As your behind-the-scenes partner, our mission is to ensure your greatest MedTech ambitions become a reality. That’s why Resonetics is laser-focused on the details—ensuring every aspect of your critical components is engineered, prototyped, and manufactured to the highest specifications. And with our unmatched dedication, we’re able to move rapidly from design to full-scale production so you can bring exciting developments to market. Speak to an engineer by visiting resonetics.com.

Why not receive your medical cords the way you want them—customized. Add cord clips, customized lengths and colors, packaging and labeling to meet your needs. Interpower North American and international hospital-grade cord sets provide the correct amperages and voltages for medical devices such as portable CT scanners and X-ray machines, medical-grade treadmills, and ECMO machines worldwide. Interpower cords are made in America, and shipped anywhere in the U.S. without additional surcharges or duties.

North American and Japanese hospital-grade plugs and receptacles bear the green dot, signifying the plugs have passed the rigorous UL 817 Abrupt Removal Test (UL 817, 18.2.4.1) and C22.2 No. 21-14 requirements for hospital-grade cords.

Lock in your price today with Blanket Ordering: order a specific quantity of an Interpower cords at the current price (e.g., 1,000 cord sets), and request shipments as needed throughout a 1-year time frame.

• 1-week U.S. lead times

• Same-day shipping on products in stock

• Made in and shipped from America

EDITORIAL

CREATIVE SERVICES

PRODUCTION SERVICES

Editor-in-Chief Chris Newmarker cnewmarker@wtwhmedia.com

Managing Editor Jim Hammerand jhammerand@wtwhmedia.com

Senior Editor Danielle Kirsh dkirsh@wtwhmedia.com

Senior Editor Sean Whooley swhooley@wtwhmedia.com

Editorial DirectorDeviceTalks Tom Salemi tsalemi@wtwhmedia.com

Managing EditorDeviceTalks Kayleen Brown kbrown@wtwhmedia.com

Editor-in-ChiefR&D World Brian Buntz bbuntz@wtwhmedia.com

VP, Creative Director Matthew Claney mclaney@wtwhmedia.com

DIGITAL MARKETING

VP, Operations Virginia Goulding vgoulding@wtwhmedia.com

Digital Marketing Manager Taylor Meade tmeade@wtwhmedia.com

AUDIENCE DEVELOPMENT

Director, Audience Growth Rick Ellis rellis@wtwhmedia.com

Customer Service Manager Stephanie Hulett shulett@wtwhmedia.com

Customer Service Rep Tracy Powers tpowers@wtwhmedia.com

Customer Service Rep JoAnn Martin jmartin@wtwhmedia.com

Customer Service Rep Renee Massey-Linston renee@wtwhmedia.com

Customer Service Rep Trinidy Longgood tlonggood@wtwhmedia.com

LEADERSHIP TEAM

Audience Growth Manager Angela Tanner atanner@wtwhmedia.com CEO Matt Logan mlogan@wtwhmedia.com

Senior Vice President Courtney Nagle cseel@wtwhmedia.com

As the inventor of the spiral retaining ring with 100+ years of innovation, here’s why Smalley is The Engineer’s Choice®:

ᘩ 11,000+ standard parts in stock

ᘩ Customizable with No-Tooling-Charges™

ᘩ Trusted performance in 25,000+ applications

ᘩ Award-winning quality backed by leading industry certification

Smalley Retaining Rings

ᘩ No Ears to Interfere®

ᘩ High RPM Capacity

ᘩ Easy install and removal

ᘩ Diameters from .118" to 120" in 40+ materials

The Medtech Big 100 hits a new record high, but R&D growth is stalling

The Medical Design & Outsourcing

Medtech Big 100 is our biggest project of the year, and while I wish we could celebrate its completion, we found a troubling trend in our latest analysis.

Though our annual ranking of the world’s largest medical device companies once again posted a new record for cumulative revenue at nearly half a trillion dollars, total employment dropped as aggregate research and development spending growth slowed to a near halt.

In fact, collective year-over-year R&D spending growth among the Medtech Big 100 companies that report this figure (the majority do) has slowed from 20% two years ago and 10% last year to around 1% this year. And we’re not the only ones worried about this.

“Companies need to invest heavily and not hold back on R&D,” former Medtronic CEO Bill George told us after we shared our findings. “... Sometimes big companies are not willing to take the risk on breakthrough ideas, [but] they should.”

Meanwhile, the Medtech Big 100 company spending the most on R&D — Johnson & Johnson MedTech — is growing that investment by nearly 20% and appears on track to take the top spot in a future Medtech Big 100

ranking. A big driver is Shockwave Medical, which J&J acquired in a $13 billion deal. Our cover story explores how Shockwave leaders changed their approach while shopping the company and how J&J ultimately sealed the deal. We’ve also interviewed Shockwave Chief Medical Officer Dr. Nick West to learn more about their R&D efforts and where the technology is headed.

At the top of the Medtech Big 100, Medtronic is preparing to separate its diabetes business into a standalone company called MiniMed. Many questions remain about what that will mean for Medtronic and MiniMed, and we bring you answers in a feature by Senior Editor Sean Whooley. By the way, please allow me to congratulate Sean on his recent promotion!

We’ve got more coverage of Medtech Big 100 companies throughout this issue, including GE HealthCare, Boston Scientific, Intuitive Surgical, Edwards Lifesciences, and more.

Make sure to join our team on Sept. 25 for a live webcast and audience Q&A where we’ll discuss top trends from the Medtech Big 100, and watch out for our Medtech Big 100 Special Report available at wtwh.me/ big100 as soon as Sept. 17.

As always, I hope you enjoy this edition of Medical Design & Outsourcing, and thanks for reading.

HERE’S WHAT WE SEE:

The Medtech Big 100 hits a new record high, but R&D growth is stalling

INTELLECTUAL PROPERTY:

Why IP and product diligence is especially critical in the medical device industry

NITINOL:

With Medtronic’s next-gen RDN devices and procedures advancing, Project Galileo is next

PRODUCT DEVELOPMENT:

Q&A with Darshin Patel, who led the Edwards Lifesciences Sapien M3 TMVR system’s development

SUSTAINABILITY:

GE HealthCare says this costsaving sustainability initiative is a hit with hospitals

TUBING:

How Boston Scientific is advancing its PAD-treating drug-eluting stent

DEVICETALKS:

Intuitive’s Brian Miller: User need, not tech, should drive telesurgery adoption

AD INDEX

latest list ranks the giants of medtech manufacturing by annual revenue, R&D spending and employee headcount.

& JOHNSON BACK ON TOP Shockwave Medical is clearing the way for Johnson & Johnson MedTech to retake its title as the world’s largest medical device company.

MEDTRONIC’S DIABETES SPLIT COULD BE A SHOT IN THE ARM FOR BOTH MiniMed comes full circle as Medtronic plans to slim down and sharpen its focus.

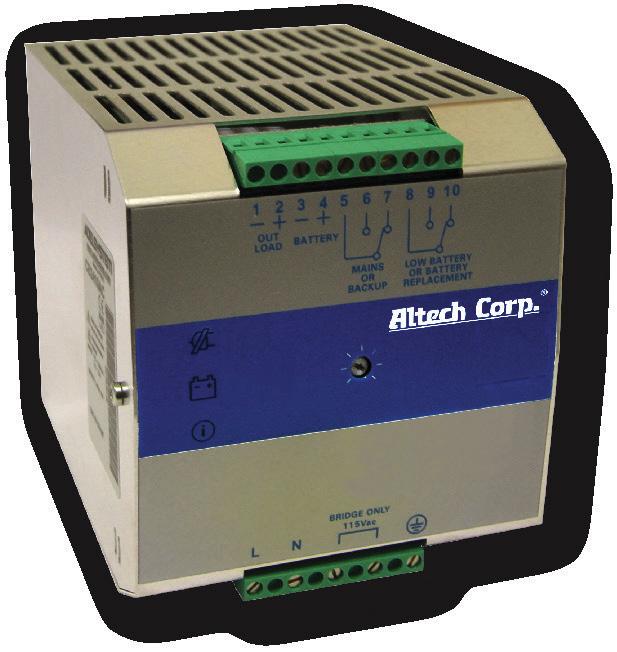

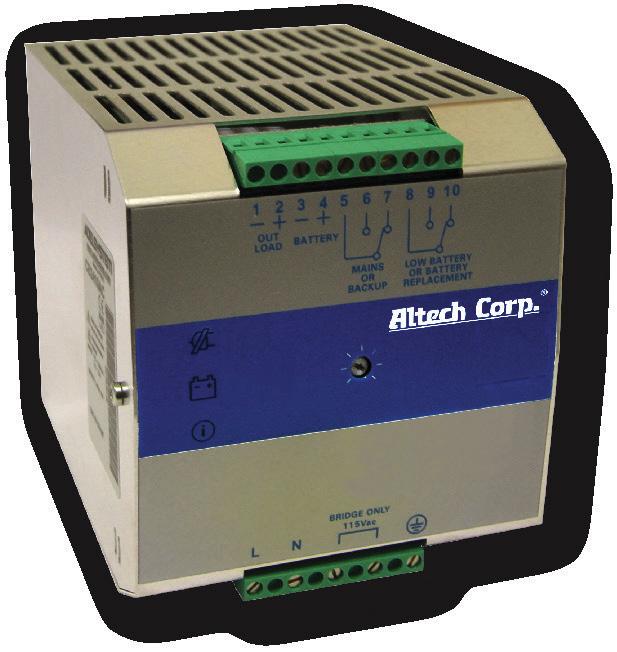

• Real-time adjustable PID control

• Integrated 0 to 10 VDC, 4-20 mA signal, or 3.3 VDC serial communication

• 0 to 10 VDC feedback pressure monitor

• Virtually silent

• No integral bleed required

• Multiple pressure ranges from vacuum to 150 psig

• 2.7 to 65 l/min flow control

digital. Clippard’s Cordis products are revolutionary microcontrollers primed for escape velocity from a proportional control market that has grown stagnant.

With unparalleled performance and flexibility not possible with current analog proportional controllers, the Cordis makes everything from calibration, to sensor variety, to future development opportunities more accessible and less complicated.

Contact your distributor today to learn more about how the Cordis can provide precise, real-time control for your application, or visit clippard.com to request more information.

Perhaps one of the most significant pieces of news in the latest edition of Medical Design & Outsourcing’s annual Medtech Big 100 report is what will likely happen next year: a change at the top of the list. With Medtronic planning to separate out its $2.8-billion-a-year diabetes tech business, Johnson & Johnson MedTech appears set to surpass it as the world’s largest medical device company.

Meanwhile, Boston Scientific and Intuitive are rapidly moving up the rankings among the top 20 as they each pursue strategies to disrupt and transform surgery for the better. In the case of Boston Scientific, it’s about minimally invasive, cath-labbased procedures. (Terumo moves into the top 20 on the strength of its own catheter-delivered technologies.) Intuitive, meanwhile, remains the dominant company in surgical robotics, one of medtech’s most exciting fields.

This is just a sampling of the insights to be gained from this year’s Big 100, which collects thousands of data points to rank and analyze the largest public and private medical device companies. These figures include revenue, R&D spending and headcount, plus CEOs and key leaders, headquarters locations and more.

This year, for the first time, we’ll provide even more information in a free, downloadable, special report that we plan to launch on MDO’s website in mid-September. THE 2025 MEDTECH BIG 100: THE WORLD’S LARGEST MEDICAL DEVICE COMPANIES

As a global leader in pump technology, we specialize in providing customized solutions to meet your unique needs.

From design and production to distribution, we deliver high-performance diaphragm pumps and systems for handling both gases and liquids.

Find your perfect pump solution – contact us today!

We gather the data from regulatory disclosures filed with the U.S. Securities and Exchange Commission and annual reports from foreign and privately held firms, as well as other sources of publicly available data. In the case of conglomerates such as Johnson & Johnson and Abbott, we separate out the medtech businesses. For many companies, we include data they share with us. We have made efforts to double-check facts with all of the companies on the list.

A majority of the companies on the list have fiscal years based on standard calendar years, but some have fiscal years for which we’ve collected data as recently as April 2025. In the case of companies with fiscal years ended in June or September (for example, Siemens Healthineers, BD, Cardinal Health, and ResMed), we used 2024 data because their annual reports don’t come out in time to work with our production timing.

In the case of companies reporting revenue and R&D spending in foreign currencies, we convert to U.S. dollars using standardized Federal Reserve rates.

We're counting revenue differently this year than last year for two companies.

For Solventum, this year we're just counting MedSurg revenue instead of the company's total revenue.

And for Demant, we're focusing in on hearing aid business revenue instead of the broader hearing healthcare segment.

– Editor-in-Chief Chris Newmarker

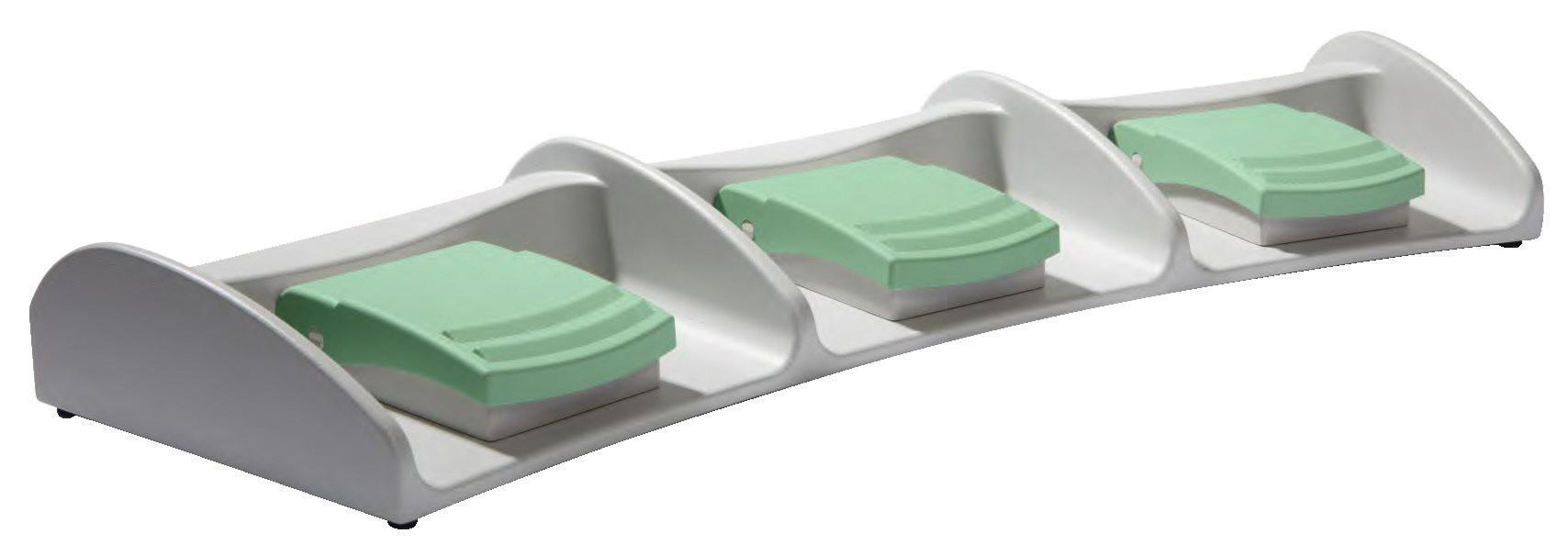

To be sure, Medical Device OEM’s face a lot of challenges. But there are 3 things that are fundamentally important to your product image and profitability:

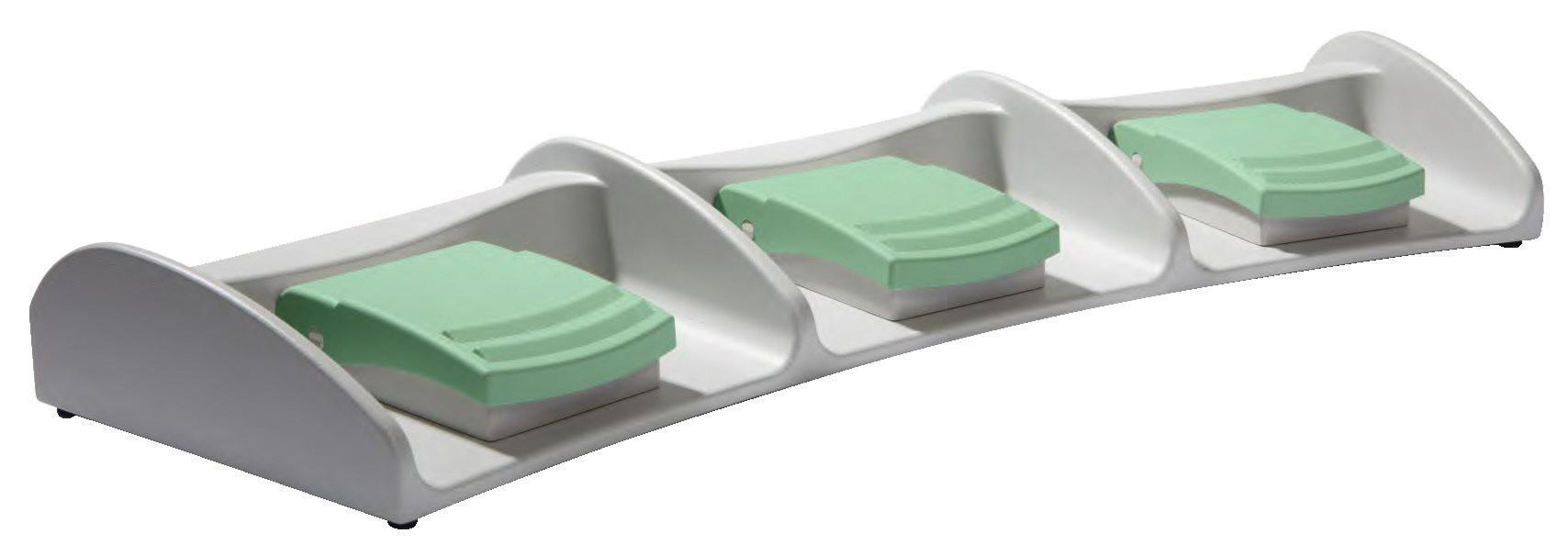

• Product Reliability and Quality – Steute foot switches are built to last, not built too fast. All models are hand-assembled, IPX-8 rated and put through a stringent battery of durability tests before they are shipped to you: drop tests, IP test (submerged for 30 minutes in water), test for 1 million actuations and a 100% final inspection test to ensure your medical device remains up and running.

• Technology – We have been the world leader for over 35 years in medical-grade foot switches because each product optimizes functionality, user-comfort, ease-of-use and aesthetic appearance. And we stay ahead of the trends by offering custom options with no tooling or NRE. These include actuator styles, consoles/platforms, cable type/colors, wiring configurations, console colors and finishes, and many more.

• Pre-certification and Documentation – Steute saves its customers a lot on documentation headaches, pre-certification costs and time wasted, which disproportionately tie up your engineers, R&D and regulatory people. We will address (partial list): ISO 9001, ISO 13485, MDR & FDA requirements, cybersecurity, IEC 60601 and applicable subclauses and risk management protocols (plan, report and governance & control)

We deliver all of this while remaining price-competitive with other foot switch suppliers.

Challenge your current supplier to match a ll that Steute offers you!

David Spangler, Sales Leader

Galway, Ireland

(Operational HQ in Fridley, Minnesota) United States

$33,537,000,000

Fiscal year ended 4/25/2025

2024 rank: 1

R&D spend: $2,732,000,000

Employees: 100,229

CEO: Geoff Martha

medtronic.com

A decade after MEDTRONIC acquired Covidien in a $50 billion deal that made Medtronic the world’s largest medical device company, leaders continue to whittle down operations for better focus. The latest plan is the separation of Medtronic Diabetes (which had revenue of $2.8 billion in fiscal 2025) into an independent company called MiniMed. The deal could result in Medtronic ceding its No. 1 spot to Johnson & Johnson MedTech by the time the 2026 version of the Medtech Big 100 publishes. (Check out Senior Editor Sean Whooley’s feature story in this report that further explores what the MiniMed move will mean for the diabetes tech space.) Overall, CEO Geoff Martha says the company is accelerating toward higher and more profitable growth. Growth drivers for the company include its AFib-treating Affera and PulseSelect pulsed-field ablation systems, BrainSense adaptive deep brain stimulation (aDBS), and a spine treatment tech business buoyed by Stryker’s decision to exit the market. Next up could be hypertensiontreating Symplicity Spyral renal denervation, which company officials say is a multibilliondollar opportunity. Medtronic could also soon compete against Intuitive in the U.S. soft tissue robotic surgery market with its Hugo surgical robot under FDA review for a urologic indication. – CN

2

New Brunswick, New Jersey

United States

$31,857,000,000

Fiscal year ended: 12/31/2024

2024 rank: 2

R&D spend: $3,703,000,000

Employees: not available

CEO: Joaquin Duato; Tim Schmid, EVP and J&J MedTech worldwide chair

jnjmedtech.com

JOHNSON & JOHNSON MEDTECH’S cardiovascular business was up 20% yearover-year during the first six months of 2025, driven by growth from major acquisitions in recent years. Those deals included the $13.1 billion purchase in 2024 of Shockwave Medical and its intravascular lithotripsy (IVL) technology that uses sonic waves to treat calcified arterial plaque. (Managing Editor Jim Hammerand reports on Shockwave Medical and its IVL in this report.) The Shockwave purchase followed J&J’s $400 million acquisition of left atrial appendage (LAA) device maker Laminar in 2023 and the $16.6 billion purchase of Abiomed and its catheter-delivered Impella heart pumps to treat heart failure in 2022. “We are seeing significant traction with our new product launches, and the integration of Shockwave and Abiomed is progressing well, contributing to our strong performance,” said Tim Schmid, EVP and worldwide chair of J&J MedTech, during the company’s Q2 earnings call in July. J&J’s efforts to compete in pulsed-field ablation hit a snag earlier this year when it paused sales of its Varipulse system to investigate neurovascular events, but the company later announced FDA approval of an update to Varipulse’s irrigation flow rate. In July, J&J Medtech also had an update on progress with its Ottava soft-tissue surgical robotics platform, saying it planned to submit the system for FDA clearance in 2026. J&J has already launched its Dualto energy system, which combines multiple energy modalities into an integrated platform for use across open and minimally invasive surgery. When it comes to artificial intelligence, J&J has joined with Nvidia and Amazon Web Services (AWS) to launch the Polyphonic AI Fund for Surgery. – CN

3

Northfield, Illinois United States

$25,500,000,000

Fiscal year ended 12/31/2024

2024 rank: 4

R&D spend: not available

Employees: 43,000

CEO: Jim Boyle

medline.com

MEDLINE revenue grew nearly 10% in 2024 after 9% growth in 2023, boosting it to the No. 3 spot on the Medtech Big 100. The privately-held medical supply manufacturer, distributor and services provider has a portfolio of 335,000 products. They include 190,000 Medline brand offerings, a third of which Medline makes itself in 27 global manufacturing facilities. The company is the largest kitting manufacturer in the U.S., producing more than 200 million kits annually. Medline operates 68 global distribution centers, with more than 26 million square feet of U.S. warehouse space. Late last year, Medline announced it was taking steps toward a potential IPO, with Reuters announcing at the time that Medline sought to raise $5 billion from going public. As of early August, Medline hadn’t had any updates on an IPO since that December 2024 announcement. – CN

4 5

Erlangen Germany

$24,152,040,000

Fiscal year ended 9/30/2024 (€22,363,000,000)

2024 rank: 3

R&D spend: $2,071,440,000

Employees: 72,000

CEO: Bernd Montag

siemens-healthineers.com

During SIEMENS HEALTHINEERS’ secondquarter earnings call in July, CEO Bernd Montag said the German medtech giant is focused on mastering and combining three capabilities that he saw enabling better patient outcomes and healthcare efficiencies:

• Patient twinning, creating a dynamic digital representation of an individual patient to support personalized and precise medicine;

• Precision therapy, such as what the company’s Varian business achieves with customized cancer therapy;

• And digital, data and artificial intelligence.

Montag was also excited about what Siemens Healthineers was accomplishing through the more than 200 Value Partnerships it has already signed with healthcare organizations. “We enter into long-term collaborative relationships with the customer that entail not only product and service business, but also improve the customers’ delivery of healthcare in a joint endeavor,” he said. “These Value Partnerships transform our revenue streams from classical transactional product business into recurring revenue streams, thanks to their long-term nature.” – CN

Portage, Michigan United States

$22,595,000,000

Fiscal year ended 12/31/2024

2024 rank: 5

R&D spend: $1,466,000,000

Employees: 53,000

CEO: Kevin Lobo

stryker.com

STRYKER seeks to expand the reach of its Mako orthopedic surgery robotic system even more with this year’s launch of nextgen Mako 4 systems for knee, hip, and spine applications. (Mako shoulder applications remain in a limited market release this year.) The orthopedic and surgery tech giant has been on offense with M&A to diversify and expand its portfolio, completing a $4.9 billion acquisition of Inari Medical and its venous thromboembolism clot removal tech in February. Meanwhile, Stryker sold its spinal implants business to Viscogliosi Brothers and their new VS Spine business, which will have access to Mako Spine and Copilot as a Stryker strategic partner. Overall, Stryker spine implants brought in $707 million in sales in 2024, according to the company’s most recent annual report. Stryker CEO Kevin Lobo said in April: “The sale of our spinal implants business enhances our strategic focus, positioning us to meet evolving customer needs and invest where we see the greatest opportunity for innovation and longterm growth.” – CN

6

Chicago, Illinois United States

$19,672,000,000

Fiscal year ended 12/31/2024

2024 rank: 7

R&D spend: $1,311,000,000

Employees: 53,000

CEO: Peter Arduini

gehealthcare.com

During GE HEALTHCARE’S Q2 earnings call in July, CEO Peter Arduini spoke of how the company’s innovation pipeline is boosting growth. “A great example of this is the fast growing sector of nuclear medicine where we play a significant role enabling better care for multiple diseases. In the first half of the year, orders grew strong double digits across our proprietary diagnostic imaging agents and leading molecular imaging solutions made up of AI-enabled equipment and digital tools. PET imaging is a core component of nuclear medicine and a cornerstone to precision care.” GE HealthCare has also topped the FDA’s list of AI-enabled medical device authorizations for the fourth year in a row, with 100 listed authorizations to date in the U.S. – CN

Amsterdam Netherlands

$19,462,680,000

Fiscal year ended 12/31/2024

(€18,021,000,000)

2024 rank: 6

R&D spend: $1,886,760,000

Employees: 67,823

CEO: Roy Jakobs

philips.com

PHILIPS this year has sought to move beyond its massive recall of CPAPs and other respiratory devices. It recorded a more than $1 billion payment in the first quarter to settle Respironics recall lawsuits. It’s also seeking greater focus, with the sale of its Emergency Care business to Bridgefield Capital expected to close in the second half of the year. As of early August, the company expected 1–3% comparable sales growth this year, but company officials see momentum from recently launched AI-powered innovations and a multiyear agreement with the Indonesian Ministry of Health to boost access to image-guided therapy. Other major announcements out of Philips this year included:

• An expanded patient monitoring collaboration with Medtronic;

• A collaboration with leading U.S. electronic health record software company Epic to integrate cardiac ambulatory monitoring and diagnostic services;

• The launch of a new electrocardiogram (ECG) AI marketplace to give cardiac care teams access to multiple vendor offerings;

• The launch of SmartSpeed Precise, an MRI solution powered by dual-AI engines;

• FDA 510(k) clearance of its AI-powered MRI scanning software tool, SmartSpeed Precise;

• And a new collaboration with Nvidia to harness AI advances for MRI technology.

– CN

9

(medical device segment)

Abbott Park, Illinois United States

$18,986,000,000

Fiscal year ended 12/31/2024

2024 rank: 8

R&D spend: not available

Employees: not available

CEO: Robert Ford; Lisa Earnhardt, EVP and group president of medical devices

abbott.com

ABBOTT’S medical device segment remains a standout performer in the company, driven by the success of innovative medtech, including FreeStyle Libre continuous glucose monitors, Navitor transcatheter aortic valve implantation (TAVI) system, the TriClip transcatheter tricuspid valve repair (TTVR) system, and the Aveir leadless cardiac pacemaker system. The medtech segment grew sales 12% year-overyear during the first half of 2025. Abbott Diabetes Care, the world’s largest diabetes treatment business, led the way with 18% sales growth. Abbott’s diabetes growth could accelerate even more through a partnership with Medtronic’s soon-to-be-independent MiniMed diabetes business, which has Medtronic making an FDA submission for an interoperable pump system that pairs with an Abbott CGM based on the FreeStyle Libre platform. Abbott seeks to compete in the AFib-treating pulsed-field ablation space as it rolls out its Volt PFA system in Europe. It’s also eyeing a move into IVL for coronary artery disease , announcing in March an FDA investigational device exemption (IDE) to proceed with a trial expected to enroll up to 335 subjects at 47 U.S. sites. Other achievements this year included FDA approval of the Tendyne transcatheter mitral valve replacement (TMVR) system and the launch of a next-gen delivery system for its Proclaim DRG neurostimulator for pain relief. – CN

Marlborough, Massachusetts United States

$16,747,000,000

Fiscal year ended 12/31/2024

2024 rank: 11

R&D spend: $1,615,000,000

Employees: 53,000

CEO: Michael Mahoney

bostonscientific.com

BOSTON SCIENTIFIC is on a tear. Revenue grew nearly 18% last year, enabling it to move up two spots to No. 9 in the Medtech Big 100. As of early August, company leaders expected sales to grow another 18–19% this year. Analysts noted that Boston Scientific faced a setback with the discontinuation of its Accurate transcatheter aortic valve replacement (TAVR) systems amid heightened U.S. and EU regulatory requirements. The systems had been Boston Scientific’s next bet to compete against Edwards Lifesciences and Medtronic in TAVR after the discontinuation of its Lotus TAVR program five years ago. However, Boston Scientific’s AFib-treating Farapulse pulsedfield ablation system and complementary Watchman left atrial appendage (LAA) closure device continue to shine for the company. Farapulse and Watchman each won expanded FDA approvals in July. Boston Scientific has been buying into other hot medtech areas, acquiring Bolt Medical and its FDA-cleared IVL technology and entering the now-competitive renal denervation (RDN) space by buying intravascular ultrasound system developer SonVie. It’s also acquired hepatic artery infusion pump maker Intera Oncology. – CN

BD (medical and interventional segments)

Franklin Lakes, New Jersey United States

$15,054,000,000

Fiscal year ended 9/30/2024

2024 rank: 12

R&D spend: not available

Employees: 50,000

CEO: Tom Polen

bd.com

BD made a significant move in July to heighten its focus on medtech with plans to separate its Biosciences & Diagnostic Solutions business and merge it with Waters Corp. in a $17.5 billion deal. CEO Tom Polen said at the time: “This transaction is an important milestone for BD, as it enhances our strategic focus as a leading medical technology company. BD is committed to unlocking long-term value through continued investment in our strong innovation pipeline, and operational and commercial excellence that will drive durable and profitable growth.” BD is also creating a new Connected Care segment, bringing on former Masimo COO Bilal Muhsin to run the operation. BD Connected Care’s goal will be to combine advanced analytics and artificial intelligence with the company’s smart devices to boost efficiency and patient outcomes. – CN

Stopcocks you can count on

Explore our candy store for engineers and discover our diverse range of stopcocks, available in multiple configurations and port options to suit any fluid management application.

Our products are designed to inspire ingenuity and deliver reliable results for critical projects. We’re here to provide the sweetest solutions for your toughest challenges!

Shop stopcocks and thousands of in-stock medical components at qosina.com.

11 13 14 12

Melville, New York

United States

(medical segment)

Dublin, Ohio

United States

$12,673,000,000

Fiscal year ended 12/28/2024

2024 rank: 13

R&D spend: not available

Employees: 25,000

CEO: Stanley Bergman

henryschein.com

HENRY SCHEIN opened the year with a $250 million investment from private equity firm KKR, which purchased a 12% stake that made it the largest nonindex fund shareholder in the healthcare products and services distributor. KKR also got seats on Henry Schein’s board of directors through the deal. Board additions included Max Lin, a KKR advisor who leads the firm’s health care industry team, and Dan Daniel, an executive advisor to KKR and former EVP at Danaher Corp. At the time, CEO Stanley Bergman said of the deal: “Our board and management have great respect for KKR, including its partnershiporiented approach and experience in supporting value creation across its investments.” By July, Henry Schein was announcing that Bergman would retire at the end of 2025 after more than 35 years in the corner office. As of early August, a formal search for a new CEO was underway. – CN

$12,381,000,000

Fiscal year ended 6/30/2024

2024 rank: 9

R&D spend: not available

Employees: not available

CEO: Jason Hollar

cardinalhealth.com

CARDINAL HEALTH, like many global companies, is facing significant additional costs from tariffs. Company officials said in early May that the Global Medical Products and Distribution (GMPD) segment was the part of the business affected most, with the company engaging in mitigation efforts to avoid price increases. In a June presentation to investors, Cardinal Health said it has increased domestic manufacturing for its company brand products, which include key categories such as incontinence, syringes, and fluid management and make up about a third of the products that the company distributes. About 35% of Cardinal Health brand products are presently made in the U.S. – CN

Glen Allen, Virginia United States

$10,700,883,000

Fiscal year ended 12/31/2024

2024 rank: 14

R&D spend: $13,000,000

Employees: 23,200

CEO: Edward Pesicka

owens-minor.com

OWENS & MINOR continues to seek potential buyers for its Products & Healthcare Services segment. CEO Edward Pesicka said in June: “We continue to work with a number of interested parties [and] will continue to actively work to strengthen that business and tap into its significant upside.” This year, the company opened a new distribution center with advanced automation and robotics technology in West Virginia and a second center in South Dakota that integrates augmented reality (AR) for supporting the order-picking process. Meanwhile, Owens & Minor in June called off plans to acquire privately held home-based care business Rotech Healthcare amid regulatory hurdles. When announced last year, the proposed deal had been valued at nearly $1.4 billion. – CN

Deerfield, Illinois

United States

$10,636,000,000

Fiscal year ended 12/31/2024

2024 rank: 10

R&D spend: $590,000,000

Employees: 38,000

CEO: Andrew Hider (starting Sept. 3, 2025)

baxter.com

BAXTER’S stock price fell more than 22% at the end of July on second-quarter misses and reduced full-year guidance. Among other things, company officials noted continued softness in demand for IV solutions amid conservation efforts that healthcare providers enacted after Hurricane Helene last year temporarily closed the 1.4 million-ft² Baxter facility in North Carolina that makes the products. With the retirement of José (Joe) Almeida as CEO and the spinoff of the Kidney Care business as a standalone company called Vantive — which both happened in February — Baxter looks to better focus under a new CEO joining the company from industrial automation firm ATS Corp. “The company is poised to enter a new chapter with the appointment of Andrew Hider as our next CEO,” said interim CEO Brent Shafer. “Andrew’s extensive experience in driving operational excellence, innovation and growth at global, diversified companies will help propel Baxter into a new era of progress and performance.” – CN

Melsungen

Germany

$9,867,864,960

Fiscal year ended 12/31/2024 (€9,136,912,000)

2024 rank: 15

R&D spend: $568,179,360

Employees: 64,262

CEO: Anna Maria Braun

bbraun.com

B. BRAUN manufactures more than 5,000 medical devices and pharmaceutical products, which it supplements with an extensive range of services.

B. Braun has locations in 64 countries and three divisions: Hospital Care, Aesculap (surgical and interventional), and Avitum (chronic disease treatments).

The Braun family has owned the company for generations since its founding in the 19th Century. Braun said in the company’s 2024 annual report: “Our sales rose by 4% to €9.1 billion. Our profit before taxes also improved — primarily because we have become more efficient in many areas of the company, while also optimizing structures. This enabled us to be more competitive and invest €1.3 billion in technologies, research and development, and our production sites.” – CN

16 18

Switzerland

$9,836,000,000

Fiscal year ended 12/31/2024

2024 rank: 16

R&D spend: $876,000,000

Employees: 25,000

CEO: David Endicott

alcon.com

Formerly a subsidiary of pharmaceutical giant Novartis, ALCON spun out as a separate eye care business in 2019. The company was founded in 1945 by Robert Alexander and William Conner as a small pharmacy in Fort Worth, Texas, where its U.S. headquarters remain. News this year included plans to acquire Lensar and its robotic cataract laser system in a $430 million deal, followed by the announcement in August that Alcon intended to buy Staar Surgical for $1.5 billion. – CN

17

Sunnyvale, California United States

$8,352,100,000

Fiscal year ended 12/31/2024

2024 rank: 19

R&D spend: $1,145,300,000

Employees: 15,638

CEO: Dave Rosa

intuitive.com

INTUITIVE sales continue to boom after the 2024 launch of its nextgen da Vinci 5 surgical robotics system, which secured its CE mark in the EU this year. Revenue for the first six months of 2025 was up more than 20% over last year. The company expects worldwide da Vinci procedure growth at or slightly below last year’s 17% growth. Overall, the company remained in a dominant position in the soft-tissue surgical robotics market as it promoted up Dave Rosa into the corner office in July. Former CEO Gary Guthart grew Intuitive’s market capitalization 20fold during his 15 years in charge. Under Rosa, Intuitive is angling for new opportunities. It’s returning to its roots with a renewed focus on cardiac surgery amid increased interest from surgeons. There’s also the potential to get da Vinci robots involved in telesurgeries. – CN

Warsaw, Indiana United States

$7,678,600,000

Fiscal year ended 12/31/2024

2024 rank: 18

R&D spend: $437,400,000

Employees: 17,000

CEO: Ivan Tornos

zimmerbiomet.com

ZIMMER BIOMET has ambitious goals to transform over the next decade as it expands beyond ortho, including in areas such as cardiac surgery and consumer healthcare, CEO Ivan Tornos explained during a keynote interview with DeviceTalks Editorial Director Tom Salemi during our DeviceTalks Boston show in May. “We aspire to be the boldest medtech company on Earth,” Tornos said. “We’ll start with orthopedics, and then we’ll move into other areas. And being the boldest medtech company on Earth is having the courage to solve some of the most meaningful challenges in healthcare.” In April, ZB closed its $1.2 billion purchase of Paragon 28, a deal representing a significant play in the foot and ankle surgical treatment space. In July, ZB announced plans to expand its surgical robotics offerings through the $177 million purchase of Monogram, which develops semi- and fully autonomous robotic technologies. Zimmer Biomet is also seeking to reach more people directly through its new “You’ll be back” marketing campaign featuring celebrity spokesperson Arnold Schwarzenegger. – CN

Tokyo

Japan

$6,841,440,136

Fiscal year ended 3/31/2025

(JP¥1,036,171,000,000)

2024 rank: 22

R&D spend: $489,914,172 Employees: 30,689 CEO: Hikaru Samejima

terumo.com

TERUMO saw its revenue grow 12% in 2025, boosting it three spots to No. 19 in the Medtech Big 100. “Overall, the increase in sales was largely due to continued demand growth. In addition to Blood Solutions, the Cardiovascular Company, led by [Terumo Interventional Systems], was a key driver,” CFO Jin Hagimoto said during a May earnings presentation. The company has had a string of new product announcements this year:

• The launch of the Sofia Flow 88 large-bore aspiration catheter, designed for supporting clot removal in stroke procedures;

• Early commercial availability of its FDA-approved Roadsaver Carotid Stent System;

• And the launch of its Sofia 88 neurovascular support catheter in the U.S. – CN

Tokyo Japan

$6,751,836,022

Fiscal year ended 3/31/2025

(JP¥1,022,600,000,000)

2024 rank: 20

R&D spend: $400,765,639

Employees: not available CEO: Teiichi Goto

fujifilm.com/us/en/healthcare

Revenue was up about 5% in in fiscal 2025 for FUJIFILM’S Healthcare segment, which makes up about a third of the Japanese conglomerate’s revenue. Fujifilm’s healthcare products include diagnostic equipment such as X-ray systems, endoscopes, ultrasound systems, and medical IT systems. Fujifilm Healthcare Americas is headquartered in Lexington, Massachusetts. Fujifilm reported strong 2025 sales of endoscopes, CT/MRI systems, and in-vitro diagnostics products. Fujifilm Healthcare Americas in July announced the U.S. launches of its FDR Go iQ, a portable digital radiography (DR) system, and several automated functions for its FDR Visionary Suite digital radiography room. – CN

Cadence partners with medical device OEMs worldwide to design and manufacture the critical devices and components that power the future of healthcare. As the leading expert in sharps, with deep roots in custom blades and needles, we deliver end-to-end contract manufacturing solutions. With facilities across the U.S. and Costa Rica, we offer scalable manufacturing solutions that help the world’s top MedTech and Pharma companies move from concept to commercialization with confidence. cadenceinc.com

Miniaturization Exper ts

tight tolerances, micro holes, thin walls, and/or complex geometries

All In-House

Protot yping, ultra-precision tooling, micro molding, automated assembly, and C T scanning

Experienced

35 years as a trusted par tner, 7,000+ molds.

Quick turn protot yping, D fM, D fA, D fX.

Achieving <1.5 micron positional accurac y.

Materials Exper tise

All thermostatic, PEEK , long-term implantable,

Scan me to learn more about Isometric Micro Molding Capabilities

Co-development Opportunities

Access, Delivery, & Retrieval Systems

Wire & Catheter Based Devices

Contract Manufacturing

Vascular Access Devices

Guidewires, Therapeutic & Diagnostic

Braided & Coiled Catheter Shafts Class 8 Clean Room

MEDTECH BIG 100 REVENUE HIT A NEW RECORD HIGH, BUT COLLECTIVE R&D SPENDING BY THE WORLD’S LARGEST MEDICAL DEVICE COMPANIES IS LEVELING OFF.

BY JIM HAMMERAND MANAGING EDITOR & DANIELLE KIRSH SENIOR EDITOR

Aggregate research and development spending growth across the world’s largest medical device companies is grinding to a halt after double-digit growth in recent years.

That’s the most urgent finding from Medical Design & Outsourcing’s analysis of our 2025 Medtech Big 100 ranking of medtech developers and manufacturers by revenue. The companies and business segments in our latest ranking include public and private firms across the world.

Collectively, Medtech Big 100 companies reported aggregate revenue of $486.7 billion in their most recent fiscal years, a nearly 3% increase over the year before and a new high record for the Medtech Big 100. Total

employment shrank by 3.5%.

The R&D trend is a worrying sign as medical device manufacturers grapple with higher costs for materials and components due to new import taxes, which could push the U.S. economy into a recession.

On top of the tariffs, medical device developers face potential slowdowns due to layoffs at the FDA, CDC, NIH, Centers for Medicare & Medicaid Services (CMS) and elsewhere within the U.S. Department of Health & Human Services. The Trump administration is also slashing federal R&D funding and could cut healthcare spending by more than $1 trillion over the next decade.

Some of the double-digit R&D growth from recent years can be

attributed to companies coming out of the worst of the COVID-19 pandemic. But the slowdown is concerning because today’s R&D investments are the future’s groundbreaking products.

“This is an industry that’s built on innovation,” former Medtronic CEO Bill George said in an MDO interview. “Everything that I was associated with at Medtronic was built on innovation, and the companies that have been highly successful [focused] on innovation and R&D. When I say innovation, I’m distinguishing between another stent or another hip and real innovation where you’re talking about new, breakthrough ideas that fulfill unmet medical needs and bring new technology to patients.” >>

TO THE VARYING

OF THE U.S. DOLLAR, THE ANALYSIS USED FOREIGN CURRENCIES IN THE YEAR-OVERYEAR ANALYSES FOR COMPANIES THAT DON’T REPORT THEIR SALES AND R&D SPENDING IN U.S. DOLLARS.

Medtech Big 100 R&D spending by the numbers

Seventy-three Medtech Big 100 companies disclosed their annual R&D spending for a total of $29.2 billion, up less than 1% from last year. Medtech Big 100 R&D spending grew 10% last year and 20% the year before.

Nine companies in the Medtech Big 100 spent more than $1 billion on R&D, with varying year-over-year growth:

• Johnson & Johnson MedTech ($3.7 billion, up 19%)

• Medtronic ($2.7 billion, down 0.1%)

• Siemens Healthineers ($2.1 billion, up 3%)

• Royal Philips ($1.9 billion, down 8%)

• Boston Scientific ($1.6 billion, up 14%)

• Stryker ($1.5 billion, up 6%)

• GE HealthCare ($1.3 billion, up 9%)

• Intuitive Surgical ($1.1 billion, up 15%)

• Edwards Lifesciences ($1.1 billion, down 2%)

Medtronic spokespeople did not respond to messages from MDO for our Medtech Big 100 coverage. In its latest annual report, the world’s largest medical device company said its flat R&D budget reflects a drive to “optimize innovation” and improve R&D productivity.

Medtronic “will significantly increase investment in our growth drivers to maximize future growth” in fiscal 2026, CFO Thierry Piéton said on the company’s end-of-year earnings call in May.

“For the first time in four years, we are planning to grow R&D faster than revenue … deliberately focused” on cardiac ablation, surgical robotics and renal denervation, he said, forecasting an R&D spending increase of roughly $200 million.

Of the 43 companies that reported increased R&D spending, the average year-over-year growth was 14.4%.

Orthopedics companies and broad interventional device makers accounted for 13 of those companies, including Globus Medical, Stryker and J&J MedTech. Six patient monitoring and

developers also raised their R&D budgets, despite flat or falling sales at several.

(continued on page 38)

Extensive

(continued from page 36)

Investment in chronic disease management continued as well. Diabetes management and continuous glucose monitoring companies like Tandem Diabetes Care, Dexcom and Insulet all boosted R&D spending, while Fisher & Paykel Healthcare and ResMed did the same in respiratory and sleep care. In critical care, Getinge, B. Braun and ICU Medical increased spending on life support platforms such as ventilators, infusion pumps and heart-lung machines.

The largest year-over-year R&D spending increase was 91% at Elekta. However, the oncology firm said that spending included impairments from the development project discontinuations.

“The decision to discontinue some projects has been affected by the continuous development of new techniques that will serve Elekta’s future products in a better way than internally developed solutions,” the company said in its annual report, offering as an example an internally developed cloud solution that will be replaced by a supplier’s platform.

Getinge increased its spending 76% to advance its ventilator and heart-lung technology, while Globus Medical raised R&D spending 32% as it folded in NuVasive.

Twenty-three companies cut R&D spending yearover-year. Six of those companies had double-digit reductions. MicroPort reported the largest cut at 43%, with Chair Zhaohua Chang saying the company narrowed its focus to projects with “clearer returns.”

Twenty-five companies spent more than 10% of their revenue on R&D in their most recent fiscal year. Of those companies, Glaukos spent the largest percentage of revenue on R&D (36%) to support clinical trials of its ophthalmic implants.

“We expect our R&D and clinical expenditures to increase as we continue to devote significant resources to clinical trials and regulatory approvals of our pipeline products,” Glaukos wrote in its annual report. “We currently conduct R&D activities primarily in the U.S. but continue to expand our clinical capabilities to sites internationally.”

The R&D slowdown is a wider trend across the economy, with private-sector R&D down nearly 2% (adjusted for inflation) over the last three quarters, economist Daniel Altman told MDO

“It means the economy is becoming less innovative and losing its potential to grow,” he said. “… There’s been a lot of uncertainty since the election in November, and uncertainty tends to freeze investment decisions in corporate boardrooms.”

“To a great degree, this uncertainty has been justified,” he continued. “Tariffs are taking a big bite out of profits, though their costs will soon be passed on to consumers. But more importantly, the costs of inputs are changing almost weekly as tariff rates fluctuate. Also, long-term interest rates are still high, so the cost of capital is prohibitive. The growing federal debt does nothing to help long-term rates, either.”

Altman predicts the medtech industry’s R&D slowdown will result in a slower pace of innovation and, for patients, “a stall in the trend of longer life expectancies.”

“That’s something we’re unfortunately seeing already, for a variety of reasons,” he said.

Medtech companies cutting R&D “may be sitting on cash to be able to handle what might be coming” from those import taxes, along with other big changes globally and from the Trump administration, Stanford Mussallem Center for Biodesign cofounder and Director Dr. Josh Makower said after being briefed on our findings.

“The headwinds with private insurance/artificial intelligence/priorauthorization and delays for CMS coverage could also be playing a role, but it’s unclear,” he said.

George says executives who cut

BAYCABLE’s molded cable assemblies offer enhanced flex life, environmental sealing, and custom interconnects, with the ability to add logos and unique mechanical features for your specific needs. From fine wire terminations to over-molded connections, we collaborate with you to design solutions that meet the most demanding applications, including specialized endoscope camera cables with advanced shielding and polyurethane strain reliefs.

R&D are primarily pressured to hit more immediate financial targets by shortsighted shareholders.

“You have to give it a long time,” he said. “That’s what makes the industry go. To the ones that are up in R&D: Great. Bravo. I think everyone should be.”

There’s an opportunity for those able and willing to ramp up R&D.

“In this environment, companies that can still invest in R&D are likely to maintain their potential to grow in the long term,” Altman said. “Moreover, they might be able to pick up talent. … This will be especially true of companies that have deep cash pools and can avoid tapping external capital markets. They can take advantage of the constraints their competitors are facing to push ahead.”

The aggregate decrease in R&D growth suggests heightened mergerand-acquisition activity ahead by large device OEMs with deep pockets.

Designs and manufactures custom electro-mechanical assemblies, including molded cables, flex circuits, power distribution units, and complex interconnect systems, tailored to meet your unique needs with precision and reliability.

Our team collaborates with your engineers to create custom cable solutions, optimizing conductor materials, insulation, shielding, and jacket selections to perfectly fit your project, whether it’s for high-voltage silicone cables, flexible composite designs, or hybrid construction cables with advanced noise-reducing and strength-enhancing features.

We specialize in custom coil cords, offering high-flex, durable solutions with excellent retractile memory and long life, designed with various insulation, shielding, and jacket materials for applications ranging from automotive defrost functions to industrial sensors and audio/video cables.

Industry we serve

BAYCABLE delivers innovative interconnect solutions across medical, industrial, and semiconductor sectors, transforming design challenges into next-gen devices with optimized performance, reliability, and custom engineering expertise.

Bay is a trusted partner

www.baycable.com

46840 Lakeview Blvd. Fremont, CA 94538

510-933-3800

bayinfo@baycable.com

THIS RANKING EXCLUDES COMPANIES WITH NON-MEDICAL DEVICE OPERATIONS THAT DO NOT BREAK OUT R&D SPENDING BY DIVISION AND COMPANIES THAT DO NOT DISCLOSE R&D SPENDING. FOR MORE DETAILS, PLEASE REFER TO OUR RANKING METHODOLOGY ON PAGE 12 AND INDIVIDUAL COMPANY RANKINGS ON THE PAGES THAT FOLLOW.

“ WE EXPECT OUR R&D AND CLINICAL EXPENDITURES TO INCREASE AS WE CONTINUE TO DEVOTE SIGNIFICANT RESOURCES TO CLINICAL TRIALS AND REGULATORY APPROVALS OF OUR PIPELINE PRODUCTS. WE CURRENTLY CONDUCT R&D ACTIVITIES PRIMARILY IN THE U.S. BUT CONTINUE TO EXPAND OUR CLINICAL CAPABILITIES TO SITES INTERNATIONALLY.”

- 2024 GLAUKOS ANNUAL REPORT

Glaukos makes its iStent infinite Trabecular Micro-Bypass System implants to reduce the intraocular pressure of the eye for glaucoma patients. Glaukos spent more on R&D as a share of its revenue than any other company on the 2025 Medtech Big 100. Image courtesy of Glaukos

HERE’S HOW MANY PEOPLE EACH COMPANY REPORTED AS EMPLOYEES, EITHER IN THEIR MOST RECENT ANNUAL REPORTS (FOR YEARS ENDING IN OR BEFORE APRIL 2025), OTHER FILINGS, THEIR WEBSITES, OR PROVIDED DIRECTLY TO MEDICAL DESIGN & OUTSOURCING. IN CASES OF TIES, COMPANIES SHARE THE SAME RANKING.

its $4.5 billion kidney care business, and intravenous solutions production disruptions starting in September 2024 due to flooding from the remnants of Hurricane Helene.

By February, Baxter said production was back to pre-hurricane levels, and in May the company said its inventory levels were fully restored. The FDA declared an end to the resulting IV solutions shortage in August.

“I am incredibly proud of the Baxter team worldwide who stepped up for their colleagues, our patients and customers in response to the devastation caused by Hurricane Helene,” Baxter Chief Operating Officer Heather Knight said.

Other sizable declines came from Omron Healthcare (down 10%), Cardinal Health’s medical segment (down 18%) and Highridge ( down 21%). Highridge spun out of ZimVie in 2024 and reported lower revenue due to the June 2025 sale of its EBI bone healing business.

Of the 21 companies that reported sales losses, one-third make patient monitoring or imaging systems. Philips (which continues to deal with its massive Respironics recall), Olympus, Canon Medical, Fujifilm, Nihon Kohden, Fukuda Denshi and Omron Healthcare all recorded lower sales. In particular, Omron, down 10%, blamed softer demand for nebulizers and oxygen concentrators as respiratory illness patterns normalized.

We work alongside you to transform your innovative medical device ideas into successful products. Some say partners, we say co-creators. With Surface Solutions Group, you get fast, on-time delivery, consistent and repeatable quality, and unequaled customer service and collaboration.

Hiring follows high-growth niches

Eighty-two companies disclosed employee counts for a total of 1.21 million workers across the Medtech Big 100, a 3.5% decrease from last year. Employment increased 6% in our 2024 analysis, decreased 5% in 2023, and increased 6% in 2022.

Avanos Medical had the greatest employment decrease at 41%. The company divested its respiratory health business in October 2023 as part of a three-year transformation program. The company hired former Siemens Healthineers and Abbott leader David Pacitti as CEO in June.

The Medtech Big 100 businesses with the most employees are Medtronic (100,229, down 0.5%), Siemens Healthineers (72,000, up 1%), >>

For more from Bill George and many of our Medtech Big 100 companies, download our free special report at wtwh.me/big100 as soon as Sept. 17.

“ OUR MORE THAN 500,000 PODDERS ARE PASSIONATE AND ENGAGED R&D PARTNERS WITH A DEEP INTEREST IN CONTINUOUSLY ENHANCING OUR PRODUCTS FOR THE BENEFIT OF EVERYONE WITH DIABETES.”

Royal Philips (67,823, down 2%) and B. Braun (64,262, up 2%).

Fifteen medtech companies reported double-digit headcount increases. Insulet led the pack, hiring 30% more people in its most recent fiscal year.

After reporting double-digit revenue growth for the year and a nearly 10% increase in R&D spending for its diabetes management technology, Insulet has since then increased its guidance for the current year, driven by strong adoption of its Omnipod 5 automated insulin delivery system.

“Our more than 500,000 Podders are passionate and engaged R&D partners with a deep interest in continuously enhancing our products

for the benefit of everyone with diabetes,” Insulet CEO Ashley McEvoy said on an earnings call in August, just 100 days after she joined the company. “Building off of this grassroots space, we have tremendous potential to broaden our reach, become an iconic world-class brand, and grow faster with targeted and compelling marketing strategies to reach distinct segments of type 1 and type 2 patients.”

“We’ll accelerate the pace of innovation,” she later continued. “We will ensure we are earlier on nextgeneration sensor integrations, invest in technology to modernize the customer experience and improve retention and patient outcomes.

From design to finished device, we help bring life-enhancing medical devices to market faster, smarter, and with the quality patients deserve.

The experts in design, development, and scalable manufacturing of interventional catheter-based devices and implants. Your trusted partner for bringing current and future medical devices to market

Learn more about our offerings at www.confluentmedical.com or email sales@confluentmedical.com for a custom quote.

SHOCKWAVE MEDICAL IS CLEARING THE WAY FOR JOHNSON & JOHNSON MEDTECH TO RETAKE ITS TITLE AS THE WORLD’S LARGEST MEDICAL DEVICE COMPANY.

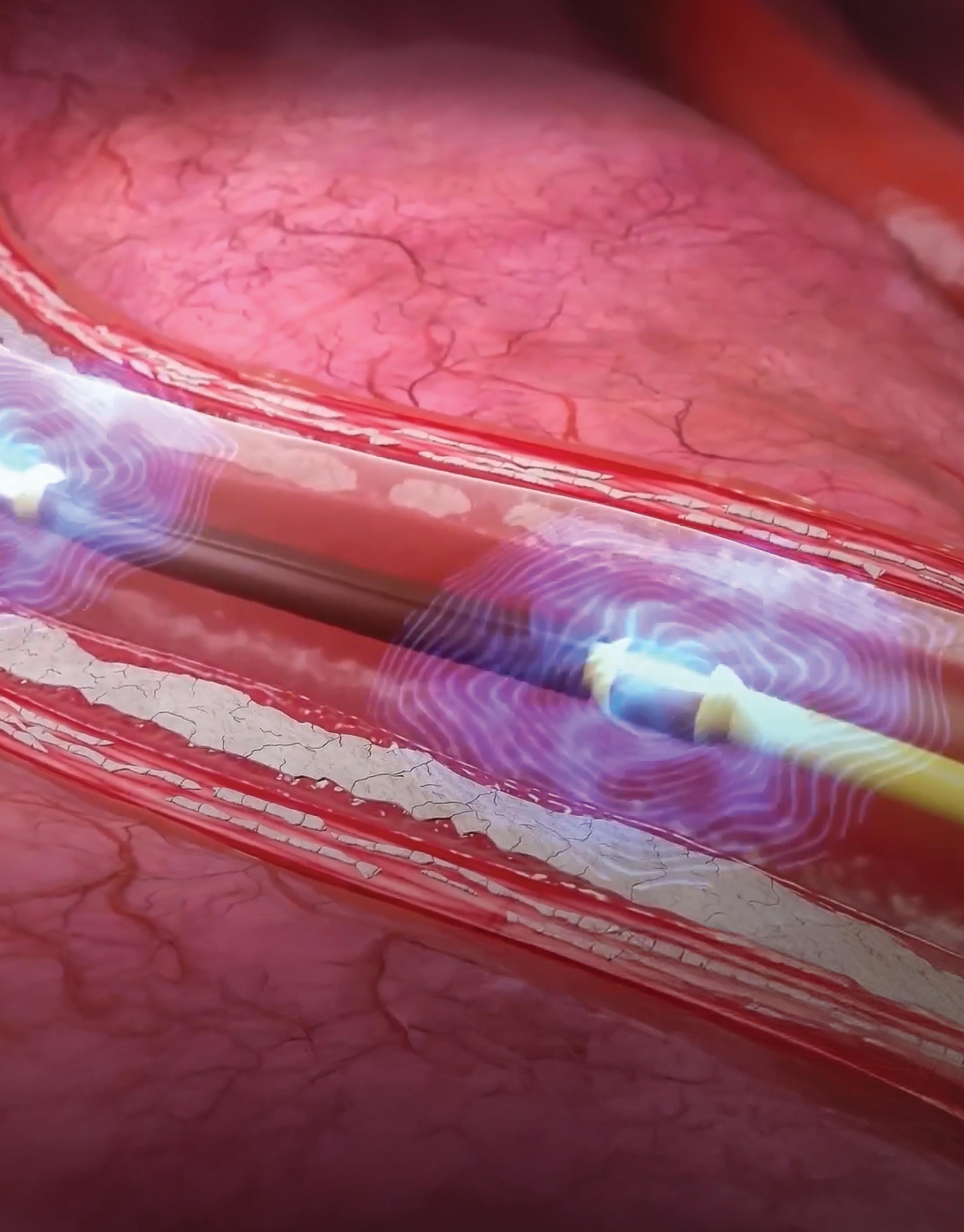

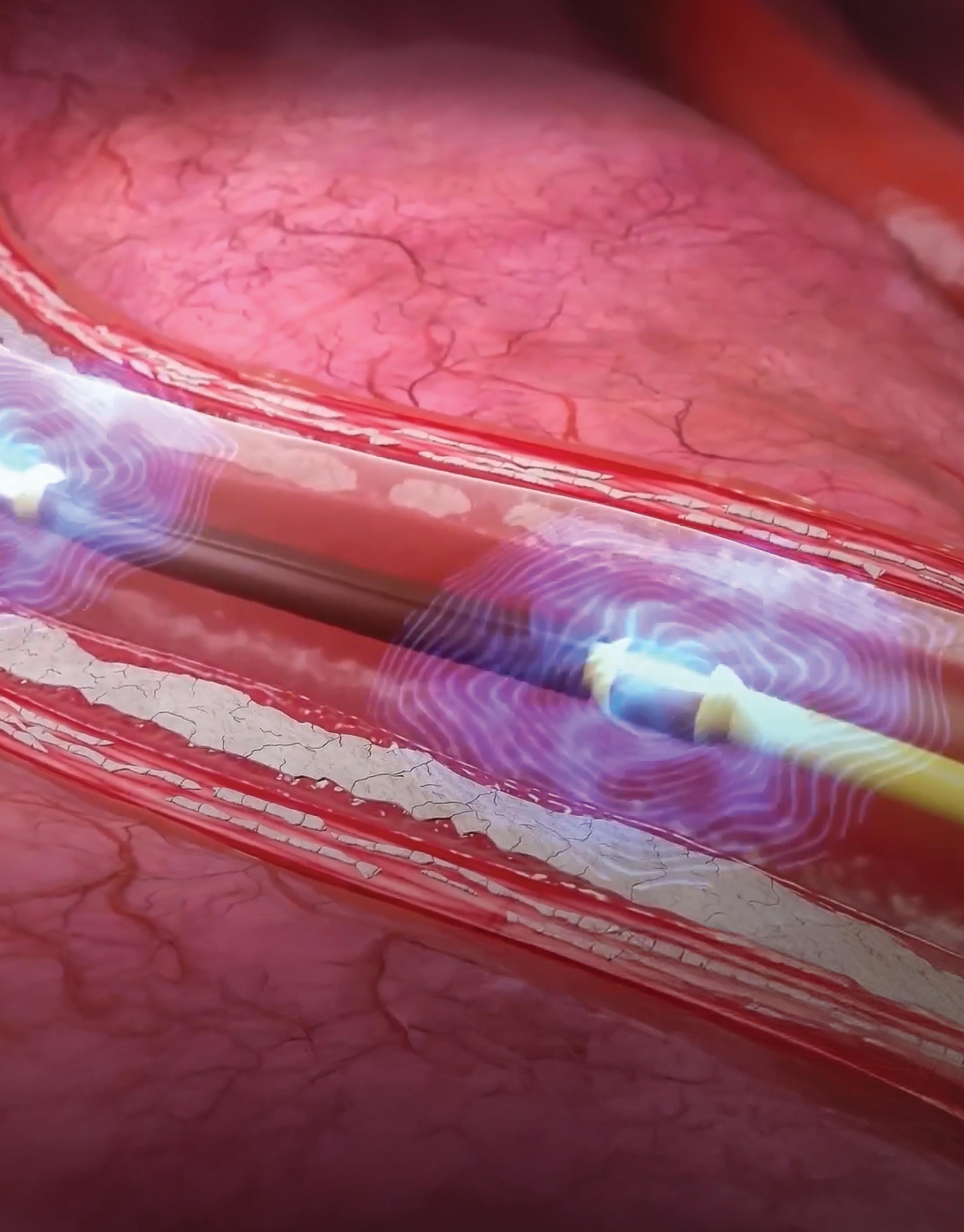

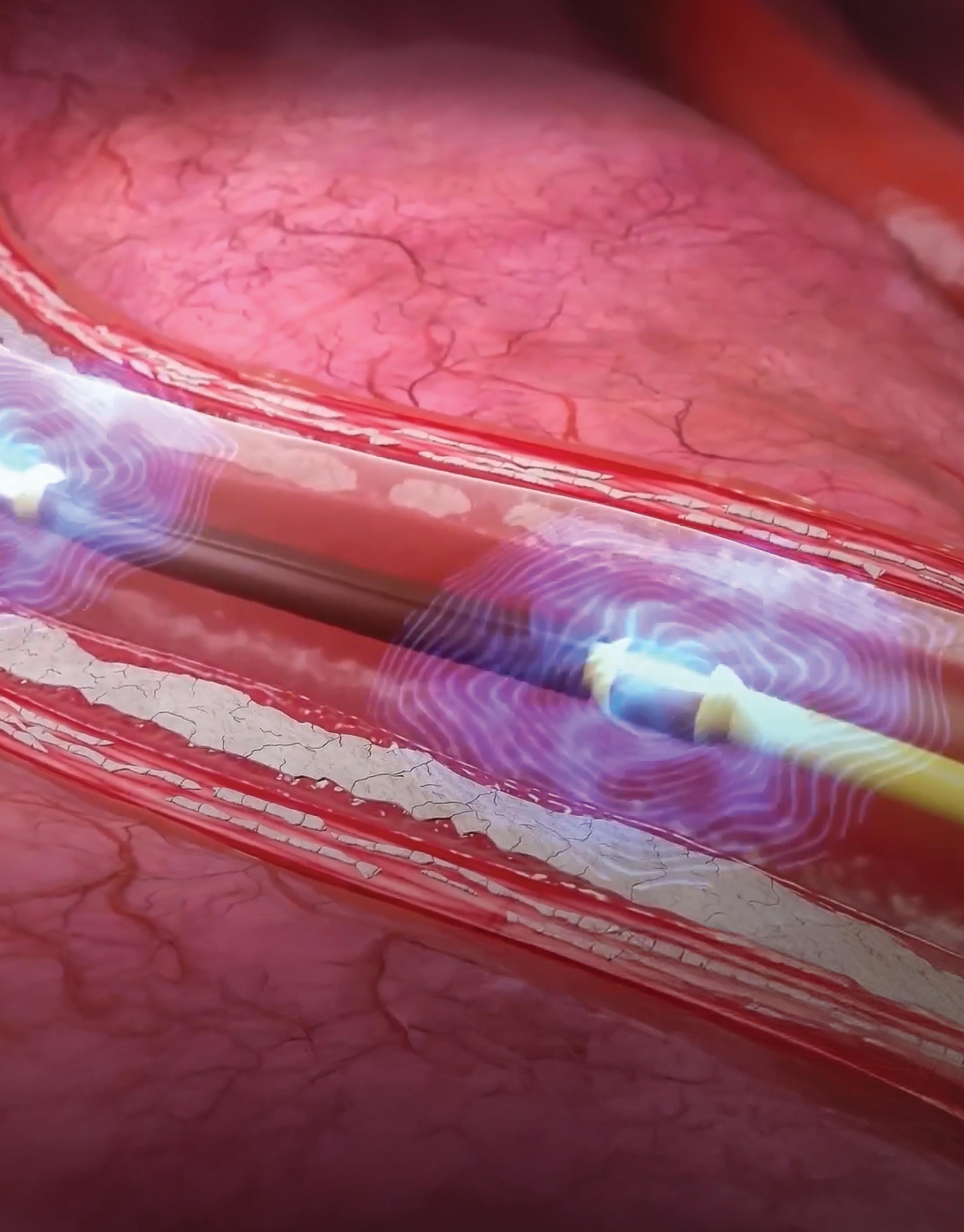

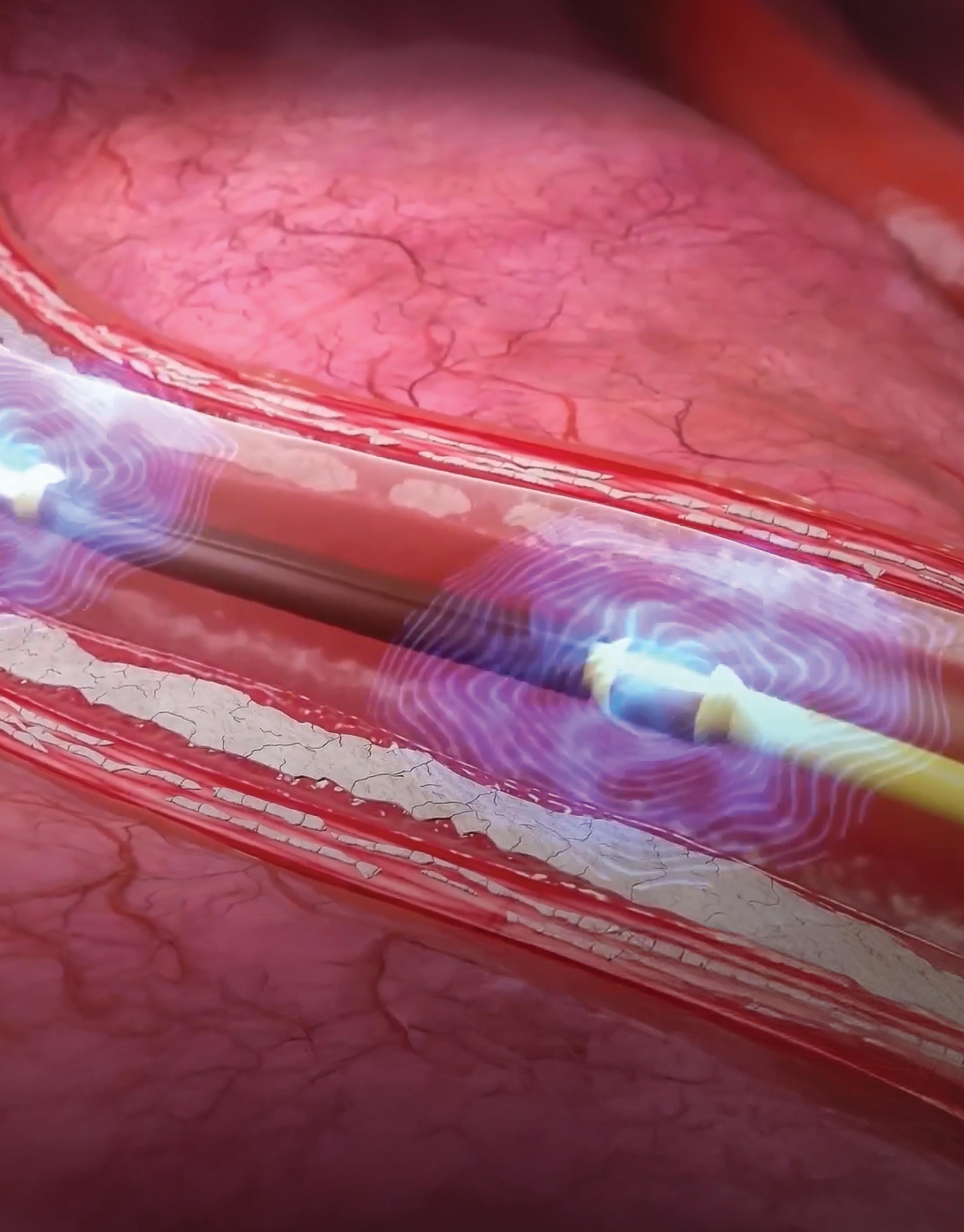

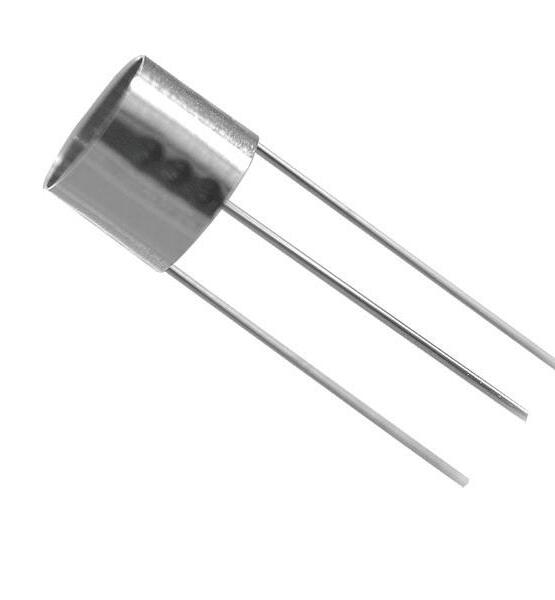

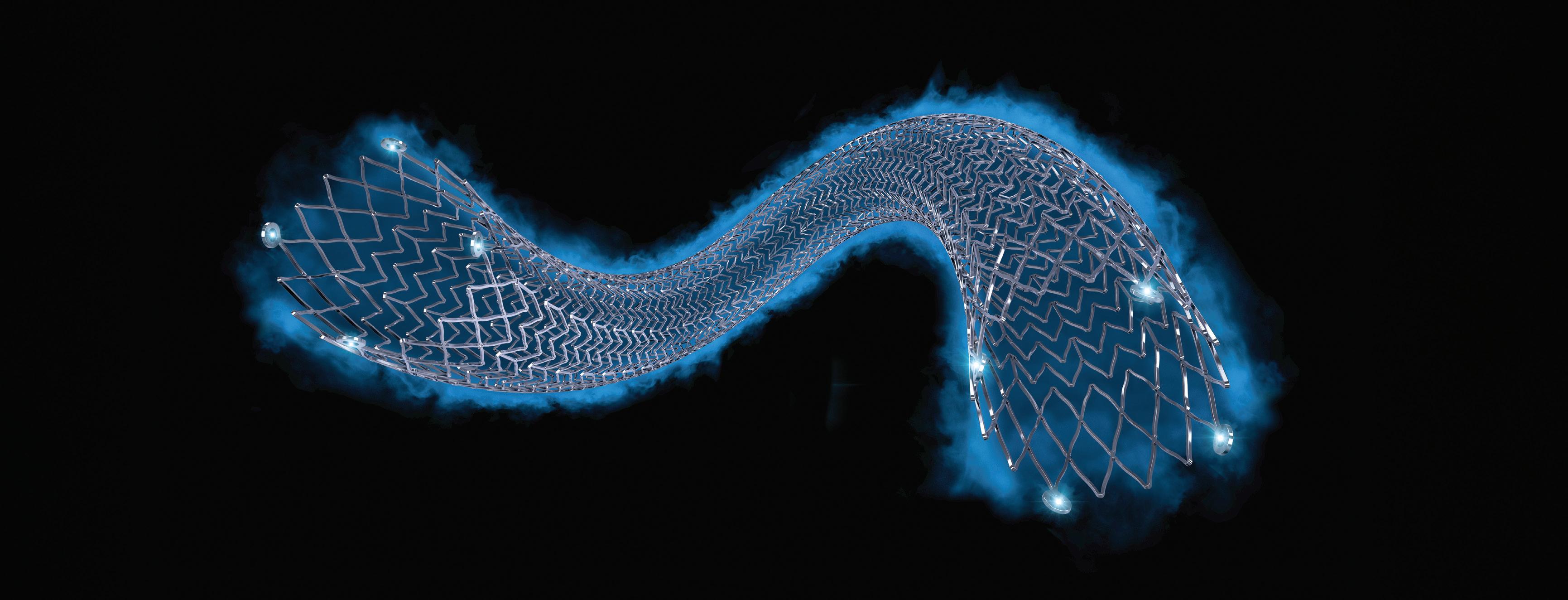

Shockwave Medical’s intravascular lithotripsy catheters generate sonic pressure waves to crack calcium within blood vessels without damaging the surrounding soft tissue. Image courtesy of Johnson & Johnson MedTech

BY JIM HAMMERAND MANAGING EDITOR

After buying Shockwave Medical in one of the biggest medtech deals in recent history, Johnson & Johnson MedTech is poised to pass Medtronic as the world’s largest medical device company.

Medtronic has reigned atop Medical Design & Outsourcing‘s annual Medtech Big 100 ranking by revenue ever since 2016. Medtronic passed J&J on that year’s ranking after buying Covidien for $50 billion in January 2015. Two weeks before Medtronic announced that deal, J&J completed the $4 billion sale of its Ortho-Clinical Diagnostics business to Carlyle.

Now, the tables have turned, with Medtronic seeking to separate its diabetes business (which had 2025 revenue of $2.8 billion) before the end of 2026 as Shockwave — purchased by J&J for $13.1 billion in May 2024 — fuels double-digit growth in J&J’s cardiovascular business.

“Our acquisition of Shockwave accelerates our continued shift into high-unmet-need, high-growth areas,” J&J EVP and J&J MedTech Worldwide Chair Tim Schmid said in a statement to MDO. “The Shockwave intravascular lithotripsy (IVL) platform positions us to better serve patients with heart disease, which as you know is the leading cause of death worldwide.” >>

MTD’s advanced processes cater to the specific demands of these industries, from orthopedic and pharmaceuical to wearables and dental (as pictured above).

We ensure that vital components and devices meet the highest standards of precision, quality, and performance.

• Drug delivery devices with extremely tight tolerances and high-aspect ratio flow lengths

• Complex, intricate medical products that demand robust quality systems

• Bioabsorbable components that require consistent and minimal post-mold IV loss

• Overmolded components with ultra-thin walls encapsulating delicate substrates

LEARN MORE: mtdmicromolding.com

J&J MedTech is “by far and away now one of the largest and certainly the fastest-growing medtech company in cardiovascular,” Schmid said on the company’s July 16 earnings call, crediting not only Shockwave but also Abiomed (purchased for $16.6 billion in 2022) and the electrophysiology portfolio, which includes pulsed-field ablation technology for treating atrial fibrillation.

Medtronic (including its diabetes business) is ahead of J&J MedTech in our 2025 ranking by less than $1.7 billion in revenue, but J&J is growing at about 5% compared to 4% at Medtronic.

More importantly for future growth, J&J is outspending Medtronic on R&D by more than $1 billion. J&J reported R&D expenses of $3.7 billion in its most recent year — up 19% year-over-year — while Medtronic said it spent $2.7 billion on R&D, down 0.1% year-overyear. (Medtronic spokespeople did not respond to messages from MDO editors about our Medtech Big 100 coverage.)

Shockwave, which developed its minimally invasive IVL technology for calcified coronary artery disease (CAD) and peripheral artery disease (PAD), is outperforming the deal model estimates J&J calculated when pursuing the company, Schmid said.

On that same earnings call, J&J CEO Joaquin Duato said Shockwave’s technology “has transformed the treatment of atherosclerotic cardiovascular disease and is driving significant growth.”

“Shockwave is expected to be our 13th billion-dollar medtech platform by the end of the year, a position that is further strengthened by a compelling body of evidence on the benefits of this technology,” he continued. “This includes data showing an IVL-first approach can achieve excellent outcomes in female patients with complex calcified coronary artery disease.”

And under J&J’s ownership, Shockwave continues to increase its R&D spending. Shockwave spent $145 million on R&D in 2023. That spending now exceeds $200 million per year under J&J, Shockwave Chief Medical Officer Dr. Nick West said in an MDO interview.

“We are not standing still,” West said. “We’ve led this market. We’ve been the pioneering force in it. We intend to stay there … by launching at least one new IVL device every year, which we’ve managed to do ever since the first catheter was commercialized in 2017. That’s a lofty goal, but we’ve been good for that promise to date, and we intend to continue that.”

So how did Shockwave’s deal with J&J come together? The following timeline draws upon regulatory filings, other publicly available information and reporting from MDO and MassDevice.

In January 2023, executives from Shockwave and J&J discussed potential strategic relationships, but Shockwave said J&J “did not make a proposal to Shockwave with respect to any transaction.”

In February, Shockwave CEO Doug Godshall spoke with executives from another medtech identified only as

“Company A” and came away thinking that company “would not prioritize pursuing large-scale acquisitions in the near-term.”

That same month, Shockwave stock was trading just over $201 per share after posting strong quarterly financials. (That price, however, was down from the $310-per-share price the stock hit in August 2022 after reporting big sales gains and positive clinical trial results.)

In late March 2023, the chair and CEO of another medtech identified only as “Company B” proposed a $260-pershare acquisition of Shockwave, paid half in cash and half in stock. Shockwave’s board turned it down through Godshall on April 2, but asked to make the case for a higher price with on a presentation by management.

Company B increased its offer to $270 per share after the presentation, but Shockwave said it wanted “a significant reverse termination fee” at

that price in case regulators spiked the deal. Company B countered at $275 and asked for a window of exclusivity, but Godshall declined, and Company B soon after made a “best and final” offer at $275, plus a $500 million reverse termination fee, among other terms.

Figuring Company B was unlikely to increase its offer again, the Shockwave board directed Godshall to keep negotiating over the reverse termination fee. At the same time, the board told its financial advisor, Perella Weinberg Partners (PWP), to reach out to tell J&J that Shockwave was seriously considering an offer.

The same day, PWP contacted Ashley McEvoy, who was leading J&J MedTech at the time. (She’s now CEO at Insulet.) McEvoy said J&J would consider exploring a transaction.

Then the Centers for Medicare & Medicaid Services (CMS) issued a

proposed rule with new Shockwaves IVL coverage codes and higher payments, pushing Shockwave’s stock up.

As a result, Godshall told Company B’s CEO that the Shockwave board would need a better offer, but Company B declined on April 17.

Meanwhile, PWP asked J&J to make an offer by April 19, but on April 20, J&J told Shockwave it had other strategic priorities and wouldn’t make an offer in the near term.

The next day, Reuters reported Boston Scientific was considering buying Shockwave, citing unnamed “people with knowledge of the matter.” The news sent Shockwave’s stock above $286 per share.

Later that day, Company B’s CEO increased his offer to $278 at the most, while a senior business development executive at Company A said it was interested in striking a cash deal quickly. >>

The Shockwave board figured it could get more than $278 and opened talks with Company A.

On April 22, Godshall spoke with Company B’s CEO, and the two men agreed to suspend negotiations after failing to close the gap.

On April 26, McEvoy called Godshall to express potential interest in a transaction down the road, but not right away.

On April 30, Company A said it wouldn’t make an offer after all. And with that, despite another report citing an unnamed source in May that Medtronic and J&J were interested, there would be no sale of Shockwave in 2023.

The Shockwave deal comes together

The next year, J&J MedTech New Business Development VP Jennifer Kozak reached out to Godshall in March to set up a meeting with Duato. When they met in New Brunswick, New Jersey on March 8, Duato said J&J was

“We are not standing still. We’ve led this market. We’ve been the pioneering force in it. We intend to stay there.”

interested in buying Shockwave and would soon make an offer.

On March 14, Duato called Godshall with a price: $320 per share. The deal would be cash, and J&J wanted to complete due diligence review and negotiate a definitive agreement within four weeks.

Two days later, the Shockwave board convened and reconsidered its strategy from the year before.

The board “determined that Shockwave’s value was more likely to be optimized by seeking to improve [J&J’s] offer and using the promise of engaging exclusively with [J&J] to do so rather than soliciting bids from other companies in

light of Shockwave’s experience during the 2023 stage of the strategic process with Company A and Company B [and] that process having become public,” Shockwave said in materials it would later send to investors considering whether to approve J&J’s bid.

With that in mind, the Shockwave board directed Godshall to counter J&J’s offer at either $345 or $350 per share (“at management’s discretion”) with the intent to move forward at $330 or higher.

On March 18, Godshall proposed a $350-per-share price on a phone call with Duato, who countered the next day with a “final” offer of $335 and a 30-day window of exclusivity.

With approval from the Shockwave board, Godshall told Duato they could move forward on price, but with a shorter exclusivity period and immediate termination of exclusivity if J&J reduced its proposal below $335.

J&J agreed, and Shockwave gave the company access to internal files for due diligence on March 22.

Two days later, Godshall and other Shockwave executives — President and Chief Commercial Officer Isaac Zacharias, CFO Renee Gaeta and Finance SVP Trinh Phung — offered a presentation in Mountain View, California to J&J leaders Duato, Schmid, Kozak, EVP and CFO Joseph Wolk, and Global Head of Heart Recovery Michael Bodner.

Another two days later, news of acquisition talks leaked once more, boosting Shockwave’s stock price by about 10% to $316. Godshall and Duato got in touch that same day to assure each other they were still committed to the deal.

Negotiations continued. In the final days, Shockwave and J&J came together on a termination fee, agreeing to 3.15% of transaction equity value.

J&J also pitched retention agreements to Zacharias (who now serves as worldwide president of Shockwave) and Shockwave R&D SVP Patrick Stephens, making them the only Shockwave executives to receive such an offer. They accepted the next day.

On the morning of April 5, J&J and Shockwave announced the deal before markets opened.

“Shockwave offers a truly differentiated opportunity to further enhance our leadership position in medtech, expand into additional

Johnson & Johnson

Chair and CEO

Joaquin

Duato

Johnson & Johnson

EVP and J&J MedTech

Worldwide Chair

Tim Schmid

Former

Shockwave

Medical CEO

Doug Godshall

high-growth segments, and ultimately transform the future of cardiovascular treatment,” Schmid said in the announcement. “Shockwave’s IVL technology for treating CAD and PAD, and its strong pipeline, are in a class of their own. We look forward to bringing Shockwave’s solutions into Johnson & Johnson MedTech and the hands of more physicians around the world.”

In the same release, Godshall — who is no longer with Shockwave and lists himself as “semi-retired” on LinkedIn — explained how the deal supported his company’s “mission to make this remarkable technology available to patients worldwide.”

“As part of a larger, more diverse organization, with broad expertise and a core focus on improving patient outcomes, we are confident we will be able to further solidify IVL as the global standard of care for patients,” he said. “I am deeply grateful to our team members and colleagues whose efforts have made today’s milestone possible; their accomplishments and passion have been extraordinary. I could not think of a better partner and home than Johnson & Johnson as the Shockwave team prepares to write its next exciting chapter.”

There’s more to come from J&J MedTech and Shockwave, Schmid told MDO

“We aren’t slowing down,” he said. “With new technologies like the Shockwave Javelin and E8 catheters, and real-world evidence demonstrating the impact of IVL, we’re confident we will continue to help more patients around the world and drive long-term value for Johnson & Johnson.”

J&J MedTech is growing Shockwave’s R&D budget by double digits

J ohnson & Johnson MedTech is growing Shockwave Medical‘s R&D budget by double digits as the intravascular lithotripsy (IVL) developer endeavors to release a new device every year.

“Our mission at Shockwave has not changed,” Shockwave Chief Medical Officer Dr. Nick West said in a Medical Design & Outsourcing interview.

“We remain completely committed to addressing unmet physician and patient needs — which are kind of the same thing — and thereby improving the treatment options for patients with calcific vascular disease.”

“Calcific vascular disease is here to stay,” he continued. “As you know, there’s going to be an explosion of cardiovascular disease with a globally aging population over the next several decades. Aging is one of the predominant drivers of calcification of blood vessels, valves, etc., and we are committed to providing physicians the tools to treat their patients, no matter in what territory they present with calcification.”

Shockwave reported $145 million in R&D expenses for 2023, its final full year as an independent, publicly traded company before the J&J acquisition. Shockwave’s R&D spending is now more than $200 million per year under J&J’s ownership, West said.

Shockwave

Medical

Medical

Dr. Nick West

BY JIM HAMMERAND MANAGING EDITOR

We also discussed Shockwave Medical’s ambitious plans for nextgeneration devices to treat peripheral artery disease (PAD) and coronary artery disease (CAD), efforts to bring IVL therapy to new parts of the anatomy for the first time, and the latest on the company’s non-IVL Reducer device for coronary sinus reduction. Go to wtwh.me/nickwest for that and more from this interview. The following has been lightly edited for space and clarity.

MDO: Now that Shockwave’s part of J&J, how does that affect the Shockwave team’s ability to develop and get new and improved technologies to physicians and patients?

West: “J&J has continued to invest in us. It’s enabled us to build our pipeline and our portfolio. … Shockwave has the critical first-mover advantage in the IVL space. We’re not assuming there is no competition, but we’re not looking backward over our shoulder. We’re aware they’re coming. We have the first-mover advantage. We are going to keep moving the target of what best-in-class looks like, of what physicians and patients expect from an IVL device. To give you a flavor of the degree of R&D investment we have, in 2021 Shockwave was investing about $50 million a year in R&D, and at that stage we had two technologies >>

on the market and seven development programs. In 2025, we have over 30 R&D development programs and we are now investing over $200 million a year in R&D. We are not standing still. We’ve led this market. We’ve been the pioneering force in it. We intend to stay there. What we’re trying to do is remain at the forefront of the market by launching at least one new IVL device every year, which we’ve managed to do ever since the first catheter was commercialized in 2017. That’s a lofty goal, but we’ve been good for that promise to date and we intend to continue that.”

How do you keep the R&D team going with that cadence?

West: “It’s important that we obviously feed back to R&D what physicians are telling us and what patients are experiencing. The reach of Shockwave has been astonishing. The very first catheters were commercialized in the peripheral vasculature back in 2017, with the coronaries following a couple of years later. In 2025, we will reach our millionth patient treated. The ramp has been maybe not quite exponential, but it’s been pretty rapid, and I think that the R&D team will feed off the positive feedback from physicians, the positive feedback on patient stories and driven on by the unmet needs that physicians fuel us with: ‘Wouldn’t it be good to have a device for this indication, that indication?’ Some of our novel iterations and new device programs that we’re developing have been driven by use that we have seen from physicians and publications in the literature where our devices have been used off-label. We have then taken that unmet need and developed a dedicated device for those specific indications.”

Why is vascular calcification such a problem?

West: “Although we have lots of great technologies for balloon expanding narrowed vessels, placing stents or not as the case may be, drug-coated balloons, the problem is you can’t always open a lesion with a balloon. As the population gets older, there’s more and more hardening or calcification of vessels, and we know that one of the major things that causes vessels to fail after treatment

is an inability to expand that narrowing at the first sitting. That’s usually due to calcification. So if we can modify that, it allows much better vessel expansion, it allows full stent expansion, and that increases the likelihood that a patient will not run into bother down the track.”

What can you tell us about coronary IVL for women and what sort of growth that might unlock for Shockwave and J&J?

West: “Women are an underserved population in the world of vascular disease, and in particular in coronary heart disease. If you look at a wide variety of presentations of coronary heart disease, women are underrepresented in clinical trials. Given the fact that they make up at least half of the population, they often are 20%, 25% of clinical trial populations. There are many reasons behind that. … ‘Atypical chest pain’ used to be used to describe female presentations of coronary heart disease. We should not use that term anymore. Women present differently to men, for sure, and therefore they are often not

calcification, often require specialized equipment, can require specialized training, and there is the possibility of severe complications. And if you compare women with men with atherectomy tools, we know that studies have consistently shown an increased risk of occlusive vascular dissection, of adverse outcomes, perforations in women compared with men. Now we looked at our data from our Disrupt CAD III and IV studies — the pivotal studies for the U.S. approval and the Japanese approval — and in a post hoc analysis, we looked at the differences between men and women, and we were encouraged to see there was equipoise, no sex difference in the way that you see with atherectomy. This sparked us to commence the Empower CAD trial several years back, which looks at a real-world population with very few exclusions of women undergoing percutaneous coronary intervention for complex calcific coronary disease. We presented the primary endpoints at EuroPCR in Paris in May, and in this study we encouraged a Shockwave IVL-first approach, i.e. reaching for the Shockwave

are a variety of tools in the toolbox that interventional cardiologists, interventional radiologists and vascular surgeons can use for the management of vascular disease in any patient. They include atherectomy tools, but unfortunately these tools, whilst they’re very effective at treating

for calcific coronary disease and creates equipoise between women and men.”

Go to wtwh.me/nickwest for more from this interview, including discussion of Shockwave’s Reducer implant (pictured above).

the arm for both

MINIMED COMES FULL CIRCLE AS MEDTRONIC PLANS TO SLIM DOWN AND SHARPEN ITS FOCUS.

If all goes to plan, Medtronic will have a different, leaner look within about 16 months.

Medtronic’s expected separation of Medtronic Diabetes into a publicly traded company named MiniMed marks a new beginning with some old themes.

About 24 years before Medtronic outlined its diabetes split, the medtech giant paid approximately $3.7 billion to buy a company called MiniMed and an affiliate. That deal included the technology that still carries the MiniMed name, inspiring the not-so-new name of the soon-to-be independent company.

Through trials and tribulations, including an FDA warning letter that seemingly had the business on the

Medtronic CEO Geoff Martha posing for the Medtronic Diabetes Blue Balloon Challenge in 2024 to recognize National Diabetes Awareness Month.

BY SEAN WHOOLEY SENIOR EDITOR

chopping block a few years ago, Medtronic Diabetes is one of the largest diabetes technology developers in the world. And it’s the only one that currently offers a fully automated insulin delivery system that includes a proprietary continuous glucose monitor (CGM). Based on annual revenue, the unit is the third-largest diabetes tech manufacturer, behind Abbott and Dexcom.

Medtronic spokespeople did not respond to messages from Medical Design & Outsourcing editors about our Medtech Big 100 coverage.

But when Medtronic announced the deal, Chair and CEO Geoff Martha called it “a win for both diabetes and for Medtronic.”

The move — which Martha described as “active portfolio management” — could leave both entities better off, even if it results in Medtronic eventually losing its status as the world’s largest medtech company, as ranked by revenue on Medical Design & Outsourcing’s annual Medtech Big 100 list.

As optimism surrounds the soonto-be standalone MiniMed, questions remain around the futures of the two companies after they separate.

Medtronic became a leader in the automated insulin delivery space through several iterations of the MiniMed insulin pump system. >>

As analysts began speculating that the diabetes unit was a candidate for a spinoff, Martha brushed off the possibility when asked about it in November 2021, but called a separation “an opportunity over time.”

Less than a month later, Medtronic disclosed an FDA warning letter related to inadequacies of medical device quality system requirements at the Medtronic Diabetes headquarters in Northridge, California.

The regulatory action spurred more spin-off suggestions, but Medtronic led the unit through a turnaround. In April 2023, Medtronic received FDA approval for its next-generation MiniMed 780G automated insulin delivery system. Not long after, the company fully resolved its warning letter issue.

Medtronic Diabetes has since then racked up milestones, including advancements for its InPen smart insulin pen platforms and nextgeneration Simplera continuous glucose monitor platform.

In August 2024, the company inked a landmark deal with Abbott to combine their CGM and insulin delivery technology, a collaboration allowing Medtronic to bring its MiniMed systems to Abbott’s large base of CGM users.

Medtronic EVP and Diabetes President Que Dallara will become CEO of the new, independent MiniMed. In Medtronic’s fourth-quarter earnings call, she said Martha’s decision to “double down” on the diabetes unit has positioned the business to “generate significant returns for stakeholders.”

“I’m very excited to be leading this large-scale, direct-to-consumer diabetes business,” Dallara said. “As an independent company, we will have a shareholder base that is aligned to our business and financial profile. This will enable more focused investment in innovation as well as manufacturing scale and automation, positioning us for success in automated insulin delivery and smart [multiple daily injections] while also driving margin expansion over time.”