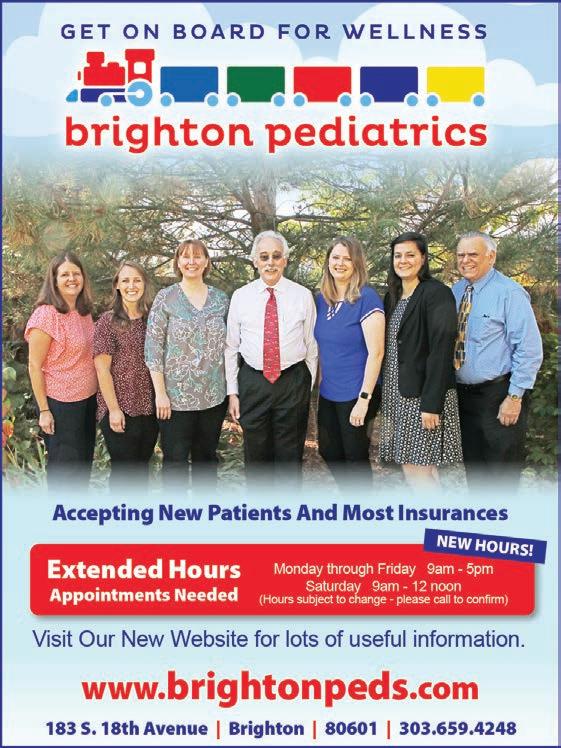

Welcome to this one-of-a-kind property offering the perfect blend of comfortable and serene living with an established six-figure business opportunity situated on over 11 acres!

Discover a well-maintained and fully operational 2,800 squarefoot dog boarding facility and a separate grooming business that generates a semi-passive six-figure income with a long-standing, fully competent staff in place. The kennel facility is equipped with 32 kennels.

The charming farmhouse has been recently updated and features a unique silo addition with an integrated bathroom and laundry room, 3 bedrooms, and 2 bathrooms, along with finished attic space totaling over 1900 square feet.

Enjoy country living with 2 barns, 1 that features horse stalls and the other well situated for additional livestock, a lean-to, a loafing shed, multiple storage sheds, feeders, and 2 pastures.

Schedule a private tour and discover how this unique property can become your dream home and business all in one location!

Dawa Sherpa Publisher

The Brighton Buzz

February has been particularly cold this year. But fear not, the days will soon be gettting longer as Daylight Savings Time (DST) arrives on March 9. While its goal is to conserve energy and maximize daylight hours, the practice remains a topic of debate.

The idea of adjusting clocks to match daylight hours dates back to the late 18th century. Benjamin Franklin first suggested the concept in 1784 as a way to save on candle usage. The modern DST was formally introduced during World War I by Germany in 1916 as a way to conserve fuel and it was widely implemented during World War II and later standardized in the U.S. with the Uniform Time Act of 1966. Today, more than 70 countries observe some form of daylight saving, though the start and end dates vary.

Whether you are a fan or foe, if you’re like us, you can’t wait to get out and enjoy the many summer activities Colorado has to offer and focus on toning up, cleaning up, and sprucing up ourselves and our surroundings as we get ready for “all-things” outside. Check out the many exceptional services and special offerings that can be found inside our pages.

Our March issue is filled with valuable resources to get you up and out this spring. Be sure to check out every page and we’ll

up and out this spring. Be sure to check out every page and we’ll see you outside soon!

O ered by: Michael A. Dolan / Dolan & Associates, P.C.

Estate planning is more than avoiding probate and saving taxes. A properly designed estate plan can provide so much more to protect your family. Most of these protections are ignored in cookie-cutter, form-driven estate plans. For example…

Mary and Bill were good parents, and their son John turned out to be a great person but a poor money manager. John grew up, married, completed college, and had a good job. But John spent every dime he earned, often before he ever earned it. John had to have the latest things, and thought using a credit card to get them was a better approach than saving for them. If John got a dollar, he spent two.

Bill and Mary sought legal advice before their deaths. e first lawyer they spoke with said they did not need estate planning because their estate was less than the estate tax exemption. She told them to designate John as the beneficiary on all the assets, because “it is simple and avoids probate.” ey weren’t comfortable with that advice and sought advice from a counseling-oriented attorney who took the time to learn more about them, their estate, and their goals.

eir primary objective was to protect John from squandering his inheritance after their deaths. erefore, Bill and Mary left their assets in trust for John, not directly to him. As a result, John had the help he needed to use his inheritance wisely. ey designed a system to help John learn how to properly manage his inheritance so it could support him for the rest of his life.

Bill and Mary had sometimes wondered if the planning they did was worth the extra time and effort. Clearly it was.

If you would like to learn more about an estate planning process that is producing great results for families, visit www.EstatePlans atWork.com to sign up for a complimentary educational workshop.

your home sold fast and for top dollar while saving you $1000s in commissions.

*When you mention this ad. Some restrictions apply. Please call Mike Dahl at 720.982.1153 for complete details. EXP 03.31.25

Absolutely! Mike and Lindsy are awesome realtors and had our back throughout our entire process. They has sold 2 of our properties and helped us purchase our old house. They is knowledgeable, educated and is passionate about what they do. Mike and Lindsy are always readily available and even though they are busy with other clients they make you feel like you’re the most important. – The Dawson Family

Mitch Clausen & Sons have been in the contracting business a combined total of 48 years. They are third generation contractors. Mitch began working in construction and remodeling as a child, working for his father’s Minnesota-based company. It was under his father’s tutelage that Mitch acquired all the skills necessary to build and remodel homes. When Mitch turned 18, he had the realization that it was “now or never” to dream big and pursue building his own contracting company. Mitch soon found that he really enjoyed building garages and in 1983 decided to make garage building the primary focus of his business. Since then, Mitchco has built over 5,000 Garages in the greater Denver Metro area. Mitchco Specializes in RV garages and builds 30-50 complete garages annually. Mitchco now focuses primarily on the Adams County region where they reside, but builds garages all over the North East Denver Metro area. Costs have consistently risen the past few years for building materials. Working with a family-owned business makes your purchasing experience more understandable.

Jen Roberts - Edward Jones

Your Social Security benefits can be an important part of your retirement income — but when should you start collecting them? It’s a big decision, so you’ll want to consider your options carefully. Essentially, you’ll need to decide whether you’re going to take your benefits as early as possible — age 62 — or if you should wait until your “full retirement age” or even longer. If you begin accepting benefits at 62, they’ll be about 30% lower than if you waited until your full retirement age, which is 67 if you were born in 1960 or later. And if you wait until 70, your benefits will be about 24% higher than at your full retirement age.

In deciding when to claim benefits, you’ll want to weigh these factors:

• Income needs — If you need the money to help meet your daily cost of living, then you may not feel you have much of a choice about when to take Social Security. However, if you have sufficient income from other sources, such as your 401(k) or other retirement accounts, you may be able to delay taking benefits until they’re much larger.

• Employment — If you’re still working and you haven’t reached your full retirement age yet, it might be a good idea to wait before claiming Social Security because your benefits will be reduced by $1 for every $2 earned above $23,400. In the year in which you reach your full retirement age, your benefits will be reduced by $1 for every $3 earned above $62,160. (But once you reach your full retirement age, Social Security will adjust your payments to credit you for the months during which your benefits were lowered because of your income.)

• Claim SpecialistsWe will help you obtain the insurance coverage you

• We Provide a 5 Year Labor Warranty on your roof and a 1 Year Labor Warranty on your deck in addition to Manufacturer’s Material Warranty.

• Enhance your outdoor space with a high quality deck built by our team of professionals.

• Life expectancy — None of us can say for certain how long we’ll live — but you may have some hints. For example, if you have a family history of longevity, and you’re in good health, you might decide it makes sense to delay taking Social Security until your full retirement age, or even later, as you could potentially have more years of receiving larger checks.

• Spouse — If you’re married, decisions about when to claim benefits could affect you or your spouse. e spouse with lower Social Security payments may be eligible to receive spousal benefits, which, when combined with their own benefits, can reach up to 50% of the higherbenefit spouse’s payment at their full retirement age. To qualify, the lower-benefit spouse’s benefit at their full retirement age must be less than half of the other spouse’s full-retirement-age benefit. But if the lower-benefit spouse claims their benefits before their full retirement age, their own retirement benefit and the spousal benefit will be reduced. Also, the lower-benefit spouse reaches their maximum benefit amount at their full retirement age — they won’t receive additional benefits even if they or the higher-benefit spouse delays taking benefits past their respective full retirement ages.

One other point to keep in mind: If the higher-benefit spouse claims early, the survivor benefit to the other spouse is reduced, but if the higherbenefit spouse delays their benefit beyond their full retirement age, the survivor benefit is increased. By making the appropriate choices, you can help maximize your Social Security benefits — and possibly enjoy a more comfortable retirement.

Social Security will likely be the foundation of your retirement income. Before you retire, it’s important to understand your options and the impact your decisions have on your retirement.

Join us for our presentation Social Security: Your questions answered. We’ll discuss:

•How does Social Security fit into my retirement income plan?

•When should I start taking benefits?

•What about taxes?

What matters most to you matters to us

We hope you will join us. Feel free to bring friends and family.

We’ll help you identify and define your unique financial goals. And then we’ll tailor-build investment strategies that help you work toward those goals.

What matters most to you matters to

We’ll help you identify and define your unique financial goals. tailor-build investment strategies that help you work toward Our single focus is helping you achieve what’s most important. backed by our

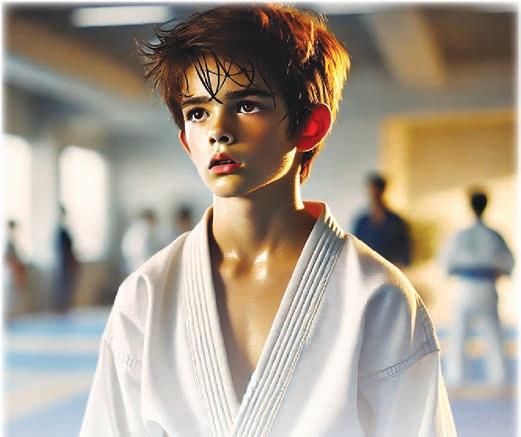

I’ve seen that look before – the eyes fi xed on something distant, yet seeing nothing at all. Sweat beads dripping off the brow, but more telling than the physical strain is the quiet sense of defeat. Poor Roger. He’s just standing there, not giving up, but clearly lost.

Just a week ago, he was my star student, beaming with confidence and bravado. He believed there was nothing he couldn’t do. Other students looked up to him – he led warm-up exercises, volunteered for demonstrations, and showed off his skills, impressing everyone in class. He thrived in that role. So what changed? Quite simply, Roger got promoted.

For some, earning a promotion can feel like a setback rather than an achievement. ey become comfortable excelling at a certain level, but the moment they are faced with greater challenges, they falter. e security of being at the top disappears, and the demands of the next level can feel overwhelming. It’s the classic case of the athlete who peaked in high school, forever looking back at past accomplishments rather than forward to future growth.

I’ve seen students quit right after earning their promotion – whether to the intermediate class or the advanced ranks. Not because they lacked skill, but because their mindset couldn’t handle the challenge. e ego struggles with going from the best in the class to the newest, from mastery to uncertainty.

But that’s just life. High school athletes experience it when they transition to a college team, and college athletes face it when they’re drafted into the pros. Growth means stepping into unfamiliar territory, facing new challenges, and embracing the struggle.

Roger, however, will not become a statistic. He may feel lost now, but by pushing through the discomfort – by overcoming the insecurity of not knowing, the higher physical demands, and the self-doubt – he will emerge stronger and more confident.

I tell my students they are like rubber bands; to be useful, they must be stretched. It’s uncomfortable, but that’s the nature of growth. And when they come out on the other side of the challenge, they won’t just be better martial artists – they’ll be better versions of themselves.

Roger will find his footing again, I have no doubt, he’s that kind of kid; and when he does, he’ll realize that every challenge was simply a stepping stone to something greater.

a targeted beam of light to stimulate cellular activity and speed up the body’s natural healing process. The M7

laser’s robotic head scans the treatment area and delivers a beam of light that penetrates deep into the tissues stimulating mitochondria in cells, which increases ATP production, cell growth, and blood flow to the area. MLS laser therapy can help with pain reduction, decrease swelling, increase circulation, and improve healing time.

ered by: Headwaters Health and Wealth LLC - Lisa Asmussen

Applying for Medicare on your own can feel like hunting for a four-leaf clover—confusing, frustrating, and sometimes just plain overwhelming. But you don’t need luck to get it right—I’m here to help!

Medicare is complicated, and here’s why:

Too Many Choices – Part A, Part B, Part C, Part D… Original Medicare or Medicare Advantage? Add a Medigap plan or not? What about dental? It’s a lot to sort through.

Tricky Deadlines – Enroll too late, and you could face penalties or coverage gaps. Changes are limited to certain times.

Surprise Costs – Premiums, deductibles, and co-pays can add up, especially for higher-income earners.

Other Insurance Confusion – If you’re still working or have retiree coverage, figuring out how Medicare fits in can be a headache.

e good news? You don’t have to navigate this alone. My guidance is always free—just give me a call at (303) 887-8584, and let’s find the Medicare fit for you.

is St. Patrick’s Day, let’s take the guesswork out of Medicare—no lucky charms required!

We do not offer every plan available in your area. Currently we represent 10 organizations which offer 106 products in your area.Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program(SHIP) to

O ered by T. Lloyd Worth, Worth Wealth Management

Marriage changes everything, including insurance needs. Newly married couples should consider a comprehensive review of their current individual insurance coverage to determine if any changes are in order, as well as consider new insurance coverage appropriate to their new life stage.

Auto

e good news is that married drivers may be eligible for lower rates than single drivers. Since most couples come into marriage with two separate auto policies, you should review your existing policies and contact your respective insurance companies to obtain competitive quotes on a new combined policy.

Newly married couples may start out as renters, but they often look to own a home or condo as a first step in building a life together. e purchase of homeowners insurance or condo insurance may be required by the lender. While these policies have important differences, they do share the same purpose — to protect your home, your personal property, and your assets against any personal liability.

You should take special care of what is covered under the policy, the types of covered perils, and the limits on the amount of covered losses. Pay particular attention to whether the policy insures replacement costs or actual cash value.

Like auto insurance, couples often bring together two separate individual health insurance plans. Newly married couples should review their health insurance plans’ costs and benefits and determine whether placing one spouse under the other spouse’s plan makes sense.

Married couples typically combine their financial resources and live accordingly. is means that your mortgage or car loan may be tied to the combined earnings of you and your spouse. e loss of one income, even for a short period of time, may make it difficult to continue making payments designed for two incomes. Disability insurance is designed to replace lost income so that you can continue to meet your living expenses.

Keep in mind that this article is for informational purposes only and is not a replacement for real-life advice, so make sure to consult your legal professional before implementing a strategy that includes disability insurance.

Central to any marriage is a concern about the other’s future well-being. In the event of a spouse’s death, a lifestyle based on two incomes may mean that the debt and cash flow obligations can’t be met by the surviving spouse’s single income. Saddling the surviving spouse with a financial burden can be avoided through the purchase of life insurance in an amount that pays off debts and/or replaces the deceased spouse’s income.

Several factors will affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

Personal liability risks can have a significant impact on the wealth you are beginning to build for your future together. Consider purchasing umbrella insurance under your homeowner’s policy to help protect against the financial risk of personal liability.

Extended care insurance may be a low priority given other financial demands, such as saving for retirement. Nevertheless, you may want to have a conversation with your parents about how an extended care program may play a role in their retirement financial strategy.

Please don’t hesitate to reach out to Lloyd Worth, Worth Wealth Management at (303) 558-0214 or Lloyd.Worth@LPL.com to discuss any financial matters.

Self-employment offers freedom and flexibility, but it also comes with unique tax responsibilities. Unlike traditional employees, self-employed individuals must handle their own tax obligations, which include selfemployment tax and income tax. Understanding these requirements can help entrepreneurs avoid surprises and stay compliant with the IRS.

Understanding Self-Employment Tax

Self-employment tax consists of Social Security and Medicare taxes, totaling 15.3% of net earnings. Typically, employees and employers share this cost, but self-employed individuals must pay both portions. However, entrepreneurs can deduct the employer-equivalent portion (7.65%) when calculating their adjusted gross income.

Estimated Quarterly Payments

Because no employer withholds taxes from self-employment income, the IRS requires estimated quarterly tax payments. Entrepreneurs should calculate their expected annual tax liability and make payments by the deadlines: April 15, June 15, September 15, and January 15 of the following year.

Deductible Business Expenses

Self-employed individuals can reduce taxable income by deducting legitimate business expenses, such as:

• Office supplies and equipment

• Home office expenses (if exclusively used for business)

• Travel and mileage

• Health insurance premiums

• Marketing and advertising costs

Keeping detailed records of these expenses ensures accurate deductions and minimizes tax liability.

Record-Keeping and Compliance

Maintaining organized financial records is crucial. Using accounting software or hiring a professional can help track income and expenses, ensuring accurate reporting and compliance. Filing the appropriate tax forms is essential for accurate reporting.

Seeking Professional Guidance

Tax laws change frequently, and self-employed individuals may benefit from consulting a tax professional. Let us be your expert to provide strategic advice on deductions, estimated payments, and retirement contributions, helping entrepreneurs maximize tax savings while remaining compliant.

Take control of your financial future today – stay informed, plan ahead, and make smart tax decisions to keep your business thriving. Start implementing these strategies now and set yourself up for long-term success!

Asa kid I was fascinated by the stories of people returning from extended stays in outer space for the first time. When they returned to earth and tried to walk on the ground, they collapsed. Eventually, scientists figured out why and how to prevent this. e lack of gravity in space meant little to no resistance for the body when moving. Even though the astronauts were moving around while in space, their muscles had so little resistance that they atrophied and weakened. e density of their bones also decreased. In the worst cases, teams of doctors had to work with astronauts to help them relearn how to walk. Fortunately, most of the issues were reversed after being back on the earth at normal gravity for a period of time.

Eventually, special machines were developed that helped individuals in space to exercise their muscles in the absence of gravity. Using these machines in space on a regular basis decreased the negative impact of zero gravity on bones and muscles, but did not completely eliminate them, as all individuals who spend time in space lose some muscle and bone density. While experiencing weightlessness can be fun and gives a person the ability to do many things that are otherwise impossible, the prolonged lack of resistance has a negative impact later on when resistance is encountered. I think of this when someone who has hearing loss says they prefer their quiet world. I believe much like weightlessness, silence is enjoyable at the

time. But then when a noisy environment is encountered, or in other words resistance is reintroduced, it is much less comfortable and can be impossible to function.

Individuals with hearing loss experience a lack of stimulation of the auditory nerve and brain. For a time, this may seem peaceful, but lack of stimulation leads to atrophy and weakness. e longer this occurs, the more severe and permanent the long-term impact. Permanent decreased ability to understand speech and inability to understand in noise are all but guaranteed to happen the longer the auditory system is unused or underused.

e likelihood of dementia also significantly increases with untreated hearing loss.

As with individuals in space, some form of technology is needed to stimulate the nerves to maintain function. Stimulating the auditory system with hearing aids maintains nerve and brain function. With most cases of hearing loss, the only way to properly stimulate the nerve is amplification through the use of hearing aids.

Astronauts who are able to walk when they return to earth are not able to do so just because of luck. ey have to put in the effort to maintain their muscles. Likewise, people with hearing loss who maintain their ability to understand speech, hear in noise, and avoid dementia by wearing hearing aids are not just lucky.

Offered by: Intermountain Health

March marks Colorectal Cancer Awareness Month – it’s a time to shed light on the importance of early detection and prevention of colon cancer. Colorectal cancers affect hundreds of thousands each year, and historically, the prevention focus has been on people 50 years or older. However, recent studies show the rate of colon cancer patients under 50 is growing.

Jeffrey Owsley, DO, at Intermountain Health’s Lutheran Hospital, helped unpack the latest guidelines for colon cancer screening, and gave insight into the rising trend of diagnoses among younger adults.

Standard colon cancer screening guidelines

Colon cancer doesn’t discriminate based on age, but certain risk factors can increase your chances of developing this disease. According to standard guidelines, individuals aged 45 and older should undergo regular colon cancer screenings.

“I recommend screening at age 45, or ten years prior to a first degree relative that had a colon cancer diagnosis,” said Dr. Owsley. “Then follow-up depends on what they find at the time of colonoscopy.”

Understanding your personal risk factors is crucial. Factors such as family history of colon cancer, inflammatory bowel disease, unhealthy diet, obesity, smoking, and sedentary lifestyle can all contribute to an increased risk. Discuss your risk factors with your healthcare provider to determine the best screening plan for you.

Understanding the rising trend

Recent trends have shown a concerning rise in diagnoses among younger adults. The American Cancer Society estimated that since 2020, there’s been a nine percent increase in colon cancer diagnoses in people under 50. Considering that colorectal cancer is the second most common cause of cancer death, these new statistics are a reason for alarm.

“It is true that we are seeing colon cancer at a younger age than we have historically, and it’s unclear why that is the case,” said Dr. Owsley. “It likely is multifactorial with environmental exposure, versus dietary, versus sporadic genetic mutations.”

Dr. Owsley pointed out that younger patients don’t think of screening. “Most patients still think that the recommended age for screening is 50,” he said. “Also, the idea of having a colonoscopy is not appealing to a lot of people, so they will put it off for that reason.”

This trend underscores the need for increased awareness and early detection efforts. Younger individuals face unique barriers when it comes to colon cancer screenings. These barriers can include a lack of awareness about screening, fear or discomfort associated with the procedure, and challenges in navigating the healthcare system.

Early detection is key to effectively treating colon cancer and improving outcomes. When caught early, colon cancer is highly treatable, with a fiveyear survival rate over 90 percent. Dr. Owsley added that there is a near 20 percent improvement in survival rate when colon cancer is localized, instead of a regional spread.

“With colon cancer, early detection can be the difference between needing chemotherapy or not, or needing only three months of chemotherapy versus six months,” said Dr. Owsley. “So not only from a survivability standpoint, but also from a quality of life standpoint, the earlier it is caught, the better it is for the patient.”

Regular screenings can help detect precancerous polyps or early-stage cancer before symptoms develop, allowing for prompt intervention and treatment.

Getting screened can save your life. Maybe it’s genetic history or an unknown symptom, it’s better to be safe than sorry. And while the colonoscopy is still the gold standard, you can ask your provider about starting with noninvasive stool-based tests.

For younger adults, it’s important to be proactive about your health and advocate for early screening. Don’t hesitate to discuss your risk factors and screening options with your healthcare provider. Remember, early detection saves lives.

Offered by:

As the final month of the first quarter comes around, I thought I would offer a few reminders for those of you who are on Medicare.

e biggest reminder I’d like to offer is for folks on a Medicare Advantage Plan. If you have a Medicare Advantage Plan, you likely have an Over-the-Counter (OTC) benefit. is is a benefit that gives you credit each quarter to spend on OTC items - things like bandaids, toothbrushes, vitamins, shower stools, etc. ese benefits are often quarterly and unused dollars don’t roll into the following quarter.

Some companies have cards that you can use in specific retailers, others have online catalogs that you can order from, and other companies give both options.

e other reminder is also for those on Medicare Advantage plans.

e Medicare Advantage Open Enrollment Period goes from Jan 1Mar 31. is allows you to make a one time plan change if you have discovered the current Medicare Advantage Plan you’re on isn’t working quite right for you. is is only for people who started January 1 on a Medicare Advantage Plan.

My final reminder is a little outside the scope of Medicare but indeed important. I have been getting quite a few questions about scams and concerns with Identity eft. Unfortunately this is a real problem and it gets bigger everyday. Because of this, I have offered Identity eft Protection as a service since 2015. If you have questions about this, please don’t hesitate to shoot me a text or give me a call.

1150 Prairie Center Parkway, Brighton, CO 80601 303-655-2075 I evacinfo@brightonco.gov www.brightonco.gov

Hours: Monday - Friday 8:00 a.m. - 4:00 p.m.

Hair Sparkles

Silk hair tinsel is tied onto hair strands and can stay in for weeks. Hair must be clean, straight or slightly wavy and at least 4 inches long. Make an appointment at the front desk and pay Rosalie Farrer directly, cash only.

Tuesdays and Thursdays

$32 for 30 minutes

Deadline: 2 days ahead

Feathered Friends: Peregrine Falcon

This month’s Feathered Friends features the fastest animal in the world, the peregrine falcon. These raptors are found worldwide and have a storied history as one of the great successes of saving an endangered species. Enjoy close-up views of this speedy aerial predator.

Tues. Mar 11 - 1:00 p.m.

$5.00

Deadline: Fri. Mar 7

Note: Not all offerings are listed here. Please visit www.brightonco.gov for a complete listing.

Kindness Counts

Ever wish you could make a difference in Brighton? You can! This group is about fun, easy ideas for spreading a little kindness throughout the community. Each month we pick a project. Call Sue at 303-655-2076 for information.

Wed. Mar 12 - 11:00 a.m.

Duplicate Bridge

In Duplicate Bridge, two-player teams compete against each other using predetermined hands. Teams earn points by outbidding and outplaying their opponents, with the highest-scoring team receiving recognition. Players must have a partner and use the same partner throughout a two-month challenge. Facilitator: Bobbi Jo Unruh.

Wed. Mar 12 & 26 - 11:30 a.m. - 3:30 p.m.

$10 (2 wks)

Deadline: Mon. Mar 10

If you’re 62+ and own a home, you may qualify for a Reverse Mortgage to pay off your mortgage, gain extra retirement income, or buy your dream home. Learn about your options. Instructor: Jackie Hahn.

Thurs. Mar 13 - 2:00 - 3:00 p.m.

Free Deadline: Tues. Mar 11

Blood Pressure Screening

The firefighters from the Brighton Fire Department will perform FREE blood pressure checks for one hour. Stop by!

Fri. Mar 14 @ 10:30 a.m.

Thurs. Mar 27 @ 10:30 a.m.

Friday Feast

Walker Williams will be performing today. He’s a county music singer and is well known throughout the area. We’ll be serving chicken casserole, salad, and cookies.

Fri. Mar 14 - 12:00 noon

$6.00

Deadline: Wed. Mar 12

Medicare Counseling

Receive one-on-one assistance on Medicare issues from Rosemary Evans. She is specially trained on Medicare insurance programs, including Medicare Part D. Call Evon at 303-655-2079 to make an appointment. For general Medicare questions you can also call Benefits in Action at 720-221-8354. Counseling by appointment only.

Tues. Mar 18 - 10:00 a.m. - 12:15 p.m.

Deadline: Thurs. Mar 13

Mortgage interest rates are slowly drifting lower, giving a muchneeded boost to both homebuyers and home sellers. Yet, home prices continue to rise, even as more sellers put their homes on the market. Why? e U.S. is still several million homes short of a balanced market. So, do you want to wait for cheaper rates or go ahead a buy a home before home prices rise further?

To time the housing market perfectly, you need to:

1. Find the right home.

2. Buy at the right price.

3. Obtain the right mortgage interest rate.

You may get lucky and get one out of three or even two out of three, but it’s nearly impossible to get all three at the same time unless the market is in a recession or depression. Only then will there be plenty of homes to choose from, low prices, and low mortgage interest rates.

Start with finding the right home—one that best meets your household’s needs for space and features, your finances, and a reasonable interest rate.

Looking for guidance on navigating the current market? Your Forever Agent® at Berkshire Hathaway HomeServices Colorado Real Estate is here to help you find the perfect home while balancing price and interest rates. Contact us today for personalized advice and to explore your options. Call us at 303-905-8850 or visit BHHScoloradorealestate.com. Let’s make your next move the right one!

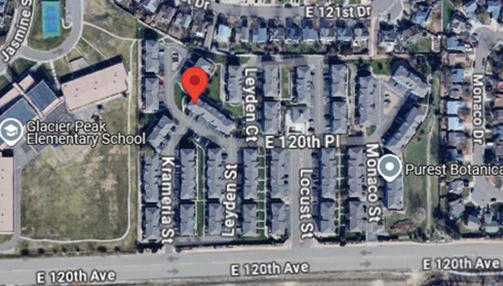

COMMERCE CITY $540,000

FREDERICK $650,000

4 Beds | 4 Bath | 3,632 Sq Ft 614 Moose St, Frederick, CO

Amy Figliola 303-514-2633

BRIGHTON $452,900

2 Beds | 2 Bath | 966 Sq Ft | 1 Car Garage 709 Twining Avenue, Brighton, CO

Holly Vejrostek 720-556-0080

GOLDEN $1,500,000

4 Beds | 4 Bath | 4,445 Sq Ft 457 Buena Vista Rd, Golden, CO

Karin Kallander 303-669-3982

BRIGHTON $495,900

3 Beds | 2 Bath | 1,293 Sq Ft | 2 Car Garage 869 Sawdust Drive, Brighton, CO

Holly Vejrostek 720-556-0080

BRIGHTON $684,500

3 Beds | 3 Bath | 3,852 Sq Ft 312 Las Lomas St, Brighton, CO

Mandy Jury 720-371-6733

BRIGHTON $452,900

2 Beds | 2 Bath | 966 Sq Ft | 1 Car Garage 5913 Sawdust Drive, Brighton, CO

Holly Vejrostek 720-556-0080

DENVER $210,000

1 Beds | 1 Bath | 617 Sq Ft | Remodeled 4110 Hale Pkwy 1E, Denver, CO PJ Magin 303-921-7944

THORNTON $500,000

Commercial In-Fill Lot | .73 Acres Many approved uses 8881 Huron Street, Thornton, CO

PJ Magin 303-921-7944

Raising awareness for colon cancer screenings.

Colon