THE LURE OF LATAM

THE LURE OF LATAM

Why Nium and PPRO both headed south

aaS

Fifth Third’s blueprint for embedded success

Top-tier banks reveal their strategies

THE ‘OTHER’ AI Is Angst and Indecision crushing your CFO?

6

A tech tonic for CFOs

Pleo’s new report reveals just how much stress finance leaders are under, a lot of it driven by too many tools – and never the ones they need! So how can the platform help?

8 CORE MODENISATION

From tomorrow to ‘now’

As legacy systems drag on profitability, and fintech challengers reshape expectations, Temenos redefines modernisation, putting banks back in control of their future, as William Moroney explains

12 ARTIFICIAL INTELLIGENCE

A healthy approach to AI

RBI’s Renato Rocha Souza takes us on a deep dive into the bank’s business-centred approach to AI adoption, and ponders the dangers of the ‘culture war’ between developers

14 SPEED & COMPLIANCE

The AI balancing act

Data transparency and transaction security are two sides of the same coin. By bringing together specialists in each and leveraging AI across a single platform, Vyntra amplifies their powers 8

The next-gen CISO

In the escalating war against cybercrime, defence is the best offence – but that doesn’t mean it’s passive, says ING's Debbie Janeczek

Making global local

A new licence in Brazil has strengthened Nium’s position as one of the most comprehensive infrastructure services powering cross-border payments

6

If you’re reading this hot-off-the-press issue at our Fintech Awards in London, firstly: what ARE you doing? Go party!

Secondly, we hope the Awards are a welcome distraction from worrying about what’s going on down the road at No. 11 Downing Street right now.

Is the Chancellor burning the midnight oil, revising her much-trailed plans to plug the fiscal black hole with a bung of stealth taxes? And, when she opens the battered budget box (that’s the state of her fiscal plans, not the box itself, which is fairly new), will entrepreneurs get a hammering?

There’s been talk that, even if they run for the UK exit, there’ll be an HMRC inspector at the door, demanding a farewell fee. But, if you are thinking of relocating, where would you go? Our cover feature on Fintech Islands explores some possible locations.

Meanwhile, much of the rest of this issue is dominated by AI – also known as Angst and Indecision in the CFO’s office, according to business spend management platform, Pleo.

Its report reveals that financial leaders are facing an overwhelming number of critical business decisions that are made harder by technology, not easier.

As we rush towards peak AI, it's worth pausing to read Pleo’s advice on page 6 about making savvy choices.

So that’s it for 2025. Go hang out with some real people and have fun.

See you next year... unless, of course, you're rowing furiously for a smaller island!

Sue Scott, Editor

This issue's spinetingler is, appropriately, a joke generated by ChatGPT.

22

FINTECH ISLANDS

Start-ups in Paradise

Seemingly, small jurisdictions have a disproportionately large interest in fintech founders. If living and working on an island appeals to you, perhaps it’s time to set sail

26

FINTECH ISLANDS

Lift-off in Barbados

As the Caribbean island charts a real-time path, Payment Spayce is already looking at the next frontier

28 CROSS-BORDER

Check, check… and check!

Having launched its own IPR-compliant Verification of Payee service with added-value features, Italy’s financial utility provider CBI is ready to ‘revolutionise’ B2C transactions with fast, seamless and cost-efficient Request To Pay

30 ARTIFICIAL INTELLIGENCE

Agents of change

While Citi’s 4,000 human AI Champions are driving a new operational era at the bank, its new platform is poised for an agentic upgrade

32 A2A PAYMENTS

A tough gig

The fast-changing nature of work in the US is demanding new, real-time financial solutions that reflect a much more unpredictable household income. Dwolla and Ualet are providing one alternative, using A2A rails

36

Crossings and corridors

How PPRO’s Therese Hudak sees the next frontier for US to LATAM payments

40 MIDDLE EAST

A dawning realisation

Local banks in the Middle East are dependable and profitable – the backbone of the financial services system. But the market is changing, and its culturally specific demands create particular challenges for any modernisation programme. So how should they go about it?

44 EMBEDDED FINANCE

Follow the yellow brick code BBVA was determined to find its own way across the new financial landscape by embracing open banking early and going into co-opetition with challengers. Carmela Gómez describes how it’s now pushing further

46

BANKING AS A SERVICE

Time to step up

With a storied history of payment innovation, Ohio-based Fifth Third Bank believes it’s providing a blueprint for others to follow with the embedded payments business, Newline

48

CROSS-BORDER

Setting African payment flows free Freemarket is working alongside Axiym and Fincra on improving cross-border payments in what is potentially one of the biggest wealthcreating regions in the world. But technology is just one part of the solution. The other is trust

Pleo’s new report reveals just how much stress finance leaders are under, a lot of it driven by great expectations created by too many tools! So how can the platform help?

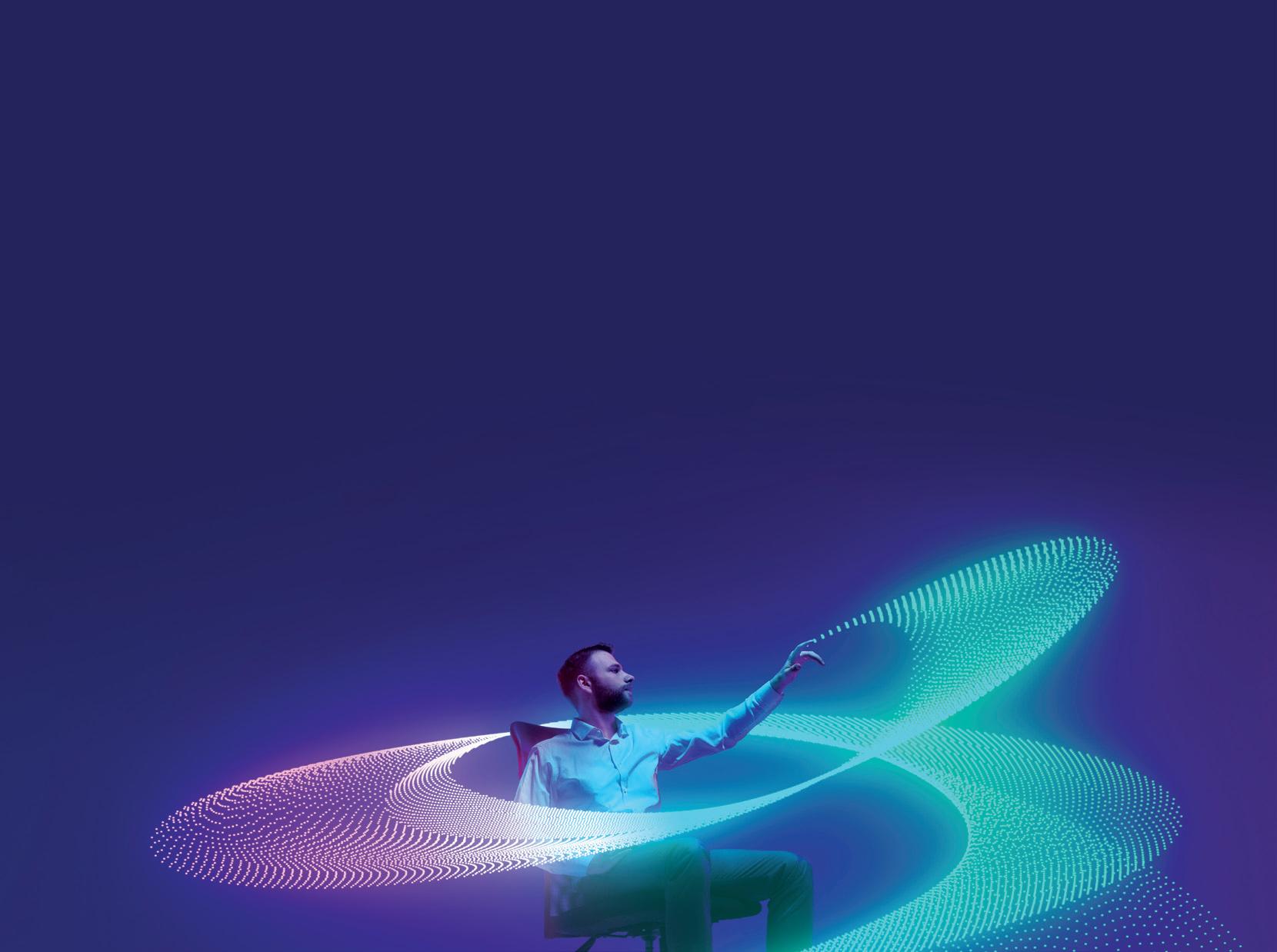

Who’s the most stressed-out individual in your C-suite right now? According to a recent survey of 2,650 financial executives and decision makers across Europe, it’s probably your CFO. And the sleepless nights, days of gut-clenching anxiety and round-the-clock indecision are taking their toll – not just on the officeholder, but also on the organisation, impacting its bottom line performance and team morale.

The irony is, in an age of being constantly told intelligent, labour-saving technology can improve our output and liberate us to be our best selves, many of the most important people in the room are, in fact, suffering tech shame. They’re struggling to realise the elevated expectations placed on them as a consequence of all these tools. And that, not surprisingly, is leading to a collapse of confidence. It’s a vicious and punishing cycle. Søren Westh Lonning feels their pain. He’s the CFO of Pleo, the fintech behind the report, The Power Of Better Business Decisions, and his peers have been telling him privately what the report makes public: ‘we’re in decision-making crisis’.

“What I hear a lot is that the data availability is growing exponentially, as is the ability to record and track

so many more metrics,” he says. “But turning that into insights that give you clarity of where to go as a business doesn’t match the data growth. There are higher expectations that you will be able to make informed decisions and faster decisions, but you can’t.”

The Danish unicorn that built its success on being a pure-play expense management platform, has recently evolved to become more of a much-needed tech tonic for CFOs.Because, while their role has been transformed from number cruncher to strategic influencer in less than a working lifetime, they often don’t have the corresponding insight into the business to make crucial decisions that never used to be part of their job spec. Top of that list is (increasingly AI-driven) tech investment – which 32 per cent cited in the report as being the most difficult call they’re asked to make. And for good reason.

A report by Gartner in May 2025 revealed that 72 per cent of organisations are only breaking even or are losing money on their AI investments.

Taking the strain: New solutions can relieve some of the pain for CFOs

“For every AI tool organisations buy, they should anticipate 10 hidden costs plus the transition costs of training and change management,” said Gartner, adding, “If organisations don’t get the technical capabilities right, value returns will be fragile and prone to failure.“ No pressure, then, CFOs!

The honesty with which thousands of finance leaders responded to Pleo’s polite inquiries about their state of mind and management, indicates just how vulnerable they are feeling in the role. Nearly half felt stressed; around a third were losing sleep; a similar number admitted to suffering anxiety; and a quarter owned up to indecision.

That last should set alarm bells ringing, because their naturally analytical, numerically predisposed natures then led them to make some stark observations. There was a direct line, they said, between poor financial decisions and lack of business growth (29 per cent), loss of revenue (28 per cent) and cashflow problems (24 per cent).

With brave self-awareness, they also admitted decision freeze had led to missed business opportunities (23 per cent), decreased business efficiency (22 per cent), and many felt bad about how their performance was affecting their teams, with 18 per cent pointing to high levels of employee frustration.

So, what’s to be done about it?

Well, Pleo’s respondents were clear on that, too: better communication and information exchange across their organisations, with improved collaboration, real-time insights and visibility of the data, as well as something to boost their own professional self-confidence.

The fintech has responded – with some clever artificially intelligent tools, yes, but also, respecting the candour with which finance leaders shared their deepest fears, an honest caveat.

“You have to be mindful of where a tool can make a real difference to you,” says Lonning. “That level of intention is critical. It’s difficult to say you should have ‘X’ number of digital solutions, but what you should look for is tools that can do multiple things and cut across departmental functions.

“So, keep in mind when you select a tool how well it integrates, because

when these solutions flow seamlessly together, it makes things so much easier for the user. That’s high on our radar, too – Pleo’s solutions integrate well with HR and ERP systems, for instance.”

The fintech, which has just celebrated its 10th anniversary, can confidently claim to give the reliable insights CFOs crave, thanks to the critical mass of data it processes across 40,000 SMEs in 16 European countries. That’s not only helped it design a new, intelligent cash management solution, but it will also allow clients on its higher-tier plans to benchmark their performance against similar organisations, giving strategic context to a CFO’s advice.

The cash management tool, currently in Beta mode with select customers, is the latest, powerful addition to Pleo’s intuitive platform that already gives employees smart company cards, automates expense reports, and provides real-time tracking of all company spending.

Data availability is growing exponentially as is the ability to record and track so many more metrics. But turning that into insights that give you clarity of where to go as a business doesn’t match that growth

“Cash management is more about managing the organisation’s funds and their availability,” says Lonning. “Even if you are operating in multiple countries with different banks, it allows you to automatically connect them in a single platform and provides a view of all the money a business has in one cockpit.”

It addresses one of CFOs’ key asks: for confidence and control.

“These are sensitive figures that treasury management doesn’t outsource to anyone, so automating them helps the most senior people in the finance team,” says Lonning. “They can create rules to automatically transfer funds from one account to

another to take advantage of higher interest rates, for example. In effect, it’s optimising fund management.

“We’re excited to see how much time it’s saving CFOs and how it’s helping support their decision-making,”

Another key area creating strain for finance leaders is a simpler one for Pleo to solve – because it’s embedded in its DNA. While every organisation is different – and Pleo’s customer base is hugely diverse – its simplified approach to spend management is based on integrated, seamless flows, plugging HR into finance teams, and giving instant, real-time visibility of every expense and invoice.

“The way we can help with collaboration across the organisation (or lack of it!) is related to people using the same source of information,” says Lonning.

“Many companies struggle with departments producing slightly different reports in a slightly different way. It’s a complicated area, but we try to make sure people operate on the same data source and follow the same rules for document making. And we’re continuing to bring even more innovation to address that need.”

While Pleo is working to solve current finance leaders’ frustrations, the good news is that Lonning believes the next-gen CFO won’t have anywhere near the same level of stress to deal with.

“Younger finance leaders are more savvy when it comes to understanding the tools, data and neural technology,” he says. “The profile and background of these leaders has shifted, too. I meet more and more CFOs who have not followed the classic audit background. They have a naturally strategic mindset… which is related to technology and AI.

“That’s not to downplay the traditional skillset of the CFO – you need to have that in your toolkit, or a strong team that covers the bases. You cannot replace a strong understanding of what’s going on under the hood – the data that’s being processed. But the overall balance [between these two skill sets] has changed.”

The CFOs today are making decisions that the CFOs of tomorrow will inherit. With Pleo, there’s a stronger chance they’ll be the right ones.

As legacy systems drag on profitability, and fintech challengers reshape expectations, Temenos redefines modernisation, putting banks back in control of their future. Will Moroney explains how

Three decades after the industry first began talking about modernisation, banks are finally doing it, and doing it fast.

Artificial intelligence is no longer a promise on the horizon but the accelerant in the engine. The ‘tomorrow’ approach has given way to a ‘now’ culture, and Temenos finds itself in the middle of what Will Moroney describes as a ‘perfect storm’ of transformation: the pressure to modernise – again.

Back in 1997, when Moroney, now Chief Revenue Officer at Temenos, first entered the game, it was Y2K that spurred the urgency to renew. “Then came digitisation, then big data,” he recalls. “Now, AI is what’s pushing the requirement to modernise.”

But this time, the pressure isn’t just technological, it’s financial, too. Legacy systems are now an active drag on profit.

According to recent figures, banks in the UK now spend an estimated £3.3billion each year on maintaining outdated core systems – roughly a quarter of their total IT budgets. And across global institutions,

Will

Moroney,

Chief Revenue Officer at Temenos

transformation costs are rising while returns are flattening.

The industry’s compound annual revenue growth sits around four per cent, while non-interest income has fallen nearly 20 per cent per asset over the past five years, according to The True Cost Of Legacy Systems: A Deeper Dive Into Banking IT Modernisation report from Digital Bank Expert

At the same time, fintechs are eating into banks’ income potential and their customer relationships. The result, says Moroney, which they could arguably have seen coming, is ‘modernisation under pressure’.

“We’re hearing it everywhere,” he explains. “Banking leaders must show they can work with AI, not just talk about it. That means modernisation under pressure. It means modernisation that delivers impact now.”

For all the noise about chatbots and digital assistants, the real story in banking AI is happening behind the scenes – in data management, infrastructure, and regulatory compliance.

“There’s definitely an appetite for understanding what AI brings to banking technology,” Moroney says. “But, crucially, there’s also a growing understanding that it’s not just about using AI in the customer layer. That might only be 10 or 15 per cent of the capability. The rest is internal – fixing errors, cleaning data and reducing false positives when protecting against financial crime.”

The hard truth, he adds, is that most banks aren’t ready.

“Once they see what AI can do, they realise they don’t have the data structure, the infrastructure, or the regulatory clarity to support it. AI readiness has become the first big topic in every client conversation.”

This readiness gap comes at a time when technology spending has never

been higher. Yet revenue is falling: despite average tech investment growing by nearly nine per cent a year, bank productivity has declined by around 0.3 per cent annually since 2010, according to The Financial Brand’s analysis, which references figures from Boston Consulting and McKinsey.

The industry is still weighed down by compliance complexity and legacy debt. This is why, Moroney says, ‘banks can’t afford to wait for perfect conditions anymore. Artificial Intelligence is exposing every inefficiency they’ve tolerated for too long’.

At this year’s Temenos Community Forum (TCF) in Madrid, banks, regulators and technology partners debated not just AI’s potential, but how to introduce it responsibly.

As Santander’s José Manuel de la Chica put it at the time: “We’ve moved from deterministic to probabilistic systems. The agent is the new API, but there must always be a human in control.”

is of the essence: Banks must face the reality that slow modernisation means sluggish profitability

Banks can’t afford to wait for perfect conditions anymore. AI is exposing every inefficiency they’ve tolerated for too long Will Moroney

If patience was once a banking virtue, it’s now a luxury few can afford. After nearly three decades of talk about core modernisation, executives are understandably losing interest in the idea of five-year journeys and want to see what can change this quarter.

“There’s more of an interest in ‘how can I have an immediate impact in one of my business lines, in the next six months?’,” says Moroney. “And ‘can we look at a minimum viable product that delivers real results, and then build from there?’. The market’s just not waiting anymore.”

The numbers bear him out, too. The KPMG study, State Of The Banks, from earlier this year, suggested UK banks’ return on equity

will drop from roughly 13 per cent in 2023 to just eight per cent by 2027 – equivalent to £11billion in lost annual profit. Meanwhile, new digital challengers and embedded-finance players are siphoning deposits and transaction revenue at record pace.

This demand for immediate, measurable value is also reshaping the vendor-client relationship. Banks want partners that can deliver in fast, iterative bursts, and vendors who will share accountability for outcomes.

Temenos’ response has been to re-engineer its own organisation around the full customer lifecycle – uniting sales, delivery, customer success, and partner management under one CRO-led structure.

“When we started that transformation, the goal was simple,” Moroney says. “Put the customer at the centre of everything we do, from first touchpoint to renewal.”

At TCF 2025, Temenos showcased what it calls ‘modernisation with immediate impact’. By that, it means modular architectures, Cloud-native components and AI-assisted delivery tools that cut months from project timelines. In the first half of 2025 alone, Temenos supported more than 150 go-lives with clients globally – a figure the company sees as proof of its ability to execute at scale.

Barb Morgan, Temenos’ Chief Product & Technology Officer, described the company’s product philosophy shift succinctly: “Build less, but smarter. Focus on what really makes the dial creep.”

That approach is driving a whole host of new collaborative initiatives, including

a Design Partner Programme, inviting banks to co-create products and prototypes that solve immediate pain points.

And AI isn’t just something Temenos enables for clients; it’s also using it internally to accelerate its own delivery. From analysing legacy code to automating testing cycles, AI is speeding up execution and, crucially, freeing people up to focus on higher-value work.

Perhaps the biggest change is not in technology but in mindset. Banks no longer want a single vendor to ‘do everything’. They instead want ecosystems – open frameworks where specialised partners collaborate.

“Instead of looking for one big partner that will do everything, banks are asking ‘how do we build an ecosystem?’,” says Moroney.

“That’s where we fit in – proven technology, domain expertise and a hybrid delivery model that brings the right people together.”

It’s an idea rooted in the philosophy of Temenos founder George Koukis, who once said: “Profitability is the consequence of happy clients.” That ethos – that great technology must serve human needs and trusted relationships – still defines the company’s culture. Or, as one TCF speaker, Dr Jonnie Penn of Cambridge University, reminded TCF 25 delegates: “Fortune will favour the collaborators.”

The future that Temenos envisions is one where banking transformation happens continuously, not cyclically. AI has become the catalyst for that, exposing the limits of legacy systems, but also offering the tools to finally transcend them. For the first time in 30 years, the technology exists to do in months what once took years – and the economic reality means banks can’t delay.

“Modernisation used to be about preparing for tomorrow,” Moroney reflects. “Now it’s about surviving today.”

Nowhere is the Temenos philosophy of ‘modernisation with immediate impact’ more visible than in its payments division.

Under Business Line Director, Mick Fennell, the company is reshaping the payments landscape for banks and non-banks alike – from start-ups chasing market entry to incumbents weighed down by legacy debt.

“The volumes keep climbing, up seven per cent globally every year, and the diversity of payments is exploding,” Fennell says. “Our customers are processing instant, cross-border and batch payments across different clearing systems, all under tightening regulation. They need a single, seamless way to manage that complexity.”

Temenos’ answer is its Money Movement and Management platform, a pre-integrated environment for payments, accounts, risk, and treasury. Built on the Temenos Banking Platform, it offers deep functionality across more than 100 markets, deployable in the Cloud, on-premise, or as Temenos software-as-a-service (SaaS). It’s designed to cut

time-to-market dramatically, whether replacing outdated systems or enabling fintech-speed innovation.

“We talk a lot about being seamless,” Fennell says. “You can’t have a seamless experience without integrated platforms. Customers expect low latency, instant execution and immediate feedback – and that means accounts and payments have to work together in real time.”

AI runs through this platform like ‘soaked fruit through a Christmas cake’, as Fennell

The volumes keep climbing, up seven per cent globally every year, and the diversity of payments is exploding Mick Fennell

puts it. Temenos has infused AI models throughout the stack, reducing fraud false positives from six to under two per cent; automating payment repairs and embedding co-pilots powered by Microsoft and NVIDIA to help users create products faster through natural-language commands.

It’s all part of what Fennell calls the ‘attention-economy of payments’, an age where both banks and their customers demand instant outcomes.

“We’re helping institutions industrialise and modernise their capabilities,” he says. “There’s no patience left for legacy debates — it’s about delivering impact now.”

Power instant FX and multi-currency accounts – built for g aming, money service, and digital asset companies ready to scale without the slog.

Chief information officers agree that all their organisations’ IT work will involve some level of artificial intelligence by 2030, according to a poll by US consultancy Gartner. But 72 per cent of them also admitted that their existing AI investments were losing money for their organisations, or were, at best, breaking even.

RBI’s Renato Rocha Souza takes us on a deep dive of the bank’s business-centred approach to AI adoption… and ponders on the dangers of the ‘culture war’ between developers

important, but staff need to be able to envision how AI can be used so we can embed it in the core business.”

Its strategy has been to ensure the technology can be used ‘top down’ to revolutionise organisational processes, and also from the ‘bottom up’ to boost staff efficiency and productivity.

Souza says: “Our AI Ambassadors have a responsibility to promote reverse mentoring with the business’s leaders. We are upscaling leaders because there are so many layers of understanding needed to implement AI, and to foresee potential consequences.

This has led to the emergence of another strain of AI – Angst and Indecision among senior executives, which is having a trickle-down effect on teams. So, how can banks ensure they capitalise on the technology’s promise without becoming overwhelmed by the constant hype and noise?

Raiffeisen Bank International (RBI) took steps to avoid AI Type 2 by implementing a roadmap that ensures AI Type 1’s use is strictly businessand not technology-driven.

Renato Rocha Souza, Director of RBI’s AI Centre of Excellence, believes large doses of humility and realism are required to avoid wasting time and money.

He admits: “A five-year horizon is too long, it’s hard to predict what will happen – we don’t know if we will have artificial general intelligence by then. So, from the beginning we’ve been focussed on people, mindset and culture. Of course, the technology is

Souza says RBI began its AI journey in 2018, and the examination of generative AI started three years ago. While his AI Centre of Excellence leads the development of AI use cases and drives the bank’s technological transformation, an AI Committee works to ensure compliance with regulations such as the EU AI Act, and strategic alignment across the organisation’s various divisions, which span 23 countries with a particular focus on central and eastern Europe.

A use-case group was formed to highlight areas for implementation and provide ideas on how solutions would work. And to ensure staff at all levels were aware of AI’s potential and the need to be open to its adoption, RBI introduced an AI Pioneer programme, which began with 200 staff members across divisions who allocated 20 per cent of their time to AI.

The programme progressed, and now RBI has what it calls ‘AI Ambassadors’ in every department. All staff are trained in using AI, and, crucially, in using it responsibly.

“We are embedding AI within RBI based on business priorities, not technological priorities. If your managers cannot understand how far they can go in embedding AI in their processes, they risk just playing with nice and exciting tools without having a proper goal.”

AI use cases are assessed and prioritised with what Souza describes as a matrix that considers revenue expectations, regulatory constraints and the technology available.

He admits that the speed of technological development means it’s ‘not unusual’ for objectives to change as more powerful solutions emerge.

“AI models are evaluated in three ways, and the first is by considering the model providers,” he says. “Use cases are developed over the layer of IT platforms. We check for model compliance, model bias and ethics. We agree service level and non-disclosure agreements with providers, and we only use the technologies that are approved by our platform teams.

Man vs machine: As technology improves, humans must remain at the heart of AI transformation

“Next, we have the AI Committee, which is made up of data scientists and other experts, who must approve every use case. Then we have internal audits. Model governance systems track each algorithm deployed in each model. That’s our third layer in this ‘many eyes inspection and evaluation’ of the models.

“No models are run without human oversight, so there’s constant supervision over performance and results of models, so we can check for biassed results, for example.”

Souza adds that to assess a project’s success, financial KPIs are important but not the only measure. “For instance, the AI Pioneers’ objective was to upskill the workforce, and it’s hard to attach financial KPIs to that,” he says. “But you can measure other things, like productivity, satisfaction and retention. So we connect our artificial intelligence KPIs to people as well.”

The bank works with a range of providers, such as OpenAI, Amazon Web Services, Azure, and the Databricks Lakehouse platform, with solutions typically created in-house.

He doesn’t mince his words, arguing that differences across jurisdictions and platforms amount to a ‘culture war’, and a failure to appreciate the impact of inherent biases means such factors will affect a bank’s own AI models.

“We know models are biassed because they follow the data that they were trained on,” he says. “We see differences in how the US regulates AI, and the emphasis in China, for example. So we must take care not to outsource creative aspects, because the more we outsource decisions, the more we delegate them to AI.

“If you’re using Grok, for example, you buy into certain decisions that are acceptable to Grok. Likewise, if you’re using models based on OpenAI, or Gemini.

“At RBI, we’re not changing the future of our business, but we are changing our future business with AI. We believe it’s important for us to plan the AI transformation with people at the centre. We can automate, but in the future, when agents outweigh employees, humans must remain in the pilot seat and AI in the co-pilot seat, and not vice versa.

“There’s a huge discussion around the consequences of AI adoption that goes far beyond our business processes, though.”

Souza admits the deployment of AI to run low-knowledge, data-intensive tasks will disrupt a whole layer of junior positions, and businesses will inevitably prioritise the hiring and cultivation of ‘senior and high

In the future, when agents outweight employees, humans must remain in the pilot seat and AI in the co-pilot seat, not vice a versa

“Internally, our solutions are containerised because we have a pre-occupation to avoid critical mission systems becoming vendor-locked,” he explains. “That doesn’t prevent us from developing use cases with fintechs, but we evaluate and provide oversight of models from third parties.

“A model we’re considering right now is an AI agent that takes collections for sales teams. So, if a customer owes something to the bank, they can negotiate with an agent instead of a person. With customer-facing models, we must be extremely careful to prevent hallucinations and bias. Because we are governed by the EU AI Act, there must be human oversight, so human input is a given for use cases.”

Souza stresses that caution is required when choosing AI platforms to underpin services, since platforms are shaped by governmental regulations and the societal norms from which they draw data.

expertise professionals’. Ultimately, some organisations will one day be run entirely autonomously by agents, although he believes that it won’t happen overnight.

“We’re going to get there, but not as fast as some might wish,” he says. “We’ll have a smooth progression by implementing low-risk, high data-intensive agents, or level-one agents, then two, three, four and five until we have more complex, high-risk use cases that will always demand human oversight.

“Looking at society in general, what consequences will this deep dependence on AI models have on our lives? What geopolitical effects will result if we depend on the models of one particular provider?

“We must understand that we are deciding our future without ultimately knowing what kind of decisions are being taken by the technology we adopt. This is the silent battle that is going on.”

Data transparency and transaction security are two sides of the same coin.

By

bringing together specialists in each and leveraging AI across a single platform, Vyntra has amplified their powers

In an era where payments move at the speed of light and fraudsters are never far behind, banks face a defining challenge: how to keep transactions fast, frictionless… and safe.

That delicate balance between efficiency and security is precisely where Vyntra, a new fintech born from the merger of Belgium’s Intix and Switzerland’s NetGuardians, aims to make its presence felt.

Formed in June 2025 and backed by Summa Equity, Vyntra unites two specialist companies that were already pursuing the same vision from different perspectives – Intix, providing deep visibility into payment flows, and NetGuardians, deploying advanced AI to detect and prevent fraud.

Together, they promise to give banks a single, intelligent platform that can monitor, analyse, and protect every transaction in real time – without slowing it down.

“We are forming Vyntra to solve a very unique problem for banks,” says

Joel Winteregg, Chief Executive Officer at Vyntra

Alexandre Guidou, Associate Director for Europe at Vyntra

Antoine Cuypers, Director of Strategic Alliances and Key Accounts at Vyntra

its CEO Joel Winteregg. “They need to find the right balance between payment risk and payment security. Our mission is to provide tools that enable speed monitoring of payments – what we call transaction observability – and risk reduction through AI fraud prevention.

“We have joined those two solutions together to really deliver a one-stop shop for banks.”

Both firms had been (and in their new form, continue to be) part of the Summa Equity portfolio – Intix since 2022, NetGuardians since 2024 – and the synergies between them were clear.

Intix built its reputation helping financial institutions gain real-time visibility over transaction data, enabling compliance teams and operations specialists to trace payments instantly and identify anomalies.

NetGuardians, meanwhile, focussed on AI-driven fraud detection. Its technology applied behavioural analytics and machine learning to distinguish legitimate transactions from suspicious ones, thus reducing false positives and saving banks time and money.

By combining these capabilities under one roof, Vyntra becomes a transaction-intelligence platform that ‘unites data observability with predictive analytics’, effectively blending the worlds of compliance, operational resilience, and fraud prevention.

“Customers today are ready to sacrifice a little bit of speed on their payments to ensure there is less risk,” Winteregg says, referencing The Hidden Tension In Every Payment, a recent Vyntra study of 1,000 banking customers worldwide.

“That tells us we are moving in the right direction – banks need to deliver speed and safety together.”

At the heart of Vyntra’s proposition is the idea that trust comes from transparency. If banks can monitor every step of a transaction’s lifecycle, not just technically, but from a business perspective, they can spot issues early, communicate better with customers, and prevent problems before they escalate.

“It’s all about the customer experience,” says Antoine Cuypers, Director of Strategic Alliances and Key Accounts at Vyntra. “Speed has become a commodity. If a transaction is processed on time, no one notices. But if something goes wrong, customers will certainly let you know.

“That’s where visibility makes a real difference, ensuring transactions remain frictionless across their lifecycle.

“Transaction observability gives financial institutions a single version of the truth across departments. You’re able to monitor in real time the health of your flows from a business perspective, not simply a technical one.”

For banks, real-time observability isn’t only about customer satisfaction, it’s about resilience. Payment interruptions or fraud incidents can cause reputational damage and regulatory headaches, not to mention lost revenue.

Winteregg says Vyntra’s software helps banks monitor the resilience of payments to avoid outages or blackouts, while also safeguarding transactions against fraud and money-laundering schemes.

“We want to help banks to be proactive,” he explains. “We bring them

the software suites – AI fraud prevention, money-laundering detection, and transaction observability – that solve the two biggest issues for a head of payments: ensuring payments flow smoothly and securely.”

Social engineering attacks have exploded in recent years, as criminals exploit human trust as well as technical vulnerabilities. Vyntra is on that battlefront, offering specific tools to detect and prevent various types of fraud, including Authorised Push Payment (APP) scams and phishing.

“Scams are a worldwide disease,” says Winteregg. “We’ve all received those messages claiming to be from our bank, urging us to act fast. Customers believe they’re sending money to a trusted source – sometimes even to someone famous. It’s happening everywhere.

“Detecting such scams is difficult because, technically, the customer initiates the payment.

No single bank will solve this alone. By sharing data on fraudulent activities through community scoring, banks can become more powerful together Joel Winteregg

The challenge is to have tools powerful enough, like ours, to detect that and to convince the customer that they are doing something strange.”

He believes customer education is a key part of the story, and so too is collaboration.

“No single bank will solve this alone. By sharing data on fraudulent activities through community scoring, banks can become more powerful together. That’s how we prevent fraud on a global scale,” he says.

Within Vyntra, AI is the driver; the intelligence that learns from billions of transactions and

continuously adapts to new threats. Alexandre Guidou, Associate Director at Vyntra, says the company focusses on the most pressing types of financial crime: scams, account takeovers, and money-laundering techniques such as ‘smurfing,’ where criminals break large sums into smaller deposits to avoid detection.

“For these scenarios, we take a proactive approach,” Guidou explains. “We learn the usual habits of customers and detect suspicious behaviour in real time. AI allows us to generate new layers of due diligence at the customer level, dynamically and continuously.

“And as fraudsters evolve quickly, we use two approaches to stay ahead. First, we leverage what banks know best – their customers. We learn from their behaviour and compare them with peers to assess risk.

“Second, we ingest third-party data from the market, such as suspicious beneficiaries

Transaction observability gives financial institutions a single version of the truth across

departments

Antoine Cuypers

reported by other institutions, and orchestrate that information to boost our fraud-detection performance. It’s about combining internal insight with external intelligence.”

Cuypers argues that secure data-sharing between partners will become a cornerstone of modern payment resilience. “In areas like cross-border payments or remittances, every participant is performing similar compliance checks,” he notes. “If we can reuse the richness of ISO 20022 standards and pass validated data securely along the chain, we’ll save everyone a lot of hassle and cost. Collaboration will be essential.”

That vision aligns with the broader industry trend known as FRAML – the convergence of fraud and anti-money-laundering systems into one cohesive framework. By combining detection capabilities and sharing data across functions, banks can uncover patterns that isolated teams might miss.

“The current challenge for banks is to break the silos,” says Guidou. “At both the analytical and operational levels, fraud prevention and compliance need to learn from each other. Using AI, we can make that collaboration seamless.”

Vyntra’s launch comes at a pivotal time. Financial institutions are under pressure from regulators and customers alike to strengthen defences without compromising user experience. The company already serves more than 130 institutions in more than 60 countries, supported by a workforce of around 150 people, spanning 25 nationalities.

The current challenge for banks is to break the silos.

At both the analytical and operational level, fraud prevention and compliance need to learn from each other Alexandre Guidou

For Winteregg, that illustrates how universal the problem has become.

“Every bank, everywhere, is facing the same dilemma,” he says. “How do we make payments fast, resilient, and secure?

Vyntra brings those worlds together.

“As a company, we are at the beginning of an exciting journey. We’re moving forward to bring that new balanced approach to create a single point of management for risk, efficiency and trust in payments, all at the speed that consumers demand.”

In the escalating war against cybercrime, defence is the best offence – but that doesn’t mean it’s passive

When a major bank appoints an ex-military intelligence expert as its new global information security officer, it’s surely a sign that cybercrime has evolved into full-blown cybercombat.

The bad news is, it’s a war without end. The threat landscape is evolving faster than the industry can come up with defences to stop it. The good news is that, if they’re smart, they can dodge the bullets indefinitely.

That’s precisely how Debbie Janeczek, who started her career in US naval intelligence before moving into US Cyber Command, intends to keep ING Bank and its customers safe. In her own words, ‘you can’t possibly fill all the holes’ when the attack surface is as large as the world’s financial system, pin-pricked with millions of vulnerabilities.

“So [as an industry] we have moved from ‘stop and block’ to filling the gaps, security by design, and making sure that we can react quickly, mitigate fast, and contain the threat so that the business can keep going,” she says.

The skill is in knowing where the next assault will come from and having countermeasures already in place to deflect it. While a recent survey by CFO.com revealed that 85 per cent of cybersecurity professionals attribute

the increase in cyberattacks to generative AI used against them – and that’s bad enough – Janeczek is thinking several steps ahead to what could be a defining moment in cyber warfare.

While quantum computer systems can’t yet break current encryption methods, cybercriminals are already harvesting sensitive data to store for when they can – and experts predict that this alarming reality could be within the next 10 years. It reinforces Janeczek’s urgent call for businesses to act now, not later.

“Large organisations like ING have cryptography embedded in everything that we do. So we have to prepare now,” she says. “And that means knowing where your cryptography is. If you don’t, you don’t know how to make sure it’s quantum safe.

“Companies need to start with an inventory. Once you have that, you need to prioritise it. And you have to know what the quantum safe algorithms are, which ones you need to implement first, then you have to do testing. It’s an evolution, because things will change.

“At the same time, you have to look at what your vendors are doing. We have a lot of dependence on third parties, so we have to make sure they’re on the journey to being quantum safe, too.”

Debbie Janeczek, Chief Information Security Officer (CISO) at ING

ING, as part of its forward-looking strategy, has already initiated preparations by working closely with research consortiums on the future of quantum-safe algorithms, such as those published by the US National Institute of Standards and Technology (NIST). However, as Janeczek emphasises, cybersecurity isn’t just about technology; it’s also about people and process.

“From my intelligence background, I know you can’t make decisions without the right information,” she says.

“So threat intelligence is one of the foundations of any security programme – having a team that is collecting intelligence from vendors in the dark web, working with the Financial Services Information Sharing and Analysis Center and local governments, looking at other companies when they are impacted.

“And not just providing information, but interpreting what it means to the company – where in its ecosystem it is vulnerable and what mitigation is available. Higher level strategic reports like this help the business make better decisions. Our security teams must be equipped with more than technical skills.”

Since taking up her role at ING earlier this year, Janeczek has addressed

the transformation of cybersecurity from a technical exercise into a core component of business resilience.

“ING Bank takes it very seriously; our CEO is involved in a security forum himself,” she says. “Traditionally, the CISO’s role was very technical; it was about what tools we were going to use. It has moved to being a risk executive role. But it needs to move to the next level – what I like to call the next-generation CISO, where you’re a value creator for the company – because cybersecurity is no longer just a cost centre, it’s a business enabler. We must understand the strategic implications of what’s at stake.”

According to the CrowdStrike 2025 Global Threat Report, the attacks facing organisations today are not only more sophisticated, but also more frequent and increasingly costly.

Ransomware remains the most financially devastating form of cybercrime. In 2024, more than 50 per cent of organisations globally reported being victims of a ransomware attack.

Ransomware-as-a-service (RaaS) platforms, which allow even low-skilled criminals to launch highly effective attacks, have surged by 50 per cent in the last year. The average ransom demand reached a staggering $4.5million in 2024, and, even more disturbingly, the technique of ‘double extortion’ – where attackers steal and threaten to release sensitive data – has risen by 150 per cent.

As Janeczek emphasises, banks are part of critical infrastructure – one of the pillars that must be protected in a national crisis. So cybersecurity isn’t just about defending the organisation; it’s about actively participating in global efforts to disrupt cybercriminal networks. ING collaborates at all levels with external organisations.

Jethro Cornelissen, ING’s Global Anti-Fraud Officer, demonstrates this commitment. When he’s not defending ING from fraud, Cornelissen leads a global task force tackling cybercrime through the Cybercrime Atlas initiative, a World Economic Forum-hosted project.

In one of the largest cybercrime takedowns ever seen in Africa, Cornelissen described in a recent company blog how his team helped disrupt an online fraud network that spanned 18 countries, recovering nearly $100million in stolen assets. This collaborative operation, known as Operation Serengeti 2.0, highlights the importance of cross-border collaboration.

“Criminals are smart, especially in social engineering. A bank can’t win that fight alone,” wrote Cornelissen. “But collaboration across borders and industries makes a real difference.”

At the same time, the regulatory landscape is also undergoing significant changes. In Europe, the introduction of the Digital Operational Resilience Act (DORA) has had a transformative impact on how financial institutions like ING manage third-party risk. DORA drives continuous monitoring and assessment of third-party vendors, shifting responsibility from a compliance task to a board-level responsibility.

“It’s not just simply about answering a questionnaire once; it’s about ongoing vigilance,” Janeczek notes.

Cybersecurity shouldn’t be an afterthought. It has to be part of the DNA of the business

“DORA brings a framework to third-party risk management, and it has driven us to implement continuous monitoring and on-site assessments of our most critical vendors,” she adds. “And we have to engage with them closely to get early warnings, such as breaches that might affect us.”

Understanding and adapting to the evolving TTPs (tactics, techniques and procedures) of cybercriminals is crucial. This is why ING’s cyber threat management strategy is deeply informed by continuous threat intelligence and collaboration with other financial institutions.

By combining its internal expertise with partnerships like FS-ISAC and with the World Economic Forum’s Cybercrime Atlas, ING is actively working to disrupt the very infrastructure cybercriminals rely on. Cornelissen’s teams are tackling online fraud through cross-border collaboration, alongside ING’s internal cybersecurity efforts, highlighting the critical role of teamwork in combating cybercrime at scale.

The CrowdStrike report underscores the increasing use of AI by attackers to enhance their tactics. Phishing, for instance, has become more personalised and harder to detect, with AI-powered tools helping criminals craft convincing messages manipulate employees’ trust. More than 60 per cent of breaches in 2024 were attributed to phishing and social engineering, and this trend is expected to grow.

However, while cybercriminals weaponise AI for offence, the industry is leveraging it for defence. “We’re looking at how AI can help us to respond faster, identify threats in real time, and even automate lower-level tasks to free up analysts for more complex investigations,” says Janeczek.

Next-generation endpoint detection and response (EDR) tools, which are increasingly incorporating AI, allow businesses to automatically isolate and mitigate threats before they can spread across networks. Also, according to the CrowdStrike report, businesses that have implemented such systems have seen a marked reduction in the time it takes to neutralise an attack.

Janeczek returns time and again to the importance of aligning cybersecurity strategies with broader business goals.

“We need to embed security from the ground up,” she explains. “Cybersecurity shouldn’t be an afterthought. It has to be part of the DNA of the business.”

Organisations that are proactive in security and threat intelligence – sharing insights with industry peers and participating in collaborative defence initiatives – have been shown to be far more resilient to attack. In fact, companies that shared threat intelligence experienced 40 per cent fewer successful phishing attacks than those that didn’t, according to CrowdStrike.

Whilst the threat landscape is evolving fast, Janeczek isn’t downhearted, because she knows businesses can be agile, adaptable, and well-prepared for what’s on the horizon.

It’s clear that the only real defence is proactive preparation.

80%

Streamline KYC/KYB processes with automated evidence extraction and risk assessment. Onboard clients in record time without compromising compliance.

100%

Stay compliant with evolving regulations using a system built on deep industry expertise and AI precision.

Joining the dots: Brazil’s payments landscape is rapidly evolving, with a shift from traditional to digital methods

A new licence in Brazil has strengthened Nium’s position as one of the most

comprehensive infrastructure services powering cross-border payments

When Nium was granted its licence to operate as a payment institution in Brazil, it was a milestone that followed years of work in the country.

The authorisation by the Central Bank of Brazil in October 2025 means Nium can now onboard and serve its Brazilian customers directly, alongside its partnerships with intermediaries.

The move underlines the firm’s unwavering commitment to a region that is witnessing a huge shift from cash to real-time digital payments through national systems such as Pix, QR codes and Boleto barcode payments, which provide financial inclusion for the unbanked.

But Nium’s global success hasn’t just been based on chasing what’s new. It has taken a pragmatic approach to build a network for cross-border payments using whatever works – witnessed in late 2024 when it leveraged Swift messaging as a method for banks to connect with its system.

“I call us a real-time payments infrastructure, not a payments company – I don’t even like to refer

to us as a PSP [payment services provider],” says Nium Chief Payments Officer Alexandra Johnson.

“We are that interoperable infrastructure to move money in real time securely, quickly, seamlessly. And for us to do that, we need the tech and regulatory infrastructure to be able to support any payment method that comes to the fore – be that stablecoins, the real-time payment schemes we’re already connected to, or whatever the future may bring.”

Nium was founded in Singapore in 2014 to create a fast and transparent alternative to the correspondent banking system. Initially with a focus on the travel industry, which still makes up a significant proportion of its clients, it’s now a £50billion company operating a cross-border payments platform with users in banking, payroll, other platforms and marketplaces. And it offers them complete spend management solutions, virtual cards, and white-label payout systems.

Today, it describes itself as ‘the global infrastructure for real-time payments’, covering 190 countries and territories,

Alexandra Johnson, Chief Payments Officer at Nium

around 100 real-time markets, and is regulated in 35 countries.

Nium’s network has been constructed by creating links with national payment systems that were built for specific use cases but which didn’t interconnect.

In this way, it acts as a bridge between markets, but also between old and new. In many cases, it leverages old infrastructure, sometimes decades-old, and innovates on top of that to facilitate real-time money flows with visibility for sender and receiver.

Brazil beckons

Latin America was a natural destination for Nium, given the efforts of governments in the region to shrink the shadow economy through financial digitisation.

The launch in October of Colombia’s low-value, real-time payments rail Bre-B follows the success of Pix in Brazil and Mexico’s SPEI and CoDi systems for moving funds between bank accounts.

The speed and low cost of these systems support the growth of e-commerce and gig platforms, which typically operate on low margins.

Nium already had a presence in Brazil through clients who use its rails to move money across borders. Many operated in the foreign exchange space. They include Oz Cambio, which offers a cross-border platform aimed at SMEs to facilitate import-export operations (typically Brazilian importers doing business with Chinese sellers), payment for workers such as IT staff employed from abroad, and companies with international payrolls.

Frustrated by the costs and speed of existing systems, Oz partnered with Nium in 2023, and it now offers a white-label, cross-border mass payments platform. Using Nium’s rails, Oz can settle payments in Brazil using methods such as Pix, the TED system for high-value payments, credit/debit cards or Boleto. Meanwhile, Frente Corretora de Câmbio joined forces with Nium because the fintech

Singapore-based global bank DBS to its cross-border payment platform via Swift.

Nium developed the Swift solution after recognising that financial institutions would be attracted to a system that leveraged the Swift messaging protocol they had already adopted.

Johnson says: “Nearly all financial institutions are already connected to Swift, so in our minds, we want to meet our customers where they are. I am a former banker, so I can tell you firsthand that getting the resources prioritised to integrate with a new partner takes time just to get to a roadmap.

“So, banks use their existing connections and get access to the real-time seamless rails that we have connectivity to. They send us that Swift message just as if they’re sending a wire,

Reaching

they are’

was one of the few companies in 2019 that could integrate with the RippleNet blockchain system – a method of moving money that appealed to many of Frente’s influencer, investment broker and travel agency clients. Foreign exchange broker Treviso used Nium to scale its business via the use of digital services and now offers current account credit, using local corridors as a means of payment.

Nium says winning a licence to operate in Brazil will ‘streamline operations’ and ‘reduces reliance on intermediaries, offering greater efficiency in the market’. It is also seeking a foreign exchange licence to strengthen its position in a country that Nium CEO Prajit Nanu describes as ‘not just a market for us it’s a critical node in our global infrastructure, a strategic hub for our growth’.

Beyond Latin America, Nium achieved a major business win in September when it announced a deal to connect

Worldpay is among Nium’s clients and chose to use Nium as it is ‘one of the only solutions on the market that allows us to verify account ownership in real-time across multiple markets, saving us costs associated with reconciling misdirected payments’.

Johnson says: “You can be absolutely certain about who you’re sending [the payment] to, but now we’re thinking about how we continue to evolve that. What are the other behavioural nodes, behavioural markers that we can look at within a transaction, or within the activity on an account?

“We’re at this inflection point. It’s not just about the payment anymore. And it’s not just about the last mile. Value-added services become key in creating a pleasing, customer-facing, end-to-end payment experience. It’s making sure you have strong compliance tools that end up being a moat for your business.

“It means fraud prevention tools, foreign exchange. All of these components are coming together in an integrated, singular payment solution.”

Johnson says the business acts as an aggregator for its customers. And she foresees that this aggregation, with the continued development of tech and regulatory infrastructure, will enable Nium to stay ahead of its competition.

She says: “The way we operate is to create a system we can continue to build upon to create that global interoperability as more of these efficient payment mechanisms come into the ecosystem.

Nearly all financial institutions are already connected to Swift… so, banks send us that Swift message just as if they’re sending a wire, and we map that to the local payment scheme

and we map that to the formatting of the local payment scheme, which is real-time payments in several markets. It allows our customers better, faster access to these tools while they figure out where they are on their API journey.”

Johnson adds that a focus on value-added services is another cornerstone of Nium’s competitive advantage, as it builds its globe-spanning, cross-border payment platform.

Fraud protection is a key area, and the firm last year launched Nium Verify, whereby the identity of the account receiving payment can be verified in real time in 50 markets.

“We don’t see this as something that will disrupt our business; if anything, it will bolster our business.

“It’s not just the integration of different payment mechanisms, but bringing together all the different capabilities involved in a payment: the pay-in, the data, compliance, and so on. And then look at the new payment types as they emerge – real-time payments, wallets, stablecoins, agentic payments, and whatever comes next.

“Working with partners, as in the case involving Swift, means we’re ready to create that interoperable system, be at the forefront of new payment capabilities and be ready when our customers need them.”

Not so remote:

Small jurisdictions seem to have a disproportionately large interest in fintech founders. If living and working on an island appeals to you, perhaps it’s time to set sail

‘Home to myths, fairies and, one day, unicorns’ is how Digital Isle of Man, an executive agency of the Manx government, positions this tiny financial services hub – on a historic, strategically important piece of land, equidistant between the UK and Ireland

Flying into the windswept Ronaldsway Airport on a twin-prop Loganair plane, munching complementary Tunnock’s chocolate wafer bars, it doesn’t feel like you’re entering an international money metropolis. But, having taken a conscious decision in the 1980s to shift from a then-faltering economy,

based on tourism, fishing and agriculture, to one powered by data – and specifically financial data – the Isle of Man has indeed made a remarkable (if well-camouflaged) shift. It’s one of a handful of independent isles that have pinned their future to a fintech mast – floating ecosystems with regulatory and

fiscal frameworks that encourage outside-the-box thinking. That has led –perhaps inevitably – to some being sanctioned by the international community for a lack of compliance, while even those that work hard to be on the right side of global regulators have struggled to overcome a reputation for opaqueness. ‘Offshore’ has become a shorthand for ‘off limits’.

Increasingly, though, these territories are tempting entrepreneurs to forge their destiny there, not as outliers but as pioneers of a new financial system. That’s particularly, but not exclusively, in the areas of digital assets, cryptocurrency, and blockchain. Many of the new generation of island fintechs are also related to wealth management and life insurance, sectors that have tended to gravitate towards sympathetic island tax regimes and are now creating strong demand for back-office and regulatory tools: onboarding, KYC, workflow automation and reporting solutions.

While the Isle of Man shuns the descriptor ‘tax haven’, the still growing number of family offices, and the discrete presence of more than 70 licensed trust and corporate service providers is a tell-tale sign that extreme wealth is not only welcomed but protected here.

It would be foolish to turn capital away today, especially as there is likely to be a lot more of it looking for a home as high earners continue to leave the UK in record numbers. But, like many other jurisdictions whose appeal was once their anonymity, the Isle of Man is now actively courting attention with groundbreaking initiatives such as its new Digital Asset Foundations, international partnerships, recruiting high-profile fintechs, and advertising itself as a well-equipped nursery for digital startups.

It’s generally recognised as a respectable place to do business, governed by a globally-aligned regulatory framework. But the presence of edge technologies, and some high-risk sectors, such as eGaming has caused many of its fellow islands to double down on oversight, which, in turn, is creating new opportunities for regtechs.

Take Malta. A shock greylisting in 2021 by the Financial Action Task Force, which had concerns about the robustness of Malta's anti-money laundering regime, dented investor confidence in the short term and raised the spectre of correspondent banks de-risking. But the long-term consequence has been to build back better. And that created an innovation gap that fintechs filled.

Binderr, which coincidentally won the Isle of Man Innovation Challenge this year, has been

instrumental in helping the Malta Business Registry (MBR) redesign itself as a gatekeeper for the country’s financial integrity and ensure the country adheres to AML standards going forward.

Moving from a paper-based to digital system has not only reduced onboarding time for those who want to do business in Malta, but it has also allowed the Registry to integrate APIs for corporate service providers (CSPs). Through Binderr, a platform that matches businesses expanding overseas with CSPs and banks, entrepreneurs can now complete their registry on Malta remotely, and in just a few days.

In fact, the MBR has gone further than the minimum that EU regulators required for company mobility. It’s leveraged digital systems to support the relocation of both EU and non-EU native businesses, including those from the UK.

Binderr Co-founder, CEO and serial entrepreneur Jacob Appel, originally from Denmark, now considers Malta his home. And it has plenty in its favour. English is the language

The Isle of Man is now courting attention with groundbreaking initiatives, international partnerships, recruiting high-profile fintechs, and advertising itself as a well-equipped nursery for digital startups

of business; the Malta Startup Residence Programme offers a way in for non-EU entrepreneurs and their families; corporate tax can effectively be as low as five per cent, thanks to a shareholder refund system; there are also deep government wells of startup cash, including grants, loans and investment. And Malta’s location in the Med’ not only makes it a comfortable base to live and work, but also a good launchpad for breaking into EU markets on its doorstep, the Middle East and North Africa. Five-year-old Binderr now has clients in Malta, wider Europe, the UAE and UK. Trophy-seekers came from more than 20 countries for the most recent Isle of Man Innovation Challenge – several from Malta, Guernsey and Singapore, the last of which signed a Memorandum of Understanding on AI development with the Isle of Man last year.

Lyle Wraxall, who leads Digital Isle of Man, an executive agency of the Manx government, describes Singapore as its ‘big brother’ when it comes to AI innovation, helping the Isle of Man inform plans for a new National Office for AI Development and Regulation, which is slated to begin work in January 2026.

Singapore itself is the tech island to which others aspire. The Monetary Authority of Singapore has a legendary track record of offering extensive support for fintechs who challenge the status quo, including substantial funding and grants through the FSTI scheme for innovation and experimentation.

The startup/scaleup ecosystem is so crowded with opportunity – Enterprise Singapore, Elevandi, Singapore Fintech Association, incubator Tenity, the API Exchange, Startup SG and a raft of big-hitting FIs with their own established innovation hubs – that sometimes it’s hard for entrepreneurs to decide what to turn down.

Regulatory sandboxes in Singapore allow safe, rapid testing and deployment, while robust IP protection and a mature ecosystem attracts huge wadges of investment from VCs and global financial institutions.

You can also get yourself certified as a bona fide fintech, which gives newcomers credibility when approaching larger clients in particular.

Singapore has already worked well for Staple AI, a trust platform established six years ago and now operating across 58 countries. It helps companies capture and interpret unstructured data in 300 languages and uses fully auditable AI to keep them compliant with standards in real time, including the EU AI Act, the General Data Protection Regulation, and ISOs in multiple jurisdictions.

“Some of the grants and funding available [in Singapore] is contingent on fintech companies doing a project with a financial institution… so, proofs of concepts delivered to banks or FIs. In that sense, there’s kind of an incentive to make these connections,” says CEO Ben Stein, who relocated to the island to take up a regular job in financial services, through which he was introduced to a VC and incubator programme called Entrepreneur First (Singapore). That’s ultimately where he met his co-founder – and the rest is history.

Networking on and between the islands has time and again proven to be the best path to growth. Many Isle of Man Innovation Challenge attendees were there to tap into the ecosystem, and to find commercial partnerships among the FS companies that drive more than a third of the island’s economy and account for around one-third of all employment.

Extending hands across the seas also helps build a sense of belonging to a special island race of innovators. Wraxall believes the fintech islands can not only add value by working together, but also be bell weathers for wider change – safe petri dishes for experimentation.

“Because we are a small island, we have the freedom to try new things,” he says. What it chooses to explore is uniquely influenced by both its infrastructure and its environment. The island boasts six Tier 3 data centres and it’s just completing a major fibre network rollout. But while that’s an advantage when positioning yourself as a digital financial hub, it creates a problem if you’re also the world’s only UNESCO Biosphere Nation, recognised for its unique landscape, culture, and commitment to sustainability.

Because it’s a small island we have the freedom to try new things

Lyle Wraxall, Digital Isle of Man

Wraxall admits there’s a contradiction at the heart of the island’s strategic goals, but that’s the beauty of being an innovation super cluster: you can fix it. it’s already attracting players whose core offer is reconciling the digital world’s demand for galactic quantities of energy with protecting the planet, offering itself as a living lab for companies such as Earthscope, which aims to put Nature in the boardroom, and Zumo, a green cryptowallet.

“As a nation, the island is incredibly proud of its Biosphere status,” says Wraxall, a former banker who gave up the bright lights of New York to relocate his family, so they could enjoy a better quality of life. “There’s a real commitment and desire to do the right thing.”

With a land mass of less than 572sq km the Isle of Man is almost 10 times the size of another UK crown dependency that has carved a unique place among the fintech islands.

The founders of RuleWise, which helps firms automate compliance tasks, manage risk, and adapt to evolving regulations across multiple jurisdictions, chose to base its operations in Guernsey for a combination of reasons.

“Guernsey was a natural fit,” says Co-founder Mort Mirghawameddin. “The tax environment is helpful for a growing company, but what really made the difference was the regulatory approach.

“Guernsey, along with the other Channel Islands, has recognised the importance of AI and is putting it at the centre of its innovation strategy. [And] Guernsey’s financial sector already has deep expertise in banking, funds, Insurance, fiduciary and wealth management, so many of our potential users were here from day one.

“Being close to both clients and the regulator meant the island was an ideal test bed for our proof of concept. We were able to meet people in person, iterate quickly and refine RuleWise, based on direct feedback, which accelerated our development far more than working from a larger city would have.

“The lifestyle aspect also plays a role. The island offers a balanced pace of life, (very) short commutes and a strong sense of community, which helps with retaining experienced people long term.

“There are a few obvious challenges. Travel requires more planning and is very expensive, especially for last-minute meetings in London or elsewhere. The tech talent pool on-island is naturally smaller, so we often have to recruit globally and work in a partly remote model.

Guernsey was a natural fit. The tax environment is helpful for a growing company, but what really made a difference was the regulatory approach

Mort Mirghawameddin, RuleWise

“In addition, the ecosystem isn’t as dense as a major city, so networking is more intentional than spontaneous. And costs, such as property, can also be higher.”

So, could RuleWise have launched in London or even Paris?

“It could have, but it would not have been the same,” says Mirghawameddin.

“Larger cities have bigger talent pools and easier access to events, but they also come with higher overheads and more complex regulatory pathways.”

Like many smaller jurisdictions, the Isle of Man is famous for its favourable tax regime. Most businesses benefit from zero per cent corporation tax, there is no capital gains tax, and founders pocket more of their hard-earned wealth, thanks to low personal tax taxes.

The government rolls out a red carpet for founders with a generous Financial Assistance Scheme for capital and operating items for both startups and relocating businesses. And there’s more cash available for relocating employees or hiring graduates. It’s worth noting that the island is now a year into an ambitious programme to train and upskill the entire community in AI, building a network of specialists, and supporting local businesses to adopt the technology.

The Isle of Man takes a ‘technology-agnostic’ approach – the activity is regulated, not the tech. It developed regulations around the use of distributed ledger technology and crypto as far back as 2015, and has a Blockchain Office to support businesses, and a government-backed blockchain sandbox. The government has just announced that it’s planning a National Office for AI

Development and Regulation to co-ordinate AI activity, manage risks and set direction.

But it’s also about to tighten regulations and enforcement around eGaming, following a rocky few months for the sector.

The finance industry accounts for 50 per cent of the Isle of Man’s GDP and it’s the second biggest employer. And if you’re a DLT-based business, there’s a positive buzz. Around 30 blockchain projects have emerged over the past 10 years, including CoinCorner, Unikrn and Qadre. It has six Tier 3, ISO-accredited data centres connected to the mainland by five high bandwidth subsea cables with ‘self-healing technology’ that ensures any fault doesn’t interrupt service. And you’re unlikely to go offline: the island’s gas and green fuel sources generate 200 per cent of peak electricity.

As the Caribbean island charts a real-time path, Payment Spayce is already looking at the next frontier

When the name Payment Spayce first began circulating, observers might have expected some kind of space-tech experiment. The reality is something far more grounded, yet no less forward-looking.

Recently rebranded, the US payment services provider is anchoring itself in the Caribbean’s emerging fintech ecosystem just as the island’s regulatory, infrastructural and reputational stars begin to align. Because Barbados, long known for its picture-postcard beaches and conservative banking sector, is quietly becoming one of the region’s most intriguing fintech testbeds.

The Central Bank of Barbados and the Financial Services Commission (FSC) have spent the past five years methodically modernising their oversight frameworks, separating regulatory functions from government, and opening pathways for digital innovators through a sandbox regime that was first launched in 2018.

Jonathan Brathwaite, Chief Legal Officer and Marilyn Brathwaite, Chief of Staff at Spayce Technologies Inc

It’s a measured, deliberate evolution – one that reflects both lessons learned and ambitions renewed.

The FSC’s latest annual report, pointedly titled Navigating Change: A Regulatory Odyssey, signals a more confident stance: independent, future-facing, and increasingly open to collaboration with private innovators like Payment Spayce.

From compliance burden to compliance advantage

In fintech, timing is everything, and Payment Spayce is ready to take advantage of a moment when Barbados’ institutional foundations are catching up with its entrepreneurial appetite.

The island’s removal from the Financial Action Task Force’s (FATF) list of jurisdictions under increased monitoring marked a turning point in 2024, restoring international confidence and giving local firms a clearer runway to engage global partners.

At the same time, the Central Bank’s partnership with global financial technology provider Montran to deliver BiMPay, a national instant payments platform capable of sub-10-second transactions, is setting the stage for a cash-light economy by 2026. And in September this year, the Central Bank issued a new regulatory framework for payment service providers.

Within this ecosystem, Payment Spayce believes it stands out for its regulatory discipline and organic growth model.

“We’ve built our stack in-house over 20 years, without venture capital or private equity funding,” explains Jonathan Brathwaite, Chief Legal Officer at Payment Spayce’s parent, Spayce Technologies Inc. “That gives us agility – our wallet, gateway and card infrastructure have all been designed with compliance in mind, from the ground up. As regulations evolve, we can adapt in real time.”

That adaptability is proving central to the company’s value proposition, which is closely aligned with two of the world’s biggest card schemes. Spayce’s digital wallet integrates directly with Visa in the United States and Mastercard in Canada, offering both digital and physical cards tailored to each market.

Rather than view regulation as an obstacle, the company sees it as a differentiator. It recently announced a partnership with Israel-based AI-powered financial crime compliance solutions provider ThetaRay, which uses advanced AI-driven transaction monitoring to strengthen anti-money laundering and fraud detection, without sacrificing transaction speed – a key consideration for markets still under scrutiny for financial transparency.

The Barbados advantage

What makes Barbados an ideal proving ground for a company like Payment Spayce?

Stability, says Marilyn Brathwaite, Chief of Staff at Spayce Technologies Inc.

“Barbados has had a stable banking sector for more than half a century,” she notes. “Fintech is the natural next step – bringing the financial system into the 21st century while creating new career opportunities for young professionals. The legislation is in place, the infrastructure is growing, and the talent is here.”

One of the early fintech entrants in the Barbadian market, the company has leaned heavily on that local strength.

Barbados has had a stable banking sector for more than half a century.