WBA’s Building Our Leaders of Tomorrow (BOLT)

By Cassandra Krause

If one thing is certain about young professionals in Wisconsin’s banking industry, it is that they are ambitious. Their careers mean more to them than just a paycheck, and they’re looking for ways to grow and make meaningful contributions. Nearly ten years ago, the

Building Our Leaders of Tomorrow (BOLT) Section was created to tap into the potential of emerging leaders in banking across the state.

Julie Redfern was one of the inaugural BOLT Section Board members in 2013 and has advanced in her career to executive vice president, chief operations officer at Monona Bank.

“Fostering growth and leadership skills in our industry was a motivational factor for joining the BOLT

initiative in its infancy stages,” said Redfern. “We had a gap in our industry, and I think BOLT is now a great tool to offset that gap for bank CEOs looking to develop bench strength with future leaders at their community banks.”

Motivations for joining BOLT vary from banker to banker. Some are seeking opportunities to learn the skills needed

to be a respected, contributing community banking officer able to handle increasing responsibility.

Others join because of the access to a tremendous network of Wisconsin bankers with a vast background of knowledge and experience who are willing to share it in a non-competitive environment. Still others may be looking to become more engaged in legislative,

regulatory, and public affairs advocacy.

BOLT was launched to ensure ongoing success for community banks by focusing on talent development and providing networking opportunities for the next generation of community bank leaders to grow and develop the necessary skills to be effective leaders.

(continued on p 8)

WBA Building Our Leaders of Tomorrow

By Hannah Flanders

By Hannah Flanders

Accelerated by the COVID-19 pandemic, changes in worklife balance, employee expectations, and workplace culture have all dramatically shifted among every industry. However, as new cultures of service emerge internally, an increasing number of businesses are considering how this company culture shift may widely benefit both

current and prospective employees as well as the perspective of customers.

The Culture of Serving Others Company culture, or the shared values and beliefs held within an organization, continues to prove itself as a significant factor not only in talent attraction and recruitment, but in how Wisconsin’s community banks are able to stand out from large competitors.

community banks focus their efforts into doing what they do best — providing high quality service to every member of their communities — it will come as no surprise that talent and customers will follow.

Celebrating a Decade of Building Banking Leaders BRANDING YOUR CULTURE Wisconsin banks empower employees, drive service

Establishing an Effective Company Culture

WI53718

Time and time again, poor management or lack of service are often to blame for individuals leaving businesses or finding new providers. However, as Wisconsin’s

According to Amanda EmeryMorris, training and marketing coordinator at Farmers & Merchants Union Bank in Columbus, company culture is largely connected to the mission, vision, and beliefs held by the (continued on p. 18)

AddressService Requested

PRSRTSTD U.S.POSTAGE PAID UMS WisconsinBankersAssociation 4721SouthBiltmoreLane Madison,

NOVEMBER 2022 WISCONSIN BANKERS ASSOCIATION FOUNDED 1892

Midwest Economic Forecast Forum Virtual on January 12

By Daniel J. Peterson

As we quickly approach the end of another calendar year, I am reminded of last year when the residual effects of the COVID-19 pandemic still cast uncertainty into the new year. Though many of us can agree that the pandemic no longer directly impacts us in the ways seen previously, it has continued to force record-level inflation and recessionary fears onto the wallet of every Wisconsinite.

As our neighbors look to bankers as experts on both the economy and communities they serve, it is important that we as banking leaders take the opportunity to interpret and pass on the economic data and trends that we will likely see into 2023.

Annually, the Wisconsin Bankers Association (WBA), in partnership with several

Message from the Chair

customers, directors, and others to join in on the viewing. Mark your calendars now for January 12, 2023 from 10:30 a.m.–noon CT and visit wisbank.com/econ to register.

» Visit wisbank.com/econ to register for the 2023 Midwest Economic Forecast Forum.

other Midwestern banking associations, hosts a virtual Midwest Economic Forecast Forum. This forum is focused specifically on providing bankers with the chance to hear from nationally renowned experts on the challenges expected to impact our industry in the new year and also opportunities that are in store.

This year’s forum will once again be held virtually and provide individual or group rates to banks interested in inviting staff, business

This year, bankers will gain an economic outlook from James Bullard, president of the Federal Reserve Bank of St. Louis and member of the Federal Open Market Committee (FOMC), as well as Gus Faucher, senior vice president and chief economist at the PNC Financial Services Group.

The last several years have certainly proven it is difficult to predict what is to come. As uncertainty continues to surround many aspects of our economy, it is necessary for the continued prosperity of our banks and community members that we

look ahead. Without doubt, 2023 will create challenges and opportunities and prove to be a very unique year for many industries. The interest rate environment will cause many to pause and reevaluate, with fears of a recession on the horizon. Bankers will need to stay tuned in to the economic environment as we navigate through the next year.

I look forward to the discussion on these topics at the Midwest Economic Forecast Forum and hope many of you will join us.

Peterson is president and CEO of The Stephenson National Bank & Trust, Marinette, and the 2022–2023 WBA Chair.

An Economic Discussion with… JAMES BULLARD President and CEO Federal Reserve Bank of St. Louis James “Jim” Bullard is the president and CEO of the Federal Reserve Bank of St. Louis. In that role, he is a participant on the Federal Reserve’s Federal Open Market Committee (FOMC), which meets regularly to set the direction of U.S. monetary policy. He also oversees the Federal Reserve’s Eighth District, including activities at the St. Louis headquarters and its branches in Little Rock, Ark., Louisville, Ky., and Memphis, Tenn. Bullard is a noted economist and scholar, and his positions are founded on research-based thinking and an intellectual openness to new theories and explanations. He is often an early voice for change.

Register online at: wisbank.com/Econ

Questions: Contact wbaeducation@wisbank.com or 608-441-1252.

THE PNC Financial Services Group

Augustine (Gus) Faucher is senior vice president and chief economist of The PNC Financial Services Group, serving as the principal spokes person on all economic issues for PNC. Previously, he worked for six years at the U.S. Treasury Department, and taught at the University of Illinois at Urbana-Champaign. He was named senior vice president in March 2015, deputy chief economist in February 2016, and to his current role in April 2017. Faucher earned a Ph.D. in economics from the University of Pennsylvania, with concentrations in labor economics and public economics. He also has a B.A. in economics from Cornell University.

VIRTUAL | JANUARY 12, 2023 10:30 a.m.–Noon CT | 11:30 a.m.–1 p.m. ET 9:30 a.m.–11 a.m. MT

An Economic Oulook with… AUGUSTINE FAUCHER, Ph.D. Chief Economist

Bullard

Faucher

Daniel J. Peterson

2 NOVEMBER 2022

www.bell.bank Member FDIC 34607 Reg. O loans | Holding company loans & lines of credit | Equipment financing | Participation loans Whether your loan is large or small, get faster turnaround from our experienced correspondent team. Partner with Bell for: Participation loans Bank stock and ownership loans Holding company loans and lines of credit Reg. O loans to bank employees, insiders or directors Equipment financing Callie Schlieman Call me at 701.433.7430 – Based in Fargo 34607 AD Wisconsin Bankers Association 2022_Callie.indd 1 3/28/22 4:16 PM NOVEMBER 2022 3

414.298.1000 reinhartlaw.com/banking Reinhart’s multi-disciplinary Financial Institutions group brings together one of the Midwest’s deepest benches in banking law. Our experienced attorneys represent a comprehensive range of banking and financial industry legal services, all coordinated by a single touchpoint for you to simplify even the most complex challenges and opportunities. John Reichert jreichert@reinhartlawcom Melissa Y Lanska mlanska@reinhartlawcom

Rebecca Greene

Employee

Benefits

Sara McNamara Bankruptcy/Restructuring

Katherine Bills Commercial Real Estate

Andrew Price Commercial Lending

Experience in Many Directions 4 NOVEMBER 2022

Determining What Corporations are Covered by the Customer Due Diligence Rule Compliance Q&A

By Scott Birrenkott

Q AAre Nonprofit Corporations Covered by the Customer Due Diligence Requirements for Certification of Beneficial Ownership?

Answer: Yes. All corporations that file articles of incorporation with the State of Wisconsin are covered by the Customer Due Diligence (CDD) Rule regardless of nonprofit status.

The CDD Rule requires covered financial institutions to develop written procedures to identify and verify beneficial owners of legal entity customers upon opening of new account. A legal entity customer is described, in part, as a corporation, limited liability company, or other entity that is

Scott Birrenkott

created by the filing of a public document with a Secretary of State. Thus, a nonprofit corporation would be a legal entity customer for purposes of the CDD rule.

The key determination is whether the customer is a “legal entity customer.” Tax status, such as nonprofit status, does not directly affect a customer’s legal entity status. Meaning, a nonprofit organization such as a

Visit the compliance section of the WBA website at wisbank. com/resources/compliance

church could decide to incorporate, file articles of organization, or otherwise file with the State and be covered by the CDD Rule. Typically, however, a nonprofit organization will opt for an unincorporated association status. Unincorporated associations are not legal entity customers and are not covered by the CDD Rule. Wisconsin’s Uniform Unincorporated Nonprofit Association Act can be found under chapter 184 of the Wisconsin Statutes.

For this reason, nonprofits are often exempt from the

WBA In-House Legal Counsel Webinar Series

The WBA In-House Legal Counsel Webinar Series is designed to give in-house bank attorneys the content they need to keep up-to-date on legal issues that affect a

WEBINAR SERIES

bank’s day-to-day operations. CLE credits are also available. Join us on: November 22, 2022 (9–11 a.m.)

The Complex Issues in Dealing with a Customer’s Death

CDD Rule. This is, however, by their decision to organize as an unincorporated association rather than their tax status.

For any questions regarding the CDD Rule, or other topics, contact WBA legal at wbalegal@wisbank.com or 608-441-1200. Additional compliance resources can be found on the WBA website at wisbank.com/resources/ compliance

Birrenkott is WBA director – legal. For legal questions, please email wbalegal@wisbank.com

Note: The above information is not intended to provide legal advice; rather, it is intended to provide general information about banking issues. Consult your institution’s attorney for specific legal advice or assistance.

Presenters: Christopher Schmidt, Thomas Vercauteren, Boardman Clark Law Firm, Madison Register at: wisbank.com/ LegalCounselWebinar

WBA Comments on Proposed Policy Statement on Prudent Commercial Real Estate Loan Workouts

Summary of a recent comment letter below

On October 3, WBA filed comments on a policy statement proposed by FDIC, OCC, and NCUA (agencies) that would update the agencies’ previous statement regarding commercial real estate (CRE) loan workouts. The current policy statement was adopted in 2009 for prudent CRE loan accommodations and workouts. The proposal would update and expand the 2009 Statement by incorporating recent policy guidance on

loan accommodations and accounting developments for estimating loan losses, build on existing guidance for financial institutions to work prudently and constructively with creditworthy borrowers during times of financial stress, update existing interagency guidance on commercial real

View this and previous comment letters filed by WBA at www. wisbank.com/CommentLetters

estate loan workouts, and add a new section on short-term loan accommodations.

WBA commented largely in support of the agencies’ efforts to update the 2009 statement and incorporate recent policy guidance and accounting developments. Comments included acknowledging that the proposal accurately reflects approaches Wisconsin banks already take with regard to

troubled CRE loans. However, WBA requested that the troubled debt restructuring (TDR) examples be removed, given the recent changes to accounting principles eliminating the need for lenders to identify and account for a new loan modification as a TDR. Instead, WBA requested examples for how to report financial difficulty regardless of TDR status.

For copies of this or other WBA comment letters, please contact the WBA Legal Department at 608-441-1200 or visit www. wisbank.com/CommentLetters.

NOVEMBER 2022 5

Setting Yourself and Our Industry Up For Success

WBA’s Advocacy Officer program offers leadership opportunity

By Lorenzo Cruz

Leadership in your bank is about more than networking. As many bank leaders can attest, having a wide range of experience in many different areas of the bank is critical in ensuring a broad understanding of the industry as a whole. As our industry continues to evolve, one significant area of focus for leaders continues

» WBA Pro-tip: If you have someone signed up for the BOLT program, name them as your Advocacy Officer! A CEO can definitely be the Advocacy Officer, but giving another individual this leadership opportunity frees up time and helps the bank plan for the future!

to be government involvement. As members of the Wisconsin Bankers Association (WBA), banks have an opportunity to designate Advocacy Officers, or volunteers who assist in coordinating community advocacy efforts, to work alongside the WBA Government Relations Team on regulatory, legislative, and political activities that impact our industry each day.

In working with WBA staff; fellow bankers; state, local, and federal levels of government; and other state

Advocacy in Action

» Aiming to receive the Bankers Involved in Grassroots and Gov ernment (BIGG) Award this year? Naming an Advocacy Officer is one of the easiest pieces of criteria to meet.

or national trade groups, WBA Advocacy Officers continue to help make life easier for bankers and accomplish the goals of the banking industry.

The typical background for this position usually includes an interest in public policy, a strong understanding of the banking industry (compliance, credit, external relations, etc.), the ability to speak for the bank regarding matters of regulatory or public policy, and a flexible schedule.

But what does an Advocacy Officer (AO) actually do and what are the rewards and advantages for the banker? Here are five opportunities for every Advocacy Officer:

1.Receive relevant, up-to-date information. Every week, AOs receive a report detailing emerging topics, upcoming regulation, key legislative items, and inside information that will help you be at the front end of important business, banking, and economic issues in Wisconsin. In addition to weekly reports, AOs who are subscribed to the Wisconsin Banker Daily will receive timely updates on the events impacting the industry.

on

Above, right: The Stephenson National Bank & Trust (SNBT), Marinette, recently hosted a visit with State Senator Eric Wimberger (R-Green Bay). The discussion included a wide variety of topics including banking issues such as various regulations, labor market and inflation, the current interest rate cycle and the role that community banks play in maintaining a strong local economy. Pictured (left to right) are: SNBT President and CEO Dan Peterson; SNBT Vice President & Risk Management Officer Brooke Frehse; WBA Vice President – Government Relations Lorenzo Cruz; and Senator Wimberger.

Advocacy Update

Lorenzo Cruz

Above, left: The Greenwoods State Bank, Lake Mills recently welcomed State Assembly Speaker Robin Vos (R-Burlington) to the bank for a Take Your Legislator to Work event. Pictured (left to right) are: Board Member Keith Pollock; President Rob Cera; Speaker Vos; and Chief Executive Officer and Chairman of the Board Bill McDonald

»

Plan a Take Your Legislator to Work event

by contacting

WBA’s

Lorenzo Cruz at lcruz@wisbank.com Cruz

can help arrange the visit, offer talking

points,

and

help coordinate your advocacy efforts for the meeting.

Thank

you Greenwoods State Bank and SNBT for your recent grassroots efforts!

(continued

p. 7) 6 NOVEMBER 2022

Third Annual Agricultural Banking Scholarship Now Open

Applications are due November 15, 2022

As part of its mission to empower Wisconsin communities to make responsible financial decisions, the Wisconsin Bankers Foundation (WBF) offers scholarships to students who demonstrate financial literacy and responsibility.

In addition to other programming such as Reading Raises Interest Kits offered in the spring for Teach Children to Save Day and quarterly reports compiled on Banconomics.com, WBF

College students pursuing agricultural banking should apply now by visiting wisbank foundation.org/scholarships

strives to provide ample resources and avenues that every member of our communities can use to succeed.

This year’s Agricultural Banking Scholarship is now open to all currently enrolled students attending an

accredited Wisconsin college, university, or technical college. As the cost of college continues to rise, the Foundation is now offering two scholarships, $1,500 each, to qualified applicants who are interested in pursuing a career related to agricultural banking and who submit a completed application by November 15, 2022.

Please share this exciting opportunity with any current or former agricultural banking interns or students you think may qualify, as well as local educators who can spread the word. We look forward

New this year: Two qualified applicants will be awarded $1,500 each.

to hearing from students pursuing careers so important to Wisconsin’s economy. Visit wisbankfoundation. org/scholarships to access the online application. Please contact Wisconsin Bankers Foundation Coordinator Hannah Flanders at hflanders@wisbank.com with any questions related to activities of the Foundation, or this year’s scholarship.

Advocacy Update (continued from p. 6)

2.Testify before the Wisconsin Legislature or communicate with key elected officials. This unique leadership opportunity allows AOs to speak directly to legislators and other community leaders about how the banking industry works and how legislation will impact the banking industry. Working directly with WBA staff, an AO is prepared and reinforced with information to help the banker put their best foot forward. AOs email or call elected officials about banking items to help provide information, meet in Madison at WBA’s annual Capitol Day, and host elected officials at the bank as part of “Take Your Legislator to Work Days.”

3.Recognition before your bank leadership and peers.

WBA recognizes AOs in publications and directly with bank leadership for their efforts to help the banking industry AOs also have the opportunity to attend events that allow

an individual to connect with other bankers and WBA leadership. AOs are given the contact information for every Advocacy Officer peer in Wisconsin.

4.Elect pro-banking officials.

Once per year, the AO helps coordinate fundraising activities at the bank for Wisbankpac (PAC) political action committee or the Alliance of Bankers for Wisconsin (ABW) conduit to help support pro-banking candidates. AOs are provided information by WBA in an Advocacy Toolkit that helps with all aspects of the event. WBA is not “D” nor “R,” but “B” for Banking!

5.Meet with leaders from other industries and represent WBA.

AOs regularly attend local and statewide events to represent Wisconsin’s banking industry. These events create an entirely new network of individuals who are leaders in other industries, such as healthcare, accounting, manufacturing, and real estate.

To learn more about the Advocacy Officer position, please visit wisbank.com/ advocacyofficer or email

me at lcruz@wisbank.com.

Cruz is WBA vice president – government relations.

Take comfort in the sound investments of ICBA Securities.

Find your snug investment options at icba.org/securities Member FINRA/SIPC

Cover your community bank in the comfort of knowing you have quality investment products.

ICBA Securities powered by Vining Sparks is interwoven with ICBA — so when you put your trust in us, you support the community banking industry.

NOVEMBER 2022 7

BOLT Marks 10 Years (continued from p. 1)

“Nearly a decade later, talent recruitment and retention, as well as succession planning, continue to be top concerns for community banks,” said Daryll Lund, WBA executive vice president and chief of staff. “We have grown to have over 500 BOLT Section members representing over 135 banks.” It is free for WBA members to join the BOLT section, so many banks take advantage of the opportunity to sign up multiple employees.

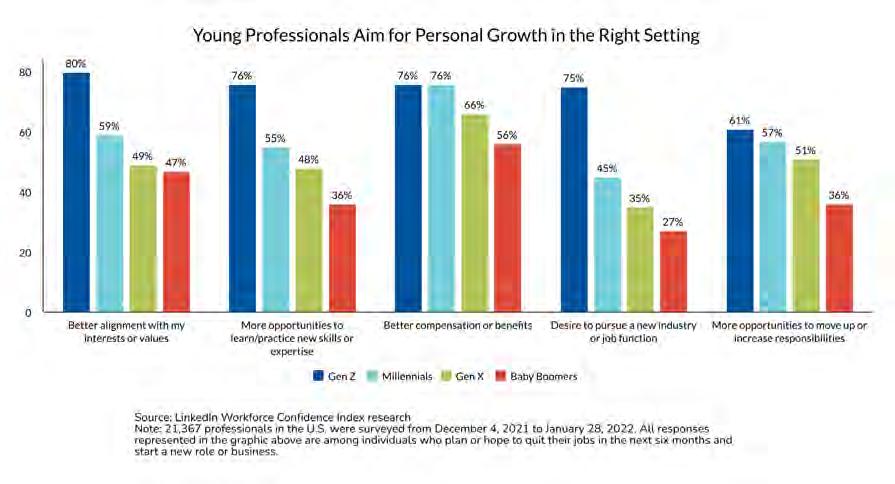

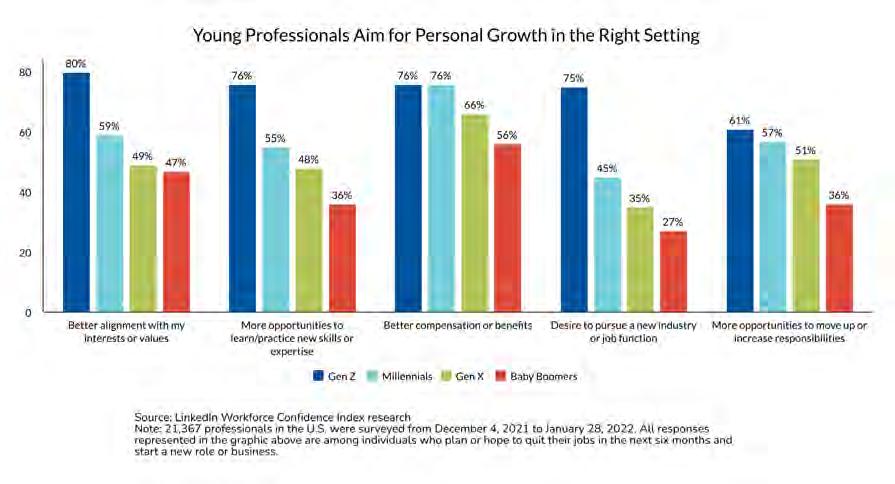

The Deloitte Global 2022 Gen Z and Millennial Survey found that approximately 40% of Gen Zers and 24% of millennials would like to leave their jobs within two years, and about a third would quit without another job lined up. While those numbers may be startling, a recent LinkedIn Workforce Confidence Index gives some insight into the priorities of job seekers.

As the chart above shows, a career path that aligns with the employee’s interests or values (80%) and more opportunities to learn/practice new skills or expertise (76%) are equally important to — or even more important than — better compensation or benefits (76%) for Gen Zers. Younger employees’ desire to pursue a new industry or job function and interest in moving up or increasing responsibilities underscore the importance of offering professional development opportunities.

A major draw to the BOLT Section is the access to the biannual BOLT Leadership Summits. Attendees often talk about the “spark” that’s

BOLT is the equivalent of onboarding an employee to the bank — but on an industry level. It opens doors, shares knowledge, and increases every banker’s likelihood to succeed.

— Loni Meiborg senior vice president and director of organizational development Fortifi Bank, Berlin

ignited in them through the Summit programming and networking. Dan Ravenscroft was the inaugural BOLT Section Board chair and has since become president and CEO of Royal Bank, Elroy and continues his service to the industry on the WBA Board of Directors. “BOLT is designed to provide bankers with the additional knowledge, skills, and tools

that they need to take their careers to the next level,” said Ravenscroft. “The connections, experiences, and relationships built through participation in the interactive BOLT Leadership Summits have proven invaluable in my personal career development.”

Lori Kalscheuer, WBA director – education, serves as the staff liaison to the BOLT Section Board and heads up the planning for the Summits.

“The energy at the BOLT Summits is always very high, and the participants are eager to make the most of their experience,” said Kalscheuer.

“Along with new skills and ideas, they bring back a lot of enthusiasm to their banks.”

Kalscheuer emphasizes that leadership skills are applicable to any employee at the bank, regardless of job function, age, or experience level.

Ryan Boebel (center, right), assistant vice president – market manager and business banker at Community First Bank, Baraboo shares about his experience as a WBA Advocacy Officer onstage at the 2022 BOLT Summer Leadership Summit with Lorenzo Cruz (center, left), WBA vice president –government relations. Boebel is vice chair of the 2022–2023 WBA BOLT Section Board.

She encourages any banker who wants to build their leadership skills to get involved with BOLT.

Now almost a decade in, the BOLT program sees continued engagement of longtime participants as well as many referrals for fellow bankers to get involved. Jennifer Sobotta, vice president and marketing director at Forward Bank, Marshfield, and current BOLT Section Board chair, views BOLT as an important benefit of WBA membership. “Joining the BOLT Section Board gave me an opportunity to stay connected with industry peers and the WBA,” explains Sobotta. “Being part of this group fits beautifully with the leadership initiatives

on p. 9)

» Please visit wisbank.com/BOLT to learn more about the WBA BOLT Section.

(continued

8 NOVEMBER 2022

BOLT Marks 10 Years (continued from p. 8)

Being a part of this group fits beautifully with the leadership initiatives we have going on at Forward Bank and has allowed me to identify and send our up-and-coming leaders on to fine tune their skills.

— Jennifer Sobotta, CFMP WBA BOLT Section Chair vice president and marketing director

Forward Bank, Marshfield

we have going on at Forward Bank and has allowed me to identify and send our up-andcoming leaders on to fine tune their skills.”

As Loni Meiborg, senior vice president and director of organizational development, Fortifi Bank, Berlin rounds out her time on the BOLT Section Board as past chair, she has sought out a new opportunity to stay involved and continue to grow her career by serving on the WBA Marketing Committee. Her testimonial speaks for itself:

Without BOLT, I can honestly say I wouldn’t be where I am today in my career. Early on, the Summits allowed me to meet influential people who shared their knowledge and experience to help me grow. Once joining the BOLT Section Board, I was inspired by each member’s passion and commitment to fostering success among bankers and

Did You Know?

W INTER L EADERSHIP S UMMIT • November 9

WBA Building Our Leaders of Tomorrow Glacier Canyon Lodge & Convention Center • Wisconsin Dells

Join emerging bank leaders on Wednesday, November 9 in Wisconsin Dells for the WBA BOLT Winter Leadership Summit. BOLT (Building Our Leaders of Tommorow) is a great opportunity for current and emerging leaders to come together and learn from both peers and industry experts. The Summit connects community bankers from around Wisconsin for one day full of education and networking.

Visit wisbank.com/BOLT to learn more about the BOLT Winter Leadership Summit or to register.

Congratulations WBA BOLT Winter Leadership Summit Scholarship Awarded

Linda Cutler, has been selected to receive a scholarship to attend the WBA BOLT Winter Leadership Summit on November 9 in Wisconsin Dells.

Cutler, a regulatory residential loan specialist at

Associated Bank in Stevens Point, has served 20 years in the banking industry. With her scholarship and attendance at WBA’s BOLT Summit, Cutler hopes to not only continue learning and growing in her career, but also to inspire others.

The WBA and FHLBank Chicago, a WBA Gold

Associate Member, are offering three scholarships for bankers to attend select WBA events. The scholarships are being awarded in conjunction with the Association’s DEI plan and mission to provide bankers with education and resources to expand their careers, Congratulations, Linda!

the industry overall. And now as past chair, I reflect on all the folks I’ve met and the speakers I’ve heard along the way, which have left their indelible mark on how I lead, how I think, and how I feel about banking Thank you to the WBA leadership and team for focusing on, and knowing the importance of, Building Our Leaders of Tomorrow.

To learn more about BOLT, visit wisbank.com/BOLT

Krause is WBA communications manager.

Uncomplicate regulatory compliance

Wisconsin Banker occasionally prints informative articles submitted by Gold, Silver, and Bronze WBA Associate Members. Interested in sharing your expertise? Please contact WBA’s Nick Loppnow at 608-441-1259 or nloppnow@wisbank.com or email sales@wisbank.com for more information about purchasing Sponsored Content space in WBA’s electronic publications.

Gain access to Wipfli’s team to help untangle complicated regulatory compliance rules. Learn more at wipli.com/ComplianceHelp

Perspective changes everything.

Cutler

NOVEMBER 2022 9

»

Ensuring Financial Success for Wisconsinites

FINRA’s National Financial Capability Study and other helpful financial resources

By Rose Oswald Poels

Ensuring the financial success and prosperity of our community members is at the heart of the banking industry. Recently, the FINRA Investor Education Foundation released its National Financial Capability Study results,

FINRA: Financial Industry Regulatory Agency, https://www.finra.org.

providing insights into the financial capability of U.S. adults. The findings are a helpful resource in understanding the financial circumstances of households in Wisconsin compared to the region and nation.

The summary of FINRA’s findings — split into specific sections such as making ends meet, planning ahead, managing financial products, and financial knowledge — underscore a few of the most important areas relating to financial literacy. Conducted June through October 2021, the survey results show that Wisconsinites stand ahead of the rest of the U.S. in many critical areas such as having emergency funds, a savings account, and a plan for their future.

Bankers play an important role in outreach efforts in your communities to equip consumers young and old with the knowledge and resources needed to achieve financial stability and prosperity.

In countless ways, Wisconsin bankers do so much to promote financially healthy communities. To support you in this work, the Wisconsin Bankers Foundation (WBF) serves as the hub for all things financial literacy. Annually, Wisconsin bankers venture into schools as part of Teach Children to Save

WBA President and CEO

Rose Oswald Poels

wisbankfoundation.org or email hflanders@wisbank.com

Is your bank looking for resources to help keep your communities financially healthy? Visit wisbankfoundation.org/ resources for more details.

Living Paycheck to Paycheck (above): 52% of Wisconsin residents spend equal to or more than their income (compared to 53% in USA).

No Rainy Day Fund (right): 37% of Wisconsin residents do not have emergency money of three months of income (compared to 43% in USA).

*Graphs provided by the Wisconsin Department of Financial Institutions (DFI) based on information provided by the FINRA Investor Education Foundation National Financial Capability Survey

Day in April using WBF’s Reading Raises Interest Kits. In addition, the Foundation is actively working to curate relevant resources bankers can use with people of all ages and levels of financial experience — please visit wisbankfoundation.org/ resources to view what we have available now.

As a reminder, the 2022–2023 Financial Education Summary Forms are now open. Not only does the Foundation assist Wisconsin bankers in providing resources for all consumers, but we also celebrate these important contributions you make each day to our state.

If your bank employees participate in any financial education-related event from June 1, 2022 through May 31, 2023, please submit a form as you go to record your activity. Questions related to WBF and resources available for your bank can be directed to Hannah Flanders, WBF coordinator, at hflanders@ wisbank.com.

FINRA Foundation National Financial Capability Study (NFCS), visit: finra foundation. org/know ledge-wegain-share/ nfcs

» America Saves, AmericaSaves.org: Accessible online guidance, best practices, and goals consumers can pledge themselves to.

» ELEVATE Wisconsin, financialfitnessgroup.com/ elevate-wi: An online wellness program providing interactive, effective, and unbiased instruction in personal finance and investing fundamentals to Wisconsin employees.

» Wisconsin Saves, Auto Save.Wisconsinsaves.org: Smalland medium-sized businesses can promote the ease and benefits of saving automatically for emergencies through split deposit to their employees.

Bankers should also be aware of programs such as America Saves, Wisconsin Saves, and ELEVATE Wisconsin that can be implemented in the office, shared with business customers, and members of the community.

Thank you to every bank that assists our industry in continuing its commitment to serving and educating members of our communities. Time and time again, data such as FINRA’s National Financial Capability Study reminds us of the strength in our industry — where we’ve come from and where we have yet to go.

Oswald Poels is WBA president and CEO and WBF chair and treasurer. She can be reached at ropoels@wisbank.com

10 NOVEMBER 2022

Pursuing a Life-Long Passion of Serving the Community A Graduate Profile of NaKecia Dean, Johnson Financial Group

By Hannah Flanders

NaKecia Dean began her career in financial services at just 14 years old. The then high school student started in the cash room of a local grocery store before tran sitioning to a check cashing store as a teller and eventually assistant manager.

Dean eventually left this job to pursue a position in customer service and grow her family, however, after nearly 25 years, a bachelor’s degree in business with a minor in small business and entrepreneurship, and previous experience in the financial services under her belt — the mother of two was craving a return to the world of banking.

Shortly after mentioning her desire to her fiancé, André, Dean received an email from EmployMilwaukee regarding their upcoming eight-week BankWork$ program.

“It was an ‘oh wow’ moment,” describes Dean. “I jumped on the opportunity right away because it was

God and the universe speaking very clearly to me.”

Though Dean entered the program with a slew of previous experience, she and her classmates learned the hard and soft skills necessary for entry-level retail and operations positions such as deepening the customer relationship, functions of a bank, and general cash handling.

“Some may think that banking is simple — you just need to be able to count money. Banking is so much more than that,” states Dean of the experience she gained during the eight-week training program. “Having the knowledge and [ability] to develop by taking on new challenges has made me a better banker.”

Following her graduation in June 2021, BankWork$ graduates and partner banks took part in a hiring event in which Dean was recruited to join Johnson Financial Group.

At Johnson Financial, Dean serves as a Relationship Banker 1, and with her knowledge, particularly in small business and entrepreneurship, Dean has formed a close connection to many small business owners in the Milwaukee area. To anyone she meets, Dean’s passion for not only banking, but assisting her community is evident.

“Not only do I have the opportunity to work face to face with real people every day, in handling their money, I build their trust and form a very strong relationship, especially with those I see regularly,” highlights Dean. “I love helping customers, greeting them by first or last name — getting to know them.”

Dean’s passion and experience in serving customers has allowed her career in banking to flourish. In addition, the BankWork$ training program provided Dean with the ability to hone these critical skills.

Thanks to the tools, resources, and confidence

“I love helping customers, greeting them by first or last name — getting to know them. ”

offered by the BankWork$ program and its instructors, Dean sees herself continuing her success in the banking world and progressing to new levels in the bank. She one day hopes to assist in managing her own branch.

To prospective bankers, Dean underscores the BankWork$ program as a rewarding opportunity to not only expand banking knowledge but leave prepared for the workforce.

“The instructors are so willing to assist because their main goals is to see you succeed in the program and in the banking industry.”

Flanders is WBA writer/editor.

Learn more about the BankWork$ program at https://www.employ milwaukee.org/Employ-Milwaukee/ Programs--Services/Adult-YouthPrograms/BankWork.htm

WISCONSIN BANKERS ASSOCIATION Nov. 16–17 | Wisconsin Dells wisbank.com/lead360 >Learn more about LEAD360 Conference on pgs. 1, 18, and 19 in this issue <

Dean

— NaKecia Dean relationship banker 1 Johnson Financial Group Milwaukee

NOVEMBER 2022 11

The New Face of Identity Theft

The rapid growth of synthetic identity fraud

By Hannah Flanders

Like many aspects of our day-to-day lives, the expansion of technology has both enhanced and complicated the ways in which we operate. As more and more of our information lives online, identity theft — once more likely to occur because of a stolen wallet — has also assumed a digital appearance: synthetic identity theft.

What is Synthetic Identity Fraud?

Synthetic identity fraud is defined as the use of a combination of pieces of personally identifiable information (PII) to fabricate a person or entity in order to commit a dishonest act for personal or financial gain.

This form of identity theft has allowed bad actors to combine a stolen Social Security Number (SSN) and other false information — such as a fake name, address, date of birth, or phone number — to create a counterfeit identity to steal funds, escape prosecution, or any other number of criminal and fraudulent activities.

An Alarming Trend

In 2020, the Federal Bureau of Investigation (FBI) named synthetic identity theft as the fastest growing financial crime in the United States. Fraud targets are often those who do not typically use credit or are less likely to monitor their credit activity — including children, homeless individuals, and the elderly. These victims may find themselves blindsided as fraudsters create a new identity, apply for credit, and after years of building good credit by making payments for a time, abandon the account without paying anything back to the financial institution.

While this type of fraud is already difficult to detect due to its elusive or “normal” nature, many bad actors go to incredible lengths to appear as such, states Forbes In addition to establishing good credit by making payments quickly and on time, some create digital profiles or use P.O. boxes for addresses.

Not only has technology and access to the dark web made PII more accessible to fraudsters, in 2011 the Social Security Administration (SSA) began randomizing the ninedigit social security codes rather than assigning them to individuals based on their geographical location and group number. No longer do social security numbers raise red flags when enrolling or opening accounts “out of state.”

As online banking grows in popularity, so too do concerns for synthetic identity theft. Between prevalent phishing schemes and heightened risks for data breaches — accessing PII and conducting synthetic identity fraud has become much easier than in years prior.

How to be Proactive Against Bad Actors

Inconsistent categorization and reporting make it difficult to identify and mitigate this type of fraud — as far as banks and credit bureaus can tell, these individuals are just like anyone else. . . until they “bust out” or abandon the maxed-out account with no intention of repayment.

After abandoning the false identity’s account, a fragmented file is created. This additional file not only becomes associated with the original SSN but also holds the additional credit report information and other fabricated PII. Unfortunately, this information could negatively impact the credit rating of the real individual.

When working with customers, bankers should advise frequent credit report checks or freezing unused credit at credit bureaus throughout the U.S. as to deter criminals or catch them early.

In addition, customers may take additional steps to protect themselves and their family

[Community banks] most likely have synthetic ID fraud in their deposit and loan accounts that remains undetected with traditional third-party ID verification programs that most community banks use.

— Lenore Breit past chair, WBA Financial Crimes Committee and vice president –compliance manager Prevail Bank, Wausau

against synthetic identity theft. One way parents can protect their children from fraudsters is by requesting their child be added to their credit profile.

By adding a child to an adult's credit profile, not only does the child’s own credit profile become established in his or her name and SSN, but the child is also able to begin building their credit.

The Cost of Synthetic Fraud

While victims of identity theft typically are not liable for fraudulent purchases or accounts, as long as they can prove they are the real SSN holder and not the thief, banks and other financial institutions are left to absorb the cost. This scheme is not only incredibly costly to banks across the country — with losses estimated at $20 billion in 2020, according to the Federal Reserve Bank of Boston — but gaps in the U.S. Fair Credit Reporting Act may have also increased the likelihood of repeat offenders.

The Federal Reserve has reported that bad actors are able to ‘flood the financial

(continued on p. 13) 12 NOVEMBER 2022

Synthetic Identity Fraud (continued from p. 12)

institution with an overwhelming number of claims’ on their fake accounts, and when creditors are unable to fulfill the investigation in the allotted timeframes, the disputed item is removed from the false credit report and time and time again, fraudsters get away with the act.

“Synthetic IDs are a struggle for community banks to identify,” states Lenore Breit, vice president – compliance manager at Wausau’s Prevail Bank. “Based on a recent presentation, [community banks] most likely have synthetic ID fraud in their deposit and loan accounts that remains undetected with traditional third-party ID verification programs that most community banks use.”

“There are other, more robust ID verification programs

available to detect synthetic ID fraud,” adds Breit. “But they are costly and may not interface with legacy software.”

One such software program, the electronic Consent Based SSN Verification service, was created in part by the Economic Growth, Regulatory Relief, and Consumer Protection Act. The electronic service offered by the SSA was created in 2018 to aid financial institutions in combating synthetic identity fraud and verify an authorizing individual’s name, date of birth, and SSN against the SSA records. Services are based on the annual transaction volume and can cost thousands or even millions of dollars.

Common Signs of Synthetic Identification Theft

While difficult to trace, there are a few significant ways bankers can remain attentive to

PII and other key indicators of synthetic identity fraud.

Most obvious is ensuring all SSNs match to the PII given. Do not assume a name change or relocation; ask questions or require verification for the sake of your bank and the security and privacy of all customers. This extra step could make all the difference in protecting the personal information of every customer.

If an account is already open, bankers should note applicants who have the same contact information or SSN as well as those with multiple authorized users.

As synthetic identity fraud becomes increasingly prevalent throughout the U.S., it is critical, for the safety of customers and security of all financial institutions, that Wisconsin bankers are prepared to combat

Synthetic identity fraud is incredibly costly to banks across the country — with losses estimated at $20 billion in 2020, according to the Federal Reserve Bank of Boston. this emerging fraudulent activity, caution community members against sharing unnecessary personal information with others, and assist individuals in regaining their rightful identity if necessary.

If you are interested in learning more about synthetic identity fraud, how these schemes can impact your bank or customers, or more ways you can take a stand against bad actors, please contact WBA’s Legal Team at wbalegal@ wisbank.com or 608-441-1200.

Flanders is WBA writer/editor.

PROTECT YOU from the Unexpected

Lines

Property & Casualty Lines

Lending Related Lines

Property

WE

Professional/Specialty

• Financial Institution Bond • Directors & Officers Liability • D&O Civil Money Penalties • Cyber Liability • EFT Guard • Excess Deposit Bond

• Property & Casualty • Foreclosed Property • Workers Compensation • Umbrella Liability

• Master

(Force Placed) • Mortgage Protection • Lenders Single Interest • Flood Compliance Solutions www.mbisllc.com Jeff Otteson Vice President of Sales jeffo@mbisllc.com 608.217.5219

Melissa

Noonan Account Manager melissan@mbisllc.com 608.441.1275 Contact Us!

NOVEMBER 2022 13

Bulletin Board

News about people working in Wisconsin’s financial institutions

Promotions and New Hires

Arcadia

First National Bank and Trust Company is pleased to announce Josh Grzadzielewski (pictured) as the new vice president –community banking.

Fitchburg

Oak Bank has welcomed Nick Meier (pictured) to the team as a credit analyst.

Galesville

Bluff View Bank is proud to announce Lindsay Spitzer (pictured) has been promoted to president and chief executive officer following the retirement of Scott Kopp. Additionally, Stuart Kuzik (pictured) has been hired as chief credit officer and commercial loan officer.

Horicon Frederick C. Schwertfeger (pictured) has been named president of Horicon Bank.

Little Chute

BLC Community Bank is excited to announce Dennis Hietpas (pictured) has joined the team as vice president –commercial lending.

Madison Capitol Bank is pleased to announce the promotions of

Justin Hart (pictured) to president and Ami Myrland (pictured) to executive vice president. Additionally, Amanda Noles (pictured) has joined the team as bank manager – Verona.

Amanda Postel (pictured) has joined the Park Bank team as senior vice president operations.

Manitowoc Bank First is pleased to announce that Andrew Kittelson (pictured) has joined the bank as vice president –business banking and AJ Spackman (pictured) has been promoted to assistant vice-president – retail loan operations officer.

Marinette Michael Ebbensgard (pictured) has joined The Stephenson National Bank & Trust as vice president – retail market manager.

Marshfield

Sheri Dick (pictured) has been promoted to chief operating officer at Forward Bank.

New London

First State Bank recently announced the addition of Ken Seubert (pictured) to its agricultural lending team.

(continued on p. 15)

WBA Honors Bankers in Greenleaf and Deerfield with Lifetime Service Awards

Have good news? To submit a notice, please email bulletinboard@wisbank.com or mail entries to WBA Bulletin Board, 4721 South Biltmore Lane, Madison, WI 53718. Send photos as JPEG files. Questions? Contact WBA’s Hannah Flanders at 608-441-1237 or hflanders@wisbank.com

Meier

Myrland

Ebbensgard

Kuzik

Postel Seubert

Grzadzielewski

Hart

Spackman

Hietpas

Kittelson

Spitzer

Noles

Dick

Schwertfeger

On September 15, WBA President and CEO Rose Oswald Poels presented WBA Lifetime Service Awards to GreenLeaf Bank employees. Above (left to right) are: Mary Fritsch (47years); Oswald Poels; Sharon Bucholz (47years); and Lora Cornette (40 years).

Winkler has been with the bank for a total of 30 years and also has several years of prior banking experience.

On September 8, WBA President and CEO Rose Oswald Poels presented Darren Winkler, president and CEO of Bank of Deerfield, with a WBA Lifetime Service Award in recognition of his tenure in the banking industry.

Meier

Myrland

Ebbensgard

Kuzik

Postel Seubert

Grzadzielewski

Hart

Spackman

Hietpas

Kittelson

Spitzer

Noles

Dick

Schwertfeger

On September 15, WBA President and CEO Rose Oswald Poels presented WBA Lifetime Service Awards to GreenLeaf Bank employees. Above (left to right) are: Mary Fritsch (47years); Oswald Poels; Sharon Bucholz (47years); and Lora Cornette (40 years).

Winkler has been with the bank for a total of 30 years and also has several years of prior banking experience.

On September 8, WBA President and CEO Rose Oswald Poels presented Darren Winkler, president and CEO of Bank of Deerfield, with a WBA Lifetime Service Award in recognition of his tenure in the banking industry.

14 NOVEMBER 2022

Bulletin Board

News about people working in Wisconsin’s financial institutions

Promotions and New Hires (continued from p. 14)

Oconomowoc

Bank Five Nine is pleased to announce the hiring of Tim Schneider (pictured) as its next president and chief executive officer while Mark W. Mohr transitions into retirement.

Oregon

One Community Bank welcomes Justin Hanson (pictured) as business development and treasury management to the Stoughton location and Brittnie Ketter (pictured) as treasury management business development specialist to the Waunakee location.

Platteville

Mound City Bank is excited to welcome Lu Ann Bowman (pictured) as vice president –retail banking. Additionally, the bank has announced the promotions of Molly Heimerdinger (pictured) to assistant vice president – portfolio manager,

Jenni Mullikin (pictured) to assistant vice president – operations, and Nancy Salzmann (pictured) to assistant vice president – deposit compliance/ BSA administrator.

Waterloo Farmers & Merchants State Bank is excited to announce the promotions of Malinda

Five Honored at Bank of Lake Mills with WBA Lifetime Service Awards

Weisensel (pictured) to vice president – IT and operations and Jena Bleecker (pictured) to include account specialist to her job title.

Waukesha Waukesha State Bank is excited to welcome Melissa Gramza (pictured) as controller. Additionally, Meena

Granado (pictured) has been promoted to commercial banker and Tyler Kern (pictured) to assistant vice president – investment officer.

Anniversaries

Fond du Lac

National Exchange Bank & Trust congratulates Karen Henning (pictured), administrative assistant, who celebrated 35 years of service at the bank in August.

Tigerton

First National Bank of Tigerton congratulates Patricia Boldig, branch manager – Bowler, on her recent milestone of 50 years of service to the industry.

Congratulations Madison

First Business Bank congratulates Craig Cerbins (pictured), vice president – commercial banking, on his selection by the Waukesha County Business Alliance as one of five 2022 Emerging Leaders.

2022 Frank Lamping Community Service Award Recipient Named

On August 29, five bankers from the Bank of Lake Mills were presented with WBA Lifetime Service Awards. Congratulations to: seated (left to right): Ty Neupert (32 years) and Michael Sweeney (37 years). Standing (left to right): Kay Kasten (32 years), Beverly Klug (46 years), and Debra Jardine (43 years).

The WBA Lifetime Service awards recognize bankers who have served the Wisconsin banking industry for 30 and 40 years.

Community State Bank, Union Grove is proud to announce that Cary Madrigal (right), captain of Racine County Sheriff’s Office, has been named as the 2022 Frank Lamping Community Service Award recipient for her exemplary positivity, selflessness, and leadership in giving back to the local community. She is pictured with Dave Moyer, senior vice president, Community State Bank. Madrigal was also gifted $1,000 to donate to a non-profit organization of her choice. She chose the Go Frank Go Foundation, which was created to inspire local youth to be involved in their community and to “live like Frank.”

Bleecker

Cerbins

Bowman

Kern

Gramza

Ketter

Mullikin Salzmann

Granado

Heimerdinger

Hanson

Weisensel

Henning

Schneider

Bleecker

Cerbins

Bowman

Kern

Gramza

Ketter

Mullikin Salzmann

Granado

Heimerdinger

Hanson

Weisensel

Henning

Schneider

NOVEMBER 2022 15

EDUCATION Calendar

NOVEMBER 2022

Mortgages Webinar: Session 2

3-part series; $500/bank

Banker School

Madison; $495/attendee

Mortgages Webinar: Session 3

3-part series; $500/bank

Winter Leadership Summit

Wisconsin Dells; $150/attendee

Manager Boot Camp: Session 3

4-part series; virtual half-days; $800/attendee

Forum: Session 2

Wisconsin Dells; annual membership (pricing varies)

Conference

Wisconsin Dells; $350/attendee

Legal Cousel Webinar: Complex

When Dealing with Death of Customer

Virtual; $250/attendee

Manager

series; virtual half-days;

FEBRUARY 2023

MARCH 2023 (continued)

Compliance School

Madison; $1,295/attendee

Estate Compliance School

Madison; $795/attendee

to Commercial Lending School

Madison; $895/attendee

Officer Workshops

Wisconsin Dells or virtual; $245/attendee

Report Review & Update Workshop

Virtual half-days; $245/attendee

APRIL 2023

Mortgage Lending School

Madison; $1,045/attendee

Bankers Conference

Wisconsin Dells; $300/ag section member or $350/non-section member attendee

of Community Week

wisbank.com/BanksPowerWI

Management School

Madison; $795/attendee

in Banking Conference

Wisconsin Dells or virtual; team pricing available

Bankers for Compliance (CBC) — Session II

Wisconsin Dells or virtual; membership (pricing options vary)

of Banking Course

Locations TBD; $550/attendee

Conference

Location TBD; $245/attendee

MAY 2023

Mortgage Conference

South Carolina

and

registration.

Education at wbaeducation@

or call 608-441-1252.

•Adjustable-Rate

1

•Personal

2–3

•Adjustable-Rate

8

•BOLT

9

•Branch

10

•Compliance

15

•LEAD360

16–17

•In-House

Issues

22

DECEMBER 2022 •Branch

Boot Camp: Session 4 15 4-part

$800/attendee JANUARY 2023 •Midwest Economic Forecast Forum 12 Virtual •Community Bankers for Compliance (CBC) — Session I 24–25 Virtual half-days; membership (pricing options vary)

•Bank Executives Conference 8–10 Wisconsin Dells •Compliance Forum: Session 3 14 Wisconsin Dells; annual membership (pricing varies) MARCH 2023 •Advanced IRA Workshops 7 Madison or virtual; $245/attendee •Loan

13–17

•Real

15–17

•Introduction

20–22

•Security

22

•Call

TBD

•Residential

11–14

•Agricultural

13–14

•Power

17–22

•Compliance

18–20

•Women

25

•Community

26

•Principles

TBD

•HR

TBD

•American

1–3

» Visit www.wisbank.com/education for more information

online

» Or email WBA

wisbank.com

16 NOVEMBER 2022 Conferences I Summits Schools I Boot Camps Seminars I Workshops WBA Webinars Other Events

Your

THANK YOU

WBA extends its gratitude to our Gold Associate Member companies for standing by and supporting the banking industry and the Association. These companies not only provide services, information, and products to assist Wisconsin banks in serving their customers and communities, they also support WBA in offering its member banks the highest quality resources and education. Thank you.

WBA G OLD A SSOCIATE M EMBERS

Who is the 2022 WBA Banker of the Year? You Tell Us!

Nominations are due Friday, December 9

WBA is now accepting nominations for the 2022 Banker of the Year Award! This award recognizes someone who has made an outstanding effort in service to their bank, to their community, and to the banking profession.

To qualify, nominees must be an employee of a

Wisconsin bank and a member of the WBA. In addition, the individual should be a bank president/CEO, or have held this role in the recent past. Nominations may be submitted by an individual who can describe the banker’s civic and professional accomplishments.

Steve Burgess, president and CEO of National Bank of Commerce in Superior,

was honored as the Wisconsin Bankers Association Banker of the Year for 2021, recognizing his innovation, service, and leadership. Burgess was recognized during the 2022 Bank Executives Conference by 2020 Banker of the Year, Jim Hegenbarth, president and CEO of Park Bank in Madison. This year’s award will be presented at the Bank Executives Conference,

February 8–10, 2023 in Wisconsin Dells.

Download a nomination form at wisbank.com/bankernomination. The form must be returned by December 9, 2022 Questions about the award or the nomination and selection process may be directed to WBA Executive Vice President Chief of Staff Daryll Lund at dlund@wisbank.com or 608-441-1203.

Honoring Wisconsin Bankers for a Lifetime of Service

Nominations are due Friday, December 9

Each year, WBA presents awards recognizing bankers for their long service to our industry and their community, and the tradition will continue this year.

The 50-Year and 60-Year Clubs recognize bankers who have served in the banking industry for 50 and 60 years, respectively. These awards will be presented at the WBA

Bank Executives Conference, February 8–10, 2023 in Wisconsin Dells.

If your bank has individuals who should be recognized, please nominate them by completing the form found at wisbank.com/ServiceAwards If the nominated individual is unable to attend the conference, WBA staff will work with you to plan an event at your bank in honor of the individual.

»Eligibility Rules for 50- and 60-Year Club

Memberships

Any Wisconsin banker who is an active or retired officer, director, or employee and has completed 50–59 or 60-plus years of service. (U.S. Military service counts in the 50-year or 60-year span if the proposed recipient was in banking both before and after time spent in the military.)

Bankers enrolled in past

WBA 50-Year Clubs are not eligible to be honored again in that specific award category but may make an application to be honored for 60 or 70 years of service to the financial services industry. Before nominating an individual, we strongly suggest checking with the person or your institution’s records to confirm dates of service as well as to determine whether they have received the honor in a past year.

WBA INSURANCE SE RV ICES WBA Employee Bene ts Corporation Midwest Bankers Insurance Ser vices WBA INSURANCE SE RV ICES WBA Employee Bene ts Corporation Midwest Bankers Insurance Services

|

|

Correspondent Banking

NOVEMBER 2022 17

Branding Your Culture

(continued from p. 1)

bank. In this, most Wisconsin banks have already completed the most challenging aspect.

In order to encourage employees to adopt these values, managers should ensure a sense of trust among their staff.

Robb Rempel of Nebraskabased Haberfeld highlights that in order to empower the employee, it is critical that they are provided with, and have an understanding of, products they

Whether it be more training or mentoring, [our goal is to] help that individual be the best banker he or she can be.

— Amanda Emery-Morris training and marketing coordinator

Farmers & Merchants Union Bank, Columbus

BRANDING YOUR CULTURE

Wisconsin banks empower employees, drive service

believe in and have processes that encourage follow through.

These processes should not only include training and equipping every team member to identify customer needs but ensuring every team member understands where they can turn with questions or direct others. These skills are vital in fostering a confident team.

Sustaining Culture Among Employees

Of course, setting employees and prospective

talent up for success is one aspect to consider — but how can banks ensure they are continually boosting employee morale and that company culture is evident to new or prospective employees? Rempel suggests that community bankers should lean into the changes caused by COVID.

“Regularly check in with your team — really get to know them as people,” he notes.

This follow through not only drives engagement and performance but develops a personal connection between

Build a brand around service, not so much procedure.

— Robb Rempel executive vice president Haberfeld

team members. As our industry demands this intimate connection with others in order to better serve, it is critical that at every level, managers show this care for their employees who then feel inclined to pass it on to the customer.

“Part of our retention strategy is to provide the tools

(continued on p. 19)

Fueling Turnaround, Acquisition, and Expansion Solutions

We help companies overcome financial obstacles through innovative Asset-Based Lending solutions, focusing on small- and mid-market companies in transition with credit requirements from $2,000,000 to $18,000,000.

firstbusiness.bank/abl

First Business Bank offers Asset-Based Lending solutions through its wholly owned subsidiary, First Business Specialty Finance, LLC. Member FDIC CALL US TODAY TO LEARN MORE Mike Colloton – Milwaukee – 262 792 7180 Pete Lowney – Madison – 608 232 5987

18 NOVEMBER 2022

Branding Your Culture

(continued from p. 18)

[our team members] need to do their jobs efficiently,” says Emery-Morris. “Whether it be more training or mentoring, [our goal is to] help that individual be the best banker he or she can be.”

Additionally, banks should recognize team members based on their contributions to the overall culture of the organization — not just top job performance. By building a brand surrounding the service provided by employees of the organization and celebrating the successes, others are encouraged to take part.

By building a brand around the service provided by employees of the organization and celebrating the successes, others are encouraged to take part.

The Society for Human Resources Management (SHRM) considers reward and recognition programs as key mechanisms to motivate employees to act in accordance with the culture and values.

While strategy remains an important factor not only in keeping Wisconsin’s community banks relevant and competitive against the growth in competition for customers and talent, Rempel encourages banks to “build a brand around service, not so much procedure.”

How to Leverage Culture Externally

While commonly considered as a way to form rooted connections among employees and the business, culture can also be used to make community banks stand out. In focusing specifically on expanding the culture of service bankers bring to their communities, new ways to market closely follow.

In particular, word-ofmouth marketing is one of the

Interested in learning more about empowering your team?

WBA’s upcoming LEAD360 Conference, November 16–17, will cover several topics related to talent retention and common disconnects between banks and customers.

Thank you to Amanda Emery-Morris, Farmers & Merchants Union Bank, Columbus and Haberfeld’s Robb Rempel for agreeing to be interviewed for this article. They are two of the speakers you’ll hear from at the upcoming LEAD360 Conference. Additional speakers include Christine Specht, Cousins Subs; Dave DeFazio, StrategyCorps; Tim Roberts, Sandler Training by Trustpoint, Inc.; Jeff McCarthy, Bank Five Nine; Amber Buker, Totem; and Richie Burke, GGMM. In addition to over eight plus hours of educational content, the conference also includes special training tracks for retail, sales, marketing, and financial literacy.

Please visit wisbank.com/Lead360 to see the full agenda and to register

most valuable tools a business can utilize. According to Semrush, an online visibility management and marketing platform, around 90% of people are likely to trust a recommended brand.

This tactic has the potential to not only drive sales in new customers, but it is also a simple and highly effective way for community banks to increase the awareness of their organization.

During the recruiting process, community banks may also emphasize company culture by ensuring prospective employees align with the bank’s mission, rather than solely by skill.

“By knowing who we [Farmers & Merchant Union Bank] are and what we want to achieve, employees and prospective employees know what we stand for and what’s expected of them,” states Emery-Morris.

In this, community banks that intertwine culture into the standard hiring process may find that employees are more likely to have higher performance and the business will suffer less from the costly impact of departures.

Staying Informed and Ahead

As company culture continually shifts and services

valued by employees and customers evolve, it is critical that Wisconsin’s community banks are prepared to deliver.

During the Wisconsin Bankers Association’s (WBA) upcoming LEAD360 Conference, bankers will be equipped with the tools, skills, and understanding to cultivate an environment of productivity and foster connections.

Retail, sales, marketing, and financial literacy bankers convening in Wisconsin Dells November 16 and 17 will have the opportunity to learn more on topics related to service culture and talent retention from Rempel and EmeryMorris as well as several other speakers.

To learn more about the conference or register, please visit wisbank.com/lead360.

The conference is designed to help ensure Wisconsin’s community banks are prepared to promote the value of staff and assist team members in efficiently and effectively serving their communities.

The ability to stay abreast of the ever-evolving workplace culture shifts and trends in our industry will prove essential in remaining competitive and ready to serve.

Flanders is WBA writer/editor. Haberfeld is a WBA Associate Member.

WBA Associate Member Program

The WBA Associate Membership program offers three membership package levels in addition to the standard membership: Gold, Silver, and Bronze. Through their investment in a package-level membership, these WBA Associate Members not only streamline their involvement with the Association through advertising, sponsorships, and exhibiting opportunities, they further demonstrate their commitment to supporting Wisconsin’s banking industry as a whole.

To learn more about the WBA Associate Member Packages, visit www.wisbank.com/associates/associate-memberpackages or contact WBA‘s Nick Loppnow at nloppnow@ wisbank.com or 608-441-1259.

Nov. 16–17 | Wisconsin Dells WISCONSIN BANKERS ASSOCIATION

NOVEMBER 2022 19

Passwords: Ensuring Secure Data How you can be your own best first line of defense against hackers

By Rob Foxx, CCBTO

Depending on how old you are, you will have a different perspective on passwords. The more seasoned professionals would have come in at a time when a minimum of six characters, no capital letters, numbers, or symbols was a commonplace practice.

In comparison, passwords today usually consist of eight characters — at least one being one upper case — a number, and a symbol.

With a good computer and access to a vulnerable system, even now those passwords could be cracked by a common tool to brute force into the system in less than six hours. While our technology continues to evolve, unfortunately, so too do the bad actors and threats to our data security.

Digital Security Threats

While some threats are technology based, a consistent number of threats to our passwords are not. Saving a password to a browser is an invitation for trouble. Once you walk away from an unlocked computer, it would not take much effort to log in or even change your credential without your knowledge. There are many tools that can copy these passwords quickly and with very little expertise.

» fipco.com

Additionally, those who reuse passwords or only slightly change them is a direct invite to bad actors. If your password was compromised on a common website and associated with your email, someone has that information, and there is a good chance they are going to try it elsewhere. For example, changing a password from Carl!123 to Carl@123 is also risky as a list of passwords associated with users’ names fed into a computer could

guess this in seconds rather than hours.

Many people write their passwords down and tape it to a monitor. The inside of a desk drawer, or under the keyboard or mousepad are not much safer a hiding spot.

As many of us are aware, sharing passwords is a bad idea from an accountability point of view. Once someone else has it, you can no longer secure it from being written down or reshared.

Be aware if your passwords or accounts have been breached in the past. The website have ibeenpwned.com is a staple for those in the information security field. This allows you to check if both passwords and email accounts have been used or discovered in past breaches.

(continued

Introducing the Newest Member of FIPCO’s Team

for every Wisconsin depository institution and branch by city.

This annual bank directory has the most current Wisconsin financial institution information, including every depository institution and branch by city. The handy (4.5” x 9”) size includes more than 200 directory pages.

:

FIPCO is pleased to announce that Donny Wilson (pictured) has joined its staff as vice president – business development. Donny has previous experience working with the banking industry and technology sales. He is known for his professionalism and transparency when working with customers. With FIPCO, Donny will assist in providing effective and compliant services to nearby states.

Donny is a graduate of Iowa State University with a bachelor’s degree in zoology and currently resides in Altoona, Iowa.

Donny and FIPCO’s business development staff are here to help. Contact Donny at dwilson@fipco.com, or a FIPCO team member at fipcosales@fipco.com or 800-722-3498, option 5.

Did You Know?

Wisconsin Banker occasionally prints informative articles submitted by Gold, Silver, and Bronze WBA Associate Members. Interested in sharing your expertise? Please contact WBA’s Nick Loppnow at 608-441-1259 or nloppnow@wisbank.com or email sales@wisbank.com for more information about purchasing Sponsored Content space in WBA’s electronic publications.

–Wisconsin Edition –2023 American Financial Directory

Information

WBA Members

$145 each Non-Members: $170 each To place your order: order@fipco.com 800.722.3498 www.fipco.com

FIPCO IT & Audit Services

Rob Foxx

™

on p. 22) 20 NOVEMBER 2022

CONGRATULATIONS 2022 GRADUATES FROM WISCONSIN

We congratulate you on completing the rigorous 25-month program and joining the more than 23,000 alumni who have gone on to leadership positions in their organizations, associations and the financial services industry. Best wishes for continued success!

Educating Professionals, Creating Leaders

Ryan Ackerman Monona Bank Sun Prairie

Krissy Bowe Denmark State Bank Whitelaw

Erika Brink Monona Bank Monona

Kari Davis State Bank of Cross Plains Waunakee

Tim Dively Peoples State Bank Wausau

Ami Dregne Citizens First Bank Viroqua

Dave Englebert Denmark State Bank DePere

Scott Freiburger Benton State Bank Benton

Eric Hurd PyraMax Bank, FSB Grafton

Bobbie Jorgensen The Park Bank Madison

Mike Kiguta FDIC Madison

Travis LeRoy Nicolet National Bank Green Bay Jamie Morales Community Bank of Cameron Siren

Barry Ranallo

Cumberland Federal Bank, FSB Cumberland

Molly Schissler

North Shore Bank, FSB Brookfield

Miranda Schultz Wolf River Community Bank Hortonville

Ryan Shea The Park Bank Madison

Phil Whitehead Blackhawk Bank Janesville

Vicki Yenter Community First Bank Rosholt

Sponsored by:

GSB.ORG

NOVEMBER 2022 21

FIPCO: Passwords (continued from p. 20)

Additional Protective Steps

Like many threats, the best answer is in the hands of the people most at risk. With a little education and a few resources, you could be on your way to making yourself an unappealing target.

» While our technology continues to evolve, unfortunately, so too do the bad actors and threats to our data security.

» Multi-Factor Authentication

Multi-Factor Authentication (MFA) is the latest and greatest in terms of locking an account if available. It requires a token or application on your phone to give a random code that

matches up to a login service. Using MFA makes unauthorized access very difficult.

» “Real” Passwords

The NIST (National Institute of Standards and Technology) in their 800-63 publication points out that complexity does not matter to a computer. It only makes it harder for users to remember. Password length makes it exponentially more difficult for a computer to guess or break a password that has not been breached. A15-character password with all lowercase letters would take a computer an estimated 12 million years to breach. Passwords can be as simple as three unrelated words or based on items found on your desk — coffeelampmouse is a good example. The internet is filled with random password generators, but they are only

of limited use as the passwords they generate are impossible to remember.

» Password Vaults

Password vaults are very reliable and inexpensive or free. They can make and save passwords for you requiring a single password to access all your other passwords. Additionally, they can generate passwords for you. This removes the requirement to come up with something new every time you make a password. Some vaults are cloud based, and for those who are looking for a business version or an entirely offline vault, these are also available.

Armed with the knowledge of the problem and the tools presented you can use them to be your own best first line of defense against people trying to take over your digital

life. You would not choose a lawyer, doctor, or bank officer who barely meets minimum requirements to do something important, so do not skimp on the passwords that secure your data with a minimum requirement either. If you have questions, feel free to ask your local IT or information security professional — they are generally very happy to help people safeguard themselves, as it makes their lives easier as well!

Foxx is director – infosec and IT audit services for FIPCO. He can be reached at rfoxx@fipco.com or 608-441-1249.

For more information about FIPCO forms, software, or other products, visit fipco.com, call 800-722-3498, or email fipcosales@fipco.com

FIPCO is a WBA Gold Associate Member

W

WBA Building Our Leaders of Tomorrow

EADERSHIP

Glacier Canyon Lodge & Convention Center 45 Hillman Road | Wisconsin Dells

>Visit wisbank.com/BOLT to review the agenda and to register online.

BOLT’s Mission: Building Execeptional Leaders Through Involvement.

November

Learn more about BOLT and November’s Winter Leadership Summit in the lead article on pgs. 1, 8, and 9 of this issue.

INTER L

S UMMIT •

9

22 NOVEMBER 2022

IS YOUR BANK SUFFERING UNREALIZED SECURITY PORTFOLIO LOSSES?

ARE YOU IN NEED OF A CAPITAL INJECTION?

Bank Stock and Bank Holding Company Stock Loans up to $50 Million Done the Simple Way

1. Calling us is the first step.

3. CVB preparing the loan documents generally within 5 to 10 days.

5. CVB wires the funds.

You email us the appropriate documents of information.

Meeting the customer. We will come to you to sign loan documents.

»Call Rick Gerber or Ryan Gerber at 1-866-282-3501 or email rickg@chippewavalleybank.com ryang@chippewavalleybank.com

6. Wow that was easy.

2.

4.

NOVEMBER 2022 23

Five Years In, AHP a Financial Success for Members

Experience the savings with WBA’s Association Health Plan

By Brian Siegenthaler

By Brian Siegenthaler

Five years ago, the Wisconsin Bankers Association (WBA) became the first Wisconsin business group to launch a statewide Association Health Plan (AHP). AHPs provide the same flexibility to small businesses that large organizations enjoy when it comes to negotiating pricing and coverage options for healthcare.

The plan — offered exclusively to WBA-member banks through WBA Employee

Since its inception, WBA’s Association Health Plan has saved WBA member banks over $1.8 million.

Brian Siegenthaler 608-441-1211 bsiegenthaler @wisbank.com

Benefits Corporation

(EBC), a subsidiary of the WBA, is administered by UnitedHealthcare (UHC).