YMCA of GREATER RICHMOND

Job Title: President & Chief Executive Officer

Job Code: EX1011

OVERVIEW

Grade: 3512

Focus Area: Social Responsibility

Our mission: To put Christian principles into practice through programs that build healthy spirit, mind, and body for all.

Our cause: At the Y, strengthening community is our cause. Every day, the Y works side-byside with our neighbors to make sure everyone, regardless of age, income or background, has the opportunity to learn, grow, and thrive.

Our position: The Y is a leading nonprofit organization that is committed to strengthening communities through youth development, healthy living, and social responsibility.

Who we are: The Y is committed to access, inclusion and engagement for all. At the Y we recognize, appreciate and value all dimensions of diversity and the ways that our communities are unique. We seek to engage and connect diverse populations in a welcoming environment focused on building bridges towards empathy and equity. Our employees exemplify and adhere to our four Brand Behaviors of Honesty, Caring, Respect and Responsibility

LEADERSHIP COMPETENCIES: Values, Community, Volunteerism, Philanthropy, Inclusion, Relationships, Influence, Communication, and Decision Making.

GENERAL DESCRIPTION: To provided full leadership, vision and direction to the YMCA of Greater Richmond Overall responsibility for all functions and operations within the YMCA of Greater Richmond. Serve as a member of the Executive Leadership Team (ELT), providing strategic leadership to advance the YMCA’s mission. Oversee development of an actively engaged philanthropic volunteer board of directors, positioning the YMCA as a “charity of choice” for the investment of donations within the local community, and creating relationships and collaborations with community stakeholders.

KNOWLEDGE & SKILLS:

YMCA Organizational Leader with a minimum of ten years of Y professional experience with at least five of those years in executive/management role with full facility responsibility. Bachelor’s Degree required.

PRINCIPAL RESPONSIBILITIES:

1. Interpret, communicate, and promote Y mission, goals, and objectives to staff, employees, volunteer leaders, members, and the community.

2. Promote, foster and support the Y’s commitment to access, inclusion and engagement for all by engaging diverse populations in a welcoming environment.

3. Ensure an excellent customer and volunteer experience that embodies the Y core values and commitment to the cause of strengthening communities.

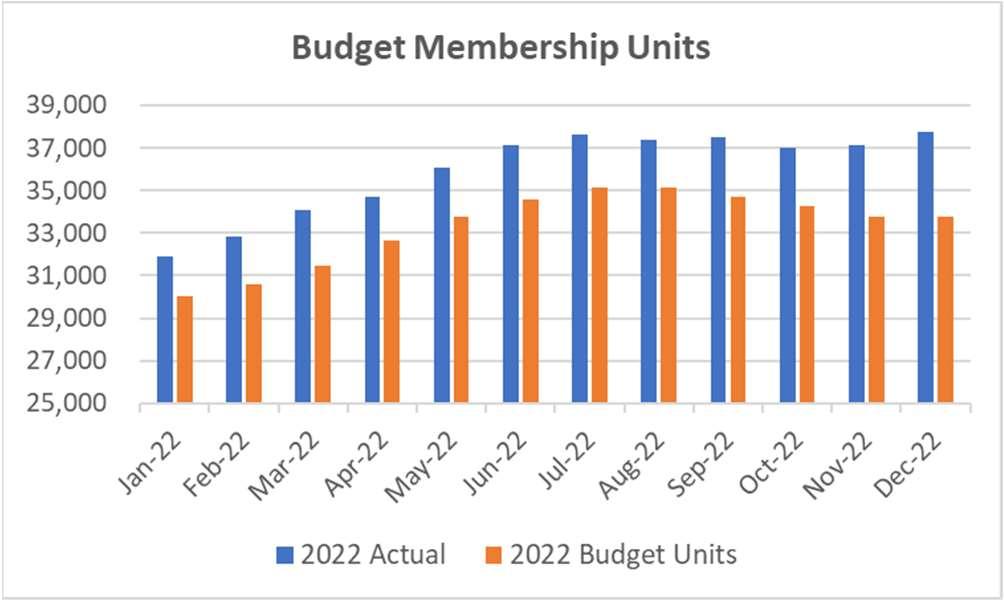

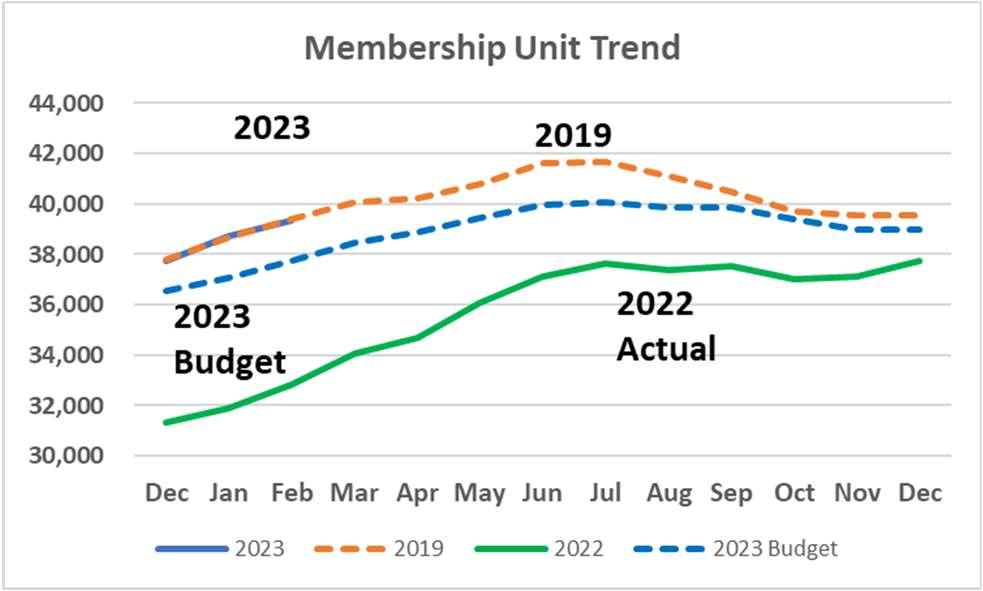

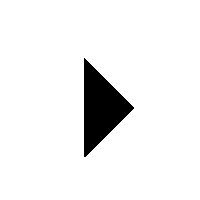

4. Lead initiatives related to membership retention and Annual Giving goals.

5. Demonstrate a commitment to the ideals of the Y movement.

6. Recommend appropriate policies and actions for the Board’s consideration.

7. Keep the Board Chair and the Board Members informed in a timely and accurate manner regarding programs, financial, and management issues.

8. Direct the processes of planning and financial development.

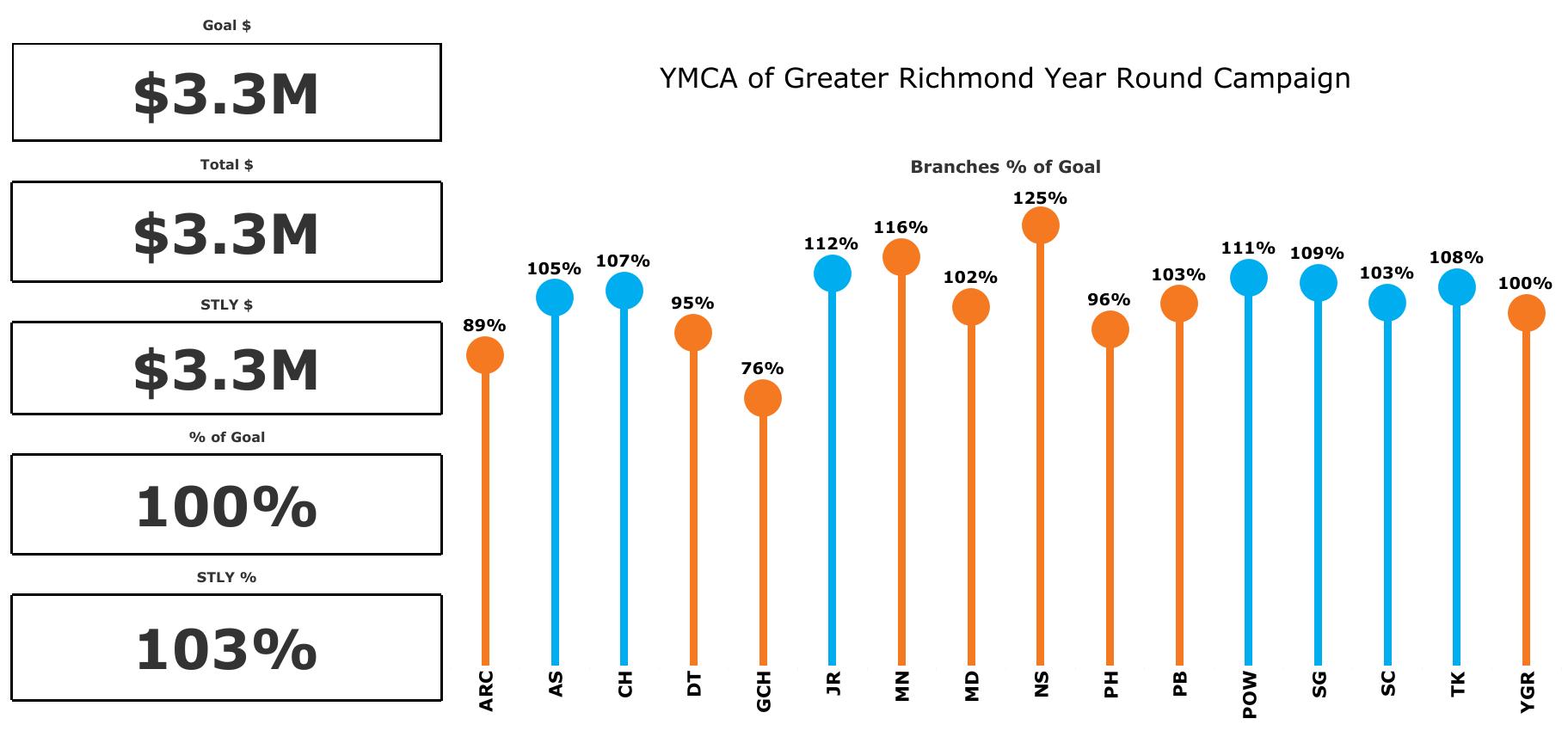

9. Responsible for all campaigns and fundraising efforts for the association.

January 2021

YMCA OF GREATER RICHMOND JOB DESCRIPTION

YMCA OF GREATER RICHMOND JOB DESCRIPTION

10.Make recommendations on building projects.

11.Manage the affairs of the Y in accordance with the policies and directions established by the Board of Directors and Y-USA.

12.Maintain updated knowledge of available resources within the community and the YMCA nationally.

13.Maintain a high community profile and involvement. Serve on various boards and attend numerous community functions.

14.Cultivate and develop board members and other volunteers.

15.Oversee all development and fundraising efforts.

16.Responsible for the supervision of Executive level staff.

17.Maintain appropriate relationships with YMCA of the USA.

18.Provide the necessary administrative support for the Board to carry on its work.

END RESULT:

• The YMCA of Greater Richmond aligns strategically for effective operational and business decisions and is viewed, by the community, Board, and stakeholders, as an organization well positioned to advance the mission and cause within the Richmond communities.

• The CEO/President embodies excellent team work with the Executive Leadership Team, Board, and all staff in furthering the goals and objectives of the YMCA of Greater Richmond.

PHYSICAL REQUIREMENTS:

Ability to sit and/or stand for long periods of time, use a computer, telephone and related business equipment as necessary for this position. Must be able to communicate effectively with others. Requires the ability to travel to and between branch locations, and community locations and may be exposed to weather conditions prevalent at the time. Noise level is moderate. May be required to lift to 25lbs.

Employee Name: ___________

Employee Signature: __________________________ Date: ___________

This job description is a summary of this position and other responsibilities may be assigned as needed. The YMCA of Greater Richmond reserves the right to review and modify this position as needed.

January 2021

2023 Employee Benefits Guide YMCA of Greater Richmond

This brochure summarizes the benefit plans that are available to YMCA of Greater Richmond eligible employees and their dependents. Official plan documents, policies and certificates of insurance contain the details, conditions, maximum benefit levels and restrictions on benefits. These documents govern your benefits program. If there is any conflict, the official documents prevail. These documents are available upon request through the Human Resources Department. Information provided in this brochure is not a guarantee of benefits.

Open Enrollment Guide 2 Table of Contents A Message to Our Employees ................................................................................................................................. 3 Benefits for You & Your Family............................................................................................................................... 4 Medical Insurance 5 Health Savings Account......................................................................................................................................... 10 Flexible Spending Accounts 12 Dental Insurance................................................................................................................................................... 13 Vision Insurance.................................................................................................................................................... 14 Life and Accidental Death & Dismemberment Insurance 15 Voluntary Life Offerings........................................................................................................................................ 15 Long-Term Disability Insurance 16 Voluntary Disability Offerings............................................................................................................................... 16 Employee Assistance Program.............................................................................................................................. 17 Dependent Care Benefits 18 Voluntary Benefits ................................................................................................................................................ 20 Contacts 22

A Message to Our Employees

The Benefits Open Enrollment Period Is Here!

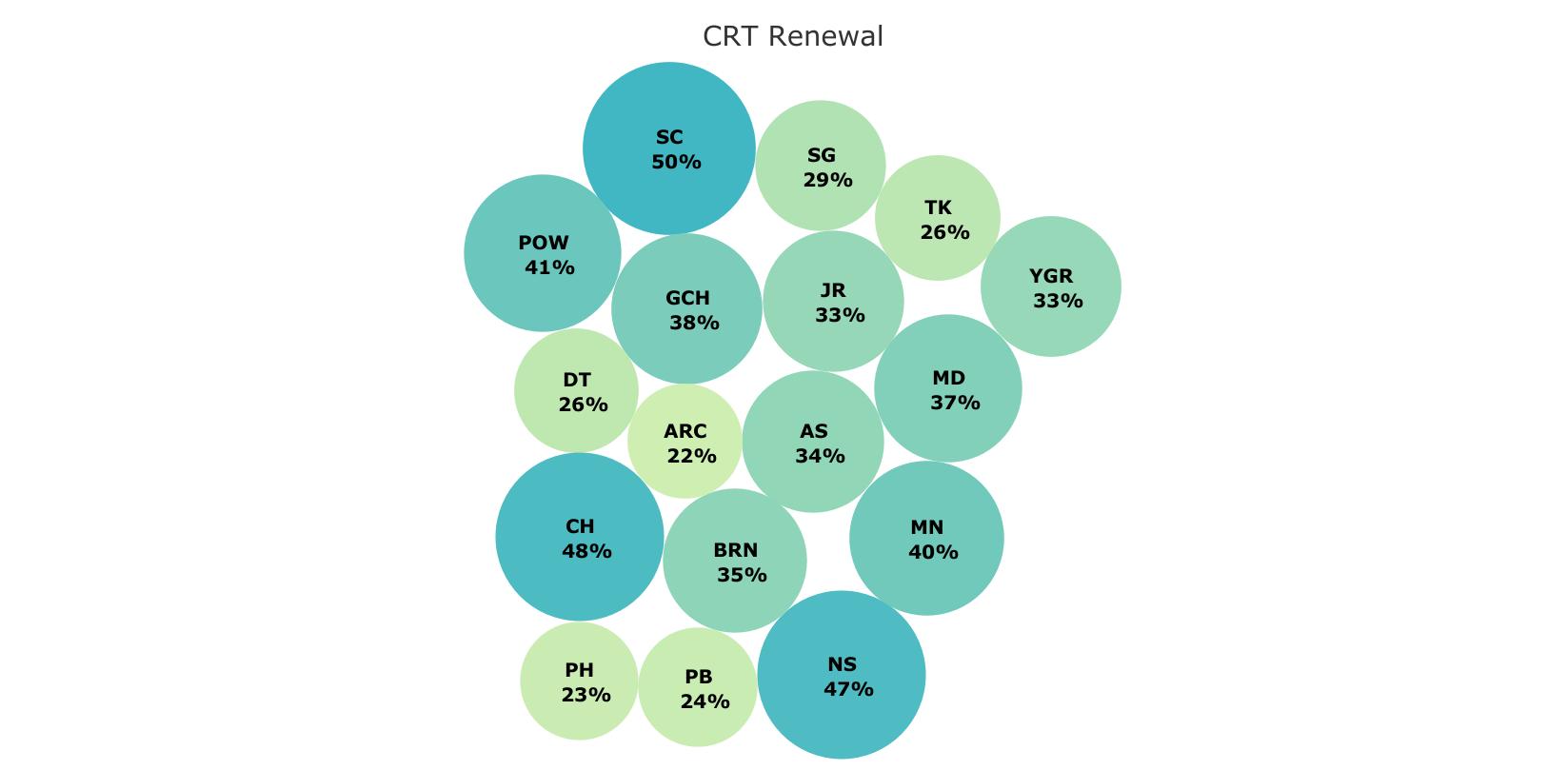

The YMCA of Greater Richmond’s renewal was excellent! The Anthem Health renewal was up 15% overall which means your health rates will be slightly increase for 2023. Anthem Dental and Vision rates will remain the same.

Good news! Anyone on our health insurance in 2022 received a letter from Anthem stating we would receive a refund for overpayment on administrative fees in 2022. The ACA (Affordable Care Act) establishes limits on administrative fees health carriers may charge a group. Because there was an overpayment, we received a refund. The refund we received will be applied to your portion of the health insurance premium on the 10/21/2022 check. You will see a reduction on your employee deductions for health insurance taken from your 10/21/2022 paycheck.

2023 Benefit Plan Highlights

Anthem Dental will not change for 2023. We will continue the self-funding dental benefit

Medical – For 2023, we will continue to offer the four Anthem HealthKeepers plans we have enjoyed over the past years. You will see this in detail under the Medical Benefits Overview. Walgreen’s is not a part of the Anthem pharmacy network.

Your other benefits: dental, vision, life, Legal Resources, Identity Theft, pet insurance will remain the same.

Open Enrollment Guide 3

Benefits for You & Your Family

YMCA of Greater Richmond is pleased to announce our 2023 benefits program, which is designed to help you stay healthy, feel secure, and maintain a work/life balance. Offering a competitive benefits package is just one way we strive to provide our employees with a rewarding workplace. Please read the information provided in this guide carefully. For full details about our plans, please refer to the summary plan descriptions. Listed below are the YMCA of Greater Richmond benefits available during open enrollment:

Medical

Health Savings Account

Dental

Vision

Life Insurance/ Long Term Disability

Short Term Disability

Voluntary Life

Flexible Spending Accounts

Who is Eligible?

Retirement

Legal Resource/Identity Theft

Dependent Care Assistance Program

Pet Insurance

VA 529

Employee Assistance Program (EAP)

Full-Time employees working at least 40 hours (at least 30 hours for health coverage) and their eligible dependents may participate in the YMCA of Greater Richmond benefits program.

Generally, for the YMCA of Greater Richmond benefits program, dependents are defined as:

Your spouse

Dependent “child” up to age 26 (Child means the employee’s natural child or adopted child and any other child as defined in the certificate of coverage)

When and How Do I Enroll?

Open enrollment will be conducted November 14 to December 5, 2022.

All eligible employees are required to complete the enrollment process, even if you do not wish to make any changes to your benefits. We will continue to use Benefit Connector’s link: https://ymcarichmond.benefitconnector.com .

When is My Coverage Effective?

The effective date for your benefits is January 1, 2023.

Changing Coverage During the Year

You can change your coverage during the year when you experience a qualified change in status, such as marriage, divorce, birth, adoption, placement for adoption, or loss of coverage. The change must be reported to the Human Resources Department within 30 days of the event. The change must be consistent with the event.

For example, if your dependent child no longer meets eligibility requirements, you can drop coverage only for that dependent.

Open Enrollment Guide 4

Medical Insurance

YMCA of Greater Richmond will continue to offer medical coverage. The chart on the following page is a brief outline of the plan. Please refer to the summary plan description which can be found on Share Point.

Open Enrollment Guide 5

Benefit Coverage Anthem HealthKeepers Elements Choice (4500/40%) Anthem HealthKeepers HSA 3000 Anthem HealthKeepers HSA 2000 In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network Annual Deductible Individual $4,500 $9,000 $3,000 $6,000 $2,000 $4,000 Family $9,000 $18,000 $6,000 $12,000 $4,000 $8,000 Coinsurance 40% 40% 20% 30% 20% 30% Maximum Out-of-Pocket* Individual $6,900 $17,250 $5,500 $13,750 $4,250 $10,625 Family $13,800 $34,500 $11,000 $27,500 $8,500 $21,250 Physician Office Visit Primary Care $25 copay after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible Specialty Care $50 copay after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible Preventive Care Adult Periodic Exams 100% 40% after deductible 100% 30% after deductible 100% 30% after deductible Well-Child Care 100% 40% after deductible 100% 30% after deductible 100% 30% after deductible Diagnostic Services X-ray and Lab Tests 40% after deductible 40% after deductible 20% after deductible 30% after deductible 20% After deductible 30% after deductible Complex Radiology 40% after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible Urgent Care Facility $50 copay after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible Emergency Room Facility Charges* 40% after deductible 40% after deductible 20% after deductible 20% after deductible 20% after deductible 20% after deductible Inpatient Facility Charges 40% after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible Outpatient Facility and Surgical Charges 40% after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible Mental Health Inpatient 40% after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible Outpatient 40% after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible Substance Abuse Inpatient 40% after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible

Open Enrollment Guide 6 Benefit Coverage Anthem HealthKeepers Elements Choice (4500/40%) Anthem HealthKeepers HSA 3000 Anthem HealthKeepers HSA 2000 In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network Outpatient 40% after deductible 40% after deductible 20% after deductible 30% after deductible 20% after deductible 30% after deductible Other Services Chiropractic 40% after deductible ; 30 visits per year 40% after deductible 20% after deductible ; 30 visits per year 30% after deductible 20% after deductible ; 30 visits per year 30% after deductible Retail Pharmacy (30 Day Supply) After medical deductible met Includes Preventive Rx Plus Includes Preventive Rx Plus Generic (Tier 1) $15 copay 40% after deductible $10 copay after deductible 30% after deductible $10 copay after deductible 30% after deductible Preferred (Tier 2) $60 copay 40% after deductible $40 copay after deductible 30% after deductible $40 copay after deductible 30% after deductible Non-Preferred (Tier 3) $100 copay 40% after deductible $70 copay after deductible 30% after deductible $70 copay after deductible 30% after deductible Preferred Specialty (Tier 4) 40% up to $500 40% after deductible 20% to $300, after deductible 30% after deductible 20% to $300, after deductible 30% after deductible Mail Order Pharmacy (90 Day Supply Generic (Tier 1) $38 copay Not covered $25 copay after deductible Not covered $25 copay after deductible Not covered Preferred (Tier 2) $150 copay Not covered $100 copay after deductible Not covered $100 copay after deductible Not covered Non-Preferred (Tier 3) $250 copay Not covered $175 copay after deductible Not covered $175 copay after deductible Not covered Preferred Specialty (Tier 4) 40% up to $500 (for 30-day supply) Not covered 20% to $300 after deductible for 30 day supply Not covered 20% to $300 after deductible for 30 day supply Not covered

Employee Contributions (Bi Weekly 26 per yr)

HK Elements Choice (4500/40%)

Employee Contributions (Bi Weekly 26 per yr)

HSA 3000

Employee Contributions (Bi Weekly 26 per yr)

Open Enrollment Guide 7

Employee $7.50 Employee & Child(ren) $80.77 Employee & Spouse $170.77 Employee & Family $156.92

Employee $20.00 Employee

Child(ren) $121.85 Employee & Spouse $216.92 Employee & Family $221.54

HK

&

HK

Employee $53.08 Employee & Child(ren) $180.00 Employee & Spouse $279.23 Employee & Family $316.15

HSA 2000

Open Enrollment Guide 8 Benefit Coverage Anthem HealthKeepers POS OA 30/1000/30% POSIn-Network POSOut-of-Network Annual Deductible Individual $1,000 $2,000 Family $2,000 $4,000 Coinsurance 30% 30% Maximum Out-of-Pocket* Individual $5,000 $12,500 Family $10,000 $25,000 Physician Office Visit Primary Care $30 copay per visit 30% after deductible Specialty Care $50 copay per visit 30% after deductible Preventive Care Adult Periodic Exams 100% 30% after deductible Well-Child Care 100% 30% after deductible Diagnostic Services X-ray and Lab Tests 30% after deductible for x-ray ; 100% for Lab-office; preferred reference lab 30% after deductible Complex Radiology 30% after deductible 30% after deductible Urgent Care Facility $50 copay per visit 30% after deductible Emergency Room Facility Charges* 30% after deductible 30% after deductible Inpatient Facility Charges 30% after deductible 30% after deductible Outpatient Facility and Surgical Charges 30% after deductible 30% after deductible Mental Health Inpatient 30% after deductible 30% after deductible Outpatient 30% after deductible 30% after deductible Substance Abuse Inpatient 30% after deductible 30% after deductible Outpatient 30% after deductible 30% after deductible Other Services Chiropractic 30% after deductible; 30 visit per year 30% after deductible Retail Pharmacy (30 Day Supply) Generic (Tier 1) $10 copay 30% after deductible Preferred (Tier 2) $40 copay 30% after deductible Non-Preferred (Tier 3) $70 copay 30% after deductible Preferred Specialty (Tier 4) 20% up to $300 maximum 30% after deductible

Open Enrollment Guide 9 Benefit Coverage Anthem HealthKeepers POS OA 30/1000/30% POSIn-Network POSOut-of-Network Mail Order Pharmacy (90 Day Supply Generic (Tier 1) $25 copay Not covered Preferred (Tier 2) $100 copay Not covered Non-Preferred (Tier 3) $175 copay Not covered Preferred Specialty (Tier 4) 20% up to $300 maximum Not covered Employee Contributions (Bi Weekly 26 per yr) HK POS OA 30 Employee $80.77 Employee & Child(ren) $230.77 Employee & Spouse $330.00 Employee & Spouse & Child(ren) (Family) $380.77

Health Savings Account

A Health Savings Account (HSA) provides a tax-advantaged way to save for future medical expenses. The HSA is a component of a High Deductible Health Plan (HDHP).

An HSA is your account and you can build on it over the years. It’s portable. If you leave, your HSA account still belongs to you.

There is no “use it or lose it” rule as with an FSA.

Who Is Eligible to Enroll?

• You must be enrolled in a qualifying HDHP to be eligible to contribute to an HSA.

• You cannot be enrolled in Medicare (generally those over 65) and contribute funds to the account. However, HSA funds can be used when enrolled in Medicare for qualifying expenses not covered by Medicare. (Note – You may not contribute to an HSA once you are enrolled in Medicare.)

• You cannot be covered by another health insurance program.

• You cannot be eligible to be claimed as a dependent on another’s tax return (does not apply to joint filing).

• You cannot be enrolled in a medical Flexible Spending Account (you or spouse) and put funds in an HSA. However, you can be enrolled in the HDHP without the HSA.

If you or your spouse is currently enrolled in an FSA today, you must exhaust all money in your FSA account by the end of the plan year (December 31) to be eligible to open an HSA on January 1

If your spouse is enrolled in an FSA plan, you cannot cover your spouse under YMCA’s plan and open an HSA account until the end of their plan year. For example, if their plan does not end until December 31, you are not able to open the HSA until then.

CONTRIBUTIONS

HSAs function much like an IRA, where employees can invest money, reduce taxable income for the amount invested and use the funds without penalty for eligible medical expenses (similar to the FSA eligible list).

You may contribute up to the Federal limit ($3,850 individual or $7,750 family in 2023). If you are age 55 or older, you can make an additional $1,000 contribution. Contributions can be made on a pre-tax basis or can be deducted on your tax return at filing time.

The YMCA will contribute a matching contribution up to $250 for 2023.

You may start or stop your contributions throughout the year.

The maximum contribution is allowable for partial year participation in a qualified HDHP as long as you remain in the plan the following full year.

Open Enrollment Guide 10

PLAN ADMINISTRATOR

Our administrator is WealthCare and you can access your account online at www.wealthcare.com.

You can invest the contributions in a choice of funds. Please contact WealthCare for additional information.

For assistance, contact customer service at 1-866-287-2520 or the number on the back of your card.

ELIGIBLE EXPENSES

Expenses that are eligible for reimbursement from an HSA are similar to those that are allowed under an FSA. You can refer to IRS Publication 502, Medical and Dental Expenses to identify eligible expenses. This publication can be found at www.irs.gov/pub/irs-pdf/p502.pdf

PAYING CLAIMS AND REIMBURSEMENTS FROM ACCOUNT

Show your Anthem ID card when you receive care. The provider will submit a claim to Anthem for the application of discounts and credit to your deductible. Most providers will not require a payment from you at time of service. They will bill you for the balance due after the insurance discount has been applied.

You pay the bill one of the following ways:

• HSA debit card

• Direct from HSA (check)

• From regular funds, then reimburse yourself from HSA

• From regular funds, don’t reimburse yourself, but save the HSA funds for a rainy day

If you withdraw funds in an account after age 65 and use the fund for anything other than eligible medical expenses, you will be subject to a tax but a penalty does not apply.

Open Enrollment Guide 11

Flexible Spending Accounts

The Flexible Spending Account (FSA) plan with P&A Group allows you to set aside pretax dollars to cover qualified expenses you would normally pay out of your pocket with post-tax dollars. The plan is comprised of a health care spending account and a dependent care account. You pay no federal or state income taxes on the money you place in an FSA.

How an FSA works:

Choose a specific amount of money to contribute each pay period, pre-tax, to one or both accounts during the year.

The amount is automatically deducted from your pay at the same level each pay period.

As you incur eligible expenses, you may use your flexible spending debit card to pay at the point of service OR submit the appropriate paperwork to be reimbursed by the plan.

Important rules to keep in mind:

The IRS allows you to carry over up to $610, however you should plan your FSA contribution carefully.

Once you enroll in the FSA, you cannot change your contribution amount during the year unless you experience a qualifying life event.

You cannot transfer funds from one FSA to another.

Re-enrollment is required each year.

Please note: If you are enrolled in a HSA health plan, you can have a Limited Flex Spending which covers eligible dental and vision expenses.

Open Enrollment Guide 12

Maximum Annual Election – 2023 Health Care FSA $3,050 Dependent Care FSA $5,000

Change

Dental Insurance

YMCA of Greater Richmond will continue to offer a dental program. The chart below is a brief outline of the plan. Please refer to the summary plan description for complete plan details.

Open Enrollment Guide 13

Benefit Coverage Anthem HealthKeepers High Plan Anthem HealthKeepers Low Plan In-NetworkBenefits Out-of-NetworkBenefits In-NetworkBenefits Out-of-NetworkBenefits Annual Deductible Individual $50 $50 $50 $50 Family $150 $150 $150 $150 Waived for Preventive Care Yes Yes Yes Yes Annual Maximum Per Person / Family $1,500 $1,500 $1,000 $1,000 Preventive 100% 100% 100% 20% Basic 20% 20% 20% 40% Major 50% 50% 50% 50% Orthodontia Benefit Percentage 50% 50% Not covered Not covered Adult (and Covered Full-Time Students, if Eligible) Not covered Not covered N/A N/A Dependent Child(ren) Covered Covered N/A N/A Lifetime Maximum $1,500 $1,500 N/A N/A Benefit Waiting Periods N/A N/A N/A N/A Employee Contributions (Bi Weekly 26 per yr) Dental High Plan Employee $3.00 Employee & Child(ren) $10.00 Employee & Spouse $12.00 Employee & Spouse & Child(ren) (Family) $20.00 Employee Contributions (Bi Weekly 26 per yr) Dental Low Plan Employee $0.00 Employee & Child(ren) $5.00 Employee & Spouse $5.00 Employee & Spouse & Child(ren) (Family) $12.00

Vision Insurance

YMCA of Greater Richmond provides Vision Insurance.

Coverage

Copay

Routine Exams (Annual) $10 copay

Vision Materials

Materials Copay $0 copay

Lenses

Contacts

Covered in lieu of frames.

Medically necessary contacts may be covered at a higher benefit level

Benefit varies by type of lens. Covered every 12 months

Elective contacts covered $130 allowance every 12 months

Frames Covered at $130 allowance then 20% off any remaining balance every 24 months

Employee Contributions (Bi Weekly 26 per yr)

Open Enrollment Guide 14

Benefit

Anthem Blue Cross and Blue Shield Anthem vision summary

Employee $2.88 Employee & Child(ren) $5.77 Employee & Spouse $5.48 Employee & Spouse & Child(ren) (Family) $8.47

Anthem vision summary

Life and Accidental Death & Dismemberment Insurance

YMCA of Greater Richmond provides Basic Life and AD&D benefits to eligible employees at no cost to you. The Life insurance benefit will be paid to your designated beneficiary in the event of death while covered under the plan. The AD&D benefit will be paid in the event of a loss of life or limb by accident while covered under the plan. Anthem Life Group Term Life and AD&D

You Benefit 1 times yearly earnings

Benefit Maximum $250,000

Guaranteed Issue 1 times yearly earning or $250,000, whichever is less

The above benefits will begin to decrease at age 65 to 30% of the original amount and at age 70 to 50% of the original amount.

Voluntary Life Offerings

In addition, you have the option to purchase additional voluntary life insurance for yourself and your family. Your election, however, could be subject to medical questions and evidence of insurability. You can increase your voluntary life insurance each open enrollment by $30,000.

Voluntary Life Insurance

You may purchase additional Life insurance with Anthem Life if you want more coverage. Your contributions will depend on your age and the amount of coverage you elect.

Open Enrollment Guide 15

Anthem Life Group Voluntary Life and AD&D You Benefit increments $10,000 Benefit Maximum $500,000 Guaranteed Issue $275,000 Your Spouse Benefit increments $5,000 Benefit Maximum $250,000 Guaranteed Issue $50,000 Your Child Benefit Maximum $10,000 Guaranteed Issue $10,000

Long-Term Disability Insurance

YMCA of Greater Richmond offers long-term income protection through Anthem Life at no cost to you. This benefit will assist in the event you become unable to work due to a non-work-related illness or injury. This benefit covers 60% of your monthly base salary up to $10,000. Benefit payments begin after 90 days of disability. If you become disabled before you reach age 60, the maximum benefit duration will be until the normal social security normal retirement age. Please see the summary plan description for complete plan details.

Voluntary Disability Offerings

Short-Term Disability Insurance

YMCA of Greater Richmond offers a short-term disability option through Anthem Life This benefit covers 60% of your weekly base salary up to $500 per week. The benefit begins after 14 days of injury or illness and lasts up to 12 weeks.

Please see the summary plan description for complete plan details.

Open Enrollment Guide 16

Employee Assistance Program

Open Enrollment Guide 17

Open Enrollment Guide 18 Canopy – Additional Employee Assistance Program

Dependent Care Benefits

All free dependent care benefits provided by the YMCA are considered a taxable fringe benefit unless all or part of the value of that benefit can be sheltered using a Dependent Care Assistance Program. This account is part of our Section 125 Cafeteria Plan.

We will now have two parts to our Dependent Care Assistance Program:

1. Contributory – An employee may contribute to a 125 pre-tax, Flexible Spending Account out of their paycheck. This is optional and employees will need to re-enroll in this portion of the plan each year.

2. Noncontributory – This is available to YMCA employees who have children in licensed YMCA day care or camp programs. Dependent Care election form needs to be completed during open enrollment each year. Employees must qualify to have their amounts added to a Dependent Care Assistance Program (see requirements below).

Both the contributory and noncontributory portions will be added together to calculate your Dependent Care Assistance amount at year end. There are Federal regulations related to the Dependent Care Assistance Program that apply in order for you to participate.

1. The child must be a dependent. There is an exception on the dependency requirement for parents who are divorced and share the exemption each year.

2. The child can not be older than 12 years of age. There are YMCA programs that benefit children over the age of 12; however, the value of these programs received is taxable as an employee fringe benefit. This does not apply to a child who is physically or mentally incapable of self-care.

3. Both parents must be working, seeking work, or attending school full-time during the time the child is in daycare. If one or both parents stay home, you may not participate in the Dependent Care Assistance Program.

4. The maximum amount a parent can pre-tax in a Dependent Care Assistance Program per calendar year is limited to the lesser of (a) $5,000 if you file your taxes as single or married filing jointly, (b) $2,500 if you file your taxes as married filing separate, or (c) the earned income of the employee or employee’s spouse (whichever is less). Therefore, if the contributory and noncontributory portions of your daycare exceed those amounts, the remaining amount will be added to your income and taxed as an employee fringe benefit. A 20% discount will apply to any taxable amounts.

If you participate in a Dependent Care Assistance Program at your spouse’s place of work, you will be responsible for making sure you do not exceed the required maximum amount in any calendar year between the two programs.

The YMCA does not advise on any personal income tax requirements or issues. This benefit summary is provided as general information only. We encourage you to seek professional tax advice for personal income tax questions and assistance.

Open Enrollment Guide 19

Voluntary Benefits

Legal Resources

YMCA of Greater Richmond offers voluntary Legal Resources to our employees. Legal Resources the following services:

• General advise and Consultations

o Unlimited in-person or telephone advise for fully covered services

• Family Law

o uncontested domestic adoption

o uncontested divorce

o uncontested name change

• Criminal Matters

o Defense of misdemeanor

o Misdemeanor defense or juveniles

• Wills and Estate Planning

• Traffic Violations

• Civil Actions

• Preparation and Review of Routine Legal documents

• Real Estate

o Purchase, sale or refinance of primary residence

o Tenant – Landlord matters

• Consumer Relations and Credit Protection

The cost is $19.00 per month.

Identity Theft

Identity Theft is available through Legal Resources and provides protection to your personal information. Under this plan, we offer three benefit options which include Monitor and Alerts, Control, and Resolve:

• Basic – Essential Protection (monitoring, alerts, online tools, restoration specialist and theft insurance)

• Gold – Trusted Value (the Basic plus 1 bureau credit report, monthly credit reports and score tracker)

• Platinum – Comprehensive Coverage (The Basic plus 3 bureau credit reports, monthly credit reports and score tracking)

The rates below are per paycheck:

Open Enrollment Guide 20

Plan/ Coverage Basic Gold Platinum Employee only $2.75 $4.59 $7.82 Employee & Spouse $5.06 $8.28 $14.28 Employee & Family $6.44 $10.59 $18.43

Pet Insurance

YMCA of Greater Richmond offers voluntary pet insurance administered by Nationwide to our employees.

✓ 90% back on eligible vet bills

✓ Exclusive to employees, not available to the general public

✓ Same price for pets of all ages

✓ Best Deal – average savings of 30% over similar plans from other pet insurers

✓ Wellness plan option that includes spay/neuter, vaccinations and more

Get a free quote, no obligation at PetsNationwide.com

Easy Enrollment – Select the species (dog or cat), provide your zipcode, and pick your plan.

(To enroll your bird, rabbit, reptile or other exotic pet, please call 888899-4874)

FreeWill and YMCA of Greater Richmond

YMCA of Greater Richmond has a partnership with FreeWill which offers the following services:

✓ Free online estate planning tools to write a legal will Go to FreeWill.com/YMCARichmond to write your free will in less than 25 minutes.

If you have any questions, please contact Elaina Brennan at brennane@ymcarichmond.org

Open Enrollment Guide 21

Contacts

Have Questions? Need Help?

YMCA of Greater Richmond is excited to offer access to the USI Benefit Resource Center (BRC), which is designed to provide you with a responsive, consistent, hands-on approach to benefit inquiries. Benefit Specialists are available to research and solve elevated claims, unresolved eligibility problems, and any other benefit issues with which you might need assistance. The Benefit Specialists are experienced professionals and their primary responsibility is to assist you.

The Specialists in the Benefit Resource Center are available Monday through Friday 8:00am to 5:00pm EST at 855-8746699 or via e-mail at BRCEast@usi.com. If you need assistance outside of regular business hours, please leave a message and one of the Benefit Specialists will promptly return your call or e-mail message by the end of the following business day.

Additional information regarding benefit plans can be found on Share Point – Human Resources – Benefits. Please contact Lori Walker in Human Resources to complete any changes to your benefits that are not related to your initial or annual enrollment. (804-474-4353)

Carrier Customer Service

Open Enrollment Guide 22

BENEFITS PLAN CARRIER PHONE NUMBER WEBSITE Medical and Vision Anthem HealthKeepers (833) 674-9260 www.anthem.com Dental PPO Anthem HealthKeepers (866) 956-8607 www.anthem.com Life and AD&D Anthem Life (800) 552-2137 www.anthem.com Short Term Disability (STD) Anthem Life (800) 813-5682 www.anthem.com Long Term Disability (LTD) Anthem Life (800) 813-5682 www.anthem.com Voluntary Life Anthem Life (800) 552-2137 www.anthem.com Legal Resources Legal Resources (800) 728-5768 www.legalresources.com Identity Theft Legal Resources (800) 728-5768 www.legalresources.com Pet Insurance Nationwide (877) 738-7874 www.petsnationwide.com EAP Anthem Life / Resource Advisor (888) 209-7840 www.resourceadvisor.anthem. com Flexible Spending Account/Dependent Care P&A Group (716) 852-2611 www.padmin.com Health Savings Account WealthCare (866) 287-2520 www.wealthcare.com Employee Assistance Program Canopy (800) 433-2320 Mycanopywell.com

YMCA of Greater Richmond 201 West 7th Street, Suite 110 Richmond, Virginia 23224 LOGO

Dependent Care Benefits

All free dependent care benefits provided by the YMCA are considered taxable unless all or part of the value of that benefit can be sheltered using a Dependent Care Assistance Program. This new account is part of our Section 125 Cafeteria Plan.

We will now have two parts to our Dependent Care Assistance Program:

1 Contributory – An employee may contribute to a 125 pre-tax, Flexible Spending Account out of their paycheck. This is optional and employees will need to re-enroll in this portion of the plan each year. Some employees have already enrolled in this account for this year; others may wish to do so.

2 Noncontributory – This is not paid for by the employees and is only available to YMCA employees who have children in YMCA day care or camp programs. A YMCA Dependent Care Qualification Form will need to be completed during future open enrollment each year, but for the 2005 year, we are providing a participation form for you to fill out now. Unfortunately, not all employees will qualify to have their amounts added to a Dependent Care Assistance Program (see requirements below).

Both the contributory and noncontributory portions will be added together to calculate your Dependent Care Assistance amount at year end. There are certain Federal rules and regulations related to the Dependent Care Assistance Program that will apply in order for you to participate

1. The child must be a dependent. There is an exception on the dependency requirement for parents who are divorced and share the exemption each year

2 The child can not be older than 12 years of age There are YMCA programs that benefit children over the age of 12; however, the value of any free daycare received for that child must be taxed This does not apply to a child who is physically or mentally incapable of self-care.

3. Both parents must be working, seeking work, or attending school full-time during the time the child is in the daycare. If one or both parents stay home, you will not be able to participate in the Dependent Care Assistance Program If this is only applicable to a portion of the time your child is in daycare, we will need to prorate the benefit between taxable and non-taxable.

4 The maximum amount a parent can pre-tax in a Dependent Care Assistance Program per calendar year is limited to the lesser of (a) $5,000 if you file your taxes as single or married filing jointly, (b) $2,500 if you file your taxes as married filing separate, or (c) the earned income of the employee or employee’s spouse (whichever is less). Therefore, if the contributory and noncontributory portions of your daycare exceed those amounts, the remaining amount will be added to your income and taxed. A 20% discount will apply to any taxable amounts. If you participate in a Dependent Care Assistance Program at your spouse’s place of work, you will be responsible for making sure you do not exceed the required maximum amount in any calendar year between the two programs.

FOR EMPLOYEES WHO USE YMCA DAYCARE/CAMP

Calculation of Dependent Care Assistance Program (DCAP) Participation

Description

Projected Total Free YMCA Daycare/Camp Costs for Year. $

Amounts

Comments

Be sure to include any increases for summer camp and deduct any allowed deductions for vacation, etc

$5,000 (single or married filing jointly), $2,500 (married filing separately). You must also meet all the criteria for participation outlined below. Difference $

Subtract: Maximum Allowed Participation in DCAP $

If this amount is negative or zero, stop here All of your daycare expenses will be considered part of the DCAP and not taxed. If this is a positive number, go to the next calculation

This is the taxable amount that will be added to gross wages Your actual tax amount will depend on you individual tax situation.

Criteria for Participation in a DCAP

1 The child must be your dependent Divorced parents who share the exemption qualify.

2. The child must be 12 years old or younger.

3. All parents must be working, seeking work, or attending school during the time the child is in the daycare or with a provider.

WORKSHEET

Less

Discount (IRS Tax Code) $

20%

Taxable Benefit $

Programs that are Discounted currently for FT Staff

All are Taxable Benefits, whether you qualify for a benefit or not.

Considered deminimus and do NOT qualify as taxable benefit

School Aged Child Care (100%) Nursery

All Full-Day Day Camps (100%) Sports Camps (half days)

Full Day preschool (50%)

½ Day Preschool

Youth Sports

Gymnastics

If you qualify for the DCAP, you will include the total amount of the discount the Y gives you, for the programs on the left. You do not pay taxes on them, up to the limit.

If you do not qualify for the DCAP, the YMCA must report the total amount of the discount the Y gives you for the programs on the left. This amount will be included in your wages as “taxable income” and you will pay taxes on them.

No staff has to pay taxes on the amount of the discount the Y gives you for the programs on the right.

Summary of Benefits

Employee Name: Start Date: Branch:

Benefits Start Date:

Health

Tobacco Surcharge

HSA – Health Savings Account

Dental Vision

FSA – Medical

FSA – Dependent Care

Voluntary Life

Spouse Life

Dependent Life

Short-Term Disability

Legal Resources

Identity Theft

Retirement

403B(B) Smart Account

Processed:

Date entered: by:

Y – 12% after vesting

Benefit Type Benefit Option Employee Rate per check

Paid by YMCA

Paid by YMCA

FSA Service Fee

Life

Paid by YMCA

Long-Term Disability

January 2021

January1,2021

January 2021 INTRODUCTION 5 PURPOSE 5 ADMINISTRATIONOFPOLICY 5 EMPLOYMENTPOLICIES 5 OFFICIAL EMPLOYER 5 QUALIFICATIONS 6 EQUAL EMPLOYMENT OPPORTUNITY 6 ETHICSPOINT 6 NEW EMPLOYEE PROCEDURES 6 RECOGNITION OF PRIOR YEARS OF SERVICE 7 DRUG AND ALCOHOL POLICY 7 EMPLOYEE RECORDS 8 UNLAWFUL ACTS WHILE EMPLOYED 8 USE OF VIDEO RECORDING 8 CONDITIONSONTHEJOB 8 HARASSMENT POLICY 8 COMPLIANT PROCEDURE – ALLEGED HARASSMENT, DISCRIMINATION OR UNFAIR TREATMENT 9 CODE OF ETHICS 9 REPORTING POLICY VIOLATIONS 9 CHILD PROTECTION 9 CONFLICT OF INTEREST POLICY 9 HOURS OF WORK AND PAY PERIODS 10 TIME AND ATTENDANCE 10 OVERTIME 10 TELECOMMUTING 11 INCLEMENT WEATHER 11 CONFIDENTIALITY/ PERSONAL RECORDS/ RETENTION PERIOD 11 CONFIDENTIALITY OF INFORMATION 12 TECHNOLOGY POLICY AND INTELLECTUAL PROPERTY 12 STAFF MEETINGS 12 COMPENSATION FOR SERVICES TO OUTSIDE INTERESTS 12 VOLUNTEERING 12 COMMUNICATION 13 COUNSELING PROCESS FOR WORK PERFORMANCE IMPROVEMENT 13 COUNSELING FORMS 13 SUSPENSION 13 OCCUPATIONAL SAFETY & HEALTH ACT (OSHA) 14 EMERGENCY PROCEDURES POLICY 14 EMPLOYMENT OF RELATIVES 15 EMPLOYMENT OF MINORS 15

January 2021 RELATIONSHIP WITH LABOR AND PROFESSIONAL ORGANIZATIONS 15 RELOCATION/MOVING EXPENSES 15 EXPENSES AND ALLOWANCES 16 GARNISHMENT AND WAGE ASSIGNMENTS 16 OUTSIDE EMPLOYMENT 17 VOLUNTARY CONTRIBUTIONS 17 VEHICLE POLICY 17 PHONES/COMPUTER USAGE/ INTERNET 17 SMOKE-FREE WORK ENVIRONMENT 17 PERSONAL POSSESSIONS 17 APPEARANCE AND GROOMING EXPECTATIONS AND UNIFORMS 17 CHILD WATCH USAGE 18 EMPLOYMENT BY MULTIPLE BRANCHES 18 CLASSIFICATION,COMPENSATION,BENEFITS 18 CLASSIFICATION 18 FULL-TIME SALARIED EXEMPT EMPLOYEES 18 FULL-TIME SALARIED NON-EXEMPT EMPLOYEES 18 PART-TIME EMPLOYEES 18 SEASONAL EMPLOYEES 18 JOB DESCRIPTIONS 19 PAYROLL RECORDS 19 CONTRACT LABOR 19 COMPENSATION 19 BENEFITS 19 VACATIONS 19 GUIDELINES 20 PAID TIME OFF FOR PART TIME EMPLOYEES 21 HOLIDAYS 21 OTHER TYPES OF LEAVE 21 PERSONAL LEAVE 21 SICK AND ACCIDENT LEAVE 22 SICK LEAVE GUIDELINES 22 FAMILY AND MEDICAL LEAVE ACT (FMLA) POLICY 22 SICK LEAVE POOL 23 FMLA POLICY FOR MILITARY-RELATED LEAVE 24 FMLA PROCEDURES 26 FMLA JOB RESTORATION 27 BENEFIT COVERAGE DURING LEAVE OF ABSENCE 27 LACTATION POLICY 27 JURY DUTY 27 MILITARY SERVICE 27 BEREAVEMENT LEAVE 27 LEAVE OF ABSENCE WITHOUT PAY 28 OTHERBENEFITS 28 LIFE AND ACCIDENTAL DEATH 28

January 2021 HEALTH AND DENTAL 28 SECTION 125 28 LONG TERM DISABILITY PROGRAM 29 TRAVEL/ACCIDENT 29 SHORT-TERM DISABILITY 29 UNEMPLOYMENT COMPENSATION 29 WORKERS COMPENSATION 29 EMPLOYEE ASSISTANCE PROGRAM 29 RETIREMENT 29 ELIGIBILITY AND VESTING 29 CONTRIBUTIONS 29 STAFF RECOGNITION 30 YMCA EMPLOYEE MEMBERSHIP 30 YMCA EMPLOYEE PROGRAM BENEFITS 31 SEPARATIONS 31 SEPARATIONS 31 VOLUNTARY RESIGNATION 31 REDUCTION IN WORK FORCE 32 UNSATISFACTORY PERFORMANCE 32 DISMISSAL FOR MISCONDUCT 32 UPON SEPARATION 32 TERMINATION PROCEDURES (PART-TIME SEPARATIONS) 33 LEADERSHIPDEVELOPMENTANDTRAINING 33 EMPLOYEE RESOURCE GROUPS 33 EDUCATIONAL ASSISTANCE 34 STAFF TRAINING PAY 35 POLICIESREFERENCED 35 EMPOYEESIGNATUREPAGE 37

INTRODUCTION

Welcome to the YMCA of Greater Richmond! The YMCA is excited to have you as part of the team. The YMCA of Greater Richmond is committed to the core values of caring, honesty, respect and responsibility. With that in mind, the YMCA strives to maintain the highest ethical standards in the conduct of our affairs. Our goal is to consistently attract, develop, motivate, and retain the best employees possible so that each person can achieve the objectives and enhance the values of the YMCA. The YMCA is an Equal Opportunity Employer. All employment decisions are made on a non-discriminatory basis in compliance with applicable local, state, and federal laws. The policies stated here are not intended to be, nor should they be construed to be, a contract between the YMCA and any employee. The policy may be changed, modified, or altered in whole or in part without prior notice to any employee in order to move forward the mission of the YMCA of Greater Richmond.

PURPOSE

These policies are established for the purpose of defining human resources policies and procedures. The Human Resources Policy of the YMCA of Greater Richmond applies to all employees, exempt, non-exempt, part-time and seasonal. Any changes or additions to this policy shall become a part of the terms and conditions of employment for each employee. Revised editions shall supersede all previous versions, and will be available on the Human Resources SharePoint page.

ADMINISTRATIONOFPOLICY

The Board of Directors of the YMCA employs the CEO to whom it delegates responsibility for the administration of human resources matters. The direct administration of this policy and supervision of staff are the responsibility of the CEO. However, responsibility and authority may be delegated to others.

EMPLOYMENTPOLICIES

The YMCA of Greater Richmond seeks to hire employees who meet high standards of character, education, and occupational qualifications. All employment shall be in compliance with the Fair Labor Standards Act, Equal Employment statutes, and other federal and state laws and regulations.

The YMCA of Greater Richmond is committed to delivering high quality programs and services to our community; therefore, our hiring philosophy is to strategically place employees where their skill sets best align with the functions of the position and the makeup of current staff. To accomplish this, hiring may be done by executive appointment, reorganization, or open position process. All hiring, regardless of type, must be approved by executive leadership prior to placement.

Both the employee and the YMCA may terminate employment on an at-will basis, with or without cause, with or without notice except as prohibited by applicable law.

Official Employer

All employees are employees of the YMCA of Greater Richmond and are subject to the policies established by the Board of Directors and approved designees.

5

YMCAofGreaterRichmond

RevisedOctober2020

Qualifications

Employees of the YMCA should be in alignment with the purposes and goals of the Association and should serve the mission in an ethical and professional manner at all times. Employees should also possess the aptitude, skills, and capabilities required in their field of work. The YMCA of Greater Richmond will make reasonable accommodations to the needs of qualified applicants and employees who have a known disability, so long as it does not create an undue hardship on the Association.

Because the YMCA of Greater Richmond serves the needs of the community and the individuals and families within it, the YMCA requires that all employees possess a cooperative spirit and hold goodwill toward their associates, the individuals they serve, and the public. The YMCA strives to hire employees who exhibit the desire and capacity to learn, to grow, and continuously improve. Additionally, the YMCA ascribes to Brand Behaviors associated with core values of Honesty, Caring, Respect and Responsibility, and expects that staff will demonstrate these behaviors.

Equal Employment Opportunity

The YMCA’s open to all policy applies to recruiting and employment, and complies with all federal employment regulations. The YMCA’s Equal Employment Opportunity program is committed to accomplishing the following objectives:

Ensure that recruiting, hiring, and training for all job classifications is done without regard to any classification protected by applicable law.

Ensure that employment decisions further the principle of Equal Employment Opportunity.

Ensure that promotion decisions further the principle of Equal Employment Opportunity and that non-discriminatory criteria for promotions are used.

Ensure that other human resources policies and procedures governing compensation, benefits, transfers, training and development are administered without regard to any classification protected by applicable law.

All employees are expected to conduct themselves in a manner consistent with the YMCA’s core values and their obligation to maintain a work environment free from discrimination, including discrimination on the basis of race, color, religion, sex, sexual orientation, gender identity, age, marital status, national origin, disability, genetic information, or any other characteristic protected by the law. The YMCA of Greater Richmond will also make all decisions of employment with consideration to appropriate principles of the Equal Employment Opportunity and Affirmative Action.

EthicsPoint

The mission of the YMCA of Greater Richmond is to put Christian principles into practice through programs that build healthy spirit, mind and body for all. The ability of the YMCA to carry out its mission is aided by policies which clarify the ethical and legal obligations and responsibilities of its staff and volunteers. Like all organizations, the YMCA is faced with risks from wrongdoing, misconduct, dishonesty fraud, discrimination and harassment. As with all exposures potentially affecting the YMCA, we must manage these risks in a professional and effective manner.

6 RevisedOctober2020 YMCAofGreaterRichmond

To facilitate reporting of suspected violations of misconduct, the YMCA of Greater Richmond has established a hotline for employees which may be accessed as follows:

Telephone: 1-888-340-2420

Internet: www.ethicspoint.com

The hotline is managed and staffed by a third-party provider which is not associated with the YMCA of Greater Richmond. Any individual utilizing this hotline to report a violation may remain anonymous. The individual should provide as much detail as available.

Reports from EthicsPoint go to the Vice President of HR and the Director of Risk Management. Reports concerning VPs and Board Members also go to the CEO and the Board’s Chairman of the Audit Committee.

All reports are thoroughly investigated and where appropriate, corrective action is taken. Staff are expected to cooperate fully with investigations of misconduct without fear of retaliation.

New Employee Procedures

An individual may not begin to work for the organization until the new employee onboarding has been completed. Requirements include, but are not limited to, an employment application, signed offer letter and job description, and Employment Eligibility Verification (I-9) documentation. Additionally, all new employees will be asked to submit names and contact information for personal and professional references. These references will be verified as a part of the hiring process.

Prior to hiring, all employees are subject to a national background criminal check, including a national database search of sex offenders. Any individual who has been convicted of or has pending charges of barrier crimes as stated in the Code of Virginia (Sections 63.1–1719 or related codes), or have been the subject of a founded complaint of child abuse or neglect within or outside the Commonwealth of Virginia, will not be accepted for employment by the YMCA of Greater Richmond. In the case of an applicant who has been convicted of, or is the subject of pending charges for any other felony or misdemeanor, the application will be subject to an adjudication process.

New employees must complete New Employee Orientation before beginning work, which includes Blood-Borne Pathogens and Child Abuse Awareness training. Employees will be required to sign off and verify the completion of these trainings annually.

Recognition of Prior Years of Service

An employee transferring from YMCAs outside of the YMCA of Greater Richmond will be given credit for previous full-time service for purposes of calculating service awards, retirement, and vacation.

Drug and Alcohol Policy

To ensure a healthy and safe environment free from substance abuse within the programs, activities and premises, employees are subject to drug and alcohol testing in accordance with the YMCA’s Drug and Alcohol Policy. The use of illegal drugs is never acceptable on the job and will result in termination.

7

RevisedOctober2020 YMCAofGreaterRichmond

All employees will complete a pre-employment drug test and random drug testing as a condition of employment with the YMCA of Greater Richmond. A positive test result may result in termination.

Employee Records

Employees are subject to termination if they are found to have falsified or tampered with personal records, employment documents, timekeeping records, reports or any other documentation at any time. Employees may not alter his/her own personal membership operations (DAXKO) account.

If any part of an employee’s status (ex. name, address, emergency contact information) should change during employment, it is the employee’ responsibility to update their information in the HR software program (UltiPro).

Unlawful Acts While Employed

An employee may be terminated while in service to the YMCA of Greater Richmond if convicted of a crime against children or felony, upon notification of conviction.

Use of Video Recording

The YMCA of Greater Richmond makes every effort to provide a safe and secure environment and facilities for staff members. The YMCA may conduct video surveillance of any portion of its premises at any time, with the exception of certain private areas, such as restrooms, showers, locker rooms and dressing rooms. Video surveillance will be conducted in a professional, ethical and legal manner consistent with all existing YMCA policies, including the Equal Employment Opportunity and AntiHarassment Policies.

Only executive level and authorized staff members may review any video footage, and only in order to comply with their roles and responsibilities. Video surveillance may also be reviewed by law enforcement agencies, other third-parties pursuant to a Court Order, or individuals who receive approval from an Executive Level staff member or their designee. Unauthorized staff or members have no right to view footage.

Recorded video may be stored for a period not to exceed 30 days and will then be erased, unless retained as part of a criminal, safety or security investigation, or for other evidentiary purposes. Video footage will be stored in a secure location. Security cameras may be used to review questionable behavior or actions on the part of employees, members, guests, service providers, or anyone entering YMCA facilities.

CONDITIONSONTHEJOB

Harassment Policy

The YMCA is committed to providing an atmosphere where everyone is treated with dignity and respect and to preventing unlawful harassment. Harassment, intimidation, coercion of or violence or threats against another employee, member, program participant, vendor or business associate of any kind, whether racial, sexual, religious, verbal, or otherwise, in or outside the workplace, is unacceptable, and will not be tolerated or condoned. These are violations of both YMCA policy and the law.

8 RevisedOctober2020 YMCAofGreaterRichmond

Complaint Procedure - Alleged Harassment, Discrimination or Unfair Treatment

An employee who believes that he/she is being harassed, discriminated against, treated unfairly, or that a condition of employment or a decision affecting him/her is unjust or inequitable, he/she should address the issue with a supervisor, branch executive, or the VP of Human Resources. YMCA of Greater Richmond will attempt to resolve allegations of all such matters through confidential investigation, discussion with the persons involved, and/or appropriate disciplinary action against persons found to have engaged in harassment, discrimination or unfair treatment. All such complaints will be promptly and thoroughly investigated, and violations of Association policies will be treated as serious disciplinary infractions that may result in disciplinary action.

Code of Ethics

The YMCA of Greater Richmond is committed to the highest ethical standards and requires those representing the YMCA in any capacity to commit to acting in the best interest of the YMCA and its Mission. The YMCA is also committed to the deterrence, detection and correction of misconduct. All employees will read, acknowledge and comply with the Code of Ethics.

Reporting Policy Violations

Each employee is responsible for bringing to the YMCA’s attention any circumstances that the individual believes constitute harassment, discrimination, unfair treatment, violations of the Code of Ethics or misconduct as set forth in the related policies of the YMCA of Greater Richmond. Failure by the employee to discharge this responsibility may result in disciplinary action. Retaliation against any employee because that individual, in good faith, reported any such circumstances or violation is strictly forbidden, and will be subject to disciplinary action.

Child Protection

The YMCA will not tolerate the mistreatment or abuse of children in its programs. Any mistreatment or abuse by a staff member or volunteer will result in disciplinary action, up to and including termination. Further, the YMCA of Greater Richmond will not tolerate the mistreatment or abuse of one child by another child including any behavior that is classified under the definition of bullying.

All reports of suspicious or inappropriate behavior with children or allegations of abuse will be taken seriously. The YMCA will fully cooperate with authorities in the investigations of alleged abuse. YMCA staff and volunteers are also expected to cooperate fully with any internal and external investigations. Failure to do so will result in disciplinary action up to and including termination.

Conflict of Interest Policy

Employees of the YMCA of Greater Richmond shall adhere to the highest standards of honesty, ethics, propriety, good faith and fair dealing in all activities relating to the YMCA. Compliance with the YMCA’s Conflict of Interest Policies and Procedures is a condition of employment with the YMCA of Greater Richmond.

Hours of Work and Pay Periods

The workweek is Sunday through Saturday. 40 hours constitutes a workweek for fulltime, non-exempt employees. The immediate supervisor is responsible for the preparation and supervision of the working schedule for all employees. Federal and state

9 RevisedOctober2020 YMCAofGreaterRichmond

laws regulating hours of labor shall govern all such work schedules. All employees’ work schedules (including lunch and other breaks for part-time staff) should be scheduled and approved by the Branch Executive or Program Supervisor. Employees will receive a paycheck every other week. Enrollment in direct deposit or debit card is a condition of employment.

Time and Attendance

Online timekeeping must be completed on a regular basis for each payroll period in accordance with the procedures established by Human Resources. Timekeeping must be complete and accurate, and submitted and approved by employee and supervisor. All work hours must be reported, including vacation, sick and other types of leave and overtime hours worked. Knowingly providing incorrect timekeeping information is grounds for disciplinary action up to and including termination. Time records are the property of the YMCA of Greater Richmond.

Overtime

Non-exempt employees are eligible for overtime, which is any time physically worked over and above the regular 40-hour workweek. Non-exempt employees should not work more than 40 hours per work week unless the time over 40 hours is specifically approved by the Supervisor. The Supervisor must grant approval in advance. All paid overtime will be paid at the rate of 1.5 times the employee’s hourly rate for any hours worked over 40 hours per week. Overtime pay will not exceed 1.5 times the hourly rate even when the employee works premium hours for a portion of the work week (such as nights, weekends, or holidays). Overtime worked by non-exempt employees will be the exception, rather than a normal practice, and require prior supervisory approval. If an employee works unapproved overtime due to unforeseen circumstances, the employee must be compensated.

Exempt employees are those that are excluded from the overtime pay requirements of the Fair Labor Standards Act. Exempt employees are paid a salary and are expected to work beyond their normal work hours whenever necessary to accomplish the work of the organization. Exempt employees are not eligible to receive overtime compensation.

Exempt and non-exempt employees should consult with the VP of Human Resources for questions regarding classification.

Telecommuting

Telecommuting is a flexible work arrangement where an employee performs their job responsibilities from an approved site other than their normal workplace. Telecommuting is a work alternative granted at the discretion of an employee’s supervisor and YGR leadership. It is not an Association-wide benefit nor is it intended to meet the needs of every employee – it is not an employee right or entitlement. Telecommuting is a viable, flexible work option when both the employee and the job are suited to such an arrangement. The business needs of YGR will be considered for every telecommuting arrangement. Telecommuting employees will be able to work remotely for up to three days per week. The YMCA will routinely evaluate telecommuting work arrangements to determine continued effectiveness.

Generally, non-exempt/hourly paid employees are not permitted to take work home. Any special exceptions must be approved in advance by their supervisor. If approved,

10 RevisedOctober2020 YMCAofGreaterRichmond

accurate reporting of all time worked is mandatory.

Inclement Weather

All staff should refer to their supervisor for specific operating plans in the event of severe weather conditions. All staff are to report to work, as usual, unless otherwise notified. In the event of severe weather, information about facility closure will be made available on YMCA of Greater Richmond website as soon as possible.

Full time employees will receive regular pay during facility closure due to inclement weather or emergency. In the event that facilities do not close, full time employees who are unable to get into work will utilize PTO. Part time employees will not be paid on a day when inclement weather prevents the branches from opening unless they have, and use, accrued PTO.

Confidentiality/Personal Records/Retention Period

Official employee records will be kept at the Association Human Resources department in secured electronic files. Access to these records will be limited to the employee, or their immediate supervisors, by appointment through Human Resources. Employee files will be kept for a period of at least five years after the employee leaves employment and in accordance with applicable laws. These records will be kept confidential unless subject to legal or authorized requests. Employee files are the property of the YMCA of Greater Richmond and employees may not remove, copy or add materials without the permission of the VP of Human Resources.

Employment will be verified when requested by reliable, trusted parties, at the request of the employee and as required by law. All employment verification requests should be directed, in writing or via fax, to the Association Human Resources office. Information on an employee’s name, work location, position and hire/termination dates will be released. No other information will be released without a signed authorization from the employee.

Confidentiality of Information

During employment with the YMCA, employees may have access to and become acquainted with various trade secrets and/or other information, knowledge, and documents the YMCA considers private property. The YMCA collectively deems all such materials as Confidential Information. The YMCA considers all internal information to be Confidential Information, unless designated otherwise. This includes, but is not limited to, information concerning financial condition, information associated with actual or prospective YMCA members or donors, training materials, manuals, forms, marketing materials, trends, or activities of the YMCA. Employees are not to disclose Confidential Information to others (including other YMCA Associations), or use Confidential Information for themselves or for others, except when such disclosure or use has been approved in writing by Executive Management or is required by law. These obligations apply not only to YMCA representatives during their period of employment or service to the YMCA, but also after termination of employment, service or retirement. Any YMCA representative who has a question regarding the confidentiality of information should contact Executive Leadership (CEO, COO, CFO, or CAO) prior to disclosing the information. All YMCA documents, records, memoranda, contracts and other materials, whether in written or electronic form (and all copies thereof) are solely the YMCA’s property and must be returned to the YMCA immediately upon termination of employment.

11

YMCAofGreaterRichmond

RevisedOctober2020

Technology Policy and Intellectual Property

All electronic data created and stored by the YMCA’s electronic processing systems are subject to these confidentiality standards. All employees shall comply with the YMCA’s Technology Policy. The YMCA retains all rights, title, and interest in and to all inventions, discoveries, improvements, ideas, computer or other apparatus programs and related documentation, and other works of authorship (collectively, Intellectual Property) conceived, developed, made, created, written, and or/prepared by YMCA employees in the course of performing YMCA related work or with the use of the YMCA’s time, material, private and proprietary information, or facilities, including Intellectual Property prepared outside of regular working hours. The YMCA is the sole owner of Intellectual Property, whether or not subject to patent, trademark, copyright, or other form of protection. Employees are prohibited from appropriating and exploiting Intellectual Property during or after their employment.

Staff Meetings

Staff meetings are mandatory for all full-time employees. Employees may also be required to attend other mandatory meetings or trainings. Non-exempt staff will be paid for the time they spend attending any mandatory staff meetings and/or trainings.

Compensation for Services to Outside Interests

When outside work is determined to benefit another Y Association or a kindred organization, a maximum of ten working days is allocated to serve in a consulting or training role in any given calendar year (internal or external to the Association) unless the training is for specific benefit of YGR. Should the consulting or training exceed ten working days, employees must utilize their leave banks (personal or vacation time). An employee who accepts a second job in a non-training or consulting role, must utilize leave or work during non-scheduled hours.

An employee may, generally, retain consulting fees and expense reimbursement for their outside work. Use of YGR facilities and resources should be approved in advance as part of the consulting/training arrangement. Finally, staff engaged in external paid employment or training must be in compliance with the YMCA of Greater Richmond’s conflict of interest policy. Specifically, an employee may not use their outside consulting arrangement to influence decisions made at YGR in such a way to give unfair competitive advantage to any person or firm or corporation.

Volunteering

Non-exempt/hourly employees must meet the following circumstances for volunteering within the YMCA of Greater Richmond: services are entirely voluntary, with no coercion by the employer; the activities are predominantly for the employee’s benefit; the employee serves without contemplation or expectation of pay; the activity does not take place during employee’s regular working hours or scheduled overtime hours and are approved by the employee’s supervisor; the volunteer time is insubstantial in relation to the employee’s regular volunteer services must be distinctly different from normal employment duties.

Communication

The YMCA of Greater Richmond encourages open communication between an employee and their supervisor. When an employee would like to discuss career opportunities, Association policies or other work-related concerns, they should first discuss the issue

12 RevisedOctober2020 YMCAofGreaterRichmond

with their immediate supervisor. If not resolved, they may arrange to meet with successively higher levels of management. In the event that the employee does not feel comfortable discussing the issue with the supervisor or management, they may ask the VP of Human Resources for assistance in addressing the issue.

Counseling for Work Performance Improvement

Counseling is the supervisor’s responsibility and should be used with discretion, consistency, fairness and firmness. When appropriate, an employee may be counseled and given an opportunity to improve or correct performance. In some instances, such as misconduct, the employee may be terminated without written warning. When appropriate, consideration may be given to the range of available alternatives such as suspension, training, reassignment, and referral to the Employee Assistance Program, prior to making a decision to terminate. Written records should be kept of all staff meetings.

All supervisors and employees are encouraged to follow a four-part counseling process. Counseling should be specific, clear, and documented. The VP of Human Resources should be made aware of all counseling actions and should be forwarded copies of all related documentation.

These four steps, or those taken, must be followed and documented (all steps need not be taken in all circumstances; discussion shall take place with the VP of Human Resources if some steps are to be omitted or conducted out of order).

A verbal reprimand, warning or counseling session;

A written reprimand, warning or counseling session with specific guidelines for improved behavior or performance which should be signed by the supervisor and the employee;

A final written probationary reprimand, warning, or counseling session, listing a specific time frame and the specific performance or behavior expected;

A notice of separation should list specific reasons for the termination and previous actions taken to resolve the situation prior to coming to this final step.

Counseling Forms

Supervisors should fill in the form and check Verbal, Written, etc. for the level of action and the giving date. The incident should be described and the form completed for every counseling session with the employee, even if “Verbal”. The employee will then sign the form, and a copy will be made for the employee. If the employee refuses to sign, note this on the form. The supervisor will send the original document to the VP of Human Resources. It is important that Section III, “Methods and Time Frame for Improvement” and Section IV, “Follow up Review Date” are to be filled out for each counseling session. The employee will be given a copy of the document. Prior to any termination action, the completed forms for levels of Verbal and Written counseling sessions must be on file, unless the employee is being terminated for “cause”. (Termination “For Cause” is explained in the HR Policy Handbook). Any termination must be discussed with the VP of Human Resources prior to taking place.

Suspension

When an employee has been accused of a violation of a YMCA policy but denies the violation, the employee may be suspended with or without pay, while a confidential investigation is conducted into whether the violation occurred. If the employee is

13 RevisedOctober2020 YMCAofGreaterRichmond

exonerated after the investigation and they have been on unpaid status, the employee shall be paid for lost time during which they would normally have been scheduled and paid prior to termination. If the employee is found to have committed the violation, he/she may be terminated without additional compensation.

Occupational Safety and Health Act (OSHA)

A safe, healthy and environmentally sound workplace is accomplished through a variety of YMCA activities including safety education, training on the use of certain equipment, and job instruction. Participation in the federally mandated Hazard Communications Awareness Program is required for selected YMCA employees, volunteers and outside contractors in order to ensure that all are fully informed and aware of any chemical hazards in their workplace. Property Directors or appropriate branch staff are required to keep a record of all chemicals and hazardous materials brought into their facility. These substances are recorded in the MSDS notebook set up at each branch. The MSDS notebook is located at the information or service desk or another previously designated and widely communicated location at each branch. Upon employment, all staff of the YMCA of Greater Richmond are required to review this book, become familiar with its contents/usage, and sign in the appropriate section of the notebook. The YMCA prohibits bringing any substance containing hazardous chemicals of any form into our facilities. This policy includes bleach, spray sanitizers, etc. All members or staff bringing these items into the building must report this to a supervisor who should alert the Branch Executive or Property Director/Head Custodian.

Property Directors/Head Custodians are responsible for lockout or tag-out procedures. They are also responsible for the upkeep and maintenance of their branch MSDS notebook, ensuring that it is being used effectively, is maintained appropriately and is available at the designated branch location at all times.

Emergency Procedures

In case of an emergency, employees should call 911 immediately, if warranted, and should report the incident to a supervisor as soon as possible. Should an employee or contractor become injured, someone should remain with the injured party. Blood or body fluid should be cleaned with a spill kit, and the facilities staff should be notified. For all injuries sustained on-site (whether to employee, member or program participant, or other individual), the YMCA of Greater Richmond Incident Form must be completed. When appropriate, information and signatures from any witnesses should be obtained. Once all of the appropriate forms are completed, the forms should be given to the supervisor on duty so that the remainder of the form may be completed and processed properly and promptly.

In the event of a blood or body fluid spill, a trained person will contact all parties involved. All Blood Borne Pathogens procedures should be followed. If an employee is injured while on duty, they must go to a Worker’s Compensation approved physician (a list is available at the employee’s branch or location). It is crucial to ensure that the injury is reported to the supervisor who must report the injury to the Director of Risk Management within 24 hours of the injury. Upon the arrival at the treatment facility, the employee should inform the medical staff that he/she was injured on the job and works for the YMCA of Greater Richmond so that the paperwork will be filed properly. If necessary, be sure to complete all Workers’ Compensation forms.

In the event of any type of emergency or crisis, employees should not communicate with

14 RevisedOctober2020 YMCAofGreaterRichmond

the press or media, but rather provide the name and phone number of the VP of Marketing & Communications or Association Marketing & Communications Director.

Employment of Relatives

Relatives, by blood, marriage, adoption, or domestic partners, may not be employed in positions where one is required to report to or supervise the other; nor may they be employed in the same department where one is a supervisor.

Employment of Minors

The YMCA operates in accordance with the requirements of the federal Child Labor Act and applicable state laws including terms of occupations, work hours and days. Individuals under 16 may only be hired as Lifeguards or with prior approval of VP of Human Resources.

Relationship with Labor and Professional Organizations

Employees are free to decide whether to join a labor or professional organization. No intimidation or coercion of any employee to join or not to join any organization is permitted.

Relocation/Moving Expenses