page 86

Guest editors Steven Pearce and Ford Graham from McGuireWoods take a bird’s eye view at sourcing the component parts that make America’s data centers run.

PAGE 22 A Zebra in the Room

PAGE 25 The Legal Limits of DEI

PAGE 62 The New Math Behind Mexico and U.S. Manufacturing

When a zebra charges out of the woods during a routine site visit, it’s a reminder wild surprises lurk around every corner. What every company should do before purchasing land.

PAGE 65 Trade Policies Add Complexity to Site Selection

Unpredictability is reshaping how manufacturers evaluate risk. The rules for cross-border production and supply chain planning are being rewritten in real time.

New legal challenges are reshaping DEI goals in hiring and contracting. More than ever, companies pursuing incentives, must understand what’s lawful. Here’s what the courts say.

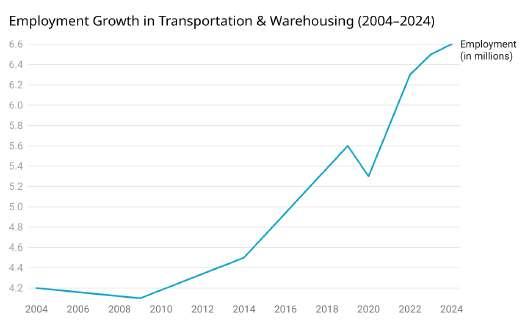

PAGE 82 The Quest for Logistics Supremacy

States are pouring billions into ports, air cargo hubs, and cold storage to win the race for logistics dominance. Infrastructure, policy, and innovation are where states need to win.

Labor, power, tariffs, and site readiness are reshaping how manufacturers choose between the U.S. and Mexico. Here’s why site selectors are rethinking old assumptions.

PAGE 94

Choosing a Site In Volatile Times

Learn how top manufacturers are minimizing risk and avoiding delays by rethinking site selection as a strategic business decision—not just a race to the most shovel-ready site.

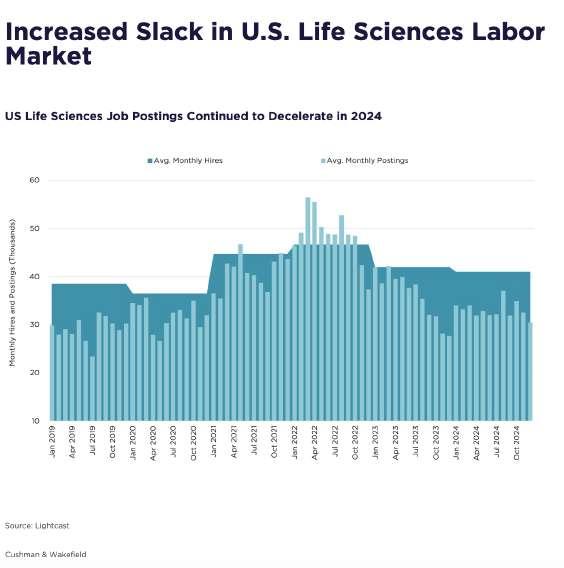

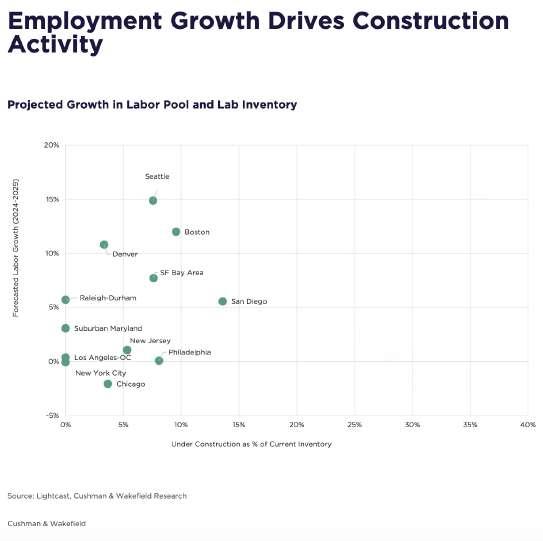

As market pressures reshape the real estate landscape, we dive into where opportunities still exist From AIpowered drug discovery to renewed VC funding and shifting workforces, learn about 2025’s macro trends.

Site selection isn’t just about lab space or incentives, it’s about timing, talent, and precision. Here’s a guide for companies that are navigating today’s two-speed market and looking for an edge.

Learn how utilities, wastewater infrastructure, and workforce strategy are driving new life sciences facility development, and learn how community collaboration is making all the difference.

It’s that time again. Area Development reviewed the

Inside this quarter’s site selection pressure points

6

Meet the thought leaders who shared their expertise in Q2

Why AI creates a headcount conundrum

Dave Robey, Co-CEO of QTS Data Centers, sits for a chat

Our guest editors teamed with a Moody’s economist to talk about data center supply chain risks

96 Last Word

States have more power now DEPARTMENTS

There’s no sugarcoating it—this is a tough moment to be making long-term decisions. Between rising trade tensions, shifting investment flows, and growing pressure on logistics and infrastructure, the old playbook doesn’t cut it anymore. But that’s also what makes this work interesting.

In this issue, we try to make sense of some of it. We dig into the intrastate tug-of-war unfolding in The Quest for Logistics Supremacy by Greg Canfield, where ports, railroads, and air cargo networks are increasingly seen not just as infrastructure, but as leverage. Charlie Smith brings this idea home in his opinion piece, Time for States to Shine. We trace how every part of the data center ecosystem—from chip fabs to transformers—is under strain in Mapping the Data Center Supply Chain by guest editors Ford Graham and Steven Pearce. And in FDI and Tariffs by Alexandra Segers and Michael Johnson we revisit the long shadow cast by Donald Trump’s initial tariff announcements, and how those policies continue to ripple through today’s site selection decisions. We’re also giving life sciences the attention it deserves. With three pieces focused on real estate strategy, utility demands, and market shifts, we look at how the sector is adapting to a new reality. Capital is tighter, timelines are longer, and the bar for site readiness is higher than ever. But the fundamen-

2025 EDITORIAL ADVISORY BOARD

Scott Kupperman Founder KUPPERMAN LOCATION SOLUTIONS

Eric Stavriotis Vice Chairman, Advisory & Transaction Services CBRE

Brian Corde Managing Partner ATLAS INSIGHT

Amy Gerber Executive Managing Director, Business Incentives Practice CUSHMAN & WAKEFIELD

Alexandra Segers General Manager TOCHI ADVISORS

Dennis Cuneo Owner DC STRATEGIC ADVISORS

Publisher Dennis J. Shea dshea@areadevelopment.com

Sydney Russell, Publisher 1965-1986

Events / Business Development Director

Matthew Shea (ext. 231) mshea@areadevelopment.com

Media / Accounts Director Justin Shea (ext. 220) jshea@areadevelopment.com

Courtney Dunbar Site Selection & Economic Development Leader BURNS & MCDONNELL

Stephen Gray President & CEO GRAY, INC.

Bradley Migdal Executive Managing Director, Business Incentives Practice CUSHMAN & WAKEFIELD, INC.

Brian Gallagher Vice President, Corporate Development GRAYCOR

Marc Beauchamp President SCI GLOBAL

David Hickey Managing Director HICKEY & ASSOCIATES

Editor Andy Greiner editor@areadevelopment.com

Staff and Contributing Editors

Kimberly Graulein

Amy Matias

Jim Richardson

Brian Eddow

Garrison Partridge Circulation/Subscriptions circ@areadevelopment.com

tals—aging demographics, scientific breakthroughs, and the demand for localized production—remain strong. Whether you’re planning for R&D, manufacturing, or hybrid facilities, these stories offer a cleareyed view of the road ahead.

That same sense of volatility makes this year’s Shovel Awards all the more impressive. These projects weren’t easy wins—they were earned through smart planning, tough negotiations, and serious follow-through. Whether it was landing a billion-dollar EV plant or transforming a rural site into a hub for aerospace manufacturing, the states recognized this year proved they could not only compete—but deliver. If you’re looking for models of what economic development looks like under pressure, start there. If you’re reading this magazine, you’re likely grappling with questions that don’t have easy answers: Where will the next constraint show up? What will this election cycle do to capital flows? How do you build resilience without losing speed? We don’t pretend to have a crystal ball, but we do aim to offer context, clarity, and—when possible—a little foresight.

Chris Schwinden Partner SITE SELECTION GROUP

Chris Volney Managing Director, Americas Consulting CBRE

Matthew R. Powers, Lead Site Selection Consultant REDI SITE SELECTION

Scott J. Ziance Partner and Economic Incentives Practice Leader VORYS, SATER, SEYMOUR AND PEASE LLP

Chris Chmura, Ph.D. CEO & Founder CHMURA ECONOMICS & ANALYTICS

Alan Reeves Senior Managing Director NEWMARK

Production Manager Jessica Whitebook jessica@areadevelopment.com

Web Designer Carmela Emerson

Print Designer

Victoria Corish

Business/Finance Assistant

Barbara Olsen (ext. 225) olsen@areadevelopment.com finance@areadevelopment.com

Lauren Berry Senior Manager, Location Analysis and Incentives MAXIS ADVISORS

Courtland Robinson Director of Business Development BRASFIELD & GORRIE

Dianne Jones Managing Director, Business and Economic Incentives JLL

Joe Dunlap Chief Supply Chain Officer, LEGACY INVESTING

Halcyon Business Publications, Inc.

President Dennis J. Shea

Correspondence to:

Area Development Magazine

30 Jericho Executive Plaza

Suite 400 W Jericho, NY 11753

Phone: 516.338.0900

Toll Free: 800.735.2732

Fax: 516.338.0100

W. Ford Graham, (Guest Editor) Partner, Steven Pearce, (Guest Editor) VP of Infrastructure and Economic Development, and Margaret Rockwell, Counsel at McGuireWoods. Page 86

Amy Gerber, Executive Managing Director, and Tyler Hales, Executive Managing Director at Cushman and Wakefield. Page 12

Olivia Byrne, Partner at K&L Gates. Page16

Allen S. Kinzer, Partner, and Jonathan K. Stock, of Counsel at Vorys. Page 25

Jenna Hassam, Senior Associate, Business Consulting at JLL. Page 62

Alexandra Segers, General Manager at Tochi Advisors and Michael Johnson, Shareholder at Baker Donelson. Page 65

Connor Barnes, Executive Vice Chair at Cushman & Wakefield and Sandy Romero, Research Manager at Cushman & Wakefield. Page 68

Andy Wozniak, Principal, Global Facilities Group and Courtney Dunbar, Director of Site Selection at Burns and McDonnell. Page 74

Alan Reeves, Senior Managing Director of Global Strategy at Newmark. Page 78

Greg Canfield, Managing Director of Economic Development at Burr & Forman. Page 82

Charlie Smith, Managing Director of Geopolitical Strategy at Newmark. Page 96

Chris Urchell, Senior Manager, Site Selection and Incentives at Baker Tilly. Advises manufacturers on site evaluation, growth strategy, and large-scale capital investment planning. Page 94

By John Bourdeaux, President & CEO at AdvanceCT

Corporate decision makers crave predictability. Achieving this elusive goal has become increasingly challenging due to the unpredictable nature of our economy. Tariffs and trade wars are causing paralysis among decision makers worldwide as they seek guidance on navigating these turbulent times. A lack of predictability means more risk – that is difficult to quantify.

The concept of risk is evolving. Traditionally, location decisions have been driven by cost and resources, often reduced to mere numbers in a spreadsheet. Global tariff uncertainty is just one of many risk factors that have typically been omitted from the calculus when companies are making location decisions. This raises the question: what other factors are being missed?

Traditional risk scenarios include weather events and infrastructure instability. However, new challenges impacting business performance are increasingly cultural, political, and social. For example, a lack of childcare in a particular area can significantly impact productivity if working parents must stay home to care for their children. Productivity is crucial for business success, so any condition that impedes it must be carefully examined.

Factors affecting productivity can range from inadequate public transportation to a lack of nearby restaurants where employees can quickly get lunch. These seemingly minor details will impact the time employees spend working. Since the pandemic, other community factors such as access to healthcare and the overall health of the community have also become more important when considering locations.

Recently, a defense manufacturer chose to locate a facility near a city known for attracting former hippies and activists. Community members organized protests, disrupted operations, and blocked hiring events. These cultural risks should have been considered during the decision-making process.

Given today’s political turbulence, it is essential to evaluate policy, politics, and civic leaders for potential risk factors, even at the local or state level. Depending on the business, local political landscapes can present costly barriers, especially if the jurisdiction faces fiscal challenges or legacy financial obligations.

Another critical consideration is the centralization of facilities. For instance, a large industrial fire in a 1,000,000 square foot facility outside of Philadelphia, which produced fasteners for the global aerospace industry, destroyed the entire facility. This created shortages in the global aerospace supply chain and disrupted operations to the extent that it could take years to recover. Decentralizing operations could have created redundancy and allowed for 24-hour shifts at different locations, mitigating the impact.

Discussing “what if” scenarios and unlikely events is crucial because they can quickly become reality. Evaluating culture, social infrastructure, political landscape, and the work culture of the population is essential for understanding their potential impact on productivity and operations. Examining a jurisdiction’s track record for philanthropy, giving, and volunteering can provide insights into the social fabric and culture of a community. Choos-

ing a location that aligns with your company’s values and culture is best practice. Therefore, it is time to move beyond numerical values and cost savings, which can quickly become obsolete, and view risk through a more comprehensive lens that reflects the long-term, valuable investments that are being considered.

John Bourdeaux, President & CEO at AdvanceCT

John Bourdeaux is an experienced leader with a track record of success in marketing and development, strategic planning, professional fundraising, and market research. Prior to joining AdvanceCT, he served as the Vice President of Advancement for the Connecticut Science Center, an organization dedicated to scientific exploration, teacher development, and educational transformation. At AdvanceCT, John’s focus is on operations, member development, and strategic initiatives. John brings valuable non-profit stakeholder engagement experience to AdvanceCT.

Prior to his work at the Connecticut Science Center, John served as the Director of Development for Hartford Stage and worked for the Melville Charitable Trust and the Partnership for Strong Communities, organizations focused on homelessness and affordable housing policy.

He has served in the development offices of the University of Chicago, The Hotchkiss School, and Yale University. In each of these positions, he was responsible for securing tens of millions in philanthropic support while promoting the mission of each organization, bringing many new supporters and advocates into the fold.

Early in his career, John founded and managed his own not-for-profit theater company in Chicago, IL, producing modern American drama and late-night improvisational comedy. He has also served as a consultant and board member for academic institutions as well as social action and arts organizations. John is a graduate of The Hotchkiss School and the University of Chicago.

This advertisement was written by AdvanceCT and approved by Area Development.

Connecticut is home to Sikorsky, Pratt & Whitney, and hundreds of aerospace firms manufacturing everything from helicopters to jet engines. Nearly ¼ of all U.S. aircraft engines and parts are made here by the most highly productive and skilled aerospace workforce in the world. Quite literally, nothing flies without Connecticut.

By Brian Eddow Area Development Staff

Artificial intelligence isn’t just transforming how companies operate — it’s also disrupting how economic development incentives should be measured.

That was the message delivered by CBRE Managing Director John Lenio during a presentation at Area Development’s Consultant Forum Workshop in San Antonio.

As automation and machine learning reduce the need for certain types of labor, companies are delivering more economic value with fewer jobs. And yet, many incentive agreements still rely on rigid job creation targets written for a different era.

The result? A growing disconnect between how companies grow and how they’re rewarded for that growth.

Lenio offered a real-world example of this disconnect. In one case, a client committed to 1,000 new jobs as part of a major facility project and initially delivered on that promise. But over time, automation and AI allowed the company to eliminate many lower-wage, routine positions. Headcount declined — but payroll rose.

“The jobs that remained were higher-wage, higher-skill

roles — people overseeing the AI systems, maintaining the technology, providing strategic insights,” Lenio explained. “The company wasn’t shrinking. It was evolving.”

When it came time to review compliance with state incentive agreements, it became clear the original job target was based on an outdated assumption — that more jobs always equal more value. If the incentive was based on 1,000 jobs at $73,000 each, and the company had fewer people but much higher total payroll, they calculated how many “$73K equivalent” jobs that added up to. The answer: closer to 1,500.

Traditional incentives often focus on simple metrics: number of jobs, capital investment, square footage. But AI-driven transformation is forcing a rethink, and companies investing in automation and reskilling efforts shouldn’t be penalized.

“Incentive agreements that focus solely on headcount risk punishing the very innovation communities want to attract,” Lenio noted.

Some states have begun adapting, including provisions for alternative compliance

where payroll can serve as a proxy for jobs. Others remain rigid — creating friction for companies caught between outdated terms and modern operations.

Companies and consultants should raise these issues early in the site selection and negotiation process.

Questions like: If we automate this process in three years, what happens to our eligibility? If payroll exceeds expectations but headcount drops, are we still compliant? Is there flexibility in the agreement to reflect

economic impact?

“Better to build these scenarios into the contract than scramble for a fix later,” he advised.

At the end of the day, both communities and companies want the same thing: sustainable economic growth. That means thinking beyond job quantity and measuring economic impact through wages, tax revenue, and workforce quality.

As Lenio put it, “If you’re still using a 2015-era incentive model in 2025, you’re playing last decade’s game. It’s time to update the rules.”

How the return to campuses is blurring the line between operations and corporate strategy

By Amy Gerber, Executive Managing Director, Business Incentives Practice, and Tyler Hales, Executive Managing Director, Strategic Advisory at Cushman & Wakefield

Across the country, companies are rethinking how they deploy their headquarters and R&D functions—and, as we’ve seen with some recent announcements, they’re bringing them closer to where things are made. The traditional gap between corporate strategy and operations is narrowing, driven by shifting workplace preferences, real estate pressures, talent needs and the growing importance of collaboration and innovation. As organizations adapt to a hybrid work environment, the single-location campus is making a comeback.

During the height of the pandemic, distributed hub-and-spoke office strategies became common. Teams were scattered across regional footprints to reduce density and give employees flexibility. But in recent years, we’ve seen an increasing number of companies pivot toward

consolidating operations, bringing their R&D, back-office and even executive functions into closer proximity to production.

One of the key forces behind this movement is the imperative to align engineering and innovation talent with on-the-ground operations. For instance, Duracell recently announced a move of its R&D headquarters from Connecticut to Atlanta. The decision was based on several strategic factors: proximity to its Georgia manufacturing facilities, a robust local innovation ecosystem, and deep pools of engineering talent. The company cited the need to innovate “with speed and efficiency” as a central reason for the shift.

These realignments are not just about cost savings or convenience. They reflect a larger transformation in how companies see their workplaces—not just as containers for people, but as tools to drive

At the nexus of access and influence exists a place where the frontiers of the future are being reimagined. Here in Fairfax, businesses from rising startups to Fortune 500s find fertile ground to put down roots and scale to new heights. A community grounded in diversity of thought, we are the center of gravity where purpose and progress intertwine. In this place, icons come to reinvent, and the workforce of the future is being built today. From here, you can dent the universe.

www.fairfaxcountyeda.org

business performance. That means real estate choices are now squarely connected to workforce strategy. It’s no surprise that HR teams are involved in site selection alongside real estate and operations leaders.

Companies like Foot Locker and Sally Beauty have taken similar approaches in their recent relocations, emphasizing collaboration, cross-functional synergy and talent retention in their public statements. In many of these cases, a return to a campus-style environment has emerged as the preferred solution. These developments typically feature multiple departments, amenities and even manufacturing or distribution components within a single footprint or close geographic cluster.

Recent data underscores the trend. For headquarters deals announced between January 2023 and January 2025, the average capital investment was modest—about $20 million—but the intent behind many of them was strategic realignment rather than sheer scale. Roughly 21 percent of these HQ announcements were tied to foreign direct investment, often driven by international firms looking to establish a U.S. presence that integrates closely with their operational assets. Coca-Cola Bottling’s recent $338 million investment in Alabama created only 50 new jobs but reaffirmed its long-term commitment to the region. The move brought together major operational functions into a single campus, providing room for future growth and a more integrated work environment. In Indiana, a major life sciences company invested $300 million in a new headquarters facility—again with a modest job count but a clear focus on unifying leadership and production functions.

This return to campuses is not simply a nostalgic turn back to pre-COVID layouts. Today’s campuses are being designed with flexibility, wellness and sustainability in mind. Mass timber buildings, for example, are increasingly popular. These structures offer natural lighting, reduced stress environments and greater energy efficiency. Tenant preferences are also shaping where and how companies expand. The concept of “flight to quality” has taken hold, with companies seeking out new Class A spaces that support employee experience and align with environmental, social and governance (ESG) goals. This trend has real implications for site selection. Employers are not just

The HQ of the future might not be a gleaming tower downtown—it might be a thoughtfully designed campus down the road from your next factory site.

That’s the average capital investment for HQ deals announced between January 2023 and January 2025.

comparing markets on costs and incentives—they’re also evaluating what a particular location can offer in terms of the complete “streetto-suite” experience. That includes everything from daily commute patterns to adjacent dining, childcare and wellness amenities.

Commute patterns in particular are influencing how companies think about hybrid work policies. If a policy requires two or three days in the office, the catchment area for hiring may expand dramatically. That can be a selling point for more remote or emerging markets that previously struggled to compete with major urban centers. It also makes real estate flexibility essential, with demand surging for spaces that can adapt to peak occupancy days and then scale down for the remainder of the week.

In some markets, local governments are taking proactive steps to make their urban cores more attractive to companies eyeing this kind of hybrid headquarters model. Arlington, Virginia, for example, recently streamlined its permitting process for redeveloping Class B and C office space. The change cut timelines from two years to five months and reduced fees by half. That type of responsiveness could be a key differentiator as more companies weigh whether to build new campuses or retrofit existing buildings.

The focus on urban planning extends to broader conversations around walkable environments. New research on so-called “urban doom loops”—the negative cycle where office vacancy drives down tax revenue and services, further degrading downtowns—suggests a rebalancing of urban asset types is essential. The future of healthy, vibrant business districts may lie in more balanced mixes of live, work and play amenities, rather than in a dense concentration of office space alone.

These changes have wide-reaching implications for site selectors and C-suite decision-makers. Manufacturing executives who once considered corporate real estate decisions separate from production strategy are now reevaluating that assumption. Co-locating functions like R&D, HR and IT with production facilities can streamline communication, accelerate product development and reinforce culture.

As the numbers show, these relocations may not generate thousands of jobs, but they are increasingly strategic. The quality of the space—and how it connects people and functions—matters more than ever. The HQ of the future might not be a gleaming tower downtown. It might be a thoughtfully designed campus down the road from your next factory site

With QTS rapidly scaling to meet hyperscaler and enterprise demand across North America and Europe, Co-CEO David Robey shares his perspective on site selection, utilities, incentives, and what’s next for the industry. Robey, who previously served as COO, brings a tactical mindset to an evolving set of location priorities.

Area Development: QTS has grown into one of the top co-location providers in North America. What are some of the key site selection considerations that have enabled you to scale rapidly?

David Robey: I would put those in two categories. The first is obvious—resources, local processes, permitting, and tactical items. You have to have labor, resources, and the ability to execute, including geographic considerations. But the second critical element is community engagement. That’s core to our culture. We’re in service to our customers, employees, and communities. The only way to move quickly is to create value for all three—workers, communities, and customers. When those elements align, you can do amazing things.

That community angle is one we hear about often, especially in the face of growing NIMBYism. But utilities might be an even bigger pressure point. How does QTS engage with power providers when you’re scouting locations?

Robey: It used to be that site selection led the process. Today, we start with the utility. Especially as workloads get larger, you need to lead with what makes sense from a utility point of view. Then you can go source land to support that project. That’s been the major pivot in recent years with the shift toward larger cam-

puses. We’re committed to partnering with utility companies to identify innovative and sustainable ways to generate and secure power.

You’re known for those large campuses. How do you balance the need to bank land for the future with the need to move fast?

Robey: The scale and land banking require you to be intentional. You have to understand upfront that you’re building for a future. Our large-scale campus approach began many years ago, which put us in a great position as demand grew. It’s about being proactive with the community and the utility—otherwise, you’re trying to make something into what it was never intended to be.

There’s been a lot of conversation in our pages lately about water use and the cooling needs of new compute loads. What’s your view on that?

Robey: The industry is moving away from water-intensive designs. Seven years ago, QTS made the change so that any new buildings do not consume water to cool the data center. This QTS Freedom design is one that employs solutions to remove heat without consuming water. Evaporative systems, which consume large amounts of water, are something we’ve moved away from. We believe the industry should push harder on that. It

affects communities, and we all need to be cautious with water as a resource. Our water-free system saves more than 48 million gallons of water annually per data center – the equivalent of water use from more than 2,200 U.S. homes per year. We will continue to implement this system to improve water conservation in every community in which we operate.

How about connectivity? How important is proximity to long-haul fiber in your location strategy?

Robey: Historically, data centers followed the old real estate rule of “location, location, location”—defined by fiber routes and proximity to diverse connectivity options. But the model has evolved. Today, AI workloads allow us to be more flexible. That’s a good thing. If you can get utilities and some fiber to more remote locations, you’re able to spread these out across geographies. It’s not just about being central anymore.

That likely helps with siting challenges too. But how do you manage the labor aspect in more remote regions?

Robey: It’s not as much about where the data center is located now—it’s about the labor to build and support it. If you’re 200 miles from the next town, you don’t have a data center problem—you have a resource problem. So you still have to solve for the people side of the equa-

tion. It’s also interesting to see the trickle effect—data centers elevate localities as active technology markets by creating technology ecosystems, driving more technology and infrastructure companies to the area, and creating more high-wage technology jobs.

Let’s talk incentives. Data centers don’t always fit neatly into a traditional incentive structure. What kind of programs are most meaningful to QTS?

Robey: That really depends on the local area. There’s no one-size-fits-all approach. Historically, sales tax abatements have been the simplest vehicle. But in any engagement, the economic stimulation that comes with a project far outweighs the incentive offered. For us, it’s not about the structure—it’s about whether it brings value to our customers and communities. We’re trying to bring those two things together: customer value and community value.

What trends are you seeing from your customers—especially hyperscalers—

in terms of ESG, infrastructure, and location priorities?

Robey: The biggest challenge they’re facing is capacity planning. It’s hard for them to predict where they need to be and what they need. That creates timing issues. QTS’s unique access to infrastructure at scale helps us move quickly to meet our customers’ accelerating needs. The more we can be transparent and communicate with each other, the better we can prepare. We want to do this in a way that’s socially responsible, serving communities as well. Transparency helps everyone plan, and it’s about all of us partnering. One group can’t succeed at the expense of others. It has to be a joint success.

Would you say that transparency is a differentiator for QTS?

Robey: I would. Historically, the data center industry was more closed off in terms of information sharing. But over the past five to 10 years, we’ve been more open—sharing data, project info, and our perspective. We hope the whole

industry, our customers, and our communities benefit from that. It’s our way of doing our part to support this innovation economy. We’re able to do things like this video chat because we built and operate a data center.

Looking ahead, what markets—domestic or global—are primed for QTS growth?

Robey: The U.S. is still a very favorable market, and we’re coast to coast here. We also have a lot of work going on in Europe. Within the U.S., it’s about finding the right mix of utility access, labor, and geographic diversity. There’s value in being dispersed—coast to coast and north to south—to meet client needs.

Finally, is there anything else you’d want site selectors or commercial real estate professionals to understand about the data center space today?

Robey: It’s about blocking and tackling, and hopefully we added some insight that’s valuable to your audience.

By KansasDOC

When companies are ready to expand or relocate, they need more than a great location — they seek competitive advantages to increase their odds of success. Those that choose Kansas get all of the above.

Kansas’ central location offers company supply chains the ability to distribute more, in less time, and at a lower cost. Located in the heart of the country, 85 percent of the U.S. can be reached in two days or less by freight. Kansas is well equipped for virtually all logistics ventures, offering:

• 25,000 highway miles

• 4,257 total rail miles

• 140 public-use airports

• The second-largest rail hub in the nation

In addition, Kansas is home to major logistics parks — including the Logistics Park Kansas City Intermodal Facility, the second largest in the nation — providing companies with the infrastructure for quick and efficient distribution to anywhere in the world.

These resources and economic opportunities have attracted major supply chain and distribution companies to the state, including Urban Outfitters, Kubota, American Eagle Outfitters, Amazon, The Home Depot, Frito-Lay, Cargill, Walmart, and others. More than 7,000 logistics and distribution businesses currently operate in Kansas.

As the logistics ecosystem expands, the case becomes even stronger for companies in other sectors to capitalize on Kansas’ distribution advantages.

“Kansas is attracting world leaders in advanced manufacturing, agriculture, food production, aviation, transportation, and other sectors for a variety of reasons,” said Lieutenant Governor and Secretary of Commerce David Toland. “While our central location is cited as a key starting point, our ready workforce and commitment to innovation often seal the deal.”

Kansas’ robust infrastructure has been a key factor in attracting supply chain and logistics companies. Several logistics and industrial parks across the state offer direct access to highways, rail hubs, and commercial airports. As a result, supply chain distributors are investing in Kansas at a higher rate than ever, making the state a dominant hub for logistics success across industries.

Whether a company is looking to relocate to an urban or rural area, Kansas offers logistics and industrial parks throughout the state — most with access to at least one mode of transportation. Notable parks include:

• Logistics Park Kansas City, Edgerton: highway, railroad, and commercial airport hub

• Kansas Logistics Park, Newton: highway and railroad access

• Great Plains Industrial Park, Parsons: shovel-ready site for a megaproject

• New Century AirCenter, New Century: commercial air and rail hub

There are currently 17 designated Kansas Certified Sites

available, ranging from 13 to more than 500 acres. These shovel-ready industrial parks are primed for development and ready for investment.

“We have available, move-in-ready spaces at several of our logistics and industrial parks — and they are eager to assist companies expanding their distribution efforts,” said Deputy Secretary of Business Development Joshua Jefferson. “Whether your business is looking for quicker delivery options or establishing more supply chains here in the U.S., Kansas has a place for you to succeed.”

Kansas’ recruiting success is driven by its economic development strategic plan, the Kansas Framework for Growth. This blueprint aims to foster sustainable partnerships and economic expansion through workforce development, innovation, community assets, and policy alignment.

The plan outlines key industries that strengthen the Kansas economy and attract new business. Target sectors include advanced manufacturing, aerospace, food and agriculture, professional and technical services, distribution, logistics, and transportation.

In the past six years alone, this intentional strategy has helped secure more than $23 billion in committed private investment and created or retained over 75,000 jobs. Approximately 90 percent of those projects align with the Framework’s target industries.

An available, skilled logistics workforce is another key factor in attracting businesses to Kansas. Partnerships with the state’s colleges and universities help prepare future workers and sustain long-term industry growth.

Institutions such as Wichita State University, WSU Tech, the University of Kansas, Kansas State University, and Johnson County Community College offer programs ranging from CDL certificates to advanced degrees in supply chain management. These schools actively collaborate with the private sector to support continued success.

By investing in educational institutions, Kansas is also investing in its workforce. The state supports technical colleges, internships, and registered apprenticeships to ensure a strong talent pipeline for years to come.

Whether your company is looking to lower shipping costs, expand its workforce, or improve delivery speed, Kansas has the options and infrastructure to support long-term success.

Ready to move it to the middle? Learn more about Kansas — the State of Unexpected — at kansascommerce.gov.

Area Development magazine caught up with its Q2 guest editors, Ford Graham and Steven Pearce from McGuireWoods consulting, to talk about their reporting on data center supply chains. We invited Ermengarde Jabir Director of Economic Research at Moody’s who also explored data centers for an Area Development article to join the discussion. This conversation has been edited for style and length. For a full transcript and audio of this conversation, head to areadevelopment.com.

Area Development: Let’s start with introductions and a quick story. When did it hit you—just how essential data centers are?

Ermengarde Jabir: I realized how foundational data centers are during the pandemic—when remote work and e-commerce took over. Without data centers, none of that would’ve been possible.

Steven Pearce: I think it clicked for me when I bought my first iPhone. Around that time, Apple had just announced a big data center in western North Carolina. I started connecting the dots—Siri, iCloud, all of it running through that building. The whole idea that your phone doesn’t work if the data center doesn’t? That’s when it sunk in.

Ford Graham: Honestly, I was a bit late to the game. It wasn’t until I worked on a large data center investment in central Virginia three years ago that I fully grasped their critical role. Since then, it’s been a crash course.

Area Development: Ford and Steven, Let’s talk about your article in this issue. You mapped the supply chain behind data centers—the stuff most people don’t think about. What’s the most underappreciated piece?

Ford Graham: All of it, really. People see a big box filled with servers and assume that’s it. But you’ve got backup generators, cabling, cooling systems—an entire ecosystem. It’s deeply tied to global commerce. Most of us don’t appreciate that.

Steven Pearce: I’ll get specific: the skilled labor behind these projects. Electricians, HVAC techs, low-voltage specialists—they bring these facilities to life. It’s not off-the-shelf talent. Some markets simply don’t have the specialized workforce. That’s a hidden bottleneck.

Area Development: Ermengarde, you agree?

Ermengarde Jabir: Absolutely. People forget there’s rarely a daily operations team onsite—beyond security. Most technicians are flown in. And beyond labor, let’s not overlook power and water. A single megawatt can power up to 1,000 homes. Hyperscale data centers need dozens of those. And they rely on water-based cooling systems. The natural resource intensity is massive.

Area Development: How has the approach to supply chain redundancy changed in recent years?

Ford Graham: The pace of growth and competition has forced companies to diversify. Everyone’s racing for land, power, and materials. You can’t afford to be caught waiting for a single component. Diversification has become strategy, not luxury.

Steven Pearce: Exactly. Five years ago, it was all just-in-time and cost-driven. Now it’s about risk. Tariffs, pandemics, shipping delays—it’s made companies rethink their sourcing models. We’re seeing a shift toward regionalization and greater visibility, often with AI helping track every link.

Area Development: Ermengarde, your current piece focuses on downside risk. Any threats people aren’t talking about?

Ermengarde Jabir: Yes—obsolescence. Not only of the equipment, but also the buildings. Servers and racks are shrinking fast. Many older data centers were built with far more square footage than needed today. So now we’re seeing empty space inside expensive buildings. That affects zoning, tax bases, and future land use. Municipalities might have to adjust expectations. The physical footprint of a data center won’t always reflect its power or value going forward.

Area Development: Let’s talk incentives. Are governments adapting?

Ford Graham: Depends on the region. Metro areas are getting more skeptical, especially when it comes to job creation. But rural areas still see data centers as high-value investments. Even with limited jobs, the property tax impact can be huge. Some states are offering long-term incentives to lock in multiple phases of growth.

Steven Pearce: There’s also growing NIMBYism. Some communities don’t want them, and that’s bleeding into incentive decisions. The misconception is that no jobs equals no benefit. But not every community can support a 1,000-person factory. Data centers bring capital investment, which many regions need.

Ford Graham: In South Carolina, we’ve seen proposed legislation to limit sales and use tax exemptions for data centers, citing energy constraints. Without that incentive, it’s hard to compete. Georgia’s had similar debates. It’s a trend worth watching.

Ermengarde Jabir: Look at what’s happening in Virginia and Maryland. Northern Virginia has long been the data center capital. But NIMBY sentiment is rising. Now Maryland counties are attracting those same projects—same users, same power, just across the river. Policy and public perception are shifting the geography.

Area Development: That’s a great note to end on. Thanks to all of you—this was smart, timely, and generous. We’ll do it again soon.

A surprising encounter reveals why environmental due diligence isn’t just paperwork — it’s protection

By Olivia S. Byrne, Esq., Partner at K&L Gates

Every seasoned lawyer or site selection consultant has a story that underscores the importance of thorough environmental due diligence. Mine involves a zebra.

Yes, a zebra — the four-legged, black-and-white-striped kind.

A few years ago, a client wanted to establish an industrial facility and identified what seemed like an ideal property. The site was a vast, mostly wooded area that matched all their requirements: a good location, a reasonable price, and a preliminary report suggesting no major environmental concerns.

As part of our routine due diligence process, we arranged for an environmental team to conduct a Phase I Environmental Site Assessment (ESA). We expected the usual findings — potential wetland encroachments, some soil composition concerns, maybe a few other environmental flags. What we did not expect was an urgent call from our field team: a zebra was chasing them across the property.

As it turned out, the land was not what it seemed. It wasn’t just a wooded tract — it was also a weekend hunting ground for exotic game. The game included not just the lone zebra but also wild boar, non-native deer species, and other exotic animals legally maintained on the land. Had the client skipped due diligence and proceeded with the purchase, they would have inherited not just a property, but a complex set of wildlife management issues, regulatory hurdles and a potential public relations nightmare.

The zebra incident is an extreme, but illuminating, example of why environmental due diligence is a critical — and often underestimated — step in site selection. While most sites won’t include exotic animals, they may harbor equally wild problems beneath the surface. Below, I highlight why this process matters and what companies should consider when evaluating a site.

Environmental due diligence begins with a Phase I ESA, which assesses a property for potential environmental liabilities. This includes reviewing historical land uses, examining records of contamination and conducting a physical inspection. A Phase I ESA is crucial to establish liability defenses under the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (CERCLA) 1 .

If a Phase I ESA raises red flags — such as indications of underground storage tanks, chemical spills or soil contamination — then a Phase II ESA is typically conducted. This includes soil and groundwater sampling, geotechnical studies and sometimes vapor intrusion assessments to determine the extent of contamination.

In the case of our zebra encounter, the Phase I ESA flagged the

presence of an active hunting ground, prompting deeper inquiries into land use restrictions and conservation laws

Beyond contamination, environmental due diligence can reveal unexpected regulatory and operational challenges. Common surprises include:

Wetlands and waterways -- Many industrial sites, particularly in the South and along the Eastern Seaboard, contain wetlands subject to strict federal and state regulations. Developing these areas often requires costly permits that can take years to obtain. Wetlands are not typically part of a Phase I ESA but can be added as a supplemental assessment. Endangered species --The presence of endangered or threatened species — such as the northern long-eared bat or the bald eagle — can delay or block development. If a site includes nesting trees, developers may be restricted from clearing them during certain seasons. Endangered species assessments are usually not included in a Phase I ESA but may be required for greenfield developments or projects using federal grants or financing. Vapor intrusion and soil contamination -- Sites with industrial histories may contain vapor hazards such as benzene, which can seep into buildings and pose serious health risks. Cleaning up these hazards is often expensive and time-consuming, if possible at all.

Zoning and land use restrictions -- Some properties carry hidden deed restrictions or zoning limitations that prevent certain types of development. A zoning compliance evaluation is typically not covered by a Phase

I ESA but can be handled by legal counsel experienced in site selection. Legal and community pushback -- Properties with a history of industrial pollution may face opposition from community groups, legal restrictions or ongoing litigation, making development far more complicated than anticipated. A mitigation strategy should be developed early.

The two most common reasons companies cut corners on due diligence are timing and cost. But environmental studies vary by site and project, and what works for one may not work for another. A full due diligence process requires a team of professionals to perform each assessment in a compliant and thorough manner.

That team should be prepared to conduct the following, depending on the site:

Phase I ESA; Phase II ESA (if necessary); Geotechnical analysis; Wetlands delineation; Greenfield development studies.

These assessments can cost up to several hundred thousand dollars, but when compared to the financial and reputational risks of unforeseen liabilities, these costs are not only reasonable — they’re essential. While they may add weeks to the transaction timeline, they can save months or years in the long run.

Most environmental issues won’t involve dodging exotic wildlife — but every site has its surprises. The lesson from my zebra experience wasn’t just about the unpredictability of undeveloped land. It was about the importance of knowing exactly what you’re buying.

Had my client skipped due diligence, they would have inherited a host of regulatory headaches, logistical issues and ethical challenges — including the question of how to responsibly rehome exotic animals. Instead, we caught the problem early and shifted focus to a more suitable property.

At the end of the day, site selection is about more than location and price. It’s about long-term viability, risk mitigation and smart decision-making. Environmental due diligence isn’t just a regulatory checkbox — it’s a critical safeguard. And if you ever find yourself being chased by a zebra on a potential industrial site, consider it a sign: dig a little deeper.

1. The steps for establishing a CERCLA defense are laid out in 42 U.S.C. §9601(35)(B) and the American Society for Testing and Materials (ASTM) methodologies. Companies should not rely on old reports or assume previous assessments are sufficient. CERCLA requires these steps to be completed within six months of closing. Relying on outdated reports could negate the defense and leave a company exposed to liability.

637,000 workers in a 30-mile radius

6 Million workers in a 60-mile radius

Innovative workforce training, career pathways, and advanced technology center, to train and upskill existing and future workforces

Close proximity to major transit routes, rail, and four international airports

Numerous local and state incentives for savings and increased ROI

How the Trump administration’s rejection of diversity, affirmative action, and contracting targets may impact your next location decision

By Jonathan K. Stock, Of Counsel, & Allen S. Kinzer, Partner at Vorys

Diversity, equity and inclusion programs have come under fire. President Trump issued an executive order prohibiting federal contractors from engaging in “illegal DEI.”¹

However, there is no formal definition of “illegal DEI” or “legal DEI.” Based on case law, there are some boundary lines.

Consider this situation: A federal and state highway contractor puts out to bid a guardrail subcontract. The government contract has minority set-aside requirements of 15 percent of the total contract amount that is to be awarded to subcontractors owned or controlled by disadvantaged groups. The guardrail contract is awarded to a subcontractor owned by a Latino family. Claiming race and national origin discrimination, a losing bidder — a white-owned guardrail contractor — sues.

A similar situation occurred more than 30 years ago and made its way to the U.S. Supreme Court several times. The losing contractor was Adarand Constructors Inc. After a decade of litigation during the 1990s and early 2000s, the Supreme Court set some ground rules for determining whether such set-aside programs are lawful. The result is that lawful set-aside programs are rare.

The Supreme Court concluded that any person, of whatever race, has the right to demand that any governmental actor “justify any racial classification subjecting that person to unequal treatment under the strictest judicial scrutiny.” That phrase generally means the federal, state or local government must justify any mandated setasides based on race, national origin or sex by showing that there was past discrimination, and that the set-aside program for minorities or women is narrowly tailored to rectify that past discrimination.

In the Adarand case, the Supreme Court elaborated: “In other words, such classifications are constitutional only if they are narrowly tailored measures that further compelling governmental interests.”

With the Adarand litigation and the few cases that followed, federal, state and local governments largely failed to meet the high burden of proving their set-asides were narrowly tailored. To end the litigation, the government eventually certified Adarand as a disadvantaged contractor, removing race-based criteria from qualification. Any contractor able to show disadvantage — regardless of race or gender — was eligible to be considered under set-aside programs. The compelling government interest was recast as assisting disadvantaged contractors.

With recent executive orders, the Trump administration has changed the government’s view of what constitutes compelling governmental interest in awarding contracts, whether from local, state or federal entities. According to the most recent order, minority or women set-aside programs with targets or quotas are no longer consistent with the administration’s view and are to be considered unlawful. Furthermore, the U.S. Department of Justice is expected to pursue legal action based on this interpretation.

To minimize risk, general contractors and developers should clearly define legitimate, nondiscriminatory business criteria for awarding subcontracts. Once awarded, they should be prepared to explain their decision based on those criteria.

The circumstances are similar in hiring. Federal and state laws generally prohibit employment decisions based on race, color, religion, sex, national origin, age, disability or military status. These protections apply equally to white applicants and applicants of color. The U.S.

Supreme Court will likely reaffirm this in a reverse sex discrimination case: Ames v. Ohio Department of Youth Services. Ms. Ames alleges she was denied promotions because of her heterosexuality by a homosexual manager who promoted homosexuals. Many legal analysts predict the Court will rule that members of a majority have no greater burden to prove discrimination than those in a minority.

So what does this mean for affirmative action? Making employment decisions based on race or other protected categories has long been unlawful. The narrow exception — as with contracting — is to remedy past discrimination in a narrowly tailored way. The Civil Rights Act of 1991 states that nothing in the act “shall be construed to affect court-ordered remedies, affirmative action, or conciliation agreements, that are in accordance with the law.” However, as with minority contracting programs, such affirmative action in employment is rarely upheld as lawful. One exception includes certain preferences for veterans by federal contractors.

Legal affirmative action or DEI involves casting a wide net for applicants. Employers may advertise widely to ensure diverse demographics have access to job openings. For instance, it is legal to include historically Black colleges and universities in campus recruitment efforts. But when it comes to hiring, employers must choose the best-qualified candidate, regardless of race, color, sex or other protected characteristics.

The same principle applies to subcontracting. Federal contractors can lawfully solicit bids from minority-owned businesses. But excluding potential bidders based on race or sex is unlawful. Final contract awards must be made on the basis of legitimate, nondiscriminatory

business reasons, not the demographics of the bidders.

DEI and affirmative action challenges also arise in the context of incentive agreements. Many municipalities and local governments require incentive recipients to meet or exceed participation goals for minority- and women-owned businesses.

The City of Cleveland, for example, adopted Ordinance No. 297-2023, requiring companies receiving financial assistance to contract with certified Minority Business Enterprises (MBEs) and Female Business Enterprises (FBEs). Projects receiving $250,000 or more in city assistance must enter into a Community Benefit Agreement (CBA). A standard CBA applies to projects under $20 million, while an expanded CBA is required for those over $20 million. Both versions include mandatory community benefits, with the expanded version also requiring additional considerations for legislative approval.

Incentive recipients must submit a specific plan to meet or exceed participation goals of 15 percent for certified MBEs and 7 percent for certified FBEs. Certification requires that a business be at least 51 percent owned and controlled by a minority or woman, respectively. Companies must report quarterly to Cleveland’s Office of Equal Opportunity to demonstrate CBA compliance.

Other cities have similar requirements. Cincinnati, for example, has mandated “best efforts” by developers to employ minority (11.8 percent) and female (6.9 percent) workers in each construction trade, referencing City Resolutions No. 32-1983 and 21-1998. Although these are often described as “goals,” the enforceability of such provisions remains unclear.

Similar contracting requirements have sparked legal challenges. A federal lawsuit was filed Feb. 5, 2025, by a landscaping business against Harris County, Texas, alleging that the county’s Minority and Women-Owned Business Enterprise (MWBE) program unconstitutionally prioritizes race over merit. See Landscape Consultants of Texas Inc. v. Harris County, Texas, Case No. 4:25-cv-00479 (S.D. Texas).

The lawsuit claims that Harris County imposes mandatory MWBE utilization goals on individual public contracts to meet an annual 30 percent “aspirational” MWBE goal. The complaint seeks declaratory and injunctive relief, citing violations of the Equal Protection Clause and 42 U.S.C. §§ 1981 and 1983.

In light of the new executive order targeting “illegal DEI,” it remains to be seen whether the Department of Justice will join or initiate similar litigation. Section 4 of the order seeks to “encourage the private sector to end illegal DEI discrimination and preference” and instructs the attorney general to propose a strategic enforcement plan. This includes identifying litigation “potentially appropriate for federal lawsuits.”

The order has likely increased the legal risks surrounding DEI and affirmative action. It has also complicated matters for companies that are bound by existing incentive agreements and now face the challenge of aligning their compliance with evolving federal interpretations.

1 See Executive Order issued Jan. 21, 2025, titled “Ending Illegal Discrimination and Restoring Merit-Based Opportunity.”

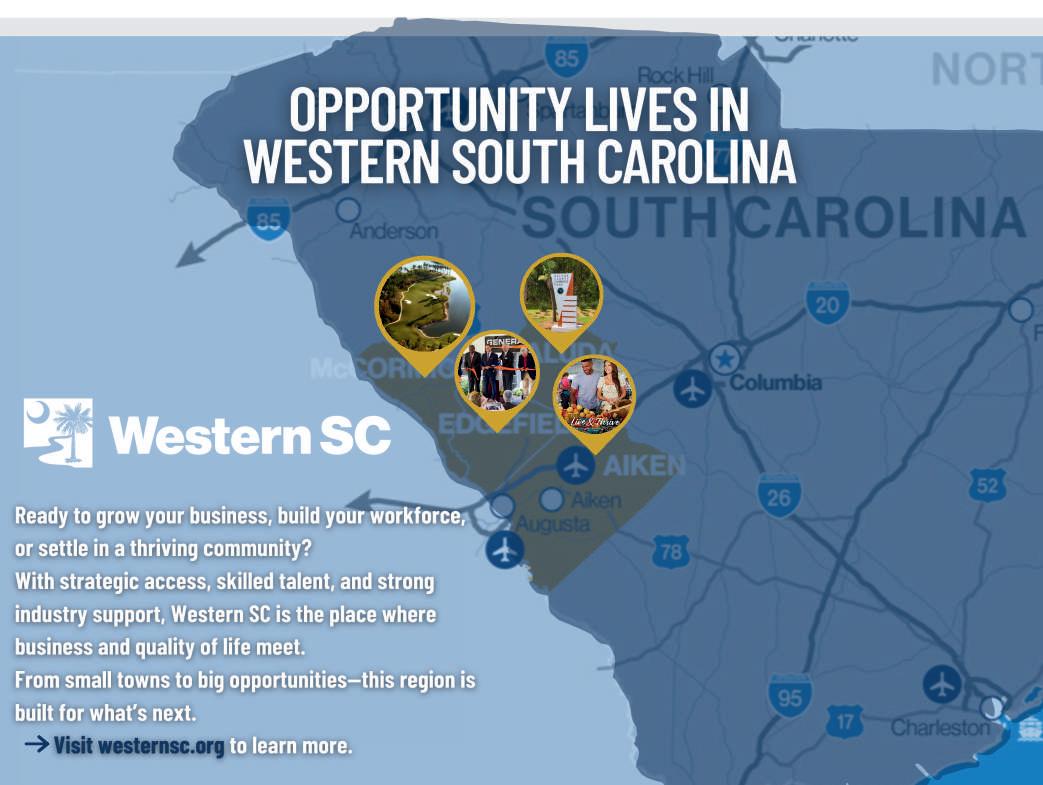

Our story is best told through the success of our members. Since 1988, South Carolina Power Team has been championing great stories through industry recruitment and by offering highly reliable power through South Carolina’s electric cooperatives. As an essential economic development partner, we continue to commit resources and incentives to help businesses thrive in South Carolina, and we play a critical role in the creation of job and career opportunities for those we serve.

MEYN AMERICA, LLC

$50 MILLION INVESTMENT

Expanding operations in Oconee County with 172 new jobs Served by Blue Ridge Electric Cooperative, Inc.

META

$800 MILLION INVESTMENT

Establishing its first South Carolina based data center in Aiken County Served by Aiken Electric Cooperative, Inc.

www.scpowerteam.com

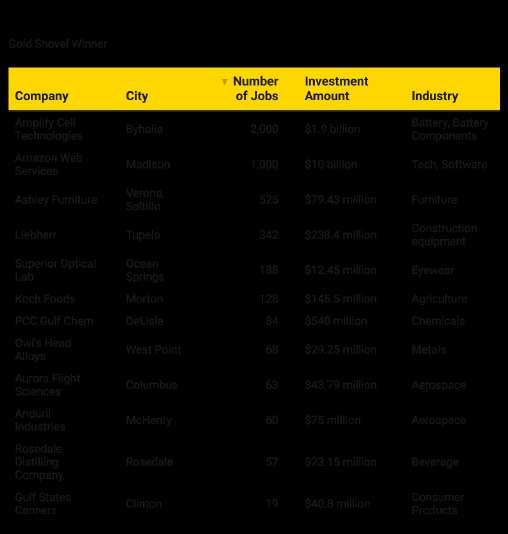

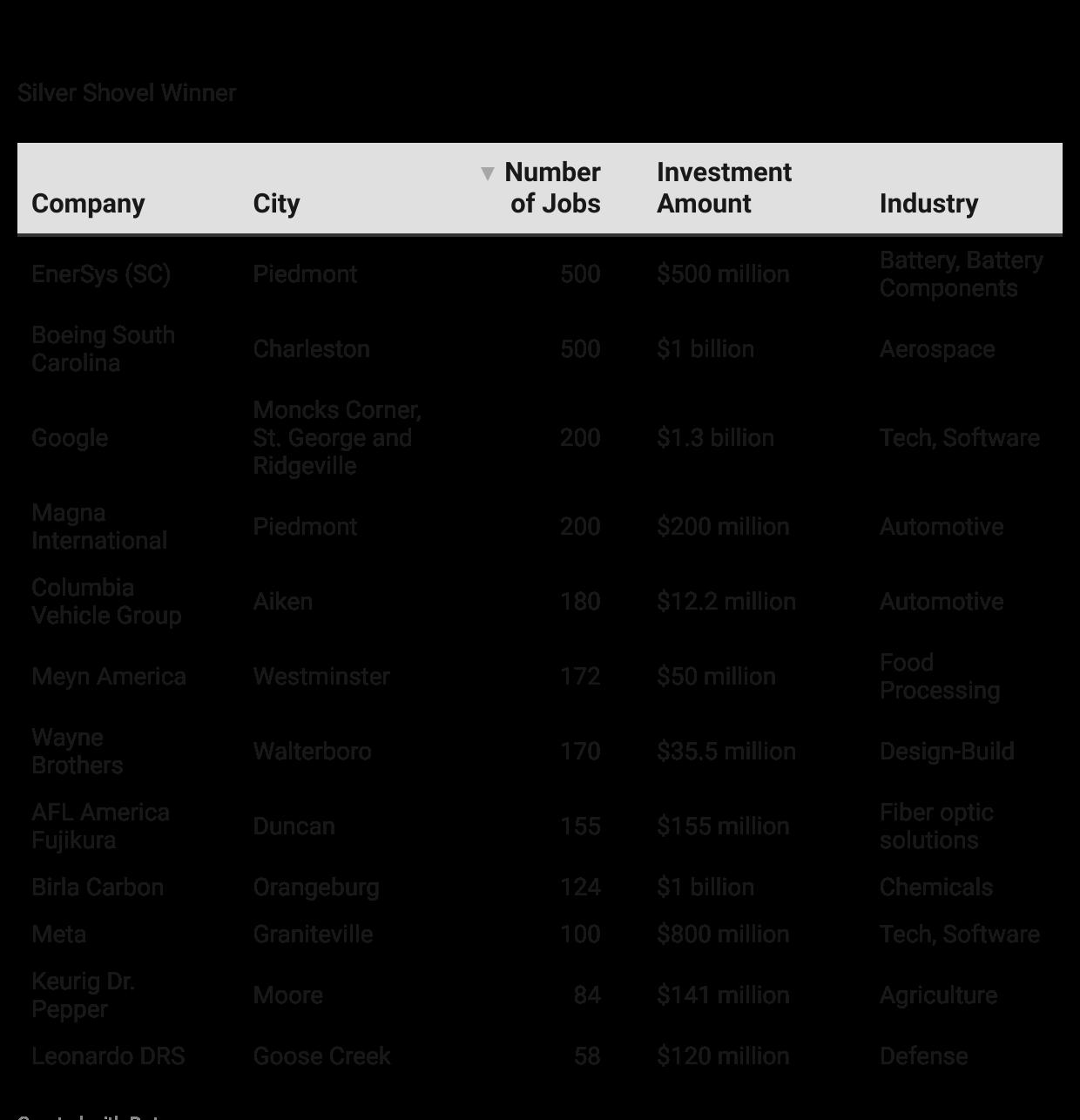

Two decades of dealmaking, diversification, and economic momentum — this year’s Shovel Awards celebrate the states digging deepest to build the future.

By Andy Greiner Editor

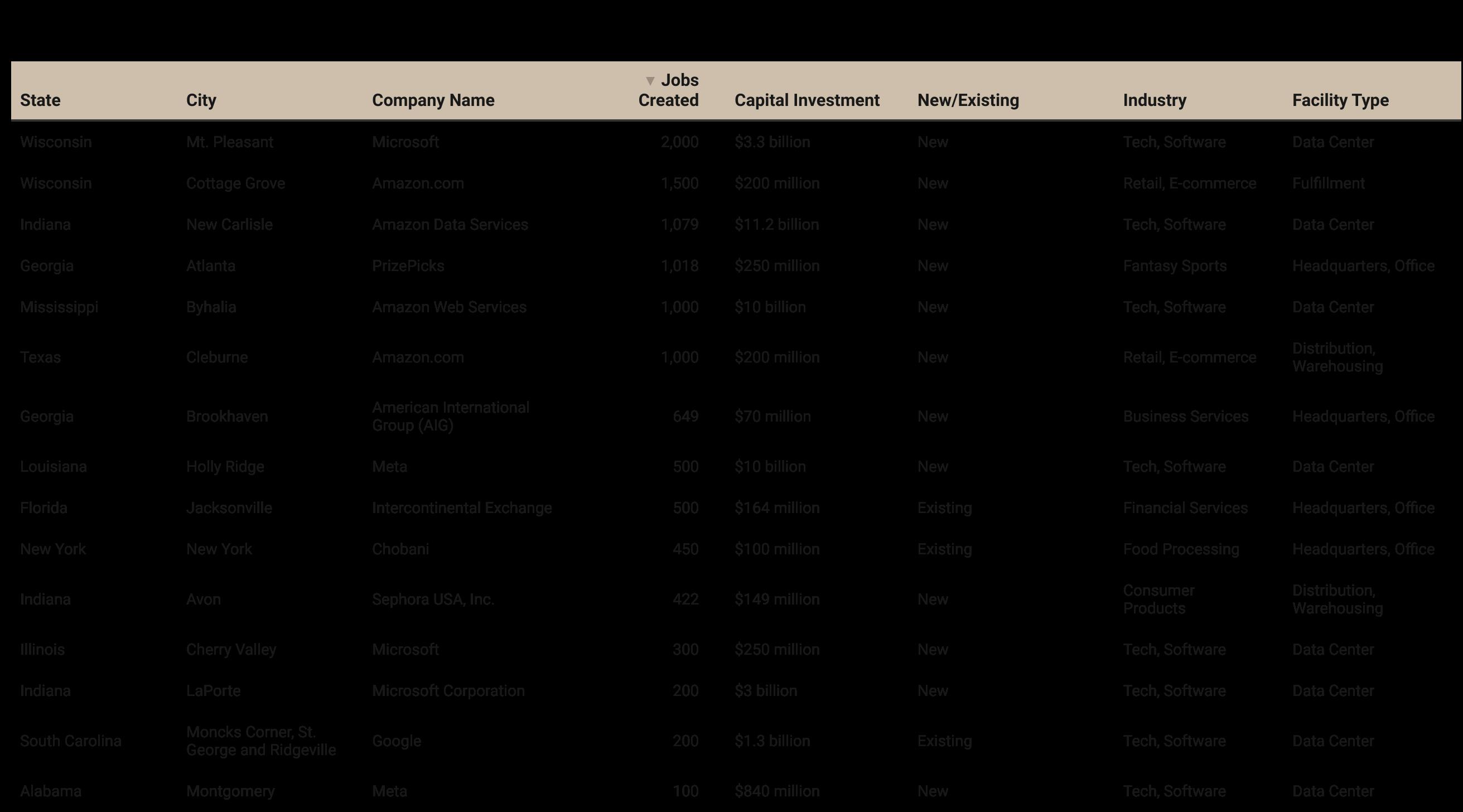

It’s been 20 years since Area Development first handed out its inaugural Shovel Awards. In those two decades, we’ve seen seismic shifts in where and how America grows. From the rise of the electric vehicle industry to the return of semiconductor manufacturing on U.S. soil, the momentum has never let up. If anything, the pace has only quickened. And through it all, the states that earn Shovel Awards have led the charge, securing investments, creating jobs, and laying the groundwork for sustainable, long-term economic success.

The 2025 Gold and Silver Shovel Awards arrive during a time of remarkable resilience and forward-looking energy. Despite global headwinds, domestic uncertainty, and technological upheaval, the American economy continues to expand, fueled by billions in capital investment and a renaissance in domestic manufacturing. From EV batteries to semiconductors, aerospace to food production, and from rural communities to megaregions, the growth stories behind this year’s winners offer a powerful testament to the vision and coordination it takes to compete in today’s global economy.

Each year, Area Development recognizes states that stand out for their ability to attract high-impact economic development projects. Using data submitted by state economic development agencies, we evaluate the top projects based on job creation, capital investment, diversity of industry, and each state’s overall economic strategy. Gold and Silver Shovel Awards are given out in five population categories to ensure fair comparisons, and in recent years we’ve added Platinum and Green Shovel Awards to highlight standout overall performance and leadership in environmentally sustainable development, respectively.

Read on for a detailed look at this year’s topperforming states, the projects that earned them recognition, and the broader economic trends shaping America’s industrial future.

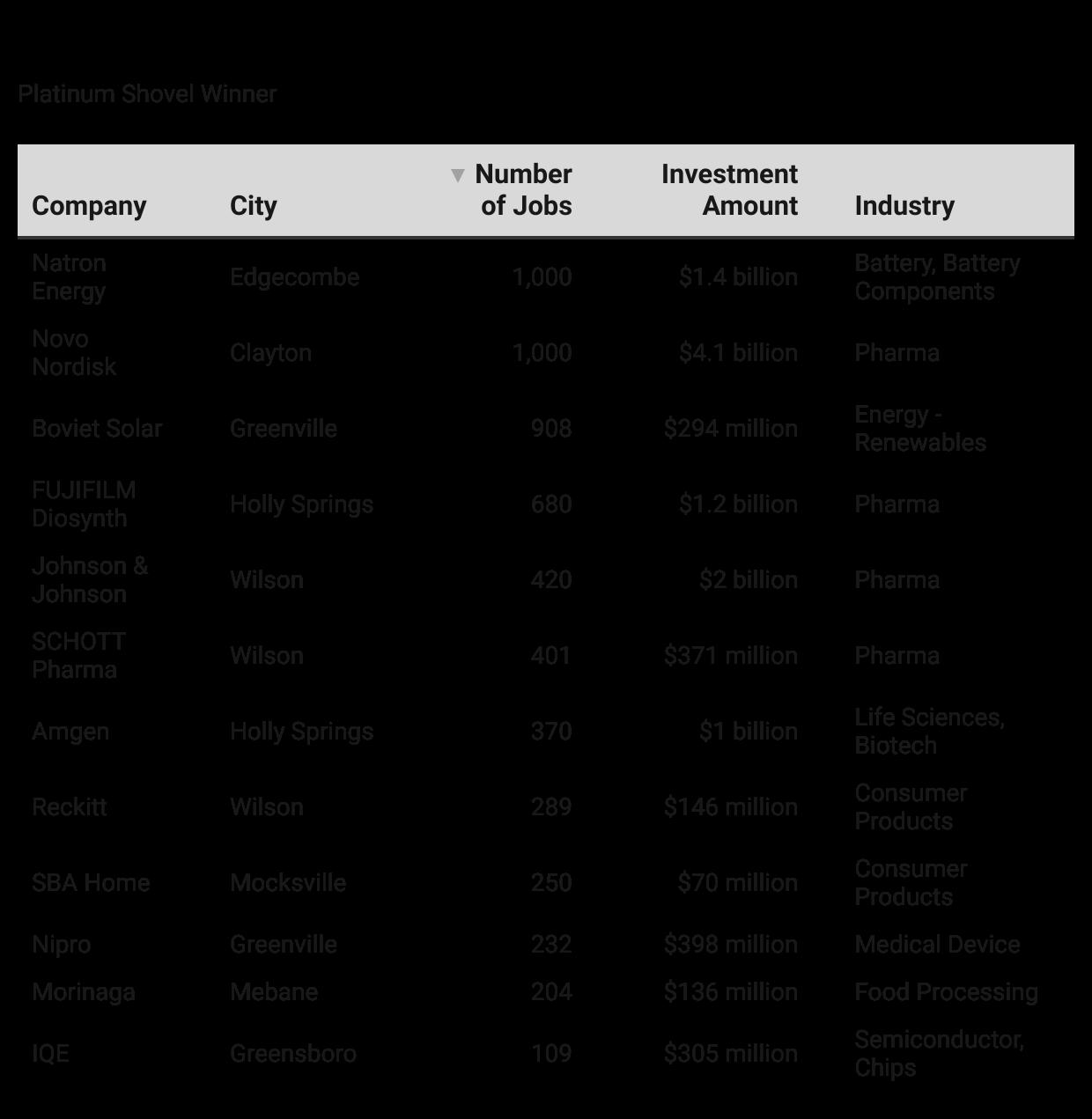

North Carolina earned this year’s Platinum Shovel with a remarkable blend of scale, sectoral breadth, and future-forward vision. At the heart of the state’s success are four standout Projects of the Year — each reinforcing a different aspect of North Carolina’s competitive advantage.

In Clayton, Novo Nordisk committed $4.1 billion to expand its pharmaceutical production campus, adding 1,000 jobs and reaffirming the Research Triangle’s place

Expansion Manufacturing Project of the year

as a global life sciences leader. The project represents not only capital investment but also the kind of long-term, knowledge-based employment that lifts entire regions.

Also in pharma, FUJIFILM Diosynth Biotechnologies is investing $1.2 billion in its Holly Springs site, expanding capacity for biologics manufacturing and creating 680 new jobs. It’s a critical node in the nation’s healthcare supply chain and a clear signal that biomanufacturing is a North Carolina specialty.

The clean energy economy is growing here, too. Natron Energy selected Edgecombe County for a $1.4 billion battery component plant with 1,000 jobs, and Boviet Solar is launching a nearly $300 million solar manufacturing facility in Greenville. Together, these projects place North Carolina on the map as a key contributor to the renewable energy supply chain.

Supporting these mega-deals are a wide range of additional investments, including IQE’s $305 million semiconductor expansion in Greensboro, Nipro’s $398 million medical device project in Greenville, and a trio of new and expanded facilities from Johnson & Johnson, Reckitt, and SCHOTT Pharma in Wilson County.

Whether it’s chips, drugs, batteries, or solar cells,

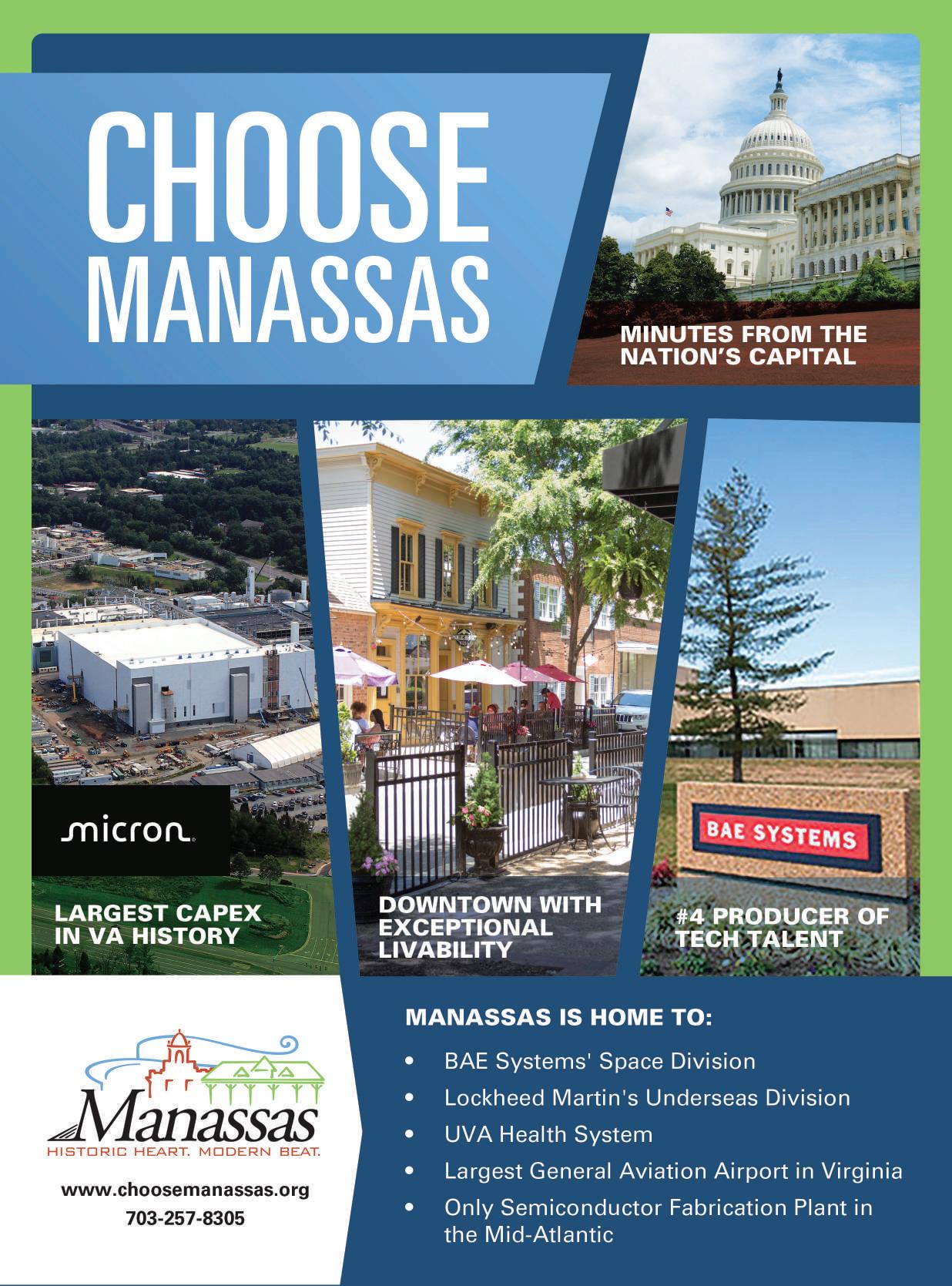

Shovel-ready sites and talent programs are helping Virginia win major manufacturing projects

By Virginia Economic Development Partnership (VEDP)

In April, LS GreenLink USA, Inc., broke ground on its highvoltage direct current submarine cable manufacturing facility on a brownfield site in the city of Chesapeake. The facility, conveniently located near the Port of Virginia’s Norfolk Harbor and the Atlantic Ocean, is expected to begin operations in 2028 and will create 330 full-time jobs. The new facility will serve the global offshore wind industry and, as Gov. Glenn Youngkin noted, “showcase the Commonwealth as a leader in offshore wind industry manufacturing.” LS selected Chesapeake over potential sites in 15 states, in large part due to its skilled workforce — notably its strong veteran population.

The LS GreenLink project was one of three Virginia wins recognized with a Gold Shovel Award from Area Development in 2025, alongside Micron Technology Inc.’s $2.2 billion expansion in Manassas and Microporous LLC’s $1.4 billion facility in Pittsylvania County.

The use of a brownfield site highlights Virginia’s adaptability in delivering shovel-ready sites. A key contributor is the Virginia Business Ready Sites Program (VBRSP) — a major reason why Virginia ranked as America’s Top State for Business in CNBC’s

2024 analysis. The program pre-certifies sites by partnering with localities, utilities, and state agencies to streamline permitting and set the stage for smooth construction.

The VBRSP identifies and prepares potential industrial sites of at least 100 acres — or 50 acres in western, mountainous regions — and has awarded more than $200 million in grants over the past two years. These funds help develop infrastructure and secure approvals to enable speed to market, a top priority for companies establishing new facilities.

Site readiness was a decisive factor in major projects such as the LEGO Group’s sustainably designed manufacturing plant, now under construction in Chesterfield County’s Meadowville Technology Park. To date, 44 sites have received development grants, and more than 10,000 jobs have been announced on sites that benefited from the VBRSP. The 2024 grants alone supported 22 sites representing more than 10,000 acres of developable land.

The VBRSP is just one way Virginia works to eliminate risk for corporate investors. In early 2024, the General Assembly passed legislation establishing the Virginia Business Ready Permitting Program, designed to fast-track approvals for transformational economic development projects and eliminate major delays.

Another advantage for employers is the Virginia Talent Accelerator Program, which supported both the LS GreenLink and LEGO Group projects. Named the top workforce program in the U.S. by Business Facilities in 2024, the Talent Accelerator combines custom recruitment marketing, direct candidate outreach, and training support. Since launching in 2020, the program has helped secure nearly 13,000 jobs.

Virginia’s commitment to reducing risk and accelerating project success transcends politics. Whether led by Democrats or Republicans, the Commonwealth has consistently delivered a best-in-class business climate. Its proactive approach to site readiness, permitting, and workforce development makes it easier for companies to move quickly — and with confidence.

This article was paid for and written by Virginia Economic Development Partnership and approved by Area Development.

North Carolina has emerged as a magnet for capital and innovation. Its well-coordinated ecosystem — from community colleges to logistics corridors — has proven to be more than ready for today’s advanced industries. That’s why, in 2025, North Carolina stands alone at the top of the Shovel Awards podium.

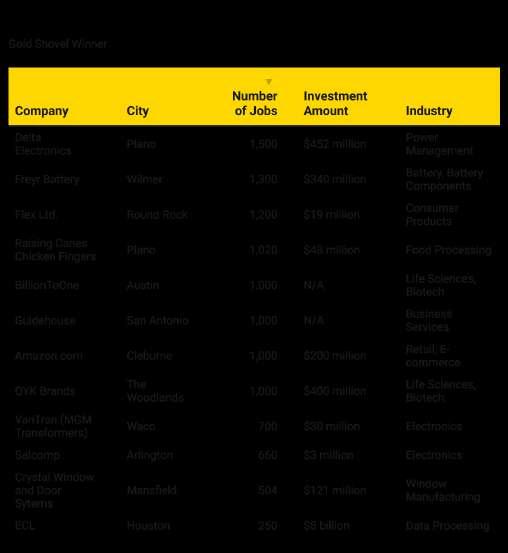

Texas takes home the Gold Shovel once again in the largest population category, anchored this year by an astonishing $10.6 billion in total capital investment across a dozen highimpact projects. Leading the charge is ECL, with a massive $8 billion commitment to build a new data processing facility in Houston — a transformative project that positions the state as a backbone of the global cloud and AI infrastructure economy.

But Texas’s wins this year go far beyond digital infrastructure. The state is seeing notable growth in energy-related technologies, including battery and power management. Freyr Battery is investing $340 million in a facility that adds crucial momentum to the domestic energy storage sector, while Delta Electronics, a manufacturing project of the year, is contributing another $452 million to strengthen Texas’s role in power electronics and grid support.

Life sciences are also taking root in Texas, with projects from QYK Brands, a manufacturing project of the year, and BillionToOne — the former committing $400 million to biotech production and the latter contributing intellectual and R&D firepower to the mix.

Meanwhile, companies like Crystal Window and Door Systems are reinforcing the state’s role in advanced construction products with a $121 million facility in Mansfield expected to bring more than 500 jobs. Rounding out the year’s highlights are expansions from Amazon, Flex Ltd., and Raising Cane’s, each playing a role in strengthening Texas’s logistics, consumer products, and food processing base.

Expansion

Non-Manufacturing Project of the year

Manufacturing Project of the year

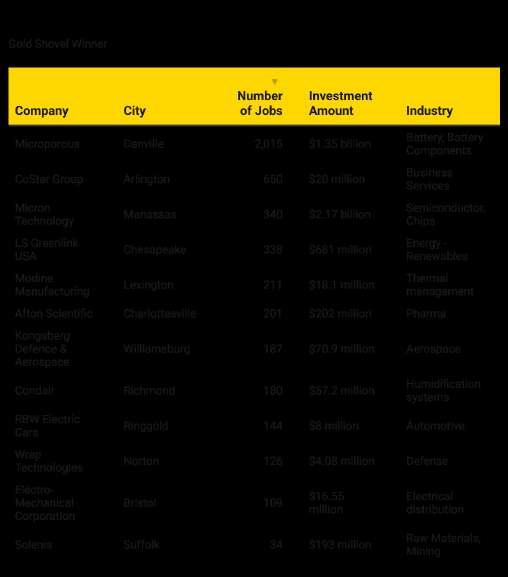

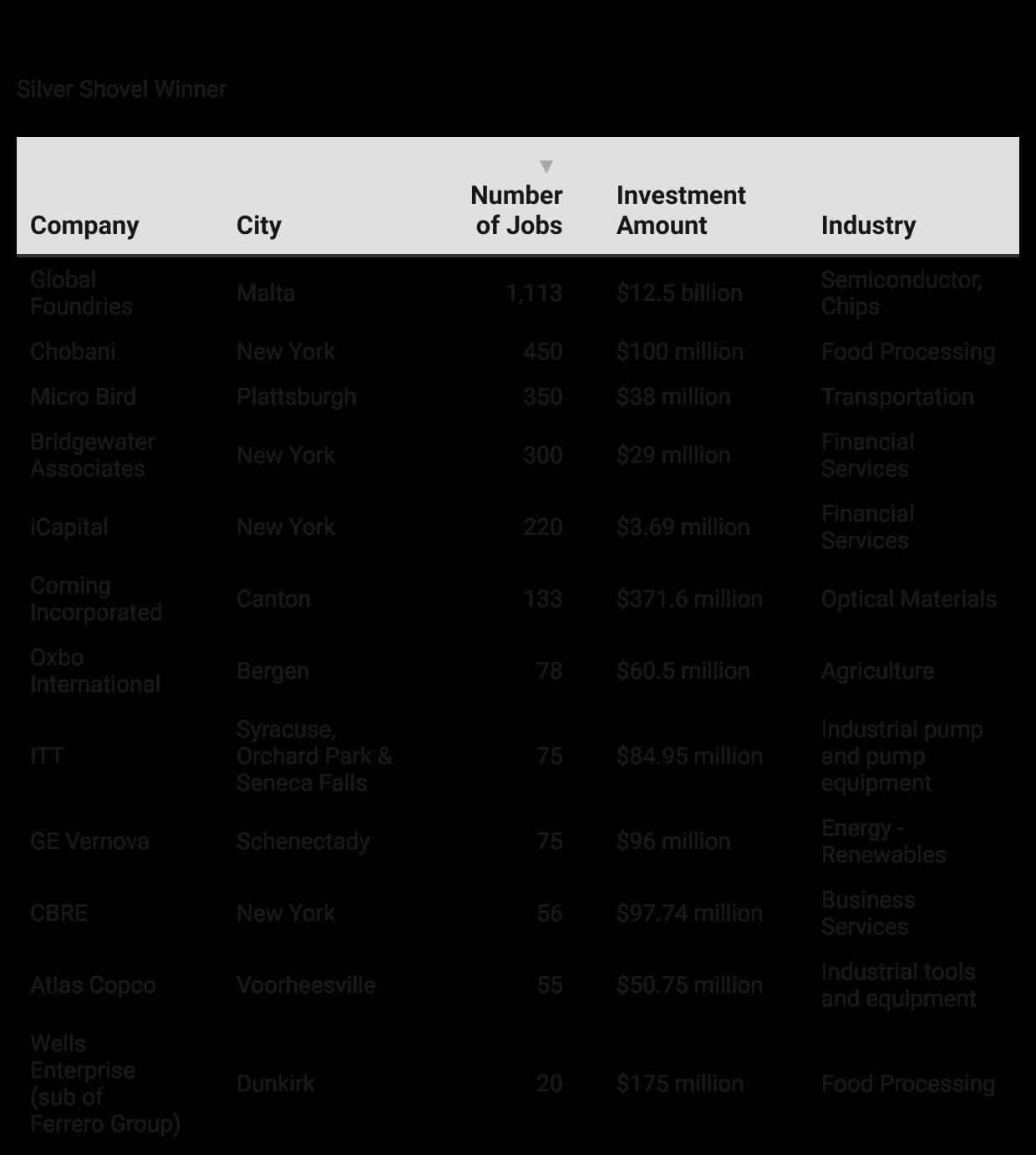

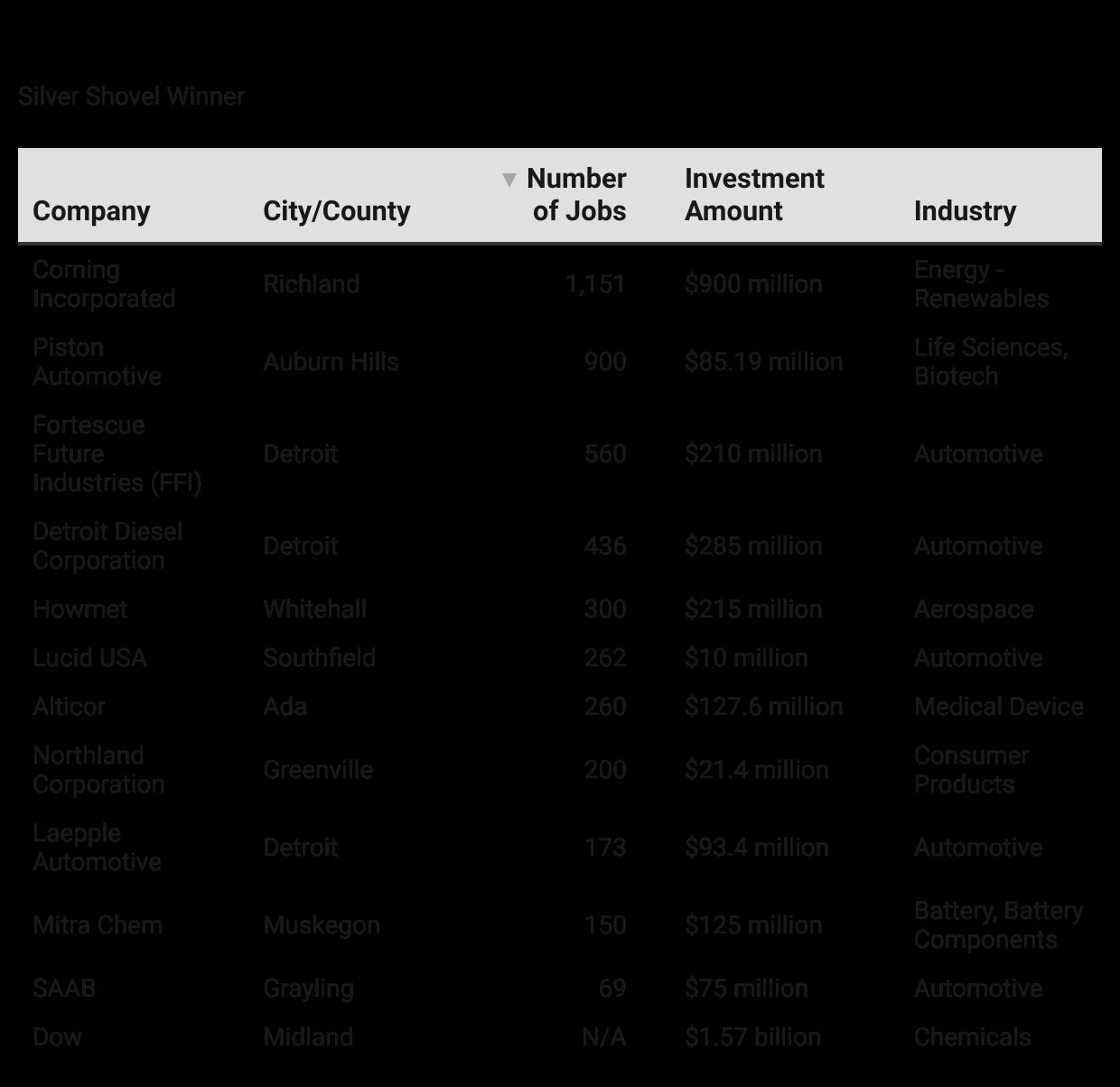

Virginia earns this year’s Gold Shovel with a slate of projects that showcase the state’s range — from deep-tech investments in semiconductors and batteries to strategic growth in pharmaceuticals, defense, and clean energy. Together, these initiatives represent billions in capital investment and more than 4,500 new jobs across the commonwealth.

At the top of the list is Micron Technology’s $2.17 billion expansion in Manassas, a project of the year that reinforces Virginia’s role in the domestic semiconductor supply chain. It’s a major vote of confidence in both the region’s technical talent and its global competitiveness in high-tech manufacturing.

Another standout project and project of the year is Microporous, investing $1.35 billion in Danville to produce advanced battery components. That single project accounts for more than 2,000 of the new jobs in Virginia this year and is a critical building block in the broader transition to electric vehicles and grid-scale storage.

Energy is also part of the story, with LS Greenlink USA committing $681 million to Chesapeake for a renewable power transmission project. On the life sciences front, Afton Scientific is expanding in Charlottesville with a $202 million pharmaceutical manufacturing facility.

Virginia’s momentum also reaches into aerospace, defense, automotive, and advanced HVAC. Kongsberg Defence & Aerospace, RBW Electric Cars, and Condair are just a few of the companies helping round out a roster that touches virtually every corner of the advanced manufacturing economy.

What binds these projects together is a strong workforce pipeline, strategic infrastructure, and the ability of state and local leaders to move fast on opportunity.

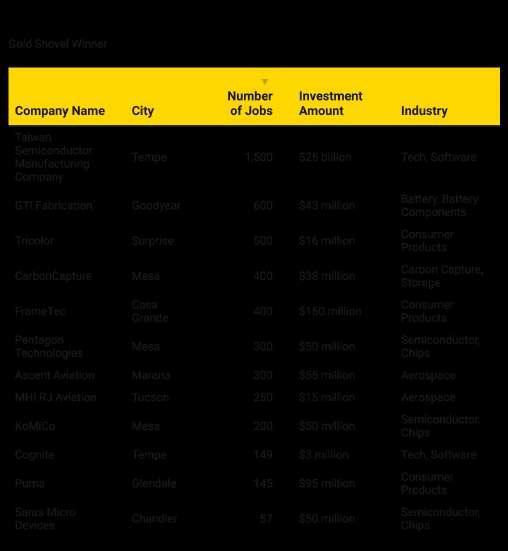

Arizona reclaims Gold Shovel honors in 2025 with a blockbuster year led by one of the largest investments in U.S. tech history. Taiwan Semiconductor Manufacturing Company (TSMC) has committed $25 billion to its Tempe operations, adding 1,500 high-wage jobs and accelerating Arizona’s transformation into a global hub for advanced microelectronics.

TSMC’s staggering commitment headlines a deep roster of semiconductor and chiprelated investments. KoMiCo, Pentagon Technologies, and Saras Micro Devices all added multimillion-dollar expansions in Mesa and Chandler, further solidifying Arizona’s semiconductor cluster and its strategic value to U.S. reshoring efforts. These moves build on the state’s growing reputation as a critical piece of the national supply chain for everything from smartphones to satellites.

But chips weren’t the only bright spot. GTI Fabrication in Goodyear is ramping up battery component production with a $43 million investment and 600 new jobs. And in Mesa, CarbonCapture is laying the foundation for a new carbon storage hub — a rare play in the climate tech space that underscores Arizona’s diversity of innovation.

Aerospace also had lift. Ascent Aviation in Marana and MHI RJ Aviation in Tucson committed to growing Arizona’s MRO (maintenance, repair, and overhaul) capabilities, expanding the state’s aviation workforce and infrastructure. Meanwhile, major consumer goods expansions from FrameTec, Puma, and Tricolor round out the state’s industrial growth with more than 1,000 additional jobs.

From semiconductors to carbon storage, and aviation to batteries, Arizona’s 2025 project

Expansion

Manufacturing Project of the year

Expansion

Manufacturing Project of the year

slate proves it’s not just scaling — it’s evolving. That dynamic, future-facing growth earns the Grand Canyon State a well-deserved Gold Shovel.

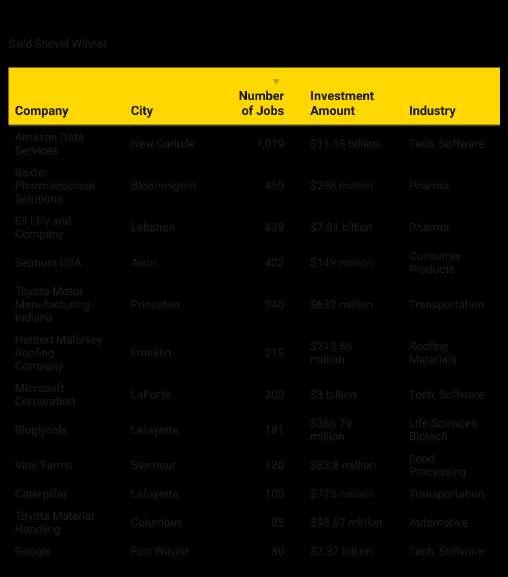

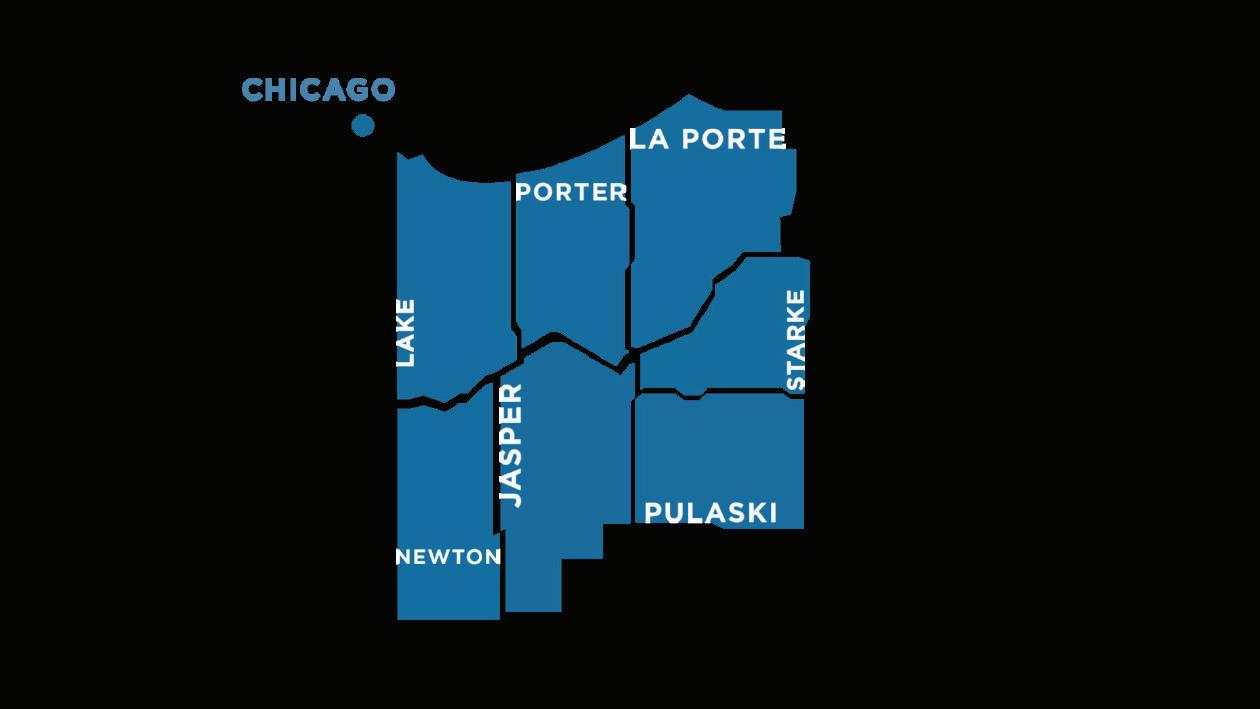

Indiana moves up to the Gold Shovel ranks this year on the strength of a high-powered portfolio that spans pharma, automotive, aerospace, and digital infrastructure — with multiple billiondollar-plus projects driving statewide impact.

The headliner is Amazon Data Services, building a $11.2 billion data center campus in New Carlisle, one of the largest single capital investments in state history. It’s a transformative project not only for St. Joseph County but for Indiana’s long-term role in supporting the nation’s digital backbone.

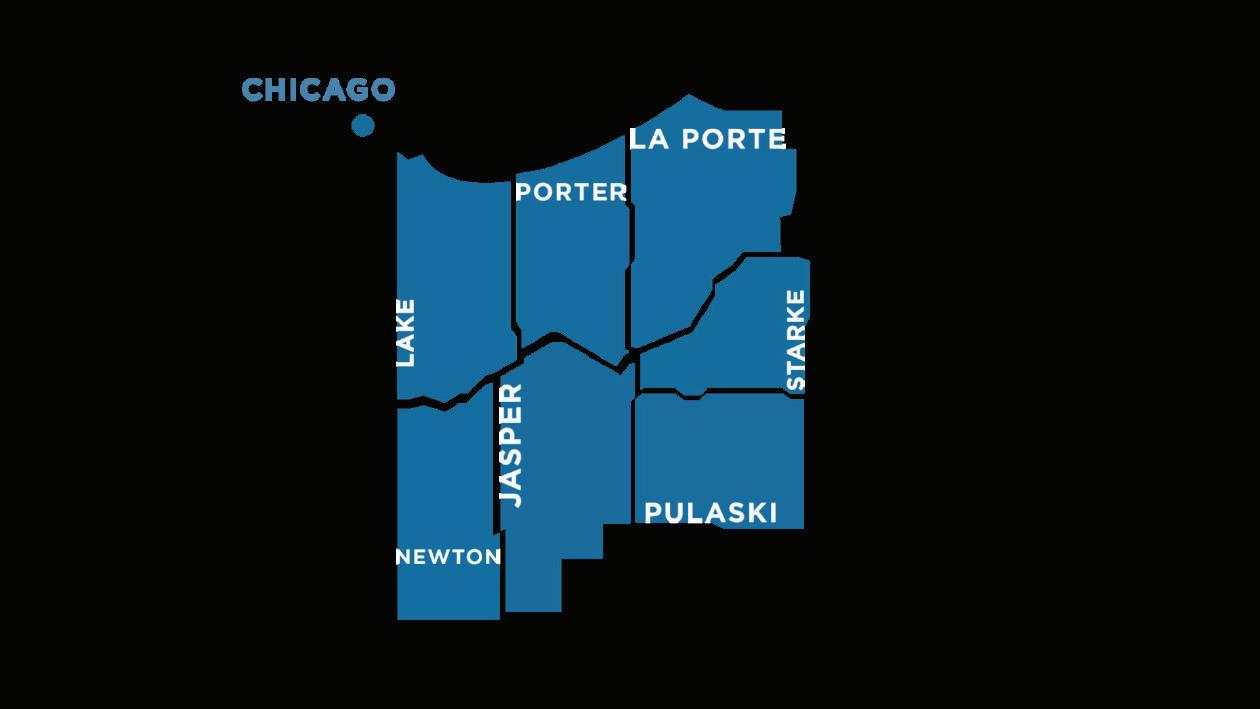

But that’s far from the only headline. Eli Lilly’s $7.8 billion pharma campus in Lebanon will create nearly 440 jobs and anchor a biotech cluster outside Indianapolis. And Microsoft has committed $3 billion to a new data center in LaPorte County, reinforcing Indiana’s dual role in tech and life sciences.

There’s muscle in the industrial sectors, too. Toyota Motor Manufacturing Indiana is putting $632 million into its Princeton facility. Caterpillar continues to deepen its Lafayette presence with a $725 million investment, and Google adds a $2.4 billion site in Fort Wayne, further reinforcing Indiana’s draw for tech titans.

Complementary growth includes Sephora’s new distribution center in Avon, Vital Farms’ expansion in Seymour, and additional projects in roofing materials, R&D, and advanced manufacturing.

This year’s Gold Shovel for Indiana reflects the state’s steady evolution — from a manufacturing stalwart to a modern logistics and tech magnet, ready for a reshaped industrial era.

Expansion

Non-Manufacturing Project of the year

Manufacturing Project of the year

The future is firmly rooted in Arizona as the home of innovative businesses from around the world. Major investments made in 2024 continued to advance the state’s thriving ecosystem and has earned Arizona its 7th Gold Shovel Award. Arizona’s banner economic activity is marked by TSMC’s ongoing expansion in the state. The leading-edge chip manufacturer in April 2024 announced it will build its third fab at TSMC Arizona. The project will leverage the most advanced semiconductor process technology in the United States and is recognized as Area Development’s 2025 Manufacturing Project of the Year.

Arizona is a premier location to catalyze advanced technologies and offers a lifestyle that allows employees to achieve their personal goals with endless outdoor activities, vibrant arts and culture, and affordable living. It’s this perfect balance that makes life better here — and provides the winning combination for global innovators.

Louisiana’s Gold Shovel is marked by a sweeping surge in energy transition investments, advanced manufacturing, and carbon capture infrastructure — a bold new chapter for a state long known for its industrial might. It’s no surprise that Louisiana also earned Area Development’s Green Shovel honor, too.

Leading the way is Lake Charles Methanol, committing $3.2 billion to a major facility in southwest Louisiana that will use carbon capture technologies to reduce emissions in hydrogen and methanol production. It’s one of several projects in the state’s rapidly growing climate-tech corridor, which also includes Heirloom Carbon Technologies in Shreveport and Climeworks in Calcasieu Parish — two next-generation direct air capture hubs.

Meanwhile, Woodlands Biofuels Inc. is bringing $1.35 billion to Reserve for a biorefinery that converts biomass into clean fuel, and UBE C1 Chemicals America is investing $500 million in Jefferson Parish for advanced materials manufacturing. These projects signal a shift in the state’s industrial strategy — one that layers clean energy priorities onto an already deep foundation of chemical and refining expertise.

But the biggest single deal is squarely in the digital space. Meta’s $10 billion data center in Holly Ridge — one of the largest in the country and a non-manufacturing project of the year— is more than a capital commitment; it’s a transformation. The project not only introduces high-tech jobs into a traditionally manufacturing-heavy region, but also places Louisiana on the digital infrastructure map for decades to come.

Smaller-scale but equally diverse wins round out the story: Global Seamless Tubes & Pipes in Mansfield, Agile Food Storage in Pearl River, and Life for Tyres in Reserve add jobs in metal fabrication, logistics, and recycling, respectively.

Expansion

Non-Manufacturing Project of the year

For the second year running, Louisiana also claims this year’s Green Shovel Award, recognizing its leadership in clean energy and carbon reduction.

The state’s 2025 portfolio includes a powerful lineup of climate-forward projects: Lake Charles Methanol’s $3.2 billion low-carbon facility, Woodlands Biofuels’ $1.35 billion biorefinery, and two emerging direct air capture hubs from Heirloom and Climeworks. Together, they form one of the country’s most ambitious energy transition ecosystems.

From biomanufacturing to carbon removal, Louisiana is proving that legacy industrial states can also lead the green future.

In a stunning show of confidence from one of the world’s biggest tech giants, Amazon Web Services announced a $10 billion investment in Madison, Mississippi — the kind of jaw-dropping number that reshapes an entire state’s economic trajectory. This hyperscale data center project is not only the largest single investment in Mississippi history, it places the Magnolia State squarely in the conversation about cloud infrastructure and next-generation digital economy assets.

But Amazon’s megadeal was just the headline. Another transformational project comes from Amplify Cell Technologies, with a $1.9 billion battery component manufacturing facility in Marshall County that’s expected to create 2,000 jobs – which earned it project of the year honors. With this investment, Mississippi deepens its ties to the fast-growing EV supply chain while bringing high-tech manufacturing to the northern corridor.

Elsewhere, the state continues to diversify its industrial base. Liebherr is investing more than $238 million to grow its construction equipment footprint in Tupelo,

Non-Manufacturing Project of the year Manufacturing Project of the year

and PCC Gulf Chem is expanding its chemical production capabilities in DeLisle with a $540 million commitment. Aerospace firms like Anduril Industries and Aurora Flight Sciences are scaling operations in McHenry and Columbus, respectively — further boosting Mississippi’s standing in defense and aerospace manufacturing.

Consumer products and legacy sectors had their moment, too. Ashley Furniture is investing in twin facilities in Verona and Saltillo, while Koch Foods, Superior Optical Lab, and Gulf States Canners are anchoring food, eyewear, and packaging production across multiple counties.

With more than $13 billion in capital investment tallied across just a dozen major projects, Mississippi proved this year that small states can land big deals — and that when tech titans and clean tech manufacturers go shopping for locations, Mississippi is ready with shovelready sites and statewide support.