10 minute read

Exness zero account minimum deposit: A Comprehensive Guide

The exness zero account minimum deposit is a critical aspect for traders looking to start their journey in the Forex market with minimal financial risk. This account type provides an excellent entry point for new traders who wish to practice and hone their trading skills without making significant monetary commitments. Understanding the intricacies of the zero account, including its advantages, funding methods, and overall value, is essential for anyone considering this option.

The minimum deposit for the Exness Zero Account is typically $200. This amount is required to start trading with this account type.

Key Points about the Exness Zero Account Minimum Deposit:

$200 Minimum Deposit: You need at least $200 in your account to begin trading with the Exness Zero Account. This is relatively affordable compared to some other account types with higher minimum deposits.

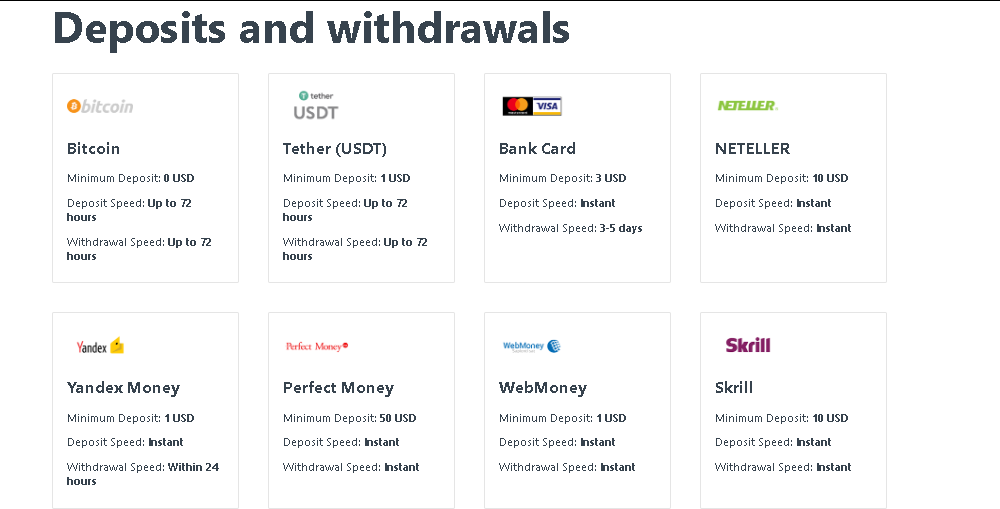

Funding Your Account: Exness supports multiple deposit methods, including bank transfers, credit cards, e-wallets like Skrill, Neteller, and others, making it easy to fund your Zero Account from various payment options.

Leverage: The Exness Zero Account offers leverage of up to 1:2000, which can help traders control larger positions with a smaller initial deposit.

Risk Management: While the minimum deposit is low, it's important to use appropriate risk management strategies and only trade with capital you can afford to lose.

Start Exness Trade: Open Exness Account and Visit site

Understanding Exness Zero Account Minimum Deposit Requirements

When considering a trading platform, one of the first aspects that a potential trader investigates is the minimum deposit required to open an account. The Exness Zero Account shines in this regard, designed to be accessible while providing opportunities for profitable trading.

The Significance of Minimum Deposit

The minimum deposit plays a crucial role in any trading account, acting as the entry barrier for participants. For many traders, especially beginners, the implications of this initial investment can feel daunting. A low minimum deposit means that traders can test the waters without substantial financial commitment, allowing them to gain valuable experience and insights into Forex trading.

With Exness account, the minimum deposit for the zero account is notably low, which is appealing for those just starting out. It allows traders to experiment with different strategies and develop their trading style without the pressure of losing a large amount of capital. Furthermore, it attracts individuals from diverse financial backgrounds, promoting inclusivity within the forex market.

Features of Exness Zero Account

The Exness Zero Account offers several features that make it an attractive option for traders seeking a low-barrier entry point. Not only does it have a low minimum deposit, but it also provides access to a variety of trading instruments, including Forex, cryptocurrencies, commodities, and indices.

In addition to its extensive asset offerings, this account type boasts tight spreads, which can positively influence profitability. Given that the account uses a commission-based model, traders can enjoy competitive trading conditions without hidden fees. This transparency enhances trust between the trader and the broker.

What is a Zero Account in Exness

How to Open a Zero Account in Exness

How to Use Maximum Leverage in Exness Trading

Risk Management Considerations

While the low exness zero account minimum deposit enables more people to participate in trading, it's essential to approach this opportunity with a solid understanding of risk management. Trading in the forex market carries inherent risks, and having a limited amount of capital can lead to quick losses if not managed appropriately.

As such, aspiring traders should educate themselves on risk management techniques, such as setting stop-loss orders, diversifying their portfolios, and only risking a small percentage of their trading capital per trade. By prioritizing risk management, traders can not only protect their investments but also leverage the benefits offered by the Exness Zero Account.

Step-by-Step Guide to Opening an Exness Zero Account with Minimal Deposit

Opening an Exness Zero Account is a straightforward process that can be completed in just a few steps. This guide will walk you through the entire procedure, ensuring that even those who are new to online trading can navigate the registration seamlessly.

Start Exness Trade: Open Exness Account and Visit site

Registration Process

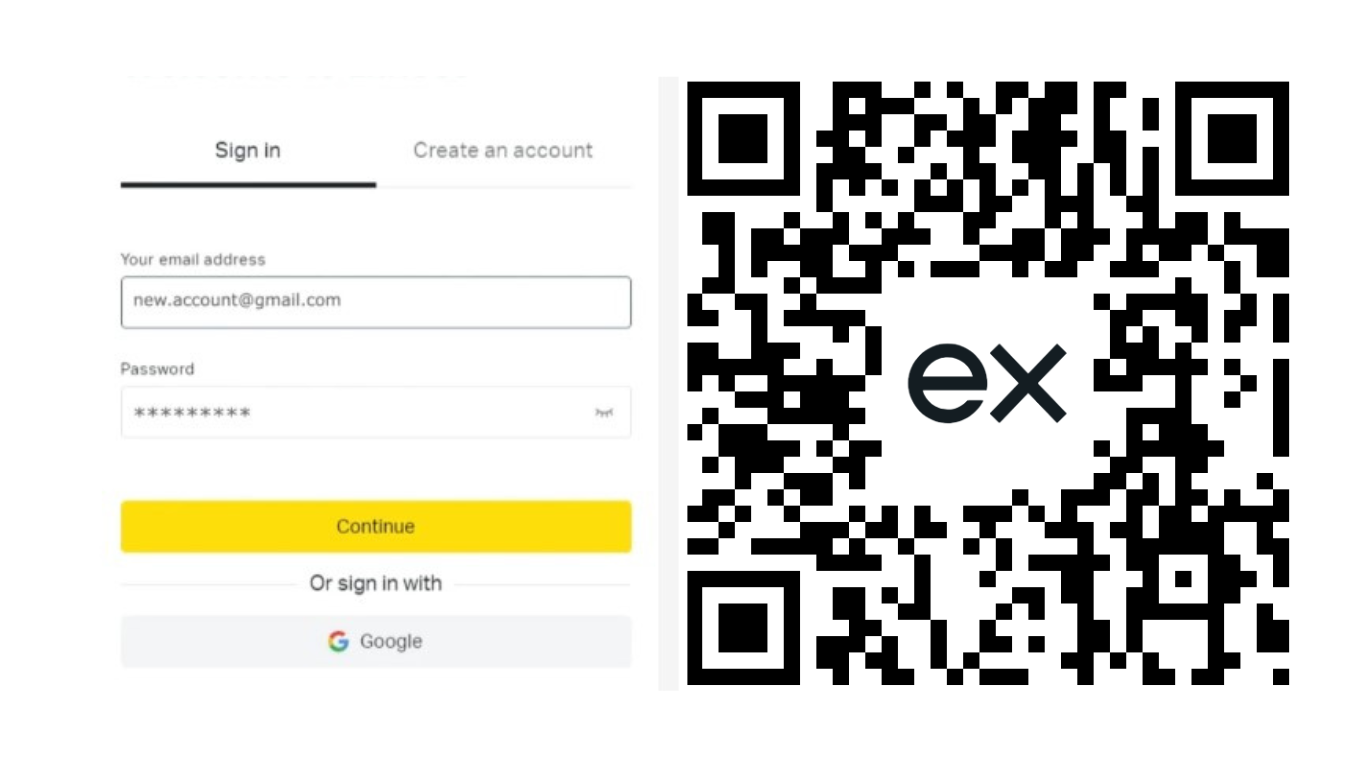

To begin your journey with Exness, you must first create an account. Visit the Exness website and locate the registration button. Upon clicking it, you'll be prompted to fill out a registration form, requiring basic personal information such as your name, email address, and phone number.

After submitting the form, you will receive a verification email. Clicking on the link provided will confirm your email address. Once verified, log into your newly created Exness account, where you can choose the type of account you wish to open. Select the Zero Account option, and you'll be guided through the setup process.

Verification Requirements

Before you can start trading, Exness requires users to complete a verification process. This step is essential, as it ensures compliance with financial regulations and promotes a secure trading environment.

To verify your account, you will need to provide identification and proof of residency. Acceptable forms of identification include a passport or national ID card, while proof of residency can typically be shown via a utility bill or bank statement. Be sure that the documents meet Exness's guidelines regarding clarity and legibility to expedite the verification process.

Making Your Minimum Deposit

After completing the verification process, you can fund your Exness Zero Account. As mentioned earlier, the minimum deposit requirement is low, making it an ideal choice for beginner traders. Exness supports various funding methods, including credit cards, e-wallets, and bank transfers, so you can select the option that best suits your needs.

When depositing funds, ensure you understand any potential fees associated with your chosen method, as these can impact your trading capital. After successfully making your deposit, your account will be activated, and you are ready to begin trading.

How to Fund Your Exness Zero Account with the Minimum Deposit

Funding your Exness Zero Account is a crucial step in your trading journey. With a low minimum deposit, you have the flexibility to start trading with minimal financial commitment, but knowing how to manage this process effectively can set you up for success.

Available Funding Methods

Exness offers several funding options to cater to different preferences and geographical locations. Understanding these methods can help you choose the most efficient way to deposit funds into your account.

One of the most popular methods is using credit or debit cards. This method is renowned for its speed, often reflecting the deposit in your trading account almost instantly. E-wallets, such as Skrill and Neteller, are also convenient options that allow for instant transactions. Bank transfers, while reliable, may involve longer processing times, sometimes taking several business days to reflect in your account.

Steps to Make a Deposit

Once you've chosen your preferred funding method, making a deposit is quite simple. Log in to your Exness account and navigate to the ‘Deposit’ section. Here, you can select your funding method and enter the required details, including the amount you wish to deposit.

Ensure that you adhere to the minimum deposit requirements specific to your selected payment provider. After confirming your transaction, the system will prompt you with a confirmation message, and you can monitor the status of your deposit in your account history.

Tips for Efficient Depositing

To maximize your depositing efficiency, consider planning your funding ahead of time. If you know when you plan to trade, try to ensure that your funds are available well before you intend to execute trades. Additionally, maintaining a clear record of your deposits can help you track your financial progress more accurately.

Moreover, be aware of the currency conversion rates and fees if you are depositing in a currency different from your trading account’s base currency. Such costs can diminish your trading capital, so always strive to minimize unnecessary charges wherever possible.

Exness Zero Account: Is the Minimum Deposit Worth It?

Considering the low exness zero account minimum deposit, many traders wonder whether this option is genuinely worth pursuing. To answer this question, it's important to evaluate the benefits and limitations that come along with this account type.

Advantages of Low Minimum Deposit

One of the standout features of the Exness Zero Account is its low minimum deposit, which opens doors for many individuals who may have hesitated to enter the Forex market due to financial constraints. The ability to start trading with an affordable amount allows newcomers to explore various strategies and tools without feeling overwhelmed by high stakes.

Additionally, the zero account provides access to advanced trading platforms like MetaTrader 4 and MetaTrader 5, which are loaded with features that enhance the trading experience. These platforms support automated trading and technical analysis, ensuring that traders have the necessary tools to succeed in the competitive Forex landscape.

Limitations to Consider

Despite its numerous advantages, there are some limitations tied to the Exness Zero Account that traders should take into account. For instance, while the low minimum deposit may make it easier to get started, traders must still be mindful of their overall financial management.

Entering trades with very little capital can lead to high levels of risk; therefore, it is vital to adopt sound trading practices. Furthermore, while the account does offer competitive spreads, the commission structure may not appeal to all traders, especially those who prefer a fixed spread model. It's essential to weigh these factors against your trading style and preferences.

Personal Assessment of Value

Evaluating the worthiness of the exness zero account minimum deposit comes down to individual circumstances and trading goals. For novice traders seeking practical experience with minimal risk exposure, this account type could prove invaluable.

However, seasoned traders with specific strategies may find more value in other account types that better align with their trading objectives. Ultimately, the decision should be based on careful consideration of both immediate and long-term trading plans.

Maximizing Gains with Exness Zero Account's Low Minimum Deposit

Leverage the low minimum deposit offered by the Exness Zero Account to your advantage. With effective strategies and disciplined trading practices, traders can optimize their trading experience and capitalize on market opportunities.

Crafting a Solid Trading Plan

A well-thought-out trading plan serves as the foundation for successful trading. When starting with a low minimum deposit, it becomes increasingly important to establish a structured approach to your trading activities.

Your trading plan should encompass various elements, including entry and exit strategies, risk management rules, and performance assessment metrics. By clearly defining your goals and parameters, you will be better equipped to navigate the volatile Forex market effectively.

Start Exness Trade: Open Exness Account and Visit site

Utilizing Leverage Wisely

Exness provides traders with the option to utilize leverage, which can amplify potential gains. While this can be advantageous, it also increases the risk of substantial losses. Therefore, it's vital to use leverage judiciously, particularly when trading with a lower deposit.

Understanding the dynamics of margin trading and leveraging your positions appropriately can help achieve greater returns while minimizing risk exposure. Always calculate your position sizes carefully to ensure that you do not overextend your capital.

Continuous Education and Improvement

The Forex market is constantly evolving, and ongoing education is key to staying relevant and informed. Take advantage of Exness's educational resources, including webinars, articles, and tutorials that address various aspects of trading.

By keeping abreast of market trends, economic indicators, and trading psychology, you can refine your trading strategies and improve performance. Investing in knowledge and training will undoubtedly yield dividends in your trading endeavors.

Conclusion

The exness zero account minimum deposit represents an exceptional opportunity for traders at all levels, particularly those embarking on their Forex journey. With its low initial financial commitment, accessible features, and robust trading platforms, it stands out as a compelling option for aspiring traders.

Through a clear understanding of the account's requirements, the steps to open it, and effective funding methods, traders can embark on their trading adventure with confidence. While there are inherent risks associated with trading, employing sound risk management strategies and continuously educating oneself can significantly enhance chances of success.

See more:

Exness Account Types Review: Standard, Raw Spread, Zero, Pro