FROM THE EDITOR

External forces shaping ag

It has become a cliché at this point in the 2020s to note how nothing is predictable anymore, how the biggest influences on businesses and supply chains have come out of nowhere, how the only precedents are decades old, leaving us in uncharted territory.

And yet, that doesn’t excuse us from the responsibility of keeping a lookout for potential sources of disruption. That is what this issue of Feedinfo Review attempts to do: to look beyond the confines of the animal nutrition space and try to understand how things that are happening out there — decisions being taken by those who aren’t familiar with these value chains or forces that are much larger than our sector — might end up shaping the environment we operate in this year.

As my colleagues can tell you, I am a worrier. And indeed, “should we be worried?” could be considered the alternative theme for this issue of Feedinfo Review. Should we be worried that the wild increases in fertilizer prices will have knock-on effects on the availability of grains and oilseeds? Should we be worried that short-sighted regulatory rulemaking will add unaffordable costs to imported feed ingredients in the EU?

Ultimately, these stories are not aiming to simply answer these questions and calm anxious minds like mine, but instead to provide a deeper understanding of how these dynamics work – how the fertilizer market has gotten into this situation, or how different ways of interpreting

and implementing traceability requirements can have dramatically different impacts. Beyond this, we hear from a wide variety of animal nutrition leaders on different factors which will shape the industry’s future, from the imperative to curb greenhouse gas emissions to the availability of labour to the forces driving consolidation. The influence of inflation was mentioned across multiple responses, underlining once again how forces outside of our control can have profound and wide-ranging impacts on how we meet both old and new challenges. Inflation is also discussed in greater depth by the meat market analysts of Urner Barry as they unpack factors expected to shape the U.S. animal protein sector going forward.

Finally, there are the feed additives and ingredients stories. From an analysis of how recent political and economic developments will shape Chinese amino acid supply and demand, to news about production and expansion decisions, to an explanation of why a feed phosphate sector facing a structural decline in demand continues to see new capacity brought online, this issue provides the specialised insight into these markets that Feedinfo readers rely upon us for.

This issue aims to bring together the short and long terms, the causes and effects, to provide a look at our value chain that rises above the daily buzz and chatter and hones in on the deeper and more impactful themes and trends. Read Feedinfo Review to better understand the developments that matter.

BREEDER MANAGEMENT AND NUTRITION Moving the industry forward

A carefully curated 14-chapter reference book of current breeder production best practices and considerations from industry leaders and academics around the world, including Novus poultry team members.

NOVUS® is a trademark of Novus International, Inc., and is registered in the United States and other countries. © 2022 Novus International, Inc. All rights reserved.

RISING COMMODITY PRICES

Fertilizer’s wild ride

INDUSTRY PERSPECTIVES

Huvepharma deploys wide-ranging portfolio & specialised local expertise against coccidiosis threat

ANALYST’S CORNER

What’s ahead for Chinese amino acid markets? 16

EU LEGISLATION

Will new deforestation-free sourcing rules upend soy imports in the EU? 18

INDUSTRY PERSPECTIVES

Environmental stewardship sets U.S. soy’s story apart, says USSEC ........... 22

DYNAMICS OF PRODUCTION EXPANSION

Fertilizer needs drive decision-making about phosphates capacity 24

DIRECT FROM THE SOURCE

CJ Bio says valine production to resume in Shenyang in January; Brazil tryptophan expansion slightly delayed 26 Eppen’s new European subsidiary a mark of confidence amid depressed feed additives prices 26

Ukrainian premix company ABM to open new factory in spring 2023 27

RECRUITMENT UPDATES

Industry moves 28

INDUSTRY EXEC OUTLOOKS

Carbon emissions tracking 30 Ag’s recruitment challenges 31 Industry consolidation 32

INTERVIEW WITH URNER BARRY

On the radar: external factors impacting the U.S. animal protein sector

28 Ufa agricultural holding

8 United Petfood

Urner Barry

34, 35 U.S. Soybean Export Council (USSEC)

Vishnevsky Genetics and Breeding Center 8

Women in Food and Agriculture 33 Ÿnsect 7 Yufeng

Zdorovaya Ferma

Recharge your gut health strategies.

Known for their robust pathogen reduction properties and health benefits, α-monoglycerides are an effective alternative to antibiotics and zinc oxide. Combined with organic acids, they enhance gut health in swine and poultry.

Eastman Entero-Nova™ and Eastman Protaq™ solutions include short- and medium-chain fatty acid glycerides and are effective in both feed and water applications. Let’s talk about α-monoglycerides as a part of your gut health regimen. Get in touch at Eastman.com/AnimalNutrition.

Production

SHUT DOWN: ADISSEO’S DL-METHIONINE PRODUCTION

In late October, Adisseo stopped production of DL-methionine in Commentry, France, citing cost pressure. The halt was scheduled to last until at least the end of 2022. This plant represents 12% of Europe’s methionine capacity.

SHUT DOWN: DSM’S VITAMIN A PRODUCTION

DSM is halting vitamin A production in Sisseln, Switzerland, for at least two months commencing 2 January 2023. Vitamin E 50 production will also be “significantly impacted”, said the company, due to its common upstream infrastructure. These are measures put in place to cope with the higher energy costs foreseen this winter. Capacity at Sisseln amounts to 5,600 tonnes/year of vitamin A 1000 and 18,000 tonnes/year of vitamin E oil.

SHUT DOWN: NHU’S VITAMIN E PRODUCTION

NHU stopped production at its vitamin E plant in Weifang, Shandong from 1 January 2023, citing the impact of rising Covid infections. The shutdown is expected to last around six weeks.

SHUT DOWN: TWO VALINE PRODUCTION OPERATIONS

CJ Bio temporarily halted valine production in Shenyang, Liaoning this autumn in order to produce specialty amino acids on the same lines instead (more on this story on page 26). Meanwhile, Chinese producer Julong shut down its own valine production in Ruzhou, Henan in October, a situation expected to last through the Chinese New Year.

METEX TO RESTART AMINO ACID PRODUCTION AND EXPAND PRODUCT LINE

On the other hand, METabolic EXplorer (METEX) announced in late December that it had secured financing that would allow it to progressively restart the production of amino acids at its factory in Amiens, France where activity had been dialled back in response to the decline in the animal nutrition market and the rise in raw ingredients and energy prices. It will also be able to develop production capacities for specialty amino acids such as valine, tryptophan, arginine, isoleucine, and leucine.

OfflineFUFENG BEGINS THREONINE PRODUCTION

Fufeng Biotechnologies began production at its new threonine 70% factory in Angangxi, Heilongjiang by late November. In its first phase, it will be able to make 20,000 tonnes/year. When fully operational, the facility will be able to produce 50,000 tonnes/ year. Commissioning on this plant had originally been scheduled for August-September 2022.

NEW CHINESE D-CALPAN PRODUCTION BEGINS TO COME ONLINE

Tianxin has started pilot-scale experimental production of d-calpan at its plant in Jiangxi, and reportedly has product for sale. Meanwhile, NHU also began pilot-scale experimental production of d-calpan in Heilongjiang. The site’s nameplate capacity for d-calpan is 2,500 tonnes per year, currently destined exclusively for the export market. However, it is understood that NHU’s project to make d-calpan in Weifang, Shandong has been suspended.

GLOBAL BIO-CHEM TECHNOLOGY GROUP RESTARTS LYSINE PRODUCTION

China’s Global Bio-chem Technology Group Co is understood to have restarted lysine production at its plant in Dehui, Jilin, a site which has been shut since 2019. The site makes both lysine HCl and lysine sulphate.

KEMIN LAUNCHES EUROPEAN PLANT FOR CHOLINE CHLORIDE AND ENCAPSULATED AMINO ACIDS

Kemin inaugurated two new facilities at its site in Cavriago, Italy: one for choline chloride ingredient manufacturing, and the other for encapsulated methionine and lysine for ruminants.

NESTLÉ PURINA INVESTING HUNDREDS OF MILLIONS IN US PRODUCTION

As the year closed, Nestlé Purina Petcare announced it would be investing USD 110 million to further expand petfood production in Clinton, Iowa (where the most recent expansion was inaugurated in October), and is reportedly seeking permission to build further facilities at a plant soon to be brough online in Williamsburg Township, Iowa.

HOUSE OF RAEFORD FARMS EXPANDS FEED PRODUCTION CAPACITY

US poultry company House of Raeford Farms opened a new feed plant in Louisiana which can produce 12,500 US tons per week. The company says that the expansion will allow it to reduce production days per week and thus afford time for preventative maintenance procedures on the mill and on its fleet of feed trucks.

ADM OPENS PET PREMIX PRODUCTION IN FRANCE

ADM has opened a new premix production line at its pet nutrition facility in Château-Thierry, France. The line will produce premium and functional pet premixes.

CALYSSEO STARTS UP CHINESE ALT PROTEIN PLANT; UNVEILS PLANS FOR SAUDI PRODUCTION

Calysseo, a joint venture between Adisseo and Calysta, began operations at its industrial-scale fermentation-derived protein facility in Chongqing. It is understood it will make around 20,000 tonnes/year of this protein, which in the first instance will be sold into the aqua feed market. Calysseo also announced plans for a plant to make 100,000 tonnes/year of protein ingredients in Saudi Arabia, a facility which is projected to become operational in 2026.

ALLTECH MAKING TRACE MINERALS IN VIETNAM

Alltech has opened an organic trace minerals plant in Vietnam. The plant’s production capacity is 7,000 tonnes/year.

NEWS BITES

VARIOUS OTHER PROJECTS EXPAND FEED PRODUCTION IN SOUTHEAST ASIA

Dutch animal nutrition firm De Heus inaugurated its fourth feed mill in Indonesia, as well as its first premix plant in Vietnam.

A new 450,000 tonne/year feed factory belonging to CNC Group was inaugurated in Hai Duong, in northern Vietnam.

Marcela Farms, part of the Alturas Group of Companies in the Philippines, has launched a new feed mill capable of producing 30 tonnes per hour.

ŸNSECT COMMISSIONING AMIENS PLANT; SIGNS NORTH AMERICAN PARTNERSHIPS

The first insects have arrived on-site at a facility in Amiens which Ÿnsect, the French company behind the project, claims will be the world’s largest insect farm. According to the company, it has already sold more than the capacity of this plant. It also announced in December that it had signed agreements with partners in the U.S. and Mexico in order to begin construction on insect farms there in 2023.

NEW FUMARIC ACID PRODUCTION IN CANADA

Bartek Ingredients has finished the first phase of a CAD 160 million capacity expansion in southern Ontario. Among the products concerned is feed-grade fumaric acid.

Brewers‘ yeast upcycling at world-market level - since 1954.

M&A

NOVOZYMES AND CHR. HANSEN TO JOIN

Denmark’s Novozymes and Chr. Hansen have announced merger plans. The combined entity will have a network of 38 R&D and application centres, and 23 manufacturing sites, and bring in annual revenue of approximately €3.5 billion.

ADISSEO TO ACQUIRE NOR-FEED

Adisseo will acquire phytogenic feed additives company NorFeed, the two French companies revealed this December. NorFeed will continue to autonomously manage its R&D, production and sales network.

DARLING INGREDIENTS BUYING POLAND’S MIROPASZ GROUP

Darling Ingredients has said it will acquire Polish rendering company Miropasz Group for approximately €110 million. Miropasz processes around 250,000 tonnes/year at its three poultry rendering plants in southeast Poland.

NUTRECO ACQUIRES DANISH MINERALS AND PREMIX PROVIDER

Nutreco has purchased Mosegården, a Danish livestock nutrition supplier. Mosegården’s portfolio for cattle and swine is focused on minerals and premixes.

CHERKIZOVO EXPANDS VIA MULTIPLE ACQUISITIONS

Russia’s Cherkizovo Group acquired the poultry, crop and feed production businesses of Ufa agricultural holding at auction for around RUB 6.37 billion, giving it a leading position in the poultry market of the Ural mountain regions; it went on to sell part of this operation, Bashkir Poultry Farm, a table egg operation, shortly thereafter.

In a similar transaction, it purchased the assets of Zdorovaya Ferma for RUB 5 billion, adding 120,000 tonnes of live weight poultry production capacity and 240,000 tonnes of feed production capacity.

It also acquired the swine-focused Vishnevsky Genetics and Breeding Center in Q4.

PINTALUBA ACQUIRES LEK VETERINA

Spain’s Pintaluba Group acquired Lek Veterina, a Slovenian supplier of premixes, nutritional supplements and animal health products, expanding its activities in the Balkans and its liquid and water-soluble powder portfolios.

BACHOCO ANNOUNCES NORSON ACQUISITION

Mexican meat firm Bachoco S.A.B. de C.V. announced plans to acquire pork producer and exporter Norson Holding. Based in Sonora, Norson’s business includes genetics, hog farms, feed mills, slaughter and cut facilities, value added facilities, distributions centers and owned retail shops.

MOWI TO ACQUIRE ICELANDIC SALMON FARMER

Mowi has agreed to acquire 51.28% of the shares in Arctic Fish, a leading salmon farmer in Iceland. Arctic Fish has licenses for 10 ASC approved sites and expects to harvest 10,600 GWT in 2022.

MARS PETCARE ANNOUNCES CHAMPION PETFOODS ACQUISITION

Mars Petcare is planning to acquire Canada’s Champion Petfoods from an investor group led by Bedford Capital and Healthcare of Ontario Pension Plan. Champion employs around 800 people and produces pet food sold in more than 90 countries.

UNITED PETFOOD ACQUIRES UK BUSINESS AND EU-BASED PLANTS

United Petfood has announced plans to acquire Gold Line Feeds in the UK. Based in Northamptonshire, Gold Line Feeds supplies about 20,000 tonnes of dry pet food each year. Gold Line Feeds was spun off from Dodson & Horrell in 2020.

In a separate transaction, the Belgian private label pet food company acquired two production sites from Cargill: one in Krzepice, Poland, and the other in Karcag, Hungary.

JV BETWEEN FORFARMERS AND BOPARAN REQUIRES FURTHER INVESTIGATION

The UK’s Competition and Markets Authority’s Phase 1 investigation found the possibility of competition concerns arising from the proposed animal feed joint venture between ForFarmers UK and 2 Agriculture Limited (part of Boparan). In spite of the businesses’ subsequent proposals to address these concerns, the authority recommended an in-depth investigation of the deal in early January.

MILK SPECIALTIES GLOBAL CHANGES HANDS

Milk Specialties Global was acquired by Butterfly, a private equity firm. Milk Specialties Global is a vertically integrated ingredient manufacturer focused on processing raw dairy inputs into functional ingredients for human and animal nutrition. Its animal nutrition portfolio includes rumen-protected amino acids, choline, and other feed additives.

CARGILL ENTERS ECUADORIAN SHRIMP FEED JV

Cargill and Naturisa in Ecuador are creating a new shrimp feed joint venture (JV) with Skyvest EC Holding S.A. Through this JV, Cargill will own and operate the shrimp feed production facility located in Guayaquil, which is currently owned by Skyvest subsidiary Empagran. Cargill says it plans to invest in the facility and expand its shrimp feed offerings.

Global context

CHINA EASES ZERO-COVID POLICIES

China spent December rapidly unwinding what had been the strictest anti-Covid regime of any major nation. These policies, particularly the widespread lockdowns, had been burdensome for both personal freedom and economic production (in the animal nutrition sector, valine and tryptophan had been among the products most recently affected). However, the wave of infections following this dramatic policy U-turn is having its own impacts on industrial activity.

BRAZILIAN ELECTIONS RETURN LULA TO POWER

Luiz Inacio Lula da Silva (Lula) defeated Jair Bolsonaro in the runoff for the Brazilian presidency. Bolsonaro supporters protested, causing delays at ports and on highways which affected the transportation of agri-commodities. The Lula administration plans to make protection of fragile ecosystems like the Amazon and the Cerrado a priority, an objective which may push it into conflict with agribusiness interests such as soy and beef production.

BLACK SEA EXPORTS CONTINUE, BUT SLOWLY

In late November, warring parties Russia and Ukraine agreed to a renewal of the deal brokered by the United Nations and Türkiye to allow shipments of grains and foodstuffs out of ports in the Black Sea. However, for the months when the deal was in place, Ukraine’s exports of grains were still 40% lower than the same period last year. According to Reuters, those ports which are included in this deal are still not exporting at capacity, with Ukraine blaming Russia for slowing the inspections process. The Black Sea export situation has been a major factor in worldwide grains prices since the war began in February.

HIGH PATHOGENICITY AVIAN INFLUENZA REACHES SOUTH AMERICA; SETS RECORDS ELSEWHERE

Since October, outbreaks of HPAI have been detected in northern South America, beginning with wild birds in Colombia; at the point of publication, outbreaks had also been declared in Peru, Venezuela, Chile, and Ecuador, including in domestic poultry in some cases. These mark the first instances of HPAI in South America in 20 years.

Indeed, the HPAI situation has been particularly bad in many areas recently. In the US, the number of poultry deaths from avian influenza or from related culling in 2022 have broken records, and Europe is experiencing its largest-ever HPAI epidemic as well. Egg prices in both the US and Europe reached record highs in the quarter. And there are concerns about the virus becoming endemic in new parts of the globe and/or persisting in seasons when it has traditionally retreated.

U.S. FEDERAL GOVERNMENT SEEKING REFORM OF POULTRY TOURNAMENT SYSTEM

The U.S. Justice Department launched a civil investigation into the contracts and payment practices between chicken companies and the farmers who grow birds for them, according to reporting in the Wall Street Journal, citing a regulatory filing.

This is one of a number of actions the federal government has taken to address the balance of power between these two parts of the value chain; as Feedinfo has reported on, the U.S. Department of Agriculture’s ARS is also looking to address concerns about transparency in poultry tournament systems and retaliation or discrimination on the part of meatpackers using rulemaking under the Packers & Stockyards Act.

CLIMATE CHANGE CONFERENCE FOCUSES ATTENTION ON AGRICULTURE’S GHG FOOTPRINT

Around the UN’s COP27 climate change summit, the European Union agreed to include agriculture in national targets for emissions reductions, and China has included agriculture in its action plan on methane. Moreover, an official from the Food and Agriculture Organization reportedly told Reuters at the conference that in the next year, the UN body will be launching a plan for bringing agriculture and food production in line with global goals on emissions reduction.

Meanwhile, the UN’s COP15 biodiversity conference in December prompted the EU to announce its new regulation on deforestation in certain supply chains, including soy; read more about this on pages 18-20.

Fertilizer’s wild ride

Fertilizer makes modern-day agriculture possible — it ensures the 8 billion people and several billion more animals we raise for food do not starve to death. And this vital commodity has had quite a wild ride recently, tripling in price over the last two years. Today we take a look at what happened, where we’re at now in terms of availability and affordability, and what this all means for upcoming grains and oilseeds harvests.

HOW DID WE GET HERE

As in so many other markets, the disruption in the fertilizer market is at least partially rooted in the coronavirus pandemic. Laura Cross, Director of Market Intelligence for the International Fertilizer Association (IFA) recounts how, given the deep levels of uncertainty about the future caused by the 2020 lockdowns, demand for food crops went up. “We saw two things happening: on the one hand, we saw governments putting a really strong emphasis on food security... And then secondly, we saw a period of price inflation — food prices, crop prices. Now what that does for farmers is that incentivises growing more in a given year, and that in turn requires more fertilizers.”

importance of. China, a major producer of nitrogen and phosphate fertilizers, implemented export restrictions on fertilizers in the second half of 2021 and extended them through 2022. “When there is the risk of global shortages and when domestic prices are high for farmers, [China] tends to want to keep more product domestically… we’re seeing about 50% of the normal volumes being exported from China compared to [similar time periods without export restrictions].”

A FEW BASICS

Fertilizer is divided into three categories: nitrogen, phosphate, and potassium (potash).

The main input for nitrogen fertilizer is chemically-synthesised ammonia, and the manufacturing process generally requires a lot of natural gas.

Phosphate fertilizer is made from phosphate rock, which is mined and is only found in naturally-occurring deposits, primarily in northern Africa, although other areas such as China and the US also have some. Sulphuric acid, produced by petroleum refining, is another major input in its production.

Potassium fertilizer is made from potash, which again is mined. The main chokepoint in its production is the fact that potash deposits are only available in a few areas around the world, including Canada, Russia, and Belarus.

©Antony Trivet / Pexels.comAmid a background of strong demand, 2021 brought the same supply chain disruptions experienced by many industries, compounded by weather events which took some fertilizer capacity offline. “Examples would be the hurricanes in the US — a lot of nitrogen and phosphate capacity in North America is centered in that region. That led to several months of downtime for those producers.”

But the biggest issues of 2021 were those that that outsiders to the fertilizer industry might have failed to understand the

Next, Belarus, one of the few countries in the world endowed with natural potash deposits, came under sanctions by the EU and the US after violations of democratic rights and international norms, most notably Belarus coercing a commercial flight flying between two EU destinations to land in Minsk to allow the Belarusian regime to arrest two dissidents on board. Both the EU and the US included sanctions specifically concerning the potash industry.

As the sanctions situation evolved over time, the threat of them caused uncertainty in the market, driving demand for these fertilizers upward even before the Belarusian supply began to dry up. “You had this uncertainty about what could be sourced from Belarus, which alone is about 20% of the globally traded market,” recalls Cross. “That had another impact on price, because there were lots of people who were wanting to buy potash before there were potentially supply issues.”

Moreover, even while there might have been customers in other parts of the world still willing to buy potash from Belarus, the sanctions had an ability on the physical availability of product. The country is landlocked, and the majority of its production (up

World Bank Commodity Price Data

to 90% according to the World Bank) was shipped through Lithuania, which stopped Belarusian potash from accessing its port in response to these sanctions.

Amid this already tumultuous background came the whirlwind caused when Russia, the world’s single biggest exporter of fertilizer, invaded Ukraine.

2017-Oct2017-Dec2018-Feb2018-Apr2018-Jun2018-Aug2018-Oct2018-Dec2019-Feb2019-Apr2019-Jun2019-Aug2019-Oct2019-Dec2020-Feb2020-Apr2020-Jun2020-Aug2020-Oct2020-Dec2021-Feb2021-Apr2021-Jun2021-Aug2021-Oct2021-Dec2022-Feb2022-Apr2022-Jun2022-Aug2022-Oct

“At the outset of the war in Ukraine, there were concerns that there would potentially be a shortage of all three [types of fertilizer, i.e. nitrogen, phosphate, and potash],” explains Cross. “Because nobody really knew how sanctions would impact the flow of fertilizers, that was the concern, that there would be a shortage.”

Ultimately, it has been established that fertilizer products are not included among the US’s sanctions on Russia, and can be traded without fear of falling foul of the US Treasury Department. “But in the immediate aftermath of the invasion of Ukraine, that really wasn’t clear,” says Cross. Hence the record-high prices this spring, as companies scrambled to secure supply.

WHERE WE’RE AT: AN AFFORDABILITY RATHER THAN AN AVAILABILITY ISSUE

According to Cross, the situation today has somewhat eased. When it comes to the nitrogen and phosphate fertilizers, she says, “we’ve moved away from the initial concerns about an actual shortage.” However, in its place are very serious concerns about affordability, something which will be deeply felt by smallholder and subsistence farmers.

Meanwhile, in Cross’s words, “There is very much a shortfall of potash fertilizers in the market. That’s because there’s a very small concentration of producers around the world…there hasn’t been any way to replace the lost potash supply from [countries like Belarus who are effectively out of the market].”

While still quite high in historical terms, by Q4 of 2022, fertilizer prices seemed to be coming down from the eye-watering highs seen in the initial months after the invasion of Ukraine. “They haven’t gone back to the levels that they were at prior to the war in Ukraine. But they’re lower than they were at their peak.”

This can be explained as a result of both supply and demand. “On the supply side, Russia [is] exporting more than was originally expected, for nitrogen and phosphates,” says Cross. Meanwhile, on the demand side, she highlights the “very close relationship between affordability and demand… when prices increase significantly, farmers tend to use less because they only have a certain budget they can apply to crop inputs.” She hesitates to call this demand destruction, pointing out it is more a question of “delayed demand” in some parts of the world, but the effect is that the high prices at some point became self-correcting, as demand has dropped off until fertilizers became more affordable.

This might be a heartening assessment to those in Europe, whose news feeds have been dominated by stories of shutdown after shutdown of fertilizer producers who have been pushed into furlough by the continent’s natural gas crisis.

“At the end of October, our estimate of how much European ammonia capacity was shut down was 40%. So it’s actually better than the worst of the situation, which was [around] August, when European gas prices were sky high, at their absolute peak. So, the situation has improved a little bit… but there’s still a lot of risk around the outlook for that, because Europe’s still in a very vulnerable position when it comes to gas prices.”

That being said, in a market which is currently dominated by concerns about price rather than physical availability of product, well-resourced European planters are in a comparably better position than their peers in the Global South, and will be able to import enough fertilizers for their needs.

“European farmers, while they may not be having the best of times at the moment, are very much better leveraged than farmers in the developing world. And so they’re actually in a stronger position to import product from elsewhere. That tightens the global market further, because you’re pulling product from other parts of the world where it might go otherwise.”

IMPACTS ON UPCOMING GRAINS AND OILSEED HARVESTS

Given this environment — one which appears to be (thankfully) devoid of shortages of fertilizer, but in which high prices are still discouraging many from using it — the big question for the feed industry is what to expect in terms of impacts on feed ingredients next year.

To help answer this big question, the IFA (along with CRU Group) have contributed to Gro Intelligence’s modelling of the yield response which can be expected in light of the reductions in fertilizer applications. Known as the Global Fertilizer Impact Monitor, it focuses specifically on nitrogen fertilizer, which farmers typically have to use every year, rather than potash and phosphate fertilizers, whose application can be slightly more flexible.

According to this model, corn, one of the most intensive consumers of nitrogen, sees a 2.3% reduction, while wheat experiences a 2.5% reduction.

It is also critical to remember that these impacts will not be evenly divided. “You have developed farms who are in, for the most part, more commercial environments, and they are higher up the yield curve in terms of the nitrogen that they apply. What that means is that if they reduce their applications slightly, you typically don’t get a large yield response. So you may have a number of farmers, especially in the northern hemisphere and in markets like

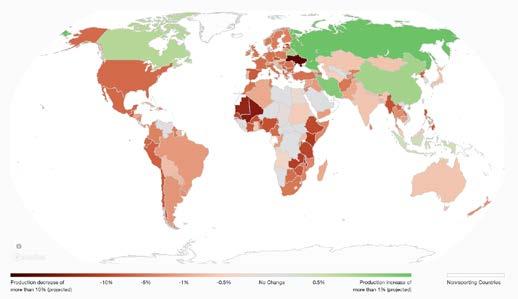

Projected Production Change in Calories Based on IFA Estimates for Global Nitrogen Fertilizer Application Changes

Latin America where, if they reduce their nitrogen application by relatively modest percent, they might actually see very little yield impact… the concern for us is the more fragile markets where fertilizer use is already at a pretty low level, relatively speaking. And that means that you get a bigger yield response from being already further down that yield response curve,” notes Cross.

“And so you think, ‘oh, [a few percentage point drop], that doesn’t really feel so bad’, but then when you look at some parts of the world, you have as much as 10 or 20%, that could really trigger a food crisis in those particular regions.”

The dynamic is different for soybeans, which can fix their own nitrogen and thus don’t require nitrogen fertilizers. On the one hand, Cross shares that she has “heard reports [from Brazil] that farmers are planning to use reduced volumes of phosphates, which is an important ingredient in soybean production. We don’t

yet know exactly what the impact of that will be, so it’s almost a case study of what happens if you reduce your application.”

But on the other hand, it could also be possible that any reduction in soybean yield might be more than made up for in an expansion of acreage, as farmers who might have planted corn (which they’d have needed to fertilize with nitrogen) turn to soybeans instead. According to analysts from Feedinfo’s sister publication Stratégie Grains, this dynamic was visible in the US in 2022, where the areas planted by soybean increased by 0.5% while the corn area decreased by 5%, despite the relatively good price of corn versus soybeans at the time; this movement can be explained by the high nitrogen price. However, for the next marketing year, Stratégie Grains forecasts a 3% increase in corn area and a 1% decrease in soybean area in the US.

WHAT TO LOOK FOR IN 2023

Going forward, Cross says she has her eyes on three areas.

“The first thing is European gas…we don’t really have an internal view on what could happen there, because there is just so much uncertainty, but it’s an area to watch, whichever direction it moves in.

“The [next] area is the Chinese export restrictions, whether next year the government decides to reduce those restrictions or if they keep them in place. That will have an impact on global availability.

“And the [final] thing that we’re looking out for, very specific to potash: there have been some plans to expand the rail capacity from Belarus through Russia, to export potash from Russia…in the next year that could make a big difference on how much can actually be exported.”

By Shannon Behary, senior editorHuvepharma deploys wide-ranging portfolio and specialised local expertise against coccidiosis threat

Coccidiosis is by far the most important parasitic disease in poultry. Because of the damage which coccidiosis causes to the intestinal tract, birds afflicted by it underperform versus the breed standard (which has improved significantly over the last few decades), and this gap has the potential to widen if coccidiosis is not effectively controlled. One recent calculationi estimates that the financial burden of coccidiosis in chickens worldwide amounted to around £10.4 billion at 2016 prices.

Today’s INDUSTRY PERSPECTIVES piece consults Ben Dehaeck, Global Product Manager for Coccidiostats at Huvepharma® about the best ways to control this global threat and how Huvepharma® is maintaining its leadership in this high-stakes category.

[Feedinfo] What trends have you identified within coccidiosis prevalence and control?

[Ben Dehaeck] Because we’re seen as the reference company for coccidiosis control, Huvepharma® is frequently consulted for advice. As a result, we have a very good view of the evolution of coccidiosis over the years in different parts of the world. Coccidiosis data has been entered over the last 6 years and we currently have data from > 60,000 flocks entered in Aviapp® Aviapp® is our software platform used to manage different types of data, ranging from health data to management, treatment and performance data. This allows us to produce prevalence graphs of coccidiosis in all parts of the world. As an example, we can

share the prevalence data from Europe, where E. acervulina peak score was 0.63 at 25 days of age, E. maxima 0.16 at 30 days and E. tenella 0.04 at 29 days in 2022. Lesion scores in various European countries increased significantly in the months after the outbreak of the war in Ukraine. Gut integrity was apparently challenged by changes in feed formulations which became necessary to cope with the reduced availability of feed ingredients.

In general, large differences exist between countries and producers as a lot of factors have an influence on the evolution of the coccidiosis pressure: climate conditions, management, feed quality, and the use of coccidiostats or coccidiosis vaccines, to name a few. The goal is always to have the most efficient coccidiosis control under local conditions. Obviously, challenges are different in different regions, and this is why we believe it is so important to have local technical experts present on-farm.

[Feedinfo] How do countries around the world differ in their approaches to coccidiosis?

[Ben Dehaeck] Many variables influence the approach to coccidiosis control: climate, market requirement, and availability of products. Basically, the coccidiosis pressure can be linked with outside temperature and humidity, with higher moisture in the litter increasing the infection pressure. Depending on the climactic region, a winter/summer programme or a wet/dry season programme might be used.

Beyond that, market requirements, such as desired end weights, possible restrictions on the usage of coccidiostats, animal welfare requirements and so on will have a huge impact on how we manage coccidiosis. In general, the Asian and Middle Eastern countries grow broilers until a lower end weight (1.8 kg) which will have an influence on the usage of coccidiostats or coccidiosis vaccines. It is less common to vaccinate against coccidiosis in these countries, as the birds will not have enough time to develop immunity against all Eimeria species. In the US, heavy birds (> 4kg) are a large part of production and in this case the birds have enough time to benefit from the immunity development as stimulated by the vaccination.

Furthermore, there are huge differences in the availability of coccidiosis vaccines in different areas/countries. In Europe for example, only attenuated vaccines are allowed, whereas in most other parts of the world, non-attenuated vaccines can be used as well.

All these differences will result in a different approach towards coccidiosis control and will influence the coccidiosis pressure.

[Feedinfo] Can you take us through the different elements of your coccidiosis control portfolio?

[Ben Dehaeck] Huvepharma® can offer solutions for every aspect of coccidiosis control to customers around the world. Coccidiosis control starts with thorough cleaning and disinfection of the poultry house in order to reduce the coccidiosis pressure as much as possible. Even though it is not possible to eradicate the parasite, we offer the hygiene products crucial to reduce the infection pressure as much as possible. The second step in coccidiosis control is to prevent the exponential development of the parasite because of the damage which it causes in the animal. The prevention of coccidiosis can be achieved by the use of coccidiostats in the feed, by vaccination, or by a combination of both. Huvepharma® has marketed coccidiostats since its beginning in the early 2000s and its coccidiostat portfolio has expanded significantly over the years to incorporate ionophores, synthetics and combination products. Although the application of coccidiostats is still considered as the gold standard for coccidiosis control in many parts of the world, coccidiosis vaccination is gaining popularity. For example, in the US, the number of broilers which are vaccinated year after year is increasing. Recent estimates indicate that 42% of the broiler production in the US is vaccinated with a coccidiosis vaccine. To complete the portfolio, Huvepharma® also offers options for coccidiosis treatment. For customers, it is a benefit to rely on one company that can provide a holistic strategy for coccidiosis control, as this ensures that advice is unbiased towards one part of the coccidiosis portfolio.

[Feedinfo] What is Huvepharma’s® philosophy when it comes to coccidiosis control?

[Ben Dehaeck] There are only a limited amount of products available to control coccidiosis and we need to keep all of them viable. There are no new molecules for coccidiosis control on the immediate horizon, so it is essential to handle all currently available products responsibly in order to safeguard their efficacy as much as possible. This can be done by respecting the recommended times for a product to be in use vs. out of use. Both are equally important and, in general, we can say that synthetic molecules should be used for a shorter period of time compared with ionophores, and even less compared with combination products. The best way to determine the optimal time for rotation would be by regular evaluation of the coccidiosis pressure. Monitoring at regular time intervals (at least on a monthly basis) can provide trend lines which indicate the evolution of the coccidiosis pressure (up or down).

[Feedinfo] Beyond the use of coccidiostats or vaccines, what are some of the techniques growers should be using to minimise their risk of coccidiosis or to mitigate the impacts of it on their birds?

[Ben Dehaeck] The first step in coccidiosis control is biosecurity and disinfection. We will never be able to eradicate the disease

but we need to keep the infective pressure at the start of the flock as low as possible. This can only be achieved by respecting cleaning and disinfection protocols. Along with effective biosecurity, management must be optimised. This includes sufficient feed availability for each bird, adjusting the drinking lines to the needs of the birds, controlling ventilation in order to optimise litter quality, selection of sick birds, and so on. Basically, it takes time, effort and experience to manage a poultry house correctly but it will definitely have a big impact on the risk of coccidiosis in a flock.

[Feedinfo] You argue that part of what distinguishes Huvepharma® in this area is the strong technical support it provides. What does that consist of?

[Ben Dehaeck] Huvepharma’s® technical support is unparalleled. This includes feed sampling, field or farm visits by technical experts, biosecurity advice, sampling oocysts, nutritional support, statistical analysis and sensitivity testing of the parasites. As Huvepharma® has a global presence, we can provide this technical support (veterinary, biosecurity, management) in all parts of the world. This support is crucial in a few ways: first, it helps to understand and map the specificity of each situation. Second, data collected during the visit or collected by the producers themselves can be entered in Aviapp® and used to analyse the situation. As every producer is confronted with different challenges, customised advice is of paramount importance. With the growth and success of Aviapp®, we identified the need for in-house and in-depth statistical analysis. The data is biological data and a lot of variables will determine the outcome of a flock. If the variables aren’t taken into account, one could make assumptions and come to the wrong conclusions.

Beyond this, I would also like to point out that Huvepharma® is a privately owned company, which makes us flexible and agile. We are able to adapt ourselves to the local situation and to respond to individual customer needs. Huvepharma’s® leadership is based on continuous investment in local registrations of coccidiostats and in bringing new products to the market. Coccidiosis is an old disease but still extremely relevant, and we promise to stay on top of this problem and keep offering the best solutions to our customers.

Published in association with Huvepharma® BEN DEHAECKi Blake, D.P., Knox, J., Dehaeck, B. et al. Re-calculating the cost of coccidiosis in chickens. Vet Res 51, 115 (2020). https://doi.org/10.1186/s13567-020-00837-2

“Lesion scores in various European countries increased significantly in the months after the outbreak of the war in Ukraine. Gut integrity was apparently challenged by changes in feed formulations”Ben Dehaeck Photo ©Huvepharma

ahead for Chinese amino acid markets?

Corn and soybean meal prices have been at high levels this year, live hog prices are following a bullish trend, China is starting to move away from its ‘Covid dynamic zero’ policy, and large new lysine and threonine capacities are set to launch next year. All of these factors are expected to have a major impact on Chinese amino acid markets in 2023.

Chinese lysine and threonine prices started 2022 at high levels, supported by elevated raw material costs, global logistical problems, and the Chinese power shortage. Lysine HCl FOB China prices fluctuated within a range of $1.68-1.85/kg until May, after which they steadily declined, reaching an average of $1.18/kg in September. For overseas markets, falling prices were mainly the result of overpurchasing in Q1 2022.

As many overseas purchasers have been hesitant to book material for delivery in Q1 2023, stock levels are set to drop, meaning that “a bullish market is likely to appear just as everyone has become accustomed to the bearish market”, a Chinese source said.

In the Chinese domestic market, average lysine HCl prices were within a range of CNY 13.15-12.15/kg from January to the beginning of May, after which they too followed a downward trend.

Most Chinese amino acid producers enjoyed good profit margins in H1 2022. This was partly because soybean meal prices started

CORN AND SOYBEAN MEAL

Given that fermented amino acids in China use corn as a feedstock, rising corn prices, together with lower lysine and threonine prices, squeezed producers’ profit margins in H2 2022. However, continuously high corn prices would normally be expected to cause a rise in amino acid prices, according to the same Chinese source.

Corn prices in 2022 were already high, while planting costs for corn in China (such as land rents, labour, seeds, and fertilizer) are all increasing. The producer said it expected average corn spot prices to rise by CNY 100-200/tonne in 2023.

Another Chinese source said that domestic Covid lockdown rules have eased and logistics have improved, meaning that farmers could sell more corn. The source suggested that spot prices for

What’s

Meihua’s new capacity would be equivalent to Europe’s consumption for a whole year; where would they find this market next year?

corn could drop by a further CNY 100/tonne at most, because Chinese stocks are at 200 million tonnes compared to the normal level of 800 million tonnes. If prices were to drop any further, the government would quickly take action to build up its corn stocks, the source predicted.

Although soybean meal prices have been dropping since mid-November, they have remained at historically high levels. Average spot prices for soybean meal in 2022 were around CNY 4,600/tonne but were expected to drop to CNY 3,800-4,300/tonne, a third Chinese source said. Soybean meal spot prices were in a range of CNY 3,000-3,500/tonne at the end of 2020.

The same source said, “It’s not normal to have soybean meal prices so high, so a price drop is expected; the soybeans are growing well in Argentina and Brazil, and the US bean harvest is almost complete. I have heard the harvest rate is said to be higher than ever... I think this will affect a part of amino acids usage.”

An EU premixer said that it did not think valine and tryptophan intake in Asian formulas would be high, as soybean meal prices in China had dropped significantly in the last 2-3 weeks.

“It seems [soybean meal prices] will keep on dropping, therefore the intake of specialty AA is going to be lower. We do not expect the market will purchase at [the current] high prices in Asia,” it said. “For January shipments, maybe prices will still remain high, but afterwards we are expecting to go fast to previous levels for valine and tryptophan in China.”

However, the Chinese government’s policy of low-protein feed is likely to continue giving support to specialty amino acids demand.

MEAT MARKET

In terms of Chinese downstream markets, live hog, poultry, and aqua replenishment have all increased in H2 2022, meaning that demand for amino acids is expected to be higher in 2023 compared to 2022, a fourth Chinese source said.

Another source said that overseas amino acid stock levels remained high due to supply exceeding demand, but the domestic market was performing well because of better breeding industry profits.

The most actively traded pig futures on the Dalian Commodity Exchange settled at CNY 19,485/tonne ($2,796/tonne) on 8 December for January delivery, compared to CNY 12,820/tonne ($2,011/tonne) on 15 March for May delivery.

NEW CAPACITIES PLANNED FOR 2023

Notwithstanding these drivers, large-scale capacity increases planned for next year are causing a great deal of uncertainty in the amino acids market.

One market source said that “normally Q4 is peak season, but in the current year, the prices were on a downward trend due to the producers’ sales strategy differences and the expectation of new capacity launching, such as GBT and Yufeng on lysine, and Meihua and Fufeng on threonine.”

GBT, which stopped production in 2019, is expected to restart with a capacity of 360,00 tonnes/year of lysine sulphate and 80,000 tonnes/year of lysine HCl. Yufeng Industrial is planning to start up 500,000 tonnes/year of new lysine capacity.

Meanwhile, Fufeng is set to complete its addition of 50,000 tonnes/year of threonine 70% capacity in 2023, while Meihua is planning to launch 250,000 tonnes/year of new threonine capacity.

Industry sources expressed the view that it would be impossible for the market to absorb such a large increase in output next year, so the new capacities’ utilisation rates are expected to be low.

“Meihua’s new capacity would be equivalent to Europe’s consumption for a whole year; where would they find this market next year?” a Chinese producer said.

“It will take time for new entries to get into the market and build up a customer base,” another Chinese producer predicted.

CHINA COVID UPDATE

China has been relaxing its famously-strict anti-Covid policies since December 7.

Feed additive market sources said that logistics and production were no longer being impacted, and people could travel freely once again.

This was a departure from the situation observed from October to 5 December, when many cities entered lockdown or ‘silent mode’, especially in North China, Henan, Hebei, Sichuan, Chongqing, etc. Major cities like Beijing and Shanghai also saw more stringent Covid control policies being implemented.

Sources reported during this period that production and logistics were being impacted, but it was hard to measure to what extent as policies varied from village to village, city to city, and province to province.

By Lydia Ma, analystWill new deforestation-free sourcing rules upend soy imports in the EU?

It is understood that there’s a lot of technical work still to be done, including decisions to be made about the inclusion of different provisions in the legal text.

Perhaps the most critical of the outstanding points for him is the need for implementation guidelines which would explain how the new law should be applied, commodity by commodity, with more specificity than has been available in the high-level discussions.

“We do believe that there is agreement that the European Commission will develop what they call commodity-specific implementation guidelines, and that they would commit to getting that done within 12 months after the publication in the Official Journal,” he says.

“I would expect that authorities [such as] customs authorities at ports are eagerly anticipating these implementation guidelines, just as we are, because they also probably do have questions about how they’re actually supposed to enforce this, and determine whether something is compliant or not.”

In early December — not coincidentally, on the eve of the UN’s COP 15 Biodiversity Conference — the European Commission, European Parliament, and the Council announced that they had come to a provisional agreement for a regulation on deforestation-free supply chains. Seven commodities, including soy, cattle, and palm oil, are covered by the framework, which requires that anyone placing these commodities or goods made from them on the market in the EU must demonstrate that they were not produced on recently deforested land.

When Feedinfo spoke with Anton van den Brink, Deputy Secretary General of FEFAC, the European Feed Manufacturers’ Federation, just days following the announcement, the text to which the three EU lawmaking bodies had agreed was not yet available (something he says is not particularly unusual for these sorts of negotiations.) However, this is likely to be a temporary state of affairs; as van den Brink understands it, the goal is to wrap up the negotiations on the deforestation regulation before the end of the Czech presidency of the Council at the close of December, rather than passing it on to the next Council presidency. Ultimately, he estimates that we might see the legislation formally published in the Official Journal of the EU around May or June of 2023. Given the 18-month implementation period for the most relevant provisions, its entry into force might be expected in early 2024.

The journey to this point, though, has passed at “lightning speed”, in van den Brink’s words. “This proposal was first made by the Commission in November last year, so [in] a little bit more than a year, they managed to squeeze out this agreement.”

PROBLEMATIC LACK OF CLARITY ABOUT TRACEABILITY REQUIREMENTS

Why are these guidelines so important? To begin with, there is a feeling that those who operate in these commodity markets, who have first-hand experience in how these markets function and the impacts that different changes will have, have not been heard in the drafting of the agreement to this point. “It hasn’t been written through, let’s say, the perspective of logistical supply chains,” says van den Brink.

“We’ve had a lot of questions about how this is actually supposed to work in practice…with these implementation guidelines, where there should be stakeholder consultation foreseen, hopefully, there will be a closer look into the functioning of bulk commodity trade, and how this legislation could best be adapted to [those realities], or the other way around.”

More specifically, many of the industry’s questions are centred around the traceability requirements which are a key feature of the new law. The different commodities covered by the deforestation regulation — palm oil, cattle, soy, coffee, cocoa, timber and rubber, as well as products derived from any of these raw materials — have very different supply chains, with different chain of custody models.

“So in the [deforestation] legislation, it doesn’t say ‘you must use this kind of chain of custody model’,” explains van den Brink.

“A legislative text will be silent on any chain of custody model. That’s going to be [in] the implementation guidelines.”

This means that it is currently unclear to what standard of

“Having legislation [eliminating deforestation in commodity supply chains] is certainly welcomed. It shows the urgency, that this is something that needs to be tackled. But we’re just asking for something that is pragmatic, and will not leave the European continent with burdens without actually leading to solutions.”

traceability these different commodities will be held. And that standard could make the difference between a rule that the industry can work with, and one which imposes huge costs for little benefit.

An example: in statements such as the one FEFAC put out with FEDIOL and COCERAL (associations representing the EU’s oilseed crushing and agricommodity trading sectors) after this political deal had been reached, the associations refer to an implied chain of custody. “In our sector, it’s often understood to [mean] segregation…if you need to be able to trace [for example, 50,000 tonnes of soy entering the harbour] back to the farm plot level… you would need to have segregated supply chains…dedicated silos [at] dedicated ports,” explains van den Brink.

“That’s been the key question: is that the way we need to understand [the traceability requirements of the new rule]? Ok, then we are looking at supply chain disruption, then we are looking at a lot of elevated costs, then we are looking at elevated administrative burden.”

Let’s break that down a bit. If, ultimately, a maximalist view of the concepts of traceability and chain of custody is taken, soy destined for the European market might need to be physically segregated off all throughout the supply chain. Building and maintaining a parallel system of infrastructure to do so would take time, hence the possibility of supply chain disruption. It would also be mind-bogglingly expensive, and those costs would be passed on to the final users (such as those purchasing animal feed), who are already struggling with low margins.

“In Europe [animal feed will] need to be deforestation-free now, by law. But if you talk about animal production outside of Europe, they will have no such obligation to use deforestation-free soy,” observes van den Brink.

Industry associations such as AVEC, which represents the EU poultry production sector, have expressed the unfairness of having to pay a significant premium for their feed compared

© Alexandros Michailidis / Shutterstock.com

© Alexandros Michailidis / Shutterstock.com

to producers in Brazil, Thailand, or Ukraine; interestingly, the solution AVEC have identified is that EU authorities “should correct their mistake as soon as possible by including poultry meat in the scope of the next revision of the legislation to ensure a level playing field for our producers.”

And in some cases, it could be simply physically impossible to add dedicated silos to busy ports already straining at the seams. “If you go to Brazil, you go to the Santos port, for example, they have limited storage capacity, and they ship not only to the EU, they also ship to China, or Thailand. We just don’t have dedicated EU infrastructure in these countries,” van den Brink notes.

Moreover, it is important to understand that other options exist; physical segregation with dedicated infrastructure is not the only way to ensure that Europe’s consumption of these commodities does not drive net deforestation. Van den Brink points to options such as “book and claim” or “mass balance” chain of custody models, which feature in discussions about green energy (and indeed, mass balance was used in the EU’s Renewable Energy Directive).

In such systems, it is volumes or credits, not the physical products themselves, which must be traceable to deforestationfree commodity production. He explains: “If you buy credits [for deforestation-free soy, for example], it’s a system outside of the supply chain functioning. It’s like with green electricity: you cannot control what you get out of the grid [i.e. whether a given unit of electricity delivered to you was produced with renewables or traditional sources]. That’s a system that has worked for many countries, and I think it has its merits.”

Unfortunately, it is not clear that such a system would satisfy those who are leading the charge against deforestation in the EU supply chains. “You can look at initiatives like from the Consumer Goods Forum, for example, or you see different types of soy

ANTON VAN DEN BRINK

ANTON VAN DEN BRINK

“That’s been the key question: is that the way we need to understand [the traceability requirements of the new rule]?

Ok, then we are looking at supply chain disruption, then we are looking at a lot of elevated costs, then we are looking at elevated administrative burden.”

EU LEGISLATION

manifestos in several countries; they all want to have an increased level of physical traceability,” observes van den Brink.

Moreover, he fears that the mass balance concept may be perceived as a bit of a soft option, a half measure. “Mass balance, from what [environmental legislators and regulators] know of it, is a system that allows a certain level of mixing,” he explains. “The political goal in mind [is made clear by] Commissioner Timmermans always using the coffee reference: any European should be able to buy a cup of coffee anywhere in Europe and not feel a guilty conscience that there could be deforestation at the heart of it. So segregation for them sounds like something that will do the trick.”

Still, this remains one of the main hopes from the implementation guidelines: that they will make clear exactly what form the traceability demanded by the deforestation legislation will take. “That’s exactly why we need these words of guidance from the Commission or an authority [ensuring] that there must be the possibility of some kind of aggregated traceability…the Commission will have to address [the possibility that] you cannot 100% exclude it.”

LEGALITY AND EFFECTIVENESS IN COUNTRIES OF ORIGIN

There are other concerns about the deforestation regulation beyond the headaches that an insistence on physical segregation would create.

For one thing, even if it is data, and not the physical commodities themselves, which must be traced through the chain of custody, European schemes could raise data privacy concerns in the countries of origin — which span the globe from Canada to Indonesia to Argentina. FEFAC and its partners have been warning since February that mandating the collection of geolocation coordinates from producers would be incompatible with the laws in some jurisdictions. “[EU trading partners are] not exactly happy with this idea of having to provide all that data. You always have to prove your innocence, with a whole batch of data about the location of where [commodities] are growing.”

Perhaps most ironically, though, there are also worries that the regulation will not do very much when it comes to influencing the net deforestation taking place. One reason for this is because the regulation divides countries up into high, standard, and low risks for deforestation, something which FEFAC and others have criticised because it will lead to risk avoidance. In other words, conscientious buyers will decide that the potential damage to their reputation from dealing in commodities from country classed as “high risk” is too great, and they will stick to those produced in areas where there is no risk of deforestation — meaning that the

only buyers left for soy or beef from countries where there is a risk of deforestation will be less conscientious buyers, those who will put no pressure on the producers to do the right thing or pay no premium for responsibly-produced soy.

Or as van den Brink puts it: “In the areas, particularly in South America, where soy expansion still can [sometimes] be a driver of deforestation, we [in Europe] would be disconnected from those places. It would be impossible to do business with these farms, with the farms that would want to have Europe as a partner for sustainable trade.”

THE OUTLOOK

In spite of his serious reservations about the ways in which the EU authorities could yet decide to implement the deforestation regulation and concerns about potential effects throughout the value chain, van den Brink says he “wants to be fairly optimistic” about the possibility of a somewhat positive resolution to the dossier.

For one thing, he says, the fact that food security has taken centre stage in the light of world events recently makes him hopeful that lawmakers will not take decisions that render imported feed ingredients inaccessible. “Politically-speaking, you cannot imagine the EU would shoot themselves in the foot, kind of consciously saying ‘oh, we’ve just developed something that is completely going to cause the breakdown of soy imports from entire regions of the world.’”

And for another, he was encouraged to see that the idea of implementation guidelines — which were not even part of the original EC proposal but which were added in by the Parliament — reportedly made it into the final political agreement. “[The commitment to implementation guidelines] gives us some hope that there is room to really look into practical solutions.”

More generally, he is pragmatic about the fact that the world is changing, and the industry must change with it, about the fact that the demand for sustainable supply chains is coming not only from the EU authorities, but also from the market, and indeed from society at large.

“The idea that the origin [of commodities] is behind closed curtains, I think that’s a paradigm we’re going to have to let go. Because of the pressures that are on us, we need to know where we get [our raw materials] from. Otherwise, it’s the license to produce [livestock] that is at stake…the concerns around feed production, soy production and cultivation specifically, it’s one of the key concerns for people [deciding] to eat meat or not.

“We’re going to pay for [responsibly-produced soy] somehow, either with money or with reputation.”

By editorShannon Behary, senior

“In Europe [animal feed will] need to be deforestation-free now, by law. But if you talk about animal production outside of Europe, they will have no such obligation to use deforestation-free soy...”

ANTON VAN DEN BRINK

•

•

•

•

https://animalnutrition.iff.com/home info.animalnutrition@iff.com

Environmental stewardship sets U.S. soy’s story apart, says USSEC

As the global demand for animal protein continues to rise, so has the demand for soy as a feed ingredient. But while the oilseed can be a valuable source of nutrition for livestock, the environmental impacts of its production have increasingly become a source of concern, with topics like deforestation, land use change, and greenhouse gas emissions often making their way into the soy conversation.

But as U.S. Soybean Export Council (USSEC) CEO Jim Sutter explained to Feedinfo, while there is some truth to these sustainability concerns, they are incorrectly being attributed to soy of all origins. In the following Industry Perspectives piece, he talks us through the U.S. soy sustainability story and the innovations adopted by soy farmers in the country to address environmental concerns. We also talk about where he is seeing growth opportunities for U.S. soy as the rising costs of inputs continue to put pressure on livestock producers.

[Feedinfo] Can you start by explaining your “product”, that is, U.S. soy? How is it different from soy from other origins?

[Jim Sutter] Among global soy origins, U.S. soy has an excellent amino acid content and amino acid profile, increased metabolizable energy content due to higher sugar levels, lower fibre content and improved amino acid digestibility, higher total phosphorus content, and greater uniformity of nutrients. It’s also important to note that U.S. soy is widely recognised as having the lowest carbon footprint versus soy of other origins. For example, a recent study conducted by the Global Feed LCA Institute (GFLI) identifies U.S. soybean meal as having the lowest kilogrammes of carbon dioxide equivalent (CO2-eq) per ton of broiler liveweight.

[Feedinfo] Have concerns in Europe about the links between deforestation and soy proved to be a positive or negative development for U.S. soy? Are they hurting the image of soy as an ingredient, or are feed industry customers and the final

consumers making a distinction between soy grown in North vs South America?

[Jim Sutter] It is concerning that soy as a valuable feed ingredient is being broadly labelled as an environmental risk. In the U.S. we have not been responsible for deforestation. In fact, according to the USDA National Resources Inventory, between 1982 and 2017, U.S. forest land increased 2.1 million hectares while cropland decreased 21.3 million hectares.

Also, the U.S. Soy Sustainability Assurance Protocol (SSAP), which includes all of the U.S. laws to protect the country’s natural resources and biodiversity, is a verified aggregate approach, audited by third parties, that verifies sustainable soybean production on a national scale. SSAP certificates can be transferred to customers up to four times.

The SSAP has received numerous third-party accreditations, including from FEFAC and the Sustainable Agriculture Initiative Platform’s Farm Sustainability Assessment.

[Feedinfo] What are some of the innovations in soybean production that are encouraging sustainability? How is U.S. soy actively improving its sustainability story?

[Jim Sutter] U.S. Soy has several sustainability goals, including using land more efficiently, reducing soil erosion, more efficient use of energy, and reducing greenhouse gases. U.S. soybean farmers are some of the most sustainable in the world and their ongoing commitment to sustainability, according to the Field to Market National Indicators Report for 2021, have resulted in:

soy production by 130% using roughly the same amount of land. Innovations adopted by soybean farmers contributing toward these improvements include cover crops, conservation tillage, and precision production methods, including emerging cutting-edge applications like the use of artificial intelligence to enable targeted herbicide applications only on weeds.

[Feedinfo] How big is the market for soy with particular sustainability attributes? Where are such principled buyers coming from (in terms of geography, sector, motivation...)? Is it fair to say that most buyers of soy are simply looking for the best deal available, and sustainability criteria are a distant second in terms of priorities?

[Jim Sutter] We are observing increasing interest in sourcing sustainable soybeans; more than half of U.S. soy exports have requests for SSAP certificates. Exports of verified sustainable U.S. soy were up 33% in 2022 versus 2021 representing 59% (approximately 40.6 MMT) of U.S. soy’s total exports (approximately 68.8 MMT) in market year (MY) 2021/22.

Historically, we have seen the most interest in sourcing sustainably from Europe. More recently, demand has been growing globally.

In addition to sustainability, price matters for soy customers. But not all soybeans are created equal. We are focused on demonstrating the total value of U.S. soy to our buyers. In fact, our online Soybean Value Calculator uses an individual’s data to help shed light on these origin-based differences. It enables crushers to calculate and compare the economic value of crushing soybeans from the U.S., Brazil and other origins. Based on origin-specific whole soybean characteristics, the calculator estimates the true, quality-adjusted whole soybean crush margin by accounting for co-product yields, soybean meal nutrient value, soybean oil refining costs, and plant efficiencies.

This tool helps bring together two existing calculators — the Nutrient Value Calculator and the Soybean Oil Value Calculator — and in doing so, paints a more wholistic picture of the value of soybeans.

[Feedinfo] Livestock and poultry producers in many parts of the world are losing money at the moment, as they struggle to cover the rising costs of inputs. Where are the growth opportunities for U.S. soy in such an environment?

[Jim Sutter] We are always concerned when we hear that customers are facing challenges, but we know that soybean meal from U.S. soybeans has advantages that can bring efficiency and value to livestock and poultry producers.

That said, aquaculture is a growing opportunity as it has immense potential to help meet the world’s nutrition and food security needs as an affordable and sustainable source of protein

Sponsored | INDUSTRY

PERSPECTIVES

The FAO forecasted global aquaculture production to increase 32% from 2018 to 2030 (from 179 million tons in 2018 to 204 million tons in 2030). We see growth opportunities here for U.S. soy as an excellent ingredient choice for aquafeed and a more sustainable option to wild caught fish feed.

[Feedinfo] The very low water levels of the Mississippi River, an important corridor for shipping U.S. soy, have affected the carrying capacity of this channel. Should international buyers be concerned about the ability of the U.S. to actually get its soy exports on the water in a timely manner? Are other modes of transportation, such as the rail or trucking industry, able to make up the slack caused by reductions in barge transport?

[Jim Sutter] Fortunately, the low water situation on the Mississippi has pretty much resolved itself. The variety of transportation modes, the quality of the transportation infrastructure, and the number of ports available in the U.S. result in the reliability of the U.S. soy supply even in the face of periodic challenges.

[Feedinfo] Over the last year, the feed ingredients markets have been dominated by news about drought and conflict. Do you think there are other developments, on either the supply or demand side, which are worth keeping an eye on?

[Jim Sutter] The onslaught of the four Cs (COVID, Climate, Conflict and Currency) simultaneously has not only wreaked havoc in the agriculture industry; the reverberations are felt in almost every aspect of every person’s day-to-day experience.

Despite these challenges, and according to the USDA, global production and consumption of soybeans have been steadily increasing year-over-year and are forecasted to continue in this market year.

As for other developments, the uncertainty and volatility of the energy market is an area to monitor closely along with the overall state of the global economy. We strongly believe that trade delivers solutions to these challenges. Finally, we are always optimistic about the future as we see growing demand for protein and other products from soybeans — we look forward to working with customers and potential customers of U.S. soy all around the world to help them take advantage of all the opportunities that U.S. soy can deliver.

Published in association with USSEC

Published in association with USSEC

Fertilizer needs, not feed, drives decision-making about phosphates capacity

The main use of phosphate rock today is to produce fertilizers. With approximately 85-90% of phosphate going into crop nutrition, its use for other applications, including feed, food, and technical applications such as metallurgy or LFP (lithium ferrophosphate) batteries, is quite small. At best, feed applications represent 5-6% of phosphate rock production.

In 2021, according to USGS, about 220 million tonnes of phosphate rock was produced in the world, representing about 47 million tonnes of P2O5. The three largest producers are China, Morocco, and the US, which make up 66% of total production. Approximately 74% of the phosphate rock is used to produce phosphoric acid.

For the time being, phosphate producers continue to increase production to meet the ever-growing needs of the global agriculture sector. Therefore, phosphate rock mining will

World

continue developing. Estimates vary from one source to another, but production should grow by 4-5% in the next three years. This represents approximately 2-3 million tonnes of P2O5, which is roughly equal to the entire estimated annual demand of feed phosphates.

This demonstrates the relative importance of feed phosphates for the fertilizer industry.

INEXPENSIVE ADD-ON TO COUNTER SEASONALITY OR MANAGE BY-PRODUCTS

Still, one can easily understand that fertilizer producers have an interest, albeit limited, in feed phosphates. This application is something of a midway point between fertilizer and food/ technical applications.

One advantage of feed phosphate production is that, unlike technical and food quality which require high purity levels and

production in 2021

DYNAMICS

VERY LONG-TERM PERSPECTIVE:

According to USGS, there is no substitute for phosphate rock to supply the world’s agriculture needs. That is true considering current demand and use. Phosphate recycling technologies are still in their infancy for the time being, with limited volume potential. Still, world phosphate rock reserves are estimated at 71 billion tonnes, meaning that, assuming production levels remain constant, reserves will last for about 300 years.

Before the long-term supply of phosphate rock becomes an issue, the industry might instead need to face a potential lack of another input: sulphur. As discussed in a previous Feedinfo article, the phosphate industry is the main user of sulphur today, since most phosphoric acid is produced with sulphuric acid (the wet process). Because sulphur is a by-product of oil refining, if global consumption of oil products declines with the advent of greener energy sources, the volume of elemental sulphur available will drop significantly.

specific technologies, producing feed phosphates is relatively simple and inexpensive. In some cases, the production of feed phosphate is even done in refurbished fertilizer granulation units once used to produce NPK or DAP.

Another advantage is that, compared to DAP or MAP (major phosphate fertilizers produced today), its production cost is lower (given that the ammonia needed for fertilizer production requires natural gas, oil or coal). Indeed, feed phosphates offer a better return than fertilizers per P unit.

Moreover, producing feed phosphate along with fertilizer helps integrated producers to mitigate the seasonality of fertilizer sales since feed phosphate consumption is relatively stable from one month to another.

Finally, in some cases, feed phosphate production can be a way to deal with by-products from other processes. The best example is the production of potassium sulphate (also called SOP, or sulphate of potash). To produce SOP, potassium chloride (KCl) is digested with sulphuric acid to remove chloride. Consequently, large amounts of hydrochloric acid are produced as a by-product. One way to manage this by-product is to produce dicalcium phosphate (DCP), a feed product.

This process was originally developed in the 1930s by Tessenderlo Chemie in Belgium. In addition to the existing plants using it, there are several ongoing projects that would bring additional DCP capacities online in the coming months or years.

GROWTH PROSPECTS FOR FEED PHOSPHATES

In most cases, investment in new feed phosphates production capacities is linked to fertilizer production expansion. As discussed in a previous Feedinfo article, feed phosphates demand is not growing much, and is even declining in some cases. But this is not keeping producers from investing in additional production capacities; for the reasons mentioned above, it makes sense for fertilizer producers to invest in feed phosphates production even if demand is, at best, stagnant.

OF PRODUCTION EXPANSION

For this reason, we have seen in recent years the emergence of Russian producers on the international scene. The same goes for China, which is the largest producer of phosphate today, with about 40% of global production.

China has set food security as one of its top priorities in its most recent five-year plan on national security strategies. The fertilizer industry is key to meeting the plan targets. Therefore, phosphate production will keep on growing, and consequently, so will feed phosphates.

When it comes to fertilizer, China has strict controls on exports to ensure supply to local farmers at reasonable prices, but there are, so far, no restrictions on feed phosphates and no reason to believe that the authorities will restrict feed phosphate exports (as again, the size of IFP production is negligible compared to that of fertilizer).