Eastnets CEO Hazem Mulhim on revolutionising compliance with AI

Eastnets CEO Hazem Mulhim on revolutionising compliance with AI

Join us at Money/2020 Asia to learn how we’re shaping the future of finance.

Your customers shop, pay, and bank with the tap of a finger, and expect a fast, safe, and seamless experience every time.

From secure onboarding and digital wallets to eCommerce checkout journeys—G+D enables financial institutions all around the world to create human-centered journeys to win loyalty, outpace fraud, and lead in a competitive digital world.

Drawing on our over 170 years of PayTech expertise, more than 5000 banks and issuers and over 160,000 thousand merchants rely on us—worldwide.

Scan the QR to explore how we’re making payments and banking secure, convenient, sustainable, and accessible for everyone.

6

CORPORATE BANKING

Tomorrow’s treasury today

A rigorous focus on the needs of clients and their customers shapes BNY’s approach to technology adoption and development, as Carl Slabicki explains

8

ARTIFICIAL INTELLIGENCE Planning for AI

Whether it’s buried deep in the operational heart of an organisation or powering customer-facing chatbots, AI is a tool that requires careful preparation and a clear sense of what you want it to achieve, says Finastra’s Adam Lieberman

10 SME BANKING

The great rebundling U.S. Bank is becoming a trusted resource of integrated back-office services for its 1.5 million small business customers, reversing a decadelong banking trend and addressing a real need

12 CORE BANKING

Zee whizz! Adapting to a new banking generation Legacy banks and fintechs could just stay in their lanes, but as digitally native customers come to dominate the workforce, pairing up adds value for both of them, as Joud Zaumot from Mambu and Andrzej Szelemetko of GFT Technologies discuss here

The heavy lifting has been done. Now the moment of truth. SEPA Instant Credit Transfer is about to go live. Bank of America considers what the reality might be for banks and their corporate clients

Open banking and AI have contributed to a turnaround in UK bank TSB’s lending procedures. It empowers customers with detailed information about their financial circumstances and provides the bank with more accurate risk ratings

Eastnets’ Hazem Mulhim and Daoud Abdel Hadi on why they’re convinced AI is the enabler for effective compliance and enhanced fraud prevention

There were two massively anticipated events poised to take place as we went to print.

One moves the world a step closer to the holy grail of truly global instant payments. The other sees many of those involved in that crusade gathering to consider the next frontiers in finance at Sibos.

Go-live for SEPA Instant – the final implementation for both receivers and issuers under the Instant Payment Regulation – marks a profound change for payment service providers in Europe. They can no longer choose to offer instant payments; they must – and, crucially, at the same price as transactions that use the slower SEPA Credit Transfer rail.

Ultimately, it will be users who drive demand and determine how successful it will be. And adoption is still hard to predict. Nearly half of Brazil’s transactions were instant within four years of launching Pix. Roughly the same percentage now goes through India’s UPI.

But the UK, which has been chipping away at it since 2008, still only sees 10 per cent of transactions over its Faster Payments service.

Confidence in the system’s ability to protect payments made at the speed of light will likely be a determining factor… although a frightening spike in financial crime didn’t seem to damage the love for Pix.

Fast and fraudproof. We really need to breach that frontier.

Sue Scott, Editor

This issue's spinetingler quote comes from legendary fashion designer and businessman Georgio Armani, who died in September 2025, aged 91

22

ARTIFICIAL INTELLIGENCE

Smarter decisions, stronger operations

Rebranding is tricky for a company as established and respected as Smartstream. But with AI broadening the customer base and transforming its relationships with existing clients, CEO Akber Jaffer has decided it’s time for change

24 INNOVATION BANKING Raising the phoenix

Two years on from Silicon Valley Bank UK’s assimilation into HSBC, Ad van der Poel, Chief Commercial Officer at HSBC Innovation Banking UK, shares its journey to becoming the go-to bank for the nation’s tech ecosystem

26 REGTECH

Taking the pain out of compliance

As the EU’s new AML package of reforms approaches, Sinpex is helping cure the headache that is KYB onboarding

29 DATA

Sharing is caring

Bank of Ireland’s payments data analytics team produces information that’s useful to the bank, its customers and the wider economy. But could it play an even more important role?

32 CROSS-BORDER PAYMENTS

Game changer

No business wants to be sitting on cash that’s not working for it. But that’s precisely what many higher-risk sectors are forced to do if they need to make cross-border payments. Freemarket has a solution to release that lazy liquidity

34 PAYMENTS

Passion project

We don’t just want to buy ‘stuff’ any more. We want to experience it. And Mastercard’s vision for an agentic future can help deliver that for consumers

36 ARTIFICIAL INTELLIGENCE

The right tool for the job

Marcus Rabe of Insight Softmax Consulting is one of AI’s biggest cheerleaders, but even he cautions it’s not a silver bullet

38 SUSTAINABILITY

Turning back the tide

G+D’s partnership with sustainability-bydesign champion Parley for the Oceans is helping financial services answer one of the biggest environmental challenges of our time

40 CUSTOMER RELATIONSHIPS

Mission-driven banking

We go inside USAA’s digital transformation to deliver the ultimate service to military personnel and their families

42 SME LENDING

‘Shadow’ boxing

Banks want to win back the portfolio of SME loans they’ve lost to the private credit market. Acuity Knowledge Partners is helping them achieve it with AI and

experience

44 CORE BANKING

Move fast… and fix things!

Temenos has sharpened its focus in response to one of the biggest technology shifts of a generation. Barb Morgan explains how its helping clients through this transformation

46 REGTECH

Scaling safely without debanking

Another hefty fine for a UK neobank highlights the need for better compliance controls in fast-growing fintechs. Flagright’s Imam Saygili says its AI-driven system offers a nuanced solution that keeps genuine customers and regulators happy

49 BRANCH BANKING

Face the truth

Restoring in-branch banking to thousands of UK communities isn’t just possible – it’s happening, with or without the banks, says Ron Delnevo

Simplify global transactions with our cost-effective payment platform. We support everything from traditional POS to SmartPOS and SoftPOS, with integrated apps, on-device reporting, smart routing, and more.

Boost efficiency and grow your business with our all-in-one payment solution.

A rigorous focus on the needs of clients and their customers shapes BNY’s approach to technology adoption and development, as Carl Slabicki explains

A significant force in global banking, Bank of New York (BNY) processes digital payments at a rate of $3trillion a day in around 130 different currencies.

Its banking-as-a-service infrastructure fuels almost 2,500 organisations that are operating in a vast number of markets globally, by facilitating local and cross-border transactions, including US dollar payments into and out of local regions.

BNY’s Executive Platform Owner for Treasury Services, Carl Slabicki, is at the heart of that fast-paced, rapidly evolving operation, responsible for providing ‘really deep, integrated working capital through the entire life cycle’ – from payments, cash management and trade finance to bank, broker-dealer, fintech and money service business clients globally.

We asked him what developments, opportunities and threats he believes are currently foremost in financial services players’ minds.

THE FINTECH MAGAZINE: What does the day-to-day look like for BNY’s Treasury Services division?

CARL SLABICKI: We’re involved in facilitating global money movement and giving clients access to foreign exchange (FX) markets, letters of credit and trade finance and receivables financing, as well as cash management capabilities to help safeguard their assets.

It’s about working with bank treasurers, corporations, CFOs, accounts payable and receivable managers, or

the financial services product managers who are serving their own clients, providing them with services to help them offer better products downstream to their customers.

This gives us a great sense of what’s going on across these markets, the trends our clients are seeing, what they need to do to stay competitive, what’s really important to their businesses. Ultimately, how our services can help them achieve those goals.

The main theme is both financial services and the broader business ecosystem moving into more of a 24/7, always-on operating model.

It means payments need to be able to move instantly, not just within specific regions but cross-border, too. We’re doing that in a lot of markets

Carl Slabicki, Executive Platform Owner, Treasury Services, Bank of New York

worldwide using our direct clearing or correspondent network partners to connect into instant payment rails and facilitate real-time money movement.

We’re also looking to help our clients analyse and manage their cash flow, balances and liquidity. Then there’s seven-day accounting and interest calculations for always-on FX services.

TFM: How do you deliver true always-on capability in a world where doing so 99.99 per cent of the time isn’t, ultimately, good enough?

CS: Knowing how important this is to our clients, we’ve invested in the infrastructure to ensure they can provide a resilient offering to their clients, including rotation between data centres.

APIs help us and them stitch together multiple capabilities for a more seamless real-time workflow – including third-party partner capabilities for real-time processing of things like sanctions screening, fraud anomaly detection, checking for balances and updates and funds control, to support their millisecond-driven service level agreements.

We have lots of great data, and also bring in components from partners to offer our clients better value. So, they might take pieces of our API workflow to validate a data point, a beneficiary or an account number before a transaction process. Then they might use another API to get a status for that transaction,

This concentrates the leadership, technology, skill sets, tooling and processes into a once-and-best owner – often through APIs – so every use case has a single, best-in-class source. That’s helped us move faster and deliver repeatable components to a higher standard.

Then, in terms of technology, strategy and architecture, we’re also looking at AI in areas including engineering to accelerate our output. We can use it to supplement the people writing user stories within product management, or help our engineers draft code as a starting point to then finish and put into deployment.

Then, once the code’s written, we can use AI to write and run more robust test cases to assist our testers with deployment – adding quality and speed along that lifecycle. These two things together are positioning us well for the future.

TFM: How do you ensure your digital transformation delivers real strategic value and substance to clients?

CS: There’s always a hype cycle around new technologies – buzzwords and investment going in to chasing technology that’s maybe not grounded directly in a problem.

Our approach is to look at what our clients are trying to do – like the moving to always-on operation in multiple currencies, globally, including FX. In this example, we work that back to the fact that this means they need a seven-day operating calendar for their accounts, investments, working capital, and interest on balances, investments and lending – which means their systems need to be able to consume our APIs continuously.

we’re thinking and what proof-of-concepts we’re building. It means they can drive the products that we either build, deploy, pivot or, ultimately, scrap and move on from

We take the same approach to our interactions with peer banks and market infrastructure providers, like The Clearing House, Federal Reserve and Swift, where there are investments to be made.

There’s a lot of work and proof-of-concept going on around blockchain, stablecoin and tokenised deposit infrastructure, for example. These are all technical tools for helping bridge legacy infrastructure and enable our clients to achieve round-the-clock capability. We ask ‘what do we need to do to make that infrastructure more available, resilient and digitised to meet the modern demands of this evolving market?’. We’ll support and lead on those things that are going in the right direction, strategically, and let our clients know where the market is headed, what the benefits could be for their business and what that means for them.

We always try to represent their voices in deciding where we place our bets in both the short and long term.

TFM: Finally, what excites you most about the future of financial services technology and its potential to transform not just the client experience but how you best equip your internal teams to deliver that?

which they share with their client through a mobile or web interface.

Essentially, our clients can merge pieces of their ecosystem into a workflow for a customer to offer an instantaneous front-end experience, whereas much of the treasury ecosystem used to be an afterthought, a batch process that happened end-of-day or next day.

TFM: All of this clearly improves external processes, but can it also help internal stakeholders deliver more?

CS: We’re considering what common capabilities we can do once and best to remove duplication, a proof point being the platform operating model we have deployed across our entire enterprise for dealing with core requirements like know-your-customer, billing, onboarding and risk management across multiple lines of business and products.

Lots of financial ecosystem layers need to come together through technology solutions that help us and our clients make the jump from legacy infrastructure.

With digital transformation, I always ask ‘what is it helping our client do?’. For example, is it helping them move assets more efficiently than the legacy model? Is it helping them exchange assets more seamlessly, or improving fraud and anomaly detection and cash forecasting? If the answer is yes, and it usually is, we can continue to test the benefit for the end user, i.e. is it helping them function faster, safer or more autonomously?

We don’t want to build tools because they sound cool or make a nice headline. We want things that help businesses and consumers, at scale, to move their assets more efficiently.

Some investments are short-term, some are mid-term and some long-term and, if we’re pairing a new technology, model or capability, we always bring our clients into that journey. We showcase things, let them know what

CS: Collectively managing the future will involve being able to navigate the intersection of evolving legacy technology and expanding its operating hours to 24/7. It’s also about building associated fraud controls, speeding up the infrastructure’s money-moving capabilities, connecting assets together from an exchange perspective, and bridging some of the newer technology being built by private banks.

It involves things such as the tokenised deposit models that banks are rapidly deploying, evolving market infrastructure, new technologies, instant payments ecosystem, leveraging AI as an acceleration tool, and increasing fraud controls.

And then you have to consider how you deploy all this to make a difference to what the consumer at the end of it all actually cares about. It’s important to ensure we’re leveraging the tools that are growing at a very rapid pace to funnel things in the right way.

There’s a lot of opportunity and potential to harness the momentum of what’s coming across the industry, and to maximise that for all the users at the end of that workstream, whoever they might be.

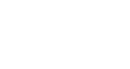

Whether it’s buried deep in the operational

heart of an organisation or powering customer-facing chatbots, AI is a tool that requires careful preparation and a clear sense of what you want it to achieve, says Adam Lieberman

THE FINTECH MAGAZINE: With so much investment going into AI today, what advice would you give financial services organisations to help them maximise their return on AI initiatives?

ADAM LIEBERMAN: The desire to deliver efficiency and automation with AI is understandably the key driver of adoption, but projects will fail to deliver return on investment (ROI) when there is a lack of solid objectives from the outset. Setting the parameters of success, such as well-defined metrics and KPIs, is crucial.

An organisation with a mature AI roadmap will have clearly defined strategic objectives, against which AI implementation and integration is mapped, so that the technology directly supports organisational goals. Jumping straight into adoption, without considering the technological and cultural limitations and challenges will almost certainly lead to poor ROI.

Banks and financial institutions are full of legacy technology, and with that comes a culture that leans towards legacy practices and ways of working. In this regard, AI projects that support internal workflows, such as those underpinned by generative AI tools, require a shift in the organisation’s mindset that prioritises upskilling employees and updating security and governance frameworks to achieve ROI. For more advanced projects, such as those that relate to the development and delivery of products and services, bottlenecks may occur that can also affect ROI. For example, in industries in which sensitive data are commonplace, gaining access to datasets may take some time or new regulations may emerge that restrict or limit access to data. Being aware of potential restrictions from the outset will help to protect against these bottlenecks.

TFM: Chief artificial intelligence officers are still a relatively new addition to the C suite. Speaking as a CAIO yourself, how important is effective leadership when it comes to implementing and developing AI initiatives?

AL: Leaders can be well-intentioned, but if they do not involve all stakeholders from the inception of AI initiatives, successful projects will elude them.

Success relies on buy-in and validation of AI use cases from internal stakeholders and delivery teams, from product owners, data science teams and developers, to the C-suite, with all agreeing on KPIs and the wider roadmap. This ensures a critical mass of investment and resource bandwidth and ensures everyone is working towards the same goal.

As well as stakeholder management, AI leaders should be familiar with the core principles and ethical concerns that will govern the development and use of AI-powered solutions across the organisation. Across financial services, there has been a rise in the number of AI-related leadership roles. This is evidence that AI maturity is an increasing priority for the C-suite.

TFM: How should financial services firms measure their level of AI maturity?

AL: AI maturity can be measured against a number of factors, from educational initiatives and skills development programmes, to ensuring the right talent and leadership is in place across technical roles. Measuring how often employees are using the available AI tools is also a good way to assess the general state of enterprise fluency with the technology.

When it comes to the development and delivery of AI-powered products and services, maturity is measured by the business’s approach to defining use cases, so that a robust AI roadmap can be

determined, incorporating architectural best practices and frameworks, so that systems are able to adapt and scale as the technology advances.

A crucial point for financial services firms is that data infrastructure must be mature enough to ensure organisational data is AI-ready. If this is not in place, the focus must be on data transformation and the modernisation of systems.

TFM: How can organisations upskill their employees and increase AI maturity?

AL: AI maturity will ultimately mean different things for different employees. For example, developer teams will already likely be working with AI coding tools and applications regularly, while marketing teams will still be experimenting with generative AI to assist with content development. There is no one-size-fits-all approach to advancing users from low-maturity to high-maturity, but looking at the requirements of departments and teams across an organisation can help leaders establish bespoke frameworks for upskilling and increasing engagement with AI-powered tools. Identifying AI evangelists and superusers within departments and teams is another way to help advance other employees’ understanding and engagement with available AI tools, enabling them to deliver efficiencies within their own workflows. Creating a collaborative culture around skills development comes back to leadership, as employees must be given the space and opportunity to upskill and share their learnings and expertise with peers.

TFM: What does the future hold for AI in financial services?

AL: AI is poised to supercharge the industry across multiple tiers. Enhanced and streamlined customer support will

be a primary focus, with AI-powered chatbots and virtual assistants providing instant, accurate responses to customer inquiries. These systems will handle complex interactions, from account management to support issues, freeing up human agents to focus on more nuanced issues.

In-product assistance will enable users to navigate traditional financial products through natural language interactions. This will make complex financial tools more accessible and provide a seamless UI/UX experience.

Agentic workflows will represent the next evolution, with AI systems connecting to tools and functions, capable of executing

coverage, and overall improve the productivity and enjoyment factor of software development. As AI continues to evolve, its impact will strengthen, creating a future of more efficient, personalised, and intelligent financial services.

TFM: Talk us through some use cases for AI in areas such as payments and lending.

AL: We’re exploring AI to solve some of the real-world challenges facing banks. This includes providing instant assistance to operational staff in areas such as trade finance, lending and payments processing.

Trade finance is complex, and it’s notable that the industry faces a significant talent gap. AI

The

realisation of fully autonomous agentic AI systems is where we are heading, and banks and fintechs need to understand how they can incorporate them into their service offerings

complex tasks autonomously, assisting users with their daily tasks. By automating routine tasks and providing data-driven insights, AI will significantly boost productivity for financial institutions, enabling employees to focus on high-value activities.

AI will also continue to drive developer productivity – serving as a first-line assistant to auto-complete code, streamline the documentation process, provide better test

tools can help new team members learn and become productive much more quickly through prompt-based assistance. They can navigate processes much more easily without having to sift through extensive documentation.

Payments teams can also benefit in using AI, particularly in relation to data. The power to analyse vast amounts of complex payment data through natural language processing drives more robust insights for banks, particularly

around payment activity and in turn about the best products and services to offer.

It’s clear that AI can remove time-consuming, low-value work across the board. Significant efficiency gains can be realised using AI for transcription, for translation and for digitising paper-based contracts. For lending teams, the ability to digitise, query and manage high volumes of complex loan documentation at scale, and to incorporate the data in downstream applications, is transformational.

TFM: What emerging AI technologies should financial services firms be paying close attention to right now?

AL: The rise of AI agents is leading to the development of many business use cases for AI. One of the main reasons behind this is that agents are able to plug into the investment most organisations have made over the last two years in generative AI tools.

By extending the capabilities of chatbots, for example, organisations can revolutionise customer experience, as well as deliver advanced knowledge and data search and discovery for internal teams. Through combining agents with frameworks like LangChain, agents can connect LLMs to external data and APIs, allowing them to provide further context and detail when responding to prompts.

The realisation of fully autonomous agentic AI systems is where we are heading, and banks and fintechs need to understand how they can incorporate them into their service offerings. Payments and retail are both areas where use cases for agentic AI systems will be delivered in a meaningful way, with experts believing agentic commerce will account for a significant portion of all commerce by 2030.

Connected to this is the use of different protocols for agents and LLMs to connect and communicate with one another. In simple terms, agent-to-agent (A2A) protocols are frameworks that enable them to communicate and collaborate with one another, creating larger, more dynamic AI systems. The Model Context Protocol (MCP) is another framework that allows LLMs to access other databases, APIs, and tools, such as agents, extending the capabilities of the LLM to the systems organisations prefer to interact with.

These protocols are supporting the rapid evolution of agentic systems and should be key investments for financial services organisations and fintechs alike.

n Adam Lieberman will be at Sibos from 29 September to 2 October. If you’d like to speak to the Finastra team at Sibos, visit booth #H036

U.S. Bank is becoming a trusted resource of integrated back-office services for its 1.5 million small business customers, reversing a decade-long banking trend and addressing a real need

Much of the past decade’s digital progress in financial services has been achieved through the so-called ‘unbundling’ of banks, with non-banks satisfying customers’ fast-evolving service needs, by overriding the limitations of legacy systems and offering nimble – and often substantially cheaper – solutions.

It was perhaps inevitable that incumbents would seek to reinstate their proprietary advantage by ‘rebundling’ such services within their own estate – sometimes even subsuming the competitors through buy-outs/buy-ins or partnerships to do it.

One of the most fought-over segments by fintechs has been small

and medium-sized businesses (SMBs) who, for years, got a raw deal from banks. In the States, U.S. Bank is reversing that.

Many of its fellow banks have struggled to support SMBs due to the imbalance between cost-of-provision and revenue potential. But U.S. Bank is finding new ways to service this segment cost-effectively, utilising digital advances like artificial intelligence to its, and their, advantage.

For three years, the bank, which serves around 1.5 million such enterprises with up to $25million turnover in the States, has sought SMB owners’ views via its annual small business survey. Its most recent results, gathered just as new economic and trade policy was being introduced, were published this Spring.

Shruti Patel heads up U.S. Bank's business banking arm and says respondents’ calls for help to future-proof their businesses through tech and ensure growth amidst significant macroeconomic stressors, have been getting louder.

The bank is using that feedback to directly inform its technology strategy. It’s giving SMBs access to

Shruti Patel Chief Product Officer for Business Banking at U.S. Bank

tools to help run their back-office functions more efficiently.

By engaging in integrations, acquisitions and partnerships with fintechs it’s helping them up their game in light of the new economic playbook. That includes everything from new products and technologies to enhanced support from its frontline sales team, offering both hardware solutions and plug-in functionality that businesses can access via a single U.S. Bank online banking hub.

Patel says: “We’ve certainly seen an increasing reliance on digital tools over the past decade. This year’s survey showed a 15 percentage point jump from last year in terms of how much small businesses are relying on digital tools to run their back office, whether for workflow automation or cash flow management.

“More than 50 per cent of our respondents told us they are already using and deploying genAI tools, or plan to do so, over the next 12 months. Most of these businesses are using budget-friendly genAI solutions with a cost of less than $50 per month for uses that include content and marketing strategies, and back office efficiency.”

But they need help navigating the right path – and who better than banks like this one, with its longstanding legacy of trust, to do that?

“Most of our small business owners wear multiple hats. They are running their operations, focussed on consumer spending, bringing production costs down and bottom-line profitability up. So, they are struggling to keep pace with how quickly genAI technology is changing, in terms of learning about it and deploying it,” says Patel.

“Our survey has shown small business owners are increasingly overwhelmed by the number of software solutions now in the marketplace. It’s almost mental gymnastics to calculate the cost and how these solutions come together, so they’re relying more and more on their banks to provide integrated products across banking, payments and software.

“Our more notable investments include embedded payroll and accounts payables and receivables, as well as spend management capabilities. We’re trying to bundle these and bring them to market as one holistic solution for our small businesses.”

So, by focussing on their pain points, U.S. Bank is positioning itself as a transformation gateway.

“We are taking a multifaceted approach,” says Patel. “We want to continue to invest in our own infrastructure, data layers, and the technology systems needed to deploy genAI at scale and with speed.

“In parallel, we are looking at use cases

across the bank, such as smart assistants to help our bankers with product recommendations, as well as small business-facing tools to help them navigate our software solutions more seamlessly.

“We’re also using genAI to help our customer services support teams utilise data transcription and synthesisation when someone calls us, to increase our response speed and efficiency.”

The bank’s Connected Partnership Network support platform is building out a marketplace of solutions from partners, including cash management and treasury solution providers, who integrate with U.S. Bank APIs.

Similarly, businesses can see which platforms are certified to easily plug into Elavon, U.S. Bank’s merchant processing business which also operates in Europe. WorksWith Elavon is a searchable, digital platform designed to help businesses find integrated software and payment solutions compatible with Elavon's payment processing services.

Meanwhile, the bank’s free Business Resources Central support hub, created with the help of small business training and solutions provider Next Street, complements the technology with educational courses on topics such as accessing capital, business continuity planning and how to prepare to seek financing.

“We also recently launched our Business Essentials, best-in-class premium checking account coupled with merchant and payment acceptance capabilities,” says Patel. “It’s a no-monthly-maintenance-fee account offering SMBs unlimited digital transactions.

“When they sign up for our payments capabilities, we also give them a free card reader, fraud prevention tools, with same-day availability of funds, and the ability to integrate a business’s accounting and budget management software

as this is still the primary way that a lot of small businesses transact,” says Patel.

The Connected Partnership Network of fintech services facilitates such innovations, and it continues to grow as U.S. Bank collaborates with hundreds of fintechs every year.

Upbeat and determined

Patel describes the overall mood among business owners participating in its latest survey, as being relatively upbeat. But, above all, they are determined. They recognise the need to remain fighting fit – with technology being a key enabler, she says.

“Small businesses have viewed their businesses as very successful over the last 12 months, and, generally speaking, are optimistic that future growth will remain strong.

However… macro-environment challenges such as tariffs were very top of mind [in the survey], followed by access to working capital and inflation increasing cost to their businesses. There were also concerns around consumer spending and whether that will remain strong.”

The report acknowledges that this adds up to a ‘pivotal moment for small business owners, who are navigating a rapidly evolving landscape’. They are responding to these by focussing on ‘streamlining operations, adopting new technologies, and making deliberate decisions about the future’, it said.

Eighty-three per cent said that using modern tools and technologies is a major success factor, while a similar number said they need more innovative tools to make their job easier and/or they were consolidating their digital tools to streamline their workflows.

Small business owners are overwhelmed by the number of software solutions in the marketplace… so they’re relying on their banks to provide integrated products

“And all this is within a simple application and single onboarding event.”

Bento, added to US Bank’s suite in 2021, completes the circle by pairing this payments capability with banking services like spend tracking and card transaction controls, using its accounts receivable software solutions to help SMBs track and control spend.

“We’re investing in our online digital capabilities, making our app seamless for money movement and electronic transfers as well as improving our online banking offering,

In this context, there is clearly a prime opportunity for banks to claim space as most trusted suppliers of key services, embedded into SMBs’ accounts.

U.S. Bank is helping lead the way on a ‘great rebundling’ of services that had been lost to fintech players. And Patel makes it clear it intends to stay right out front of that.

“We’ve always kept a keen eye on the marketplace to see who’s doing a fantastic job with new innovations,” she says. “And so, as we think about some of the needs of our small business owners, whether this is embedded payroll, embedded accounts, payables, or receivable solutions, we're going to continue to look at partnerships with fintechs.”

Legacy banks and fintechs could just stay in their lanes, but as digitally native customers come to dominate the workforce, pairing up adds value for both of them, as Joud Zaumot from Mambu, and Andrzej Szelemetko of GFT Technologies discuss here

“Collaboration between banks and fintechs is an instance of where two plus two equals five.” That’s how GFT Poland’s Andrzej Szelemetko describes the value that can come from the two working together to meet not just their own business needs but also those of a generation that’s reaching financial app overload.

GFT – a core banking specialist –partners with composable core banking provider Mambu and Amazon Web Services (AWS) to develop and deploy full-stack technology that has propelled the likes of challenger banks Alba, Allica and Raisin. But they also help legacy institutions move to a modern multi-core banking environment that allows them to play to their strengths.

Here, Andrzej Szelemetko from GFT Poland, and Mambu’s Joud Zaumot, who lead their respective companies’ solutions engineering teams in EMEA, discuss the challenges and the opportunities for those established providers in meeting the needs of Gen Z.

THE FINTECH MAGAZINE: How is the changing customer demographic influencing banks’ technology choices?

JOUD ZAUMOT: Gen Z is now entering the workforce [and will become the largest generation by 2035], so banks need to start catering for them in terms of products and services, and by focussing on the digital engagement layer. This new generation definitely prefers to deal with their financial institutions digitally, using their mobile app and internet banking.

Joud

Zaumot, Senior Solutions Manager at Mambu

Andrzej

Szelemetko, Client Solution Director PL & CEE from GFT Technologies

ANDRZEJ SZELEMETKO: Gen Z were raised with phones in their hands that have access to the internet. They’re used to completely different experiences. They trust the internet more: it never fails them, it is always available. They shop differently. They communicate differently. Onlineexperiences-first is normal to them.

In order to attract this generation, banks need to be where these customers are. We’re talking about embedded banking, seamless banking, even invisible banking, so that the financial products are available at the point of sale, without the customer having to move to another application.

TFM: How does data and personalisation play into this?

AS: Data is key here. But this is often a challenge with legacy systems that have monolithic databases built around them – making that data usable is a project in itself. Whereas, with a modern core, that data is being streamed all the time, with every transaction and interaction with the core banking system.

Then, the banks have to be smart about using it, because this information is a gold mine – you can understand user behaviour, their habits, what they are spending on and where, whether it’s over the internet, in the shops. Using this information, the experience can be really tailored by differentiating their experience in the journeys they use, as soon as they log into the app.

JZ: Being offered the right product at the right time is one of the

main attractions for Gen Z. I mean, how cool is it if your banking app says on the purchase of your 10th cup of coffee, ‘you’re going to get a discount’?

Gen Z loves this kind of small personalisation and, because fintechs know how to use data, they’re giving it to their customers.

Offering more personalised service and products, based on the customer needs, creates customer stickiness because they feel they’re heard. They feel they’re seen.

TFM: How important are partnerships to this new banking era?

JZ: Fintechs take the partnership approach very seriously. They don’t focus on building everything themselves, which is completely different to what we’re used to seeing from traditional banks, where they want to build everything, from front end to core to the back end.

Fintechs focus on specific partnerships and sometimes strategic partnerships. So, for example, TymeBank [part of the South African banking group that launched with a Mambu core banking system in 2019 and has now expanded into South America and is poised to enter Asia] has partnered with different retailers in order to offer more products to a wider customer base.

If traditional banks want to survive in today’s economy, they need to collaborate more with fintechs, for sure. There’s room for both to work together and create value by offering the right product to the right customers.

They need to focus on what they do best: banks on their customer base, because they’ve already created that trust, and fintechs on their agility, flexibility and ability to create different products at a very fast pace and time to market.

A good example of a collaboration is ABN Amro’s BUUT, a new neobank, specifically for Gen Z, based on Mambu’s underlying technology, which was built with the ABN Amro team behind Dutch payment app Tikkie.

When you see big names such as this involved in such collaboration, you realise they understand the competition, they feel the

The digital experience: Gen Z want nimble and intuitive banking at their fingertips

do it under the regulatory supervision.

The fintechs pay for this, but it is a very innovative model and creates new value for the market. When the customer is looking for clothes or looking for cars, the loan to finance what they want to buy could be available there.

VeloBank in Poland has built on this to create exactly that solution. In this case, when you’re shopping, you can take a photo of the product you like, along with the price tag. Based on the photo, VeloBank will give you an offer for a loan, right there in the shop, which, if you agree, can pay you instantly.

AS: I talk to technology directors all the time, and I often hear ‘my best experts for the current core banking system are now starting to retire’. It’s becoming an issue, and we need to deal with it.

When it comes to innovation, one of our customers has a release cadence of three months, whereas tech companies can release daily – multiple times a day, as soon as the new feature or bug fix is available. And upgrades make the issue worse because sometimes these projects block business as usual and the release of anything that’s innovative.

burn. But it’s great for customers, because they end up with multiple offerings, multiple products, multiple services to choose from.

AS: Collaboration between banks and fintechs is an instance of where two plus two equals five. You get more value than working separately. You can deliver those fintech experiences within the banking context, within the banking app.

But there is another angle to this. The bank does not have to be in front of the customer for many services. For instance, the customer wants to be able to access a loan. But that doesn’t have to happen in the banking channel. Enabling fintechs to use banking products and to innovate around them is also important. Although not a bank, the Polish Credit Bureau, which enabled collaboration with fintechs by providing their data for APIs, illustrates the point. Fintechs can use this data and, instead of the Credit Bureau building new views on the customer, new models, they enable fintechs to

TFM: What are the dangers for banks that delay modernising their core systems?

JZ: When banks delay, they’re increasing business risk, especially when competing against agile fintechs. There are not only the risks around efficiency and cost – dealing with and maintaining those old tech stacks is very expensive. There is also the huge knowledge gap around core systems created when expert employees retire, which they are now doing.

Another risk is related to innovation. Traditional banks face a lot of innovation roadblocks. An average fintech rolls out, on average, 20 to 30 releases or features per year. Traditional banks are barely maintaining the minor upgrades for their tech stack. This inability to be flexible, and to create new features and products, means they can’t keep up with the market.

Cloud-native systems gives them this agility – the ability to create different products, very quickly and gives them time to market.

It’s a bank,

Launching in 2025, BUUT claims to be the ‘first bank developed entirely around the world as young people experience it’.

BUUT uses Mambu’s underlying technology to integrate ABM Amro’s super-successful Tikkie payments platform with AI-powered tools for simplified budgeting and with the parent bank’s full banking services.

ABM Amro says BUUT is a response to the confusion of payment choice available to young people. A 2024 Nibud study found that 60 per cent of young Dutch adults can’t track their spending due to multiple apps, cards, and digital wallets.

At the same time, BUUT recognises that they handle their money differently to previous generations. By adopting an Insta-like interface and solving Gen Z’s financial pain points it aims to disrupt the disrupters and capture this emerging cohort of customers before the neos do.

The performance issues are where the agility issues are. So, you need to focus on the core, otherwise you can do only so much around it in terms of modernising the middleware and front-end channels.

The heavy lifting has been done. Now the moment of truth.

SEPA Instant Credit Transfer is about to go live. What will be the reality for banks and their corporate clients?

When visitors go back to their banks from Sibos, they’ll walk into a new, always-on world of instant payments in Europe. They can rightly congratulate themselves on having got everything in place in time – the heavy lifting has been significant.

But it’s not until Europe pulls that big switch on SEPA Instant Credit Transfer on October 9 that we’ll see the true impact on liquidity and treasury teams.

From that date, all banks are mandated to both issue and receive instant payments. But is it a catalyst for a revolution or an evolution? Specifically, are corporates ready to take advantage of the opportunities that instant payment transfers bring?

We asked Chris Jameson and David Voss of Bank of America’s Global Payments Solutions (GPS) team in EMEA to give their insights into what SEPA Instant payments means for their corporate clients who are dealing both inside and with the European bloc.

For Jameson, Head of Product Management for GPS EMEA, the October deadline marks a ‘hugely important development’ for the banking industry that creates ‘an important change for us and our clients’.

“What we and corporates need are resilience, convenience and security, and the SEPA Instant infrastructure provides all of these things,” he says.

Chris Jameson,

Head of Product Management

for

Global

Payments Solutions EMEA at Bank of America

David Voss, Head of Payments and Receivables for Global Payments Solutions EMEA at Bank of America

“Up until now, we’ve seen instant payments used in sectors such as ecommerce, where there’s a retail element to the payment flow. Now, we’re going to see that open up to other sectors, with SEPA Instant becoming more mainstream.”

Voss, Head of Payments and Receivables for GPS EMEA, adds: “What the regulation essentially does is make SEPA Instant payments just as accessible as SEPA Credit Transfers. It’s put them on equal terms with classical payment methods.

“While we may not see an overnight avalanche [in increased usage of instant payments], clearly, for the industry, it’s a very important milestone, and we see it as a potential inflection point for instant payments to grow.

“It’s a call to action for corporate treasuries to think about what an increase in volume of instant payments means for them. From a treasurer’s perspective, we need to be prepared for scenarios that didn’t exist before.”

With the emergence of national real-time payment systems in the EU, starting with the UK in 2008, the European Payments Council developed SEPA Instant to facilitate flows across the economic area.

It was launched in November 2017 but was only available to businesses and consumers whose banks chose to support it – many charged a premium for using it, and some subsequently withdrew. Mandating instant capability, charged at the same price as credit transfers, breathes new life into the framework.

October’s deadline for all EU banks and payment service providers to be able to send instant payments follows January’s deadline for them all to be set up to receive payments. At the start of 2025, the proportion of credit transfers made via instant payments

in the EU was below 20 per cent – so the potential for growth is huge. But a key implication is the need for banks to have an increased liquidity buffer to cope with money being withdrawn from accounts outside traditional office hours. Conversely, businesses can take advantage of faster money flows that arrive around the clock.

Voss says new payment scenarios include ‘large volumes of instant payments that are coming in out-of-hours – it could be receiving payments in patterns that they’re not typically used to seeing, in terms of liquidity, and that may require them to be more flexible to have different approaches to pooling and payments’.

He adds: “In a digital world, speed is key to our clients, their users and end-users. There is an opportunity now for corporates to differentiate themselves by using speed of payment as a way of more actively managing their liquidity line, and, ultimately, building new kinds of client experience.

“So, we think this is potentially a big change for corporates over time, and one that our corporates will need to look at from both a technology and staffing perspective.”

Jameson says new instant payment use-cases could include wage payments to staff or the settlement of invoices between businesses.

But just because payments can be made at any time, he doesn’t believe firms will necessarily switch overnight.

“Despite us being really bullish about instant payments and SEPA Instant, at the outset, many of our clients will continue to be focussed on ‘on time’,” he says. “Based on their own infrastructure and payments landscape, the clients they have and counterparties they need to pay, they’ll be considering what’s best for them.

“Many large companies have run their treasury organisations in a certain way for many years. They will be

using batch processing structures, and using instant payments would be a material shift from a process and technology perspective for many corporates.

“Some of the newer companies that have grown in the last 10 years will be digitally native, API native and will be ready to move quickly, and some are already using SEPA Instant, for example, with us, via API.

“But, for other companies, this will require a lot of effort. They will need to evaluate their current processes and infrastructure and consider whether the benefits outweigh the costs of making a change.

“Some will want to move to instant collections. From a working capital perspective, that definitely makes sense. Corporates could collect money faster and perhaps pay money slightly later, so that could be a first step, and it’ll be a gradual process for clients to move along that continuum.

“When you start to make payments 24/7, your treasury team and your accounts payable

teams may also need to align their availability accordingly. How do you build out the talent within your corporate treasury organisation that can facilitate that across time zones and 24/7? There’s a lot for clients to think about.”

Jameson also points out that the data richness offered by SEPA Instant will allow for more automation of reconciliation processes, and thereby reduce administrative costs. It could even result in lower prices all round – for both SEPA Credit Transfer payments, which typically clear in one day, and SEPA Instant payments, which cannot cost more than its slower cousin under the regulation.

“A treasury team may be able to leverage SEPA Instant to solve a new challenge or opportunity within their business, and doing that would help them justify the technology

From a treasurers’ perspective, we need to be prepared for scenarios that didn’t exist before David Voss

build and dip their toe in the water from a SEPA Instant perspective,” he suggests. “Then, if there is an opportunity for them to shift some of the core SEPA Credit Transfer activity and move that across, that will come over time.”

Regarding use cases that suit SEPA Instant payments in the near term, Voss and Jameson can draw on what they’ve witnessed in other regions when instant payment systems were rolled out.

Jameson suggests insurers could use it to forward cash to policyholders in the process of making a claim – for example, someone with injuries who needs to pay for care in a foreign hospital. Likewise, emergency payments of social security benefits is another ideal candidate for SEPA Instant.

Voss adds: “Logistics, cash-on-delivery and anything that’s related to movement of goods is a key place to look at. If you l ook at the finance area, beyond insurance, things like high-value deposits, auto deposits, mortgage deposits. These kinds of use-cases come into play as well.”

A point of inflection: SEPA Instant Credit Transfer is a game-changer

Under the EU Instant Payments Regulation, a SEPA Instant payment must be received, with funds available to the payee and confirmation sent to the payer’s payment service provider, within 10 seconds.

In an effort to mitigate against criminal activity, from the October 9 deadline, EU banks must screen all customers daily against EU sanctions lists. Banks are managing potential fraud threats with a range of screening systems to flag problems and reduce volumes of false positives.

Payment service providers must also facilitate SEPA Instant’s Verification of Payee feature from October 9 [see also CBI’s Name Check tool, page 16], which cross-checks the payee’s account name and IBAN. If they don’t match, the payer is alerted.

focus on fraud risk. That was certainly seen in Brazil with Pix.”

Instances of ‘lightning kidnappings’, where people were forced, often at gunpoint, to initiate a Pix transfer, soared in Brazil within a year of the payment system’s introduction, and the government was forced to take measures to limit its use.

Real-time payments mean the money goes out of the door in real-time, and that equates to real-time fraud, too.

“In the UK, a 50-50 liability split [between the respective payment service providers involved in an authorised push payment fraud] was brought into play.

“There was a high [liability value] cap, which ultimately came down because that would have been extremely restrictive for some smaller PSPs to operate in the market – the

parties outside the SEPA zone via its One Leg Out Credit (OCT) Instant scheme, which can allow payments from across the globe to arrive in participating EU bank accounts in seconds, 24/7, via an entry-payment service provider within the SEPA zone.

Voss says: “There are clear opportunities for cross-border real-time payments to really take off. That is something that many of us in the industry have been working on for many years, and for which there is a lot of client demand.

“They are looking to manage their liquidity position for all of their trade, including complex supply chains, so this becomes something that is really high value.

“As the SEPA scheme goes live and matures, we have to think how we can help move money cross-border in a real-time fashion. As a global bank that has witnessed and participated in many of these schemes in other parts of the world, we realise there remain challenges, but we’re already seeing good examples of collaborations, whether that’s between India and Singapore, or in the Middle East, based on ISO 20022 or other standardisation.

“There are also other initiatives, from Swift, or, in the SEPA space, there’s the OCT Instant initiative, largely used at the moment by banks in Spain and Andorra, but there’s an ongoing consultation about potentially expanding that.”

For Jameson, the fact that SEPA Instant payments feature ISO 20022 messaging standards gives him hope that global connectivity isn’t too far away.

It's a small world: Will regulation see global instant payments become the norm rather than the exception?

Ultimately, much of the responsibility to minimise fraud is carried by payment service providers. But once money is transferred to a payee’s account, it’s gone, and consumers and businesses don’t have the consumer protections offered by a credit card payment, for example.

While Jameson and Voss believe Verification of Payee will go a long way to boost confidence in SEPA Instant payments, they say more will continue to be done at an industry level.

“As a global bank, we’ve benefited from insights from other parts of the world.” says Jameson. “So, if you think about Brazil and its Pix infrastructure, or India with UPI, where some of these payment systems have grown rapidly, there’s been an increased

liabilities would have been so significant for any payment that they initiated.

“For the EU, Verification of Payee is really being pushed as the main protection tool as we go into the real-time payments era. But I do think there’s more work needed around that liability piece.”

After decades of navigating labyrinthine global payment systems, the holy grail for instant payments is surely integration that allows money to flow in real-time between continents.

The latest milestone for SEPA Instant Credit Transfer mandates access to the system for all EU bank customers. But more than that, the European Payment Council provides access for

The huge body of work the industry has done around ISO 20022 will be a core foundation to build on for that interoperability we’re all looking for Chris Jameson

He says: “The huge body of work the industry has done around ISO 20022 will be a really firm foundation. It won’t be a silver bullet that ties all of these infrastructures together, but it’s certainly a core foundation to build on for that interoperability that we’re all looking for.

“From an interoperability perspective, the ISO layer underneath SEPA Instant will be a major facilitator. And all of this is tied into what the G20 was trying to achieve by 2027 in terms of faster, cheaper, more resilient cross-border payments which will come about by tying these real-time payment schemes together.”

Open

TSB

banking and AI

have contributed to a turnaround in UK bank

’s lending procedures. It empowers customers with detailed information about their financial circumstances and provides the bank with more accurate risk ratings

“Data, data, data” – that’s the mantra of Delphine Emenyonu, who heads up Unsecured Lending and Open Banking at UK retail bank TSB. And its use at an increasingly granular level is at the very heart of the bank’s drive to better serve and grow its more than five-million-strong customer base, particularly when it comes to fair and affordable lending decisions.

That has meant leveraging open banking and AI together – a powerful combination that has not only resulted in creating safer, more personalised borrowing for its customers but also substantially reduced the number of missed payments they make.

Through real-time analysis, Open Banking enables much more precise income and expenditure assessments.

Emenyonu says: “With a click of a button, we give customers clear visibility of their expenditures, so they can really understand what they can afford. With all that data, we can then guide our customers – maybe in how they can potentially reduce expenditure to enable them to pay for what they need. That’s the first element.

“The second is income verification. Gone are the days when you had a job for life. Customers move jobs all the time now, and, in the gig economy, people’s incomes change, month to

Delphine Emenyonu, Head of Unsecured Lending and Open Banking at TSB Bank

month. While the average consumer might not understand how much they really earn, by leveraging open banking, we’re now able to categorise all that income information and give it back to them, to help them make more informed decisions.”

Keeping the customer in the loop and ensuring they are provided with easy-to-understand personal financial information is not only important at a societal level (up to seven million people in the UK are deemed to be at risk of financial exclusion due to limitations in the information used by providers that make key decisions that shape their lives), but it can also help banks stay within the UK’s Consumer Duty law and not fall foul of irresponsible lending regulations.

Now, more than two years into a tech-enabled project to bring Open Banking, personalisation and data-driven financial marketing to life – with a mission to create money confidence for its customers – the bank’s digital strategic reset is starting to bear fruit.

Open and insightful

By 2024, it had the data to be able to reach out to more than 120,000 customers who were at heightened risk of falling into financial difficulty, to offer extra support and help them to avoid personal financial harm.

A step in the right direction: TSB is using data to help customers better manage their finances

Its own probe into overdrafts identified a set of customers who did not have direct debits set up, affecting their credit score when they failed to pay on time. It resulted in a significant uplift in payments in the first week after the bank sent personalised messages to those affected.

Things are undoubtedly tough for many consumers. Millions continue to experience their own cost of living crisis, which was starkly highlighted in a 2024 survey by the Civil Justice Council that found about 28 per cent of adults were not coping financially. It’s an area where Emenyonu passionately believes TSB can help its customers through the use of open banking and AI.

“The current lending stack is very much based on bureau data,” says Emenyonu. “But the reality here is that there is a lag within that data. If you, for example, change your job in February, then you apply for a lending product in March, the information that the bureaus have is based on the information they had as of January.

By leveraging open banking we’re now able to categorise all that income information and give it back to customers, so they can make more informed decisions

“The beauty of Open Banking is that if you apply for a loan and say ‘my new salary is £50,000’, we can see that has come into your bank account to support with a lending decision. So I do think that open finance is going to play a great role in terms of improving financial inclusion as well.”

When it comes to repaying loans, specifically business loans for those who took advantage of the 2020 Bounce Back Loan (BBL) scheme, TSB has an ongoing relationship with Flexys, which provides collection management technology, based on real-time insights provided by open banking. TSB is using it to help customers manage their BBL repayments and Pay As You Grow options.

And, as financial literacy has a direct impact on how well customers handle their money, TSB also runs a schools education programme for pupils aged from 13 to 18. The programme encourages students to complete short learning modules to boost money confidence.

“It’s focussed on supporting them in reducing financial anxiety, but also really improving the understanding of finance,” says Emenyonu.

TSB is working hard to help its older customers overcome the barriers they face in an ever-changing digital world, too.

“I see TSB as a digital bank with a human touch,” says Emenyonu. “We are very fortunate in that our brilliant team of Money Confidence Experts is available in our branch network, as well as on the phone, on video call and online – meaning all our customers, including older customers, can access the support they need from a person. Having that human interaction does make a difference.”

The continuing development and increasing use of digital wallets – UK consumers are now the third heaviest users in Europe behind Denmark and Norway – is a key part of TSB’s tech drive.

“From an industry perspective, I think the UK is moving towards what I consider to be a smart-wallet-first society where payment is instant, intelligent and identity-based,” Emenyonu says. “Our role is to enable that ecosystem safely for customers who wish to use it, but at the same time, anchor it to ensure money flows securely and inclusively. It’s not just about payments, but also working with customers in terms of identifying the value that wallets have.”

Eastnets’ Hazem Mulhim and Daoud Abdel Hadi on why they’re convinced AI is the enabler for effective compliance and enhanced fraud prevention

“The fight against financial crime is no longer just a regulatory obligation; it is central to preserving trust in the financial system. As criminals adopt advanced technologies, banks and regulators must move just as fast, if not faster. At Eastnets, we believe artificial intelligence is not simply another tool, but a turning point: it enables compliance teams to move from chasing alerts to preventing crime before it happens. This is why AI must be embedded at the heart of the compliance model, explainable, scalable, and always aligned with global regulatory expectations.”

Hazem Mulhim, CEO, Eastnets

Our CEO is right. Financial crime is evolving at a rapid pace, and we’re seeing an explosion in sophisticated new fraud tactics.

According to a 2024 Regula survey, nearly half (49 per cent) of businesses worldwide reported experiencing deepfake or AI-related scams, which resulted in losses per company reaching $600,000.

The creation of synthetic identities, cross-border mule networks co-ordinated via the dark web, and the use of privacy coins and decentralised mixers in crypto laundering are all on the rise. For banks and institutions, tackling these tactics is one thing, but they must do it against an increasingly complex regulatory environment. It requires a new approach to both fraud and compliance – one that goes beyond the traditional models in use today.

Legacy systems rely on fixed rules that often lack the nuance to distinguish between suspicious and benign activity, leading to high false positive rates, operational inefficiencies, overwhelmed compliance teams, and ballooning compliance costs. More critically, these rigid systems also divert attention away from complex, high-risk cases that demand deeper investigation.

The result is a compliance model that’s reactive, inefficient, and increasingly unsustainable. And this is where artificial intelligence (AI) comes in. It’s revolutionising how banks and financial institutions meet today’s challenges, not by replacing human judgment, but by enhancing it.

AI offers a smarter, more scalable alternative. By learning from vast historical datasets, AI models can identify patterns of both legitimate and illicit behaviour across thousands of variables – something static rules simply can’t do.

Automated systems can detect subtle anomalies and evolving fraud tactics, and prioritise high-risk alerts with greater precision, reducing false positives and operational overhead. AI not only increases the accuracy of alerts but also enables compliance teams to focus on what matters most: investigating genuinely suspicious activity and staying ahead of emerging threats.

And, of course, AI can continuously adapt with new data, which is vital in an evolving ecosystem with ever-more sophisticated scammers and fraudsters.

If you want to move compliance and fraud detection from a reactive burden

Hazem

Mulhim, Chief Executive Officer at Eastnets

Daoud

Abdel Hadi, Data Science Lead at Eastnets

to a proactive intelligence-driven function, AI is now a must-have.

But the transition to AI can seem daunting for banks and institutions. That’s why we, as a global provider of financial crime compliance and payment solutions, implement AI using a three-step phased approach, enhancing what institutions already use and gradually building trust rather than a one-and-done switch-over from legacy systems.

First, using an institution’s existing transaction data, we insert our Calibration Module, which works on refining the existing rule thresholds. It does this by simulating various rule settings and scenarios before recommending the optimal thresholds to use, each tailored to specific customer segments.

There is no one-size-fits-all approach to this, and by segmenting clients into more homogeneous groups, banks and institutions can significantly reduce false positives.

Next, with an optimised rule system in place, we deploy AIDa (AI Detection Advisor), a machine learning engine that predicts which alerts are likely to be false positives. AIDa is able to do this by analysing and learning from past alert outcomes, intelligently suppressing low-value alerts and sharpening its focus on truly risky transactions.

With a strong AI foundation now established, we introduce an advanced deep learning model that is able to identify when an entity’s actions

diverge from historical patterns, flag when a client behaves significantly differently from others in their segment, and map suspicious clusters and relationships within financial networks.

These insights provide compliance teams with much richer, smarter and more informed views of risk, empowering them to spot sophisticated laundering schemes and hidden financial crime networks. A human member of the compliance team can then investigate further, knowing that the due diligence has been completed beforehand.

In a regulated industry, black-box solutions won’t suffice. In accordance with the EU AI Act, any AI system used in credit scoring and fraud detection is subject to stringent requirements. And this is why our suite of AI solutions offers, as standard, everything needed to be explainable and auditable.

We embed explainability into every single AI-generated alert, offering clear, plain-language justifications and visual tools, like link analysis and behaviour charts. Before deployment, we provide comprehensive documentation, outlining the model’s design, methodology and intended use.

During an in-depth, pre-deployment analysis phase, our data scientists run simulations using the bank’s historical data, fine-tuning the model to align with the institution’s specific risk profile and operational realities.

This process ensures the bank has a clear, upfront understanding of how the model will perform in day-to-day scenarios, fostering trust and accountability from day one.

As AI capabilities continue to evolve, the next major leap lies in agentic AI; intelligent systems that are capable of acting as digital compliance assistants and operate beyond simple question-answering.

They can ingest multiple large data sources and use third-party applications to independently answer your queries, analysing challenges, developing strategies and executing tasks.

Imagine an AI agent being alerted by the transaction monitoring system after a particular entity is flagged. Instantly, it initiates a comprehensive investigation, gathering and synthesising data from both internal and external sources. Within moments, it produces concise, coherent, and actionable insights, enabling

the investigator to make a well-informed decision about whether the entity’s activity is genuinely suspicious.

And it doesn’t stop at surface-level checks. The agent can autonomously review the outputs of related rules and models, analyse historical alerts, and assess transaction patterns over time. Simultaneously, it scours external data sources such as news articles or public databases to uncover any additional context that could inform the case.

The result is a thorough, context-rich narrative that brings clarity to even the most complex scenarios, saving valuable time and effort for human investigators. When it’s time to file a suspicious activity report (SAR), that too can be just a click away. The agent can generate a detailed and well-structured write-up, incorporating all relevant findings and insights, streamlining the reporting process while enhancing its quality and completeness. All from a single user query.

Agentic AI will free up human officers, allowing them to transition into strategic oversight roles. They can then use their expertise for high-value decision-making rather than time-consuming reviews. It promises to revolutionise the world of compliance, allowing banks and institutions to work with speed, precision and scalability.

AI promises to revolutionise the world of

compliance, allowing banks and institutions to work with newfound speed, precision and scalability

And Agentic AI is closer to reality than many think – we’ve already embedded large language models (LLMs) into key compliance workflows, enhancing sanction screening and detecting trade-based money laundering risks such as

over- and under-invoicing. For example, we’ve built a lightweight AI agent that’s capable of browsing the web to validate the market pricing of goods and services, an early demonstration of autonomous, real-world decision support.

But this is just the beginning. By the end of 2025, we will launch a fully capable agentic AI copilot designed to support investigators across sanction screening, AML, and KYC.

This next-generation assistant will allow compliance teams to interact with the AI through natural language, enabling it to retrieve relevant data, summarise alert histories, and provide contextual insights to support human decision-making.

And we’re actively developing the core agent framework, validating use cases with clients, and conducting rigorous evaluations on real-world data. Our focus is on delivering transparent, explainable, and regulation-ready agentic AI that works seamlessly within existing compliance ecosystems.

Financial crime and regulatory complexity mean that banks and institutions can no longer stay static; they have to move with the times. Compliance doesn’t have to be a burden. With the right AI strategy, it truly becomes a strategic advantage.

“What gives me confidence is that this is not a distant future; it is happening now. Institutions that embrace AI today will not only cut costs and reduce risk, they will also gain a strategic advantage in speed, precision, and resilience. At Eastnets, we are committed to ensuring that this transformation is safe, transparent, and built on trust. Compliance is evolving from a burden into a source of competitive strength. And AI is the catalyst.”

Hazem Mulhim,

CEO, Eastnets

When Akber Jaffer took over as CEO of data solutions provider Smartstream in 2023, its reputation as a global financial technology giant among more than 2,000 clients – including the majority of Tier 1 institutions – was already firmly cemented. Understandable, therefore, that the new boss wouldn’t rush to shake things up. Instead, he invested time listening to colleagues, clients, and the market, before starting to chart a bold new strategic course for delivering automation and operational excellence with AI at its core. And he is signalling that intent through a rebrand designed to reflect both Smartstream’s evolution into a more agile, AI-driven partner to its existing financial services clients while raising its profile in other data-driven industries and markets.

There’s a change to the Smartstream domain, refreshed messaging, a new website and a product naming strategy whereby each solution now carries the ‘Smart’ prefix.

We asked Jaffer to talk us through the rationale behind the new visual

identity, with its interlocking links representing an industry shift from the transactional provision of software-as-a-service (SaaS) bolt-ons to relationship-based interconnectivity, and his broader vision for Smartstream as he takes it into a new era.

THE FINTECH MAGAZINE: Tell us about the journey that’s brought you to this rebrand, and what it means for Smartstream’s strategic direction.

AKBER JAFFER: Smartstream is widely recognised as a mission-critical part of our clients’ business operations, unlocking insights from very complex data for them. We wanted to reflect the value we were providing with the right narrative.

The rebrand has been about making sure there’s a clear articulation and understanding of our business, what we stand for, the value we deliver, how we should be perceived and the kind of relationship we want to have with our clients and the relationship they want to have with us.

Akber Jaffer,

Chief Executive Officer at Smartstream

I’ve been CEO for just under two years now, so this change isn’t something that happened straightaway. It’s been percolating in the background and resulted from having conversations internally and talking to customers about the core value of what Smartstream provides. We consulted internally, too, to make sure all views were reflected, which is why it took a little time to complete – and our people feel really good about it. So, the end result you see is a reflection from multiple stakeholders, including our own folks.

It’s also important to recognise we come from a place of having done some really great work with great brands – particularly in the capital markets, financial services and investment management space, both buy side and sell side – as well as on a broader basis with insurance and other corporates.

TFM: So, you’ve obviously taken the time to really understand not just Smartstream but its stakeholders, too. How

Rebranding is tricky for a company as established and respected as Smartstream. But with AI broadening the customer base and transforming its relationships with existing clients, CEO Akber Jaffer has decided it’s time for change

has that period of reflection impacted on your view of future priorities?

AJ: There are shifts going on in the market, in terms of how insights are garnered from data, and we’re seeing a marrying of human intelligence with artificial intelligence (AI). As consumers, we can see the real value of that and, increasingly, business is acknowledging it, too.