Mary C. Gannon • Editor-in-Chief

Mary C. Gannon • Editor-in-Chief

JUST A FEW YEARS AGO, the hype over electrified machinery was giving some pause to many machine makers and users, as they wondered if electromechanical actuators could top the power density of hydraulics. But that pause was short-lived, and most experts on both sides of the aisle agree hydraulics still has one big advantage — power density. Two recent examples come to mind.

Over the past few months, we’ve heard about a new market disruptor in the cylinder market — Rise Robotics’ new Beltdraulic design, which it says is faster and smoother than hydraulics. The company says it offers the power of hydraulics without the fluid and efficiency losses. As someone covering these technologies for 20 years, this is an amazing feat. Especially as efficiency loss is our biggest foe in the fluid power industry.

I’ve seen the Rise design in person recently at a trade show and watched videos of it online. It’s an incredible design, but it still seems longer than many cylinders offering comparable forces. So, while I do see great potential in this design, I don’t see it completely displacing hydraulics anytime soon, especially where compact designs are required.

At Cedar Point in Sandusky, Ohio (not far from my hometown) we have one of the world's most famous roller coasters. Originally, the Top Thrill Dragster shot riders 420 ft up a nearly completely vertical hill using a hydraulic launch at 120 mph. Throughout its many years, the hydraulic

system needed maintenance and sometimes the ride was down for days at a time.

After a metal bracket came loose a few years ago and struck a rider waiting in line, the amusement park shut the ride down for evaluation and decided to reimagine the ride. It’s now called Top Thrill 2 and instead of a hydraulic launch, the ride uses linear synchronous motors to propel the train up the hill.

When I first learned about the engineering on Top Thrill Dragster more than 20 years ago, I was informed by Cedar Fair’s engineering team that the ride could only accomplish the incredible speeds and height with hydraulics — any electric motors would just be too large for the allotted space. Here, we could truly sing the praises of hydraulics — power density meant smaller pumps and motors could easily launch the train over the massive, nearly 90-degree hill.

So when I learned that the ride now uses LSMs, I was so impressed that they have come that far in the past 15 to 20 years. Imagine that they could now sling-shot 18 passengers up that hill!

Then I visited Cedar Point with my family for the first time since the ride opened. And I saw just exactly how they accomplish this feat. No, LSMs are not suddenly more powerful. It’s a triple-launch coaster, meaning that it is launched forward, partly up the hill, then rolls back up a vertical tower to gain the proper momentum and then, it flies up the 420 ft hill. Engineering

marvels don’t need to apply, this is straight up physics at this point.

I’m not throwing shade on LSMs — they are incredibly fast motors that propel riders smoothly on many roller coasters, including Cedar Point’s Maverick, one of the best coasters out there. But they can’t stand up to the power density that hydraulics offer, and likely won’t anytime soon.

There are many detractors that say the maintenance issues were a big problem with the hydraulics on Top Thrill Dragster. And it did have its fair share. But from what I saw myself in person and what I’ve seen online, the new Top Thrill 2 still has many issues and is constantly shut down for maintenance. You can’t blame the hydraulics anymore.

I’ve always sung the praises of hydraulics. I love this industry and see the power and strength it provides to keep our world moving. There’s a place for all modes of power transmission in industry, and they can all get along (in fact, on Cedar Point’s newest coaster, Siren’s Curse, the vertical drop would not be possible without the combination of hydraulics, mechanical and electrical designs). If only we can say that about the rest of our world. FPW

Mary C. Gannon • Editor-in-Chief mgannon@wtwhmedia.com

linkedin.com/in/marygannonramsak

Continental’s

EDITORIAL

VP, Editorial Director

Paul J. Heney pheney@wtwhmedia.com @wtwh_paulheney

Editor-in-Chief Mary Gannon mgannon@wtwhmedia.com @dw_marygannon

Technology Editor Ken Korane kkorane@wtwhmedia.com @fpw_kenkorane

Senior Editor Rachael Pasini rpasini@wtwhmedia.com

Contributing Editor Josh Cosford @FluidPowerTips

Contributing Editor Carl Dyke @carlindustry

Contributing Writer Robert Sheaf rjsheaf@cfc-solar.com

www.nfpa.com

VP, Creative Services

Matthew Claney mclaney@wtwhmedia.com @wtwh_designer

Art Director, FPW Erica Naftolowitz enaftolowitz@wtwhmedia.com

Art Director, FPW Digital Eric Summers esummers@wtwhmedia.com

Director, Audience Growth Rick Ellis rellis@wtwhmedia.com

Audience Growth Manager Angela Tanner atanner@wtwhmedia.com

PRODUCTION SERVICES

Customer Service Manager Stephanie Hulett shulett@wtwhmedia.com

Customer Service Representative Tracy Powers tpowers@wtwhmedia.com

Customer Service Representative JoAnn Martin jmartin@wtwhmedia.com

Customer Service Representative Renee Massey-Linston renee@wtwhmedia.com

Customer Service Representative Trinidy Longgood tlonggood@wtwhmedia.com

1111

Ph: 888.543.2447

FLUID POWER WORLD does not pass judgment on subjects of controversy nor enter into dispute with or between any individuals or organizations. FLUID POWER WORLD is also an independent forum for the expression of opinions relevant to industry issues. Letters to the editor and by-lined articles express the views of the author and not necessarily of the publisher or the publication. Every effort is made to provide accurate information; however, publisher assumes no responsibility for accuracy of submitted advertising and editorial information. Non-commissioned articles and news releases cannot be acknowledged. Unsolicited materials cannot be returned nor will this organization assume responsibility for their care.

FLUID POWER WORLD does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2025 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher.

VP, Operations

Virginia Goulding vgoulding@wtwhmedia.com @wtwh_virginia

Digital Marketing Manager Taylor Meade tmeade@wtwhmedia.com @wtwh_taylor

SALES

Ryan Ashdown 216-316-6691 rashdown@wtwhmedia.com

Jami Brownlee 224.760.1055 jbrownlee@wtwhmedia.com

Mary Ann Cooke 781.710.4659 mcooke@wtwhmedia.com

Jim Powers 312.925.7793 jpowers@wtwhmedia.com @jpowers_media

Courtney Nagle 440.523.1685 cseel@wtwhmedia.com @wtwh_CSeel

CEO Matt Logan mlogan@wtwhmedia.com

Co-Founders Scott McCafferty Mike Emich

SUBSCRIPTION RATES: Free and controlled circulation to qualified subscribers. Nonqualified persons may subscribe at the following rates: U.S. and possessions: 1 year: $125; 2 years: $200; 3 years: $275; Canadian and foreign, 1 year: $195; only US funds are accepted. Single copies $15 each. Subscriptions are prepaid, and check or money orders only.

SUBSCRIBER SERVICES: To order a subscription please visit our web site at www.fluidpowerworld.com

FLUID POWER WORLD (ISSN 2375-3641) is published six times a year: in February, April, June, August, October, and December by WTWH Media, LLC; 1111 Superior Ave., Suite 2600, Cleveland, Ohio 44114. Periodicals postage paid at Cleveland, OH & additional mailing offices.

POSTMASTER: Send address changes to: Fluid Power World, 1111 Superior Ave., Suite 2600, Cleveland, OH 44114

Ron Marshall • Contributing Editor

A COMPRESSED AIR AUDITOR was surprised to see an air compressor under test was consuming excess power when unloaded. A check of the sump pressure (Figure 1) showed the sump was not blowing down during unload cycles. And the installed flow meter showed the compressor was producing a small amount of air, even in the unloaded condition.

In a lubricated rotary screw compressor, the sump blowdown valve plays an important role — not just during shutdown, but every time the compressor unloads during normal operation. When working correctly, it helps protect your equipment, reduce energy use, and ensure smooth cycling.

Most compressors operate in a load/unload mode, where the unit temporarily stops compressing air once system pressure is met. During unloading, the sump blowdown valve opens briefly to vent pressure in the separator

tank down to about 60 psi. This reduces energy consumption and allows for a smooth restart when the compressor reloads, reducing motor strain and improving efficiency.

If the valve fails closed, the compressor tries to restart under full sump pressure. This can cause motor overloads, high startup currents, and excess wear. You may notice long startup delays or frequent breaker trips.

If the valve fails open or leaks, air escapes continuously during unloaded operation. This leads to pressure instability, frequent cycling, and higher energy use. Oil mist may also escape, increasing lubricant consumption and risking air quality issues.

These failures are often overlooked but can have significant long-term effects: poor efficiency, damaged components, and rising

maintenance costs. Fortunately, the fix is simple. Regular checks — such as listening for a brief hiss when the unit unloads — can catch problems early.

In compressed air systems, small failures can cause high operating costs; in this case, the compressor was found to be consuming 3-4 times its normal power consumption per unit output! The sump blowdown valve is one of those small parts that deserves more attention. In this case, it needs quick action. FPW

For training in compressed air optimization visit: compressedairchallenge.org.

Edited by Mary C. Gannon • Editor-in-Chief

, Floating Production Storage and Offloading (FPSO) vessels take extracted oil and gas from a subsea well and process them onboard. They also remove any water, sand and other byproducts, store the treated oil and eventually, offload the oil to a tanker or pipeline. They operate in deepwater environments where fixed platforms and direct pipelines are either technically infeasible or prohibitively expensive. Their ability to rotate and move around a subsea well is accomplished thanks to Floating Production Systems (FPS) swivels.

Typically comprised of electrical slip rings, hydraulic utility swivels and fiber optic rotary joints, swivels are used in buoys, turret moorings and offshore loading towers. These swivels permit the continuous delivery of electrical power and signals, hydraulic fluids, and fiber optic signals, with unlimited freedom of the vessel to rotate about its mooring point.

To remain on station, most modern FPSOs use advanced mooring systems which is anchored to the seabed with multiple mooring lines. The FPSO can rotate around this turret in response to prevailing wind, wave, and current conditions, which maintains platform structural integrity and safe operation.

To continuously transfer power, fluids, and signals across a rotating interface, the mooring system uses a swivel stack. These rotary swivels allow uninterrupted transfer of the following:

• Electrical Slip Rings – enabling power distribution and control signal transmission across the rotating interface.

• Hydraulic Utility Swivels – carrying hydraulic pressure for valve actuation, subsea controls, or chemical injection systems.

• Fiber-Optic Rotary Joints (FORJs) –providing high-bandwidth data transmission for monitoring, SCADA, and subsea communications.

FLOATING PRODUCTION STORAGE AND OFFLOADING (FPSO) UNITS PROCESS AND STORE OIL AND GAS EXTRACTED FROM UNDERSEA WELLS, AND CAN ROTATE AROUND THEIR STACK FOR BETTER DELIVERY OF THE PROCESSED OIL ONTO TANKERS.

COMPRISED OF ELECTRICAL SLIP RINGS, HYDRAULIC UTILITY SWIVELS AND FIBER OPTIC ROTARY JOINTS, SWIVELS ARE USED IN FPSOS TOP CONTINUOUSLY TRANSFER POWER, FLUIDS, AND SIGNALS ACROSS A ROTATING INTERFACE.

• Fluid Swivels – for oil, gas, water, and chemicals transported between topside facilities and subsea infrastructure. Moog specializes in designing integrated FPS swivels that combine these functions into compact, robust units certified for hazardous offshore environments. Their systems are engineered for high reliability under continuous duty, capable of handling hundreds of electrical channels, multiple high-pressure hydraulic passes, and multi-gigabit fiber-optic connections—all while withstanding harsh marine conditions.

According to Deepak Jagannathan, manager of strategic growth and innovation for Moog, “The swivel allows the ship to weathervane around. And,with a large FPSO, the diesel generator is your biggest carbon footprint. Reducing that is a huge win for the industry as a whole.”

As workhorses for deepwater oil production, FPSOs depend heavily on swivel technology. By enabling continuous, safe transfer of power, fluids, and data across a rotating turret, Moog’s integrated swivel stacks provide the critical link between subsea reservoirs and topside facilities. For engineers designing, operating, or maintaining FPSOs, understanding swivel systems is key to optimizing uptime, safety, and long-term asset performance. FPW Moog Inc. moog.com

Paul J. Heney • VP, Editorial Director

NFPA MAINTAINS A ROAD MAP Committee, one of the association’s largest and most active committees. Its job is to develop, maintain, and supplement a document called the NFPA Technology Road Map. This effort tries to align the ongoing development of fluid power technology with the needs of customers in the numerous core end markets. At this year’s NFPA International Economic Outlook Conference, several panelists from the committee discussed how fluid power is working with mobile and industrial machinery to drive efficiency, as well as what customers are asking for today.

For builders of mobile and industrial machines, the committee has identified four highlevel machine level performance objectives. Customers of these OEMs are asking that those machines provide increased availability and uptime, increased productivity and performance, lower total cost of ownership, and compliance with environmental and other regulations.

Ryan Jenkins, Hydraulics Engineer, CNH Industrial explained that all of these metrics matter to his company, although customers’ opinions can vary.

“They’re really hard to separate. When we talk about the drivers of why we build the machines the way we build them, it’s usually all of these together, almost with equal importance. But in some ways, productivity and performance outweighs the others because that’s really what is defining the value to the customer,” he said.

Jenkins noted that different customers have different approaches. Some really don’t care about the regulations, and instead are laser focused on how much they can get done with their machine and get the work done that they need to.

“In the mobile sector at least, there’s a lot of importance on the total cost of ownership. It also depends on what segment of the industry you’re in. If it’s agriculture versus construction, if you’re talking high horsepower versus low horsepower, the way that these show up and the way that they get graded and weighed is different.”

For Anant Jain, Area Sales Manager, Danfoss Power Solutions, the key customer drivers also depend on the industry they are dealing with.

“For industries like oil and gas, the key value for them is uptime. They cannot have downtime. The key part for them is if they have downtime, they are paying penalties. So, we need to provide the product which is in line with that,” Jain explained.

“I think the availability of time and productivity and performance have always been the key drivers,” said Jon Jensen, Product Sales Manager for Energy Related Products, SMC Corp. “[A customer may say] ‘I need to make so many widgets per minute on this machine, and I want it to be at an attractive price for that particular machine.’ The lower total cost of ownership conversation was not one we were having. Now, we’re starting to see more of that because traditionally the capital equipment buyer does not get any incentive to purchase a machine that costs less to run or costs less to own. That was another person’s department.”

However, Jensen said they are starting to see that there’s more cross talk in the bigger companies — that not only do they need to buy a machine at a good price that does what they need it to do — but they also need to consider the cost of ownership.

“I think along with the total cost of ownership, we’re also seeing, especially in large manufacturers of fast-moving consumer goods and food products, that they’ve all published a goal to be carbon neutral in the next few years and some of them have an idea that’s not moving the needle,” he said. “So, we’re starting to see not only should we reduce our energy costs, we need to also reduce our carbon footprint of our own factory and including the products we buy; they need to have a lower carbon footprint.”

IN OIL AND GAS, UPTIME IS THE MOST CRITICAL CONSIDERATION.

“For industries like oil and gas, the key value for them is uptime. They cannot have downtime. The key part for them is if they have downtime, they are paying penalties."

—Anant Jain, Danfoss Power Solutions

Given the size of equipment that CNH produces, Jenkins said that electrification is not one of their top priorities, but there are a couple of different sides to electrification.

“It’s not just decarbonizing the prime mover,” he said. “In my mind, it’s also an evolution to more electronification. A lot of our equipment that we’ve produced, we’ve produced for years and years and it’s great iron, as we call it. But it’s a largely mechanical system that doesn’t have a lot of circuits on it that are electrical or intelligent. Part of what we’re trying to do is become a tech company as well is making those machines have more of an electronic presence — to increase our connectivity and be able to increase some of the performance, whether that’s precision control, automation, and all sorts of tools.

Jenkins said that sometimes what he sees discussed is going to a full electric machine.

And in other areas of the mobile industry, electrification is certainly a higher priority for more of that traditional electrification concept.

“But I think with the larger equipment in ag and construction, it’s more of a broad sustainability point of view and electrification may not be the most reasonable approach. However, it will come in parts of the machine that are going to be more electrified or at least have more of an electronic presence than they used to,” he said.

Jain added that maybe the electrification bandwagon has slowed just a bit.

“All our distribution partners we work with are working on an electrification package and all the OEMs we work with also are building some sort of electrified machine. But when I was in Bauma in April, I noticed that it wasn't as big of a push as it was back at Bauma in 2022. Everything then was electrification, electrification — and then you go this year and there was not much noise about it. Electrification is not going anywhere, I just think it’s cooled a little bit,” said Andy Gray, Director of Sales – North America, Scanreco.

“I think it really does depend on what part of the industry you're looking at,” said Jenkins. “For something like a Class Nine combine, electrification probably won’t make sense. But if you’re talking about little 100-hp or below tractors, it starts to make a lot more sense. We’ve seen that maybe some of that initial excitement has cooled down some because we’re realizing that certain markets are not going to be asking for it.” FPW

Josh Cosford • Contributing Editor

HYDRAULICS OPERATE AT HIGH PRESSURES THAT IF RELEASED ACCIDENTALLY, CAN CAUSE SERIOUS HARM. IT IS CRUCIAL TO FOLLOW PROPER SAFETY STEPS WHEN DEALING WITH PRESSURE LOSS.

“WITH GREAT POWER COMES GREAT RESPONSIBILITY,” could not be any truer of hydraulics. These wise words, first penned by Voltaire (and not Peter Parker's uncle Ben), warn us fluid power professionals that the highest power density mechanical transmission method should be respected for its potential to cause harm.

High-pressure injection injuries are perhaps the most nefarious danger in hydraulics. Although not as immediately lethal as some other dangers, when a high-pressure jet of hydraulic oil penetrates your skin, the

subsequent horror could disfigure you for life. Injection injuries occur when a pinhole leak creates a mini waterjet that can slice through or into your body with ease.

Hydraulic fluid injection injuries most frequently occur on the hand as mechanics and technicians touch or brush up against an unknown pinhole leak, which can be hard to see. Even gloves don’t stand a chance against a 3,000 psi liquid laser. If you’re feeling brave, search Google images for "hydraulic oil injection wound" to see why this is so dangerous (warning: not for the queasy). To prevent this,

use visual inspection methods such as fluorescent dyes, and never touch the spray from a fitting, hose or other component.

A sudden and catastrophic failure of a hose or fitting poses a similar risk for injection but may also allow the sudden movement or drop of a load, such as a bucket, boom, or platform. Although modern machines will use counterbalance or check valves to prevent dropped loads, older machines may not be so equipped. Avoid operating under a hydraulically locked machine, and instead, use physical supports as support. And again, do not try to stop the

escaping fluid with your hands. Just because it looks like a leaking garden hose doesn't mean it won’t slice your hand in twain.

When working on machines, always eliminate stored or potential energy. Working under a machine supported only by hydraulics could result in the previous scenario, where loads may drop onto the mechanic. Even when locked out, a machine may still store potential energy simply by its mass, creating trapped pressure with the potential for harm. An elevated load creates a similar pressure profile as a hydropneumatic accumulator, and you must be sure to dump stored energy back to tank using the safety valves all accumulators should have installed.

Stored hydraulic energy can travel unpredictably through the hydraulic system, even backwards, where it can damage sensitive components or cause unintentional movement. Well-designed systems will have provisions and circuitry to prevent any drama, but again, you never know who designed or built an old

machine. Always verify that sources of potential energy are neutralized.

And if you think a jet of hydraulic fluid is dangerous, you should see a hydraulic flame thrower. Hydraulic oil, being a hydrocarbon, is flammable, and especially so when it's atomized, as when it's spat out under high pressure from a leak. Despite the mostly metal construction of hydraulic machinery, they can quickly turn into enormous fireballs in the right conditions. Be sure to keep open flame away

from machines using mineral oil-based fluid, especially while the machine is running. For machines operating near open flame or around molten metal, special fire-resistant hydraulic fluid must be used.

Because of the power potential of hydraulic machines and the unique nature in which they operate, you must take care to avoid dangerous designs and habits. Always keep in mind the potential dangers of a hydraulic machine so you never become complacent with safety. FPW

Smart testing tools and structured maintenance strategies help companies extend equipment life, cut costs, and boost uptime without compromising safety.

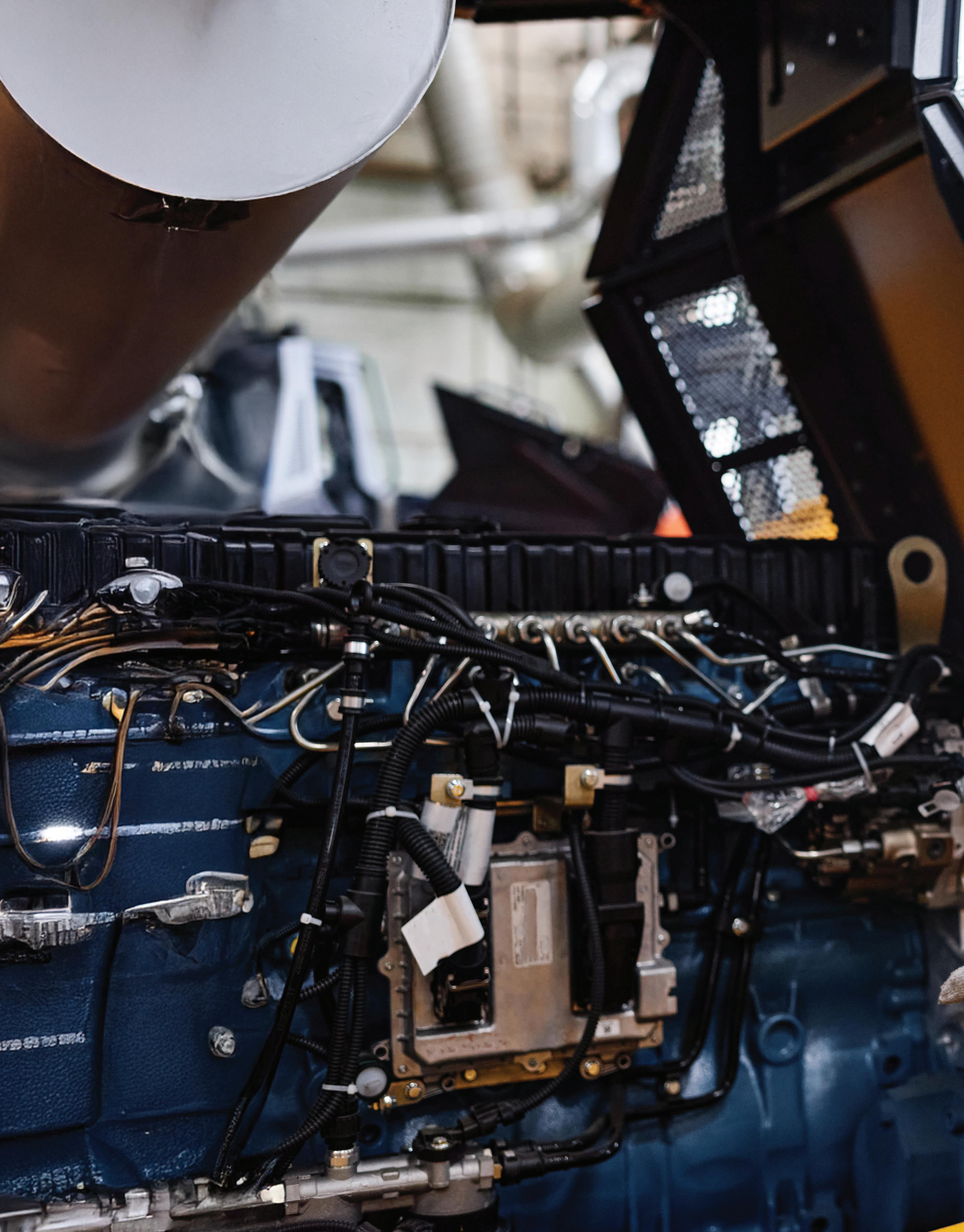

By Martin Cuthbert, Managing Director, Webtec

COMPANY supporting mines and oilfields with hydraulic powered machinery, one factor second only to safety is maximizing machine uptime. Fleets of mobile and industrial machines inevitably age and, in turn, become less reliable, reducing uptime and potentially damaging the company reputation. In this situation, the choices are clear: make large capital investment in new machinery, or attempt to get the most value from the machinery you already own such as excavators, crushers, winches and mobile drilling rigs without compromising safety or reliability. It’s time to get smart with hydraulic maintenance.

This challenge is typical of many that Webtec encounters when helping mobile and industrial machinery OEMs and operators with their measurement and control solutions. Customers find themselves in this position due to three common challenges that include: a team that lacks experience or the necessary training; the absence of a structured maintenance program; and high operating costs.

The antidote to team inexperience is competence-based training. The company has long-standing relationships with

training providers around the world to help companies build a team with skills and proficiency in hydraulic maintenance. When looking to identify an authorized training course, Webtec turns to relevant associations such as: CETOP in Europe; the NFPA (National Fluid Power Association) in the United States; the BFPA (British Fluid Power Association) in the UK; or the IFPS (International Fluid Power Society), which hold registers of accredited training organizations. Webtec is also an advisory member to the NFPC (National Fluid Power Centre) in the UK which offers in-person

and online training as well as free online assessments to test prior knowledge.

Any company looking to improve machine reliability needs to develop a structured maintenance program that identifies the tasks and tools required to improve the situation.

If the maintenance manual for older machinery has gone missing, it may be necessary to develop one in-house, perhaps by reverse engineering a machine to determine its circuit and what

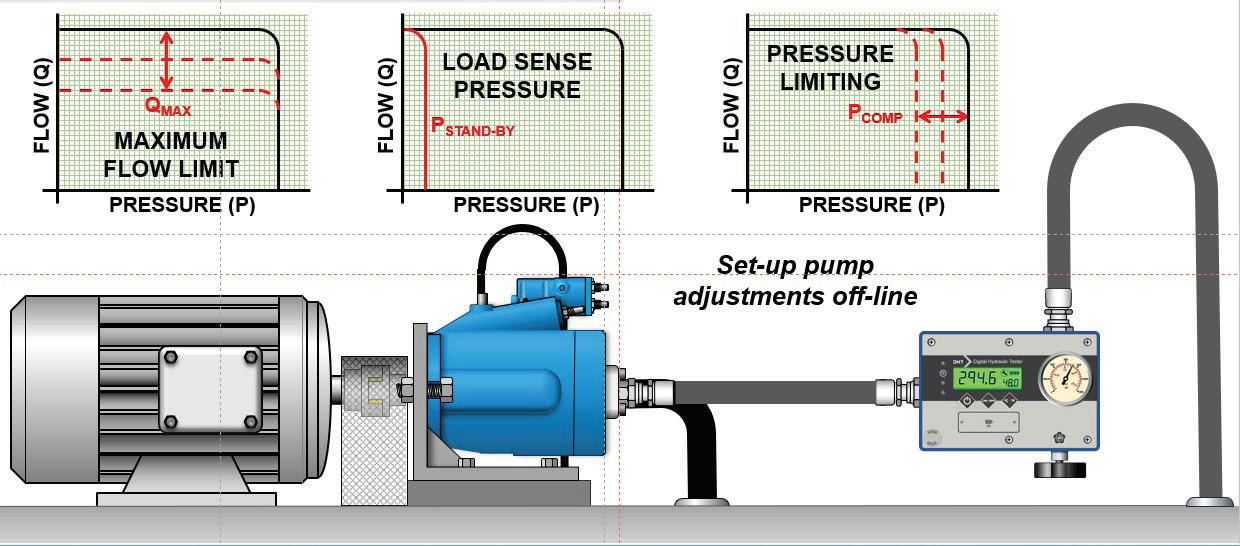

SETTING OPTIMUM FLOWS AND PRESSURES FOR EXCAVATOR ATTACHMENTS

maintenance it requires. This maintenance will fall into different categories: reactive (wait for it to go wrong and fix it); preventive (estimate when it will go wrong and fix before it does); predictive (monitor condition and fix when necessary); and proactive (try to stop it going wrong or minimize the consequences of a failure if it does).

Predictive maintenance differs from the others in that it involves online condition monitoring via the permanent installation of sensors. This is a topic for another day, whereas the focus here is on portable tools you can use for proactive, preventive and reactive maintenance.

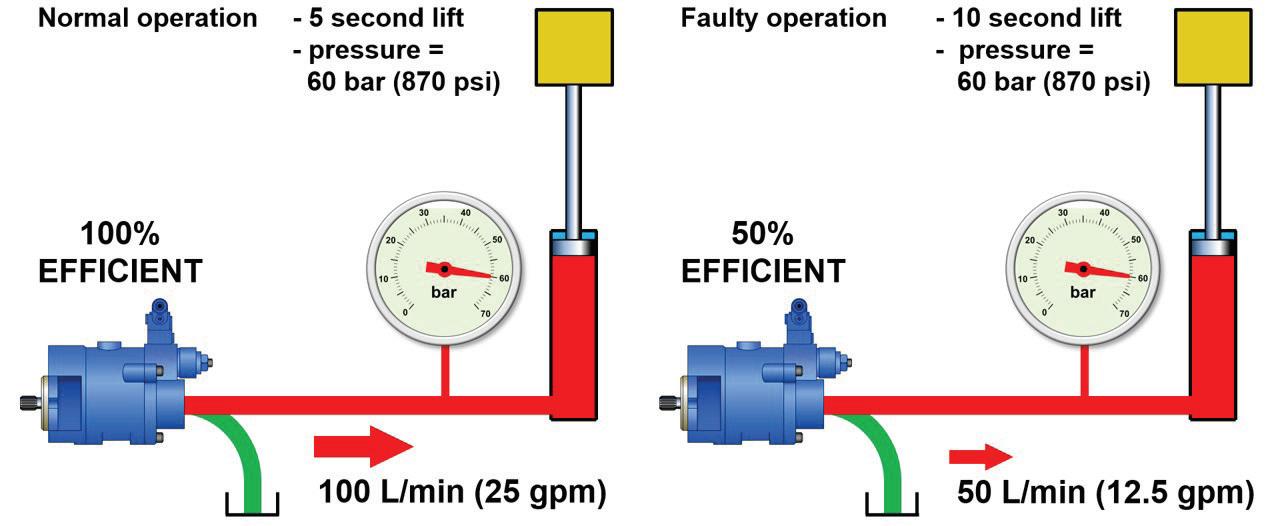

To monitor pressure, the trusty tool of choice for many is a glycerine pressure gauge. But is that really the answer to

everything? Consider the example of a 100% efficient pump running at 60 bar that feeds 100 lpm of hydraulic oil into a cylinder for lifting a weight in a cycle time of 5 seconds.

If the technician puts the same glycerine pressure gauge on a pump that is only 50% efficient, the pump will still run at 60 bar even though it would only deliver 50 lpm of oil to the cylinder and take 10 seconds to lift the weight. Therefore, using a glycerine pressure gauge will not diagnose the fault because the pump’s operating pressure shows as the same value. You need to know the flow, because the flow determines the speed.

Webtec offers a trio of products when it comes to hydraulic testers: the RFIK, DHT and DHM series.

The RFIK is a purely mechanical tester, using the pressure drop to move a piston

against a spring for operation that is independent of batteries or electronics. In contrast, DHT and DHM series testers use a turbine flow sensor, offering more precision and compatibility, as well as bi-directional flow measurement. The DHM also adds wireless connectivity, internal memory and real-time visualization for advanced diagnostics. Importantly, all Webtec hydraulic testers measure flow, pressure and temperature. They also include an integral load valve and built-in Interpass safety protection for complete peace of mind.

With the right hydraulic tester, it becomes possible to deliver regular cost-effective proactive, preventive and reactive maintenance as necessary.

The first area to target should be ensuring effective proactive maintenance, for example on construction machinery where tools should be commissioned before use. An excavator could switch attachments between machines on a daily basis. Operators simply assume that everything is interchangeable and will just work. However, it is not that straightforward. Unless you have a very modern excavator with an auto-setup feature, users should set up correct flow, pressure and back-pressure on each hydraulic excavator attachment before use.

Doing so will lead to enhanced performance, extended attachment operating life, reduced downtime, improved safety and lower costs. A Webtec DHT tester provides the optimal solution through inline installation at the end of a boom. The DHT will quickly and precisely check the flows and pressures that the excavator delivers.

Another example of proactive maintenance would be setting up a variable displacement axial piston pump

in terms of its displacement limiter, standby (load sense) pressure and pressure limiter (compensator). Here, Webtec’s DHT presents a way forward.

The service manager also needs to ensure existing machinery is subject to regular checks, which links to their preventive maintenance strategy. Preventive maintenance could mean estimating the life of the pump (for example) to identify the optimal time for replacement. With preventive maintenance, the technician can take tests over time to see how the pump is performing compared with previous experiences and the OEM’s specification.

Using a device such as the Webtec DHM tester also introduces the ability to perform datalogging and the transfer of results to a smartphone. This capability means historic data is automatically stored for future reference.

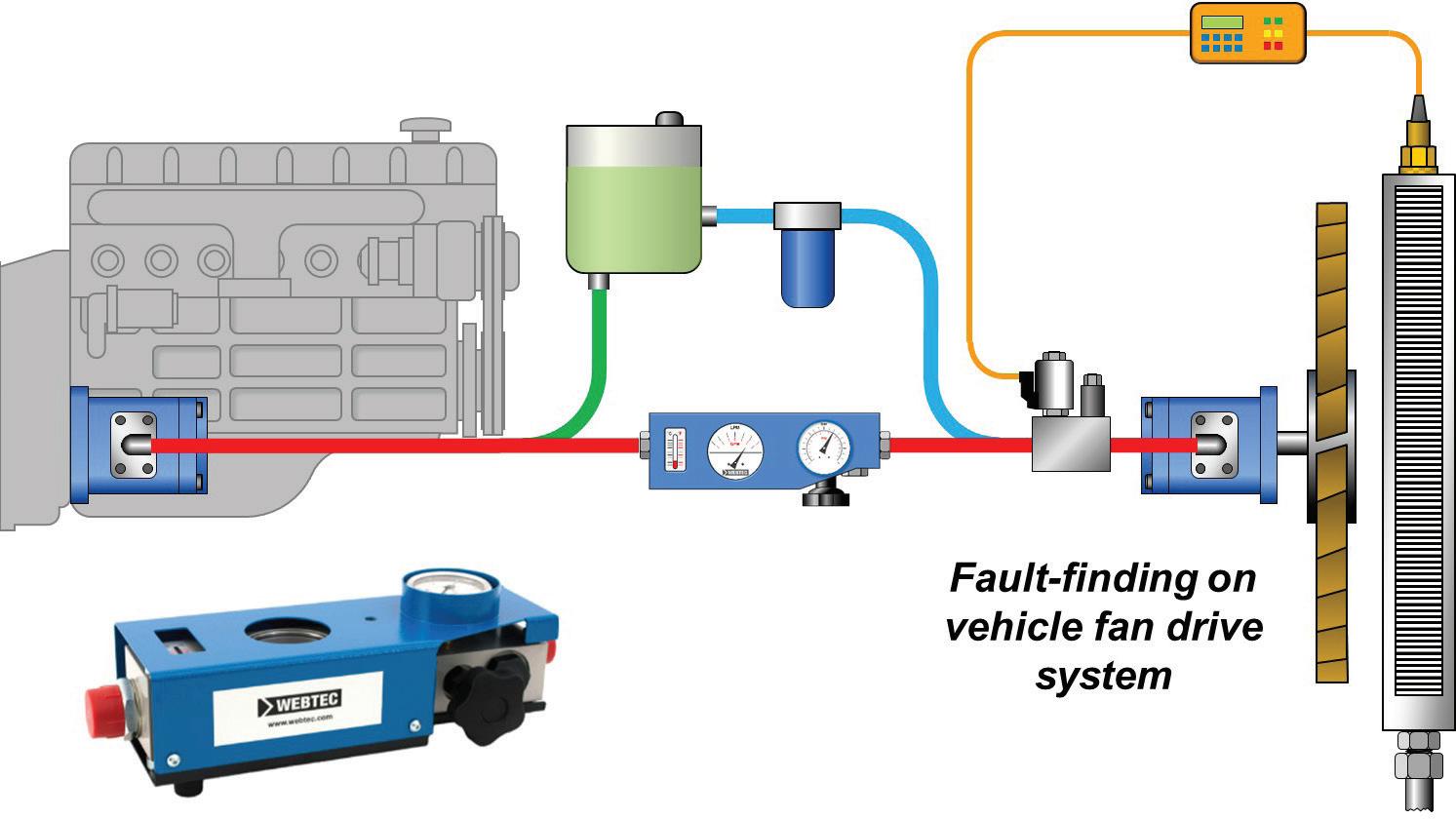

Although typically a last resort, reactive maintenance still has its place simply because service managers need to make fault identification as efficient as possible during troubleshooting. Subsequently, if breakdowns occur, they can be dealt with quickly.

Take the example of fault finding on a fan drive system for a pump or main excavator

drive, where installing the Webtec RFIK hydraulic tester will pay dividends.

As already explained, testing pumps at low pressure may appear to show the correct flow rate. However, with the help of the Webtec load valve, technicians can restrict the flow, elevating the working pressure to the pump’s normal operating level.

The user will subsequently see volumetric efficiency deteriorate more quickly if the pump is worn, in comparison with a new pump.

By overcoming the three main challenges of an inexperienced team, the absence of a structured maintenance program, and high operating costs, a busy mining or oilfield services company operating a lot of hydraulic machinery can increase uptime and prevent possible damage to its reputation. Perhaps most importantly it can reduce costs and delay the need to buy new machinery. FPW

Webtec webtec.com

Since 1945, OFCO has specialized in turning ideas into custom-manufactured filtration solutions, built to your exact specifications.

We have these products & more available for all your hydraulic tank requirements.

By Mary C. Gannon, Editor-in-Chief

Contitech is poised for growth with independence, plant expansions, and a stable manufacturing base.

Continental is undergoing one of the most significant transformations in its history — the spin-off of its ContiTech group. For the Americas region, that change means sharper focus on core markets, a stronger distributor base, and new opportunities in energy, mining, agriculture, and beyond.

FPW sat down with Andreas Gerstenberger, CEO of ContiTech USA and Head of Business Area Industrial Solutions Americas (IAM), to discuss what the restructuring means for customers, how tariffs and onshoring are shaping strategy, and where the company sees its next phase of growth.

FPW: Let's start with the biggest news — the spin-off that's going to happen eventually here of the ContiTech group from Continental. Is the goal to have that all done by the end of this year?

Gerstenberger: What we can say is that if you look at the history of Conti, this is one of the most fundamental changes the group is going through.

(For example, more than 20 years ago, Continental made several major acquisitions, culminating with Siemens VDO, which included several different divisions to basically build a new automotive supplier giant at that time.) It was the dream then to continue to grow and diversify, which led to further

CONTITECH RECENTLY HOSTED ITS TOTAL CONVEYANCE EVENT IN CELEBRATION OF THE EXPANSION OF ITS CONVEYOR BELT MANUFACTURING FACILITY IN PONTA GROSSA, PARANÁ, BRAZIL. TOTAL CONVEYANCE PROVIDES CUSTOMERS WITH AN INTEGRATED APPROACH THAT COMBINES PRODUCTS, SERVICES AND DIGITAL TECHNOLOGIES TO SUPPORT MATERIAL HANDLING ACROSS MINING, AGRICULTURE, CONSTRUCTION AND LOGISTICS.

acquisitions and moves of different businesses under the roof of Continental. That gave a very good run for the company, for its customers, and its people. And now, in the last couple of years, I would say the change here in America, and also globally — not only in the automotive industry — is requiring different organizational setups and more focus. Instead of being so diversified that sometimes you don't know what's on the left or right side, that's what's driving it. And that's why Conti as a group — declared fittingly on the Fourth of July — independence for the three sectors, as we call them today.

So what we are doing in ContiTech, and what that means for us here in the Americas, is that we see it as an opportunity to be more focused on our customers. And if you take out the automotive side for GM, Chrysler, and so on and so forth … we do not have too many customers together with tires or with automotive that we share. We do have, for example, customers like John Deere or Caterpillar, where we provide products like tires or automotive brakes. But if I look at our distributor base — and more than half of our business here in America is distributor-based — we have a different customer base to focus on.

FPW: How has the distribution base reaction been?

Gerstenberger: We have a customer council on the distributor side, and we met with our end users. They have said, “We ask you to continue to do what you're doing, and focus on us customers, and then we will stay with you, as we did before.” We have a very strong base.

FPW: You're poised for growth, with a lot of opportunity to hone in on the industrial market. And like you said, 50% of your business is distributors. Is that where you want to keep going? Or do you think that with this change, you might move more toward a different side of the business?

Gerstenberger: Here in this region, we do most of our business in five countries — Canada, the U.S. (by far the biggest), Mexico, Brazil, and Chile. And if you look at

the GDP of those different countries and compare them and the growth predictions you have for Canada, the United States, Mexico, and Brazil, compared to other GDPs globally where my colleagues in Asia Pacific or in Europe are active, then we are in a very blessed region. The Americas overall is one of the biggest growth regions in the world.

We are in energy. We are in oil and gas. We are in hydrogen. We are mid, up, and downstream — active along the energy value chain in the region and also globally. Mining, e.g. copper which is not only strong in the United States, but also in Brazil and Chile which is important in the energy transition, including building data centers and the required batteries to support them. We are active in food and beverage. North America is very independent of food imports. We have a very strong

WITH THE OPENING OF ITS PLANT IN AGUASCALIENTES, MEXICO, GERSTENBERGER SAID THAT CONTITECH CONTINUES TO EXPAND ITS “IN THE REGION FOR THE REGION” MISSION, AS IT IS POISED TO BETTER SERVE THE NORTH AND SOUTH AMERICAN MARKETS.

agricultural sector here in the country, with plants in Nebraska and Iowa.

We see a chance with onshoring. Companies coming back and expanding what they have — because we are in construction design, in material, and in hydraulic solutions, which are helping those companies to build or rebuild their facilities. So overall, we are quite optimistic.

We want to go more into systems. For example, we are working in our conveyor belt business — which we call Total Conveyance. This is our largest business in the region in terms of sales. What does that mean? If you operate a mine, the major concern of a mine operator is not if the conveyor belt is working. The major concern is, how many tons of whatever they are mining do I get out every day, and send for production. The conveyor belt is

just the means of getting it there. So what we are trying to do is take care of the entire system for the miner, which is far more than the conveyor belt. It has to do with digitalization, with predictive maintenance, with engineering know-how, and with people directly on the front line, working for the customer, on the ground with the customer, with our products and other products. That will be a new approach if you look at the value chain, rather than being just a component supplier.

We are pretty bullish when we look at the region. If you look at the economic data, we have challenges like every other company, but also many opportunities related to that.

FPW: How are tariffs affecting this growth plan?

Gerstenberger: I think the biggest challenge to any change is the uncertainty that comes with it. And I think companies like ContiTech are used to change. We are also used to managing uncertainty. The question is, how long can we live with this uncertainty? Because when you have uncertainty, regardless of who you are and where you are, most companies and human beings first hold back and wait. And waiting as an entrepreneur means I'm not investing as much as I wanted to, I'm not doing the next thing because I will wait. I think that's a little bit of the concern right now related to tariffs. We will do the best with the situation thanks to our footprint. Would we be impacted if certain tariffs stay or are increased for certain products? Yes. But the impact for us is manageable, and with a new plant in Mexico, and our plant in Canada, and the rest here in the United States, we have more than 90% of what we use here in the region.

FPW: You're already manufacturing where you're selling. And you are sourcing more locally where you can?

Gerstenberger: Yes. Long before this tariff discussion, we had a philosophy in the Conti group called, "in the region, for the region" — so in the country, for the

country. If you are more in the Americas, it doesn’t make sense, as it maybe did 20 years ago, to produce everything in Southeast Asia. For us, a big wake-up call in that direction was COVID. When COVID happened, we started to proactively look for finished products and also raw materials or compounds as close as we can to our origin of production and sale. And the vast majority of our sales in the region are in the United States. So that’s where most of our plants are. We still source certain raw materials from other regions, and we are working with purchasing and R&D to minimize it as much as we can.

FPW: Size-wise, how big is the Norfolk hydraulics business compared to others in the region or world?

Gerstenberger: If you look at our hydraulic capacities globally, and our expertise in hydraulics globally, the vast majority of the origin of the hydraulic expertise comes from Norfolk, Nebraska. That was then exported and shared to other facilities in Asia and in Europe many years ago. And now, with the plant in Aguascalientes, Mexico, Norfolk is the mother plant, helping to build up this brand-new facility in terms of capacity. If you look at the new plant and then Norfolk, the new plant would be significantly bigger than Norfolk. But Norfolk is not only doing hydraulics — they’re also doing other things, and I think that’s the strength they have.

FPW: Let's talk a little bit about the Mexico plant and its grand opening.

Gerstenberger: We officially opened on the 25th of August. It is our biggest plant in hydraulics in the region, and it was a pretty fast process. We had the groundbreaking at the beginning of last year. The official opening will be coming this November. It will be a plant working in phases. So if we're doing well in the first phase, then we go to the second and then the third phase. The capacity can be used almost like a butterfly — you have a center line and then you can double, then triple each line.

FPW: In the past year, you have been doing many product developments and releases in the hose field, not just hydraulics, even with data cooling and food hose. Let's talk about your plan for future product growth.

Gerstenberger: If you look at our portfolio today, we have four major product groups — conveyor belts, fluid power/ hoses, power transmission belts, and air springs. We consider ourselves to have opportunities in terms of hydraulics, and that’s why we are investing. This is also an area where acquisitions could make sense, on a regional but also on a global basis. For conveyors, we consider ourselves already pretty well-positioned here in the region. We have various plants in Marysville, Ohio, and Lincoln, Nebraska. And we are also in South America. With the latest expansion, which we just opened in Ponta Grossa — a $30 million expansion — we see more opportunity. On the air spring side, we are very well positioned with certain OEM customers who build trucks or trailers.

And then there are other areas where we are trying to excel more, and that is this total conveyance, or service mindset. That’s why we also looked into data cooling hoses, which is a huge change in the entire region. If you talk to companies, North America is probably one of the leading regions pushing this more than Europe at this point in time. We had been approached some years ago by some of our really close customers if we wanted to be development partners. And that’s exactly what happened, and that’s what we then launched at the last NAHAD in San Diego to the market.

IN THE PAST YEAR, CONTITECH HAS LAUNCHED SEVERAL NEW HOSE LINES, INCLUDING THE X-LIFE XCP5 HYDRAULIC HOSE WITH BRAIDED CONSTRUCTION FOR HIGH-PRESSURE APPLICATIONS IN AGRICULTURE, MINING, MANUFACTURING, CONSTRUCTION AND ENERGY INDUSTRIES. ADDITIONALLY, THE COMPANY HAS EXPANDED WITH HOSES FOR FOOD SERVICE, DATA CENTERS, AND MARINE APPLICATIONS.

I think this data center business is going to keep going well. All those data centers need energy. But if I can say, together with my colleagues, we make sure that our data center solutions support your AI solutions. We have to think and communicate more in value chains, and not only products. We want to be strong in our classics, but we also want to set innovation highlights here and there. And that’s true for all products we have in our portfolio.

FPW: With some of your preventive maintenance technology in conveyance, will you take that technology to your other groups?

Gerstenberger: If you consider tire pressure monitoring, which today is normal, that’s progress toward a smart tire. And I would say that’s also true for hoses. We have tested various potential solutions for measuring pressure in a hose.

If you have highly technical, demanding solutions — like in highpressure hydraulic operations, or in conveyor operations — predictive maintenance related to safety would be very helpful, and customers would appreciate it. There’s not one answer for the total market. I would differentiate a little bit by channel, absolutely, and by application — it makes total sense.

FPW: How are industry regulations impacting your sustainability initiatives in terms of rubber development?

Gerstenberger: The meaning of sustainability in the region really differs by country. And if you then look globally, it differs even more by region. For us as a corporation in the current structure, Conti decided for its corporate goals to include sustainability with sub-objectives. That’s true for Automotive, for Tires, and for Tech.

For example, here in America, in Mount Pleasant, Iowa, we developed for garden hose a solution that, in the end state, contained more than 90% recycled material. We launched that product to the market, but the demand here was very limited. On the other side, if you talk to conveyor belt customers in Canada, for example, they want to know: how can you help me recycle?

We are trying, also on the component side and on the mixing side — which starts with product and design — to use materials that are more environmentally sustainable, and to exchange certain sources that are no longer compliant, which is driven by purchasing. In general, we are adapting because of regulations and customer requirements.

I think some of the key questions that companies and customers should ask are: why is it good for me to be part of a circular economy? What does it cost me? What does it bring me? Can I use that to help convince my eventual end-users? It will remain, it will be here, but it must be differentiated. FPW