LEADER

AG CREDIT FEATURES

Stay up to date with the latest Ag Credit features!

Digital Banking Online

Our online/mobile banking tool allows you to view statements, make payments and transfer funds.

AgriLine

Write your own loan advance when you need it.

AutoDraft

Automatically deduct your loan payment from your checking or savings account.

Customer Referral Program

Recommend someone to Ag Credit and, if they receive a qualifying loan, you’ll receive a gift!*

DocuSign

Electronically sign documents.

FastCash

Electronically transfer funds from your line of credit into your personal or business checking account.

Online Banking Portal

Secure communication and document transfer.

Social Media

Ag Credit is on Facebook , Twitter, YouTube, Instagram and LinkedIn . Follow and Like Central Kentucky Ag Credit to keep up with the Association.

LOCATIONS

LEADER

is published quarterly for stockholders, directors, business associates and friends of Central Kentucky Ag Credit.

PRESIDENT AND CEO

Jonathan Noe

BOARD OF DIRECTORS

Alvin Lyons

Jim Rankin, III

Joe Myers, Chairman

Lee Blandford, Vice Chairman

Patrick Higginbotham

Mary-Lynn Hinkel

Dan Grigson

EDITOR

Cassie Johnson, Marketing Coordinator

Shelby Terrell, Marketing Assistant

PUBLISHER

AgFirst Farm Credit Bank

DESIGNERS

Joey Ayer

Gwen Carroll

Jessica Deas

Phereby Derrick

Jonathan Mashack

PRINTER

Professional Printers LLC

COVER PHOTO CREDIT

Scott Grider

ADDRESS CHANGE

Address changes, questions, comments and requests to cancel your free subscription to the Ag Credit Leader should be sent to Central Kentucky Agricultural Credit Association by calling 859.253.3249 or mailing to PO Box, 4100 Lexington, KY 40544-4100.

FINANCIAL INFORMATION

The Farm Credit Administration does not require the association to distribute its quarterly financial reports to stockholders. Copies of the association’s annual and quarterly reports are available upon request free of charge by calling 859.253.3249 or writing to Thomas Whitaker, Chief Financial Officer, Central Kentucky Ag Credit, PO Box, 4100 Lexington, KY 40544-4100, or at AgCreditOnline.com

PRIVACY POLICY

Your online privacy is always a top concern at Ag Credit. For a complete copy of the latest version of the online privacy policy, please visit our website and click on the home page link.

President’s Message

Tara’s Hashbrown Casserole 4 5 6 7 8 9 10 11 12 13 14 16 17

91st Annual Stockholders’ Meeting 2026 Nominating Committee

Blandford Re-Elected to Ag Credit Board

Ag Credit Extends Appreciation

Ag Credit Attends KCA Convention

Ag Credit Judge FFA Regional Day

Ag Credit Hosts Fourth Annie’s Project

Washington County Ag Leader of the Year

Bourbon County Beef Day

Central Kentucky Ag Credit Celebrates Customer

Appreciation Day

Harrison County Beef Day

Snell Winner of Ag Credit Scholarship

Madison County Beef Day

Montgomery County Beef Day

Central Kentucky Ag Credit Sponsors UK Ag Week

Danville Christian Academy

Scott County Ag Day

Marcum Mclean Spring Intern Thank You

New Employees

Loan Officers Visit Area Farmers Markets

TURNING THE PAGE

By: President and CEO Jonathan Noe

Since we’ve turned the page on 2024, I believe we’ve turned the page on more than just the calendar. Our Association has faced some changes and challenges over the last few years, and we’re finally putting some of those hurdles in the rearview mirror. Looking back, we’re now about 18 months into the implementation of some significant technology upgrades. I wish I could say that such upgrades always generate immediate results, but that’s just not the case. It’s taken some time, but we’re now smoothing out new processes and transitioning nicely into these new systems. On top of that, the interest rate market has stabilized after a long stretch of rising rates. We’ve even seen a decline in the Prime Rate, which immediately impacted shorter-term rates. There’s also a drop in long-term rates in the forecast, but it may take a little longer to get there.

In general, we’ve seen our marketplace return to normalcy, and our staff has taken advantage of it. The Association saw strong growth in 2024, ending the year with an approximate 9% increase in loan volume. Coming off 2023, when loan growth was tough, we stayed the course. Even with rising rates and competition, we kept pursuing business in our market. I probably say this a lot, but the years we’ve spent developing a strong market presence, focusing on customer service and building relationships has proved to be invaluable. The transition from 2023 to 2024 served as a reminder that we can’t always control the environment around us or what changes may come our way, but we can control how we deliver service to our customers.

The recent growth we’ve had has provided excitement for the Association over the past year – especially in our Frankfort market, where the growth has led to the construction of a new office building. We’ve outgrown our current location, so something had to give! After looking for a new site for several months, we found a lot to build on early in 2024 located just off Highway 127 near Interstate 64 (at the intersection of Highways 127 and 420 in Frankfort). The new building is expected to be completed and open for business in the spring of 2025!

While the growth of 2024 was exciting, we still faced some adversity. The price of corn, beans and wheat all came down over the last 12 months. On top of that, growing conditions were not ideal in some areas, which significantly decreased crop yields. I fully expect that some of our borrowers will be impacted by this, but despite any setbacks, Central Kentucky Ag Credit will still be there to serve the needs of its members. We may not be the largest lending institution around, but we offer a personal connection with our customers that includes an intimate knowledge of their operations. Our staff remains accessible to our customers, has a deep understanding of their needs and work hard to add value to those relationships. We believe ag lending is done best when there is a relationship involved. There are times when our customers simply need a loan, but often they need a trusted adviser that can offer much more. After all, we finance decisions that impact our customers’ livelihoods, and we don’t take that lightly.

Being there for our members through good and bad times is all part of the cooperative model that is the Farm Credit System. We have a mission of serving the farmers and rural residents of central Kentucky. These same folks make up our customer base and are the owners of our organization. Our members elect their own representation in the form of a Board of Directors to set the direction of the organization. The end goal for our cooperative is to maximize the value of return to our members in the form of competitive interest rates, value-added service and patronage dividends. In 2024, we turned the page on our 90th year in existence, and as long as we stick to those core principles, we have a recipe for success that will continue for many more.

The Central Kentucky Ag Credit Annual Stockholders’ Meetings were held on March 3rd, 2024, in Lexington and March 4thh, 2025 in Harrodsburg marking our 91st year. Member-borrowers, along with Ag Credit staff, enjoyed the opportunity to gather for a delicious meal and fellowship. This year’s attendance was as strong as ever, with a total of 362.

Joe Myers, Board Chairman of the Board of Directors, presented the Directors’ Report detailing the Boards role in the guidance of the Association as well as some of the actions and events the Board participated in during 2024. President and CEO Jonathan Noe provided a recap of another successful year and commented, “In 2024, the

91ST ANNUAL STOCKHOLDERS’ MEETING

Association had $15.3 million in net income, while the capital level was $153.4 million with an average growth rate of 7%.”

It was also announced that over $5.4 million in patronage would be distributed to qualifying Ag Credit member-barrowers in April 2025. Over the last 27 years, Central Kentucky Ag Credit has distributed over $62 million in patronage.

The 2024 Annual Report, outlining in-depth information regarding the Association’s financial operations, was mailed to all member-borrowers in March. More information can be found in detail within the report, which is also available on our website.

2026 NOMINATING COMMITTEE

Members for the 2026 Central Kentucky Ag Credit Nominating Committee were elected during the voting process at the Annual Stockholders’ Meeting. The Nominating Committee will recommend candidates for any open, non-appointed director seats in 2026.

2026 Nominating Committee members are:

• Clay Darnell

• Wayne Day

• David Dotson

Central Kentucky Ag Credit is a financial cooperative and part of the national Farm Credit System. Memberborrowers of Ag Credit participate in filling elected positions with a one-member/one-vote election system during each year’s Annual Meeting.

• Jeremy Hardin

• John Irving Mathis

• Lucas Stevens

• Brett Welty

Staff from all branches came together for the meeting.

Board Chairman Lee Blandford speaks to the voters.

Board Chairman Joe Myers addresses attendees.

Loan Officers cooked up steaks to serve at the 91st Stockholders Meeting.

BLANDFORD RE-ELECTED TO AG CREDIT BOARD

Lee Merrick Blandford was recently re-elected to the Board of Directors for a four-year term. The election followed the completion of the Annual Stockholders Meetings. She was first elected to Ag Credit’s Board in 2017.

Lee and her husband, J.P., own and lease a total of 700 acres in Washington County where they have a cow-calf operation and background approximately 300 head of feeder cattle each year. They also own and operate Blandford Mills, LLC, a feed mill and farm supply retail store in Springfield, Ky.

Lee is also the Chief Financial Officer for Clements Ag Supply Inc. Lee and J.P. have six children, who enjoy exhibiting cattle through 4-H and FFA, and are members of St. Dominic Catholic Church in Springfield.

AG CREDIT EXTENDS APPRECIATION

Serving on the Ag Credit Board of Directors not only requires a significant time commitment, but it also involves a deep understanding of agricultural economics. The Board of Directors and staff of the Association are deeply grateful for individuals who are willing to serve the Association.

Johnathan David Shepherd of Franklin County extended his willingness to serve on the Central Kentucky Ag Credit Board of Directors during the 2025 election. Aside from his significant hands-on experience in farming, managing a commercial cow/calf and ewe farm in Franklin County with his wife, Claire, and their children. Jonathan has accumulated 20 years of farming experience, including grain production before transitioning to a livestock and hay operation in 2018. In addition, he nis currently an extension specialist, Director of the UK Income Tax Seminar Program and an instructor in the Department of Agricultural Economics in the Martin-Gatton College of Agriculture, Food and Environment at the University of Kentucky. He is also pursuing a PhD in agricultural economics and is set to graduate in May. While Lee Blanford was re-elected, Ag Credit offers its appreciation to Johnathan David Shepherd for his readiness to serve on the Ag Credit Board of Directors.

AG CREDIT ATTENDS KCA CONVENTION

As a trusted financial partner to farmers and ranchers throughout our region, Central Kentucky Ag Credit recognizes the importance of actively engaging with the agricultural community and staying abreast of industry developments. The KCA Convention provided the perfect platform for the organization to connect with clients, network with fellow professionals and gain valuable insights into the challenges and opportunities facing the cattle industry.

Throughout the convention, Central Kentucky Ag Credit representatives actively participated in seminars, workshops and panel discussions covering a wide range of topics, including market trends, best practices in herd

management and strategies for mitigating risk. By staying informed and engaged, the organization reaffirmed its commitment to providing tailored financial solutions and personalized service to meet the evolving needs of its clients.

Moreover, the convention offered Central Kentucky Ag Credit the opportunity to strengthen relationships with existing clients and forge new connections within the agricultural community. From casual networking sessions to formal meetings, the organization seized every opportunity to listen to the concerns and aspirations of its clients and reaffirm its role as a trusted advisor and ally in their success.

AG CREDIT JUDGE FFA REGIONAL DAY

Central Kentucky Ag Credit employees volunteered their time to judge FFA regional day contests. They evaluated students based on their performance in their designated categories. We were able to judge students

in the Bluegrass Region at UK Martin- Gatton College Of Agriculture, Food and Environment. Central Kentucky Ag Credit represents eight out of 11 counties in this region.

Patrick Durham and Billy Cameron chat with convention attendees at the YETI giveaway table.

Abigail Bonzo talks to KCA attendees.

Staff from different branches joined up to volunteer.

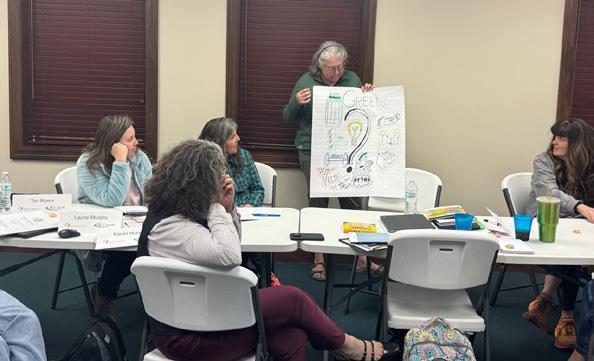

AG CREDIT HOSTS FOURTH ANNIE’S PROJECT

Central Kentucky Ag Credit recently hosted its fourth Annie’s Project, reinforcing its commitment to supporting and empowering women in agriculture. Annie’s Project is a national educational program designed to strengthen women’s roles in modern farming by providing them with the knowledge, skills and resources necessary to successfully manage agricultural enterprises.

Annie’s Project focuses on five key areas: financial management, human resources, legal issues, marketing and production. Through a series of interactive sessions, participants engage in hands-on activities, discussions and networking opportunities that address the unique challenges faced by women in agriculture. The program also encourages the development of leadership and decision-making skills, which are crucial for managing the complexities of today’s agricultural businesses.

Central Kentucky Ag Credit is proud to be an integral part of Annie’s Project, recognizing the vital role that women play in the agricultural industry. By hosting this program, Ag Credit provides a platform for women to enhance their professional development, gain confidence in their abilities and connect with other like-minded individuals.

The most recent iteration of Annie’s Project brought together a diverse group of participants from various agricultural backgrounds. Throughout the program, attendees benefited from expert-led workshops, real-world case studies and peer-to-peer learning experiences. Topics ranged from farm financial statements and budgeting to risk management and succession planning, ensuring that participants left with a comprehensive understanding of both the strategic and operational aspects of farming.

Ag Credit’s involvement in Annie’s Project underscores its broader mission to support and nurture the agricultural community. By facilitating educational initiatives like this, Ag Credit helps to build a more resilient and knowledgeable farming sector, capable of adapting to evolving industry demands.

The success of the fourth Annie’s Project at Central Kentucky Ag Credit highlights the organization’s dedication to fostering an inclusive and supportive environment for all agricultural professionals. As the agricultural landscape continues to change, programs like Annie’s Project play a crucial role in ensuring that women have the tools and support they need to thrive in their farming endeavors.

This year’s Annie’s Project graduates.

Renee Carrico of the state’s Farm Bureau offers an understanding of estate planning.

The group participated in an activity called Real Colors.

WASHINGTON COUNTY AG LEADER OF THE YEAR

Congratulations to Denise and Bob Osbourne, Riney Dairy and Bernie Bourbeau (not pictured) for receiving the Agricultural Leader of the Year award from the Springfield-Washington County Chamber of Commerce. This award was sponsored by Central Kentucky Ag Credit. These wonderful representatives are pictured with Loan Officer Abigail Bonzo.

BOURBON COUNTY BEEF DAY

Bourbon County Beef Day helps promote the beef industry within Bourbon and surrounding counties. This year’s event featured a giveaway for a bucket of goodies, which was won by William Tullis.

Olivia and Shelby get ready to chat with attendees at the giveaway table.

CENTRAL KENTUCKY AG CREDIT CELEBRATES CUSTOMER

APPRECIATION

DAY

Central Kentucky Ag Credit hosted its annual Customer Appreciation Day April 3 to celebrate the relationship between the organization and its valued customers. Each branch welcomed its patrons with a hearty breakfast and lunch, creating a festive atmosphere that underscored the organization’s gratitude for the community’s continued support.

A highlight of the day was the distribution of annual patronage checks, a significant event that has been a cornerstone of Ag Credit’s relationship with its members for the past 28 years. This year, 693 customers participated in the Customer Appreciation Day. This shows a testament to the enduring trust and partnership between Ag Credit and the agricultural community it serves.

Annual patronage checks are a tangible reflection of Ag Credit’s commitment to sharing its financial success with its customers, reinforcing the cooperative principle that members should benefit from the profits generated. This practice not only provides financial returns but also fosters a sense of shared purpose and community.

As Central Kentucky Ag Credit continues to support the agricultural sector, events like Customer Appreciation Day highlight the strong bonds and mutual respect between the organization and its members. Here’s to many more years of successful collaboration and community spirit.

Loan Assistant Lisa Damelio hands out a patronage check.

Sr. Loan Officer John Peek enjoys talking with Stanford customers.

Stanford Sr. Loan Officer SaraVard Gruenigen hands out a patronage check.

Paris Loan Officer Shelby Kirby enjoys passing out checks to Paris customers.

Loan Officer Ben Vanhook and customer were all smiles onHCustomer Appreciation Day.

HARRISON COUNTY BEEF DAY

Harrison County Beef Day was a huge success this year, and Ag Credit was happy to be a main sponsor. Loan officers from our Paris Branch attended the event. The Harrison County Cattleman’s Association fed 850 people. This year, we gave away a bucket of goodies, which was won by Phillip Wright. The event helps to promote the beef industry within Harrison and surrounding counties.

SNELL WINNER OF AG CREDIT SCHOLARSHIP

Layla Snell received the Ag Credit Scholarship at the Clark County FFA chapter banquet. Layla currently serves as the Clark County FFA Secretary. She was also on the Clark County FFA Veterinary Science Team. Layla plans on attending Western Kentucky University to study agriculture education.

MADISON COUNTY BEEF DAY

Madison County Beef Day had a great turnout this year with 1,100 people fed over a two-hour period. In addition to Central Kentucky Ag Credit, other sponsors included the Kentucky Cattlemen’s Association, Kentucky Farm Bureau, Bluegrass Stockyards- Richmond, Southern States, Tri- County Fertilizer and Propane, and the Madison County Conservation District. The event helps promote the beef industry to Madison and it surrounding counties.

The Paris Branch talked with attendees at the Harrison County Beef Day.

Senior Loan Officer Chris Cooper, CEO Jonathan Noe and Madison County Judge Executive Reagan Taylor.

MONTGOMERY COUNTY BEEF DAY

Montgomery County Beef Day was a huge success this year, and Ag Credit was happy to be a main sponsor. This year’s giveaway winner was Eddie Rice. The annual event helps promote the beef industry to Montgomery and surrounding counties.

CENTRAL KENTUCKY AG CREDIT SPONSORS UK

AG WEEK

We had a great time sponsoring Ag Week at the University of Kentucky, which took place the week of March 27. Central Kentucky Ag Credit was honored to sponsor this significant event, reaffirming our commitment to the future of agriculture and the next generation of agricultural leaders.

Ag Week brought together students, faculty and industry professionals in a dynamic celebration of agriculture. The event featured a diverse lineup of guest lectures, workshops, panel discussions and networking opportunities aimed at advancing knowledge and fostering connections within the agricultural community.

Feedback from attendees has been overwhelmingly positive. Students expressed their gratitude for the chance to learn directly from industry professionals and gain hands-on experience that complements their

academic studies. Faculty members and industry leaders also appreciated the collaborative spirit and the platform to share their expertise.

As we reflect on this year’s Ag Week, we are filled with optimism for the future of agriculture. Central Kentucky Ag Credit remains dedicated to supporting educational initiatives and fostering growth within our community. We believe that by investing in events like Ag Week, we are helping to cultivate a prosperous future for farming and agribusiness.

Pictured are the student leaders who helped make Ag Week a success along with members of Ag Credit, Kelli Buckley and Willie Wilson.

Loan Officers, Shelby Kirby and Olivia Randolph were excited to pass out cookies on Montgomery County Beef Day.

DANVILLE CHRISTIAN ACADEMY

Loan Assistant Tara Davis joined Danville Christian Academy elementary students on Ag Day. Tara was able to share her passion for agriculture and inspired the next generation of farmers.

MARCUM MCLEAN SPRING INTERN THANK YOU

Central Kentucky Ag Credit would like to extend our sincere thanks to Marcum McLean for his outstanding contributions during his internship with us this spring. Marcum brought enthusiasm, dedication and a strong work ethic to every task he undertook.

Throughout his time with us, Marcum played a key role in managing digital leads, gaining hands-on experience in credit analysis and the loan process alongside our loan officers, and engaging directly with farmers across our 17-county service area. His willingness to learn and his passion for agriculture were evident in every interaction.

SCOTT COUNTY AG DAY

Central Kentucky Ag Credit had the privilege of engaging with Scott County fifth-graders at the Bluegrass Stockyards. We guided them through the detailed process of becoming a tomato farmer, from developing a comprehensive business plan to grasping the complexities of land investments. Some students left inspired to pursue farming, while others gained a deeper appreciation for the effort involved in growing crops.

A native of Lexington, Marcum grew up on his family’s thoroughbred farm, where he developed a deep appreciation for the agricultural industry. He recently graduated from the University of Kentucky and continues to be actively involved in his family’s thoroughbred operation. In his free time, Marcum enjoys hunting and spending time outdoors.

We are grateful for Marcum’s hard work and positive attitude, and we wish him all the best in his future endeavors!

NEW EMPLOYEES

SHELBY TERREL

Marketing Assistant

Central Kentucky Ag Credit celebrates the hiring of six new employees across our region.

Shelby is a Bourbon County native who grew up actively involved in 4-H and FFA, showing livestock and developing a strong passion for agriculture. In addition to her new role with us, she also runs her own small business, Terrell Digital Marketing.

OLIVIA RANDOLPH

Loan Officer – PARIS

Olivia Randolf grew up on a row-crop and swine farm in Indiana. She attended University of Kentucky and earned a degree in agricultural economics and a minor in animal science. She looks forward to helping cus-tomers accomplish their goals –whether they involve buying a farm, a piece of new equipment or financing and building their dream home.

LISA DAMELIO

Loan Assistant – LEXINGTON

Shelby is a Bourbon County native who grew up actively involved in 4-H and FFA, showing livestock and developing a strong passion for agriculture. In addition to her new role with us, she also runs her own small business, Terrell Digital Marketing.

RYAN REEVES

Loan Officer Trainee – RICHMOND

Morgan White has joined the Ag Credit team as a loan assistant in our Paris branch. Morgan attended Morehead State University, where she studied music education. Before joining Ag Credit, Morgan worked at Central Bank as a client services specialist. She lives in Paris with her 5-year-old son Carter.

TREY CLANCY IT Assistant

Trey Clancy lives in Lexington with his fiancé Caterine, their blue heeler Mira and cat Abraham. He has a bachelor’s degree in marketing from Western Kentucky University and is currently completing his bachelor’s degree in cybersecurity and information assurance from Western Governors University. Trey is a soccer fan and enjoys kayaking and snowboarding.

CHARITY MOORE Loan Officer Trainee – LEXINGTON

Charity Moore graduated from the University of Kentucky in 2025 with a bachelor’s degree in animal science and a minor in agricultural economics. She was raised on her family’s farm in Ohio, where they produce corn, soybeans, hay and straw, along with feedlot cattle sold for freezer beef and a small herd of Simmental cattle. Charity grew up heavily involved in 4-H, FFA and showing cattle, which is what sparked her passion for agriculture. In college, Charity was a member of Sigma Alpha, the professional agricultural sorority, and was a founding member of Collegiate Cattlemen’s Association.

LOAN OFFICERS VISIT AREA FARMERS MARKETS

Central Kentucky Ag Credit loan officers visited local Farmers Markets to distribute reuseable grocery bags. We had the opportunity to hand out about 800 bags across 17 counties. Loan officers got the chance to connect with local vendors and customers while out in the counties, showcasing out commitment to supporting local farm families.

Tara’s Hashbrown Casserole

Ingredients:

2 lb. bag of shredded hashbrowns

2 cans of cheddar cheese soup

1 16oz. container of sour cream

1 8oz. bag of shredded cheddar cheese

1tsp pepper

1tsp salt

1tsp garlic powder

3 packs of Ritz crackers

1 stick of butter

Instructions:

1. Preheat oven to 350 degrees.

2. Use a large bowl to mix all the ingredients together.

3. Use non-stick spray on a 9x13 casserole dish.

4. Spoon mixture into the casserole dish.

5. Crush crackers and sprinkle on top of mixture.

6. Melt one stick of butter and pour over crackers.

7. Cook for one hour or until a butter knife is warm when stuck in the middle of dish.

INSURANCE PROTECTION AGAINST LOSS IS GOOD BUSINESS

Central Kentucky Agricultural Credit Association loan agreements stipulate that borrowers obtain and maintain insurance on property that is pledged as security for loans, with the Association named as mortgagee or loss payee.

This notice is a reminder that the minimum amount of coverage required to be maintained is the lesser of your loan balances, the actual cash value of the property, the replacement cost of the property or the amount stipulated by your loan officer. Since the amount required could be less than the value of the property is insured, you are encouraged to consider higher limits where applicable to adequately protect your equity interest in the property.

If the property securing your loan consists of improved real estate, unless otherwise advised, at a minimum your policy must insure against the following perils: fire and lightning, wind, hail, aircraft or vehicle damage, riot or civil commotion, explosion, smoke damage, water damage (other than flood), falling objects, weight of snow, ice or sleet and vandalism. Loss of damage from flooding is also required if your loan was made after Oct. 4, 1996, and at the time the loan was made the property was located in a government mandated Special Flood Hazard Area and flood insurance was available.

Central Kentucky Ag Credit PO Box 4100 Lexington, KY 40504

Scan the QR code to view our LEADER online, view videos from the LEADER, and have access to our information online! Like the online version better? Be sure to opt-in to receive our LEADER online in the future!