The independent news source for users of accounting apps & their ecosystems

Main Contacts -

CEO:

David Hassall (Co-Founder)

Managing Editor: Wesley Cornell (Co-Founder)

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Victoria Young

Editorial/News Submissions:

If you have any editorial content (news, comment, tutorials etc.) that you would like us to consider for inclusion in the next edition of XU Magazine, please email us at editorial@xumagazine.com

Advertising: advertising@xumagazine.com

E: hello@xumagazine.com

W: www.xumagazine.com

© XU Magazine Ltd 2014-2025. All rights reserved. No part of this magazine may be used or reproduced without the written permission of the publisher. XU Magazine is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, Merseyside, L3 4BN, United Kingdom. All information contained in this magazine is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine a licence to publish your submission in whole or in part in all/ any editions of the magazine, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in XU Magazine are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

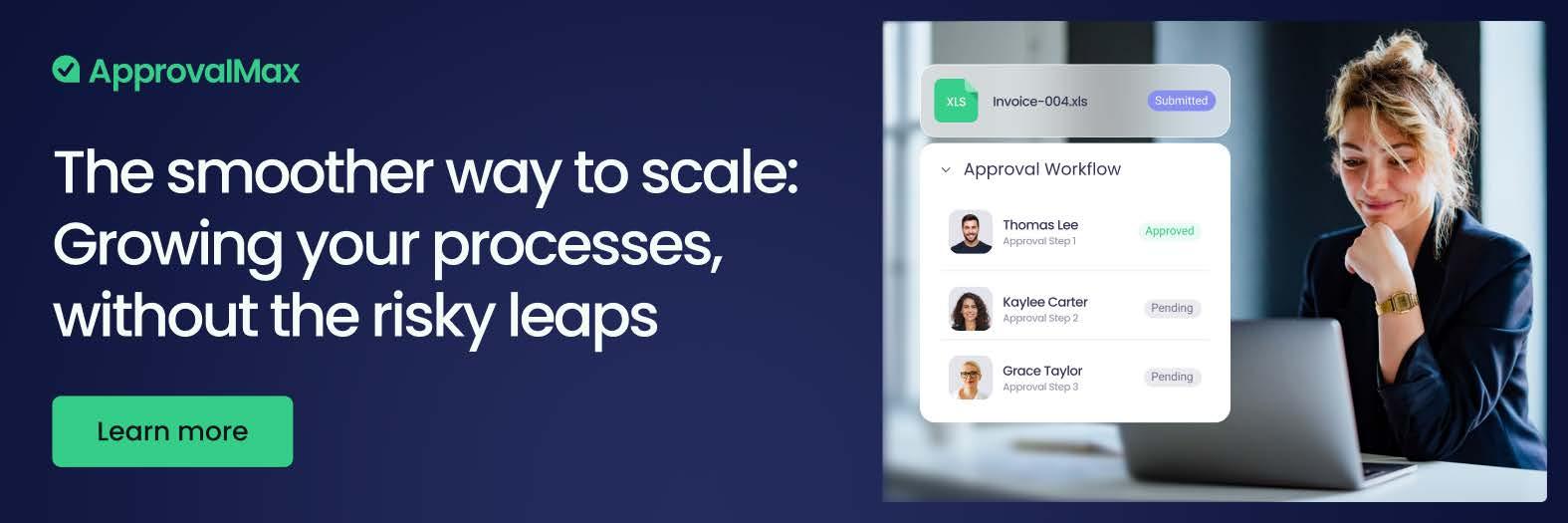

The smoother way to scale: Growing your processes, without the risky leaps

As you are reading through the

any article that shows the CPD Certified logo has been approved to count towards your CPD points. We are really excited to have been able to secure this

as it means all approved articles can now be used towards your CPD points and building up your CPD register.

48 Fishbowl Racking Up Results: How Jimba Lamb Got Its Inventory in Shape

50 Nick Elston

The Numbers Don't Lie, But Your Silence Does

56 Tidy Tidy now has powerful quoting capabilities

58 Sinchii Sinchii: Small Business Software Funded by SmallBusiness

62 Frontline Accounting The Power of a Good Assist

64 Allica Bank

The SME Lending Gap is stalling growth and stunting productivity

66 Zahara Threats and opportunities: How Vibe coding is changing the face of software

70 Tall Emu

Xero Does the Books. What’s Doing the Rest?

72 Spotlight Reporting Leverage the power of benchmarking

76 AppVentory

The Overlooked and Urgent Opportunity: Why Financial Reviews of Software Spend Matter

78 Workflowmax Beyond the Dashboard: How Workflowmax Helps Businesses Find Their Focus & Drive Profitability

82 Worldpay How to supercharge your Xero payments

86 SuiteFiles Make Your Workday Easier: SuiteFiles Now Connects with HubSpot

90 XBert AI Bookkeeping: The Evolution Into a Smarter Work Intelligence System

92 Link Supercharge your Xero Practice Manager

94 A2X Camp A2X enters year three (and the conversations have never mattered more)

98 BGL Reimagining company secretarial and AML compliance for modern UK firms

100 Ignition How firms can pick the right AI tools

104 ApprovalMax In conversation with Dan Schonfeld, ApprovalMax’s new CFO

106 Gojee Why SMEs Don’t Need a $500K ERP

118 Dext Myth-busting MTD for Income Tax

122 Castaway Castaway Q&A

126 Avalara Simplifying business licenses and 1099s with Avalara

128 EVENT Accountex Canada Accountex Canada 2025: Four Years Strong and Building the Future of Accounting

108 ExpenseOnDemand The Human Side of Automation: Empowering Finance Teams with Voice + AI

112 ChangeGPS The Workpaper Revolution

114 HR Partner What’s Your Policy on Personal Relationships at Work?

116 G-Accon From Spreadsheets to Smart Sheets: How One Firm Transformed Its Xero Reporting

132 EVENT Accountex Manchester Accountex Summit Manchester unveils CPD-accredited programme spotlighting AI and MTD

136 Buddy Never Miss a Payroll Deadline Again

138 Xonboard No one had solved employee onboarding for Xero, until now...

140 EVENT Accounting & Business Show Asia Asia’s leading tech and strategy event returns in 2025

On 30th Nov ‘22, OpenAI launched ChatGP and the AI boom began.

Talk about Artificial Intelligence (AI) is now everywhere. Some talk about it with excitement, others talk about it with fear. Some talk about its effect on jobs, some talk about its effect on education, some talk about its effect on entertainment and others talk about its effect on society.

The aim of this article is to help you get some answers about AI and the impact it is going to have on accounting & bookkeeping, and the Xero ecosystem.

1 - Is AI just hype (aka can I ignore it)?

Every few years there is hype around a new technology. Some of these technologies change the world (e.g., smartphones), while others remain niche (e.g., virtual reality). Therefore a very understandable reaction to AI is to ask the question “Is it just hype?”

To answer this let’s look at what knowledgeable people and companies are saying:

• “The defining technology of our time” - Microsoft

• “(AI) has the potential to drive one of the greatest transformations in history.”Google

• “AGI will be the most powerful technology humanity has yet

invented” - Sam Altman

• “AI is the most important technology advance in decades.”

- Bill Gates

• “I actually think the analogy isn’t to the cloud or to the internet. I think the analogy is to the invention of the microprocessor. I think this is a new kind of computer.” - Marc Andreessen

• “AI will be far more intelligent than humans and will overtake us in less than five years.” - Elon Musk

All the CEOs and technologists who have seen AI up close are convinced that it is a more transformational technology than the internet. But, rather than just look at what they are saying, let’s look at what they are doing:

These companies alone spent more than $250bn in CapEx in ‘24. JP Morgan estimates that $163bn of this was due to AI therefore it is safe to conclude that the world’s biggest companies aren’t just talking about AI but acting on AI. To put this spend in contextmore will be spent on AI than many of the biggest and most famous human endeavours in all of history!

Takeaway - AI cannot be ignored.

2 - What does AI mean for work?

In 1995 it was impossible to identify the myriad impacts of the internet. Similarly, today, it is incredibly difficult to forecast the eventual impacts of AI because they will be so huge and widespread. However we can identify the four changes that AI creates that will cause these huge effects. AI means that:

1. Everyone will be able to create their own software

Over the past 30 years every employee became a user of software. But creating software was something that required coding skills that remained very rare and hence was something that was restricted to specific individuals or teams. For most companies this meant that software was something that was bought from software vendors.

No off-the-shelf package can do everything. The need for customisation and flexibility has

always been strong, and until now these gaps were usually bridged by Excel—the tool every employee was expected to master.

AI has already shown its ability to enable anyone to create software and apps just by writing down a short description of what they want. This means that everyone will be able to create their own software and, more than that, everyone will be expected to create their own software.

2. There will be far more software

Many people today feel that we have a lot of software; maybe too much!

The reality is that the volume of software we have today is still highly constrained by the number of people available to build it.

A good way to visualise this is to picture a company having a ‘3rd time rule’. This rule would state that if a task occurred three times then the assumption was

that it would continue to repeat and so the expectation would be to use software to facilitate or automate it in the future. It could apply to small tasks - like copying a number from one piece of software to another; to larger tasks - like seeking an approval; or to truly large tasks - like creating a report. If you think about the number of tasks that each of us continues to manually do today then it is easy to picture how much more software we could all use.

AI will enable this increase in volume of software.

3. The range of tasks that software can accomplish will hugely increase

AI, "Artificial Intelligence”, is different from the software that came before it. It can do tasks that we previously thought required a person. Examples that are already common include:

• Coding

• Translation

• Transcription

This list will get longer and longer. A good way to think about what AI can accomplish is to think about the length and size of a task:

• In 2022, AI could only complete tasks lasting around one minute of human effort

• Today it can handle tasks taking up to an hour

• The maximum task length is doubling roughly every seven months

Note that this is only at a 50% success rate but it is the trend that is most important: accuracy and task length will continue to increase at an exponential rate.

Another factor that expands what AI can do is the range of tools it can access. A well-known example is ChatGPT, which initially had a fixed knowledge cutoff. Later versions gained the ability to search the internet (a tool the model could use), giving the model access to up-to-date information. The more tools a model can use, the broader its capabilities become.

4. And so the range of tasks that any single person can do will hugely increase

The fact that software can do more and that everyone will be able to create their own software will completely transform the world of work.

We are used to working in roles that are dictated by the limits of our skills but AI gives everyone access to skills (and knowledge) that we don’t possess. For example, we can all now write copy (without being a copywriter), we can all now design marketing assets (without being a designer), we can all develop an app (without being a developer), etc.

AI will give everyone a much wider breadth of skills that they currently possess and so change the definition and expectation of roles.

Takeaway - AI will transform work for everyone.

3 - What does AI mean for software vendors?

As more and more people realise that they now have the ability to create software this will create a new “DIY” software category.

The volume of DIY software will hugely outnumber the volume of Apps that are available on Xero.

This trend has already been seen in video games. The volume of published video games has grown year-on-year for over twenty years - 30k new games were estimated to have been published in 2024. But, since 2006, Roblox has enabled gamers to create their own games - there are now over 5m active games on Roblox. Therefore there are now more than 10x more DIY games than there are published games.

This trend will play out in bookkeeping and accounting over the next five years.

Early signs can be seen in the current stats for Xero. In 2011, there were approximately 30 Apps in the Xero App Store, by 2023 there were more than 1,000. But that isn’t the whole story…there were another 100,000 custom, private Apps built on Xero. It is these “custom” apps that will explode in number because of AI.

But this undersells the impact that DIY apps will have. As these apps get created, they will be shared: shared between colleagues, shared between firms and shared across the internet. As they get shared, AI will be able to adapt or “remix” them so that each DIY App has the potential to be the parent of multiple other apps. This means that we will end up with three software categories in accounting:

• “Paid” apps produced by traditional software vendors

• Free “DIY” apps created by users for their own use

• Free “semi-pro” apps created by a user but then adopted by the wider community

Takeaway - AI will create huge price pressure for traditional software vendors.

4 - What does AI mean for my work?

For everyone, the threats and opportunities of AI can be daunting. There is, however, a framework that is useful to navigate this tectonic shift.

AI enables each of us to significantly broaden our role by doing adjacent tasks and to deepen our role by dramatically increasing our productivity. (This applies whether you are an intern or a CEO!). Those that find AI most challenging will be those that spurn these opportunities and those that thrive the most will be those that pursue both:

Takeaway - Those that use AI to broaden and deepen their role will thrive.

5 - How can I use AI to broaden my role?

The breadth of your role today is defined by the skills and knowledge that you can reasonably be expected to possess. There are tasks that are adjacent to you that you are not expected to perform because they require additional skills or knowledge, e.g.:

AI changes this. AI enables you to perform adjacent tasks and broaden your role.

Most companies still work in a serial, production-line fashion, where tasks move between people and often wait in queues for each person to complete their part. AI will change the way companies work to a parallel basis where work can be completed by fewer people and each person will be expected to add their expertise but the work will be required to wait for them.

The main AI software you will need to broaden your role will be an AI Assistant. These are already available today:

The AI Assistants will give you the knowledge you need to complete adjacent tasks. In addition to this they will often be able to complete adjacent tasks for you.

Takeaway - Start using an AI Assistant today.

6 - How can I use AI to deepen my role?

The depth of your role today is defined by the productivity that you can reasonably be expected to perform. These expectations will hugely increase because of AI.

Increased productivity is going to be possible because of automations or, as they are better known, Agents.

To understand what Agents are it is useful to look at two Agents that you will already be familiar with: the bank feed and the expense feed.

AI assistants are the types of AI software most often in the news today. You can choose whichever one you prefer but the most popular today is OpenAI’s ChatGPT.

These are great templates for what Agents will be in accounting & bookkeeping: AI software that completes a specific, discrete task. Expect to see an explosion of Agents over the next 24 months: Bank Rec, Consolidation, Credit Control, Payment Runs, etc.

Takeaway - Start experimenting with the Agents that can boost your productivity.

7 - How do I start building my own tools and software?

You no longer need to be a developer to build useful software. The landscape has three main layers today:

1. AI Assistants The easiest place to start. Assistants like Claude can create simple tools and transform data directly from a chat. Try uploading a spreadsheet and asking for a change, it’s a quick way to see what’s possible without coding.

2. AI App Builders Platforms like Lovable and Replit let you create more complex applications, connect to databases, and deploy online. They still use natural language but give you more control over the result.

Bank feeds were pioneered by BankLink (later acquired by Xero) and popularised through Xero’s accounting platform. It provided a significant productivity boost for individuals and firms by automating the ingestion of bank statement lines into Xero. The expense feed was pioneered by Receipt Bank (aka Dext) and is now most frequently provided by Dext or Hubdoc. It provided a significant productivity boost for individuals and firms by automating the ingestion of receipts and AP invoices into Xero.

3. Workflow Builders Tools such as Zapier and n8n let you chain multiple applications into automated workflows. Start small - perhaps with one of our blog tutorials or by automating a task you do regularly - then work up to more advanced automations.

And Translucent are creating the fourth:

4. The future App Exchange for building accounting tools For DIY creations to become clientgrade, they need an extra layer to ensure accuracy, security, and trust. That’s the platform

Translucent is building, a place where accountants and developers will be able to access and share reliable and scalable AI powered tools.

Members of translucent.network will get early access to Translucent’s developer-grade toolkit for accounting software: live data connections, pre-built workflows, and specialised AI building blocks. It will be everything you need to turn an idea into a reliable, production-ready solution, fast.

8 - Why is AI a big deal for accounting and bookkeeping?

AI = automation

It is obvious that bookkeeping and accounting are services. It is, however, worth stating because the effect of technology, over time, is to evolve services into products.

The last big technology shift in the industry was the adoption of cloud accounting. Its contributions to this shift included giving clients the same user interface (UI) to log into (Xero) and key technical changes - such as the single ledger, APIs, bank feeds, and mobile apps - all of which were widely available by 2013.

• Evolution from service to product

• Productivity

• The data warehouse

• Past data to present and future data

Takeaway - AI will push accounting and bookkeeping to be more product-like.

9 - What does AI mean for firms like mine?

The first visible effect of AI for accounting and bookkeeping firms will be the rise of software vendors advertising to clients that they can replace you.

This is obviously not a new trend (there have been businesses like this for more than ten years) but there will be a lot more of them and they will be more credible.

We know that this will happen because of the public moves by Venture Capitalists (VCs) to invest in these types of companies. Previously VCs would invest in software companies that would provide tooling to an industry (like Xero and Dext). Post-AI, VCs are looking to invest in firms that displace the incumbents in an industry:

• “If you build a great AI accountant, why sell it to legacy accounting firms when you could start an AI accounting firm and beat them?” Y Combinator

VCs are also following the recent trend of private equity firms buying companies with the intention of deploying AI to transform them from within.

These trends will mean new competitors who will be aiming to compete on price, consistency and convenience (i.e. being more product-like).

Takeaway - AI will accelerate the creation of new competitors.

10 - Where do I go from here?

The best way to understand AI is to use it. Think of translucent.network as the App Exchange for accountant-built AI tools: a marketplace where you can discover ready-made solutions, adapt them to your needs, and share your own creations.

You’ll find tutorials, templates, and a growing library of peerbuilt apps to inspire new ideas. In time, we’ll add Translucent’s own developer-grade components for accounting software, make syncing your data seamless, and give you direct access to AI building blocks.

Takeaway, Visit www.translucent.network to discover, adapt, and share AI tools for accountants.

We’ve rebuilt reporting so you can spend less time wrestling formulas and more time doing literally anything else. From off-the-shelf to custom reports, Joiin delivers real-time, single-entity reporting or full multi-entity consolidation.

Powerful integrations, AI-driven insights, and now with our all-new reporting experience, you’ll get dashboards that don’t just look good, they tell you what to do next

Real-time dashboards

Presentation-ready report packs

Report across multiple currencies

Sales & Financial reports including P&L, Cashflow, AR/AP

Intercompany eliminations

Multi-client, unlimited users

XU: Riley, tell us a bit about your background - what led you to launch Xonboard?

RJ: The path to building Xonboard started from my time at Xero, back in 2012 - 2015. At Xero I led the Australian effort to build the ecosystem of apps that are connected to Xero. I worked with hundreds of partners, and fell in love with partnerships that created better solutions than one app could deliver alone.

When I left Xero, I looked for another space where an ecosystem approach could foster innovation and collaboration similar to what spawned around Xero.

Superannuation was the space I found, and employee onboarding was the critical workflow that made life hard for businesses and their employees.

XU: What was it about the team and timing that made this feel right?

RJ: Sam Richardson, Ben Styles and I had been exploring the idea back in 2022. It felt like a generational shift was coming for payroll and super between growing compliance pressures, regulatory reforms, and early signs of Payday Super legislation. Employers were already feeling the strain, so 2023 felt like the right time to launch a solution. Since then, we've been fortunate to find the right people, partners, and investors to back the vision.

XU: For those unfamiliar, what is Xonboard, and what problem does it solve for bookkeepers and small businesses?

RJ: Xonboard adds employee self onboarding to Xero payroll. Xonboard gives employers and their advisors a compliant and automated employee onboarding process, which requires only an email address from a new employee to get them set up in Xero payroll, ready for payday.

That’s a big step forward from the current state, that relies on the employer creating their

own process. Inevitably this involves chasing employees to collect paper versions of the TFN and Super Choice forms and manually keying all that info into Xero. No one likes that!

XU: What kinds of clients are the best fit for Xonboard?

RJ: Anyone using Xero Payroll who needs to onboard staff is a perfect fit. We’ve now got over 4,000 Xero businesses using Xonboard, and it’s growing fast, which is a bit wild considering we haven’t spent much time marketing or selling it. We’re taking a page from Xero’s original playbook: build something advisors love, and they’ll bring their clients along for the ride. So far, it’s working.

XU: What inspired you to focus specifically on the employee onboarding experience within Xero Payroll?

RJ: We knew it was an immediate pain point for Xero users. Xero was not offering a solution and I knew the Xero APIs could support the use case. It was also a common theme across a bunch of other payroll software providers, so we set out to solve the customer pain point that no one else was focussed on.

XU: Sounds like it is working, why do you think that is?

RJ: It might seem obvious in hindsight, but there really wasn’t anything out there

that solved both the employee onboarding experience and the employer’s compliance obligations.

We were the first to embed the ATO’s super stapling service directly into onboarding, removing the need for an advisor to enter an employee's super details into the ATO portal. Plus, we’re connected to SuperStream, which means we can register employees with the default fund automatically.

Honestly though, I think the time we spend with our customers has been the most powerful. Our customers tell us they love genuine support and real conversations, especially in the age of AI Bots. It also helps that they give us some great feature ideas while we chat!

What are the most common pain points bookkeepers face when onboarding employees manually into Xero Payroll?

RJ:

It’s a twofold problem. First, the quality of employee data bookkeepers receive is often poor, coming in via scanned forms, handwritten notes, emails, or mismatched software. It’s rarely complete, and there’s no validation for things like addresses, phone numbers, bank accounts or superfund membership.

Second, the process of collecting that data is messy, time-consuming and unsecure. Chasing employees over email or phone just to get the basics for payroll is frustrating. And even when everything is finally correct, it comes via email and someone needs to manually enter it into Xero Payroll.

XU: In your experience, how much time is lost due to manual onboarding processes, and what are the downstream effects for bookkeepers managing multiple clients?

RJ:

Even in the best-case scenario, onboarding an employee takes around 15 minutes. But that doesn’t include the days of back-andforth before you’re even ready to enter anything into Xero.

The asynchronous nature of it all is a real time suck. Documents arrive from the employee usually when you're busy doing something else. Trying to remember what’s still outstanding, entering details only to realise something’s missing, chasing down employees you can’t reach, and sometimes running payroll anyway just to keep things moving. Then comes the correction: special pay runs, follow-ups, and admin that no one values and no one tracks.

It’s distracting, time-consuming, and frustrating.

It’s a broken workflow … and one Xonboard was built to fix.

XU: How does this inefficiency affect small businesses directly, especially those relying on bookkeepers for payroll compliance and reporting?

RJ:

Time is money. If it’s not automated, you’re paying someone to do it for you. And if you’re not charging for your time, you’re spending it. But you’re also paying for all the compounding mistakes that can creep in when you do things manually. From typos to lost or incomplete forms, if it doesn’t make it into payroll correctly it’s usually the employer that has to pay to fix it. Whether that’s due to a penalty from the ATO or just more time and effort for the bookkeeper / payroll team to revert and fix the error.

XU: With Payday Super on the horizon, how are you seeing bookkeepers and small businesses prepare for the changes?

RJ: Everyone should be having conversations with their clients about Payday Super, making sure they understand what’s coming and why it matters. The most proactive businesses are already shifting from quarterly super payments to monthly, or even payday cycles now. Making that move now avoids disruption later, and there are no penalties for getting it wrong while you're still ahead of the curve.

There’s no sugar-coating it: paying super on payday will put real pressure on small business cashflow. But this is where advisors play a critical role. Helping clients prepare now means they can gradually adjust their processes and start closing the gap before July 1, 2026.

Just like when super was first introduced, Payday Super will, eventually, feel like a nobrainer. But getting there takes planning.

XU: What are the common misconceptions about Payday Super? What do business owners and advisors need to be aware of right now?

RJ: The biggest misconception is that “I’ve got 7 days to pay super”. The reality is, you’ve got 7 days to get every employee’s super to their super fund. That’s a very different challenge!

Super funds have 3 days to reconcile contributions before refunding them, and the payments world is full of intermediaries touching the payment, banks, gateways, clearing houses, super payment services, so the process can get stuck anywhere along the way. There’s no perfect product that can tell you exactly where a super payment is in real time and was it successful.

If you’re still scrambling to collect super details from

employees between making payday and the 7 days expiring, you’re almost guaranteed to trigger an SG Charge, which is yet another round of admin you don’t want.

XU: Why is employee onboarding such a pivotal part of being Payday Super-ready?

RJ: It’s the only way to be ready on payday. It’s how you can stay ahead.

Tired of offshore letdowns? BASE Global builds powerhouse accounting teams that perform, stay longer, and drive real growth

The offshore staffing market hasn’t always had the best reputation. Many accounting firms have grown tired of incumbent providers - frustrated by poor service levels, disengaged offshore staff, and a lack of strategic support.

That’s where BASE Global Solutions comes in.

Founded by Stephen Watts and Wyatt Bacon, BASE is changing the narrative by helping firms build high-performing, long-term teams

that feel like a true extension of their business.

Real Results, Real Change

@base global solutions @stephen watts

Stephen Watts, CEO, BASE Global Solutions

Stephen believes business success starts with the right people. With 20+ years in financial services and accounting, he saw firsthand how top talent drives growth. That led him to co-found BASE Global Solutions, helping businesses scale through highimpact workforce strategies. BASE goes beyond filling roles, focusing on partnerships and performance to deliver tailored people solutions that empower businesses to thrive in a fastchanging market.

“We’ve

doubled our advisory revenue in the last three years,” said director Mark Giglia. “

Just ask AR & B Advisors, a fastgrowing Australian accounting and advisory firm. Like many, they were hitting a ceiling - local recruitment was slow, expensive, and couldn’t keep pace with client demand.

After partnering with BASE, things changed fast.

“We’ve doubled our advisory revenue in the last three years,” said director Mark Giglia. “BASE Global Solutions has changed the way we work, the way we serve clients, and the way we think about growth. It’s been a game changer.” They haven’t wasted any time either. In their first year, BASE Global placed over 100 highquality Philippines candidates into accounting and bookkeeping roles across Australia, helping firms reduce time-to-hire, lift capacity, and ease pressure on stretched local teams.

That kind of result isn’t a oneoff. It’s the product of BASE’s tailored approach to recruitment, onboarding, and team engagement - built specifically for accountants and bookkeepers.

Solving the Big Pain Points

What holds firms back from growing? It’s rarely a lack of ambition or opportunity. More often, it’s capacity.

“Time and time again, we saw great firms limited by one thing - access

to the right people,” says Wyatt. “That’s why we built BASE Global.”

BASE addresses three core problems:

• Capacity – Helping firms scale sustainably by building reliable, skilled teams offshore

• Retention – Creating a supportive environment where offshore staff stay longer and contribute more

• Culture – Building teams that feel like your own - not just staff, but part of the business

It’s an approach that turns offshoring from a compromise into a competitive advantage.

People First, Always

From the beginning, BASE Global was founded on one core belief: business success starts with people. And that means putting just as much care into your offshore team as your clients.

“We don’t see offshore staff as temps or contractors,” says Stephen. “They’re valuable contributors to our clients’ longterm vision - and we treat them that way.” That mindset runs through everything BASE does - from how they recruit, to how they develop culture, communication, and career pathways.

“When people feel supported and part of something bigger, they stay longer, contribute more, and genuinely care about the firm they’re supporting,” says Wyatt.

It’s this culture that sets BASE apart - and creates consistent, lasting results.

“We’re

“We’re not here to fill seats,” Wyatt adds. “We’re here to build high-performing teams that transform your business.”

who serve multiple industries, BASE has a clear focus: accounting and bookkeeping.

“That’s our DNA,” says Stephen. “We know the profession, we speak the language, and we understand what firms need to succeed.”

That specialisation means clients get more than just talent. They get insights, strategic support, and a team that genuinely understands how accounting practices work. And with platforms like Xero making global collaboration seamless, there’s never been a better time to scale in smarter, more sustainable ways.

The Best of Both Worlds: Remote + Office Support

Another part of BASE’s secret sauce? Their new, flexible office space in the Philippines.

“We wanted our team to have the best of both worlds,” says Wyatt. “The freedom to work from home, and the option to come into a vibrant, collaborative space.”

The space also creates a unique opportunity for BASE clients - many of whom travel to the Philippines to connect with their teams in person.

“we saw great firms limited by one thingaccess to the right people,”

“Our office becomes a home base,” says Stephen. “It’s where work gets done, and where partnerships are built.”

This hybrid model gives clients the visibility and access they often miss with other providers - without losing flexibility.

proud of what we’ve built, but

we’re

even more excited about what’s next.”

Built for Accountants and Bookkeepers

Unlike other offshore providers

What’s Next?

Now, as Stephen and Wyatt gear up for Xerocon Brisbane 2025, they’re doubling down on what makes BASE different - people, performance, and partnerships.

They’re expanding their local support team, launching customer and employee-focused engagement programs to keep relationships intimate, and investing in the longterm growth of their offshore workforce.

“Offshoring shouldn’t feel like a risk,” says Wyatt. “With the right partner, it should feel like growth.”

Stephen agrees: “We’re proud of what we’ve built, but we’re even more excited about what’s next.”

Discover how BASE helps firms scale smarter, connect with us to build your highperforming team.

See a Report You Like? Consider it

Replicated.

@vibe-cfo @Cameron Lynch

Cameron Lynch, Founder, Vibe CFO

Cameron Lynch specialises in AI, accounting, reporting, and data analytics. With his background as a chartered accountant, Cameron has substantial experience in both practice and commerce, followed by a decade in accounting technology. He is adept at leading development teams and is highly skilled in data engineering and data analytics writing in both Python and SQL. Cameron is at the forefront of transforming small business reporting by leveraging AI.

The value of your reporting is no longer in the template, but in the questions you can finally ask.

e’ve all seen them. A stunning dashboard posted on LinkedIn or presented at a conference. A report that goes beyond a simple P&L to tell a deep, compelling story about a business, weaving together sales, operations, and financial data into a single, clear narrative. For years, that level of insight felt completely out of reach for most—the exclusive domain of data scientists or companies with six-figure budgets for custom business intelligence projects.

That era is now over.

Imagine seeing a report you admire, taking a screenshot, and having an AI instantly replicate its structure, logic, and visualisations using your own business’s data. This isn't science fiction. This is the new reality. The

technology now exists to make the most sophisticated reporting accessible to everyone, providing an incredibly soft entry for those who do no reporting today and a powerful upgrade for those who do. The barrier to entry has not just been lowered; it has been completely vaporised.

• Why did our sales in Victoria dip after that marketing campaign?

• How does our labour efficiency in the warehouse connect to our gross profit margin?

Go beyond the P&L. It's time to connect financial data to your operations and marketing.

The 360-Degree View: Beyond the Financial Report

Your greatest value is no longer building the report, but leading the conversation.

The accounting ecosystem has excellent reporting apps that provide a solid, trusted view of a company's financial health. They are the bedrock of financial analysis, and they do their job well. However, the most critical business questions often live outside the standard financial statements.

• What is the real return on investment of our digital ad spend? Answering these questions requires a 360-degree view of the business—a seamless connection between financials and data from operations, payroll, marketing, and sales systems. This has always been the holy grail of business intelligence. AI is the technology that finally makes it achievable, acting as the universal translator between all your different data sources.

The ‘Magic’ in the Machine: From Aspiration to Instant Insight

This leap forward is powered by AI's ability to understand context and requests in plain English. With

technologies like EVA's 'Replicate', the "how-to" of building a report is handled for you. Your focus shifts from the technical process to the business outcome.

You are no longer constrained by the fixed menus and capabilities of a specific application. Your creativity and business curiosity are the only limits. The time once spent wrestling with software or exporting data to spreadsheets can now be spent on analysis and strategy. It democratises insight, allowing every accountant, CFO, or finance manager to operate at the highest strategic level.

Value Has Shifted: If the Answer is Instantly Available, the Real Skill is Asking the Right Question

This is the most exciting part. When the report itself is a commodity that can be generated instantly, its value as a standalone product disappears. The value shifts entirely to the professional who can wield this new power effectively.

Your expertise is no longer measured by your ability to produce the chart. It's measured by your ability to:

The magic behind the insights. Vibe CFO's engine combines data from all your key integrations (like Xero and simPRO) with your business's strategic context to deliver truly intelligent answers.

• Guide your client or your company with a strategic narrative.

Your greatest value is no longer in building the report, but in leading the conversation that the report sparks.

From Static Reports to Strategic Conversations

See a dashboard you love? AI can now replicate its structure and logic in minutes.

• Ask the insightful questions that unlock true understanding.

• Interpret the answers the data provides.

This new paradigm calls for a more dynamic and collaborative approach. It’s about moving away from presenting historical data and towards exploring future possibilities in real-time.

This is the world Vibe CFO was built for. It’s not another reporting tool; it’s a conversational intelligence platform. It’s

designed to facilitate a live, strategic dialogue between you, your client, and their data. By making the creation of any report effortless, Vibe CFO frees you to focus on the intellectual property that can never be replicated: your experience, your business acumen, and your strategic mind.

Stop wrestling with reports. Start asking bigger questions with Vibe CFO today.

vibecfo.ai

@qasim-a @b2b-wave

Qas Ali, Senior Account Executive, B2B Wave

Since joining B2B Wave, Qas has helped hundreds of SMBs in the UK and abroad start their B2B eCommerce portal. Qas has deep knowledge of B2B ordering processes for various industries (medical, food distribution, and more) and can advise on what's the best approach to doing so.

Selling online for wholesalers is a tricky business. Different prices per product, private categories, exclusive deals. B2B Wave makes it easy.

o fully reap the benefits of online B2B selling, integrating your B2B eCommerce platform with your Xero account is of the essence. It makes everything more efficient; from your daily business operations to your sales team to the customer ordering process.

B2B Wave is a powerful all-inone B2B e-Commerce platform, exclusively made for wholesale distributors and brands. With B2B Wave you can get your B2B eCommerce portal up and running by easily importing your Xero data (products and customers), inviting customers, and automating invoice creation. Your customer’s experience can be fully personalised with different price lists and privacy settings, and use the sales rep feature to let them manage orders on behalf of their customers.

In addition to Xero integration B2BWave also connects with several payment and inventory systems and with over 2,000+ apps through Zapier — in addition to custombuilt integrations should you feel creative, you can also use the B2B Wave API.

User-friendly B2B eCommerce experience

The all-in-one B2B eCommerce solution will streamline the wholesale order management process with an attractive, user-friendly, wholesale private website where retailers can log in, place orders, and find out about new product offerings and what's currently on sale.

PDF catalogue generation

B2B Wave allows you to instantly accept orders through your own wholesale website, import and manage products on your B2B eCommerce website quickly, generate easily fully customized PDF catalogs for a single customer, a group of customers, specific product categories, and much more.

Localisation features

In today's international world, localisation is a must. You can easily use B2B Wave for selling abroad (even in a different language). We support creating price lists and invoices in different currencies, assigning customers to different VAT schemes, and even assigning different Xero invoice templates to each customer

Mobile app and sales rep management

With the quick import of a spreadsheet, you can immediately start managing your retailers and other B2B customers, including assigning customers to a sales rep and allowing sales reps to place orders on behalf of customers.

Through the B2B Wave new sales reps mobile app you can further streamline your order management and empower your sales reps to deliver superior results by dramatically reducing the time it takes sales them to manage new and existing orders.

B2B Wave values customer relations and we'll do our best to thoroughly understand your business and help you get the most out of the integration. Our friendly support team is available 24/7 to help with urgent issues and with product-related questions.

FIND OUT MORE...

Start a free trial or request a demo here:

https://www.b2bwave.com

XU: James, let’s start with the big news—Content Snare’s recent expansion into the UK market. What prompted the decision, and how has the reception been?

JR: The UK market is probably the most similar to Australia, so as we scale it’s a natural next step especially given how techforward the UK is. With major changes like MTD on the horizon, getting information and documents from clients quickly has never been more important for accountants and bookkeepers.

The response so far has been excellent, thanks in large part to Tom Johnson, who recently joined our sales team. He brought strong UK contacts from his time there, and with integrations like FYI already established in the UK, it’s been easy for firms to slot us into their existing workflows.

XU: Making Tax Digital (MTD) continues to reshape the UK compliance landscape. How is Content Snare positioning itself to help accountants and bookkeepers stay ahead of these changes?

JR: With the roll out of MTD, firms now need to get information from their

smaller clients on a quarterly basis. The problem is these aren’t usually high fee paying clients, and MTD is going to lead to more touch points, more ‘just chasing this up emails’ that can slowly build up into lots more hours of work and internal costs.

Content Snare shines when things become repetitive, eliminating chasing clients up with automatic reminders and so on. We are also working to build ready-to-use templates, this lets accountants and bookkeepers get the information they need quickly, cut down on chasing, and stay focused on getting the work done.

XU: Have you received any feedback from UK accounting firms using Content Snare specifically for MTD-related workflows?

JR: We’ve had plenty of UK customers long before MTD was even a thing, and the feedback has been incredible. Now, the biggest challenge that comes with MTD is queries. For example, Jessica Pillow and her team at Pillow May started using Content Snare specifically for queries, because they were getting out of hand and they needed a way to keep everything in one place. So while we haven’t had a huge

@content-snare @jamesrose

James Rose, Co-Founder

Jimmy is the co-founder of Content Snare - a software platform that helps professionals collect content & files from clients.

Once an automation engineer, his new priority is to help business owners regain their lives, be more productive and get more done in less time.

amount of direct feedback on MTD-related workflows yet, as this is still very new, we do get a lot of feedback on how much time we save firms when it comes to queries. And that’s going to be a big factor in the near future.

Upload portals have been around for years. In your view, why aren’t they enough when it comes to collecting documents and data efficiently?

JR:

It all comes down to client experience.

Traditional “client portals” sound great in theory, but they rarely get used because they aren’t easy for clients. If you’re asking someone to do extra work, it has to be frictionless otherwise they resist or give up.

Logins are the classic barrier. Many people forget passwords, and as soon as they hit that wall, they stop using the portal.

Another issue is that portals often become dumping grounds, no different from a shared Google Drive or SharePoint folder. There’s no checklist, no visibility into what’s done or outstanding, and clients end up cross-referencing emails and spreadsheets. That messy experience is exactly why they fail.

XU: Beyond just collecting documents, what role does Content Snare play in enhancing collaboration and decision-making between professional service providers and their clients?

JR:

Content Snare isn’t just for documents, it’s for collecting any kind of info and with information comes power, the power to help clients make informed decisions.

Another big area is advisory. Accountants and bookkeepers can send out questionnaires before an advisory meeting to gather the right information upfront. It’s almost like giving clients a bit of homework, so when the meeting happens, both sides are better prepared. And then, of course, it’s useful for the follow-up after those meetings as well.

XU:

One of Content Snare’s strengths is automation. How do features like automated reminders, item–level rejection, and embedded instructions contribute to improving completion rates and client experience?

JR: Instructions are the number one thing because that’s what clients see first when you ask them to answer a question or upload a document. Good instructions help them get it right the first time, which is the best way to avoid all the back and forth. You can add formatted text, checklists, images, GIFs, or even videos. For example, if you’re asking a client to give you access to a piece of software, you can include a short video showing exactly where to go in the system or how to find the document you need. This reduces room for error and makes the client experience far better.

Then there are reminders, which are by far our most

popular feature. You’ll always have to chase some clients, sometimes multiple times over long periods, and no one likes doing that. It’s not the kind of work accountants or other professionals should be doing, because it’s a huge waste of their talent. And honestly, even admin staff don’t want to do it, because it’s repetitive and tedious. With automated reminders, that job is handled for you. There’s also this interesting side benefit: accountants can “blame” Content Snare. They’ll say to clients, “You’ll be getting reminders from the app, so just get it done and they’ll stop.” It takes the pressure off the accountant and puts the responsibility back on the client.

Finally, there’s rejection. It’s really common for people to misunderstand a question and send the wrong thing, or to accidentally upload last year’s bank statement. With item-level rejection, you can quickly flag just that one mistake and ask them to fix it, without going back to email or making more calls. That saves a huge amount of extra time or confusion.

How do you see the balance between automation and the human touch evolving in Content Snare’s design philosophy?

A big part of what we preach is personalizing and branding the way you build requests. That means writing in your own tone of voice, adding videos, and making it feel like your firm. We provide default videos and instructions, but we always recommend people make them their own because it improves brand recognition and just creates a nicer experience for clients.

The automation side ties into what we touched on earlier with auto reminders and item-level rejection. Overall, the process is still very customizable. Some firms use the same checklist across all clients, while others create bespoke checklists for each client. In that case, it’s usually the same checklist reused with that client every time. There’s a bit of upfront work to set it up, but then you’ve got this custom, personal request that still benefits from all the automated follow-up later on.

To me, that’s the sweet spot: creating a personalized client experience while automating the repetitive parts. That’s really what allows personalization at scale. You get higher response rates, a better client experience, and you come across as more professional, all while making the process much easier for yourself.

XU: For firms hesitant to change their current systems, what would you say to them about the cost of not fixing this part of their process?

JR: Most firms know when their process is broken. Relying on email, spreadsheets, and PDFs is inefficient, so when they see Content Snare, it’s often a nobrainer.

The hesitation is usually about how clients will respond: Will they like it? The best approach is to test it with a small group of trusted clients. Send a request to yourself first, then roll it out to 5-10 clients, gather feedback, refine, and expand. When firms provide clear instructions, videos, and their own tone of voice, feedback is overwhelmingly positive.

The cost of not fixing this is obvious. Highly skilled staff end up wasting time chasing clients for basic information. We’ve seen firms with a fulltime employee dedicated just to chasing. One firm told us that Content Snare replaced what would have otherwise been a full-time role.

The other big cost is scalability. Without proper systems, growth hits a bottleneck. Firms often tell us Content Snare removed that roadblock and let them scale. Most firms' current

process is them chasing clients and emailing back and forth, whilst the deadline gets closer. Eventually, after hours of chasing they get what they need from the client and it becomes this mad rush to get everything done before the deadline. That’s not a scalable process.

XU: Content Snare is often described as a “client-friendly” platform. What makes the experience smoother or easier for end clients compared to other tools?

JR: I often describe it as an iceberg since people see this simple client interface, but beneath the surface there’s a huge amount of planning, design, and testing that goes into making it feel that way. Every decision we make in the design comes back to one question: can the most difficult person I know figure this out? We spend hours going back and forth to make things as seamless as possible, then test it with real people, get their feedback, and improve it again. It’s a constant process of optimizing the client experience to be as frictionless as possible. And that’s really the key word: frictionless. Removing every bit of friction is what ensures people actually get their information in on time.

Can you share any success stories from firms who’ve transformed their info collection process using Content Snare?

JR: We actually ran a results survey, and the numbers were pretty staggering. Some firms reported saving so much time that the averages looked almost unbelievable, so we used the median instead. The big stat that came out was a 71% reduction in the time spent chasing clients for information.

For example, Liston Newton Advisory, an Australian

accounting and business advisory firm, told us: “In terms of numbers, I would say that Content Snare has increased our efficiency by 50 percent, but we’re still continuously improving it. Data accuracy and completeness improved massively, I would say 70 percent.”

And we also got this from All In Advisory, a multi-award-winning accounting firm that offers accounting, tax, bookkeeping, and advisory services: “I wanted something that really represented us, and so when I started using Content Snare, I was absolutely blown away by how customizable it was.”

XU: Looking to the future—what’s next for Content Snare? Are there any upcoming features or innovations on the roadmap you’re particularly excited about?

JR: We just released a massively updated AI request builder, which allows people to paste in client queries from almost any source. You can drop text into a box, add a prompt, or even upload a PDF, and it will build requests from that. What excites me is where this is heading - using AI to create truly bespoke requests for clients, based on prior year information or data that’s already in your systems. For example, in Australia we have prefill reports from the tax office that can be used to generate custom questions. In the UK, there isn’t an equivalent yet, but as soon as something like that becomes available, we’ll build it in.

Another big development is our new client portal. Historically, Content Snare has been great at receiving information from clients, but there wasn’t a way to securely send information back to them. Now, firms can do exactly that. Clients have a single, secure place where they can always access the

files you’ve shared with them. We’ve got more improvements planned in this area - ideas we’re not ready to share just yet - but I believe it’s going to drastically reduce the number of client questions firms receive.

We’re also looking to expand what can be done during onboarding. Right now, you can collect information, verify identity, and gather documentation, but we want to add signing and initial payments into that process as well. And for larger firms, one of the big requests we hear is more granular control over who can see what within the account. That’s something we’re working on too, and I think it’ll be a game changer for those firms.

As Content Snare grows its footprint in the UK, how are you supporting adoption and training for new users?

We support adoption in the UK the same way we always have: by providing really good, worldclass support. Our support team gets incredible feedback. We’ve been very reluctant to use AIbased support, which a lot of apps are moving toward. The reason is that even with simple questions, there’s often some reading between the lines, understanding what someone is really trying to do based on experience. That’s the kind of next-level support you don’t get from an AI bot or a first-tier team. Our support staff know the product inside out, as well

as the challenges firms face.

On top of that, we have a customer success team and sales team available for conversations and onboarding. It’s really the same approach we’ve always taken, just adjusted for a different time zone. We also put a lot of effort into education, running webinars, building out our help center, and making sure there are always three or four different ways people can reach out if they need help. We’re also starting to run webinars with our current users, showing others how they’re using Content Snare, that kind of peer-to-peer learning is really powerful.

How do you see Content Snare fitting into the broader tech stack for modern accounting firms—especially those embracing digital transformation?

Our approach is to fit into the other tools firms are already using. We’ve got an open API, plus integrations with Zapier and Make.com. We’re also building more connections with document management and CRM tools. We already integrate with FYI, XPM, SharePoint,

OneDrive, Dropbox, and Google Drive, and we’re continuing to add more. The idea is to make Content Snare plug in as easily as possible.

In a way, we sit holistically above everything else. At almost any point in a firm’s workflow, you need to ask clients for something, whether it’s documents, data, or clarifications. That’s where we come in. You could be sending queries to close out a month, or sending cash flow reports, like some of our users do through Content Snare. So we’re kind of an umbrella that sits across most of the tech stack, while also slotting neatly into the tools firms already rely on.

XU: Finally, if you had to sum up the mission of Content Snare in one sentence, what would it be?

JR:

Our mission is to get rid of all the back and forth with clients and make the whole process frictionless for both sides.

contentsnare.com/ industries/accounting

@ApprovalMax @vipulsheth @advancetrack-outsourcing

Vipul Sheth, Managing Director, Advancetrack

Vipul Sheth qualified as an ICAEW Chartered Accountant and a Chartered Tax Adviser. He started with a regional practice, Rabjohns LLP (now Bishop Fleming) in Worcester before joining Ernst & Young and KPMG where he worked up to management.

In 2003, after over a decade of professional experience, he built Advancetrack, an ICAEW Member Firm, which delivers on-demand, trained accounting & tax professionals for UK, USA & Australian standards.

Such a move will see it stick to what it’s knows best: worldclass outsourcing, offshoring and podsourcing® services.

Advancetrack has been very UK-centric for a long time. And the UK will remain an integral place for where we offer our services. But, in tandem, it’s time to push into new territories.

If you asked me 23 years ago about my vision for Advancetrack, it would have been one that leverages technology alongside brilliant teams in Indian centres

to serve accountancy practices internationally.

It has been a long journey to put ourselves in a market-leading position in the UK, but, during that time, we didn’t want to just ‘stick flags’ in other jurisdictions saying ‘we’re here’ without a presence.

We have tentatively and patiently built knowledge and relationships in Australia/New Zealand and in the US. We’re well-regarded in Ireland. And Canada is on our list too. We are now stepping up in regard to business development teams.

Because of Australia’s proximity to Asia, their accountants have probably embraced outsourcing and offshoring much faster – in a similar way to being cloud advocates. North America has historically embraced outsourcing in areas such as IT – but, facing a shortage of accountants, there is an opportunity for us to help.

A business like ours that understands tech and process, makes it a very different offering to the bulk of the providers. Equally, we will have serious brand-building to do and winning some great firms that will be able to share their experience and see what we’ve said we do is true!

Gaining a footprint might seem to be about marketing, branding and business development. But as important is the work going on in our Indian centres. The teams recruit and train to be able to produce tax and accounting files that meet jurisdictional law and regulations. While our teams and offering will never be exactly the same, country-by-country, we ‘get’ that excellence in service is everything.

Looking in, and looking forward

It is reminiscent of when I launched Advancetrack in the UK – you feel that you’re on

the outside looking in, with opportunities abound. Certainly, in the UK, we consider ourselves one of the leading players.

While not going too granular on competitor analysis, we know who the main players are in those jurisdictions. It’s more important for us to focus on the good work we’ve already done and replicating that as much as possible. The incumbents are doing things ‘their way’ and we’re looking to bring ‘the Advancetrack way’ of delivering services to the market.

We think – and hope –that we will challenge them with a great, robust, way of outsourcing, offshoring and our own proprietary podsourcing® offering.

The offering has been written, or spoken, about many times. We talk about how we help to change lives: of those using our service, of end clients that see the benefits, and even the lives of our teams. It’s more than filling a workflow gap.

A practice that has partnered with Advancetrack over the long-term, looks to evolve its direction of travel – using Advancetrack’s latest service offering.

Describe your practice to us

We’re an independent, multi-partner, practice providing a broad range of services – with specialisms in farming clients and academies.

How long have you worked with Advancetrack, and what issue/s were you looking to solve?

It’s been around ten years working with Advancetrack – and our partnership has evolved over time.

At first the main reason, and something

For us, it’s very much about building a group of people that do things our way. That means doing more with our existing customer base and augmenting this with new accountancy partner firmsany territory we move into will be no different.

We have a culture of excellence within our teams – our team’s mindset is to ‘please’, and the only way to do that is turn up and become a better version of yourself, individually and collectively. By doing that, you’ll have happier and growing customers. And if they’re happy, they’ll share that with fellow professionals.

Want to talk to us about your growth plans? Visit Advancetrack.com to get in touch.

advancetrack.com

that’s still relevant, is dealing with capacity overflow. Initially it was about dealing with peaks and troughs where we couldn’t justify hiring another member of staff. But it’s also freed us up to support trainees, as well as provide backup if there is any illness in the team. Originally, it was solely for accounts production, but then our tax team wanted to try out what we were doing. The Advancetrack team were able to turn around work fast, and this particularly helped during tax season.

This continued for a while. We then thought it would be good practice to work with another provider too, so not all our eggs were in one basket. However, the service wasn’t as good and promises weren’t kept. At this point we began

using Advancetrack’s offshoring support as well.

Why did podsourcing® fit your practice's plans?

We felt that work was good and on time, but for us we wanted a dedicated team that we could always talk to. Podsourcing® is more personal – we can speak to someone preparing the job in real-time and they understand what we expect from them. They also have other members within the pod there to support them.

We can have high-level conversations with clients having reviewed the work - it frees our time up to look at higher value offerings such as MBOs, funding and IHT.

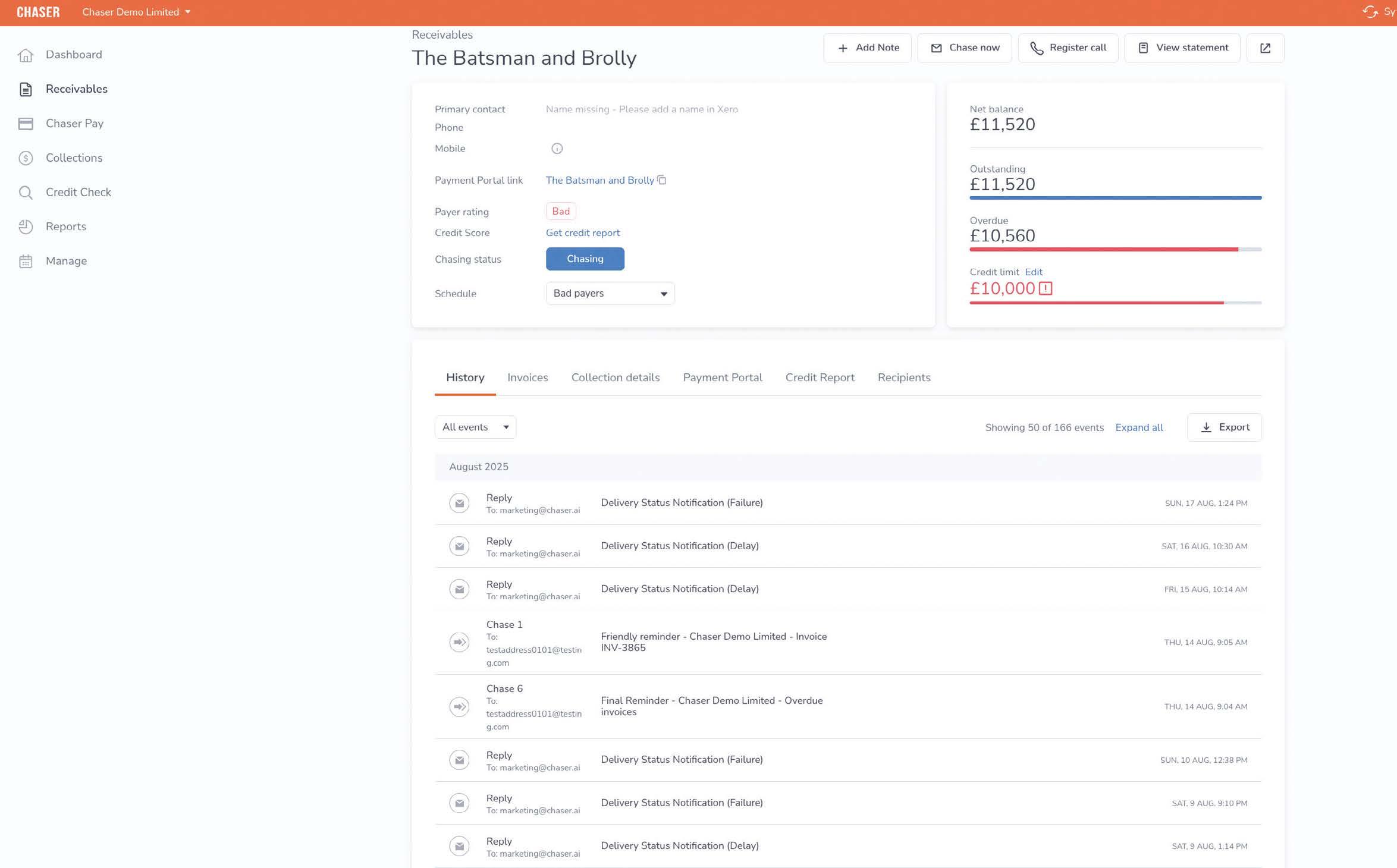

Late replies, missed follow-ups, scattered comms. Keeping track shouldn’t be this hard.

Chaser brings every debtor conversation, reminder, promised payment date, and response into one view. You can monitor what was sent, when it was seen, and what’s still overdue without switching tabs. With CRM logging, you can now track every interaction where it matters most.

See everything. Track everything. Get paid faster.

ext has recently taken a major step forward in its journey to transform how accountants, bookkeepers, and small businesses manage financial workflows. Following the launch of a unified, intelligent platform bringing together Prepare, Precision, and Commerce, Dext delivers AI-powered automation you can trust, cutting admin, improving accuracy and freeing up time for you to focus on higher-value work and achieving your bigger goal.

In this interview, we sit down with CEO, Sabby Gill, to discuss what this evolution means for customers, how innovation and AI are shaping Dext’s long-term vision, and where the company sees its biggest opportunities for growth on a global scale.

XU: Dext recently announced a significant step in its evolution—can you walk us through what this next phase means for your customers and the wider accounting industry?

SG: At Dext, we’ve always been clear on our mission - help people work smarter, not harder. This next step is about making that a reality in a bigger way. We’re bringing Prepare, Precision, and Commerce together into a single, unified platform.

This isn’t just a product update. It’s a milestone for us and a major time-saver for accountants, bookkeepers, and small businesses. No more juggling between tools; everything works together, seamlessly. That means more time for the work that actually matters: serving their clients and growing businesses.

For us, it’s also about momentum. This move sets us up for another strong year of growth and shows the industry that we’re serious about building the most complete, automated financial workflow on the market.

XU: You’ve spoken about consolidating and simplifying the user experience across the Dext product suite. How will this unified experience impact accountants, bookkeepers, and small business users day-today?

@hellodext @sabbygill

SG: It’s going to feel simpler and faster. One login, one dashboard, and data that flows naturally between tools. For accountants and bookkeepers, that means fewer clicks and less admin. For small businesses, it’s easier collaboration with their advisors, fewer errors, and more space to focus on strategy rather than paperwork.

XU: What role does innovation play in Dext’s long-term vision, especially as automation and AI continue to shape the accounting technology landscape?

SG: Innovation isn’t a side project for us - it’s the engine. AI and automation are changing the game, and we’re putting them to work where they have real impact.

Today, we process over 173 million receipts and invoices with 99% accuracy, turn around bank statements in under ten minutes, and handle millions of line items without breaking a sweat.

Our research tells us SMBs are spending huge amounts of time - often more than 20 hours a month - on financial admin. Many are already looking to AI for relief. We’re here to lead that shift and make sure our users are ready for what’s next, whether that’s regulatory changes, cost pressures, or new technology.

XU: Dext serves users in countries all over the world. What are some of the unique challenges— and opportunities—you’ve encountered while scaling Dext on a global level?

SG: Across the board, skills shortages have been a major issue for companies looking to scale, with those working in tech highly sought-after. However, our remote-first policy has turned this into an opportunity, rather than a challenge, by removing location barriers and allowing us to tap into a much wider pool in regions like Bulgaria and Indonesia which have strong tech talent.

XU: How do you ensure the Dext platform remains locally relevant in diverse markets while maintaining a consistent global strategy?

SG: Accounting isn’t one-size-fits-all as regulations and practices vary everywhere. We stay close to our customers, partner councils, and community in every region so we can adapt while keeping the overall platform consistent. Personally, I make a point of speaking directly with users from different markets every week. Their input shapes what we build.

XU: Are there any particular regions or markets where you see major growth potential for Dext over the next 2-3 years?

SG: We’re expanding our reach in the UAE, Malta and Cyprus. The UAE, in particular, is booming - double the new businesses in the last five years and a big influx of independent professionals from the UK. The appetite for digital bookkeeping and compliance solutions is huge, and we’re well positioned to meet it.

IRIS Software Group’s acquisition of Dext gives us a great opportunity to explore the US which we have done through a remote first approach, however with IRIS’s customer base, acquisitions and relationships, that is a tremendous opportunity that I am excited to uncover. I’ve already attended three major events in the US this year with IRIS and the engagement levels and interest has been exceptional.

XU: The partnership between Dext and Airwallex to power Dext Payments is a major move. What inspired this collaboration, and how does it align with your product vision?

SG: Our collaboration with Airwallex was inspired by our shared vision to modernise financial workflows for SMBs and their accounting and bookkeeping partners, resulting in tighter control over cash flow, fewer delays and less admin.

Airwallex stood out as the ideal partner for two reasons. Its global presence allows us to support customers in every region we operate in, and their secure, developer-friendly platform integrates seamlessly with Dext, giving us the confidence to bring this product to market at scale.

Ultimately, Dext Payments aligns with our product vision of delivering a unified platform for financial professionals that eliminates friction and gives customers clarity, control and confidence over how they pay and get paid.

XU: Do you see Dext expanding its ecosystem with more partnerships like Airwallex in the future? If so, what kind of partners are you looking for?

SG: Absolutely - strategic partnerships have been a key driver of our growth and international expansion, from becoming part of IRIS Software Group to

our partnerships with Xero, Quickbooks, Scope Solutions, Zoho Books and Square Payments to name a few.

We will continue to seek out partners who share our vision and can help us provide even more value to our customers through our platform.

XU: Let’s talk about Vault—what gap in the market were you aiming to fill with this new feature?

SG: Vault is about solving a simple but common problem: document chaos. Too many accountants, bookkeepers, and their clients use disconnected tools for storage and sharing, which creates security risks and wastes time. Vault gives them one secure, AI-powered space that’s part of their existing workflow.

XU: Security and compliance are top priorities when it comes to document storage. How does Vault ensure peace of mind for users, particularly in regulated industries?

SG: Vault gives accountants,

bookkeepers and their clients the peace of mind that their important and confidential business documents are stored securely, using encrypted storage and following best practices for data security which includes GDPR and ISO compliance. It’s a safe place for critical business documents, without the complexity.

XU:

What’s the future roadmap for Vault? Are there more capabilities you're planning to roll out to enhance its functionality?

SG: Absolutely. Vault is very much part of our ongoing innovation journey. Customers are increasingly asking for AI-powered capabilities, and those are firmly on the roadmap for Vault’s future. I can’t share specifics yet, but they’re designed to open new opportunities while strengthening what’s already there. Watch this space.

XU: As CEO, how do you foster a culture of innovation and customercentricity within the Dext team?

SG: I believe fostering innovation and

customer-centricity starts with staying true to our company values. Even during periods of change, when people feel supported and trusted, they deliver their best work - and that’s where innovation happens. We embed a culture of continuous learning by equipping our teams with the tools, training, and autonomy to explore new ideas and challenge the status quo. This empowers them to keep innovating and, ultimately, deliver exceptional value to our customers.

XU: How has your leadership approach evolved as Dext has grown from a startup to a global SaaS provider?

SG: When I joined Dext, we were already on a strong growth path, but still very much in “startup mode” - fast-moving, hands-on, and laser-focused on proving our value. As we’ve scaled into a global SaaS provider, my role has evolved from being in every detail to ensuring we have the right strategy, the right people, and the right culture to sustain that growth.

I see myself first as a servant

leader. My job is to remove roadblocks, give people clarity and resources, and create an environment where they can do their best work. That means listening, really listening, to both our teams and our customers.

I make a point of staying close to the customer voice because it’s the most reliable guide for where we should invest, what we should improve, and where the next opportunity lies.

At the same time, scale demands a more deliberate, strategic approach. I’ve had to balance our bias for action with thoughtful decisionmaking, ensuring we’re not just chasing growth, but building something resilient. That involves constantly scanning for risks - whether it’s market shifts, regulatory changes, or competitive threats - while also spotting opportunities where we can lead rather than follow.

Ultimately, my leadership today is about focus and foresight: keeping the customer at the centre, empowering our people,

making strategic bets, and ensuring that every decision strengthens both the business we have today and the one we want to be in five years’ time.

What excites you most about Dext’s team right now, and how are you preparing the company for its next stage of growth?

We recently reported our strongest year of growth which has come from a commitment to delivering value through product innovation, strategic partnerships we’ve made and becoming part of the IRIS Software Group - allowing us to offer an end-to-end solution to a joint customer base of 35,000 accountants and bookkeepers and 736,000 clients.

As we look to the next stage of growth, we’re focused on strengthening our unified platform and continuing to involve our customers in the innovation process. Customer-centricity has always

been at the heart of how we grow, working alongside users to understand how we can be an indispensable asset to their business. Whether it’s through advisory groups or inviting customers to trial Beta versions of our products, we ensure every decision is guided by their needs and aligned with how businesses, accountants, and bookkeepers work today. This collaborative approach creates a powerful feedback loop that fuels continuous improvement and innovation. And with the dedicated and talented team we have today, I’m confident we’ll keep raising the bar.

“Just

Konstantin

Bredyuk, CEO, ApprovalMax

Konstantin Bredyuk, co-founder and CEO of ApprovalMax, began his entrepreneurial journey in 2016 to help SMBs scale faster. Driven by a mission to help businesses build strong financial controls, he leads by example, proudly propelling ApprovalMax’s growth with dedication and hands-on leadership.

Thinking about moving on from your accounting software? Here's what you should know about getting the functionality you need.

There often comes a time when the existing technology a business uses no longer does the job. What worked well in the beginning might not last you or your client to the next stage of the business journey.

It starts with small gaps, team members creating workarounds and haphazardly meshing spreadsheets with email systems to plug what they can. But over time, this doesn’t cut it.

This is when cracks start appearing. Maybe you’re asked about cash flow in a meeting and realise you don't have a clear answer. Your finance manager doesn't have time to analyse the financial performance of the group since they’re consumed by the manual process of consolidating and reconciling five separate Xero or QuickBooks Online files each month.

Without clear approval processes and controls, small errors keep happening – but they add up fast.

A few duplicate payments here, a missed payment there and a near miss with a fraudulent invoice that could have cost tens of thousands.

Ideally, you’d have full visibility of

your financial operations, including everything from cash flow to spend tracking and approvals, all in real-time. But you don’t –and this holds back planning for future growth. Rather than being able to spend time planning the organisation’s expansion, you’re up late manually reconciling documents to get a clear view of your financial position.

So what’s next?

At this point, many businesses weigh up two options: stay with their existing accounting software, like Xero or QuickBooks Online, or take the leap to a full ERP like NetSuite. Each has its own challenges:

1. Stay with Xero or QuickBooks Online. While you’d enjoy familiar functionality, you’d increasingly need to find workarounds for capabilities not found in the platform – like scheduling, multientity reporting and workflows. Over time, errors would happen more often, like duplicate payments, missed approvals and inconsistent coding across entities, impacting cash flow, visibility and wasting huge amounts of time.

2. Move to NetSuite. This would bring the extra capabilities