Paving the Way for Women in Banking

As of September 2022, women in the position of president and/or chief executive officer represented 16 of the over 170 banks in Wisconsin.

By Hannah Flanders

In Wisconsin, we are lucky to not only see a growing number of women emerging into leadership positions in banks across the state, but to be surrounded by women in leadership who advocate on behalf of our industry each day.

Women Leading Wisconsin’s Banks

As of September 2022, women in the position of president and/or chief executive officer represented 16 of the over 170 banks in the state. While this number has grown over the course of the last several years, a lack of female mentors and leaders advocating on behalf of their female peers is often cited as a reason why the banking industry continues to be heavily male dominated.

» Attendees enjoyed making new connections with their banking peers during the 2022 WBA Women in Banking Conference. Next year’s conference is April 25, 2023.

Unfortunately, the stark gender disparity often begins even before individuals enter the workforce. According to UW–Madison’s School of Business, the school has 66% male alumni and only 34% female. This issue is not just the case in Wisconsin. Gender inequality is seen throughout the country at many of the largest business schools and is often reflected in the number of women pursuing careers in banking or finance.

Donna Hoppenjan, president and CEO of Platteville’s Mound City Bank and chair-elect of the WBA Board of Directors, states that “women bankers need to be confident and surround themselves with successful leaders in banking.”

To her, a critical aspect of this success is having the confidence to attend training and to build relationships with bankers from other institutions.

It is without a doubt that the banking industry has come a long way — even since the turn of

the century. According to Jenny Provancher, CEO of The Equitable Bank S.S.B. in Wauwatosa, leaders today are more likely to find a more diverse mix of both male and female decision makers, rather than there being only one or a few women in the room.

Creating Opportunities to Grow

In addition to encouraging team members to attend conferences and training events, and network with other professionals — bankers

agree that creating a space where every individual feels they have the opportunity to learn, grow, and advance in their careers is a critical step in ensuring that qualified individuals are able to reach their full potential, no matter their gender.

Hoppenjan states that the best reward of working in leadership is empowering others to make decisions and allowing them to grow in their positions.

Dawn Staples, president of Superior Savings Bank, noted that she was able to forge her own opportunities by having the confidence to volunteer and assist on other projects throughout the bank during her down time.

(continued on p. 22)

SouthBiltmoreLane Madison,WI53718

Wisconsin bankers reflect on the importance of women in industry leadership roles

AddressService Requested

>>>> SAVE THESE 2023 DATES <<<< MIDWEST ECONOMIC FORECAST FORUM JANUARY 12 | VIRTUAL BANK EXECUTIVES CONFERENCE FEBRUARY 8–10 | WISCONSIN DELLS WOMEN IN BANKING CONFERENCE APRIL 25 | WISCONSIN DELLS OR VIRTUAL Visit www.wisbank.com/education for more details.

PRSRTSTD U.S.POSTAGE PAID UMS WisconsinBankersAssociation 4721

OCTOBER 2022 WISCONSIN BANKERS ASSOCIATION FOUNDED 1892

Is Your Team Ready for Next Month’s Election?

The 2022 Wisconsin general election is November 8

By Daniel J. Peterson

As we emerge into the postpandemic world of recordlevel inflation and new ways of doing business, ensuring bankers’ voices are heard is now more important than ever. This year’s general election is expected to be action packed and politically divided as many key seats are up for grabs throughout the state.

With the election quickly approaching, members of the WBA Government Relations team are hard at work advocating on behalf of the banking industry and the pro-banking candidates who support our initiatives. However, it is no secret that without the dedication of each of our members —

»

Message from the Chair

Daniel J. Peterson

including, but not limited to, the efforts of WBA’s Advocacy Officers from around the state — the achievements our Association continues to have in supporting the industry would not be possible.

As you and your team look ahead to November 8, it’s important to remain informed on the candidates running and what topics are being discussed.

In preparation for the statewide general election next month, the American Bankers Association (ABA) has created a Wisconsin-specific resource

and toolkit for the use of bankers around the state. Whether you would like to see the candidates on your ballot, find your polling place, or track important upcoming dates — including the deadline to request your absentee ballot (the deadline is November 3, by the way) — this handy tool offers all the information you and your peers will need to stay up to date on Wisconsin’s election and the contested issues that may impact our industry.

In addition to staying educated this election season, it’s important for every Wisconsinite to be active. The easiest way to do this is by registering to vote and getting to the polls next month. While WBA staff and banker volunteers do excellent work at both the state and federal levels advocating on behalf of

Please visit secureamerican opportunity.com/vote-2022/ state=WI to learn more about Wisconsin’s election or to access an election toolkit to share with your employees.

the banking industry, the single greatest factor as to whether or not pro-banking laws are enacted is whether pro-banking candidates are in office. Whether voting in person or absentee (no excuse required) — it’s easy to do your part! Now’s the time to make a plan and mark your calendars for the betterment of the communities in which we live, work, and play.

Peterson is president and CEO of The Stephenson National Bank & Trust, Marinette, and the 2022–2023 WBA Chair.

Creating meaningful relationships is our culture.

From executive management to front-line employees, we live it and believe it every day.

As your correspondent partner, and a community bank ourselves, we understand the value community banks bring to the clients we serve.

Davenport, Iowa

Kevin

qcbt.com/correspondent-banking 4500 N. Brady Street,

At Quad City Bank & Trust Isn’t Just a Buzz Word. RELATIONSHIP Sarah Dolan 773.354.4837

Volker 608.213.4987

See pgs. 6 and 7 for more election-related resources. 2 OCTOBER 2022

www.bell.bank Member FDIC 34607 Reg. O loans | Holding company loans & lines of credit | Equipment financing | Participation loans Whether your loan is large or small, get faster turnaround from our experienced correspondent team. Partner with Bell for: Participation loans Bank stock and ownership loans Holding company loans and lines of credit Reg. O loans to bank employees, insiders or directors Equipment financing Denise Bunbury Call me at 608.234.1438 –Based in Eau Claire, Wis. Serving Wisconsin, and the U.P. of Michigan 34607 AD Wisconsin Bankers Association 2022_Denise.indd 1 3/28/22 4:12 PM OCTOBER 2022 3

SOMETIMES IT DOES.

To find out more about the Silver Lining and a special discount on home and auto insurance just for members of the Wisconsin Bankers Association, contact an official supplier of the Silver Lining.

For the name of an agency near you, visit thesilverlining.com.

It shouldn’t take a six-by-six barn beam crashing through your bedroom wall to find out who you can trust. And that’s the Silver Lining®. BUT

4 OCTOBER 2022

New Compliance Resources Now Available

Help your team make the most of WBA’s robust online resources Compliance Q&A

By Scott Birrenkott

Does WBA Have New Resources Available for Compliance Officers?

Q

Answer: Yes. WBA recently added new, updated resources to its website.

A

WBA continues to add to its new website — one such section recently updated was the Compliance Resources page.

The Compliance Resources page can be found by visiting wisbank.com/resources/ compliance or by navigating from the home page to the News and Resources tab found in the top menu, scrolling down, and looking for the red button under the heading Don’t Face Changes Alone

On this section of the website, bankers will find previously listed resources such as the most recent WBA Compliance Journal, the

Scott Birrenkott

Visit the compliance section of the WBA website at wisbank. com/resources/compliance

comment letter library, links to Wisconsin laws, various compliance toolkits, and a number of new resources.

New sections and resources include a monthly FAQ, a recently released resources section, most frequently requested resources, popular legal Q&As, and a new video series called the “WBA Compliance Corner.”

These resources will be updated and refreshed frequently as well as discuss hot topics, recently issued rulemakings, and commonly faced situations.

For example, the monthly FAQ is taken from questions received through the WBA legal call program to provide an answer to the most frequently asked question by Wisconsin bankers each month. The recently released resources section provides WBA’s newest creations — such as a flowchart for Wisconsin’s newly Revised Uniform Unclaimed Property Act. The most frequently requested resources section compiles some of the most useful guides and articles. The popular legal Q&As includes answers to the most frequently asked questions, and common scenarios bankers are likely to encounter. Lastly,

WBA Files Comment Letter on Proposed Deposit Insurance Rate Increase

Summary of a recent comment letter below

On August 19, the Wisconsin Bankers Association (WBA) filed a comment letter in response to FDIC’s proposal to uniformly increase initial base deposit insurance assessment rates by 2-basis points, beginning with the first quarterly assessment period of 2023.

In the letter, WBA stated that a 2-basis point increase would be a significant cost and that WBA members have shared it will be difficult to afford the proposed raise in assessment; even more so if and when there is an economic downturn. WBA also stated that members have shared

that the proposal will result in reduced product and service offerings, sluggish deposit rates, and higher or new fees to customers as a means to offset the cost associated with the increase in assessment.

WBA stressed the fact that Wisconsin’s community banks remain leaders in their communities having helped customers through the pandemic and with the current, ongoing recovery

the WBA Compliance Corner is a brand-new, monthly video series designed to provide the most recent compliance news in a concise presentation of 30–40 minutes, along with links to applicable material.

WBA hopes compliance staff and others interested in these resources find them useful. Additionally, while not new, WBA of course still maintains the legal call program. Certainly do not hesitate to contact WBA legal at wbalegal@wisbank.com or 608-441-1200.

Birrenkott is WBA director – legal. For legal questions, please email wbalegal@wisbank.com

Note: The above information is not intended to provide legal advice; rather, it is intended to provide general information about banking issues. Consult your institution’s attorney for specific legal advice or assistance.

View this and previous comment letters filed by WBA at www. wisbank.com/CommentLetters

and as a result of those efforts, many Wisconsin banks’ deposit ledgers remain inflated primarily due to funds remaining on deposit from customers participating in Small Business Administration’s (SBA) Paycheck Protection Program and the various pandemic recovery programs implemented by Congress, such as the CARES Act. WBA further emphasized that Wisconsin’s banks should not be penalized by being assessed higher deposit assessments

from the Federal Deposit Insurance Corporation (FDIC) due to deposit growth resulting from government actions.

WBA also shared that members have reported high deposit balances have begun to run off and that increased costs and the further tightening of the economy overall will drive many deposits lower yet. WBA stated that FDIC’s proposal is premature and should not be implemented. WBA recommended FDIC postpone its proposed increase and instead further monitor deposit runoff before implementing a universal assessment increase.

For copies of this or other WBA comment letters, please contact the WBA Legal Department at 608-441-1200 or visit www. wisbank.com/CommentLetters.

OCTOBER 2022 5

Staying Informed and Prepared this Fall

Wisconsin’s general election is November 8

By Lorenzo Cruz

With less than one month until the Wisconsin general election on November 8, candidates are in the home stretch of their campaigns. WBA members can expect to see a relentless onslaught of television and radio advertisements, direct and digital mail, social media messaging, get out the vote (GOTV) calls, and door knocking literature drops at homes around the state. These coordinated and sophisticated campaigns are directed at voters to drive party bases, independents,

ELECTION / VOTING RESOURCES

» secureamericanopportunity. com/vote-2022/?state=WI

» wisconsinvote.org/ candidates-races

» secureamericanopportunity. com/wp-content/uploads/ 2022/04/GOTV_ toolkit_2022_WI.pdf

» maps.legis.wisconsin.gov/? version=2022

Advocacy Update

Lorenzo Cruz

» Interested in making a political contribution in support of WBA’s efforts? Visit wisbank.com/give to learn how.

and undecideds out to vote in state and federal races.

The costs to fund these campaigns are staggering, and record spending is expected in 2022. AdImpact, a media tracking group, predicts that about $350M will be spent on Wisconsin races in 2022. Of that, the media group projects $160M in the U.S. Senate race and over $125M in the gubernatorial race. Chair of the Democratic National Committee (DNC) Jaimie Harrison said that Wisconsin is one of the top battlegrounds in the nation. Since 2018, the committee has quadrupled their investments in the state.

WBA Advocacy Officers Needed

Offering input and acting on legislative and regulatory policies are critical responsibilities in the banking industry. Help shape the future of banking in Wisconsin and provide a leadership experience for one of your bankers by signing up a member of your team to be a WBA Advocacy Officer! You’ll be joining over 100 banks that have already named someone.

Have someone in mind at your bank or want to appoint someone? Learn more or sign up to become an Advocacy Officer at wisbank.com/advocacy/advocacyofficers to get your name or the name of someone at your bank on the list and start making a difference today. Or contact WBA’s Lorenzo Cruz at lcruz@wisbank.com if you have any questions or for more information about WBA’s Advocacy Officer program.

»See p. 7 for a brief summary of key election races to watch.

general election. Wisconsinites should mark their calendars for Friday, October 14 and plan to tune in for the opportunity to hear from each candidate on hot-topic issues such as the economy and jobs, education, and crime.

What to Watch

Already, Republicans have control of large majorities in the Assembly (61–38) and Senate (21–12) and have hopes for super majority dominance in both Houses of the state legislature. Assuming the GOP holds onto all incumbents, the Senate would need one seat and the Assembly would need five. The prospects of a super majority are better for the Senate than the Assembly — but anything is possible if there is a significant red wave.

This fall, voters should pay attention to the 5th, 19th, 25th, and 31st state Senate districts and the 33rd, 54th, 71st, 73rd, 74th, 84th, and 94th in the state Assembly districts — these could easily be tipping points for our state legislature.

» Gubernatorial Race

Following the results of the August primary, incumbent Governor Tony Evers (D) faces construction executive Tim Michels (R) in the general election. Neither candidate has shown a significant lead according to recent polls.

In September, Joan Ellis Beglinger (I) withdrew from the gubernatorial race and endorsed Michels. Beglinger garnered 7% of the vote in the primary. With her departure, a majority of these voters could join the Michels camp.

Both campaigns have also agreed to hold only one debate before the November

» Senate Race

GOP U.S. Sen. Ron Johnson is running against Democratic nominee Lt. Gov Mandela Barnes. Johnson is seeking a third term in a state Biden won in 2020. Politico has Wisconsin as a toss-up. With some Republican Senate candidates struggling in other states, the GOP needs to hold the Johnson seat if they hope to regain the majority in the U.S. Senate.

Resources to Stay Informed

It’s important that as the November 8 election quickly approaches, voters stay informed, active, and show up prepared to cast their vote. In addition, our Association encourages all members to support the PAC and conduit, if you haven’t done so already, by visiting wisbank.com/give

WBA also strongly urges members to spend a majority of the conduit funds on state elected officials before the November election. Your efforts in supporting probanking candidates directly results in the support we see of pro-banking actions.

For more information on advocacy, candidates, toolkits, voting, election deadlines, or issues, please visit the websites (blue box, at left) to learn more or contact me at lcruz@ wisbank.com.

Cruz is WBA vice president –government relations.

6 OCTOBER 2022

Key Races This Election Season Critical legislative seats up for reelection

U.S. Senate

R- Ron Johnson (Incumbent)

D- Mandela Barnes

U.S. Representative

District 3

D- Brad Pfaff

R- Derrick Van Orden

Governor

D- Tony Evers (Incumbent)

R- Tim Michels

Lieutenant Governor

D- Sara Rodriguez

R- Roger Roth

Attorney General

D- Josh Kaul (Incumbent)

R- Eric Toney

State Senate

District 5

R- Rob Hutton (Incumbent)

D- Jessica Katzenmeyer

District 19

D- Kristin Alfheim

R- Rachael Cabral-Guevara

District 25

R- Romaine Robert Quinn

D- Kelly Westlund

District 31

D- Jeff Smith (Incumbent)

R- David Estenson

Learn more: secureamericanopportunity.com/vote-2022/?state=WI | wisconsinvote.org/candidates-races

ANNOUNCING

New Staff Hires at WBA Inc. — EBC and FIPCO

Kelly Hageman

Account Administrator

WBA Employee Benefits Corporation, Inc. khageman@wisbank.com

The Wisconsin Bankers Association – Employee Benefits Corporation (WBA–EBC) is excited to announce that Kelly Hageman has joined the Association as account administrator.

Hageman comes to WBA–EBC from the Wisconsin Association of Independent Colleges and Universities and has past experience in employee benefits with an emphasis on corporate wellness promotion. Hageman is a graduate of UW-Madison with a bachelor’s degree in dairy science.

Donny Wilson FIPCO Vice President Business Development dwilson@fipco.com

Donny Wilson FIPCO Vice President Business Development dwilson@fipco.com

FIPCO is pleased to

announce that Donny Wilson has joined the Association as vice president business development. Wilson has previous experience working with the banking industry, in technology sales, and is known for his professionalism and transparency when working with customers. With FIPCO, Wilson will assist in providing effective and compliant services to nearby states.

State Assembly

District 33

R- Scott Johnson

D- Don Vruwink District 54

R- Donnie Herman

D- Lori Palmeri

District 71

D- Katrina Shankland

R- Scott Soik

District 73

D- Laura R. Gapske

R- Angie Sapik

District 74

D- John Adams

R- Chanz Green District 84

D- Lu Ann Bird

R- Bob Donovan

District 94

D- Steve Doyle (Incumbent)

R- Ryan Huebsch

Cindy Thoennes

FIPCO Accounts Receivable and Administrative Specialist cthoennes@fipco.com

FIPCO is excited to announce that Cindy Thoennes has joined the team as accounts receivable and administrative specialist. Thoennes brings over 14 years of experience working in accounts receivable roles and working with the banking industry. In her new position, Thoennes will assist FIPCO customers with product and service orders, contracts, and billings.

Thoennes is new to Wisconsin from Kansas City, Missouri and currently resides in Fall River. She is excited to learn more about FIPCO/ WBA and explore Wisconsin.

Wilson is a graduate of Iowa State University with a bachelor’s degree in zoology and currently resides in Altoona, Iowa. wisbank.com fipco.com

Barnes Rodriguez Van Orden Kaul

Johnson Michels Pfaff Roth Evers Toney

™ wisbankins.com

OCTOBER 2022 7

»

Partnering with Wisconsin’s Diverse Small Businesses Empowering underrepresented communities, expanding our economy

By Hannah Flanders

Bankers are always focused on their mission of serving their communities, and lending to local businesses is at the heart of that mission. As more small businesses are looking to start or expand, access to capital remains a challenge, and disproportionately so for firms owned by people of color, according to the Small Business Credit Survey conducted by all 12 Federal Reserve Banks. Partnering with community-based organizations such as chambers of

commerce allows both banks and the organization to assist historically underrepresented individuals to gain access to the credit they need.

Diverse Chambers and Community-based Organizations in Wisconsin

In Wisconsin, there are 20 chambers of commerce and community-based organizations with a specific mission of supporting underrepresented individuals that WBA is familiar with. While our state boasts many other chamber models representing specific cities and regions, demographically focused chambers are established with the purpose of representing a specific group of business owners.

Of these chambers, many underrepresented groups — including veterans, people of color, and women — have the ability to access local networks of fellow underrepresented business owners, and can acquire resources and opportunities to gain knowledge from other professionals.

Ruben Hopkins, chairman and CEO of the Wisconsin Black Chamber of Commerce, works to help prepare Black business owners in Milwaukee to take out small business loans.

“Money’s in the paperwork,” Hopkins states. “Our organization works to establish a more aware business owner and save bankers time. When my business owners walk into the bank, you know

In Wisconsin, there are 20 chambers and organizations with a specific mission in supporting underrepresented individuals.

they’re prepared with whatever is necessary [to complete the application].”

How Your Bank Can Get Involved

Over the last several years, Wisconsin bankers have become even more intentional in hiring employees who represent their local communities so customers “seem themselves” when they enter the bank. This certainly helps foster connections

(continued on p. 9)

Ethnic Chambers and Other Organizations in Wisconsin

•African American Chamber of Commerce Greater Racine aaccgr1.wixsite.com/aaccgr | 262-456-7427

•African American Chamber of Commerce of Wisconsin aaccwi.org | 414-462-9450 | info@aaccwisconsin.org

•American Indian Chamber of Commerce of Wisconsin aiccw-facc.org | 414-604-2044 | beverly@aiccw-facc.org

•The Business Council | mketbc.wordpress.com 414-287-4172 | mrucker@mmac.org

•Cinnaire* cinnaire.com | 312-882-5559 | phetz@cinnaire.com

•First American Capital Corporation, Inc.* aiccw-facc.org | 414-604-2044 | gary@aiccw-facc.org

•Hispanic Chamber of Commerce of Wisconsin hccw.org | 414-643-6963 | hccwtoday@hccw.org

•Hmong Wisconsin Chamber of Commerce hmongchamber.org | 414-645-8828 – Milwaukee Office, 715-298-6071 – Wausau Satellite Office hmongchamber.org/contact-us

•Impact Seven, Inc.* | impactseven.org 715-251-8450 | bob.mayer@impactseven.org

•Latino Chamber of Commerce of Dane County lccwi.org | 608-712-3522 | info@lccwi.org

•Latino Chamber of Commerce of Southeastern Wisconsin latinochambersew.org | 414-988-4082

•Latino Entrepreneurial Network latinoentrepreneurialnetwork.org | 414-888-2270 info@lenwisconsin.org

•Madison Black Chamber of Commerce madisonblackchamber.com | 608-729-1238 info@madisonblackchamber.com

•National Association of Minority Contractors –Wisconsin Chapter namcwi.org | 414-454-9475 | contactus@namcwi.org

•Wisconsin Black Chamber of Commerce twbcc.com | 414-306-6460 | admin@twbcc.com

•Wisconsin Chinese Chamber of Commerce wisccc.org | 414-409-6288 | info@wisccc.org

•Wisconsin Indigenous Economic Development Corporation wiedc.org | 715-437-0465 | coordinator@wibanative.org

•Wisconsin LGBT Chamber of Commerce wislgbtchamber.com | 414-678-9275 info@wislgbtchamber.com

•Wisconsin Veterans Chamber of Commerce wiveteranschamber.org | 414-207-4376 cthornton@wiveteranschamber.org

• Wisconsin Women’s Business Initiative Corporation (WWBIC)* wwbic.com | wwbic.com/contact

Learn more about WBA’s DEI efforts by visiting wisbank.com/community/dei

*Indicates WBA Associate Member | Learn more by visiting wisbank.com/associates

8 OCTOBER 2022

Chambers of Commerce

(continued from p. 8)

with the bank from these represented groups.

Another way banks are developing relationships with historically underrepresented businesses is by becoming involved with specific ethnic or community-based chambers and organizations.

As bankers already know, one of the easiest ways to become involved is to become a member or sponsor a chamber event. This effort alone highlights to community members the care and support bankers have for local businesses. According to a study conducted by The Schapiro Group, consumers are 19% more likely to think favorably of a company that is involved with its local chamber.

From galas to art fairs, summits, and workshops — the are many opportunities for banks to assist and support ethnic chambers and other community-based organizations in their mission to help marginalized small business owners reach new heights.

For the Wisconsin Black Chamber of Commerce, the 3,000 Black Business Challenge is a bootcamp program that sets Black business owners up for success. The program features

education on a wide range of topics including financial literacy, business accounting, and funding.

Not only does the 3,000 Black Business Challenge bootcamp offer a great opportunity for Black business owners to hone a diverse range of financial skills, but bankers who volunteer as partners will also play a significant and memorable role in the growth of these businesses.

Additional ways of getting involved include serving on an organization’s Board, contributing to loan funds, or making an increased effort to work with business owners who are members of the partner organization.

Benefits for Banks and Communities Alike

For banks looking to increase their Community Reinvestment Act (CRA) performance or become involved in new ways within their community, partnering with community-based organizations offers various opportunities to achieve those goals while assisting underrepresented small business owners.

According to the Association of Chamber of Commerce Executives (ACCE), historical

WBA Associate Member Program

The WBA Associate Membership program offers three membership package levels in addition to the standard membership: Gold, Silver, and Bronze. Through their investment in a package-level membership, these WBA Associate Members not only streamline their involvement with the Association through advertising, sponsorships, and exhibiting opportunities, they further demonstrate their commitment to supporting Wisconsin’s banking industry as a whole.

To learn more about the WBA Associate Member Packages, visit www.wisbank.com/associates/associate-member-packages or contact WBA‘s Nick Loppnow at nloppnow@wisbank.com or 608-441-1259.

circumstances, population fluctuations, differing ambitions, and the needs of employers have all played a role in the formation of different chambers.

Chambers today remain effective for representing business in a certain location or those focused on a certain demographic.

Partnering with a local chamber of commerce that serves underrepresented business owners is an excellent opportunity for bankers to assist entrepreneurs in the expansion of their businesses and support the growth of the local economy, all the while establishing the bank as a trusted partner for diverse members of the community.

In addition, banks may find that working with local chambers will offer them

opportunities to reach new talent. Many local chambers offer members the opportunity to post recruitment ads on their websites, offering an additional avenue for talent recruitment that may reach a new population of individuals.

In developing a connection with an ethnic chamber or other community-based organization, banks are able to widely support the growth of marginalized small businesses in the communities in which they serve. This commitment to Wisconsin’s underrepresented entrepreneurs will provide not only an opportunity for banks to reach into historically underserved communities but offer creative ways in which to support diverse local businesses and the growth local economies.

Flanders is WBA writer/editor.

From outlook to outcomes.

Solve competition, workforce challenges and digital disruption with insight and con idence. Visit wipfli.com/fi-tm.

Perspective changes everything.

OCTOBER 2022 9

Reinhart’s multi-disciplinary Financial Institutions group brings together one of the Midwest’s deepest benches in banking law. Our experienced attorneys represent a comprehensive range of banking and financial industry legal services, all coordinated by a single touchpoint for you to simplify even the most complex challenges and opportunities.

John

Amy Barnes Exec Compensation/Tax Sara McNamara Bankruptcy/Restructuring

Katherine Bills Commercial Real Estate

Andrew Price Commercial Lending

John

Amy Barnes Exec Compensation/Tax Sara McNamara Bankruptcy/Restructuring

Katherine Bills Commercial Real Estate

Andrew Price Commercial Lending

414.298.1000 reinhartlaw.com/banking

Reichert jreichert@reinhartlawcom Melissa Y Lanska mlanska@reinhartlawcom

Experience in Many Directions 10 OCTOBER 2022

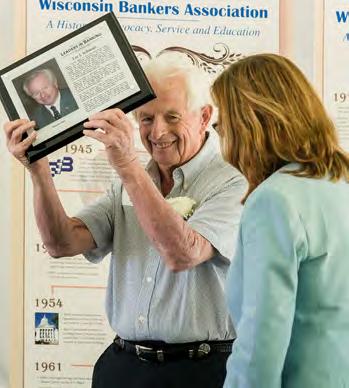

Class of 2022 Honorees Celebrated at Leaders in Banking Excellence Ceremony

Six individuals were honored by the Wisconsin Bankers Association for their leadership in banking, community service, and civic involvement. A celebration was held on Friday, September 9 at the WBA headquarters in Madison, where a Leaders in Banking Excellence Wall installation displays a tribute to outstanding current and former bankers. The wall was established in 2020, and the five Class of 2022 honorees join the 17 honorees from the Classes of 2020 and 2021.

The honorees in the 2022 Leaders in Banking Excellence Class are:

» Robert J. Just, Jr., Mound City Bank, Platteville;

» Debra R. Lins, the former Community Business Bank, Sauk City (and others);

» John K. Reinke, The Stephenson National Bank & Trust, Marinette;

» Lee J. Schmalz, East Wisconsin Savings Bank, Kaukauna; and

»the late James B. Wigdale, M&I Bank (now BMO Harris Bank), Milwaukee.

Also honored at the event was Richard (Dick) Pamperin of Premier Community Bank, Marion who was unable to attend the Class of 2020 celebration.

Read the full biographies of the honorees at wisbank.com/ excellence2022 or stop by WBA’s office in Madison

to see the Wall of Excellence in person.

WBA Chair Dan Peterson, president and CEO of The Stephenson National Bank & Trust in Marinette, began the event with opening remarks on the legacy that the individuals have left. Rep. Bryan Steil, U.S. Representative from Wisconsin’s 1st Congressional District, and Wisconsin Department of Financial Institutions Secretary-designee Cheryll Olsen-Collins offered congratulatory remarks to the honorees. The family, friends, and colleagues shared heartfelt stories of the honorees’ contributions to the banking industry and to their communities, making the event memorable.

It was also a pleasure to welcome back four honorees from the inaugural 2020 class who attended the event:

Steve Eager; Tom Farrell, Steve Schowalter, and Fred F. Schwertfeger

In addition, two Class of 2021 honorees,

» (1) Honorees (left to right): Lee J. Schmalz, John K. Reinke, and Robert J. Just, Jr. (2) Julie, daughter of the late James B. Wigdale, and Jud Snyder. (3) John Reinke (4) Lee J. Schmalz celebrates his achievement. (5) Class of 2020 honoree Dick Pamperin with WBA’s Rose Oswald Poels. (6) Robert J. Just, Jr. (7) DFI Secretary-designee Cheryll Olson-Collins with WBA’s Rose Oswald Poels.

» 2023 Class nominations are being accepted through May 12, 2023 at www.wisbank.com/excellence

Bob Gorsuch and Gof Thomson, were also in attendance.

Debra R.Lins (left) was unable to attend.

1 2 5 7 4 6 3 «

OCTOBER 2022 11

Wisconsin Dells Banking Leaders Convene in Dells for Education, Networking

Annual Management Conference informs and inspires

Following two years of virtual or hybrid gatherings, bankers were excited to return in person for several education and networking opportunities at WBA’s 2022 Management Conference. The event was held in Wisconsin Dells at the Glacier Canyon Convention Center and offered a range of general and breakout sessions pertaining to bank management.

The conference began on Tuesday, September 13 with a pre-conference golf outing at the Wild Rock Golf Club in the Dells where bankers enjoyed networking with their peers and event sponsors.

MANAGE MENT

C ONFERENCE

That evening officially brought about the conference kick off with a welcome reception and dinner program. During the dinner, a 50-Year Club certificate and 20 WBA Lifetime Service Awards were presented in recognition of bankers who have served the industry for 30, 40, and 50 years (see honorees photos below).

The following day, Eric Cook, chief digital strategist at WSI Digital and a former community banker, welcomed

attendees during his keynote on the evolution of digital banking. The discussion focused on the ways in which Wisconsin’s community banks have the ability to leverage current trends that continue to shape our industry. Cook emphasized ways bankers can add value to their services and ensure their banks remain relevant even as consumers’ banking preferences shift.

Sarah Sladek, founder and CEO of XYZ University, LLC,

presented the second keynote of the day on managing and leading following the pandemic and Great Resignation. Sladek highlighted for bankers the opportunities for increasing innovation, shifting values, and global connectivity as a new generation of talent is ushered into the workforce.

In addition to many networking opportunities, the afternoon included two rounds of breakout sessions on topics ranging from bank culture to crypto, strategic loan growth, and tax law changes — something for every member of the bank management team!

Thank you to all of the event sponsors and attendees for making this year’s event a success!

WBA Recognizes 21 Bankers for Their Service and Dedication

Kathryn Gessert, Partners Bank, Stratford (left) was inducted into the WBA 50-Year Club. The club recognizes bankers who have committed an extraordinary level of service to their banks and their communities for half a century. Congratulations, Kathryn.

(continued on p.

Pictured are: Janet Behnke, Cleveland State Bank (42 years); Sonja Bjerkos, Citizens First Bank, Viroqua (43 years); Judith Bogenschutz, Cleveland State Bank (33 years); LuAnn Bowman, Mound City Bank, Platteville (40 years); Tammy Diebold, State Bank of Cross Plains (32 years); Paul Kuplic, Oostburg State Bank (30 years); Beth Munnik, Cleveland State Bank (37 years); William Neville, Forward Bank, Marshfield (32 years); Peter Reichardt, Citizens Community Federal National Association, Tomah (40 years); Laurie Richardson, Mound City Bank, Platteville (40 years); Cynthia Roeck, Cleveland State Bank (38 years); Steven Schmudlach, Fox Valley Savings Bank, Fond du Lac (46 years); Timothy Schueler, Cleveland State Bank (33 years); Vicki Schulenberg, State Bank of Cross Plains, Waunakee (30 years); Jacqueline R. Sliter, Bank of Prairie du Sac (40 years); Brenda Tornow, First State Bank, New London (40 years); Robert Van Asten, First State Bank, New London (30 years); Colleen Whaley, Settlers Bank, Madison (32 years); Mark Wurtz, Cleveland State Bank (39 years); and Darlene Zschernitz, Citizens State Bank of Loyal, Neillsville (43 years).

Kuplic

Schulenberg

Munnik

Sliter Neville Tornow

Behnke Reichardt Van Asten

Bjerkos RichardsonBogenschutz

Roeck

Gessert

Whaley Bowman WurtzSchmudlach

Zschernitz Diebold Schueler

» During the evening program at the WBA Management Conference at Glacier Canyon Lodge & Convention Center in Wisconsin Dells, the Association recognized 20 Wisconsin banking professionals with 2022 Lifetime Service Awards in thanks for their dedication to the banking industry. Additionally, Kathryn Gessert (50 years) of Partners Bank, Stratford was inducted into WBA’s 50-Year Club. In total, the bankers honored at the Management Conference dinner program have a combined 790 years of service to the banking industry!

13) 2022 L IFETIME S ERVICE A WARD R ECIPIENTS WISCONSIN BANKERS ASSOCIATION

Sept. 13–14 |

WISCONSIN BANKERS ASSOCIATION

12 OCTOBER 2022

WBA Management Conference | Sept. 13–14 | Wisconsin Dells Thank You to Our Conference Sponsors and Exhibitors WBA INSURANCE SERVICES WBA Employee Bene ts Corporation Midwest Bankers Insurance Services WBA INSURANCE SERVICES WBA Employee Bene ts Corporation Midwest Bankers Insurance Services SILVER Associate Sponsors BRONZE Associate Sponsors GOLD Associate Sponsors GENERAL Associate Sponsors Correspondent Banking Graduate School of Banking | Haberfeld | Hovde Group | Lenderful Solutions | Olsen Palmer LLC Performance Trust Capital Partners, LLC | Primax OCTOBER 2022 13

Bulletin Board

News about people working in Wisconsin’s financial institutions

Promotions and New Hires

Abbotsford

AbbyBank is excited to announce that Heather Beiler (pictured) has joined the bank as chief retail officer.

Brookfield

North Shore Bank’s commercial banking team has expanded with the hire of new vice president, Derek E.Wheeler (pictured), and business relationship specialist, Max Schommer (pictured).

Fitchburg

Oak Bank welcomes Larry Van Epps (pictured) to the team as a business banking vice president.

Fond du Lac

Following the retirement of Steven R. Schmudlach, chief executive officer at Fox Valley Savings Bank, Steven R. Walber has been

named president and chief executive officer.

National Exchange Bank & Trust has announced that Wendy Casetta (pictured) has joined as the vice president – portfolio manager, Calla Olvera (pictured) has joined as operations manager for the Sheboygan Falls office, and Hazel Reese (pictured) recently returned as operations manager for the Mayville and Allenton offices.

The bank also announced the promotions of Bailey Guth (pictured) to operations manager for the Brownsville office, Heidi Sattler (pictured) to operations manager for the Chilton and Marytown offices, and Ben Wagner (pictured) to IT manager.

Fort Atkinson Badger Bank is pleased to announce the promotions of Cierra Pryce (pictured) to

accounting assistant and Taylor Eppler (pictured) to the position of operations associate.

Madison First Business Bank is pleased to welcome Marcus Riccio (pictured) as assistant vice president – commercial banking.

Manitowoc

Bank First is pleased to announce that Andrew Thomas (pictured) has joined the bank as senior vice president –business banking. Amanda Sitkiewitz (pictured) has also been promoted to senior vice president – market president at the bank’s Manitowoc region.

Mazomanie The Peoples Community Bank is pleased to announce the addition of Bridget Krueger (pictured) as vice president –

(continued on p. 15)

Denmark State Bank Employees Presented with WBA Lifetime Service Awards

On July 20, WBA’s Executive Vice President and Chief of Staff Daryll Lund (far right) visited Denmark State Bank and awarded several employees with WBA Lifetime Service Awards. The recipients were recognized for their lengthy service to Wisconsin’s banking industry. In addition, the event celebrated 10 upcoming retirements at the bank.

Congratulations to Stephen Arps, Deborah Carlson, Annette Commons, Joan DeGrand, Teri Deprey, Jacqui Engebos, Jan Hall, Mark Hoefs, Dave Kappelman, Mark Kropp, Linda Kuik, Carl Laveck, James Meyer, Chris Mueller, Tami O’Brien, Tammy Phibyl, John Rehn, Lori Sisel, Jeannie Swagel, Scot Thompson, Deanna Tilot, Jeff Vandenplas, Bonnie Vogel, Jeff Wilke, and Cindy Winiecki!

The WBA Lifetime Service Awards recognize bankers who have served the banking industry for 30 and 40 years. See p. 12 for photos of other recent 2022 Lifetime Service Award recipients.

Have good news?

To submit a notice, please email bulletinboard@wisbank.com or mail entries to WBA Bulletin Board, 4721 South Biltmore Lane, Madison, WI 53718.

Send photos as JPEG files. Questions? Contact WBA’s Hannah Flanders at 608-441-1237 or hflanders@wisbank.com.

Wheeler Guth Van Epps Wagner Beiler

ReeseOlvera Schommer

Sattler

Casetta

14 OCTOBER 2022

Bulletin Board

News about people working in Wisconsin’s financial institutions

Bulletin Board

(continued from p. 14)

commercial lending. The bank also announced the promotions of Quinn Christensen (pictured) to the role of chief information officer and Diane Wipperfurth to data processing manager.

Medford

Prevail Bank is pleased to announce that Abigail (Abi) Mlsna (pictured) has joined as a marketing coordinator.

Oregon

One Community Bank is thrilled to welcome Holly Brickson (pictured) to business development and treasury management at the Sun Prairie location. Michael Adler (pictured) has also been promoted to bank manager of the Middleton location.

Stevens Point

First State Bank recently announced the addition of Jennifer Girard (pictured) as mortgage loan officer for its Stevens Point office.

Waukesha

Waukesha State Bank announces the promotion of Brenda Chadwick (pictured) to personal trust assistant – estate settlement & real estate within their Prairie Trust® division.

Wauwatosa

WaterStone Bank is pleased to announce that Tara Lagerman has joined as the new vice president –director of marketing.

Gary Inducted Into WBA 50 Year Club

During his retirement reception on July 21, George E. Gary, president and CEO of Columbia Savings and Loan Association, Milwaukee, was presented with a WBA 50-Year Club certificate in recognition of his 50-year tenure in the banking industry. WBA’s Executive Vice President and Chief of Staff Daryll Lund (left) presented the award to Gary.

Associated Bank Donates $15K for Installation of Solar Energy Panels

Associated Bank recently contributed the final $15K needed to support installation of solar energy panels at the Food Enterprise Center through the Vernon Economic Development Association (VEDA). Pictured (left to right) are: Susan Noble, VEDA; Crystal Kinnunen, Bill Kopka, and Peter Ruud, Associated Bank; Mike Breckel, VEDA; and Billy Mahan, Associated Bank.

Image courtesy of: Associated Bank and Vernon Economic Development Association.

Wisconsin Dells

Matthew Schaefer (pictured) was recently promoted to chief credit officer at Bank of Wisconsin Dells.

Congratulations

Fond du Lac

Cheryl Miller (pictured), a personal banker at National Exchange Bank & Trust’s Campbellsport office recently celebrated 35 years with the bank in July.

Wauwatosa

WaterStone Bank’s Chief Financial Officer Mark Gerke has been recognized as one of the BizTimes Media 2022 Notable CFOs.

The First National Bank and Trust Company Donates $10,000

First National Bank and Trust Company made a $10,000 donation to the Gundersen Tri-County Memorial Foundation to assist in the construction of a new hospital in Whitehall and to help support at-risk families with insurance needs. Pictured (left to right) are: Tami Eid, recently retired branch manager, and Josh Grzadzielewski, vice president of community banking, of First National Bank and Trust Company, as well as Joni Olson, CEO, and Kurt Johnson, board chairman of Whitehall Community for Gundersen Tri-County Hospital and Clinics.

Brickson Miller

Thomas Chadwick

Adler Riccio

Krueger Christensen Girard

Sitkiewitz

Eppler

Mlsna Schaefer

Pryce

Brickson Miller

Thomas Chadwick

Adler Riccio

Krueger Christensen Girard

Sitkiewitz

Eppler

Mlsna Schaefer

Pryce

OCTOBER 2022 15

OCTOBER 2022

•Principles of Banking Course

5–6 Mineral Point; $550/attendee

•Commercial Lending School 12–14 Madison; $895/attendee

•Midwest Trust & Wealth Management Conference 12–14 Plymouth, Mich. (multiple locations available)

•Family-owned and Closely Held Bank Strategic Retreat 13–14 Madison; $245/banker attendee

•Supervisor Boot Camp 18–19 Madison; $535/attendee

•FIPCO Software & Compliance Forum: Loan & Mortgage 19–20 Madison or virtual

•Branch Manager Boot Camp: Session 2

20 4-part series; virtual half-days; $800/attendee

•Community Bankers for Compliance (CBC) — Session IV

25 Stevens Point; membership (pricing options vary)

26 Madison; membership (pricing options vary)

•FDIC Bank Directors College 26 Wausau; $225/attendee 27 Madison; $225/attendee

•Principles of Banking Course 26–27 Eau Claire; $550/attendee

NOVEMBER 2022

•Personal Banker School

2–3 Madison; $495/attendee

•BOLT Winter Leadership Summit

9 Wisconsin Dells; $150/attendee

•Branch Manager Boot Camp: Session 3

10 4-part series; virtual half-days; $800/attendee

•Compliance Forum: Session 2

15 Wisconsin Dells; annual membership (pricing varies)

•LEAD360 Conference

16–17 Wisconsin Dells; $350/attendee

DECEMBER 2022

•Branch Manager Boot Camp: Session 4

15 4-part series; virtual half-days; $800/attendee

JANUARY 2023

•Midwest Economic Forecast Forum

12 Virtual

•Community Bankers for Compliance (CBC) — Session I

24–25 Virtual half-days; membership (pricing options vary)

FEBRUARY 2023

•Bank Executives Conference

8–10 Wisconsin Dells

•Compliance Forum: Session 3

14 Wisconsin Dells; annual membership (pricing varies)

MARCH 2023

•Advanced IRA Workshops

7 Madison or virtual; $245/attendee

•Loan Compliance School 13–17 Madison; $1,295/attendee

•Real Estate Compliance School 15–17 Madison; $795/attendee

•Introduction to Commercial Lending School 20–22 Madison; $895/attendee

•Security Officer Workshops 22 Wisconsin Dells or virtual; $245/attendee

•Call Report Review & Update Workshop TBD Virtual half-days; $245/attendee

APRIL 2023

•Residential Mortgage Lending School 11–14 Madison; $1,045/attendee

•Agricultural Bankers Conference 13–14 Wisconsin Dells; $300/ag section member or $350/non-section member attendee

•Power of Community Week 17–22 wisbank.com/BanksPowerWI

» Visit www.wisbank.com/education for more information and online registration.

Or email WBA Education at wbaeducation@ wisbank.com or call 608-441-1252.

»

FULL 16 OCTOBER 2022 Conferences I Summits Schools I Boot Camps Seminars I Workshops WBA Webinars Other Events EDUCATION Calendar Your

Investing in Your Team

Always remember that your employees are your greatest asset

By Loni Meiborg

“People don’t leave bad jobs; they leave bad managers.”

— Unknown

“Those who have a best friend at work are twice as likely to be engaged in their jobs.”

— 2018 Gallup Poll

“Alone, we can do so little; together, we can do so much.”

— Helen Keller

We’ve heard it all. We’ve read it all. We’ve experienced most of it. But how, in today’s tumultuous employment atmosphere, do we keep our team engaged, grow great talent, and keep everyone happy without breaking the bank (both the brick-andmortar and the piggy bank)?

With average costs of onboarding a new employee exceeding $4,100, it’s in every bank’s best interest to crack this code. Taking a page from the marketer’s playbook, it is much more cost effective to focus on growing existing relationships than acquiring new ones. And that adage adds up for employees as well. Here are six strategies to consider to build strength and longevity among your team:

Purpose

Most people will agree, without purpose there’s no point. In fact, performance soars when you can tie an employee’s work to a bankwide purpose. Providing a strong purpose to an employee’s role will ensure a deeper level of engagement, and even increased satisfaction.

To do this, make sure you are providing transparent communication. Explain the goals of the team, the bank, and offer a big picture perspective. Take an active interest in their development, both professionally and

Strategic Connections

Loni Meiborg

personally when possible. When their service positively impacts the overall goal of the bank, make sure they know that they are part of that success, it will encourage them to find more ways to contribute.

Development

Each year Fortifi Bank surveys its employees to measure satisfaction. And each year, the number one desire is for more career advancement opportunities. An interesting response since, if you asked senior management, they would say the sky is the limit for every employee. So where is the disconnect?

During monthly check-ins, have open conversation about what each employee wants to be “when they grow up.” Then find the appropriate training and development opportunities to support that. Let them know you’re grooming them towards their goals, even if it’s in a different department. Once the right position opens, they’ll be ready and set-up for success. Don’t let your stellar employees leave for a “perceived” growth opportunity — offer it to them first.

Recognition

No matter how long you’ve been a leader, rewards and recognition take constant focus and practice. Set up a system — whether it is a Microsoft® Outlook reminder or an assistant who follows through — to ensure your rewards and recognition efforts are timely

» How to keep your team engaged, grow great talent, and keep everyone happy without breaking the bank.

and consistent. Although major performance achievements and milestones are important to note, don’t miss the little things either. Post their achievement on the intranet for all to celebrate, send flowers to a new parent or grandparent. When that big project wraps up, acknowledge their work and share your appreciation. Making that human connection with each employee will quell fears, instill trust, and develop a lasting relationship.

Voice

Okay, one more quote —

“In teamwork, silence isn’t golden. It’s deadly.”

— Mark Sanborn

This topic is multi-faceted. In part because when an employee has a voice at work, it opens the door for them to influence decisions. The other part is building the confidence that when an idea, concern, or perspective is expressed, there will be no workplace consequences.

When both are accomplished appropriately, you will get the feedback you need to achieve better results as well as having the team’s full support along the way. Make

(continued on p. 19)

Take comfort in the sound investments of ICBA Securities.

Cover your community bank in the comfort of knowing you have quality investment products.

ICBA Securities powered by Vining Sparks is interwoven with ICBA — so when you put your trust in us, you support the community banking industry.

Find your snug investment options at icba.org/securities Member FINRA/SIPC

OCTOBER 2022 17

IS YOUR BANK SUFFERING UNREALIZED SECURITY PORTFOLIO LOSSES?

ARE YOU IN NEED OF A CAPITAL INJECTION?

Bank Stock and Bank Holding Company Stock Loans up to $50 Million Done the Simple Way

1.

Calling us is the first step.

3.

CVB preparing the loan documents generally within 5 to 10 days.

5.

CVB wires the funds.

2. You email us the appropriate documents of information.

4.

Meeting the customer. We will come to you to sign loan documents.

»Call Rick Gerber or Ryan Gerber at 1-866-282-3501 or email rickg@chippewavalleybank.com ryang@chippewavalleybank.com

6. Wow that was easy.

18 OCTOBER 2022

Graduates!

BankWork$ Milwaukee Training Program for Bankers

The August BankWork$ class has now graduated! The Wisconsin Bankers Association is proud to partner with Employ Milwaukee to bring this nationwide program to Wisconsin. BankWork$ is a free, eight-week training program to prepare participants in primarily underserved neighborhoods for retail banking careers.

This graduating class of seven included Rayan Berryman, Bianca Carroll McDaniel, Davina McKee, Janiaya Rainey, Ayleene Rodriguez, Raynique Scott, and Christina Summerville WBA’s Rose Oswald Poels attended the ceremony and congratulated the graduates on their achievement.

Strategic Connections

(continued from p. 17)

sure you’re asking for their input regularly.

Share ideas and concepts well before execution to give them time to process and come back with a thoughtful response. And, whether you take their suggestions or not, it is important to circle back to share why their thoughts were accepted or rejected; and regardless of which, recognize their contributions to the conversation.

Solutions

When building trust among your team, you need a sharp focus on being solution oriented. You might say, “well then what am I paying them for,” but I’m not talking about the day-to-day blocking and tackling. I’m talking about the issues that impact their passion, purpose, and drive to do a good job.

If a team (or individual) is toxic, they look to you for

Over the eight weeks, these students learned the hard and soft skills necessary for entry-level

retail and operations positions. The program began in 2019 with the goal of training 400

» BankWork$® is a public-private partnership that primarily trains participants from underserved neighborhoods for careers in retail banking. Learn more about the BankWork$® program at employmilwaukee.org/EmployMilwaukee/Programs--Services/ Adult Youth-Programs/Bank Work.htm

» Are you interested in becoming a BankWork$® employer partner? For more information, contact Jovo Potkonjak at 414-270-7529 or jovo.potkonjak@employ milwaukee.org

students for positions in the banking industry over the next three years.

resolution. If they’ve hit a hurdle (or brick wall) on a project they want to see through, they look to you to remove it. If they need a change in process that is outside of their authority, they look to you to have their back. So, ask yourself, do your employees have frustrations? Take them seriously. Work with them to build an action plan and then see it through. You will have their loyalty in return.

Compensation

It is not by accident I list this one last. Don’t get me wrong, money is still a high priority for many, however, with the right mix of compensation strategies, it doesn’t just come down to dollars and cents. In fact, if you jump right to money and skip the previous five strategies, you’ll find your employee turnover rate growing.

Nowadays people expect flexibility. And no, this doesn’t only mean “work from home.”

They want to make it to their child’s dance recital at 3 p.m., they want to work at night sometimes to accommodate a later start to their day, they want to take a vacation without feeling guilty. That’s flexibility.

So do your due diligence when setting your compensation philosophy and dive into market research, but keep an eye on what else their package includes. Take an interest in their mental and financial health to keep your employees feeling appreciated. And, when you can, give them grace and stop watching the clock.

If you plan to adopt these or other strategies to engage your employee base on a deeper level, be sure to align your efforts with your entire management team for consistency as they will not be as effective when administered in a silo. In fact, if done in a here-or-there approach, it could cause animosity between teams and break down your culture even faster.

Engagement strategies should also reflect your company’s core values, which are truly the cornerstone of your culture. Consider your values when creating strategies, and how you deliver those strategies — it will make all the difference.

We know things will likely get harder when conducting business and the competition is fierce. Recognize that employees are your greatest asset and take good care of them; in turn, they will take good care of your customers. The dividends are priceless and the rewards vast.

Meiborg is senior vice president –organizational development at Fortifi Bank, Berlin, a member of the 2022–2023 WBA Marketing Committee, and serves as past chair of the WBA BOLT Section Board of Directors

This column is published bi-monthly in Wisconsin Banker and is written by members of the WBA Marketing Committee.

The August BankWork$ graduates (left to right) are: Raynique Scott; Christina Summerville; Bianca Carroll McDaniel; Jovo Potkonjak, BankWork$ program manager; Janiaya Rainey; Davina McKee; Ayleene Rodriguez; Rose Oswald Poels, WBA president and CEO; and Adriene Wright, BankWork$ instructor. Seated in the center is Rayan Berryman.

Congratulations,

OCTOBER 2022 19

The Importance

How to Assist the Non-Technical in Understanding Technology

By Rob Foxx, CCBTO

As an information technology or information security professional, have you ever had a conversation with a member of your team and watched their eyes glaze over and think to yourself, ‘did they just understand a word I said?’ Welcome to the industry — this is part two in my series assisting technical and non-technical staff to better communicate on the subject of technology. Before breaking down a few simple ideas tech professionals can keep

» Having technic al skills, aside communication, is one of the most important skills one can have.

FIPCO IT & Audit Services

Rob Foxx

»Part two in a two-part series on learning how to communicate effectively about technology.

in mind when communicating with non-technical peers — we should first discuss where (and why) we as technology professionals falter in our communication.

Gaps in Experience

Like many of my peers, I spent my younger years studying both in college and independently to absorb as much information as I could

» Four Communication Tips:

1)Don’t get frustrated with your audience.

2)Know your audience.

3)Find a beta user.

4)Don’t be judgmental.

in preparation for my career. In many ways, college helped me build my baseline for what I would need to learn both on my own as well as on the job. In addition to the standard classes within my major, I was also required to take speech classes like many college students. I did very well in speaking classes, however, my speeches were often on topics far more engaging to the audience than disaster recovery, firewalls, or server specifications.

Since then, I’ve spent much of my career working in teams with non-technical co-workers and, considering my target audience is usually within the banking industry, more than likely you too are a single individual or part of a very small team supporting your enterprise with minimal contact with those sharing your understanding of technology.

If you are of my generation or older, you were likely told somewhere along the way that you were very gifted or had aptitudes that leaned towards the up-and-coming field of information technology. Unfortunately, if you had any degree of awkwardness, it may have also been sold to you as something that would not require you to regularly communicate with people — a detail probably very few people have found to be true.

Having technical skills, aside from communication, is one of the most important skills one can have. On the upside, many of us have found being an effective communicator does not

mean being a master orator or an excellent writer. As proof to that, I will tell you in all honesty that I am neither. I stumble over my words, and I need someone to proofread anything holding more content than a short email or technical report.

Four Things to Keep in Mind

As I continue through my career and often work closely with non-technical individuals, I have found that there are a few ways our profession can not only communicate better, but also build relationships for better future communications.

1) Do not get frustrated with your audience. None of us learned our profession overnight, so do not set the expectation that your non-technical team members will learn yours after one chat. By getting frustrated, you do a great disservice to the effort of everyone who was patient enough to make sure you understood your profession well enough that you could work successfully and independently.

In further developing good communication skills, technical people will realize the importance of asking co-workers to be specific in their requests. You may frequently get calls from peers saying, “my computer does not work.” By asking follow up questions such as “what are you trying to do,” “what does the computer do when you do that,” or “walk me through the problem,” tech professionals will generally get a better overall response and diagnosis of the issue at hand.

2) Know your audience Knowing who you’re talking to and their level of understanding in the subject you are talking about is the major difference

(continued on p. 21)

IT AUDIT & SECURITY SERVICES • IT Auditing • Cyber Security Consulting • Vulnerability & Penetration Testing • Board Cyber Security Awareness • GLBA Compliance & IT Risk Assessment • Managed Social Engineering with Integrated Learning Management System • Facilitated DRP/BCP Tabletop and IRP Testing • Threat Intelligence Briefings ContactFIPCO’sRobFoxxtogetstarted. rfoxx@fipco.com 800-722-3498x249 www.FIPCO.com

of Communication:

20 OCTOBER 2022

WBA’s LEAD360 Conference Is One Month Away!

Retail banking, sales, and marketing professionals reconvene in the Dells

This November 16–17, retail, sales, marketing, and financial literacy banking peers from across the state will once again gather in Wisconsin Dells at the Glacier Canyon Conference Center for WBA’s annual LEAD360 Conference.

The two-day event will provide bankers expansive opportunities for education and professional development — including several keynote sessions and tracks specifically designed for retail, marketing, sales, and financial literacy bankers — as well as repeated information geared towards today’s competitive landscape and how bankers can get ahead. The conference will kick off on November 16 with keynote speaker Dave DeFazio of

Tech Communication

(continued from p. 20)

between public speaking and speaking with business leaders. Never make assumptions about their level of understanding or be afraid to ask how familiar they are with virtual environments. The least technical executive at your bank most likely still receives business articles that could offer a baseline understanding of the subject matter at hand. Either assuming too much or too little could lead to your target getting frustrated with you expending their limited time.

3) Find a beta user. My original career goal was to become a software developer. I said from day one that I would want to hire someone who is older and less tech savvy to work with my team and test my product. If my non-technical mother could operate it without significant

Strategy Corps. With the consistent and steadily increasing competition within the banking industry, DeFazio’s keynote session will assist Wisconsin bankers in better understanding trending apps and fintech companies that are increasing pressure on today’s banking products.

As always, general and breakout sessions will offer bankers timely and relevant information that can be taken back to the office and put into action. Topics include talent recruitment, establishing

culture and driving loyalty, and how to make your community bank stand out — you do not want to miss this event!

Bankers will also enjoy networking opportunities and a breakfast program on November 17 in which the winners of the Wisconsin Bankers Foundation’s (WBF) Excellence in Financial Education Awards will be announced, in addition to the over eight hours of educational sessions scheduled for the two-day event.

WBA’s LEAD360 Conference will adjourn at noon on November 17 Specht following a keynote presentation by Christine Specht, CEO of Milwaukee-based Cousin Subs. Interested in attending or want to learn more about the annual conference? Please visit wisbank.com/ LEAD360 or contact WBA’s Miranda Gustafson at mgustafson@wisbank.com.

Learning complex concepts and making decisions is a process.

Talking over the heads of your co-workers and business leaders may only make the process more difficult. Remember, technology is your profession — not theirs.

guidance, then I would have succeeded in developing a product that offers an intuitive and user-friendly design and would be well accepted for its ease of use.

To apply this idea in dealing with business leaders, remember that if you can explain it to someone non-technical — be it a spouse, parent, or even a helpful co-worker — business leaders should have a better chance of understanding what thoughts you are trying to convey.

4) Don’t be judgmental Make sure to have a

non-judgmental way of communicating if a decision that is being made or considered is problematic. In technology, it may be stating that “this is a band aid to the problem,” or “we will need to readdress this problem sometime in the near future.” In information security, the cue is often “we can do that if you are willing to accept the risk and sign a risk acceptance form.”

Now that we have looked at the issues and a few things to

help keep in mind, I encourage you to keep in mind that learning complex concepts and making decisions is a process. Talking over the heads of your coworkers and business leaders may only make this process more difficult. Remember, technology is your profession — not theirs.

Foxx is director – infosec and IT audit services for FIPCO. He can be reached at rfoxx@fipco.com or 608-441-1249.

FIPCO is a WBA Gold Associate Member

Did You Know?

Wisconsin Banker occasionally prints informative articles submitted by Gold, Silver, and Bronze WBA Associate Members. Interested in sharing your expertise? Please contact WBA’s Nick Loppnow at 608-441-1259 or nloppnow@wisbank.com or email sales@wisbank.com for more information about purchasing Sponsored Content space in WBA’s electronic publications.

DeFazio

Nov. 16–17 | Wisconsin Dells WISCONSIN BANKERS ASSOCIATION » Visit www.wisbank.com/LEAD360 to see the full agenda or to register online.

OCTOBER 2022 21

Women Leaders

(continued from p. 1)

“I was connected to, and mentored by, some pretty seasoned supervisors, employees, and management from all areas of the bank by doing this,” she states.

Bankers agree that confidence, and the ability to advocate for yourself and your abilities, is a critically important factor in establishing a team player and a leader.

Gender Diversity Allows for a Well-Rounded Board

In the board room, diversity is key not only in best serving all members of the community but in recognizing the strengths of every team member. The

American Banker magazine reported that the push for greater opportunity for women in executive positions must start at the top. This means more gender diversified boards will recruit diverse CEOs who will ultimately recognize the efforts of and promote a greater diversity of individuals into leadership positions.

As Provancher puts it, “[individuals should] surround themselves with good people who don’t see gender as an impediment to success.”

Peshtigo National Bank President Kelly Heroux states that “the banking industry is changing at an exponential pace, and new opportunities are constantly developing. Women

who have the motivation and drive to take on leadership roles will excel in this industry.”

In this, leaders should not only invest in the professional development of women in the bank but ensure there is representation at every level.

Heroux adds that both men and women have attributes that can be leveraged within the bank. “It’s important [as a leader] to know your own abilities and your colleagues’ strengths, then build your teams around those qualities.”

Leading Our Leaders

The Wisconsin Bankers Association (WBA) has been led by Rose Oswald Poels

since 2011. In 2016, the Board of Directors welcomed its first female Chair Cynthia Erdman, who at that time served at Partnership Bank, Tomah, and is currently with Farmers and Merchants Bank of Kendall. Additionally, the Association is expected to welcome Donna Hoppenjan as WBA’s second woman as chair of the Board in the coming year.

Several women have served in leadership roles at Wisconsin’s Department of Financial Institutions (DFI), the state’s regulatory agency, including Secretarydesignee Cheryll OlsonCollins, her predecessor Kathy Blumenfeld, and the

(continued on p. 23)

What are a few words of wisdom for any women aspiring to be in your position?

“Be open to learning by showing enthusiasm and saying yes to new projects outside of your comfort zone that build your résumé and expand your expertise.”

— Donna Hoppenjan, president and chief executive officer, Mound City Bank, Platteville

“Believe in yourself! Have faith in your abilities! Without a humble but reasonable confidence in your own powers, you cannot be successful or happy.”

— Kathryn Robbins, president, First National Bank in Tigerton

“Be your authentic self, always! If they don’t like you for you, it is not going to be a good fit long term. Get involved! With your team, with your community, with peer groups, with trade associations. Never stop learning! Banking is constantly changing, and it is a must to stay well-informed of issues, changes in the industry, and the evolution of products and services.”

— Shay Horton, president and chief executive officer, Cumberland Federal Bank

“It is extremely inspiring and encouraging to see so many more women in executive roles in banking than ever before. Work hard and don’t be afraid to be the loudest voice in the room.”

— Rachael Gadbois, president and chief executive officer, The Pineries Bank, Stevens Point

Why do you believe it is important that more women are considered for leadership positions?

“I believe that an institution is doing their stakeholders — both internally and externally — a disservice if they were not promoting based on merit.”

— Jenny Provancher, CPA chief executive officer, The Equitable Bank S.S.B., Wauwatosa

“I believe a diverse group of people who have the skills needed to fill leadership positions is needed — a qualified mixture.”

— Dawn Staples, president, Superior Savings Bank

“The true nature of a woman is to be in a leadership role, not to change others, but to be the change we wish to see and then lead by example. The world of banking is changing at a rapid pace; what better time than now to encourage our women bankers to pursue leadership positions and lead by example.”

— Amy Smith, president, First National Bank at Darlington

“Women often pay great attention to detail and have the ability to juggle multiple projects simultaneously. In addition, a woman’s perspective at the table brings another viewpoint that hasn’t always been considered in the past.”

— Kelly Heroux, president, Peshtigo National Bank

What is the greatest piece of advice you were given when pursuing your career in banking?

“Out of high school when I didn’t know what I wanted to go to college for, my dad said: ‘Go down to the Savings and Loan and see about getting a part time job there — the people are nice. While you decide what to go to school for, learn everything you can about everything; you never know when it will come in handy.’”

— Kathy Rankin, president, Crossbridge Community Bank, Tomahawk

“Sometimes the best thing you can do for a loan customer is to tell them no.”

— Mary Bomkamp, president, Highland State Bank

How can our industry continue to create more opportunities for women in leadership?

“For us women fortunate to be in a leadership role, we need to make sure we are visible and serve as mentors. We also need to encourage and develop women early in their career. Awareness of the opportunities is a must.”

— Cynthia Erdman, president, Farmers & Merchants Bank of Kendall

“Over the course of my banking career, I have seen more and more opportunities open up for women. It is important that we continue to provide networking opportunities, leadership development, and think outside of the box. I also would encourage all women to speak up, try new things, and promote yourself — you are your own best cheerleader!”

— Teresa (Terry) Rosengarten, president and chief operating officer, Unity Bank, Augusta

22 OCTOBER 2022

Women Leaders (continued from p. 22)

division of banking’s Acting Administrator Kim Swissdorf.

Not only do these women at DFI and WBA play a substantial role in supporting the state’s banking industry, working tirelessly to advocate on behalf of all Wisconsin bankers at both the state and federal levels, for many, they serve as examples of mentors of powerful women in our industry and encourage more women every year to pursue their passions, break stereotypes, and create opportunities for both themselves and their institutions.

Recognizing the Strength of Women in Leadership Roles

One frequently cited barrier to women holding leadership positions is stereotyping. In banking, male leadership has been at the forefront for

centuries and unfortunately our society has been slow to recognize the misconceptions placed on women taking on these positions.

Staples states that there isn’t a one-size-fits-all solution to the challenges women often face when looking to expand their career, however, it’s important to not give up.

Although our society as a whole has become increasingly more accepting of women in positions of power, women are often being held to a higher standard than men. According to a Pew Research Center study conducted in 2018, 60% of people say that women have to do more to prove themselves than men to become top executives in businesses.

“Misconceptions such as leading too emotionally, distractions at home, and work/life imbalance affect all leaders —

not just women,” said Heroux.

As our business practices and societal norms continue to evolve throughout the 21st century, many women have received greater recognition for their efforts throughout the pandemic. In fact, many businesses found that their women leaders took initiative and acted with resilience during the crisis.

An article by Forbes highlighted that aggressive, transactional approaches to business have created lower engagement, higher turnover, and the emulation of toxic behavior. As diversity, equity, and inclusion (DEI) become a greater focus of Wisconsin banks, it is important to consider how leadership style plays into this, and how both men and women alike can re-think traditional models of leadership.

It is clear that though the

banking industry, and the financial sector in general, is no longer as divided as it once was, there is still work to be done in leveling the playing field for men and women alike by creating opportunities for women to expand their careers and encouraging more diversity at every level.

While women continue to push against tradition and gain leadership positions by demonstrating their abilities, seeking knowledge and information, and taking on greater responsibilities, Provancher encourages women to “actively get involved in making your bank a better place.”

“Know and understand the value that you can offer and to be able to advocate for yourself and the experience you bring to the table when necessary.”

Flanders is WBA writer/editor.

Family-Owned AND Closely Held

STRATEGIC RETREAT

The Edgewater Hotel | 1001 Wisconsin Place

Wisconsin

www.wisbank.com/FOCH

Presented by:

Madison,

13–14 O C T O B E R 2022

OCTOBER 2022 23

Connecting Leaders From Throughout the State

Join emerging bank leaders on Nov. 9 in Wisconsin Dells