www.areadevelopment.com GIANTS CLASH ALONG THE GRID UP NEXT FOR INDUSTRIAL IN 2024 P 18 P 8 NAVIGATING THE DIGITAL TRANSFORMATION P 41 PUBLIC-PRIVATE PARTNERSHIPS DEVELOPMENT AREA AREA COMPETES FOR SPACE ALONG THE GRID COMPETES FOR SPACE ALONG THE GRID NAVIGATING THE DIGITAL TRANSFORMATION RETHINKING INDUSTRIAL SITE SELECTION P 30 MANUFACTURING MOMENTUM IS BUILDING P 24 P 24

The Winds of Change are in Virginia. Dominion Energy’s Coastal Virginia Offshore Wind project is breaking new ground in the energy industry. The 8.8-million-megawatt project is the first offshore wind farm installed in federal waters, the first developed and owned by a utility company, and the largest offshore wind project under development in the United States — and a major pillar of Virginia’s efforts to meet increasing power demands while moving toward a reliable, affordable, and clean energy future.

Find your advantage at VEDP.org.

Coastal Virginia Offshore Wind

Virginia Looks to Renewables to Meet Long-Term Energy Needs

The best way to conceptualize Virginia’s energy ambitions is to look to its past supporting one of the most power-intensive industries in existence.

“Data Center Alley” in Loudoun County is the world’s largest concentration of hyperscale data centers — its capacity exceeds that of either China or Europe. The area requires massive energy to power and cool computers, servers, and virtual machines. Fueled in part by plans to add more hyperscale data centers, the demand for electricity in Virginia is forecast by Dominion Energy, Inc. to grow 5% annually, more than double the pace of growth in the decade before the pandemic.

While a significant portion of the expected increase in demand for energy will be driven by data centers, some additional demand will come as drivers switch from vehicles powered by gas to those powered by batteries. That’s even more true if Virginia sticks with previous plans to ban the sale of gas-powered vehicles in 2035.

The Three-Legged Stool

The traditional energy model is often described as a “three-legged stool” based on reliability, affordability, and environmental stewardship. Virginia has been on a gradual trajectory of expanding renewable energy over the last two decades. Three long-term factors have coalesced to create a period of potential growth in clean energy generation in Virginia:

• Investment in new energy infrastructure over many years by the state’s main electric utilities, Dominion Energy and Appalachian Power;

• Development of technology that brought the cost of renewable energy down sharply; and

• Continued development and investment in a tech-savvy workforce with the skills needed to build and maintain cutting-edge energy infrastructure.

Renewable energy in Virginia hit a major milestone in late 2023 when the Coastal Virginia Offshore Wind project received public final approval, paving the way for a wind farm that could power as many as 660,000 homes by 2026. Once completed, the project will be one of the largest offshore wind farms in the world.

“Both/And” Instead of “Either/Or”

With high projected growth, Virginia can’t afford to leave an energy stone unturned, which is why the Commonwealth of Virginia 2022 Energy Plan builds on the Virginia Clean Economy Act of 2020 to include both renewables (solar, offshore wind) and more traditional energy sources (nuclear, natural gas, hydrogen). While natural gas remains the Commonwealth’s primary

fuel for generating energy, Virginia continues to work toward reducing its use to zero by 2050.

The Commonwealth continues to aggressively pursue solar generation. Virginia is seeking $250 million through an Environmental Protection Agency program called “Solar for All” that will commit $7 billion across the country for residential solar, enabling millions of low-income households to access affordable and clean solar energy.

Virginia’s priority is to anticipate future energy challenges and build the capacity to mitigate them. That means using the data about expected demand to create goals, then using flexible means to get there.

This article was paid for and written by the Virginia Economic Development Partnership and approved by Area Development.

AREA DEVELOPMENT | Q1 2024 1

The first eight monopile foundations for the Coastal Virginia Offshore Wind commercial project arrived at Portsmouth Marine Terminal in October 2023. The project will provide 8.8 million megawatts of power when complete, enough to power up to 660,000 homes.

16 Up Next for Industrial in 2024

Here is a look at the normalizing sector’s upcoming supply, demand, and pricing outlook. .

20 Navigating the Digital Transformation

Courtney Dunbar, site selection and economic development lead at Burns & McDonnell, recently asked Matt Olson, Burns & McDonnell’s chief innovation officer, about how companies are navigating the digital transformation and its potential of fostering sustainable, resilient manufacturing practices.

Growth of the digital economy has put transmission-adjacent properties and the ability to interconnect at the forefront of the site selection process.

Features

22 Why Smaller May Be Better for Some Businesses

After records have been set for massive industrial spaces, the market has shifted to smaller buildings.

28 How to Break the Bad News: Navigating the Conversation When a Company Doesn’t Meet Expectations

When a company cannot meet the original parameters set by its project, communication is critical to identifying potential solutions.

30 Manufacturing Momentum Is Building

A desire to bring manufacturing closer to the consumer, recent federal funding initiatives, as well as access to a skilled workforce and reliable power among other advantages have converged to spur growth in construction of U.S. manufacturing facilities.

32 Public-Private Partnerships Incentivize Industrial

Development

Communities that embrace creative solutions and collaborative approaches are well-positioned to thrive and attract jobs and investment from the private sector.

64 Applied Learning Fuels Investment in Workforce Training Facilities

With tailwinds such as government incentives and changing vocational preferences, workforce training facilities are poised for continued growth throughout the U.S.

2 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Area Development® Site & Facility Planning (USPS 345-510) is published four times per year (Q1, Q2, Q3, and Q4) at Lancaster, PA, by Halcyon Business Publications, Inc., 30 Jericho Executive Plaza – Ste 400W Jericho, NY 11753. Periodicals postage paid at Jericho, NY, and additional offices. Single copies, $20. Yearly subscription U.S. & Canada, $75; foreign, $95. CONTENTS

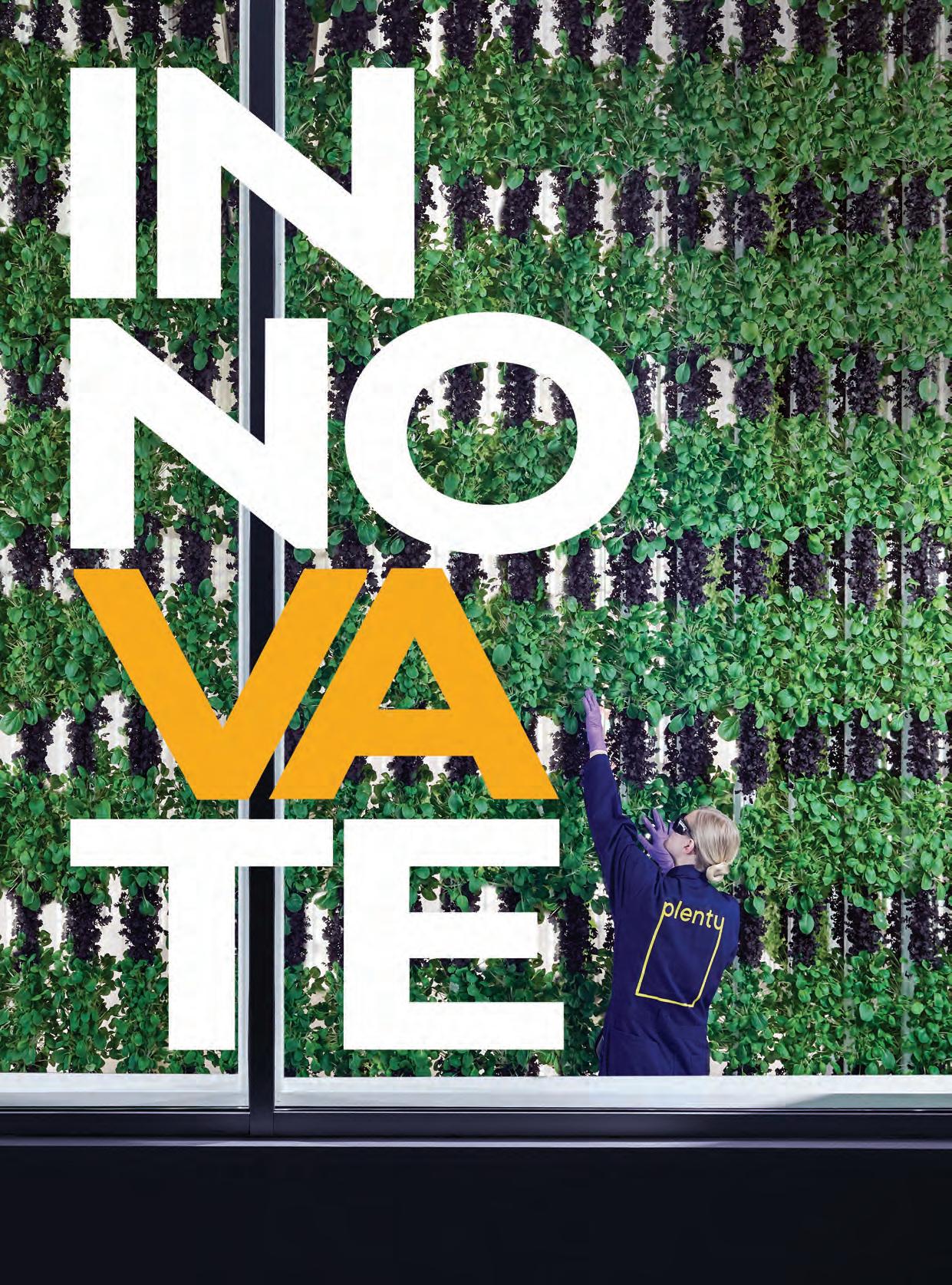

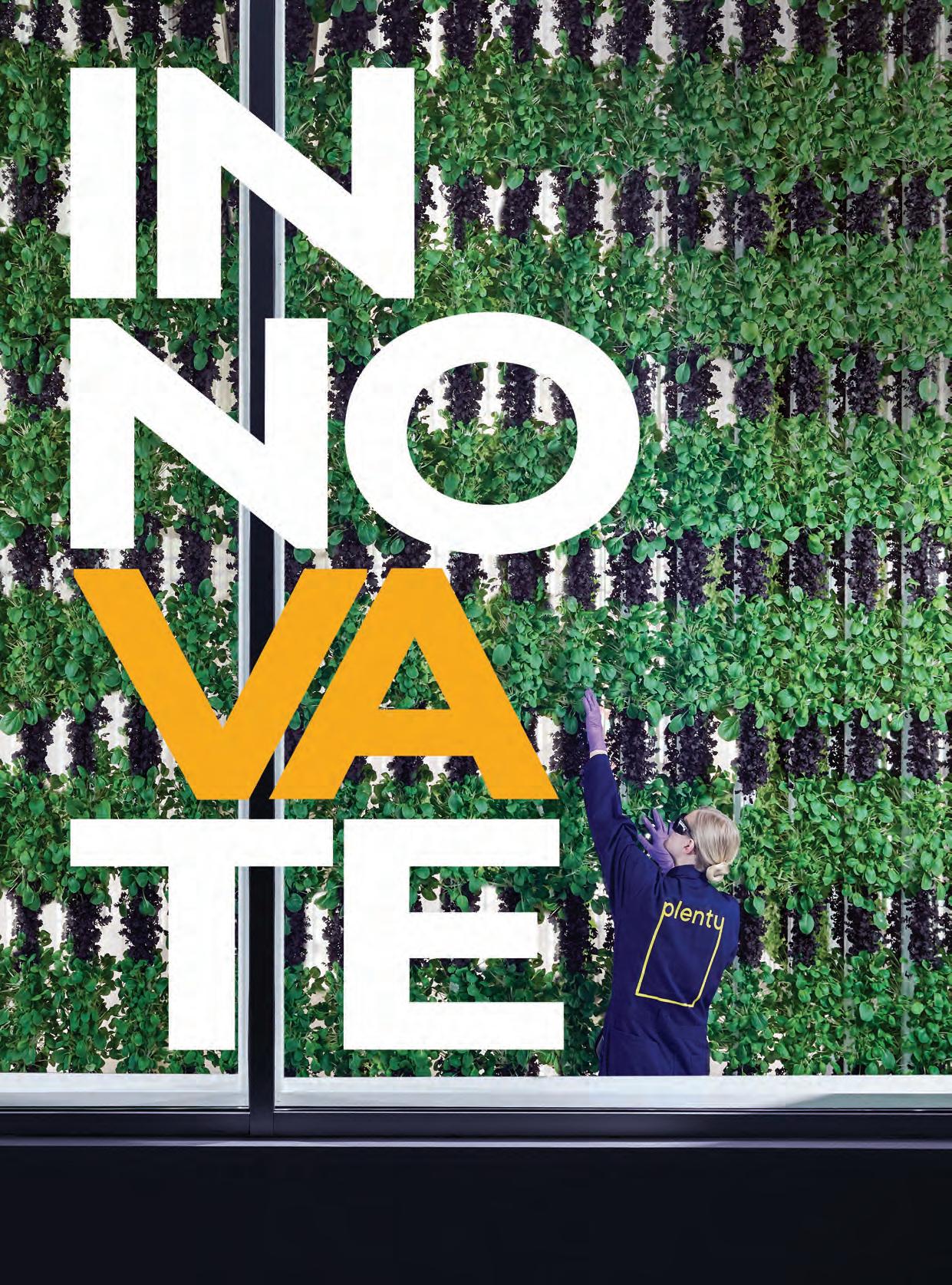

Industry in the Era of the Electron C O VER STORY

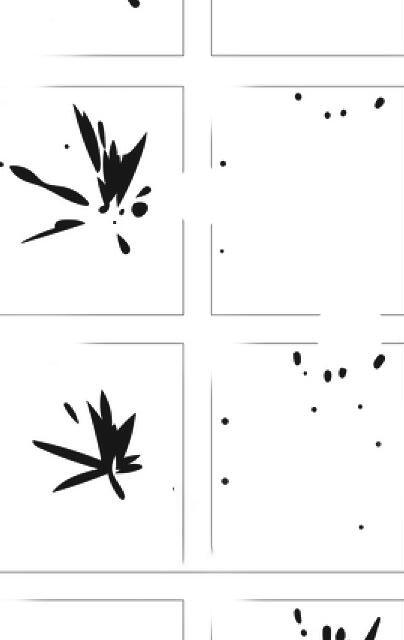

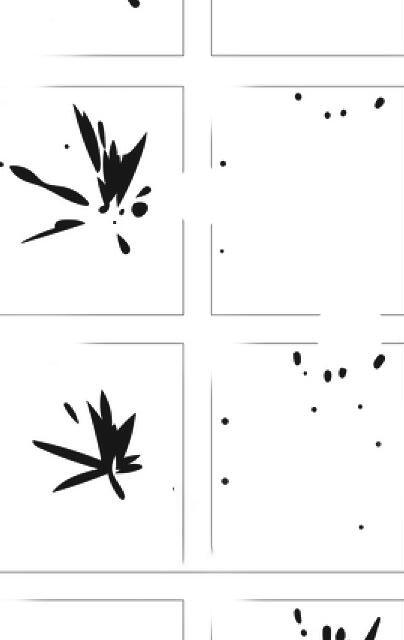

24 Overall Vacancy While Up Is Still Healthy Rent growth remained positive in 2023 but cooled compared to the highs registered in 2022 Annual Rent Change (%) Growth Vacancy Rate (RHS) 22% 18% 14% -6% -10% 10% 8.7% 8% 5.2% 4.9% 5.2%

66 Making Hybrid More Human in 2024

From theory to action — CRE leaders are putting strategies in place to make the workspace a center of collaboration and innovation.

68

Small and mid-size firms — which account for most of our Corporate Survey respondents — are holding their plans for new and expanded facilities in check despite economic news being better than what had been predicted.

48

The responding consultants say economic pressures are creating the biggest potential impact for their clients’ location and expansion plans, with finding available skilled labor being the most important concern.

“We’ve got to make sure we’re building the energy source of the future, not just thinking about next year, but 10 years from now, 20 years from now. That’s why we’ve invested in solar, and wind, and biofuels, [and] energy efficient cars.”

Barack Obama (1961– )

6 Editor’s Note

72

8 Rethinking Industrial Site Selection: A Retail Perspective

10 Smart Building Resolutions for 2024

11 Solutions Needed for Truck Driver Shortage

12 Impact of the Latest Minimum Wage Increases

Brian

AREA DEVELOPMENT | Q1 2024 3

Annual Reports

Electric Power Demands Key to Location Decisions In Focus

Frontline

14 First Person

Murphy, Americas Power, Utilities & Renewables Tax Leader, EY

Index/Web

71 Ad

Directory

Last

Word

POSTMASTER: Send address changes to Area Development, Circulation Department, 30 Jericho Executive Plaza – Ste 400W Jericho, NY 11753. Subscribers requesting address changes must provide both old and new addresses. © Copyright 2024 by Area Development® magazine. ISSN: 1048-6534. Printed in the U.S.A. Area Development® is a registered trademark of Halcyon Business Publications, Inc.

Striking a Balance: Prioritizing Electric Infrastructure While Preparing for the Next Wave of Industrial Expansion

59 | Number 1 Q1 2024

Departments Volume

44th President of the United States

interconnected

Survey Corporate

The Dynamic Landscape of Logistics in Mexico Companies considering nearshoring operations to Mexico will find a resilient and

logistics network to handle their import and export processes. Annual38th

34

Annual20th Survey Consultants

Electric Power Demands Key to Location Decisions

Analysts say that the biggest barrier to getting consumers to purchase electric vehicles is the dearth of charging infrastructure. In fact, according to a CNBC poll,1 nearly half of Americans say they doubt they would purchase an EV as their next car, citing a lack of charging options as well as the high costs.

Looking at the situation from another angle, it’s not just consumers who are looking to “plug in” but industry as well. Courtland Robinson, a guest editor of this issue and an energy and location strategist, tells us that “access to electricity has materialized as a dominant location determinant in the corporate site selection process.” As the digital economy has grown, companies have begun to compete for transmission-adjacent properties.

Matt Olson, Burns & McDonnell’s chief innovation officer, who was interviewed by Courtney Dunbar, site selection director at Burns & McDonnell and another guest editor of this issue, agrees that today’s digital transformation of industry is prioritizing access to electricity. He notes that corporate site selectors are now focused on “electron superhighways spanning nearly 160,000 miles.” Courtney and Courtland conclude that striking a balance between “the demands of utility driven industrial projects and the diverse needs of developers and communities is paramount.”

Others responding to our 20th Annual Consultants Survey concur with Courtland Robinson and Matt Olson, ranking energy availability and costs among the top-10 site selection factors. It appears that as the digital transformation of industry continues, the consumption of electricity is only predicted to increase.2

Editor

1 https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/ 2 https://insideevs.com/news/657660/us-electric-car-sales-january2023/

AREA DEVELOPMENT

Publisher Dennis J. Shea dshea@areadevelopment.com

Sydney Russell, Publisher 1965-1986

Business/Finance Assistant Barbara Olsen (ext. 225) olsen@areadevelopment.com finance@areadevelopment.com

Advertising/National Accounts advertising@areadevelopment.com

Editor Geraldine Gambale editor@areadevelopment.com

Staff and Contributing Editors

In-House Art & Design Circulation/Subscriptions circ@areadevelopment.com

Production Manager Jessica Whitebook jessica@areadevelopment.com

Business Development Manager Matthew Shea (ext. 231) mshea@areadevelopment.com

Guest Editors

Courtney Dunbar

Digital Media Manager Justin Shea (ext. 220) jshea@areadevelopment.com

Web Designer Carmela Emerson

Courtney Dunbar, CEcD, EDFP, AICP, manages the site selection consulting group at Burns & McDonnell. Her career has centered on industrial development, creating solutions for corporate and institutional clients around the world and delivering multimillion-dollar, bottom-line growth. She is actively engaged in industrial site planning, site selection, site certification, economic analysis and community planning. She is a sought-after speaker on topics related to economic development site preparedness, as well as a faculty instructor on topics of real estate and infrastructure development at both the Heartland Basic Economic Development Institute and the University of Oklahoma's Economic Development Institute.

Courtland Robinson

Over the last decade, Courtland Robinson has supported hundreds of industrial and commercial site selection projects, representing economic development interests through local, state, and Fortune 500 employment. Most recently, Courtland provided power-intensive site selection consulting services for one of the largest energy holdings companies in the U.S. Prior to that, he served as managing director for the Virginia Economic Development Partnership, where he oversaw the strategy and implementation of business development efforts in both Asia and North America.

EDITORS NOTE 4 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Q1 2024

www.areadevelopment.com

Lisa Bastian Mark Crawford Dan Emerson

Business Publications, Inc. President Dennis J. Shea Correspondence to: Area Development Magazine 30 Jericho Executive Plaza Suite 400 W Jericho, NY 11753 Phone: 516.338.0900 Toll Free: 800.735.2732 Fax: 516.338.0100

Steve Kaelble Mark Schantz Karen Thuermer Halcyon

2024 EDITORIAL ADVISORY BOARD

Scott Kupperman

Kupperman Location Solutions Founder

Amy Gerber

Cushman & Wakefield Executive Managing Director, Business Incentives Practice

Courtney Dunbar

Burns & McDonnell Site Selection & Economic Development Leader

Brian Gallagher

Graycor Vice President, Corporate Development

Chris Schwinden

Site Selection Group Partner

Scott J. Ziance

Vorys, Sater, Seymour and Pease LLP Partner and Economic Incentives Practice Leader

Lauren Berry

Maxis Advisors Senior Manager, Location Analysis and Incentives

Joe Dunlap

CBRE Consulting Managing Director, Supply Chain Advisory

Eric Stavriotis

CBRE Vice Chairman

Alexandra Segers

Tochi Advisors General Manager

Stephen Gray

Gray, Inc. President & CEO

Marc Beauchamp

Hickey Canada Managing Director

Chris Volney

CBRE Managing Director, Americas Consulting

Chris Chmura, Ph.D.

Chmura Economics & Analytics CEO & Founder

Courtland

Robinson

Energy & Location Strategist

Brian Corde

Atlas Insight Managing Partner

Dennis Cuneo

Walbridge Director, Site Selection Services

Bradley Migdal

Cushman & Wakefield Executive Managing Director, Business Incentives Practice

David Hickey

Hickey & Associates Managing Director

Matthew R. Powers

OnPace Partners Partner

Alan Reeves

Newmark Senior Managing Director

Dianne Jones

JLL Managing Director, Business and Economic Incentives

6 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

#5 Business Incentives Program in U.S. #7 Overall Cost of Doing Business 5% Corporate Tax Rate 20% Below National Average Cost of Living mississippi.org More leverage for your bottom line. GET MIGHTY.

FOCUS

Rethinking Industrial Site Selection: A Retail Perspective

The idea of putting the needs of the potential workforce first when making the location decision mirrors retail’s tradition of prioritizing customer satisfaction.

BY EVAN L. STAIR, Managing Director, Analytics, Vista Site Selection

In the dynamic world of industrial real estate, the art of pinpointing the ideal location for business operations is experiencing a profound evolution. Gone are the days when decisions were made solely on the basis of logistics and bottomline costs. In a refreshing twist, savvy companies are now borrowing a page from the retail sector’s book, embracing a strategy that places the spotlight on an often-overlooked aspect: the workforce. This innovative approach mirrors the retail industry’s longstanding tradition of prioritizing customer satisfaction, underscoring a significant shift toward a more peoplecentered business model.

Traditionally, the quest for the perfect industrial site was dictated by logistical imperatives — proximity to transportation arteries, supplier accessibility, and the allure of cost efficiencies. Yet, in today’s competitive landscape, where attracting and retaining top-tier talent has become a Herculean task, businesses are compelled to rethink their priorities. The modern industrial site selection process now ventures beyond the conventional, aiming to create environments that cater not just to the operational machinations of business but to the holistic well-being

and engagement of the workforce.

Adopting tactics reminiscent of retail’s savvy in engaging customers, businesses are meticulously analyzing workforce demographics, lifestyle inclinations, and the pulse of local communities to infor m their site selection. Imagine an industrial powerhouse opting for a location not just for its logistical conveniences but for its vibrant community, rich in amenities and educational opportunities, poised to attract the skilled workers essential for its operations.

This paradigm shift extends its reach into recruitment and workplace ethos. In a move akin to retail’s targeted marketing strategies, industrial entities are harnessing the power of digital platforms and social media to woo potential employees, showcasing not just job openings but a vision of a fulfilling career within innovative and sustainable workspaces. These environments are designed with an eye towards promoting health, well-being, and a commitment to environmental stewardship.

Prioritizing Employee Satisfaction

Illustrative of this trend are companies making strategic location decisions that align with their workforce’s needs. A tech firm may gravitate toward areas abuzz with academic institutions, ensuring a steady

influx of fresh talent, while a logistics enterprise might prioritize sites with robust public transport links, easing the daily commute for its team. Such decisions are a testament to a nuanced understanding that operational efficiency and employee satisfaction are two sides of the same coin.

Moreover, the emphasis on community engagement and forging meaningful partnerships with educational bodies echoes the retail industry’s knack for creating immersive customer experiences. Through these collaborations, businesses not only secure a pipeline of skilled labor but also cultivate a brand persona that resonates with community values and aspirations, thereby attracting a more engaged and dedicated workforce.

The narrative of reimagining industrial site selection, inspired by retail insights, is a harbinger of a broader movement toward sustainable, people-first business practices. This forwardthinking approach acknowledges employees as crucial stakeholders, whose preferences and needs are pivotal in shaping the future of industrial sites. Embracing this transformation, companies are poised to navigate the intricacies of the modern labor market with agility and foresight, ensuring their longevity and prosperity in an ever-evolving economic landscape. This story, rich in innovation and strategic acumen, invites readers to contemplate a future where businesses flourish by putting people at the heart of their operations, heralding a new era in industrial site selection.

8 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com IN

A Division of the Missouri Department of Economic Development

Smart Building Resolutions for 2024

By John Fleming, Vice President, Global Development for Sustainable Infrastructure at Johnson Controls

Building owners may look at the new year as a time to make good on goals they set for their buildings in previous years – whether that means upgrading outdated technology, focusing on net-zero carbon goals, or enhancing occupant experience.

The key to reaching any of these lies in the strategic advancement of smart building initiatives by building owners. This can look different for each building depending on the needs, goals, and budget set in place for a given year. However, certain steps should be considered before embarking on the

journey to transform an existing structure into a smart building.

1. Revisit your priorities. The first step in determining a direction is understanding where you’re starting from. Have priorities shifted? Should they? What are your goals around automation, deferred maintenance, improving building performance and more, and how are you getting there?

2. Ask these questions: Create a list and prioritize setting time with teams to uncover the following:

• How can we increase energy and water efficiency to reduce operating costs?

• What are our opportunities to automate manual tasks to manage labor shortages and boost productivity?

A new year brings fresh opportunities to elevate your building in order to reach your energy and infrastructure goals.

• How do we plan to tackle deferred maintenance to ensure continued operation?

• What are our plans to improve building performance to meet sustainability mandates?

3. Walk the terrain. See how your priorities are playing out across facilities. If you’re focused on reducing energy costs, are you having discussions around controlling energy use? Or if you’re aiming to streamline workflows, pay attention to what’s happening manually day-to-day. Put yourself in each situation to see how things are currently being done and how they can be improved.

4. Find a trusted advisor and schedule assessments (often). Work with an expert to learn what technology and infrastructure options are available for your specific needs. Once a partnership has been made, it’s time to assess your building’s current state – look at your building holistically to help address opportunities to upgrade indoor air quality, energy efficiency, security, and more.

5. Maximize available funding. Understand the cost of upgrades and retrofits then look to take advantage of any government initiatives or innovative funding approaches. How is the infrastructure bill impacting your work? What are the financing options available to you based on your energy efficiency goals? Will your city or county provide support if you meet certain criteria? Knowing the answers to these questions can help lower your stress while bringing your project to life.

Proactive measures taken early will help prevent costly and unwanted infrastructure challenges in the future. A new year brings fresh opportunities to elevate your building in order to reach your energy and infrastructure goals. Setting resolutions and sticking with them will ensure your smart building stands strong in 2024 and beyond.

10 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com IN FOCUS

FRONT LINE

Solutions Needed for Truck Driver Shortage

The supply chain continues to be negatively affected by a shortage of long-haul truckers, in particular, but recruiting more military veterans and women may be part of the solution.

BY DAN EMERSON

No one would dispute the importance of the trucking industry in the U.S. supply chain. Truck drivers transport more than 70 percent of the nation’s goods across the country. However, the industry has been hamstrung by a shortage of long-haul truckers. The American Trucking Associations (ATA) estimates that the industry will need to hire nearly 1.2 million new drivers over the next decade to replace truckers leaving due to retirement or other reasons.1

Increasing pay and other incentives have helped the industry attract new drivers, says Steve Viscelli, a sociologist at the University of Pennsylvania and the author of the book The Big Rig: Trucking and the Decline of the American Dream, but there are not enough new drivers entering the industry each year to make a significant difference in the shortage — especially in the longhaul, for-hire truckload sector, the part of the industry most acutely impacted by the shortage.

The average trucking company has a one-year turnover rate of roughly 95 percent, according to Trucking Info.com.2 Why the high turnover? Industry observers say the primary reason is poor working conditions that

make long-haul trucking an undesirable profession.

One of the major root causes of those problems was the deregulation of the industry in the 1980s, which, over time, transformed trucking from a steady, wellpaid profession to poorlypaying gig work with long hours, according to Viscelli. Today’s drivers earn about 40 percent less than they did in the late 1970s, Viscelli says, but are twice as productive as they were then.

Now that truck drivers are gig workers, the inefficiencies of the supply chain are making the jobs worse and worse. Viscelli says the solution to the retention problem “has been known for a while — higher pay, and pay for all the work,” which includes the time drivers spend waiting for their cargo to be loaded, and overtime work caused by that delay. By contract, drivers for some employers are supposed to get “extra” pay for that time, “but they have to ask for it,” Viscelli told Area Development. “That model of putting inefficiency on drivers and having the cost come out of their paycheck is a fundamental problem,” he explains. However, one of the models that has emerged is having a local driver who is being paid hourly assemble loads, so they are ready to go, which “dramatically improves the

experience” for long-haul drivers.

Some Solutions

In 2023, Reps. Mike Gallagher (R-WI) and Abigail Spanberger (D-VA) reintroduced their bipartisan Strengthening Supply Chains Through Truck Driver Incentives Act, which would provide a short-term, fast, and straightforward incentive to attract and retain new drivers. The GallagherSpanberger bill would create a two-year refundable tax credit of up to $7,500 for truck drivers holding a valid Class A commercial driver’s license (CDL) who drive at least 1,900 hours in the year. It would also establish new incentives for Americans to enter registered trucking apprenticeships.

To recruit more long-haul drivers, there are at least two under-utilized categories of workers — women and military veterans, according to experts.

The Biden-Harris Administration’s plan to address supply chain problems includes “focused” outreach and recruitment of veterans, with the help of the various service branches. There are an estimated 70,000 vets who are “likely” to have certified trucking experience within the last five years, according

to the Department of Labor’s Veterans Employment and Training Service. The plan also includes reducing barriers to drivers getting commercial driving licenses and encouraging more Registered Apprenticeships.

Women drivers are grossly under-represented in the trucking industry, according to government statistics, accounting for only 4.8 percent of the 1.37 million drivers in the U.S., as of 2021.3 Gender discrimination and sexual harassment are major causes, according to industry experts. Trucking companies often refuse to hire women if they do not have women available to train them. Because there are few female trainers to meet the need, same-sex training policies are common across the industry, truckers say, even though a federal judge ruled in 2014 that it was unlawful for a trucking company to require that female job candidates be paired only with female trainers.

1 https://www.prnewswire.com/ news-releases/ata-drivershortage-remains-near-recordhigh-301658985.html

2 https://www.nytimes. com/2022/09/28/business/ driverless-trucks-highways.html

3 https://www.nytimes. com/2023/10/05/business/ economy/women-truck-drivers. html?searchResultPosition=8

AREA DEVELOPMENT | Q1 2024 11

FRONT LINE

Impact of the Latest Minimum Wage Increases

The new year brings some significant changes that will impact employers who have entry-level workers, with 22 states raising their minimum wages effective January 1st.

BY DAN EMERSON

The impact of raising the minimum wage has been a perennial topic of debate. The new changes come in the midst of what continues to be a historically tight labor market, with heightened competition among employers looking for workers.

However, in the modern era, many manufacturers are less impacted by minimum wage requirements than in the past, since today’s manufacturers tend to rely less on low-skill workers. Even so, for manufacturers, “it has been challenging the last few years not only to find skilled employees, but also to find entry-level workers,” says Kathy Mussio of New Jersey-based consulting firm Atlas Insight. “Some manufacturers have lines idling because they can’t find enough people.”

Many manufacturers had already adjusted before the most recent January 1st minimum wage hikes took effect, according to Mussio. There were labor shortages pre-Covid, but the pandemic made the labor shortage problem even worse for many.

Automating processes can be a partial solution to the labor shortage problem, along with other ways to streamline, cut waste, and find other operational efficiencies. “But manufacturers are not thinking, ‘I’ll

automate so I can fire more people.’ They’re focused on how to make more product, increase their efficiency, and minimize downtime,” Mussio says.

While manufacturing in the U.S. has evolved to incorporate more technology and automation in the process, “not all manufacturing is easy or clean,” she points out. “We’ve come a long way, but there are still some manufacturing jobs where the plant floor is loud, hot, and sometimes even dirty.”

For a jobseeker choosing between working in a loud, sometimes hot manufacturing plant for $15 an hour, or working at an air-conditioned warehouse stocking shelves for $15 an hour, the manufacturing job option may well seem less appealing.

Absorbing the Increase

“Not every manufacturer has a high profit margin. If labor costs increase further, squeezing the profit margin for lower margin businesses, the higher wage costs will have to get passed on somewhere,” Mussio points out. The higher labor costs get passed ultimately to customers, increasing the cost of the goods. While some companies do try their best to absorb some of these increased labor costs, at some point, “they have to get passed along.”

The higher labor costs get passed ultimately to customers, increasing the cost of the goods.

Labor is very cost-sensitive. If minimum wage increases require employers to pay lower-end workers more per hour, that typically leads to pay increases for those who are above them on the corporate “ladder.” And companies vary widely in their ability to absorb wage increases.

Along with raising prices, there are other ways to absorb minimum wage increases — especially long-term — experts say. Those include making processes more efficient, investing more in technology, outsourcing some “noncore” functions, increasing and improving employee training, and adopting part-time or flex staffing.

Employers who have workers employed in “remote” locations need to be aware of the difference in minimum wage in a particular state and even locally where the remote

employee is working. “For example, you may have an entry-level employee working remotely, and while the employer may be located in a low minimum wage state and city, you typically would be required to pay at least the state and local minimum wage where the entry-level remote employee works,” Mussio explains.

A study released in 2023 by economists at Wharton University and several other institutions1 shed some new light on the minimum wage debate. One of their conclusions is that raising the minimum wage does not automatically guarantee workers higher income, employment, and welfare in the long run.

The authors suggested a more effective way to improve the long-term situation of low-income workers than large increases in the minimum wage. Combining existing “transfer programs,” such as the earned-income tax credit, or a progressive tax system, with a modest increase in the minimum wage provides even larger welfare gains for those workers, according to the study.

1 https://knowledge.wharton.upenn. edu/article/why-raising-theminimum-wage-has-short-termbenefits-but-long-term-costs/

12 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Some of the best educated, most productive workers in the country live here. They send their children to America’s best public schools. And they’re a perfect fit for complex engineering challenges, like the space suits made for NASA at Collins Aerospace. Tomorrow is here in Connecticut. advancect.org

FIRST PERSON

BRIAN MURPHY, AMERICAS POWER, UTILITIES & RENEWABLES TAX LEADER EY

The Inflation Reduction Act passed in 2022 will provide approximately $270 billion in tax incentives to stimulate the nation’s clean energy industry. Do manufacturers need to meet certain requirements to qualify for the tax credits and other financial inducements?

Murphy: To receive the credits and/or incentives outlined in the IRA such as the Advanced Manufacturing Tax Credit (45X) or the Advanced Energy Project Investment Tax Credit (48C), manufacturing companies must meet certain criteria. For 45X, eligible outputs or “components” are organized into five buckets: inverters, solar energy, wind energy, qualifying battery and applicable critical minerals. As a

manufacturer, if output falls into one of those categories, then the taxpayer is generally qualified for the credit Guidance recently stated that the amount of credit received is entirely dependent on the component produced; the origin of subcomponents and other inputs does not impact a taxpayer’s ability to claim the credit for U.S.-based manufacturing of eligible components (i.e., 45X does not have a domestic content rule). For 48C, during the first round of funding, manufacturers had to apply for each of their individual facilities, ensure the eligible property had not yet been placed in service, and “submit an application narrative, an application workforce and community engagement plan, a business entity certification, an application data sheet and appendix files.” When the second round of funding opens in 2024, manufacturers who did not apply in the first round should look to follow the same instructions. It’s worth noting that after an allocation is received, taxpayers have a four-year window in which to place the project in service.

Among the federal agencies through which IRA funds will flow are the departments of the Treasury as well as Agriculture, Energy, and the EPA, the latter three receiving $120 billion combined to promote renewable, clean energy and accelerate key U.S. sustainability goals. How does this tie in with manufacturers’ ESG goals?

Murphy: In addition to reducing carbon emissions (“E”) in the U.S., the IRA has a number of critical and socially (“S”) focused objectives including elevating wages, retraining people, developing careers, restoring impacted communities, and bringing critical manufacturing back to the U.S. Having the IRA’s funds flow through these federal agencies also promotes and facilitates the establishment of stricter, and necessary, environmental regulations and standards (“G”). By concentrating funds and incentives on a sustainability and carbon reduction agenda, energy and related manufacturing companies pursuing these incentives will directly advance federal policy objectives while also elevating and accelerating their own ESG-related goals and objectives.

14 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Why is collaboration between a company’s tax and finance departments and those charged with meeting its ESG goals important?

Murphy: The opportunities for synergies between tax, finance, and operations departments, with those focused on ESG-related goals and reporting, have expanded significantly with the IRA. According to a recent study by Morningstar,1 corporate tax risk is rising, and tax transparency is an absolute necessity for shareholders. Companies qualifying for incentives under the IRA typically have significant ESG-style requirements to secure the benefits. By proactively embracing both these increasing shareholder expectations and IRA compliance obligations, companies can position themselves as leaders in responsible financial reporting and gain a competitive advantage. These reporting requirements continue to progress (as we recently saw in December’s FASB update2) and will continue to evolve over time — which is all the more reason for tax teams to be (or remain) at an organization’s “ESG center.”

Considering the amount of data gathering needed to comply with the IRA, tax departments should look to work closely with the relevant divisions within their organization to ensure goal alignment. A key opportunity is to ensure that data gathered is being utilized to not only comply with the IRA, but to provide shareholders and investors with the necessary information to measure and track company progress related to ESG or related sustainability objectives. With tax playing such a centralized role in communications between the critical departments (HR, finance, procurement, legal, accounting, etc.), tight coordination will likely streamline the effort to confirm ESG goals are being met while also remaining compliant from a reporting standpoint.

What

reporting mechanisms will companies need to put in place to show that they are in compliance with sustainability and other goals they have set?

Murphy: As reporting requirements evolve, so should the company’s data collection. Information gathering is important, but companies often don’t have streamlined processes in place to handle the true scope of their reporting needs. Collecting and analyzing data for reporting can be complex, and more and

The opportunities for synergies between tax, finance, and operations departments have expanded significantly with the IRA.

more companies are requiring in-depth process reviews to ensure compliance. By proactively addressing these challenges and investing in the right technology solutions, companies can maintain accurate, efficient, and timely reporting. In 2024, companies must consider reporting requirements linked to the SEC’s proposed carbon and ESG reporting, as well as ensuring that tax benefits are being realized and properly reflected in business plans when working with vendors, contractors, and regulators.

Is there anything else you’d like to add?

Murphy: The convergence of tax policy and ESG related requirements in the U.S. creates a unique opportunity for companies to develop their data collection processes in a manner that will satisfy and promote multiple objectives. Tax departments need to have a seat at a company’s ESG table, and by embracing the transformative power of total tax contribution reporting, companies can strive toward a more transparent, inclusive, and responsible global business environment.

1 https://www.morningstar.com/sustainable-investing/tax-risk-isgrowing-companies-trouble-ahead-cisco-systems-microsoft

2 https://tax.thomsonreuters.com/news/newly-issued-fasb-rulesrequire-fuller-disclosure-of-taxes-paid-in-us-other-countries/

THE ASSIGNMENT

The Inflation Reduction Act (IRA) of 2022 set aside $369 billion for investments in clean energy and advancing key U.S. sustainability goals. Brian Murphy of EY was asked by Area Development’s editor how tax and finance can collaborate to advance a company’s key sustainability goals. To read EY’s full paper on this topic, go to https:// www.ey.com/en_us/power-utilities/tax-andfinance-to-lead-key-provisions-of-ira

AREA DEVELOPMENT | Q1 2024 15

Up Next for Industrial in 2024

Here is a look at the normalizing sector’s upcoming supply, demand, and pricing outlook.

SBy Jason Price, Americas Head of Logistics & Industrial Research, Cushman & Wakefield

SBy Jason Price, Americas Head of Logistics & Industrial Research, Cushman & Wakefield

everal trends guide what is ultimately a normalizing industrial sector after back-to-back years of pandemic-fueled growth. Though we’re observing a slowdown and industry recessions across some industrial sectors, several factors show us that the sector overall is looking healthy.

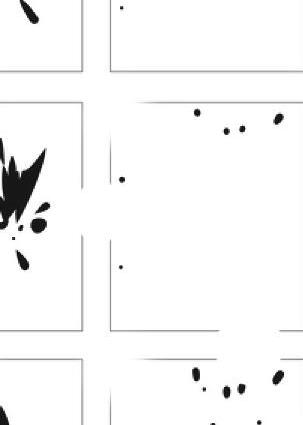

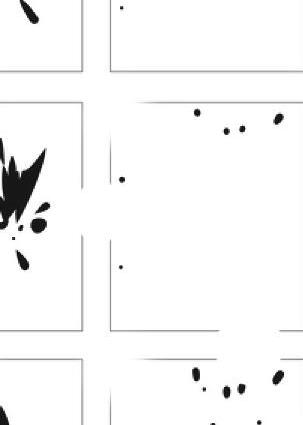

Changes are coming for absorption as driven by demand. Coming off frenetic years in 2021 and 2022, industrial net absorption downshifted in 2023. For context, in 2021 and 2022 combined, the market absorbed just under 1.1 billion square feet, which is about twice the norm — meaning that four years’ worth of demand occurred in just a two-year timeframe. We estimate that roughly half of this demand came from pull-forward impacts, as companies — namely those tied to online shopping — had to build out facilities networks sooner than planned.

The flip side of this surge is that it “borrowed” demand from the future, which is one reason why we expected demand to moderate meaningfully this year and next. We’re forecasting vacancy to continue to edge higher in 2024, especially in the first half of the year. However, context matters. Cushman & Wakefield has been tracking industrial data going back to 1995, and from 1995 to 2019, the U.S. industrial vacancy rate averaged 8 percent. The industrial boom that we observed over the last few years brought vacancy down to 2.8 percent in Q2 2022, which is more than twice as tight as the market had ever been. Now, we’re observing the inverse effect as demand slows.

Downward trends in goods consumption will also lessen the pace at which occupiers scale moving forward. While real incomes are now rising, consumers also face higher interest rates, a labor market in the early stages

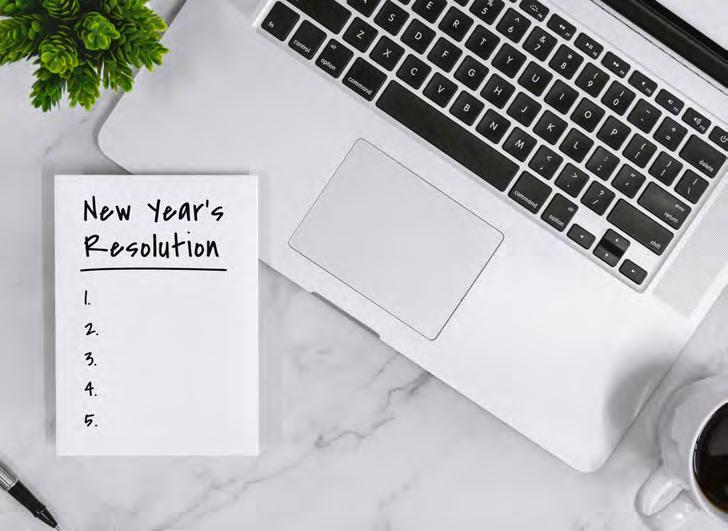

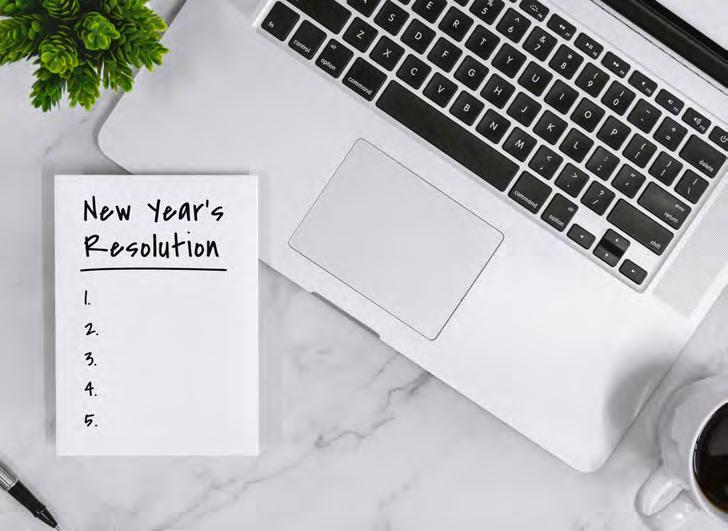

Overall Vacancy While Up Is Still Healthy

Rent growth remained positive in 2023 but cooled compared to the highs registered in 2022

16 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com > MARKET ANALYSIS

Source: Cushman & Wakefield Research Annual Rent Change (%) Rent Growth Vacancy Rate (RHS) 22% 18% 14% 10% 6% 2% -2% -6% -10% 200920102011201220132014201520162017201820192020202120222023 10.8% 10.8% 10% 8.7% 8% 7% 5.9% 5.2% 4.8% 4.5% 4.7% 4.9% 3.3% 3.1% 5.2% 10% Source: Cushman & Wakefield Research

Development-ready sites. Powerful incentives. Unrivaled global transport infrastructure. Explore the advantages at OpportunityLouisiana.gov/sites. 6 Interstates Certified Sites Incentives 6 Class 1 Railroads 6 Deepwater Ports IT ALL LEADS TO LOUISIANA

There is a finite window of about 18 months in which occupiers may find a slightly easier market to navigate, but that will quickly fade in 2025 as vacancy begins to recompress.

of softening, and an affordability crunch across the largest household budget line items. Given these formidable headwinds that will ultimately translate into weaker demand for goods, global trade flows will slow, and freight markets will remain oversupplied in the near-term.

Some occupiers are looking for new product to lessen the pressure on the market, but a decent share of the existing pipeline is accounted for, and development will taper off quickly as construction starts (measured in square feet) were down by 60 percent in 2023. Of the 452 msf currently under way, 114 msf is build-to-suit, and 23 percent of the total is preleased. The abundance of vacant spec product, while confronting a softer demand backdrop, still places an upper bound on vacancy. We still have approximately 330 msf of industrial product anticipated to deliver throughout the year, and as the new vacant speculative supply delivers, we’ll continue to see that upward pressure on vacancies, and our U.S. rate should peak around 6 percent.

There is a finite window of about 18 months in which occupiers may find a slightly easier market to navigate, but that will quickly fade in 2025 as vacancy begins to recompress. As we head to the second half of the decade, we forecast demand to return to its pre-pandemic pace (around 275 to 300 msf per year), while completions start to ramp back up. The current supply-demand imbalance will reverse, and vacancy will return to sub-5 percent.

Vacancy is our single most important predictor of where rent growth will head. Gearing down from just under 21 percent year-over-year (YOY) growth in 2022, we finished 2023 with rent growth at 10 percent YOY, and we expect that to be followed by approximately 4 percent in 2024.

There will undoubtedly be variation across markets and within markets. Some cities are structurally supply constrained due to land scarcity or zoning, while others will benefit from demand shifts (like being a cheaper inland market near expensive coastal cities). In almost all cases, vacancy will remain historically tight and demand for last-mile space, in particular, will remain fiercely competitive. The bottom line: Although there are some nearter m headwinds, the industrial sector still has extremely strong longer-term tailwinds. Rents are projected to start to reaccelerate in the second half of 2025 and into 2026, and industrial is demonstrating sustainable levels of rental rate growth — just not those double-digit growth rates that were recorded throughout 2022 and most of 2023.

Overall, expect absorption to moderate but remain positive, vacancy to rise but remain below long-term historical averages, and rents to tick higher — albeit at a slower rate. These are the signs of a normalizing market.

Industrial Absorption Decelerates in 2023

Source: Cushman & Wakefield Research

18 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Just under 1.1 billion square feet absorbed from 2021 to 2022 Net Absorption (MSF) 2020 2021 2022 2023 600 500 400 300 200 100 0

YOUR FUTURE

IS IN OUR SITES

in tennessee, you don’t have to look far for perfectly prepared sites. each site that bears our name is backed by the most rigorous set of site selection standards. when you consider your next project, look no further than tennessee.

experience all that tennessee has to offer at tnecd.com.

Navigating the Digital Transformation

Courtney Dunbar, site selection lead at Burns & McDonnell, recently asked Matt Olson, Burns & McDonnell’s chief innovation officer, about how companies are navigating the digital transformation and its potential of fostering sustainable, resilient manufacturing practices.

Dunbar: How did the COVID-19 pandemic impact the U.S. economy and industrial landscape, setting the stage for the digital transformation?

Olson: The COVID-19 pandemic delivered a harsh blow to the U.S. economy, triggering a deep recession and uneven recovery. While the government intervened with stimulus measures, industries reliant on in-person interaction like travel and retail were hit hard. However, this crisis also spurred a dramatic shift towards digitalization.

Lockdowns and social distancing measures necessitated a rapid adoption of remote work, benefiting industries like telecommunications and cloud computing. Consumers turned to online shopping, boosting e-commerce and lo gistics sectors. Businesses across various fields accelerated automation processes to adapt to labor shortages. These trends exposed the limitations of traditional models and highlighted the need for a digital future

This realization ushered in the “digital transformation.” Businesses embraced digital tools like cloud solutions and collaboration software. The remote work trend normalized, fostering a long-term shift in work culture and the growth of the digital workforce. The pandemic also exposed the critical need for robust digital infrastructure, paving the way for investments in reliable broadband Internet to support remote activities across various sectors.

Dunbar : How does the digital transformation impact corporate site selection, particularly in the context of electricity consumption and the expansion of energy prospectors?

Olson: The landscape of corporate site selection, particularly for clean energy components and advanced technology manufacturers, now prioritizes access to electricity as a primary determinant. The market’s focus has shifted toward transmission-adjacent properties, experiencing high demand from manufacturers, data centers, and various sectors vying for real estate along high-voltage corridors — electron superhighways spanning nearly 160,000 miles. This shift underscores the strategic importance of transmission-adjacent real estate in the corporate site selection process.

In addition, the recognition of supply chain leakage for critical components to support products produced in the U.S. has led to heightened demand for either reshoring or manufacturing duplicity that is putting significant strain on power availability. Aging transmission and distribution infrastructure, coupled with rising demand, has led to an environment where electric demand is outpacing electric availability.

Dunbar: How do labor force constraints, e-commerce trends, and the rise of cloud computing contribute to the increasing electricity consumption in industries?

Olson: The motivators pushing industrial occupiers toward higher levels of electricity consumption are multifaceted. Labor force constraints, including a shortage of skilled workers, coupled with the ascent of e-commerce and the demand for cloud computing, are compelling corporations to analyze more data and operate with fewer people. The resultant digital economy underscores the significance of transmission-adjacent real estate, making it a forefront consideration in the site selection process.

Dunbar: How can technology address labor shortages in manufacturing facilities, especially in the context of the digital transformation?

Olson: Technology plays a pivotal role in addressing labor shortages by leveraging advanced automation and robotics. The digital transformation, characterized by the bridge between digital possibilities and industrial realities built with electrons, aligns with the implementation of technology in manufacturing. Automation handles repetitive tasks, freeing up human workers for more complex roles. Predictive analytics and workforce management software are valuable tools that can help forecast poten -

The landscape of corporate site selection…now prioritizes access to electricity as a primary determinant.

20 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com > SUSTAINABILITY

tial labor shortages, enabling proactive adjustments in staffing levels and the implementation of training programs.

Dunbar: How can manufacturing facilities reduce their carbon footprint, and how does this align with the broader push toward sustainability in the industrial sector?

Olson: Achieving sustainability involves adopting ecofriendly practices and leveraging technology. The focus on renewable energy sources, energy-efficient machinery, smart building technologies, and energy storage in manufacturing facilities mirrors the broader industrial push toward a lower carbon footprint. Many industrial processes need heat, driving industrial carbon emissions; by using thermal heat batteries, we can turn low-carbon intermittent energy sources into reliable 24/7 power sources needed for industrial work. By integrating these technologies, manufacturing facilities contribute to reducing environmental impact and promoting leaner, more ef ficient operations with lower goods costs.

Dunbar: How can technology enhance supply chain resilience, and what role does it play in addressing disruptions?

The focus on renewable energy sources…in manufacturing facilities mirrors the broader industrial push toward a lower carbon footprint.

strategy, and what role does risk mitigation play in site selection?

Olson: Recent economic development announcements and pressures, coupled with the digital transformation, continue to reverberate through 2024. Risk mitigation, a core aspect of site selection, demands a higher degree of collaboration. While electric service delivery and scalability remain crucial, they must be managed alongside considerations such as water availability, labor demands, supply chain modeling, and other real estate criteria. Industrial occupiers are urged to adopt a utility-first and an all-of-the-above approach to site selection.

Dunbar: How do these technological advancements collectively shape the industrial landscape, and what should

The best LOCATION on the web to help with your corporate LOCATION needs. The best LOCATION to start your site and facility search. The best LOCATION to stay on top of industry needs. The best LOCATION for the newest and most relevant industry produced studies and research papers. LOCATION. LOCATION. LOCATION. Visit www.areadevelopment.com

Why Smaller May Be Better for Some Businesses

Although records have been set for massive industrial spaces, the market has been shifting to smaller buildings.

By Tim Logan, Partner at Parker Poe

The market for industrial projects exploded during the COVID-19 pandemic when the industrial real estate market pushed a frenetic pace for expansion. In 2021 and 2022 new developments were planned for major distributors and logistics companies that needed more space to meet demand from consumers who were spending more time at home, completing home improvement projects, or rushing to set up remote offices.

The construction pipeline to build large, 100,000-plus square foot industrial sites was seemingly bursting at the seams. At its peak in 2021, the U.S. industrial market set records by completing nearly 400 million square feet of new construction, according to data from Colliers, a real estate services firm. To add to that impressive statistic, the market was also seeing historically low vacancy rates of around 4 percent coupled with record high asking prices for rent.

But today, the industrial market may be moving in a different direction. Demand dropped over the past several quarters and vacancy rates stand a percent higher at the end of 2023 , according to Colliers. Construction starts dropped off last year compared to new heights reached two years ago. Developers started construction on nearly 90 million square feet of industrial space in the U.S. in the third quarter of 2023, down by about half of a record 176 million square feet of starts during the third quarter from the previous year, according to Colliers.

As the market rights itself to pre-pandemic levels, a post-pandemic demand trend is emerging in the industrial market: building space for smaller end-users. Those companies that struggled to find the right facility in the 10,000 to 49,000 square foot range at the height of the industrial market boom are again looking for space.

Benefits of Building Smaller Industrial Sites

As that happens, developers will find there’s still a demand for smaller space. Companies looking to relocate or expand can find success in smaller industrial sites, which for the most part did not see the same boom in new development. As developers navigate the industrial market landscape, it’s important that smaller sites are considered to meet the demand.

At the height of the industrial market boom, most developers and investors were in search of credit tenants to fill 100,000-plus square feet spaces. The underlying financial prowess of these large tenants makes them less risky tenants because they are much more likely to be able to continue paying rent in the event of a lease or market disruption.

But leasing to multiple smaller tenants can also reduce the risk of new development by allowing developers to diversify their portfolios. Using this model, developers can diversify not only through different companies, but also different industry sectors and lease expiration dates. The risk of taking on a smaller tenant with less financial might is softened by the potential for other tenants to continue rent payments after one tenant vacates the property or its lease terminates in accordance with its terms.

During the development and construction phase of industrial developments, a flexible space allows developers to fur ther hedge risk until tenants can be identified. Developers have found success following a model of designing a large project that can be easily subdivided into spaces or multiple buildings.

Advance design planning on issues such as the placement and style of loading docks and tenant parking allows

22 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com > ASSET MANAGEMENT

Leasing to multiple smaller tenants can also reduce the risk of new development by allowing developers to diversify their portfolios.

a developer to seek a credit tenant for an entire project or divide space into multiple suites capable of a diversified portfolio of tenants.

The shift to smaller industrial sites comes with other benefits. It frees up users and investors from only looking at large sites that are increasingly rare close to larger population centers. Smaller sites can naturally fit on overlooked pieces of land that are closer to an urban core, the workforce, and key transportation arteries.

Even if a large site becomes available, it is still possible to develop smaller sites in stages. Property restrictions can

be drawn that give a developer great control over the nature of development, architectural consistency within a project, use restrictions or grants of exclusive users, and shared expenses for common amenities to the site. A patient developer can have great flexibility in dictating what can be built and when.

Final Takeaways

Vacancy rates may be high across the industrial market, but a need for smaller, flexible spaces for tenants may present an ongoing development opportunity.

The pandemic created a high demand for industrial space, which developers rushed to meet. As vacancy rates begin to creep up, the question today is what types of spaces are most in demand. With so much development of large spaces in the past two years, the need by companies for smaller spaces could remain as an area for continued development.

Tim P. Logan is a partner at law firm Parker Poe. He advises companies and individuals in the acquisition, sale, development, leasing, and financing of commercial real estate. He can be reached at timlogan@parkerpoe.com.

AREA DEVELOPMENT | Q1 2024 23

Photo: Kettering University

By

By

C O VER STORY 24 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com > INDUSTRY IN THE

OF THE ELECTRON

ERA

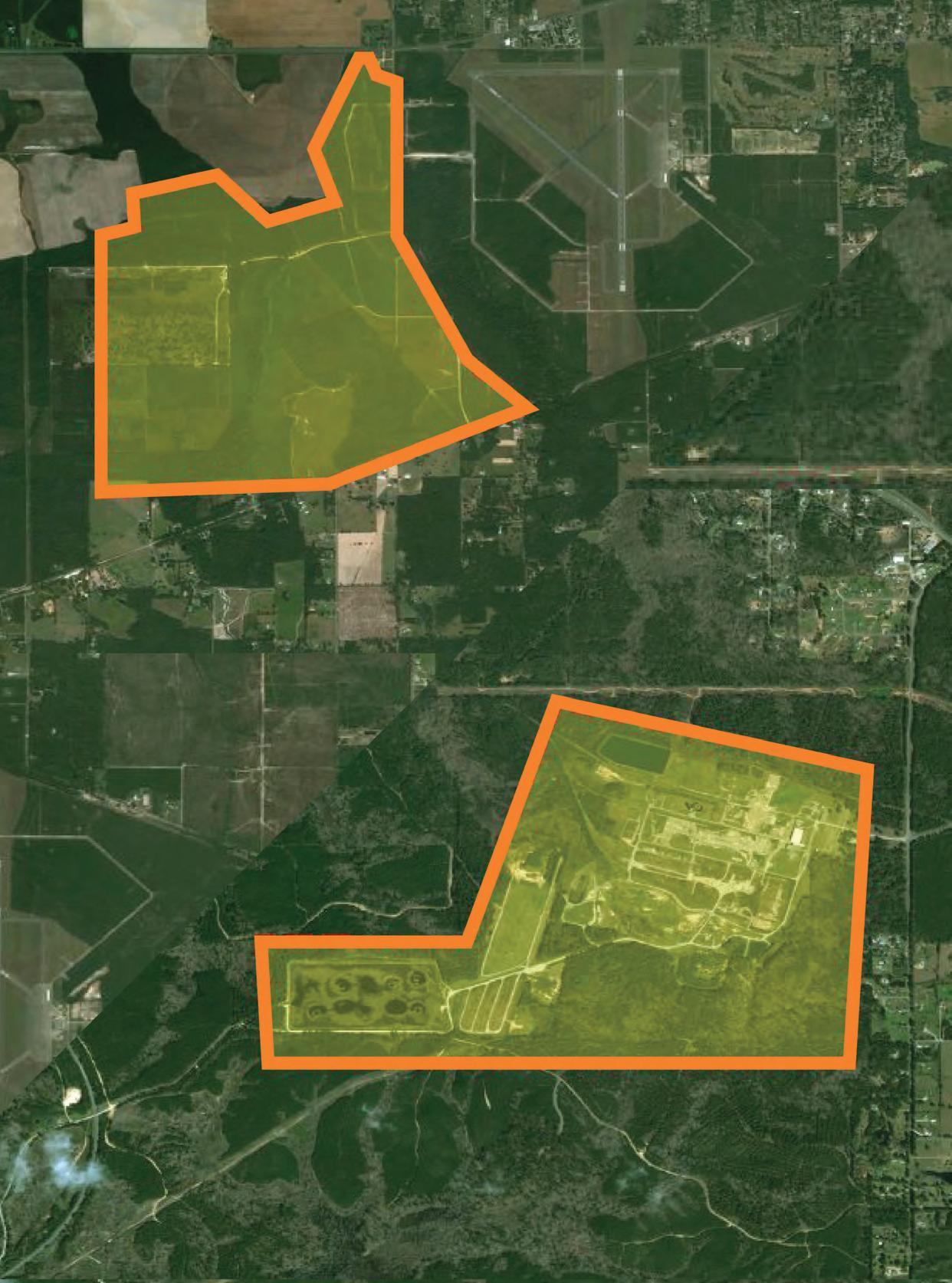

Location Strategist Growth of the digital economy has put transmission-adjacent properties and the ability to interconnect at the forefront of the site selection process.

Courtland Robinson, Energy &

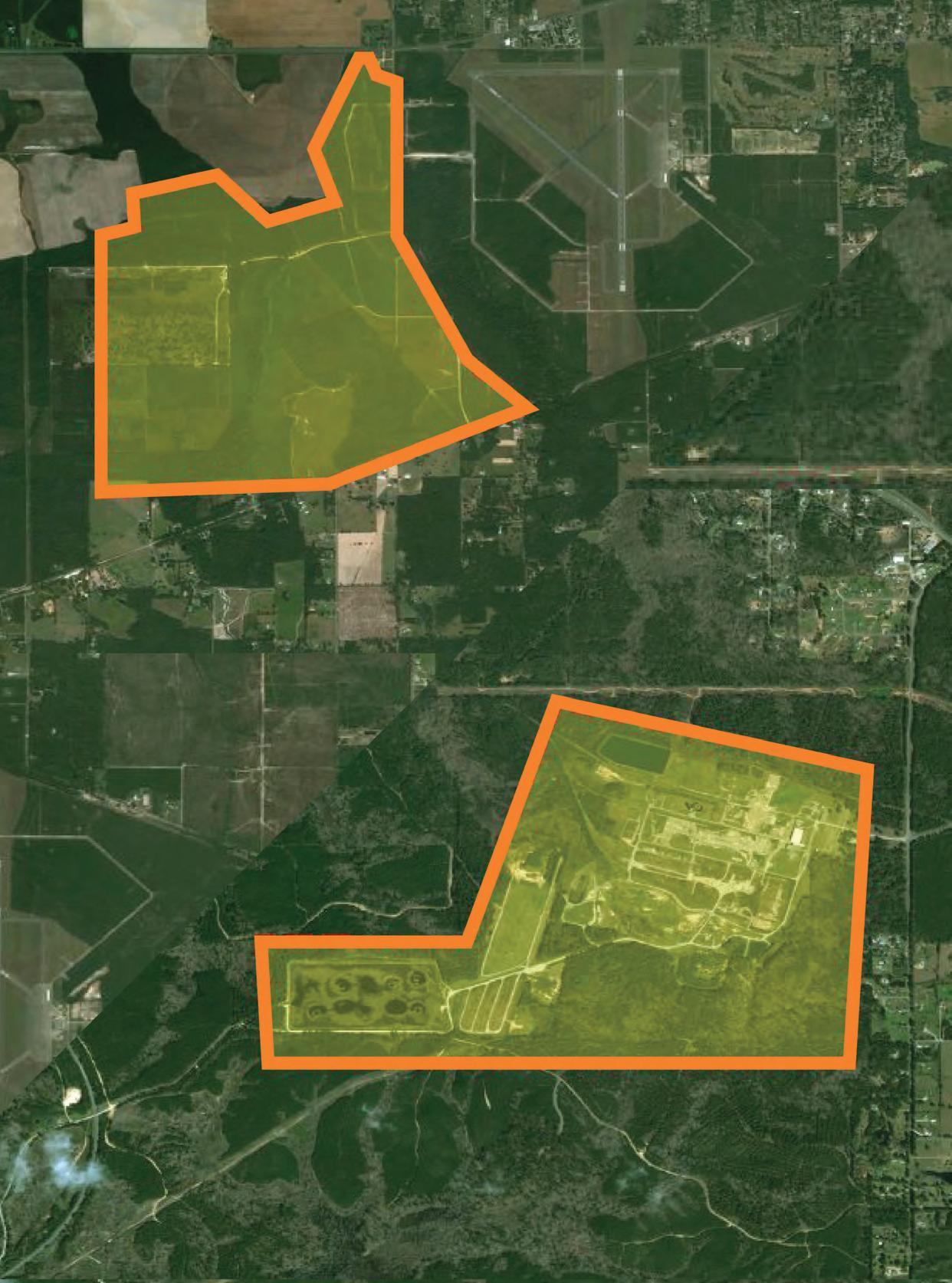

Along the backbone of the nation’s power grid is an expanded chessboard of energy prospectors posturing for control of power-intensive industrial real estate.

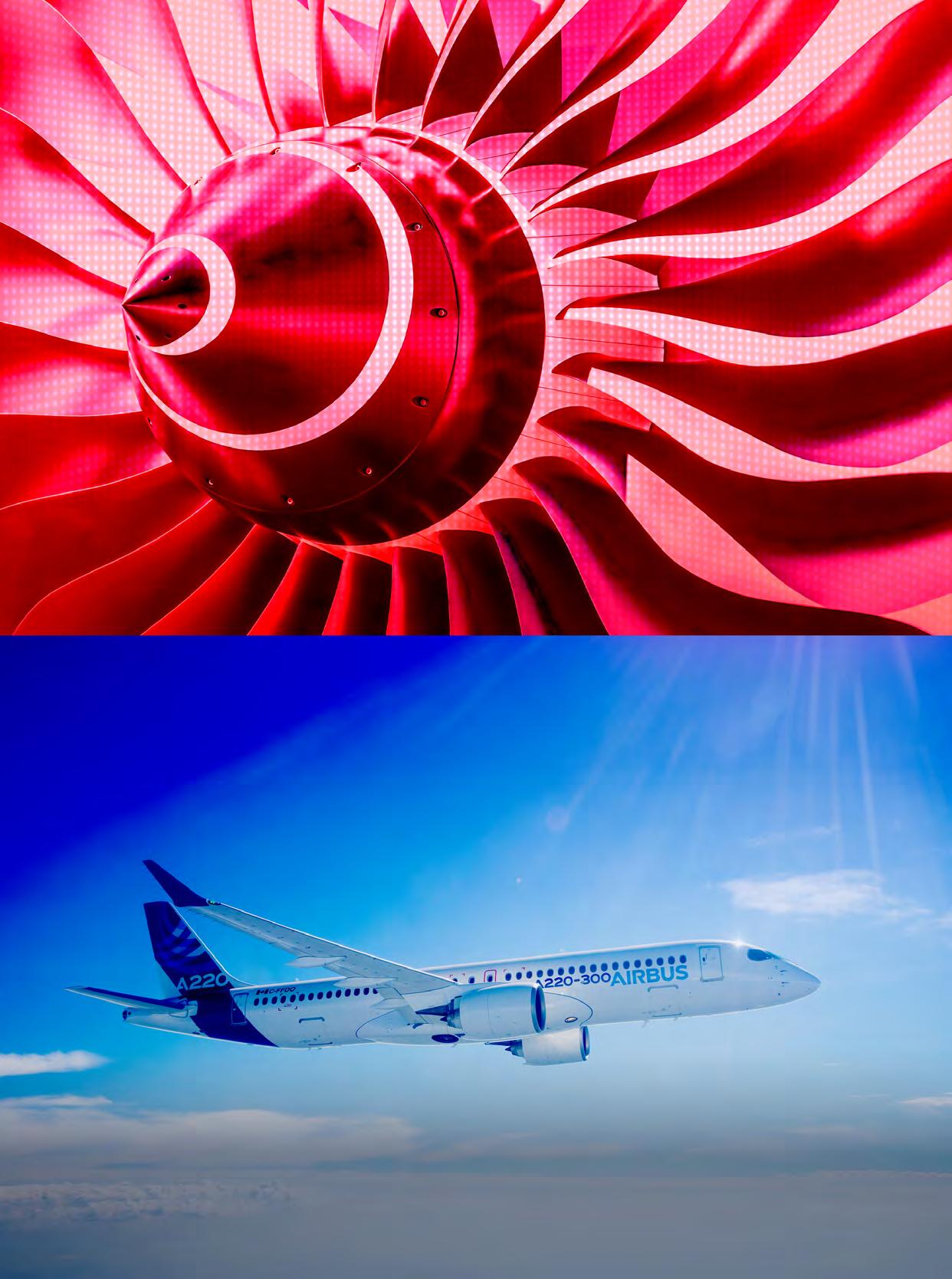

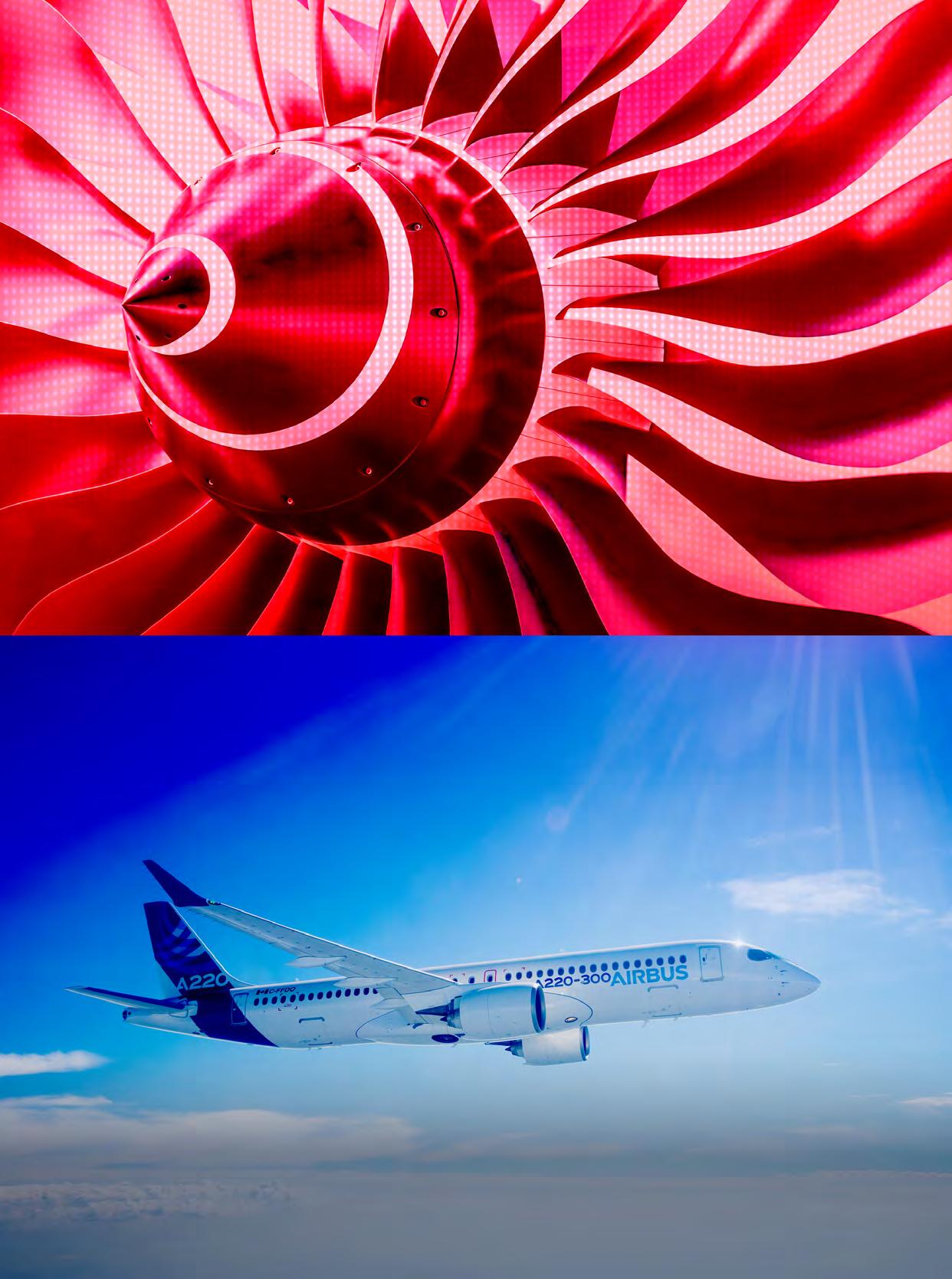

In 2020, the Unites States recorded a 49 percent drop in foreign direct investment (FDI)1, the U.S. economy contracted 3.5 percent2, and the country lost 9.4 million jobs during the COVID-19 pandemic.3 While uncertainty surrounding the pandemic and many other variables painted a negative picture for the economy in the following years, what went down as one of the deepest recessions in U.S. history ended up being one of the shortest, lasting only a few months. Federal stimulus quickly reignited GDP and global FDI flows in 2021 shot up 64 percent above 2020 levels4 — a pendulum-swing that catalyzed the digitalization of industry, prompted large-scale manufacturing construction projects around the country, and ushered in an era of unprecedented industrial electric demand.

A digital renaissance has now ballooned across industrial and commercial segments. A measure of market potential for clean energy component and advanced technology manufacturers, access to electricity has materialized as a dominant location determinant in the corporate site selection process. Along the backbone of the nation’s power grid is an expanded chessboard of energy prospectors posturing for control of power-intensive industrial real estate.

Reborn

Today, in pursuit of business capabilities forged only by data and advanced analytics, the bridge between digital possibilities and industrial realities is built with electrons. Electricity consumption required to scale cloud-based technologies is challenging transmission capacity in parts of the country, complicating project timelines following a significant surge in manufacturing construction.5 While today’s contenders for power are not new, they are reborn — each attempting to solve for headwinds that require additional quantities of power. Among the motivators pushing industrial occupiers toward higher levels of consumption are a concurrent shift in consumer habits and desire for digital goods and services, labor force constraints including a shortage of skilled workers, the continued ascension of e-commerce, carbon emission targets, mounting overhead costs, and the rise of AI and cloud computing.

Simultaneously, federal legislation introducing tax credits and incentives strengthened the business case for large investments within energy-intensive industries. These pervasive conditions have created a fresh environment for competition among different real estate classes, as transmission-adjacent properties across the country swarm with interested parties of all segments and sizes.

Semiconductor fabrication plants, electric vehicle and grid-scale battery manufacturers, data centers, solar panel producers, along with other sectors emboldened by private equity and tax credits, race to secure real estate along these high-voltage corridors — electron superhighways that connect the U.S. through nearly 160,000 miles of line. 6

Positioning for scalability in a crowded field, manufacturers commercializing innovative technologies move expeditiously through the site selection process, often without the abundance of historical data to forecast facility loads. Navigating these considerations while defending a gainst a trailing competitive position, models sometimes rely on inflated power demands to hedge against operating constraints or extrapolate data from pilot plants testing new production technologies. Fluctuating production targets, along with innovations in manufacturing technologies and process design, add to the complexity of these projects and further cloud the variance between usage prediction and meter readings.

One thing, however, is clear. The digital economy that we are quickly building suggests that transmission-adjacent real estate, and moreover the ability to interconnect, will continue to be at the forefront of the site selection process.

Industries in Perspective

Accelerated by shifting U.S. work habits, a switch to cloud-based technologies, and the use of AI, data center growth is soaring. Data centers now consider consolidation, growth in nontraditional markets, and investments into energy storage and generation as methods to rise above challenges related to the cost of capital, supply chain constraints, and issues with transmission-level interconnections. Energy density requirements to support processing power are hitting record levels, with “hyperscale” developers sometimes requiring peak demands between 500–1,000 megawatts (MW), approaching the generating capacity of a single nuclear reactor.

Driven in part by recent legislation — notably the Inflation Reduction Act and Chips and Science Act — electricvehicle, battery, and semiconductor projects have also raced to the grid. The U.S. Treasury reports that $100 billion in private-sector investment has been announced across the clean vehicle and battery supply chain. 7 Electrode, cell, module and packs, and other battery grade components manufacturing have inundated power-rich sites across the automotive belt and beyond. Similarly,

AREA DEVELOPMENT | Q1 2024 25

semiconductor announcements have swallowed large chunks of generating capacity in some U.S. markets, as larger fabrication campuses approaching full buildout can require a peak demand upwards of 1,200 MW.

Warehouse and distribution centers are lowering operating costs, reducing maintenance, and supporting sustainability goals by automating operations and adopting electric fleets. A large distribution center combined with an electric shorthaul fleet needs upwards of 15 MW at peak demand. Another way to look at the transportation sector’s potential impact on a single circuit — 50 Class 8 trucks/tractor trailers require approximately nine MW of peak demand availability, equal to that of New York City’s Empire State Building.

The buildout of refrigerated storage is another critical and more capital-intensive component to warehousing and logistics. However, the U.S. has struggled to keep up with ecommerce’s Covid-induced home-cooking and grocery shopping trends, despite millions of square feet of temperaturecontrolled storage space being added in recent years. On average, refrigerated warehouses consume upwards of 25 kilowatt-hours (kWh) of electricity per square foot. This puts the average 100,000-square-foot cold storage facility at a peak demand of 3.5 MW, equivalent to the needs of approximately 1,700 households.

Endgame

The steady advance of intelligent technologies and electrification will further etch power’s footing within industrial real estate strategy. While grid modernization, investments supporting greater transmission and generation capacities, and the commercialization of advanced energy systems will ultimately allow for much of this electrification to occur in concert, recent pressures placed by historically large U.S. economic development announcements will continue to reverberate through 2024.

Risk mitigation, the essence of site selection, has never demanded a higher degree of collaboration. Certainly, electric service delivery and scalability still need to be managed along with other pressing considerations including water availability, labor demands, supply chain modeling, and other real estate criteria. Industrial occupiers of all sizes should heed the utility-first and all-of-the-above approach to site selection.

1 https://unctad.org/news/global-foreign-direct-investment-fell-42-2020-outlookremains-weak#:~:text=The%20United%20States%20recorded%20a,mostly%20in%20 the%20primary%20sector

2 https://www.bea.gov/news/2021/gross-domestic-product-third-estimate-gdpindustry-and-corporate-profits-4th-quarter-and

3 https://www.bls.gov/opub/mlr/2021/article/covid-19-ends-longest-employmentexpansion-in-ces-history.htm

4 https://unctad.org/news/global-foreign-investment-recovered-pre-pandemic-levels2021-uncertainty-looms

5 https://www.census.gov/construction/c30/pdf/release.pdf

6 https://www.ncsl.org/environment-and-natural-resources/electric-transmissionplanning-a-primer-for-state-legislatures

7 https://home.treasury.gov/news/press-releases/jy1939

26 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com Who

Area Development Magazine The industry’s most respected magazine since 1965 Digital Media AreaDevelopment.com & Newsletters The leading website for corporate site and facility planning Face to Face Consultants Forums The industry’s leading best practices conference events for economic developers Let us work with you. Add to your marketing success. Area Development Magazine 30 Jericho Executive Plaza, Suite 400W Jericho, NY 11753 516-338-0900 Fax: 516-338-0100 www.areadevelopment.com

we are. What we do. Print Media

Cut through the noise.

Labor market insights to lead the way.

For site selection, workforce planning, and all your growth goals, JobsEQ by Chmura helps you synthesize traditional labor market data with real-time job posting data in one convenient platform. Cut through the noise with powerful analytics that neatly display information on demographics, industries, occupations, wages, and more. Discover how you can move your community or organization ahead with accurate and timely labor market data from Chmura. Schedule your free demo at www.chmura.com/demo.

Features

Cloud-Based Software

Access JobsEQ from anywhere, at any time.

Customizable for a User’s Needs

Create custom regions, industry groups, occupation groups, forecasts, and more.

Schedule your free demo at www.chmura.com/demo.

Intuitive Workflows

JobsEQ walks you through the steps you need to answer your research question.

Maps & Charts

Tell your region’s story with clear maps and charts.

Live Chat

Get a response to your question from a real economist, in less than a minute.

Forecasts

Find out what industries and occupations will be in-demand in the future.

How to Break the Bad News: Navigating the Conversation When a Company Doesn’t Meet Expectations

When a company cannot meet the original parameters set by its project, communication is critical to identifying potential solutions.

By Ben Worrell, Principal, McGuire Sponsel

“Hey, we need to set up a call to discuss some changes with the project…” This correspondence always triggers a red flag — the project could be increasing substantially. However, those positive indicators usually cause further embellishment and urgency for a followup dialogue. The more ambiguous the communication, the less likely it is to indicate a positive outcome for the project.

Economic credits and incentives are inherently a “best guess” for the future. If we all had the magic crystal ball for predicting the future, we would likely use it for financial gains in Vegas! However, as we are trying to forecast the growth and success of projects five, 10, or even 20 years into the future, there is a risk that things don’t go quite as planned.

In fact, the best-laid plans never go the way they look on paper. As with most business ventures, flexibility is key in these circumstances. However, many incentive programs don’t have the necessary flexibility to adapt to project changes, for better or worse.

A Lot Can Happen

Site and facility planning projects are years in the making. Many projects start the planning process for site selection one to two years before any RFPs are sent out. Then, there is the scramble to complete and compete for the project. Once a project location has been decided and the economic incentives secured, the project is just “getting started.” In some circumstances, even small to medium-sized investments can take four to five years before the project sees its ribbon-cutting, first products going out the door, or first employees moving into their new offices.

A lot can happen in that amount of time. Regular communication with community stakeholders is required to overcome any hurdles along the way. Four years is the typical time for most political positions to encounter another election, from the national presidential race down to the local town council seat. Personalities, preferences,

and policies can all change, imposing risk on a company and its project. Risk is the chief enemy of most location projects. Experienced location advisory consultants stay in close contact with their clients throughout the development process to help navigate and mitigate risk and any challenges that arise from inevitable change.

But what happens when “changes” are insurmountable? Economies shift; buyers alter their practices; workforce becomes depleted; lead times extend; construction costs go to all-time highs — all these difficulties are recent realities in the post-pandemic world. If a company encounters the unexpected and needs to alter the project, it is the role of the location advisor to help navigate potential fiscal impacts on the project. Location advisors should work closely with community stakeholders to communicate changes and anticipate potential pitfalls for reporting and compliance.

Most economic incentives have a legal agreement between the taxing authority and the company. How flexible are these agreements? Often, contracts are fairly iron-clad. If the company meets the measures outlined early in the process, then it gets the benefit. But what happens when a company falls just short of the mark? Economic development officials should consider the levels of rigidity of their pro gram agreements. Some flexibility may be appropriate

28 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com > FACILITY PLANNING/ INCENTIVES

to anticipate the time required to make a project happen. Performance-based incentives can allow for this needed flexibility, but the delicate balance between the community’s interests and the company’s interests can be a tricky circumstance, especially when legal documents are years in advance of the project being completed.

Communication Is Key

When a company cannot meet the original parameters set by its project, communication is critical to identifying potential solutions. Early contact with economic development decision-makers is the best first step. Logical, clear explanations of the current circumstances are typically met with understanding, though there is likely to be disappointment. Remember, many incentives are offered due to the excitement generated by the potential project years before. The dreams of the project that “wer e to be” can be demoralizing for a community. Ideally, the project itself can still move forward, but in a dif ferent capacity. Again, flexibility within the economic incentive programs may help soften or lessen dramatic changes to project plans.

When projects consider an area, clawbacks are heavily weighted in the site selection process. Performance-

Economic credits and incentives are inherently a “best guess” for the future.

based incentives can vastly reduce a community’s risk in a project. However, those incentives shift that risk to the company. Certainly, non-performance should not be rewarded; however, careful review and reasonable extension of deadlines and compliance reporting could further considerations toward advancing a reduced project.

Working in economic development is like walking a tightrope between strict agreements and unforeseen challenges. Contracts offer stability, but all involved parties need to be flexible when projects take unexpected turns. Project advisors and stakeholders must communicate clearly and consistently to achieve practical solutions when things go awry. It’s all about finding that sweet spot between sticking to agreements and being adaptable. This approach can rescue projects, keeping the impact low and the original vision intact, even when the economic landscape throws us a curveball.

committed to Economic Development and a clean

future in

AREA DEVELOPMENT | Q1 2024 29

New York

We offer a wide range of economic development grants, rate discount programs, and energy efficiency rebate programs to help grow your business. Learn how our programs can benefit your business. Visit www.shovelready.com

We’re

energy

State.

Manufacturing Momentum Is Building

A desire to bring manufacturing closer to the consumer, recent federal funding initiatives, as well as access to a skilled workforce and reliable power among other advantages have converged to spur growth in construction of U.S. manufacturing facilities.

By Brian Gallagher, Vice President, Corporate Development, Graycor

Over the past three years, North America has witnessed many announcements regarding new and expanded manufacturing facilities. The pipeline for manufacturing development has reached an unprecedented level, indicating a solid trajectory for further growth in this sector.

Numerous factors have converged to build momentum and spur investment in manufacturing construction, creating a manufacturing renaissance in the United States. Various elements, such as supply chain complications, geopolitical unrest, energy costs, proximity to consumer bases, the impact of federal laws and funding initiatives, and emerging market dynamics influence this scenario.

While the broader economic landscape, monetary policy shifts, and prevailing market uncertainties have exerted varying degrees of influence on different industry sectors, capital investment in manufacturing facilities is strong. According to Census data, manufacturing-related construction hit a $210 billion annual rate in November 2023, more than triple the average rate in the 2010s. 1 Deloitte recently reported that manufacturing construction spending had the most significant annual increase in construction spending (65.5 percent) as of August 2023. 2

Key determinants influencing regional expansion trends in the manufacturing sector include land availability, cost-effective energy sources, robust logistics infrastructure, a conducive business climate, and a wellsupported labor environment, as outlined in an industry analysis by Newmark.3

According to the Newmark study, which analyzed significant manufacturing announcements in the U.S. over the past three years, nearly every state in the U.S. has benefited from recent announcements in manufacturing construction, with a notable focus in regions from the Midwest to the Southeast and Southwest. Texas and Arizona lead in investments, alongside Georgia and North Carolina. The study reveals substantial commitments in advanced manufacturing, totaling around $400 billion, expected to generate over 210,000 jobs and require constructing at least 250 million square feet by 2030. This manufacturing surge offers a timely boost to the construction industry amid a general slowdown in sectors like commercial, retail, and office construction due to economic factors.

Development in the U.S. supports advanced manufacturing, where information technology, automation, and more improve productivity, safety, sustainability, and innovation.