Off-road should not mean off radar

Despite nearly half of all heavy-duty engine oils ending up in a construction, mining or agricultural vehicle, the off-road market and its specific needs remain something of a blind spot for many. Afton Chemical examines this large, growing, yet often overlooked market, sharing insights from recent research that emphasise end user needs and highlight the potential rewards for those looking beyond the highway.

As the global population continues to multiply, the already substantial Off-road market is mirroring the trend. With every passing day the agriculture sector has more mouths to feed, and mining companies have more metal to dig, from iron ore to lithium in the race to meet the rising needs of eMobility. Meanwhile increasing urbanisation drives demand for new infrastructure and housing that keeps the construction industry, well, building.

In turn, this industry growth is fuelling the equipment market. Standing at over 41m vehicles in 2020, the global Off-road parc is expected to grow at a CAGR of 3.0% until 2030 - adding another 14.5m vehicles to the parc. This will be reflected in the finished fluid market, currently close to 6 billion litres per year across engine oil and transmission fluids alone.

Opportunities vs challenges

Asia is by far the largest market, with nearly 40% of the global equipment parc – around 70% of which is in China – whereas the fastest growth is in the Middle East, India and Africa. These emerging markets may be at the heart of growth in equipment and therefore fluids, but that’s not to say mature markets like Europe are static. Although more stable quantitatively, Europe is experiencing rapid qualitative change driven by emissions reduction legislation.

With change, comes opportunity. A highly fragmented market, Off-road is characterised by diversity of equipment, applications and OEMs, presenting not just one opportunity but many. Capitalising upon these opportunities involves understanding the profile of each Off-road sector and what its end user needs are, in each hemisphere.

OEM influence

The global north-south divide includes OEMs. In Europe just 6 OEMs represent some 80% of the agriculture and forestry parc and the top two, CNH and AGCO, account for around half of all vehicles. By contrast, the European construction and mining sectors have twice as many OEMs vying for 80% of the market share. This pattern is repeated in India, with greater OEM fragmentation in construction and mining vehicles than in tractors, the latter being dominated by local OEMs such as Mahindra and TAFE.

OEM fragmentation and equipment diversity adds complexity to the Off-road lubricant market because different vehicles have varying needs, encouraging robust fluid solutions. At the other end of the

spectrum are multifunctional fluids, designed to meet broader needs that span entire vehicle fleets and different components within those vehicles. End users can sit anywhere along this spectrum, with each Off-road sector having a distinct but overlapping profile.

Sector insights

The agriculture sector typically sees smaller fleets of purchased vehicles, maintained in-house, working in harsh environments that are challenging to lubricant performance. Vehicle demand is predictably seasonal at a macro level but fluctuates greatly at short notice with changing weather conditions. Unplanned vehicle downtime can impact crop viability or the quality of fresh produce, with significant financial implications.

In contrast, the construction sector generally employs larger fleets of newer vehicles, mostly leased and with maintenance outsourced, serving highly regulated sites with a strong focus on safe operations. Environmental conditions such as dust can be challenging. Completing projects on time through efficient work sequencing is crucial; ensuring vehicles are always available, in a safe, well-maintained condition, is a priority because needs can be difficult to forecast.

Mining equipment tends to be older, a mix of purchased and leased vehicles. Levels of regulation are close to those in the construction industry but in mines the emphasis is on productivity, so operation is frequently continuous. An efficient maintenance program is essential to prevent extended or unplanned vehicle downtime that bites into profitability.

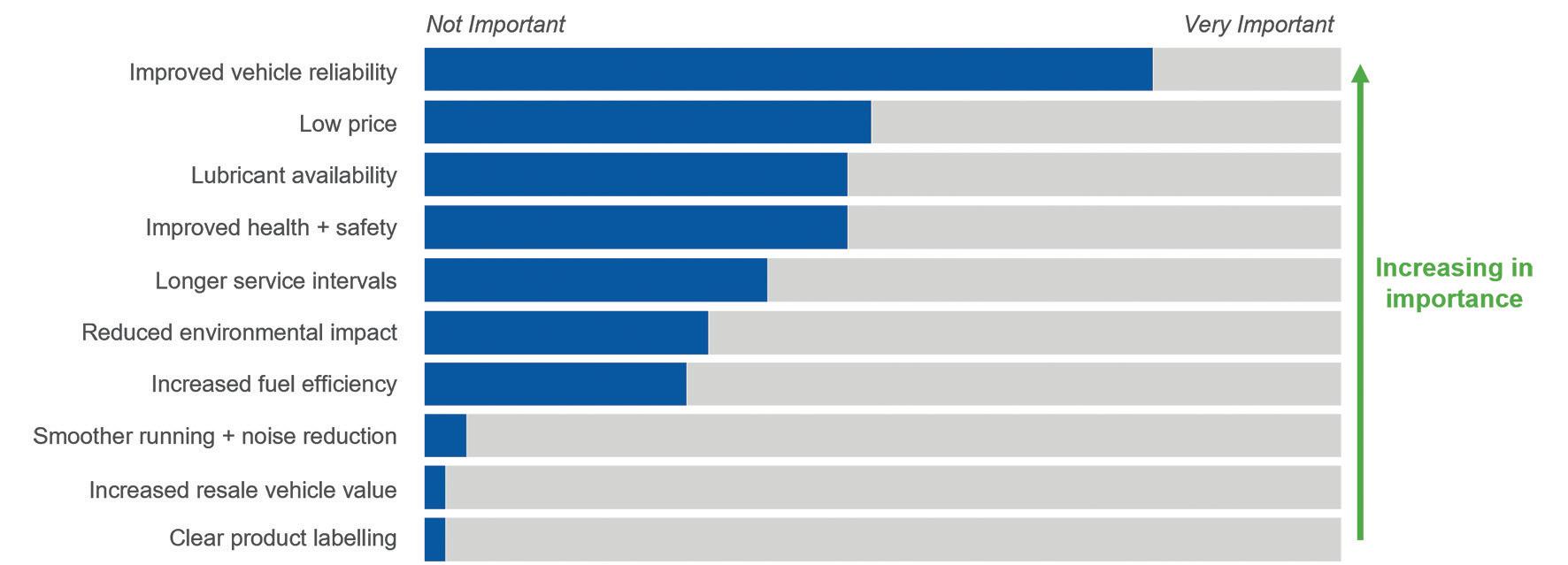

Despite sector differences, there is a common thread: the overarching need for reliability, particularly under the harsh conditions in which these vehicles operate. Good vehicle availability supports productivity, helping to bring down the total cost of equipment ownership.

But how do end users in each sector view the lubricant in terms of achieving reliability?

Lubricant role and perceptions

Lubricants are used in many elements of Off-road machinery, from the engines to the transmissions to the hydraulic systems. The environment that these fluids work in is especially challenging, often with long operating periods, high temperatures and exposure to external contaminants, so markets demand the kind of strong performance that is delivered by tailored additive packages.

Additive components may include anti-wear agents for protection from damage, detergents to keep machinery clean and antioxidants to maintain lubricant stability despite these severe operating conditions. As additive components often interact with each other, chemistries must be carefully selected to avoid issues while delivering the right balance of performance to cover the needs of a range of vehicles. Additional economic and environmental requirements for the fluid may also apply in each sector, which can further constrain the choice of additives.

in their fluid choices, because they view lubricant as a specialist product that plays an essential part in optimising vehicle performance.

Emerging market and agricultural users tend to be less reliant upon OEM specifications, believing that a proven, fit-for-purpose lubricant is more relevant for their needs than a branded fluid with a built-in performance reserve.

Such users are more likely to seek evidence that the lubricant has been fully tested – in the laboratory and particularly in field trials – and shown to reduce wear and protect from damage successfully in an extreme operating environment. These same end users, prefer the simplicity and availability of a multifunctional lubricant that can be used across all parts and all vehicles in their fleet. These fluids therefore need the kind of additive support that offers a balance of performance across all these needs.

Switch to reduced SAPS

Working in partnership with additive suppliers to develop a targeted Off-road lubricant range that really speaks to the needs of end users, their equipment and their operating environment, will help oil marketers to capitalise on these growth opportunities.

Most end user decision makers acknowledge the reassurance of using OEM-branded or OEM-approved heavy-duty engine or transmission oils. For some, buying the OEM brand almost comes with an implicit understanding that, should there be an issue, the manufacturer will be more likely to intervene.

Construction and mining users in mature markets are the most likely of all to follow OEM guidelines

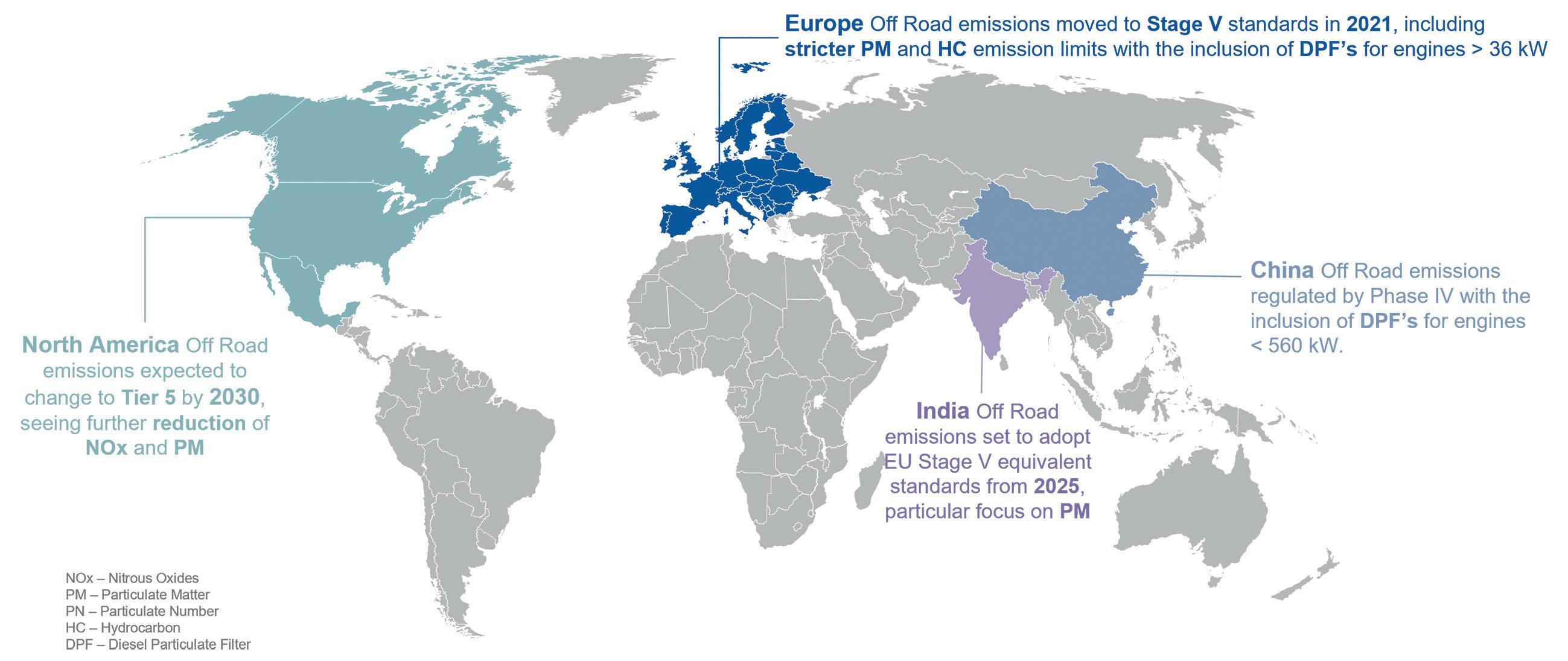

Opportunities arise not only through growth, but also through change. European Off-road emissions moved to Stage V standards in 2021, bringing stricter particulate and hydrocarbon emissions limits and the inclusion of diesel particulate filters for engines over 36 kW. By 2025, it is estimated that 1 in 5 Off-road vehicles in Europe will be Stage V compliant.

These Stage V vehicles all require a reduced SAPS engine oil, which uses alternative additive chemistries to maintain fluid performance while protecting sensitive exhaust aftertreatment systems. Emerging

markets are close behind, with India set to adopt Stage V equivalent standards from 2025 and China mandating inclusion of DPF’s for engines < 560 kW; these changes will stimulate further need for reduced SAPS oils.

Already common in the On-road market, reduced SAPS oils are usually low viscosity as well, for fuel efficiency. For off-road, higher viscosity fluids are more desirable as a thicker lubricant film better protects parts from wear under high loads, prioritising reliability over fuel efficiency. While On-road fluids do not translate directly to Off-road use – the highway operating environment is usually less severe – their additive chemistries can form the basis of robust and effective Off-road formulations.

Just as mature and emerging market end users are reviewing their lubricant’s suitability for aftertreatment-equipped vehicles, this is the perfect time to introduce Off-road fluids developed to meet their specific needs.

Marketing opportunities

Off-road opportunities abound for oil marketers. The volume growth shift from northern to southern

hemisphere is ripe for tapping. With end users still prioritising reliability, collaboration between oil companies and additive suppliers to develop and promote fluids relevant to these regions holds real promise, as do partnerships between local OEMs and suppliers. With vehicle life spans getting longer, there is also growth potential in serving the out-of-warranty equipment market.

In more established markets, there is a chance to take the lead on solutions designed to protect emissions reduction technology, as well as fluids to support Off-road electrification and alternative fuels or forging agreements with OEMs to deliver factory fill and approved fluid specifications.

Understanding end users encourages specific marketing strategies tailored to each sector, all underlined by reliability. Informed by Afton’s valuable insights into end user needs, which shape planned and reactive lubricant purchasing, Off-road oil could finally end up where it should be: firmly on the radar

www.aftonchemical.com