Valuing Appraiser Professionalism: The Blueprint for Survival What’s Happening With Appraisal Fees? New Survey Seeks Answers Real Estate Appraisers Read Working RE Online – Keep up with the latest news – workingre.com NAR SETTLEMENT: What It Means for Appraisers Summer 2024, Vol. 65 Working RE 6353 El Cajon Blvd, Suite 124-605 San Diego, CA 92115 14 HOURS FREE CE PAGE 38

From the Editor

Readers Respond

NAR Settlement: What It Means for Appraisers by Isaac Peck, Publisher

Valuing Appraiser Professionalism: The Blueprint for Survival by Jo Traut, McKissock Learning

What’s Happening With Appraisal Fees?

New Survey Seeks Answers by Tony Jones, Senior Editor

Appraisal Institute CEO Cindy Chance Addresses Bias Flak by Tony Jones, Senior Editor

Discrimination Lawsuit Update: Baltimore Case Carries On by Isaac Peck, Publisher

Appraisal Insights With Freddie Mac by Scott Reuter, Freddie Mac

When Is Single Family a Multi-Family Appraisal? by Richard Hagar, SRA

NAA President Malinda Griffin on Career, Advocacy, Barriers by Tony Jones, Senior Editor

Industry News

Mission

Working RE is published to help readers build their businesses, reduce their risk of liability and stay informed on important technology and industry issues.

Subscribe to Print and Receive Premium Content WorkingRE.com/Subscribe/ Subscription included with OREP Membership (Visit OREP.org).

Comments & letters are welcome! All stories without attribution are written by the editor.

Publisher Isaac Peck isaac@orep.org

Senior Editor Tony Jones tony@orep.org

Editor Kendra Budd kendra@orep.org

Marketing and Design Manager Ariane Herwig ariane@orep.org

Working RE

OREP’S LIVE CHAT at OREP.org. 5am-5pm PST, Monday-Friday. CHECK

6353 El Cajon Blvd., Suite 124-605 San Diego, CA 92115 (888) 347-5273

Fax: (619) 704-0567 subscription@workingre.com www.WorkingRE.com

Working RE Summer 2024 2

30

Serving Real Estate Professionals

published quarterly and mailed to real estate appraisers, agents and other real estate professionals nationwide. The ads and specific mention of any proprietary product contained within are a service to readers and do not imply endorsement by Working RE. No claims, representations or guarantees are made or implied

their publication. The contents of this publication may not be reproduced either in whole or in part without written consent. Published by E&O Insurance Experts (OREP.org) OREP Insurance Services, LLC Calif. Lic. #0K99465

Working RE is

by

Summer 2024, Vol. 65

6 4 16 22 36 26 40 12 32 4

OUT:

From the Editor

Finding Synergies With an Outside Perspective

by Tony Jones, Senior Editor

G reetings! I’m the new guy. I’ve been on the job for a couple of weeks, and I can already tell I’ve got a lot to learn from you folks. My name is Tony, and I’m excited to join our talented editorial team as senior editor. As a way of introduction, I thought it would be helpful to step in front of the curtain and give you a brief overview of how my professional experience and content philosophies align with the guiding mission of Working RE

As a career trade journalist and editor, I’ve spent nearly three decades learning, absorbing and covering a wide range of industries with the overarching goal to help small business operators succeed. That is best achieved by producing quality content that’s informative, educational and insightful.

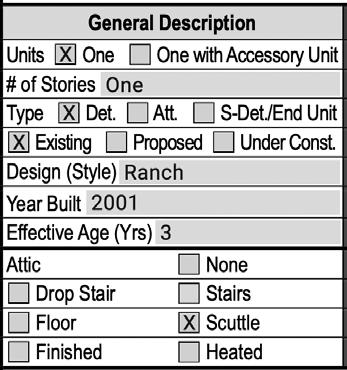

Within that context, we strive to understand and alleviate your business pain points on myriad fronts. In this Summer 2024 issue, for example, Jo Traut, director of appraisal curriculum at McKissock Learning, underscores the characteristics that will help appraisers survive in today’s climate in Valuing Appraiser Professionalism (pg. 12), while educator, author and appraiser Richard Hagar guides you through the appraisal trickery of accessory dwelling units in When Is Single Family a Multi-Family Appraisal? (pg. 32).

Another component is to stay on top of and report on important trends, particularly if they help

improve efficiencies, increase revenue and—critically—protect your business. As Working RE readies to launch a new survey on appraiser fees, get context as to why the timing is right and your participation is critical on pg. 16.

These principles all fall under the big-picture umbrella of what’s occurring in the larger market. It’s our job to convey how ripples at the highest levels may affect you and impact your business. The collective nuances and driving market factors comprise the special sauce that makes the appraiser space distinct and worthy of dedicated, insightful coverage.

As such, Publisher Isaac Peck breaks down the landmark National Association of Realtors (NAR) classaction settlement for this issue’s cover story. At a time when appraisers are dealing with a prolonged slow market and other stressors that are likely to persist through 2024, they’ll also be touched by the ramifications of this case. For a deep dive into the settlement, its fallout and how it’ll likely affect you, turn to pg. 6.

My goal is to be a worthy steward in upholding the high standards that have already been set for the magazine, while adding value to our coverage. Your input is crucial. If you have story ideas, big-picture thoughts about the appraisal market and profession, or otherwise just wish to reach out and connect, please don’t hesitate to email me at tony@orep.org. WRE

Readers Respond

A Look Into PAREA

So, who are the providers of this program? I’ve been hearing about it for some time, but they never publish who the actual course providers are. —Rob

The appraisal profession is like any other—it is supply and demand. If there is enough demand, the appraisers will come. In my area there are now too many appraisers after the high demand from the last three years. Now the new guys are taking anything at any price, and the fees I am getting are 20-25 percent lower than they were two years ago. Let the market decide.

Taco Mac Smith

So, they compare the virtual training of appraisers to surgeons and pilots. I sure wish they paid appraisers anywhere near those salaries, given the extreme liability we are facing in today’s climate. As for diversity, here is what I have to say about it. We don’t appraise race; we appraise homes. So, the thought is that having more minorities will suddenly improve the values of minority neighborhoods? I sure hope not, as that is the true definition of biased appraising. I guess maybe it will reduce bias complaints, Black on Black or Latino upon Latino appraisers/homeowners. Less people will sue someone of their race? Really? No! If they perceive a low value, they can still claim bias and it has already happened Black on Black. Good luck to new appraisers out there without a supervisor. Without my supervisor, I would never have been able to go out on my own. They need to know how to run a business or maybe the powers that be want it that way. They will all get jobs

4

WRE Online Opportunity (and News) Await! Opt In at WorkingRE.com

Working RE Summer 2024

at banks and AMCs. This way, they will have their thumbs on these new trainees so that values will always make the deals work. Good luck to the public out there who have no clue what is coming down the pike as it relates to the valuation industry. I am close to retirement— I cannot wait! This profession has gone down the tubes all in the name of racial bias! —Mary T.

The dynamic has changed; many real estate salespeople will be looking to become appraisers (see Realtor lawsuit). They have some experience and would become great appraisers, maybe widening the gap for them and allowing them to join PAREA. Honestly, the whole issue of killing the industry is the appraisal management companies. They clean the scraps off the plate, and there is nothing left Pat S.

HUD Discrimination Complaints Skyrocket

The increasing number of discrimination complaints against appraisers with HUD highlights a pressing concern in the industry. Appraisers face prolonged investigations, often without clear resolution, leading to significant uncertainty and potential financial strain. With HUD’s emphasis on settlements rather than dismissals, appraisers are frequently compelled to settle to avoid lengthy legal processes, even at considerable costs. It underscores the urgent need for clearer guidelines and training to ensure fair and efficient handling of appraisal discrimination cases.

Texas Commercial Appraiser

Inside Access to Fannie Mae’s Complaint Process

Here’s a “tip”: Stop letting the AMCs and lenders bid appraisal assignments. The bid winner is always the cheapest and fastest which in many cases results in the lowest quality. —Steve S.

The AMC model is broken. I have been waiting for years for someone to remedy and it is not happening. AMCs could not care less about geographic competency or individual assignment complexity. I hope they get exactly what they pay for. —Kelly K.

Hmm. Seems to me that their parameters are racist? —Pat T. WRE

Summer 2024 Working RE 5

Calif. Lic. #0K99465

“Appraisers will need to pick up the phone, call the agent and try to get answers around how

was structured on each comparable used in the appraisal.”

NAR Settlement: What It Means for Appraisers

by Isaac Peck, Publisher

T

he real estate community has been abuzz with talk about the National Association of Realtors’ (NAR) settlement. It’s made the national news, too, becoming a lively discussion item for the American public. Even President Joe Biden has chimed in.

Some real estate experts say nothing will change as a result of the settlement. Others believe it will fundamentally shift the way homes are sold in the United States.

While real estate agents and brokers are frantically wondering if the sky is falling, with some brokers preemptively retiring or getting out of the business, the general sentiment in the appraisal community has been much more muted. Though many appraisers are members of NAR—because it controls the majority of the multiple listing services (MLSs) across the country—most question whether this monumental piece of real estate news will have any effect on them at all.

Should appraisers care about the NAR settlement, and will it have any effect on how most appraisers perform their work? Here are the details of the settlement and what appraisers need to know.

Background

The class-action lawsuit, Burnett et al. v. National Association of Realtors et al., was filed in 2019 against NAR and nearly two

dozen of the largest real estate brokerages, including RE/Max, Keller Williams, Compass and almost every “big name” brokerage you can think of.

In October 2023, a jury in the Western District Court of Missouri issued a $1.8 billion verdict against NAR and the brokerages, finding that they had conspired to artificially inflate real estate agent commissions and misrepresent the way buyers’ agents were compensated.

As a matter of law, damages from an antitrust verdict are tripled, putting NAR and the brokerages on the hook for more than $5 billion in damages—a sum that likely would have bankrupted NAR and many of the brokerages. (NAR openly contemplated Chapter 11 bankruptcy after the verdict.)

However, some of the largest players in the case quickly began settling with the plaintiffs for lesser amounts. For example, RE/Max announced a $55 million settlement within 30 days of the verdict, Keller Williams settled for $70 million in February, and NAR announced a $418 million settlement in March. All settlements still need court approval to be finalized.

Settlement Fallout

In addition to agreeing to pay the princely sum of $418 million (over four years), NAR has made a series of commitments to drastically change how it and its members operate.

The NAR agreement is more than 100 pages and full of procedural changes and concessions, but some of the most notable updates to NAR’s business model include:

Working RE Summer 2024 6

Isaac Peck

the Publisher of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over 10,000 appraisers with comprehensive

coverage, competitive rates,

hours

free CE

is

E&O

and 14

of

for OREP Members (CE not approved in IL, MN, GA). Visit www.OREP.org to learn more. Reach Isaac at isaac@orep.org or (888) 347-5273. CA License #4116465.

compensation

• Listing brokers will now be prohibited from offering buyer broker compensation through NAR’s MLSs.

• NAR’s buyer brokers must now enter into an agreement with a buyer before providing any services and specify the amount or rate the buyer broker will be compensated as well as how it’ll be calculated. This amount cannot be open-ended (Example: “buyer broker compensation will be whatever amount the seller will offer to the buyer”).

• NAR buyer brokers are prohibited from receiving compensation from any source that exceeds the amount specified in the buyer broker agreement.

• NAR members are prohibited from screening or filtering listings presented to their buyer clients based on the compensation offered by the seller or seller’s agent. (Unless the buyer specifically requests this screening.)

• NAR agreed to make other changes to ensure that sellers and buyers always receive full, complete disclosures about broker compensation.

While NAR’s settlement is a legal agreement between a trade association and certain plaintiffs, it’s likely most brokerages and MLSs will modify their practices in line with the NAR settlement to shield themselves from liability.

What Changes for Brokers?

To understand how appraisers might be affected, it’s necessary to first analyze what exactly is changing for real estate brokers. Unfortunately, there appears to be little agreement on what exactly is going to change and when.

Pundits point to the fact that RE/Max, one of the largest broker franchises with more than 140,000 real estate agents, settled its case for $55 million over seven months ago. RE/Max agreed to the same process changes as NAR, but little has changed with

respect to how its agents operate in the market—at least so far.

The most impactful change might be that listing brokers are now prohibited from making an offer of compensation to the buyer’s broker via the MLS. Without any compensation being offered via the MLS, buyer brokers will no longer know what compensation they’ll receive from guiding their buyers to particular homes. Instead, they’ll need to call or communicate with the listing broker to determine what commission, if any, is being offered.

This, combined with the fact that buyers’ brokers (at least those who are members of NAR) will be required to enter into a written compensation agreement with the buyer that specifies the amount or rate they’ll be compensated and how it’ll be calculated, creates a problem for buyers as well as their brokers.

With the increased uncertainty about whether the seller or listing agent will be paying the buyer’s broker, buyers’ agents will want their Buyer Representation Agreement to include a clause stipulating that the buyer will pay their commission if necessary. Consider that the median U.S. home price is more than $420,000, and a 3 percent commission on such a house would be $12,600. Many buyers simply won’t be able to afford this. In certain low-income communities, brokers argue that most buyers struggle to come up with a 1 or 2 percent down payment, which makes the prospect of paying their own broker over $10,000 at closing a non-starter.

Location, Location

Just like everything else in real estate, the impact of these changes will vary by location. In some smaller localities, where all real estate brokers “hold the line” and take only listings in which sellers agree to include an offer of compensation to buyers’ brokers, very little will change in the market.

However, in larger, dynamic markets where some sellers balk at the 5 or 6 percent commission that listing agents typically request (and then split with the buyer’s broker), uncertainty in the marketplace will increase substantially. Some sellers might include compensation for the buyer’s broker, while some will not. Buyers who don’t want to pay their broker’s commission themselves will know that if they do sign a buyer’s broker agreement, they might be unable to purchase their dream home because they can’t come up with the extra $10,000 to $20,000 in cash to pay their own broker.

Alternatively, these buyers might develop specific strategies for how they will deal with sellers that don’t offer to pay their buyer broker’s commission. If they don’t have the desire or the ability to pay their broker themselves, a buyer might make their purchase offer contingent on the seller paying the buyer broker’s commission, or they might request a $10,000 or $15,000 concession to help cover closing costs (and pay their broker). And, of course, a buyer might increase their offer price to help either of these options be more palatable to the seller.

Local market reaction to this shift may vary substantially. Real estate brokers in some markets may continue business as usual. In other markets, the rise of flat-fee or à la carte buyer broker services may become popular. Elsewhere, sellers may overwhelmingly balk at paying the buyer broker’s commission. New customs and norms might develop.

Why Should Appraisers Care?

While this landmark legal case has the potential to really change how real estate agents and brokers do business, one question largely unaddressed by the hundreds of journalists covering this issue is how all this will affect appraisers. page 8 8

Summer 2024 Working RE 7

Many appraisers and key stakeholders in the valuation space have begun discussing this question—most recently at the 2024 Association of Appraiser Regulatory Officials (AARO) Spring Conference in Nashville.

Danny Wiley, senior director of single-family valuation at Freddie Mac and Lyle Radke, senior director of collateral policy at Fannie Mae, gave a joint presentation at AARO in which the audience questioned how appraisers (and their regulators!) should view the issue.

The consensus from Wiley and Radke is that nobody really knows how the market(s) are going to respond, but the government sponsored entities (GSEs) will monitor the situation closely.

The central question arising for appraisers is: At what point, if any, does an appraiser need to adjust for seller-paid commissions?

One point highlighted in the discussions at AARO is that, to date, appraisers have generally ignored the real estate brokers’ commissions that sellers have paid because these commissions have been silently baked into appraisers’ opinions of value for decades.

Appraisers need look only at how the Uniform Residential Appraisal Report (Form 1004) defines market value, specifically the section on adjustment for concessions: “Adjustments to the comparables must be made for special or creative financing or sales concessions. No adjustments are necessary for those costs which are normally paid by sellers as a result of tradition or law in a market area; these costs are readily identifiable since the seller pays these costs in virtually all sales transactions.”

In other words, if there are costs that are normally paid by sellers in “virtually all sales transactions,” the appraiser doesn’t need to account for them and no adjustment is necessary.

However, if a market shifts to the point that sellers stop paying for the buyer broker’s commission in “virtually

all sales transactions,” then an appraiser in that market may need to start paying attention, make note of those costs and adjust to the comparables accordingly. Again, it will depend on how the local market responds. Will 5 or 10 percent of sellers refuse to pay the buyer broker’s commission? Will there be some markets in which 20, 30 or 40 percent of sellers ultimately decline to offer a buyer broker commission over the next three to five years?

There are a number of scenarios for how a residential transaction might play out:

• Seller offers to pay commission for buyer broker.

• Seller offers no commission and buyer pays their own broker.

• Seller offers no commission and buyer submits an offer contingent on seller paying the buyer broker’s commission.

• Seller offers no commission and buyer submits an offer contingent on a cash concession toward closing costs (think $10,000 or $15,000).

There are myriad other scenarios that buyers and sellers might creatively invent for how to make a transaction work. For starters, a buyer desperate to make a deal work might increase their offer price but then ask for the same amount to be paid as commission to their broker, or returned to them as a concession at closing.

Investigative Appraising

In markets that have no uniformity with respect to how sellers compensate buyer brokers, appraisers will need to do some investigating to determine if an adjustment is warranted.

Ryan Lundquist, a Sacramento, California, appraiser and author of the popular sacramentoappraisalblog.com, acknowledges that because commissions have been baked into the market for so long, it’s not really something appraisers have had to consider. “With a

buyer’s agent commission now potentially being handled like a concession, this is something new that we need to analyze. The gist is we’re going to have to see if there is any price difference between homes with and without the buyer’s agent commission covered,” says Lundquist. “This isn’t just something appraisers will have to ask either. Real estate agents are going to dig into this, and savvy buyers, too. If you were a buyer looking at comps, wouldn’t you ask, ‘Did the seller pay for the buyer’s commission on this one?’ That seems like a relevant question when considering what to offer.”

Craig Capilla, a partner at Franklin, Greenswag, Channon & Capilla LLC and an attorney on the frontlines of defending appraisers, says the impetus will fall on appraisers to take additional steps in data verification. “Especially since the commission paid or offered to the buyer broker is not going to be in the MLS, appraisers who are operating in markets where compensation is not universal will need to work harder to get an accurate view of what’s what,” says Capilla. “Appraisers will need to pick up the phone, call the agent and try to get answers around how compensation was structured on each comparable used in the appraisal.”

For sellers and listing agents offering commission to the buyer broker, Capilla says it might be easier to suss out than appraisers think. “The expected settlement terms would mean the only place the listing agent can’t put the commission is the MLS, so check their social media and websites. If they’re offering buyer side commission, they’re probably going to shout that information from the rooftops. Appraisers can screenshot that information or take notes on any phone conversations they have and save it to their workfile,” suggests Capilla.

Working RE Summer 2024 8

7page 7 page 10 8

Of course, taking this approach is ultimately going to be more work for appraisers. “If the local market isn’t handling commission in a uniform way, the appraiser will have an obligation to try to obtain more information and make heads or tails of it,” notes Capilla. “That’s going to require extra effort on the appraiser’s part.”

Concessions Already a Problem

Setting aside this new commissions issue, some appraisers are already in hot water for failing to adjust for concessions. In its December 2023 Appraiser Newsletter, Fannie Mae explains that it recently analyzed appraisal data from Q4 2021 to Q3 2023. In that sample, appraisers reported seller concessions for 7.6 million comparables, but didn’t make adjustments on 58 percent of the comparables. Addressing this failure, Fannie writes: “Of course, this tends to inflate the appraisal results and undermines the credibility of the appraiser.”

Fannie Mae reminds appraisers that “market theory suggests that sellers would typically aim to recover the expense of the seller concession by increasing the price, so something close to a dollar-for-dollar adjustment would be the predicted outcome of the appraiser’s analysis in most cases.”

This has been a popular discussion item for GSE representatives, including Radke, at numerous appraiser conferences over the last 12 months. An example Radke offers in his presentation is the following: “If I am in my car driving down the road and a man is standing on the street corner with a sign that says, ‘Please give me $10,000,’ no one is going to do that. No one is going to give away $10,000 for nothing. Yet, we see these kinds of concessions be completely ignored by appraisers all the time. They will say, ‘Oh this is typical for my market, so I don’t have to adjust for it.’”

At the AARO conference, Radke and Wiley suggested that many ap-

praisers simply don’t want to spend the time to calculate the adjustment for concessions. However, the GSEs are signaling that this will be a key focus for them going forward, implying that appraisers who refuse to adapt to their standards will likely be on the receiving end of warning letters, board complaints and loan buyback demands.

At the moment, however, the GSEs (along with the Federal Housing Authority) have indicated they will not treat the seller’s payment of the buyer broker’s commission as a concession or an interested party contribution (IPC). While seller concessions have typically been limited to between 2 and 9 percent of the property value, the GSEs directly addressed the uncertainty around this issue created by the NAR settlement in writing, noting that because “buyer agent fees have historically been fees customarily paid by the property seller or property seller’s real estate agent,” they will be excluded from the financing concession limits.

However, Fannie leaves the door open to reassess the situation later, writing: “It is Fannie Mae’s standard practice to continuously evaluate its requirements to determine whether updates are appropriate based on changes to the market and industry. Fannie Mae will continue to monitor and assess the impact of the proposed NAR settlement and other real estate agent commission lawsuits to determine if any updates to its requirements are necessary.”

Another thing to note is that the GSEs will ultimately be able to track how uniformly commissions are paid by the seller in a given market because they have access to the final closing statements of each transaction.

Consulting Opportunities?

In addition to changing how appraisers might need to monitor, analyze and report on the real estate market, there may also be opportunities for appraisers

interested in building up their private appraisal and consulting business.

Kern Slucter, MAI, SRA, author of Real Estate à la Carte (second edition) and CEO of the International Association of Real Estate Consultants, believes this is a tremendous opportunity for appraisers to step into the role of real estate consultants and grow their businesses with private work. Slucter, who’s licensed as an appraiser and real estate broker in Michigan, says that depending on an appraiser’s home state regulations, they may or may not need to get licensed as a real estate agent or broker to truly take advantage of the consulting opportunities that will arise from this change.

“In my home state of Michigan, the regulator will give appraisers credit for the three years of experience that’s required to get the broker’s license. So, all you need is an additional 60 hours of education and to pass an exam to get your broker’s license,” reports Slucter.

Appraisers are uniquely positioned to consult with buyers who don’t want to work with a traditional buyer’s broker. “Some percentage of buyers is going to reject the traditional broker model and hire consultants instead. It’s cheaper for them because they’ll be able to negotiate a lower sales price in many cases. In today’s market, buyers can do a lot of the legwork themselves and then hire a real estate professional by the hour to do what they can’t,” argues Slucter. “Appraisers know about homes, they know about the buying and selling process, and because of their education and experience, they are often far more qualified compared to traditional brokers. Appraisers are truly in the best position to serve as consultants to these buyers.”

Moving Forward

While appraisers are in a “wait and see” dynamic right now, Capilla advises

Working RE Summer 2024 10

7page 8

keeping a close eye on your local market over the next 12 months. “Now more than ever, data verification is king,” he says. “Appraisers sometimes expose themselves to liability by simply citing the MLS or public record where they found the data, and they never bother to verify that data or look further into it. So, if we see markets begin to shift on how commissions are paid, there’s definitely potential risk for appraisers who aren’t doing data verification that they really should’ve been doing all along.”

Capilla also recommends appraisers verify the sales data and data sources they rely on. “In terms of verifying sales

data, it’s not just about the transaction in question but also the closed sales and comparables that you’re using in your report,” he advises. “Do you have a sense of whether or not what you’ve obtained from MLS is accurate? Especially as we move into August and NAR starts implementing changes in the MLS and the markets start responding, appraisers need to face these changes with both eyes open and an ear to the ground. A significant concern here is that historical data might be removed from viewable information in various MLS systems so appraisers should be sure to keep a good record of their data verification sources to support their conclusions.”

Will these new changes also create meaningful opportunities for appraisers to diversify more into private appraisal and consulting work? Only time will tell. Stay safe out there! WRE

Summer 2024 Working RE 11

(888) 347-5273 | OREP.org If you are struggling to reach your insurance agent with a simple question or just to renew your policy, wait until you have a claim! In business for over 22 years, we still know the meaning of customer service. It’s time to shop OREP. We Answer the Phone! We Don’t Make You Press “3” for Customer Service… CALIF. LIC. #0K99465 Ser g R E te P essi nal Ser v i n g Re a E s t a te P r o f essi o nal s W nter 2020 Volume 52 Purchase Working RE for only $60 a year WorkingRE.com/Subscribe/ Subscription included with OREP Membership (visit OREP.org).

“Professionalism isn’t just a skill, it’s a mindset—a commitment to excellence, integrity and respect that guides us through challenges and paves the way for long-term success.”

Valuing Appraiser Professionalism: A Blueprint for Survival

by Jo Traut, McKissock Learning

Having spent nearly three decades in the field of real estate appraisal, I’ve witnessed firsthand the evolution of our profession, particularly with respect to technological advancements. However, alongside these positive changes, I’ve also observed a troubling trend toward increased unprofessionalism. This phenomenon isn’t unique to our discipline. It’s permeated other careers, from medical professionals to teachers to business managers.

In some cases, widespread use of social media has led to inappropriate online behavior and become a significant contributor to declines in professionalism. This can have detrimental effects on crucial, valued qualities, such as integrity, empathy and selflessness, among professionals.

This trend is particularly concerning for real estate appraisers, as professionalism is an indispensable skill, especially during periods of slower market activity. Without a foundation of professionalism, an appraiser’s business is at risk of collapse. Compared to other sectors like education and healthcare, our profession is relatively small. Any lack of professionalism, whether on social media, during client interactions or when responding to requests for appraisal modifications, can quickly follow the appraiser.

Regrettably, I’ve seen instances in which appraisers have responded to lender requests unprofessionally and publicly criticized colleagues, companies or clients on platforms like LinkedIn or Facebook, or even in direct communication. Real estate appraisers must remember that their behavior online, in emails or over the phone serves as their calling card, potentially impacting their current and future opportunities.

Further, appraisers also need to recognize that anything communicated via email or posted on social media is discoverable, underscoring the importance of exercising caution and professionalism in all forms of communication. Whether seeking job opportunities, pursuing roles as appraiser educators or engaging as expert witnesses, appraisers must always consider the potential repercussions of their words and actions, now and into the future.

Professionalism isn’t limited to communication; it’s the combination of all the qualities connected with trained and skilled people. These qualities include integrity, reliability, expertise, accountability, respectfulness and a commitment to excellence. As such, its preservation and promotion must be a top priority to survive turbulent times in the residential or commercial real estate markets.

As an appraisal educator, I’ve received requests from fellow appraisers, regulatory officials, owners of major appraisal firms and other stakeholders to teach about professionalism and emphasize its importance to colleagues.

12

page 148 Jo Traut has been a real estate appraiser since 1997 and currently holds a certified residential appraiser license in Illinois and Wisconsin. Jo specializes in appraising luxury homes, valuations for lending purposes, relocation appraisals, appraisal review and appraisal compliance. Jo previously was residential chief appraiser for the fifth largest bank in the United States. She currently serves as director of appraisal curriculum at McKissock Learning (www.mckissock.com). Working RE Summer 2024

Recently, in a conversation with a medical professional, I learned that their education includes courses on professionalism. Inspired by this, let’s discuss what professionalism means in the appraisal profession and how we can all work toward achieving it.

Integrity

Remain steadfast in your commitments, stay true to your word, and uphold your principles, even if this requires declining an appraisal assignment or future work with a client or their agent. By staying honest and true to your values, others are more likely to trust and collaborate with you or recommend you and your business.

Reliability

Demonstrate reliability by consistently meeting deadlines, delivering quality work and showing up to inspections or meetings on time. When committing to an appraisal assignment or project, ensure you can complete it effectively and on time. Communicate with your client promptly if unexpected issues arise. Avoid overpromising; only accept assignments you can fulfill with excellence and within the designated time frame.

Building a reputation for dependable, high-quality work increases your chances of receiving future assignments. In my experience working with a panel of fee appraisers, we prioritized appraisers known for their reliability and quality, often offering them higher compensation. During slower periods, these trusted individuals were our first choice for assignments.

Expertise

Professionals strive for proficiency in their field, continually enhancing their knowledge through education, webinars and personal development efforts. It’s not just about acquiring designations but staying informed about market dynamics, industry changes and emerging trends.

This involves sharpening your technological skills and perfecting your ability to apply methodologies and techniques. For example, establish annual objectives to develop new skills, like mastering Excel or refining methods for conducting market analyses.

Accountability

Professionals prioritize accountability, especially when acknowledging mistakes. This personal responsibility is closely linked with honesty and integrity, forming a crucial aspect of professionalism. If a client requests a review of an appraisal for potential errors or possibly overlooked comparable sales, approach the situation objectively. Determine whether there was a missed comparable sale or an error in the development or reporting of the appraisal.

It’s better to take ownership and correct the issue rather than make excuses or avoid accountability. Refrain from justifying subpar work by citing payment or time constraints, and instead, meet the expectations of the appraisal assignment without shortcuts. While mistakes happen, admitting and addressing them is a hallmark of professionalism.

Respectfulness

Professionalism entails serving as a model of politeness and good manners, extending courtesy to all, regardless of the need to impress. This involves punctuality, maintaining a positive demeanor and dressing in appropriate attire. Avoid attending appointments in ripped jeans or flip-flops, which projects an image unsuitable for professional engagements.

Seek to understand others’ perspectives, fostering empathy and offering support accordingly. Avoid using sarcasm or disrespectful comments when responding to an underwriter’s inquiry about your appraisal report.

When using social media for business promotion, ensure the content

remains professional and refrain from insulting other professionals, organizations or entities. If you disagree with a policy or decision, there are appropriate channels to express your opinion or advocate for change. However, you need to do so in a professional manner. Consider how you would feel if someone published similarly disparaging remarks about you or your business, and refrain from resorting to slander against individuals or entities.

When meeting with a homeowner or attending meetings or classes, avoid checking your personal social media sites and turn off phone notifications, so you won’t be distracted while completing the inspection or attending the meeting or class. Being respectful means giving your dedicated attention. Do you need to prioritize that Facebook posting, email message or text message, or can it wait for an hour or more?

Also, offer to help colleagues when they ask questions or are trying to solve challenging appraisal issues. Don’t feel compelled to discourage someone from asking questions or convey condescending remarks when responding. We all have room for growth, and learning from one another fosters an open and welcoming environment.

Commitment to Excellence

True professionals are prepared, which entails advance planning, dedicating sufficient time and giving proper attention to tasks. Before delivering work to clients, conduct a thorough review to mitigate potential errors. Acknowledge and address any skill gaps or lack of competency promptly and transparently, ensuring a commitment to excellence in every endeavor.

Clients and colleagues value working with individuals who exude positivity and optimism. By approaching tasks with motivation and a positive attitude, you can inspire similar behaviors in others.

Working RE Summer 2024 14

7page 12

In the face of challenges in your appraisal business, prioritize problemsolving over dwelling on grievances or blaming policies and others.

A Professional Mindset

Professionalism stands as the cornerstone of survival and success in the everevolving landscape of real estate appraisal, especially amidst turbulent times. At its essence, professionalism isn’t just a skill, it’s a mindset—a commitment to excellence, integrity and respect that guides us through challenges and paves the way for long-term success.

When we strive to uphold professionalism, we not only safeguard our own reputation but ensure the sustainability and credibility of the real estate profession for generations to come. WRE

A nnouncement

The National Society of Real Estate Appraisers, Inc. (NSREA) is pleased to announce several significant updates. Brian Cox, the incoming president, brings enthusiasm about the qualifications and energy of the new executive team and Board of Directors. NSREA has a long-standing legacy of advocating for minority appraisers, and the new board is ready to address the lack of diversity in the appraisal profession.

Brian Cox represents NSREA on TAFAC (The Appraisal Foundation Advisory Council) and has been elected as the board chairman of the newly established Appraisal Foundation Partners, replacing the former Appraisal Foundation Sponsors. Additionally, Lawrence Netterville of NSREA’s Executive Vice President is the newly elected board chairman of the Appraisal Foundation’s CARE Council (Council to Advance Residential Equity), and David Beard of NSREA Board of Directors is a newly appointed member of the Appraisal Foundation’s Board of Trustees.

Furthermore, NSREA’s Appraisal Education and Training program with Fayetteville State University has officially started.

Join NSREA today and help become part of the solution. For more information, visit www.nsrea.org.

Summer 2024 Working RE 15

#1 Source of News for Appraisers STAY INFORMED! years Sign Up Today for FREE e-News at WorkingRE.com

Mr. Brian Cox, President

“When it comes to actually setting fees, reality rests within the dynamics of every local market.”

What’s Happening With Appraisal Fees? New Survey Seeks Answers

by Tony Jones, Senior Editor

While appraisal volume is varying widely by location, the prevailing general consensus in the market today is that appraisal fees are under pressure nationwide. What’s been characterized as the slowest time in appraisal history has no doubt contributed to the downward pressure on fees, but just how much compression has taken place across the nation is difficult to say.

To try to gauge where “customary and reasonable” fees are landing and help appraisers strategically adjust pricing within the markets they serve, OREP/ Working RE is launching a nationwide survey to collect data straight from the source. The 2024 Appraiser Fee Survey is the fourth such exercise the company has conducted in the last 14 years, offering appraisers across the country the opportunity to anonymously share what they’re experiencing in their markets and then mine the data collected to adjust accordingly.

Historical Perspective

To better understand how markets are performing currently, it helps to retrace where we’ve been. Our first survey in 2010 was launched in the wake of the Home Valuation Code of Conduct (HVCC) and the rise of appraisal management companies (AMCs). Go to WorkingRE.com/Surveys to view past Customary and Reasonable Fee Surveys.

At that time, the fee issue had grown in importance due to appraisal independence mandates in Dodd Frank, and nearly 18,000 appraisers participated— many of whom were struggling to cope with severe fee splits they were facing from opportunistic AMCs. This proved to be a pivotal turn, and many licensed appraisers could no longer afford to stay in business.

When the second survey launched in 2017, drawing more than 7,000 participants, the tide for many appraisers had begun to turn and fees were rising, though this was largely credited to years of sector erosion and a severe thinning of the ranks. Still, the turnaround was vindication for many longtime appraisers who managed to push forward despite the litany of adversities spearheaded by the Great Recession and collapse of the housing market.

The third survey, conducted in 2021, came after an unprecedented surge in business was ushered by the COVID-19 pandemic. With about 30 percent fewer licensed appraisers operating nationally compared to 2010, 2020 had been a boon for total mortgage originations and appraisal volume. In fact, Freddie Mac reported that the seven-month stretch at the outset of the pandemic (March to September 2020) represented the seven highest volume months on record in terms of appraisals received via the Uniform Collateral Data Portal (UCDP), the submission platform used by Freddie Mac and Fannie Mae that facilitates the electronic collection of appraisal report data.

Working RE Summer 2024 16

Tony Jones is senior editor of Working RE magazine, published by OREP, a leading provider of E&O insurance for real estate professionals. Based in San Jose, California, he has nearly 30 years of business publishing experience and graduated with a bachelor’s degree in journalism from the University of Arizona. To reach him, email tony@orep.org.

By the time the 2021 survey was launched, the boost in volume, coupled with a stabilized pool of appraisers available to complete assignments, suggested appraisal fees were increasing in many markets. This was supported by lenders reporting longer turn times and fee bumps in high-volume markets as well as appraisers who indicated they had raised their fees in response to the higher demand.

Knowing what’s occurring on a national scale provides some context and a baseline by way of comparison, but when it comes to actually setting fees, reality rests within the dynamics of every local market. For example, tracking the prevailing appraisal fees in Bend, Oregon, follows the path of expectation through the first three surveys. In 2010/2011, appraisers in Bend were earning a typical fee of $401-$450 for a standard 1004 (single-family detached) order. By 2017, the typical fee in Bend ballooned to $651-$700, and in 2021, the benchmark had pushed past the $751 mark.

By comparison, appraisal fees in the Miami metropolitan market followed a similar path over the same time frame, though not as positively pronounced or well-defined. In 2010/11, the typical fee for a standard 1004 was slotted evenly between $301-$350 and $351$400. In 2017, it was an even split between $351-$400 and $401-$450, suggesting some modest improvement. In 2021, the typical fee had settled in the $451-$500 range.

This type of comparative data is available to all appraisers and industry stakeholders for free at WorkingRE.com The fourth installment of the fee survey should give appraisers a snapshot of how colleagues and competitors are adjusting to present conditions occurring within the markets they serve, but the value of the data will be dependent on the level of participation.

Fee Pressures Persist

What’s occurring across the nation currently is decidedly a mixed bag. Whereas fees were increasing incrementally in many markets during the last two surveys, the general sense right now is appraisers have been hit by a steady array of factors persistently pushing fees downward. Just how much and where are key motivators for collecting new data.

In terms of big-picture numbers, a 2023 fact sheet from the Appraisal Institute indicates there are roughly 70,000 individual licensed and certified appraisers, though that figure is down about 8,000 from 2022. Further, 75.7 percent of appraisers have spent more than 15 years in the valuation profession, while just 8.8 percent have joined the ranks in the last five years. This supports the popular notion that mass attrition continues to occur throughout the profession without significant replenishment from new trainees. As experienced appraisers retire or simply exit the market in search of other/better income, the net loss is glaring.

Even as the number of appraisers continues to decline (slightly), appraisers continue to face fee pressure because low inventory gives AMCs additional leverage to play individual appraisers against each other. According to a survey by the National Association of Realtors (NAR), many appraisers are clearly feeling the pinch, with 47 percent of survey respondents citing “fee pressures” as being among their greatest business challenges last year. This stands in stark contrast to just 27 percent in 2022. While the causes of those pressures can be varied, comments collected by NAR indicated AMCs were the primary source of frustration, according to the survey analysis.

This is in line with NAR’s 2022 survey results in which 54 percent of appraisers said AMCs were among their biggest business challenges.

The Bidding Conundrum

Of course, independent appraisers’ annoyance with AMCs is hardly new. This includes the email-blast bidding process that some AMCs use to fill orders. In this scenario, an AMC emails its preferred list of appraisers in a given area, detailing a particular property and inviting those appraisers to bid on the order—providing their proposed fee and turn time. In some instances, the email is sent to multiple appraisers at once and AMCs are often accused of selecting the lowest bidder. In other cases, the AMC will broadcast an order offering a low fee and the first appraiser to accept the low fee gets the order.

The problem with this model is it treats the appraisal fee and turntime as the only material factors in the selection of the appraiser, ignoring the experience, skill and, in some cases, the geographic competency of the appraiser.

In many cases, appraisers have aired their grievances online with colleagues, venting about the process and its effect on fees. “I am really getting tired of bidding on work and having to look up the details of the home before bidding,” one appraiser noted in April 2023 to a professional group on Facebook. “At one time, the lender had to fill out an information sheet when submitting work to my company. If they wanted me to look up details, it was called a paper search, and my fee was $75 for this service. Now, I have to look up details on five to 10 properties a day and not get paid anything for it. Even worse, most of the time I do not get the appraisal because I refuse to work for free.”

The appraiser went on to opine that any collective determination of what a fair fee might be is often construed as “price fixing,” while other types of businesses routinely are able to see what competitors charge for services as a matter of normal business

Summer 2024 Working RE

17 page 188

practice. “Something has to happen to value our profession, and the newbies need to stop working for free to get more business,” the appraiser wrote. “[I have] 18-plus years in this profession, and appraisers are still accepting fees that I was getting paid more for 18 years ago. Shameful.”

Assessing Volume

Appraisal volume through the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, can also be an indicator of where fees are lying. Through the first three months of the year, purchase and refinance volumes were about on par with where they were in 2023, according to UCDP figures, but the number of active GSE appraisers also has been increasing steadily since hitting a historic low last December and was back above 30,000 at the end of March, according to an April “Appraiser Capacity” report from Freddie Mac.

What that means in terms of GSE appraisals per appraiser depends heavily on where you’re located. Through the first quarter, the top 10 states for volume, particularly the top four of Nevada (57), Florida (51), Texas (49) and Georgia (48), are all well above the 37.81 average. As a result, we’d expect fees to be competitively high or holding steady in those markets.

Conversely, the bottom 10 markets are all below 30 appraisals per appraiser, with North Dakota (18), Vermont (20), Alaska (21), Washington, D.C. (21) and Wyoming (22), occupying the bottom five rungs.

According to February 2024 figures from the American Enterprise Institute (AEI), which tracks the mortgage and appraisal production numbers of Fannie Mae and Freddie Mac, total GSE valuations tallied 114,802 for the month. Of those, 16,316 were comprised of appraisal waivers and property data collections (PDCs), leaving 98,486 appraisals for the GSEs.

With about 32,000 appraisers active on UCDP in February, that equates to about 3.1 appraisals per appraiser.

Though appraisal waivers and PDCs are potential factors in taking work away from appraisers and placing stress on fees, their current impact appears to remain relatively small. In February, for example, waivers accounted for about 11.7 percent of GSE valuations, according to AEI data, which is a little less than the 12 to 13 percent that was trending late last year.

The GSE “Appraisal Waiver Plus Property Data Collection” options are even less impactful. In terms of the total valuations (including waivers) the GSEs processed in February, PDCs comprised about 2.5 percent, according to AEI, though it’s worth noting that figure is up from the less than 1 percent that was trending through much of last year.

Though this volume snapshot doesn’t account for volume occurring through the Department of Veteran Affairs, the Federal Housing Administration, private lender appraisal work, direct lender appraisals, or commercial appraisals that exist outside the GSE’s domain, it’s still representative of more than 60 percent of the market and a reasonable barometer for the market as a whole.

Survey Participation

All of this is to say that collecting new data on where appraisal fees are landing currently is warranted and a valuable pursuit. Hard numbers are always better than speculation, but data value is wholly dependent on survey participation.

Similar to our three previous fee surveys, this new installment is broken out by 365 Metropolitan Statistical Areas (MSAs) as defined by the U.S. Census Bureau, with rural areas included by state. It focuses on eight different appraisal products, including reviews and FHA appraisals.

Similar to three years ago, the survey also asks appraisers for input on:

• If (and by how much) appraisers are lowering their fees for desktop and exterior-only assignments

• Current fees for 1004D Appraisal Update Assignment

• Current fees for 1004 Certification of Completion

• Estimated reasonable fees for Fannie Mae’s 1004 “Desktop” form

• Estimated reasonable fees for Fannie Mae’s 1004 “Hybrid” form

In addition, the survey addresses appraisal turnaround time, which some believe directly correlates to report quality. Though Working RE’s first survey in 2010 included only nonAMC appraisal reports, the new survey draws no distinction between AMC and non-AMC appraisals. It also assumes assignments that are not complex (complex assignments require higher fees).

With the cyclical nature of the market, now’s the time to gauge what’s happening within the specific areas you serve. Survey participation is anonymous and takes only a few minutes to complete. To weigh in with your customary and reasonable fees for various products, visit WorkingRE.com/2024survey

Once you’ve completed the survey, we encourage you to send the survey link to as many appraisers as possible encouraging fellow colleagues to contribute.

The initial results should be published by Oct. 1 and will be updated regularly as the various market areas become more populated. In addition to individual appraisers, AMCs can use the data to measure the customary and reasonable fees they offer as well as turn-time policies. The data will be accessible to the government, AMCs and the public at large. WRE

Working RE Summer 2024 18

7page 17

Follow Working RE for C&R Fee Survey Updates: Facebook.com/WorkingRE Linkedin.com/Company/WorkingRE

“Always a pleasure to work with such a professional and efficient group, thanks!”

—Chris Dinan

10,000+ SERVING APPRAISERS

ACROSS THE COUNTRY

Here’s what they are saying:

“The E&O insurance renewal experience could not have been easier.”

—Sean Mozal

“OREP continues to impress us with their fast response and fair pricing.”

—Anthony Howell

“Really glad I made the switch to OREP! Reasonable prices and great service.”

—Shawn Sutton

“It’s always super easy to sign up for a decently priced insurance policy. And you can always rely on someone.”

—Erin W.

“They explain the policy in detail so you understand clearly. I recommend them to anyone starting a small business.”

—David Clauw

Call (888) 347-5273 or Visit OREP.org OREP E&O INSURANCE Open 12 hours a day to serve you 8 am - 8 pm EST M - F (5 am - 5 pm PST)

U p to $500,000 Discrimination Claim Coverage Up to $10,000

FOR THE MODERN PROFESSIONAL years OREP BROAD COVERAGE for Appraisers $100,000 Premises Claim Coverage State Board Complaint Coverage Calif. Lic. #0K99465 *(Not approved in GA, IL, MN) *MEMBER BENEFITS 14 HOURS *Free CE EXPERT Claims Support WORKING RE Magazine STATE BOARD Complaint Consulting APPRAISER E&O INSURANCE *Member benefits provided as part of the OREP Risk Purchasing Group, Min. Membership fee of $60.

INSURANCE

“Let’s not call that ‘bias,’ let’s just call it a rushed, bad appraisal.”

Appraisal Institute CEO Cindy Chance Addresses Bias Flak

by Tony Jones, Senior Editor

Four years ago, the notion that racial bias is a systemic problem within the real estate appraiser profession exploded into a feeding frenzy of negativity against the sector. A highly critical study published by the Brookings Institution, discrimination complaints filed with Department of Housing and Urban Development (HUD), subsequent public hearings and press attention from major media outlets all heaped unwanted attention on appraisers and, arguably, helped to erode the public trust that appraisers enjoy.

The danger of widespread negative viewpoints about any industry is that they can quickly become the prevailing public perception. Many appraisers, including members of the Appraisal Institute (AI), became openly critical of industry leadership and organizations which, in their view, inadequately responded to the allegations and increased scrutiny. Not only have many appraisers criticized the sector’s response as slow and tepid, some felt betrayed by leadership for not emphatically sticking up for the profession in visible media and public hearings.

As the industry’s largest association of appraisers, AI has faced its share of ire, so it’s of interest that its new CEO, Cindy Chance, devoted considerable space to the bias issue in three consecutive April e-newsletters to members. Prior to taking over as CEO in September 2023, Chance was executive vice president of the Urban Land Institute, a commercial real estate association, where she led its education programs. According to her LinkedIn profile, she previously spent nearly 17 years as an administrator in higher learning. She attended Oxford University and holds a doctorate in philosophy from Georgetown University, where she also spent 11.5 years in administration.

In a series of three letters collectively titled “What Appraisers Do,” Chance offers her views on the issue of biases (not just racial), defends the integrity of appraisers based on the scope of their training and professionalism, and shines light on the increased reliance on “big data” and its existential threat to the profession. Space limitations prevent Working RE from publishing Chance’s letters in their entirety. What follows is a condensed version of her views, highlighting some of her most salient points.

Part 1: What Appraisers Do

In her first letter, published April 12, Chance opens with an acknowledgement of membership discontent regarding AI’s response to the wave of racial bias allegations:

I’ve heard from many appraisers, particularly residential appraisers, that the Appraisal Institute should have done better at standing up for them by making the public aware of their skills and professional discipline. I agree. Sweeping, sensationalized claims of “bias” about our profession ignore appraisers’ core skills, ethical standards and professional disciplines. The valuer is the only party to a real estate transaction without a financial interest in its outcome; moreover, the appraiser’s duty is to uphold the public trust, by providing an unbiased, impartial opinion of value based on a rigorous process that is continually refined and improved by the profession. Appraisers are heavily regulated to ensure quality standards, held to a rigorous ethical professional code of conduct, and our SRA and MAI designations reflect the profession’s highest standards. Why then has it been difficult for appraisers to respond effectively as a profession to unfair accusations of bias?

Working RE Summer 2024

22

One reason is that claims of bias are antithetical to what appraisers do. (In case you’re interested, philosophers and linguists call this a “failure of presupposition,” and it is hard to address because it assumes something that is not actually the case.) As of now, the public is hearing from the media and politicians about a certain terrible kind of bias. What they need to know is that professional real estate appraisal has long been built on eliminating all kinds of irrational bias. Appraisers, ironically, have been ahead of the curve in working continuously to identify and eliminate every kind of bias from their professional analysis.

In the letter, she highlights the work of Daniel Kahneman and Amos Tversky as well as the scientific understanding of “cognitive bias” and how it is a

normal and necessary part of human brain function. In her assessment, Chance argues that licensed appraisers are trained specifically to weed out biases from their valuations:

Cognitive bias is powerful and can only be managed through the application of methodologies and procedures that require disciplined analysis of data and information (sound familiar, appraisers?). In fact, cognitive bias is why we depend on professionals trained to be unbiased specifically where our proneness to irrationality could create serious problems, such as science, finance, and economics. Appraisers’ impartial analysis protects the public from our hardwired, everyday biases that would undermine the healthy function of the real estate industry.

Checklist and eBook

Work Faster and More Efficiently

Appraisers are essential to a healthy economy because there are all kinds of opportunities for cognitive bias to infect real property valuation; real estate is a context ripe for “loss aversion,” “anchoring bias,” “availability bias,” “conformity bias” or “conflict avoidance,” to name a few. Appraisers are trained not to fall into these irrationality traps. Appraisers are continually trained to adjust their opinions of value based on data and professional discipline, precisely to avoid cognitive biases to which homeowners, loan officers, and all of us are susceptible.

She closes the letter with an acknowledgement that refocusing the “terribly flawed appraiser bias narrative” to one framed by facts and science is a long

Written by Lore DeAstra, SR/WA, MRICS, SRA

Written by Lore DeAstra, SR/WA, MRICS, SRA

Summer 2024 Working RE 23

FHA eBook & Checklist FHA

Purchase eBook at WorkingRE.com/FHA and Download Immediately Only $49 The FHA eBook and Checklist used successfully by thousands of appraisers includes information on FHA appraising, with NEW Q&A, explanations, pictures, and links. · Easy to Use, Streamlined Checklist Saves you Time · Interactive eBook - Searchable by Topic for a Fast Look-up · Valuable New Resources with Web Links for Fast and Easy access to Additional Information · FHA Contacts at your Fingertips. Check Competencies and Get Help Fast! OREP Members Save $10

page

248

road but asserts that AI is “committed to advocacy and communications” predicated on appraisers’ “commitment to doing the right thing, the right way.”

Part 2: Moving Past the ‘Noise’

In her second letter, published April 12, Chance notes that “identifying and studying cognitive biases … have taught us that it is hard to be fair and rational.” She then addresses the “charge of racism” directly:

The kinds of biases to which humans are naturally prone, such as “loss aversion,” are completely different from what has been referred to, and has entered the cultural lexicon, as “Appraisal Bias,” which is, in its essence, a charge of racism. ... I have yet to meet an appraiser who is not appalled by racist behaviors, but I’ve met and heard from many who are deeply hurt that their profession, which they chose because they care very much about fairness, impartiality, and the importance of real property ownership, is now associated with racism in the minds of many.

Chance goes on to tout the importance of professional training and education—in lockstep with licensing standards and professional ethics—as tools to help appraisers consider only relevant facts in their valuations. She maintains that flawed appraisals aren’t typically due to the “predictable patterns of error” that define biases but rather mistakes, which Kahneman called “noise”:

It is the mark of an outstanding appraiser to include everything relevant and nothing irrelevant; this is the heart of what a market analysis requires. This is important because the charge is that appraisals reflect patterns of terribly biased decisions, reflective of racism.

Racism is a learned, persistent bias; it is not variable, so it shows up throughout behavior, and racism in appraisal would show up as a persistent wrong and unjust weighting over multiple assignments that reflected the appraisers taking into account race as a factor relevant to a valuation assignment. But we do not see this.

Even with the exceptional scrutiny on the professional appraiser, the facts have not borne out the existence of such a fixed pattern of social bias in appraisals. On the contrary, the facts show us that better and worse appraisals are characterized by how well factors relevant to the appraisal are taken into account—the strength of the market analysis, and the absence of “noise.” Often these irrelevant factors are the result of the use of hasty methods such as template descriptions of market areas rather than careful individual treatment of every subject property. And this is why AMCs [appraisal management companies] that offer jobs to the lowest bidder are such a problem, because shortcuts proliferate when fees are too low for the work required.

The fact that the public is now genuinely concerned about “Appraisal Bias” is deeply upsetting. Black Americans have been negatively impacted by racist public policies from redlining to “urban renewal,” and they are now further harmed by the fear and stress they experience based on this unfair narrative. The fact that market values of residential properties have been impacted by racist lending policies of the past and urban land grabs by the government is not the fault of the appraiser, nor can the appraiser correct for these issues. The appraisal must reflect market value using the most impartial process available, a market analysis.

attract new appraisers to help alleviate attrition within the profession, and also asserts that being a “small, fragmented” profession “without deep pockets for lobbying” has made the sector an “easy target.” She then addresses “why there has been a myopic focus on banning certain words as a way to monitor appraisals for bias, when there is no evidence that pernicious biases exist,” drawing a comparison to Aldous Huxley’s dystopian novel Brave New World:

Appraisal is fact-based work that is transparent and subject to intense review. Appraisers must show their work and they must keep their workfile for review by a second market lender or in case of a challenge or lawsuit. “Banned words” are being used as a standard of fairness in large part because they are easy for data mining “tools” to pick up. They are easily flagged, easily reduced, and “technologically enforceable” just like in Brave New World. This frightens appraisers and makes them seem and feel more like “box checkers,” when they are highly skilled professionals.

Analyzing a market is the crucial skill appraisers need, not avoiding banned words. … Just like AMCs bidding out jobs without reference to quality, the increasing use of untrained data collectors, and major for-profit players putting shortterm gain in front of long-term economic health, politicians and regulators focusing on “banned words” and cynically representing that they reflect racist behaviors is damaging a professional practice committed to the public trust and restricting opportunities for the communities they claim to defend. …

Part 3: The Way Forward

Chance notes that the “false narrative” and focus on bias makes it difficult to

In her third letter, published April 26, Chance re-emphasizes her stance that

Working RE Summer 2024 24

7page 23

the value of appraiser independence and industry best practices—including neutrality, objectivity and efforts to eliminate cultural bias—are fundamental safeguards that help “protect the public from the dangers of property valuations disengaged from real estate market reality.”

Within this context, she pushes back against the validity of the Brookings study findings that helped ignite the widespread charges of bias and decries the subsequent fallout as unfair to the appraiser profession:

The Brookings study that supposedly confirmed “appraisal bias,” i.e. racism, included assessment data along with appraisals, and an independent analysis of the data reflected that socioeconomic differences better explained the data than race. … The media fanned the political flames and the public became increasingly concerned. Worries that the race or perceived race of the homeowner influenced appraisals led to efforts to “protect the public” where strong protections were already in place. Real property, not people, is the subject of appraisals. Amid all the noise, the words “appraisal bias” became a catch-all for any and all issues with appraisals, even though, in the minds of the public, that meant racism—that isn’t fair, and it isn’t right.

She goes on to assert that research indicates that “bad appraisals reflect the influence of big, bad data” and “perhaps buckling to the pressure of banks and consumers,” noting that the best appraisals remain “independent of those influences.” “Let’s not call that ‘bias,’” she writes, “let’s just call it a rushed, bad appraisal.”

She then takes a big swing at external parties in the mix that stand to benefit from a weakened, reduced appraiser pool and the removal of hu-

man elements in the appraisal process, including “ethics and independence”:

Replacing the appraiser with automated valuation models and other technical solutions sacrifices accuracy for the sake of expediency and profit. If it conveniently fits a false political narrative, “Oh well, that’s politics.” Commoditizing the profession with a race to the bottom in terms of fees ensures more appraisals done too quickly to be good. This may be easier, but it is not better. Weakening appraisers is not in the long-term interest of the public. And neither the banks nor the regulators want widespread loan defaults leading to another financial crisis.

Regulators, banks, and the public need to understand that undermining or replacing the appraiser is bad for people— a weakened appraisal profession promises devastating consequences for consumers and the economy. We must share with the public the real value of professional appraisers.

We must highlight the risks to banks of reliance on big, increasingly bad, data. We must ensure that appraisers’ judgments on data quality and analysis continue to inform risk analysis in real estate transactions.

To close her thoughts, Chance offers that while all the forces she’s highlighted and discussed are collectively ushering change, the skills and human elements appraisers bring to valuations will likely increase in importance and value to ensure the system’s integrity. She acknowledges that no one truly knows what the future holds but stresses the importance of being prepared for the opportunities and challenges that lie ahead:

This is a moment of change, but the end is not near. This is just the beginning. We stand with the appraiser and with other professional organizations that support the appraisers being the educated professionals the world needs them to be. In a data-driven world, people’s wisdom and connection to other professionals will be more important than ever, as will appraisers’ skill and experience at applying high quality data and analysis in the face of increasing noise and pressures.

In a postscript, Chance indicates AI intends to post the letters entirely on its website. To read them, visit appraisalinstitute.org WRE

Summer 2024 Working RE 25

STAY INFORMED! Opt In at WorkingRE.com Sign Up Today for FREE e-News #1 Source of News for Appraisers years

“I am not the person I have been made out to be in this lawsuit, or the large media outlets that have covered the situation, and I am confident in the appraisal that I completed.”

Discrimination Lawsuit Update: Baltimore Case Carries On

by Isaac Peck, Publisher

The case of Connolly & Mott v. Shane Lanham et al. has been one of the most widely publicized lawsuits alleging racial discrimination in a real estate appraisal to date. And it’s still ongoing.

One of the most notable factors of this case is that Shane Lanham, the appraiser, filed a countersuit against his accusers, Nathan Connolly and Shani Mott, seeking dismissal of their lawsuit and alleging that they falsely labeled him a racist and defamed him on national television, which he claims has caused severe harm to his business, reputation and well-being. (See Appraiser Countersues Black Plaintiffs Who Alleged Discrimination; visit WorkingRE.com/countersuit.)

Since Lanham’s counterclaim was filed in January 2023, a number of material developments have taken place in the case, including co-defendant LoanDepot’s settlement of Connolly’s and Mott’s claim against them (the claims against Lanham continue), the tragic death of co-plaintiff Mott, and Lanham’s launching of a GoFundMe account to help pay for his ongoing legal expenses.

Here’s the latest on this monumental case in which the appraiser is not only refusing to settle, but fighting back.

GoFundMe

One of the dangers facing appraisers in today’s legal environment is that, depending on who their E&O insurance carrier is, their insurance coverage for discrimination claims is often completely excluded or severely limited. Just like fraud, all professional liability policies exclude discrimination, and

only a select few policies add back any discrimination coverage.

In Lanham’s case, his E&O insurance policy provided only $100,000 of Discrimination Claim Coverage. Since the case has been in litigation for more than two years, Lanham launched a GoFundMe in March to help him cover the legal expenses involved in his defense and counterclaim.

In his initial GoFundMe post, Lanham writes: “I am an independent fee appraiser of residential real estate. … I have been wrongfully accused of intentionally assigning a low value to a home in Baltimore City because of the owner’s race. I am currently being sued in The United States District Court of Maryland. I am not the person I have been made out to be in this lawsuit, or the large media outlets that have covered the situation, and I am confident in the appraisal that I completed. I fully intend to fight this allegation through trial. I am also countersuing the accusers for defamation and have engaged a consultant with significant experience in these types of cases.”

Lanham goes on to describe how his insurance coverage falls short. “Through an insurance policy I carry, I have limited funds (only $100,000) to cover the costs of the lawsuit through investigation, discovery, motions and trial. However, my understanding is that the $100,000 amount will not be enough to take this case through trial both defending myself from the false allegations and prosecuting the defamation case,” Lanham writes.

The goal of Lanham’s GoFundMe is to raise $50,000 to cover the lawsuit

Working RE Summer 2024 26

costs that his insurance policy will not. Any excess funds raised that aren’t used for his litigation costs will go to an appraiser scholarship fund run by an appraiser association.

Ken Y., one of the supporters on Lanham’s GoFundMe account left the following words of support for Lanham: “Keep pushing; please do not back down. This is very important. I encourage all appraisers to donate. Please donate again if you’ve already done so (I have). I think it’s very important to take this case forward to teach lessons that will help the profession.”

Appraisers interested in donating to Shane Lanham’s GoFundMe can visit gofundme.com/f/raise-funds-for-trial

LoanDepot Settlement

In Connolly’s and Mott’s initial discrimination lawsuit, Shane Lanham and

LoanDepot were both named in the lawsuit as co-defendants.

On March 22, a settlement agreement between LoanDepot and the plaintiffs was filed with the court. In many of the other appraisal discrimination lawsuits that have named either an appraisal management company (AMC) or lender, it’s often the AMC or lender that drives the settlement negotiations. For example, AMC Links settled first in Tate-Austin v. Miller et al In Washington v. Wells Fargo and Bryan Klosterman, Wells Fargo led settlement negotiations, and the case was settled quietly last year with respect to the appraiser and lender.

A tragic twist to the Lanham case is that 10 days before the LoanDepot settlement was announced, co-plaintiff Mott, who was Connolly’s wife, passed away from adrenal cancer. On his

GoFundMe page, Lanham acknowledged Mott’s passing, writing that the timeline of his case will be extended and likely carry into 2025, owing to Mott’s and Connolly’s legal team asking for an extension on depositions and other legal next steps.

The case against Lanham will continue with Connolly and Mott’s estate as plaintiffs.

Settlement Details

In their settlement with the plaintiffs, LoanDepot agreed to pay Connolly and Mott an undisclosed amount to “resolve all claims for damages and attorneys’ fees and costs” as well as make a number of structural operational changes within their mortgage operation.

The operational changes that LoanDepot agreed to include: