then cover the entire loan process by which a commercial real estate (CRE) loan is marketed, underwritten, approved, documented, closed, and monitored. The process will include a discussion of CRE underwriting techniques and loan documentation issues. Additionally, strategies to handle a problem CRE loan will be addressed.

August 10

W E D N E S DAY 9 A.M. – 4 P.M.

UNIVERSAL BANKER S T R AT E G I E S Today’s retail branch is a valuable delivery channel and customer touch point that is rapidly declining. The strategy for retail brick and mortar banking must be revisited. Explore the answers to these questions (and more) during this interactive training session. LOCATION: Virtual Learning

11

THURSDAY 9 A.M.– 4 P.M.

ESSENTIALS OF B A N K I N G : PA R T I

INSTRUCTOR: Christie Drexler LOCATION: Virtual Learning

6

•

SUMMER 2022

ESSENTIALS OF B A N K I N G : PA R T I I

This informative, intensive three-day school is designed to educate and prepare consumer lenders. The program provides essential knowledge and skills, and establishes a network of lenders for continued support by sharing experiences with fellow lending professionals. LOCATION: ABA

30

TU E S DAY 9 A. M.– 4:3 0 P.M .

L OA N A S S I S TA N T S & PROCESSORS WORKSHOP

All of the objectives of this program are directed at increasing the performance effectiveness of the loan assistant/loan processor. This session is perfect for any members of the bank’s loan support staff with credit administration responsibilities.

INSTRUCTOR: Christie Drexler

INSTRUCTOR: Ron Rushing

LOCATION: Virtual Learning

25

2022 CONSUMER LENDING SCHOOL

INSTRUCTOR: David Kemp

THURSDAY 9 A.M.– 4 P.M.

This four-part virtual series is a must for the new bank employee, and all bank staff with up to five years’ experience in the industry. It is recommended that participants attend all four sessions of the series to receive an entire overview of banking; however, each session’s material stands alone.

LOCATION: Virtual Learning

We are pleased to offer the Essentials of Banking Series, designed to provide a complete overview of banking principles and operations. This four-part virtual series is a must for the new bank employee, bank veterans who are looking to deepen their banking knowledge, and all bank staff with up to five years’ experience in the industry. It is recommended that participants attend all four sessions of the series to receive an entire overview of banking; however, each session’s material stands alone.

31

INSTRUCTOR: Christie Drexler

INSTRUCTOR: David Osburn

21

29

MO N DAY 9 A. M.– W E D N E S DAY 4 P.M .

LOCATION: ABA

THURSDAY 9 A.M.– 4 P.M.

OPENING NEW ACCOUNTS

This full-day workshop, customized to your state law, teaches essential new account opening procedures, best practices, and compliance requirements. It answers complex questions asked by customers and staff while focusing on vital information for every new account type. INSTRUCTOR: Suzette (Suzie)

31

WEDNESDAY 9 A.M.– 4:30 P.M.

FOUNDATIONS FOR COMMERCIAL LENDING

This event provides an overview of commercial lending through an assessment, type and structure of a commercial loan, as well as building relationships with new and existing clients. You will learn the necessary skills to analyze, and if required, approve a business loan.

Jones, CFP®

INSTRUCTOR: Ron Rushing

LOCATION: ABA

LOCATION: ABA