Is electrification slowing down?

October 2024

Is electrification slowing down?

The electrification rate of passenger cars remains a pivotal topic within the eMobility industry, with recent trends sparking debates about the true pace of Electric Vehicle (EV) growth. Are these signs indicative of a genuine slowdown? A temporary hiccup? Or simply exaggerated concerns? This article delves into the latest data and trends to provide valuable insight for decision-makers and stakeholders.

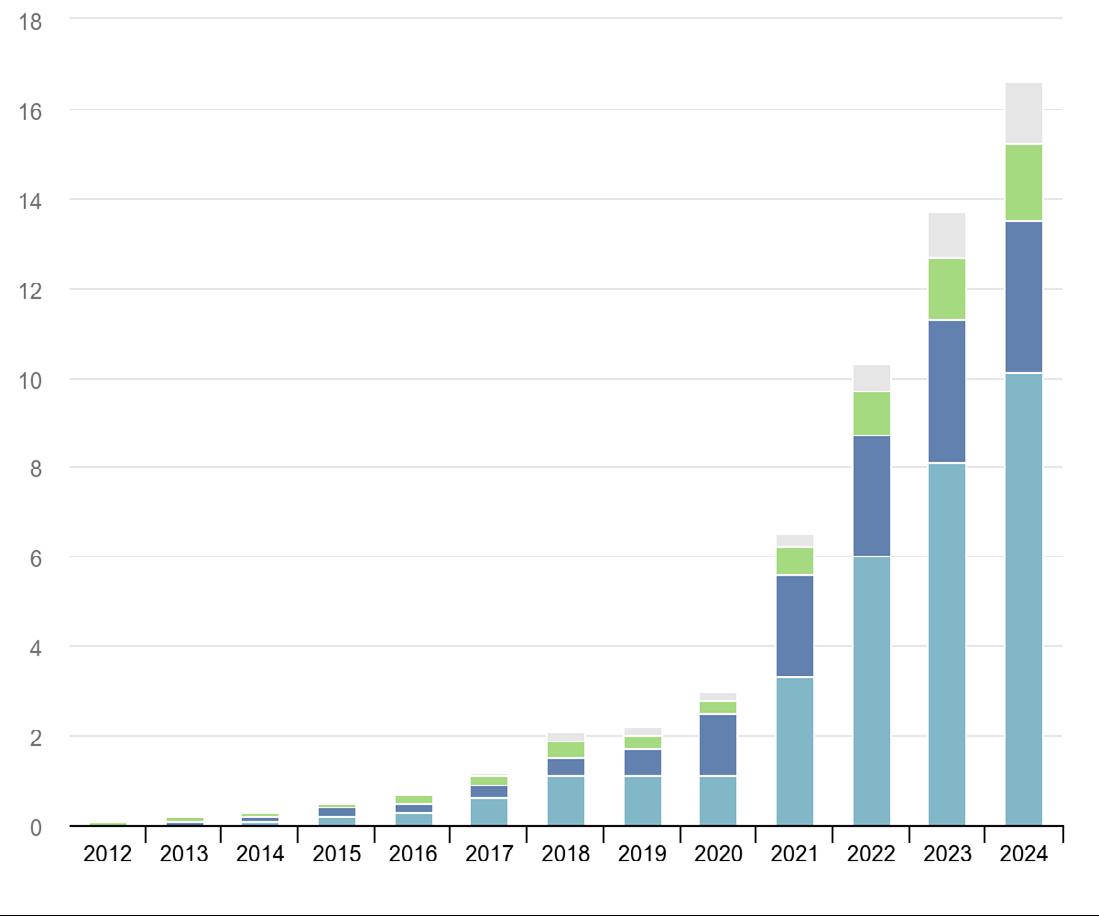

Since 2013, the global electric car parc has experienced exponential growth, driven by legislative support (e.g. climate neutrality by 2050 for the EU), technological advancements (battery cost and charging times), increasing consumer awareness of environmental issues and more desirable Electric Vehicles (EVs) being produced.

To determine if electrification is slowing, we analysed data from ACEA, EV Volumes and IEA. The data below illustrates a steady and significant rise in the number of electric cars worldwide, reflecting the industry’s rapid progress.

Globally, electric car sales remained strong during Q1 of 2024, surpassing the same period in 2023 by 25% to reach more than 3 million sales. Majority of sales were in China - selling 500,000 more vehicles over the same period in 2023. Europe saw a year-on-year growth of 5% and in the United States, first quarter sales reached 14% higher than the same period a year prior. (1)

This clearly indicates that, despite fluctuations in annual registrations, the trend towards electrification is not reversing; in fact, it continues to rise; just at a slower rate. The growth trajectory suggests a robust expansion, especially in China, United States and Europe.

China

In 2023, China’s Battery Electric Vehicle (BEV) market share of sales had been 23%, softening down to 25.5% year-to-date. The reasoning behind this is China’s focus on Plug-in Hybrid Electric Vehicles (PHEV). Following the direction set by the government to domestically use various technology to drive emissions lower, not just Battery Electric Vehicle. This result can be seen in the data, China’s total Plug-in Hybrid Electric Vehicle market share expected to increase from 33.9% to 36.11% (3) this year, illustrating how China’s market share of Plug-in Hybrid Electric Vehicles have been steadily rising.

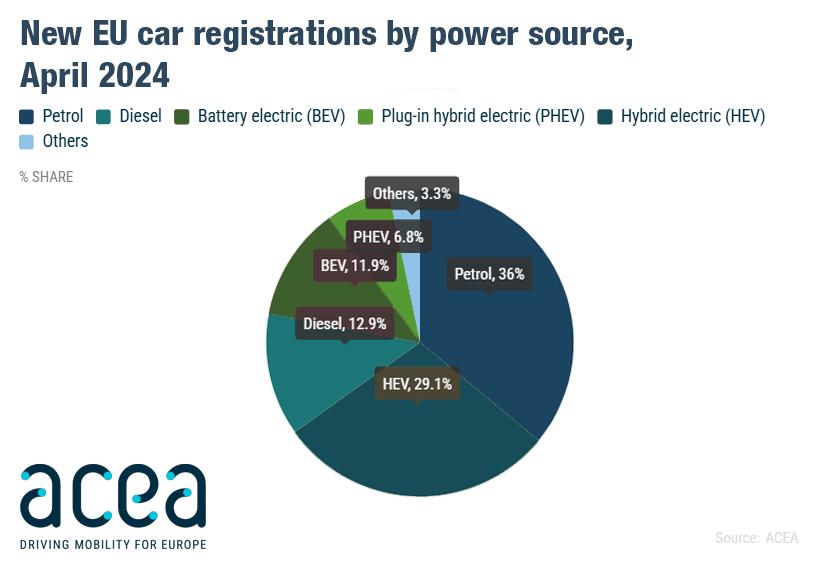

Europe

From January to April 2024, a total of 442,000 new batteryelectric cars were registered in Europe, marking a 6.4% increase from the previous year, bringing their market share to a steady 12%. More specifically France and Belgium saw significant increases of more than 40%. However, the phaseout of purchase subsidies in Germany slowed overall EV sales growth. German sales share for EVs fell from 30% in 2022 to 25% in 2023 FY.

IEA (2024), Electric car sales, 2012-2024, IEA, Paris

https://www.iea.org/data-and-statistics/charts/electric-car-sales-2012-2024, Licence: CC BY 4.0 (1)

Is electrification slowing down?

For the first time since the inception of the UK automotive industry, new car sales of petrol and diesel vehicles are no longer the majority. The combined share of new cars of petrol and diesel vehicles have dropped to less than half the market, at 48.9%, down from 52.8%.(2)

United States

The market share of sales in 2023 of BEV was 7.4%, and for PHEV was 1.8% during Q1 of 2024. Halfway through the year the US market share is around 6.7% and 2.2%. Although the BEV market share has slightly softened in the past year, the overall plug-in vehicle market share is expected to continue growing. The annual growth rate of Electric Vehicle (EV) sales is expected to be around 18-20% compared to 2023. However, it is important to note that this is the regions’ first quarterly decline since Q2 2020.(3)

Developed markets represent nearly 95% of global EV sales, highlighting that while global electrification is rising and smaller EV markets are showing considerable growth - the volume is most prominent in developed countries.(1)

The signs of a slow down

Mercedes-Benz

Mercedes-Benz Group AG has softened their ambitious target to become fully electric by 2030 due to weakening sales and higher demand for combustion-engine and hybrid vehicles. The company’s EV deliveries fell by 8% in the first quarter of 2024, contrasting with BMW’s 28% increase in EV sales (4) (5) (illustrating that an industry-wide analysis is required, as a single organization may be influenced by multiple factors such as Mercedes’ focus on high-end vehicles).

General Motors (GM)

GM’s EV production faced challenges in 2023, and the company is now focusing on 2024 as the “year of execution” to ramp up production. CEO Mary Barra emphasized that consumer demand will guide their EV strategy, reflecting a cautious approach with a multi-pronged strategy that includes hybrids and hydrogen fuel cells.(6)

Tesla

Tesla experienced a decrease in EV production and deliveries in the first quarter of 2024, marking the first year-on-year decline since 2020. Production issues and economic factors contributed to a nearly 9% drop in deliveries. More recently in Q2

of 2024, Tesla reported total deliveries of 443,956 which is a 4.8% drop from a year earlier. Although deliveries are decreasing, the rate of decline has slowed down. (7) (8)

Volvo

On September 4, 2024, Volvo Cars announced a significant shift in their electrification strategy. Originally committed to a 100% electric lineup by 2030, the automaker has now adjusted its plans, citing changes in market conditions. While Volvo will continue to expand its EV offerings the company now aims to have around 90% of their global sales volume to be electric by 2030, with the remaining 10% to consist of a limited number of mild hybrid models.

Adjusting their previous goal, they are now projecting to reach net zero greenhouse gas emissions by 2040 instead of 2030. This move reflects the broader trend in the auto industry. While electrification is still progressing, it is happening at a slower pace than initially anticipated.

Horse Power Train

In May 2024, Renault Group and Geely Group launched a joint venture named ‘HORSE Powertrain’ aimed at developing ultra-low emission internal combustion engines (ICE) and highly efficient hybrid technologies. This investment in ICE vehicles reflects their belief that achieving significant decarbonization in a world where more than half of the vehicles still rely on combustion engines is more feasible with ultra-low emission ICEs rather than a complete shift to EVs. Additionally, as of June 2024, Aramco one of the world’s leading integrated energy and chemical companies has acquired a 10% equity interest, valuing the company at €7.4 Billion. This indicates that many OEMs remain cautious about fully transitioning to electric vehicles and that investment in ICE-based technologies is expected to provide a return. (9) (23)

Reduction of Government Incentives and new Tariffs

Governments are scaling back grants and benefits that initially spurred EV adoption. For example, Germany has reduced subsidies for electric vehicles. Subsidies for BEVs priced below €40,000 decreased from €6,000 to €4,500 in 2023, and further down to €3,000 in 2024 (Reuters). Scandinavian countries are also easing benefits for ZeroEmission Vehicles (ZEVs), making the public more hesitant to buy. As a result of these changes Germany has experienced a significant drop in its BEV market share over the past couple years. In 2023 BEVs consisted of 17.37% of new car sales

Is electrification slowing down?

- boosted by a generous tax on company cars. In contrast, through September of 2024, BEVs only accounted for 11.1% of the new car sales market. (10)

Additionally, United States and Europe have raised tariffs on Chinese EVs significantly, towards a range of 17.4% to 37.6% which is on top of a 10% duty that was already in place for EVs imported from China. This will in turn keep BEV prices higher for longer - inevitably slowing down the adoption curve even more. (11)

Initial Surge from Fleet Purchases

Government benefits related to EVs were fully utilized by private corporations or fleet buyers. This was significant in the initial rise in EV sales. For example, fleet and business registrations hold 62% of the overall market in the United Kingdom (equivalent to 512,244 new cars in 2024).

This is further emphasized by Richard Peberdy, UK head of automotive for KPMG who stated that “Fleets are also driving the growth in EV market share, leading industry players to continue to call for the kind of consumer incentives that have helped to boost business EV buying.” (12)

As these benefits change, the market will become more reliant on individual consumers, in turn further affecting the adoption curve.

Rate of Adoption for EVs

As the industry struggles with persistent growing pains; for the first time since 2021, new-vehicle buyer consideration has flattened and perhaps dropped slightly from the previous year. A 2024 study conducted by J.D. Power on US consumers revealed that 24% of shoppers are ‘very likely’ to consider purchasing an EV, down from 26% a year ago.(13) while 58% of shoppers state they are ‘overall likely’ to purchase an EV, down from 61% in 2023.

In contrast, a study by the European Alternative Fuels Observatory aggregating responses from 19,080 people across 12 countries revealed that despite on-going challenges, 33% of non-BEV European drivers are considering purchasing a BEV within 5 years.(14) Although the end-user insights indicate a flattening, it is important to note the percentages are substantial compared to previous years. (13)

Why Electrification Will Continue To Grow?

Understanding the Short-Term Variability vs. Long-Term Growth

Despite these signs of slowing, several factors suggest that the long-term potential for electrification remains robust:

Legislation and Grants

Governments worldwide continue to implement stringent emission regulations and offer subsidies for EV purchases. For instance, the UK has set intermediate targets, including a 23% BEV sales goal for 2024, with significant fines for OEMs that don’t meet this target. This could lead to an uptick in sales as manufacturers may drastically reduce prices to meet these targets; providing strong incentives for consumers to lease or invest in electric mobility. (15)

Regulatory Support

Governments are also expected to strengthen support for EVs through regulations and financial incentives. An example of this is the introduction of low emission zones. For instance Ultra-Low Emission Zone (ULEZ) charges have been recently introduced in London.

Automaker Commitments

Major automotive companies are increasingly committed to electrification. Despite shortterm adjustments, companies like General Motors, Mercedes-Benz, and Volkswagen continue to plan for a fully electric future, with numerous new models launching soon. For instance, GM aims to produce 200,000 to 300,000 Ultium-based EVs in North America in 2024 (6). Tesla aims for 20 million EVs annually by 2030, and Audi plans to launch 10 new electric models by 2025 (16). In a recent 2024 interview with CNBC, CEO Mary Barra of GM noted that “We will not get to a million EVs produced by 2025 as initially hoped for as the EV industry is seeing a bit of a slowdown” however she did reiterate that they are still confident in an EV future and are still confident that “we will get there eventually, just being guided by the customer”. (22)

Is electrification slowing down?

Incremental Gains and Long-term Vision

While some OEMs have extended their deadlines for reaching net-zero, their longterm vision remains intact. Companies like Dongfeng have committed to reducing carbon emission intensity by 15% by 2025 and will continue to invest 50 billion Yuan (£5.2 Billion) up to 2026 to develop its NEV (New Energy Vehicle) business. They plan to launch 18 electric passenger cars and 22 basic commercial vehicles during this period. These commitments reflect confidence in the sustained growth of the EV market and are supported by substantial financial investments. (17) (18)

Charging Infrastructure and Batteries

Significant investments are being made to enhance the charging network, addressing one of the major barriers to EV adoption. Current charging infrastructure is insufficient to meet the needs of a fully electrified transportation system. To combat this, the European Union aims for one million new public charging points by 2025 and the Biden-Harris Administration funding $1.3 Billion towards EV charging in the United States (19) (20). According to research conducted by Goldman Sachs, it is forecasted that battery prices will continue to fall thereby further improving vehicle margins and affordability. It is expected that in 2025 the price of batteries will fall under $100/kWh. This is a significant milestone that will finally bring EVs into price parity with ICE-Vehicles.(21)

What does this mean for the future of electrification?

While the growth rate of electrification in passenger cars has shown some temporary variability, particularly between 20222024, the overall trend remains towards growth.

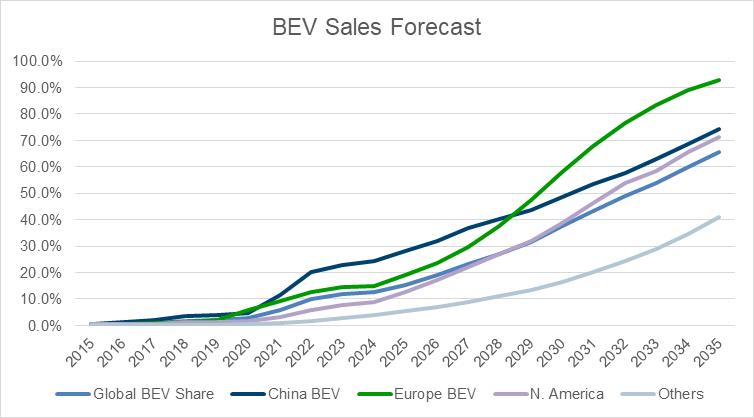

The BEV Sales forecast updated as of June 2024, data provided by EV Volumes illustrates that we are currently in a phase of relative lull, which has been accounted for in longterm forecasts. The projections indicate a significant upward trajectory, anticipating an increase in global BEV share in the coming years.

Addressing existing challenges while leveraging opportunities will be key to sustaining and accelerating this growth. By doing so we can shape a cleaner and more sustainable future for transportation. No matter the direction the vehicle industry develops towards, Afton Chemical will remain at the forefront of additive technology, adapting to all future needs.

For more information about future trends or specifics about our lubricants, contact your Afton Chemical representative.

Is electrification slowing down?

21. Battery prices are expected to boost demand (goldmansachs.com)

22. GM Delays 1M EV Production Target Beyond 2025, CEO Mary Barra (webull.com.au)

23. Aramco to acquire 10% equity interest in HORSE Powertrain Limited | Aramco China

Mercedes back-pedals on 2030 electrification target | Fortune Europe 5. BMW EV Sales Exploded in Q1 2024,(electrifynews.com)

6. GM Plans 200,000 To 300,000 Ultium-Based EVs This Year (gmauthority.com) 7. Tesla (TSLA) Q2 vehicle deliveries and production numbers (cnbc. com) 8. Tesla Stock Tumbles as Q1 Deliveries Fall (investopedia.com) 9. Renault Group and Geely announce the creation of, “HORSE Powertrain Limited”

Germany to reduce electric car subsidies in 2023 | Reuters

Chinese electric car makers hit with new European Union tariffsBBC News 12. Half a million company cars registered as fleets drive new car sales (fleetnews.co.uk)

13. 2024 U.S. Electric Vehicle Consideration (EVC) Study | J.D. Power (jdpower.com) 14. European consumers show growing interest in Electric Vehicles | EVMarketsReports.com 15. UK to Net Zero by 2050 - GOV.UK (www.gov.uk) 16. Audi will Launch At Least 10 New EVs By 2025 (insideevs.com)

17. China’s Dongfeng Motor Launches New EV Brand Nammi (yicaiglobal.com)

18. The 2024 Beijing International Auto Show. (dongfeng-global.com)

19. Biden-Harris Administration $1.3 Billion in Funding to Electric Vehicle Charging Network · (driveelectric.gov)

20. Electric vehicle charging infrastructure.pdf (europa.eu)