In the age of online shopping, retail brand decision-makers must strike a balance between their immediate space requirements and long-term sustainability.

Reducing emissions, developing sustainable solutions, and leveraging renewable energy are among the steps that manufacturers can take to change the trajectory of climate change.

Today’s employees want to maintain their quality of life, including hybrid work, well-being support, and competitive pay; employers need to creatively meet their needs in order to keep them from jumping ship.

Manufacturers should prioritize accuracy in their load schedule, as there’s a downside to both underestimating and overestimating load requirements.

As company needs have evolved, many are gravitating to smaller urban areas that often provide them with a lower tax burden, affordable real estate, and development-ready sites.

28

The states considered the best locations for doing business according to an expert panel of location consultants are the highest performers in more than a dozen categories upon which companies make their site selection decisions.

Through its investment in infrastructure development, sitereadiness initiatives, transformation of its power sector, and workfocused immigration policies, FDI in Canada continues to grow at a healthy pace.

Through their ESG-oriented policies, Canada’s federal and provincial governments are working to position themselves as an attractive investment destination for businesses seeking sustainable long-term growth.

4 Editor’s Note Workforce Stats Paint a More Optimistic Picture, Although Challenges Remain

6 In Focus

Picking the Right Joint Venture Partners

8 Frontline Green Energy Companies Building a Qualified Workforce

10 Frontline Satisfying the Semiconductor Industry’s Workforce Needs

12 First Person Tom Schneberger, CEO, USA Rare Earth

72 Ad Index

“The world is reaching the tipping point beyond which climate change may become irreversible. If this happens, we risk denying present and future generations the right to a healthy and sustainable planet.”Kofi Annan (1938–2018)

Despite high inflation, U.S. labor force growth has been better than expected — with the workforce adding 187,000 jobs and unemployment decreasing to 3.5 percent in July 2023, according to the Bureau of Labor Statistics.1 Manufacturing construction also continues to surge. Since the beginning of 2022, construction spending on new factories has more than doubled, from an annualized rate of $91 billion in January 2022 to $189 billion in April 2023 — the biggest increase since data going back to 2002!2

So, while the Fed is still worrying about rising prices throwing the economy into a downturn, the positive statistics cited above paint a different picture. Companies are still expanding, and individuals are still employed and spending, with much of that spending still online post-pandemic, with the U.S. topping $1 trillion in e-commerce sales3 for the first time last year. This does, however, present a challenge for the businesses engaged in e-commerce as they compete for prime real estate on which to place distribution facilities, especially those covering the last mile. According to Matt Powers of JLL, in order to stay competitive, industry leaders must think ahead of challenges in space constraints, supply chain management, and more.

With low unemployment, industry leaders must also “think outside the box” when trying to satisfy their workforce needs. JLL’s Dianne Jones points to the shift in how people work brought about by the pandemic, encompassing employees’ desire for flexibility and a better work/life balance. Office workers want to keep their hybrid schedules that allowed for working at home at least some of the time. But even industrial workers who must be on site are demanding more flexible schedules or shifts. All companies should also have clear metrics in place for advancement, says Jones.

Thinking outside the box often involves finding workers whose skills can be transferrable to those a company requires if provided with the correct training. It’s for this reason — outstanding workforce development programs — among other factors, such as available real estate, cooperative state and local governments, and speed of permitting that growing firms continue to locate in the Southeast region of the U.S. Our 14th annual Top States for Doing Business survey of location consultants confirms this fact. Read more about the factors that landed the states on top in this issue.

Editor

1 https://www.bls.gov/news.release/pdf/empsit.pdf

2 https://finance.yahoo.com/news/a-factory-boom-is-finally-happening-190048801.html

3 https://www.digitalcommerce360.com/article/us-ecommerce-sales/

AREA DEVELOPMENT

Publisher Dennis J. Shea dshea@areadevelopment.com

Sydney Russell, Publisher 1965-1986

Business/Finance Assistant Barbara Olsen (ext. 225) olsen@areadevelopment.com finance@areadevelopment.com

Advertising/National Accounts advertising@areadevelopment.com

Editor Geraldine Gambale editor@areadevelopment.com

Staff and Contributing Editors

Lisa Bastian Mark Crawford

Dan Emerson

Steve Kaelble Mark Schantz Karen Thuermer

In-House Art & Design Circulation/Subscriptions circ@areadevelopment.com

Production Manager Jessica Whitebook jessica@areadevelopment.com

Business Development Manager Matthew Shea (ext. 231) mshea@areadevelopment.com

Digital Media Manager Justin Shea (ext. 220) jshea@areadevelopment.com

Web Designer

Carmela Emerson

Josh Bays Senior Partner site selection group

Marc Beauchamp Managing Director hickey canada

Brian Corde Managing Partner

atlas insight

Kate Crowley Principal baker tilly capital

Dennis Cuneo Director Site Selection Services

walbridge

Courtney Dunbar Site Selection & Economic Development Leader burns & mcdonnell

Brian Gallagher Vice President Corporate Development

graycor

Amy Gerber Executive Managing Director Business Incentives Practice

cushman & wakefield

Stephen Gray President & CEO

gray

David Hickey Managing Director hickey & associates

Scott Kupperman Founder kupperman location solutions

Bradley Migdal

Executive Managing Director Business Incentives Practice

cushman & wakefield

Matthew R. Powers Managing Director Brokerage jll

Alan Reeves Senior Managing Director Global Strategy Consulting newmark

Chris Schwinden Senior Vice President site selection group

Alexandra Segers General Manager tochi advisors llc

Eric Stavriotis Vice Chairman cbre

Steven Tozier US-East Region Credit & Incentives Leader ey

Halcyon Business Publications, Inc.

President Dennis J. Shea

Correspondence to: Area Development Magazine 30 Jericho Executive Plaza Suite 400 W Jericho, NY 11753 Phone: 516.338.0900

Toll Free: 800.735.2732

Fax: 516.338.0100

Chris Volney Senior Director Americas Consulting/Labor Analytics cbre

Dan White Director Government Consulting & Fiscal Policy Research moody’s analytics

Scott J. Ziance Partner vorys

in tennessee, you don’t have to look far for perfectly prepared sites. each site that bears our name is backed by the most rigorous set of site selection standards. when you consider your next project, look no further than tennessee.

survey of construction business owners, nearly 10 percent of respondents reported interest in pursuing joint ventures, while 39 percent of respondents listed “seek new markets” among their top priorities.1

to determine whether these are run-of-the-mill matters, simple misunderstandings, or may constitute something more sinister.

BY JOSEPH NATARELLI, National Construction Leader, MARCUM LLP

Thanks to government supported efforts to bring certain manufacturing capabilities to the U.S., construction firms specializing in industrial projects are in for a busy few years. That’s particularly true of firms with experience building data centers, microchip and computer component production facilities, and all kinds of clean energy infrastructure.

The only thing standing between businesses with relevant expertise and exponential growth may be

access to sufficient labor resources. In the wake of the pandemic, residential construction interests adopted a novel solution to overcome this same challenge — the joint venture. Here are three tips to keep in mind concerning joint ventures.

While backlogs remain strong in the short term, the longterm outlook for the residen-

With that in mind, industrial firms should recognize that they can add a lot of value as partners to contractors entering the industrial market. Those courted by commercial and residential contractors seeking partnerships should know their worth and keep in mind that they are in high demand as partners. With experience managing complex industrial projects, they’ll have a big advantage winning the major projects

Understand that you may be held responsible for any illicit activity associated with your joint venture, even if you aren’t aware of it. That’s why it’s extremely important to establish the bonafides of any partner before entering an agreement. Don’t sign with anyone until you’re satisfied the prospective partner has no history of participating in collusive bidding, material overcharging or substitution, questionable labor practices, ineffective supervision, or illegal payments.

tial and commercial sectors suggests their work may be drying up. In Marcum’s 2023

going out for bid over the next few years.

It goes without saying, but make sure you sufficiently vet anyone approaching you proposing a joint venture.

A legal database like Westlaw is a great source on any organization’s history in court. The Better Business Bureau and reviews on search sites like Yelp or Google can be equally revealing. Search databases by business name, owner/operator, and key officials to uncover complaints and cases involving the organization and key employees. Maintain an open dialogue

Entering a joint venture doesn’t change the day-today work but does require a lot of up-front preparation. Start the process by establishing a stand-alone entity created for a particular project. Get legal help forming the entity and formalizing the agreement. Having specialized help early could save you time and headaches down the road.

Industrial developers and construction firms stand to leverage their experience to engage partners and greatly expand their project capacity — but only if they’re sharp and prepared for the road ahead.

1 http://info.marcumllp. com/2023-marcum-nationalconstruction-survey?utm_ campaign=Construction%20 Survey&utm_ source=construction%20business%20 owner&utm_medium=article&utm_ content=construction_survey_2023

The only thing standing between businesses with relevant expertise and exponential growth may be access to sufficient labor resources.

Some of the best educated, most productive workers in the country live here. They send their children to America’s best public schools. And they’re a perfect fit for complex engineering challenges, like the space suits made for NASA at Collins Aerospace. Tomorrow is here in Connecticut. advancect.org

noted that “mutual interest” motivated the union and Ingeteam to work together on this effort. “It’s coming together quite well, and the plan is expanding” he told Area Development. They hope to train the first group of 15 applicants by the end of this year, and the state of Wisconsin is working on providing tuition grants to each trainee.

Standardized training will be provided by Milwaukee Area Technical College. With increased federal funding for green energy projects, Bruening says he hopes the program will eventually serve several dozen trainees. “We’ve been working on this for a couple years, and federal tax credits for turbine generators are creating more orders.”

In 2022, Danish-based offshore wind developer Ørsted signed a historic Project Labor Agreement (PLA) with North America’s Building Trades Unions (NABTU), the labor organization representing more than three million skilled craft professionals. The partnership is designed to transition U.S. union construction workers into the offshore wind industry in collaboration with the leadership of the U.S. NABTU affiliates and the AFL-CIO.

“The signing of this unprecedented agreement is historic for America’s workers and our energy future,” said Sean McGarvey, president of NABTU.2

BY DAN EMERSONHistorically, the working relationships between labor unions and employers have often been contentious and difficult. But some new partnerships between “green” energy companies and U.S. labor unions seem to be taking a more compatible approach.

In Milwaukee, Ingeteam, a Spanish-based manufacturer, which has been making wind turbine generators in the U.S. since 2010, announced a partnership with IBEW Local 2150, which represents 5,100 members in building transmission, utilities, and manufacturing.

Ingeteam’s Milwaukee plant is the only one in the U.S. that builds and repairs

wind turbine generators, according to the company. Last

October, Ingeteam asked the Local’s help in recruiting and training more workers, due to increased investment and deployment of turbines and greatly increased demand for repair services. The union worked with Ingeteam to start new apprenticeship programs focused on repair and assembly work.

Mike Bruening, the Local’s assistant business manager, says the plan is to create two, two-year apprenticeship programs, one for generator assembly technicians and one for repair technicians. He

In an interview with the U.S. Labor Department,1 Garan Chivinski, Ingeteam’s human resources manager, said “a new generation” of HR professionals is taking a different approach in dealing with labor unions. He said the company wants to serve as a model for other employers who want to be involved in the clean energy transition “in a way

puts workers

To anyone who is engaging with unions, especially for the first time, my biggest advice is to approach your conversations with an open heart and an open mind,” Chivinski said. “You might find a good partner who shares many of your goals.”

Ørsted said it has already committed $23 million for improved and new programming to train American workers for jobs in offshore wind. Ørsted operates America’s first offshore wind farm, Block Island Wind Farm in Rhode Island, and has the largest U.S. offshore wind energy portfolio. With its joint venture arrangements, Ørsted has six offshore wind projects in development on the Atlantic Coast, which will generate about 5GW, enough to power more than two million homes.3

1 https://blog.dol.gov/2023/04/26/ how-ingeteam-and-ibew-areadvancing-the-clean-energytransition-together

2 https://www.nycclc.org/news/202205/nabtu-orsted-sign-historicproject-labor-agreement-usoffshore-wind

3 https://www.oedigital.com/ news/496331-u-s-union-workers-tobuild-rsted-s-u-s-offshore-wind-farms

“A new generation” of HR professionals is taking a different approach in dealing with labor unions.Labor unions and the offshore wind energy industry are working together to advance the transition to clean energy.

A whole new business perspective.

# 1

Tech Workforce Growth

Technology Councils of North America

# 1

Most Diverse (East Coast)

U.S. Census Diversity Index

Maryland. See what’s here. And why it’s time to add it to the shortlist.

A highly-educated workforce. Ground-breaking innovation hubs in life sciences, cybersecurity and aerospace. And, a quality of life that makes employees feel right at home. See why businesses are starting up or relocating here, here!

Business.Maryland.gov/here

BY DAN EMERSON

BY DAN EMERSON

In July, chipmaker Taiwan Semiconductor (TSMC) announced it was postponing the start of production at its new factory in Arizona. The firm says chip manufacturing will no longer start next year, due to a shortage of skilled workers.

The announcement came at a crucial time for the U.S. semiconductor industry. In August 2022, President Biden signed into law the CHIPS and Science Act, which will provide about $280 billion in new funding over the next decade to help grow domestic research and manufacturing of semiconductors.

A number of chipmakers have responded by announcing plans to build new plants. Along with the Arizona plant, those include Samsung’s plans for a $17 billion facility near Austin, Texas, and Intel’s groundbreaking for the first of two large fabrication plants worth $20 billion in Ohio. Intel is one of the few companies producing all of its silicon chips in the U.S.

Right now, the industry’s biggest problem may be finding enough skilled engineers and technicians to staff those plants. As U.S. manufacturers’ share of the world’s computer chips has dropped to just 12 percent, educational programs have followed a similar direction. But efforts to power

up the labor supply have been ramping up, nationally. Universities and colleges have been updating their semiconductor-related curricula and forming partnerships with industry and other educators to remedy the shortfall.

There were around 20,000 job openings in the semiconductor industry at the end of 2022, according to Peter Bermel, an electrical and computer engineering professor at Purdue University. “The workforce needs of the semiconductor industry are going to evolve quite

in their products. He notes that the rapidly developing artificial intelligence sector “will heavily impact the semiconductor labor market, and drive labor toward less absolute number of workers, but better-educated workers who understand the big picture and understand all of the different parts” of manufacturing processes.

Bermel is director of the Scalable Asymmetric Lifecycle Engagement Microelectronics Workforce Development program (SCALE), a $19.2 million multi-university public/private/academic partnership intended to foster work force development across engineering universi-

and the University of Central Florida.

“We’re working on reviewing curriculum,” to make sure it is current and relevant to developing scientific knowledge, she says. “We hire a lot of graduates from the U of M material science and chemical engineering program, and we partner locally with technical schools. There is a great need for technical talent within equipment and facilities maintenance,” she adds.

According to Johnson, SkyWater, founded in 2017, continues to see rapid growth in its custom chip manufacturing business and is approaching 800 employees in the Minneapolis area, and another 60 at its Florida location. It currently has about 85 unfilled positions, from entry-level to leadership levels.

quickly, with the industry just beginning to be aware of the future needs, and developing students,” Bermel says. “Universities have to be part of the solution; a lot of workers need specialized (industry) knowledge. Even trade schools and community colleges need support and guidance from research universities, which is why we’re working with them on workforce development.”

Bermel says there is a developing cluster near Purdue of companies involved in the semiconductor industry and those that use them

ties in the U.S. It includes a partnership of 19 universities, 17 government agencies, and 31 industrial defensebased companies to ensure that workforce needs are being met.

One of the companies partnering with Purdue is Minneapolis-based SkyWater Technology. Sara Johnson, director of talent acquisition for SkyWater, says the company also has training partnerships with several other universities and technical schools, including the University of Minnesota College of Science and Engineering

“The fact is that, in order for the industry to thrive, we are going to need about 250,000 new employees in the next five years, including about 50,000 engineers,” Johnson says.

Meeting that need will require a “holistic” approach, she says, and create programs focused on K–12, all the way up to university and post-graduate individuals.

SkyWater offers “immersive” learning experience to high school and collegelevel interns. It also partners with organizations that help veterans make the transition out of the military.

There were around 20,000 job openings in the semiconductor industry at the end of 2022.As the semiconductor industry announces plans to grow domestic production, it is facing a workforce shortage.

Establishing a domestic supply of rare earth elements in the United States or among our allies is therefore crucial for ensuring the security and resilience of our economy and national defense. We can mitigate the risks of supply chain disruptions, price volatility, and unfair trade practices by reducing our dependence on China.

This past April, The Rare Earth Magnet Manufacturing Production Tax Credit Act was reintroduced as a bipartisan bill to Congress. If the Act becomes law, how would its tax incentives support U.S.based magnet and metal production?

SCHNEBERGER, CEO, USA RARE EARTH

What are rare earth permanent magnets? How are they made?

Schneberger: Rare earth magnets are strong magnets that maintain their magnetic properties indefinitely. These magnets are typically used to turn electricity into motion. They are manufactured from a few naturally occurring rare earth elements that are readily found, but difficult to manufacture cost effectively.

What are some important products manufactured with these magnets? What industries do they represent?

Schneberger: Rare earth magnets are critical to make electric vehicle motors, wind turbines, and the many small motors used in robotics and electronics. The unique magnetic properties of rare earth magnets also are vital to other applications such as military guidance systems and medical devices. One way or another, this type of magnet is a part of our day-to-day lives while the military depends on them to protect our way of life.

I understand most of these magnets are not made domestically. How does that impact our nation’s economy or national security interests?

Schneberger: Currently, over 90 percent of rare earth magnets are produced in China, and nearly all of the balance is produced in Japan. This massive concentration of manufacturing in one country leaves us vulnerable to geopolitical tensions and creates excessive supply chain disruption risk.

Schneberger: This Act1 is a step in the right direction for our industry by creating a domestic supply of these elements. It would create a production tax credit for rare earth magnets manufactured in the United States; presently, no domestic manufacturer of such magnets exists. These magnets are critical for clean energy projects and used in a wide variety of applications necessary for our modern economy. This effort by the federal government will help domestic companies compete with the existing production in China, which is operating at a larger scale and receiving support from the Chinese government in many forms.

How is USA Rare Earth (USARE) helping jumpstart domestic rare earth magnet manufacturing?

Schneberger: Although we’re not the only American company operating in this industry, we’re definitely one of its key players. USARE’s mission is to create a fully integrated, U.S.based “mine-to-magnet” critical mineral supply chain with no dependence on China. Our operations are in Oklahoma (rare earth magnet production starts next year), and Texas (rare earth oxide production begins in a couple of years). Both states will benefit from high-paying jobs and collaboration to innovate new products associated with those operations.

What is the estimated economic impact of a robust U.S.-based supply chain of such magnets? Will this be a growth sector?

Schneberger: The transition to electric vehicles, keeping Western companies competitive via the use of computing and robotics, using the personal devices we’ve become reliant on, and our national security are all dependent on developing a more

TOMdiversified supply chain. Even if all announced magnet production to date is brought online, we estimate that demand outside of China will still exceed supply outside of China by more than 40 percent by 2030. For this reason, it is of the utmost importance that we all work together to increase our supply capability in Western regions.

I believe America was the world’s leading producer of rare earth elements until the 1980s, when stricter environmental laws negatively affected this U.S. mining industry. What safeguards are in place today to protect our citizens’ health and environment when magnet production is restarted here?

Schneberger: The production of rare earths can be done in an environmentally friendly manner. Our process utilizes continuous ion exchange technology instead of the traditional solvent extraction process. This allows for a significant improvement in the environmental profile of our operation.

Schneberger: We appreciate the interest and look forward to opportunities to provide more information to your readers. We are going through a fundamental transition of how we store and use energy. This transition will create significant opportunity and change both in the U.S. and worldwide. Ensuring reliable supply chains for the critical materials we need, such as rare earth magnets, is fundamental to the United States’ maintaining a healthy economy for future generations.

Rare earth magnets are critical to keeping America’s economy strong and protecting our way of life. With this in mind, Area Development’s staff editor Lisa Bastian asked Tom Schneberger, CEO of USA Rare Earth, to share his perspective on this issue.

1 https://swalwell.house.gov/media-center/press-releases/swalwelland-reschenthaler-introduce-bill-incentivize-american-made

Reducing emissions, developing sustainable solutions, and leveraging renewable energy are among the steps that manufacturers can take to change the trajectory of climate change.

By Jennifer Dodson, Director, Global Customer Sustainability, PPG

By Jennifer Dodson, Director, Global Customer Sustainability, PPG

In an era defined by extreme weather conditions that are causing unprecedented environmental challenges, it is important for manufacturing companies to recognize their responsibility to mitigate the broader impacts of climate change. As the world grapples with the consequences of rising temperatures, extreme weather events, and ecological degradation, businesses must rise to the occasion and prioritize sustainability as a strategic business imperative. By committing to science-based emissions reduction targets, working collaboratively across the value chain, and taking a proactive role in mitigating climate impacts through sustainable products and processes, we can create a brighter tomorrow for current and future generations.

Business leaders must take immediate action to slow the trajectory of climate change. Committing to science-based emissions reduction targets is a pivotal step in this journey. Such targets ensure that companies align their actions with established climate science data to define and transparently report against their decarbonization strategy.

By integrating these targets into their business strategies, companies can encourage the development and use of low-carbon technologies and foster accountability across the value chain. These types of public commitments send a clear message that companies are determined to take clear, measurable action.

By improving the durability of assets, the coatings industry plays an important role in extending product lifecycles, while preserving resources for generations to come. Coatings manufacturers must leverage this as a strategic advantage and prioritize the continued development of industryleading sustainable solutions to meet the needs of customers in the building industry.

First and foremost, it’s important for manufacturers to leverage recycled content, biogenic or chemical recycled content. By placing emphasis on circularity and reusing and recycling, we can significantly reduce environmental impacts, and offer sustainably advantaged solutions to customers, ultimately supporting their sustainability efforts.

Secondly, building developers are often required to meet green building standards — and paints and coatings can play a vital part in supporting this goal. Coatings are used extensively in the building and construction market for protective and decorative purposes on the building itself and as part of components or machinery installed in the building.

It is pivotal to take a multi-faceted approach to sustainability and product stewardship. At PPG, we developed a comprehensive and multi-variable methodology, which was informed by the World Business Council for Sustainable Development (WBCSD) and further tailored to meet our specific value chain demands. The assessment methodology includes the introduction of

Kentucky has set a new, higher standard. With our certified Build-Ready sites, we have drastically shortened the time needed to plan and begin construction. With a Build-Ready site, a company is guaranteed that:

•A building pad is ready

•Zoning is in place

•Environmental issues have been resolved

•Infrastructure plans are set

•Construction costs and timetables have been estimated

•Funding plans have been developed, with sale and lease options

•Building renderings are available

https://cedky.com/r/gold_shovel @cedkygov

the United Nations Sustainable Development Goals (UNSDGs) and industry best practices, to designate which of our product lines are sustainably advantaged.

Equally as important, building material manufacturers must leverage data to produce declarations that support the requirements of green building schemes. These include the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED®) certification, and the WELL BUILDING STANDARD® certification.

In addition, life cycle assessments enable the development of environmental product declarations (EPDs), which declare the environmental impact of the product over its life cycle. To support LEED material reporting, it is important for manufacturers to gener-

ate health product declarations (HPDs), which outline the substances present and indicate the results of screening these substances against the HPD priority hazard lists and the GREENSCREEN FOR SAFER CHEMICALS® designation.

As well as supporting the requirements of green construction schemes, assessments and certifications enable users to make informed choices on the products they choose in relation to the chemicals used, the impact on indoor air quality, and the broader environmental impact.

Beyond product offerings for customers, it is essential to leverage a strong renewable energy strategy to ac-

By improving the durability of assets, the coatings industry plays an important role in extending product lifecycles, while preserving resources for generations to come.

celerate the reduction of carbon emissions within your own operations. Companies should seize the opportunity to lower their carbon footprint and reap long-term benefits. By investing in renewable energy solutions, implementing energy efficient projects, and engaging the right partners, we can enhance operational excellence and reduce emissions across the value chain. Taking advantage of clean energy offerings is a powerful way for business leaders to reshape the trajectory of climate change.

Every touchpoint along the value chain has a responsibility to support a more sustainable future. Climate change poses systemic risks that affect communities, ecosystems, and economies on a global scale. The global paints and coatings industry should continually seek to use resources more efficiently and develop value-added sustainable solutions to support customers’ sustainability objectives. The coatings industry is critical in contributing to building a better future for customers, suppliers, and communities.

To address these challenges, companies must

prioritize sustainability as a driver of their overarching corporate strategy and engage their workforce to support the journey. Beyond involving employees as allies, business leaders should collaborate with local communities and governments to support climate resilience efforts. This can involve investing in research and development for sustainable solutions, funding infrastructure improvements, supporting educational programming that helps grow the next-generation workforce, and advocating for policies that prioritize climate action. By assuming a proactive role, companies can make a meaningful, measurable impact.

The urgency of addressing climate change cannot be overstated. Business leaders must do more to change the trajectory of climate change by committing to science-based emissions reduction targets, investing in clean energy solutions, implementing energy-efficient projects, and mitigating the broader impacts of climate change. By heeding these calls to action, companies can become agents of change and pave the way toward a sustainable and prosperous future for all. Together, we can rise to the challenge and reshape the course of our planet’s destiny.

With resources like low-cost, reliable power, creative incentive packages and a wide-ranging property portfolio, Santee Cooper helps South Carolina shatter the standard for business growth.

In fact, since 1988, Santee Cooper has worked with the state’s electric cooperatives and other economic development entities to generate more than $22 billion in capital investment and helped bring more than 89,000 new jobs to our state. It’s how we’re driving Brighter Tomorrows, Today

In the age of online shopping, retail brand decision-makers must strike a balance between their immediate space requirements and long-term sustainability.

By Matt Powers, Executive Managing Director, Retail/E-Commerce Distribution, JLLThe surge in online shopping observed in the past three years, as the world adapted to changes in consumer behavior spurred by the pandemic, has had a revolutionary impact on the retail landscape. Simultaneously, business owners face a daunting challenge: How can we meet the increasing demand of customers while protecting our market share from competition?

This growing pressure, coupled with rising expenses and inventory struggles plaguing many verticals, is cause for pause. While some in the industry may celebrate a leading market, such as the U.S. topping $1 trillion in e-commerce sales1 for the first time last year, now more than ever before, the smartest players are developing innovative strategies to fuel all aspects of their operations. Today, to stay competitive, industry leaders must think ahead of challenges in space constraints, supply chain management, and more. Four focal areas for e-commerce-focused retailers are explored below.

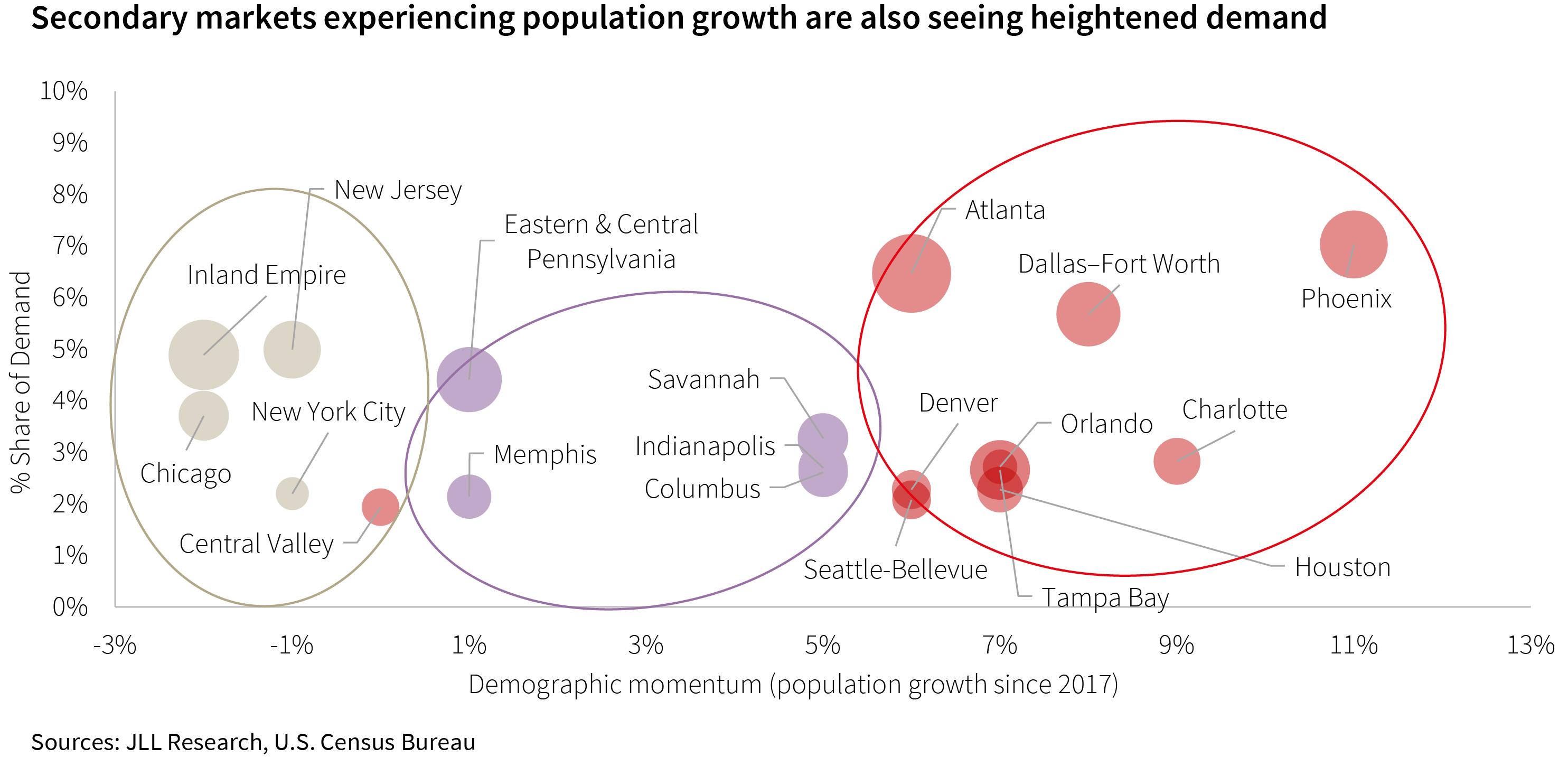

As fiercely competitive price wars and customer acquisition competition play out online in the e-commerce arena, physical space is a fast-growing battleground among the major players. Fortune 500 companies and powerhouses are vying for prime real estate to place distribution facilities or last-mile locations. According to JLL’s Q1 Industrial Outlook,2 this has led to an increase in industrial rental rates and annual escalations, particularly in densely populated regions, such as New York, Chicago, and Los Angeles, where opportunities for growth are limited.

Higher costs, scarcity in available inventory, and the intense competition among mega-site users have a ripple effect — and one that is particularly adverse — on second- and third-tier retailers, who may struggle to achieve a sufficient return on investment (ROI) in this challenging environment. As a result, these retailers find themselves caught chasing profit margins to offset securing space at a higher cost or sacrificing market share if they stand pat with a current footprint. Add the economic climate and rising interest rates to the equation, and many second- and third-tier players are erring on the side of caution and adopting a holding pattern.

According to JLL’s Industrial Tenant Demand Study,3 secondary markets are exploding in popularity as attractive alternatives for e-commerce providers and retailers. Nontraditional areas like Little Rock, Arkansas, and Pensacola, Florida, have witnessed a growing need for “last-mile” e-commerce to meet the increased demand from consumers for fast shipping. These markets come with their own set of challenges, which may include inefficient infrastructure and construction delays as they’re removed from major metropolitan areas.

There is also an increased focus on Sunbelt markets, such as Atlanta, Georgia; Orlando, Florida; Phoenix, Arizona; and even Dallas, Texas, as opportunities for expansion due to land availability and explosive population growth.

Additionally, the Southeast region was the top market for de-

To stay competitive, industry leaders must think ahead of challenges in space constraints, supply chain management, and more.

mand in 2022, accounting for 240 million square feet in requirements. Specifically, Savannah, Georgia, and Charlotte, North Carolina, have emerged as top markets due to their prime geographical locations and growing populations.

These markets are expected to remain bright spots in the industrial market as e-commerce brands prioritize the availability of space, cost-effectiveness, and the ability to deliver workplaces that can have staffing needs met by the nearby labor pool.

The impact of construction slowdowns or halts is likely to result in a shortage of industrial deliveries in the near future. Many companies had a strategy for building out their e-commerce infrastructure spanning a decade or more. However, the pandemic disrupted even the bestlaid plans and continues to have lasting ripple effects.

During the initial stages of the pandemic, there was a surge in customer demand, leading to a rapid acceleration in network optimization efforts. However, as the demand has slowed down and the economy faces strains, these networks remain incomplete, and, in some cases, they have become even more inefficient than before, resulting in a patchwork network for many retailers. In response to these challenges, retailers turned to thirdparty logistics providers (3PLs) as a temporary solution to alleviate the strain on their operations.

Improving building efficiency, maximizing sales space, and streamlining operations are key business fundamentals for e-commerce retailers. Now, many companies have come to the realization that they must take control of their destiny rather than relying solely on 3PLs. The pandemic shifted the focus from a “justin-time” mentality to a “just-in-case” approach, and now the industry is seeking an equilibrium that emphasizes the need for diversified supplier bases and regionalized networks to meet global demand.

Having the right real estate, suppliers, fulfillment facilities, and stores — and constantly evaluating if the mix of locations is being used in an optimal way — is central to driving the efficiency of supply chains.

Consumers’ expectations of near-immediate click-to-door delivery have made the proximity of fulfillment centers to customers’ homes of the utmost importance. Retailers are rapidly exploring solutions to the issue, including repurposing existing buildings such as vacant malls, parking lots, and old retail stores. Movie theaters, in

particular, due to their size, have been transformed into distribution centers due to their proximity to major population centers.

In densely populated areas, where the construction of a 50,000-square-foot building is not feasible, the conversation around the conversion of aging and vacant office spaces into vertical service distribution centers is gaining momentum.

While both approaches offer advantages, they also present challenges, such as limited dock doors, floor slab concerns, zoning issues, and potential political opposition. To encourage more conversions, increased investments from landlords and tenants, along with community understanding and support, are vital. By addressing these challenges, retailers can better serve their customers and solve the “last-mile problem.”

A comprehensive strategy that strikes a balance between immediate space requirements and long-term sustainability should be top of mind for any e-commerce and retail brand decision-makers. Retailers must invest in innovative technologies, foster collaborations, and maintain open lines of communication to adapt to the evolving landscape.

The best are embracing creativity in their real estate holdings while continuing to take a customer-centric approach in the age of online shopping. Ultimately, the battlefield may be intense but, with the right strategies and resources, retail can thrive.

1 https://www.census.gov/retail/index.html

2 https://www.us.jll.com/en/trends-and-insights/research/industrial-marketstatistics-trends

3 https://www.us.jll.com/en/trends-and-insights/research/industrial-tenantdemand-study

Secondary markets are exploding in popularity as attractive alternatives for e-commerce providers and retailers.

Today’s employees want to maintain their quality of life, including hybrid work, well-being support, and competitive pay; employers need to creatively meet their needs in order to keep them from jumping ship.

By Dianne Jones, Managing Director, Business and Economic Incentives, JLLCreative” and “Workforce” are not words that have historically gone together. Fast forward to 2023, and they go together like peanut butter and jelly!

But why are we having to be creative with the workforce? What does it mean to be creative with your workforce, and how can your creativity set you up for success within your industry? Also, while we are having a hard conversation, let’s talk about Gen Z and how they play a role in all of this.

What we can see from the statistics is clear: the babyboomers are retiring in droves. According to Pew Research Center,1 the rate of retirement for baby-boomers has accelerated. Nearly 29 million boomers retired in 2020, and three million the year before that. By 2030, 75 million boomers are expected to retire. That translates to about 10,000 workers per day.

While this trend is not new or unexpected, the pandemic did escalate the rates of retirement, putting a major strain on the labor force participation rate. Currently, the U.S. labor force participation rate is the worst it has been since 1964, despite job openings being at an historical high in March of 2022. While there has been a shift in the number of people available to work, there has also been a shift in how people work — 2020 forced the “ability” to be flexible, by working from home or the need for one parent to stay at home as opposed to prepandemic dual-income households.

Regardless of how we got here, we must deal with where we are and understand the differences between expectations of employers and employees. Conversations with our clients tell us that employees view productivity as completing their required task. Employers view productivity as innovation and new ideas generated by

the organization. This is a sharp disconnect.

JLL’s 2022 workforce report2 shows that employees renewed their focus on maintaining their quality of life, including hybrid work, well-being support, and competitive pay. Seventy-four percent of employees who have been working remotely three to four days a week were the least loyal and have left their jobs in the past 2.5 years, and 79 percent could do so in the coming months. This statistic is not shocking when you think about the limited connectivity and camraderie of remote work. The statistics go on to show that 59 percent of employees prioritize working in a company that supports their health and well-being, while 60 percent of employees believe the office will remain central to their working life in the long term.

Let’s break down the workforce discussion by two different sectors: office and industrial. We know the ability to allow flexibility is much easier with employees in an office setting as opposed to those on a manufacturing floor, but that doesn’t change the desire of those workers to have flexibility.

Wisconsin loves to help all sorts of companies find their version of success. That includes yours. From site selection through construction, opening and expansion, we provide support to ensure your vision becomes reality. After all, your success may inspire other companies to relocate or expand here, too. That’s how we look forward.

When we look at the office attendance numbers, JLL research reports that about 46 percent of the employees are having some sort of in-office attendance numbers. When we look at other key lifestyle indicators, the “attendance” is in the 90th percentile! These are things like gym attendance, air travel, restaurant reservations, and hotel bookings. So, what do all these numbers mean for the office sector? For starters, if your company’s inoffice attendance policy conflicts with some amount of flexible work, you may be seeing high turnover. Finding a happy medium of providing flexibility while still providing required days in the office can be a win-win. If your boomers and Gen Xers want to come in everyday, they should have a space to do that and be welcomed with open arms. If your millennials and Gen Zers want more flexibility, you need to allow for that as well.

The industry’s leading best practices conference events for economic developers

Speaking about Gen Z, they have been watching and listening and are going to do things differently, and I think we all owe them a huge “Thank you.” This generation has a focus on the things that go past the office. They are making the dash on their headstones count, and their legacy won’t be the job they had — but the places they went. After watching many of their parents work day-in and day-out until they were too old to enjoy retirement, they are making some changes — working smarter not harder, making their health a top priority, and taking mental health as seriously as it should be taken.

If you want to create a positive environment for all employees and make your Gen Z employees the happiest, you must focus on the employee experience. Incentivize the drive! What are they coming to an office for? The culture, a diverse environment, transparency between positions and pay, a place to have their voice heard, and some natural light. Yes, they also want good snacks, a sparkling water machine, and a barista-like coffee machine as well. Lunch a few times a month would be icing on the cake! But, they also want access to both a physical fitness center and access to mental healthcare. If you don’t have exercise facilities in your building, provide an allowance for gym memberships. Confirm your insurance provider has easily accessible telehealth options for mental health, and if they do not, add on a separate service that provides this and encourage your employees to use it. The mental struggle of this generation and those to follow is real. You can blame it on the pressures of Instagram, Snapchat, Tick Tock, Threads, or X, and we as leaders need to help change the narrative. Everyone has some type of mental struggle. It may not be every day, but it is real, and it is okay. In short, success in your corporate office environment means leaning into making your environment one where people want to be and feel good about being.

Regardless of the sector in which your employees work, there is a new urgency to understand the progression of where they are and where they are going. Having clear metrics in place for advancement make it easier on both parties for promotions. If an employee knows in year three that there is the ability for a promotion if they do X, Y and Z, they will think twice about jumping ship at the 18-month mark.

The industrial workforce has grown significantly over the past few years and, as the EV revolution continues, will continue to grow. Hiring and retaining workers is harder than ever. Their skills are often transferable, and the company across the street may be paying $0.25 more an hour than you are. So how do you compete with that?

Like those in the office sector, the industrial workforce wants flexibility. While there is an expectation that work happens on the manufacturing floor, being flexible with when the work happens is a new trend in manufacturing. With HR teams already working overtime, a company like My Work Choice can leverage technology to give your employees what they want.

Speaking with Adam Raimond and Holly Pennington at My Work Choice, they explained their platform allows for a manufacturer or a distribution company to build a community of full-time workers who need work-life balance: “A company can have the long-term, quality people that they need, while allowing them to have time off because they are building a backup community of workers to pick up where one left off.” There are also trends of same-day pay that keep employees coming back, since there is instant gratification in seeing your money in your account before you get home. Flexibility on the shifts you offer and seasonally changing what shifts are preferred to allow your employees time to make their kids sports games and the church potluck will go far, they say.

While some problems are easier to solve than others, child-care is still a major issue. Child Care Aware of America3 estimates that nearly 16,000 child-care programs across 37 states have permanently closed since 2020. Several companies have invested in on-site or

nearby child-care centers. These are built by the company and operated by local providers who are skilled in the rules and regulations of running a daycare.

Many states like Georgia have tax credits equal to 75 percent of the operating cost of the child-care program for the employer or business that purchases property specifically to build, expand, or operate these facilities. In some cases, child-care facilities are credited 100 percent of the cost of the qualified property over a 10-year period. Women make up about 30 percent of the manufacturing workforce, and 63.1 percent of women cited the lack of flexibility, and 49.2 percent cited child-care support as their top challenge. If the industry increased the share to 35 percent, 746,000 job vacancies would be filled today.

To add a few more things to this discussion, make sure your leadership is trained. While some leaders are born, some are trained, and if people are advancing with technical skills in your organization, you need to make sure they have people skills as well. Also, you should hire the whole family! Sixty-nine percent of workers in a manufacturing study said their employer’s familyoriented culture was important. Sponsor the softball team…have a company picnic…and put a wall of photos up for people to show off their children and grandchildren. Our JLL Charlotte team did this and it was appreciated by the employees. Bring back the boomer, but give them flexibility. They may not want 40 hours a week, but 15 hours of their knowledge can go a long way. Make the application process easy, as most of us have short attention spans, so don’t make the first step the hardest. But, of all the measures outlined above, I would put listening to your employees at the top of the list.

1 https://www.pewresearch.org/short-reads/2020/11/09/the-pace-of-boomerretirements-has-accelerated-in-the-past-year/

2 https://www.us.jll.com/en/trends-and-insights/research/industrial-marketstatistics-trends

3 https://info.childcareaware.org/media/16000-childcare-providers-shut-downin-the-pandemic.-its-a-really-big-deal

CURRENTLY, the U.S. labor force participation rate is THE WORST IT HAS BEEN SINCE 1964, despite job openings being at an historical high in March of 2022.

Mississippi Development Authority’s streamlined process makes it happen faster, no matter what you make. Our flexible incentives, qualified shovelready sites, low costs and critical infrastructure empower your business. Get mighty at mississippi.org.

Accelerate Mississippi propels your business with tailored workforce development programs. Specialized training and ongoing education ensure Mississippians are ready to work now and fuel long-term success for you. Get your team moving at acceleratems.org.

WITH THE POWER OF HUMAN MOMENTUM.

What makes a state a great place to do business? Let us count the ways.

There are more than a dozen factors that enterprises find are important to their success — and, in particular, vital considerations as they decide where to locate, relocate or expand. These factors influence various aspects of the cost of doing business, the ease and speed of proceeding with a new project, the ability to hire and train the right people, and the overall hassle factor. Every year, Area Development consults with a panel of experts whose careers are involved in location selection and economic development, asking them which states excel at these all-important characteristics.

The result is our annual Top States for Doing Business feature. If you’re a regular reader, you’ll see a lot of familiar names here, which is not entirely surprising because it takes a lot of time and effort for a state to hardwire these valuable traits and build solid reputations.

We generated an overall list of Top States by analyzing and compiling the highest performers in more than a dozen different categories, about which there will be a lot more detail below. Check the first 10 overall honorees and you will see the same 10 states that were there last year. The order is a bit rearranged, but one important thing is unchanged: Georgia tops the list. Again. For the 10th year in a row, in fact.

That can be explained by the fact that as you look through the individual lists of what makes a state a great place to do business, you will find Georgia uniformly at or near the top of most of them. The state has carefully assembled most of the building blocks that location decision-makers are looking for, and that work translates into success on this ranking.

Another thing that hasn’t changed is the fact that the South is well-represented here. Jurisdictions in the Southeast, in particular, have built attractive incentives, workforce programs, and a generally business-friendly attitude, and their labor markets tend to be favorable in terms of cost, availability, and right-to-work status. There are standouts elsewhere, too, including traditionally industrial states such as Ohio, Indiana, Michigan, and Illinois. You’ll find the sun shining on such places as Arizona, Kansas, Arkansas, and Iowa, and it’s no surprise that

New York is a leading destination, too. Read on for more details on the factors that went into these overall rankings, and which states excel in these areas. Note that we have a separate sidebar that takes a deeper dive into the highly important category of workforce training.

It’s always worth pointing out that which state is best for your project depends entirely on the details, your requirements, and other unique circumstances. Just because a state isn’t near the top of some of these lists, or any of them, doesn’t mean it’s not the perfect place for your company’s expansion. Every state is eager for your jobs, and any state could be the perfect match for reasons that pertain to your most important needs.

Plenty of things go into the cost of doing business, some of which have to do with geography and resources, some of which relate to matters that are more under the direct control of state officials. Georgia tops this list in part because it’s well-located in the booming Southeast, and well-connected from a logistical perspective. But it certainly doesn’t hurt to have a low corporate tax rate that hasn’t risen in many decades, and even dropped a quarter point a few years back.

continued on page 34

Our 2023 Top States for Doing Business rankings reflect the results of our recent survey asking leading consultants to industry to give us their top state picks in 14 categories that impact companies’ location and facility plans. The states in each category were ranked based on their number of mentions in the particular category, and total mentions in all 14 categories — weighted by the diversity of categories in which a state was mentioned — were calculated to rank the top 20 states overall.

Employers often say that people are the most important part of their success. They’re doing the work, creating the innovations, serving the customers. Without the right people, and enough of them, an enterprise is likely to falter.

That’s what makes workforce training such a critical part of what it takes to be a Top State for Doing Business. And it’s why we’re putting some extra spotlight on this topic.

Georgia sits atop the list of states with the best workforce training opportunities. At the heart is the state’s Quick Start program. It’s offered through the Technical College System of Georgia and delivers customized training targeted at new and expanding businesses. Companies in manufacturing, biotechnology, information technology, and other sectors need techsavvy workers with specific skills, and this program has helped attract those businesses to Georgia.

SK Battery America began mass production of electric vehicle batteries last year in Jackson County, and as it ramped up for that milestone the company was able to significantly beat its hiring goal. “The state’s Quick Start program has helped us attract and train workers with a speed and scale that would be difficult for any company to do on its own,” says the company’s CEO, Timothy Jeong.

Virginia, landing second on this list, has its own top-notch training programs to boast, and its programs have helped land a number of big deals. Lego Group, for example, is building a billion-dollar manufacturing facility that it will populate with all kinds of automation technicians, engineers, IT professionals, and others. The company and state officials are busily developing training and recruitment programs.

Leading the way in this state is the Virginia Talent Accelerator Program brought together by the Virginia Economic Development Partnership and the Virginia Community College System. The program aims to accelerate new facility and expansion through tailored recruitment and training services. The Virginia Jobs Investment Program also facilitates customized recruit-

ment and training services but by means of grant funding of up to a thousand dollars per eligible job impacted. Companies pick their own training and recruitment providers.

In third-ranked South Carolina, a wide range of employer resources assist in various situations. SC Works, for example, helps employers through the process of screening, matching, hiring, training, and retaining. And its experts help expanding companies to sort through available workforce programs and tax credits. Specialized programs include one supported by local technical colleges providing training resources for the state’s auto suppliers to tap into during periods of slowed production, so that when they ramp back up, they have upskilled workers on the factory floor.

The LED FastStart program from Louisiana Economic Development has been around for a decade and a half, providing customized recruitment and screening, as well as development and delivery of customized training, ranging from hands-on simulations to interactive e-learning modules.

All kinds of businesses can tap into LED FastStart resources, including manufacturing, software, corporate headquarters, warehouse and distribution, R&D, and digital media. And by the way, there’s no cost. The program is one of the reasons this state lands at #4 on the workforce training list, and also one of the reasons it landed a billion-dollar promise from First Solar for a solar panel plant worth 700 jobs.

Customized technical training can be had for free in #5 Alabama, too, including through AIDT. Companies share what they think the ideal applicant would look like, AIDT assesses applicants and creates a companyspecific training program, and once the best candidates are chosen, AIDT delivers job training and process improvement. The program has trained roughly a million people.

Alabama’s industries are strong partners in training and preparing the workforce. Take the state’s auto continued on page 32

Georgia has been named the Top State for Doing Business. See how Georgia’s decades-long success can accelerate the growth of your business.

continued from page 30

industry as an example. Hyundai Motor Manufacturing Alabama has a Hyundai Initiative for Robotics Excellence program that creates robotics teams and programs at public schools. Meanwhile, Toyota Alabama is investing in public STEM education in this state ranked fifth for its workforce development programs.

Tennessee, ranking sixth on this list, takes a holistic approach to delivering a well-trained and qualified workforce. There are multiple programs that together are aimed at giving Tennesseans a solid educational foundation that employers can easily tap into and build upon. The GIVE initiative, short for Governor’s Investment in Vocational Education, is expanding access to vocational and technical training at the high school level. The Tennessee Promise ensures that high school graduates can access two years of tuition-free training at a community college or technical school. There’s also a program aimed at Tennessee adults who don’t have an advanced degree, offering them free access to community college.

North Carolina places seventh with its well-honed

reputation for training and educating its workforce. NCWorks, the statewide workforce system, is one example. Its job training programs include both classroom instruction and on-the-job training. There are customized training opportunities along with the potential for employer reimbursement. Also available are recruiting services that range from advice on trends to hands-on help with the candidate search. There are 80 career centers across North Carolina.

Indiana moves onto this list in the #8 spot with such programs as the Employer Training Grant. It’s reimbursement of up to $5,000 per employee helps employers train, hire and retain workers in various priority industry sectors such as advanced manufacturing, health and life sciences, transportation and logistics, IT and business services, building and construction, and agriculture. Beyond the grants, there are apprenticeship programs, recruitment programs, and other resources.

Arizona is ninth, and its “Business First” navigator program is one of the reasons. It’s no-cost talent acqui-

Home to Fortune 500 companies and Fort Moore (formerly Fort Benning). Columbus continues to thrive because of a strong business environment. Our advanced manufacturing, food and defense companies continue to Choose Columbus and are growing with us! An ideal location with steady leadership, top talent and a track record of innovation. Explore Columbus because we do Amazing!

sition assistance from the Arizona Commerce Authority, and as the word “navigator” suggests, it’s intended to guide businesses through a variety of workforce-related needs, including both training and recruiting. In fact, Arizona’s navigators also help companies figure out federal workforce programs, which is an area a lot of states don’t cover.

The state has, for many years, been a leader in semiconductor industry talent, and that has helped it Arizona land billions of dollars in investments in the past few years. Universities have helped build that talent, along with other training programs involving industry partners. A new BuilditAZ initiative aims to add deep benches of talent in various trades through apprenticeships.

The 10th slot on this all-important list goes to Ohio. Its Office of Workforce Transformation is one of the ways Ohio aims to keep its workforce trained for what’s coming next — for example, a new electric vehicle workforce strategy focuses on preparing the state to meet the talent needs of that booming sector.

continued from page 29

Likewise, neighboring Alabama aims to keep the cost of business low with such pluses as competitive tax rates, abatements for various reasons, and Opportunity Zones that offer incentives for targeting geographic areas of need. Alabama’s neighbor to its north, Tennessee has the second-lowest state and local tax burden per capita, as well as no income tax on wages. And a step to the west, in Mississippi, the cost of doing business is kept favorable with a low corporate tax rate, various incentives, and, in general, business and living costs that are well below the national average. Indeed, when it comes to overall favorable business costs, most of the leading states are in the Southeast, along with Indiana, Ohio, and Texas.

Incentive programs are among the business cost factors that economic development leaders can really influence, whether we’re talking tax breaks, grants, low-interest loans, or other kinds of assistance. Perennial leaders in this regard include Georgia and South Carolina, once again the #1 and #2 on this list. To take South Carolina as an example, state and local sales tax exemptions lower manufacturing costs. Serviceoriented businesses such as data centers, along with enterprises in other sectors, can earn their own exemptions by investing and creating jobs.

Once again, this category is largely dominated by Southern States, but two further north not only make a repeat appearance but move higher on the list. Ohio moves up a spot to third, and Indiana slides up two places to fourth on the business incentive program list. And Arkansas jumps onto this list with a wide range of generous incentives, including its Tax Back sales and use tax refund for such things as machinery and building materials, job creation incentives, equity investment credits for encouraging creation of higher-paying jobs, R&D incentives, and even credits for bringing Hollywood to Arkansas.

Money may make the world go around, but there are parts of the world where there are especially large sums being made available for business capital and funding. This is a category where areas of the country away from the South have a chance to excel. The innovation hotbed of California is not coincidentally the leader in access to capital and funding, according to our experts. One look at the Statista rankings1 of venture capital by state last year shows just how much California leads the pack, at $104 billion, far ahead of the $29 billion raised in New York, second-place on Statista’s list (and also ours).

Texas lands third on our list of access to capital and funding. It’s

Plenty of things go into the cost of doing business, some of which have to do with geography and resources, some of which relate to matters that are more under the direct control of state officials.

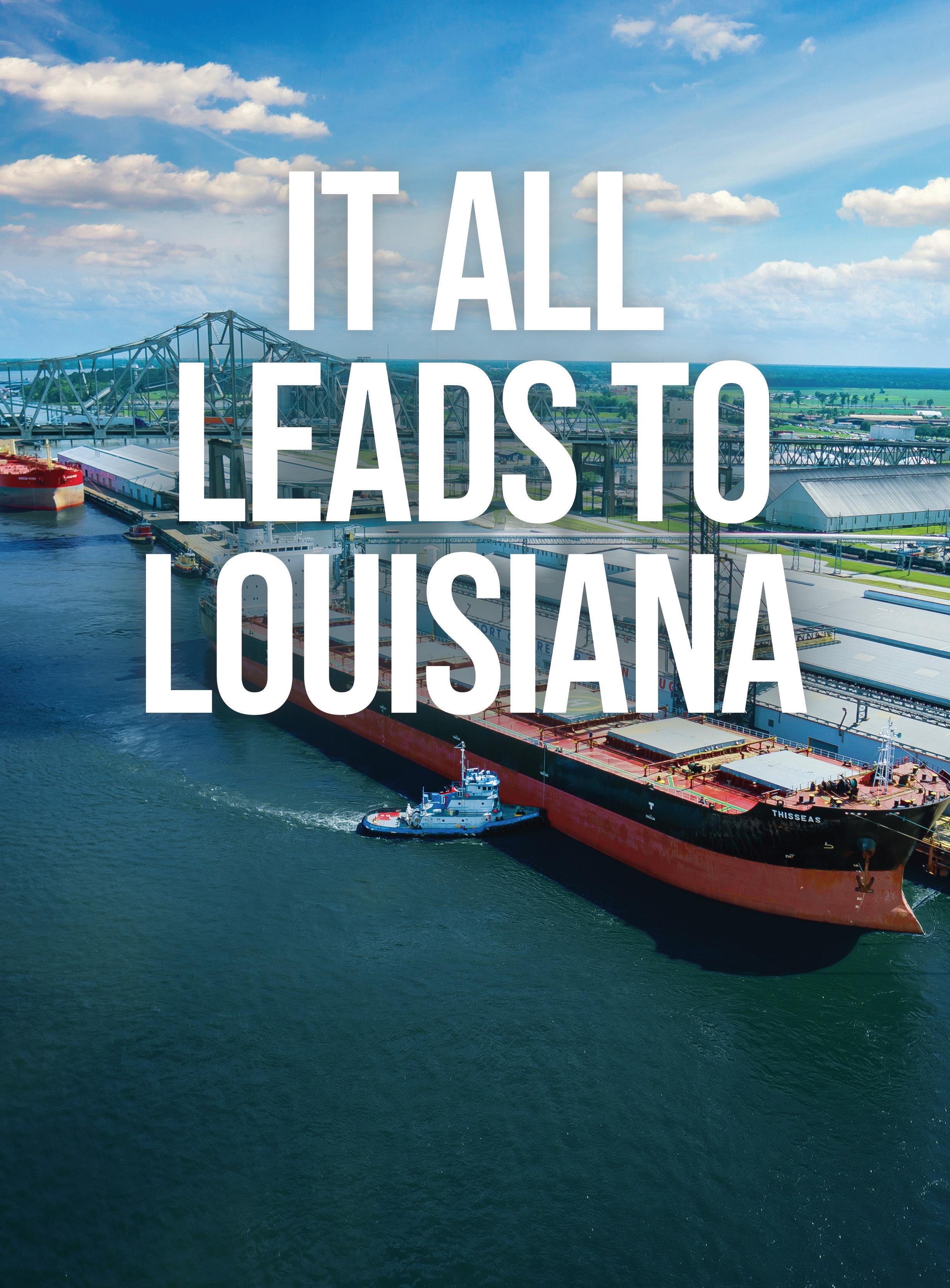

Unrivaled global transport infrastructure. Powerful incentives. Award-winning workforce training. Explore the advantages at OpportunityLouisiana.gov.

6 Class 1 Railroads

7 Primary Airports

6 Deepwater Ports

6 Interstates

6 Class 1 Railroads

7 Primary Airports

6 Deepwater Ports

6 Interstates

fifth on Statista’s overall VC list, but of course, VC isn’t the only kind of funding out there. Texas boasts the nation’s largest dealclosing fund, the Texas Enterprise Fund, which is a performancebased incentive designed to move the state over the goal line in competitive economic development situations.

As with a number of these categories, there are multiple factors that make for a competitive labor market. One of the most important is simply the availability of labor, which these days is anything but a given — to do well here, a state either needs a solid supply of existing labor or it needs to be good at attracting more. The leading 10 states can all check one or both of those boxes, and Georgia is once again at the top of this list.

A competitive labor market also, of course, suggests labor at a competitive rate of pay, and once again, the top 10 states do well in that regard. All but one are among the bottom half of states when it comes to median wages. All but one also are right-to-work states. And if you cross-reference this list with our separate section on workforce training, you’ll see a lot of overlap, too, since exceptional training resources help boost the availability of qualified and competitive labor.

Pretty much annually, you’ll find Georgia and Tennessee at the top of the list for energy availability and cost. They are perpetually attractive for industries requiring lots of energy, and reliable energy.

It’s worth pointing out that the cost factor is not just a matter of basic energy rates. For example, Georgia Power helps boost busi-

ness bottom lines through energy efficiency programs and rebates, management tools that can lead to savings, and business advisory services that help users deal with energy-related challenges and increase efficiencies.

Tennessee’s perpetual spot at or near the top has to do in part with the rates charged by local power providers served by the Tennessee Valley Authority, a federally created public power wholesaler that sets rates below roughly 70 percent of the country. In the #3 spot, South Carolina’s energy-related business advantages include the series of rebate and incentive programs provided by Santee Cooper, the state’s largest power provider and one of the nation’s biggest public power utilities.

A new category on our list is water availability, and it’s a sign of the times. Certainly, many industrial users have long had significant water needs, but climate change is impacting availability as certain regions cycle in and out of drought conditions.

Ohio lands atop this list, and its positive water picture can be pegged in part to the fact that its entire southern boundary and much of its northern edge are bordered by fresh water, lots of it. But the state is also aiming to be forward-thinking in terms of water infrastructure. For example, the Ohio BUILDS initiative includes millions of dollars of grant funding for water projects, including construction of new water systems, replacement of aging water lines, and installation of new water mains.

Michigan also has many miles of fresh water along its borders and within its central areas, and it also is dedicating significant resources to its water infrastructure. A multibillion-dollar infrastructure program approved last year

To learn more about how inspiring businesses are leading the way to a strong economy, visit ArkansasEDC.com/ whyarkansas

“

We have people come in here every day who say, ‘This is something I wouldn’t expect to have in the Delta.’”

Harvey Williams, Co-founder – Delta Dirt Distillery, Helena

includes substantial sums targeted at water improvement projects, along with wastewater and stormwater upgrades.

Measures of infrastructure are likely to be rather fluid in the coming years, as the nation’s infrastructure is getting more attention and investment these days than it has in years past. Improvement projects, funded locally and by new federal dollars, are literally all over the map.

In the meantime, though, Georgia remains at the top of this category, as it has been in the past. From a logistics perspective, it sits in a perfect geographic location for serving the population centers of the Southeast. It has excellent deepwater port access,

including the nation’s fastestgrowing container port in Savannah, and air connections through the Atlanta International Airport that is literally the world’s busiest and also most efficient. In the #2 spot, Texas claims more miles of public roads and freight rail than any other state, plus 11 deepwater ports and a half dozen of the nation’s busiest airports.

Advantageous locations and solid infrastructure also are helpful for neighbors Indiana, Ohio, and Kentucky. Indiana has an evergrowing logistics sector along its “Crossroads of America” highway system, while Ohio is strong in multiple modes of transportation. Kentucky lies within a day’s drive of two-thirds of the American population, has been a strong state investor in road infrastructure, and hosts the biggest hub and primary international gateway for UPS.

Several familiar states are on Area Development’s 2023 Top States for Doing Business list, including Georgia, South Carolina, Tennessee, North Carolina, Ohio, Indiana, Virginia, and Texas. These states share similar traits: good overall business climates, predictable regulatory and permitting processes, developable sites, and responsive economic development organizations. These states continue to win projects because they are strategic, opportunistic, and proactive.

It is important to note the presence of some states that have not appeared on the top-20 list as near the top as they are this year or at all. These states reflect well on their respective state’s economic development organizations and team members. In addition, they have demonstrated success in winning projects and addressing key issues impacting site selection decisions.

By Larry Gigerich, Executive Managing Director, Ginovus; and Chair, Site Selectors GuildNo state is perfect, and every state has policies or other attributes that need to be made better. Talent, infrastructure, real estate, quality of place, tax structure, regulatory environment, and economic development incentives all have an important role to play in the site selection process for corporate decision-makers.

The lesson learned from the states appearing on this list is that they are proactively working on their weaknesses, leveraging their assets, and have talented economic development officials focused on growing the economies of their cities, regions, and states. As a result, they have established a demonstrated track record of success and positioned themselves well for the future. The closing message to all economic development officials is to not get complacent and continue to innovate for long-term success.

The top ranked states are leveraging their assets and positioning themselves for future economic development success.

For over 120 years, SRP has ensured that Greater Phoenix has had a reliable water supply — and that’s not changing any time soon.

As our residential and business populations continue to grow, we’re finding new ways to expand water storage capacity, use hydrologic data and activate long-term climate plans. If you’re searching for a new place to plant your business, Greater Phoenix has enough water to help it grow strong roots.

Get the full story at powertogrowphx.com.

1

2

3

4

5

6

7

8

9

The real estate markets, which have been messy and unpredictable in recent years, may be cooling off some, but it can still be a challenge to locate an available property or facility at just the right time, in just the right place. Our rankings for the top states for available real estate have shifted somewhat, and South Carolina now tops the list. Georgia, which had led in this category, drops to fourth. Texas holds onto the second-place spot, and Ohio leaps up to third.

Needless to say, obtaining a suitable piece of real estate is essential for location or expansion,

but it’s only part of the story of getting that facility up and running. Check the categories below that relate to site readiness, the regulatory environment, and the general friendliness of the state and local governments — all of these are essential elements to taking a real estate story all the way to a happy ending.

This category is arguably a bit subjective, but it’s one of the most important factors along with the ability to find the right workers and put together an affordable deal. This category reveals a list

Access to training programs as well as incentives for automation are helping companies meet their workforce needs in the top-ranked states.

With two of McGuire Sponsel’s four offices in the Midwest and Southeast, our Location Advisory Services team was not surprised to see high rankings for Midwest and Southern states. Our work with many of these state and local authorities and economic development teams would support such a leading ranking for these states. Southern and Midwest states have done a tremendous job in supporting environments that help to control costs and make resources widely available. These two factors are critical to future successful business operations, which companies integrate into their location decisions.

We also observe that companies are still highly influenced by the average wages and available workforce within an area. Understanding that wages are high and that the available workforce has been limited over the last couple of years, access to training programs is extremely important for growing a workforce internally for many businesses. Additionally, states that support companies with investment incentives for automation help them bridge the gap due to a limited available workforce and increasing production demands. Process automation will only continue in the future, and states that support these investments will continue to see significant economic development traction. Similarly, states

should expect greater demand for support with sustainable or renewable projects as more and more businesses are looking to make direct investments in those areas.

The results of the Area Development’s Top States for Doing Business survey show that regions appear to have what we call a “node” state (a top performer), with surrounding states competing for business with similar programs and resources. For example, Georgia was listed as the numberone state in seven out of 14 categories and in the top five for five other categories. However, Tennessee and North and South Carolina were always within a few positions. Similarly, Ohio performed well in many categories, with Indiana, Virginia, and Kentucky close behind.