CStoreDecisions Solutions for Convenience Retailers Decisions INSIDE Lifting Beverage Sales Into Autumn ...........30 Building Dynamic Foodservice Dayparts .....40 Improving Supply Chain Practices .............60 YATCO CELEBRATES 30 YEARS Yatco, a second-generation, family-owned c-store chain, eyes expansion through acquisitions, new-to-industry stores and a franchising program, while updating its look and investing in technology. August 2023 • CStoreDecisions.com

• Establishes a digital foundation to optimize the ATCs 21+ journey

• Enables an integrated marketing approach for your ATCs 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Help responsibly connect & engage with your ATCs 21+ in the digital environment

Invest in digital infrastructure that responsibly optimizes & enables new channels for ATCs 21+ experiences

Enhance your retail digital capabilities & build a foundation of responsibility to meet the evolving ATCs 21+ expectations & improve their experiences

OR024 | ©2023 Altria Group Distribution Company | For Trade Use Only

Serving ketchup and our country. Red Gold is a registered trademark of Red Gold, LLC. Elwood, IN RG-1352-0822 Ketchup with a Cause. You can’t beat the taste of Red Gold Ketchup, and now you can get it in a convenient 1 oz. dunk cup! With its thick, tangy tomato flavor and the perfect balance of sweet and sour notes—it’s a delicious flavor As proud supporters of the Folds of Honor Foundation, Red Gold helps to provide educational support to the spouses and children of deceased or disabled U.S. service members. That means, when you serve Red Gold, you’re serving the families of our fallen troops, too. you can feel good about serving. Request a sample today of the 1 oz. Red Gold Ketchup that’s easy to love and easy to share at Redgoldfoodservice.com/sample-requests RedGoldTomatoes.com/FoldsOfHonor Products must earn the ChefsBest® Excellence Award by surpassing quality standards established by professional chefs.

the CSD Group

EDITORIAL

EDITOR EMERITUS

John Lofstock

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR

Zhane Isom zisom@wtwhmedia.com

ASSOCIATE EDITOR

Marilyn Odesser-Torpey

ONLINE EDITOR

Kevin McIntyre

CONTRIBUTING EDITOR

Anne Baye Ericksen

COLUMNISTS

Abbey Karel

Bruce Reinstein

SALES TEAM

KEY ACCOUNT MANAGER

John Petersen jpetersen@wtwhmedia.com

(216) 346-8790

VICE PRESIDENT, SALES

Tony Bolla tbolla@wtwhmedia.com (773) 859-1107

REGIONAL SALES MANAGER

Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

REGIONAL SALES MANAGER

Simran Toor stoor@wtwhmedia.com

(770) 317-4640

CUSTOMER SERVICE

CUSTOMER SERVICE MANAGER

Stephanie Hulett shulett@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE

Jane Cooper jcooper@wtwhmedia.com

WTWH MEDIA, LLC

LEADERSHIP TEAM

CEO Scott McCafferty smccafferty@wtwhmedia.com

CO/FOUNDER, VP SALES Mike Emich memich@wtwhmedia.com

EVP Marshall Matheson mmatheson@wtwhmedia.com

CFO Ken Gradman kgradman@wtwhmedia.com

CREATIVE SERVICES

VICE PRESIDENT, CREATIVE SERVICES Mark Rook mrook@wtwhmedia.com

VICE PRESIDENT, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

DIRECTOR, AUDIENCE DEVELOPMENT Bruce Sprague bsprague@wtwhmedia.com

EVENTS

DIRECTOR OF EVENTS Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MARKETING SPECIALIST Olivia Zemanek ozemanek@wtwhmedia.com

EVENTS COORDINATOR Alexis Ferenczy aferenczy@wtwhmedia.com

VP, ASSOCIATION & COMMUNITY ENGAGEMENT Allison Dean adean@wtwhmedia.com

1111 Superior Ave., 26th Floor, Cleveland, OH 44114

Ph: (888) 543-2447

EDITORIAL AND NAG

1420 Queen Anne Road, Suite 4, Teaneck, NJ 07666

Ph: (201) 321-5642

SUBSCRIPTION INQUIRIES

VIDEO PRODUCTION

VIDEOGRAPHER Garrett McCafferty gmccafferty@wtwhmedia.com

VIDEOGRAPHER Kara Singleton ksingleton@wtwhmedia.com

DIGITAL MARKETING

VICE PRESIDENT, DIGITAL MARKETING Virginia Goulding vgoulding@wtwhmedia.com

DIGITAL MARKETING MANAGER Taylor Meade tmeade@wtwhmedia.com

WEBINAR COORDINATOR Halle Kirsh hkirsh@wtwhmedia.com

WEBINAR COORDINATOR Kim Dorsey kdorsey@wtwhmedia.com

DIGITAL DESIGN MANAGER Samantha King sking@wtwhmedia.com

MARKETING GRAPHIC DESIGNER Hannah Bragg hbragg@wtwhmedia.com

WEB DEVELOPMENT

DEVELOPMENT MANAGER Dave Miyares dmiyares@wtwhmedia.com

SENIOR DIGITAL MEDIA MANAGER Pat Curran pcurran@wtwhmedia.com

DIGITAL PRODUCTION MANAGER Reggie Hall rhall@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Lender nlender@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Lisa Dell’Alba, President and CEO

Square One Markets • Bethlehem, Pa.

Raymond Huff, President

HJB Convenience Corp. • Lakewood, Colo.

Bill Kent, President and CEO

The Kent Cos. Inc. • Midland, Texas

Olivia Beck • Operations

Beck Suppliers Inc. • Fremont, Ohio

Reilly Robinson Musser, VP, Marketing & Merchandising

Robinson Oil Corp. • Santa Clara, Calif.

Bill Weigel, CEO

Weigel’s Inc. • Knoxville, Tenn.

NATIONAL ADVISORY GROUP (NAG) BOARD

Vernon Young (Board Chairman), President and CEO

Young Oil Co. • Piedmont, Ala.

Joy Almekies, Senior Director of Food Services Global Partners • Waltham, Mass.

Mary Banmiller, Director of Retail Operations

Warrenton Oil Inc. • Truesdale, Mo.

Greg Ehrlich, President Beck Suppliers Inc. • Fremont, Ohio

Doug Galli, Real Estate/Government Relations Reid Stores Inc./Crosby’s • Brockport, N.Y.

Derek Gaskins, Senior VP, Merchandising/Procurement Yesway • Des Moines, Iowa

Joe Hamza, Chief Operating Officer Nouria Energy Corp. • Worcester, Mass.

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Robin Hunt, Sales Hunt Brothers Pizza • Nashville, Tenn.

Kyle May, Director External Relations Reynolds Marketing Services Co. • Winston-Salem, N.C.

Tony Woodward, Manager Sr. Account McLane Company Inc. • Temple, Texas

YOUNG EXECUTIVES ORGANIZATION (YEO) BOARD

Kalen Frese (Board Chairman), Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Jeff Carpenter, Director of Education and Training

2011 - 2020

To enter, change or cancel a subscription, please go to: http://d3data.net/csd/indexnew.htm or email requests to: bsprague@wtwhmedia.com

Copyright 2023, WTWH Media, LLC

CStore Decisions (ISSN 1054-7797) is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 2600, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers. Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries. Periodicals postage paid at Cleveland, OH, and additional mailing offices. POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, 26th Floor, Cleveland, OH 44114. GST #R126431964, Canadian

Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2023 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher. Circulation audited by Business Publications Audit of Circulation, Inc.

Cliff’s Local Market • Marcy, N.Y.

Megan Chmura, Director of Center Store GetGo • Pittsburgh

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise Gate Petroleum Co. • Jacksonville, Fla.

Alex Garoutte, Director of Marketing The Kent Cos. Inc. • Midland, Texas

Daillard Paris, Director of Petroleum Supply and Trading Sheetz Inc. • Altoona, Pa.

4 CSTORE DECISIONS August 2023 cstore decisions.com

Leading Through Innovation www.cstoredecisions.com CStoreDecisions National Advisory Group for Convenience Retail NAG CONVENIENCE CStoreDecisions .com CStoreDecisions asbpe.org GOLD REGIONAL AWARD 2022 asbpe rg SILVER REGIONAL AWARD 2023 asbpe.org

Contact your local ChapStick representative on how to order or email John.L.Hankins@haleon.com ©2023 Haleon group of companies or its licensor. All rights reserved. Carries our top 4 selling skus: Original Cherry Strawberry Moisturizer w/SPF 15 Fish Bowl 72pc Display You have the potential to make OVER 60% MARGIN! Save 29% $90 IN PROFIT from 1 Fish Bowl at $1.99 * @ $1.99 SRP

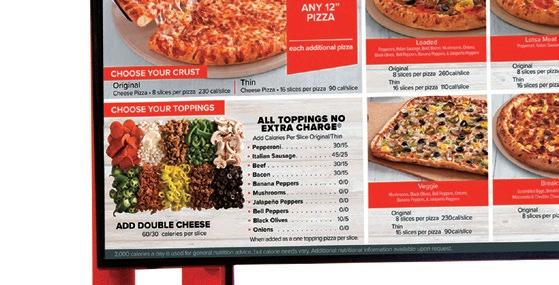

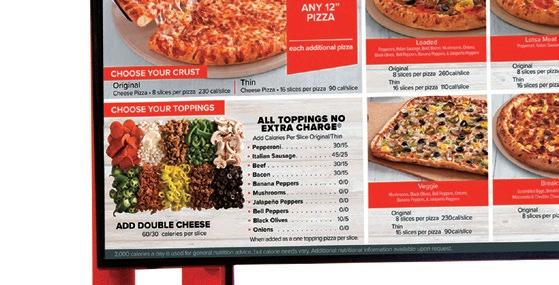

6 CSTORE DECISIONS • August 2023 cstore decisions.com CONTENTS FRONT END 8 Editor’s Memo: Finding Success as an Independent Operator 10 Big Mike’s Celebrates 15th Anniversary, Eyes Expansion 14 Quick Bites: Online Ordering Continues to Rise CATEGORY MANAGEMENT 26 Keeping an Eye on Vape, Cigars 30 Lifting Beverage Sales Into Autumn 36 Health and Beauty Product Sales Soar FOODSERVICE 40 Building Dynamic Foodservice Dayparts 46 May Delivers Delicious Eats at Kwik Stop TECHNOLOGY 52 Convenience Drives Contactless Payments in C-Stores 56 Why Your Tech Should be as Craveable as Your Snacks OPERATIONS 60 Improving Supply Chain Practices COVER STORY 16 Yatco Celebrates 30 Years Yatco, a second-generation, family-owned c-store chain, eyes expansion through acquisitions, newto-industry stores and a franchising program, while updating its look and investing in technology. BACK END 64 Product Showcase 70 Industry Perspective: How to Achieve Consistent Menu Execution August 2023 • Number 8 • Volume 34 CStoreDecisions® 40

Join the IHOP Family

Seeking multi-unit operators and developers to continue IHOP’s growth in travel centers nationwide and offering varied incentives for development.*

• Develop/operate a nationally recognized and trusted brand that will broaden your customer appeal

• 65+ years of giving guests the good comfort food they love and the updated favorites they want to try… at a great value

• A variety of menu options serving all dayparts, giving guests the flexibility of choice

• Updated exterior and interior restaurant design to provide all travelers a comfortable environment at any daypart

• Portable menu items and digital ordering offer a convenient guest experience

Interested in learning more…

Contact Us franchising@ihop.com

*Subject to Franchise Agreement and Development Agreement Terms.

© 2023 IHOP Franchisor LLC. This is not an offer to sell a franchise. An offer can be made only by means of a Franchise Disclosure Document that has been registered and approved by the appropriate agency in your state, if your state requires such registration, or pursuant to availability and satisfaction of any exemptions from registration.

CONTACT US

For any questions about this issue or suggestions for future issues, please contact me at edelconte@wtwhmedia.com.

Finding Success as an Independent Operator

Family-owned and independent c-store businesses are the backbone of the convenience store industry. But running a familyowned c-store chain and successfully integrating second-generation leadership into the company all while scaling the business isn’t for the faint of heart.

When the convenience store chain is family owned, the owners also have to find ways to separate family time from the business of running a convenience store. One key is to avoid discussing the business outside of work, unless absolutely necessary, shared Hassan Yatim, chief operating officer of Marlborough, Mass.-based Yatco convenience stores. Despite the challenges, building a c-store business and creating a legacy together as a family brings big rewards.

Yatco is featured as this month’s cover story. Tarek and Khadijeh Yatim co-founded Yatco in 1993 after immigrating to the U.S. to escape civil war in Sierra Leone, Africa. Today, their three sons, Hassan, Hussein and Mohamed, are active in the family business. What started as a single store has now grown to a 13-store chain with four new-to-industry stores on the horizon. Now, as Yatco celebrates its 30th anniversary, it’s looking ahead. The chain plans to double its store count through new builds and acquisitions, develop its franchising program and integrate mobile fueling, self-checkout, delivery and more.

This month’s profile article highlights another independent c-store chain, Big Mike’s, based in Lebanon, Ohio, which operates five stores and plans to grow its footprint. Despite its size, the independent c-store chain features a competitive offering with a proprietary foodservice program and drive-throughs. It’s also eyeing future opportunities in loyalty programs and delivery.

MEETING THE COMPETITION

Like Yatco and Big Mike’s, many family-owned and/or independent chains are increasingly taking their c-store operations to the next level to compete with larger chains that are setting the bar high. They’re launching initiatives that were once the exclusive domain of much larger chains, such as building new-to-industry stores with an emphasis on modern design, adding quality foodservice programs and integrating technology from loyalty apps and delivery to self-checkout. Bean-to-cup coffee machines are providing benefits in terms of waste, labor and convenience, even for small operators.

Still, as the c-store industry steps up to meet growing customer expectations, it can be hard for smaller chains to keep pace. From sourcing products to funding electric vehicle chargers to launching a foodservice operation, it’s a lot more expensive for smaller businesses to compete. But time and again family-owned and independent chains are stepping up to the plate, and many are finding success.

The National Association of Convenience Stores (NACS) during the 2023 NACS State of the Industry Summit reported that the c-store industry is 150,174 stores strong, having grown 1.5% in 2022. That growth came from an uptick in single-store operators, which grew by 1,087 sites for a total of 90,423 stores. Many of those c-store operators likely have their eye on growth much like the Yatims did when they began by opening their first site 30 years ago. With perseverance, due diligence and a focus on customer demands for convenience, independent and family-owned chains are building a bright future in today’s market.

Editor’s Memo

Erin

Del Conte

8 CSTORE DECISIONS • August 2023 cstore decisions.com

NEVER RUN OUT 76% of all nicotine pouch dollars come from ZYN. Stock up on America’s #1 Nicotine Pouch and keep your customers coming back. Call 800-367-3677 or contact your Swedish Match Rep to learn more. FOR TRADE PURPOSES ONLY. | ©2023 Swedish Match North America LLC

Big Mike’s Celebrates 15th Anniversary, Eyes Expansion

Kevin McIntyre • Online Editor

Big Mike’s Gas N Go is celebrating 15 years in business.

Headquartered in Lebanon, Ohio, Big Mike’s recently opened its fifth convenience store in the state and plans to continue expanding its footprint. The independent c-store chain features a proprietary foodservice program and drive-throughs and is eyeing opportunities in loyalty programs and delivery.

Owner Mike Schueler’s extensive business experience, customer-centric mindset and hands-on approach has helped the chain find success.

Schueler is also the chairman and CEO of real estate services company The Schueler Group, and he draws on his vast real estate experience, along with his background in the c-store industry, as he develops Big Mike’s.

BUILDING BIG MIKE’S

Schueler first started working in the c-store world back in college to pay his way through school.

He later moved into the real estate business, purchasing numerous c-store properties for a private company. When two of the locations that he rented went out of business, Schueler decided to start his own chain of c-stores.

In 2008, Schueler founded Big Mike’s Gas N Go,

taking over two sites in Troy and Tipp City, Ohio. From there, Schueler developed the Big Mike’s Gas N Go logo and brand.

In 2009, the chain expanded through its first ground-up new build in Batavia, Ohio. Schueler later added a fourth store in Landen, Ohio, when he saw an opportunity to add a large, renovated store to a property for sale there.

In April of this year, Big Mike’s introduced its latest site in Lebanon, Ohio, in the same town as its company headquarters.

“The one thing that’s a little bit different with our company is our owner is very involved in our stores,” said Judy Duchemin, director of store operations for Big Mike’s Gas N Go. “He wants to know everybody that works for him. It doesn’t matter how far he’s got to travel.”

Duchemin described Schueler’s ownership style as “old school,” with Schueler being actively involved in day-to-day operations of all the locations he owns.

“You just don’t get that anymore from small businesses to where the owner actually wants to meet everybody that works for him,” said Duchemin. “I think one of the reasons why he’s done so well is because (employees) actually know the owner and actually feel like ... they’re an important part of the company. Well, because they are.”

With five stores in Ohio, Big Mike’s delivers for customers with proprietary foodservice, ample parking and drivethroughs as it looks toward expansion.

FRONT END Profile

10 CSTORE DECISIONS • August 2023 cstore decisions.com

STORE DESIGN

When it comes to store design, each Big Mike’s c-store is tailored to meet the needs of its customers, and that starts in the parking lot.

“We have really nice big parking lots because we want to be able to cater to the lawncare guys, the semis that they need to come in,” said Duchemin. “So, we always make sure that we have two different easements to where they can come in and out of.”

Two of the chain’s locations also feature spacious drive-throughs. Duchemin noted that this is an important aspect of the chain’s design because many customers have young children, and getting out of the car to go into the store may not always be easy. She also mentioned that police officers appreciate the drive-throughs when they need to stop and get a drink while they are on call.

The company is set to rebuild its Batavia location after the city altered the configuration of the roads surrounding the store. When Big Mike’s realized it needed to raze and rebuild the store so that it faced the new roads, it also saw an opportunity to add a drive-through, which will bring the chain’s drivethrough count to three.

The color scheme for each store is based off of the colors of the fuel brand offered at each location.

In the forecourt, Big Mike’s partners with gas brands BP and Shell. The first three sites — located in Troy, Tipp City and Batavia — are supplied by BP. The two newest stores — located in Landen and Lebanon — are supplied by Shell.

While the chain does not currently offer electric vehicle (EV) charging, it’s currently evaluating its stations to see if and where EV charging might be a fit.

cstore decisions.com August 2023 • CSTORE DECISIONS 11

The color scheme for each store is based off of the colors of the fuel brand offered at each location.

Schueler has been in talks with Shell about adding EV charging to its sites.

Duchemin noted that one aspect to consider with EV charging is space, as not all retailers have enough room to implement the chargers. She added that Big Mike’s Lebanon location does have enough space to potentially accommodate chargers, so out of the five stores, that is the most likely one to implement the charging stations.

FOODSERVICE FORWARD

Despite being a small chain, Big Mike’s features a successful proprietary foodservice program that includes breakfast sandwiches and pizza.

“We make breakfast sandwiches every morning, which does really well for us because we hear they’re better than McDonald’s in places,” said Duchemin. “Breakfast is one of our biggest categories compared to lunch.”

To make the program fast and easy for employees, Big Mike’s relies on frozen food products that are heated and served in-store. In addition to its break-

fast offerings, the chain also welcomes call-ahead orders for lunch products such as pizza.

Duchemin noted that many times workers from the factories near the stores will call ahead and order pizzas for lunch.

Each store is also equipped with a wide variety of coffee options, from Columbian to House Blend and the popular Highlander Grogg flavor.

CUSTOMER SERVICE

As all retailers know, customer service can be a key point when it comes to building relationships with communities and encouraging loyalty from customers. At Big Mike’s, this is a point of emphasis when it comes to the operations of each store.

“We really are very picky about the people that we hire because we want our main goal to be customer service,” said Duchemin. “Our customers are very important to us. So, if we get people that don’t provide that, then we find somebody else.”

In addition to having exceptional customer service, the chain makes cleanliness another top priority.

“I truly believe that’s our leverage over some stores because we always hear how clean our bathrooms are, how clean our stores are and how friendly our people are,” said Duchemin.

THE FUTURE FOR BIG MIKE’S

Big Mike’s has plans to expand further throughout Ohio in the future.

“(Schueler) has a couple more stores on the horizon after we rebuild our Batavia location,” said Duchemin.

While expansion is top of mind, other plans for the future include introducing new technology, particularly a proprietary loyalty program. Currently it offers the Fuel Rewards Network program through Shell.

Additionally, the chain has been in talks with DoorDash and is considering the possibility of adding delivery to its offerings soon.

While the chain continues to expand and grow, one thing that is certain is that with hands-on, active involvement from Schueler, the chain’s future is in good hands.

Profile

FRONT END

Each store is equipped with a wide variety of beverage and coffee options from Columbian to House Blend and the popular Highlander Grogg flavor.

12 CSTORE DECISIONS • August 2023 cstore decisions.com

Two Big Mike’s locations feature spacious drive-throughs, which is an important aspect of the chain’s design.

QUICKBITES

ONLINE ORDERING CONTINUES TO RISE

The COVID-19 pandemic pushed online ordering to all-time highs and instilled new shopping habits in customers that remain even as the pandemic has subsided. Convenience stores are responding to the trend, adding order ahead, e-commerce and delivery options to meet this ongoing customer demand.

ONLINE SHOPPING INCREASES

According to Adtaxis’ “2023 E-Commerce Survey,” shopping online is at an all-time high. Adtaxi found:

• Nine in 10 online adults (93%) engage in e-commerce during the typical month, compared to seven in 10 back in 2017.

• Entering 2023, one in four online shoppers engage in e-commerce on a daily basis, compared to just 5% in 2017.

MEASURING ONLINE SHOPPING FREQUENCY

In Jungle Scout’s “Consumer Trends Report,” the company surveyed 1,000 U.S. consumers to poll shoppers’ online ordering frequency. The report found:

11% of consumers shop online once a week.

shop even greater

• Two-thirds shop online weekly, compared to one-fourth (27%) six years ago.

• The frequency with which Americans shop online is posting even greater gains and will drive further growth moving forward.

Source: Adtaxis’ “2023 E-Commerce Survey,” June 2023

WILL LOAN REPAYMENT IMPACT FOOD DELIVERY?

When student loan repayment restarts in October, some shoppers might have less disposable income for food orders. CivicScience data found 52% of borrowers who order food delivery at least weekly are “very concerned” about paying back student loans.

16% of consumers shop online two to three times a month. 21% of consumers shop online once a month or less. 7% of consumers have never shopped online.

Source: Jungle Scout’s “Consumer Trends Report,” May 2023

MOTIVATIONS FOR ONLINE SHOPPING

Consumers shop online for many reasons. Adtaxis’ “2023 E-Commerce Survey” found:

Source: CivicScience, June 2023

Source: Circana’s “The Snacking Supernova,” April 2023

MOST POPULAR PRODUCTS BOUGHT ONLINE

PwC found 35% of consumers purchase food and beverages online.

Source: PwC’s June 2023 “Global Consumer Insights Pulse Survey”

DIGITAL ORDERS TREND UPWARD

• 52%

• 51%

• Year after year, convenience remains the most cited reason why U.S. consumers shop online (79%) of consumers shop online to look at price comparisons. of consumers shop online for consumer reviews.

• 46% of consumers shop online to find coupons.

Source: Adtaxis’ “2023 E-Commerce Survey,” June 2023

Digital orders now consistently make up 25–30% of all orders, compared to less than 10% in late 2019. Those placing digital orders are increasingly members of that brand’s loyalty program.

Source: Paytronix, “Online-Ordering Report 2023”

14 CSTORE DECISIONS • August 2023

Now Available All Day, Every Day A top selling Limited Edition joins White Owl’s every day lineup of cigars! IN STORE JULY 2023 AVAILABLE IN 2 FOR $1.19 AND SAVE ON 2 FOR MORE INFORMATION CONTACT YOUR SWEDISH MATCH REPRESENTATIVE 800-367-3677 • CUSTOMER.SERVICE@SMNA.COM WHITEOWLCIGAR.COM © 2023 SMCI Holding, Inc.

YATCO CELEBRATES 30 YEARS

Yatco, a second-generation, family-owned c-store chain, eyes expansion through acquisitions, new-toindustry stores and a franchising program, while updating its look and investing in technology.

industry stores and a

Erin Del Conte • Editor-in-Chief

Erin Del Conte • Editor-in-Chief

Cover Story / Yatco

16 CSTORE DECISIONS • August 2023

cstoredecisions.com

company

As Yatco celebrates 30 years in business, the family-owned, second-generation c-store chain has aggressive plans to double its company-operated stores and grow its franchising program. The Marlborough, Mass.-based company is currently building four new-to-industry (NTI) stores, updating its exterior branding and investing in technology from mobile payment to self-checkout kiosks.

“Currently, we are in a build phase,” said Hassan Yatim (pictured left), chief operating officer and a second-generation member of Yatco, which operates 13 c-stores in Massachusetts, Connecticut and Rhode Island.

Yatim’s parents, Tarek and Khadijeh Yatim, co-founded Yatco. Tarek helms the company as CEO and knows exactly what he wants when it comes to building stores today.

“He’s 30 years in the business, and building stores is what he loves to do at this point; finding prime estate, building beautiful stores with beautiful foodservice and quick-service restaurants available,” Yatim said.

30 YEARS OF GROWTH

Yatco can trace its roots to the early 1990s when Tarek and Khadijeh immigrated to the U.S. to escape civil war in Sierra Leone, Africa.

“When they were in Sierra Leone, my (paternal) grandfather owned a little wholesale business. When he passed away, my dad had to take it over to support his family when he was 16,” Yatim said. Tarek’s two older brothers were in the U.S. at the time, studying at Suffolk University in Boston.

August 2023 • CSTORE DECISIONS 17

As the civil war broke out in Sierra Leone, Tarek and Khadijeh married.

“My eldest brother, Mohamed, was born in Africa. (My father) had to send my mother to Lebanon during the war while she was pregnant, and she had to give birth there to the second brother, Hussein,” Yatim said.

In 1991, the family immigrated to the U.S., and moved to the Roslindale neighborhood in Boston.

“There, my parents’ work history started in retail,” Yatim said. “My mom was working at a Dunkin’ making about $4 an hour.”

His father found work at a gas station in Boston pumping gas for customers at a full-service station.

But it wasn’t long before they set out to create a business of their own.

In 1993, they acquired an abandoned Exxon gas station on Lincoln Street in Worcester, Mass., and worked in the store 16 to 18 hours a day to grow it into a successful business. One year later, the Yatims opened a second store in Worcester, on Park Ave., and then a third in Marlborough, Mass.

“They just kept working and building, and my dad’s brothers got involved at the second and third acquisitions, and the company just kept growing from there,” Yatim said.

The family formed Yatco Distribution in 2012 to supply its fuel locations as well as external customers in the New England market.

The company’s first NTI store was built in Norfolk, Mass., around 2013.

In 2021, the chain expanded into Connecticut when it acquired a single store there, and in October 2022, it grew its footprint into Rhode Island with the acquisition of a site in Chepachet, R.I.

Three years ago, the family restructured the

Top left: Tarek Yatim, CEO of Yatco, and his wife Khadijeh Yatim, who handles human resources for the chain, co-founded Yatco in 1993.

Bottom right: Brothers Hussein, Hassan and Mohamed represent the second generation of the family business.

business. Yatim’s uncles exited the company, leaving Tarek, Khadijeh and their three sons as the primary business owners.

Today, Khadijeh handles talent acquisition and oversees human resources. Hussein, the middle brother, is the vice president of marketing. Mohamed, the eldest brother, is a principal engineer at Boston Scientific but still finds time to help with the family business.

“He’s written a lot of our policies — our dress code policies, the onboarding handbook — that have helped keep us in compliance,” Yatim said.

Yatim started helping out with the family business during the summers starting when he was only 12 years old.

“I gained a mastery level understanding of a point of sale and a cash register at that time,” he said.

Even though he went on to gain a degree in chemical engineering from Northeastern University, Yatim always expected he would work in the family business one day.

“I got my MBA from Northeastern as well. Working in gas stations and convenience stores was always in the family blood, from both of my grandfathers down to us.

Yatim officially joined Yatco as chief operating officer after finishing his MBA in 2021.

18 CSTORE DECISIONS • August 2023 cstore decisions.com

Cover Story / Yatco

Craveworthy FRANCHISING

“Many brands spend so much time and energy trying to build themselves up to then get bought out,” Majewski says. “We believe that with access to our resources and restaurant expertise early on in their journey, we can help brands reach their potential faster.”

While the franchisor is looking for all types of franchisees, Craveworthy Brands is unique in that it values first-time franchisees—and not just in theory. Majewski has set up several incentives to help those who want to achieve their dream of owning a restaurant: anyone who stays with Craveworthy Brands in a management role for three years earns the right to open up their own store. The franchisee is then entitled to two royalty-free years of operations.

“The great thing about the franchise model is that it allows people to achieve the American Dream,” Majewski said. “However, it’s painful to me where the franchise model has gone. Most brands won’t franchise with you if you don’t have experience doing it, and that means you have these huge groups that own all these different brands. We want to create a system that helps make the American Dream more accessible.”

The following pages contain details on three of the concepts currently owned by Craveworthy Brands and why they might be attractive opportunities for seasoned franchisees—and aspiring ones as well.

SPONSORED BY CRAVEWORTHY BRANDS

THE BUDLONG HOT CHICKEN

• The Budlong Hot Chicken • Wing It On! • Genghis Grill INSIDE:

CRAVEWORTHY BRANDS was founded in 2022 by Gregg Majewski, former CEO of Jimmy John’s. His goal was to build a portfolio of brands with craveable food and significant white space within their category—and to provide the resources necessary to streamline their growth via franchising.

The Budlong Hot Chicken: a Chicago-Area Favorite, Now Franchising

Brand has developed a ‘cult-like’ following at its four locations.

BY CHARLIE POGACAR

NASHVILLE HOT CHICKEN HAS TAKEN the country by storm. Soon, The Budlong Hot Chicken will be doing the same—the chef-driven concept originated in the Chicagoland area in 2016 and quickly became known as the area’s go-to spot for Nashville hot.

Basing his recipes on those from famous Nashville establishments like Prince’s Hot Chicken and Hattie B’s, The Budlong Founder Jared Leonard developed an original menu that would capture authentic Southern flavor. The brand features a full menu of Nashville hot sandwiches that range from mild all the way up to “berserk!!!”, designed for only the bravest connoisseurs of spice.

Diners can choose from several different versions of Nashville hot sandwiches, including the Southern Style, smothered in pimento cheese and pickles, or the Yo Momma’s, served with black-pepper pickle relish mayo, lettuce, tomato, red onion and Budlong pickles. Other menu items include Southern staples like buttermilk biscuits, creamy mac ‘n’ cheese, scratch-made farm slaw, popcorn chicken, and a Southern-style salad.

The Budlong caught the eye of Craveworthy Brands CEO Gregg Majewski when it first opened. He became a devoted follower of the brand and its mouth-watering menu items and eventually acquired it in 2021 after COVID-related restrictions put the brand in a tough position. Majewski’s goal was to scale the brand while keeping the authenticity that makes it so unique.

LOCATIONS: 4

FRANCHISE FEE: Single Unit - $30,000; additional units$20,000 each; development fee$10,000, credited to franchise fee.

TOTAL START-UP COSTS: $178,000 to $989,500/store

“The Budlong Hot Chicken truly has a cult following in the city,” Majewski says. “Who doesn’t love fried chicken and Southern-style food? And The Budlong blows the competition out of the water.”

Majewski says one thing that sets The Budlong’s food apart is the fact that the brand gives diners the option of selecting thighs for their hot chicken sandwich—a chef hack that creates differentiation in the saturated fried-chicken segment. “It’s more of a Southern

fried chicken than it is a Nashville Hot Chicken,” Majewski says. “But you’ve got different flavor profiles and levels of spice in there to choose from. We’re going to own the Southern chicken segment because we’re differentiated from everyone else.”

The brand is still in its initial stages of growth, with four locations open. Majewski sees a world where The Budlong Hot Chicken grows across the Midwest and all over the country thanks to its craveable, standout menu and its ease of operation. Like many Craveworthy Brands’ concepts, The Budlong Hot Chicken requires very little square footage or operational complexity. Franchisees can open locations for under $200,000 in some cases.

“This is the perfect brand,” Majewski says. “This is truly the one to jump in on if you want to live the American Dream. The food is incredible, there’s so much room to grow, and the buildouts are right on the money in terms of price point.

CF THE BUDLONG HOT CHICKEN (4)

SPONSORED BY THE BUDLONG HOT CHICKEN

“ THE BUDLONG BLOWS THE COMPETITION OUT OF THE WATER.”

Ready To Make Your Mark? franchising@craveworthybrands.com franchise.thebudlong.com e Hot Chicken Concept at’ Rock Your P tfolio A HOT FRANCHISE TREND FOR 2023 Chicken is what's for dinner and with the latest growth trends in fast-casual you don't want to miss your opportunity grow with this popular food segment. CULINARY MASTERY The Budlong Hot Chicken introduced its latest menu in collaboration with world-renowned Chef Robert Kabakoff and Craveworthy Brands’ VP of Culinary and Menu Innovation, Becca McIntyre. FRANCHISE SUPPORT

not successful unless you are. Franchisees are set up for success from day one with personalized and comprehensive start up assistance and on-going support. OPEN FOR GROWTH FUTURE EXPANSION

We’re

Wing It On! Award-WinningRidingRecipe to Growth

BY CHARLIE POGACAR

UNTIL 2022, THERE HAD NEVER been a fast-casual restaurant to win a “best wing sauce” category at the annual National Buffalo Wing Festival in Buffalo, New York. That changed when Wing It On! secured the top prize for the traditional medium sauce category in September 2022.

Wing It On!’s best-in-class wing sauces are part of the reason why Craveworthy Brands purchased the brand with intentions of scaling it.

not just because of its mouth-watering food, but also due to the wing category’s white space. Majewski calls it out: his goal is to give Wing It On! all the resources it needs to grow into the second-biggest brand in the category.

With 14 locations, including a food truck, currently open and 17 more agreements signed, Wing It On! is a real contender to achieve that goal—in 2022, Wingstop was the only wing concept that appeared in the QSR Top 50. Majewski says Craveworthy’s current projections show Wing It On! checking in at 200 units within the next five years, with “100 or more in the pipeline at all times.”

“And that’s a scaled down version of our projections,” Majewski says. “That’s the sure-thing bet of locations we’ll have open by 2028. I think the sky’s the limit with this brand, because the product is there and now we’ve got the infrastructure built up around it.”

“That gave me proof of concept,” Craveworthy Brands CEO Gregg Majewski says. “Usually you see mom-andpop restaurants win in contests like that. Wing it On!’s sauce is that much better than other brands trying to grow out there. I knew we could build a Craveworthy type of experience with it.”

The Wing It On! menu also features chicken sandwiches, tenders, dumplings, french fries, and more. All of the food is built to travel—Wing It On! boasts up to 90 percent off-premises orders at its stores.

Wing It On! fit the Craveworthy Brands playbook

LOCATIONS: 14

FUTURE LOCATIONS

SIGNED: 17

FRANCHISE FEE: $30,000 for single unit, $22,4500 for second, $14,500 each additional unit

TOTAL START-UP COSTS: $210,500–$440,000/store

One of the key upsides of Wing It On!’s model is the fact that it requires minimal up-front investment—estimated between $210,500 and $440,000 per store—and very little square footage. It’s a brand that a franchisee can really run with, too: Craveworthy Brands charges a $30,000 franchise fee for a single unit, $22,500 for a second unit, and just $14,500 for each additional unit.

“This is a brand that scales everywhere,” Majewski says. “We are aiming to grow all throughout the northeast, up and down the eastern seaboard, and even into the midwest, in places like the Dallas-Fort Worth area, and we’ll soon be opening up corporate stores in Chicago. But we’re really open to a lot of different places right now.

CF WING IT ON! (3)

The wing nut’s kind-of-wing joint takes aim at 200 locations in the next five years.

SPONSORED BY WING IT ON!

“ THIS IS A BRAND THAT SCALES EVERYWHERE.”

SAY HELLO TO THE WING NUT'S KIND OF WING JOINT

AMERICA'S #1 BUFFALO SAUCE

Our obsession with wow-factor flavors has earned us the title of America's #1 Buffalo Sauce. Our Medium Buffalo was voted best-tasting traditional buffalo sauce at the National Buffalo Wing Festival, in Buffalo, NY - the birthplace of the wing.

A HOT FRANCHISE TREND FOR 2023

Invest in a winning concept. Ranked one of the hottest franchise trends in 2023 by Entrepreneur Magazine. 2021 winner of QSR Magazine's 40 under 40. Ranked on the Inc. 5000 list as a Top 50 Food Brand in 2022.

WE'RE MORE THAN JUST WINGS

An innovative menu to keep fans coming back for more. Our mix of classic wings, boneless tenders, chicken sandwiches, dumplings, fries and unique sides brings a diverse menu offering not seen in other“wing-joints”.

WANT THE KEYS TO THE WINGDOM? franchising@craveworthybrands.com franchise.wingiton.com OPEN FOR GROWTH FUTURE EXPANSION

Genghis Grill is King of Its Segment

The legacy brand has a new look—and unlimited white space.

BY CHARLIE POGACAR

IN MANY WAYS, GENGHIS GRILL was before its time. Long before other brands were leaning into customization and menu items with a health halo, Genghis Grill was founded in 1998 as a design-your-own bowl concept beloved by all different types of diners.

Guests at Genghis Grill come in and select from over 80 of the freshest ingredients—from proteins to handcut veggies to signature sauces and spices. Genghis Grill has also always offered a variety of chef-curated bowls for every type of eater and dietary lifestyle.

“Genghis Grill is a really fun concept that has absolutely no competitor in the space,” says Craveworthy Brands CEO Gregg Majewski. “We are the king of this

of having to wait too long.

Under Majewski’s leadership, the brand transitioned from a full-service restaurant model to a fast-casual concept, cutting staffing from 15–20 team members during peak hours down to 5–7. Suddenly, fresh bowls were coming out in a maximum of 3–5 minutes during those peak hours. With streamlined operations, the brand is now a 50-plus unit concept and has already sold 24 franchise agreements in 2022.

“Genghis Grill is by far the easiest concept that we have,” Majewski says. “Guests come down the line and point to what they want and it’s cooked in the time it takes to cook a burger.”

When taking a look at the brand’s menu prices, it’s easy to see another reason why guests love Genghis Grill. The concept offers 20 of its bowls for under $10—Chef Bowls and Fried Rice Bowls are available for $9.99 or less. The brand recently launched a new “VALUEBOWLS” lineup with bowls priced under $8. There’s plenty of margin left for the operator, too: the COGS for VALUEBOWLS run between 18–23 percent, while Chef Bowls’ COGS average between 15–30 percent.

space already. We have so much white space because nobody does it like we do.”

When Majewski and his team acquired Genghis Grill in 2021, Majewski put his Jimmy John’s hat on. As the former CEO of the “freaky fast” sandwich concept, Majewski saw a world where Genghis Grill customers could have all of the upside of customizing their own bowl and watching it get cooked to order with none of the downside

Another area where Genghis Grill continues to grow is its off-premise ordering channels. Genghis Grill locations currently do about 30 percent of their orders to-go, with goals to grow that number to 50 percent at future stores. Best of all, Genghis Grill’s intentional move away from solely Asian stir-fry and push towards more global influences has showcased the capacity of the ingredients—and franchisees benefit from the new menu with boosted productivity, reduced complexity, and increased profitability.

“The white space is all ours in this category,” Majewski says. “The way customers are eating now, everything is customized, they want food on the go. This is truly the perfect concept to fill both of those needs.” CF

GENGHIS GRILL

LOCATIONS: 50+ FUTURE LOCATIONS SIGNED: 24 FRANCHISE FEE: Single Unit - $30,000; Additional Units$20,000 each; development fee$10,000, credited to franchise fee TOTAL START-UP COSTS: $450,000–$975,000/store SPONSORED BY GENGHIS GRILL

“GENGHIS GRILL IS BY FAR THE EASIEST CONCEPT THAT WE HAVE.”

A TRUSTED BRAND

Today, Genghis Grill has more than 50 locations open across the country, serving 3.2 million customers annually. We’re on our way to offer customization, freshness and fun in more communities across the nation.

OPERATIONAL EXPERTISE

Genghis Grill owns and operates over 50% of our current locations. You can say we're a brand built by operators for operators and we'll pass our knowledge and insight to you to ensure your success.

SUPPORT FROM DAY 1

We're not successful unless you are. Genghis Grill offers personalized and comprehensive start up and on-going support to franchise owners from day one. Whether it's real estate selection, marketing or on-the-job training, we have your back.

TO FIRE UP THAT GRILL? franchising@craveworthybrands.com franchise.genghisgrill.com OPEN FOR GROWTH POTENTIAL AVAILABILITY FUTURE EXPANSION

READY

SATISFY

FRANCHISING CRAVINGS

LEGACY AND EMERGING BRANDS!

YOUR

REACH OUT TO OUR DEVELOPMENT TEAM

Yatco is building four new-to-industry stores and updating the interiors of its existing sites with a unifying color scheme. Its new builds feature laminate wood floors for a modern look.

DESIGN PLANS

Yatco stores vary in size, but the chain’s goal is to build sites that are 4,000 to 5,000 square feet.

At press time construction was underway on an NTI store in Leicester, Mass., and construction was expected to start soon on a location in Uxbridge, Mass. Yatco also recently acquired the license to build its fifth c-store in Worcester, Mass. Yatim anticipates construction should begin on that store in three to four months. Yatco also has plans to build a site in Taunton, Mass.

“The new builds have really nice floors. They look like laminate wood. They look very elegant,” Yatim said. “We’re using materials that are easy to update, so if there’s a crack or if anything breaks, you’re not having to redo the entire floor.”

Legacy sites are getting a refresh as well. Yatco shortened its name from Yatco Food Mart to Yatco in 2021. Ever since then, Yatco has been reimaging the exterior of its stores to feature the updated branding. The store exteriors now feature a “Y” at the top of the front door that is made up of blue, green and white LED lights.

“That really pops out,” Yatim then continued. “It’s very bright.”

Yatco has also been busy updating the interiors of its locations over the past two years. It’s working on unifying the color scheme inside its stores, transitioning stores to its colors, white, blue and green. The foodservice areas are also receiving a facelift that includes the addition of granite counters and whitetiled walls.

“The tile is all one piece. It’s white, and it looks really clean,” Yatim said. “You want your foodservice area to represent cleanliness.”

Yatco also installed LED TVs, which hang from the ceiling in its foodservice area to highlight promotions on food and beverages. The TVs are also situated between the gondolas on the sales floor to alert customers to deals on snacks and candy.

“We’re trying to future-proof the store as much as we can,” Yatim said, an idea that informs how it

approaches NTI stores as well. Yatco is building new stores with similar layouts and features, which will make the business easier to scale going forward. That includes having a set outline for where each section of the store is situated, so as Yatco grows it can copy and paste that formula from store to store.

“It’s a much quicker way for us to scale up and get these builds done,” Yatim said.

Yatco is looking to model future stores off the best features of its Boylston, Mass., store, and its Webster Square site in Worcester.

The Boylston site is one of the chain’s premier stores and measures 5,000 square feet. It features a full foodservice section and a Dunkin’. In the forecourt, it includes a diesel island. The site’s gas sales by volume are on par with major cities, Yatim noted.

“(Webster Square) has the best register area. It’s huge, where the two sales associates have a lot of room. There’s enough space for all the tobacco and all the lottery. We don’t really need to decide on what needs to be cut out,” Yatim said.

In the Webster Square store, which measures 4,500 square feet, the office storage and the cooking area are located behind the front counter. The isolated area helps prevent theft as customers can’t accidentally wander into the office, and because the office is close to the front counter, the manager is nearby if the cashier needs assistance.

cstore decisions.com August 2023 • CSTORE DECISIONS 19

In the forecourt, Yatco partners with Gulf at all Massachusetts sites and its Connecticut store. Its Rhode Island site is branded Sunoco. The chain also distributes fuel through its Yatco Distribution arm to five states in New England.

While Yatco doesn’t currently offer electric vehicle (EV) charging, it plans to add it in the next year.

“There’s a lot more adoption for it, and it’s just another market that we need to cater to,” Yatim said of EV charging. “It’s coming, for sure.”

FOODSERVICE OFFERING

Yatco’s Leicester site, which is currently under construction, is set to feature a full-service, 2,400-squarefoot Burger King.

Yatco partners with several quick-service restaurants, including Gourmet Donuts in two stores, Dunkin’ in eight locations and Subway in two stores. All of the Dunkin’s have drive-throughs.

Additionally, Yatco has a Pizza Mike’s at its Chaplin, Conn., site.

“Their second site is in our store, and it’s one of the best pizzas in Connecticut, and it’s now known,” Yatim said. “People drive from pretty far to our store to get Pizza Mike’s.”

Yatco also features a Mighty Chicken program through its main wholesaler at several locations. It also serves up burgers, taquitos, quesadillas and Tornados through its wholesaler. Its Webster Square and Boylston sites feature a Smoodi machine, which serves up smoothies with all natural ingredients.

“You take the cup out of the fridge with the flavor you want — you see all the ingredients inside, all the

vegetables, all the fruit. You put (the cup) inside a closed compartment, and you see the water mixed in, you see the blending. It’s all (mixed) in front of you, and then it pops out your cup,” Yatim said.

Yatco also sells fresh-baked cookies, which are available in the foodservice section and also at the front counter.

The company’s Rhode Island site features a beanto-cup coffee program.

“That store does really well with coffee,” Yatim explained. “That site is in the center of a town. It’s a very tight-knit community, and there are no other restaurants or coffee shops in the area. So, we sell a lot of coffee there. People come there strictly for their coffee.”

All stores feature open-air coolers with grab-andgo sandwiches, burritos, breakfast sandwiches, fruit cups, hard-boiled eggs, and packages of higher-end meats and cheeses. The stores feature microwaves where customers can heat up the sandwiches.

TECHNOLOGY FOCUSED

Yatco’s Yatco Rewards app debuted 16 months ago. Already the chain has 10,000 members on its app.

“Through this app, you can build up points through your purchases, get gas discounts, get discounts on in-store purchases and get free stuff in-store around holiday time,” Yatim said. “We do special things, like on Super Bowl Sunday, we’ll do buy a bag of Tostitos, get dip free. Last Easter we did 30 cents off a gallon, and that was a big deal when the gas prices were almost $6.”

Customers receive a 15-cents-per-gallon discount on their first fill-up following signing up for the loyalty program.

Yatco is preparing to offer order ahead and delivery through its Yatco Rewards app. All items in the c-store including food but excluding tobacco and lottery will be available for delivery. Customers will order through the app, and Yatco employees will collect the order, which will then be delivered by a third-party delivery service like Grubhub or Uber Eats. Yatco is currently developing the infrastructure to support the rollout, including testing iPads for employees that alert them when a customer places an order. The iPads are expected to roll out to stores by the end of this year.

Yatco is also investing in self-checkout kiosks, which are expected to roll out to its Boylston and Webster Square locations by the end of 2023.

In 2024, Yatco plans to integrate mobile payment into its app.

20 CSTORE DECISIONS • August 2023 cstore decisions.com

Cover Story / Yatco

Yatco shortened its name from Yatco Food Mart to Yatco in 2021. Yatco is now reimaging the exterior of its stores to remove the words “Food Mart” from its name.

Yatco introduced its Yatco Rewards app 16 months ago. Now Yatco is preparing to launch order ahead and delivery through its Yatco Rewards app. All items in the c-store except for tobacco and lottery are expected to be available for delivery.

“It’s similar to the Starbucks model. You load your credit card or money straight onto the app,” he said.

Also, in 2024, Yatco is set to launch mobile fueling via its Yatco Rewards app, which will allow customers to select their pump number and type of gas and pay right from their phone.

“They won’t have to touch the buttons on the screen,” Yatim said.

Since the COVID-19 pandemic began, a lot of customers don’t want to touch the screens or buttons at the gas pump, Yatim pointed out.

“Customers use wipes to wipe the screen,” he said. “It can cause damage, if people are using certain chemicals to wipe down the pump screen.”

The mobile fueling option is expected to be popular with customers, but it’s also expected to protect the longevity of the dispenser screens.

COMPANY CULTURE

A big part of Yatco’s company culture is ensuring employees are treated well, and the chain has been rewarded with loyal long-term employees.

It offers an incentive program for employees through its Yatco Rewards app, which gives them 25 cents off per gallon on one gas fill-up per week. Yatco also awards bonuses to associates when a store sells a winning lottery ticket and offers an aggressive bonus structure for sales associates.

“We aggressively incentivize employees because our success is on our people, and the people who run the cash registers or who clean the bathrooms are the most important people,” he said.

The family spends time working in the stores and training employees.

“I actually trained stores on cleaning the bathroom myself because when the owners are out there on their hands and knees cleaning or ringing up customers at the register … then employees know that they’re working for people and for a chain that cares and practices what they preach,” Yatim said.

The average tenure for Yatco managers is above 10 years, with its two longest managers celebrating 21 and 20 years with the business. One general manager has been with the business for 25 years.

“The last two to three years, we’ve had about

10 associates cross the one-and-a-half to two-year mark. In the sales associate workforce, that’s not common,” he said.

Yatco also pays above the minimum wage, including sign-on bonuses in some instances, and offers employees a path from the associate level up to management.

“I would say you get better people applying potentially when you’re raising your store’s minimum wage and you train them a little more hands on. And you get the retention because you incentivize them through the bonus structure, through the ability to grow, because I don’t consider working at Yatco a job for anybody. It’s a career.”

Within the next five years, Yatco is looking to double in size. To prepare, Yatco is opening new roles as it expands its office staff and builds out its back-office infrastructure.

“People want to work for us now, so we’re investing in these positions in our backend office, and we’re getting successful individuals in this industry to join us, whether that be in pricebook, in marketing, in sales,” Yatim said.

“That’s helping us get bigger because you can’t scale without having that backend infrastructure taken care of and the manpower on the backend,” he added.

22 CSTORE DECISIONS • August 2023 cstore decisions.com

Cover Story / Yatco

Reduce Oil Cost with Masterfil® Filters Reusable Up to 7 Days Extends Oil Life Often 50% Longer Saves Labor 2-Minute Task to Clean Safer Option No Handling of Hot Daily Filter Scan for Samples www.OilSolutionsGroup.com 888.459.2112 Follow us: Atlanta | Dallas | Phoenix

GROWTH OUTLOOK

As Yatco looks ahead to the future, it plans to grow through franchising, acquisitions and new store builds.

After growing through single-store acquisitions, it’s now looking at five- or six-site portfolios, but it hasn’t found the right fit yet.

Yatco’s franchising model is also a focus going forward. It currently has one Yatco franchisee in Orange, Mass., and it leases a second site to an unbranded operator. It’s currently developing standards of operations for its franchisees so it can scale the program.

“Going forward with our franchising, we want to make it a bit more stringent where we do score our franchisees,” Yatim said.

As part of that initiative, Yatco developed an internal mystery shopper program for all of its locations, with tough criteria to motivate managers to raise the bar. Yatim sees the franchising model as a way for the company to acquire sites quickly.

Through the distribution business, Tarek knows hundreds of gas station owners in New England, and when mom-and-pop operators are looking to sell, he often gets a call.

“We can’t just buy (and run) 20 stores at once at the size we are currently,” Yatim said. But he sees an opportunity in purchasing stores but leasing them out to other operators.

Yatim noted Yatco is looking to lay the ground-

work now to allow it to expand into more states and still have a good eye on the operations of the convenience stores.

“We want to make sure that as we expand, we don’t lose that quality,” he said.

NAVIGATING A FAMILY BUSINESS

Navigating a family business can have its challenges, but Yatim said that the key is to avoid discussing the business outside of work unless it is absolutely necessary.

“Having family time is important,” Yatim elaborated. “Certain things, you have to (discuss), but it can consume you. If you’re doing it outside of work, your relationship becomes business. There’s no separation.”

Yatim also noted transparency in the information you’re relaying to family members is particularly important to avoiding confusion or conflict.

But being a part of a family business also has great benefits.

“You grow something together as a family,” Yatim said. “There’s always beauty in the struggle, and with struggle comes accomplishments as well. My parents went through immense struggle when they were younger trying to start this business, and they’ve grown it into what it is today. I’m very proud of what my parents have done and appreciate everything they did.” CSD

24 CSTORE DECISIONS • August 2023 cstore decisions.com

Cover Story / Yatco

Yatco is looking to expand through a combination of new-to-industry stores and acquisitions, and it also plans to start growing its franchising program.

THE PERFECT CIGAR SOLUTION GRAB-AND-GO

WARNING: This product can expose you to chemicals including tobacco smoke, which is known to the state of California to cause cancer and birth defects or other reproductive harm. For more information go to www.P65Warnings.ca.gov.

Smoking cigars casues lung cancer, heart disease, and emphysema, and may complicate pregnancy.

Keeping an Eye on Vape, Cigars

Cigars in particular are a question mark with c-stores as they wait on the FDA to make a decision regarding a flavor ban this fall and how consumers might respond. Additionally, vape is constantly on retailers’ radars since FDA is still issuing marketing denial orders to brands and cracking down on those who sell and market those products.

The FDA served warning letters to 30 retail-

ers in May for selling Puff and Hyde brand disposable e-cigarettes as part of a nationwide effort to halt the sale of unauthorized vape products. In June, FDA issued 180 warning letters to retailers for selling Elf Bar and Esco Bars e-cigarettes illegally.

“It’s getting tougher for our industry to survive; we need everyone to work together and overcome obstacles, such as government regulations, by getting involved with a form of advocacy,” said Lance Klatt, executive director of the Minnesota Service Station & Convenience Store Association.

Minnesota proposed a statewide ban of flavored tobacco in February, with some cities already having bans or restrictions on flavored tobacco in place.

Massachusetts was the first state to ban flavored tobacco, followed by California.

C-store retailers await the FDA’s fall verdict on the potential cigar flavor ban, while monitoring FDA vape product marketing decisions, all while continuing to stock customer favorites at the backbar.

Emily Boes • Senior Editor

Category Management | Cigars / Vape

Concern for the tobacco category isn’t new among retailers, and as the Food and Drug Administration (FDA) proposes regulations and issues marketing decisions, c-store operators are continuously assessing inventory.

26 CSTORE DECISIONS • August 2023 cstore decisions.com

Unique Blends + Superior Value = Unmatched Satisfaction Contact your E-Alternative Solutions Representative or visit EalternativeSolutions.com/Leap Featuring an unrivaled range of satisfying tobacco and menthol blends. High-capacity pods deliver better value with a smooth, long-lasting experience. 100% product guarantee. WARNING: This product contains nicotine. Nicotine is an addictive chemical.

Vape, Cigar Unit Sales Fall

While cigar dollar sales remained relatively flat, electronic smoking device dollar sales increased by 4.3%. Unit sales for both categories dropped — 8.9% for electronic smoking devices and 1.3% for cigars. The price per unit for both categories saw increases.

VAPE AND CIGAR TRENDS

For the latest 52 weeks ending June 18, cigar dollar sales remained flat at convenience stores (down 0.3%) at $4 billion, according to Circana, a Chicago-based market research firm. Unit sales dipped a slight 1.3%.

At Grub Mart’s 11 stores in Alabama, flavored cigars are leading the tobacco subcategory.

“Cigar (smokers) seem to be a little bit more fluid in what they will smoke. It could be strawberry this week, kiwi or whatever the next week. It could be different,” said Brian Young, vice president of Young Oil, operator of Grub Mart.

So far, Alabama has not experienced any flavor bans at the state level. However, FDA’s crackdown on certain vapes has kept the chain on its toes. For example, Grub Mart carried Elf Bar products, many of which are now no longer legal.

Vuse is a top seller for the chain, however, with the tobacco flavor being the most popular. “We’re over a hundred a week or so in (pods),” said Young. “… It’s really been a good mover for us.”

Electronic smoking devices saw a 4.3% uptick in dollar sales at c-stores for the 52 weeks ending June 18, reaching $7.09 billion, per Circana. Unit sales, on the other hand, dropped 8.9% to $419 million. This is likely due to a 14.5% increase in the price per unit.

At Grub Mart, however, Young believes inflation, particularly the higher cost of cigarettes now, is driving customers to vapes.

“Our vape business has continued to grow. We have not really had (price) increases in it. We’ve had (increases) in the others, and it may be driving people to the vapes more. … It seems like in our marketplace, our Newports have really hit the wall in what people will accept on the price,”

Young said. He added that Grub Mart has seen a pretty large decrease in two of the biggest fullpriced cigarette brands that it sells.

Trends have clearly been influenced by inflation, which is leading many c-store retailers to take stock of their backbars.

“Retailers cannot absorb higher costs of goods and increases in labor. That’s always a factor. Minnesota just passed a gas tax increase tied to inflation, not the consumer price index. It may hurt inside store sales, including tobacco sales,” said Klatt.

In Minnesota c-stores, vape represents a small portion of sales, although they do sell a variety of closed systems.

Cigars are also becoming a smaller part of the tobacco business at Minnesota c-stores due to higher taxes as well as pack restrictions and flavor bans. CSD

FAST FACTS:

• Cigar dollar sales stayed flat, but unit sales decreased 1.3% for the 52 weeks ending June 18, per Circana.

• Vape unit sales saw an 8.9% drop for the same time period and a 14.5% uplift in price per unit.

• The Food and Drug Administration is expected to make a decision on the proposed flavored cigar ban in the fall.

Product Dollar Sales Unit Sales Price Per Unit Current 1-Year % Change Current 1-Year % Change Current 1-Year % Change Electronic Smoking Devices $7.08 B 4.3% 419 M -8.9% $16.90 14.5% Cigars $4.00 B -0.3% 2.33 B -1.3% $1.71 1.1%

Source: Circana Total U.S. Convenience data for the 52 weeks ending June 18, 2023

Category Management | Cigars / Vape 28 CSTORE DECISIONS • August 2023 cstore decisions.com

As the world’s leading natural leaf cigar brand, Game is driving more sales than ever with our groundbreaking Game Rewards customer loyalty program. That means when you stock Game, it’s a win-win for you and your customers. CONTACT YOUR SWEDISH MATCH REPRESENTATIVE 800-367-3677 • CUSTOMER.SERVICE@SMNA.COM GAMECIGARS.COM ©2023 SMCI Holding, Inc.

GAME IS NATURALLY MORE REWARDING.

Lifting Beverage Sales Into Autumn

Beverage sales are heating up as c-stores prepare for the summer-tofall transition. Popular fall flavors, new products and promotions can help keep customers returning for drink purchases as summer ends.

Summer came early for much of the nation this year when heat domes settled over cities from the Pacific Northwest to the Eastern Seaboard as early as May and stuck around for most of the season. For convenience stores, hot temperatures typically translate into increased sales of cold beverages — packaged from the cold vault as well as dispensed carbonated sodas and frozen blended drinks.

Category Management | Beverages

Anne Baye Ericksen • Contributing Editor

30 CSTORE DECISIONS • August 2023 cstore decisions.com

For c-stores, hot temperatures typically translate into increased sales of cold beverages — packaged from the cold vault as well as carbonated sodas and frozen blended drinks.

“On the dispensed side, guests are continuing to move back toward fountain beverages after the impact of the pandemic over the last few years. Convenience retailers are once again investing in aggressive fountain promotions as a traffic-driving tactic this summer. At Casey’s, we are offering an 89-cent medium fountain or frozen dispensed beverage across our footprint this summer selling season,” said Chris Stewart, vice president of merchandising for Casey’s. The Ankeny, Iowa-based convenience store chain operates more than 2,500 stores across 16 states.

With September around the corner, does it pay for c-stores to turn their attention to fall beverages before the temperature outside drops?

MARKETING VARIETY

An industry review released by Goldman Sachs in June, based on NielsenIQ data, revealed carbonated beverages in all retail channels, including convenience stores, racked up more than $39 billion over the previous 52 weeks ending June 3. Energy drinks also brought in more than $19 billion, as did

Drinks Up

bottled water. Sport drinks posted a respectable $10.1 billion. Tea, coffee and sparkling flavored waters also earned billions. Although some volumes were down, several subcategories experienced double-digit growth for the same period, including low-calorie carbonated beverages as well as energy and sport drinks.

Retailers enjoy sales gains across beverage product families.

Of course, category managers hope a prolonged hot summer this year means hot sales, but fall spices things up for the beverage category too. It’s the time of year when consumer desire for warm flavors kicks in. However, Stewart noted that in-store traffic tends to cool off somewhat in autumn, which puts more onus on beverage promotions to grab consumers’ attention.

“In relation to preparation, we will focus on fall flavor favorites, like pumpkin, along with ensuring our equipment is calibrated to be ready to serve the increased guest interest,” he explained.

Pumptoppers, bright oversized posters and other signage certainly highlight beverage deals, but loyalty programs create lanes to send marketing messages directly to customers. A growing population of c-stores have

Category Management | Beverages

Beverages Change in Y/Y Dollar Sales (ending 6/3/23) 2-wk 4-wk 12-wk 52-wk Carbonated Beverages 13.5% 12.6% 13.2% 14.4% Energy Drinks 16.0% 15.0% 13.1% 11.9% Bottled Water 6.5% 4.2% 7.3% 12.4% Sport Drinks 7.9% 5.4% 10.9% 11.7% Tea — Liquid 6.1% 5.4% 6.7% 9.0% Sparkling Flavored Water 4.3% 3.9% 4.8% 5.2% Coffee — Liquid 5.5% 5.9% 6.7% 9.8%

32 CSTORE DECISIONS • August 2023 cstore decisions.com

Source: Goldman Sachs, Americas Beverages: NielsenIQ data through June 3 — Non-alcoholic beverage sales strong and accelerated sequentially, driven by improved volumes, received June 13, 2023

PREMIUM MALT BEVERAGE WITH NATURAL FLAVORS IN STORES

APRIL 2023

SELECT MARKETS ONLY

revamped their programs to deliver more personal incentives, such as announcing deals on individuals’ favorite thirst quenchers.

“Leveraging loyalty to drive differentiation continues to be an important tool for retailers in an increasingly competitive market,” said Stewart.

“Given the daily sales volume of beverages (both non-alcohol and dispensed), it creates an opportunity to drive traffic and repeat business.” The Casey’s Rewards program boasts more than 6.5 million members.

Loyalty programs also offer a prime platform to introduce new beverage products. According to

FAST FACTS:

• Twenty percent of consumers either closely or occasionally follow a sober-curious lifestyle, per NielsenIQ.

• Favorite fall flavors and promotions can boost beverage sales heading into autumn.

• Loyalty programs also offer a prime platform to introduce new beverage products.

the NielsenIQ “Sip Into Summer” report, some of the hottest trends in drinks right now have less to do with flavors and more to do with purpose. For example, the authors found that more than 20% of consumers either closely or occasionally follow a sober-curious lifestyle, thus promoting the emerging field of mocktails. What’s more, people are interested in creating their own mocktail recipes, and therefore, are keen on buying juices, tonics and mixers. Another trend highlighted is the demand for plant-based products poured from biodegradable packaging.

“Most of the successful new products coming into the marketplace are healthier, and in many cases, offer functional benefits as well,” noted Gary Hemphill, managing director of research for the Beverage Marketing Corp.

He also emphasized the unique role c-stores play in piquing consumer curiosity and why it pays to focus on new-product promotions any time of year.

“Convenience stores in particular are a key channel for new products because consumers are more likely to experiment with different drinks sold single-serve,” Hemphill explained. “Convenience store consumers are often more likely to experiment with their product choices than consumers in more take-home oriented channels like grocery stores.” CSD

Category Management | Beverages

34 CSTORE DECISIONS • August 2023 cstore decisions.com

The Rich, Bold FlavoR oF Our premium quality cigarettes, pipe tobacco, cigarette tubes, and roll-your-own tobacco products are all made from the finest U.S. tobacco. ContaCt us today! www.gopremier.com/contact

Health and Beauty Product Sales Soar

The demand for self-care products and over-thecounter medication in c-stores keeps health and beauty sales rising.

Zhane Isom • Associate Editor

Now that the days of wearing face masks and using large amounts of hand sanitizer are over, consumers are getting back to their normal routines of using self-care products and over-the-counter medication when needed. With demand rising for self-care products and medicine, retailers are finding new ways to rearrange their store shelves to meet these requests.

Revenue in the beauty and personal care market amounts to $92.79 billion in 2023. The market is expected to grow by a compound annual growth rate of 2.52% from 2023 to 2028, Statista stated in its 2023 Markets Insight Report. However, the report also noted that personal care is the market's largest segment, with a market value of $42.18 billion in 2023.

“Health and beauty is one category that is up for us this year. Both dollar and unit sales are up, with dollar sales up 16.92% and unit sales up 7.75%,” said Jennifer Whitman, category manager for Rotten Robbie, which operates 37 stores in northern California. “Most of our center of store categories, with a few exceptions, are down in unit sales this year, but health and beauty is booming in all of our locations.”

Category Management | Health and Beauty Care

36 CSTORE DECISIONS • August 2023 cstore decisions.com

Contact your local Advantage Rep on how to order or email Ed Baker at ed.d.baker@haleon.com ©2023 Haleon group of companies or its licensor. All rights reserved. Read and follow label directions. * Latest 52 Week Pd Ending 1/29/23 Total MULO. Did You Know? TUMS market shareis nearly 20 x bigger than Rolaids* TUMS Chewy Bites sales alone are Innovation is driving our growth! than all of Rolaids*! 4x larger Available in Convenient Rolls & Packs • Chewy Bites Assorted Berries - 8ct Bottle • Ultra Strength Assorted Berries - 12ct Roll • Ultra Strength Peppermint - 12ct Roll • Smoothies Assorted Fruit Extra Strength - 12ct Bottle • Chewy Delights Very Cherry Ultra Strength - 6ct Stick • Extra Strength Assorted Berries - 8ct Roll • Extra Strength Assorted Fruit - 8ct Roll

The Army and Air Force Exchange, which operates more than 580 Express stores, has also seen an increase in health and beauty product sales.

Kye Corn, Army and Air Force Exchange Service divisional merchandising manager, also mentioned that self-care products have been driving sales in stores.

“Sales are trending up year-to-date. The Exchange expects to see health and beauty sales increase in the high single digits for the year,” said Corn. “Self-care, immunity support and respiratory treatment products are among the top gainers year-to-date in 2023.”

HEALTH AND BEAUTY TRENDS

Retailers are seeing smaller sample sizes specifically flying off shelves.

“Customers seem to be waiting until they need something before purchasing it. They’re not taking advantage of sales on larger sizes at a larger price point and stocking up,” said Whitman. “Trial-sized everything is up in units. Regular-sized items such as hand and body lotions, medications and deodorant are down in units.”

Whitman also noted that she anticipates this trend to continue partly due to the unstable economy and consumers’ reluctance to spend a lot of money.

TACKLING CONSUMER DEMANDS

Supply chain issues that began during the height of the COVID-19 pandemic have largely resolved, which means the biggest challenge for retailers now is making sure they have the right products and enough space on their shelves.

“Finding the space to expand is the real challenge,” said Whitman. “With an uncertain economy,

it is more important than ever to take a hard look at your product assortment across center store and really hone it in. Whether more space for health and beauty care is available remains to be seen. For us, that will probably be a mid-2024 decision.”

Both Army and Air Force Exchange and Rotten Robbie are taking a second look at their health and beauty section to make changes to offset demands.

“The Exchange offers a broad assortment of products in all health and beauty categories. In addition to leading national brands, we also offer Exchange Select, a private-label brand that typically saves shoppers money,” said Corn. “The Exchange keeps its assortments fresh with new products while continuing to offer top-selling brands.”

Rotten Robbie offers most of its health and beauty products in trial sizes, including gastrointestinal, hand sanitizer and mouthwash. The c-store also provides an assortment of cough drops, which are top sellers, according to Whitman.

“Every year, we tweak our product assortment based on sales/trends,” she said. “We didn’t change much in 2023, but I’m considering eliminating or severely cutting back SKUs in vitamins/ supplements for our 2024 planogram in the spring. They are just not selling at all. I will most likely expand cough drops and feminine hygiene.”

Nonetheless, retailers should continue to pay attention to trends and stock their shelves accordingly to see health and beauty sales rise.

“I’m anticipating that this upward trend in units for health and beauty products will continue through the year until the economy stabilizes and retailers can go back to stocking up on larger sizes,” said Whitman. “I believe that the category growth can be as much as 10% compared to last year.” CSD

38 CSTORE DECISIONS • August 2023 cstore decisions.com

Revenue in the beauty and personal care market amounts to $92.79 billion in 2023 and is expected to grow by a compound annual growth rate of 2.52% from 2023 to 2028.

•

The

•The fastest growing cigarette brand in the nation

•Lowest-priced cigarette available in most markets

• Lowest-priced