Wisconsin Banks Receive Significant Tax Parity Thank

By Rose Oswald Poels

By Rose Oswald Poels

Bankers have been advocating for tax parity for decades with state and federal elected

officials due to the unfair tax advantage that two of the industry’s primary competitors — credit unions and the

Farm Credit System — receive from policymakers. During that same time, the Wisconsin Bankers Association (WBA) has

(continued on p. 18)

By Hannah Flanders

When asked if artificial intelligence (AI) would replace the workforce, experts agreed that most jobs require a human connection. However, some economists assert that automation by platforms like ChatGPT — an AI program with capabilities to understand and generate human-like text — may lead to displacement in some areas.

Although human resources and talent acquisition-related positions continue to be

among the fastest growing user role on LinkedIn, according to World Economic Forum’s 2023 ‘Future of Jobs’ report, many agree that AI will only augment the abilities of human

professionals, rather than replace them entirely.

“If the staff are not robots, the process shouldn’t be either,” says Renée Peterson, vice president – talent acquisition and devel-

opment manager at Horicon Bank. “Being a community bank, it is important that we don’t lose the community feel.”

While the World Economic Forum predicts that AI will help create nearly 70 million jobs in the next five years, another 83 million are expected to

be eliminated. Human resources professionals and bankers in Wisconsin, however, should not let this staggering number deter them from embracing AI’s potential.

Oliver Buechse, owner of Advancing Digital, explains that incorporating AI into an organization allows employers to empower their team. “AI allows individuals to do. By providing the opportunity for those that are interested to explore AI and its capabilities in their job function, employers will not only

(continued on p. 14)

Organizations use AI to recruit, retain talent

>>>> SAVE THESE 2024 DATES <<<< MIDWEST ECONOMIC FORECAST FORUM JANUARY TBD | VIRTUAL BANK EXECUTIVES CONFERENCE FEBRUARY 7–9 | WISCONSIN DELLS Visit www.wisbank.com/education for more details. PRSRT STD U.S. POSTAGE PAID UMS Wisconsin Bankers Association 4721 South Biltmore Lane Madison, WI 53718 SEPT. | OCT. | 2023 WISCONSIN BANKERS ASSOCIATION FOUNDED 1892

you, banking advocates!

AI Reshapes the Workforce

Advance Our Industry by Investing in Your People

By Donna J. Hoppenjan

One of the Association’s primary goals for the year ahead is to continue shaping a solid future for the banking industry. As our members are well aware, the industry has evolved a great deal in the last several years. In order to remain receptive to the development that is yet to come, it is vital that our current bank leaders prioritize their investment into the future success of the industry.

Through the Wisconsin Bankers Association (WBA), over 30,000 bankers across Wisconsin gain access to ongoing educational opportunities. These various schools, workshops, and conferences are designed specifically to aid bankers across the state in gaining leadership skills, expanding their expertise, and serving

Message from the Chair

Donna J. Hoppenjan

as advocates on behalf the industry they represent.

As we invest in our emerging leaders and bankers of the future, it is important to provide relevant, high-quality resources and connections.

BOLT (Building Our Leaders of Tomorrow) and WBA

Connect are just two of the programs WBA offers that combine personal and professional development opportunities with numerous chances to build networks, ask questions, and share ideas. Annually, hundreds of bankers benefit from cultivating relationships with their peers

and becoming involved with the Association.

Additionally, bankers may choose to utilize WBA’s Legal Call Program to connect with seasoned attorneys that understand the industry, review best practices created by bankers in Wisconsin, or stay abreast of the latest industry news by subscribing to the Wisconsin Banker Daily e-newsletter or the Wisconsin Banker bimonthly publication.

Beyond developing our current teams, focusing on the future workforce is a priority for many. In order to drive our industry forward, it is critical that bankers commit themselves to promoting banking as a career. Taking part in volunteer work, hosting financial literacy presentations, and connecting with students are just a few meaningful and inspirational actions our membership can highlight when talking

Access all these resources online at wisbank.com

about the many rewarding aspects of a banking career. WBA provides resources to help members interact with future bankers including consumer-focused resources, financial education tools, and engagement opportunities at colleges across the state.

As your team considers new ways to invest in your employees and attract new talent, I encourage you to utilize the opportunities provided by WBA. No matter how your bank decides to make the most of WBA’s programs, it is gratifying to know that the success of our institutions and team members is the sole mission of the Association.

Hoppenjan is president and CEO of Mound City Bank, Platteville and the 2023–2024 WBA Chair.

STRATEGIC RETREAT

Presented by: Family-Owned AND Closely Held The Edgewater Hotel | 1001 Wisconsin Place Madison, Wisconsin wisbank.com/FOCH 12–13 O C T O B E R 2023

2 SEPT. | OCT. | 2023

Already Solving Your Next Challenge.

From regulatory requirements to working toward enhancing your financial institution’s performance, the challenges are growing even more demanding by the day. Fortunately, we understand what you’re up against. We can help you navigate the many complexities of your operation with confidence, as well as provide you with solutions that are backed by our own experience and resources. We know how to get you there, because we’ve already been there.

Learn more at www.bokfi nancial.com/institutions.

BUDGETING

PROFIT PROJECTIONS

ALCO

CAPITAL PLANNING

DECAY/BETA ANALYSIS

REGULATORY

INVESTMENT PORTFOLIO

INVESTMENT MIX

INTEREST

RATE RISK

LOAN PRICING

ASSET DURATION

LIQUIDITY MANAGEMENT

BROKERED FUNDING

We go above. So you can go beyond.

BOK Financial® is a trademark of BOKF, NA. Member FDIC. Bank dealer services offered through BOK Financial Capital Markets, which operates as a separately identifiable department of BOKF, NA. BOKF, NA is the bank subsidiary of BOK Financial Corporation. Investment products are: NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

23-BOKW-04531-Wisconsin_Banker_Capital_Markets_8x11.indd 1 3/17/23 9:39 AM SEPT. | OCT. | 2023 3

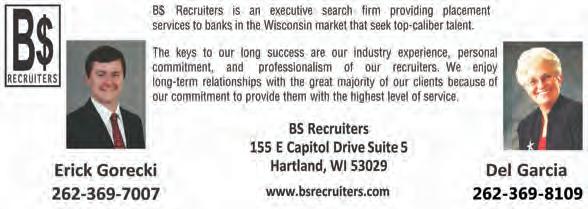

Committed to the Industry. Committed to your Bank.

•M&A

•Regulatory Compliance

•Strategic Planning

•Ownership Succession

•Securities Offerings

•Vendor Contracts

•Compensation Plans

•Commercial Lending

As a WBA Gold Associate Member, we prioritize our commitment to the Wisconsin banking industry and beyond.

Whether a day-to-day regulatory, compliance or operational matter, or an acquisition or other strategic transaction, Godfrey & Kahn has the resources, depth and expertise to handle a wide range of issues for our financial services clients.

4 SEPT. | OCT. | 2023

A Historic Win for Banks in Wisconsin Updates from the 2023–2025 state budget

By Lorenzo Cruz

As the summer of 2023 comes to a close, the Wisconsin Bankers Association (WBA) is pleased to help usher in a number of historic changes for banks across the state. In July, Governor Tony Evers approved Senate Bill 70 as 2023 Wisconsin Act 19 and established Wisconsin’s 2023–2025 budget. As the Association has previously reported, budget negotiations — which included a massive $6.6 billion surplus — have been ongoing for several months. Undoubtedly, the passion demonstrated in the last several decades by banking advocates has led us to this moment. Thank you to those who have committed their time and efforts to ensuring the banking industry remains relevant and thriving for years to come!

The following recaps business-related provisions from Act 19:

Tax-Exemption for Small Business and Ag Purpose Loans

Act 19 creates a new, historic tax-exemption for banks

Advocacy Update

Lorenzo Cruz

» Want to get involved with WBA’s advocacy efforts? Learn more at wisbank.com/advocacy.

related to certain business and agricultural lending.

Largest Investments of $525 Million in Workforce Housing in Wisconsin History Act 19 provides one-time funding for several new Wisconsin Housing & Economic Development Authority (WHEDA) programs.

Increased Shared Revenue for Municipalities

Act 19 added aid for municipalities for fiscal year 2024–2025 and represents a 36% increase over current county and municipal aid entitlements.

Income Tax Reduction for Two Lowest Tax Brackets

Act 19 reduced income tax for the lowest two individual brackets leaving more than $3 billion in the general

fund for more income tax cuts or spending.

Increase in Retailer Vendor Compensation

Act 19 revises section 77.61 (4)(c) and increases vendor compensation for retailers. The WBA Government Relations team will continue to monitor this development but are hopeful the vendor compensation increase will reduce an interest in a state credit card interchange fee bill.

Creates Sales and

Use

Tax for Equipment or Software Used at Qualified Data Center Act 19 creates a sales and use tax exemption for equipment or software used for the processing, storage, retrieval, or communication of data at a qualified data center, as certified by the Wisconsin Economic Development Corporation (WEDC).

Personal Property Tax Repealed

Another significant change in tax policy occurred on the personal property front. For several decades, the business community has been working on legislation to eliminate completely the personal property taxes in Wisconsin. Many states have eliminated

the personal property tax and Wisconsin was becoming an outlier in that area. WBA was a member of the Coalition to Repeal Wisconsin’s Personal Property Tax which successfully advocated for a legislative solution that fully repealed the personal property tax effective January 2024 in the 2023 Wisconsin Act 21, which was signed by Governor Evers on June 20. The repeal of the personal property tax eliminates an outdated administratively burdensome requirement and saves the business community nearly $200 million annually.

Upcoming Priorities

With the state budget behind us, the WBA Government Relations team will shift the focus towards fall/spring floor periods and political fundraising/ grassroots efforts. Despite the huge tax parity victory in the state budget — which was a top priority for WBA — the team is now working on other priorities that include, but are not limited to, financial institutions modernization reform, elder fraud, taxes, privacy, trust code updates, and credit card swipe fees.

Cruz is WBA vice president – government relations.

» Learn more about the Summit on p. 23 of this issue. Visit wisbank.com/FLEX to see the complete agenda and to register.

FLEX Retail and Marketing Summit WBA

2023

November 15–16,

SEPT. | OCT. | 2023 5

Learn more about this tax parity on p. 1 of this issue.

A Refresher on Rescission Rules

By Scott Birrenkott

One of the consumer protection rights afforded by Truth in Lending is the right of rescission. While there are no changes to this rule, it is a frequent topic for questions received through the Wisconsin Bankers Association’s (WBA) Legal Call Program. It is important that bankers understand and consider various aspects of this rule.

The right of rescission can be found under Regulation Z for both closed-end and open-end credit. Generally speaking, rescission applies in a credit transaction secured by a consumer’s principal dwelling. For purposes of rescission, each consumer whose ownership interest is subject to the security interest shall have the right to rescind the transaction, unless exempt.

One of the most common questions WBA receives is: who gets rescission?

All consumers receive the right of rescission. Reg Z

Compliance Column

Scott Birrenkott

defines consumer as a natural person to whom consumer credit is offered or extended. However, for purposes of rescission, the term also includes a natural person in whose principal dwelling a security interest is, or will be, retained or acquired, if that person’s ownership interest in the dwelling is or will be subject to the security interest. In short, any consumer with an ownership interest in the dwelling taken as security receives the right of rescission. This could include a non-borrower.

For example, consider a situation where a borrower’s parents pledge their house as security for a covered

WBA IN-HOUSE

Compliance TRAINING

transaction. The parents are not borrowers and thus, not obligated to the transaction. However, because their ownership interest in the house is subject to the security interest, they must be provided with the right of rescission.

It is also worth noting that sometimes a trust can be considered a consumer for purposes of rescission. Credit extended to trusts established for tax or estate planning purposes or to land trusts is considered to be extended to a natural person for purposes of the definition of consumer. In the case where the property is held by a trust, lenders should make sure to review Reg Z to see whether the trust might be a consumer for purposes of rescission.

Another common question WBA receives is whether a consumer can waive the right to rescind. In certain rare circumstances this is possible, but only in the case of a bona fide personal financial emergency.

The rule does not provide examples, but the situation must present a true emergency.

For example, during the COVID pandemic, there may have been truly bona fide personal financial emergencies which warranted a need to receive credit without a waiting period. As a result, whether such an emergency exists is a fact-specific question. WBA has heard of situations where the borrowers are going on vacation and want to close without a waiting period, or where the seller is growing anxious and does not want to wait any longer. Such situations are not emergencies. A true, bona fide financial emergency must exist for it to be possible to waive rescission.

(continued on p. 7)

NEW… WBA Legal now offers In-House Compliance Training for members. Through this new resource, WBA Legal provides customized compliance training, either in-person or as a virtual meeting! Visit wisbank.com/compliance-training to learn more.

WBA Comments on FDIC’s Proposal to Impose Special Assessments

Summary of a recent comment letter below

In July, the Wisconsin Bankers Association (WBA) filed comments on the Federal Deposit Insurance Corporation’s (FDIC) proposed special assessments to recover the loss to the deposit insurance fund (DIF). The matter began on March 12, 2023 when FDIC invoked the statutory systemic risk exception to complete

its resolution of SVB and Signature Bank. Because the FDI Act requires recovery of loss to the DIF from special assessments on insured depository institutions,

View

FDIC issued the proposal to do so.

WBA commented in general support of the special assessment proposal, commending FDIC’s swift action. However, WBA did offer recommendations

that FDIC provide more transparency when invoking the systemic risk exception, exclude collateralized or otherwise insured public deposits from the base calculation, and undertake future, separate rulemaking to propose changes to increase the SMDIA in certain instances.

For copies of this or other WBA comment letters, please contact the WBA Legal Department at 608-441-1200 or visit www. wisbank.com/CommentLetters

Visit the compliance section of the WBA website at wisbank. com/resources/compliance

this and previous comment letters filed by WBA at www. wisbank.com/CommentLetters.

6 SEPT. | OCT. | 2023

Huge Tax Savings for Banks

By Jessica Schwantes, CPA

On July 5, 2023, Governor Tony Evers signed into law Section 71.05(1)(i) and 71.26(i) of the Wisconsin tax code with the 2023–2025 State Budget. These two sections provide significant tax savings for banks that provide business and agricultural loans to Wisconsin businesses. The estimated tax saving is $34 million in 2023 and $37 million in 2024.

The reason Section 71.05(1)(i) and Section 71.26(i) basically read the exact same is because one section is for the exclusion from individual income taxes and the other is from corporation income. The law states that effective for taxable years beginning after December 31, 2022, income of a financial institution as defined in s.69.30 (1) (b), including interest, fees, and penalties, derived from a commercial loan of $5 million or less provided to a person residing or located in Wisconsin and used primarily for a business or agricultural purposes is exempt from tax.

The exclusion is effective for this year already. It applies to C Corporations,

Compliance Column

(continued from p. 6)

Conclusion

While rescission is not a new rule nor have there been any changes, the above article covers some of the more frequently asked questions.

For reference, also consider the following citations to Regulation Z:

»Rescission for open-end credit: 1026.15

»Rescission for closed-end credit: 1026.23

» www.wipfli.com

These two sections provide significant tax savings for banks that provide business and agricultural loans to Wisconsin businesses. The estimated tax saving is $34 million in 2023 and $37 million in 2024.

S Corporations, and S Corporations that elect to be taxed as a C Corporation for Wisconsin purposes. The interest, fees, and penalties earned on business and agricultural loans of $5 million or less to Wisconsin customers should be removed from your monthly state tax calculation.

We are waiting for additional guidance from the Wisconsin Department of Revenue. As of this writing, the current understanding is that these two sections apply to business and agricultural loans that have a commercial loan agreement where the original principal is $5 million or less. It does not matter if the loan was issued prior to the effective date of the

law of 1/1/2023. While the intent of the $5 million threshold was not to create multiple smaller loans to achieve the exemption, we are expecting the additional guidance to clarify how aggregation of related transactions will occur.

What we do know, however, is that the loan needs to be to a Wisconsin customer. It does not need to be a Wisconsin incorporated business or have the collateral located in Wisconsin. The customer needs to be located in Wisconsin and the use of the loan is primarily for business or agricultural purposes.

I know many banks have already done the analysis to see how this change impacts them. The new law may eliminate all your Wisconsin taxable income. However, with this

fact pattern, banks should consider whether or not they should record a deferred tax asset for the net operating loss carryforward that is created. Banks will have 20 years to use a Wisconsin net operating loss carryforward. Banks should consult their tax advisor to discuss the implication for their institutions.

Schwantes is Madison market leader and tax partner at Wipfli, LLP. She can be reached at 608-274-1980

Wipfli has dedicated financial institution professionals who are committed to serving clients with their regulatory compliance, cybersecurity/IT, risk management, HR, audit, and tax needs.

Wipfli, LLP is a WBA Silver Associate Member.

»Definition of consumer: 1026.2(a)(11)

»Discussion of trusts, which may be a consumer, for purposes of rescission: 1026.3(a)-10

Birrenkott is WBA director – legal. For legal questions, please email wbalegal@wisbank.com

Note: The above information is not intended to provide legal advice; rather, it is intended to provide general information about banking issues. Consult your institution’s attorney for specific legal advice or assistance.

Pressures and expectations have never been higher. We help you remain fully staffed so you can thrive.

V isit wipfli.com/banks

SEPT. | OCT. | 2023 7

Perspective changes everything.

38368 *We do not reparticipate loans. Partner with us for: •Loan participation purchases and sales* •Bank stock financing •Bank executive and employee financing Denise Bunbury Call me at 608.234.1438 Based in Eau Claire, Wis. Serving Wisconsin, and the U.P. of Michigan Our Mission Is to Help You Succeed 8 SEPT. | OCT. | 2023

There’s Still Time to Register for WBA’s Management Conference

Bank management teams benefit from education and networking opportunities

September has arrived, but there is still time to register for the WBA Management Conference, taking place September 20–21 in Middleton. The conference is an ideal space for community banking leaders to come together for networking and education about the everchanging banking industry.

On Wednesday, September 20, a pre-conference golf outing at University Ridge Golf Club lets attendees get a head start on networking with their peers. A limited number of spaces remain for the optional outing! That evening, the conference will officially kickoff with a reception and dinner program recognizing the 2023 WBA Lifetime Service Award recipients. This year, several individuals will be

WISCONSIN BANKERS ASSOCIATION

MANAGEMENT CONFERENCE

Sept. 20–21, 2023 | Madison Marriott West | Middleton wisbank.com/Management

honored for dedicating over 30 years of their professional careers to the banking industry.

The following day, C-suite bankers and management team members will enjoy a full day of general session presentations, breakout sessions, time in the exhibit hall, and various opportunities to network among peers.

The first general session, presented by Dave Martin of bankmechanics, will inform attendees of the ways in which

banks can communicate, model, and apply values to create a culture of engagement and resilience. In the second session, Economist Dr. Ed Seifried will help leaders navigate the industry’s unprecedented challenges by introducing several techniques to monitor the local and global economy, forecast a recession, and prepare resources and responses to assure customers of the stability of the U.S. financial system.

Additionally, WBA will host several industry experts to lead breakout sessions on topics related to credit/lending risk, financial management, and general banking trends. Ranging from what a raising rate environment may mean for community banks to succession planning — this is a must-attend event for all members of the bank’s leadership team.

To make the most of the conference, and to help all leaders stay abreast of new developments, banks are encouraged to take advantage of team pricing at registration.

Register for the Conference now through September 20 at wisbank.com/management

Turnaround, Acquisition, and Expansion Solutions

firstbusiness.bank/abl

We help companies overcome financial obstacles through innovative Asset-Based Lending solutions, focusing on small- and mid-market companies in transition with credit requirements from $2,000,000 to $18,000,000. First Business Bank offers Asset-Based Lending solutions through its wholly owned subsidiary, First Business Specialty Finance, LLC. Member FDIC CALL US TODAY TO LEARN MORE Mike Colloton – Milwaukee – 262 -792 -7180 Pete Lowney – Madison – 608 -232 - 5987

Fueling

SEPT. | OCT. | 2023 9

Golf Outing

Aug. 17, 2023 • Trappers Turn Golf Club • Wisconsin Dells

On August 17, over 150 bankers from 78 banks joined WBA staff and event sponsors on the links at Trappers Turn Golf Club in Wisconsin Dells for the annual WBA Chair’s Member Appreciation Golf Outing. Thank you to all the bankers who participated!

In her brief remarks to the golfers, WBA 2023–2024 Chair Donna Hoppenjan encouraged attendees to continue inspiring others and emphasized the importance of standing united, staying engaged, and making their voices heard.

A special thanks to our special guest speaker, former banker and current State Representative Jerry O’Connor (R-Fond du Lac), for providing attendees with political insights from the state capitol. WBA extends a sincere thank you to the 37 event sponsors (listed below) who made this event possible.

Eighteenth Annual WBA Chair’s Member Appreciation

Gold Associate Members Silver Associate Members • FIPCO • Godfrey & Kahn, s.c. • ICBA Services Network® • Midwest Bankers Insurance Services (MBIS) • WBA Insurance Services • BMO Harris Bank — Correspondent Banking • BOK Financial Capital Markets • Bankers’ Bank • Cinnaire • FHLBank Chicago • Bell Bank • Locknet –An EO Johnson Company • UFS LLC • Wipfli LLP

You,

Above (circle): WBA Chair Donna Hoppenjan. At left: Rep. Jerry O’Connor (red shirt) and several WBA Board members.

Thank

Golf Outing Sponsors

Aug. 15, 2024 Join Us Next Year • GOLF SPONSORSHIP: Interested in being a sponsor? Contact WBA’s Nick Loppnow at nloppnow@wisbank.com for more information about WBA’s Associate Member Packages! Bronze Associate Members Associate Members •Arctic Wolf Networks •BHG Financial •The Baker Group • Bank Compensation Consulting •Boardman & Clark LLP • Delta Dental • Eide Bailly LLP® • AmTrust Financial • BPAS • First Business Bank • Generations Title • Executive Benefits Network • forbinfi • JMFA • Jefferson Wells • Plante Moran • Quad City Bank & Trust • Reinhart Boerner Van Deuren s.c. •SHAZAM® • West Bend Mutual Insurance •Ironcore, Inc. •Remedy Consulting •UnitedHealthcare® •Wolf & Company, P.C. Thank You, Golf Outing Sponsors Trappers Turn Golf Club • Wisconsin Dells SEPT. | OCT. | 2023 11

Trust.

Do you trust your insurance carrier? Well, you’d better. Insurance coverage is really just a promise. A promise to be there when things go bad. Find out more about the Silver Lining and a special discount on home and auto insurance just for members of the Wisconsin Bankers Association.

To find an agency near you, visit thesilverlining.com.

out our best.®

The worst brings

12 SEPT. | OCT. | 2023

Tapping into the Power of AI for Bank Marketing

By Lauren Moran

If you are like me, you often consider technology a blessing and a curse. However, when it comes to a small marketing team with an endless to-do list, some recent advancements in technology are welcome conveniences. With staff shortages and conservative budgets becoming more common, artificial intelligence (AI) is allowing marketers to do more with less.

AI: The Game Changer

While the vast capability of AI has yet to be fully uncovered, a variety of industries have benefitted from AI’s automation and agility — especially marketing. Although many banks are approaching AI with caution from a risk perspective, I’d like to share a few AI-driven tools that can help lighten the load of a busy bank marketer. Please be sure to connect with your IT, compliance, and/or risk management teams before diving into any AI platforms.

» Copywriting

Writer’s block is no longer a threat. Tools like ChatGPT or Bard can help create content

WBA, I

Strategic Connections

Lauren Moran

» While it can be hard to keep up, AI can provide bank marketers with the tools to be more efficient and effective in their positions.

or copy for blogs, email campaigns, webpages, social media posts, or even radio ads by simply writing one line of text explaining what you are looking for.

» Design

Illustrator or Photoshop aren’t your strong suits? No problem. Canva has taken what used to be a tedious creative process and has made it quick and easy with boatloads of design templates, pre-sized canvases, and instant background removers. More recent features like “magic design” allow users to insert a photo and have a multitude of custom templates created within seconds.

The “text to image” feature lets users type a description of an image and the AI will generate suggested images instantaneously. Both of these tools have proven to be extremely useful, especially for social media content.

» Video

My skills as a videographer are limited to filming my kid’s tee ball game, so I need all the help I can get. Have an idea in your head but don’t have the time or film crew to make it a reality? Platforms like Runway can help bring your ideas to life with text-to-video AI-generation. Runway allows users to type in a description of the video footage they’d like to see, and the program generates it on the spot. Other platforms like Fliki can help marketers create a narrated and captioned how-to video that’s ready for the bank’s website or social media in minutes.

» Headshots

In community banking, our people are our greatest asset. However, it can be tough to keep up with current staff headshots to use in marketing materials. AI apps like Fotor

can help. With submission of some current casual photos of your staff members, Fotor can spit out 40 or more professional headshots at a cost that’s likely less than a professional photographer’s studio fee.

» Presentations

Need an eye-catching presentation in a flash? Platforms like Tome can help build presentations with a simple description of your subject matter.

AI technology is moving even faster than the community banks who stay on the bleeding edge of new technologies. While it can be hard to keep up, AI can provide bank marketers with the tools to be more efficient and effective in their positions. Who knows, one of the platforms mentioned above could be a game changer in your daily work life.

Moran is the marketing director at Wolf River Community Bank, Greenville, and vice chair of the 2023–2024 WBA Marketing Committee.

Visit wisbank.com/community/ get-involved to learn more about WBA Committees.

NC. A NNOUNCES FIPCO S TAFF P ROMOTION AND WBA R ETIREMENT

FIPCO, a subsidiary of the Wisconsin Bankers Association (WBA), is pleased to announce that Beth Kowing has been promoted to director – digital innovation.

Kowing, who recently celebrated 20 years of service with FIPCO and was previously project manager – software, is now guiding the modernization efforts of FIPCO programs and expanding the digital offerings of software solutions.

Kowing has continued to demonstrate her dedication to FIPCO’s growth and a willingness to embrace new technology while forming positive peer camaraderie. FIPCO is also pleased to welcome her to the management team.

Kowing can be reached at bkowing@fipco.com or at 800-722-3498, ext. 1261.

Sonja Vike, a longtime WBA employee, retired on August 31 after serving the Association for more than 53 years.

As WBA’s graphic artist, she was responsible for the graphics and layout of numerous association publications and marketing pieces (both print and digital) and most notably for a total of 484 Wisconsin Banker newsletters. Vike’s skill as a designer and attention to detail evolved the newsletter into the premier financial trade publication it is today.

Her work has helped deliver important information and brand awareness of WBA to its members during some of the banking industry’s most challenging times, including the S&L crisis, the Great Recession, and the COVID-19 pandemic.

Thank you for your dedication and commitment to WBA and the banking industry. Enjoy your well-deserved retirement!

SEPT. | OCT. | 2023 13

AI in Banking

(continued from p. 1)

be fostering a culture of innovation but also assisting their organization in remaining ahead of a world increasingly reliant on technology.”

» Recruiting, Retaining Talent

According to the Society of Human Resource Management (SHRM), it takes, on average, 36 days to fill an open position. During this time, HR professionals are occupied preparing a recruitment plan; sourcing, screening, and selecting candidates; making offers; and onboarding.

» By providing the opportunity for those that are interested to explore AI and its capabilit ies in their job function, employers will not only be fostering a culture of innovat ion but also assist ing their organization in remaining ahead of a world increasingly reliant on technology.

— Oliver Buechse, owner Advancing Digital

— Oliver Buechse, owner Advancing Digital

While AI cannot completely automate the recruiting process, some experts say that it may help streamline processes.

“AI is great at processing and analyzing massive amounts of data,” highlights Beth Ziesenis, a popular speaker known professionally as ‘Beth Z, Your Nerdy Best Friend.’ “By using generative AI (such as ChatGPT), hiring managers have the ability to analyze what people are looking for and consider feedback from current and former employees to develop a job description that may better communicate the benefits and responsibilities.”

Experts noted that HR professionals may also utilize AI to quickly screen public social media profiles, brainstorm relevant interview

questions, and even personalize regret letters.

“In addition to saving time that would otherwise be spent researching or writing, HR teams will greatly benefit from the perspective AI can provide during the recruiting process,” Peterson emphasized.

Despite the large amount of data AI has the ability to process, Horicon Bank’s Senior Vice President – Chief Information Officer Cyrene Wilke states that staff needs to ensure that they are correctly leveraging the tools available to them.

“AI has existed in some capacity for many years, but its abilities only continue to expand,” says Wilke. “While AI at this current moment may allow us to identify top candidates for the position, it is important to recognize that not every qualified candidate makes their information public on LinkedIn or other social media and that sometimes, trained AI bias may still disqualify candidates with differing experience. For this reason, it is important that AI doesn’t entirely replace your staff — just helps enhance their abilities.”

In addition to helping HR professionals recruit for open positions, AI may also be beneficial in assisting and analyzing current employee retention efforts.

During the onboarding process, employers may utilize AI to automate training programs efficiently and inexpensively. As well as tracking employee progress, automating certain aspects

AI Reshapes the Workforce

Organizations

of the onboarding process may help provide a more comprehensive training environment for individuals with varying skills or learning styles. Day to day, AI may also prove a powerful tool in assisting employees to understand how their role impacts the organization as a whole or to uncover new career paths within the organization.

“Companies that embrace the transparency AI provides will find a greater sense of belonging among their team members,” notes Buechse.

“With the ability to make predictions based on trends and patterns, AI can provide new perspectives,” says Wilke. “Of course, trained professionals would notice an unengaged employee through details such as excessive and unplanned paid time off. AI, however, would augment and complement the work HR professionals already do to help assist in recognizing trends or insights that are not always apparent at a surface level.”

As such, companies have begun deploying AI to assist in the process of gathering feedback from current and departing employees. Programs such as CultureAmp utilize AI to track employee engagement, measure employee satisfaction and company culture, as well as gather insight into the employee lifecycle. While many organizations already routinely connect with their employees for feedback and provide exit

» If the staff are not robots, the process shouldn’t be either.

— Renée Peterson, vice president –talent acquisition and development manager Horicon Bank

surveys to those leaving the organization, AI provides managers with a systematic and detailed analysis of employee sentiment.

“By taking the time to collect comments from team members, and understand what this feedback signifies, employers will stand apart in a huge way,” emphasizes Wilke. “AI has the potential to not just enhance the efficiency of multiple processes, but also aid in comprehending the employee experience and implementing necessary adaptations.”

» Embracing Change

According to research by the Pew Research Center, 45% of Americans are equally concerned and excited about the growing use of AI.

“In order to curb the discomfort some may feel towards AI, it is critical that organizations have a written policy related to its use in human resources, and generally,” says Ziesenis. “Whether your team is waiting for more information or using it all the time — now’s the time to define your bank’s approach and protocol.”

Buechse agreed, “The U.K. has already released information related to its approach to harness the powers of artificial intelligence. In order to remain a step ahead, bankers should familiarize themselves with regulatory frameworks that are beginning to be published around the

(continued on p. 15)

use AI to recruit, retain talent

14 SEPT. | OCT. | 2023

WBA Leaders in Banking Excellence Honored

WBA is proud to honor the fourth class of WBA Leaders in Banking Excellence. An award presentation was held for 2023 honorees, Michael Bock and John Kujawa (posthumously), along with Class of 2022 honoree Debra R. Lins,

Michael Bock

Michael Bock

graduated from college with an accounting degree and began his career in public accounting. After eight years spending significant time in the bank audit, exam, and tax area learning about the banking industry, an opportunity presented itself with Dairy State Bank. That opportunity turned into over 34 years with the bank.

Mike was the first Wisconsin banker to sit on the Advisory Committee on Community Banking of the Federal Deposit Insurance Corporation (FDIC). Throughout his tenure, Mike demonstrated exemplary leadership of Dairy State Bank and was dedicated to keeping the bank safe and sound, even during difficult times. Under Mike’s leadership, the bank grew to

and their families and friends on August 25 at the WBA Office.

Established in 2020, the WBA Leaders in Banking Excellence celebrates exceptional bankers from

be one of the largest locally owned community banks in Northwest Wisconsin with over $700 million in assets.

John Kujawa

“You can’t change the world, but you can change the world around you.” These were the words by which John Kujawa, president emeritus of Farmers & Merchants Bank in Berlin, lived.

After returning from serving his country in the U.S. Army for two years, John began working at the bank his father had founded 21 years prior. It meant a great deal to John to work side by side with his father and later continue the family tradition with three of his children and eventually some of his grandchildren. Farmers & Merchants Bank was designed to be a place

throughout Wisconsin’s history. Through this program, current and former banking leaders who have helped shape our state’s banking industry are honored with recognition as a fixture on the Wall of Excellence.

where farmers felt comfortable coming in straight from the fields to do their banking business, and the welcoming family environment extended to the bank’s customers, employees, and community.

In his more than 60-year time at the bank, John never missed an opportunity to support, encourage, and “scholarship” the people of his community.

Debra R. Lins

Class of 2022

Debra R. Lins began her banking career at the Federal Land Bank Association of Baraboo in 1979. She then served in several capacities for Farmers & Citizens United Bank in Sauk City. She assisted First Business Bank of Madison in its start-up phase and then served as Vice President/Senior

A brief biography of each honoree is below. Read their complete biographies at wisbank.com/excellence or stop by the WBA office in Madison to view the Wall of Excellence in person!

AI in Banking

(continued from p. 14)

world. While regulation in the U.S. hasn’t quite caught up yet, that doesn’t mean it isn’t coming.”

As of this writing, bipartisan legislators have introduced a bill aimed at establishing an artificial intelligence commission to review, recommend, and

develop frameworks for AI in the U.S. However, for those in the banking industry, it is important to consider the utilization of disclaimers, programs that have been tested for safety and effectiveness, as well as what protections are necessary to ensure privacy prior to launching new systems.

Given the ongoing

expansion of AI throughout our lives, experts underscore the need to reframe how technology will amplify the abilities of humans.

“While AI may automate certain aspects of the profession, human resource teams may find that they have a greater ability to focus their energy and efforts on the most impactful aspects

Lender. She went on to become the first woman to open a rural de novo bank in Wisconsin. Debra was founder, CEO/ President and charter director of Community Business Bancshares, Inc. and Community Business Bank.

Later in her career, Debra served in leadership roles for several banks including as Director of MidAmerica Bank, CEO/Director of Markesan State Bank, and as CEO/President/Director of First National Bank of Muscatine in Iowa.

Debra has served on the WBA Board, FIPCO Board, and WBA Agricultural Bankers Section Board. She was also appointed to serve on the American Bankers Association’s Community Bankers Council and ABA’s Membership Council.

» 2024 Class nominations are being accepted through May10, 2024 at wisbank.com/excellence

of the hiring and retention processes,” says Peterson. “AI will ultimately allow us to spend more time on fine-tuning the outcome.”

Flanders is WBA writer/editor Read “The Rise of Artificial Intellegence in Banking” in the July/ August 2023 edition of Wisconsin Banker for more information about AI.

Bock

Kujawa

Bock

Kujawa

SEPT. | OCT. | 2023 15

Lins

Bulletin Board

News about people working in Wisconsin’s financial institutions

Promotions and New Hires

Fond du Lac

FVSBank is pleased to welcome Brian Wendt as vice president – business banking.

Galesville

Bluff View Bank is proud to announce the hiring of Joe Thesing (pictured) as chief credit officer and commercial loan officer.

Hartford

Forte Bank is pleased to announce the promotions of Aaron Lensink (pictured) to executive vice president –commercial lending and Gary Heckendorf (pictured) to senior vice president –business banking manager.

Lake Mills

Greenwoods State Bank is pleased to announce the

additions of Patrick Cops (pictured) as vice president –business banking and James (Jim) Meyer (pictured) as executive vice president –commercial banking officer.

Luxemburg

Bank of Luxemburg is pleased to announce the appointments of Darren Voigt (pictured) as executive vice president –chief lending officer and

DeAnna Tittel (pictured) as chief operating officer

Madison

Michael Johnston (pictured) has joined the Capitol Bank team as senior vice president –commercial lending.

Manitowoc

Kathryn Schmitz (pictured) has been promoted to vice president – retail market

manager and Bank First. Additionally, Mike Gintner (pictured) has joined the bank as vice president –agricultural banking.

Marinette

Aron McDonald (pictured) has joined The Stephenson National Bank & Trust as senior vice president – head of wealth management.

Medford

Renée Leinfelder (pictured) has been promoted to vice president – growth development at Prevail Bank.

New Glarus

The Bank of New Glarus is pleased to announce the promotion of Jance Marty (pictured) to chief operating officer.

(continued on p. 17)

WBA Honors Five Wisconsin Bankers with Lifetime Service Awards

WBA President and CEO Rose Oswald Poels recently presented WBA Lifetime Service Awards to five bankers. Congratulations to: 1) Barb Krueger executive administrative assistant, First State Bank, New London (45 years). Krueger (center), is flanked by Oswald Poels and First State Bank President and CEO Matthew Lemke; 2) Sam Miller (right), managing director – head of agriculture at BMO, Appleton (34 years) during his retirement celebration in June; 3). Wendy Swansby (right), teller at Fortifi Bank, Berlin (45 years); 4) Tracy McNulty (right), operations center specialist, Farmers & Merchants Union Bank, Columbus (30 years); and 5) Barbara Miller (left), personal banker at Unity Bank, Neillsville (45 years)

Lensink Johnston

Heckendorf

Voigt

Meyer Thesing Tittel

Cops Schmitz Gintner

WBA President and CEO Rose Oswald Poels recently presented WBA Lifetime Service Awards to five bankers. Congratulations to: 1) Barb Krueger executive administrative assistant, First State Bank, New London (45 years). Krueger (center), is flanked by Oswald Poels and First State Bank President and CEO Matthew Lemke; 2) Sam Miller (right), managing director – head of agriculture at BMO, Appleton (34 years) during his retirement celebration in June; 3). Wendy Swansby (right), teller at Fortifi Bank, Berlin (45 years); 4) Tracy McNulty (right), operations center specialist, Farmers & Merchants Union Bank, Columbus (30 years); and 5) Barbara Miller (left), personal banker at Unity Bank, Neillsville (45 years)

Lensink Johnston

Heckendorf

Voigt

Meyer Thesing Tittel

Cops Schmitz Gintner

Have good news? To submit a notice, please email bulletinboard@wisbank.com. Or mail entries to WBA Bulletin Board, 4721 South Biltmore Lane, Madison, WI 53718. Send photos as JPEG files. Questions? Contact WBA’s Hannah Flanders at 608-441-1237 or hflanders@wisbank.com

1 2 4 5 3 16 SEPT. | OCT. | 2023

Bulletin Board

News about people working in Wisconsin’s financial institutions

Promotions and New Hires

(continued from p. 16)

New London

First State Bank recently announced the promotions of Lynn Olson (pictured) to executive vice president –chief credit officer and Randy Zietlow (pictured) to executive vice president – chief financial officer. Additionally, Jason Wery (pictured) has joined the bank as senior vice president –consumer banking.

Oregon

One Community Bank is delighted to welcome Audra Dalsoren (pictured) as vice president – commercial banking officer.

Sun Prairie

One Community Bank has welcomed Kelsey Hudson (pictured) as vice president –commercial banking officer.

Union Grove

Bob Findysz (pictured) has been appointed to the position

of senior vice president – chief financial officer.

Waukesha

Waukesha State Bank is pleased to announce the promotion of Heather Pfalz (pictured) to vice president –retail banking manager.

Anniversaries

Bangor

Celebrating Fifty Years in Banking

WBA recently honored two bankers for 50 years of service to the banking industry.

WBA Executive Vice President and Chief of Staff Daryll Lund (right), presented a WBA 50 Year Club certificate to David Stack (left), current Board chair and former president of Superior Savings Bank.

The First National Bank of Bangor is pleased to honor Helen Wegner (pictured), assistant vice president – loans, for 40 years with the bank.

Fond du Lac

In June, National Exchange Bank & Trust’s Program and Event Manager Janet Johnson (pictured) celebrated 50 years of service at the bank.

Retirements

Union Grove

After 43 years in finance and a decade with Community State Bank, Chief Financial Officer Peter Schumacher (pictured) has announced his intent to retire at the end of 2023.

Waukesha

On June 16, Devon Arnold (pictured), senior vice president – retail banking manager, retired after 45 years of dedicated service to the banking industry.

Associate Member News

Detroit

Cinnaire has announced the promotion of Lucius Vassar (pictured) to chief legal officer and corporate secretary.

Visit wisbank.com/Bulletin for more good news in Wisconsin’s banking industry, including recent hires, staff achievements, and community involvement.

Premier Community Bank Supports Legacy Park in Iola

WBA president and CEO Rose

Oswald Poels (left), presented a WBA 50 Year Club certificate to LuAnn Hasenfuss (right), assistant vice president, Farmers & Merchants Union Bank, Columbus.

Thank you both for your many years of dedicated service to the banking industry!

Premier Community Bank, Marion was honored to support the Chester L.Krause Legacy Park project in Iola with a $10,000 donation.

Pictured (left to right) are: Jeannine Harbridge, Premier Community Bank customer service representative; Dixie Anderson, universal banker; Mark Sether, legacy park coordinator; Jerry Kopecky, legacy park coordinator; Kim Karski, customer service representative; Casey Gardner, Premier Community Bank branch manager; and Michael Koles, Premier Community Bank Board Member.

Marty Hudson

Zietlow

Pfalz

Vassar

Findysz Arnold

McDonald

Dalsoren

Schumacher

Olson

Leinfelder

Wery

Marty Hudson

Zietlow

Pfalz

Vassar

Findysz Arnold

McDonald

Dalsoren

Schumacher

Olson

Leinfelder

Wery

SEPT. | OCT. | 2023 17

Wegner Johnson

Tax Parity

(continued from p. 1)

been actively engaged in that fight alongside the industry, including lobbying for a tax break for banks at both the state and federal level as an option in addition to the option of taxing larger credit unions and Farm Credit. Our collective perseverance paid off this year at the state level in Wisconsin, so every banker that ever attended a Capitol Day in Madison or a

This historic tax law change, signed by the Governor on July 5, 2023, is estimated to save the industry at least $30 million in Wisconsin income taxes annually.

Washington D.C. trip or made a call to a legislator on this subject should give themselves

and the industry a loud round of applause.

The historic tax law change included in the budget bill this session by the legislature and signed by Governor Tony Evers on July 5, 2023 gives C-and S-Corp banks a tax exemption on the interest, penalty, and fee income earned on commercial and ag purpose loans of $5 million

Wisconsin Banks Receive Significant Tax Parity

Thank you, banking advocates!

»Learn more about several other state budget items on p. 5 of this issue.

or less where the loan is made to a Wisconsin resident, or a business located in Wisconsin. The change is effective for tax years after December 31, 2022. This meaningful tax exemption further enhances the positive economic climate in Wisconsin and is another reason why Wisconsin is a good place to do business for banks. This change is estimated

to save the industry at least $30 million in Wisconsin income taxes annually. Wisconsin is the first state in the country to have a tax exemption like this for the banking industry.

When WBA and its Board of Directors looked at the data about 18 months ago, we realized that the arguments we’ve been raising for decades about the credit union industry

Get strategies to support your institution’s future and plan for growth at the nation’s premier conference for ag bankers. We’ll look at what’s in store for ag this year and beyond, from Farm Bill reauthorization to ESG issues, arti cial intelligence and more. 2023 ABA AGRICULTURAL BANKERS CONFERENCE November 5–8 Oklahoma City Convention Center Oklahoma City, OK REGISTER NOW aba.com/AgConfSA 18 SEPT. | OCT. | 2023

» Join WBA’s advocacy efforts at wisbank.com/advocacy. (continued on p. 19)

Tax Parity

(continued from p. 18)

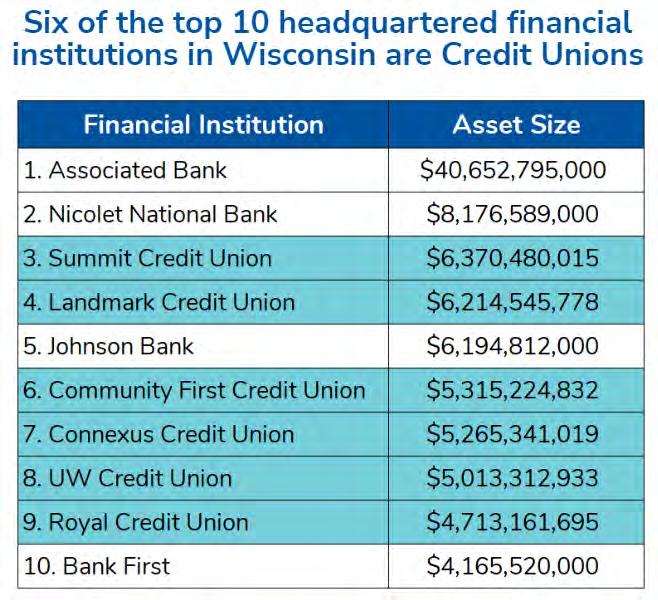

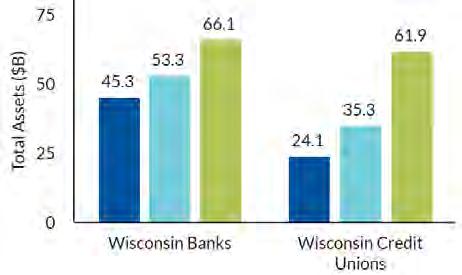

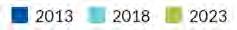

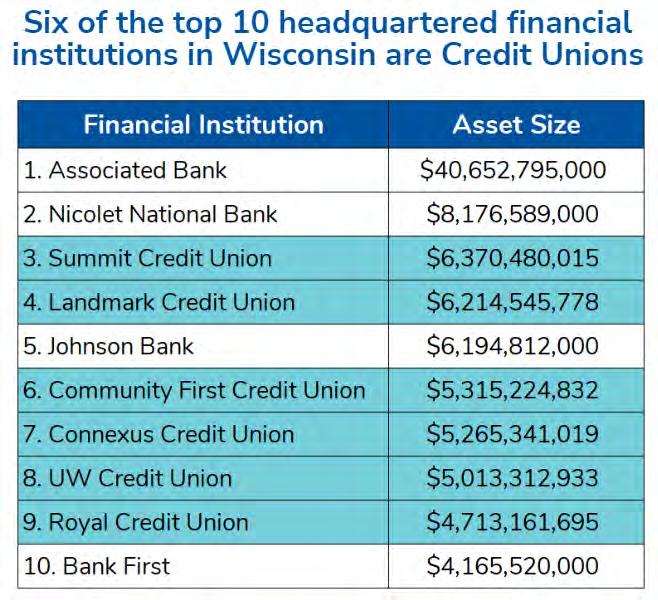

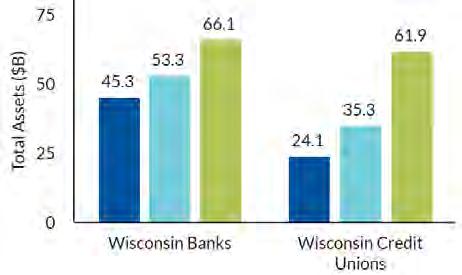

were coming to fruition. As a result of their tax advantage, state-chartered credit unions have grown in total assets three times faster than statechartered banks in the last ten years. Indeed, total assets of state-chartered credit unions are now almost as large as the total assets of state-chartered banks (see chart, near right).

Furthermore, the average size of state-chartered credit unions exceeds that of state-chartered banks. As of the first quarter of 2023, the average asset size of state-chartered credit unions is $568 million compared to $529 million for statechartered banks. This disparity continues to grow each quarter that WBA has been

measuring since last year.

Given the current environment, the WBA Board decided that now was the time for some type of tax parity to happen in order to preserve the breadth of financial institutions in Wisconsin. If we continued to do nothing, credit unions in Wisconsin will only grow larger at the expense of the banking industry. As of the first quarter of 2023, six of the top 10 headquartered financial institutions in Wisconsin are credit unions (see chart above, far right)

The WBA Board put substantial resources behind

this strategic advocacy priority which staff leveraged to achieve this unprecedented bi-partisan result. WBA, with the help of its outside law firm Godfrey & Kahn, drafted several different potential legislative options for key leadership to consider as we engaged in conversations and necessarily pivoted when hurdles arose. WBA’s

without the relentless (and often frustrating) conversations that current and former bankers have had with legislators throughout the decades to set the stage. WBA has always said we need bankers to be engaged in our advocacy efforts with us to achieve our goals — even when the conversations seem pointless. If elected officials had not continually heard from

the new law. WBA continues to advocate for an interpretation that aligns with the plain meaning of the language and the terminology as it is understood in banking law. WBA shared a Frequently Asked Questions document on the tax law change with the membership soon after the bill was signed into law. WBA members may request a

Government Relations team, working alongside our contract lobbying firm of Schreiber GR, spent countless hours talking with many key elected officials to ensure passage of the ultimately agreed upon language in the budget bill. Many bankers were also involved in conversations with key elected officials at various times throughout the last 18 months to provide a constituent voice on behalf of the industry. This multi-faceted, coordinated effort was necessary to achieve this milestone; however, it also would not have happened

their constituents and WBA about this unfair tax advantage and the impact it has and is having on the banking industry, we would not have achieved this result. If the industry is silent and not represented, the industry will be on the menu for dinner.

Despite this historic achievement, WBA’s advocacy on this new tax law is not done! WBA staff is shifting focus to the Department of Revenue as we look for guidance and rules to interpret

copy from our Legal team at wbalegal@wisbank.com

Thank you to the banking advocates who continue to stand alongside the Association to promote a heathy environment for banks in Wisconsin — your voice makes a difference! WBA staff look forward to seeing you at one of our upcoming events and celebrating this historic victory with you.

Oswald Poels is WBA president and CEO.

W INTER L EADERSHIP S UMMIT • November 8 WBA Building Our

Tomorrow Glacier Canyon Lodge & Convention Center • Wisconsin Dells wisbank.com/bolt

Leaders of

SEPT. | OCT. | 2023 19

Total Assets of Wisconsin State-Chartered Financial Institutions

Serving Amish and Mennonite Communities in Rural Wisconsin Getting to know diverse bank customers

By Cassandra Krause

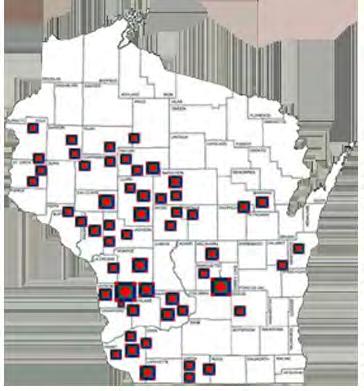

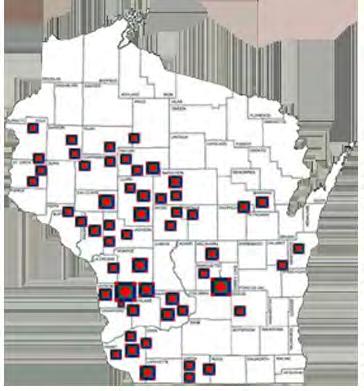

The Amish may not be the first group to come to mind when thinking about the fastest growing populations in the United States (and even the world), however these communities — whose populations double about every 20 years — play an important role in rural America, especially in Wisconsin. The Amish trace their heritage on this continent back about 300 years, when a small group of settlers immigrated to colonial Pennsylvania. According to the Max Kade Institute for German American Studies, today, there are approximately 350,000–400,000 Amish in North America (none remain in Europe), with more than 21,000 calling rural Wisconsin home. Wisconsin has the fourth-largest Amish population among 32 U.S. states and four Canadian provinces. Wisconsin also has a population of approximately 5,000 Old Order Mennonites as well as smaller numbers of other Mennonite groups and Old German Baptist Brethren. These groups are collectively described as Plain people, referring to their plain style of dress. Plain communities add to Wisconsin’s diversity and are familiar faces at many community banks.

Who Are the Amish and Mennonites?

Dr. Mark Louden, professor of German linguistics at UW–Madison and director of the Max Kade Institute, is a leading expert on the language and culture of Amish and Mennonites. He explains that Amish and Mennonites are Anabaptist Christians who practice believer’s baptism (babies are not baptized; rather, members formally join the church as teens/young adults)

and are nonresistant, meaning that they do not engage in violence, including serving in the military. Old Order Mennonites and Amish wear modest, traditional clothing as an outward expression of humility. Women wear simple dresses and a veil, also called a prayer covering or kapp, over their hair. A larger bonnet is something that may be worn over the veil. Men wear solidcolored shirts and suits with wide-brimmed hats. The degree to which Plain people limit the use of technology depends on the group — as is the case in mainstream American culture in which some people may, for example, limit screen time or opt for a paper calendar rather than a digital one. Most Amish groups do not have electricity in their homes and do not own or operate motorized vehicles.

Farming and Beyond: Economic Activity

Plain people are active in a number of areas of the economy. The percentage of Amish families that depend on agriculture as their main source of income is only around 10–15% nationally, however, Amish and Old Order Mennonites live in rural areas and typically have large gardens. Businesses commonly owned by Plain people include carpentry — especially in Wisconsin

where lumber is abundant — construction, and retail stores selling quilts, crafting supplies, bulk food, and baked goods. Outside of Wisconsin, some Amish are employed by non-Plain-owned businesses such as factories.

Finances in Amish and Mennonite Communities

Amish and Mennonite communities practice mutual aid, which sometimes involves assisting each other financially. Amish do not purchase commercial insurance or accept government assistance, so when there is a special need, the community steps in to help. They also do not typically take out loans other than mortgages for property, especially farms. Business loans are very uncommon, as the types of businesses Amish run are generally relatively small and do not require large amounts of capital to start up or grow. Amish farmers also do not use the types of equipment that other farmers may borrow larger sums for. Louden notes that “Amish and Mennonites are known for being extremely good customers… bad debt is hardly a concept.” He adds that if, in a rare instance, somebody were unable to pay their mortgage, the community would likely step in to, “not necessarily give them a lot of

fish, but teach them to fish,” in order to help them with their money management and get them back on their feet. Louden emphasizes that financial responsibility is important in Amish and Mennonite culture.

Louden said that a misunderstanding persists that the Amish do not pay taxes, when they do, in fact, pay income and property taxes. The only exception has to do with Social Security and Medicare taxes. Members of Amish, Old Order Mennonite, and other churches who decline any form of government assistance may apply for an exemption from Social Security and Medicare withholding by filing IRS Form 4029.

Tips for Best Serving Amish and Mennonite Customers

“Small scale and face to face is preferred” when it comes to banking Amish and Mennonite customers, Louden explains. “Folks who work in banks in small communities in proximity to Amish and traditional Mennonites get to know their Amish and Mennonite customers well and see them a lot because they’re coming in there. . . they’re even using the drive through windows with their horse and buggy.” He said

on p. 21)

(continued

Wisconsin Amish Settlements, 2019

20 SEPT. | OCT. | 2023

Map created by Mark L. Louden

(continued

that there aren’t really special accommodations bankers need to make for their Amish and Mennonite customers; just treat them in the same friendly manner they do for any other customer. Amish and Old Order Mennonites are fully bilingual in Pennsylvania Dutch and English, so translation is not needed.

Having a hitching rack available for parking is considered a best practice for banks and other businesses (e.g. Walmart, Costco, etc.) that serve Amish customers.

A 2021 Banking Dive article highlights how a community bank in Lancaster County, Pennsylvania (home to one of the largest Amish populations), took an even more creative approach. The Bank of Bird-inHand debuted their first “gelt bus,” which translates from

Pennsylvania Dutch to “money bus,” for mobile banking in 2018. They now offer a fleet of bank branches on wheels to visit their Amish customers.

Amish and Mennonites tend to use checks most frequently and will balance their checkbooks by hand. They will use debit cards, and many will use credit cards; paper statements in the mail are usually preferred.

Photo identification may be a topic banks need to navigate, as many Amish do not like to have their photo taken due to religious belief. “Banks are required by law to establish a reasonable belief as to the true identity of their customers,” notes Scott Birrenkott, WBA director – legal. “Fortunately, the law does give some flexibility. In that regard, a bank working with Amish customers should consider how their policy is tailored given the unique lifestyle of the Amish.”

Sheila Kast, BSA Officer, AVP at Horicon Bank, explains that their bank’s Amish customers do have Social Security numbers and cards. For their Amish customers in the Kingston area, their deposit and loan operations team will verify the customer’s name in the Kingston Amish Directory. For verification of identification, Horicon Bank requires at least two of the following documents:

»Social Security Card (required)

»Property Tax Bill

»Tax Document/Tax Return

»Marriage Certificate

» Birth Certificate

»Fishing/Hunting License

On the lending side, banks may find that mortgages for Amish customers necessitate unique procedures since they do not have electricity or carry insurance. A lender may find difficulty working with investors if the borrower

is unwilling to obtain homeowners insurance, requiring a tailored risk management approach.

Birrenkott explains that some banks may have policies tailored to working with Amish borrowers. For example, Horicon Bank has indicated that policies from the Amish Aid (a non-profit alternative to commercial insurance) are accepted for insurance. The issue of flood insurance may offer less flexibility, however, because if the property is in a flood zone, Federal law requires flood insurance with no exception due to religious belief.

A Look Ahead at Wisconsin’s Rural Communities

As Wisconsin experiences shifting demographic and migration trends — particularly outmigration from rural areas as younger people flock to urban and suburban areas —

(continued on p. 23)

Amish/Mennonites

p. 20)

from

Kevin Volker 608.213.4987 Sarah Dolan 773.354.4837 qcbt.bank/correspondent-banking 4500 N. Brady Street, Davenport, Iowa CorrAccess A web-based cash management tool that allows us to serve as the bridge between your financial institution and the Federal Reserve. CorrExchange Lowers costs of clearing transit items through our OnWe® Image Exchange Network Correspondent Lending Available for Bank Stock Loans, Personal Loans, Officer/Director Loans, Participation Loans, Secured and Unsecured Lines of Credit and Letters of Credit. Additional Services Wealth Management Equipment Financing/Leasing Safekeeping International Services Trust Services A Full-Service Partner You Can Bank On. Quad City Bank & Trust is committed to building long-term relationships by providing the right tools and personalized service. SEPT. | OCT. | 2023 21

Moving Banking Forward

At Reinhart, we take the time to understand your financial institution inside and out so we can be at your side for whatever comes your way. We’ll earn your trust and loyalty with our integrity, agility and responsiveness. And we’ll work collaboratively with you and each other to pursue and achieve your greatest ambitions.

Our experienced attorneys represent a comprehensive range of banking and financial industry legal services, all coordinated by a single touchpoint for you to simplify even the most complex challenges and opportunities.

reinhartlaw.com

mlanska@reinhartlawcom John Reichert jreichert@reinhartlawcom 22 SEPT. | OCT. | 2023

Melissa Y Lanska

Introducing FLEX: Retail and Marketing Summit

The newly rebranded event kicks off on November 15

In 2013, the Wisconsin Bankers Association (WBA) brought together retail, sales, marketing, and financial literacy bankers in Wisconsin for its first annual LEAD360 Conference. The event — which focused specifically on education, networking, and idea sharing — has provided thousands of bankers with the opportunity to connect with their peers, learn from industry experts, and return to office with action items. As the event approaches its tenth year, and the banking industry continues to undergo significant development, LEAD360 has now been rebranded as the FLEX: Retail and Marketing Summit.

“In today’s fast paced retail and marketing world, it is only appropriate that the Association continues to provide resources and highlight the efforts of bankers who work diligently to assist their bank in remaining up-to-date and relevant,” stated Miranda Gustafson, WBA assistant director – education. “Although the name has changed, the Summit continues to connect attendees with opportunities to expand their networks, exchange ideas, and deepen

Amish/Mennonites

(continued from p. 21)

it is important to recognize the role of the growing populations of Plain people in rural communities. Amish, for example, have on average six to seven kids per family, approximately 85–95% of whom formally join the church as young adults, depending on the group. This is notable, as national trends show younger Americans identifying less and less with formal religion. Data from the Pew Research Center in 2015 showed the highest

FLEX

“Both new and experienced bankers are sure to leave motivated and inspired for the year ahead.”

— Lisa Lyon vice president – treasury management director Pillar Bank, Baldwin

their understanding of various industry trends and innovations.”

A familiar face at many WBA events, Lisa Lyon will be attending her eighth FLEX Summit in 2023. Having served in various retail and marketing-support positions since beginning her tenure at Pillar Bank, Baldwin in 2013, Lyon finds significant value in the connections she has had the opportunity to foster and new ideas she has been able to introduce to the bank.

“Every year, WBA’s FLEX Summit provides several general sessions focused on particular, big ideas related

Retail and Marketing Summit

November 15–16, 2023

to retail and marketing,” highlights Lyon. “These sessions are often complemented by additional round table discussions and peer networking sessions in which attendees have an opportunity to discuss various topics in greater detail, or dive into other ideas. To me, this is the most valuable aspect of the annual event, and why I — and many of my colleagues — return year after year.”

Gustafson notes that attendees can expect over eight hours of presentations — including general and breakout sessions — as well as ample time to network with exhibitors and bankers from across the state during the two-day event. The Summit will kick off in Wisconsin Dells on the morning of November 15 and adjourn at noon the following day.

Sales, marketing, and retail-focused bankers will also benefit from tracks planned in conjunction with the WBA Retail and Marketing Committees.

In addition to more than a day’s worth of sessions, the FLEX Summit will also feature two award ceremonies during a breakfast program on November 16. The first, which is presented by the Wisconsin Bankers Foundation, will recognize the efforts of bankers involved with financial education in Wisconsin communities from June 1, 2022 to May 31, 2023.

Interested in being recognized with WBA’s inaugural Marketing Award? Submit your bank’s innovative marketing technique at wisbank.com/MarketingExcellence by September 30.

retention rates for Millennials were among Jews (70%) and those raised unaffiliated with a religion (67%), followed by those raised in the evangelical Protestant (61%), historically black Protestant (60%), Catholic (50%), and mainline Protestant (37%) traditions. Plain people are woven into the fabric of their rural communities. As such, they play an integral part in the past, present, and future vitality of Wisconsin.

Krause is WBA director

communications.

In addition to attending the annual event, Lyon — who now serves as vice president –treasury management director — is actively involved with the WBF Financial Literacy Advisory Board. The Advisory Board, representing bankers involved with promoting financial literacy and capability throughout their communities, is charged with aiding WBA staff in the planning and organization of the financial literacy track during the Summit.

“Financial literacy often falls to a bank’s retail and marketing team, so tying financial education-focused components into an event like FLEX ensures that bankers who wear many hats are able to make the most out of their time away from their desks,” says Lyon.

The second award ceremony — a new addition to FLEX in 2023 — will recognize one member bank that demonstrated an innovative marketing campaign between August 1, 2022 and July 31, 2023. Submissions for the inaugural WBA Marketing Award are now being accepted at wisbank.com/ MarketingExcellence through Saturday, September 30.

Lyon underscores that FLEX is the perfect opportunity for bankers of all levels to get involved. “So much good comes out of events like FLEX. From broadening your knowledge to fostering connections statewide, new and experienced bankers are sure to leave motivated and inspired for the year ahead.”

» Visit wisbank.com/ FLEX to see the complete agenda and to register

WBA

–

SEPT. | OCT. | 2023 23

Are Your IT Audits Serving Your Cybersecurity Needs?

By Rob Foxx, CCBTO

Cybersecurity is quickly joining phishing, artificial intelligence (AI), and ransomware on the list of information technology (IT) industry buzzwords — but that isn’t entirely a bad thing. Cybersecurity is the practice of protecting your digital data and is just one aspect of the information security charged with protecting the institutions whole database.

When asked how they know if their institution is correctly safeguarding its data, many may refer to their IT team. While it is not wrong to rely on these individuals, it is important that all bankers understand their bank’s positioning. To do so, bankers may consider

FIPCO IT & Audit Services

Rob Foxx rfoxx@fipco.com

sitting in on an IT audit, or at the very least, familiarizing themselves with the process of a risk assessment and review of all policies, procedures, guidelines, and standards. While not all IT audit programs are created equally, and the review may also examine a host of other items, many audits are required by regulators and are performed at some frequency related to the bank’s level of risk.

Many IT audit programs only cover IT operations,

governance, and general controls. However, these are limited in scope and often do not cover the areas of highest risk in greater detail. In the banking industry, these highrisk areas usually include:

»Access controls: How your data and information systems are accessed;

»eBanking: Outward facing digital profile;

»Disaster recovery and business continuity planning: What do you do in a disaster and how do you recover business functions; and

»Vendor Management: How do you manage your third-party vendors.

Although many professionals are able to write a document review, the errors are often not as clear as it might be to an outside source and management may not have the expertise to see these problems. In order to receive high quality feedback, employing an outside auditor may be the best solution for your bank. However, it is important to select your auditor carefully.

While some auditors do not review all the documentation provided to them, others may only review documents that are sanitized or redacted for confidentiality. Finding an industry peer to conduct a complete review may be difficult, but it is entirely worth it for the security of the institution. One of the most obvious signs of a poor auditor will be their lack of comments on the provided documentation. If this happens, chances are that the documentation was not reviewed.

When selecting an auditor, it is also important to understand what security standard they adhere to. Many may only consider guidance presented by the

Federal Deposit Insurance Corporation (FDIC) or Federal Financial Institutions Examination Council (FFIEC). While these are both fine for remaining compliant, they may not have your security best interest in mind.

Guidelines from the National Institute of Standard and Technology (NIST), International Organization for Standardization (ISO), or Center for Internet Security (CIS) offer a better framework for security controls and can help make the institution more than just compliant. Additionally, it is often a best practice to invest in an auditor who has experience working with the banking industry and will work with the bank’s needs and goals in mind.

Finally, consider auditors who do more than just an audit. A good auditor will take the time to explain their findings and offer recommendations, advice, sample documentation, or even connections with other resources to help answer your questions.

While IT audits can be a stressful event for everyone involved — it does not have to be. FIPCO’s IT Audit & Security Service is designed to cover critical aspects of business operation and ensure that vulnerabilities are identified before its too late. To learn more about this service, please contact me at rfoxx@fipco. com or reach out to our team of professionals at 800-722-3498.

Foxx is director – infosec and IT audit services for FIPCO. He can be reached at rfoxx@fipco.com or 608-441-1249.

For more information about FIPCO forms, software, or other products, visit fipco.com, call 800-722-3498, or email fipcosales@fipco.com

FIPCO is a WBA Gold Associate Member.

24 SEPT. | OCT. | 2023

October is national cybersecurity month LOAN & MORTGAGE FORUM October 11, 2023 | Wisconsin Dells or Virtual Join FIPCO and your banking peers for software training and presentations regarding the following topics: •Trusts in Compliance Concierge •Admin Parameters in Compliance Concierge •Discussion with FDIC Examiners •Recent Exams – Lessons from the Field •Manufactured Homes With and Without Real Property in Compliance Concierge •All Things Business in Compliance Concierge •Harmful Cyber Attacks •Legal and Compliance

Principles of Banking

September 26–27 | Madison

October 25–26 | Tomah

Intended to give those who are new to banking a general understanding of the industry, this school provides a comprehensive introduction to the banking industry, fundamental banking concepts and principles, and much more.

Consumer Lending Boot Camp

October 3–4

Developed to help build the foundation and skills necessary to become a successful

It’s Back-to-School Time!

Upcoming education opportunities for Wisconsin bankers

Fall has arrived and schools are back in session, and that means your WBA banking schools are back in session as well! Every school offers in-depth learning experiences for various roles of staff within your bank. Each school will be held at the WBA office in Madison, unless otherwise noted. Visit wisbank.com/education for more information about these schools and to register your team.

consumer lender or processor. During the course, students will learn, and put into practice, the process of basic lending.

Supervisor Boot Camp

October 16–17

Interactive workshop geared at new and experienced supervisors who are looking to expand their leadership skills and succeed as a highly effective supervisor.

To learn more or to register, visit wisbank.com/education

Commercial Lending School

October 18–20

An advanced-level program assuming participants have work experience and prior training in commercial lending and/or financial statement analysis.

Personal Banker School

November 14–15