CStoreDecisions

CStore Decisions highlights five growing chains with fewer than 70 units standing out in the industry today.

p. 12

Aulakh is VP of marketing and a second-generation member of his family business, Onvo — one of this year’s Emerging Chains to Watch. p. 18

At House Autry we make serving southern flavor easy and quick. With more than 200 years of milling breadings, mixes and batters with southern spice blends, there’s no easier way to offer authentic southern-made fried chicken or seafood, biscuits, hushpuppies, pancakes and more.

Leading Through Innovation

EDITORIAL

VP EDITORIAL — FOOD, RETAIL & HOSPITALITY

Danny Klein dklein@wtwhmedia.com

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR Kevin McIntyre kmcintyre@wtwhmedia.com

EDITOR EMERITUS John Lofstock

CONTRIBUTING EDITORS

Anne Baye Ericksen Marilyn Odesser-Torpey

EVENTS DIRECTOR OF EVENTS

Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MANAGER

Jeannette Jelks jjelks@wtwhmedia.com

EVENTS COMMUNICATIONS COORDINATOR Emma Paul epaul@wtwhmedia.com

WTWH MEDIA, LLC

1111 Superior Ave. Suite 1120 Cleveland, OH 44114

Ph: 888-543-2447

SUBSCRIPTION INQUIRIES:

LEADERSHIP

CHIEF EXECUTIVE OFFICER Matt Logan mlogan@wtwhmedia.com

CHIEF OPERATING OFFICER George Yedinak gyedinak@wtwhmedia.com

CHIEF REVENUE OFFICER Scott Kelliher skelliher@wtwhmedia.com

VP OF OPERATIONS Virginia Goulding vgoulding@wtwhmedia.com

SENIOR VP, AUDIENCE GROWTH Greg Sanders gsanders@wtwhmedia.com

CREATIVE SERVICES

VP, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

CONTENT STUDIO VP, CONTENT STUDIO Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO Drew Filipski dfilipski@wtwhmedia.com

SALES TEAM

SENIOR VICE PRESIDENT OF SALES & STRATEGY Matt Waddell mwaddell@wtwhmedia.com (774) 871-0067

KEY ACCOUNT MANAGER John Petersen jpetersen@wtwhmedia.com (216) 346-8790

SALES DIRECTOR Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

SALES DIRECTOR Mike Peck

mpeck@wtwhmedia.com (917) 941-1883

MARKETING MANAGER Jane Cooper jcooper@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE Annie Paoletta apaoletta@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Nate Brazier, CEO

Stinker Stores • Boise, Idaho

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Herb Hargraves, Chief Operating Officer

Sprint Mart • Ridgeland, Miss.

Bill Kent, Chairman and CEO

The Kent Cos. Inc. • Midland, Texas

Nick Triantafellou, Director of Marketing & Merchandising

Weigel’s Inc. • Knoxville, Tenn.

Dyson Williams, Vice President

Dandy Mini Marts. • Sayre, Pa.

NATIONAL ADVISORY GROUP (NAG) BOARD (RETAILERS)

Greg Ehrlich, (Board Chairman) President

Beck Suppliers Inc. • Fremont, Ohio

Joy Almekies, Senior Director of Food Services

Global Partners • Waltham, Mass.

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Richard Cashion, Chief Operating Officer

Curby’s Express Market • Lubbock, Texas

Megan Chmura, Director of Center Store

GetGo • Pittsburgh

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Kalen Frese, Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Joe Hamza, Chief Operating Officer

Nouria Energy Corp. • Worcester, Mass.

To manage current print subscription or for a new subscription: https://cstoredecisions.com/cstore-decisions-subscriptions/

SUBSCRIPTIONS: Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries.

CStore Decisions (ISSN 1054-7797) USPS Publication #5978 is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 1120, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers.

Periodicals postage paid at Cleveland, OH, and additional mailing offices.

POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, Suite 1120, Cleveland, OH 44114. GST #R126431964, Canadian Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2025 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means,

Beth Hoffer, Vice President

Weigel’s • Powell, Tenn.

David Land II, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Lenny Smith, Vice President

Crosby’s • Lockport, N.Y.

Dyson Williams, Vice President

Dandy Mini Marts • Sayre, Pa.

Hussein Yatim, Vice President

YATCO • Marlborough, Mass.

Vernon Young, President and CEO

Young Oil Co. • Piedmont, Ala.

Supplier Members

Kyle May, Director External Relations

Reynolds Marketing Services Co. • Winston-Salem, N.C.

Todd Verhoven, Vice President of Sales

Hunt Brothers Pizza • Nashville, Tenn.

Steve Yawn, Director of Sales

McLane Company Inc. • Temple, Texas

Editor’sMemo

EACH YEAR CSTORE DECISIONS RECOGNIZES up-andcoming convenience store Chains to Watch. These days we see so many chains modernizing for tomorrow, expanding their footprints, remodeling, and innovating with technology and foodservice that we’re making this section a bigger focus than ever before, so we can truly celebrate the strides so many c-store businesses are making today.

In this issue, we’ll be recognizing five convenience store chains with fewer than 70 units that are standing out. These chains were selected following a nomination process and vetting by CStore Decisions’ editorial team.

Then in October, we’ll highlight five chains with 70 or more units that are making waves in the industry. There is still time to nominate larger chains for the October feature here: Cstoredecisions.com/2025-chains-to-watch/.

Chains to Watch has historically celebrated smaller convenience store chains that are emerging as more powerful players in the industry. In today’s highly competitive, consolidationheavy landscape, it’s more challenging than ever for smaller chains to compete, which makes the five chains you’re going to meet in this month’s cover story even more impressive. Our five Emerging Chains to Watch are focused on growing in ways that are often the domain of much bigger c-store entities. They’re innovating with foodservice, technology and store design; expanding through acquisitions, new-to-industry stores and/or internal operations; and pushing boundaries in new ways.

Take Yatco, which began the year with 13 stores and has already opened another four, bringing it to 17 locations. The chain is on pace to have opened a total of six new sites by the end of 2025 — a nearly 50% increase, and it has even more aggressive plans to expand beyond that. All five of these chains are carving a distinct path forward, leveraging creativity, customer focus and strategic investment to become tomorrow’s major players.

This issue also covers some additional pressing topics for c-store retailers. Learn about how artificial intelligence is converging with loss prevention to give c-stores a leg up on crime prevention. And, get inside advice from Loop Neighborhood on the ins and outs of launching a privatelabel program. As always, we have the latest overview on what’s happening with the tobacco landscape. Plus, read up on how retailers are driving traffic with frozen treats, from ice cream and milkshakes to frozen dispensed beverages, including frozen coffee and frozen energy beverages. And if foodservice is top of mind for your chain, check out our article on taking your lunch business to the next level.

If you’re a c-store retailer heading to the NACS Show in Chicago this October, we hope you’ll join us in honoring Stinker Stores as the 2025 Chain of the Year. We’ll be celebrating at Roof on theWit with the best views in the city on the evening of Oct. 15. We know it will be a busy night, so we hope you can drop into the event as it fits your schedule. Here’s the agenda to help with your evening plans:

5:30 p.m. Cocktail Hour, 6 p.m. Buffet Dinner, 7:15 p.m. Award Ceremony begins, 8:30 p.m. Event concludes. Supplier companies must sponsor to attend. Retailers must RSVP (it’s free). Register here: Cstoredecisions. com/2025-chain-of-the-year.

With c-stores rivaling traditional fast-food restaurants, they need to monitor seasonal dining trends, prioritize value and cater to customer preferences.

Beverages are a hot category when the weather gets warmer. As summer continues, cold drinks are still popular traffic drivers. According to 84.51˚, beverages that households consume more often during summer are:

Source: 84.51˚ and Kroger Precision Marketing, “Real Time

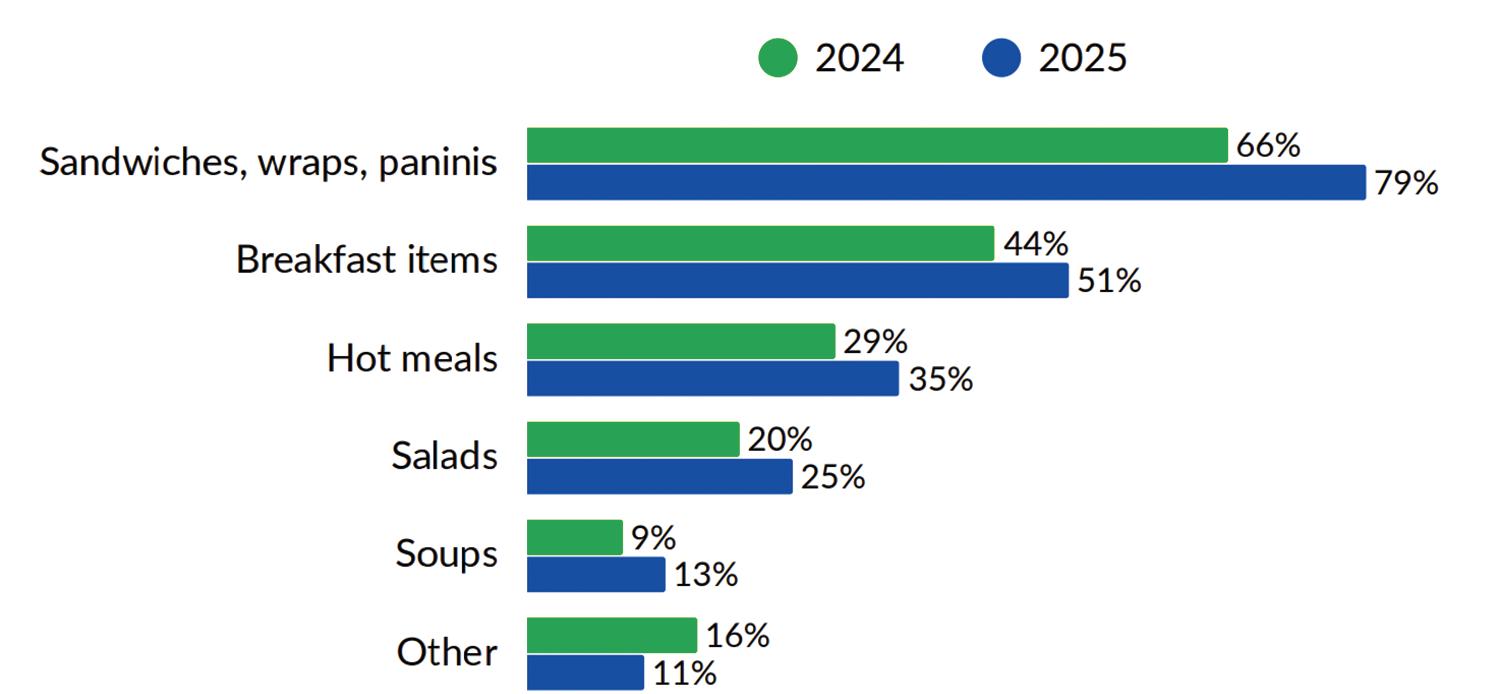

When asked “What types of made-to-order meals do you usually purchase from convenience stores?” respondents to Intouch Insight’s survey said:

Changes in weather can often shift dining habits among consumers.

Value is increasingly becoming a high priority for food shoppers. Consumers are looking to spend on value meals, and c-store retailers are taking notice.

• According to 74% of survey respondents, more meal choices would make value offers more appealing.

• Seventy-two percent said lower prices would make value offers more appealing, and 72% also said customization options would bring appeal.

• Seventy-two percent of consumers see c-stores as a viable alternative to quick-service restaurants, up from 56% in 2024.

Source: Intouch Insight, “Convenience Store Trends Report 2025,” June 2025

C-stores nationwide have established themselves as destinations that prioritize foodservice. And food has the potential to attract customers looking for a quick meal. Businesses looking to capitalize on food trends should, according to Mintel:

• Appeal to consumers seeking a balance between treating themselves and maintaining a health-conscious lifestyle

• Offer diners the chance to customize spice levels or try out alternative sauces

• Appeal to younger demographics through social media campaigns that promote dishes, limited-edition menu items and special events

Source: Mintel and Snoop, “'Posh Poultry’: The Rise of Premium Fast Food,” June 2025

CStore Decisions is proud to announce Stinker Stores as its 2025 Chain of the Year. The Boise, Idaho-based chain stands out from its best-in-class new-to-industry stores to its revamped loyalty program and mobile app to its commitment to a people-first culture, foodservice and future-focused growth. But what truly sets Stinker Stores apart is its unwavering commitment to continuous improvement, consistently upgrading and refining its systems and programs. Refusing to settle for ‘good enough,’ the chain remains focused on modernizing and adapting to meet the needs of tomorrow. Stinker Stores was founded in 1936 and today it operates 105 stores in Idaho, Wyoming and Colorado.

CStore Decisions’ Chain of the Year Award honors a c-store, travel center or petroleum chain that has established itself as a superior retailer and innovator in the industry.

CONGRATULATIONS TO THE CSTORE DECISIONS CHAIN OF THE YEAR!

OCT. 15 5:308:30pm

CStore Decisions highlights five growing chains with fewer than 70 units standing out in the industry today.

Erin Del Conte • Editor-in-Chief

CSTORE DECISIONS HAS IDENTIFIED five up-and-coming convenience store Chains to Watch. Each highlighted chain operates fewer than 70 locations and is innovating in key areas such as foodservice, technology, store design and customer experience. Some are actively growing their footprints while others are keying in on internal growth. These emerging players are carving out a niche in their respective markets and positioning themselves for future growth.

Vintners Distributors, the parent company of Loop Neighborhood Marketplace, announced the creation of its Poppy Market brand in early 2023, with the first location debuting in March 2023 near Arbuckle, Calif. Today, Poppy Market is entering a new phase of strategic growth following its recent acquisition of 11 stores from National Petroleum this spring, which brought the chain’s store count to 15 locations in California.

One of the 11 acquired sites has already been converted to the Poppy Market banner, with two larger sites to follow shortly. The remaining locations will undergo renovations starting next quarter, pending permit approvals that will allow the chain to expand some of the smaller locations.

Vintners Distributors was founded in 1978 by Nick Goyal, an engineer who transitioned into the retail fueling business. He was soon joined by his brothers Raj, Kris and Raman Goyal. Nick’s sons — Varish, Sunny and Kpish — are all active in the leadership of the family business. Nick passed away in 2018. Today, his son Varish Goyal helms the company as CEO. Sunny Goyal serves as vice president, and Kpish Goyal acts as the company’s general counsel.

The Poppy Market stores are predominantly new-to-industry (NTI) builds. The convenience stores are congregated in the Bay area and feature private-label fuel under the Poppy brand. Poppy Market stores feature a modern layout and a red color scheme.

Food is a major focus at Poppy Market stores and the locations typically include a kitchen where guests can find the company’s proprietary “Crunchy Munchy” food offering that includes fried chicken, tenders, chicken sandwiches and classic

Poppy Market debuted in 2023, and it’s fresh off an 11-store acquisition from National Petroleum that took its store count up to 15. Varish Goyal (pictured right) helms the company as CEO and is a second-generation member of the family business.

Guests can also find private-label brand Delish at Poppy Market. The brand includes products such as candy, snacks, wine, and alkaline and regular water. “We’re continuing to expand our private-label offerings to meet our customers’ financial needs — without ever compromising on quality,” explained Pervez Pir, president of retail for Loop Neighborhood and Poppy Market.

Poppy Market features a loyalty program called Poppy Points and a mobile app with a red color scheme. Shoppers earn four points for each dollar they spend in-store and two points for every gallon of gas they buy. The points can then be redeemed for anything inside the store or for discounts at the pump.

While the company plans to grow both its Loop and Poppy Market brands into the future, Pir noted the company sees Poppy Market as having significant future potential, and so it’s putting more emphasis on the brand.

“Why we’re heavily weighted on Poppy a bit more as we grow or acquire is because we want to really get into the

private-label fuel, and that’s Poppy fuel. We find a lot of benefits doing that. A lot of people have realized the quality of the fuel is not compromised with having a lower price,” Pir noted of the Poppy fuel brand.

"At Poppy Market, we’re redefining what convenience looks like. We’ve created a space where elevated food and beverage offerings meet seamless technology and exceptional customer service. Our stores are thoughtfully curated with high-quality local and national products — like craft beverages, organic snacks and premium grab-and-go meals — all in a modern, welcoming environment,” Pir said.

When asked what he felt makes Poppy Market a Chain to Watch, Pir pointed to the chain’s “commitment to innovation, our growing footprint and our ability to adapt to what the modern consumer wants. We’re not just a convenience store — we’re a destination.”

Yatco was founded in Massachusetts in 1993 by Tarek Yatim.

“Our family were ethnically of Lebanese descent, but we immigrated to the U.S. from Sierra Leone, which is a country in West Africa,” explained Hussein Yatim, vice president of Yatco and Tarek’s son, who represents the second generation of the family business.

Tarek’s father had a business selling flour, sugar, coffee and so on to local stores. When his father passed away, Tarek took over the business at 17 years old. Civil war soon broke out in West Africa, so Tarek moved his family to Boston, where he began working as a full-service gas attendant. In 1993, he and his wife, Khadijeh, began running their own cstore in Worcester, Mass., and within a year they’d opened a second location. As the real estate came up for sale, they purchased the properties and went on to become a wholesale fuel supplier.

Today, Yatco owns the real estate for 23 convenience stores. It started the year with 13 company-operated stores and is now up to 17. The bulk of its companyoperated stores are located in Massachusetts, with one in Rhode Island and one in Connecticut.

Yatco is charging ahead with impressive growth in 2025. So far this year it has opened four new locations: three NTI stores and one acquired site. Two other stores are actively under construction and scheduled to open later this year, which will bring the chain to a total of six new stores in 2025.

“The goal should be going from 13 company-operated stores (in January) up to 19, which is a significant jump from a store percentage growth,” Yatim said.

The chain has also been remodeling its legacy locations, adding fresh paint, upgrading the forecourts, refreshing restrooms and modernizing the stores. It

has plans for more extensive remodels later on to help ensure a more uniform look across the chain.

Yatim is spearheading the plan to create a cohesive brand design for the stores. Yatco is also implementing a modern design and branding that incorporates pops of its signature blue and green colors throughout the store, different lighting elements, and refreshed signage. The chain also upgraded its building sign with halo lighting for an attention-getting effect. The logo is also being added to the side of the store to drive brand awareness.

Yatco is piloting electric vehicle (EV) charging with Tesla at one store where it features eight level-four Tesla chargers. Last year, it also secured five grants through federal and state funding to add third-party chargers and is kicking off those projects now.

On the foodservice front, Yatco leverages a lot of quick-service restaurant (QSR) partnerships with both regional and national brands. In addition to beanto-cup coffee, Yatco utilizes its wholesale food and grocery supplier’s food programs in a handful of stores, which allows

Yatco started the year with 13 company-operated stores and is set to reach 19 by the end of 2025 as it sets its sights on a plan to scale to 30 stores. Hussein Yatim (pictured left), VP of Yatco, represents the second generation of the family business, which was started by his parents in the early ‘90s.

it to provide roller grill and a hot case with chicken sandwiches and tenders, as well as pizza and nachos.

Yatco first launched its Yatco Rewards program in 2021, and last October the chain introduced the second version of its app through Rovertown. Through Yatco Rewards, customers earn points when they purchase fuel or items in-store and can later redeem them for free items or discounts. It also features member pricing on fuel. Yatco is currently testing self-checkout in three of its locations, with more to come as it brings on more new-to-industry stores.

As it looks ahead, Yatco is focused on continuing to build its brand and adding to its footprint.

“We should have another five locations open next year, so by the end of 2026 we should be edging up to 30 stores — up from 13 at the beginning of this year, which is a significant jump,” Yatim said.

As the chain grows through new-toindustry stores, its ideal store size would be 5,000 to 6,000 square feet, creating “more of a destination in New England, specifically Massachusetts.”

When asked why he felt Yatco is a Chain to Watch, Yatim pointed to the chain’s “aggressive growth trajectory mainly through state-of-the-art NTIs as well our momentum-building brand recognition in our markets through our store designs, technology and service.”

Onvo got its start in 1988 when brothers Andy Aulakh and Sonny Singh launched a travel center business. The company was originally known as Liberty Travel Plazas until 2020, when it rebranded under the name “Onvo.”

“We rebranded to Onvo because we felt our brand identity as Liberty didn’t align with our company any longer,” noted Onvo VP of Marketing Harman Aulakh. “We wanted something that matched the friendly customer service that we provide our guests, and we came up with the name Onvo to perfectly capture the spirit of our company. Onvo is still a family-owned business, and I’m one of several members of the second generation involved with the business.”

Today the company operates 41 stores in Pennsylvania and New York. In October of 2024, Onvo debuted its newest location, Onvo — Highridge, located at 1297 Keystone Boulevard in Pottsville, Pa. “The location is our largest at over 10,000 square feet and features our first

made-to-order (MTO) kitchen under our Food on the Fly program,” Aulakh said. “Onvo — Highridge caters to truck drivers and passenger vehicles alike with high-flow diesel dispensers, truck parking spaces and gas dispensers.”

Other amenities include state-of-the art showers, laundry services, a full-sized Burger King, a “Beer Barn” (a walk-in beer cave) and the chain’s first dog park, which is called “The Barking Lot.”

Onvo is constructing a Towneplace Suites by Marriott on the adjacent parcel, which will be completed by the end of 2025. “This location is significant because it is not only our largest travel plaza location but also offers our most comprehensive offering to professional drivers and passenger vehicles,” said Aulakh.

Two Onvo travel centers are set to open this year. One is a raze-and-rebuild of an acquired site, while the other is an NTI.

“Both locations are in Pennsylvania and will feature a QSR offering, along with an MTO kitchen through our Food on the Fly program,” Aulakh said.

The chain also has “a robust pipeline of projects in the works to be completed within the next two to three years.”

Onvo first introduced its Food on the Fly program as a grab-and-go offering in Onvo’s Dorrance, Pa., store in Q2 of 2024 before expanding it later that year to include the MTO version of the program.

“Food on the Fly is based around our signature Craveritos, which are toasted burritos ranging from Tex-Mex-inspired flavors to recipes that lean more into more American flavors like barbecue and chicken bacon ranch. In terms of food, we also offer bowls; quesadillas; and grab-and go breakfast options including tacos, sandwiches and fresh bakery items,” Aulakh said. “Food on the Fly also includes a full range of beverage options, including hot, frozen and iced espresso-based drinks.”

The chain is set to roll the MTO program out to new locations. As the program expands, Onvo plans to launch a limited-time-offer program with “exciting new proteins and recipes.”

Earlier this year, Onvo launched a newand-improved version of its Onvo mobile app, powered by Rovertown, complete with new features like more robust in-app couponing, an enhanced loyalty interface and a game room where users can use their winnings for discounts or free items.

“In the five years since we rebranded to Onvo, we’ve been able to create something that really reflects what we stand for as a company and more importantly, something that resonates with our guests,” Aulakh said. “We continue to build on that momentum by investing in our facilities, introducing new experiences for our guests and expanding our brand’s footprint.”

Onvo is also entering the second year of its partnership with Penn State Athletics as its Official Travel Plaza Partner.

When asked what he felt made Onvo a chain to watch, Aulakh pointed to the brand’s growth, the experience it’s providing to guests and its innovating marketing partnerships. “We plan to continue to build on this momentum to help fuel further growth in the future,” he said.

Nearly 100 years ago, two road engineers, Jim Wills and his business partner Harold Swann, founded The Wills Group in 1926. In the late 1920s, the partners became Texaco motor oil distributors and began building Texaco service stations while also distributing Texaco heating oil and kerosene.

After Swann passed away, Jim Wills continued running the company, and his wife, Julia Wills, took over the business when he passed away until her son Blackie, the second generation of the family business, was ready to run the company. Blackie in turn passed on the company to his son, Lock.

Today, Julian “Blackie” Wills, the fourth generation of the family business, helms the company as president and CEO. His brother, Joe Wills, serves as executive vice president of fuels marketing and real estate and development.

The Wills Group started the Dash In convenience store chain in 1979. The first store opened that same year in Annapolis, Md., and the first full-sized Dash In Food Store opened in Laurel, Md., in May of 1981. Today, Dash In operates 57 c-stores across the Mid-Atlantic region, which consists of 21 corporate locations and 36 franchise locations in Delaware, Maryland and Virginia, and it’s set to expand its footprint to new operating areas.

So far in 2025, Dash In has celebrated the opening of three new Dash In locations, and it also completed the Dash In next-generation brand transformation of its Series 3 store concept, which debuted in 2023, across all its store locations.

Dash In is now set to expand into North Carolina, with its first site in the Tar Heel State expected to open in early 2026 in Charlotte, N.C., followed by Dash In locations in the Concord, Graham and Salisbury, N.C., communities. Each location will showcase Dash In’s unique commitment to an elevated guest experience along with Dash In’s fresh food approach.

The c-store chain has aggressive

growth plans to open 15 new locations in the next 15 months across the Mid-Atlantic and the Carolinas.

Dash In’s guest experience and fresh food approach is at the center of everything that it does. Each Dash In store features an open kitchen, highlighting the chain’s commitment to transparency. Guests can custom order any menu item and watch as the MTO meal is prepared. The chain features a wholesome ingredient menu that includes items such as specialty burgers, salads, fresh baked goods and potato chips — all made on

site. Main course salads include Dash In’s Southwest Steak and Crispy Chicken Cobb; Dash In Kitchen Bowls; along with Dash In favorites such as its Stackadillas, Turkey Avocado Sandwich and Bleu Cheese Bacon Double Burger.

Dash In customers also have the option of customizing their beverage via Dash In’s beverage wall, which includes

bean-to-cup coffee, craft sodas, refreshers and smoothies. The convenience store chain is committed to delivering fresh, exciting food that elevates the guest experience.

On the tech front, Dash In invests in solutions that allow it to deliver a personalized guest experience. It features self-checkout options as well as its award-winning Dash In Rewards app, which continues to evolve. Via the Dash In Rewards app, guests can mobile order; purchase a car wash; or select a pump, pay for fuel and receive a receipt in a few clicks. Dash in is also incorporating artificial intelligence and predictive tools to support how the chain organizes and manages inventory.

“Dash In is elevating the guest experience,” said CEO Julian Blackie Wills, when asked what he felt makes Dash In a Chain to Watch. “Our fresh food approach is supported by a people-first commitment to service excellence. The best surprise of all is Dash In’s on-site concierge, a dedicated team member who welcomes guests, answers questions and treats them like the valued neighbor they are. Our care and concern for our neighbors extends across our Dash In communities. We believe that community engagement is an extension of our guest experience. Dash In aims to demonstrate that convenience and community can come together to create better experiences for our guests, team members and their communities.”

Hawkstone Associates Inc. dba Triumph Energy has been actively updating stores across its footprint.

“This includes rolling out our new prototype design, expanding and standardizing foodservice operations across the chain, and incorporating dedicated foodservice areas in select remodels,” said David Barkett, director of retail operations, Triumph Energy, which operates 47 stores in Ohio, Kentucky, Indiana and Tennessee. It’s also a petroleum wholesaler representing the Shell, BP, Sunoco and Marathon brands in Illinois, West Virginia and Missouri.

The Cincinnati-based chain has also been adding modernized fixtures, enhanced coffee offerings and making its Triumph Energy brand a stronger presence throughout the stores to create a cohesive experience.

Triumph Energy is a family-owned business, founded in 1981 by Ron Wittekind, who currently acts as executive chairman. Ron’s son, Jason Wittekind, helms the company today as president and CEO.

The chain has grown largely through acquisitions, resulting in locations of different sizes and layouts. As it refreshes locations, it’s deciding which sites need full-scale remodels and which require smaller adjustments to bring the stores into a unified look and feel. The chain is targeting four to five full-scale remodels over the next two to three years while also focusing on the smaller adjustments across 80% of its footprint.

Triumph Energy is also innovating on the tech front. It’s in the process of revamping its loyalty program and planning the launch of a proprietary mobile app. “Internally, we have implemented digital platforms for employee onboarding and training with a strong emphasis on customer service,” Barkett said.

The chain is also investing in EV charging in partnership with a supplier company, with one site up and running and seven more in progress. And it has been testing self-checkout and is continuing to

Triumph Energy has introduced a new store prototype and is updating its stores and incorporating foodservice. Jason Wittekind, president and CEO, (pictured right) is in the second generation of the family business, which was started by his father.

evaluate whether the technology might have a future in its locations.

Recognizing foodservice as a critical part of the future of convenience retail, the chain’s leadership has brought in some individuals to help guide its foodservice strategy. At present, the stores feature a few different food programs. One acquisition came with a proprietary food program that includes a chicken tender program, which has been a strong driver for the chain. Some of the chain’s locations that offer the program are in rural areas that don’t have a lot of foodservice options. Triumph is working to be a destination for lunch, dinner and even breakfast in those locations.

At two sites, Triumph Energy features a biscuits-and-gravy breakfast offering, while most other sites include different varieties of breakfast sandwiches, such as croissants, bagels or muffins with different meats. It partnered with a local food company to add a proprietary pizza and hoagie program to about a dozen stores that has been doing “fantastic.” It also features proprietary kitchens at many of its stores. About a dozen sites feature drive-throughs. A year ago, Triumph Energy launched bean-to-cup coffee across its footprint. With the move to bean-tocup, it’s working to ensure the coffee offering is unified throughout its stores.

Looking to the future, Triumph Energy is focused on creating a consistent

experience for shoppers across its stores while enhancing internal operations to offer better service and better products for customers. While it’s open to acquisitions, it’s focused on finding properties that offer the right quality and fit as the chain grows intentionally.

“Triumph Energy’s mission is being committed to delivering high-quality, customizable food offerings that rival traditional fast food, redefining the standard for convenience store dining. By addressing the growing demand for speed and personalization, we are well positioned for significant growth. Another large part of our mission is to be a partner within the communities we serve. We want to give back to local charities, first responders and sports teams at all levels,” Barkett said.

When asked why he felt Triumph Energy is a Chain to Watch, Barkett said, “As a forward-thinking convenience brand, we innovate in operations, scale efficiently and stay aligned with evolving consumer values, whether through technology, sustainability or elevated product offerings, which solidifies our status as a Chain to Watch.” CSD

The tobacco and nicotine category racks up some wins and losses this summer as regulations pose a threat to the backbar while burgeoning favorites sweep sales.

Anne Baye Ericksen • Contributing Editor

FEDERAL, STATE AND LOCAL REGULATIONS continue to plague the tobacco category at convenience stores, demanding retailers’ constant attention. In the case of Alabama retailers, that attention to legislative movements paid off recently.

For the past several years, the Petroleum & Convenience Marketers of Alabama (PCMA) supported efforts to pass state legislation to increase penalties associated with selling vape products to minors. When the bill was reintroduced in this year’s session, the organization representing 160 members that own, operate or supply more than 2,500 stores in the Cotton State once again offered its backing. However, the language changed as it wound its way through the Senate, and suddenly retailers faced the possibility of extensive restrictions on vape sales.

“The new language effectively moved all vape retailing to retailers with limited entry to people 21 and over. It even required electronic scanning of identification at the door before individuals can enter to verify their ages,” said J. Bart Fletcher, CAE, PCMA president.

Premium Nicotine Pouches Scan here to contact our sales team

Our patented nicotine pouches boast a unique blend of premium ingredients, technology, unrivaled flavor profiles, and moisture enhancers setting them apart from the other pouches.

FULLY FUNDED PROMOTIONAL PROGRAMMING.

5 FLAVORS:MINT,WINTERGREEN,MANGO, CAPPUCCINO AND CLEAR.

DESIGNED IN SWEDEN, MADE IN THE USA WITH DOMESTICALLY AND GLOBALLY SOURCED INGREDIENTS.

100% Product Guarantee

US.Patent #US-2023-0190729-A1

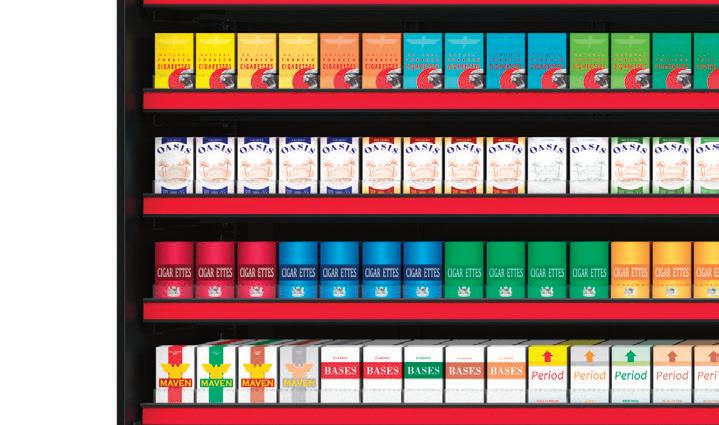

While traditional smokeless tobacco options slipped in sales, spitless and alternative products shined based on 52-week data ending June 15.

Source: Circana, total U.S. convenience stores for the 52 weeks ending June 15, 2025

In the 11th hour, PCMA scrambled to submit an amendment to minimize the potential fallout. It proposed that convenience stores and other non-agerestrictive retailers would only sell electronic nicotine delivery systems (ENDS) listed on the state’s existing directory of approved products.

“Also, the language of the (official) amendment originally only listed the 34 products that have received FDA (Food and Drug Administration) approval. We did not agree with the interpretation of that language,” he added.

In response, PCMA filed a lawsuit in federal court arguing all products on

the state directory should be available for sale in convenience stores and other retailers. The effort paid off. The court ruled in PCMA’s favor, and the revised amendment was incorporated into the law that took effect on June 1.

“There technically was no change to the law in Alabama as to what ENDS can be legally sold in the state,” said Fletcher. “If it does not appear on the state ENDs directory, it is not legal.”

However, Fletcher advises members and other retailers to expect the state’s Alcoholic Beverage Control Board, the agency charged with enforcement, to step up oversight activities.

Indeed, enforcement was a dominant theme at the Next Generation Nicotine Delivery Expo in June. Participating as both a panel moderator and speaker, Agustin Rodriguez, partner at Troutman Pepper Locke, said attendees expressed concern over the black market zapping legitimate sales.

“Concerns were how might new leadership at FDA address the large and growing market of illicit e-cigarette products, largely from China, that are not complying with FDA premarket review requirements,” he recalled. “Panelists expressed optimism that the new acting director at the FDA’s Center for Tobacco Products, Bret Koplow, could make a strategic shift in the agency’s handling of premarket tobacco product applications in a way that emphasizes the need to bring more reduced-risk products to market.”

Responding to an evolving regulatory environment has become a mainstay for many tobacco/nicotine category managers. For example, Anna Bettencourt, senior category manager for Yatco, regularly deals with moving targets in Massachusetts, home to the majority of the company’s 17 stores.

“There have been some towns that have banned nicotine pouches, which seems silly to me because it just draws people back to combustibles. Also, (we’re) seeing nicotine-free generation (laws) popping up in towns,” she said.

Despite that, Bettencourt said the category continues to benefit from the growing popularity of the modern oral segment, even with recent inventory gaps.

“Sales for nicotine pouches have been strong for us. We have seen other brands pick up in sales due to the out-of-stock situations with ZYN,” she added.

Circana reported both spitless tobacco and chewing tobacco alternatives registered dollar sales gains of more than 46% and 21% in the c-store channel, respectively, for the 52 weeks ending June 15. Other tobacco subcategories, including cigarettes, incurred losses. Goldman Sachs research, based on NielsenIQ data from all retailers, also suggested summer sales of nicotine pouches have heated up. The top three sellers each posted volume boosts of at least 10% for the four weeks ending June 28.

Heading into fall, though, Bettencourt wonders if economic pressures will cool customers’ spending.

“Pricing and value are more important on all fronts for the consumer for all purchases, especially on higher-priced items that are used frequently, like tobacco,” she said. “I see manufacturers having less pricing power moving forward, especially in states that are heavily taxed.” CSD

• The top three nicotine pouch brands each posted volume gains of at least 10% for June.

• Alabama retailers earned a legislative win when they proposed a revised amendment.

• Spitless tobacco and chewing tobacco alternatives continue to win in the category.

AS MID-TO-LATE SUMMER WEATHER HEATS UP, customers increasingly turn to frozen treats, from ice cream sandwiches to frozen dispensed beverages to soft-serve ice cream.

At Good 2 Go, which operates 81 c-stores in seven states — Idaho, Wyoming, Montana, Utah, Colorado, Arizona and New Mexico — the motto is “We’re gonna make you Smile,” so it’s no surprise the chain is leaning into offering fun, frozen treats. “We focus on a lot of fun, unique concepts. Softserve ice cream, ice cream floats, etc. are part of that offering,” explained Sean Carroll, director of category management, Good 2 Go.

About one-third of Good 2 Go stores feature a soft-serve ice cream program. “We have countertop ice cream machines — typically two machines that hold a total of four flavors per store,” Carroll explained. “We always carry chocolate and vanilla

Summertime is prime time for fun frozen treats, and c-stores are leveraging flavor trends and customer preferences to boost basket size.

Erin Del Conte • Editor-in-Chief

and mix in seasonal and fan-favorite flavors, such as strawberry, mint, huckleberry, etc.” The huckleberry flavor, in particular, is a popular local flavor. Good 2 Go has rolled its soft-serve program out to the stores gradually.

“We were looking for a point of differentiation; something fun and exciting for kids and families,” Carroll said, adding he sees lots of happy faces by the stores’ ice cream machines.

C-stores looking to capitalize on a soft-serve program should first evaluate their locations so they can strategically add the program to the select stores where the offering will most appeal to the local customer base, for example in “busy locations with ice cream-hungry clientele,” Carroll advised. For instance, one Good 2 Go store near a local school routinely sees lines of students at the ice cream machines after school lets out.

Once the stores are selected for the program, Carroll advised that retailers take time to determine the best machines, cones, cups, flavors and toppings and whether self-serve or employee-served will work best for your stores.

“Do you want to just offer ice cream, floats, freezes, etc.? (It’s) very important to choose the right equipment,” he said.

Good 2 Go has also worked to expand its frozen dispensed section over the last few years. “We primarily offer a frozen carbonated beverage (FCB) and a frozen uncarbonated beverage (FUB) option,” Carroll said. “Frostbite is our FCB option.”

The chain partners with Frazil for its FUB offering and has expanded “from standard flavors to energy options and then to its frozen coffee drink (Café Tango).”

Frozen energy drinks have been a big hit in the stores. The frozen coffee is a newer offering, “but it’s beginning to resonate,” Carroll said.

Across the country, Huck’s Market, with 135 locations in Illinois, Indiana, Missouri, Tennessee and Kentucky, is also serving up frozen fun this summer.

The chain features a section called Bigg Swirl that includes a f’real self-serve blended shake program and a Fresh Blends blend-it-your way program that features shakes, frappes and smoothies.

“F’real flavor offerings (at Huck’s) include chocolate, vanilla, cool mint chip, PB Cup Made With Reese’s, cotton candy, Oreo, Blue Raspberry Energy Freeze and Strawberry Watermelon Energy Freeze,”noted Melissa Lingafelter, category manager, Huck’s Market.

The chain’s top-selling flavors include chocolate, vanilla and Oreo.

Fresh Blends features flavors such as strawberry, strawberry banana, mixed berry, milk chocolate, vanilla, mocha, caramel macchiato and more. Huck’s topselling flavors for the program include chocolate, strawberry and vanilla.

On the frozen dispensed front, Huck’s

frozen FUB and FCB programs are branded “Bigg Chill.”

FUB flavors include Tigers Blood, blue raspberry, orange and cotton candy. FCB flavors include Frozen Coke, Mt. Dew, Dr Pepper, cotton candy, blue raspberry, cherry, orange, grape and banana.

“Our FUB and FCB are packed with bold and fruity flavors for the perfect Bigg Chill experience,” Lingafelter said.

Promotions help the c-store chain boost visibility for the program and its flavor assortment.

“We are offering a hot price point of 89 cents on our 12-ounce and 20-ounce frozen beverages,” Lingafelter said. The recent promotion has served as a strong trip driver for the chain, leading to an uptick in frozen dispensed beverage sales. Huck’s has seen both unit volume and sales dollars trend positively as a result.

When it comes to best practices for boosting frozen dispensed sales, Lingafelter emphasized the importance of including powerhouse colors blue and red in your beverage lineup, as these shades consistently drive customer interest and sales.

“We also look for eye-catching frozen beverages that are hard to resist,” Lingafelter added.

Huck’s also ensures frozen drinks are highly visible in its stores and that it has a revolving mix of limited-time offers (LTOs) to keep customers coming back

for more. Lingafelter noted that digital and loyalty promotions can help increase awareness of available frozen offerings. Getting the basics right is also key, including maintaining the dispensed beverage equipment with regular maintenance and ensuring the frozen dispensed area is clean and well stocked with cups, lids and straws.

Meanwhile at 116-store chain Duchess convenience stores in Ohio and West Virginia, pints of ice cream and ice cream sandwiches are consistently popular items, especially during the warm summer months.

“At Duchess, we offer ice cream treats, novelties and take-home packaged ice cream from a more than 100-year-old local to Ohio ice cream manufacturer Velvet Ice Cream,” said Nathan Arnold, director of marketing for Englefield Inc., Duchess’ parent company. “One Ohio-specific flavor, Buckeye Classic, a peanut butter ice cream swirled with thick fudge and candied buckeyes, is a top flavor sold in pints and other take-home packages.”

Most of the Duchess locations also feature frozen dispensed beverages. Customer favorites include popular soda flavors, cherry, blue raspberry and other fruit flavors.

“(Our) offerings include FCB, which are a classic. In addition, we have frozen fruit

smoothies and frozen coffee and mocha frozen frappes,” he added.

Frozen treats serve as more of a basket builder at Duchess stores, although Arnold noted some of the frozen dispensed drinks also drive visits, especially from families or teenagers. Duchess ensures its frozen treats are brightly colored and well positioned in the stores.

“The ice cream is in a high-impulse area and the (colorful) frozen dispensed drinks are bright and cheery and definitely draws customers to our frozen and cold dispensed area,” he said.

While knowing your customer is key in all areas of a c-store business, when it comes to the frozen treats segment, it’s very important that c-stores understand

what their customers are seeking, Arnold advised. “Our customer likes the ice cream treat they can take with them and enjoy,” he said.

LTOs are known for bringing a sales boost, but Arnold stressed that it’s important to ensure traditional flavors are also readily available.

“We’ve tried other LTO flavors of frozen dispensed, and while it may spike at the initial launch, the tried-and-true classic flavors always win. So, while it may be exciting to bring in a new flavor, often customers want to have the flavors they know and love,” Arnold advised.

Flavor trends frequently differ by region

and also by store, so savvy retailers are keyed into their customers preferences across their chain’s footprint.

At Good 2 Go, Frazil’s Tiger’s Blood has always been a fan favorite, and as a result, the chain carries it in every store.

“We are pretty good at rotating other flavors in such as Simply Mango, Blue Razzmatazz, Georgia Peach and Green Apple,” Carroll said.

When it comes to the frozen energy offering, Lemonberry, Smashberry and Orange Cream flavors are customer favorites at Good 2 Go.

“In terms of the Frostbite program, Coke and Dr Pepper are mainstays. We’ve run a recent Sour Patch LTO that has been well liked,” Carroll added.

Meanwhile at Huck’s, Coke, blue raspberry and cherry flavors are popular with shoppers, and at press time the chain was intriguing customers with a “Mystery Flavor” LTO on the f’real program.

“We are pursuing additional LTO flavors for FUB and FCB, as LTO flavors play a huge role in keeping frozen beverages exciting,” Lingafelter said.

At Duchess, it’s classic flavors that ring up the most sales.

“The classics seem to sell best for us, the blue raspberry and cherry,” Arnold said. “For some customers these are a nod to adolescence, a nostalgic fruit drink. For kids today, it’s still a popular treat. We see some customers combining multiple flavors in a cup to create a unique drink.” CSD

Retailers like Loop Neighborhood are doubling down on private label as inflationary concerns remain strong and supply chain skepticism lingers following the COVID-19 pandemic.

Kevin McIntyre • Associate Editor

MARGINAL IMPROVEMENTS CAN OFTENTIMES be the difference maker for c-store retailers looking to maximize profits. One way operators are boosting margins in the convenience industry is by introducing private-label products that allow them to oversee the entire lifecycle of a product — from manufacturing to sale.

This trend has not come out of the blue, however, as operators have adopted the strategy in recent years to capitalize on a growing demographic of customers who are looking for quality, cost-effective products as inflation continues to drive up prices on national convenience items.

Private label continues to gain traction in the U.S., according to Circana’s “From Growth to Transformation: The U.S. Private Label Story” report, which found dollar shares up in the segment in 2024. Circana noted that mature categories such as meat and bakery, in addition to newer categories like candy and snacks, are all seeing increased privatelabel sales.

In a separate report from NielsenIQ, the research firm found that private-label products grew 4.1% year over year as consumer preference continues to shift. Furthermore, 75% of consumers said privatelabel products offer good value, and 72% saw them as strong alternatives to national brands.

Additionally, the majority of consumers (54%) said the brand doesn’t matter to them as long as the product fits their needs.

LABEL IN PRACTICE

At Loop Neighborhood Marketplace, the chain’s private-label program is a significant sales driver. The company has 153 company-owned and -operated stores today in California — 138 under the Loop Neighborhood banner and 15 under the Poppy Market banner. Both banners feature the company’s private-label offerings.

Loop began its private-label journey roughly four years ago as the COVID-19 pandemic was shifting the supply chain landscape in the retail space.

“The pandemic changed everything for everyone,” said Pervez Pir, president of retail for Loop Neighborhood. “With the blockages and supply issues, I think vendors saw this and said, ‘Hey, we better also pivot.’”

Bottled water traditionally offers healthy margins for c-store retailers, especially in 2025 as customers are increasingly spending on packaged beverages. As a result, this is often where operators will begin private-label experimentation.

Loop, however, did things differently, examining its demographics and customer preferences before dipping its toe in the private-label pool. The company determined that wine would be the better starting point and launched its first white wine and red cabernet products in 2021.

After the success of its wine launch, Loop introduced its first iteration of branded bottled water in 2022, which originally came in one size, before expanding its lineup in 2023 to introduce alkaline and filtered water varieties in different sizes.

Then in 2024, Loop rolled out its signature Delish Candy and Snacks private-label brand, which initially debuted with 16 product offerings.

“As far as (branded) products go, we right now are at snacks, candy, water, wine, and we have another one right now that’s in the works,” said Pir.

“And we’re still expanding — we’re still looking for more items to add.”

When Loop initially launched its private-label wine in 2021, the company focused on starting its private-label lineup with “something that had legs.”

“Wine was growing and continues to grow in this business compared to 25 years ago, and people have evolved and are drinking more wine,” Pir continued. “So, wine seemed natural because our numbers online were good, and we thought, ‘Okay, if we can’t do water first, we can do wine.’”

Pir noted that the private-label boom we are seeing across the retail industry as a whole is benefiting Loop’s program specifically, as customers have begun to trust and seek out private-label products.

Loop Neighborhood kickstarted its private-label program with wine before expanding into bottled water. In 2024, the chain debuted its Delish Candy and Snacks line, which initially included 16 product offerings. Loop has another private-label offering currently in the works.

“Private label generally has grown significantly everywhere, and that’s why I think we’re all benefiting from it, because there’s a halo effect,” he said. “Whether it’s Kirkland or whether it’s Walmart, there’s a lot of high-quality private-label products, and people aren’t compromising it to get a lower cost.”

While private-label programs can help retailers with brand recognition and supply chain hurdles, the main appeal, according to Pir, is the margins.

“That’s one of the main reasons you go after private label — you can obviously increase velocity and make more margin,” he mentioned.

It can also serve as reassurance to retailers that manufacturers will work with them directly to overcome any supply issues.

“It’s a security blanket, but it also makes you feel confident that you know when costs go up in marketing dollars for a major chain, you can grow your brand — you don’t have to be the host to (wholesalers or other vendors),” said Pir.

Loop’s private-label program has also shown signs of increasing loyalty in-store. Within the chain’s mobile app, customers can play games to earn points that can be used on Loop products. The top two items purchased with loyalty points, according to Pir, are Loop’s two private-label water sizes.

“It felt good to get validation that people do like it,” he said. “And it’s not necessarily the price they’re looking at. Customers are saying, ‘Hey, I like this water. It tastes better.’”

For retailers looking to begin their private-label journey, Pir’s advice is simple — start somewhere.

“Don’t sit there and worry about, ‘I can’t do it. I’m too small. I don’t have the volume,’” he continued. “Start somewhere and hustle to talk to different vendors. There are so many more open now than there used to be back in the days.”

Additionally, Pir advised retailers to be creative. It is important to know what your customers are looking for, and that will never be exactly the same in any two convenience stores.

“Don’t limit your team or be stuck on ‘It has to be water first,’ or ‘It has to be snacks,’ or ‘It has to be candy’ — if there’s a high-velocity item, just get it out there, because slowly you’ll get the traction. The brand will carry itself,” he said.

Pir also mentioned that simply launching a privatelabel line is not enough — retailers will need to invest in marketing and promotion as much as they can to start and slowly pull back once there is traction around the brand. A loyalty program, he said, is also a great tool for marketing and offering customers steeper discounts on private-label products.

Exclusive deals, rewards and offers for private-label products can boost not only in-store sales of privatelabel products, but it can also increase a customer’s brand loyalty.

Looking ahead, Loop plans to expand its privatelabel wine selection in the coming months, and the chain is always looking for new categories to add to its private-label offerings. CSD

C-store retailers are finding that attracting critical lunch business over quick-service restaurants takes a laser focus on offering outstanding menu items, time-sensitive service and price-conscious value.

Marilyn Odesser-Torpey • Contributing Editor

ARMED WITH ELEVATED MENUS AND HIGH-QUALITY INGREDIENTS, convenience stores that have invested in foodservice are now routinely competing with quick-service restaurants (QSRs) for share of stomach, especially during lunch. And, in many cases, they’re coming out on top.

One c-store chain succeeding with the midday meal is northern Ohiobased FriendShip Food Stores, where lunch sales have increased by double digits year over year. Kirk Matthews, vice president of foodservice and marketing for FriendShip, attributed the growth to the “elevated,” premium, never-frozen products on FriendShip Kitchen’s midday menu, along with limited-time-offer (LTO) variety and everyday value pricing.

“All of our food is prepared in-store in small batches to ensure fresh-

The 31-store chain is known for its savory crust pizza and doublehand-breaded fried chicken, Matthews noted. Other popular items include chicken sandwiches; burritos; Bosco Sticks (bread dough filled with cheese); and chicken bowls with macaroni and cheese or mashed potatoes, corn and cheese.

FriendShip Food Stores is known for its savory crust pizza, among other items. A hot honey pizza limited-time offer was a recent success. Burritos are also popular menu items.

He pointed out that LTOs, which change every 45 to 60 days, also give customers more reasons to visit the stores at lunchtime. Recent successes have included hot honey pizza and chicken, a rib sandwich, steak ranchero, chili, and barbecue beef.

“Keeping the menu a manageable size with a core selection of everyday items and one or two LTOs suited to our equipment and labor capabilities is key to excellence in execution,” Matthews added.

During lunch, Duchess Convenience Stores vies with QSRs for lunchtime customers by providing “good if not more competitive everyday value,” according to Nathan Arnold, di rector of marketing for the com pany, which operates 116 stores throughout Ohio and West Virginia.

“Our hamburgers, which are wildly popular, are a full quarter pound, for example, larger than the standard burger

you might get at a QSR, and (they) are served on a warm bun,” he continued. “We highlight the size and provide all the toppings and customizations anyone would want.”

Loyalty club members, he noted, receive special pricing and fuel savings, making Duchess lunch items an even bigger value.

In addition to the burgers, grab-andgo deli subs, such as Italian and turkey with Colby, continue to be the stores’ top sellers at lunchtime. Popular items from the hot merchandisers include cheeseburgers, chicken sandwiches and pizza slices. All are made fresh daily.

“We prepare all of our hot items in our stores, and our company-operated commissary supports several of the stores by preparing our cold subs,” he said.

“Sheer variety of offerings, quality that goes above and beyond, and speed of service” give The Hub Convenience Stores a competitive edge at lunchtime,

stated Jared Scheeler, CEO of the fivestore North Dakota-headquartered cstore chain.

“Typically, customers might think the QSR drive-through is quicker, but I would contest that,” he explained. “People are also surprised by the quality and flavor of our food.”

The Hub offers hot and cold grab-andgo and made-to-order lunch options, including Godfather’s Pizza at select stores. Burgers, all of which are grab and go, are never frozen, resulting in a “better texture and higher-quality product,”

Scheeler noted. The stores carry a variety of burgers, including cheese and double cheese, bacon and double bacon, mushroom and Swiss, jalapeño and pepperjack, and patty melts.

A full made-to-order sandwich line rivals any QSR shop with high-end proteins and breads and homemade sauces, he continued. Signature sandwiches include Italian and reuben with pastrami or corned beef. In winter, the French dip sandwich is No. 1.

“In locations that have pizza, it wins the day at lunchtime,” he remarked. “In our other stores, burgers are our biggest movers.”

To underscore its variety of foodservice options, The Hub

features daily grab-and-go meal specials, called “baskets,” that pair items such as a Philly steak, popcorn shrimp or tacos with fries or other sides.

Overall, price points may be slightly higher than QSRs, Scheeler noted, reflecting the company’s commitment to offering premium products.

“We have no interest in playing the game of competing with QSRs on price,” he emphasized. “Our products are worthy of the higher price points.” CSD

• A streamlined menu with core everyday items and a couple of LTOs can help position a c-store for a competitive lunch offering.

• Value, variety, quality and speed are four key customer demands c-stores can address to differentiate their food program in a crowded marketplace.

• Many successful retailers credit the freshness of their food offering as helping them win customers away from QSRs.

Partner with Hunt Brothers® and unlock your pizza profi or more. Our turnkey branded program is designed specifi c-stores, fits into your existing and operates with your existing to deliver maximum profitability. of 50% pizza specifically for labor

C-store retailers are leveraging artificial intelligence to upgrade their loss prevention solutions.

Emily Boes • Senior Editor

AS THEFT SHIFTS FROM STANDARD SHOPLIFTING to organized activity, including digital fraud and internal coordination, loss prevention strategies must change as well, and digital solutions are seeing steady growth.

Convenience stores, whose very nature of high traffic and smaller staffing appeals to “bad actors,” according to Khris Hamlin, VP asset protection at the Retail Industry Leaders Association (RILA), are taking the initiative to install technology such as artificial intelligence (AI)-based camera and audio software to manage theft and even prevent it.

“Technology has definitely shifted and become much more advanced than how it used to be before. We’re seeing smart cameras, AI-driven video analytics happening that’s backed by exception-based reporting and also, at times, could be connected with their point-of-sale monitoring systems, too,” said Hamlin.

C-store retailers can use this to spot trends and suspects quicker.

“And in some instances, they’re able to actually stop the theft even before it happens because of some of the predictive-analytic models that are out there,” continued Hamlin. “So with all these tools in play, what we’re seeing across the industry is that the technology is giving the end user a single dashboard

where they can look at everything connected together and make really smart decisions and make them a lot faster than they were in the past.”

Minits, with 16 convenience stores in Texas, implemented a multitiered system to prevent theft. Its i3 International camera system provides intelligently indexed

video that can be accessed in-store and remotely. The chain also uses InStore.ai’s audio solution to gain real-time insights from conversations between customers and employees.

Minits also handles inventory reconciliation and accounting with Petrosoft’s CStore Office, allowing the chain to audit what is sold versus what’s stocked.

“These systems are further reinforced by our own auditing team who conduct retail-level inspections and compare physical counts with digital records. This full-circle approach gives us confidence in both the data and the people managing it,” said Vanessa Kidd, senior supervisor for Minits.

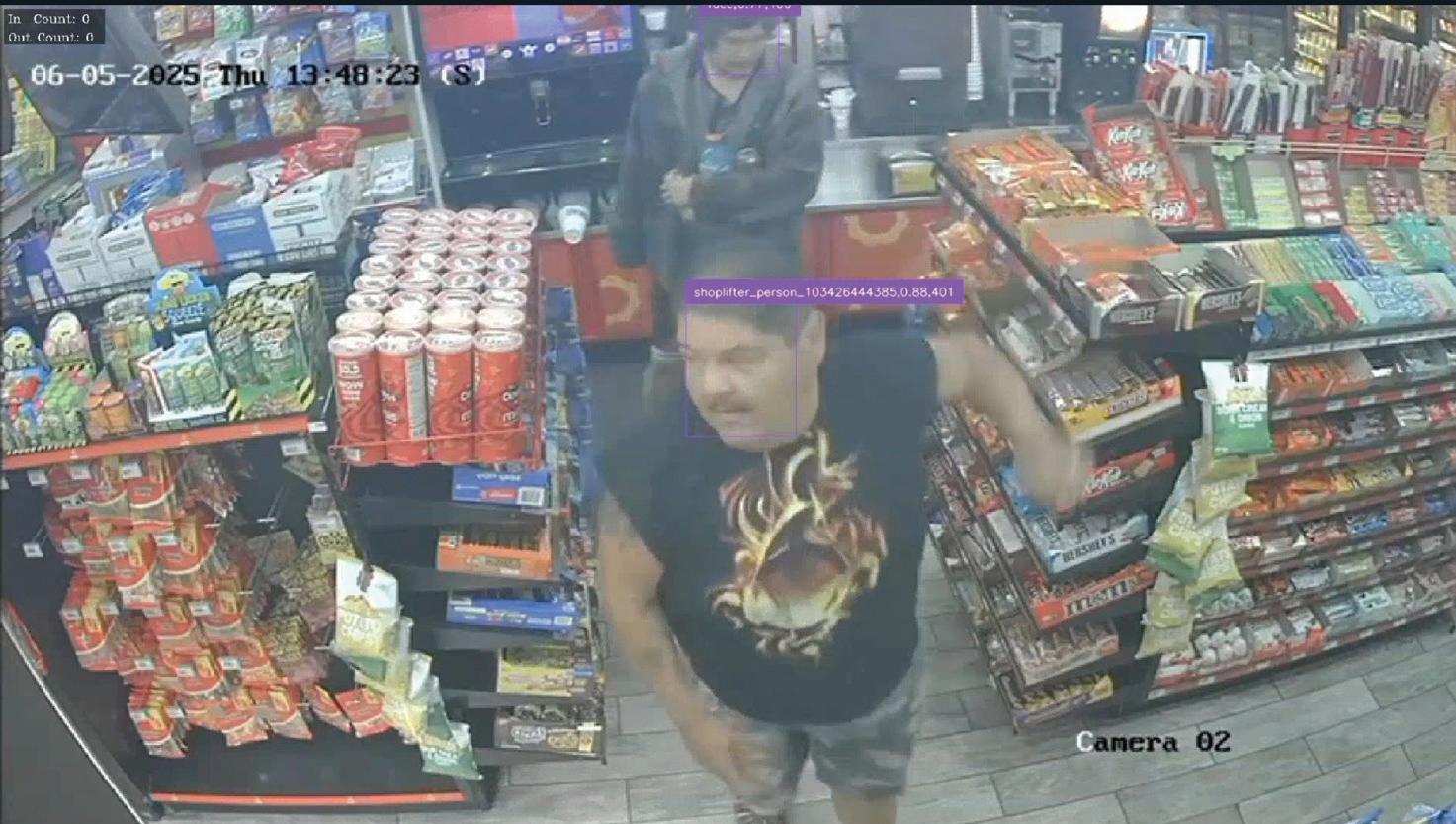

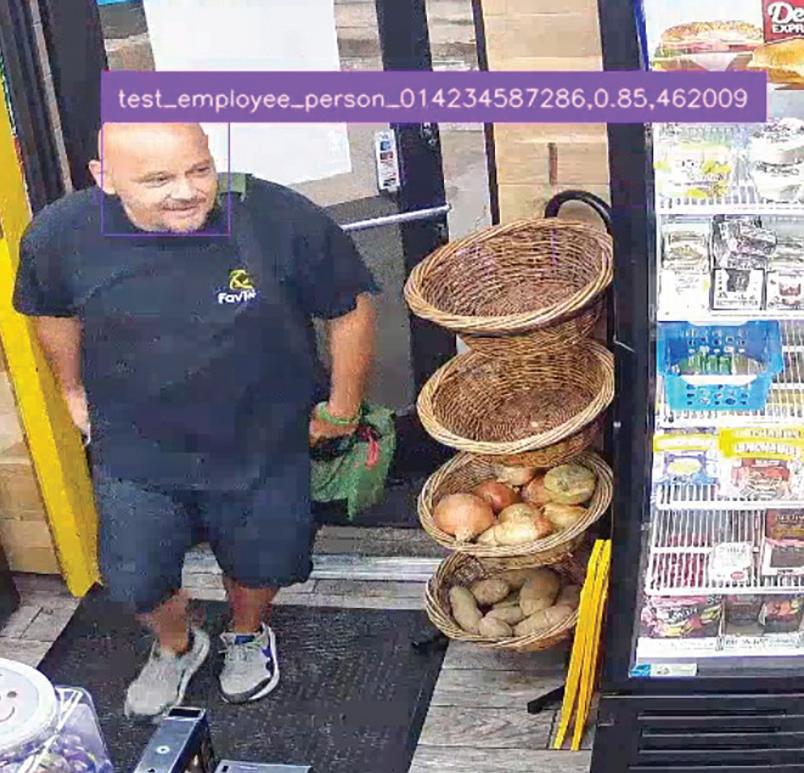

Fav Trip, which operates four stores in Missouri, is now heavily invested in AI. Recently, its AI software detected a repeated shoplifter, and Fav Trip confronted and banned the person.

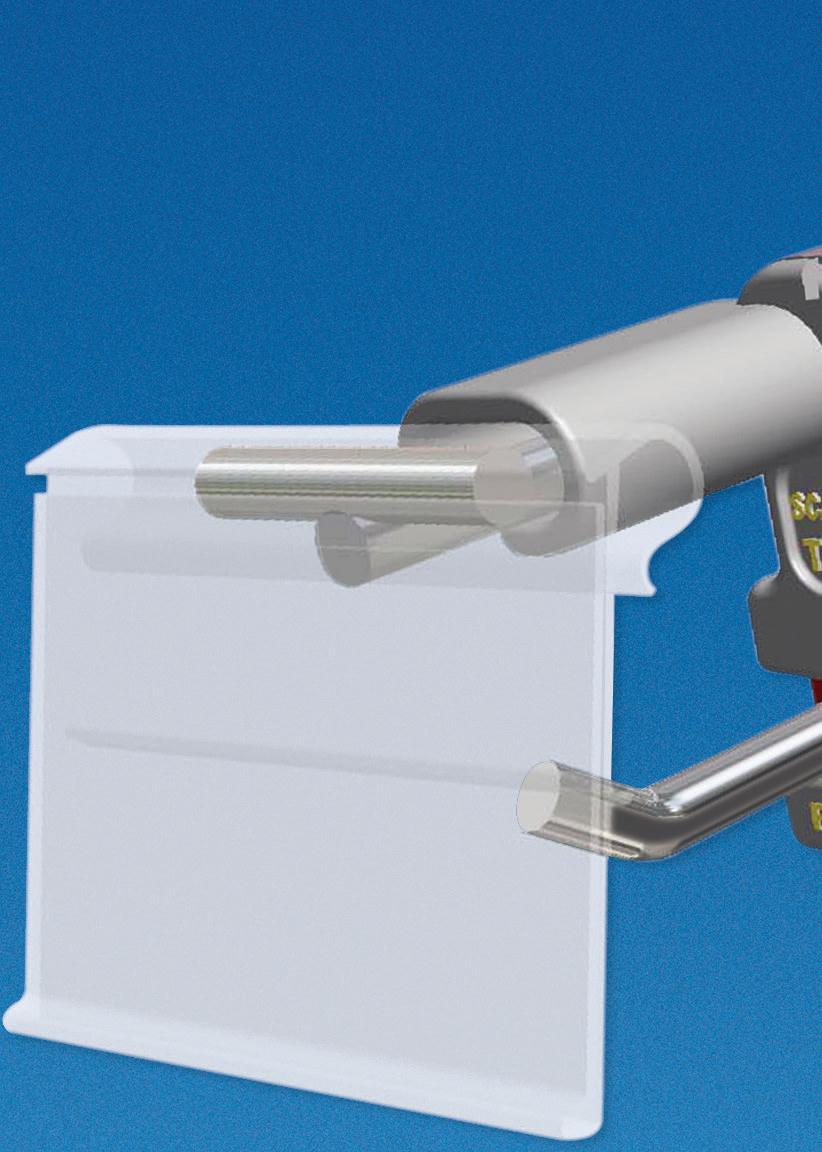

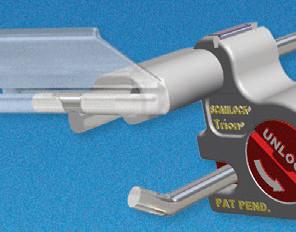

Trust the hook-makers at Trion to invent creative solutions to prevent individual item theft as well as mass “sweeping” of merchandise. Easy-to-use, ScanLock® is an inexpensive key-lock system that secures most common scan hooks — and even retrofits existing hooks in place!

■ Install locks alone to retrofit your existing hooks in-store, or full lock-and-hook combinations in your choice of hook and label holder styles.

■ Secures scan hooks up to 1/4" diameter, with 1" wire spacing.

■ Secure all items or display some unlocked. Display 1 or 2 items unlocked for easy customer access while balance of stock is locked and held secure.

■ Simple swing-aside access. No need to remove the lock to access & sell items.

■ User-friendly design re-locks without a key. Open several hooks for hands-on selling to customers, replace items and re-lock in an instant without fumbling for the key.

■ Optional Security Plate secures hook to pegboard to provide additional theft deterrence.

Made in the U.S.A.

“They entered the store, and our staff was able to say, ‘Sir, you need to leave.’ ‘Oh, why, what did I do?’ ‘Well, we have you on camera stealing multiple times.’ And he admits to it,” said Babir Sultan, CEO, Fav Trip.

Minits’ audio surveillance flags interactions that could indicate loss risks, both internally and externally.

For instance, the system pinpointed a conversation between two customers in which stealing a product was casually mentioned. Minits timestamped the audio, matched it to camera footage and confirmed the behavior.

Audio also flagged a conversation that seemed like internal theft, and after

reviewing footage, a blind spot was revealed. The chain then adjusted its camera coverage.

“The speed of reporting and the level of detail mean that issues can be addressed at the store level before they snowball into broader losses,” said Kidd.

Still, there is a learning curve with technology. While Kidd admitted the audio system is powerful, time had to be invested into creating standard operating procedures that the staff could follow and maintain.

This doesn’t mean systems such as this are too complex, however.

“Like anything new, it takes a bit of setup and buy-in, but once you get over that hill, the benefits are immediate and practical. You don’t need to be a data

“We’re paying close attention to AI in retail, especially around invoice validation, inventory variance detection and exception-based reporting. We’re also interested in how AI can bridge our different platforms, allowing data from our camera systems, audio intelligence and back-office software to be synthesized into one cohesive dashboard.” — Vanessa Kidd, senior supervisor, Minits

Below: Fav Trip first tested its artificial intelligence (AI) software with an employee test subject.

Left: Fav Trip’s AI software detected a repeated shoplifter, and the chain was then able to proceed accordingly.

scientist to use it — you just need to be curious and committed to continuous improvement. At Minits, we’ve created a culture around moving forward, and that means trusting the tools we invest in and being willing to refine our workflows around them,” said Kidd.

Retailers are continuing to lean into AI as they consider their future loss prevention options.

“We’re paying close attention to AI in retail, especially around invoice validation, inventory variance detection and exception-based reporting,” said Kidd. “… We’re also interested in how AI can bridge our different platforms, allowing data from our camera systems, audio intelligence and back-office software to be synthesized into one cohesive

dashboard. That’s where we believe the industry is headed. We’re already asking our vendors how they plan to get there.”

Down the line, Fav Trip plans to implement a feature in its AI setup that allows the chain to report the frequency in which theft has been stopped. “As we get more data, AI gets smarter and our reporting gets better, too,” said Sultan.

Sultan also mentioned the possibility of creating YouTube thumbnails with this data to supplement its popular channel. The channel, which pokes fun at shoplifters by recording their actions, now has over 100,000 subscribers. Fav Trip’s TikTok account has 47,000.

The cameras don’t only monitor shoplifters, either. They watch for Bitcoin scams and people meddling with the ATM during the night, for example.

AI isn’t only meant for the “big players,” Sultan emphasized.

To get started with any loss prevention programs, RILA’s Hamlin noted a chain must identify its biggest vulnerability.

• Loss prevention strategies now include artificial intelligence (AI)-driven analytics.

• Retailers are hoping to integrate AI systems into one dashboard.

Now, AI is using Fav Trip’s existing cameras to learn shoplifting patterns and detect incidents. The chain has 24-hour live surveillance. The goal is to unburden employees with AI playing the detective.

“Is it internal theft? Is it fraud? Is it gift card? What is that pain point? And then how do you put your finger on the pulse of that pain point and start to look for vendors or solutions that will solely target that pain point? And then the residual is catching other things along the way,” he said. “… You have to bring it down to where you can make the biggest impact and get learnings from that and then look at how you scale smartly from there.” CSD

• C-store retailers should find their biggest pain point first and develop a loss prevention strategy from there.

wednesday, august 6

3:30 - 4:30 PM Registration 4:30 - 6:00 PM CStore Momentum Welcome Mixer

thursday, august 7

8:45 - 9:00 AM

9:00 - 10:00 AM

10:00 - 11:00 AM

august 6-8, 2025

Knoxville, TN

Welcome to Weigel’s

Doug Yawberry | Weigel’s

Flavors of the Future: Innovating C-Store Cuisine

Ryan Blevins | Weigel’s

Game-Changing Marketing: NIL, Loyalty & the Weigel’s Playbook

Nick Triantafellou | Weigel’s

11:15 - 12:15 PM The Operational Edge: Best Practices from the Best in the Business

1:00 - 2:00 PM Burning Issues Exchanges: Round Table Discussions

2:30 - 4:00 PM It’s Your Business – Make it Extraordinary

David McClaskey | McClaskey Excellence Institute

4:30 - 6:00 PM Cocktail Reception

friday, august 8

9:00 - 1:30 PM Weigel’s Facility Tour and Lunch

@

CStoreMomentum is an event tailored for young leaders in the dynamic world of convenience retail. This unique gathering is a transformative experience designed to propel emerging leaders to new heights of excellence. Immerse yourself in engaging sessions, interactive workshops, and networking opportunities that will not only expand your industry knowledge but also cultivate the skills needed to thrive in a fast-paced environment. CStoreMomentum is more than just an event; it’s a catalyst for personal and professional acceleration, where young leaders converge to shape the future of convenience retail.

Swisher Sweets Leaf Wraps deliver an elevated, American-grown broadleaf experience that is “all wrap, no guts.” Launched in January 2025, these wraps offer consistent freshness and a slow, even burn in popular blends like OG, Peach Brandy and Irish Cream. Swisher Sweets Leaf Wraps embody the spirit of “Rolled to Refresh” as the company enters this exciting growth category while delivering a quality experience for customers and adult consumers in a space that requires innovative product handling. The products’ quality and precision cut makes rolling easier and more enjoyable.

Swisher www.swisher.com

Sunny Sky Products is expanding its Cinnabon beverage lineup with new products including Cinnabon Cold Brew. Cinnabon Cold Brew is a smooth, refreshing coffee experience featuring premium cold brew coffee blended with Cinnabon cinnamon roll and signature cream cheese frosting flavors. The cold brew comes in a six-liter bag-in-box and is now available upon request for c-store operators nationwide.

Rich Products is expanding its filled-croissant portfolio by adding Chocolate Flips and Blueberry Cream Cheese Flips. Featuring 16 layers of flaky, laminated dough folded over a creamy filling, Flips deliver a balance of indulgence and convenience. Going from freezer to oven and ready in minutes, Rich’s Flips are an easy-to-prepare

bakery treat requiring minimal labor. Chocolate Flips are 3.2 ounces, and Blueberry Cream Cheese Flips are four ounces each. The pastries arrive frozen with 48 per case with a freezer shelf life of 270 days.

Rich’s www.RichsConvenience.com

Improving back-office functionality and transforming operations involves the right mix of technology and strategy.

Emily Boes • Senior Editor

As technology upgrades, so too will the back office for c-store operators. With automation and artificial intelligence (AI) as tools to drive efficiency and a plethora of data becoming available, it’s important to note where retailers should be focusing and what’s ahead for the back office. CStore Decisions reached out to Perry Kramer, managing partner for Retail Consulting Partners, for his take on backoffice trends.

{CStore Decisions (CSD)} What technologies are allowing for the biggest efficiencies in the back office today?

{Perry Kramer (PK)} Changes in inventory management related to ordering, allocating, receiving and out-of-stocks are having a big impact on retailers’ ability to keep the shelves full and improve their inventory turns. The ability to get data to central systems in real time or near real time for store and distribution centers and then consume that data in back-office systems to generate and communicate orders to suppliers has had significant impacts on those that can execute it well. However, the learning curve can also be dangerous, resulting in overstocks of slow sellers and out-ofstocks of fast sellers if the product life cycle is not managed from end to end, including space planning on the store selling floor. …

{CSD} Are there any challenges retailers should be aware of as they upgrade their back-office tech?

{PK} It is more important than ever to

focus on data accuracy and integrity. These are going to be critical to any use of AI tools in the future for inventory analysis and supply chain analysis. As they upgrade their systems, they must focus on building an organization that has a chief data steward that drives integrity of data, the elimination of duplicated data, and ensures accuracy and integrity of data shared with third parties — including suppliers and marketing partners.

{CSD} What key performance indicators (KPIs) should retailers monitor in the back office but often overlook?

{PK} A critical KPI often overlooked is the slow seller or no seller report. Too often c-stores look at inventory turn as an average, which allows problem items to fall through the cracks. The slow seller and no seller report can identify a few critical things: 1.) Items that are just not selling that could be stuck in a stock room and not on the selling floor. 2.) Items just occupying selling space that needs to be converted to profitable space by marking the items down and admitting to a bad buy. 3.) Normally fast-selling items that are entirely out of stock. Focusing on the top items on this report can have a big impact.

{CSD} What back-office trends are you seeing coming down the pipeline for c-store retailers?

{PK} ... C-stores are getting much better at leveraging consumer loyalty data. They are driving this through debit cards, rewards at the pumps, food rewards and

traditional loyalty cards. The integrity and accuracy of this data is critical to the use of modern tools for consumer segmentation and marketing programs. There will be significant efficiencies in the use of the marketing data in the next few years as the use of AI and analytics moves from “diagnostic” (How did this happen?) to “predictive” and then “prescriptive” analysis … (What will happen?) followed by (How it will happen?).

The other noteworthy change coming down the road is Sunrise 2027, the use of QR codes (2D barcodes). For retailers to take advantage of the additional data contained in these barcodes, significant changes will need to be made in the inventory transactional and point-ofsale scanning and data capture technology. There are significant long-term opportunities in this area, but the systemic changes to take advantage of them is also significant in effort and cost.

{CSD} If a chain could only invest in one area of the back office this year, what should it be?

{PK} It is a combination of improving the accuracy and timing of inventoryrelated transactions throughout the entire procure-to-pay process. This will involve improving visibility into “clean and accurate” inventory data that can be leveraged for improved ordering, allocation and replenishment. In the c-store space, this is running neck and neck with consumer data for where the biggest AI-driven efficiencies will be seen in the next five years.