Commercial Real Estate

As your fiduciary, an experienced broker will negotiate the lowest possible occupancy cost in the property that best meets your business objectives. Typical negotiated savings range from 15 to 40% and include rent, improvement allowances, concessions, and lease structures.

Brokerage commissions are built into listing contracts so your firm will incur no out of pocket costs.

We will coordinate programming, space planning and construction budgets to define and validate your requirement.

Envision the desired workplace environment, establish conceptual framework, define the branding elements that align with the company’s identity.

Develop Detailed Space Requirements as well as current and future SF needs, ensuring that the physical space will effectively accommodate the operational needs of the business.

Confirm economic and locational requirements and develop an overall strategic real estate plan.

Prepare a comprehensive property survey and comparative analysis that assesses the benefits and drawbacks of each option.

Multiple proposals are negotiated and compared, detailed space planning, construction budgets, and financial models are evaluated to determine the most feasible and advantageous option.

The final terms of the Letter of Intent (LOI) are confirmed, lease agreement business comments are provided, and attorney review /negotiation coordinated.

Project management process is initiated including construction document finalization and contractor bid/selection process. Project manager ensures construction quality and completion schedule.

Project manager coordinates move related activities as well as low voltage, IT and FFE procurement and installation.

David Chapin founded David Chapin Commercial after 33 years working for International Brokerage Firms. David has negotiated over 500 Commercial Real Estate transactions valued at over $750 million.

Primarily focused on Office Tenant Representation, David has represented major Banks, Law Firms, Engineers, Accountants, Wealth Management Firms in their downtown Orlando requirements, which total over 33 transactions for 1.0 M SF.

In the Suburbs, David has represented major Defense Contractors, Utility Companies, Life Insurance, Radio Networks, Homebuilders, and Corporate Headquarters requirements.

In the Tourist Corridor, David spearheaded the redevelopment of Sea Harbor Office Center, a slab-to-slab 360,000 SF office re-build, securing Wyndham Vacation to a 320,000 SF Corporate Headquarters Lease.

Today real estate information is maintained, and marketing takes place, on third party platforms, Costar, LoopNet, and Crexi. Virtual tours and market overviews are conducted thru LoopNet and Google Earth. Similarly, Demographic Reports, Labor Market Studies, and Employee Commute Analysis are provided by third party platforms.

DCC partners with the Regions top Architectural and Engineering firms to provide enhanced Tenant Services on an ala carte basis. A&E firms are selected based on project complexity and scope.

Over the years DCC has solved the most complex property issues including Base Building Chiller Plant/Distribution HVAC issues, Landlord/ Property Management Incompetence and dealt with ACM in place management concerns.

LAW FIRMS

FINANCE

ENGINEERING/ DEFENSE/ TECHNOLOGY

HOME BUILDERS/ CONSTRUCTION

MEDICAL TOURISM

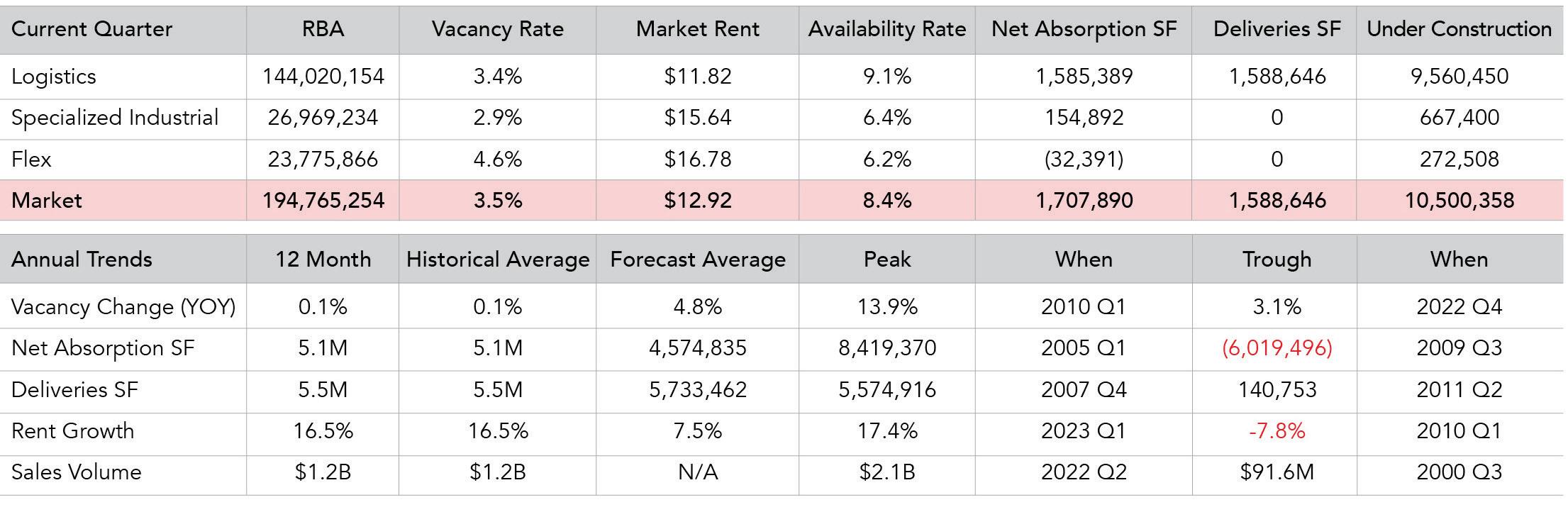

Orlando’s industrial market has been expanding at a rapid pace, with growth driven by a fast pace of inmigration to the market that added nearly 57,000 new residents in 2022 alone. Estimates from Oxford Economics call for that pace to slow in the next few years, but the projected pace of population growth will remain triple that of the U.S. at large through 2027,

resulting in a substantial increase in industrial demand. In the meantime, even with some higher-level cracks evident in national industrial fundamentals, Central Florida’s industrial market remains resilient. The vacancy rate has remained flat over the past year thanks to a strong pace of leasing, and the current vacancy rate of 3.5% is well below the national average.

5.5M 12 Mo Deliveries in SF

5.1M

12 Mo Net Absorption in SF

3.5% Vacancy Rate 16.5% 12 Mo Rent Growth

5.5M 12 Mo Deliveries in SF

5.1M

12 Mo Net Absorption in SF

3.5% Vacancy Rate 16.5% 12 Mo Rent Growth

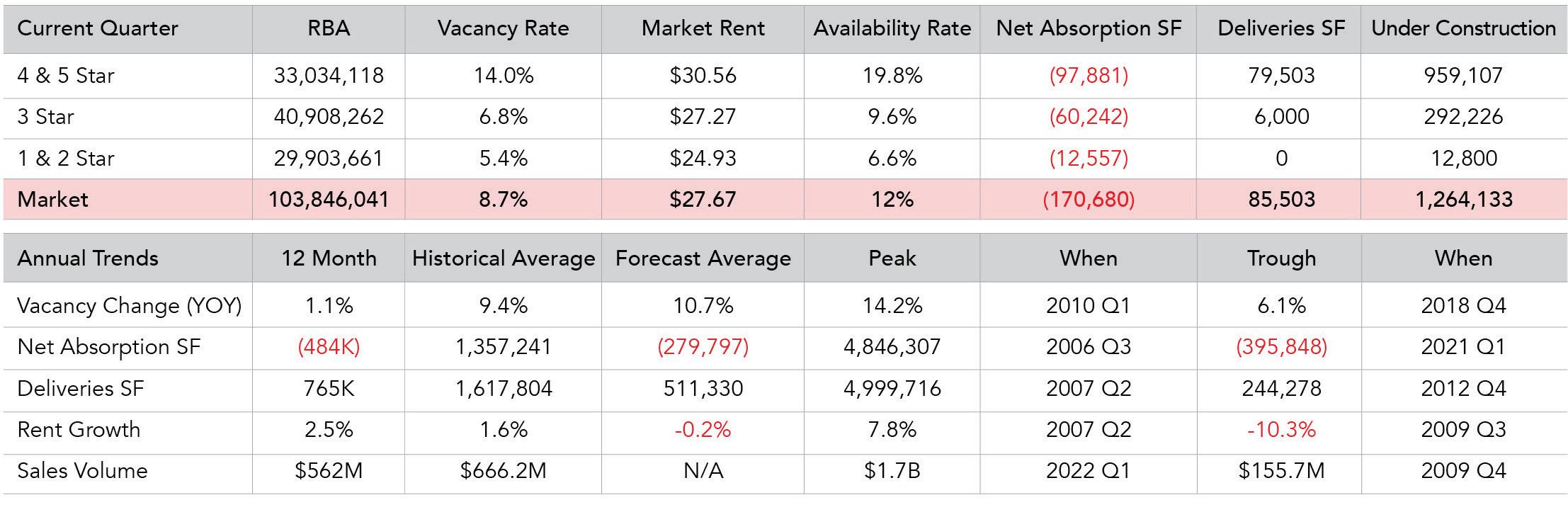

Orlando’s office market remains resilient despite economic headwinds however vacancy is on the rise and demand is down markedly year over year by nearly 1.5 million SF. The pace of rent growth has been a bright spot, with Orlando outperforming the national average since the pandemic began, and it has remained on an upward trajectory over the last two years.

Office demand remains softer than it was prepandemic and while leasing activity is taking place, deals volume and size has been slowly trending downward in recent quarters. Urban and suburban office space demand continues to outpace suburban absorption by a wide margin, a trend that will likely continue for the next several quarters.