The UK regulator is coming down hard: AutoRek looks to soften the blow

ISSUE#14 myPOS ● FreedomPay ● SEBA Bank ● Mastercard ● Danske Bank ● Deutsche Bank INSIGHTS FROM A ‘LEGO MOMENT’ FOR PAYMENTS

foundation is almost laid... now get building with your digital bricks! says

Wilson of valantic FSA ISO 20022 CRYPTO & BLOCKCHAIN TIME TO GROW UP Bitstamp on

the

child of finance MERCHANT SERVICES READY TO FACETIME? Aevi on the challenge of data-gathering when the customer is analogue! MERCHANT SERVICES SHOP TYL YOU DROP!

a high street revival REGULATION MR FIXIT

The

Simon

disciplining

wild

The NatWest paytech championing

Experience composable banking with Mambu's SaaS cloud banking platform.

Learn more

PAYTECH FOCUS

18 The payments champion

Standard Chartered is actively working with alternative payments providers to operate in its franchise markets. Anurag Bajaj explains why the bank is a flagwaver for paytech

27 Dear CEO… we’ve got you covered

The UK’s Financial Conduct Authority has put payments innovators on notice. Nick Botha, global payments sales manager for Autorek, explains how automation can help firms comply with new regulations

COVER FEATURE

4 A ‘LEGO’ moment for payments ISO 20022 could be the foundation on which financial institutions can build an infinite number of creative solutions, says Simon Wilson, MD of Payments and Transaction Automation at valantic FSA – if they get their strategy right

ISO 20022 & CROSS-BORDER

10 In parallel worlds While it sounds unlikely, combining agile methodology with a deadline-driven waterfall approach worked well for Danske Bank in meeting existential demands on its core payments system. The man who leads the teams explains

13 The new frontier

Alan Marquard looks at cross-border developments and explains how Mastercard is helping smaller payments navigate the journey

THEPAYTECHVIEW

Someone once told me that when you get too wrapped up in a problem, unable to see how your behaviour is affecting others – and theirs yours – then the best way to get some perspective is to imagine you’re sitting in the loftiest seats at a theatre, looking down at how events are playing out on the stage below.

Jared Isaacman, the founder and CEO of Shift4, a provider of integrated payment processing and commerce technology, went quite a few steps further. He orbited the Earth for three days last year on the all-civilian Inspiration4 mission. And it gave him a

16 Standard time

This is the year that the majority of the payments industry pins its colours to the ISO 20022 mast.

Marc Recker, Global Head of Product – Institutional Cash Management, Deutsche Bank, says it’s long overdue CRYPTO & BLOCKCHAIN

20 Moving fast to change things

Will crypto come of age in a new era of regulation? Amanda Shoffel, Bitstamp’s Chief Compliance Officer, has high hopes

22 Lessons from the blockchain frontline

Nish Kotecha, Chairman and Co-Founder of Finboot, a blockchain enabler, examines blockchain’s role in the financial sector and what it can learn from other industries

different view of the payments business. As part of the Thinking Differently strand at this month’s Money20/20 Europe, Isaacman shares how the so-called ‘overview effect’ that many astronauts experience changed him. Fascinating. We didn’t propel our contributors into space, but they nevertheless came up with some unique perspectives of their own… on the rocket fuel that is ISO 20022; how merchants deal with colliding worlds; and if the stars are finally aligning for crypto! Our last spinetingler was: “Sometimes completely crazy things can happen” by Saudi Arabia’s soccer coach Hervé Renard on beating Argentina!

24 Valley of the crypto kings

SEBA Bank’s Mathias Schütz explains how a medieval fishing village in the foothills of the Alps is helping to lead a decentralised revolution

MERCHANT SERVICES

31 POS and beyond

Steven Stewart from myPOS discusses how smaller businesses and ISVs are benefiting from point-of-sale systems that transform serving customers

34 The new era of transactions

Next-level technology is here – the question is, how do acquirers and merchants use it to their advantage?

Chris Kronenthal, President of FreedomPay, shares his advice

37 Endless POS-ibilities

Martin Herlinghaus, Director of Corporate Development at Aevi, describes how payments orchestration can empower merchants in and out of store

40 Open all hours

Can the battered UK high street enjoy a revival? If merchants embrace hybrid payments, it’ll not just survive but thrive, says Emily Fallon of Tyl by NatWest

ffnews.com Issue 14 | ThePaytechMagazine 3

All Rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner. While every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions. The products and services advertised are those of individual authors and are not necessarily endorsed by or connected with the publisher. The opinions expressed in the articles within this publication are those of individual authors and not necessarily those of the publisher. EXECUTIVE EDITOR Ali Paterson GENERAL MANAGER Chloe Butler EDITOR Sue Scott PRODUCTION Taylor Griffin Trinity Yau HEAD OF CONTENT Douglas Mackenzie HEAD OF MARKETING Ben McKenna CONTACT US ffnews.com DESIGN & PRODUCTION www.yorkshire creativemedia.co.uk ART DIRECTOR Chris Swales PHOTOGRAPHER Jordan “Dusty” Drew ONLINE EDITOR Lauren Towner ONLINE TEAM Joshua Hackett FEATURE WRITERS Rebecca Clifton David Firth l Tracy Fletcher Tim Goodfellow Martin Heminway Alex King l Sean Martin Natalie Marchant John Reynolds Frank Tennyson Fintech Finance is published by ADVERTAINMENT MEDIA LTD. Pantiles Chambers 85 High Street Tunbridge Wells, TN1 1XP ACCOUNTS TEAM Jacob Bruce l Tom Dickinson Nicole Efthymiou Emillie Snelgrove VIDEO TEAM Lewis Averillo-Singh Alexander Craddock Max Burton l Luke Evans Louis Jean La Grange IMAGES BY www.istock.com PRINTED BY Print it 24 seven "PROUDLY NOT ABC AUDITED" THEPAYTECHMAGAZINE 2023 ISSUE #14 Sue Scott, Editor 13 31

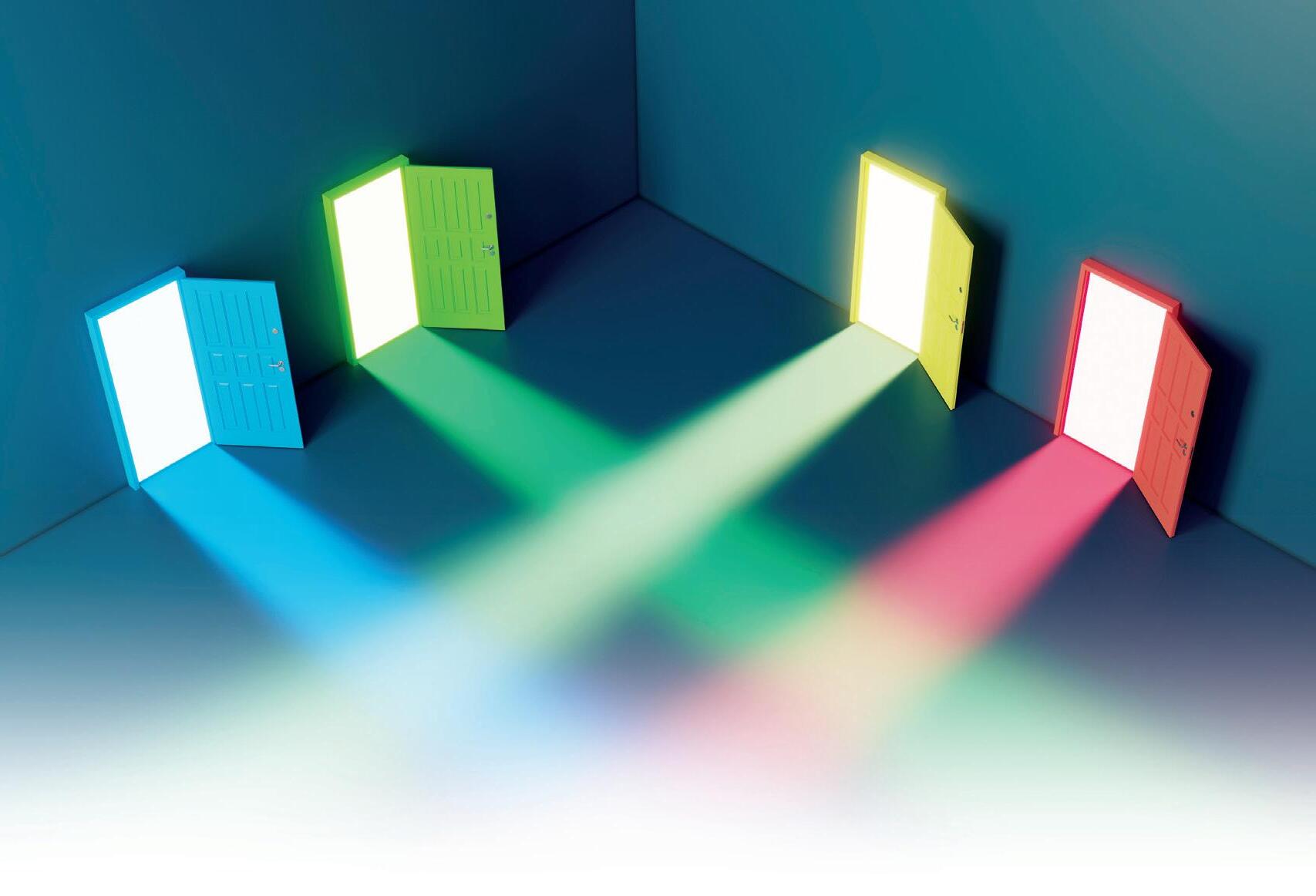

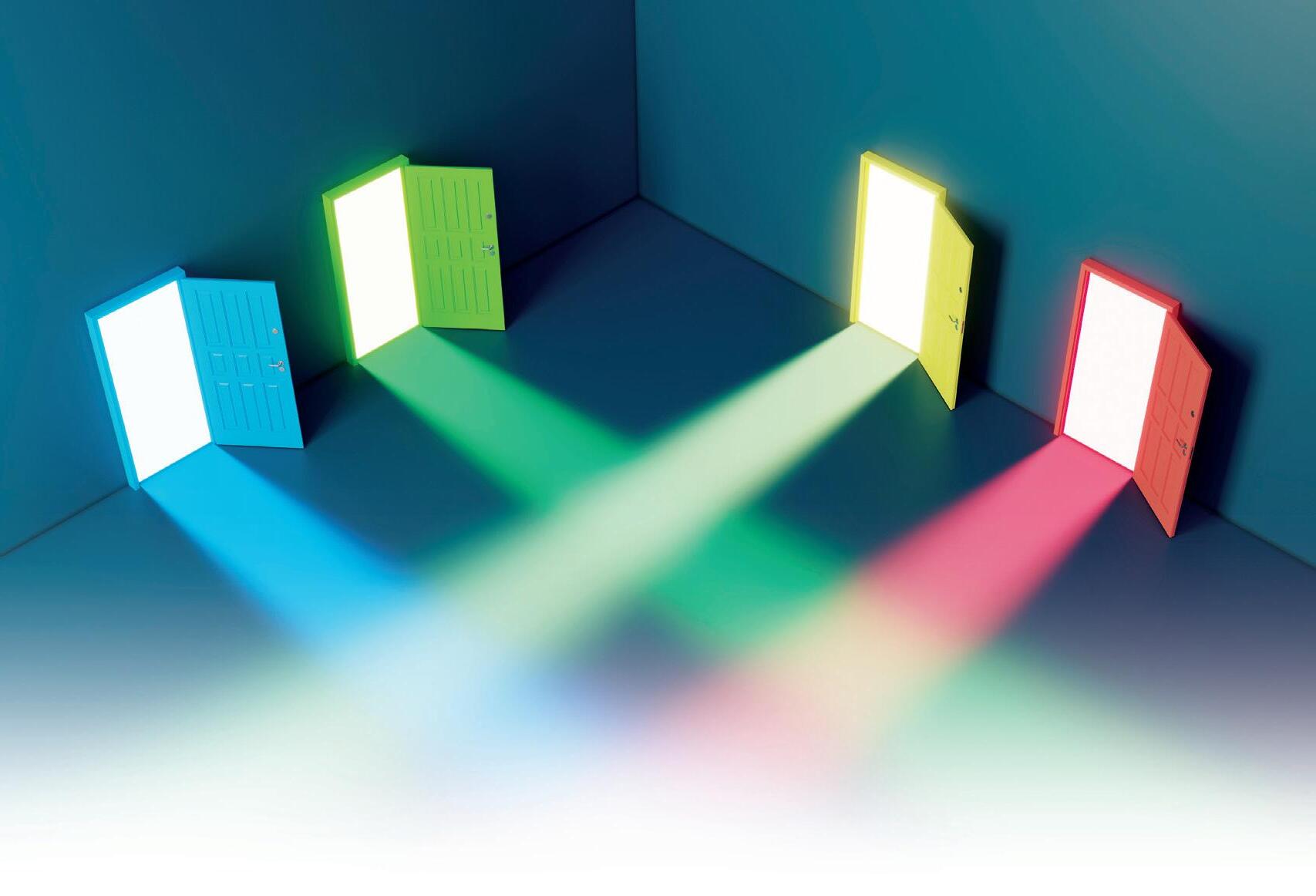

A ‘LEGO moment’ for payments

ISO 20022 could be the foundation on which financial institutions can build an infinite number of creative solutions, says

MD of Payments and Transaction Automation at valantic FSA

The interlocking principle of the LEGO brick made it unique when it was launched onto the toy market, inspiring boundless creativity as each generation added its own imaginative new layer.

According to Simon Wilson, valantic FSA’s MD of Payments and Transaction Automation, the universal adoption of payment messaging standard ISO 20022 is financial services’ own ‘LEGO moment’. Once fully embedded in the world’s transaction systems, the standard will similarly trigger a period of intense digital construction, with as-yet unimagined interlinked products and services sitting on top of a new payments architecture. What will these structures look like and how far are they from becoming a reality? Wilson is realistic: there’s a way to go. But valantic FSA is already enabling clients on the journey and inspiring their imagination.

Founded in 2012, valantic FSA is now one of the leading business solutions technology platform companies, enabling customers to flexibly buy and build powerful electronic trading, post-trade, payments, and enterprise data capabilities. Its client list includes giants of banking, such as Erste Bank, Santander and UBS. The flagship platform within its payments vertical is X-Gen, a low-code, end-to-end messaging and workflow automation solution for financial institutions, capable of handling both ISO 20022 MX messages as well as legacy formats, which slots into an institution’s existing systems, including client channels and core banking platforms.

Wilson’s colourful LEGO metaphor is an apt one for what’s happening in the payments industry and, hopefully, it’s a portent of what it can do for banks’ contested place within it. The LEGO company is, despite fierce online competition for kids’ attention, still innovating and is still the most valuable toy company in the world, after all. Could ISO 20022 better help banks compete with their own digitally native rivals? We asked Wilson how he sees this ‘LEGO moment‘ panning out.

their budget on just keeping the lights on, keeping one step ahead of the regulator, that they’re struggling to invest in real change that adds value to customers.

But to compete with those new entrants, some of which are looking pretty mature themselves now, they will have to change to offer better value and better services. The ISO 20022 standard is helping to bring that about.

TPM: The deadline for full implementation of ISO 20022 across many critically important systems is looming fast. What does that mean for the industry, and the players within it?

SW: It has taken some time for that deadline to sink in, and it’s been shifted a few times already – I think there’s a natural expectation that this stuff can be done, but it’s harder in reality than maybe many people appreciated.

THE PAYTECH MAGAZINE: How has the cross-border payments industry changed in recent years and how has that impacted the banks?

SIMON WILSON: In many ways, cross-border payments have been at the bleeding edge of change – not only because the shift to ISO 20022 has been coming for a long time, but also because, historically, cross-border has been one of the most profitable areas for banks, and, like bees to a honeypot, it’s attracted a lot of competition.

That’s forced banks to modernise. Banks have been spending so much of

Everyone knows that the hard deadline for everyone is coming, but it’s very dangerous to leave it until 2025 [when the Swift migration completes]. The sooner the basics, in terms of a compliance foundation, are in place, the sooner banks can look forward to leveraging the revenue opportunities around it. The technology modernisation journey will take some time, for sure.

So, while there’s core system ISO 20022 transformation, there are plenty of short-term fixes as well. They’re very valid and absolutely have their place, but remember that this is about reducing complexity long term, to help reduce costs, so we mustn’t let those short-term fixes become legacy themselves.

ISO 20022 & CROSS-BORDER: VALANTIC FSA ThePaytechMagazine | Issue 14 ffnews.com

4

Thinking carefully and strategically about how the path to true modernisation might look, in a risk-adjusted, sensible fashion, is part of the journey that many banks, in reality, are still on

Simon Wilson

ffnews.com Issue 14 | ThePaytechMagazine 5

Ultimately, if we are to realise the advantages of real-time for customers, and of the additional data that the new ISO standard brings into play, then new technology is needed

Thinking carefully and strategically about what the path to true modernisation might look like, in a risk-adjusted, sensible fashion, is all part of the journey that many banks, in reality, are still on.

TPM: So, would you say most banks are ready for ISO 20022 adoption and implementation, or not?

SW: I’d say the banks are broadly in a good position, and if not ready today, they will be imminently. But the pressure has been high and they’re dealing with it in different ways.

As I said, there’s lots of core transformation of technology needed, in terms of moving to ISO, but there’s a lot of shorter-term wraparound message transformation capability being used, too. Long-term, to be fully digitised, to be modern, to reduce the costs of running a payments ecosystem, there are lots of options for banks.

But then there’s also an eye to how banks make the most of the business opportunities that ISO 20022 presents. We’ve barely started on that curve yet, and it will be a refreshing change to talk more positively about the opportunities and benefits of the change, and not just the pressure of the deadline!

TPM: So, how much thought is being given to leveraging the added-value opportunities presented by a mass migration to ISO 20022, and how can technology providers such as valantic FSA help with that?

SW: There’s one challenge for banks in addressing system replacement and message transformation. There’s another in leveraging that – looking at the operational setup, bringing in new technology to analyse the data and help use it to automate processes. There’s another area, as well, and that’s educating the banks’ customer base. Ultimately, this is all about providing better value for customers,

whether that’s through smoother, faster processing of payments, or through new services that leverage the data, right? And, on the client side, their systems aren’t all shiny, new and modern, either.

The more banks can help their corporate client treasurers think about the data that they’re providing to them, the more the bank can use it in an effective way, and return value to the corporate – as, indeed, fintechs are starting to do. More value will be returned to the banks that way, too, which means they can monetise all the investment they’ve made in the move to ISO 20022.

So, there are three aspects there for them to grapple with – the first is about getting it right, the second and third are about making the most of it.

through services such as Request To Pay, combining that with the ISO 20022 data and real-time, so that maybe you’re providing invoice financing, or trade finance, on the back of goods hitting the shore, rather than waiting for a whole bunch of paperwork to be progressed?

Once ISO 20022 becomes the universal messaging standard for all transactions, the foundation will be there for creating an almost limitless range of products and services on top. It's a bit like LEGO bricks. You get your key blocks locked in place –in this case, your core technology, capable of handling MX messages – and then add or swap out other blocks to create any number of value-added services.

We’ve barely scratched the surface of the inventiveness and innovation that could come around the products as moving money becomes more standardised and more commoditised, which is part of the advantage of a single dataset.

The more that it becomes about leveraging it in the product domain – by integrating evolution and modernisation of the whole banking architecture, operations as well as IT – the more the benefits for corporates will really become apparent. And there will eventually be some big winners among the banks that lead the way in implementing those things.

TPM: What are some of the benefits for corporate clients of banks that embrace ISO readiness earlier than some of their competitors?

SW: There’s a lot of opportunity around the new data standard, not just from an efficiency perspective – which is important, but the exciting stuff is the new services that can be provided around the standard, especially when you’re combining the data with real-time.

As I said, it’s not just about how you process a payment – moving money, in the form of data, from A to B. It’s about how you leverage that in the realm of other products and services that the bank offers. How can you improve the granularity at which you credit rate your risk, from a lending perspective? How can you improve the reconciliation

TPM: What are some of the challenges, and maybe opportunities, coming out of cross-border payments, now that people’s expectation is of real-time movement of money?

SW: ‘Expectation’ is certainly the way to describe it because what we often see is people’s experiences in their lives as an individual, are also transferred to the corporate world. Even when it’s B2B, that’s true of payments, too.

ISO 20022 & CROSS-BORDER: VALANTIC FSA ThePaytechMagazine | Issue 14 ffnews.com

Building out: ISO 20022 will create entirely new structures based on payments data

6

It’s a bit like LEGO bricks. You get your key blocks locked in place – in this case your core technology, capable of handling MX messages – and then add or swap out other blocks to create any number of value-added services

The Global FinTech Ecosystem. C onnected. BE AT THE CENTRE OF THE FINTECH REVOLUTION 6th-7th December 2023 ExCeL London SAVE THE DATE LEAD SPONSORS fintechconnect.com/events-london info@fintechconnect.com SIGN UP TO FINTECH CONNECT 2023 NOW! EUROPE’S ONLY EVENT FOR THE ENTIRE FINTECH ECOSYSTEM HEAR FROM 200+ INNOVATIVE SPEAKERS JOIN 3,000+ FINTECH LEADERS SPONSORS

That expectation of speed is something that the industry has come under a lot of pressure to provide, and I believe it’s made great progress. If you look at Swift, I think the latest figures are something like roughly 70 per cent of the network payments that are cross-border go through within five minutes. Now, that’s not instant, but given the complexities, that’s pretty darn good.

Getting that last 30 per cent – that five minutes down to 30 seconds, or whatever it is – is very challenging, though. It’s challenging operationally to be able to deal with the complexities of real-time and cross-border, but it’s also challenging in terms of the technology change that is needed, and how unsuitable banks’ legacy systems are.

We’ve seen banks take different approaches, at different speeds; some are further on that journey of replacing their core with ISO-native systems, some are doing message transformation around the edge. To be honest, most are doing a bit of both, in different ways. But, ultimately, if we are to realise the advantages of real-time for customers, and of the additional data that the new ISO standard brings into play, then new technology is needed.

It’s needed to make things smoother, more efficient, to leverage that data to provide better fraud and sanctions checking, for instance, and to provide new services. It’s a challenging area, but we see a lot of customers taking a very proactive approach to it.

For me, what’s going to be really interesting is the talk of equality in terms of the credit transfer standard, SEPA, and Instant, and equality in pricing. Now you’ve got something that’s going to trigger demand, because it’s not going to cost more to do instant.

Coming back to what we said before, in the corporate world, it’s going to become much more of an expectation. And that will bring challenges. As the volume shifts, and other services are introduced around things like Request to Pay, that’s going to bring pressure on technology that was maybe introduced as a short-term fix for

some people, as opposed to a robust, long-term kind of capability.

Operationally, dealing with a higher volume of rejects and complications, albeit there should be less with ISO 20022, puts pressure on the back office, too. So the more you can use artificial intelligence and robotics to deal with those exceptions, rather than people, the lower cost and the better it will be.

TPM: You’ve alluded there to real-time payments presenting banks with an even greater challenge when it comes to identifying and preventing financial crime. Is the increased dataset behind an

technology, you can leverage that data, and react to it much more quickly, which means spotting things earlier. There’s a consistency in the data, to help with the checks around sanctions and AML.

So, yes, a general recognition and commonality helps improve efficiency and the quality of what people are doing. But there isn’t any room to be complacent. We’re going to have to keep modernising, to keep ahead of those bad guys.

TPM: ISO 20022 is just one part of the payments landscape – it just happens to be the noisiest one at the moment. What other events should banks be focussed on?

ISO payment really going to help banks combat anti-money laundering (AML) and other types of fraud? SW: It’s always been a race to stay ahead, between the bad guys and the good guys. But the world, from a payments perspective, will now at least be on the same message set. I won’t go as far as saying on the same standard, because there will still be plenty of variations, even within ISO 20022, but it clearly helps when you’ve got the same recognition of what data is there. With the upgrade of

SW: There are things on the horizon, that will be near soon enough. Dare I mention PSD3 and the further evolution of open banking, and how that’s leveraged? And, as I’ve already mentioned, you’ve instant payments in Europe, and the mandate for all banks to do that, which is coming. What I find fascinating is that with a single ISO standard in the cross-border space, there’s the coming together of the last leg – direct connectivity – from a real-time perspective between schemes. And that’s upping the ante.

There’s been an interesting proliferation of different ways to move money globally. Only a few weeks ago we saw Singapore and India link their real-time schemes – two big financial centres, with big populations, so, potentially that’s a huge volume of payments that might go through.

Whether it’s cross-border or domestic, there are also the increasing number of wallets, different mechanisms for payments, and, not least, the introduction of central bank digital currencies, and what that

enable. There is no end of change. And still so much that’s unknown. For us, it’s about helping banks modernise their technology, and have the right foundation of flexibility to be able to react to whatever that future brings, in whatever order it might be. Whatever happens, I think we all know it’s going to be an exciting ride.

ISO 20022 & CROSS-BORDER: VALANTIC FSA 8 ThePaytechMagazine | Issue 14 ffnews.com

V for… valantic FSA is working with banks on a successful ISO 20022 strategy

might

With a single ISO standard in the cross-border space, there’s the coming together of the last leg – or direct connectivity – from a real-time perspective between payment schemes. And that’s upping the ante

Dual purpose: And you thought agile working and waterfall programme management were on different planets…

While it sounds unlikely, combining agile methodology with a deadline-driven waterfall approach worked well for Danske Bank in meeting existential demands on its core payments system. Christian Luckow, the man who leads the teams, explains

Spare a thought for the Nordic banks. They managed the ‘big bang’ migration to payments messaging standard ISO 20022 by Europe’s real-time gross settlement system

TARGET2 in March. But – unlike their colleagues further south, who could catch their breath before Swift begins its transition to the same standard in November – they were already knee-deep in another structural change.

The project, called P27, would have created the world’s first integrated region for real-time domestic and cross-border payments in multiple currencies. ‘Would

have’ because the plug appeared to have been pulled on it in April.

Both the adoption of ISO 20022 and the creation of P27 for Denmark, Finland and Sweden, was in response to the demands and expectations of businesses and consumers who want and require instant, safe and cheap digital payments, especially in the cross-border space.

The pressure of demand for digital payments is exemplified in Sweden where cash was used for only eight per cent of business transactions by the end of 2022, according to the Copenhagen School of Business, while 95 per cent of the country’s 15-to-65-year-olds

have downloaded mobile payments app Swish, which is co-owned by a majority of the country’s banks.

Managing wide-ranging structural programmes like ISO 20022 and P27, while still keeping the wheels on the banking bus and an eye on future developments, like central bank digital currencies, has made for a challenging few months, admits Christian Luckow, who leads Danske’s Core Payments tribe as well as its innovative Payments Centre of Excellence. And it got even more challenging when P27 withdrew its clearing licence application from the Swedish Financial Supervisory Authority,.

10 ISO 20022 & CROSS-BORDER:

ThePaytechMagazine | Issue 14 ffnews.com

leaving no clear indication of what – if anything – will happen next.

“This actually means we are even busier now, as we have to connect directly to the central banks instead of through P27,” says Luckow. “The ‘simplification’ that P27 was supposed to bring is not happening – at least for now.”

Instead, besides ISO 20022, the Danish and Swedish central banks’ implementation of TIPS will drive additional complexity and effort for Luckow’s teams.

That’s not to say he isn’t excited about the major advantages that ISO 20022’s MX-based messaging will have over the existing MT text system.

“The challenge [with MT] is that the data in many cases has to be interpreted,” he told an audience at a Banking Renaissance event earlier this year. “That means more data gets caught up by anti-money laundering checks and by missing data elements. So, straight-through processing goes down, leading to a worse customer experience. If instant payments are not working, we get complaints. The issue is that we are getting more and more volume.”

Speaking outside of the conference, he tells us: “Especially in Denmark, instant payments have been around for quite a while, and are very heavily used. Instant cross-border payments is what people are expecting now. Customers have kind of said ‘why can I make a payment to my sister in the next town within a second, but if I want to make a payment to my sister who lives in Sweden it takes two days? It doesn’t make any sense. It’s only 30 minutes away, across the bridge?’. Which I think is a fair question. But, as you can imagine, with different legislations, different jurisdictions, it’s not easy to do anything cross-border,” says Luckow.

Regardless of what happens now to P27, he has no doubt that the standardised and data-rich formula of ISO 20022 payment messages will eventually be a true game changer. At Banking Renaissance, he cited as an example the challenge Swedish banks currently face in processing batch payments of salaries at precisely a minute after midnight, as decreed by Swedish law.

“Imagine the amount of payments that have to happen at the same time because of that legislation. Today, that’s difficult to fit into a payment standard because it’s plain text files, and, if you introduce a data element, everybody has to use slight

modifications. Whereas, with ISO, because it’s MX-based, you can essentially add optional components, which means the standard can be much more widely used than the ones we use today, and we can start adding much more specific data elements – such as remittance details. That essentially means it’s going to be a lot easier to reconcile payments with invoices. I come from invoice financing, so, for me, this is a godsend and I can’t wait for it to be widely used!”

Then there are the clear advantages to do with compliance.

“There is so much more legislation, a lot more focus on fincrime. That means we are kind of getting dragged in the opposite direction, in terms of being able to service our customers to the level that they are used to,” he says.

ISO 20022 can help streamline that, particularly when it comes to identifying the origin of a sender whose payment has gone through multiple banks before reaching the payee’s. Digging for that data among MT messages to meet compliance, means the customer may well be kept waiting for the payment to clear.

modernising agenda, each demanding very different ways of thinking and working: the waterfall versus the agile approach.

“It’s a very complex environment to work in,” Luckow told Banking Renaissance. “We have part of our business that basically runs on the mainframe… but then we have our fully agile development centre that does everything the way that we now know we should be doing things. Sometimes those two overlap.”

And that’s precisely what they did to great effect in the implementation of ISO 20022. Luckow’s teams managed to reconcile the ‘create fast, fail fast’ methodology of fintech ‘agile thinkers’ with the ‘waterfall’ approach of traditional rigid deadline programme management. And even Luckow was surprised at how well these two apparently antithetical approaches worked together in practice.

“We have established that the agile mindset works incredibly well [in a waterfall environment],” he explained. “We just have to do it slightly differently because we don’t have the luxury of developing things and fixing them on the go. We’re using the agile methodology to still move us forward in the sprint, do incremental improvements, but with a fixed deadline: it has to work by that date, no ifs or buts.

“I think our employees, once they got used to the idea, have quite enjoyed it because one of the challenges that we found as an incumbent bank with agile was ‘if I can always keep reiterating, if I can always be improving, what is the urgency to actually get something done?’

Notwithstanding these and the many other advantages of everyone adopting ISO 20022, the variable speeds at which multiple actors move towards it over the next two years will almost certainly create its own problems, particularly on the Swift network, says Luckow. It’s a situation acknowledged by Swift, which has created a workaround that allows banks to fetch any data missing in the conversion between the old and new formats in order to perform sanctions screening and other tasks.

None of this stuff is easy, but it’s made even more difficult if, like Danske Bank, you’re maintaining a 20-year-old core operating structure while introducing a

“Here, we do have very firm deadlines and the stakes of us not delivering are massive. But combining it with a methodology that means you're constantly moving, constantly improving, works really well.”

Later, he tells us: “We’ve had to change mindset. We’ve had to look at it a lot more strategically, in terms of when so much is changing at the same time, how can we do that efficiently? It also means knowing what we should not be focussing on right now, and then go back to it later.”

Luckow reckons it will take three to four years for the payments industry to stabilise after such a seismic change as ISO 20022. Once it’s fully functioning under the new regime, though, the standard will ‘enable so much more’, he adds.

“Then we can start focussing on the actual customer value again.”

11

ffnews.com Issue 14 | ThePaytechMagazine

We have very firm deadlines and the stakes of us not delivering are massive. But combining with a methodology that means you’re constantly moving, constantly improving, works really well

Ohio’s Economic Development Corporation

The world of cross-border payments has long faced a number of challenges, among them security, high costs, lack of speed, and poor transparency.

A further one is lack of uniformity and the need to bridge the disparity between large players and smaller enterprises. Small and medium-sized enterprises (SMEs) will typically experience higher costs because they make smaller transfers, meaning the cost-to-value ratio is much higher.

The goal for cross-border payments is to create fast, secure, cost-efficient transfers that work for everyone, irrespective of who is making the payment and how much is being transferred. Thanks to initiatives such as the G20 Roadmap, the new ISO 20022 standard for exchanging payment messages, and the growing number of real-time systems worldwide, the cross-border payments frontier is moving in the right direction.

Change is also being driven by organisations offering alternative rails, such as Mastercard, which is heavily involved in cross-border innovations.

Alan Marquard is executive vice president of transfer solutions at

Mastercard. “My role focusses on international money transfers, which encompasses businesses such as Mastercard Send [a platform that enables secure, near real-time payment transfers], Global Bill Pay and Cross-Border Services.

“We’re seeing that cross-border is in much greater demand than even just a few years ago and responding to that. People are sending money home more often and in large amounts, and migrant labour is increasing. And since the pandemic, there has been a big increase in digital payments.

“As domestic payments have become contactless and digitised, the expectations for service quality for cross-border payments have also increased.”

However, some customer needs and expectations are non-negotiable. “Security is fundamental,” he says. “That means transaction security, knowing where the money is and that it’s traceable, and, of course, the security of the data itself. Speed of payment is also important, particularly for remittances.”

Marquard contends that the complexity of cross-border payments is sometimes underestimated by users, not least when you compare it with email, where information moves instantly and seamlessly across borders.

“People ask, ‘why can’t I send money as quickly as an email?’,” he says. “When you look at domestic, we’ve really progressed. There are real-time payment systems in more than 60 countries now, and we’re getting used to doing things instantly. But when it comes to cross-border, it’s a complicated, spaghetti-like system.”

Those expectations among customers are not universally the same, of course. While businesses might want integration with accounts payable and accounts receivable systems, people sending money to their loved ones are usually more concerned about the speed of payment, because money is often needed urgently.

Users don’t want an explanation of why it can’t be done, of course. That‘s for the industry to solve. Historically, cross-border payments were mainly used by big corporates making large-value payments via a correspondent banking network. Although that model remains important for high-value payments, it’s not suitable for small-value payments, which is where providers like Mastercard are filling the gap.

“One of the biggest challenges is maintaining a network and having enough reach,” says Marquard.

13 ISO 20022 & CROSS-BORDER: ALTERNATIVE RAILS ffnews.com Issue 14 | ThePaytechMagazine

One of the biggest challenges is maintaining a network and having enough reach… we can connect to 90 per cent of the world’s population

Alan Marquard looks at cross-border developments and explains how Mastercard is helping smaller players navigate the journey

“You need to make payments to a huge number of destinations. In a correspondent relationship, that means having banks in every country and having an individual relationship with each one. Some of the big global players in correspondent banking have de-risked, meaning they have pulled out of jurisdictions they deem high risk because of money laundering, for example.

“We can connect to 90 per cent of the world’s population, with all the related onboarding, know your customer (KYC), transaction monitoring and fraud prevention that goes with it. It involves a lot of technology and there’s a huge operational machine behind it. Liquidity management and FX management are critical, and there’s the whole licensing regime to also take into account. We automate as much as possible, and we’ve

invest in and maintain the infrastructure. The result: they provide their customers with a full-scale cross-border solution, which gives them access to more than 100 markets from a single connection.

“The overall size of cross-border payments is something like $250trillion a year,” says Marquard. “With our cross-border service, we focus on flows of around $23trillion a year, which is a sizeable chunk, and it needs to be managed carefully.

“Remittances, in particular, have a crucial impact on people’s lives, so promoting financial inclusion is very important.”

CLIMATE FOR CHANGE

Regulations have helped to encourage innovation, and there has been a concerted effort to create a framework for

are linking payment systems with QR interoperability, so now you can make purchases in another country on QR codes, and it gets processed through your domestic instant payment system, and then on the other side.”

Requirements such as KYC, AML, messaging standards and data rights sit in the private sector, and this is where it gets complex, as you need everyone to be aligned for cross-border payments to work smoothly. Liability is an issue when there are different KYC standards in the payment chain, and because the checking process is more onerous, it slows down payments and increases costs.

So what effect will ISO 20022 have? Does Marquard view it as a panacea for cross-border payments?

“In its own right, ISO 20022 is a really

International co-operation:

Project Nexus is a blueprint to connect multiple instant payment systems

taken a really big step recently with a new tool called Cross-Border Services Express.”

It enables financial institutions to seamlessly set up an international payments offering for their customers, notably the consumers and SMEs that have long needed better cross-border payments. The Express Service levels the playing field and complements Mastercard’s existing Cross-Border Services offering.

“For a bank that wants to offer crossborder payment services, we offer integration with risk management systems, payment systems, or reporting,” he adds. “A lot of players aren’t API-ready. So, by working with the fintechs Payall and Fable FinTech we’ve devised an easy integration approach. We supply an end-to-end white label service that provides access to our network via a customisable and easy-toimplement interface, and additional high-value services, such as KYC and AML.”

This means smaller banks can do quick and easy integrations without having to

change that goes beyond the standard interpretation of ‘regulations and compliance’. Initiatives by central banks, the G20, and the Committee on Payments and Market Infrastructures, while not necessarily laws, act as a prompt to the private sector. Then you have actual legislation like PSD2, which makes transacting safer and stimulates open banking.

One of the goals of Project Nexus, which sprang from the G20 Roadmap for improvements to cross-border flows, was to create an interlinking proposition and standardise the way the growing number of instant payment systems connect.

“Project Nexus has got the industry focussed on interoperability and there’s a lot of innovation now,” says Marquard. “Take Singapore, for example. They

good thing,” he says. ”However, remember that the big players are the early adopters, while there are plenty of small institutions that aren’t there yet. So, we have a translation layer to take payment instructions in any form.

“The other thing about ISO is that everybody thinks it is a kind of universal, harmonised standard in its own right, but it’s being implemented differently and not e veryone has all the information that needs to be input to minimise failures.

“Safety, trust, and simplification of choice are what I would like to see above all,” he says. “That’s the proposition we’re building at Mastercard. Our strategy is to provide a multi-rail offering, process all transactions easily and securely, and continue to inspire trust in our brand.”

14 ISO 20022 & CROSS-BORDER: ALTERNATIVE RAILS ThePaytechMagazine | Issue 14 ffnews.com

Safety, trust and simplification of choice are what I would like to see above all. That’s the proposition we’re building at Mastercard

You deliver the experience, we power the payments. Seamlessly embed financial services into any user journey with our suite of functional APIs. eps.edenred.com Accounts & Payments Card Issuing Processing

Hailed as having the potential to revolutionise cross-border payments, the financial messaging standard ISO 20022 is set to unify the global financial industry once and for all through a common language for communicating the world’s transactions.

Already the most widely adopted financial messaging standard globally, 2023 is seen as the year in which it begins to achieve critical mass, enabling the speedy transfer of financial information – from payments to trading securities –practically everywhere by using a format in which the information accompanying a payment is less likely to get garbled or lost in translation. But not just that.

In the almost 20 years since the standard first became available, technology has advanced to unlock potential added-value services, unimagined at the time of ISO 20022’s introduction. By leveraging the

additional, much richer information that can accompany a payment in the ML format, it is envisaged that cross-border payments will not only reach the same speeds as instant domestic payments – the transparency afforded by extra data substantially reducing delays in, for example, sanctions screening – but also unlock a host of added-value services for clients.

Among the big players now signed up to the standard are the Bank of England, which moves its Clearing House Automated Payment System (CHAPS) along with its Real-Time Gross Settlement System (RTGS) to ISO 20022 in June, the Single Euro Payments Area, whose settlement system TARGET2 transitioned in March, and payments messaging infrastructure operator Swift, which began its phased migration in November.

In the US, while anyone using The Clearing House’s (TCH) real-time payments (RTP) service will already be on ISO 20022, TCH has delayed the migration of CHIPS – the largest private sector USD clearing system in the world – to 2024, so it can observe the experience of systems that have already migrated.

This year, too, the Federal Reserve’s new instant payment system, known as FedNow, will be launched using the standard. A recent Mastercard review of 61 other real-time payment systems around the world found almost two-thirds were based on ISO 20022.

We asked Marc Recker, global head of product – institutional cash management

at Deutsche Bank, to reflect on the journey so far and what might lie ahead.

THE PAYTECH MAGAZINE: Can what has happened to cross-border payments be described as a revolution?

MARC RECKER: Not a revolution, but a necessary evolution, which kicked off in 2017. Back then, some leaders from transaction banks, under the orchestration of Swift, came together and said ‘we need to change’, because there were very competitive pressure from fintechs.

If we hadn’t done something, clients would have left us. And that was where the industry, in a record timeframe, brought out a product called Swift gpi, that brings transparency, speed, and better client experience as a service.

It was a huge success because the industry embraced that change and because of the increased collaboration among industry peers in the market, and the willingness to continue to drive the change agenda. That journey is continuing, by focussing on the friction points around payments, not only the payments processing itself.

TPM: What has been the consequence of Swift gpi?

MR: What we did back in 2017 was bring in transparency. And the first result that we could observe is that now more than 70 per cent of all cross-border payments processed through the Swift network are processed in under five minutes. I know it’s not instant, but it’s close to real time, because you cannot underestimate the complexity of a cross-border payment.

Standardtime

16 ISO 20022 & CROSS-BORDER: AN ONGOING JOURNEY

ThePaytechMagazine | Issue 14 ffnews.com

This is the year that the majority of the payments industry pins its colours to the ISO 20022 mast. Marc Recker, Global Head of Product – Institutional Cash Management, Deutsche Bank, says it’s long overdue

With a domestic payment, you are in a single jurisdiction with one regulator. Once you add a different country, and potentially two countries in the value chain, it gets more complex. And we cannot solve that complexity through technology alone. It is also about collaboration with regulators, not only to improve industry technology, but also to improve the respective governance frameworks around cross-border payments.

So it’s a combination. Opportunities are there to bring better services towards our clients, which will bring the feeling of a cross-border payment close to the level of a domestic one, but there are still differences that need to be solved.

TPM: What does global adoption of the standard mean for the industry, and what is it going to mean for Deutsche Bank?

MR: That standard is long overdue. We have been working as an industry for more than 25 years with legacy formats in the cross-border payments space that were no longer fit for purpose. There was

sanctions screening. We have a lot of things that the bank can do better, when the data quality that we get from our clients is better.

So, indirectly, clients are benefitting from a more seamless and improved payment experience. But also there is an opportunity to create better insights into their payment behaviour by using structured data. So there are services that can be built on top of the ISO 20022 migration. But it will take some time.

A lot of financial institutions and market infrastructures have been working on ISO 20022 for the last three to four years, and some of them saw the March 2023 [TARGET2 transition and the start of co-existence of the old MT and new MX messages on the Swift network] as the hard deadline. We didn’t; it is just the first step of a much longer journey, because, until 2025 [under the Swift migration], it is still optional for certain banks to move to ISO 20022. As of November 2025, it will be mandatory. Then, we will definitely see a huge uptick in the advantages.

TPM: Has that prompted Deutsche Bank to have a conversation with your customers, and what is the likely impact on the roles of their employees and your own?

text [the old MT format for payment messaging], but it works much better with structured data. And that is the piece where we kicked off the process of educating the people around what ISO 20022 is, what the advantages are, but also how it impacts their working lives. Because, if somebody has worked within cash operations for 25 years with a legacy format, and now needs to go, from one day to the next, into ISO, it is a big change. So, education is key, information sharing is key, and also including the whole value chain inside Deutsche Bank, to see how this new format can bring value-added services internally, but also for our clients.

TPM: How do you see the standard changing the payments industry, going forward, and how is it going to change Deutsche Bank?

MR: There are multiple payment initiatives going on across the globe. You can hardly wake up without reading that some blockchain technology will make cross-border payments even better.

not enough space to enter the required data in the way that is demanded by our clients, but also demanded by our regulators. You didn’t even have the space to put ultimate ordering or ultimate beneficiary client.

Whole business models have changed, with, for example, the advent of payment and collection factories. With that ,there was a need to change the rails, something the industry, Swift, central banks and the public sector have embraced.

Deutsche Bank customers indirectly benefit if our own internal processes get better. Because what does ISO 20022 actually bring? It is a combination of more data and structured data. For example, it can achieve better compliance and fewer false positives regarding

MR: We cannot invent data. We get the data from our clients. So, clients absolutely need to be on board, and especially the big-volume clients for cross-border payments, because they will need to adapt their static data on their own system to be able to send us the structured information we require to be able to benefit from all the advantages. So it’s education, and also a bilateral collaboration between the banks and their respective clients.

With respect to your second point, ISO 20022 allows you to automate many more processes. For example, we already have a lot of robotic process automation (RPA) in the industry. That works on free

ISO 20022 <KEY MIGRATION DATES>

We, of course, look into these initiatives but we try very much to combine our thought leadership and our experience with the new technology. Because you cannot solve all the problems simply by technology. You need governance, you need processes; you also need to know what the problem is, what it is that the client wants. Sometimes I have the feeling somebody has a solution, but they don’t have the problem.

So, at Deutsche Bank, we watch the market and, where we believe it makes sense for us and our clients, we work on initiatives that will try to improve the cross-border payments experience in the future without disrupting the relationship with our clients.

We will look across the ISO 20022 journey, to see what kind of client demands arise that we are not aware of today, embrace those, and collaborate or co-create solutions with them.

<Nm>TARGET2> <Nm>BankofEnglandCHAPS> <Nm>FederalReserveBanksFEDNow>

<Dt>MARCH2023> <Dt>JUNE2023> <Dt>SUMMER2023>

<PstlAdr>Europe> <PostlAdr>UK> <PostlAdr>USA>

<Nm>Swift> <Nm>BankofEnglandRTGSSystem> <Nm>TheClearingHouseCHIPS

<Dt>MARCH2023> <Dt>JUNE2023> <Dt>2024>

<PstlAdr>Worldwide> <PstlAdr>UK> <PstlAdr>USA>

17

ffnews.com Issue 14 | ThePaytechMagazine

We have been working for more than 25 years with legacy formats in the cross-border payments space that were no longer fit for purpose

THE PAYMENTS CHAMPION

Standard Chartered is actively working with alternative payment providers to operate in its franchise markets. Anurag Bajaj explains why the bank is a flagwaver for paytech

In Asia, the Middle East and Africa, predominantly young, mobile-first populations are powering an explosion in non-cash retail payments.

Propelled by changes in behaviour during the pandemic, McKinsey predicts payments volumes will continue to increase by 15 per cent every year between now and 2026 in emerging markets such as these. No wonder so many global paytechs are queuing up to further their market expansion, while local companies are keen to expand regionally, too.

That puts Standard Chartered in an enviable position, because it has a wealth of experience working in these markets and navigating their financial regulations. It openly welcomes third parties to use its digital rails and infrastructure to move money.

“Standard Chartered covers a very significant proportion of the world’s population in our franchise markets,” points out Anurag Bajaj, Standard Chartered’s global head of banks and fintech. The bank’s model for capitalising on the growth of digital payments is one of partnering and working closely with fintechs that are seeking access to local payment infrastructure for the ‘last mile’ delivery of funds, Bajaj

explains. In this leg of the journey, automation is needed to drive customer growth and financial inclusion.

“We look to understand the business model of our fintech clients and evaluate that against local regulatory requirements,” Bajaj adds.

He notes that around 40 per cent of adults in low- and medium-income countries transacted digitally for the first time in 2022, pointing out: “This is only possible if you have companies focussed on automating the experience, end-to-end.”

Despite the heightened pace of activity in Asia, Middle East and Africa in recent years, he believes there is still plenty of uncharted territory to cover.

"In more established markets with big, dispersed populations and large rural areas, there is significant room for further adoption of financial services,” he says.

“India, Bangladesh, Indonesia, Pakistan and Nigeria are prime examples.”

Meanwhile, what Bajaj describes as ‘national champions’ in digital payments are maturing and spreading their wings.

“Fintechs operating in UAE, for example, would like to operate in markets such as Saudi Arabia and Egypt. We are being approached with propositions for these countries. If a fintech wants to operate in Asia, they don’t want to deal with six or seven different banks across the markets they want to launch in.

“They probably want to deal with one bank, and our footprint lends itself very well to being that bank. We may not have the nimbleness of a small local player, but we have invested heavily in infrastructure to deliver a seamless experience for digitally native companies.

“If we can’t originate the payment, we would like to intermediate it, because this gives us a whole lot of add-on value, which, over time, becomes quite significant,” adds Bajaj.

An example of such a collaboration was the launch of a cross-border remittance service for Alipay HK and GCash, so Filipino workers in Hong Kong could wire money to their families back home and make it available instantly. The system

PAYTECH FOCUS: THE ROLE OF BIG BANKS ThePaytechMagazine | Issue 14 ffnews.com

Regional fit: The growth of paytechs in Africa, Asia and the Middle East is an opportunity for big banks

18

If we can’t originate the payment, we would like to intermediate it, because this gives us a whole lot of add-on value,, which, over time, becomes quite significant

used blockchain technology and Standard Chartered provided the underlying banking infrastructure.

“The exciting bit is that the remittance wasn’t even delivered into a bank account, it was delivered directly to digital wallets,” explains Bajaj. “So it was instant and cross-border, and the infrastructure was completely bespoke.”

Other tie-ups include an investment by Standard Chartered in Singapore’s blockchain-driven clearing and settlement platform Partoir. Under a deal struck last November, the bank will use Partoir’s blockchain expertise for its wholesale payments and settlements network worldwide.

Beyond these bespoke products for specific clients, Standard Chartered has moved into services delivered via API – for example, its Payouts-as-a-Service solution, which was also launched in November and is proving quite useful for marketplaces. It allows businesses in the UK, UAE, India, Malaysia and Singapore to manage (among other features) one-to-many payments efficiently. Clients provide details of transactions as they occur, such as a purchase or sale made on an e-commerce marketplace, alongside preferences around who, when, how and how much to pay. The bank then executes these payments without the need for separate instructions from clients or their counterparties, saving time and money.

Bajaj explains that the bank’s fintech strategy is similar to that of its global subsidiaries arm, which provides banking services to foreign subsidiaries of multi-national corporations. Scale is important. Standard Chartered primarily works with fintechs that are international, or regional and national champions in its footprint. One key reason for seeking the more established players, he says, is that they ‘are there for the long run and

therefore understand the importance of embracing regulatory requirements’.

“We have seen firms for whom compliance frameworks and money laundering responsibilities are seen as potential constraints to innovation, but we always emphasise the importance of innovating within the sandbox of rules.

“For example, we worked with a large international household fintech, and helped them revamp their whole know-your-customer (KYC) processes so that their standards could match those that the local regulators expected, to the extent that almost any bank would now be delighted to bank them.

“We have many examples like this where we have worked with fintechs that are not naturally active in our

“With sanctions or financial crime, the more data you have, the better you are likely to get at pinpointing breaches,” says Bajaj. “By intermediating different types of payments from various channels, we can build knowledge bases necessary to conduct far better surveillance to protect the banking system. All these tools don’t necessarily exist today, but through advances in machine learning, we can use the data to deliver trained models that are better equipped to find the needle in the haystack.”

Looking ahead, Bajaj believes fintechs and banks will stay in their lanes – fintechs innovating use cases for digital technology around payments; and banks providing the underlying infrastructure.

He says: “New use cases and the growth of existing ones will be for fintechs to address. Because banks have indeed ceded some ground to them. But we [as banks] need to ensure our infrastructures are suited for fintechs to operate on. That includes investing in exporting more services digitally, linking to real-time payment infrastructures, keeping track of innovations such as blockchain and central bank digital currencies to assess and decide on which areas to participate in.”

markets and enabled them to operate and compete in our footprint.”

There are clear advantages for a fintech partnering with a bank, but what’s in it for the bank? Bajaj says that, once payments partnerships are in place, banks benefit from the flow of transaction data, one application of which could be to improve anti-money laundering detection. That is particularly significant for a bank that has made public its determination to come back from past missteps to become a leader in shaping security for the banking system.

He highlights particular opportunities for growth around digital media and gaming, as the in-game and in-app purchase space has grown dramatically. But keeping track of all these potential payment streams is not without challenge.

“There is huge potential for innovation for both fintechs and banks… but we must avoid becoming distracted, so choosing specific areas and excelling at them is most important.”

ffnews.com Issue 14 | ThePaytechMagazine

19

New use cases and the growth of existing ones will be for fintechs to address. Because banks have indeed ceded some ground to them. But we need to ensure our infrastructures are suited for fintechs to operate on

Moving fast to change things

Will crypto come of age in a new era of regulation? Amanda Shoffel, Bitstamp’s Chief Compliance Officer, has high hopes

Of all the financial innovation to have taken place this century, crypto occupies a space of its own, far out in the left field. Its founding myth, its faceless architect, the anarchy latent in its decentralised vision, all conspire to achieve what punk did in the 1970s –horrifying the adults.

But everyone has to grow up eventually. The Stranglers went on BBC TV’s Top Of The Pops. Johnny Rotten appeared on Question Time. And the crypto market, for all its radical swagger, now looks ready to cross the aisle, too – embracing rather than frustrating the regulatory bodies it has for so long eschewed.

The warmth of that embrace might betray the chill felt during the ongoing crypto winter, with crypto markets losing more than $2trillion since their November 2021 peak. Faith is waning, too: victims of crypto hacks and scandals lost $3billion last year, up from $2billion in 2021, and three in four Bitcoin investors are now in the red, according to the Bank for International Settlements. A February report from JPMorgan, meanwhile, found that 72 per cent of institutional traders ‘have no plans to trade crypto’ in 2023.

Crypto service providers are notoriously bullish, but while hot air alone won’t thaw this deep freeze, regulation might. That’s the view of Bitstamp, the crypto exchange, which has placed security, transparency, and regulation at the heart of its approach since 2011.

“We see regulation as very much part of the business, something that drives the business,” says Amanda Shoffel, Bitstamp’s chief compliance officer. “The more the market is stabilised, and

the more people put trust in crypto, the more we can spread adoption of crypto.”

Based and licensed in Luxembourg, Bitstamp is a compliance trailblazer in the crypto space, having been fully audited by a Big Four accounting firm since 2016. Today, 29 per cent of its workforce is devoted to risk management and regulation. Bitstamp keeps 95 per cent of its crypto offline, in bank-grade, Class III vaults – yes, just like the ones in the movies. Caution and care lends Bitstamp credibility, and better, tighter regulation will do the same for the entire crypto market, it believes.

In the US, many crypto-asset service providers have been crying out for regulation for this reason, with limited success. In February, crypto-focussed

securities, the other as commodities. It’s a regulatory mess.

The neatest regulatory intervention for the crypto space has been the extension of anti-money laundering rules to cover digital assets. In the UK, the Financial Conduct Authority (FCA) currently has some remit to check that crypto-asset firms have the right procedures in place to spot and report wrongdoing. But in April, members of the European parliament voted in favour of the Markets in Crypto Assets (MiCA) regulation, which will be the world’s first comprehensive regulation for the crypto sector, giving most firms much-needed clarity –although it will require institutions to conduct due diligence checks on large transactions and ban anonymising tools and privacy wallets.

“Regulation and know-your-customer (KYC) will help scalability because it will combat harmful stereotypes that crypto is only used for illicit purposes, or used primarily for money laundering purposes,” explains Shoffel. “So the more regulation around KYC that we have, the more trust people will have in the product, and the more comfortable they’ll be including it as part of their financial portfolio.

Custodia Bank had its application to be supervised by the US Federal Reserve rejected for the second time. In March, two separate US agencies – the Securities and Exchange Commission and the Commodities and Futures Trading Commission – sent warnings to Coinbase and Binance, respectively. One sees crypto-assets as

“But KYC isn’t enough, on its own, to combat fraud and money laundering. Firms really need to have transaction monitoring. They need up-to-date information, they need to make sure that the information that they’re seeing, or that they have about the customer, is consistent with the transaction types, and if it’s not, all those things can trigger an investigation into suspicious activity.”

All that seems reasonable, but doesn’t it

20 CRYPTO & BLOCKCHAIN: REGULATION

ThePaytechMagazine | Issue 14 ffnews.com

Transparency helps put an accurate value on crypto and on assets in the marketplace. So, you reduce the likelihood of pump-and-dump schemes, or of exchanges issuing their own tokens that are hard to value

Star performer?: Crypto firms hope regulation will bring credibility to the market

meet in Hiroshima, Japan, to hammer out the details of a joint regulatory strategy.

Still, it’s likely that the EU’s new framework will set the course, just as Europe’s General Data Protection Regulation (GDPR) reached far beyond the bloc’s borders following its 2018 implementation. MiCA will have a phased introduction but appears to be as comprehensive

that have gathered over Silicon Valley Bank, Credit Suisse, and others in recent months. The IMF has referenced the ‘crypto contagion’, while Belgium’s former Minister of Finance, Johan Van Overtveldt, recently termed crypto ‘speculative poison’ that ought to be banned outright to help shore up confidence in the banks.

We’re seeing these fears, which are without causal evidence, play out in real time. When Flagstar Bank, a subsidiary of NYC Bank, stepped in to rescue the failing Signature Bank in March, it did so without purchasing Signature’s considerable digital assets business, which includes its crypto activity. The key concern here is the depositor selloff – the crypto market’s equivalent of a bank run, and the phenomenon that felled FTX. Transparency and trust are things Bitstamp takes extremely seriously.

fly in the face of the crypto dream?

“Yeah, the downside is that KYC can be a touchy subject, especially in an industry that’s built on the founding principles of privacy and permissionless transactions,” says Shoffel. On the other hand, many crypto-asset investors aren’t in it for the vision but for the bounty. They’re likely to welcome moves to tame the Wild West status quo, especially if they’re made a regulatory requirement.

In any case, regulating a global market throws up issues familiar to readers of this magazine. “One of the problems we face in crypto is that regulations are not as standardised [as we might like],” says Shoffel, “and it really depends on not just the location of the firm or exchange, but the products that it’s offering, as to what KYC we should, can, and do collect.”

The supranational institutions are moving through the gears on this, with the Financial Stability Board, the Bank for International Settlements, and the IMF collaborating to publish guidelines. In February, the G20 announced its collective bid to standardise digital asset regulations; in May, the G7 was due to

as its digital privacy predecessor. The regulation is aimed at protecting consumers and investors, supporting financial stability, and promoting innovation in crypto-assets. And it comes with fangs: proposed fines for breaches of €5million, or between three and 12.5 per cent of annual turnover.

"One of the requirements is to issue a white paper on any token that’s being issued in the bloc, including things like who the issuer is, the team behind it, the technology underlying it, the protocol and consensus mechanisms used – even things like its impact on the environment,” says Shoffel.

“When people are more educated, and more aware of the questions they should be asking, they’re less likely to fall for scams. And unfortunately, because of the economic downturn and inflation, scams are way up.”

Some commentators have seen the spectre of cryptocurrency in the clouds

“Bitstamp has been audited since 2016,” says Shoffel. “We hold all assets on a one-to-one basis, and we have for quite some time. Exchanges are rushing to get proof of reserves to show that they are holding customer assets. But a proof of reserve is just a snapshot in time. You don’t know if they are being lent out to somebody else, or if they’re being moved into a different account. That’s why a full audit is the best way to be transparent about customer funds.”

And that would deliver an additional benefit to consumers, as Shoffel explains. “Transparency helps put an accurate value on crypto, and on assets in the marketplace. So you reduce the likelihood of pump-and-dump schemes, or of exchanges issuing their own tokens that are hard to value. On an open market, where buyers and sellers can determine value with information that they possess, it’s a more even playing field for everyone.”

Transparency might be anathema to strict crypto-evangelists, but letting the light in might be the market’s best chance of experiencing a new dawn.

And, if the cost of survival is assimilation into the mainstream, expect to see even the most crypto investors amending their principles – even if they retain the digital regalia of a rebel.

21

ffnews.com Issue 14 | ThePaytechMagazine

the technology began making headlines more than 10 years ago. Given the relentless hype, that’s hardly surprising. It remains an emerging technology, widely discussed and touted, but is yet to change the world in the same way the internet has.

However, although we haven’t reached the tipping point, the technology has matured enough to support many business applications and has proved its potential across a variety of industries, from agriculture to health, travel and many more.

The core features of a blockchain –namely decentralisation, immutability, and traceability – make it a particularly attractive technology for banks and financial institutions, where accuracy and trust are essential. Potential use cases include payments, securitisation, smart contracts, loans and credit, and clearance and settlement systems.

But, despite the obvious applications, there has only been piecemeal progress to date. Some are more notable than

others. A number of global banks are working with software company R3’s permissioned blockchain Corda, for instance, to provide a discrete number of services. And Ripple, the blockchain-based, cross-border digital payment network with its own cryptocurrency, has ruffled the feathers of incumbent providers with its three-second settlement rate and underlined what a blockchain future might mean for finance.

There are fewer sceptics than there were. In the not-so-distant-past JPMorgan’s CEO Jamie Dimon famously damned Bitcoin as ‘a fraud worse than tulips’ referring to the

tulip bulb asset bubble of the 17th century – before the bank itself entered the space with its own JPM Coin and an underlying permissioned distributed ledger for the instant clearing of multi-bank, multi-currency assets. The sound of backtracking footsteps was deafening.

So, could banking follow other sectors in embracing what many clearly see to be a progressive technology?

A QUESTION OF TRUST

Finboot is a software-as-a-service enterprise blockchain low-code technology company, launched in London and 2017, which began operations in Wales after securing £2.4million in funding in 2021 –including from the country's development bank, which is helping to grow a local blockchain technology hub.

Finboot works with a wide variety of industries with complex ecosystems. Its contribution to chemical giant Sabic’s attempt to increase the circularity of its supply chain, reduce emissions, increase efficiency and save money earned it significant praise in the company’s 2022 third-quarter report.

The report said of the project, which included packaging specialist Intraplás: “This is the first of its kind in the industry to trace the product from feedstock production to converter, going further than previous industry applications of blockchain in end-to-end tracing.” It found the platform delivered reduced costs, time and improved data integration for all the value chain partners.

Finboot’s chairman and co-founder Nish Kotecha has a background in financial services and he sees blockchain as essential to building the Web3 ecosystem, because it provides one critical element.

“Trust is the most important thing,” says Kotecha, “and it’s usually administered through intermediaries. So, for example, if you look at oil, gas, energy and similar industrial supply chains, there are a complex set of processes for each one; and at every junction point, someone will be verifying who the sellers and buyers are.

“Blockchain can provide that assurance because it can administer end-to-end traceability, which is exactly what Finboot’s MARCO platform does.”

Kotecha says that the platform is building trust for customers in Finboot’s principal industries – energy, chemicals, retail, and aviation – but that the same approach could reduce friction in any business where trust and visibility are vital, including finance.

It’s unfortunate, he says, that the crypto use case has distracted from blockchain’s many positive applications and slowed its adoption in the very industry where increased control and transparency are top of the agenda.

“Blockchain and regulation are not mutually exclusive,” he insists. “In fact, blockchain can aid regulation.”

As for the banking industry harbouring

conservative attitudes, he says: “I’ve spent many years in financial services and know that once the industry sees that innovative solutions are available out of house, it will start looking externally for help to innovate.

“Indeed, many financial institutions have completed pilots, such as green bonds that are being administered on blockchain. One of my shareholders, who is in financial services, even recently asked: ‘When will we see full payments being made across blockchain?’ My answer to that is: ‘Very soon.’”

Given their systemically important role, financial institutions are perhaps

CRYPTO & BLOCKCHAIN: TRUST AND TRACEABILITY

ThePaytechMagazine | Issue 14 ffnews.com 22

Nish Kotecha, Chairman and Co-Founder of Finboot, a blockchain enabler, examines blockchain’s role in the financial sector and what it can learn from other industries

It’s fair to say that blockchain has promised more than it has delivered since

understandably uncertain as to what role they can and should play in the blockchain universe, as well as how best to gain value from the technology. Kotecha’s view, though, is that if they don’t hurry up and get on the blockchain bus, they’ll be left out of the Web3 loop.

“A traceable, end-to-end, secure, immutable database is a core requirement in banking and finance,” he says. “In the same way that it can track oil, gas, liquids and other commodities in the industries we currently support at Finboot, it can also be used to control each part of a financial supply chain.”

Education will be fundamental to its adoption, he adds: “As with any new tech, there is a learning curve, and you have to show the return on investment to be confident of investing further and growing the technology. For that, you need platforms like MARCO, which allow organisations to move rapidly from scoping a use case to integrating

applications in a matter of weeks. Faster deployment means significantly lower costs, and you can quickly prove the value of any new application."

Web 3 is predicated on organisations being able to talk directly with their audiences, the blockchain itself taking the place of trusted intermediaries – a role banks have long played in finance.

“But banks are realising that it’s better to be part of the blockchain ecosystem," says Kotecha. And, in his view, they are also coming around to working with third parties that can support developments, rather than to try to own them.

As to the issues of privacy and regulation, which vex many in the industry, he says blockchain could be a very useful ally.

By way of illustration, Kotecha explains: “If you need to trust a supply chain, say in relation to new European environmental regulations, you need to prove provenance.

You can’t do that unless you confirm identity, and to do that you need permission. So, the person giving identity says, ‘I’m happy for you to use my identity’, and then it is encrypted and moved to the next part of the process.

“That’s what blockchain does. It collects permission and data, simultaneously locking them into the same data block, and then you can move forward.”

Kotecha says this is what regulators are looking for and what consumers will demand, and if you’re not preparing to do it today, you’ll have a big problem in five years’ time, because it will probably be too late.

“You need to start using blockchain now,” says Kotecha, “to collect data that will create value tomorrow.”

they could even have made the recently shuttered Silicon Valley Bank a more viable proposition.

“SVB unravelled quickly through a lack of trust. Blockchain can enhance trust because it gives you provenance, and, with the right permissions, transparency and traceability of what’s happening where – unlike any other database today.”

Some time prior to SVB’s collapse, America’s Harvard Forum on Corporate Governance urged the banking industry to come off the fence on blockchain. “There is a historic opportunity for the banking industry to modernise dramatically by incorporating both public and private blockchains,” the authors wrote. “Through a combination of governmental regulation and partnerships between the public and private sectors, the legal uncertainties prevalent in the space can be clarified and the banking industry... can expand its use of blockchain technology to provide more

One of Finboot’s solutions is called MARCO Track and Trace. It gathers and shares data, creating digital product passports and accurate reporting, enabling trusted connections between stakeholders in a supply chain. As well as sharing data with customers and suppliers, businesses can also share data with regulators. And Kotecha says that while you need regulation to administer blockchain in a bank, blockchain also enables banks to comply with regulation. Together

efficient and secure products and services.” Wherever supply chains are siloed and fractured, wherever data sharing is a challenge, Kotecha believes it has a role. “Every business needs to understand blockchain’s capability. To see it as a core technology that is not going away and is the key to success in the future.”

Building blocks?

Despite its potential, blockchain growth within the financial sector has been patchy

ffnews.com Issue 14 | ThePaytechMagazine 23

SVB unravelled quickly through a lack of trust. Blockchain can enhance trust, because it gives you provenance, and, with the right permissions, transparency and traceability of what’s happening where

SEBA Bank’s Mathias

Schütz

Summer visitors to Lake Zug, the picturesque, mountain-ringed hiking hotspot half an hour south of Zurich, are greeted with images of a bygone Europe. The old towns here are a palette of pastel-coloured façades, shuttered windows, and gothic spires that pierce the morning through the lake’s rolling mist.

But all is not as it seems in this chocolate-box landscape. Up in the high Alps whirr modernity’s miners, hacking

into cyberspace. Follow the cables down to the valleys, and you’ll find ordinary citizens accustomed to paying their taxes in cryptocurrency. And, in June, the world’s blockchain elite will descend on the quiet lakeside village of Rotkreuz for the fifth iteration of the Crypto Valley Conference.

Across the water lies Zug, the town at the heart of this liberally regulated Swiss canton, which is fast establishing itself as the global crypto capital. In 2021, its top 50 companies, which include Ethereum and 14 unicorns, were valued at $611.8billion. And with Zug town hosting half of the

region’s blockchain companies, it’s as close to the pulsing arteries of decentralised finance as one can get.