Barrister the

Resources, Tools, Tips, and Tricks for Surviving as a Junior Lawyer

Liability for Rear-End "Meat-In-The-Sandwich"

Motor Vehicle Accidents

Case Law Corner

Minor Injury Regulations in Alberta

Resources, Tools, Tips, and Tricks for Surviving as a Junior Lawyer

Liability for Rear-End "Meat-In-The-Sandwich"

Motor Vehicle Accidents

Case Law Corner

Minor Injury Regulations in Alberta

• Interest rate DECREASES at the two-year mark

• Legal fees & disbursements always take priority

• Approval within 24 hours

• No hidden fees or recurring charges

• Flat $250 administration fee

• No complicated application forms

• Sustainable and responsible lending decisions

The contents of The Barrister are for informational purposes only and do not constitute legal opinions by the Alberta Civil Trial Lawyers Association, its members or contributing authors, and should not be relied upon as such.

Statements and opinions expressed by the editors and contributing authors are not necessarily those of ACTLA. The official position or views of the Alberta Civil Trial Lawyers Association will be stated as such. Copyright © 2022 by the publisher, ACTLA. All rights reserved. Reproduction of any material herein without permission of the publisher is prohibited.

All advertising enquiries should be directed to the Editor-in-Chief at communications@actla.com

Publication Mail Agreement No. 40064387

Return undeliverable Canadian addresses to: Alberta Civil Trial Lawyers Association 777-10339 124 Street, Edmonton, AB, T5N 3W1

Advocating for a strong civil justice system that protects the rights of all Albertans.

Chair: Owen Lewis

Past Chair: Angela Saccomani, KC

Vice Chair: Mike McVey

Secretary: Jillian Gamez

Treasurer: Laura Comfort

Members-at-Large:

Jackie Halpern, KC

Joseph A. Nagy

Peter Cline

Geographical District Representatives:

North West: Leah Paslawski

North East: Waverly Mussle

Edmonton: Amani Abdu

Calgary: Sarah Coderre

Central: Ronke Omorodion

South East: R. Travis Bissett

ACTLA STAFF

Executive Director

Joy Jeong | executivedirector@actla.com

Communications and Events Services

Administrator & Editor-In-Chief, The Barrister

Nash Calvert | communications@actla.com

Bookkeeper

Leonie Philp | admin@actla.com

Angela Saccomani, KC - 2022-23

Maia Tomljanovic 2021-22

Jackie Halpern, KC, 2020 - 21

Shelagh McGregor, 2019-20

Mark Feehan, 2018-19

Michael Hoosein, 2017-18

Maureen McCartney-Cameron, 2016-17

Nore Aldein (Norm) Assiff, 2015-16

Craig G. Gillespie, 2014-15

Donna C. Purcell KC, 2013-14

George Somkuti, 2012-13

Constantine Pefanis, 2011-12

James M. Kalyta, 2010-11

James D. Cuming, 2009-10

Richard J. Mallett, 2008-09

Arthur A.E. Wilson KC, 2007-08

Walter W. Kubitz KC, 2006-07

William H. Hendsbee, KC, 2005-06

Kathleen A. Ryan KC, 2004-05

Ronald J. Everard KC, 2002-04

Stephanie J. Thomas, 2000-02

James A.T. Swanson, 1998-2000

Gary J. Bigg, 1996-98

Stephen English KC, 1994-96

Anne Ferguson Switzer, KC, 1992-94

Terry M. McGregor, 1990-92

J. Royal Nickerson KC, 1988-90

Derek Spitz KC, 1986-88

Spring is an exciting time for the Alberta Civil Trial Lawyers Association.

Our Annual General Meeting for 2023 has just passed, and I would like to formally welcome Owen Lewis as our new Board Chair. I am looking forward to a year of working together to continue serving our members.

I would also like to extend the utmost gratitude to Angela Saccomani, KC, and the exiting board for all their work and commitment throughout the 2022-2023 term. We were able to accomplish amazing things in the past year, and without their support, it would not have been possible. Our board said goodbye to Maia Tomljanovic, past president, in addition to Michael Hussey who served as the North West District Representative. We welcome some new additions to the board, Leah Paslawski, our new North West District Representative, and Peter Cline as a Member at Large. To our entire board, new and returning, thank you for your continued commitment and service to our organization.

Looking forward to the rest of 2023, I am filled with optimism and excitement. We have a great lineup of events already planned, with more in the works. The topics of the Barrister for the year are decided, and we are continuing to provide you with a diverse range of topics and education. We strive to make our events and publications an exceptional educational resource now and for years to come, and are honoured to share the knowledge and experience of our speakers and writers.

Joy Jeong, Executive Director ACTLA

As we head into the May 2023 Provincial Election, we’ve been working closely with New West Public Affairs on our Pre-Election Strategy and rebooting the FAIR Alberta Campaign to educate the public on our mission as well. Our office is hard at work to ensure that we are able to continue our fight against No-Fault Insurance and continue advocating for injured Albertans. I would also like to take a moment to thank all the donors so far this year and from previous years. Without the support of our donors, we would not be able to continue to advocate for our members and for Albertans. Your contributions are crucial to our work, and every single dollar counts. So thank you to all those who donate, and to those who continue to share our message and spread ACTLA’s reach.

2023 is looking to be a productive and lively year for our organization, and there is a lot of behind-the-scenes work our office is doing to improve operations to ensure ACTLA can create the best member experience possible.

As always I invite you to reach out with questions, comments and suggestions (or even to just say hello). I can be reached directly at executivedirector@actla.com.

Sincerely,

Joy Jeong Executive DirectorCaseMark Financial

Platinum Sponsor 2023

Integra

Gold Sponsor 2023

Bridgepoint Financial

McKellar Structured Settlements

Elite Experts

Platinum Donors

Shelagh McGregor David de Vere Joe Miller

Mike McVey Allison Grimsey

Gold Donors

Constantine Prefanis Joe Nagy Mark McCourt

Assiff Law Office KMSC Law

Silver Donors

Tara Cassidy Doz Yaggey Lee LLP Kubitz Law

LT Lawyers

Bronze Donors

Grace Parrotta-King Professional Corp Akrim Attia Professional Corp

Putnam Law LLP

Thanks to you, ACTLA can continue to support Access to Justice across Alberta

I am eager to assume the role of Chair of the Alberta Civil Trial Lawyers Association (ACTLA). It is a privilege to be entrusted with leading an organization with the rich history and positive impact that ACTLA has enjoyed. I am committed to building on the great work of our previous Chairs and board members.

As we move forward, I want to highlight our priorities for the upcoming year. Firstly, we will continue to advocate for injured Albertans in the face of the Insurance Bureau of Canada’s efforts

to push for continued concessions from the Alberta government. This advocacy is especially important given the upcoming provincial election. We will work hard to ensure that our voices are heard and that injured Albertans are protected. Our advocacy efforts will be essential to ensure that the IBC’s push for no fault or hybrid no fault does not become a reality.

Secondly, we will focus on increasing membership in the association. By expanding our membership base, we can increase our collective strength and impact. We will continue to engage our current members and provide opportunities for networking and professional development.

Finally, we are committed to continuing to provide exceptional educational opportunities for our members. We recognize the importance of continuing education and staying up-to-date with the latest developments in our field. Our educational programs will be designed to meet the needs of both new and experienced lawyers and will cover a broad range of topics. We look forward to getting back to in-person seminars for the benefit of our members and sponsors.

I want to take this opportunity to thank our new Executive Director, Joy Jeong, our staff and all our volunteers and members for their ongoing support and dedication to the ACTLA. It is through collective contributions that we can advance our mission to advocate for a strong civil justice system for the protection of all Albertans. I look forward to working with all of you in the coming year and beyond.

Sincerely,

Owen Lewis Chair, Alberta Civil Trial Lawyers Association

Going into 2023 has been an exercise in patience and getting out of our comfort zones. The first full year back means many of us are only now experiencing what a truly “normal” beginning of the year is like. For my part, it meant experiencing the full planning and execution process for ACTLA’s Plaintiff’s Only seminar from start to finish, while also working to develop and release this edition of The Barrister. I'm no stranger to wearing many hats, but doing it all at once has been an excellent challenge and incredibly eye-opening. In many ways, it was an excellent segue into the topic of this edition.

It's a strange feeling to be the only individual actively working with both the Seminars and Editorial committees at ACTLA - especially when they separately decide on the same topic for an offering. Junior Lawyers are the lifeblood of the profession, and developing content aimed at newcomers to the field meshes well with internal efforts at ACTLA to approach a wider range of lawyers and law students for membership, advocacy, and general involvement with our organization. This edition has been curated in an attempt to provide resources to our more junior members and those looking to start their journey in the legal profession. Of course, we’ve also made sure that the content herein can be relevant regardless of your experience.

Nash Calvert Editor-in-Chief, The Barrister Communications & Event Services Admin, ACTLAThey say you can’t teach an old dog new tricks, but I think it is safe to say that lawyers strive to turn this on its head as a rule.

From our Editorial Committee come two articles aimed squarely at junior lawyers. “Three Resources for Junior Lawyers to Rely Upon” by Justin Monahan provides a short list of resources for new lawyers from a new lawyer, while Amanu Abdu’s short article on Technology and Practice Management is an excellent resource for information on staying on top of technological trends in your practice. I recommend readers new and old keep these close at hand to reference during their day-to-day. Our series of junior lawyer focused articles concludes with a well written write-up by ALIA's Brett Stuart on how to handle the reporting process when a claim arises.

ACTLA’s industry partners have also contributed articles for this edition. ACTLA has been working closely with New West Public Affairs to revive FAIR Alberta in advance of the upcoming election, and has provided an excellent update of where we stand with those efforts. Priscilla Cicek from Viewpoint was kind enough to share an article from her personal blog, Case Law Corner, on Minor Injury Assessment in Alberta that should serve as a jumping off point for your own research.

Lastly, Bottom Line Research had provided us with yet another incredible research paper exploring the judicial precedence for assigning liability in so-called "Meat-In-The-Sandwich" fatal accident claims. As always, it is incredibly well researched and I cannot thank Linda Jensen and her team at Bottom Line enough for allowing me to include their work in The Barrister.

With a new year comes new leadership at ACTLA. You'll have been introduced to our new Chair, Owen Lewis, in his earlier letter, but make note of some of the other changes to our board and be on the lookout for emails from Kevin Koshy, our new membership services administrator!

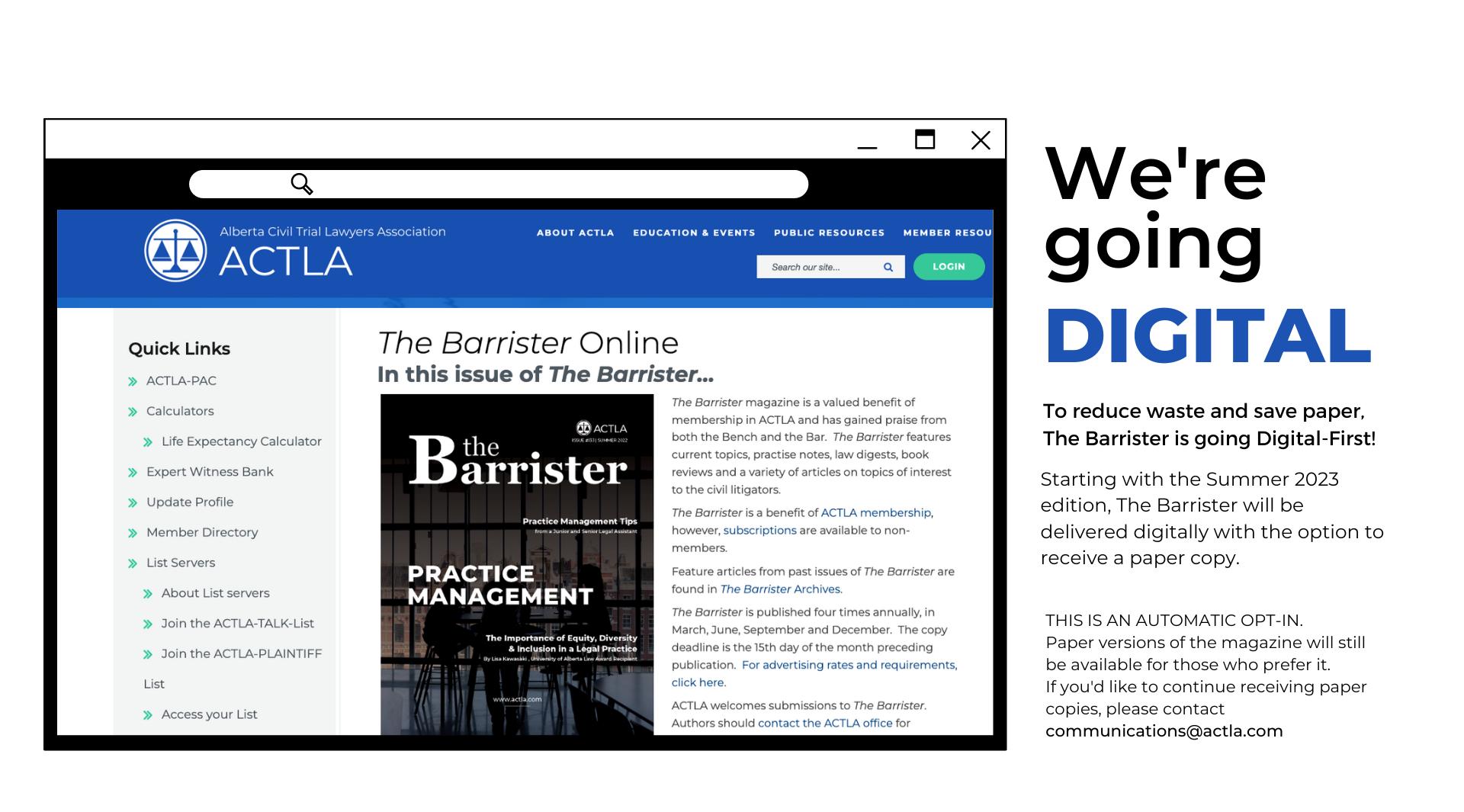

I'd also like to take this opportunity to reiterate the graphics you'll see throughout this edition - The Barrister is moving to a digital-first format, which means you'll have to opt-in to receive your paper copy at an additional cost. Please contact the office for more information.

Sincerely,

Nash Calvert Editor-In-Chief

2022 has been a year of change and transition for ACTLA. As we look back on the year, we are filled with gratitude for our member’s commitment through the years and look forward to 2023 with excitement. To you our valued members, sponsors, and volunteers, we extend a heartfelt thank you for all your support. We can’t wait to see what we are able to bring to you all in 2023. Here is what you helped us achieve in 2022:

We returned to in-person learning events with our Questioning Seminar in the Spring and our Masterclass Seminar in the Winter

9 Lunch N' Learn Webinars

2 Half-Day Webinars

Meet the Future Premier Webinar Series in partnership with New West Public Affairs

Published 5 issues of the Barrister, including 1 Special Edition 35th Anniversary Issue

Wrote letters to key government ministers advocating on behalf of our members

Met with MLAs to raise our concerns regarding tort reform and no-fault insurance

Provided written submissions to the Alberta Automobile Insurance Rate Board in response to the semi-annual Oliver Wyman report at August Annual Meeting and to the UCP Caucus

Worked with CBA (Alberta Branch) to organize the retirement gala for the Honourable Justice Catherine A. Fraser in Edmonton

Have hired new staff to better serve you

Here is what you can do to continue to support ACTLA:

You can become a member or invite new members

Our members help sustain our non-profit organization and as a member, you get access to the Barrister magazine, Education and Events, ACTLA Listservers, Litigation Group, Membership Directory, Expert Witness Bank, Looking-for-aLawyer referral service, and much more. For more information about becoming a member please contact membership@actla.com

You can become a sponsor.

These partnerships allow businesses the opportunity to be aligned with their potential clients. For more information about becoming a sponsor, please contact communications@actla.com

You can become a volunteer.

ACTLA has many opportunities for various professionals to volunteer their time and skills to support our cause. For more information about becoming a volunteer, please contact executivedirector@actla.com

Alberta’s next general election will be held on May 29th and both public and private polls indicate the election will be the province’s most competitive in 30 years. Public polls indicate a dead heat between the UCP and NDP while some private polls suggest an NDP or UCP lead. The polling and political environment is dynamic and is expected to further evolve over the coming weeks.

One thing is for certain: the election will be competitive and close. There are 87 seats in Alberta’s legislature and 44 are required to form a majority government. The NDP is widely expected to sweep the 20 seats in the City of Edmonton. There are 41 seats in rural Alberta and mid-sized urbans like Lethbridge, Red Deer, Medicine Hat, Grande Prairie and Fort McMurray. The UCP is expected to win the vast majority of these seats – at least 35 – probably more. This means the City of Calgary and its 26 seats will decide the election.

Overall, a close election can have significant implications for ACTLA. Election results could potentially affect the legal and regulatory environment in which ACTLA operates, including

areas such as auto insurance and administration of justice. It is important for ACTLA members to monitor the election closely and to engage with candidates and policymakers to ensure that its priorities and objectives are taken into account.

Before we get into how to engage effectively, let’s overview where one of ACTLA’s key priorities – the issue of auto insurance – currently sits.

Last December, a report released by the Insurance Corporation of British Columbia (ICBC) stated that Albertans were paying among the highest rates for auto insurance in Canada. This report took the Alberta government off guard and Premier Danielle Smith immediately announced that she would review insurance rates and the auto mobile insurance system with a goal to reduce premiums and enhance affordability for Albertans.

In January, the government announced it would be freezing rates for 2023 and would continue to look at options for more reforms after the provincial election.

To no surprise, the Insurance Bureau of Canada is proposing

Overall, a close election can have significant implications for ACTLA. Election results could potentially affect the legal and regulatory environment in which ACTLA operates, including areas such as auto insurance and administration of justice

reforms that will benefit them at the expense of consumers and accident victims. The IBC is requesting that government allow consumers to opt-out of pain and suffering awards, along with further tightening of the Minor Injury Regulation. These reforms are akin to a hybrid no-fault auto insurance system, which would hurt vulnerable Albertans, and negatively impact their ability to receive appropriate compensation for the injuries suffered due to the negligence of another. Furthermore, this reform would do precious little to affect consumer premiums.

Albertans are concerned about high auto premiums. Auto insurance is an affordability issue for Albertans and thus also a concern for both parties. ACTLA’s approach in this upcoming election is to execute political outreach and educate candidates from both parties, counteract policy positions from the IBC, and reboot FAIR Alberta to ensure it’s fulfilling its role of functioning as a public communications counterbalance to the IBC.

In terms of political outreach and candidate engagement, ACTLA will pursue both Executive-driven and member-driven engage-

ments. Executive-driven engagement will focus on civil service officials within the Alberta NDP and relevant critics within the NDP. Member-driven engagements will include meeting with local MLAs and candidates in key ridings. Key messaging and guidance materials have been developed and will be shared with members who are meeting with MLAs and candidates.

FAIR Alberta has gone through a slight rebrand with a fresh and updated look, and seeks to re-engage with Albertans on the auto insurance issue from a consumer perspective. The rebrand has been an opportunity for FAIR to revise its messaging and positioning for the upcoming election, which will help in communicating to an audience interested in the election.

Albertans need an insurance system that is fair, affordable, and protects fundamental civil rights. Through the work of ACTLA and its members during the election, we can help ensure that Albertans get the auto insurance system they deserve.

By Justin Monahan

By Justin Monahan

The most useful lesson junior lawyers can learn, and learn quickly, is that they know very little about the practice of law. Having been called to the Bar five months ago, I should know. The refrain of even the most experienced lawyers seems to be that, in our chosen profession, you can never stop learning.

In light of the above, here are three resources I have found valuable as a junior lawyer to help my practice and expand my knowledge:

by Karen Salmon and Ira Nishisato

by Karen Salmon and Ira Nishisato

Published by LexisNexis, the Alberta Litigator’s Pocket Reference is a must-have for any litigator starting their career. This handy guide centralizes a great deal of useful information, including directions to different Alberta courthouses, motion court days and times, and a directory of law firms. It also provides step-by-step directions on how to conduct a legal action, from commencing proceedings to interim applications, to discovery and questioning, to trial and appeal. At each step in the process, the book will raise important points to consider. For junior lawyers, this book will not only answer your basic questions, but will also answer questions you may not have realized you should be asking.

If your firm subscribes to Westlaw, you may have access to PracticalLaw. PracticalLaw is a great resource for both solicitors and litigators alike. In terms of litigation, PracticalLaw provides a host of useful resources, including draft pleadings, practice notes, and toolkits.

I was recently asked to assist in responding to a Security for Costs Application. My first stop was PracticalLaw, which turned out to have a Security for Costs Application Toolkit. The Toolkit provided a Practice Note, which is basically a research memo that Westlaw updates and maintains to reflect the current law. This Practice Note provided me with an overview of how Security for Costs applications work and served as a great starting point in my research. The Toolkit also provided draft Security for Costs precedents, including

PracticalLaw will not answer complicated legal questions and it will not do your work for you; it will, however, provide you with a solid starting point and make your work more efficient.

The greatest resource available to any junior lawyer is their team. Fellow lawyers, be they partners, associates, or counsel, are great resources. Do not hesitate to ask them questions when needed.

That said, the most valuable (and sometimes most accessible) resource for a junior lawyer is often their firm’s staff. When you are first starting out in your legal career and for many years after, paralegals, legal assistants, and other staff members will have a great deal more experience than you. They can be a great source of advice and information, especially for questions regarding firm procedure and legal processes. Staff members can also assist in drafting pleadings and locating relevant precedents.

A recent story may exemplify the value of relying upon your firm team. I was recently asked to draft pleadings for an Interpleader Application. My first step (after coming up short on PracticalLaw and other available resources) was to ask the associates at my firm if they had ever brought such an application before. One of the more senior associates had been involved with a similar application years ago, but she could not remember the name of the file. We asked her assistant, who not only remembered the name of the file but was able to also provide me with the precedents. Using those precedents, I was able to quickly draft the pleadings in a couple of hours. With the help of my Team, I was able to get the task done quickly and with a lot less stress. Hopefully the above resources will be as useful to your practice as they are to mine.

Stop hindering the ability to take on new files, manage operating expenses, and invest in growth.

Unlike traditional lenders, we fully understand the litigation practice business model. Deferred legal fees, unpredictable file durations and increasingly onerous disbursement requirements result in unique funding challenges that banks cannot address. We can.

Expert Access combines two essential services for lawyers: sourcing qualified experts using our proprietary Expert Search tool and deferring payment until settlement with no interest for two years.

A flexible tool law firms can use to finance any disbursement, on any file, at their discretion. Repayment is deferred until settlement of the underlying file, perfectly in line with a firm’s cash flow.

BridgePoint not only understand the contingency fee business model better than any bank, their disbursement funding solutions are tailor designed for it, with payments perfectly mirroring my settlement cashflow.

By Amani Abdu

By Amani Abdu

As a junior lawyer, it can be challenging to find the time to learn and develop good practice management skills. However, these skills are essential to provide competent legal services to your clients. Technology can play a crucial role in practice management by streamlining workflow, increasing productivity, and keeping lawyers organized.

The Law Society of Alberta Code of Conduct added a requirement for lawyers to maintain technological competence in 2020. Rule 3.1-2 and the relevant commentary states that lawyers should develop an understanding of, and ability to use, technology relevant to their practice.1

To learn more about the use of technology in law practice, the Canadian Bar Association's article "Legal Ethics in a Digital Context" is an excellent resource.2 It covers issues ranging from technological competence and data security to virtual work practices, online marketing, and social media.3 The Law Society of Alberta's website also offers general resources on technology and practice management.4

As a junior lawyer, it's important to learn what programs and tools are available at your firm and how to use them effectively. There are many different tools available, so it's essential to choose the ones that are right for your practice. Some of the most useful technological tools are simple features found in common programs.

For instance, Microsoft Excel can be used to create a Master File List that provides a snapshot of all open files and links to automatically open a client’s electronic folder or create an email to a client. Outlook is also highly customizable and offers features to create reminders for an e-mail sender or recipient, organize e-mail folders, and store and recall repetitive information using the InsertQuick Parts tool. Macros can also be used to automate certain activities in Outlook such as saving sent e-mails in a specific folder. The Microsoft Planner Application is a cloud-based visual task management system that can be accessible to both an assistant and lawyer to streamline communications.

Remember that the best tool is something that you will consistently use. Technology can be very useful in managing your practice effectively and efficiently, but you must take the necessary time to learn and utilize it properly. If you need external help, the Law Society of Alberta also provides Practice Management Consultations at no charge.5

1Law Society of Alberta, LSA Code of Conduct, Rule 3.1-2, Commentary [5]-[6].

2Amy Salyzen & Florian Martin-Bariteau, "Legal Ethics in a Digital Context", online: Law Society of Alberta <https://www.lawsociety.ab.ca/new-resource-legal-ethics-in-a-digital-context/>

3Amy Salyzen & Florian Martin-Bariteau, "Legal Ethics in a Digital Context", online: Law Society of Alberta <https://www.lawsociety.ab.ca/new-resource-legal-ethics-in-a-digital-context/>

4Practice Management Consultations, online: Law Society of Alberta <https://www.lawsociety.ab.ca/lawyers-and-students/practice-management-consultations/>

5Practice Management Consultations, online: Law Society of Alberta <https://www.lawsociety.ab.ca/lawyers-and-students/practice-management-consultations/>

You graduated law school, completed your articling term and CPLED, and suddenly a very lengthy journey has come to an end. You are officially a lawyer, entitled to practice law as a member of the Law Society of Alberta (“Law Society”). As for many new lawyers before you, ALIA exists on the edge of your consciousness but remains shrouded in much mystery. Yet, as a private practice lawyer and a subscriber to the Alberta Lawyer’s Professional Liability and Misappropriation Indemnity Group Policy (“the Group Policy”), you now have certain rights and obligations you should familiarize yourself with.

ALIA, a wholly-owned subsidiary corporation of the Law Society, provides Alberta’s mandatory professional liability indemnity program to lawyers who are required to participate in it. ALIA administers the Group Policy, which includes Part A (negligence claims), Part B (misappropriation claims), and the universal cyber coverage program (cyber claims).

For claims that are covered under Part A of the Group Policy, there is a $1,000,000 Occurrence limit, subject to any sub-limits, and a $2,000,000 Aggregate Limit (meaning per “policy period”, which runs from July 1st to June 30th annually).

Many law firms pay for additional, excess insurance coverage, to avoid any risk of personal exposure. The Part B Misappropriation limit is $5,000,000 with a profession-wide annual aggregate limit of $25,000,000.

The Group Policy is subject to certain conditions and exclusions; a full copy can be found on ALIA’s website, and you

However, starting your legal career off on the right foot includes being aware of the realities of practicing law. It is key to learn the systems that can be adopted to reduce the chances of such claims, as well as your obligation to report to and cooperate with ALIA.

The reality is that lawyers are human, like everybody else, and mistakes are made. Lawyers are accused of professional negligence and lawyers are sued – often by their own clients, but also by opposing and other affected parties. The best thing you can possibly do to protect yourself when a potential problem arises is report to ALIA.

would be well-served to review the FAQs and policy in full.1

Cyber coverage is provided by a commercial insurer, Zurich. The Zurich Policy and the policy limits are available to subscribers on the Law Society’s Lawyer Portal, stored behind a login to protect it from cybercriminals who seek to exploit this information.

Being sued for professional negligence is, quite understandably, not something lawyers like to think a great deal about.

When to report to ALIA is a frequently asked question, and the best way to approach it is to report as soon as you become aware of a professional negligence claim or potential claim (any circumstance that could reasonably be expected to give rise to a claim, however unmeritorious) against you. (Note that cyber claims are to be reported directly to Zurich.) That means anything from being served with a Statement of Claim, out of the blue, to an unhappy client suggesting you made a mistake or simply did not advocate strongly enough on their behalf. There is no downside to reporting true “abundance of

1. https://www.lawsociety.ab.ca/lawyers-and-students/alberta-lawyers-indemnity-association/group-policy/group-policy-faqs/.

"Starting your legal career off on the right foot includes being aware of the realities of practicing law."

caution” scenarios to ALIA. Doing so creates a record of that report with a designated file and protects you from a coverage perspective in the event that a potential claim evolves into an actual one. ALIA’s website FAQs provide more examples of when to report a claim.

Reporting a claim or potential claim is straightforward. Contact ALIA by:

(1) phone - 403.229.4716 or 1.800.661.1694;

(2) email – ALIA@lawsociety.ab.ca; or

(3) by submitting an email form via the websitehttps://www.lawsociety.ab.ca/lawyers-and-students/ alberta-lawyers-indemnity-association/report-a-claim/

You will need to submit an Indemnity Claim Report form, which can be found on the website. Once you report a claim or potential claim, a Claims Counsel with ALIA will be assigned to your file and work with you to gather all necessary information, including the Indemnity Claim Report form.

In some cases, the process of gathering all the background information and documents related to the claim or potential claim can prove to be time consuming. That being said, never delay making your initial report to ALIA in an effort to provide all relevant information from the get-go. Rather, make the initial report as soon as you become aware of it and your Claims Counsel will work with you to pinpoint the additional information that is needed.

In most cases – where you continue to act for a client and that client is the party with the potential claim against you – the next step will be to advise your client of the problem that has arisen or the potential issue with their file and recommend that they seek independent legal advice with respect to that issue. That recommendation should be made in writing. ALIA Claims Counsel can provide some guidance for the content of that letter to your client, but ALIA strongly encourages you to contact an LSA Practice Advisor to discuss and ensure you comply with your obligations under Section 7.7-1 of the Code of Conduct. Practice Advisors provide free, confidential advice and can be reached via phone (Toll free: 1.866.440.4640; Local: 587.390.8462) or by submitting an email form on the Law Society of Alberta’s website.

As a junior lawyer, it can be challenging to find the time to learn and develop good practice management skills. However, these skills are essential to provide competent legal services to your clients. Technology can play a crucial role in practice management by streamlining workflow, increasing productivity, and keeping lawyers organized.

The Law Society of Alberta Code of Conduct added a requirement for lawyers to maintain technological competence in 2020. Rule 3.1-2 and the relevant commentary states that lawyers should develop an understanding of, and ability to use, technology relevant to their practice.

Advertise your business to hundreds of legal, business and government professionals with an ad in our magazine!

Receive discounted rates when you sign onto a multiple issue agreement.

To learn more about the use of technology in law practice, the Canadian Bar Association’s article “Legal Ethics

To learn more contact communications@actla.com

Reporting to a Practice Advisor does not, however, equate to reporting to ALIA. Beyond your ethical obligations to your client, advising your client of the potential problem in writing can also assist in triggering the commencement of the limitation period with respect to any potential lawsuit against you.

There is a $5,000 individual deductible that applies to defence costs, damages, and repair costs, meaning the subscriber has to pay the first $5,000 paid out on the claim. Where repair costs or damages are paid out on Part A claims, there is a professional liability assessment (“Surcharge”) levied, payable in addition to the annual base levy for five consecutive practice years. The deductible and Surcharge are not applicable if the claim is covered by the Western Law Societies Conveyancing Protocol (Alberta) and the lawyer has fully complied with the requirements of that protocol.

If the claim is potential, perhaps reported out of an abundance of caution, it could be that Claims Counsel monitors the file for a period of time, following up occasionally, and may be able to close it with no claim arising. Assuming ALIA incurs no costs, then there would be no deductible or Surcharge.

On the other end of the spectrum, if a covered claim results in litigation, your Claims Counsel will retain defence counsel (who is on a joint retainer, representing both ALIA and the lawyer). Defence counsel will assist with assessing your liability, including exposure/risk as well as viable defences, which ALIA will use to determine the appropriate file strategy – including possible early resolution.

Between those two extremes exists a scenario where your former client has made a claim to ALIA, shy of filing/serving a Statement of Claim. In that case, ALIA Claims Counsel will work with you to determine whether the claim has any merit and whether to retain defence counsel or attempt to resolve the claim directly with the former client.

Another possible scenario is when a potential claim is reported to ALIA where there remains a somewhat distinct opportunity for particular steps to be taken to mitigate the claim or avoid it entirely. These scenarios are called “repairs”. The decision as to whether to attempt a repair is solely within ALIA’s discretion, but requires the client’s consent. A common example of a repair

is where ALIA retains counsel on behalf of the client to defend against an application to strike a claim for delay pursuant to 4.31 and/or 4.33 (the “drop dead” rule) of the Rules of Court. In such cases, successfully defending the delay application (i.e. a successful repair) means the underlying claim can proceed and avoids the claim against the lawyer altogether.

Throughout the ALIA claims process, your cooperation and assistance are required to ensure proper management of your file and, ultimately, to best protect you in the claim. Your cooperation is also a precondition for coverage under the Policy.

Some of the most straightforward and common claims made to ALIA relate to missed limitation periods. Anyone’s diary system can fail. Law practice is inherently busy, involving many deadlines. One of the key strategies to minimize your chances of an ALIA claim is making sure your firm maintains a reliable limitation/bring forward system, including backup practices. Limitations should be discussed and pinpointed from the outset of a file and immediately entered into your diary systems.

Communication errors are another leading cause of loss; these can be avoided by properly papering your file, particularly the legal advice provided to your clients and the corresponding instructions you are given. Maintain familiarity with the Rules of Court, stay on top of caselaw, and endeavor to know who your client is. Seek the advice of more senior counsel and/or a Practice Advisor when a situation you are presented with raises uncertainty or where a client becomes unresponsive with impending deadlines. And, when systems fail or strategies are missed, seriously consider whether you should be reporting to ALIA. It is always better to err on the side of caution when it comes to reporting.

If you have any questions about the ALIA process – generally, or with respect to a specific situation – the ALIA team is here and always happy to help. ALIA strives to provide up-to-date information about the Policy as well as loss prevention issues and strategies through its website, ALIAlert emails (urgent communication which provides notice of frauds that target subscribers or their clients) and ALIAdvisory emails (generally educational in nature covering topics such as policy information and loss prevention tips). Keep an eye out for ALIAlert and ALIAdvisory emails in your inbox.

We will review an Alberta Court of King’s Bench decision, published on March 14, 2023 referenced as Couch v Olatiregun, 2023 ABKB 104 (CanLII).

This was a case involving a rear end collision which occurred on April 13, 2017. The Defendant, who was unrepresented, and did not attend the trial, was found 100% at fault for the collision. This case involved an analysis and determination pursuant to the Minor Injury Regulations in Alberta, and whether the injuries caused by this rear end collision were outside of the interpretation of what is deemed to be a “minor injury.”

The Plaintiff claimed damages for the following injuries resulting from the motor vehicle collision:

• neck and upper back stiffness;

• injury to shoulders;

• headaches;

• injury to mid back;

• pain in the ribs.

A wage loss claim was not advanced, nor was there a claim for property damage.

An Alberta Collision Report Form before the Court noted that the April 13, 2017 crash was a rear end collision that did not result in any injuries, and that Calgary Police had not attended the scene. This collision was a property damage incident. There was allegedly no damage to the Plaintiff’s vehicle and minor damage to the Defendant vehicle.

A chiropractor, who was treating the Plaintiff, diagnosed a WAD II injury in April of 2017. By August of 2017, there was noted improvement and the chiropractor had recommended ongoing treatment for an additional 4 to 6 weeks. There was further evi-

dence that the Plaintiff returned to pre-accident level of activities, was working full time, and there were no noted restrictions at work.

The Court concluded:

“There is no chronic pain issue in this case. It is clear that he has not suffered a serious impairment and that he had ongoing and pre existing medical history relevant to and consistent with his post accident treatment modality.”

This case went into a discussion regarding the Minor Injury Regulations in Alberta. Of note, it can be confusing as there is the “old” interpretation of what injuries are captured under the Minor Injury Regulations, and new interpretation which is relevant for claims that occur post November 1, 2020. As a reminder, this collision occurred on April 13, 2017 and will involve the “old” interpretation of minor injuries.

The new interpretation (which is not applicable to the subject case), states the following:

Effective November 1, 2020, when the meaning of “minor injury” was expanded and redefined as sprains, strains or Whiplash-associated disorder (WAD) injuries “caused by the accident that does not result in a serious impairment and includes, in respect of a sprain, strain or WAD injury that occurs on or after November 1, 2020, any clinically associated sequelae of the sprain, strain or WAD injury, whether physical or psychological in nature, caused by the accident that do not result in a serious impairment.”

A sequelae means a condition which is the consequence

of a previous disease or injury. So, the definition was expanded to include not only sprains, strains or WAD injuries caused by an accident that did not result in “serious impairment” but also conditions that were a consequence of those sprains, strains or WAD injuries.

The analysis of whether an injury is deemed to be minor is determined on the following basis:

1. whether an injury is a sprain, strain, or WAD injury; and

2. whether the injury results in a serious impairment: MIR, s 4(1).

The following cases were referenced in Couch:

1. Sparrowhawk v Zapoltinsky, 2012 ABQB 34; and

2. Jackson v Cooper, 2022 ABKB 609.

As per the analysis in Sparrowhawk, the Court stated the following:

“I find that there is no physical or cognitive function impairment, that the sprain, strain or WAD injury was a primary factor for a minor injury of limited duration as a result of the motor vehicle accident. The impairment did not cause substantial inability, in fact did not cause any inability to perform essential work tasks, essential facets of training or education, or normal activities of the plaintiff’s daily living. With some minor exception the impairment has terminated. In all it is important to note that his training at work and his work was not impaired as a result of this accident. His employment required minimal physical activity, generally sitting and observing computer screens for x-ray analysis of carry-on baggage. Some minor pre accident household chores were impacted, but minimally. There does not appear to be much in terms of sporting or leisure activity that was interrupted, nor were physical relations with his wife, nor caring for or playing with his children, although there appears to be some minor inconvenience with respect to walking his dogs.

We want to highlight this decision, which also offers a detailed discussion on the Minor Injury Regulations (pre-November 2020) and resulted in an award above the CAP.

The Court in Jackson v. Cooper concluded that the injuries sustained by this Plaintiff were not capped by the Minor Injury Regulations. The Court did state that the evidence must be viewed as a whole and concluded that the Plaintiff’s “ongoing chronic

As noted by the Court:

“I find that, as a result of the motor vehicle accident, Mr. J. sustained a serious impairment, namely, an impairment of a physical or cognitive function, which has resulted in a substantial inability to perform the normal activities of his daily living, which has been ongoing since the motor vehicle accident, and which is not expected to improve substantially. In any event, chronic myofascial pain is not the type of injury covered by the MIR as it existed at the time of the accident.”

In Jackson v. Cooper, the Court awarded $55,000. And stated:

“Although Mr. J. received treatment for his injuries for

W e l c o m e t o t h e T e a m ! J

r M B A a t M c G i l l U n i v e r s i t y I n h e r s p a r e t i m e s h e e n j o y s b e i n g o u t d o o r s , p l a y i n g g o l f a n d s o f t b a l l , a s w e l l a s r e a d i n g a n d e x p l o r i n g n e w r e s t a u r a n t s

Viewpoint is Excited to Welcome Jessica Cook as our Business Development Manager, Alberta Business

I t i s w i t h m u c h p l e a s u r e a n d g r e a t e n t h u s i a s m t h a t V i e w p o i n t M e d i c a l i s a n n o u n c i n g t h e h i r i n g o f J e s s i c a C o o k a s t h e f i r m s n e w B u s i n e s s D e v e l o p m e n t M a n a g e r –A l b e r t a B u s i n e s s

J e s s i c a i s a s k i l l e d p r o f e s s i o n a l w h o h a s s p e n t t h e l a s t s e v e n y e a r s m a n a g i n g a l a r g e n u m b e r o f s t a f f w i t h i n t h e l e g a l i n d u s t r yp r i m a r i l y w i t h i n t h e a r e a o f p e r s o n a l i n j u r y S h e h a s o b t a i n e d i n v a l u a b l e e x p e r i e n c e a n d m e n t o r s h i p w h i l e w o r k i n g a t o n e o f A l b e r t a ’ s m o s t r e p u t a b l e l a w f i r m s a n d t h i s e x p e r i e n c e w i l l s e r v e h e r w e l l a s s h e t r a n s i t i o n s i n t o h e r n e w r o l e a t V i e w p o i n t J e s s i c a i s l o o k i n g f o r w a r d t o c o n t i n u i n g t o b u i l d h e r n e t w o r k o f p r o f e s s i o n a l c o n t a c t s w h i l e s u p p o r t i n g t h e e n t i r e V i e w p o i n t t e a m a n d i t s d e d i c a t e d c l i e n t e l e P l e a s e h e l p u s i n w e l c o m i n g J e s s i c a t o t h e V i e w p o i n t f a m i l y !

only 7 months after the motor vehicle accident and was able to continue full-time employment, he has sustained a significant and ongoing negative impact on his normal activities of daily living and his enjoyment of life. Given Mr. J.’s injuries and the impact that it has had on his life, his general damages for pain, suffering, and loss of enjoyment of life are assessed at $55,000.”

In Couch, the Plaintiff’s injuries were deemed to be minor, a WAD 1 injury. Furthermore, the Plaintiff was not able to prove that the injury resulted in a serious impairment. The Plaintiff did not have functional impairments that were of significant duration, his work was not interrupted and nor were his activities of daily living interrupted.

The Court stated the following:

I find that Mr. C. has suffered a minimal inability and has not suffered any whole person impairment. I find that there has been an injury within the WAD 1 level and that the MIR does capture Mr. C.’s claim for general damages for pain suffering and loss of enjoyment of life. I fix that amount at $3,000. I am not in a position to be able to substantiate for loss of housekeeping. There does not appear to be any evidence of any quantifiable loss to him or the members of his family in residence with him.

I do find that there were some special damages with respect to travel to and from his chiropractic clinic and there were 76 visits at .50 per kilometre. I fix that at $1,672. I am not satisfied that the claim to move his daughter back to Calgary can be justified and associated or attributed to the motor vehicle accident. I award him $50.00 for painkillers.

The maximum amount payable under the Minor Injury Regulations for accidents occurring on or after January 1, 2023 is $5,817. As per the Bulletin:

In accordance with the MIR, effective January 1, 2023, the maximum minor injury amount of $5,488 will be adjusted by six per cent, to $5,817. The new amount is applicable to minor injuries resulting from automobile accidents that occur in Alberta on or after January 1, 2023.

Priscilla Cicek is the National Director of Business Development with Viewpoint Medical Assessment Services. She has 25 years of experience as a paralegal and has been an instructor of the Paralegal Program at a Vancouver College teaching personal injury law. She has been an invited speaker and chair with multiple associations in both BC and Alberta. She has written hundreds of legal articles in her well-known blog "Case Law Corner" and her written work has been published by the Lawyer's Daily. 4

Case Law Corner is the personal blog of Priscilla Cicek. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy and completeness on any information found on this site. Legal advice should always be sought.

Rear-end collisions are among the more common types of accidents giving rise to personal injury claims. In determining liability where a vehicle is struck from behind, there is an initial presumption that the following driver is at fault. The presumption is rebuttable, but the onus to do so is heavy, and requires a demonstration that the driver who was struck was negligent under the common law on a balance of probabilities.

If multiple vehicles are involved in the incident, the driver who is struck may be the “meat in the sandwich” – stopping quickly to avoid a collision with a vehicle in front, but then struck from behind by another driver. Even in those cases, the burden remains on the following driver to demonstrate that they are not responsible for the accident.

The Alberta Use of Highway and Rules of the Road Regulation, AR 304/2002 sets out the rules regarding stopping. Section 10 (b) provides:

Use of signalling device

10 A person driving a vehicle may indicate that person’s intention to carry out the following by doing the following:

(b) in the case of stopping, if the vehicle is equipped with stop lamps that comply with the requirements of the Vehicle Equipment Regulation, by the use of the stop lamps.

At section 18, the Use of Highway and Rules of the Road Regulation contains the following provision about following too close to another vehicle:

Following other vehicles

18(1) A person driving a vehicle shall not drive the vehicle so as to follow another vehicle more closely than is reasonable and prudent having regard for the following:

(a) the speed of the vehicles;

(b) the amount and nature of traffic on the highway;

(c) the condition of the highway.

Division 9 of the Use of Highway and Rules of the Road Regulation sets out the provisions with respect to stopping. Section 35 provides:

Signalling stops

35 Before stopping a vehicle, the person driving the vehicle shall

(a) signal that person’s intention to do so in a manner as provided for in Division 3, and

(b) give the signal in sufficient time to provide a reasonable warning to other persons of that person’s intention.

In an old Supreme Court of Canada case, Rintoul v. X-Ray & Radium Industries Ltd., 1 the Court considered the liability of drivers in rear-end collisions. Cartwright J held:

There can be no doubt that, generally speaking, when a car, in broad daylight, runs into the rear of another which is stationary on the highway and which has not come to a sudden stop, the fault is in the driving of the moving car, and the driver of such car must satisfy the Court that the collision did not occur as a result of his negligence [emphasis added] (para 8).

The issue of rear-end collisions was discussed in the old case Gilchrist v. Linau.2 The plaintiff brought his car to a stop because there were four stopped cars ahead of him, and his car was run into from the rear by a car driven by the defendant. Turcotte DCJ held that

1 Rintoul v. X-Ray & Radium Industries Ltd., [1956] SCR 674, 1956 CarswellOnt 77, https://www.canlii.org/en/ca/scc/doc/1956/1956canlii16/1956canlii16.html?resultIndex=1

2 Gilchrist v. Linau, 1957 CarswellAlta 73 (Alberta District Court).

https://www.canlii.org/en/ab/abqb/doc/1957/1957canlii597/1957canlii597.html?resultIndex=1

the accident was caused solely by the negligence of the defendant for failing to keep a proper lookout. Turcotte DCJ held:

There is a heavy onus on the driver of a car running into another car from the rear and the defendant Ursula Linau has not discharged that onus in any way. The evidence shows that the plaintiff brought his car to a stop in a gradual manner. The defendant driver did not meet with a sudden emergency; at least, if she had been keeping a proper lookout, no sudden emergency should have confronted her. This is not a case of suddenly coming upon a stalled car at night or being confronted by a car stopping quickly in front of the defendant’s car [emphasis added] (para 7).

The ratio in this case emphasizes that following drivers will bear a heavy onus to show that the Accident was not caused by their negligence.

The case Moseley v. Spray Lakes Sawmills3 expressly considered the liability of drivers in rear-end motor vehicle collisions. The plaintiff sustained serious injuries when his car struck the rear end of a logging truck. At the time of the accident, the roads were bare and dry with good visibility. The truck was driving at a low speed on the shoulder with its flashers on, and the driver was driving as close as possible to the shoulder. There was no evidence that the plaintiff tried to avoid the accident. The plaintiff had been travelling at an unsafe speed. The plaintiff brought an action in negligence against the driver and owner of the truck. Paperny J held that drivers must exercise the degree of care and caution that an ordinarily careful and prudent person would exercise under similar circumstances. Paperny J held:

In Osbaldeston v. Bechtold (1952), 7 W.W.R. (N.S.) 253 (Alta. C.A.), aff’d [1953] 2 S.C.R. 177 (S.C.C.), the Supreme Court of Canada held that where the driver of an approaching car has time and opportunity or would have had it had he been driving at a proper speed and keeping a proper look out to avoid a collision and did not, he alone is responsible for the resulting damage notwithstanding the Contributory Negligence Act, even though the driver of the stationary car was at fault in putting it in a position which made the accident possible. The Supreme Court of Canada has held in Swartz Brothers Ltd. v. Wills, [1935] S.C.R. 682, and Harrison v. Bourn, [1958] S.C.R. 733, that where there is nothing to obstruct the vision and there is a duty to look, it is negligence not to see what is clearly visible. In my view that principle applies in this case (paras 57-58).

Paperny J held that the plaintiff had sufficient time to avoid the accident; the sole cause was the plaintiff’s inattention. There was no negligence on the part of the defendants, and the claim was dismissed.

In the more recent Alberta case Cullen v. Kao,4 the defendant was driving home after surgery and claimed he lost vision, memory, and consciousness. His vehicle struck the rear of the first plaintiff’s vehicle, which spun around and interacted with the defendant’s vehicle again. The defendant’s vehicle then collided with the rear of the second plaintiff’s vehicle. Poelman J cited Rintoul, supra, for the principle that when the plaintiff shows that the circumstances of an accident lead to a prima facie case of negligence against a defendant, the defendant has the burden of showing the accident was not caused by their negligence:

3 Moseley v. Spray Lakes Sawmills (1980) Ltd. (1997), 194 AR 384, 1997 CarswellAlta 1295 (QB)

https://www.canlii.org/en/ab/abqb/doc/1997/1997canlii14730/1997canlii14730. html?resultIndex=3

4 Cullen v. Kao, 2019 ABQB 799, 2019 CarswellAlta 2298

https://www.canlii.org/en/ab/abqb/doc/2019/2019abqb799/2019abqb799. html?resultIndex=1

It has been described as a “heavy burden,” in cases such as the defendant running into the rear of a plaintiff’s motor vehicle in daylight with good road conditions: Graham v. Hodgkinson (1983), 40 O.R. (2d) 697 (Ont. C.A.). The policy rationale for imposing a higher burden of proof is that such a defence “is based on factors under the defendant’s exclusive control or “wholly within” the defendant”: Nasser v. Roffey, 2019 BCSC 1263 (B.C. S.C.), para 46 [emphasis added] (para 12).

The circumstances of the collision led to a prima facie inference of negligence on the part of the defendant, placing the burden on him to show that his negligence did not cause the accident. Poelman J held:

Mr. Kao thus has the burden of showing that he had acted without negligence; that is, he could not have prevented or avoided what happened by taking the reasonable precautions that would be expected from a reasonable person in his situation (para 18).

As the defendant was unable to do so, he was held liable for the accident.

The onus on the following driver was again demonstrated in Woitas v. Tremblay.5 The defendant Tremblay was driving in the leftmost of three lanes of heavy traffic on the highway when traffic came to a sudden stop. Tremblay stopped her car safely, but was struck from behind by a vehicle being driven by another defendant, Bevans. The plaintiff was a passenger in another vehicle that struck one of the vehicles from behind. The plaintiff alleged that the defendants were negligent in stopping quickly and the defendants brought an application for summary dismissal. Master Wacowich held:

As can be seen from the legislation noted, it is a requirement of all drivers that they maintain a reasonable and prudent distance behind vehicles they are following.

If a driver collides with another vehicle from behind (a “rear-ender”) then the onus is on the following driver to prove that the collision did not occur as a result of his/her negligence (paras 15-16).

Master Wacowich stated that a vehicle stopping quickly or even abruptly in stop-and-go traffic is not an unexpected event or an event that occurs without justification. He held:

The Respondent’s position seems to be that Tremblay should not have braked heavily. But Tremblay obviously wished to avoid colliding with the vehicle that stopped suddenly in front of her. She discharged her duty of care by driving a proper distance such that she was able to stop without impacting any other vehicle (para 19).

In the result, Master Wacowich held that the evidence did not support the plaintiff’s allegation of negligence. If the driver of the plaintiff’s vehicle had been keeping a proper outlook, he would not have collided with the defendants. The accident would not have happened if he had been driving in a reasonable and prudent manner as required by law and by the existing road and traffic conditions.

The Woitas decision cites the British Columbia case Pryndik v. Manju 6 In that case, the defendant was forced to brake abruptly and steer his van to the shoulder of the road to

5 Woitas v. Tremblay, 2018 ABQB 588, 2018 CarswellAlta 1538.

https://www.canlii.org/en/ab/abqb/doc/2018/2018abqb588/2018abqb588. html?resultIndex=1

6 Pryndik v. Manju, 2001 BCSC 502, 2001 CarswellBC 704, affirmed by 2002 BCCA 639, 2002 CarswellBC 3238

https://www.canlii.org/en/bc/bcsc/doc/2001/2001bcsc502/2001bcsc502. html?resultIndex=1

avoid colliding with the vehicle in front of him, which had braked quickly to avoid colliding with another vehicle. The plaintiff was injured when his motorcycle collided with the rear of the defendant’s van. Baker J held that there was nothing the defendant did or did not do that caused or contributed to the accident. The plaintiff was negligent in following too close to the defendant:

It is true that Mr. Manju was obliged to brake abruptly in order to avoid colliding with the rear of Mr. Limoges’ vehicle, just as Mr. Limoges braked quickly to avoid the vehicle ahead of his. Had Mr. Manju’s vehicle struck Mr. Limoges’ vehicle, he might well have been found to have breached a duty of care owed to Mr. Limoges. However, I am not satisfied that anything done by Mr. Manju in stopping his vehicle, or in steering to the shoulder of the road, was unreasonable or in breach of any duty owed to Mr. Pryndik (para 17).

Baker J further held:

The operator of a motor vehicle, following other vehicles, should keep his vehicle under sufficient control at all times to be able to deal with an emergency such as the sudden stopping of a vehicle in the line of vehicles ahead and the telescope effect that results, as each successive driver attempts to bring his or her vehicle to a halt.

This is not a case, in my view, where a driver has stopped unexpectedly and for no good reason. Mr. Manju stopped his vehicle abruptly for a very good reason - because if he had not done so, his vehicle would have struck the rear of Mr. Limoges’ pickup truck. Mr. Manju had to stop quickly, just as Mr. Limoges had stopped quickly, albeit somewhat less abruptly, to avoid colliding with the rear of the vehicle ahead of him. A vehicle stopping quickly or even abruptly in circumstances where traffic is heavy and moving in a “stop and go” pattern is not an unexpected event, nor is it an event that occurs without justification [emphasis added] (paras 21-22).

The fault for the accident was completely with the plaintiff; he was aware there was traffic ahead of him and that it was moving in a stop and start fashion. The plaintiff failed to leave enough space between himself and the defendant. The action was dismissed.

In the British Columbia case Wright v. Mistry,7 the plaintiff’s vehicle was struck from behind by the defendant’s vehicle. The defendant alleged that the plaintiff had braked suddenly when the traffic light turned yellow. The plaintiff brought an action in negligence against the defendant. Choi J held:

In Skinner v. Guo, 2010 BCCA 321 (B.C. C.A.),8 our Court of Appeal wrote that generally, fault lies with the following driver in a rear-end collision. The Court wrote:

7 Wright v. Mistry, 2017 BCSC 239, 2017 CarswellBC 393

https://www.canlii.org/en/bc/bcsc/doc/2017/2017bcsc239/2017bcsc239.html?resultIndex=1

8 Skinner v. Guo, 2010 BCCA 321 (B.C. C.A.), https://nextcanada.westlaw.com/Link/Document/FullText?findType=Y&pubNum=6407&serNum=2022399657&originationContext=docu ment&transitionType=DocumentItem&vr=3.0&rs=cblt1.0&contextData=(sc.AbridgmentDigest)

[23] This is not to say that there is anything wrong with the generally accepted rule that following drivers will usually be at fault for failing to avoid a collision with a vehicle that has stopped quickly in front (Ayers v. Singh (1997), 85 B.C.A.C. 307, [1997] B.C.J. No. 350)9. Normally a sudden stop does not create an unreasonable risk of harm.This accords with common sense. It is, of course, open to the defendant, once the court has drawn an inference of liability based on the rear-end collision, to offer an explanation of how the accident could have come about without his negligence [emphasis added] (para 16).

Choi J held that the evidence overwhelmingly showed that the defendant was liable for the accident. The only plausible explanation was that the defendant was either following too closely or not paying attention as the parties approached the intersection. The defendant was held fully liable for the accident.

In Dubitz v. Knoebel, 10 the plaintiff was injured in a motor vehicle accident when she was rear-ended by the defendant and brought an action in negligence. The accident occurred in relatively heavy traffic. The plaintiff was driving at highway speed when the vehicle in front of her stopped suddenly. The plaintiff slammed on her brakes and came to a full stop, leaving some space between her and the vehicle in front of her. The defendant ran into the rear end of her vehicle. The defendant denied liability; he said the accident happened when traffic stopped unexpectedly, requiring emergency braking. With respect to liability for a rear-end motor vehicle accident, Marchand J held:

The case law is clear that:

1. The driver of a rear-ending vehicle is generally at fault, and the onus shifts to that driver to prove otherwise: Robbie v. King, 2003 BCSC 1553 (B.C. S.C.) at para. 13; Cue v. Breitkreuz, 2010 BCSC 617 (B.C. S.C.) at para. 15.

2. The driver of a following vehicle must leave enough space to stop safely in the event of a sudden or unexpected stop by the vehicles ahead: Pryndik v. Manju, 2001 BCSC 502 (B.C. S.C.) at para. 21; Cue at para. 15.

3. When a driver encounters unexpected and unforeseeable conditions, negligence cannot be presumed on the part of a driver who rear-ends another vehicle: Vo v. Michl, 2012 BCSC 1417 (B.C. S.C.) at para. 14 (para 242).

The defendant admitted that traffic was flowing normally. Marchand J held that the defendant was entirely at fault for the accident: The accident occurred on a main thoroughfare during rush hour traffic. Reasonable drivers know that traffic can

9 Ayers v. Singh,1997 85 B.C.A.C. 307, [1997] B.C.J. No. 350).

https://nextcanada.westlaw.com/Link/Document/FullText?findType=Y&serNum=1997407102&pubNum=0006698&origi natingDoc=I48ee703371fe5bfee0540021280d79ee&refType=IC&originationContext=document&vr=3.0&rs=cblt1.0&transitionType=Doc umentItem&contextData=(sc.AbridgmentDigest)

10 Dubitz v. Knoebel, 2019 BCSC 1706, 2019 CarswellBC 2923

https://www.canlii.org/en/bc/bcsc/doc/2019/2019bcsc1706/2019bcsc1706.html?resultIndex=1

unexpectedly back up and even stop in such conditions, regardless of the distance from upcoming intersections. Mr. Knoebel had a duty to leave sufficient distance between his vehicle and Ms. Dubitz’s vehicle to be able to come to a safe stop for this precise reason.

Ms. Dubitz was able to come to a safe, albeit screeching, stop when the vehicle in front of her stopped unexpectedly. Had Mr. Knoebel kept a safe distance and been paying attention, he would have been able to do likewise [emphasis added] (paras 245-246).

Marchand J held that this was a run of the mill rear-end accident where the defendant was either following too closely or not paying enough attention or both.

Cases where the driver who is struck from behind may bear a proportion of liability typically involve some out-of-the-ordinary behaviour by that driver that the following driver reasonably would not have anticipated.

For example, in Rushton v. Hofer,11 the plaintiff was the driver following the defendant; it was the defendant’s vehicle that was hit from behind by the plaintiff. The evidence was that the accident took place on a cold, snowy evening very late at night. Wilson J apportioned blame 75 percent to the defendants (who were in the vehicle that was struck) and 25 percent to the plaintiff (who rear ended the defendants). The accident took place on a curve. Based on the road and lighting conditions at the time, the defendant’s taillights were not visible to the following plaintiff. The defendant took a risk in stopping on the road where he did. Wilson J held that the defendant was therefore negligent and the main cause of the accident. However, Wilson J held that the plaintiff was partly to blame for the accident:

He is the following driver, so there is an evidentiary burden on him to show that he is not the cause of the collision. In my opinion he was a contributing cause. When Hofer passed him, entering upon this more narrow roadway, Rushton had knowledge from the radio and from observation that Hofer was hard to see from behind. He then knew that Hofer was immediately in front of him. He knew the road and weather conditions. He did not check his speed as he entered this narrow part and apparently, from his evidence, he could not check his speed once he saw where Hofer was. I have no evidence that he put on his high beam, although in the circumstances that may not have helped him. He should have been aware that Hofer was a hazard reasonably close in front of him. He must have been driving too fast for the light conditions available to him that night; in other words, overdriving his lights [emphasis added] (para. 26).

Wilson J further held:

I hold that it is a breach of duty for a following driver to drive at a speed that makes it difficult or impossible for him to stop when a hazard unexpectedly appears on the road in front of him. That would normally visit high liability on the following driver [emphasis added] (para. 28).

11 Rushton v. Hofer, 1998 ABQB 1010, 235 AR 321

https://www.canlii.org/en/ab/abqb/doc/1998/1998abqb1010/1998abqb1010.html?resultIndex=1

In Solbach v Siebert,12 Siebert was travelling south on Deerfoot when his wristwatch fell off. He stopped the car in the travelling lane to pick it up and was struck from behind by the vehicle in which the plaintiff Solbach was a passenger. The trial judge found that the stopping was unexpected and a contributing factor to the accident:

I am satisfied that the defendant, Siebert’s action in stopping his vehicle on the outside lane of the highway without making any effort to pull over to the shoulder, when there was ample opportunity to do so, and stopping on a travel portion of the highway where oncoming traffic would not expect a vehicle to be stopped, constituted negligence on his part. […] the stopping of Siebert’s vehicle in the travelling portion of the highway was a deliberate act and not an unintentional result from other causes. I further distinguish this case from the cases where an oncoming vehicle collides with a vehicle albeit on the travel portion of the highway but which has been stationary for some time and in plain view of the oncoming vehicle. Accordingly, I find that the defendant, Siebert, was guilty of negligent conduct which caused or contributed to the accident which ensued. [emphasis added] (para 11)

Siebert was held 20% liable for the accident. The following driver, however, remained 80% liable:

[…] I am satisfied that the actions of the defendant, Abrahamson, in driving his vehicle driving his vehicle directly into the rear of a stationary vehicle on the highway, without any attempt of an evasion, when there was ample opportunity to do so, coupled with the fact that the evidence establishes that warning of the slowing and stopping of Siebert’s vehicle would have been given to the defendant […] by the brake lights on the defendant, Siebert’s vehicle, constituted a very marked departure from the standards by which responsible and competent people in charge of motor cars habitually govern themselves. Accordingly, I find on the evidence before me that the defendant, Abrahamson’s course of conduct in driving his motor vehicle at the time of the accident constituted gross negligence which caused or contributed to the accident which ensued. [emphasis added] (at para 17)

As these cases illustrate, the onus in all cases remains on the following driver to demonstrate that liability for a rear-end collision should not rest entirely on his/her shoulders. In the absence of some unusual or unexpected behaviour by the other driver, the presumption of liability may be difficult to displace.

12 Solbach v Siebert (1990), 101 AR 201, [1989] AJ No 1189

https://www.canlii.org/en/ab/abqb/doc/1989/1989canlii3295/1989canlii3295.html?autocompleteStr=solbach&autocompletePos=1

The Barrister is delivered quarterly to hundreds of law firms across Alberta.

Whether you are an experienced trial lawyer, a law student, or an expert witness, contact communications@actla.com to contribute an article and get published.

Professionally selected from the Alberta Weekly Law Digest by Royal J. Nickerson, K.C.

Originally published by Thomson Reuters in the Alberta Weekly Law Digest

McBridge v. Bacovsky

AWLD 28-2566

Restitution and unjust enrichment --- Benefits conferred in anticipation of reward — Family — Common law spouses

Man and woman lived together for eight years, they had one child together, and woman had two children from previous marriage but her son passed away — Man moved into woman’s home — Man owned company that operated chartered bus service, and woman started related chauffeured limousine company — Woman brought action seeking relief, including claim for unjust enrichment — Action allowed in part — Parties had child together and lived together for continuous period of not less than three years — Considering relevant factors, parties were in adult interdependent relationship pursuant to Adult Interdependent Relationships Act — Parties functioned as domestic unit and economic unit — Parties shared each other’s lives and were emotionally committed to each other, living together for eight years, raising child, working together, taking vacations together, entertaining man’s friends and family, and holding themselves out as family — Act did not provide property division rights — During period prior to birth of child, woman did not suffer deprivation that corresponded with any enrichment to man — During period of woman’s maternity leave and after birth of child, man was enriched by woman’s contributions at her detriment — Woman was primarily responsible for caring for child which benefitted man — Woman considered herself and man to be family unit, working together for benefit of family — Woman’s contributions to man’s company and man’s involvement in setting up woman’s related company supported finding that woman’s expectation of benefitting or being rewarded for her efforts was reasonable — Woman acknowledged taking money that belonged to man and copying documents after she found out he was having affair, but her conduct took place when she was understandably upset and emotional — Woman’s actions were not fraudulent, unconscionable or so egregious that her claim should be denied — From time child was born, woman established necessary elements of unjust enrichment, and man had not established there was reason to deny claim.

2022 CarswellAlta 1016, 2022 ABQB 240, [2022] A.W.L.D. 2541, [2022] A.W.L.D. 2542, [2022] A.W.L.D. 2566, [2022] A.W.L.D. 2567, 2022 A.C.W.S. 768, 43 Alta. L.R. (7th) 360

AWLD 30-2811

Complainant was indigenous lawyer and respondent was professional regulator over legal profession in Alberta — Complainant alleged that respondent discriminated against him by accepting, advancing and/or initiating conduct complaints against him, including allegations of direct discrimination, systemic discrimination against Indigenous lawyers and unfair practices — Complainant filed complaint alleging that respondent

discriminated against him in area of membership in an occupational association on ground of race, colour, ancestry, and/or country of origin, contrary to s. 9 of Alberta Human Rights Act — Complainant requested review of director’s decision dismissing complaint — Request denied — Complainant did not meet threshold to establish reasonable basis in evidence to proceed to next stage — Regulatory practices applied to all lawyers and there was no suggestion that complainant’s race, colour, ancestry, and/or country of origin were linked to those practices, or that they impacted Indigenous lawyers disproportionately — Complainant did not supply statistical evidence or expert testimony to support his allegations and there was little or no reliable statistical evidence which showed pattern from which discrimination could be inferred — Complainant occasionally referred to potential additional records, like alleged voluminous emails that would corroborate his assertions, but he never provided those and it was not Commission’s responsibility to compel allegedly relevant records from third parties of which it had no direct knowledge — Complainant made assertions of systemic discrimination, but those assertions were mostly conjecture or unreliable — In absence of any additional information about attitudes or conduct suggestive of conscious or unconscious biases, unreliable statistics were not enough to create reasonable basis in record to proceed further — Complainant offered no evidence or argument to suggest that timing of serving new conduct complaints was in any way linked to human rights complaint or that it was deliberate response to complaint.

Clients unsuccessfully applied under R. 10.10 of Alberta Rules of Court for review of accounts rendered by their long-time lawyers which were rendered more than one year prior to application being made in 2020 — Between March 17 and June 1, 2020, during early stages of COVID-19 pandemic, limitation periods were suspended under Ministerial Order No 27/2020 (MO 27/2020) for 75 days — Review application was made within 75 days of end of one-year time limit specified in R. 10.10(2) of Rules but review officer declined to grant 75-day extension and chambers judge affirmed decision — Clients appealed decision dismissing application for review of accounts rendered by lawyers — Appeal allowed — Suspension of limitation periods in listed enactments under MO 27/2020 was mandatory and applied to one-year time limit under R. 10.10(2) of Rules — Emergency-based Henry VIII authority manifested by MO 27/2020 was intended to address unprecedented circumstances in Alberta during early stages of COVID-19 pandemic, which included shutdown of Alberta’s trial courts — Given extraordinary context in which MO 27/2020 was issued, its limited applicability period at outset of pandemic, and interpreting its words purposively, and with fair, generous, and liberal meaning, Part 1 of MO 27/2020 intended to capture time limit set out in R. 10.10(2) of Rules and was “limitation period” triggering 75-day reprieve — Appointment for review was not read as “step [that] must be taken in any proceeding or intended proceeding” as set out in Part 2 of MO 27/2020, such that reviewing officer retained discretion not to suspend one-year time limit, and similarly R. 10.17(1) (h) of Rules was not read as providing review officer with any additional discretion to override mandatory suspension of limitation periods in Part

1 of MO 27/2020.

O’Chiese First Nation v. DLA Piper (Canada) LLP

2022 CarswellAlta 1319, 2022 ABCA 197, [2022] A.W.L.D. 3381, [2022] A.W.L.D. 3506, 2022 A.C.W.S. 1641, 49 Alta. L.R. (7th) 280

AWLD 35-3386

Civil practice and procedure --- Pleadings — Statement of claim — Striking out for absence of reasonable cause of action — Facts pleaded not supporting claim

AWLD 35-3382