LAND SOURCE 2025 RESOURCE

If you've recently inherited farmland, you've likely found yourself navigating unfamiliar territory. Among the many questions you may be asking is one that seems simple yet carries significant weight: "Is now the right time to sell?"

The farmland market has experienced a remarkable journey since 2020. Land values saw substantial appreciation during the post-pandemic period, with many regions experiencing double-digit percentage increases. This bull run was fueled by historically low interest rates, strong commodity prices, and limited inventory.

Iowa State University's renowned annual Land Value Survey documented this dramatic rise, reporting that average Iowa farmland values increased by nearly 39% from 2020 to 2023, reaching an all-time high state average of $11,411 per acre. Their economists noted this represented the second-highest three-year gain in their survey's history.

However, recent data from trusted sources including Farm Credit, the Realtor Land Institute (RLI), Iowa State University, and the Federal Reserve indicate a cooling trend. Iowa State's latest quarterly analysis shows a modest decline of approximately 3.5% since late 2023. Similarly, the Federal Reserve Bank of Chicago reported that Midwest agricultural land values decreased by 4% in the fourth quarter of 2024 compared to the previous quarter—the first quarterly decline in several years. The RLI's Land Values Survey aligned with these findings, showing a modest year-over-year decline of 3.2% for high-quality cropland in the Corn Belt region.

Despite this recent softening, several factors suggest that the present market remains advantageous for sellers:

1. Historical Context Matters: Even with recent declines, today's farmland values remain significantly higher than pre-2020 levels. Owners selling today are still benefiting from the substantial appreciation that occurred over the past five years.

2. Limited Inventory Supports Pricing: Quality farmland remains scarce. For prime properties with good soil quality, adequate drainage, and favorable locations, buyer competition continues to help maintain strong valuations.

3. Long-term Investor Interest: Institutional investors and family offices are increasingly viewing farmland as an attractive alternative asset class, particularly during periods of economic uncertainty. This expanding buyer pool helps sustain demand.

4. Tax Considerations: Current tax laws still offer advantages for inheritors who choose to sell relatively soon after acquisition, potentially maximizing after-tax proceeds compared to waiting years.

While timing the market perfectly is impossible, inheritors considering a sale should consider a few key questions:

• What are your long-term plans and financial needs?

• Do you have the expertise and interest to manage agricultural property?

• How does farmland fit within your broader investment portfolio?

• Have you consulted with agricultural real estate professionals familiar with your specific region?

Dr. Wendong Zhang, associate professor of economics at Iowa State University and a leading expert on farmland markets, emphasizes that despite short-term fluctuations, farmland has historically provided stable long-term returns. However, he also notes that absentee landowner often face unique challenges in property management and staying informed about local market conditions—factors that might influence your selling decision.

The decision to sell inherited farmland is deeply personal and depends on your unique circumstances. However, for many inheritors without strong ties to farming, the current market—despite recent cooling— still represents a historically favorable selling environment.

Whether you choose to sell or hold, working with experienced land professionals can help ensure you make the most informed decision for your situation in today's evolving farmland market.

Each of the items below can be a helpful piece of information for Whitaker Marketing Group’s valuation team, and many of the documents are necessary to close the sale of a farm. However, collecting all of the items below is not necessary to begin the process.

In order to get started, some basic information is necessary. This can include things like:

• Number of Total Acres

• Number of Tillable Acres

• State

• County

• Nearest Town or City

• Section, Township, Range (address)

• Access (is the farm on a highway, or is it diff icult to access)

• Ownership History

• Ownership Structure (is it in an LLC, do you own it alone, or are there multiple owners)

• Rent Information (how does the current farmer rent the farm and for how much)

• Rent History

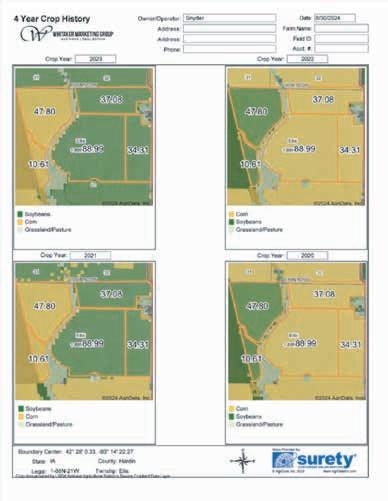

• Current & Historical Crops Grown

Maps that have notes printed or written on them are always useful. For printed copies, simply scan or take pictures with your phone and email them to us. Additional mapping information like parcel number(s), section, township, and range or FSA field and tract information may also be helpful if available.

This document may be picked up at your local Farm Service Agency office; it shows historical information about cropland amounts, acres enrolled in government programs, and yields for your farm.

FS-578

This document, also available at your local Farm Service Agency office, shows planting records on your farm for an individual year. Sharing the last several years’ planting records is useful for understanding what crops have been grown on the farm.

Any further verification of yields possible on a given farm. This can come from delivery tickets at the grain elevator, yield maps, rent checks, or any other summary data. This document helps verify the Actual Production History (APH) for a farm and can be obtained from your crop insurance agent.

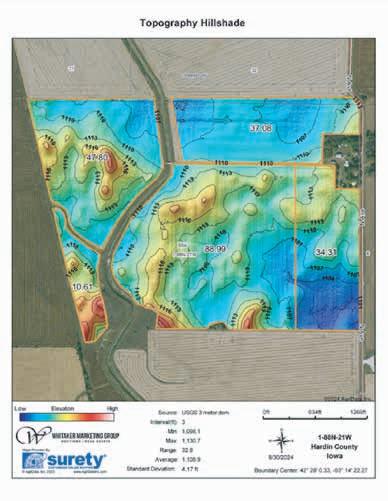

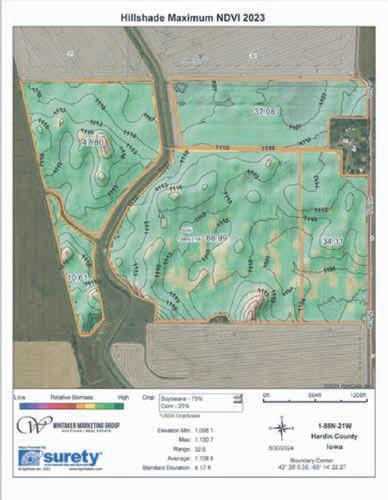

Any soil sample maps or texture typing that has been done on a farm is helpful to understand the fertility, water holding capacity, and drainage are on a given field.

How many wells are on the farm? What is the output and depth of each well, and how are they powered? In addition to wells, be sure to include whether the farm has surface water irrigation, what type(s) of irrigation systems are on the farm, and any water rights that are associated with the property.

Please provide any available information if your farm has had land leveling work performed, has drainage tile or any additional water management considerations.

Are any acres signed up in the Conservation Reserve Program (CRP), Wetlands Reserve Program (WRP) or any other government program? If maintaining certain standards on a portion of the property are required by any government programs, please provide descriptions or documentation of each program as available.

Many people don’t know where their abstract is kept. When selling farmland, we will need to have the abstract updated. The selling attorney will give clear title by reviewing the abstract for any encumbrances or encroachments.

When selling your farmland it is important to know what your tax basis is. (This is the price or the value that you the seller inherited or purchased the land for.) This is important when it comes to making the decision to sell. Sellers will need to know what their taxable income will be to make an educated decision on selling price.

Did you know that Internal Revenue Code

Section 1031 allows you to defer capital gains taxes on the sale of property held for investment or productive use in a trade or business?

To take advantage of the 1031 Tax Free Exchange, you need an independent third-party qualified intermediary. You may select your intermediary from among several options, as long as you don’t choose: yourself, a relative, your agent or your attorney, accountant or real estate broker. We suggest selecting your intermediary based on security, service, experience and price.

What Kind of Property Qualifies for a 1031 Exchange?

Real Property: Almost all kinds of real estate are classified as like-kind to each other. As long as a piece of real property is used for investment or in a business, it will qualify for 1031 treatment. Rental properties, farms, ranches, are examples of real properties that can be exchanged for one another and properties leased for 30 years or more.

Why Choose a 1031 Exchange?

The principal advantage of a 1031 exchange is the ability to use the entire equity of your property to acquire replacement property. The tax consequences of selling property are taken out of the equation and you are free to move equity into more lucrative or appropriate investments.

Specific Reasons for Using 1031 Include: Consolidation or Diversification: You might want to decrease the number of properties you hold by exchanging out of multiple relinquished properties into fewer or a single replacement property. This action could reduce managerial and maintenance burdens. Alternatively, you might exchange out of one high-value property into multiple properties to limit investment exposure, diversify holdings or increase cash flow.

Relocation of Investment: If you relocate from one part of the country to another, you can use 1031 to move real property investments to your new location and avoid payment of capital gains tax.

Stepped-up Basis for Heirs: If you have used 1031 to defer taxable gain, your heirs will acquire the property on a stepped-up basis. Your heirs’ basis equals the fair market value (FMV) of the property at the time of your death and your heirs will pay no tax to the extent the sale price does not exceed the value declared in the estate.

What are the 1031 Timeframes?

Forty-Five Day Identification Rule: You have 45 days from the closing of the relinquished property(ies) to identify your potential replacement property(ies). You can identify any property or properties, subject to the Rules of Identification. You must have the identification documentation to your qualified intermediary on or before the 45th day. You do not have to have the identified property(ies) under contract to identify them.

Exchange Period Rule: You have 180 days from the closing of your relinquished property(ies) to close on the purchase of your replacement property(ies).

What are the Rules of Identification?

The Three Property Rule: The Exchanger may identify up to three properties without regard to their value.

The 200% Rule: The Exchanger may identify more than three properties, provided their combined fair market value does not exceed 200% of the value of the property sold.

The 95% Rule: The Exchanger may identify any number of properties, without regard to their value, provided the Exchanger acquires 95 percent of the fair market value of those properties.

Other Points to Remember:

• To avoid all taxable gain you must buy a property of equal or greater value than the property. If you purchase a property of lesser value, you will be taxed on the difference.

• You must also use all the cash proceeds from the sale on your purchase to completely defer the applicable capital gains tax. If you do not use all your proceeds on the purchase, you will be taxed on the difference.

• You must place an equal amount of debt on the replacement property as was in place on the relinquished property.

• The above information should be considered general guidelines. It is very important that you work with a knowledgeable attorney and/or tax accountant and real estate professional when considering the sale of real estate and/or a 1031 Exchange.

Why Use Whitaker Marketing Group to Sell Your Farmland?

• Champion Auctioneer

• One-On-One Service

• Honesty

• Utilizing Newest Technologies

• Professional Staff

• Attention to Detail

• Integrity

• Passion

• Marketing

• Drone Video

We understand that your farmland holds not only financial but also personal value. Because we recognize the importance of your relationship with your land, we are also in a unique position to offer the objective guidance you need to make the best decisions for you and your family. Our #1 job is to work for you. It is our fiduciary responsibility to make you the most money we can. We act as your agent, and are continually educating our staff to be the most knowledgeable in selling your farm. We customize each auction to you.

Using the services of a qualified intermediary, you first sell relinquished property and subsequently acquire replacement property. Subject to certain rules, you have up to 180 days from the transfer of the relinquished property to acquire replacement property.

Using the services of a qualified intermediary and an Exchange Accommodation Titleholder (EAT), you acquire replacement property before disposing of relinquished property. The EAT must take title to the replacement property until the relinquished property is sold. You

45 day period to identify replacement property(ies).

benefit from a reverse exchange when you must purchase the replacement property before selling the relinquished property. The transaction must be completed within 180 days.

Use relinquished property proceeds on deposit with a qualified intermediary to construct improvements on replacement property by structuring the transaction as an improvement exchange. Improvement exchanges are similar to reverse exchanges in that an EAT must take actual title to the replacement property while it is under construction. Again, the transaction must be completed within 180 days.

Strawman or Build-to-Suit

At times, improvement exchanges cannot be completed within 180 days. For such occasions, a 1031 exchange can be structured outside the safe-harbor provisions of 1031 and still qualify for 1031 treatment. A third party must take actual title to the property and have a beneficial and significant interest in the transaction.

Exchanger must close on replacement investment property(ies) within 180 days of the closing date of the property that was sold.

Have you bought agricultural land within the last 15 years?

If so, you may be sitting on an untapped and substantial Legacy Nutrient Deduction™ that has averaged $1,700 per acre for our clients.

The IRS allows owners of agricultural land – cropland, ranchland, & timberland - to deduct the residual fertility value of nutrients in their soils at the time of acquisition. To benefit from these deductions, owners need to have valid, third-party assessments of their nutrient levels.

We work with companies to provide scientific data and data-driven testing, analytics, and reporting methodology to help owners of agricultural land take advantage of these nutrient deductions. The company operates in the lower 48 states and has generated tax deductions for thousands of clients for CPAs, Banks, and Brokers.

WORLD - CLASS TESTING CUSTOMIZED ANALYSIS TRUSTED REPORTING

We are the soil testing experts.

We deliver the data and analysis your CPA needs.

$1,700 AVERAGE DEDUCTION PER ACRE

Qualify for Section 180. Get the tax deduction you deserve.

Claiming the Section 180 deduction requires a mix of technical expertise and accurate record-keeping. Here’s how to approach it:

Soil Testing & Evaluation

• Start by consulting with an agronomist or soil scientist who can analyze your land’s fertility. Soil samples are tested to quantify the nutrients and amendments already present, such as lime, gypsum or compost. These experts help establish a residual fertilizer value that forms the basis of your deduction.

• If the soil fertility stems from past practices like fertilizer applications, lime treatments or crop rotations, ensure you have records of these activities. Proper documentation is necessary for compliance and may enhance the deduction’s value.

• Work with a CPA who specializes in agriculture. They will guide you in calculating the deduction based on the soil evaluation and ensure its accurately reported on your tax return. They’ll also help you navigate IRS guidelines and stay informed about any changes to the rules.

• The IRS occasionally updates regulations related to Section 180. Keeping up with these changes ensures you’re maximizing the deduction while staying compliant. A qualified agribusiness accountant can help you adapt as new information becomes available.

For many farmers, the answer is yes. The Section 180 deduction can offset a substantial amount of income, particularly if the land’s residual fertilizer value is high. However, the process requires precision. Without proper soil analysis and documentation, you could miss out on the full benefits—or worse, face challenges from the IRS.

Contact us to receive a FREE estimate on your legacy nutrient deductions.

• Stable, Predictable Returns: Average annual cash returns of 2.5-3% (similar to dividend stocks)

• Consistent Appreciation: Land values historically increase 3-7% annually

• “No Tenants, Toil, or Turmoil”: Unlike residential real estate, farm operators handle all production work

• Inflation Protection: Farmland values and income historically rise with inflation

• Tangible Asset: Farmland values and income historically rise with inflation

Let’s build your Iowa farmland portfolio.

Financial Metrics

• Cash rental yield: 2.5-3% typically

• Total ROI: 6-10% including appreciation

• Price per CSR point vs. county average

• Price per acre relative to recent comparable sales)

Critical Factors

• CSR rating (higher = better)

• Total ROI: 6-10% including appreciation

• Price per CSR point vs. county average

• Price per acre relative to recent comparable sales)

CSR Rating System: Iowa farmland is rated on a 0.5-100 scale (Corn Suitability Rating)

• Higher CSR = better productivity, higher purchase price, and higher rental rates

• Premium farms (CSR 80+) command top prices and rents

Investment Types:

• Production Agriculture: Maximum income from row crops (corn, soybeans)

• Recreational Land: Hunting, conservation, lifestyle benefits with lower financial returns

Tile Drainage Benefits:

• Properly tiled fields yield significantly better harvests

• Adding tile costs approximately $1,200/acre

• 100% tax-deductible under Section 179 tax deduction

Nutrient Depreciation: Average of $1,700/acre in nutrient depreciation potential using Section 180 tax deduction

• Section 179 Deduction: 100% deduction for drainage tile improvements ($1,200/acre average)

• Section 180 Deduction: Nutrient depreciation benefits ($1,700/acre average)

• 1031 Exchanges: Roll capital gains into new farmland purchases tax-deferred

• Estate Planning Benefits: Stepped-up basis for heirs and potential special use valuation

Think of farmland as a “dividend stock” with annual cash rent plus appreciation

Typical returns include:

• 2.5-3% annual cash return (similar to dividend yield)

• 3-7% historical annual appreciation

• 6-10% total annual return

Investment timeframe should be 10+ years for optimal results. Consider working with professional farm managers to optimize returns.

1. CoProven Long-Term Returns

Iowa farmland has consistently delivered stable, long-term appreciation and competitive annual returns compared to other asset classes.

2. Reliable Income Stream

Through cash rent or crop-share agreements, farmland generates passive income—often with multi-year lease commitments.

3. Limited Supply, High Demand

With limited land turnover and increasing demand for food and fuel, high-quality farmland is becoming harder to find—and more valuable.

4. Best-in-Class Soil Productivity

Iowa’s fertile soils (like Clarion and Nicollet series) and high CSR2 ratings drive strong yields and tenant demand.

5. Inflation Hedge

As inflation rises, both land values and rental rates tend to climb—making farmland an effective inflation-resistant asset.

6. Tax-Advantaged Investment

Farmland investors benefit from capital gains treatment, 1031 exchanges, and potential estate tax planning strategies.

7. Diverse Use Potential

Farmland offers optionality: farming, CRP enrollment, recreational use, solar leases, and future development potential.

8. Strong Agricultural Economy

Iowa is a national leader in corn, soybeans, pork, and ethanol—providing a stable backbone for farmland investment returns.

9. Low Volatility

Compared to stocks or commercial real estate, farmland shows lower price swings and is less impacted by daily market shocks.

10. Generational Wealth Builder

Farmland is often passed down through families. It builds equity, provides annual income, and preserves wealth across generations.

Farm Credit Services of America:

• Co-op Membership Benefits: 1% annual dividend to borrowers

*Disclaimer: Returns may vary based on market conditions

• Loan Types: Real estate, operating lines, equipment financing

• Terms: Fixed and adjustable rates; 15-30 year amortization

• Expertise: Deep understanding of Iowa agricultural markets

• Additional Services: Crop insurance, appraisal services

• Patronage Program: Cash-back dividends based on business volume

• Website: www.fcsamerica.com

Rabobank/Rabo Agrifinance:

• Global Perspective: International agricultural banking expertise

• Loan Types: Land purchase, refinancing, operating capital

• Farm Management: Advisory services for operational efficiency

• Terms: Competitive rates with flexible structures

• Market Intelligence: Access to agricultural commodity research

• Website: www.raboag.com

Farmer Mac (Federal Agricultural Mortgage Corporation):

• Government-Sponsored Enterprise: Created by Congress for Farm Credit

• Specialty: Secondary market for agricultural loans

• Advantages: Competitive long-term fixed rates

• Loan Size: $75,000 minimum

• Terms: 3-30 year fixed and adjustable rate products

• Website: www.farmermac.com

• Institutional Strength: largest agricultural lenders

• Focus: Commercial-scale operations and larger land purchases

• Loan Types: Long-term fixed rate agricultural mortgages

• Terms: 5-30 year fixed rates; minimum loan typically $1M+

• Website: www.metlife.com/ agricultural-investments

• Alternative Financing: Options for complex or unique situations

• Flexibility: Creative solutions for special circumstances

• Loan Types: Traditional, alternative, and bridge financing

Expertise: Restructuring and

USDA Farm Service Agency (FSA):

• Beginning Farmer Programs: Special rates for new entrants to agriculture

• Direct Farm Ownership Loans: Up to $600,000

• Guaranteed Farm Loans: Up to $2,251,000 (2025 limit)

• Down Payment Program: Only 5% down for qualified beginning farmers

• Terms: Lower interest rates than conventional loans

• Website: www.fsa.usda.gov

Iowa Finance Authority

Beginning Farmer Loan Program:

• Tax-Exempt Bond Financing: Below-market interest rates

• Eligibility: First-time farmland buyers with net worth under $820,000

• Loan Types: Land, improvements, breeding livestock

• Maximum: Up to $667,500 per borrower

• Website: www.iowafinance.com/beginningfarming-programs

Local & Regional Iowa Banks

• Community Knowledge: Understanding of local land markets

• Relationship Banking: Personalized service and local decision-making

• Typical Terms: 30-40% down payment; 15-30 year amortization

• Advantages: Potential for faster loan processing and flexibility

• Considerations: May have lending limits for larger purchases

National Banks With Agricultural Divisions

• Examples: Wells Fargo, Bank of America, U.S. Bank

• Resources: Extensive lending capacity for large purchases

• Additional Services: Wealth management, succession planning

• Terms: Conventional loan structures; typically higher down payments

• Typical Requirements: 50-70% loan-to-value (30-50% down payment)

• Prime Farmland: May qualify for lower down payment requirements

• CSR Ratings: Higher CSR farms may receive preferential terms

• Fixed Rate: Protection from rising rates; typically 5-30 year terms

• Adjustable Rate: Lower initial rates; repricing at 1-10 year intervals

• Interest-Only Options: Available from some lenders for qualified borrowers

Tax Considerations:

• Mortgage Interest Deduction: Tax-deductible interest expenses

• Section 179: Deductions for drainage tile improvements ($1,200/acre average)

• Section 180: Nutrient depreciation benefits ($1,700/acre average)

• 1031 Exchanges: Tax-deferred property exchange for farmland investors

1. Determine Your Budget: Establish clear financial boundaries

2. Check Your Credit: Review and address any credit issues

3. Gather Financial Documents: Tax returns, financial statements, asset listings

4. Research Lender Options: Compare rates, terms, and agricultural expertise

5. Request Term Sheets: Compare offers from multiple lenders

6. Consider Loan Structure: Evaluate fixed vs. variable options

7. Review Prepayment Terms: Understand any penalties for early payoff

8. Analyze Closing Costs: Factor in all fees and expenses

Wondering whether to list or auction your farm? It’s a big decision that can really affect your bottom line. As someone who works with both traditional sales and auctions every day, I want to walk you through your options so you can make the best choice for your particular situation and goals.

When selling farmland, you generally have several primary options:

• Traditional Auction

• Traditional Listing

• Online Auction

• Sealed Bid Auction

• Off-Market Listing

Each approach has its own strengths and attracts different buyers depending on your property type, location, ownership history, time constraints, and reasons for selling.

At Whitaker Marketing Group, we will help you find the best selling option for your unique property.

Traditional listing remains the most common approach to selling land nationwide. It sets an asking price and opens the door for negotiations with potential buyers.

Wider Exposure: Your property stays visible longer, reaching buyers using 1031 exchanges or those who need financing

Flexible Timeline: You can take your time reviewing offers and negotiating better terms

More Control: You maintain greater influence over sale conditions with space to consider each offer carefully

Extended Timeframe: May take longer to complete the sale, particularly in today’s market with a smaller buyer pool

Market Fluctuations: Property values could change during the listing period, potentially resulting in a lower final price

Properties that have recently been on the market, recreational land, farms with improvements or restrictions, development potential properties, or parcels that aren’t easily subdivided

Off-market sales happen without publicly listing your property, offering a more discreet selling approach.

Discretion: Maximum confidentiality throughout the transaction process

Strategic Buyers: Direct negotiations with carefully selected, qualified prospects

Leaseback Options: Perfect for sellers wanting to continue farming the land after sale

Property Preparation: We collaborate closely to enhance your property’s value before selling

Reduced Visibility: Your property might not achieve its full market potential due to limited exposure

Fewer Prospects: A smaller pool of interested buyers might extend your selling timeline

Price Uncertainty: More difficult to establish accurate market value

Auctions have gained significant popularity for land sales, particularly for tillable farmland throughout the Midwest. The competitive environment helps establish genuine market value.

(In-Person) Advantages:

Clear Timeline: Creates faster sales with specific deadlines and schedules

Buyer Competition: Fosters an environment where multiple bidders can drive prices higher Fair Process: Provides all potential buyers identical opportunities to participate under the same conditions

Challenges:

Less Predictability: Final sale price remains unknown until auction day

Potential Downside: Risk of selling below expectations if market positioning isn’t optimal

Suited For:

Premium farmland, properties attracting multiple interested parties, estate and trust sales

Offers comparable benefits to traditional auctions but takes place in a digital format

Suited For:

Smaller parcels, recreational properties, land with development potential

Off-market sales happen without publicly listing your property, offering a more discreet selling approach.

Privacy Protection: Keeps all offer amounts confidential between parties

Structured Timeline: Motivates buyers to submit their best offers from the start

Customizable Terms: Accommodates special conditions like financing requirements or extended closing periods

Challenges:

Reduced Competition: May not generate the same energy and price escalation as public auctions

Limited Back-and-Forth: Fewer opportunities to negotiate after bids are submitted

Suited For:

Specialty properties, farms with improvements, larger tracts of land, and development land.

There’s no universal approach to selling farmland. Every property and seller has unique circumstances. As your land professional, I’m dedicated to guiding you through this significant decision, drawing on my extensive experience and resources to identify the solution that best matches your specific needs and objectives.

To qualify for FSA beginning farmer programs, you must:

• Have operated a farm for less than 10 years

• Substantially participate in the operation

• Be unable to obtain sufficient credit elsewhere

• Have an acceptable credit history

• Be a U.S. citizen or qualified alien

• Ownership Limitation: You cannot own a farm larger than 30% of the average sized farm in your county, at the time of application.

Note: Program details are subject to change.Contact your local FSA office or the Iowa Finance Authority for the most current information and requirements.

Let’s get started on your farming journey.

• Maximum Amount: Up to $600,000 (limits may adjust annually)

• Purpose: Purchase farmland, construct buildings, conservation projects

• Terms: Up to 40 years

• Interest Rates: Below commercial rates (variable, based on government borrowing costs)

• Special Feature: Dedicated funding specifically reserved for beginning farmers

• Note: For direct farm ownership loans, you must have operated a farm for at least 3 years

• Value: Max $600,000

• Down Payment: Only 5% required from you

• Remaining Portion: 50% from a commercial lender

• Interest Rate: 1.5% fixed on FSA portion (subject to change)

• Term: 20 years

• Advantage: Dramatically reduces initial capital required to purchase farmland

• Maximum Amount: $400,000

• Purpose: Livestock, equipment, inputs, annual operating expenses

• Terms: 1-7 years depending on purpose

• Special Feature: Simplified application for smaller farmers

• Maximum Amount: $50,000

• Purpose: Smaller operations, specialty crops, beginning expenses

• Advantage: Streamlined application process

• Terms: Up to 25 years for farm ownership; 7 years for operating expenses

• Maximum Amount: $2,251,000 (as of 2025)

• Structure: Commercial lender provides loan with FSA guarantee

• Guarantee: FSA guarantees up to 95% of loan amount

• Terms: Negotiated with lender (40 years max for real estate)

• Advantage: More accessible commercial financing

Land Contract Guarantees:

• Purpose: Facilitates private land sales between retiring and beginning farmers

• Maximum Guarantee: $500,000

• Down Payment: 5% minimum

• Benefit: Provides financial guarantees to the seller of the farm

Iowa Beginning Farmer Tax Credit Program:

• Benefit: 5-15% tax credit to landowners who lease to beginning farmers

• Result: More accessible land rental opportunities

• Administrator: Iowa Finance Authority

IADD Loan

Participation Program:

• Benefit: Reduces interest rates by up to 4% on the IADD portion

• Structure: Works alongside your primary agricultural lender

• Advantage Lower overall borrowing costs

• Administrator: Iowa Finance Authority

Iowa Beginning Farmer Loan Program (BFLP):

• Structure: Tax-exempt bond financing for reduced interest rates

• Eligibility: Net worth under $852,000

• Maximum: Up to $575,600 per borrower

• Purpose: Purchase of agricultural land, improvements, breeding livestock

• Administrator: Iowa Finance Authority

Iowa Beginning Farmer Down Payment Program:

• Purpose: Supplemental assistance with farm purchases

• Advantage: Can be combined with federal FSA programs

• Administrator: Iowa Finance Authority

Beginning Farmer and Rancher Development Program:

• Education, training, and mentoring programs

Conservation Reserve Program

Transition Incentives (CRP-TIP):

• Incentives for retiring farmers to transfer land to beginning farmers

Environmental Quality Incentives Program (EQIP)

• Cost-sharing for conservation practices with special funding for beginning farmers

Farm Storage Facility Loans

• Low-interest loans for storage with reduced down payment (5%) for beginning farmers

1. Contact your local FSA office for initial consultation

2. Complete FSA forms and Farm Business Plan

3. Gather financial records (3 years if available)

4. Develop farm operating plan and cash flow projections

• Find Your Local FSA Office: farmers.gov/service-centerlocator (https://www.farmers.gov/working-withus/servicecenter-locator)

• FSA Beginning Farmer Programs: fsa.usda.gov/farmloans (https://www.fsa.usda.gov/programs-andservices/farmloan-programs/beginning-farmers -and-ranchers-loans/index)

• Iowa Finance Authority: iowafinance.com/beginningfarming-programs (https://www.iowafinance.com/beginningfarming-programs/)

• Iowa State University Beginning Farmer Center: extension.iastate.edu/bfc (https://www.extension.iastate.edu/bfc/)

5. Provide verification of income and credit history

6. Identify property (for farm ownership loans)

7. FSA reviews application for eligibility and feasibility

8. Loan decision based on program criteria

9. Closing process begins for approved loans

• Start Early: The application process can take 30-60 days

• Build Experience: Document your agricultural experience carefully

• Financial Records: Maintain detailed financial records and good credit

• Business Plan: Develop a realistic and detailed farm business plan

• Multiple Programs: Consider combining multiple FSA and Iowa programs

• Seek Guidance: Work with experienced FSA staff and agricultural advisors

Whitaker Marketing Group is a full service auction and real estate firm serving the Midwest since 2008. Our primary focus is agricultural real estate. Whitaker Marketing Group also regularly works with non-profit organizations to raise money for fundraising.

Whitaker Marketing Group is headed by David and Ann Whitaker, a husband and wife team, working for the common goal of doing the best job for their clients.

With agriculture in our blood, we are experts in our prospective fields. Whitaker Marketing Group also has team members, throughout the state of Iowa, that are extremely friendly, honest, knowledgeable, hard working, and talented!

Our job is to work with buyers and sellers, to connect them and have a successful exchange of property.

Phone: 515-996-LAND (5263)

Email: info@wmgauction.com

Office: 101 US 69 Huxley, IA 50124

Website: www.WMGauction.com

Our obligation is to market your assets to the largest audience,

“ Our commitment is to be your trusted advisor. yielding the most successful outcome.”

David Whitaker Broker | Auctioneer

Ann Whitaker Agent | Owner

Are you thinking about buying or selling Iowa farmland but unsure where to start? You're in the right place. At Whitaker Marketing Group, we specialize in farmland auctions, land sales, and rural property marketing across Iowa and the Midwest. Whether you're a first-time buyer, a seasoned investor, or a landowner ready to sell, we’re here to help you navigate the process with confidence. We’ve compiled answers to the most frequently asked questions about farmland auctions—from how to get started and what to expect to understanding commission structures and land value trends. Each answer reflects our deep experience managing farmland sales and maximizing landowner returns.

Scan the QR code to view all the videos!

In Iowa, farmland productivity is often measured using the Crop Suitability Rating (CSR) or its updated version, CSR2. This score helps determine the land’s potential for crop production on a scale of 0.5 to 100, with 100 being the most productive.

• Introduced: Iowa State University created CSR in 1971 and updated it to CSR2 in 2011.

• Key Factors: Soil type, topography, waterholding capability, and slope.

• CSR2 Update: Offers improved accuracy by incorporating water-holding capacity.

• Why It Matters: All government agencies, like USDA and FSA, use CSR2 to assess farmland value.

Knowing your farm’s CSR2 score provides valuable insight into its productivity and marketability. Buyers rely on this data to evaluate farmland quality, making it a key tool for pricing and negotiations.

1. CSR2 scores range from 0.5 to 100, with higher scores indicating better productivity.

2. Soil type, water-holding capacity, and topography significantly impact the score.

3. CSR2 is used by government agencies and land professionals for farmland valuation.

For more insights into your land’s potential or help determining your CSR2 score, contact our team today!

Yes, you can set a reserve when selling your farm. A reserve is your bottom-dollar price—the minimum amount you’re willing to accept for the property. This option allows sellers to ensure their farm doesn’t sell below a certain value.

• Reserve Auction: The property only sells if bidding meets or exceeds your reserve price.

• Absolute Auction: The property sells to the highest bidder regardless of the final price.

• The reserve is typically set in consultation with your broker after a farm valuation or appraisal.

• Many sellers set the reserve 10% below the targeted sale price to encourage bidding while minimizing the risk of underselling.

• Reserves are a safeguard, not a pricesetting tool. They aim to prevent financial loss, not dictate the final sale price.

Key Takeaways

1. Reserves protect your minimum acceptable price during an auction.

2. Absolute auctions lets the buyers know the seller is going to sell.

3. A well-placed reserve balances seller protection with buyer interest to drive competitive bidding.

Want to explore whether a reserve or absolute auction is best for your farm? Contact our team today for tailored advice and expert auction services!

Yes, we offer online bidding through a custom-built platform designed specifically for farmland auctions. This ensures convenience for bidders while maximizing exposure and competition for sellers.

Features of Our Online Bidding Platform

• Custom Design: Built exclusively for farmland auctions, unlike syndicated software that may resell user data.

• User-Friendly Interface: Large buttons and clear visuals make bidding easy, even for first-timers.

• Mobile Compatibility: Bid from anywhere— on your phone, tablet, or PC.

• Live Auctioneer Experience: High-quality audio and video feeds let bidders see and hear the auctioneer in real-time.

Online Bidding opens your property up to a larger pool of buyers, increasing competition and raising the potential for better results. It also accommodates busy or remote bidders, ensuring everyone has a chance to participate no matter where they are.

Key Takeaways

1. Our online platform is secure, userfriendly, and optimized for farmland auctions.

2. Bidders can participate from any device, including mobile phones.

3. Sellers benefit from wider exposure and enhanced buyer convenience.

Ready to leverage cutting-edge technology to sell your farm? Contact our team today for details on our auction services!

Yes, you can sell your farm even if it’s leased. In Iowa, whether a farm is subject to a lease or has an open lease agreement, there are options available to ensure a successful sale.

• Lease Termination Deadline: In Iowa, lease termination notices must be served by September 1. If no notice has been served, the buyer must honor the existing lease for the remainder of the term.

• Open Lease Agreements: If the lease has been terminated, the property will be sold with no lease obligations, which can appeal to buyers seeking immediate use of the land.

• Selling Subject to a Lease: Just like selling a hotel or commercial property, farmland can be sold with a lease in place. Buyers may inherit the lease terms, including cash rent payments.

Determining who receives the cash rent depends on several factors:

1. Timing of the Sale: Cash rent may be prorated based on the date of closing.

2. Buyer/Seller Agreement: This can be negotiated during the sale.

3. Tax Implications: Sellers can choose to collect the rent as ordinary income or apply it as a deduction to reduce capital gains taxes.

Key Takeaways

1. Farms can be sold whether they are leased or have an open lease.

2. Cash rent distribution depends on the timing and terms of the sale.

3. Tax considerations play an important role in deciding how to handle cash rent.

For expert advice and tailored strategies to sell your leased farmland, contact our team today!

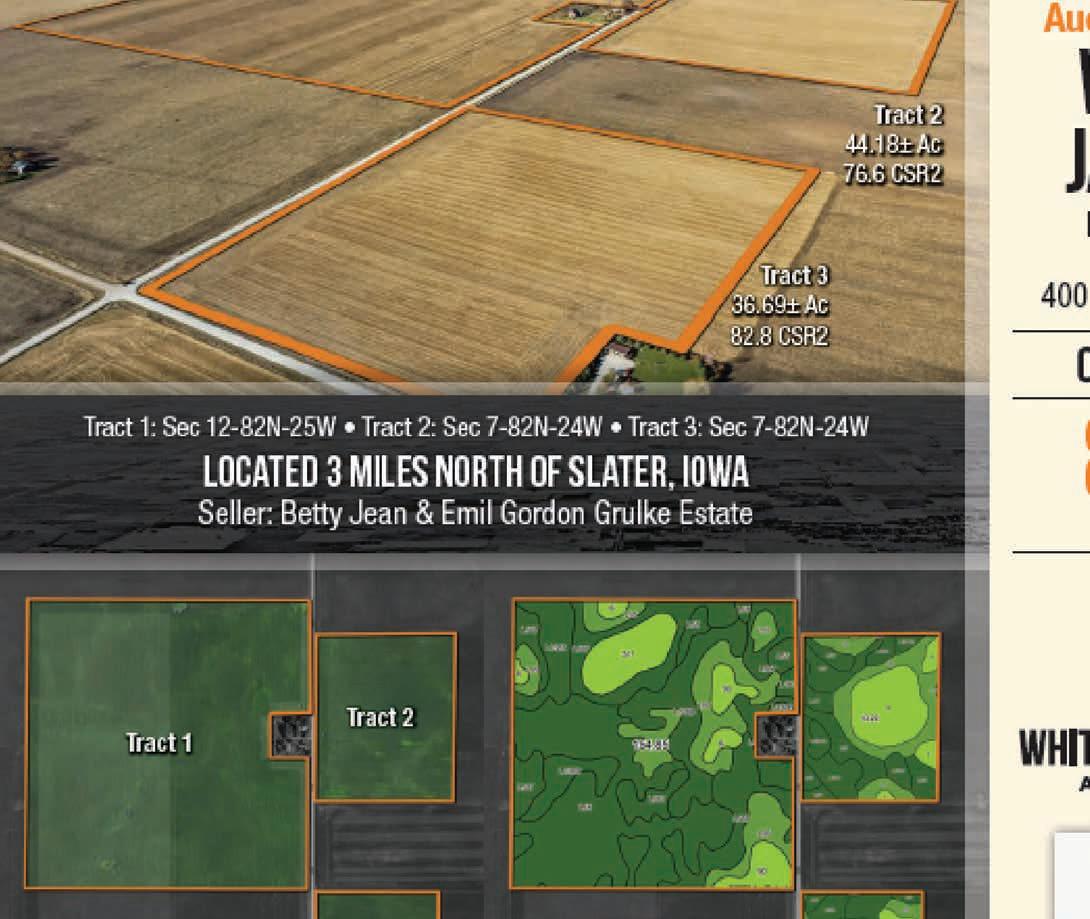

Deciding whether to split a farm into multiple tracts depends on factors like geography, buyer demand, and your goals as the seller. This decision is typically addressed during the farmland valuation process.

1. Family Preferences: Some families prefer to keep the farm intact, even if splitting it could yield higher profits.

2. Geographic Advantages: Splitting the farm may attract competitive bidding from neighbors or create more accessible parcels for different buyers.

3. Buyer Accessibility: Smaller tracts are often easier for buyers to purchase, making the farm more appealing to a wider audience.

4. Land Features: Soil type, field shape, and topography all influence whether splitting the farm makes sense.

• Valuation Analysis: A thorough evaluation of the farm will help determine whether splitting it increases its marketability and value.

• Seller Goals: Your expectations, whether financial or sentimental, play a crucial role in the decision.

Key Takeaways

1. Splitting the farm can boost buyer interest, but isn’t always the best financial or personal choice.

2. Factors like geography, tract size, and competitive bidding influence the decision.

3. Your goals as the seller guide the final strategy.

For expert guidance on maximizing the value of your farm, contact our team today!

Selling farmland when your family disagrees can be complex, but it’s possible depending on the circumstances. In Iowa, the key factor is ownership percentage and whether the land can be divided.

Important Considerations

1. Ownership Percentage:

• If you own 25% or less, selling without family agreement is unlikely.

• If you own more than 25%, you may sell your share if the land is geographically dividable

2. Partition Action:

• If the land isn’t easily divided, you can file a partition action in court.

• The court may decide to sell the property, as splitting proceeds is often simpler than dividing farmland.

• The court considers factors like size, shape, value, and farmability to ensure fairness.

3. Family Buyout Option:

• Before filing a legal action, consider discussing your plans with your family.

• They may be willing to purchase your share, avoiding court involvement and maintaining family harmony.

Key Takeaways

1. If you own more than 25%, selling your share is possible, especially if the land is easily dividable.

2. A partition action allows you to request a legal division or sale of the land through the court.

3. Communicating with your family first can lead to a resolution without legal complications.

For help navigating family farm sales or understanding your options, contact our team today!

Starting the farmland auction process requires a few key documents to ensure everything is handled smoothly and legally. Here's what you’ll need:

Essential Documents

1. Listing or Auction Agreement:

• This agreement outlines terms like price, conditions, auction date, and location.

• It formalizes the relationship between you, the seller, and the brokerage/ auction company.

2. FSA Release Form:

• Authorizes the brokerage or auction company to access farm details from the Farm Service Agency, including your farm’s "report card."

3. Executor or Trustee Paperwork (if applicable):

• Required if you’re acting on behalf of an estate, trust, or multiple owners.

• Establishes your authority to represent the group.

Optional, but Helpful, Documents

• Abstract of Title: Having your abstract available can help prevent closing delays by expediting the title search and legal review.

• Current Farm Lease Agreement: If the property is leased, provide a copy of the lease and tenant contact information to ensure proper disclosure and coordination.

• Recent Yield History: Yield data from past crop years can support marketing efforts by showcasing the farm’s productivity.

• Survey or Plat Map: Helpful in confirming property boundaries, especially if changes have occurred or if no recent survey exists.

If your farm doesn’t meet the reserve price at auction, there are two primary paths forward. These options allow flexibility and ensure the best outcome for the seller.

1. List the Farm for Sale:

• The farm is listed immediately for the next six months.

• By this stage, we know the interested buyers and sellers, and the focus shifts to negotiating a mutually successful price.

• Most farms sell within this timeframe as we continue working with the parties involved.

2. Opt Out:

• If you decide not to proceed with a listing or further efforts, you can exit the agreement.

• The only requirement is to reimburse the marketing expenses, ensuring no financial losses to the auction company.

• Reserves are designed to protect sellers from accepting an unfavorable price.

• Not meeting the reserve simply means taking additional steps to find the right buyer at the right price.

• Buyer/Seller Agreement: In some cases, terms can be negotiated during or after the sale if both parties are interested.

• Tax Implications: Sellers may choose to treat rent as ordinary income or apply it as an expense to offset capital gains. Consulting a tax advisor is recommended.

Key Takeaways

1. A signed Auction Agreement and FSA Release Form are required to get started.

2. Executor or trustee documentation is essential if selling on behalf of an estate or trust.

3. Locating your Abstract of Title early ensures a smoother closing process.

Ready to begin the auction process? Contact our team for a seamless and professional experience!

1. If the reserve isn’t met, the farm can be listed for sale to attract additional offers.

2. Sellers who choose to opt out only need to cover marketing expenses.

3. Reserves provide a safety net while still allowing flexibility after the auction.

Need help navigating post-auction options? Contact our team for personalized guidance and support!

Determining the value of your farmland is a complex process that involves multiple factors, from soil productivity to market conditions. No two farms are the same, and accurate valuations require professional insights beyond generic online estimates.

Key Factors in Farmland Valuation

1. CSR Score

2. Farm Features

3. Neighbors

4. Current Market Conditions

Why You Need a Professional Valuation

Generic online tools, like Zestimates for homes, use algorithms that don’t account for critical factors such as topography or buyer demand. For example, two farms five miles apart can differ by thousands of dollars per acre due to unique characteristics that only a local, professional evaluation will catch.

Hire a trusted farmland professional who can:

• Evaluate your farm’s specific attributes.

• Provide insights into current market conditions.

• Deliver a personalized valuation based on years of experience and local expertise.

Key Takeaways

1. Your farm’s value depends on CSR score, farmability, neighbors, and market trends.

2. Online tools provide rough estimates but often miss critical details that only a professional evaluation can uncover.

3. Consult a farmland expert to ensure accurate pricing and marketability.

Looking for a trusted valuation? Visit iowalandguy.com for a free farm assessment and let us help you maximize your land’s value.

In Iowa, a transfer tax (also known as revenue stamps) is a fee charged by the state when land is transferred from one person to another. It’s a standard cost associated with selling farmland or any real estate.

The transfer tax rate in Iowa is $1.60 per $1,000 of the sale price.

• Example 1: If your farm sells for $1,000, the transfer tax is $1.60.

• Example 2: If your farm sells for $1,000,000, the transfer tax is $1,600.

Transfer tax helps fund public services and infrastructure in Iowa. It’s a standard cost in most real estate transactions across the state.

Key Takeaways

1. Iowa charges $1.60 per $1,000 of the sale price as a transfer tax.

2. The tax applies to all land transfers in Iowa.

3. When preparing to sell your farm, be sure to factor transfer tax into your total closing costs.

For more insights on selling farmland, including understanding all costs, contact our team today!

A 1031 Tax-Deferred Exchange, named after IRS Code 1031, allows you to defer capital gains taxes when you sell a property and reinvest the proceeds into a "like-kind" property. This strategy is widely used for farmland sales to maximize reinvestment and minimize tax burdens.

1. Sell Your Farm: The exchange process begins when your farm sells. For tax purposes, the sale date is when the money changes hands at closing.

2. Identify Replacement Property: Within 45 days of the closing date, you must identify potential replacement properties in writing, following IRS guidelines.

4. Defer Your Tax Liability: Capital gains taxes are deferred by reinvesting the full proceeds into a replacement property of equal or greater value.

What Taxes Are Deferred?

• Federal Capital Gains Tax: Currently 15%, plus an additional 3.8% Net Investment Tax.

• State Tax: In Iowa, around 8%, unless you materially participate in farming operations.

• Total Tax Burden: Deferring taxes can save up to 25% or more of your gain.

Example:

• Original Purchase Price: $1,000/acre

• Current Sale Price: $10,000/acre

• Capital Gain: $9,000/acre

3. Close on the Replacement Property: Within 180 days of the closing date, you must complete the purchase of the identified replacement property.

• Deferred Tax Savings: 25% of $9,000 = $2,250/acre

1. A 1031 exchange lets you reinvest proceeds from a sale into like-kind property while deferring taxes.

2. You have 45 days to identify and 180 days to close on a replacement property.

3. Work with a qualified intermediary and a professional farmland expert to ensure compliance with IRS rules.

Interested in learning more? Contact our team for expert guidance or to connect with IPE 1031 Exchange, the industry experts who can make your 1031 process seamless!

A common question sellers ask is when to arrive for a farmland auction. While buyers often show up just minutes before the sale, sellers should plan to arrive earlier for final preparations and discussions.

Recommended Arrival Time for Sellers

• Arrive 15 minutes before the auction begins.

The auction company arrives 2 hours before the sale to:

1. Test the internet and video connections.

2. Set up equipment for a seamless live or simulcast auction.

3. Finalize the venue and ensure all logistics are in place.

Key Takeaways

1. Arrive 15 minutes before the auction for final conversations and to avoid unnecessary waiting.

2. Don’t be alarmed if buyers aren’t visible until shortly before the auction starts.

3. The auction team handles technical preparations well in advance, ensuring everything runs smoothly.

For personalized support and a stress-free auction day, contact our team for expert farmland auction services!

Possession of farmland typically transfers to the buyer when the money changes hands, unless otherwise specified in the purchase agreement. However, leases and other factors may impact the timing of full possession.

1. Purchase Agreement Terms:

• The exact possession date is outlined in the purchase agreement.

• This is the legally binding timeline for when the buyer can take control.

2. Existing Leases:

• If the property is leased, the buyer may not have immediate operational control.

• In Iowa, many farmland leases expire on March 1, meaning possession of the land’s use may be delayed until then.

3. Access to the Land:

• Buyers can typically walk the property once the sale closes and funds are exchanged.

Key Takeaways

1. Possession is usually granted when the sale closes and funds are transferred.

2. Active leases may delay operational control, even after ownership changes.

3. The purchase agreement dictates the specific terms of possession.

Need help navigating farmland transactions? Contact our team for expert advice and support!

An abstract is a crucial document that details the chain of title for farmland, tracing ownership back to when the U.S. government first granted the land. If you’re trying to locate your parents’ abstract, there are a few common places to check.

1. Safety Deposit Box:

• This is the most likely place where abstracts were often stored—in a bank safety deposit box for safekeeping.

2. Home Records:

• Check file cabinets or other storage areas where important documents have been kept.

3. Bank/Lender Vault:

• If there was a loan or lien on the property, the bank or lender may have retained the abstract in their records.

The abstract is a thick document that records the entire ownership history of the land, including:

• Government land grants.

• Transfers of ownership.

• Liens, mortgages, and divisions of the property

1. Start your search with a safety deposit box or a family filing cabinet.

2. Contact the bank if a loan or lien was tied to the property.

3. The abstract provides a complete title history and is essential for farmland transactions.

Need help with farmland documentation or transactions? Contact our team for today professional assistance!

Payment for your farmland typically happens on the closing day, which is usually around 45 days after the auction or sale.

1. Closing Day:

• The buyer transfers funds to the closing office, which is typically a title company or an attorney.

• The closing office then distributes the funds to the seller or sellers.

2. Payment Method:

• Wire Transfer: Funds are typically deposited into your account on the same day as closing.

• Check: May take 2–3 business days to arrive by mail after closing.

1. Sellers are paid on closing day, typically 45 days after the auction or sale.

2. Payment is distributed via wire transfer or check, depending on your preference.

3. Delays may occur if multiple parties are involved, as all distributions must be finalized.

For a smooth and professional closing process, contact our team for expert assistance with your farmland transaction!

In Iowa, lease termination is a critical step when planning to sell farmland that has a tenant farmer. Here’s what you need to know about the process and timeline.

• Termination Deadline: Notice to terminate a farm lease must be served by September 1 of the current year. If it’s not served by this date, the lease automatically renews under the same terms for another year.

• Lease End Date: Even if proper notice is given by September 1, most farm leases remain active until March 1 of the following year. That’s because most Iowa farm leases run on a March-to-March cycle.

1. Forms and Documentation:

• Use online forms or lease termination templates.

• Ensure the document meets legal requirements for proper notice.

2. Delivery Methods:

• Serve the notice yourself.

• Hire an attorney to handle the process.

• Work with a farmland broker (like us!) to assist with preparation and delivery.

3. Communication with the Tenant:

• If you prefer not to deliver the notice yourself, your broker or attorney can communicate with the tenant to explain the plans and handle the process.

1. Serve lease termination by September 1st to avoid automatic renewal.

2. The lease remains valid until March 1st, even after termination notice.

3. Brokers or attorneys can handle the termination process and tenant communication to ease the burden.

If you’re considering selling your farmland and need assistance with lease termination, contact our team for expert guidance!

The 156 Form is a vital document for farmland owners, often referred to as the "pedigree" of your farm. It provides detailed information about your farm’s characteristics, usage, and participation in government programs.

What Information is on a 156 Form?

1. Acreage Details:

• Total acres.

• Crop acres.

• Tillable acres as recognized by the Farm Service Agency (FSA).

2. Government Programs:

3. Yield Information:

• PLC Yield: The benchmark yield used for program payments.

4. Environmental Details:

• Wetland Designations: Identifies areas with potential environmental or land-use restrictions.

5. Mapping:

• Often includes an FSA map showing field boundaries, acreage usage, and field identifiers.

Why is the 156 Form Important?

• Current enrollment in ARC (Agricultural Risk Coverage) or PLC (Price Loss Coverage).

• Historical participation in government programs like DCP (Direct and CounterCyclical Payment Program).

• It serves as a resume for your farm, detailing its productivity and compliance with government programs.

• Buyers, brokers, and lenders often use it to evaluate the farm’s potential.

• It helps sellers accurately market their farmland with comprehensive data.

A 1031 tax-deferred exchange allows you to defer capital gains taxes by reinvesting the proceeds from a property sale into a like-kind property. However, strict IRS timelines apply.

Key Time Limits

1. Closing Date (Sale Date):

• The sale date for a 1031 exchange is the closing date—when funds officially change hands, not when the auctioneer says “sold.”

2. 45-Day Identification Period:

• You have 45 days from the closing date to identify potential replacement properties.

• This must be done according to IRS rules, such as the 3-property rule (identify up to three properties) or the 200% rule (identify properties worth up to 200% of the sold property's value).

Key Takeaways

1. The 156 Form summarizes acres, yields, and government program participation for your farm.

2. It includes critical details like wetland designations and crop history.

3. The form is essential for marketing your farm and ensuring transparency in transactions.

Need help accessing or interpreting your 156 Form? Contact our team for expert assistance!

3. 180-Day Closing Period:

• You have 180 days from the closing date to complete the purchase of the replacement property and transfer funds.

How the Process Works

• Qualified Intermediary: During the exchange, sale proceeds are held by a qualified intermediary in a separate trust account specific to your transaction.

• Funds cannot be accessed by the seller during this period—they must go directly toward the purchase of the replacement property.

Key Takeaways

1. The 45-day period starts on the closing date, not the auction date, to identify replacement properties.

2. The 180-day period is the total time to close on the new property after selling the old one.

3. Funds are managed by a qualified intermediary throughout the process.

Need assistance navigating your 1031 exchange? Contact our team for expert guidance and support!

After executing a farmland purchase agreement, the earnest money payment— typically 10% of the gross price—must be paid.

Earnest Payment Details

1. Amount:

• 10% of the sale price.

• Example: For a $1,000,000 sale, the earnest payment is $100,000.

2. Payee:

• The check is written to the seller’s attorney or a designated attorney specified in the purchase agreement.

• If the seller doesn’t have an attorney, Whitaker Marketing Group uses its inhouse attorney to hold funds in their trust account.

3. Trust Accounts:

• The attorney holds the earnest payment in a trust account until the transaction closes.

Special Cases

• If the property is part of a trust, receivership, or estate, the seller’s designated attorney will typically manage the funds.

1. Write the earnest payment check to the seller’s attorney or as specified in the purchase agreement.

2. The funds are held in a trust account for security until closing.

3. Earnest money is typically 10% of the sale price in farmland transactions.

For a smooth transaction and assistance with all auction details, contact our team today!

The typical timeframe to close on a farmland transaction is around 45 days, but this can vary depending on the specifics of the deal.

Factors Affecting Closing Time

1. Cash Transactions:

• Cash deals tend to close faster since they don’t involve lender approval processes.

• Closing can occur in as little as 30 days.

2. Financed Transactions:

• If the buyer is using a lender, the timeline may extend due to loan approval, appraisals, and title reviews.

• Expect closer to 45–60 days.

3. Other Considerations:

• Involvement of multiple attorneys or title companies can extend the timeline.

• Outstanding issues with the property title or documentation can cause delays.

1. Standard closing timeline: Approximately 45 days after signing the purchase agreement.

2. Cash transactions: Often faster, taking around 30 days.

3. Financed transactions: May take closer to 45–60 days due to additional steps.

For a seamless closing process, trust our team to guide you every step of the way!

Farmland broker fees can vary widely depending on the size of the property, its value, and the services provided. Here’s what you need to know about typical charges.

1. Percentage-Based Fee:

• Broker fees usually range from 1% to 10% of the sale price.

• Larger farms (e.g., $20 million) often have a lower percentage fee than smaller farms (e.g., $200,000).

2. Flat Fee:

• In some cases, brokers may charge a flat fee instead of a percentage, depending on the farm and the agreement.

1. Marketing and Advertising

2. Closing Services

3. Taxes or Back Taxes

Key Considerations

• Farms with higher values often receive a lower percentage rate due to economies of scale.

• Brokers invest similar effort in all transactions, ensuring equal marketing and service quality for both large and small properties.

1. Broker fees typically range from 1% to 10% of the sale price, depending on the property’s value.

2. Services like marketing, closing costs, and abstract updates may be included or billed separately.

3. Fee structures are often negotiable and tailored to the farm’s unique needs.

For transparent pricing and professional service, contact our team to learn how we can help you achieve the best results for your farm!

Yes, at Whitaker Marketing Group, we use drone videos to showcase farmland and maximize its appeal to potential buyers. Drone footage has become one of the most effective ways to attract attention and generate interest online.

1. Higher Engagement: Online videos, especially drone footage, receive more views and clicks than other types of content.

2. Comprehensive Property Showcases: Drone videos highlight key features like waterways, crop production, topography, and the beauty of Iowa farmland.

• Licensed Expertise: David Whitaker holds a Part 107 FAA License, ensuring professional and compliant drone operations.

• Strategic Video Design: 1. Information is placed at the start of the video to capture attention early.

2. Visuals highlight your farm’s best features to engage viewers and drive interest.

1. Drone videos are included in our farmland marketing strategy to maximize buyer engagement.

2. Videos highlight all aspects of your farm, from natural beauty to productivity.

3. Our licensed expertise ensures highquality, professional footage.

Ready to market your farm with stunning drone footage? Contact our team for professional and innovative marketing solutions!

The duration of a farmland auction depends on factors like the number of tracts being sold and the type of auction. On average, most farmland auctions take about 1 hour to complete.

1. Number of Tracts:

• Each tract typically takes about 30 minutes to auction.

• Larger farms with multiple parcels may take longer.

2. Auction Format:

• Live Outcry Auctions: Often completed faster, depending on bidder engagement.

• Timed Online Auctions: Set a specific countdown timer for bidding, often running for hours or days.

• Sealed Bid Auctions: Usually take longer due to the evaluation process after bids are submitted.

3. Terms and Conditions:

• Reading and explaining the auction terms and conditions at the start often takes as long as the bidding itself.

• Simulcast/Hybrid Auctions: Combine live and online bidding, potentially extending the duration.

Yes, we work with a variety of investors in every farmland transaction. These investors play a key role in driving competitive bidding and ensuring the farm reaches its highest potential sale price.

Types of Investors

1. Institutional Investors:

• Large-scale organizations that buy farmland as part of their investment portfolios.

2. Crowdsource Funding Investors:

• Groups pooling funds to invest in farmland.

3. Individual Investors:

• Private buyers seeking to expand their landholdings in specific counties or regions.

• Competitive Bidding:Investors drive up bids by actively participating in auctions, often increasing the final sale price.

• Emotion-Free Approach:Their analytical mindset helps balance emotional bidding from local or sentimental buyers.

1. The average farmland auction lasts about 1 hour in total.

2. Each tract typically requires about 30 minutes of bidding.

3. The auction format and number of parcels significantly affect the overall duration.

For a smooth and efficient auction process, contact our team to learn about the best auction options for your farm!

1. Investors include institutions, crowdsourced groups, and individuals, offering a range of buying power.

2. Their analytical approach balances the emotional bidding from local buyers.

3. Investors enhance competitive bidding, often pushing prices to the top dollar.

For access to a network of qualified investors and a strategy to maximize your farm’s value, contact our team today!

Yes, utilizing an attorney is highly recommended when selling farmland.

At Whitaker Marketing Group, we work closely with attorneys to ensure smooth and efficient closings while addressing the unique complexities of farmland transactions.

Why an Attorney is Important

1. Addressing Legal Complexities:

• Encumbrances: Handling debts or liens on the property.

• Encroachments: Resolving disputes such as neighboring fences or structures overlapping onto your property.

• Chain of Title: Verifying ownership history, including trusts, inheritances, and bank payoffs.

2. Preparing Essential Documents:

• Deed: Legal transfer of ownership.

• Declaration of Value: Required for tax purposes.

• Groundwater Hazard Statement: Ensures compliance with environmental regulations.

3. Recording and Compliance

• Attorneys ensure all documents are correctly recorded, avoiding legal issues post-sale.

How Whitaker Marketing Group Works with Attorneys

• Our in-house team manages the transaction, coordinating with attorneys for legal needs and lenders for financing requirements.

• This partnership streamlines the process, reduces errors, and often saves costs in the long run.

Key Takeaways

1. Attorneys help resolve legal complexities, prepare critical documents, and ensure compliance.

2. Using an attorney improves the efficiency and accuracy of the closing process.

3. Whitaker Marketing Group collaborates with attorneys to handle all legal aspects of your sale.

For expert assistance and access to trusted attorneys, contact our team for a seamless farmland selling experience!

Farmability—how efficiently a farmer can plant, maintain, and harvest crops on a farm—is a critical factor in determining a farm’s value. While metrics like CSR scores are important, farmability often has an even greater impact on buyer interest and pricing.

1. Shape and Layout:

• Square, Flat, and Black: Ideal farmland is easy to plant and harvest, making it highly desirable.

• Point Rows: Angled or irregular field divisions slow down operations and reduce efficiency.

2. Topography:

• Flat land is easier and faster to farm compared to land with significant slopes or hills

3. Accessibility:

• Farms with obstacles, like trees or waterways dividing fields, reduce farmability.

• If sections require leaving the field to access other parts, efficiency drops.

4. Modern Equipment Needs:

• Larger planting and harvesting equipment benefits from long, straight rows and minimal turns, making highly farmable land more valuable.

Why Farmability Matters

• Increased Efficiency: Farmers pay a premium for land that maximizes their time and equipment use.

• Higher Bids: Farmable properties attract more competitive offers, driving up the sale price.

Key Takeaways

1. Farmability significantly impacts a farm’s value—buyers prioritize ease of operation.

2. Desirable features include square fields, flat topography, and minimal obstacles.

3. Efficiency is key—the less time and effort required to farm, the more appealing the property.

For an in-depth evaluation of your farm’s value and farmability, contact our team today!

No, the earnest money check is not cashed immediately. However, it is processed promptly in compliance with Iowa Real Estate Commission rules, which require it to be deposited into a trust account within five days.

1. Post-Auction Communication:

• After the auction, the buyer typically notifies their bank about the earnest money.

• The auction team also verifies with the bank that funds are available.

2. Transfer to Attorney:

• The check is delivered to the seller’s attorney or the designated trust account manager as soon as possible.

• The attorney deposits the funds into a trust account within approximately two days of receiving the check.

Why the Process Matters

• Compliance: Iowa law ensures funds are handled securely and transparently.

• Trust Account: The money is safeguarded until the transaction closes, ensuring both parties are protected.

1. The earnest money check must be deposited into a trust account within five days.

2. The process involves verification, communication with banks, and transfer to the attorney.

3. Funds are securely held in a trust account until the transaction is finalized.

For smooth transactions and expert guidance, contact our team today for your farmland buying or selling needs!

When selling farmland, you’ll encounter three primary types of\ taxes. Understanding these taxes will help you plan for your financial obligations and maximize your sale’s benefits.

• Timing: In Iowa, property taxes are paid a year in arrears, meaning you pay this year for last year’s taxes.

• What You Owe: Taxes are prorated based on the closing date, so each party pays their fair share.

Transfer Tax (Revenue Stamps)

• This is a state tax applied when transferring property ownership.

• Rate: $1.60 per $1,000 of the sale price.

• Example: For a $1,000,000 farm, transfer tax is $1,600.

1. What You Pay: Tax is owed on the difference between your basis (what you paid for or inherited the property at) and the sale price (also known as the relinquished price).

2. Components: Consult a CPA to evaluate options for reducing your tax liability, such as using a 1031 exchange.

1. Property Taxes: Prorated to the closing date; paid only for the days you owned the farm.

2. Transfer Tax: $1.60 per $1,000 of the sale price; typically under $1,000 for most transactions.

3. Capital Gains Tax: Paid on the profit from the sale, based on federal, state, and net investment tax rates.

For personalized guidance on taxes and selling your farmland, contact our team today!

Once the auction concludes and the property is sold, several key steps follow to finalize the transaction and ensure a smooth closing process.

Step 1: Purchase Agreement Execution

• Immediately after the auction, the seller and buyer meet to sign the purchase agreement paperwork.

• Whitaker Marketing Group provides a closing plan.

Step 2: Property Updates and Communication

• Property Updates: Any necessary changes (such as lease transitions, inspections, or property access) are documented and shared with all parties.

• Closing Team Communication

• This phase involves detailed communication to ensure all documents and processes are completed accurately.

• While the brokerage may have less direct contact during this period, the team is actively working behind the scenes.

• A week before closing, the seller is updated on the status and any final steps required.

• Information Sharing: Regular updates are provided to keep both buyer and seller informed throughout the process.

1. The purchase agreement is signed immediately after the auction, and a closing plan is shared.

2. The property is marked as sold, and sale details may be shared publicly unless requested otherwise.

3. The closing process involves coordination among multiple parties to ensure all documents and taxes are handled.

For a seamless post-auction process, trust our team to handle every detail!

A Closing Disclosure is a detailed document that itemizes all fees, costs, and financial details for a farmland transaction. It ensures transparency by breaking down expenses for both the buyer and the seller.

What’s Included in a Closing Disclosure?

1. Buyer and Seller Sections:

• Both sides start with the same total at the top (sale price) and bottom (final amount owed or received).

• The middle section details specific costs for each party.

2. Common Seller Costs:

• Brokerage Fees: Commission charged for the sale.

• Marketing Fees: Costs for advertising and promotion.

• Property Taxes: Prorated to the closing date.

• Transfer Taxes/Revenue Stamps: $1.60 per $1,000 of the sale price.

• Attorney Fees: For title cleanup, deed preparation, or other legal services.

• Abstracting Fees: Updating and verifying property ownership records.

3. Other Potential Costs:

• Title Opinions: Legal review of the property title.

• Banking Fees: Origination or other loan-related charges for buyers.

Why It’s Important

The Closing Disclosure ensures all parties fully understand the financial breakdown of the transaction. It’s a legally required document for transparency and accuracy.

1. A Closing Disclosure lists all costs involved in the transaction for both buyer and seller.

2. Sellers typically see charges for brokerage, marketing, taxes, and legal fees.

3. Transparency ensures that both parties know exactly what they owe or will receive.

For expert guidance and a seamless closing process, contact our team for professional farmland services!

ALC stands for Accredited Land Consultant, a prestigious designation awarded by the Realtors Land Institute (RLI) to professionals who demonstrate expertise and experience in land transactions. It is a mark of excellence in the farmland and real estate industry.

What Does the ALC Designation Represent?

1. Education:

• ALC designees complete advanced courses covering topics like:

2. Experience:

• Candidates must prove they have handled at least $20 million in land sales volume over a five-year period.

3. Expertise:

• The designation signifies deep knowledge of farmland, market trends, and strategies to optimize land transactions.