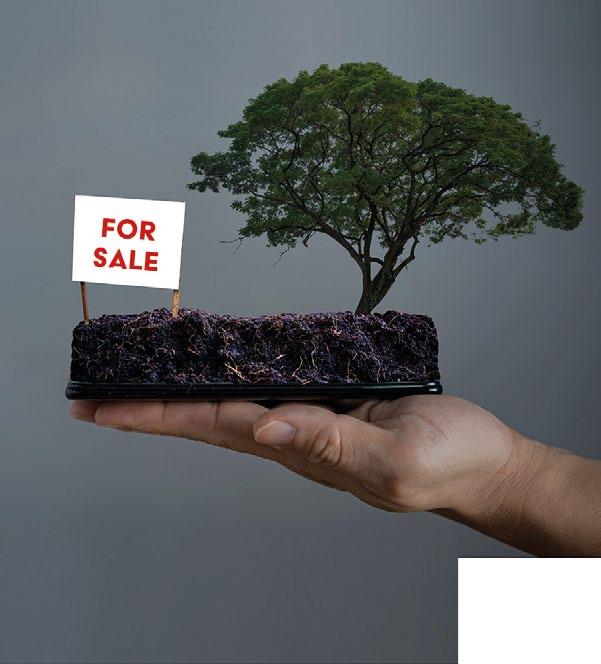

The Chancellor’s announcement that the agricultural budget will be frozen, rather than reduced to reflect Defra’s £385m three-year underspend, is welcome but is cold comfort set against the radical change in APR. There will be ways of mitigating the 2026 introduction of the 20% IHT rate on farming assets over the £1m threshold – but it has delivered another blow to the farming sector, following on the heels of the underspend and the knowledge that the transition from BPS to ELMs has been clumsily managed. Many farmers are still not being properly remunerated for delivering the ‘public good’ of an improved environment that require actions that go above and beyond sustainable food production. As a result, we know that many farmers are having to take defensive actions to reduce their debt burden, including having to sell land, something that will be further complicated once the new APR rules kick in.

We will examine the APR changes announced in the budget in more detail before we start advising our clients on how to start planning for a new future. Therefore, this edition of Law & Land will concentrate on purely practical topics – and rather a lot of law!

Disputes in farming families can have serious financial and emotional implications if not tackled early. On page 4, Katie Alsop considers the benefits of mediation, not least in providing sufficient breathing space for everyone involved to stand back and consider what outcome they really want – and ending up in court with a big bill is rarely the answer.

Alex Robinson Partner and Head of Agriculture

Have you ever given any thought to what happens to your firearms after your death? Unlike other assets, executors cannot deal with firearms at their leisure; strict UK gun control laws means that any firearms must be dealt with promptly and correctly or you risk severe legal (and potential safety) consequences. Richard Dundee takes you through the process on page 6

It is a fact of modern life that although many of us are living longer than previous generations, we’re not always entering the twilight of our years in the best of health. On page 8, Hannah Lloyd looks at the implications of having to pay care home fees for farming partnerships.

More changes to Permitted Development Rights came into force in May, enabling greater flexibility in developing redundant agricultural units in an effort to boost rural economic growth. Gemma McIntyre explains the rules on page 5

In other legal news, recent court cases have highlighted several pertinent questions for farmers: can you leave your partnership share in a will if you no longer have capacity? How easy is it to lift restrictive covenants that stop you from developing your land? And what are the rights of minority beneficiaries when it comes to selling land held in trust? All is revealed from page 10 onwards.

Finally, our news roundup covers the latest increase to phone mast rents; the abolition of tax advantages currently enjoyed by furnished holiday cottages; an HSE update; and the drive to make tax digital for all businesses by April 2026. As always, I’d be delighted to hear your suggestions for future editions.

We are sending you this information as you are either an existing client, you have recently received services from us, or you have asked us for more information about the services we provide. For full details on how we process your personal data, please see our Privacy Policy on our website. Please contact us to unsubscribe from further communications.

2024

CLA Rural Business Conference

21 November

QE11 Centre, Westminster cla.org.uk

CropTec

27 – 28 November

NAEC, Stoneleigh, Warwickshire

Wright Hassall Annual Agricultural Talk

3 December

Olympus Avenue, Leamington Spa wrighthassall.co.uk

2025

Oxford Farming Conference

8 - 10 January

‘Facing Change, Finding Opportunity’, Oxford ofc.org.uk

LAMMA

15 - 16 January

NEC, Birmingham lammashow.com

Dairy Tech

5 February

NAEC, Stoneleigh, Warwickshire dairy-tech.uk

Low Carbon Agriculture

5 – 6 March

NAEC, Stoneleigh, Warwickshire lowcarbonagricultureshow.co.uk

• Labour commitment to farming

• Making tax digital

• Phone mast rents increase by 135%

• Furnished holiday cottages

Health & safety

All too often farming-related disputes arise from a misunderstanding or a reluctance to retreat from a particular position. A greater reliance on oral agreements can often lead to a difference in recollection or opinion. Farming disputes take many forms: a dispute between the partners or family members following a death or the breakdown of a relationship; the dissolution of a partnership; or when a promise of inheritance is broken. The background to a dispute will help to determine the best way of resolving it – and mediation may well be the most constructive method, not least in helping to rebuild family relationships.

Who can conduct a mediation?

Mediators are independent, professionally trained individuals, many of whom are lawyers. For farming related disputes, it is important to appoint a mediator who understands the farming sector and the specific pressures faced by farming families. Mediators do not offer an opinion on the dispute; their role is to facilitate the parties finding a way to bridge the gap between their respective positions.

Examples where mediation can help

In the context of agricultural disputes, proprietary estoppel and partnership dissolution disputes lend themselves particularly well to mediation. If a cash

settlement is not practical, other solutions can include the granting of tenancies to allow farming to continue; varying the terms of a will to redirect funds or assets to non-farming family members; granting a life interest to a party to secure their accommodation for life; granting additional rights of way to facilitate access for all of the parties involved (it is not unusual for this to be done to retain access to a burial site); or inviting Trustees to deal with trust assets in a particular way and for the benefit of one party in preference to another, providing that accords with the terms of the trust.

Mediation is an excellent way for everyone involved to stand back and consider what outcome they really want – and ending up in court with a big bill is rarely the answer. Mediation is being actively encouraged and judges will criticise parties who come before them without having seriously considered it. They can also impose adverse costs consequences on parties who should have mediated but refused to do so, or who did not meaningfully engage with the process. For many farming businesses and families, it will be the most cost-effective and efficient way of producing an outcome acceptable to all parties – providing everyone fully commits to the process.

Following recent case law, courts can now order parties to mediate (it is already a requirement for all disputes under the value of £10,000). Mediation is cost-effective and should produce a better outcome than going to court providing both parties are fully engaged in the process. For more information about mediation please get in touch - we have several solicitors with considerable mediation experience who can advise on the level of support needed.

Katie Alsop, Partner Agricultural disputes

In May 2024, changes to Permitted Development Rights (PDR’s) came into force after a consultation by the Department for Levelling Up, Housing and Communities in 2023. The consultation sought views on changes to PDR’s which would support agricultural diversification by allowing for the development of redundant agricultural units for various purposes including housing and expanding the range of commercial uses.

Change of use of agricultural buildings:

Originally introduced in 2014, Class Q allowed the conversion of agricultural units into residential units, albeit within a prescriptive qualifying framework. This latest amendment allows former agricultural buildings that may have been used for non-agricultural purposes (such as storage), as well as existing agricultural units, to change their use.

The new rules are designed to encourage the building of more rural housing by allowing up to 10 dwellings, an increase from the previous five, that can be developed under Class Q. Although the maximum, cumulative floorspace that can be converted has increased from 865m2 to 1,000m2, each individual dwelling developed under Class Q cannot exceed 150m2

Agricultural buildings could already be converted to commercial use under Class R. Under the new rules, Class R has been expanded to permit a more flexible, wider range of uses of agricultural buildings, and land within their curtilage, for commercial purposes to support and encourage rural diversification. The amendment will allow for a change of use to outdoor sport or recreation and a general industrial use. However, a condition is to be imposed on the latter whereby this must only be used for the purpose of processing raw goods, excluding livestock, which are produced and sold on site. The amount of cumulative floorspace which can be changed to flexible commercial use has doubled from 500m2 to 1,000m2

This class relates to the agricultural development of units of less than 5 hectares. Article 8 of the 2024 Order seeks to prohibit the development of scheduled monuments which are considered nationally significant and are to be preserved. In addition, the order increases the permitted cubit content limit of an extension to an agricultural building from 20% to 25% above the cubic content of the original building. The current 1,000m2 limit is replaced with 1,250m2 allowing a substantial increase in the ground area of an extension to an existing building.

Overall, the above changes represent a move in the right direction to facilitate rural economic growth and diversification of agricultural units. Do please get in touch with the planning team if you would like to discuss any of these changes and the implications for your diversification plans.

Gemma McIntyre, Solicitor Planning

Firearm ownership among farmers and landowners is common, with thousands holding valid firearm and shotgun certificates for practical purposes related to their work and land management. Farmers use shotguns and rifles to control vermin, manage wildlife populations that could damage crops as well as engaging in the traditional rural pastimes of hunting and shooting.

When a firearm-owning individual dies, the responsibility for those weapons falls to their Executor. Given the strict gun control laws in the UK, handling these firearms promptly and correctly is imperative. Failure to do so can result in severe legal consequences and potential safety risks. This article looks at the steps that Executors must take to manage firearms from the deceased’s estate, highlighting the importance of adhering to legal requirements and addressing potential risks if these responsibilities are neglected.

In the UK, the ownership and transfer of firearms are primarily regulated by the Firearms Act 1968 and subsequent amendments. These laws classify firearms into different categories, such as Section 1 (predominately rifles) and Section 5 (prohibited weapons, including handguns). To possess a firearm legally, an individual must hold a valid certificate: a Firearm Certificate (FAC) for Section 1 firearms or a Shotgun Certificate (SGC, Section 2) for shotguns with a magazine capacity of three cartridges or less. When a firearm owner dies, their certificates become invalid, and it becomes the Executor’s duty to ensure the firearms are dealt with in accordance with the law.

On the death of a firearm owner, the Executor must act swiftly. The first critical step is to secure the firearms to prevent any unauthorised access. This typically involves locking them in a secure cabinet or safe that meets Home Office security standards for firearm storage.

1. Notify the Authorities: Executors should inform the local police firearms’ licensing department of the death as soon as possible. This notification is essential for legal documentation and further guidance from the authorities.

2. Secure the Firearms: If the deceased’s firearms are not already in a secure cabinet, the Executor must arrange for their safe storage immediately. This might involve temporarily transferring the firearms to a licensed dealer or a person who holds a valid firearm or shotgun certificate.

3. Assess Legal Ownership: Executors should review the deceased’s estate and firearms certificates to determine the legal status and specific requirements for each firearm. They must ensure all firearms are accounted for and understand the implications of their classifications.

The ultimate goal for the Executor is to transfer the firearms to a legal and safe new owner. There are several options available:

1. Transfer to a Beneficiary: If the will specifies a beneficiary for the firearms who holds the necessary certificates, the transfer can be relatively straightforward. The beneficiary must apply to have the firearms added to their certificate.

2. Sell the Firearms: Executors can arrange for the firearms to be sold through a licensed firearms dealer. This option ensures that the firearms are transferred legally and responsibly.

3. Surrender to the Police: If no suitable beneficiary or buyer is found, the firearms can be surrendered to the police. This option ensures that the firearms are disposed of safely and legally.

Executors must maintain meticulous records and documentation throughout the process, including:

a. Recording the Notification to Authorities: Keep a record of the date and details of the notification to the police.

b. Inventory of Firearms: Create an inventory of all firearms, including make, model, and serial numbers.

c. Transfer Documentation: Ensure all transfers, whether to a beneficiary or a dealer, are documented with receipts and relevant certificate details.

Failing to handle firearms responsibly after the death of the owner can have serious repercussions:

a. Legal Penalties: Unauthorised possession of firearms can result in severe penalties, including imprisonment. Executors who fail to comply with the legal requirements may face prosecution.

b. Public Safety Risks: Unsecured firearms pose a significant risk to public safety. Firearms falling into the wrong hands could be used in criminal activities or result in accidental harm.

c. Emotional and Financial Strain: Neglecting firearm responsibilities can lead to prolonged legal disputes, emotional distress for the family, and potential financial burdens arising from legal fees and fines.

Handling firearms ownership after the death of the owner in the UK is a complex and sensitive task. Executors must act quickly to secure the firearms, notify the authorities, and ensure the weapons are transferred or disposed of in accordance with the law. By adhering to these steps, Executors can protect themselves from legal consequences, safeguard public safety, and administer the deceased’s estate responsibly.

Understanding the gravity of these responsibilities and the potential risk of neglect underscores the importance of taking immediate and thorough action. Executors who are well-informed and diligent in their duties play a crucial role in maintaining the stringent firearm regulations that contribute to the UK’s safety and security.

Richard Dundee, Partner Wills, trusts and tax

As is often quoted, farming is one of the few occupations where the finances of both the business and the family are intrinsically linked leading to serious implications if either element comes under significant financial pressure. From the family perspective, the most common pressure points are divorce, death and care home fees, with the latter

becoming an increasingly significant issue as we lead longer, but not necessarily healthier, lives. Much has been written and said about the rising cost of care home fees and the need to liquidate assets to pay them – and nowhere does this resonate more than in the farming world where assets normally mean land – the very thing no farmer wants to lose.

The desire of most farmers and landowners to pass on the land intact to the next generation can be thwarted by a need to raise capital to pay for long term care. Although prices vary across the country, according to carehome.co.uk the monthly average for a care home is around £4,640, rising to £5,640 or more if nursing care is also needed. Although our private client team regularly advises farming families on estate planning in the event of death, the prospect of having to fund long term care is rarely discussed but is becoming an ever more pressing concern. Even when paying for care has been factored into the family’s plans, the length of time care may be required may not have been.

A well drafted partnership agreement, prepared in conjunction with relevant wills, can help to put the right provisions and support in place but they must be regularly reviewed together. Accurate record keeping is also essential so that everyone knows who owns which assets - including those with a beneficial interestmaking it easier to identify which assets might be at risk of being liquidated to pay care home fees. This should naturally lead into wider conversations about tax planning, business structures and any scope for investing money outside the business that can be ringfenced.

overlook

Other important documents to have in place are Lasting Powers of Attorney, one covering health and welfare, and the other finances and property. It is often the case that a sudden or gradual mental deterioration affecting the mental capacity of a family member or partner is often not recognised, let alone acknowledged, until it is too late which could severely impact the ability of the partnership to deal with any assets and to enable the farming partnership to continue operating. However, it is important to avoid any conflicts of interest – the attorney must operate in the best interests of the person affected, which may be at odds with the best interest of the business. Without a power of attorney, a family may need to apply to the Court of Protection, which is both time-consuming and costly, but may be the only way to achieve the best outcome for the family member/ partner and the partnership.

We cannot emphasise enough the importance of facing up to the possibility of mental or physical incapacity that may lead to the need for professional care. By preparing for the worst case scenario, it will be easier to lessen the potential impact of care home fees on a farming partnership arrangement. We can talk you through the elements you need to consider from protecting your business through to the care process, including when and how much you should pay, the sale of assets pay for care, contributions from family members, and how to ensure that the care placement is the right place providing the right care.

subject).

Can you leave a partnership share in a will?

Monica Lane and her son David created a trading farm partnership in 2002 (which did not include the land). The agreement provided for dissolution of the partnership in the event of one of the partners becoming permanently incapacitated. In her last will, dated 2013, Monica left her share and interest in the

partnership to David and her other assets left to her daughter, Susan, and the two children of her deceased son, Peter. The residuary estate was to be divided between the four of them. Monica died in 2019 and David in 2021. Susan was named as executrix of Monica’s will and Karen Lane of her husband, David’s, will.

A dispute arose between Susan and Karen about whether Monica was able to leave her share and interest in the partnership to David. Susan maintained that Monica became permanently incapacitated before she died so the partnership should have been dissolved, meaning that her share and interest in the partnership was no longer hers to bequeath and should have fallen into the residuary estate. Karen, David’s wife, contested that this was not the case and that the partnership remained in situ. She also wanted to remove Susan as executrix.

The first point for the judge to consider was to establish whether or not Monica’s share and interest in the partnership was hers to give. The second was the removal of Susan as executrix.

The judge determined that regardless of Monica’s incapacity, a partner’s share and interest in a partnership (generally described in financial terms) is only realised once the partnership has been wound up. Because the winding up of the partnership as a result of her incapacity had not been completed before her death, she had not received any payment for her share and ‘she would only cease to have a share and interest once she had been paid in full, and this had not happened’. As the judge noted, ‘the natural reading of the gift is that Monica wanted the value of her rights in the partnership to be passed to David so that he would have the entirety of the benefit of it’ and ruled in favour of Karen.

As far as the removal of Susan as executrix was concerned, the judge found that Susan’s administration of the estate was deficient and that it would be preferable to appoint a professional, independent administrator.

Katie Alsop, Partner Agricultural Disputes

It is a common arrangement for farming families to hold land and property within a trust for the benefit of family members. Predictably, this arrangement can enter choppy waters when one of the beneficiaries wants – or needs - to sell their share. The law governing disputes relating to property held in trust is the Trusts of Land and Appointment of Trustees Act 1996 (more commonly known as TOLATA) and it was the exercise of the court’s powers under this law that was tested in the recent case of Savage v Savage [2024] EWCA Civ 49. In it the Court of Appeal considered how much discretion a court can exercise when considering the wishes of the minority when deciding disputes between beneficiaries of a trust in relation to the sale of land.

Background to the case

Three separate parcels of land were held on trust for Raymond Savage (the majority beneficiary) and his four nephews and nieces, one of whom, Frank, ran a business on one of the blocks of land. As part of the financial remedy proceedings following Raymond’s divorce, an order was made to sell the land. However, rather than sell it as one lot which Raymond wanted to do so that he could ‘move on with his life’, the judge agreed that Frank should be given the opportunity to buy the land on which his business was based at a set price before it was offered for sale on the open market. Raymond appealed the decision.

The appeal judge ruled that the correct interpretation of TOLATA meant that only the wishes and circumstances of the majority beneficiary, namely Raymond, should be considered. Therefore, Frank’s right to buy was set aside and the land was ordered to be sold on the open market. Frank appealed, and this is the case that came before the Court of Appeal in February 2024.

The Court of Appeal noted that sections 14 & 15 of TOLATA needed to be considered as a whole in order to work out whether Frank, as a minority beneficiary, should be allowed the first right to buy the land. The Court interpreted the broad language of section 14 of TOLATA, which includes “as the court thinks fit”, to mean that the court has wide powers. It also noted that the list of factors set out in section 15 of TOLATA, which the court must consider when exercising its discretion under section 14, is not intended to be exhaustive. Factors beyond that list could be considered. The Court of Appeal therefore found that the wishes and circumstances of the minority beneficiaries could be considered.

The Court applied TOLATA more broadly in an effort to keep the land within the ownership of the beneficiaries rather than it being sold to others outside the family. This decision gave Frank the opportunity to continue his business in the same location without having to outbid other parties on the open market. This gives him a degree of certainty over the price of the land, although it does mean that Raymond may not receive as much as he might have done from a sale on the open market. Beneficiaries to trust property should keep this decision in mind if they are hoping to force the disposal of trust property. This case confirms that the courts have a wide discretion to consider the wishes and circumstances of all the beneficiaries, and not just the majority beneficiary, and make different orders beyond a simple sale on the open market, including alternative options proposed by minority beneficiaries.

Stuart Miles, Senior Associate Property Litigation

With the government’s promise to amend planning regulations to speed up the building of new housing, there will be renewed interest among farmers and landowners in exploring whether they have suitable land for development. However, what cannot be overlooked is the possibility that the land may be subject to a restrictive covenant which imposes constraints on what the land can, and cannot, be used for. The importance of restrictive covenants was explored in a recent case before the Upper Tribunal (Lands Chamber), Robertson v Pace [2024] UKUT 123 (LC). In this case, the applicant, Mr Robertson applied to discharge a covenant that restricted the use of part of his land to agricultural purposes only. His neighbouring landowners, Mr & Mrs Pace objected to his application.

The land in question (on the Kent coast) was mostly used for arable farming and was subject to a restrictive covenant that stopped it from being used for any purpose other than agricultural. Mr Robertson’s reason for wishing to remove the covenant was the desire to ‘keep his options open’ but he did acknowledge that the value of the land may well increase depending on what he did with it – and that any development may impact his neighbours’ land.

To lift the covenant, Mr Robertson had to prove, under the Law of Property Act 1925 (the Act) that there had been a material change in the character of the property or neighbourhood that rendered the covenant obsolete. He also had to prove that the lifting of the covenant would not ‘injure’ others entitled to the benefit of the restriction (such as a neighbouring landowner).

The covenant had originally been required as a condition of planning permission granted for the construction of a tannery and wastewater treatment works (neither of which were ever built) on industrial land adjacent to his property. Restricting the surrounding land to agricultural use was designed to reduce the risk to others of any problematic odour from the proposed works. He argued unsuccessfully that this precaution was no longer necessary as the proposed development never materialised.

Following a site visit, the Upper Tribunal found that nothing in connection with either Mr Robertson’s land or the neighbouring land had changed to the extent that the original purpose of this covenant can no longer be fulfilled. It concluded that there was ‘no reason to infer that it [the restriction] was intended only to meet a short-term objective…the prospect of building something else, perhaps with the possibility of unpleasant emissions, remains.’ The covenant therefore retained its original utility, and its purpose remained capable of fulfilment.

The Upper Tribunal also decided that discharging the restrictive covenant could ‘injure’ Mr & Mrs Pace in that the ‘continued agricultural use of the application land would be compatible with an unneighbourly use on the retained land’ (i.e. the partially developed industrial site on which a sewage works and bio-digester is already located).

The case highlights that the Tribunal may require the planning history of an area to determine whether it will discharge or modify a restrictive covenant impacting land. Research into the local area is advisable and utilising the local councils’ online planning portals will help with such a task. In some instances, the history of older planning applications may not be available online and enquiries will have to be made with the relevant department to obtain hard copies. Early gathering of this information can allow parties to prepare thoroughly ahead of making an application.

Stuart Miles, Senior Associate Property Litigation

Following an outbreak of bluetongue initially notified in August, the restricted zone affecting all keepers of cattle, sheep, camelids, and other ruminants has since been extended to cover 20 counties, including part of Warwickshire (as of November 1). The Animal Plant and Heath Agency interactive map showing the affected areas can be accessed here.* As a matter of urgency, Defra is asking all farmers to check for signs of the virus and report any suspicions immediately. Free testing is available for animals being moved from, or being sold in, a high-risk county.

Defra has made some changes to the guidance including new voluntary advice for each SFI action, and additional agri-forestry elements. There are now 105 capital items and five plans. Contrary to expectation, farmers and landowners wanting to add one of the new actions to an existing agreement will not be able to do so; instead, they will need to enter into a new one with the administrative tangle that might incur.

In August, Steve Reed, the new Secretary of State announced a ‘new deal’ for farmers to ‘boost food security and drive economic growth’. Initiatives include making ELMS work for all farmers including small, upland, all pasture and tenanted farms; agreeing new veterinary terms with the EU (which is likely to take some time); a commitment to encouraging private investment in rural areas to improve things like broadband; and introducing a land-use framework to balance long-term food security and nature recovery. How much of this comes to pass remains to be seen but we will monitor progress in future editions of Law & Land.

All businesses must ‘go digital’ by April 2026. To date only VAT-registered businesses have had to comply with the digitisation of tax administration but the new date means that sole traders, landlords and small businesses, including farmers, not reaching the VAT threshold must comply.

We reported in Law & Land Spring / Summer 2023 on the coming into force of the 2017 Electronic Communications Code which effectively reduced the amount of rent landlords could expect to receive from telecom operators. Two decisions in the Upper Tribunal in 2020 and 2022 resulted in £750 being considered a suitable rent for ‘unexceptional rural’ telecom sites, opening the way for telecom operators using this figure as their main offer meaning that landowners would need to go to tribunal if they wanted to challenge it, involving time and expense. A recent decision by the Tribunal involving a greenfield rural site, showed that an appropriate consideration should be set at £1,750. This likely to become the new starting point for negotiations.

In its 2024 Spring budget, the last government abolished the tax advantages for furnished holiday lettings (FHL) with the new measures due to come into effect in April 2025 to bring them into line with other rental properties. The new rules apply to all FHLs and are designed to encourage more long-term lets to help counter the shortage of suitable rental properties. Even those holiday lets that would not be suitable for long term rent, such as many of those on farms, will still be caught by the new rules. Farmers with holiday lets should take professional advice on the steps they can take to mitigate the financial effects of the changes.

In July the HSE released its latest workplace fatality figures (for 2023/24). Agriculture retains its unenviable position of being the most dangerous sector to work in, relative to the size of the workforce, with 23 workplace fatalities. The most common cause of farm-related death remains accidents involving moving vehicles with older farmworkers being most at risk. In August, Farming UK reported on the prosecution of a farmer near Swansea who was filmed driving a tractor with his pre-teen grandchild alongside him in the cab. This was in breach of an earlier prohibition notice issued by the HSE relating to the same offence. This is an example of the type of behaviour and attitude that the Farm Safety Foundation is trying hard to change.

Alex Robinson Farms & Estates alexandra.robinson@wrighthassall.co.uk 01926 883009

Fern Colwill Rural Residential Property fern.colwill@wrighthassall.co.uk 01926 883044

Rebecca Mushing Planning & HS2 Advisory rebecca.mushing@wrighthassall.co.uk 01926 883076

Richard Dundee Estate & Succession Planning richard.dundee@wrighthassall.co.uk 01926 880748

Dal Heran Matrimonial dal.heran@wrighthassall.co.uk 01926 883015

Neal Patterson Farms & Estates neal.patterson@wrighthassall.co.uk 01926 880713

Katie Alsop Agriculture Disputes & Litigation katie.alsop@wrighthassall.co.uk 01926 883035

Helen Turner-Smith Agricultural Real Estate helen.turner-smith@wrighthassall.co.uk 01926 883064

Hannah Lloyd Estate & Succession Planning hannah.lloyd@wrighthassall.co.uk 01926 880752

Tina Chander Employment tina.chander@wrighthassall.co.uk 01926 884687

Wright Hassall

Olympus Avenue, Leamington Spa, Warwickshire, CV34 6BF DX742180 Leamington Spa 6 T: 01926 886688 F: 01926 885588 wrighthassall.co.uk

This newsletter does not constitute legal advice. Specific legal advice should be taken before acting on any of the topics covered.