Q3 2025 LOWER MANHATTAN REAL ESTATE MARKET REPORT

Lower Manhattan’s office market continued to benefit from the upsurge in leasing across Manhattan with another quarter of strong market activity. Year-to-date

Lower Manhattan has seen 3.18 million sq. ft. of leasing–more than any year since 2019. While strong quarters post-COVID have often been the result of one or two large leases, activity in Q3 was driven largely by smaller deals, demonstrating a broader upturn in market activity. Downtown’s diverse retail, fitness and entertainment scene continued to grow with 28 retailers opening in Q3 including several long awaited new businesses including Barcade and Socceroof. The neighborhood’s hospitality industry continues to thrive with average daily room rates hitting new records and occupancy remaining strong despite ongoing economic uncertainty. And Lower Manhattan’s residential market remained robust for another quarter with rents setting another new record and condo sales picking up.

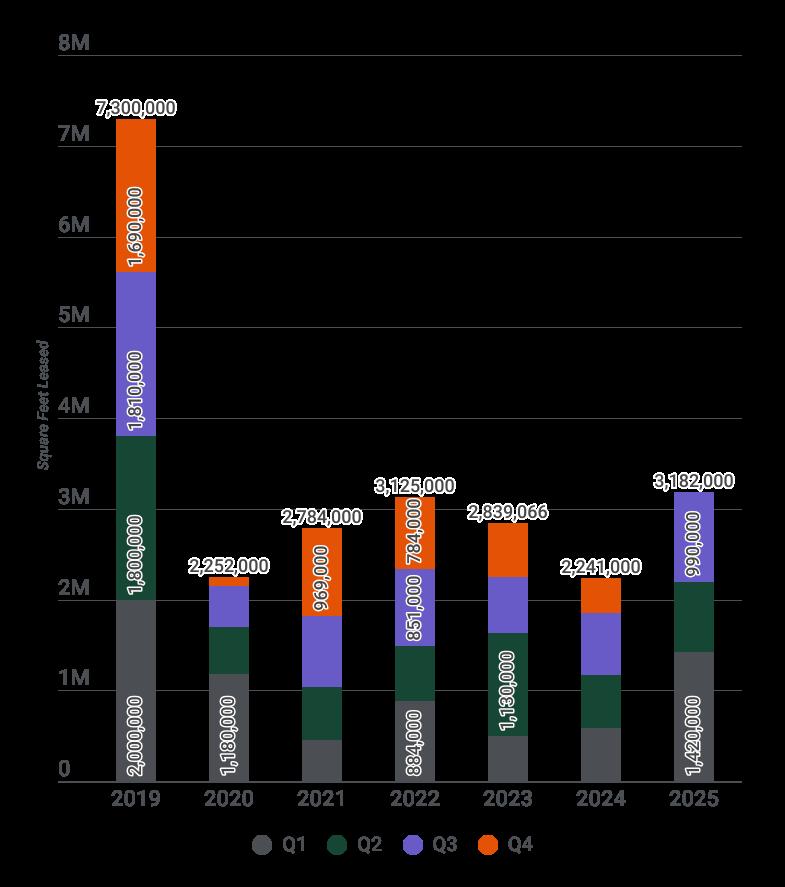

Office leasing in Lower Manhattan continued to make progress in the third quarter, ending with a total of 990,000 sq. ft. leased. This figure represents a 28% improvement over the previous quarter and a 45% improvement Y-o-Y. It also translates to a 39% increase over the five-year quarterly average.

So far, the current year-to-date figure of 3.18 million sq. ft. is 42% above 2024’s total of 2.24 million. In fact, this year’s numbers are already higher than every year since 2019. The district is also on pace to surpass 2016’s year end leasing total of 3.36 million sq. ft. – the first time a post-pandemic year end leasing number would exceed a pre-pandemic total.

Lower Manhattan Annual New Leasing Activity, 2019-2025

Source: CBRE

990,000 Square Feet Of New Leasing In The Third Quarter

The two largest deals only made up 19% of this quarter’s leasing, while deals under 50,000 sq. ft. made up 70% of activity. This is in contrast to previous quarters with strong leasing numbers, when leasing totals were anchored by one or two massive leases. The two largest deals in Q3 were NYC Department for the Aging’s 109,000 sq. ft. movein at 14 Wall St. and Lewis Brisbois Bisgaard & Smith’s 78,000 sq. ft. deal at 140 Broadway.

This rise in demand has also translated into 554,000 sq. ft. of positive absorption, marking the seventh straight quarter where more office space has left the market than entered. While this trend in previous years could be largely attributed to residential conversions coming online, Q3’s healthy level of leasing activity suggests that this positive absorption is related to an increased demand for space.

The Midtown submarket also fared quite well, recording 5.63 million sq. ft. of leasing, making it the fourth highest leasing total since 2011. This number represents an increase over the quarter and year by 48% and 62%, respectively. The total also surpassed the five-year quarterly average by a significant margin, 54%.

Finally, Midtown South finished Q3 at 1.74 million sq. ft. leased, 28% below its Q2 figure but 32% greater than last year’s Q3 total.

Five new tenants relocated to Lower Manhattan during Q3, leasing a total of 140,256 sq. ft. While this represents a substantial improvement in relocation activity over the year and the quarter, it is important to note that the largest tenant relocation, NYC Department for the Aging, is moving from the Civic Center area, just north of Lower Manhattan. The agency’s 109,000 sq. ft. lease at 14 Wall St. accounts for nearly 80% of relocation activity in Q3. The next largest deal came from Optifino, an AI platform helping governments automate workflows, communications and service delivery, which signed a 10,000 sq. ft. lease at One World Trade Center.

The relocation total is a substantial improvement over the year (+200%) and quarter (+34%). The third quarter alone saw more activity than all of 2024 combined (which saw only 117,000 sq. ft. of relocations). Also, year to date

relocation activity in 2025 is 173% over 2024.

The public sector led leasing in the third quarter, accounting for 33% of activity. As mentioned, the NYC Department for the Aging signed for the largest lease of the quarter, absorbing 109,000 sq. ft. at 14 Wall St. The FIRE (finance, insurance and real estate) sector came in second, comprising 32% of leasing activity, the bulk of which came from a 60,000 sq. ft. WeWork deal at 250 Broadway and an insurance agency named the Guarantors Agency that took up 27,000 sq. ft. at One World Trade Center. The TAMI (Technology, Advertising, Media and Information) sector finished the quarter with a 27% lease share, led by two equal sized 42,000 sq. ft. leases both located at 195 Broadway. The two entrants were Pilot Fiber, an internet service provider, and Nagarro, an IT services management company.

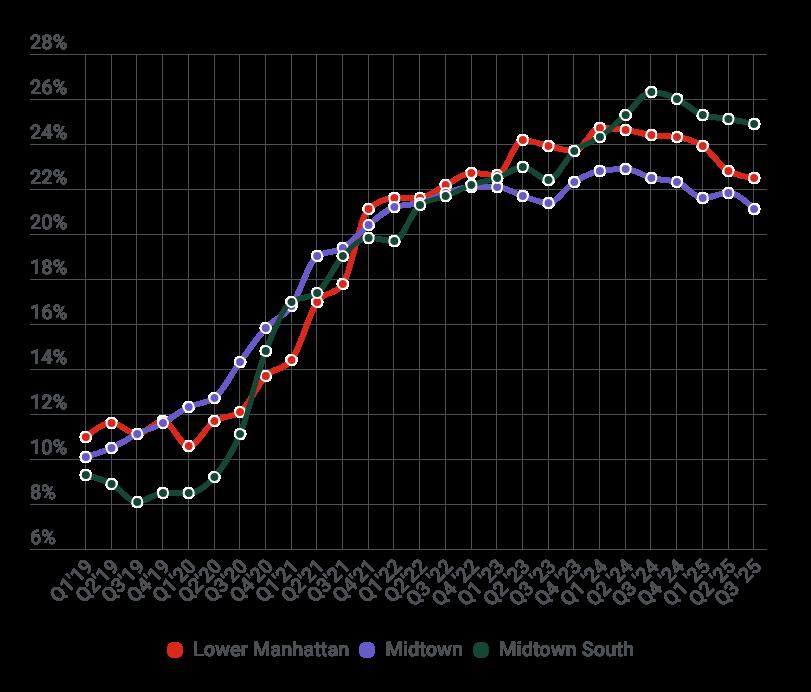

The district saw its overall vacancy rate fall to 22.5% in the third quarter, marking a Q-o-Q decline of 0.3% and the seventh straight quarter of vacancy improvement. Y-o-Y, the vacancy rate fell by 1.9%, which is tied for the office market’s greatest Y-o-Y decline since 2011.

The class A rate, which stands at 21.3%, also showed an impressive yearly improvement by inching down 2.5% – tied for the greatest Y-o-Y decrease since 2013. Over the quarter, the class A rate also fell by nearly an entire percentage point (0.8%) – marking the greatest class A improvement since the first quarter of 2020.

Vacancy improvements were widespread across the whole Manhattan market though the pace and consistency of gains varied by location and asset class. Midtown, which finished Q3 at 21.1%, saw Y-o-Y vacancy declines for its overall and class A properties, as well as modest quarterly increases. Midtown South saw its overall rate decrease slightly over the year and quarter while experiencing modest vacancy upswings in class A space.

Source: Cushman & Wakefield

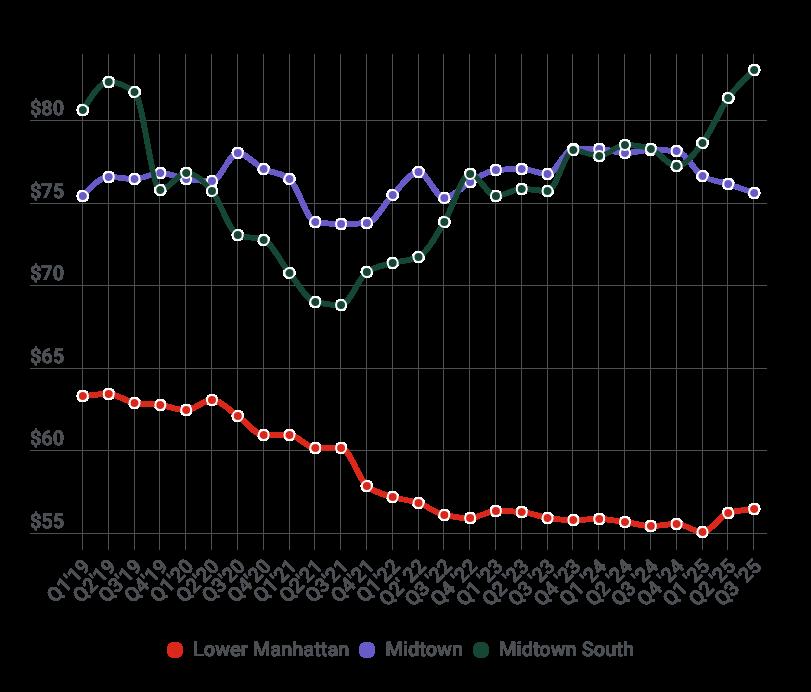

Lower Manhattan’s overall office rents increased for the second straight quarter finishing at $56.40 per sq. ft. The district’s Y-o-Y value inched up by 1.8%, making this the greatest annual increase since 2019. In fact, 2019 was the last time the Y-o-Y change was positive. The Q-o-Q figure increased by 0.4%, which is significant because the district has not seen two consecutive quarters of Q-o-Q growth since 2018.

Lower Manhattan class A rents, which finished at an average of $61.28, also increased for the second straight quarter, with respect to both annual and quarterly changes. The Y-o-Y figure shot up 4.4%, which is the highest since 2019. And the Q-o-Q value increased by 1.2%.

Overall asking rents in Midtown South reached a record high $83.06, increasing 6.2% Y-o-Y and 2.2% Q-o-Q. Midtown, on the other hand, saw its fourth consecutive quarter of rent declines, both over the year and quarter.

Source: Cushman & Wakefield Class A

Source: Cushman & Wakefield

$104.73

Office Building Sales:

• Brookfield Place: Brookfield extended its ground lease with the Battery Park City Authority until 2119, amounting to $1.5 billion that will be paid to the city and BPCA’s joint purpose fund that supports affordable housing projects throughout the five boroughs. The lease is for 9.4 million sq. ft.

Residential Sales:

• 5 Hanover Square: David Werner Real Estate Investments and developer Sam Fisch Development have secured $61 million of acquisition financing for 5 Hanover Square that’s slated for a potential residential conversion. The financing came from 99c and Deutsche Bank.

• 250 Water Street: Real estate developer Tavros acquired the land at 250 Water St. for $150.5 million from Seaport Entertainment Group, $30 million less than what SEG bought it for in 2018.

• 55 Broad Street: Silverstein Properties and Metro Loft Management have put 55 Broad St. on the market, a 344,000 sq. ft. multifamily building that is approximately 75% leased.

Residential Financing:

• 80 Pine Street: Joseph Hoffman’s Bushburg secured a $320 million construction loan for the partial residential conversion of 80 Pine St. Bridge City Capital and Deutsche Bank provided the financing for Bushburg’s efforts. The building is projected to contain 713 rental apartments.

Residential Refinancing:

• 180 Water Street: Nathan Berman’s Metro Loft has completed its $345 million recapitalization of 180 Water Street. This recap includes the sale of a 49 percent stake in the property to 60 Guilders and Sentry Realty as well as a $280 million commercial mortgage-backed securities (CMBS) loan from Deutsche Bank.

Hotel Sales:

• 51 Nassau St.: Hawkins Way Capital, a real estate investment firm, acquired the former 492-key Holiday Inn by IHG. Before the firm’s acquisition, the property most recently served as temporary housing.

• 85 West Broadway: Capstone Equities and Republic Investment Company have acquired the Smyth Tribeca hotel in Tribeca for $39.8 million. The buyers purchased the 100-room hotel at 85 West Broadway from Vanbarton Group.

• 2 West St.: Silver Creek Development acquired the lease for the Wagner Hotel, which had been abandoned since Covid amid a three-year bankruptcy process.

Education:

• 40 Rector Street: CUNY intends to purchase Metropolitan College of New York’s Lower Manhattan real estate for $40 million. CUNY plans to purchase the former Metropolitan College of New York building at 40 Rector Street to serve as a temporary home for the HunterBellevue School of Nursing. The property will be used for classrooms and administrative offices while construction continues on a new campus that will consolidate several CUNY schools.

Development Site:

• 140 Fulton St.: Bank Hapoalim paid $36.9 million to gain control of 140-142 Fulton St..

Lower Manhattan welcomed 27 new retail establishments to the neighborhood during the third quarter of 2025. Approximately two thirds of the openings consisted of F&B establishments. Eight personal and business services locations opened and two shopping locations opened as well. Some notable openings include:

• Barcade, retro arcade bar, opened at 10 Cortlandt St.

• Socceroof, a soccer complex converted from an office space, opened at 28 Liberty St.

• The Paris Cafe, an upscale Parisian eatery, opened at 119 South St.

• Luckin Coffee, a Chinese coffee chain, opened at 100 Maiden Ln.

• Warby Parker, eyewear retailer, opened at Brookfield Place.

• Tacos del Barrio, a new taquería, opened at 71 Nassau St.

• LeFlora Cannabis, a boutique dispensary, opened at 111 Fulton St.

• The Foyer at Vinters, wine bar and café, opened at 63 Barclay St.

• Leon’s Bagels, classic New York–style bagel shop, also opened at 12 John St.

Sadly, four retailers and one entertainment venue closed in the first quarter:

• Sandwich House closed up shop at 17 Ann St.

• Art to Ware closed at 185 Greenwich St.

• Starbucks closed at 140 West St.

• Plant Junkie closed at 226 Front St.

Looking ahead, 26 new retail locations are coming soon. Notable additions include:

• Sanmiwago, which will serve authentic Taiwanese dumplings, plans to open at 62 William St.

• The Golden Mall, a Chinese food emporium, plans to open at 47 Broadway.

Launching RE:Store: An Innovative Pop-Up Initiative to Revitalize Lower Manhattan’s Vacant Storefronts

Despite improvement in retail leasing over the last few years Lower Manhattan still has too many vacant storefronts. To help address this problem the Downtown Alliance is launching a new and innovative retail pop-up and storefront activation program called RE:Store.

Modeled on San Francisco’s highly successful Vacant to Vibrant initiative, which achieved a 60% conversion rate from shortterm activations to long-term leases, our program will activate three or more prominent spaces for six months beginning around Memorial Day 2026. Our goal is to find unique, creative and buzz worthy tenants that will help showcase Lower Manhattan as a neighborhood of choice for aspiring entrepreneurs and retailers.

Here’s how the program will work:

• Landlords provide free access to difficult to lease retail space during the program.

• Curated tenant selection: The Downtown Alliance will identify strong candidates for you to review and choose from with input from a committee of retail industry experts.

• Comprehensive support: the Downtown Alliance will provide participating retailers with resources (including up to $15,000 in start-up funding as well as pro-bono professional services) to help ensure their pop-ups succeed.

We bring experience to this work: in 2021 and 2023, we partnered with Art on the Ave to activate nearly 20 vacant spaces with art, events, and retail opportunities. These activations drew foot traffic, enlivened the streetscape, and generated new interest in long-term leasing.

Applications for tenants will go live on January 12th. If you are interested in partnering with us in any way, either by providing retail space or connecting us with potential tenants please visit our website at www.downtonwnny.com/restore or reach out to Ariana Branchini at abranchini@downtownny.com.

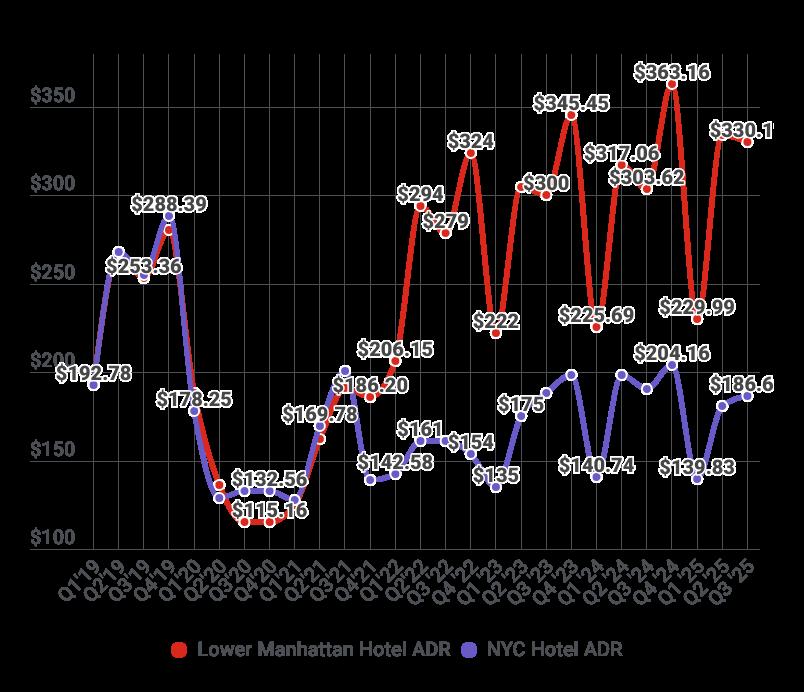

Lower Manhattan ADR reached a new Q3 record of $330, rising 9% over the year and the second highest ADR on record. Room rates in Lower Manhattan have recorded quarterly records in each quarter this year. This makes it the second instance of Lower Manhattan’s ADR exceeding $300. And compared to Q3 2019, the ADR value is 30% greater.

Overall, 2025 has been a great year for the Lower Manhattan hotel market. The remainder of NYC, however, has yet to catch up with the ADR performance of the Manhattan submarkets. It ended the quarter with a $187 ADR. Starting in 2022, the underperformance of the surrounding NYC region has been an ongoing trend with few signs of recovery.

The Midtown submarkets saw yearly ADR increases as well. The three submarkets combined (Midtown West, South, and East) saw a 6% uptick, as well as a 148% increase compared to 2019.

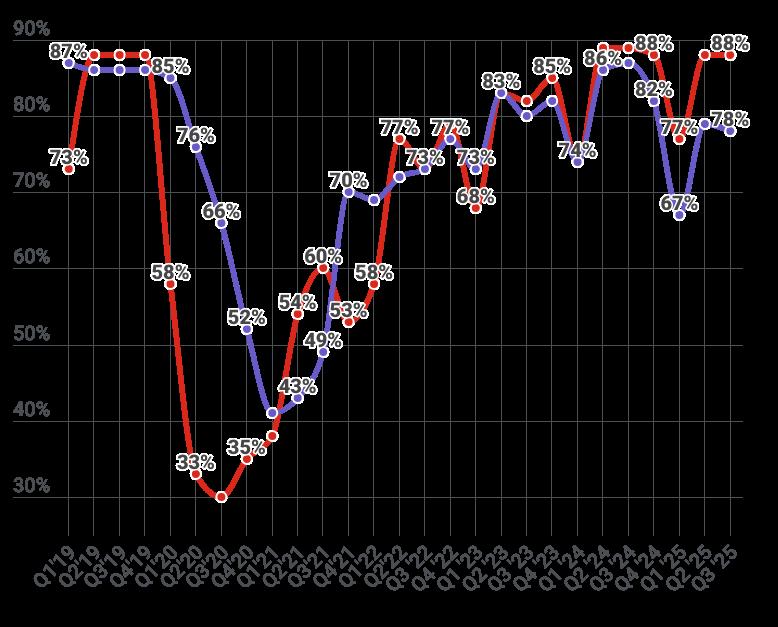

Occupancy also remained high, with the district recording back to back quarters of an 88% occupancy rate – the second highest rate on record (going back to 2016).

Midtown occupancy, though not the highest on record and down from last year, remained relatively high at 84%. Citywide occupancy, however, fell 9% over the year to 78% –low for pre and post pandemic standards.

Lower Manhattan visitorship has continued to rebound from the pandemic. The district welcomed 9.3 million tourists (defined as people living outside the NYC metro area) in 2024, a 3.3% increase from 2023 and a 29% improvement from 2022. However, the district welcomed 11.3 million unique visitors (defined as any Lower Manhattan visitor who neither works nor lives downtown) by the end of the year – a 5% decrease from 2023’s 11.9 million visitors.

Hotel Occupancy in Lower Manhattan and New York City

Source: CoStar/STR Hotel Average Daily Room Rate (ADR) in Lower Manhattan and New York City

Source: CoStar/STR

The share of unique visitors coming from NYC shrunk from 17% to 12%, which could be related to the decline in overall visitorship. Conversely, the share of international tourists grew from 54% in 2023 to 59% in 2024 –potentially explaining the increase in tourism. The share of visitors from the NYC suburbs also increased significantly, from 5% to 12%.

International tourists’ large share of overall visitation came close to mirroring 2019’s share of 61%. Countries with the highest visitor share came from Western Europe, such as the United Kingdom, Germany, France and Italy. The only non-European Country within the top five was Canada. All of these countries ranked in the top five for 2023’s international visitorship as well.

The current hotel inventory in Lower Manhattan stands at 8,534 rooms across 44 hotels. One hotel went through a makeover and rebranding in Q3, though:

• M Social Hotel New York Downtown has reopened following a major renovation and rebrand, offering 569 rooms, updated dining and meeting spaces, and sustainable design features in Manhattan’s Financial District, as part of Millennium Hotels and Resorts’ broader effort to modernize its global portfolio.

Lower Manhattan Hotel Average Daily Room Rate

Lower Manhattan currently has 349 residential buildings and 36,975 existing units. No new developments received certificates of occupancy in the second quarter. The population total continues to approach the 70,000 milestone. Looking ahead, 21 developments totalling 7,051 units are either planned for development or currently under construction. 80% are planned as rentals and the remaining 20% as condos.

Recently completed projects include:

• 55 Broad St.: MetroLoft and Silverstein Properties converted the 410,000 sq. ft. building into 571 market-rate apartments along with amenities such as a fitness center, a pool, a rooftop terrace with outdoor entertainment space and a tenants’ lounge. The project is the first fully electric officeto-residential development to achieve LEED certification. The 571-unit residential conversion project, developed by Metroloft and Silverstein Properties, has opened a housing lottery for 143 mixed-income apartments. During Q3, it was reported that Silverstein Properties and Metro Loft Management have put 55 Broad St. on the market, which is approximately 75% leased.

• 25 Water St.: A 32-story office-to-residential conversion developed by GFP Real Estate, Metro Loft Management and Rockwood Capital, the building yields 1,300 units, 330 of which are reserved for affordable housing. Amenities include a gym, spa, pool, community center and business center.

One additional residential development is expected to wrap construction and open next quarter:

• 1 Park Row: Facade installation is closing on 1 Park Row, a 23-story mixed-use residential building. Designed by Fogarty Finger Architects and developed by Circle F Capital, the 305-foot-tall structure will span 103,000 sq. ft. and yield 62 condos. The building will also contain 19,000 sq. ft. of office and retail space on the lower levels.

Recently completed projects include:

• 40 Exchange Place: GFP is expected to convert 40 Exchange Place. A permit application has been filed to convert 240,000 sq. ft. to mixed use, carving out 382 residential units and space for retail in the 20-story building.

• 7 Platt St.: Moinian Group is building a new 250-unit tower that will also contain a hotel component. 7 Platt St. is expected to open in 2025. The latest update came in September, when the reflective glass curtain wall finished enclosing the tower. Only the main entrance and the gap in the northern elevation where the hoist is anchored remain to be completed.

• 8 Carlisle St.: Excavation of 8 Carlisle St., the site of a 64-story residential skyscraper, has been paused for almost a year. A revised timetable for project completion has not been announced. Carlisle New York Apartments and Grubb Properties (which closed on an $86 million loan to finance the project) are the developers. Handel Architects was hired to design the building. The 712-foot-tall structure will yield 326,221 sq. ft. with 462 residential units, 7,000 sq. ft. of commercial space, and a 60-foot-long rear yard.

• 250 Water St.: In late 2021, the Howard Hughes Corporation was approved for its $850 million development project. It was reported that the firm would convert a parking lot into a 324-foot-tall building with 270 apartments (including 70 affordable units), Class A office space, retail and community space. The project would generate $50 million in funding for the South Street Seaport Museum, with $40 million generated from the Howard Hughes project and another $10 million committed by the City. During Q3, real estate developer Tavros acquired the land at 250 Water St. for $150.5 million from Seaport Entertainment Group, $30 million less than what SEG bought it for in 2018.

• 64 Fulton St.: Flatiron Real Estate Advisors is looking to convert the 125-year old 64 Fulton St. into 49 residential units spanning floors 3-11. The current plan calls for the units to consist of 18 studios, 22 one-bedrooms and eight twobedrooms with two loft tenants remaining. The project will benefit from the city’s 467m tax-abatement program to make 12 of the units affordable.

• 222 Broadway: GFP Real Estate and Texas Pacific Group (TPG) are converting a 31-story, 756,138 sq. ft. office building into 798 apartments. The project is estimated to cost $43.6

million. GFP purchased the property from Deutsche Bank’s asset management arm for $150 million, which is less than a third of the $500 million the bank paid for the building in 2014.

• 111 Wall St.: Nathan Berman’s Metro Loft Management and InterVest have partnered to transform a 1.2 million sq. ft. tower into 1,300 rental units. The first units are anticipated to become available in 2026.

• 77 Water St.: The Vanbarton Group agreed to purchase Sage Realty’s property at 77 Water St. for approximately $95 million. They intend to convert the 26-story office building into up to 600 residential units. The building is currently under construction.

• 80 Pine St.: Joseph Hoffman’s Bushburg has bought 80 Pine St., a 1.2 million sq. ft. office building, for $160 million. According to permits from the Department of Buildings, the developer plans to convert the 38-story office tower into a partially residential building. The project involves creating 500 housing units on floors 2 through 17, with each floor containing approximately 50 units. The building’s exterior windows will also be replaced, and there will be parking for 260 bicycles. Recently, Bushburg secured a $320 million construction loan for the project. Bridge City Capital and Deutsche Bank provided the financing for Bushburg’s efforts. The building is projected to contain 713 rental apartments.

• 2 Wall St.: 2 Wall St. is undergoing a significant transformation. The owner, Fieldston Capital, is planning to convert the upper floors of the 21-story building into 121 residential apartments.

• 5 Hanover Square: Investor David Werner is in contract to purchase 5 Hanover Square, a 25-story office building in Manhattan’s Financial District, for between $50 million and $60 million—about half of what CIM Group paid in 2013. The property is approximately 50% vacant, and a partial residential conversion is likely. 5 Hanover Square is poised to be part of Werner’s growing portfolio of discounted office assets being repositioned for residential use. Recently, David Werner Real Estate Investments and developer Sam Fisch Development secured $61 million of acquisition financing coming from 99c.

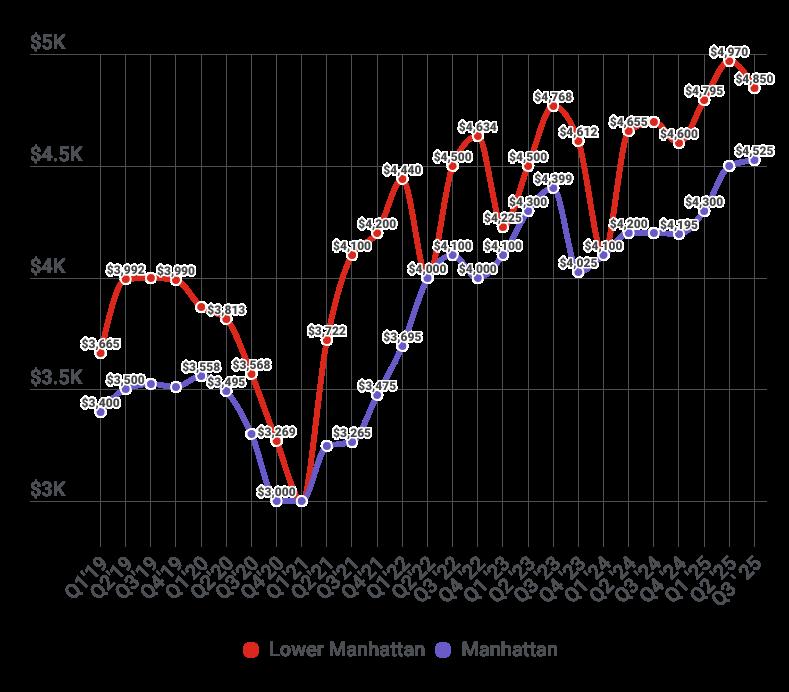

Demand for Lower Manhattan residential space remained elevated in the third quarter with rents reaching a record high of $4,850 – slightly above the market’s previous record of $4,795 set during Q1. In fact, Manhattan as a whole continued to get more expensive –setting its own median rent record of $4,525.

Condo sales have also picked up during Q3, finishing at $1,455,000. The median sales price for a Lower Manhattan condo has now risen for the past four quarters, marking an almost 50% increase over the previous year. Borough wide, the median sales value is $1,180,000 – slightly less than the downtown figure.

Moreover, the district’s sales volume increased greatly – from 86 last quarter to 121 this quarter. Q3 2021, which had 156 sales, was the last time the Lower Manhattan market saw more deals.

Interestingly, Lower Manhattan’s median sales trajectory has changed greatly compared to the first few years after the pandemic. From 2020 - 2023, sales volume greatly decreased vis a vis prepandemic trends, while median sales values fluctuated dramatically. The pandemic greatly affected these price changes, causing market uncertainty and depressing confidence. But recent price trends show evidence of market confidence. As mentioned before, Q3 marks the fourth straight quarter of median sales increases. The last time median sales prices increased over four consecutive quarters was in 2013.

Median Residential Sales Price

Source: Miller Samuel

$4,850

Median Rent Price in the Second Quarter

Median Residential Rental Price

Source: Miller Samuel

In December 2022, Pace announced plans to renovate One Pace Plaza, adding new academic spaces, a modernized residence hall and a new performing arts center. The renovation will include the reconstruction of the lower floors of One Pace Plaza East and upgrades to the dormitory building at 182 Broadway. Construction is expected to be completed in 2026.

The university recently announced the formation of the Sands College of Performing Arts, as it has just finished construction. It is housed within a new performing arts center at One Pace Plaza containing a 450-seat proscenium theater, a 200-seat flexible theater and a 99-seat black box theater. Rob and Pamela Sands gave a $25 million donation, which is part of a fundraising campaign that includes private donations and $30 million from the state and federal governments.

The new building serves as a replacement for Pace’s 50-year-old tower at One Pace Plaza East. 15 Beekman St. is the third property SL Green has built for Pace in the neighborhood. The developer previously built dorm buildings at 33 Beekman St. in 2015 and 180 Broadway in 2013. The building yields 213,084 sq. ft. and stands 338 feet tall. It is alternately addressed as 126–132 Nassau St.

As of June 2025, Major milestones include completing excavation and foundation work for the expanded Schimmel Theater, installing its new gridiron system, and placing 80% of building infrastructure using one of the East Coast’s largest cranes. Double-height spaces for the Garden Theater, Blackbox Theater, and dance studios are now formed, while renovations to Maria’s Tower modernize residential spaces.

Site 5

A partnership between Brookfield and Silverstein Properties received approval from the Port Authority and Lower Manhattan Development Corporation (LMDC) to develop Site 5 at the World Trade Center, also known as 130 Liberty St. The site recently served as a Port Authority

police depot and the southernmost area continues to function as a temporary public plaza.

The proposed 1.56 million sq. ft. tower is expected to include approximately 1,300 rental apartments, 30% of which will be affordable. LMDC approved an override to city zoning rules in order to build a tower larger than local regulations allow. 5 WTC will also include roughly 10,000 sq. ft. of nonprofit community space to be occupied by the Educational Alliance, over 190,000 sq. ft. of retail and office space and a connection to Liberty Park.

Reconstruction of Front Street between Old Slip and John Street, which began in January 2020, was finally completed this Spring. Greenwich Street reconstruction, between Barclay and Chambers streets, began in early 2022 and will be completed in August 2026; the adjacent sidewalks at 240 Greenwich St. will also be redone in tandem. Vesey Street reconstruction, between Church Street and Broadway, began in September 2022 and will be completed in 2026. Nassau Street reconstruction, between Pine Street and Maiden Lane, will be completed in 2026. These projects will replace all underground infrastructure, including water mains, sewers, electric, gas and other utilities as well as construct new streets and curbs.

The city began work on the streetscape and public-realm enhancement project along the Water Street corridor in May 2021. The $22.8 million project will transform two temporary public plazas at Coenties Slip and Whitehall Street into permanent public spaces featuring new landscaping, seating and concessions. The project also includes new street trees, rebuilt sidewalks and enhanced pedestrian safety from Whitehall Street to Old Slip.

Wagner Park

In July 2022 the Battery Park City Authority (BPCA) closed Wagner Park to begin work on the $221 million South Battery Park City Resiliency Project. As of July 2025, the project has finally been completed. Plans called for the demolition and reconstruction of Wagner Park and the Wagner Park Pavillion, ultimately elevating the park by 10 feet and installing flood walls, berms and other resiliency infrastructure from the Museum of Jewish Heritage through Wagner Park and Pier A, moving along Battery Place over to Bowling Green Plaza.

With construction completed, the park is said to protect more than 100,00 residents, 200,000 jobs, 12,000 businesses and will create 400 construction jobs, according to the Office of the Mayor.

Resilient Infrastructure

Work continues on parts of the Financial District and Seaport Climate Resilience Master Plan, a resilient infrastructure plan released in 2021 to protect Lower Manhattan from future flooding. The master plan is part of the larger Lower Manhattan Coastal Resiliency strategy, with active capital projects in Battery Park City, the Battery and Two Bridges. The plan calls for the creation of a twolevel waterfront park that extends the shoreline of the East River by up to 200 feet.

The upper level would be elevated by 15 to 18 feet to protect against severe storms, while doubling as public open space. The lower level would be a waterfront esplanade raised three to five feet to protect against sea level rise, while offering access to the East River shoreline.

New York City selected a consortium led by Stony Brook University to develop a $700 million, 400,000 sq. ft. climate research and development campus on Governors Island that will be called the New York Climate Exchange. The campus will include two new classroom and research buildings, student and faculty housing and university hotel rooms. The campus is expected to host 600 college students, 6,000 job trainees and 250 faculty members and researchers. In addition to Stony Brook University, the development consortium includes IBM, Georgia Institute of Technology, Pace University, Pratt Institute and Boston Consulting Group. Governors Island was rezoned in 2021 to allow for the campus. Construction is expected to begin in 2025 and wrap up in 2028. The Trust for Governors Island has expanded ferry service running every 15 minutes, including the addition of New York City’s first public, hybrid-electric ferry.