By Hannah Flanders

In June, Donna Hoppenjan began her yearlong term as chair of the Wisconsin Bankers Association’s (WBA) Board of Directors. As the second woman to serve as WBA’s chair — and one of only 18 women currently holding the position of president or CEO at a Wisconsin bank — Hoppenjan looks forward to shaping the future of the industry.

Growing up on a century-old dairy farm in southwestern Wisconsin, the value of hard work and commitment were

New WBA Chair: Donna Hoppenjan Mound City Bank president and CEO addresses this year’s priorities

instilled in Hoppenjan at a young age. In 1977, she began working as a teller at Platteville’s Mound City Bank. Hoppenjan graduated from the Graduate School of Banking at the University of Wisconsin –Madison and served for six years on the Graduate

School of Banking

Advisory Board.

Throughout the years, Hoppenjan has served in various roles throughout the bank including audit, compliance, human resources, trust, and operations. In 2013, she was named as the

president and chief executive officer. After 46 years at the bank, Hoppenjan looks back fondly on her mentors who encouraged her to give back.

“Early in life, I saw how involved my parents were in local organizations and non-profits,” states Hoppenjan. “They, alongside my peers, inspired me to not only pursue a career I was passionate about, but to consider how I am able to serve my community.”

Be an inspiration. By standing united, being engaged, and staying educated, we can ensure the continued success of the banking industry, the Association, and Wisconsin communities.

in many areas of her community. From serving on the boards of Southwest Health and her local church, to working on the Ambassador Committee of the

(continued on p. 8)

The Rise of Artificial Intelligence in Banking

Banks in Wisconsin explore the use of AI

By Hannah Flanders

Just five years ago, the idea that AI, or artificial intelligence, could be integrated into nearly every aspect of the human experience seemed like a topic for future generations.

However, the further we wade into the 2020s, the

more each of us comes to encounter aspects of AI

Today, Hoppenjan is actively involved in our daily lives, even without recognizing it. As the capabilities of AI multiply and the number of individuals utilizing this unique technology expands, professionals in many sectors of the U.S. economy — including the financial services — are considering the ways in which AI impacts their business and the surrounding communities.

» What is AI?

Despite what many think, AI is not a new phenomenon. Shortly after the creation of the first digital computer, scientists in the 1950s birthed the concept of AI as they explored the possibility of creating an artificial brain. Today, AI has molded into the creation of technology that has the potential to add efficiencies to our daily lives.

In its current state, AI is a computer system with the capability to sense, think, learn, and take action.

Throughout the day, we may encounter AI technology by way of recommendations on our favorite streaming platforms, the anti-virus software that scans our emails for spam, or timed traffic signals. However, the Pew Research Center recently found in its study “Public Awareness of Artificial Intelligence in Everyday Activities” that only around 50% of individuals believed that they interacted with some form of AI more than twice a week.

As technology continues to become more widely available, the development of AI

(continued on p. 22)

PRSRT STD U.S. POSTAGE PAID UMS Wisconsin Bankers Association 4721 South Biltmore Lane Madison, WI 53718 JULY | AUGUST | 2023 WISCONSIN BANKERS ASSOCIATION FOUNDED 1892

Be the Inspiration for the Future of Our Industry

By Donna J. Hoppenjan

Throughout my 46 years in banking, one thing has remained absolutely certain — the dedication of bankers in Wisconsin. For over 130 years, the Wisconsin Bankers Association (WBA) has stood as the pillar for banking throughout the state. From educational and advocacy opportunities to resources for members to utilize, our Association remains top tier in its ability to provide bankers in Wisconsin with a wide variety of ways in which they can get involved and make a difference in their bank and throughout their community.

As I begin my term as chair of WBA’s Board of Directors — representing over 30,000 bankers throughout Wisconsin — I look forward to continuing the Association’s longstanding tradition of inspiring success within our industry and

Message from the Chair

Donna J. Hoppenjan

Donna J. Hoppenjan

encouraging every member to consider their role in shaping the future.

The inspiration to expand your skillset, grow your connections, and engage with your community is around every corner. In partnership with WBA, member banks have the ability to take advantage of educational programs designed to assist all bank employees in their pursuit of knowledge and expertise. Our Association hosts a variety of in-person and virtual courses that are not only relevant to bankers in our state, but

also facilitate connections with their peers.

At its core, the Association is rooted in engagement. Without the participation of over 150 volunteer Advocacy Officers, committee participants, and advisory board members, WBA would be nowhere near as relevant or impactful as it is today. However, just as the WBA membership plays a role in shaping our Association, each of us has the responsibility to prepare our next generation of banking leaders and shape the perception of our industry.

Through WBA, bankers can participate in events or any combination of peer groups, networks, and committees to enhance their leadership skills and be inspired by the efforts of their peers. WBA also spearheads initiatives such as Power of Community Week,

Teach Children to Save Day, Capitol Day, and career nights at various schools that encourage bankers to step out of the office and into their communities. The events offer members opportunities to establish and foster relationships with students, business owners, nonprofit organizations, elected officials, and so many others.

This year, as your team considers the multitude of ways in which you can inspire your fellow bankers, encourage the next generation, and influence growth throughout the industry, I remind you to look to your Association and stand united. Together, we can continue to support the longterm growth of the banking industry and elevate our Association for years to come.

Hoppenjan is president and CEO of Mound City Bank, Platteville, and the 2023–2024 WBA Chair.

Turnaround, Acquisition, and Expansion Solutions

firstbusiness.bank/abl Fueling

We help companies overcome financial obstacles through innovative Asset-Based Lending solutions, focusing on small- and mid-market companies in transition with credit requirements from $2,000,000 to $18,000,000. First Business Bank offers Asset-Based Lending solutions through its wholly owned subsidiary, First Business Specialty Finance, LLC. Member FDIC CALL US TODAY TO LEARN MORE Mike Colloton – Milwaukee – 262 -792 -7180 Pete Lowney – Madison – 608 -232 - 5987

2 JULY | AUGUST | 2023

Moving Banking Forward

At Reinhart, we take the time to understand your financial institution inside and out so we can be at your side for whatever comes your way. We’ll earn your trust and loyalty with our integrity, agility and responsiveness. And we’ll work collaboratively with you and each other to pursue and achieve your greatest ambitions.

Our experienced attorneys represent a comprehensive range of banking and financial industry legal services, all coordinated by a single touchpoint for you to simplify even the most complex challenges and opportunities.

reinhartlaw.com

John Reichert jreichert@reinhartlawcom JULY | AUGUST | 2023 3

Melissa Y Lanska

mlanska@reinhartlawcom

38368 *We do not reparticipate loans. Partner with us for: •Loan participation purchases and sales* •Bank stock financing •Bank executive and employee financing Callie Schlieman Call me at 701.433.7430 Based out of Fargo, N.D. Specializing in bank stock and Regulation O lending Our Mission Is to Help You Succeed 4 JULY | AUGUST | 2023

Navigating Wisconsin’s Marital Property Act

WBA’s top two marital property questions

By Scott Birrenkott

The Wisconsin Marital Property Act presents unique community property considerations for Wisconsin banks. While nothing has changed in this area of law, its nature gives rise to some frequently asked questions. Below are two of the most commonly received questions through the Wisconsin Bankers Association’s (WBA) Legal Hotline.

Question 1: Is a bank permitted to pull credit on a non-signing spouse?

Answer 1: Yes. When dealing with married Wisconsin residents, a bank is permitted to pull credit on a non-signing spouse and may even be required to do so.

Wisconsin Section 766.56(1) requires creditors to consider all marital property available to satisfy the debt when evaluating a married Wisconsin resident’s application for family purpose credit. Where there is an obligation in the interest of the marriage or family, being a “family purpose” obligation, the creditor must consider all marital property available to satisfy the obligation in the same manner that it considers the availability of property of an unmarried applicant. While the law does not define “family purpose,” the presumption is that an obligation incurred by a spouse during marriage is

Did You Know?

Compliance Column

Scott Birrenkott

family purpose. Additionally, income would be presumed to be marital property unless there is a marital property agreement indicating otherwise. Because the Wisconsin Marital Property Act requires creditors to consider all marital property available to satisfy the debt, a bank may be required to do so.

Regulation B Section 1002.5(c)(2) allows the bank to request information about the applicant’s spouse if the applicant resides in a community property state or is relying on property located in such a state as a basis for repayment of the credit requested. As Wisconsin is a community property state, banks are permitted to pull credit on a non-signing spouse.

Question 2: How does the Homestead Rule Affect Mortgages for Married Wisconsin Residents?

Answer 2: Wis. Stat. Section 706.02(1)(f) requires that each spouse with homestead rights must sign the mortgage for it to be valid unless an exception applies. In this context, homestead means the dwelling, and so much of the land surrounding it as is reasonably necessary

Wisconsin Banker occasionally prints informative articles submitted by Gold, Silver, and Bronze WBA Associate Members. Interested in sharing your expertise? Please contact WBA’s Nick Loppnow at 608-441-1259 or nloppnow@wisbank.com or email sales@wisbank.com for more information about purchasing Sponsored Content space in WBA’s electronic publications.

Visit the compliance section of the WBA website at wisbank. com/resources/compliance

for use of the dwelling as a home, but not less than onefourth acre, if available, and not exceeding 40 acres. It is WBA’s understanding that title companies are typically able to provide an indication of whether the property would be considered a homestead under this definition.

Once a bank has determined the pledged property as a homestead, the bank must consider Section 706.02(1)(f). If the mortgage alienates any interest of a married person in a homestead, then each married individual must sign the mortgage in order for it to be valid.

The only exceptions to this rule are for conveyances between spouses and for purchase-money mortgages.

Conclusion

While these are the top two questions received by the WBA legal department, this list does not exhaust what marital property questions the team receives. As such, more frequently asked question related to Wisconsin’s Marital Property Act can be found at wisbank.com/compliance

Birrenkott is WBA director – legal. For legal questions, please email wbalegal@wisbank.com

Note: The above information is not intended to provide legal advice; rather, it is intended to provide general information about banking issues. Consult your institution’s attorney for specific legal advice or assistance.

•

Portfolio Analytics

Portfolio Accounting

Municipal Bond Credit Support

Asset Liability Management Reports

Staff with depth and experience

•

•

•

•

•

Leading Underwriter of Upper-Midwest Bank Qualified Municipal Bonds (Source: Bloomberg League Tables Annual Rankings) At Northland, our mission is providing direction and producing results toward our clients’ goals. We are trusted professionals in the business of investing Financial Institution portfolios. THANK YOU for your consideration! RC 22-639 Muni 22- 549 1222 Partn ering with community banks for over 20 years Visit NorthlandSecurities.com Two offices in Wisconsin to serve your bank: 2675 N. Mayfair Road, Suite 550 Milwaukee, WI 53226 414-727-2229 958 Liberty Drive, Suite 202 Verona, WI 53593 608-476-6001 800-851-2920 | Member FINRA / SIPC | Registered SEC / MSRB JULY | AUGUST | 2023 5

Advocating For Wisconsin’s Banking Industry

By Lorenzo Cruz

2023 has been off to a busy start with a tremendous amount of activity at the state government level. In between monitoring state budget negotiations and the historic shared revenue agreement between GOP leaders and Governor Tony Evers, the Wisconsin Bankers Association (WBA) continues to follow several key priorities for the 2023–2024 legislative session.

Financial Institution Modernization Reform

As of this writing, WBA is in active negotiations with the Wisconsin Credit Union League on a modernization proposal. Many of the less controversial issues have been resolved, however, contentious issues — such

Advocacy Update

Lorenzo Cruz

the issue. This session, our team intends to reintroduce another bill to provide banks the statutory tools to help prevent this criminal behavior.

Interchange/Credit Card Swipe Fees

Throughout the federal and state government, interchange has seen a great deal of activity as of late. In Wisconsin, the Association defeated a retail-driven coalition pushing for interchange fee reform. Despite this, WBA continues to monitor this issue as it could resurface in separate pieces of legislation.

Privacy

Nearly 200 bankers from throughout Wisconsin visited the State Capitol during WBA’s Capitol Day on April 26. The event gave bankers the opportunity to connect with their elected officials and share their concerns. Thank you to those who made the trip and continue to support our advocacy efforts!

as those related to credit union acquisition of banks — remain. To date, the Association has defeated the credit unions’ efforts on non-member participation on loans and on the automatic adoption of federal rules. Our team, in addition to various banker volunteers, has also neutralized the potential abuse of supplemental capital by advocating for safety and soundness standards determined by the Wisconsin Department of Financial Institutions (DFI) on credit unions.

Elder Fraud

With financial exploitation of seniors remaining a persistent issue, protecting vulnerable adults from predatory fraudsters is a high priority for WBA. Last session, WBA passed a bill in one house on

As anticipated, a Legislative Reference Bureau (LRB) draft on data protection has been circulated. With heavy regulation under the Gramm Leach Bliley Act, WBA successfully added language to the proposal which exempts financial institutions and their affiliates from the new state regulation. WBA will monitor the progress of the bill to preserve the financial institution exemption.

Financial Literacy

In June, AB 109/SB 115, which would require one-half credit of personal financial literacy for graduation, passed in the State Assembly 95–1. WBA signed on to a cosponsorship coalition memo in support of the legislation.

Achieving a Better Life (ABLE) Accounts

(ABLE) Accounts: AB 121/SB 122, which would expand the resident options for creating ABLE accounts, passed through the State Senate 30–3 in June. WBA supports the creation of ABLE accounts at the DFI rather than having to go out of state for the product.

Housing Package

WBA-supported AB 39/ SB 40 makes changes to the low-income housing tax credit. The bill, which would increase the tax credit from $40M to $100M, is part of a larger housing package related to loans and tax credits administered by Wisconsin Housing and Economic Development Authority (WHEDA) and are intended to address workforce housing concerns.

With so many priorities in the works, it remains

imperative that WBA members are engaged in the grassroots and financial contributionrelated advocacy fronts.

In addition to the Association’s Advocacy Officer program — which is currently 115 members strong — there are several ways for bankers to get involved and support the banking industry. Capitol Day, which was held on April 26, is an excellent opportunity to make connections with legislators and share your experience and expertise. Thank you to the nearly 200 attendees who joined us at the State Capitol this year.

This calendar year, WBA created two donation levels — the Leadership Circle and the Hall of Fame. So far,

Achieving a Better Life

(continued on p. 7)

6 JULY | AUGUST | 2023

View a curent list of WBA Advocacy donors on p. 28.

Wisconsin Bankers Visit D.C. for WBA/ICBA Capital Summit

In May, nine bankers from across Wisconsin joined President and CEO of the Wisconsin Bankers Association (WBA) Rose Oswald Poels in Washington, D.C. to lobby on behalf of banks throughout the state. As a fundamental aspect of WBA’s efforts to support the industry, grassroots advocacy

is critical to the success of the Association’s advocacy priorities. Each year, bankers are encouraged to attend a Washington, D.C. summit to share their stories and reinforce the impact legislative proposals have on Wisconsin banks and their communities.

WBA/ICBA Capital Summit Attendees | May 14–17

Brooke Frehse, The Stephenson National Bank & Trust, Marinette · Mike Gargaro, Citizens First Bank, Trempealeau · Dave Feldhaus, FHLBank Chicago · Jeff Gruetzmacher, Royal Bank, Lancaster · Ryan Kamphuis, Bristol Morgan Bank, Oakfield · Butch Pomeroy, International Bank, Amherst · Lonnie Przybylski, International Bank, Amherst · Dan Ravenscroft, Royal Bank, Elroy · Julie Redfern, Lake Ridge Bank, Monona · Rose Oswald Poels, Wisconsin Bankers Association, Madison · Sean Murphy, ICBA · Julie Hanson, ICBA

This year’s attendees discussed topics ranging from Section 1071 data collection to the stability of banks in Wisconsin with several representatives in our congressional delegation — including Rep. Scott Fitzgerald (R-District 5), Rep. Mark Pocan (D-District 2), and Rep. Bryan Steil

(R-District 1). Additionally, attendees had the opportunity to meet with Sen. Tammy Baldwin (D) and Sen. Ron Johnson (R).

Thank you to the bankers (listed below) who joined WBA and ICBA and helped advocate on behalf of the Wisconsin banking industry.

Advocacy

(continued from p. 6) WBA has welcomed four leaders to the Leadership Circle for their contribution

of $3,000 or more. Nineteen WBA-member bankers have also achieved Silver Triangle status for contributing at least $1,000. As always, I encourage

members to consider joining one of these donation levels or donating what you can to support our advocacy efforts.

Thank you, again, to all the

members for your generous support of WBA. It truly does make difference.

Cruz is WBA vice president –government relations.

Attendees spoke with Sen. Tammy Baldwin (D).

Attendees spoke with Sen. Ron Johnson (R).

Attendees met with Rep. Mike Gallagher (R-District 8).

Attendees visited the Wisconsin congressional delegation on Capitol Hill.

JULY | AUGUST | 2023 7

WBA Holds Ceremony Installing New Board

Meet the 2023–2024 WBA Board of Directors

WBA held a ceremony on June 7 at the WBA Office in Madison to formally announce the 2023–24 Board of Directors. The event was also livestreamed to members around the state. Board members and committee chairs completing their service were recognized, and new board members and officers were welcomed. Thank you to all who have served, past and present, for your contributions to Wisconsin’s banking community!

Serving as WBA Board chair for the 2023–2024 fiscal year is Donna Hoppenjan, president and CEO of Mound City Bank, Platteville.

“We are honored to welcome Donna as chair of the WBA Board,” said Rose Oswald Poels, WBA president and CEO. “As only the second woman in WBA’s history to lead the Association’s Board, I am excited to work alongside her and witness the impact her experience and expertise will make on our industry.”

Also serving as officers on the WBA Board are: ChairElect Alvaro (Al) Araque, senior vice president, director of consumer, private, and small business banking, Johnson Financial Group, Racine; Vice Chair Paul Northway,

WBA Chair Hoppenjan

(continued from p. 1)

Platteville Regional Chamber of Commerce, Hoppenjan takes pride in aiding her community members and encouraging her team at Mound City Bank to do the same.

“Every year, Mound City Bank takes part in WBA’s Power of Community week,” notes Hoppenjan. “For this year’s event, our team aided a local non-profit organization in building 23 beds for children

president and CEO, American National Bank – Fox Cities; and Past Chair Dan Peterson, president and CEO, The Stephenson National Bank & Trust, Marinette.

Joining the Board for three-year terms are Kelly Heroux, president and CEO, Peshtigo National Bank; Shay Horton, president and CEO, Cumberland Federal Bank; Anthony (Tony) Nguyen, senior vice president

–regional banking director for Eastern Minnesota/Wisconsin/ Chicago, Wells Fargo; and Bill Sennholz, CEO, Forward Bank, Marshfield.

Those continuing their terms on the Board are: Paul Hoffmann, president, Lake Ridge Bank, Middleton; Ryan Kamphuis, president and CEO, Bristol Morgan Bank, Oakfield; Greg Lundberg, president and CEO, Fortifi Bank, Berlin; Jay Mack,

president and CEO, Town Bank, N.A., Hartland; Tom Mews, president, First National Community Bank, New Richmond; Greg Ogren, president and CEO, Security Bank Shares, Inc., Iron River; Joe Peikert, president and CEO, Wolf River Community Bank, Hortonville; and Dan Ravenscroft, president and CEO, Royal Bank, Elroy.

Learn more at wisbank.com/ about/board-of-directors.

Read more about Hoppenjan’s priorities on p. 2 of this issue.

in Grant County. Events such as Power of Community Week are the perfect opportunity for banks throughout Wisconsin to highlight their commitment to their neighbors and inspire one another.”

As chair of the 2023–2024 Board of Directors, Hoppenjan has set her sights on encouraging the membership to be

an inspiration. By standing united, being engaged, and staying educated, Hoppenjan believes that the WBA membership will play a substantial role in continuing the success of the industry, the Association, and communities in Wisconsin.

“Not only is it critical that our current leaders understand the importance of the next generation in banking by working in their communities to demonstrate the possibilities of this career to students of all

ages, but it is also vital that we all play a role in emphasizing to our current team members the ways in which they can explore professional growth, leadership opportunities, and make a difference.”

By remaining actively involved in the Association, bankers can engage in various educational programs to hone their skills and expand their knowledge, utilize resources such as the

(continued on p. 9)

Pictured are the 2023–2024 Board of Directors. Seated (left to right) are: WBA Past Chair Dan Peterson, Kelly Heroux, WBA President and CEO Rose Oswald Poels, WBA Chair Donna Hoppenjan, WBA Vice Chair Paul Northway, and Tony Nguyen. Standing (left to right) are: Greg Ogren, WBA

Chair-Elect Al Araque, Paul Hoffmann, Greg Lundberg, Tom Mews, Dan Ravenscroft, Joe Peikert, Shay Horton, Jay Mack, and Ryan Kamphuis. Not pictured: Bill Sennholz

8 JULY | AUGUST | 2023

Thank you for your leadership

WBA Welcomes 2023–2024 Committee, Section Chairs

June 1 marked the new term for WBA’s committees and sections, resulting in a changing of the guard in the officers in those groups. Our committees and sections are comprised of banker volunteers who provide perspective on issues affecting the industry, ideas for new products and services, and input on existing WBA offerings. Thank you to the outgoing chairs of our committees and sections (listed below) for their service in leading their respective groups.

2022–2023

Outgoing Chairs:

Agricultural Bankers

Section Board:

Chris Schneider

Vice President – Senior

Ag Banking Officer

Nicolet National Bank

Manitowoc

BOLT Section Board:

Jennifer Sobotta, CFMP

Vice President

–Marketing Director

Forward Bank, Marshfield

Financial Crimes Committee:

Kim Nesbitt

Retail Banking & Security Officer, First National Bank of River Falls

2023–2024 Incoming Chairs:

FIPCO Software Users

Committee:

Keith Kilen

Loan Operations Officer

DMB Community Bank

DeForest

Government Relations Committee: (two-year term)

Mark Oldenberg

President and CEO

Security Financial Bank

Eau Claire

Human Resources Committee:

Candy Allard

Assistant Vice President –Human Resources Specialist

Badger Bank, Fort Atkinson

Marketing Committee:

Stefanie Bonesteel

Vice President – Marketing

Citizens Bank, Mukwonago

Mortgage Lending Committee:

Christine Buckman

Universal Loan Officer

Pillar Bank, Baldwin

Retail Banking Committee:

Tom Sattler, President

The Equitable Bank S.S.B.

Wauwatosa

Technology/Operations Committee:

John Kress

Vice President – Chief

The following banker volunteers will lead the Association’s committees and section boards for the 2023–2024 fiscal year:

Agricultural Bankers

Section Board:

Craig Rogan

Vice President –

Agricultural Banking Officer

Nicolet National Bank

Stevens Point

BOLT Section Board:

Meredith Strieff

Vice President –

Retail Sales Manager

Horicon Bank

WBA Chair Hoppenjan

(continued from p. 8)

WBA Engagement Center or Best Practices Library, form connections with their banking peers, and advocate for the success of the industry

Hoppenjan and her husband, Rick, currently reside in Cuba City. She has two grown children — Chad, who lives in Dubuque, Iowa, and

Financial Crimes Committee:

Dave Oldenburg

Fraud Surveillance Manager, Corporate Risk Management

Associated Bank

Milwaukee

FIPCO Software Users Committee:

Shannon Lemke

Loan Processor/Compliance Specialist

Waldo State Bank

Sara, who lives in Sussex — and four grandchildren ranging in age from three to 17. Outside of the bank, Hoppenjan enjoys spending time with her family at their cabin in Bagley, boating on the Mississippi, and attending her grandchildren’s events.

Flanders is WBA writer/editor.

Government Relations Committee: (two-year term)

Mark Oldenberg

President and CEO

Security Financial Bank

Eau Claire

Human Resources Committee:

Candy Allard

Assistant Vice President –Human Resources Specialist

Badger Bank, Fort Atkinson

Marketing Committee:

Grace Bruins

Assistant Vice President –Marketing, Horicon Bank

Mortgage Lending Committee:

Mara Hird

Assistant Vice President –Residential Relationship Manager, Peoples State Bank

Prairie du Chien

Information Security Officer

The Equitable Bank S.S.B. Wauwatosa

Trust Section Board: Terry Chier

Vice President – Manager of Personal Trust Services

Thrivent Trust Company, Appleton

COMMITTEES / SECTIONS

We Need Your Expertise to Help Shape the Banking Industry’s Future

If you want to influence your industry’s future, consider lending your experience to one of these committees or sections, and find out for yourself how much you can impact Wisconsin’s financial services industry

To learn more about volunteering, please visit wisbank.com/committee.

Retail Banking Committee: Amanda Emery-Morris

Assistant Vice President

–Marketing and Human Resources

Farmers & Merchants Union Bank, Columbus

*Note: The Technology/Operations Committee and Trust Section Board chairs were not finalized at newsletter press time.

JULY | AUGUST | 2023 9

The Baker Advantage

Interest Rate Risk and Investment Strategies Seminar

August 29, 2023 | Stevens Point, WI SentryWorld Golf Course

In 2020, the global COVID pandemic set into motion a series of historically unprecedented economic policies that upended markets and financial institutions, as well as the global economy itself. Massive amounts of liquidity and stimulus by policymakers enabled a fast recovery, but financial institutions found themselves awash in excess liquidity needing to be put to work at historic lows in yield. With time, the explosion of reserves also triggered an inflationary impulse unlike anything seen in decades. The Fed has been scrambling to get back in front of events and regain control of inflation ever since. The resulting rate hikes and monetary policy tightening have been unprecedented in both speed and magnitude. Portfolio managers now find themselves with scarce liquidity and deep unrealized losses, not because of poor management or asset quality, but simply because of the enormous swing in liquidity.

This seminar will examine the challenges now faced by CEOs, CFOs, and investment officers who must navigate the next phase of these uncharted waters. Join us for an in-depth discussion of the following topics:

• Economic and Market Update — Review of current economic conditions and the outlook for growth, inflation, and interest rates

• The Fed’s Next Moves — Update on the rate outlook and likely next steps for Federal Reserve monetary policy

• Interest Rate Risk — How to ensure you are prepared for uncertain balance sheet challenges and a constantly changing regulatory focus

• Liquidity Risk Management — Tools and best practices for managing liquidity risk

• Investment Portfolio Strategies — Adapting your strategy and finding the best relative value for the rate environment

• MBS/CMO Market — Balancing prepayment and extension risk in a changing environment for mortgage securities

• Municipal Market Update — Thoughts and strategies on managing municipal credit risk and finding the best relative value

SentryWorld Golf Course

601 Michigan Ave N Stevens Point, WI 54481 715.345.1600

AGENDA

Tuesday, August 29

Breakfast 7:30 am

Seminar 8:30 am

Lunch 12:00 pm

Golf 1:00 pm

WHO SHOULD ATTEND

Financial institutions’ CEOs, CFOs, investment officers, board members, and those who are directly or indirectly responsible for financial management functions will benefit from this seminar. There is no cost for this seminar.

3.5 hours of Economics and Finance CPE credits will be earned for your attendance.

Member: FINRA and SIPC www.GoBaker.com | 800.937.2257 Oklahoma City, OK | Austin, TX | Dallas, TX Long Island, NY | Salt Lake City, UT | Springfield, IL

AUG

10 JULY | AUGUST | 2023

Remaining

Ahead of

Emerging Trends

Bank leaders take advantage of education and networking opportunities

This fall, the annual WBA Management Conference will bring together more than 120 community banking leaders from across the state for networking and education about the ever-evolving banking industry. Scheduled for September 20 and 21 at the Marriott Madison West, C-level bankers and other members of the bank's management team are encouraged to attend as a team to take advantage of all that this conference has to offer.

The conference combines several general sessions with opportunities for networking, and unofficially starts on Wednesday, September 20 with an optional pre-conference golf outing at the University Ridge Golf Club in Madison. Bankers interested in additional opportunities to connect with event sponsors and their banking peers should visit wisbank.com/management to learn more and register. Space is limited, so register early!

WISCONSIN BANKERS ASSOCIATION

MANAGEMENT C ONFER ENCE

Sept. 20–21, 2023 | Madison Marriott West | Middleton wisbank.com/Management

The conference will begin on Wednesday evening with a reception and dinner program recognizing individual bankers who will be receiving WBA’s 30-and 40-year Lifetime Service Awards. Bankers who are interested in recognizing themselves, or another banker, should complete the nomination form at wisbank.com/ serviceawards by August 25 to be included in the program. In addition to supporting those bankers who have dedicated their career to the banking industry, the dinner reception will provide ample time for attendees to network and connect with peers prior to the

start of the educational sessions.

The next day, bankers will have the opportunity to attend general sessions and select from six breakout sessions that explore management-related topics including credit/lending risk, finance, and general banking trends.

One conference keynote speaker, Economist Dr. Edmond J. Seifried, will discuss several banking hot topics including the yield curve, inflation measures, and the banking crisis. As a former community bank director, professor emeritus of economics and business at Lafayette College in

Honoring Bankers for a Lifetime of Service

» Lifetime Service Awards

Recognize bankers who have served the banking industry between 30 and 49 years, and have not previously received an award. Lifetime Service Awards will be presented at the Conference on Sept. 20. »Visit wisbank.com/service awards to learn more or to nominate someone.

Pennsylvania, and faculty for several banking schools, Dr. Seifried understands community bankers, their directors, and those who are stepping into leadership roles.

To learn more and to register, visit wisbank.com/ management. Questions regarding the conference can be directed to WBA’s Director –Education Lori Kalscheuer at lkalscheuer@wisbank.com

And the Annual Scenes of Wisconsin Photo Contest Winners Are…

The winning photographs for the WBA 2024 Scenes of Wisconsin calendar have been chosen! A panel of five judges reviewed more than 200 submitted photographs and selected 12 striking images to be featured on each month and one photo for the cover of the calendar next year. Each photo submitted for the contest was captured in Wisconsin by a Wisconsin banker, their family member, or a bank customer.

The winning photographers for the 2024 calendar are:

» Cover: Miae Kil, Dairy State Bank, Turtle Lake

» January: Michael DeWitt, Northern State Bank, Ashland

» February: Amy Van Bramer, Nicolet National Bank, Sturgeon Bay

» March: Tyler Stamper, Bankers’Bank, Madison

» April:

» May: Walter Hofer, Alliance Bank, Osseo

» June: Amanda Andrews, Community Bank, Grantsburg

» July: Sheila Mroczynski, Premier Community Bank, Marion

» August: Lisa Rosinsky, Bank First N.A., Manitowoc

» September: Marilyn Peckham, Community First Bank, Richland Center

» October: Justin Hageman, Wisconsin Bankers Assn., Madison

» November: B.J. Lanich, Associated Bank, Wausaukee

» December: Kris Bremness, Northwestern Bank, Chippewa Falls

If you are looking to add some scenic views to your marketing lineup, consider placing an order for the high-quality, cost-effective 2024 Scenes of Wisconsin calendar. Place your order at wisbank.com/ scenesofwi. Orders are due August 15, 2023!

Dee Dee Warner, Citizens Bank, Waukesha

Dee Dee Warner, Citizens Bank, Waukesha

There’s still a little time to order your 2024 calendars!

» The 2024 Scenes of Wisconsin calendar cover. Be sure to place your order by August 15, 2023 at wisbank.com/scenesofwi

JULY | AUGUST | 2023 11

Mind the Gap: Confronting Wage and Wealth Disparity

By Cassandra Krause

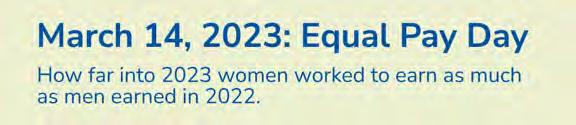

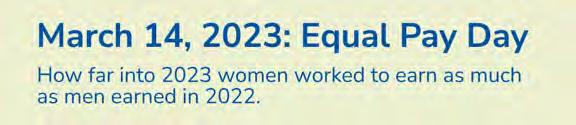

The wage gap, or the difference in earnings between different groups (most commonly women and men) — even in 2023 — continues to undermine the principles of fairness and equality in the workplace and society. The wage gap is compounded by the wealth gap, and the consequences on the economy and upward mobility can be far-reaching.

A Glance at the Numbers

The gender pay gap in the U.S. has not budged much over the last two decades. According to the Pew Research Center, in 2022, American women typically earned 82 cents on the dollar compared to men, which was about the same as in 2002, when women earned 80 cents on the dollar. Jumping back two more decades to 1982, women earned only 65 cents on the dollar compared to men. To put the current stats into perspective, Equal Pay Day in 2023 (which marks how far into the new year women would have to work to earn what men earned in 2022) fell on March 14.

disability, or being part of the LGBTQ+ community also impact the gap. For example, in 2022, Black women earned just 70 cents on the dollar compared to white men and Hispanic women earned only 65 cents on the dollar, according to Pew Research Center data.

United States

roles, “If you have one or two women — or zero — on your board, in your c-suite, do you think that’s right?”

Baumann also serves on the steering committee of Milwaukee Women inc, a nonprofit organization that was created in 2002 to change the face and quality of leadership in the Wisconsin business community. In their 2022 Research Report, Milwaukee Women inc celebrates 20 years of advancing inclusive leadership and noted that the percentage of Wisconsin public

While experts often — and rightfully so — focus attention on women in leadership roles, women at all stages of their careers in nearly all professions are paid, on average, less than their male peers. Women are also overrepresented in services occupations with lower pay and underrepresented in managerial and STEM occupations with higher pay and better benefits. While there is no one clear explanation for the gender pay gap, many point to factors such as women tending to have more unpaid caregiving responsibilities outside of work, bias in hiring and promotions, and a lack of opportunities for mentorship.

Inequality in Accumulated Resources

It is not only wages that are unequally distributed in the U.S., but wealth as well. Wealth includes assets

The earnings gap does not only apply to gender; factors such as race, ethnicity,

Generally speaking, the more marginalized identities a person has, the likelier the wage gap is to widen.

What Accounts for the Gender Wage Gap?

As Wendy Baumann, president/CVO of the Wisconsin Women’s Business Initiative Corporation (WWBIC), puts it, “Sexism is alive and well.” She emphasizes that what employers are measuring matters, including the number of women in leadership and management

companies with three or more women directors increased from 6% in 2003 to 44% in 2022. In that same period, there was a six-fold increase in the number of newly elected women directors and 4.5-fold increase in the number of women of color directors at Wisconsin’s top 50 public companies.

such as real estate, savings, investments, and ownership of businesses. The wealth gap is fueled by the wage gap and influenced by other factors like intergenerational inheritance, access to quality education, and systemic barriers to accessing capital.

50 55 60 65 70 75 80 85 90 95 100 80% 80% 79% 83% 75% 75% 75% Eau

Janesville-Beloit La Crosse-Onalaska Oshkosh-Neenah MilwaukeeWaukesha-West

Racine Wausau 50 55 60 65 70 75 80 85 90 95 100 (continued on p. 13) 12 JULY | AUGUST | 2023 White Black Hispanic Asian

Claire

Allis

Women Compared to White Men 75% 62% 93% 75% 83% 70% 65% 59% 65% 56% 56% 1982 2002 2022

Above (left to right): Wendy Baumann, Wisconsin Women’s Business Intitiative Corporation (WWBIC); Jason Fields, Madison Regional Economic Partnership (MadREP); and Michael Hetzel, WWBIC.

— Parity —

» Source for charts: Pew Research Center.

— Parity —

Wisconsin Women Compared to Men (2019)

Wage/Wealth Gap

(continued from p. 12)

Building equity in a home and being able to transfer that wealth across generations is an important factor. U.S. Census Bureau data shows the homeownership rate in the U.S. at 66.0% in Q1 2023, with gaps exposed when the data is sliced by race and ethnicity: Black alone (45.8%); Hispanic (of any race) (49.7%); all other races (58.2%); Asian, Native Hawaiian, and Pacific Islander alone (61.6%); and nonHispanic white alone (74.4%).

Furthermore, household portfolio composition and investment behavior play a significant role in the wealth gap. A 2019 Survey of Consumer Finances by the Federal Reserve showed that, on average, white households have a higher percentage of their wealth in stock equity than Black households. In a 2022 article published by the Federal Reserve Bank of Minneapolis, author Lisa Camnen McKay writes, “Housing has appreciated since the 1950s, but stock equity has appreciated five times as much. . . Now that income convergence has stalled, the difference in the capital gains rate experienced by Black and white households is the main factor pushing their wealth apart.”

Wealth inequality is significant because of wealth’s impact not only on an individual’s buying power, but its impact on a person’s quality of life, access to education and health care, retirement savings, and ability to set the next generation up for financial success.

The Role of Bankers in Closing the Gap

» Bankers in Their Communities

Both in their roles as financial industry professionals and as community members, bankers can be part of the solution to the wage and wealth gap. Jason Fields,

More awareness-building is necessary, beyond just observing Equal Pay Day.

president and CEO of Madison Region Economic Partnership (MadREP) says, “If we’re looking at cutting the wealth gap in half — or eliminating it — then I think we have to attack this from a number of perspectives. . . you have to attack the trust issue, you have to attack the education issue, and then we have to really get into what tools and vehicles are there that can generate wealth.”

Fields, a former banker himself, encourages bankers to show up in person to community events to understand what underserved communities are going through and build relationships. He also notes the contributions bankers make in providing financial education. Providing financial education is both the right thing to do and is good for business. Fields says offering free trainings — and partnering with chambers, places of worship, etc. — can reach an untapped segment, “Because [some community members] don’t understand finances, because they don’t know who to trust, they never talk about it. . . When you have bankers showing that warm relationship, that will help feed the community to go ‘hey, here’s somebody I can trust that won’t make me feel like “less than” because I don’t know this stuff.’”

WWBIC is a statewide community development financial institution (CDFI) that focuses on individuals who face barriers in accessing traditional financing — in particular, women, people of color, veterans, rural, and

lower wealth individuals. WWBIC also advocates for a holistic approach to closing gaps, encompassing relationships, education, and access to capital. WWBIC’s loan customers receive business coaching as part of their loan package. When it comes to lending, “banks don’t want to say ‘no,’ but they have their rules and regulations on what they can do in their box,” says WWBIC’s Baumann. “WWBIC’s box is bigger.”

Michael Hetzel, WWBIC statewide director of lending, points out that referring a customer to a CDFI is good for the bank because they preserve the relationship as a trusted advisor. The customer still needs the banking relationships for checking, deposit, merchant services, etc., and they may refinance the loan they received from a CDFI with the bank once they have built credit. “The banks do put their money where their mouth is,” says Hetzel, who was a banker for 25 years before joining WWBIC about a dozen years ago. “They help us help those people that maybe they can’t help.”

» Bankers as Employers and Business Community Leaders

Banks can also play a role as employers in closing the gap. The 2022 Women in the Workplace report by McKinsey & Company, in partnership with LeanIn.org, draws attention to the “broken rung” at the first step up to manager. For every 100 men promoted to first-level manager at the end of 2021, 87 women overall and 82 women of color were promoted (note: numbers assume an equal number of men, women, and women of color at the entry level). In addition, a 2019 workplace

and financial equality survey conducted by TD Bank revealed that over one-fifth (22%) of millennial workers feel that being out about their sexual orientation to more senior staff will hurt their career advancement.

The McKinsey report emphasizes the importance of flexible work and good managers, and listed key practices for driving progress toward gender equality:

» employee benefits,

» career development programs,

» data tracking, and

» trainings.

Baumann underscores that more awareness-building is necessary, beyond just observing Equal Pay Day. She points to formal and informal mentoring as important components for providing opportunity to employees who are underrepresented at senior levels. One example of rethinking mentoring would be if a company’s golf outing is primarily attended by men, then they should choose something else that is a more inclusive way for employees to network and gain mentors.

Looking Ahead

By raising awareness and increasing our understanding of wage and wealth gaps, we can help to bridge the divide. Bankers can take further steps to address bias and discrimination in their workplaces, continue to promote financial literacy in their communities, and grow partnerships with businesses and non-profit organizations to increase access to capital for underserved populations. In doing so, they will help to create a stronger and more prosperous future for all.

Krause is WBA director –communications.

WWBIC is a WBA Associate Member.

JULY | AUGUST | 2023 13

Wisconsin Bank CEOs Weigh In on Economic Outlook

WBA releases results of Bank CEO Economic Conditions Survey

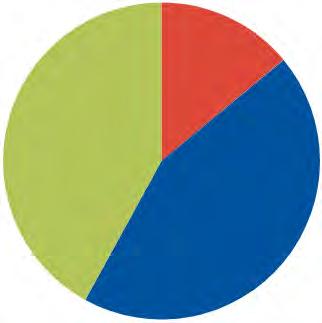

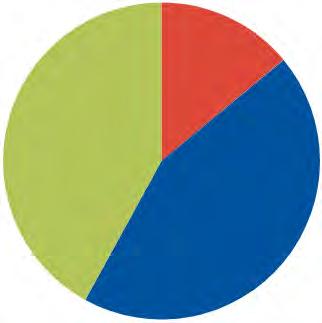

In the Wisconsin Bankers Association’s (WBA’s) biannual Economic Conditions

Survey of Wisconsin bank CEOs, nearly three quarters of respondents rated Wisconsin’s current economic health as “excellent” or “good.” These most recent survey results show some easing of inflation and recession concerns; 86% of respondents predict inflation to fall or stay about the same over the next six months, compared to 76% of respondents in the prior survey conducted at the end of 2022. Pessimism is fading as only 48% of respondents predict the economy to worsen over the next six months,

compared to 72% of respondents at the close of 2022.

“Wisconsin bank CEOs have unique knowledge of their local market dynamics, given their economic expertise along with their relationships with businesses, community organizations, families, and individuals in their areas,” said WBA President and CEO Rose Oswald Poels. “With a mild recession predicted for the remainder of the year, bankers continue to serve as trusted partners in helping community members weather challenges and achieve their financial goals.”

Among the economic bright spots

cited by CEOs in the survey were high employment and wages, demand for goods and services, strong industries — summer tourism, construction, agriculture, and manufacturing — and in-migration from the Twin Cities and Chicago. Top economic concerns reported by bank CEOs were inflation and labor — particularly in service-related industries, deposit growth, and compressing interest rate margins.

The mid-year 2023 survey was conducted May 16–31 with 66 respondents. Please visit wisbank.com/23survey to read the full report.

Mid-Year 2023

Wisconsin Bank CEO

Economic Conditions

Survey Results

May 31, 2023

How would you rate the current health of the Wisconsin economy?

In the next six months, do you expect inflation to…

How likely would you say a recession is in the next six months?

WBA Announces Four Promotions, Two New Hires

The Wisconsin Bankers Association (WBA) is pleased to announce several staff promotions within the organization as well as welcome new team members.

Sandy Giese has been promoted to chief financial officer and vice president –administration. In this role, Giese will continue her leadership of the WBA accounting, human resources, IT, and facility departments as well as oversee the financial strategy of the Association.

Ron Howe has been promoted to director –accounting after nine years at WBA. In his new role, Howe will continue to manage

the Association’s financial reporting, cash management, and investment activities.

Cassandra Krause has been promoted to director –communications after serving the Association for over two years as communications manager. In this role, Krause will continue to lead the WBA communications department in providing timely news and resources to the membership. Krause will also continue her role as the

Wisconsin Bankers Foundation’s executive director.

Jackie Lindquist has been promoted to the position of marketing specialist. Lindquist, who joined the Association in January 2022, will continue spearheading WBA marketing efforts.

WBA is pleased to announce that Angie Swanson has joined as the receptionist and administrative assistant. Swanson previously worked in the healthcare industry

and has several years of experience providing administrative support. As she begins this position, Swanson looks forward to learning more about the banking industry and assisting member bankers.

WBA is also excited to announce that Cindy Thoennes has joined the Association as accounting assistant. In September 2022, Thoennes was hired as the accounts receivable and administrative specialist at FIPCO — a subsidiary of WBA. As she transitions into this new role, Thoennes looks forward to supporting departments throughout WBA.

Fall 44% Rise 14%

14 JULY | AUGUST | 2023

Giese Howe Krause Swanson Lindquist Thoennes

5% 5% Good 68% Neutral 24% Likely 56% Very likely 15% Fair 27% Stay about the same 42% Excellent Unlikely

Year in Review 2022 2023

President’s Message:

AS I reflect upon the accomplishments our community of bankers has made in the past year, I am honored to not only work alongside a membership so dedicated to the success of its institutions and communities, but also to represent each of you in your unwavering resilience and adaptability.

For over 130 years, our Association has focused intently on the positive impact banks make on communities in Wisconsin. Above all, WBA’s top priority continues to be serving our members in this faced-paced and ever-evolving industry.

Outgoing Chair’s Message:

THE theme I chose to emphasize during my tenure as WBA chair was “member engagement.” Looking back at the numbers, it is clear to see that the Association took this message to heart. Whether it be using your voice as an advocate, taking the next step in your career with a training opportunity, utilizing products and services from WBA subsidiaries and Associate Members, or connecting with colleagues from across the state, Wisconsin bankers sought to make the most of your WBA membership. We certainly accomplished a lot together over the past year, and we had a lot of fun along the way. It has been an honor to serve as chair of this professional organization, and I look forward to our

As always, I thank you for your support of WBA and deeply appreciate your efforts in ensuring the success of our industry. Your membership allows us to continue to advocate for our industry, educate beginning and experienced bankers, and provide valued resources for all areas of the bank.

Rose Oswald Poels WBA President and CEO

Association’s continued collaboration and growth ahead. Thank you to WBA for fostering a sense of collaboration and serving as a trusted resource for Wisconsin banks.

Daniel J. Peterson, 2022–23 WBA Chair President and CEO The Stephenson National Bank & Trust, Marinette

WBA’s Mission:

For more information… www.wisbank.com ▪ www.fipco.com ▪ www.wisbankins.com ▪ www.mbisllc.com ▪ www.wisbankfoundation.org MIDWEST BANKERS Insurance Services

companies of WBA, Inc. Working together for you.

The

“We actively advocate for, educate, and support our members to help them positively impact the Wisconsin communities they serve.”

Year in Review 2022 2023

Advocating Supporting

banks earned WBA’s Gold Triangle Award, our highest level of recognition for bank fundraising, apportioned by bank asset size.

banks designated Advocacy Officers, who serve as government relations points of contact for their banks.

in contributions were given by WBA-member employees, directors, and others to WBA’s political action funds: Wisbankpac and the ABW political conduit.

bills are currently being tracked or monitored by WBA of the 601 bills introduced in the State Legislature during the 2021–22 legislative session.

banks earned the Bankers Involved in Grassroots and Government (BIGG) award, WBA’s highest achievement level for bank involvement in advocacy.

bankers earned the Silver Triangle Award for contributing at least $500 to Wisbankpac, ABW, or issue advocacy funds.

attended WBA Capitol Day in Madison, and 36 attended a Washington, D.C. trip.

candidates and four legislative party candidate committees — on both sides of the aisle — at the state and federal levels received support from WBA political action funds.

banks and savings institutions are members of WBA, representing 98% of banks in the state.

46 $276,048 197 162

Associate Members provide quality products and services to WBA members.*

600+ 150+ 160

members belong to the Building Our Leaders of Tomorrow (BOLT) Section.

90

members belong to the Employee Resource Group (ERG) for bankers from underrepresented backgrounds, and 11 virtual ERG meetings were held.

members served on a board, committee, or advisory group.

bankers are members of a WBA Connect peer group, and 20 banker-only peer group meetings were held (including Connect and CEOnly/CFOnly).

601 32

9

33 115 160 195 36 59 4

WBA legislative priorities or WBA-influenced bills introduced thus far during the 2023–24 legislative session.

10

comment letters were submitted on behalf of the membership.

press releases were issued.

4,880

35 OVER $2.2 MILLION

90+

users follow WBA on LinkedIn, 2,135 on Twitter, and 1,517 on Facebook.

Over $2.2 million in annual savings was achieved with the WBA Association Health Plan through UnitedHealthcare.

banks utilized the WBA EBC online benefit administration portal with over 3,250 benefit transactions completed electronically.

* Learn more about our highest level WBA Associate Member sponsors on p. 29.

*See a complete list of WBA Associate Members at wisbank.com/associates.

For more information… www.wisbank.com ▪ www.fipco.com ▪ www.wisbankins.com ▪ www.mbisllc.com ▪ www.wisbankfoundation.org

Wisconsin Bankers Association | FIPCO ™ | WBA Employee Benefits Corporation | Midwest Bankers Insurance Services | Wisconsin Bankers Foundation | Generations Title

Educating

2,094 6,016 93 418 4 1,000+ 113

220+ 3,040 37%

Legal Call Program calls were answered, a 30% increase over last fiscal year.

attendees took part in WBA-hosted training events.

educational opportunities were hosted by WBA

bankers completed a multi-day WBA School or Boot Camp.

complimentary member webinars were offered in 2022–23 — more than 1,000 members participated in these four webinars.

connections joined FIPCO’s four deposit, loan, and mortgage virtual forums.

2,700 500

CEOnly/CFOnly questions were moderated.

new stand-alone free legal content pieces were created, and four consumer-facing resources were created.

The new WBA Compliance page on the WBA website received over 2,700 page views and over 500 clicks to view the new resources.

The new WBA Negotiable Instrument Manual was released for purchase.

3 1,300

Legal Live events were hosted, and the new WBA Compliance Corner video, produced monthly, received over 1,300 views.

Midwest Bankers Insurance Services (MBIS) helped over 220 community banks with complex insurance renewal negotiations, internal control guidance, best practices, coverage education, and policy placement.

loan applications totaling a requested $129,000,000 were submitted via FIPCO ConnectFI — a customer-facing digital lending SaaS that integrates with Compliance Concierge™

revenue growth was achieved in ShareFI engagement services to 39 WBA members, representing 74 engagements. Banks saved over $350,000 with ShareFI’s compliance officer (and other roles) services to reduce their personnel expenses.

375

WBA members benefited from FIPCO InfoSecurity and IT Audit engagement services, representing over 100 engagements.

individuals and 59 organizations supported the Wisconsin Bankers Foundation through donations and participation in auctions and raffles.

80 15 4 New 42 64 $129 MILLION 311

5,600 254 10 92 30 104 $13,000

banks participated in the Wisconsin Bankers Foundation’s Reading Raises Interest program, giving Teach Children to Save Day presentations in elementary school classrooms and donating 2,800 copies of the book ‘Curious George Saves His Pennies.’

The WBA Compliance Journal was published monthly and delivered electronically with a new format, receiving over 5,600 clicks.

issues of the Wisconsin Banker were published.

issues of the Wisconsin Banker Daily e-newsletter were published.

videos were produced. Banconomics reports covering seven Midwest states were published by the Wisconsin Bankers Foundation in partnership with UFS.

applications were submitted for Wisconsin Bankers Foundation scholarships (an increase of 96% from the prior year), and $11,000 was awarded to six recipients.

in grants was awarded by the Wisconsin Bankers Foundation to three non-profit programs: the Finance and Investment Challenge Bowl, the Money Smart Wisconsin Big Read for Kids, and the Stock Market Game.

branches of 52 banks participated in the WBA Power of Community Week, hosting service events across the state.

For more information… www.wisbank.com ▪ www.fipco.com ▪ www.wisbankins.com ▪ www.mbisllc.com ▪ www.wisbankfoundation.org

The companies of WBA, Inc. Working together for you.

Eau Claire

News about people working in Wisconsin’s financial institutions

Bryan Gerlach (pictured) has joined Security Financial Bank as chief financial officer.

Fond du Lac

FVSBank has announced the promotions of Celeste Zemlicka, senior vice president –chief credit officer; Ryan Galligan, chief information officer; and Ellen Mielke, executive vice president –chief financial officer.

National Exchange Bank & Trust is pleased to announce the promotions of Eric Stone, who will assume the role of president/chief executive officer; Nicole Wiese, chief operating officer; Steve Holz, chief lending officer; Mitchell Frydrych, chief technology officer; and Tami Christian, chief people officer.

Fort Atkinson

PremierBank has announced that Peggy Stebbins (pictured) has been named executive vice president and will serve as chief operating officer.

Horicon

Horicon Bank is pleased to announce the promotions of Terry O’Connor (pictured) to executive vice president, Brenda Nelson (pictured)

to senior vice president, and Cassie Voight (pictured) to vice president.

Madison

Bankers’ Bank recently promoted Scott Platto to senior vice president – chief financial officer.

Nick Inman (pictured) has joined the Capitol Bank team as vice president – credit.

Marshfield

Scot Thompson (pictured) has joined Forward Bank as vice president – senior business development officer. Additionally, Gwen Schnitzler (pictured) has been promoted to vice president – human resource director.

Manitowoc

Bank First has announced the promotions of Amanda Sitkiewitz (pictured) to senior vice president — market president and Kelly Dvorak (pictured) to chief legal counsel.

Medford

Vinny Ritchay (pictured) has been promoted to vice president – commercial credit at Prevail Bank.

(continued on p. 19)

Dave Davis Celebrates Fifty Years Peshtigo National Bank Announces Five Recent Staff Promotions

The Board of Directors at the Peshtigo National Bank is pleased to announce the following five bank staff promotions. Pictured are:

» Craig Polzin to executive vice president – chief financial officer;

» Jamie Nystrom to senior vice president – chief operations officer;

» Melissa Wenzel to vice president – loan officer;

»

»

On May 2, WBA President and CEO Rose Oswald Poels presented a WBA 50 Year Club award to Collins State Bank Board Member Dave Davis. Pictured (left to right) are: Ben Becker, Collins State Bank president; Jeff Dereszynski, chief financial officer; Oswald Poels; Davis; and Steve Fleischmann, senior vice president. Congratulations!

Kirstyn Folgert to vice president – compliance officer; and

Tamara Boye to vice president – human resources manager. Congratulations!

Stebbins Schnitzler

O‘Connor

Inman

Voight Gerlach Thompson

Nelson

Sitkiewitz Dvorak

Bulletin Board

good news? To submit a notice, please email bulletinboard@wisbank.com. Or mail entries to WBA Bulletin Board, 4721 South Biltmore Lane, Madison, WI 53718. Send photos as JPEG files. Questions? Contact WBA’s Hannah Flanders at 608-441-1237 or hflanders@wisbank.com

Have

Wenzel

Boye

Nystrom Folgert

18 JULY | AUGUST | 2023

Polzin

Bulletin Board

News about people working in Wisconsin’s financial institutions

Promotions and New Hires

(continued from p. 18)

New London

First State Bank President

Matthew R. Lemke (pictured) has been named chief executive officer of the bank as of April 1. Additionally, Jennifer Foote (pictured) has been promoted to vice president – chief operating officer and Janelle Schraufnagel (pictured) to vice president – human resources director.

Oregon

One Community Bank is pleased to announce the promotions of Bill Borchers (pictured) to senior vice president – loan servicing and construction.

Reeseville

Mitch Grulke (pictured) has joined State Bank of Reeseville as senior loan officer.

Whitewater

Robert (Bob) Bastien (pictured) has joined First Citizens State Bank as vice president – business banker.

Anniversary

Augusta

Patti Kutchera (pictured), vice president – consumer relationship manager at Unity Bank, recently celebrated 40 years of service at the bank.

Retirements

Fond du Lac

James Chatterton (pictured), has retired from his role as president/chief operating officer at National Exchange Bank & Trust.

In Memorium: Wittkopf, Soderberg

Allen “Tom” Wittkopf, 83, of Florence and Naples, Fla., passed away on April 30, 2023 at his winter home in Naples.

Wittkopf and Rochelle, his wife of 56 years, served as the owners of the State Bank of Florence (now Great North Bank) and was an advocate for small businesses and community banking.

An avid golfer, boater, and active throughout his community — grooming the snowmobile trails in the winter and building floats in the summer — Wittkopf was a long-time member of the Independent Community Bankers Association (ICBA) and served as president from 1994 to 1996. In 1997, Wittkopf was named the “Community Banker of the Year” by the Association.

Memorials may be made in Wittkopf’s nickname — “Big Al” — at the Shriners Hospitals for Children.

John Soderberg, 88, of New Richland, passed away on March 13, 2023.

Soderberg, a second-generation owner of First National Community Bank (FNC Bank), worked tirelessly to influence community and economic development throughout western Wisconsin. He was not one to take credit for the work he did for his community, despite being an active member of many local organizations and spearheading the effort to build the St. Croix River Crossing.

Memorials, in the form of non-perishable food items or monetary contributions, can be made to organizations fighting food insecurity in western Wisconsin.

Green Bay

Cheryl Parker (pictured), senior lending compliance specialist at Nicolet National Bank, will retire on July 21 after over 30 years of service to the banking industry.

Luxemburg

Carol Kudick (pictured), customer service associate at Bank of Luxemburg, has recently retired after 48 years of service to the banking industry.

Medford

Becky Brost (pictured), Prevail Bank’s assistant vice president – mortgage loan originator, has retired after 47 years in the lending industry.

Congratulations

Madison

Park Bank has announced that Kelly Powell (pictured), assistant vice president –market manager, has been named the 2022 Volunteer of the Year from the Cross Plains Area Chamber of Commerce.

Associate Member News

Eau Claire

Mary Boortz, administrative manager at Wipfli, has retired after 28 years with the organization.

Visit

industry, including recent hires, staff achievements, and community involvement.

North Shore Bank, Brookfield Celebrates Centennial

Throughout 2023, North Shore Bank is celebrating its centennial. During the celebration event held on May 11, the bank created a time capsule and donated $50,000 to the financial literacy program ELEVATE Wisconsin.

Rose Oswald Poels (center), WBA president and CEO, is pictured presenting a plaque commemorating the bank’s 100th anniversary to Jay McKenna (left), North Shore Bank president, and Jim McKenna (right), North Shore Bank executive chairman.

wisbank.com/Bulletin for more good news in Wisconsin’s banking

Foote Kutchera

Borchers

Parker Chatterton

Ritchay

Bastien

Powell

Schraufnagel

Lemke

Grulke

JULY | AUGUST | 2023 19

Kudick Brost

You Trust Your Vendors, But Do You Verify Them? How to avoid greater risk in your vendor management program

By Rob Foxx, CCBTO

Across sectors, vendor management has always been an area of high risk. Onboarding trusted vendors comes with many benefits that make the lives of many — including bankers — easier. Most companies utilize vendors to offboard workloads and transfer areas of risk to another entity. However, this is often where the management of vendors end.

The process of vendor management usually begins with selection of the vendor. Then, it is critical — especially for essential vendors — to engage in risk assessment and due diligence, including monitoring and reporting on a regular basis. Institutions should also review the

FIPCO IT & Audit Services

Rob Foxx rfoxx@fipco.com » fipco.com

vendor’s exit strategy during the onboarding process. While it is an aspect that is rarely considered, I encourage bankers to add this topic to the next vendor review.

Many managed service providers (MSP) would never do wrong by their customers; however, this does not mean banks should trust nothing will go wrong and leave them to their work unquestioned. If a vendor is touching data or aspects of the institution’s environment, bankers

need to ensure these actions are tracked and verified. This is especially important in situations where vendors are able to access resources without informing the bank, requiring authorization, or those who utilize subcontractors.

In the last decade, vendor transparency has become a rule, not an exception. Although many vendors are great at reporting, banks should understand their right and responsibility to understand either the data or the process to gather it.

Coming back to the final stage of the vendor management process — exit strategy. While it can be very difficult to change critical vendors,

establishing a process early on will help the institution understand how they are able to get their data back, how long data is held by the vendor, how to properly cancel a contract, and how to ensure a smooth transition to a new service.

Due diligence, contract reviews, monitoring, reporting, and exit strategies are all important aspects of the vendor management process. Afterall, moving a service to a third party does not neutralize the risk — instead, the risk transfers to the vendor and the bank gains a new risk area in its external arrangement.

Foxx is director – infosec and IT audit services for FIPCO. He can be reached at rfoxx@fipco.com or 608-441-1249.

For more information about FIPCO forms, software, or other products, visit fipco.com, call 800-722-3498, or email fipcosales@fipco.com

FIPCO is a WBA Gold Associate Member.

FIPCO’s Newest Team Member

FIPCO is pleased to announce that Jordan Siewert has begun his role as implementation and support specialist. With a background of working in education and information technology, Siewert looks forward to supporting and assisting customers as they implement the FIPCO software.

Jordan and the FIPCO staff are here to help. Contact Jordan at jsiewert@fipco.com, or a FIPCO team member at fipcosupport@fipco.com or 800-722-3498, option 4.

About FIPCO… Founded in 1987, FIPCO (a WBA subsidiary) helps financial institutions stay compliant in a fast-changing regulatory environment. Our form sets are regarded as the industry standard. Our Compliance Concierge™ loan, mortgage, and deposit software solutions are developed and supported with a meticulous approach to compliance. Our software solutions expand to include ConnectFI cloud-based online lending software, cybersecurity solutions, and more! FIPCO also offers valuable consulting services, including risk management, IT auditing, and ShareFI compliance and management services.

Learn more at www.fipco.com.

20 JULY | AUGUST | 2023

IT AUDIT & SECURITY SERVICES • IT Auditing • Cyber Security Consulting • Vulnerability & Penetration Testing • Board Cyber Security Awareness • GLBA Compliance & IT Risk Assessment • Managed Social Engineering with Integrated Learning Management System • Facilitated DRP/BCP Tabletop and IRP Testing • Threat Intelligence Briefings ContactFIPCO’sRobFoxxtogetstarted. rfoxx@fipco.com 800-722-3498x249 www.FIPCO.com

JULY | AUGUST | 2023 21

Rise of AI in Banking

(continued from p. 1)

and its integration into day-today life has greatly increased.

The New York Times states that in 2022, nearly $1.4 billion was invested into various generative AI companies worldwide.

By 2030, PwC expects that AI will contribute over $15 trillion to the global economy by increasing productivity and allowing products and services to be more personalized and readily available.

By 2030, PwC expects that AI will contribute over $15 trillion to the global economy.

» AI in the Banking Industry

Already, banks around the country have employed AI in various areas of their daily operations. In 2020, McKinsey & Company reported that around 60%

of financial institutions had already embedded at least one AI capability into their organization. In utilizing systems that have the potential to conduct research, translate languages, create messages, and write job descriptions — among so many other possibilities — banks are able to quickly detect fraud, streamline specific services, and interact with customers at any time of the day.

However, there are many more possibilities, as noted in a Forbes article “The Future of AI in Banking.” In addition to automating routine tasks, AI is great at tracking patterns, targeting product recommendations, providing more accurate customer support, and serving as a single point of contact for banking operations.

Despite these opportunities, many banks are concerned with the challenges embracing AI may impose. Among the top concerns of Americans, reports the Pew Research Center, are digital privacy and the lack of human connection.

» Hello, ChatGPT

In November 2022, ChatGPT was released by OpenAI, a San Franciscobased AI research lab. The chatbot, unlike many others, offers detailed responses in many domains of knowledge. In early 2023, Reuters reported that the chatbot had reached 100 million monthly users.

GPT, which stands for Generative Pre-trained Transformer, is a type of Large Language Model (LLM). The UK’s National Cyber Security Centre describes an LLM as a type of algorithm that has been trained using a significant amount of text-based data, which can typically be found on the open internet. ChatGPT then utilizes “deep learning,” or the process of imitating human

Banks in Wisconsin explore the use of AI

»Everything You Need to Know about ChatGPT Webinar, July 13; register at wisbank.com/ChatGPT

learning, to formulate humanlike responses.

» The Benefits and Challenges of AI

Because ChatGPT is trained using free, unfiltered data sourced from across the internet, many are skeptical of its reliability and validity. However, it is important for users to acknowledge that many systems are programmed, using the desired or relevant algorithms and data, by humans. As many begin to harness the capabilities of AI, the benefits (and challenges) are becoming evident.

» Logic and Creativity

Rather than be influenced by emotion, most AI models only have the aptitude to make logical decisions. This capability, which may be beneficial in removing some forms of bias, may not consider the full picture of the data presented. In addition, the lack of emotion may result in less creative solutions.

» Human Connection

Unlike humans, AI is constantly available. While ensuring customers have around-the-clock access to the organization and its services is key in combating competition, many are concerned that AI may result in less human interaction or replace humans in the workforce.

Perspective

everything. (continued on p. 23) 22 JULY | AUGUST | 2023

Pressures and expectations have never been higher. We help you remain fully staffed so you can thrive. V isit wipfli.com/banks

changes

Rise of AI in Banking

(continued from p. 22)

AI has the potential to conduct research, translate languages, create messages, and write job descriptions — among so many other possibilities.

» Privacy and Risk

American Banker stated that nearly 80 U.S. financial institutions reported a data breach in 2022. As increasingly more banks look to incorporate AI to analyze large swaths of data, the risk of personal information falling into the wrong hands rises. Because the security measures of ChatGPT, and other models, are determined by the organization or platform hosting the software, businesses should ensure that their risk management practices are up to date and monitored regularly.

» Implementation/Adaption

Although AI can minimize repetitive and time-consuming tasks, banks should first consider how employing new AI programs may interact with existing software. Additionally, if the adaption process requires extensive effort for both employees and customers, AI may not be the right solution.

» Regulation

As of this writing, financial regulators have not yet published a comprehensive

set of AI-related rules. However, banks are reminded that existing regulation may apply. Several agencies — including the Financial Crimes Enforcement Network (FinCEN) and the Office of the Comptroller of the Currency (OCC) — are encouraging banks to engage with AI to determine its usefulness within their organization.

As more individuals throughout the country become aware of AI, it is important

that bankers in Wisconsin closely follow its advancements and challenges as well as continually explore the ways in which systems, such as ChatGPT, may impact their business, staff members, and customers. While ChatGPT may be just the latest trend, there is no doubt that AI has already left a lasting effect on the power of technology.

We asked ChatGPT: What’s the best boy band of the ’90s?

ChatGPT’s response…The ’90s saw the rise of several popular boy bands, each with their own dedicated fanbase. While opinions may vary, one of the most widely regarded and successful boy bands of the ’90s was the Backstreet Boys. Formed in 1993, the group achieved significant commercial success with hits like “I Want It That Way,” “Everybody (Backstreet’s Back),” and “Quit Playing Games (with My Heart).” They became global sensations and had a massive impact on pop culture during that era. Other notable boy bands of the ’90s include *NSYNC, Boyz II Men, and New Kids on the Block, each with their own devoted following. (Learn more at chat.openai.com.)

A Full-Service Partner You Can Bank On.

CorrAccess

A

CorrExchange

Lowers

Federal Reserve.

Flanders is WBA writer/editor.

Kevin Volker 608.213.4987 Sarah Dolan 773.354.4837 qcbt.bank/correspondent-banking 4500 N. Brady Street, Davenport, Iowa